SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c) of the

Securities Exchange Act of 1934

(Amendment No. 1)

|

Check the appropriate box:

|

|

|

|

|

☒

|

Preliminary Information Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

☐

|

Definitive Information Statement

|

Mike the Pike Productions, Inc.

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

|

☒

|

No Fee Required

|

|

|

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

| |

|

|

|

(1) Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

(2) Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

|

(4) Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

(5) Total fee paid:

|

|

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials:

|

|

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

|

|

|

|

|

|

(1) Amount previously paid:

|

|

|

|

|

|

|

|

|

(2) Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

|

(3) Filing party:

|

| |

|

| |

|

| |

(4) Date filed: |

| |

|

INFORMATION STATEMENT PURSUANT TO SECTION 14(C) OF THE SECURITIES

ESCHANGE ACT OF 1934 AND REGULATION 14C THEREUNDER

_________________________________________________________

WE ARE NOT ASKING YOU FOR A PROXY AND YOU

ARE REQUESTED NOT TO SEND US A PROXY

Mike the Pike Productions, Inc.

20860 N. Tatum Blvd. - Suite 300

Phoenix AZ 85050

NOTICE OF STOCKHOLDER ACTION BY WRITTEN CONSENT

Dear Stockholders:

This Notice and the enclosed Information Statement are being distributed to the holders of record of the common stock of Mike the Pike Productions, Inc., a Wyoming corporation (the “Company,” “we,” “us” or “our”), as of November 2, 2023 (the “Record Date”), as required by Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended. The purpose of the enclosed Information Statement is to inform our stockholders that on October 31, 2023, the Board of Directors of the Company (the “Board”) adopted resolutions (i) approving the change of the Company’s state of incorporation from the state of Wyoming to the state of Delaware (the “Reincorporation”); (ii) approving a one for fifty reverse stock-split with the timing of the stock-split to be contingent on further action of the Board of Directors (the” Reverse”); and (iii) approving a change of the Company’s name for “Mike the Pike Productions, Inc. to “Arowana Media Holdings, Inc.” (the “Name Change”). The Reincorporation, the Reverse and the Name Change are collectively referred to as the “Reorganization”. On STET 31, 2023, the holders of an aggregate of 3,175,429 shares of preferred stock adopted resolutions by written consent approving the Reorganization. The enclosed Information Statement shall be considered the notice required under Section 228(e) of the Wyoming Business Corporation Act (“WBCA”).

Under the WBCA, the Reincorporation required the approval of the holders of record of a majority of outstanding shares of common stock. The written consent that we received from our stockholders constitutes the only stockholder approval required to approve the Reorganization under the WBCA, our certificate of incorporation and our bylaws.

Only stockholders of record as of October 2, 2023 will be sent a copy of this Notice and Information Statement.

The Reorganization will become effective as soon as possible, but not sooner than 20 days following the date that this Information Statement is first mailed to our stockholders of record, upon the filing and acceptance of the Agreement and Plan of Merger with the Secretary of State of Delaware and the Secretary of State of Wyoming to the extent required by law. We expect to mail this Information Statement on or about November XX , 2023. The entire cost of mailing this Information Statement will be borne by us.

Under the WBCA, our stockholders are entitled to dissenter’s rights of appraisal in connection with the Reorganization which are described in this Information Statement.

PLEASE NOTE THAT THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER THE MATTERS DESCRIBED HEREIN. THIS INFORMATION STATEMENT IS BEING FURNISHED TO YOU SOLELY FOR THE PURPOSE OF INFORMING STOCKHOLDERS OF THE MATTERS DESCRIBED HEREIN. WE ARE NOT ASKING YOU FOR A CONSENT OR PROXY AND YOU ARE REQUESTED NOT TO SEND US A CONSENT OR PROXY.

| |

By Order of the Board of Directors,

|

|

|

|

|

|

| |

/s/ Mark B. Newbauer

|

|

|

| |

Mark B. Newbauer, Chief Executive Officer

|

|

|

|

|

|

|

|

November 1, 2023

|

|

MIKE THE PIKE PRODUCTIONS, INC.

INFORMATION STATEMENT

REGARDING ACTION TAKEN BY WRITTEN CONSENT

OF THE HOLDERS OF A MAJORITY OF THE OUTSTANDING SHARES

OF COMMON STOCK ENTITLED TO VOTE IN LIEU OF A MEETING.

