false0001274792Q3--12-312023MERRIMACK PHARMACEUTICALS INC0001274792mack:StockIncentivePlan2021Member2022-01-012022-09-3000012747922023-09-300001274792mack:AssetPurchaseOptionAgreementMember2023-01-232023-01-2300012747922022-07-012022-09-300001274792us-gaap:RetainedEarningsMember2022-01-012022-03-310001274792us-gaap:RetainedEarningsMember2022-03-3100012747922022-09-300001274792us-gaap:CommonStockMember2023-06-300001274792srt:MaximumMembermack:FourteenerOncologyIncMember2019-07-120001274792us-gaap:RetainedEarningsMember2022-04-012022-06-300001274792us-gaap:AdditionalPaidInCapitalMember2023-09-3000012747922023-06-300001274792us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-3000012747922023-03-310001274792us-gaap:StockCompensationPlanMember2023-01-012023-09-300001274792us-gaap:CommonStockMember2021-12-310001274792us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-09-3000012747922022-01-012022-03-310001274792mack:AssetPurchaseOptionAgreementMembermack:PegascySASMember2022-03-012022-03-310001274792us-gaap:RetainedEarningsMember2022-06-300001274792mack:FirstLineTreatmentOfMetastaticPancreaticDuctalAdenocarcinomaMembermack:IpsenSAMember2017-04-030001274792us-gaap:CommonStockMember2023-01-012023-03-310001274792us-gaap:USTreasurySecuritiesMember2023-09-300001274792srt:MaximumMembermack:MilestoneAchievementThreeMembermack:FourteenerOncologyIncMember2019-06-132019-07-120001274792us-gaap:RetainedEarningsMember2023-09-300001274792us-gaap:RetainedEarningsMember2023-06-300001274792mack:IpsenSAMembermack:AfterFailureOfFirstLineChemotherapyMember2017-04-0300012747922023-10-310001274792us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-09-300001274792us-gaap:AdditionalPaidInCapitalMember2023-03-310001274792us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-3100012747922023-01-012023-09-300001274792us-gaap:AdditionalPaidInCapitalMember2022-09-300001274792mack:StockIncentivePlan2021Member2023-01-012023-09-300001274792us-gaap:CommonStockMember2022-06-300001274792us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-300001274792us-gaap:RetainedEarningsMember2021-12-310001274792us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001274792us-gaap:GeneralAndAdministrativeExpenseMember2022-07-012022-09-300001274792us-gaap:AdditionalPaidInCapitalMember2021-12-310001274792us-gaap:StockCompensationPlanMember2022-07-012022-09-300001274792mack:MilestoneAchievementTwoMembersrt:MaximumMembermack:FourteenerOncologyIncMember2019-07-120001274792us-gaap:RetainedEarningsMember2023-03-3100012747922023-04-012023-06-300001274792us-gaap:CommonStockMember2022-09-3000012747922021-12-310001274792us-gaap:CommonStockMember2022-03-310001274792mack:AssetSaleAgreementMembersrt:MaximumMembermack:IpsenSAMember2017-04-030001274792us-gaap:CommonStockMember2023-03-310001274792us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001274792mack:AssetPurchaseOptionAgreementMember2021-01-012021-12-310001274792us-gaap:RetainedEarningsMember2023-01-012023-03-310001274792us-gaap:RetainedEarningsMember2023-04-012023-06-300001274792us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001274792mack:StockIncentivePlan2021Member2023-09-300001274792us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310001274792us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001274792us-gaap:RetainedEarningsMember2022-12-310001274792us-gaap:RetainedEarningsMember2022-09-3000012747922023-07-012023-09-300001274792us-gaap:GeneralAndAdministrativeExpenseMember2023-07-012023-09-300001274792us-gaap:CommonStockMember2023-09-3000012747922022-06-300001274792us-gaap:FairValueMeasurementsRecurringMember2023-09-300001274792us-gaap:AdditionalPaidInCapitalMember2022-03-310001274792us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001274792mack:AssetPurchaseOptionAgreementMembermack:PegascySASMember2023-01-232023-01-2300012747922022-01-012022-09-300001274792us-gaap:AdditionalPaidInCapitalMember2022-12-310001274792us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001274792us-gaap:CommonStockMember2022-12-310001274792us-gaap:StockCompensationPlanMember2023-07-012023-09-300001274792us-gaap:StockCompensationPlanMember2022-01-012022-09-300001274792us-gaap:RetainedEarningsMember2023-07-012023-09-300001274792us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300001274792srt:MaximumMembermack:MilestoneAchievementThreeMembermack:FourteenerOncologyIncMember2019-07-120001274792us-gaap:FairValueMeasurementsRecurringMember2022-12-3100012747922022-03-310001274792us-gaap:RetainedEarningsMember2022-07-012022-09-300001274792us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-3000012747922022-12-310001274792mack:AssetPurchaseOptionAgreementMembermack:PegascySASMember2021-09-152021-09-150001274792mack:IpsenSAMembermack:AdditionalIndicationMember2017-04-030001274792mack:AssetPurchaseOptionAgreementMembersrt:MaximumMember2023-01-232023-01-230001274792us-gaap:AdditionalPaidInCapitalMember2023-06-300001274792us-gaap:CommonStockMember2023-04-012023-06-300001274792mack:FourteenerOncologyIncMember2019-07-120001274792srt:MaximumMembermack:FourteenerOncologyIncMembermack:MilestoneAchievementOneMember2019-07-1200012747922023-01-012023-03-310001274792us-gaap:AdditionalPaidInCapitalMember2022-06-3000012747922022-04-012022-06-30xbrli:sharesiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-35409

Merrimack Pharmaceuticals, Inc.

(Exact name of registrant as specified in its charter)

|

|

Delaware |

04-3210530 |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

|

|

One Broadway, 14th Floor Cambridge, MA |

02142 |

(Address of principal executive offices) |

(Zip Code) |

(617) 720-8606

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common stock, $0.01 par value |

MACK |

Nasdaq Global Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

Non-accelerated filer |

☒ |

|

Smaller reporting company |

☒ |

Emerging growth company |

☐ |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of October 31, 2023, there were 14,320,953 shares of Common Stock, $0.01 par value per share, outstanding.

TABLE OF CONTENTS

PART I

FINANCIAL INFORMATION

PART II

OTHER INFORMATION

i

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements that involve substantial risks and uncertainties. All statements, other than statements of historical facts, contained in this Quarterly Report on Form 10-Q, including statements regarding our strategy, future operations, future financial position, future revenues, projected costs, prospects, plans and objectives of management, are forward-looking statements. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words.

The forward-looking statements in this Quarterly Report on Form 10-Q include, among other things, statements about:

•our rights to receive payments related to the accomplishment, if at all, of additional milestone events under the asset purchase and sale agreement with Ipsen S.A.;

•our rights to receive payments related to the milestone events under the asset purchase agreement with Elevation Oncology, Inc. (formerly known as 14ner Oncology, Inc.), when expected or at all;

•our cash runway and the sufficiency of our financial resources to fund our operations;

•our estimates regarding expenses;

•our plans to seek to divest our remaining product candidate; and

•other risks detailed from time to time in our filings with the Securities and Exchange Commission (the “SEC”), press releases and other communications, including those set forth under “Risk Factors” included in our Annual Report on Form 10-K for the year ended December 31, 2022, and in the documents incorporated by reference herein and therein.

We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, collaborations or investments that we may make.

You should read this Quarterly Report on Form 10-Q and the documents that we have filed as exhibits to this Quarterly Report on Form 10-Q completely and with the understanding that our actual future results may be materially different from what we expect. We do not assume any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

NOTE REGARDING TRADEMARKS

ONIVYDE® is a trademark of Ipsen S.A. Any other trademarks, trade names and service marks referred to in this Quarterly Report on Form 10-Q are the property of their respective owners.

1

PART I

FINANCIAL INFORMATION

Item 1. Financial Statements.

Merrimack Pharmaceuticals, Inc.

Condensed Consolidated Balance Sheets

(unaudited)

|

|

|

|

|

|

|

|

|

(in thousands, except per share amounts) |

|

September 30,

2023 |

|

|

December 31,

2022 |

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

6,083 |

|

|

$ |

19,439 |

|

Short-term investments |

|

|

12,821 |

|

|

|

— |

|

Prepaid expenses and other current assets |

|

|

390 |

|

|

|

389 |

|

Total current assets |

|

|

19,294 |

|

|

|

19,828 |

|

Other assets |

|

|

5 |

|

|

|

8 |

|

Total assets |

|

$ |

19,299 |

|

|

$ |

19,836 |

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable, accrued expenses and other |

|

$ |

493 |

|

|

$ |

589 |

|

Total current liabilities |

|

|

493 |

|

|

|

589 |

|

Total liabilities |

|

|

493 |

|

|

|

589 |

|

Commitments and contingencies |

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

Preferred stock, $0.01 par value: 10,000 shares authorized at September 30, 2023 and

December 31, 2022; no shares issued or outstanding at September 30, 2023 or

December 31, 2022 |

|

|

— |

|

|

|

— |

|

Common stock, $0.01 par value: 30,000 shares authorized at September 30, 2023 and

December 31, 2022; 14,321 and 14,215 shares issued and outstanding at September 30,

2023 and December 31, 2022, respectively |

|

|

1,343 |

|

|

|

1,342 |

|

Additional paid-in capital |

|

|

566,040 |

|

|

|

565,541 |

|

Accumulated deficit |

|

|

(548,577 |

) |

|

|

(547,636 |

) |

Total stockholders’ equity |

|

|

18,806 |

|

|

|

19,247 |

|

Total liabilities and stockholders’ equity |

|

$ |

19,299 |

|

|

$ |

19,836 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

2

Merrimack Pharmaceuticals, Inc.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

(in thousands, except per share amounts) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative expenses |

|

$ |

531 |

|

|

$ |

504 |

|

|

$ |

1,686 |

|

|

$ |

1,567 |

|

Gain on sale of in-process research and development |

|

|

— |

|

|

|

— |

|

|

|

(139 |

) |

|

|

(445 |

) |

Total operating expenses |

|

|

531 |

|

|

|

504 |

|

|

|

1,547 |

|

|

|

1,122 |

|

Loss from operations |

|

|

(531 |

) |

|

|

(504 |

) |

|

|

(1,547 |

) |

|

|

(1,122 |

) |

Other income: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

252 |

|

|

|

62 |

|

|

|

606 |

|

|

|

70 |

|

Total other income |

|

|

252 |

|

|

|

62 |

|

|

|

606 |

|

|

|

70 |

|

Net loss and comprehensive loss |

|

$ |

(279 |

) |

|

$ |

(442 |

) |

|

$ |

(941 |

) |

|

$ |

(1,052 |

) |

Net loss per common share - basic and diluted |

|

$ |

(0.02 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.08 |

) |

Weighted-average common shares used to compute basic and

diluted net loss per common share |

|

|

14,321 |

|

|

|

13,410 |

|

|

|

14,289 |

|

|

|

13,410 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

Merrimack Pharmaceuticals, Inc.

Condensed Consolidated Statements of Stockholders’ Equity

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

|

|

|

|

|

|

|

|

(in thousands) |

|

Shares |

|

|

Amount |

|

|

Additional

Paid-In

Capital |

|

|

Accumulated

Deficit |

|

|

Total

Stockholders’

Equity |

|

Balance at December 31, 2022 |

|

|

14,215 |

|

|

$ |

1,342 |

|

|

$ |

565,541 |

|

|

$ |

(547,636 |

) |

|

$ |

19,247 |

|

Exercise of stock options |

|

|

40 |

|

|

|

1 |

|

|

|

178 |

|

|

|

— |

|

|

|

179 |

|

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

17 |

|

|

|

— |

|

|

|

17 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(271 |

) |

|

|

(271 |

) |

Balance at March 31, 2023 |

|

|

14,255 |

|

|

$ |

1,343 |

|

|

$ |

565,736 |

|

|

$ |

(547,907 |

) |

|

$ |

19,172 |

|

Exercise of stock options |

|

|

66 |

|

|

|

— |

|

|

|

209 |

|

|

|

— |

|

|

|

209 |

|

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

47 |

|

|

|

— |

|

|

|

47 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(391 |

) |

|

|

(391 |

) |

Balance at June 30, 2023 |

|

|

14,321 |

|

|

$ |

1,343 |

|

|

$ |

565,992 |

|

|

$ |

(548,298 |

) |

|

$ |

19,037 |

|

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

48 |

|

|

|

— |

|

|

|

48 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(279 |

) |

|

|

(279 |

) |

Balance at September 30, 2023 |

|

|

14,321 |

|

|

$ |

1,343 |

|

|

$ |

566,040 |

|

|

$ |

(548,577 |

) |

|

$ |

18,806 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

|

|

|

|

|

|

|

|

(in thousands) |

|

Shares |

|

|

Amount |

|

|

Additional

Paid-In

Capital |

|

|

Accumulated

Deficit |

|

|

Total

Stockholders’

Equity |

|

Balance at December 31, 2021 |

|

|

13,410 |

|

|

$ |

1,334 |

|

|

$ |

558,945 |

|

|

$ |

(546,092 |

) |

|

$ |

14,187 |

|

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

20 |

|

|

|

— |

|

|

|

20 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(132 |

) |

|

|

(132 |

) |

Balance at March 31, 2022 |

|

|

13,410 |

|

|

$ |

1,334 |

|

|

$ |

558,965 |

|

|

$ |

(546,224 |

) |

|

$ |

14,075 |

|

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

17 |

|

|

|

— |

|

|

|

17 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(478 |

) |

|

|

(478 |

) |

Balance at June 30, 2022 |

|

|

13,410 |

|

|

$ |

1,334 |

|

|

$ |

558,982 |

|

|

$ |

(546,702 |

) |

|

$ |

13,614 |

|

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

17 |

|

|

|

— |

|

|

|

17 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(442 |

) |

|

|

(442 |

) |

Balance at September 30, 2022 |

|

|

13,410 |

|

|

$ |

1,334 |

|

|

$ |

558,999 |

|

|

$ |

(547,144 |

) |

|

$ |

13,189 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

Merrimack Pharmaceuticals, Inc.