NO VOTE OR OTHER ACTION OF THE COMPANY’S STOCKHOLDERS IS REQUIRED

IN CONNECTION WITH THIS INFORMATION STATEMENT.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

REORGANIZATION OF THE COMPANY

TO THE STATE OF DELAWARE

FROM THE STATE OF WYOMING

REVERSE STOCK SPLIT

NAME CHANGE

INTRODUCTION

This Information Statement advises the stockholders of Mike the Pike Productions, Inc., a Wyoming corporation (the “Company,” “we,” “us” or “our”), of the approval by the Company’s Board of Directors (the “Board”), and by the holders of a majority of the voting power of the common stock and preferred stock outstanding as of November 2, 2023 (the “Record Date”), of: (i) a change of the Company’s state of incorporation from the state of Wyoming to the state of Delaware (the “Reincorporation”); (ii) a one for fifty reverse stock split (the “Reverse”); and (iii) the change of the name of the Company from Mike the Pike Productions, Inc. to Arowana Media Holdings< Inc. (the “Name Change”) by means of a merger of the Company with and into a wholly-owned subsidiary of the Company, Arowana Media Holdings, Inc., a Delaware corporation (“DelCo”), recently established to affect the Reorganization. The Reincorporation, Reverse and Name Change are hereinafter collectively referred as the “Reorganization”. Assuming the merger, as proposed is affected, the DelCo will survive the merger and issue one share of its common stock for each fifty outstanding shares of the Company’s common stock in connection with the merger with all fractional shares being rounded up to the next whole number. The name of the Delaware corporation, which will be the successor to the Company, will be Arowana Media Holding, Inc.

The Company’s Board may abandon the Reorganization at any time prior to the Effective Time if it determines that the Reorganization is inadvisable for any reason and the Reverse is subject to review by the Financial Industry Regulatory Authority (“FINRA”) and will not be consummated until such review is complete.

AUTHORIZATION BY THE BOARD OF DIRECTORS AND THE STOCKHOLDERS

Under the Wyoming Business Corporation Act (“WBCA”) and the Company’s Bylaws, any action that can be taken at an annual or special meeting of stockholders may be taken without a meeting, without prior notice and without a vote if the holders of outstanding stock, having not less than the minimum number of votes necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present, consent to such action in writing. Under the WBCA, the merger of a Wyoming corporation with and into an entity organized under the laws of another jurisdiction requires the approval of the holders of a majority of the outstanding securities.

On the Record Date, there were 2,382,642,000 shares of common stock outstanding, with the holders thereof being entitled to cast one vote per share and 3,415,142 shares of preferred stock outstanding with the holders thereof entitled to vote with the common and cast 1,000 votes per share.

Our Board unanimously approved the Reorganization, the Reverse Split and the Name Change as well as the adoption of the Delaware Governing Documents (as defined below) on September 30 , 2023, subject to stockholder approval, and on September 30 , 2023, we received approval of the Reorganization, the Reverse Split and the Name Change from the holders of 95.5% of the combined voting power of the Preferred shares entitled to vote thereon and the 54,316,653 common shares which voted on these matters. .

Accordingly, we have obtained all corporate approval required for the matters set forth herein. We do not require and we are not seeking any further consent to these matters. This Information Statement is furnished solely for the purposes of advising stockholders of the approval of the Reorganization, the Reverse Split and the Name Change and giving stockholders notice thereof, as required by the WBCA and the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

We will, following the expiration of the 20-day period mandated by Rule 14c of the Exchange Act and review by FINRA of the Reverse, complete the Reorganization, Reverse Split and Name Change by filing the Agreement and Plan of Merger with the Delaware Secretary of State and the Articles of Merger with the Wyoming Secretary of State.

I

REORGANIZATION OF THE COMPANY

AS A DELAWARE CORPORATION

MECHANICS OF REINCORPORARTION

The Reorganization will be affected by the merger of the Company with and into, a wholly-owned subsidiary of the Company that has been incorporated under the Delaware General Corporation Law (the “DGCL”) for purposes of the Reorganization, pursuant to the terms of an Agreement and Plan of Merger, a copy of which is attached to this Information Statement as Appendix A (the “Plan”). After the Reorganization, the Company will cease to exist and DelCo will be the surviving corporation and will continue to operate the business of the Company as it existed prior to the Reorganization.

The Reorganization will be effective after we file with the Delaware Secretary of State a certificate of merger (the “Certificate Merger”) and file with the Wyoming Secretary of State articles of merger (the “Articles of Merger”) (the “Effective Time”). No action with respect to the Reorganization, including the filing of the Certificate of Merger or the Articles of Merger, will occur less than 20 days after the date this Information Statement is first mailed to or otherwise delivered to our stockholders.