Condensed Consolidated Statements of Cash Flows

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended

September 30, |

|

(in thousands) |

|

2023 |

|

|

2022 |

|

Cash flows from operating activities |

|

|

|

|

|

|

Net loss |

|

$ |

(941 |

) |

|

$ |

(1,052 |

) |

Adjustments to reconcile net loss to net cash used in operating activities |

|

|

|

|

|

|

Gain on sale of in-process research and development |

|

|

(139 |

) |

|

|

(445 |

) |

Accretion on short-term investments |

|

|

(165 |

) |

|

|

— |

|

Stock-based compensation expense |

|

|

112 |

|

|

|

54 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Prepaid expenses and other current assets |

|

|

(1 |

) |

|

|

(57 |

) |

Accounts payable, accrued expenses and other |

|

|

(96 |

) |

|

|

(114 |

) |

Other assets |

|

|

3 |

|

|

|

57 |

|

Net cash used in operating activities |

|

|

(1,227 |

) |

|

|

(1,557 |

) |

Cash flows from investing activities |

|

|

|

|

|

|

Net proceeds from sale of in-process research and development |

|

|

139 |

|

|

|

445 |

|

Proceeds from maturity of short-term investment |

|

|

3,000 |

|

|

|

— |

|

Purchases of short-term investments |

|

|

(15,656 |

) |

|

|

— |

|

Net cash (used in) provided by investing activities |

|

|

(12,517 |

) |

|

|

445 |

|

Cash flows from financing activities |

|

|

|

|

|

|

Proceeds from exercise of stock options |

|

|

388 |

|

|

|

— |

|

Net cash provided by financing activities |

|

|

388 |

|

|

|

— |

|

Net decrease in cash and cash equivalents |

|

|

(13,356 |

) |

|

|

(1,112 |

) |

Cash and cash equivalents, beginning of period |

|

|

19,439 |

|

|

|

14,203 |

|

Cash and cash equivalents, end of period |

|

$ |

6,083 |

|

|

$ |

13,091 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

Merrimack Pharmaceuticals, Inc.

Notes to Condensed Consolidated Financial Statements

(unaudited)

1. Nature of the Business

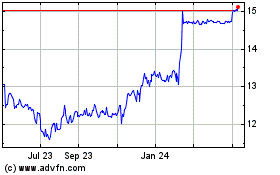

Merrimack Pharmaceuticals, Inc. (the “Company”) is a biopharmaceutical company based in Cambridge, Massachusetts that is entitled to receive up to $450.0 million in contingent milestone payments related to its sale of ONIVYDE® and MM-436 (the “Commercial Business”) to Ipsen S.A. (“Ipsen”) in April 2017 (the “Ipsen Sale”). The Company does not have any ongoing research or development activities. The Company does not have any employees and instead uses external consultants for the operation of the Company.

The $450.0 million in contingent milestone payments resulting from the Ipsen Sale consist of:

•$225.0 million upon approval by the U.S. Food and Drug Administration (“FDA”) of ONIVYDE® for the first-line treatment of metastatic pancreatic ductal adenocarcinoma (“mPDAC”), subject to certain conditions;

•$150.0 million upon approval by the FDA of ONIVYDE® for the treatment of small-cell lung cancer after failure of first-line chemotherapy; and

•$75.0 million upon approval by the FDA of ONIVYDE® for an additional indication unrelated to those described above.

In June 2023, Ipsen announced that the U.S. Food and Drug Administration (FDA) had accepted its supplemental new drug application (sNDA) Onivyde® (irinotecan liposome injection) plus 5 fluorouracil/leucovorin and oxaliplatin (NALIRIFOX regimen) as a potential first-line treatment for mPDAC and that the FDA had provided a Prescription Drug User Fee Act expected goal date of February 13, 2024 for review of the application.

On May 30, 2019, the Company announced the completion of its review of strategic alternatives, following which the Company’s board of directors (the “Board”) implemented a series of measures designed to extend the Company’s cash runway and preserve its ability to capture the potential milestone payments resulting from the Ipsen Sale. In connection with that announcement, the Company discontinued the discovery efforts on its remaining preclinical programs: MM-401, an agonistic antibody targeting a novel immuno-oncology target, TNFR2; and MM-201, a highly stabilized agonist-Fc fusion protein targeting death receptors 4 and 5.

The Company’s termination of its executive management team and all other employees was substantially completed by June 28, 2019 and fully completed by July 12, 2019. As of July 12, 2019, the Company no longer had any employees. The Company has engaged external consultants to run the day-to-day operations of the Company. The Company has also entered into consulting agreements with certain former members of its executive management team who are supporting the Company’s relationship with current partners, assisting with the potential sale of remaining preclinical and clinical assets, and assisting with certain legal and regulatory matters and the continued wind-down of operations.

On July 12, 2019, the Company completed the sale to Elevation Oncology, Inc. (formerly known as 14ner Oncology, Inc.) (“Elevation”) of its anti-HER3 antibody programs, MM-121 (seribantumab) and MM-111 (the “Elevation Sale”). In connection with the Elevation Sale, the Company received an upfront cash payment of $3.5 million. The Company is also eligible to receive up to $54.5 million in additional potential development, regulatory approval and commercial-based milestone payments, consisting of:

•$3.0 million for achievement of the primary endpoint in the first registrational clinical study of either MM-121 or MM-111;

•Up to $16.5 million in total payments for the achievement of various regulatory approval and reimbursement-based milestones in the United States, Europe and Japan; and

•Up to $35.0 million in total payments for achieving various cumulative worldwide net sales targets between $100.0 million and $300.0 million for MM-121 and MM-111.

In January 2023, Elevation announced it is pausing further investment in the clinical development of seribantumab and intends to pursue further development only in collaboration with a partner.

On September 15, 2021, the Company entered into an Asset Purchase Option Agreement (the "Asset Purchase Option Agreement") with a third party, pursuant to which the third party agreed to obtain an exclusive option, to purchase one of the Company’s preclinical programs with a consideration of $0.5 million. Under the terms of the Asset Purchase Option Agreement, the third party paid to the Company the option fee of $0.1 million. The third party had the right to exercise the option within 24 months from September 15, 2021. The Company recognized a gain of $0.1 million related to the option fee payment for the year ended December 31, 2021. On January 18, 2022, the third party provided written notice to the Company of its intent to exercise such option. On March 1, 2022 the Company and the third party entered into the Asset Purchase Agreement. The consideration of $0.5 million was paid to the Company and a net gain of $0.4 million was recognized in March 2022.

6

On January 23, 2023, the Company entered into another Asset Purchase Option Agreement (the “Option Agreement”) with another third party (the “Purchaser”), pursuant to which the Purchaser agreed to obtain an exclusive option (the “Option”) to purchase one of the Company’s preclinical programs with a consideration of $0.7 million. Under the terms of the Option Agreement, the Purchaser paid to the Company the Option fee of $0.2 million and the Company incurred transaction costs less than $0.1 million. A net gain of $0.1 million was recognized in January 2023. The Purchaser decided not to exercise the Option in July 2023.

Our remaining non-commercial assets, including our clinical and preclinical development programs, and all material other clinical and pre-clinical development programs have been sold with the exception of one program.

The Company is not developing and commercializing products. The Company expects to dividend out to its stockholders all or substantially all of any milestone payments it may receive and the Company does do not anticipate seeking to develop any new products with any of our existing cash or any future milestone payments it may receive. The Company’s failure to achieve these potential milestone payments would depress the value of the Company. A decline in the value of the Company could also cause its stockholders to lose all or part of their investment.

The Company is subject to risks and uncertainties common to companies in the biopharmaceutical industry, including, among other things, its ability to secure additional capital to fund operations, development by competitors of new technological innovations, protection of proprietary technology and compliance with government regulations. None of the Company’s product candidates sold to others or retained by the Company are approved for any indication by the FDA or any other regulatory agency. The Company operates in an environment of rapid change in technology and substantial competition from pharmaceutical and biotechnology companies, among others. In addition, the Company is dependent upon the services of its external consultants for the operation of the Company. The Company’s business strategy depends substantially upon its ability to receive future milestone payments from Ipsen. Any failure to achieve such milestones or a perception that the milestones may not be achieved will materially and adversely affect the Company and the value of its common stock.

In accordance with Accounting Standards Codification (“ASC”) 205-40, Going Concern, the Company has evaluated whether there are conditions and events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern within one year after the date that the condensed consolidated financial statements are issued. As of September 30, 2023, the Company had an accumulated deficit of $548.6 million. During the nine months ended September 30, 2023, the Company incurred a net loss of $0.9 million and used $1.2 million of cash in operating activities. The Company expects to continue to generate operating losses for the foreseeable future. The Company expects that its cash and cash equivalents and short-term investment of $18.9 million at September 30, 2023 will allow the Company to continue its operations into 2027, which the Company estimates is beyond the latest date that the longest-term potential Ipsen milestone may be achieved. The continued viability of the Company beyond that point is dependent on its ability to raise additional capital to finance its operations or to reduce operating expenses. There can be no assurance that the Company will be able to obtain sufficient capital to cover its costs on acceptable terms, if at all.

The Company expects that it would seek to finance any future cash needs through a combination of divestitures of its rights under the Ipsen and Elevation agreements, equity offerings and debt financings. There can be no assurance as to the timing, terms or consummation of any divestiture or financing, and the terms of any such financing may adversely affect the holdings or the rights of the Company’s stockholders or require the Company to relinquish rights to certain of its revenue streams or product candidates.

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying condensed consolidated financial statements reflect the operations of Merrimack Pharmaceuticals, Inc. and its wholly owned subsidiaries. All intercompany accounts and transactions have been eliminated.

The condensed consolidated financial statements are unaudited and have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”).

The accounting policies followed in the preparation of the interim condensed consolidated financial statements are consistent in all material respects with those presented in Note 1 to the financial statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022.

Unaudited Interim Financial Information

The condensed consolidated balance sheet as of December 31, 2022 was derived from audited financial statements for the year ended December 31, 2022, but the condensed consolidated balance sheet in this Form 10-Q at December 31, 2022 does not include all

7

disclosures required by GAAP. The condensed consolidated balance sheet as of September 30, 2023, the condensed consolidated statements of operations and comprehensive loss for the three and nine months ended September 30, 2023 and 2022, the condensed consolidated statements of stockholders’ equity for the three and nine months ended September 30, 2023 and 2022 and the condensed consolidated statements of cash flows for the nine months ended September 30, 2023 and 2022 are unaudited. The unaudited interim condensed consolidated financial statements have been prepared on the same basis as the audited annual financial statements and, in the opinion of management, reflect all adjustments, which include only normal recurring adjustments, necessary for the fair statement of the Company’s financial position as of September 30, 2023, the results of its operations for the three and nine months ended September 30, 2023 and 2022, its statements of stockholders’ equity for the three and nine months ended September 30, 2023 and 2022 and its statements of cash flows for the nine months ended September 30, 2023 and 2022. The financial data and other information disclosed in the notes related to the three and nine months ended September 30, 2023 and 2022 are unaudited. The results for the three and nine months ended September 30, 2023 and 2022 are not necessarily indicative of results to be expected for the year ending December 31, 2023, any other interim periods, or any future year or period.

The unaudited interim financial statements of the Company included herein have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”). Certain information and footnote disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted from this report, as is permitted by such rules and regulations. These unaudited condensed consolidated financial statements should be read in conjunction with the audited financial statements and the notes thereto contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC on March 9, 2023.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates, assumptions and judgments that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the condensed consolidated financial statements and the reported amounts of expenses during the reporting periods. Significant estimates, assumptions and judgments reflected in these condensed consolidated financial statements include, but are not limited to, the accrual of research and development expenses and the valuation of stock-based awards. Estimates are periodically reviewed in light of changes in circumstances, facts and experience. Actual results could differ from the Company’s estimates.