After the Effective Time, DelCo will be governed by the articles of incorporation of DelCo as filed with the Delaware Secretary of State (the “Certificate of Incorporation”) and bylaws that conform to Delaware corporate and other laws (the “Bylaws” and the Certificate of Incorporation and the Bylaws are collectively referred to herein as the “Delaware Governing Documents”). Copies of the Governing Documents (as defined below) are attached to this Information Statement as Appendix B and Appendix C.

Upon the Effective Time, each fifty shares share of Company’s common stock outstanding will automatically be converted into one share of the common stock of DelCo with fractional shares rounded up to the next whole number. In addition, each outstanding warrant to purchase shares of Company common stock will be converted into a warrant to purchase one Fiftieth (0.02) shares of DelCo common stock at the same exercise price with no other changes in the terms and conditions of such warrants. Each outstanding share of Company common stock prior to the Effective Time will be cancelled upon the Effective Time and will thereafter be, by operation of law, a twentieth of a share of DelCo with fractional shares rounded up to the next whole number.

Appraisal and Dissenters’ Rights

Under the WBCA, a properly dissenting shareholder is entitled to receive the appraised value of the shares owned by the shareholder in certain specified situations, including when the corporation votes (i) to sell, lease, or exchange all or substantially all of its property and assets other than in the regular course of the corporation’s business, (ii) to merge or consolidate with another corporation, or (iii) to participate in a share exchange.

The WBCA also provides that, unless otherwise provided in the corporation’s charter, no appraisal rights are available to holders of shares of any class of stock which is either: (a) listed on a national securities exchange or designated as a national market system security on an inter-dealer quotation system by the National Association of Securities Dealers, Inc. or (b) held of record by more than 2,000 shareholders. The above limitations do not apply if the shareholders are required by the terms of the re-incorporation to accept anything other than: (i) shares of stock of the surviving corporation; (ii) shares of stock of another corporation which are or will be so listed on a national securities exchange or designated as a national market system security on an inter-dealer quotation system by Nasdaq or held of record by more than 2,000 shareholders; (iii) cash in lieu of fractional shares of such stock; or (iv) any combination thereof. If any Shareholders properly dissent, the we will seek to establish the fair value of their shares and make an appropriate payment to those shareholders. Management does not believe any such payment would exceed the present market value of approximately $0.004 per share on the record date. The Board reserves the right to abandon the Reorganization if a sufficient number of shares are subject to dissenters’ rights that in the Board’s judgement the required payment to shareholders would be detrimental to the Company’s prospects.

A dissenting shareholder must notify the Company of its exercise of dissenter’s rights, in writing, by sending a communication to the Company’s office at Mike the Pike Productions, Inc., 20860 N. Tatum Blvd. - Suite 300, Phoenix AZ 85050 Attn: Secretary. The communication should state the shareholder’s name, address, number of shares held and that the shareholder is electing dissenter’s rights. All such elections must be received by November , 2023. If the mails are used, certified mail, return receipt requested, is recommended.

REASONS FOR THE REORGANIZATION

The primary reason that our Board approved the Reorganization is to increase the financial community’s acceptance of the Company. Management believes that has a Delaware corporation we may be more attractive to sophisticated investors. However, we have no arrangements for any particular financing and no assurance can be given that any financing will in fact occur. Management is aware that franchise taxes are higher in Delaware than in Wyoming, but through the chosen capital structure of Arowana Media Holdings, Inc. has sought to minimize the impact thereof. If the Reorganization had been affected in calendar 2022, we would have paid $ in franchise taxes to Delaware as opposed to the $50 we paid in Wyoming.

EFFECTS ON THE COMPANY

General

The Reorganization will not result in any change in the business, physical location, management, assets, liabilities or net worth of the Company, nor will it result in any change in location of the Company’s current employees, including management. Upon consummation of the Reorganization, the daily business operations of the Company will continue as they are presently conducted at the Company’s principal executive office located at 20860 N. Tatum Blvd. - Suite 300, Phoenix AZ 85050. The consolidated financial condition and results of operations of DelCo immediately after consummation of the Reorganization will be the same as those of the Company immediately prior to the consummation of the Reorganization. In addition, upon the Effective Date, the board of directors of DelCo will consist of those persons elected to the current Board of the Company and the individuals serving as executive officers of the Company immediately prior to the Reorganization will continue to serve as the executive officers of DelCo, without a change in title or responsibilities. Upon the Effective Date, DelCo will be the successor in interest to the Company.