3. Fair Value of Financial Instruments

The following tables show assets measured at fair value on a recurring basis as of September 30, 2023 and December 31, 2022:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2023 |

|

(in thousands) |

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

Cash equivalents: |

|

|

|

|

|

|

|

|

|

Money market funds |

|

$ |

5,725 |

|

|

$ |

— |

|

|

$ |

— |

|

Totals |

|

$ |

5,725 |

|

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

Short-term investments: |

|

|

|

|

|

|

|

|

|

Treasury bills and notes |

|

$ |

— |

|

|

$ |

12,821 |

|

|

$ |

— |

|

Totals |

|

$ |

— |

|

|

$ |

12,821 |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2022 |

|

(in thousands) |

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

Cash equivalents: |

|

|

|

|

|

|

|

|

|

Money market funds |

|

$ |

18,148 |

|

|

$ |

— |

|

|

$ |

— |

|

Totals |

|

$ |

18,148 |

|

|

$ |

— |

|

|

$ |

— |

|

8

There were no liabilities measured at fair value on a recurring basis as of September 30, 2023 and December 31, 2022.

The following table summarizes the carrying values and fair values of the Company's financial instruments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2023 |

|

(in thousands) |

|

Amortized

Cost |

|

|

Allowance for Credit Losses |

|

|

Net Carrying Amount |

|

|

Gross Unrealized

Gains |

|

|

Gross Unrealized

Losses |

|

|

Fair

Value |

|

Short-term investments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Treasury bills and note |

|

$ |

12,821 |

|

|

$ |

— |

|

|

$ |

12,821 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

12,821 |

|

Total short-term investments |

|

$ |

12,821 |

|

|

$ |

— |

|

|

$ |

12,821 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

12,821 |

|

As of December 31, 2022, the Company did not hold any short-term investments. The Company has investments in U.S. Treasury Bills and U.S. Treasury Notes as of September 30, 2023, some of which mature over a period greater than 90 days but within one year and are classified as short-term investments. The U.S. Treasury Bills and U.S. Treasury Notes are carried at amortized cost and classified as held to maturity as the Company has the intent and the ability to hold them until they mature. The carrying value of the U.S. Treasury Bills and U.S. Treasury Notes are adjusted for accretion of discounts over the remaining life of the investment. Income related to the U.S. Treasury Bills and U.S. Treasury Notes is recognized in interest income in the Company’s condensed consolidated statement of operations.

4. Accounts Payable, Accrued Expenses and Other

Accounts payable, accrued expenses and other as of September 30, 2023 and December 31, 2022 consisted of the following:

|

|

|

|

|

|

|

|

|

(in thousands) |

|

September 30,

2023 |

|

|

December 31,

2022 |

|

Accounts payable |

|

$ |

111 |

|

|

$ |

188 |

|

Accrued goods and services |

|

|

144 |

|

|

|

139 |

|

Accrued clinical trial costs |

|

|

47 |

|

|

|

71 |

|

Others |

|

|

191 |

|

|

|

191 |

|

Total accounts payable, accrued expenses and other |

|

$ |

493 |

|

|

$ |

589 |

|

5. Stock-Based Compensation

On April 15, 2021, the Company’s Board of Directors adopted the 2021 Incentive Award Plan (the “2021 Plan”) to replace the 2011 Stock Incentive Plan (the “2011 Plan”). The 2021 Plan was approved by the Company’s stockholders at the Company’s Annual Meeting of Stockholders held on June 10, 2021. The 2021 Plan is administered by the Company’s Board of Directors and permits the Company to grant incentive and non-qualified stock options, stock appreciation rights, restricted stock, restricted stock units and other stock-based awards.

There were 22,000 options granted during each of the nine months ended September 30, 2023 and 2022 under the 2021 Plan. At September 30, 2023, there were 209,000 shares remaining available for grant under the 2021 Plan.

The aggregate intrinsic value was calculated as the difference between the exercise price of the stock options and the fair value of the underlying common stock. The aggregate intrinsic value of options exercised during the nine months ended September 30, 2023 is $0.9 million. There were no options exercised during the three months ended September 30, 2023 and the three and nine months ended September 30, 2022.

The Company recognized stock-based compensation expense of $48 thousand and $112 thousand for the three and nine months ended September 30, 2023, respectively, and $17 thousand and $54 thousand for the three and nine months ended September 30, 2022, respectively, which are included in general and administrative expense on the accompanying condensed consolidated statement of operations and comprehensive loss.

6. Net Loss Per Common Share

Basic net loss per share is calculated by dividing the net loss attributable to Merrimack Pharmaceuticals, Inc. by the weighted-average number of common shares outstanding during the period.

9

Diluted net loss per share is computed by dividing the net loss attributable to Merrimack Pharmaceuticals, Inc. by the weighted-average number of dilutive common shares outstanding during the period. Dilutive shares outstanding is calculated by adding to the weighted shares outstanding any potential (unissued) shares of common stock from outstanding stock options based on the treasury stock method. Outstanding stock options were not included in the diluted net loss per share calculation because the options were out of the money or to do so would have been antidilutive (i.e., the total proceeds upon exercise would have exceeded the market value of the underlying common shares). In a period when a net loss is reported, all common stock equivalents are excluded from the calculation because they would have an anti-dilutive effect, meaning the loss per share would be reduced. Therefore, in periods where a loss is reported, there is no difference in basic and dilutive loss per share.

Stock options are excluded from the calculation of diluted loss per share because the net loss for the three and nine months ended September 30, 2023 and 2022 causes such securities to be anti-dilutive. Outstanding options excluded from the calculation of diluted loss per share for the three and nine months ended September 30, 2023 and 2022 are shown in the chart below:

|

|

|

|

|

|

|

|

|

|

|

Three and Nine Months Ended September 30, |

|

(in thousands) |

|

2023 |

|

|

2022 |

|

Outstanding options to purchase common stock |

|

|

641 |

|

|

|

1,628 |

|

7. Recent Accounting Pronouncements

From time to time, new accounting pronouncements are issued by the Financial Accounting Standards Board (“FASB”) or other standard setting bodies that the Company adopts as of the specified effective date. Unless otherwise discussed above, the Company does not believe that the adoption of recently issued standards has or may have a material impact on the Company’s condensed consolidated financial statements or disclosures.

10

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion of our financial condition and results of operations should be read in conjunction with our financial statements and the notes to those financial statements appearing elsewhere in this Quarterly Report on Form 10-Q and the audited consolidated financial statements and notes thereto and management’s discussion and analysis of financial condition and results of operations for the year ended December 31, 2022 included in our Annual Report on Form 10-K. This discussion contains forward-looking statements that involve significant risks and uncertainties. As a result of many factors, such as those set forth in Part II, Item 1A. Risk Factors of this Quarterly Report on Form 10-Q, which are incorporated herein by reference, our actual results may differ materially from those anticipated in these forward-looking statements.

Overview

We are a biopharmaceutical company based in Cambridge, Massachusetts that is entitled to receive up to $450.0 million in contingent milestone payments related to our sale of ONIVYDE® to Ipsen S.A., or Ipsen, in April 2017 and up to $54.5 million in contingent milestone payments related to our sale of MM-121 and MM-111 to Elevation Oncology, Inc. (formerly known as 14ner Oncology, Inc.), or Elevation, in July 2019. We do not have any ongoing research or development activities and are seeking potential acquirers for our remaining preclinical and clinical assets. We do not have any employees and instead use external consultants for the operation of our company.

On April 3, 2017, we completed the sale of ONIVYDE and MM-436 (the “commercial business”) to Ipsen (the “Ipsen sale”). In connection with the Ipsen sale, we are eligible to receive up to $450.0 million in additional regulatory approval-based milestone payments.

The remaining up to $450.0 million in potential milestone payments resulting from the Ipsen sale consist of:

•$225.0 million upon approval by the U.S. Food and Drug Administration, or FDA, of ONIVYDE for the first-line treatment of metastatic adenocarcinoma of the pancreas, subject to certain conditions;

•$150.0 million upon approval by the FDA of ONIVYDE for the treatment of small-cell lung cancer after failure of first-line chemotherapy; and

•$75.0 million upon approval by the FDA of ONIVYDE for an additional indication unrelated to those described above.

Our non-commercial assets, including our clinical and preclinical development programs, were not included in the Ipsen sale and remain assets of ours.

11

•In November 2022, Ipsen announced the Phase III NAPOLI 3 trial of Onivyde® (irinotecan liposome injection) plus 5-fluorouracil/leucovorin and oxaliplatin (the “NALIRIFOX regimen”) met its primary endpoint demonstrating clinically meaningful and statistically significant improvement in overall survival compared to nab-paclitaxel plus gemcitabine in 770 previously untreated patients with metastatic pancreatic ductal adenocarcinoma (“mPDAC”) and key secondary efficacy outcome of progression-free survival (PFS) also showed significant improvement over the comparator arm. Ipsen also announced that the safety profile of Onivyde in the NAPOLI 3 trial was consistent with those observed in the previous phase I/II mPDAC study. Ipsen also stated that it intends to file a supplemental New Drug Application with the U.S. Food and Drug Administration for Onivyde in combination with oxaliplatin plus 5-fluorouracil/leucovorin for the treatment of patients with previously untreated mPDAC following the Fast Track Designation granted in 2020. In January 2023, Ipsen presented clinical trial results at the 2023 American Society of Clinical Oncology (ASCO) Gastrointestinal Cancers Symposium. In June 2023, Ipsen announced that the U.S. Food and Drug Administration (FDA) had accepted its supplemental new drug application (sNDA) Onivyde® (irinotecan liposome injection) plus 5 fluorouracil/leucovorin and oxaliplatin (NALIRIFOX regimen) as a potential first-line treatment for metastatic pancreatic ductal adenocarcinoma (mPDAC) and that the FDA had provided a Prescription Drug User Fee Act goal date of 13 February 2024 for review of the application.

•In August 2022, Ipsen announced that the Phase III RESILIENT trial did not meet its primary endpoint of overall survival compared to topotecan. The trial is evaluating Onivyde® (irinotecan liposomal injection) versus topotecan in patients with small cell lung cancer, who have progressed on or after platinum-based first-line therapy treatment. RESILIENT is a Phase III trial conducted in two parts; the first part read out in 2020 confirming the safety, dosing and efficacy of Onivyde; part two is evaluating the efficacy of Onivyde versus topotecan. The analysis concluded that the primary endpoint overall survival was not met in patients treated with Onivyde versus topotecan. However, a doubling of the secondary endpoint of objective response rate in favor of Onivyde was observed. The safety and tolerability of Onivyde was consistent with its already-known safety profile, and no new safety concerns emerged. The clinical study results will be communicated with the regulatory agency. Ipsen indicated that while the results from the analysis of the RESILIENT trial have not demonstrated an overall survival benefit with Onivyde in patients in second-line small cell lung cancer, Ipsen intends to analyze the data further before decisions regarding next steps are made. To date, there have been no further public announcements by Ipsen regarding these matters and it remains unclear as to whether Ipsen will continue to seek approval for the use of ONIVYDE in the small cell lung cancer application. If Ipsen elects not to proceed with seeking regulatory approval, or if regulatory approval is not obtained, we would not be entitled to the $150 million milestone payment tied to approval of Onivyde for treating small cell lung cancer.

On May 30, 2019, we announced the completion of our review of strategic alternatives, following which our board of directors implemented a series of measures designed to extend our cash runway into 2027 and preserve our ability to capture the potential milestone payments resulting from the Ipsen sale. We have based this estimate on assumptions that may prove to be wrong, and we could use our financial resources sooner than we currently expect. In connection with that announcement, we discontinued the discovery efforts on our remaining preclinical programs: MM-401, an agonistic antibody targeting a novel immuno-oncology target, TNFR2; and MM-201, a highly stabilized agonist-Fc fusion protein targeting death receptors 4 and 5. We are seeking potential acquirers for our remaining preclinical and clinical assets.

The termination of our executive management team and all other employees was substantially completed by June 28, 2019 and fully completed by July 12, 2019. As of July 12, 2019, we did not have any employees. We have engaged external consultants to run our day-to-day operations. We have also entered into consulting agreements with certain former members of our executive management team who are supporting our relationship with current partners, assisting with the potential sale of remaining preclinical and clinical assets, and assisting with certain legal and regulatory matters and the continued wind-down of operations.

On July 12, 2019, we completed the sale to Elevation, or the Elevation sale, of our anti-HER3 antibody programs, MM-121 (seribantumab) and MM-111. In connection with the Elevation sale, we received an upfront cash payment of $3.5 million and are eligible to receive up to $54.5 million in additional potential development, regulatory approval and commercial-based milestone payments, consisting of:

•$3.0 million for achievement of the primary endpoint in the first registrational clinical study of either MM-121 or MM-111;

•Up to $16.5 million in total payments for the achievement of various regulatory approval and reimbursement-based milestones in the United States, Europe and Japan; and

•Up to $35.0 million in total payments for achieving various cumulative worldwide net sales targets between $100.0 million and $300.0 million for MM-121 and MM-111.

In January 2023, Elevation announced it is pausing further investment in the clinical development of seribantumab and intends to pursue further development only in collaboration with a partner.

12

On September 15, 2021, we entered into an Asset Purchase Option Agreement (the “Asset Purchase Option Agreement”) with a third party, pursuant to which the third party obtained an exclusive option, to purchase one of our preclinical programs with a consideration of $0.5 million. Under the terms of the Asset Purchase Option Agreement, the third party paid to us the option fee of $0.1 million.. On March 1, 2022, the third party exercised the option and we received consideration of $0.5 million and a gain of $0.5 million was recognized in March 2022.