Effect of the Reorganization on the Company’s Securities

Capital Stock

The authorized capital stock of the Company currently consists of 2,249,000,000 shares of common stock and with 2,382,642,,000 shares outstanding, each with a par value of $0.001 and 100,000,000 shares of preferred stock with 2,415,142 shares of Sereis A Preferred Stock issued and outstanding, each with a par value of $0.001 per share. Upon effectiveness of the Reorganization, we will have 500,000,000 shares of common stock authorized, each with a par value of $0.0001 and approximately 4,454,000 shares of common stock outstanding. The number of shares of preferred stock we are authorized to issue will be 5,000,000 shares and each share of preferred stock will become on share of a similar preferred stock of DelCo. Each share of common stock outstanding immediately prior to the Reorganization automatically will be converted into one fiftieth (0.02) of a share of common stock of DelCo. These changes will occur without any action required on the part of any shareholder.

Other Securities

As of the date of this Information Statement, other than the outstanding shares of common stock and shares of the Preferred A, the Company does not have any options, warrants or any other type of securities outstanding.

No Effect on the Quotation of Common Stock and the Company’s SEC Reporting Obligations

Our common stock is traded on the OTCMarkets under the Symbol “MIKP (Pink)”. After the Reorganization is completed we may seek a new trading symbol which aligns with our new corporate name and may seek to qualify for the OTCQB market. Our obligations as a reporting company subject to the requirements of the Securities Exchange Act of 1934, as amended, will be unchanged

No Action is Required by Stockholders to Receive Shares of DelCo

No action will be required on the part of the Company’s stockholders to receive shares of DelCo upon completion of the Reorganization. Pursuant to the Plan, the issued and outstanding shares of common stock of the Company will automatically be converted into shares of common stock of DelCo and certificates representing shares of common stock of the Company will automatically be deemed to represent shares of common stock of DelCo.

Stockholders are not Required to Exchange their Certificates

Stockholders are not required to exchange certificates evidencing shares of the Wyoming corporation for certificates evidencing shares of the Delaware corporation. Stockholders that wish to receive certificates of DelCo in exchange for their certificates of the Company, may submit their certificates for exchange to the Company’s transfer agent at:

Madison Stock Transfer Inc.

2500 Coney Island Avenue - Sub Level

Brooklyn, NY 11223

Telephone number: 718-627-4453

Delaware and Wyoming Governing Laws and Documents

Upon the effectiveness of the Reorganization, the Company will change its state of incorporation to Delaware and will thereafter be governed by the DGCL , the DelCo Articles of Incorporation and Bylaws. There are certain differences between the rights of our stockholders under:

|

|

●

|

the WBCA, the existing Wyoming Charter and the Wyoming Bylaws (together, the “Wyoming Governing Documents”) (collectively, such rights, the “Wyoming Rights”) copies of which have been filed with the Securities and Exchange Commission; and

|

|

|

|

|

|

|

●

|

the DGCL, DelCo’s Delaware Certificate of Incorporation (the “Delaware Charter”) and Delaware Bylaws (the “Delaware Bylaws” and together with the Delaware Charter, the “Delaware Governing Documents”) (collectively, such rights, the “Delaware Rights”), copies of which are exhibits hereto.

|

Although the DGCL and the WBCA currently in effect are similar in many respects, certain differences will affect the rights of our stockholders after the Reorganization is completed. The following discussion summarizes aspects of the Delaware Rights and the Wyoming Rights considered by management to be significant and is qualified in its entirety to the full text of the Wyoming Governing Documents, the Delaware Governing Documents, the WBCA and the DGCL.

|

Provision

|

Delaware

|

Wyoming

|

|

Dividends

|

Under the DGCL, the board of directors of a may declare and pay dividends on shares of its capital stock either: (i) out of its surplus, as defined in and computed in accordance with the DGCL; or (ii) if there is no surplus, out of the corporation’s net profits for the fiscal year in which the dividend is declared and/or the preceding fiscal year.