On January 23, 2023, we entered into an Asset Purchase Option Agreement (the “Option Agreement”) with a third party (the “Purchaser”), pursuant to which the Purchaser agreed to obtain an exclusive option (the “Option”) to purchase one of the Company’s preclinical programs with a consideration of $700 thousand. Under the terms of the Option Agreement, the Purchaser paid to us the Option fee of $150 thousand and we incurred transaction cost of $11 thousand. A net gain of $139 thousand was recognized in January 2023. In July 2023, the Purchaser decided not to exercise the Option.

We previously devoted substantially all of our resources to our drug discovery and development efforts, including conducting clinical trials for our product candidates, protecting our intellectual property and providing general and administrative support for these operations. We have financed our operations primarily through private placements of convertible preferred stock, collaborations, public offerings of our securities, secured debt financings, sales of ONIVYDE and the Ipsen sale.

As of September 30, 2023, we had unrestricted cash and cash equivalents and short-term investment of $18.9 million. We expect that our cash and cash equivalents and short-term investment as of September 30, 2023 will be sufficient to continue our operations into 2027, when we estimate the longest-term potential Ipsen milestone may be achieved.

As of September 30, 2023, we had an accumulated deficit of $548.6 million. Our net loss from our continuing operations was $0.9 million and $1.1 million for the nine months ended September 30, 2023 and 2022, respectively. We do not expect to have any research and development expenses going forward. We do not expect to be profitable from our continuing operations in the future.

Financial Operations Overview

General and administrative expenses

General and administrative expenses consist primarily of stock-based compensation expenses, legal, intellectual property, business development, finance, information technology, corporate communications and investor relations. Other general and administrative expenses include costs for board of director’s costs, insurance expenses, legal and professional fees, and accounting and information technology services fees.

Interest income

Interest income consists primarily of interest income associated with our money market fund and short-term investment.

Critical Accounting Policies and Significant Judgments and Estimates

Our management’s discussion and analysis of our financial condition and results of operations is based on our condensed consolidated financial statements, which we have prepared in accordance with the rules and regulations of the Securities and Exchange Commission, or the SEC, and generally accepted accounting principles in the United States, or GAAP. The preparation of these condensed consolidated financial statements requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported expenses during the reporting periods. We evaluate our estimates and judgments on an ongoing basis. We base our estimates on historical experience and on various other factors that we believe are reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Our actual results may differ from these estimates under different assumptions or conditions.

Our critical accounting policies and the methodologies and assumptions we apply under them have not materially changed since March 9, 2023, the date we filed our Annual Report on Form 10-K for the year ended December 31, 2022. For more information on our critical accounting policies, refer to our Annual Report on Form 10-K for the year ended December 31, 2022.

13

Results of Operations

Comparison of the three months ended September 30, 2023 and 2022

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

(in thousands) |

|

2023 |

|

|

2022 |

|

Operating expenses: |

|

|

|

|

|

|

General and administrative expenses |

|

$ |

531 |

|

|

$ |

504 |

|

Total operating expenses |

|

|

531 |

|

|

|

504 |

|

Loss from operations |

|

|

(531 |

) |

|

|

(504 |

) |

Interest income |

|

|

252 |

|

|

|

62 |

|

Net loss |

|

$ |

(279 |

) |

|

$ |

(442 |

) |

General and administrative expenses

General and administrative expenses were $0.5 million for the three months ended September 30, 2023 compared to $0.5 million for the three months ended September 30, 2022, an increase of $27 thousand, or 5%. This increase was primarily attributable to the increase in the share-based compensation expense.

Interest income

Interest income was $0.3 million for the three months ended September 30, 2023 and $0.1 million for the three months ended September 30, 2022, primarily attributable to the increased interest rate earned on our money market funds and interest income earned from U.S. Treasury Bills and U.S. Treasury Notes.

Comparison of the nine months ended September 30, 2023 and 2022

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended

September 30, |

|

(in thousands) |

|

2023 |

|

|

2022 |

|

Operating expenses: |

|

|

|

|

|

|

General and administrative expenses |

|

$ |

1,686 |

|

|

$ |

1,567 |

|

Gain on sale of assets |

|

|

(139 |

) |

|

|

(445 |

) |

Total operating expenses |

|

|

1,547 |

|

|

|

1,122 |

|

Loss from operations |

|

|

(1,547 |

) |

|

|

(1,122 |

) |

Interest income |

|

|

606 |

|

|

|

70 |

|

Net loss |

|

$ |

(941 |

) |

|

$ |

(1,052 |

) |

General and administrative expenses

General and administrative expenses were $1.7 million for the nine months ended September 30, 2023 compared to $1.6 million for the nine months ended September 30, 2022, an increase of $0.1 million, or 8%. This increase was primarily attributable to the increase in the share-based compensation expense of apporximately $0.1 million.

Gain on sale of assets

Gain on sale of assets was $0.1 million and $0.4 million for the nine months ended September 30, 2023 and 2022, respectively, attributable to the sale of certain of our preclinical programs to third parties.

Interest income

Interest income was $0.6 million for the nine months ended September 30, 2023 and $0.1 million for the nine months ended September 30, 2022, primarily attributable to the increase of interest rate associated with our money market fund and interest income earned from U.S. Treasury Bills and U.S. Treasury Notes.

Liquidity and Capital Resources

Sources of liquidity

We have financed our operations through September 30, 2023 primarily through private placements of convertible preferred stock, collaborations, public offerings of our securities, secured debt financings, sales of our common stock, sales of our commercial and in-process research and development assets and exercise of stock options. As of September 30, 2023, we had unrestricted cash and cash equivalents and short-term investments of $18.9 million.

14

Cash flows

The following table provides information regarding our cash flows for the nine months ended September 30, 2023 and 2022:

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended

September 30, |

|

(in thousands) |

|

2023 |

|

|

2022 |

|

Net cash used in operating activities |

|

$ |

(1,227 |

) |

|

$ |

(1,557 |

) |

Net cash (used in) provided by investing activities |

|

|

(12,517 |

) |

|

|

445 |

|

Net cash provided by financing activities |

|

|

388 |

|

|

|

— |

|

Net decrease in cash and cash equivalents |

|

$ |

(13,356 |

) |

|

$ |

(1,112 |

) |

Operating activities

Cash used in operating activities of $1.2 million during the nine months ended September 30, 2023 was primarily a result of our $0.9 million net loss from operations. The net loss was offset by stock-based compensation expense of $0.1 million, and also adjusted by $0.1 million gain on the sale of in-process research and development, $0.2 million of accretion on short-term investment and a decrease in accounts payable, accrued expenses and other of $0.1 million.