Share dividends: A corporation may pay a dividend in shares of capital stock. If the dividend is paid in shares of unissued capital stock the board of directors must direct that there be designated as capital in respect of such shares an amount which is not less than the aggregate par value of the capital stock being declared as a dividend; however, no designation as capital is necessary if shares are being distributed by a corporation pursuant to a split-up or division of its stock rather than as payment of a dividend declared payable in stock of the corporation.

|

Under the WBCA, the board of directors may authorize and the corporation may make distributions to its stockholders, provided that, a distribution may not be made if, after giving it effect: the corporation would not be able to pay its debts as they become due in the usual course of business; or the corporation’s total assets would be less than the sum of its total liabilities plus (unless the articles of incorporation permit otherwise) the amount that would be needed, if the corporation were to be dissolved at the time of the distribution, to satisfy the preferential rights upon dissolution of stockholders whose preferential rights are superior to those receiving the distribution. A corporation may make a distribution, among other ways, by: (i) the purchase, redemption, or other acquisition of the corporation’s shares; or (ii) the distribution of indebtedness.

Share dividends: Unless the articles of incorporation provide otherwise, shares may be issued pro rata and without consideration to the stockholders or to the stockholders of 1 or more classes or series; provided that shares of one class or series may not be issued as a share dividend in respect of shares of another class or series unless: (i) the articles of incorporation so authorize; (ii) a majority of the votes entitled to be cast by the class or series to be issued approve the issue; or (iii) there are no outstanding shares of the class or series to be issued.

The Wyoming Charter permitted us to declare and pay a dividend in shares of one class or series of capital stock to the holders of shares of another class or series of shares of capital stock but only if the designation of such class or series of capital stock to which the dividend would be declared and paid requires such distributions. The Board had the authority to provide for the payment of dividends as contemplated by the foregoing sentence in the designation of any class or series of capital stock hereafter authorized to be issued by the corporation.

|

|

Removal of Directors

|

With limited exceptions applicable to classified boards and cumulative voting provisions, under the DGCL directors may be removed, with or without cause, by the holders of a majority of shares then entitled to vote in an election of directors. Under the DGCL, directors may not be removed by the board of directors. The Delaware Bylaws provide that any director or the entire Board of Directors may be removed either with or without cause at any time by the affirmative vote of the holders of a majority of the shares then entitled to vote for the election of directors at any annual or special meeting of the stockholders called for that purpose or by written consent

|

The WBCA provides that, with limited exceptions applicable to classified boards and cumulative voting provisions, the stockholders may remove one or more directors with or without cause unless the articles of incorporation provide that directors may be removed only for cause.

The Wyoming Bylaws provide that at a special meeting called expressly for the purpose of removal of directors, the stockholders entitled to vote for a director may remove such Director, with or without cause, by the affirmative vote of the holders of 66⅔% of the shares then entitled to vote for such director.

|

|

Filling Board Vacancies and Newly Created Vacancies

|

The Delaware Bylaws provide that a vacancy on the Board, whether created as a result of the death, resignation or otherwise, or a newly created directorships created by an increase in the total number of directors may be filled solely by the affirmative vote of a majority of the remaining directors then in office, although less than a quorum, unless the Board of Directors determines that any such vacancies or newly created directorships shall be filled by the stockholders.

Under the DGCL, vacancies and newly created directorships may also be filled by the stockholders entitled to vote thereon unless the bylaws otherwise provide.

|

The Wyoming Bylaws provide that a vacancy on the Board, whether created as a result of death, resignation or otherwise, or a newly created directorships created by an increase in the total number of directors may be filled by the affirmative vote of a majority of the remaining directors then in office, although less than a quorum. Under the WBCA, vacancies and newly created directorships may also be filled by the stockholders entitled to vote thereon unless the articles of incorporation provide otherwise. The Wyoming Bylaws do not provide otherwise.

|

|

Stockholder Right to Call Special Meetings

|

Under the Delaware Bylaws, special meetings of stockholders may be called only by the affirmative vote of a majority of the Board, the Chairman of the Board, the Chief Executive Officer or the President.

|

Under the Wyoming Bylaws, special meetings of stockholders may be called only by the affirmative vote of a majority of the Board, the Chairman of the Board, the Chief Executive Officer or the President.

|

|

Stockholder Action by Written Consent

|

Under the DGCL, unless the certificate of incorporation provides otherwise, any action required or permitted to be taken at a meeting of the stockholders may be taken without a meeting if the holders of outstanding stock having at least the minimum number of votes that would be necessary to authorize or take such action at a meeting consent to the action in writing.