Cash used in operating activities of $1.6 million during the nine months ended September 30, 2022 was primarily a result of our $1.1 million net loss from operations. The net loss was offset by stock-based compensation expense of $0.1 million, and also adjusted by $0.4 million gain on the sale of in-process research and development and a net decrease in accounts payable, accrued expenses and other of $0.1 million.

Investing activities

Cash used in investing activities of $12.5 million during the nine months ended September 30, 2023, was due to purchases of short-term investments of $15.6 million, offset by proceeds from maturity of short-term investment of $3.0 million and $0.1 million net proceeds from the sale of in-process research and development.

Cash provided by investing activities of $0.4 million during the nine months ended September 30, 2022, was due to net proceeds from the sale of in-process research and development.

Financing activities

Cash provided by financing activities of $0.4 million during the nine months ended September 30, 2023 was due to proceeds from the exercise of stock options. There was no cash provided by or used in financing activities during the nine months ended September 30, 2022.

Funding requirements

We have incurred significant expenses and operating losses to date. On May 30, 2019, we announced the completion of our review of strategic alternatives, following which our board of directors implemented a series of measures designed to extend our cash runway into 2027 and preserve our ability to capture the potential milestone payments resulting from the Ipsen sale. In connection with that announcement, we discontinued the discovery efforts on our remaining preclinical programs and implemented a reduction in headcount resulting in the termination of all remaining employees as of July 12, 2019. Our future capital requirements will depend on many factors, including:

•the timing and amount of potential milestone payments related to ONIVYDE that we may receive from Ipsen;

•the timing and amount of potential milestone payments that we may receive from Elevation;

•the timing and amount of any special dividend to our stockholders that our board of directors may declare;

•the timing and amount of general and administrative expenses required to continue to operate our company;

•the extent to which we owe any taxes for current, future or prior periods, including as a result of any audits by taxing authorities;

•the extent to which we invest in any future research or development activities of our product candidates;

15

•the costs of preparing, filing and prosecuting patent applications and maintaining, enforcing and defending intellectual property-related claims;

•the extent to which we acquire or invest in businesses, products and technologies; and

•the costs associated with operating as a public company and maintaining compliance with exchange listing and SEC requirements.

We do not believe that we will be able to raise a material amount of capital through the sale of our equity securities or debt financing. Rather, our goal is to judiciously expend our remaining cash until such time, if ever, as we receive additional milestone payments from Ipsen and Elevation. There can be no assurance as to the timing, terms or consummation of any financing. We do not have any committed external sources of funds. To the extent that we raise additional capital through the sale of equity or convertible debt securities, the ownership interest of our stockholders will be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect the rights of our stockholders. Debt financing, if available, may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. If we raise additional funds through arrangements with third parties, we may have to relinquish valuable rights to our future revenue streams or product candidates.

Contractual Obligations and Commitments

There were no material changes to our contractual obligations and commitments described under Management’s Discussion and Analysis of Financial Condition and Results of Operations in our Annual Report on Form 10-K for the year ended December 31, 2022, as filed with the SEC on March 9, 2023.

Off-Balance Sheet Arrangements

We did not have during the periods presented, and we do not currently have, any off-balance sheet arrangements, as defined under SEC rules.

Recent Accounting Pronouncements

See Note 7, “Recent Accounting Pronouncements,” in the accompanying notes to the condensed consolidated financial statements for a full description of recent accounting pronouncements.

16

Item 3. Quantitative and Qualitative Disclosures About Market Risk.

We invest in money market funds and U.S. Treasury Bills and U.S. Treasury Notes. The goals of our investment policy are preservation of capital, fulfillment of liquidity needs and fiduciary control of cash and investments. We also seek to maximize income from our investments without assuming significant risk.

Our primary exposure to market risk is interest income sensitivity, which is affected by changes in the general level of interest rates, particularly because our investments are money market funds. Due to the short-term duration of our investment portfolio and the low risk profile of our investments, an immediate 10% change in interest rates would not have a material effect on the fair market value of our portfolio. We have the ability and intention to hold our investments until maturity, and therefore, we would not expect our operating results or cash flows to be affected to any significant degree by the effect of a sudden change in market interest rates on our investment portfolio.

We do not currently have any auction rate or mortgage-backed securities. We do not believe our cash and cash equivalents have significant risk of default or liquidity, however we cannot provide absolute assurance that in the future our investments will not be subject to adverse changes in market value.

Item 4. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

Our management, with the participation of our principal executive and financial officer, evaluated the effectiveness of our disclosure controls and procedures as of September 30, 2023. The term “disclosure controls and procedures,” as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act means controls and other procedures of a company that are designed to ensure that information required to be disclosed by a company in the reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the SEC’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by a company in the reports that it files or submits under the Exchange Act is accumulated and communicated to the company’s management, including its principal executive and principal financial officers, as appropriate to allow timely decisions regarding required disclosure. Management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving their objectives and management necessarily applies its judgment in evaluating the cost-benefit relationship of possible controls and procedures. Based on the evaluation of our disclosure controls and procedures as of September 30, 2023, our principal executive and financial officer concluded that, as of such date, our disclosure controls and procedures were effective at the reasonable assurance level.

Changes in Internal Control Over Financial Reporting

No change in our internal control over financial reporting (as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act) occurred during the nine months ended September 30, 2023 that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

17

PART II

OTHER INFORMATION

Item 1. Legal Proceedings

None.

Item 1A. Risk Factors.

In addition to the other information set forth in this Quarterly Report on Form 10-Q, you should carefully consider the factors discussed under the caption “Risk Factors” that appear in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2022, which was filed with the SEC on March 9, 2023 (the “2022 Annual Report on Form 10-K”) and our quarterly report on Form 10-Q for the quarter ended June 30, 2023, which was filed with the SEC on August 3, 2023 (the “2023 Second Quarter 10-Q”). There have been no material changes from the risk factors previously disclosed in the 2022 Annual Report on Form 10-K and the 2023 Second Quarter 10-Q.

Item 2. Unregistered Sale of Equity Securities and Use of Proceeds

None.

Item 3. Default Upon Senior Securities

None.

Item 4. Mine Safety Disclosures

Not applicable.

Item 5. Other Information

Dividends

We do not currently intend to pay any regular cash dividends in the foreseeable future unless and until we receive any milestone payments from Ipsen or Elevation.

18

Item 6. Exhibits.

* Filed herewith.

+ Furnished herewith.

19

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

MERRIMACK PHARMACEUTICALS, INC. |

|

|

Date: November 2, 2023 |

By: |

/s/ Gary L. Crocker |

|

|

Gary L. Crocker |

|

|

President |

|

|

(Principal Financial Officer) |

20

Exhibit 31.1

CERTIFICATIONS

I, Gary L. Crocker, certify that:

1. I have reviewed this Quarterly Report on Form 10-Q of Merrimack Pharmaceuticals, Inc.;