Under the Delaware Charter, stockholders can take action by written consent if stockholders holding not less than the minimum number of votes required to authorize or take such action consent.

|

Under the WBCA, an action required or permitted to be taken at a stockholders’ meeting may be taken without a meeting if the action is taken by all stockholders entitled to vote on the action. Wyoming law also allows a corporation’s articles of incorporation to provide that any action required or permitted to be taken at a stockholders’ meeting may be taken without a meeting, and without prior notice, if consents in writing setting the forth the action so taken are signed by the holders of outstanding shares having not less than the minimum number of votes that would be required to authorize or take the action at the meeting at which all shares entitled to vote on the action were presented and voted.

The Wyoming Charter permits action to be taken by written consent of the stockholder as described above.

|

|

Notice of Stockholder Meetings

|

Under the DGCL and the Delaware Bylaws, notice of stockholder meetings may be given by mail, courier service, email (unless the stockholder has notified the Company of an objection to receiving notice by email) or another form of electronic transmission consented to by the stockholder. Notice to each stockholder, regardless of method of delivery, will be delivered not less than 10 nor more than 60 days before the meeting.

|

Under the WBCA, notice shall be in writing unless oral notice is reasonable under the circumstances. Notice by electronic transmission is written notice.

Notice may be communicated in person; by telephone, telegraph, teletype, or other form of wire or wireless communication; or by mail or courier. Written notice is effective upon deposit in the mail or when electronically transmitted to the stockholder in a manner authorized by the stockholder. Notice to each stockholder will be delivered not less than 10 nor more than 60 days before the meeting.

The Wyoming Bylaws default to the WBCA with respect to notice of stockholder meetings and permit notice by electronic means.

|

|

Advance Notice Requirements

|

Under the Delaware Bylaws, in order to submit a proposal or director nomination at an annual meeting of stockholders, stockholders must provide the Company with advance notice of such proposal or nomination not less than 90 nor more than 120 days prior to the first anniversary of the previous year’s annual meeting; provided, however, that if the date of the upcoming meeting is delayed or advanced more than 30 days from such anniversary, then the notice must be received on the later of the 60th day prior to the upcoming annual meeting date or the 10th day following the day on which public announcement of the upcoming annual meeting date is first made.

|

Under the Wyoming Bylaws, in order to submit a proposal or director nomination at an annual meeting of stockholders, stockholders must provide the Company with advance notice of such proposal or nomination not less than 90 nor more than 120 days prior to the first anniversary of the previous year’s annual meeting; provided, however, that if the date of the upcoming meeting is delayed or advanced more than 30 days from such anniversary, then the notice must be received on the later of the 60th day prior to the upcoming annual meeting date or the 10th day following the day on which public announcement of the upcoming annual meeting date is first made.

|

|

Stockholder Vote Required for Certain Transactions

|

Under the DGCL, a merger, consolidation or sale of all or substantially all of a corporation’s assets must generally be approved by the corporation’s board of directors and a majority of the outstanding shares entitled to vote.

In a merger between a parent and a subsidiary corporation (in which the parent owns at least 90% of the subsidiary’s outstanding stock), there is no requirement of stockholder approval from either corporation, provided the subsidiary is merged into a parent corporation.

The DGCL does not require a stockholder vote of the surviving corporation in a merger (unless the corporation provides otherwise in its certificate of incorporation) if:

(a) the plan of merger does not amend the existing certificate of incorporation;

(b) each share of stock of the surviving corporation outstanding immediately before the effective date of the merger is an identical outstanding share after the merger; and

(c) either (i) no shares of common stock of the surviving corporation and no shares, securities or obligations convertible into such stock are to be issued or delivered under the plan of merger, or (ii) the authorized unissued shares or shares of common stock of the surviving corporation to be issued or delivered under the plan of merger plus those initially issuable upon conversion of any other shares, securities or obligations to be issued or delivered under such plan do not exceed 20% of the shares of common stock of such constituent corporation outstanding immediately prior to the effective date of the merger.

|

Under the WBCA, a merger, consolidation or sale of all or substantially all of a corporation’s assets must generally be approved by the corporation’s board of directors and the holders of a majority of the outstanding shares entitled to vote.

In a merger between a parent and a subsidiary corporation (in which the parent owns at least 80% of the subsidiary’s outstanding stock), there is no requirement of stockholder approval from either corporation, unless the articles of incorporation of any of the corporations otherwise provide, and unless, in the case of a foreign subsidiary, approval by the subsidiary’s board of directors or stockholders is required by the laws under which the subsidiary is organized.

Under the WBCA, approval by a corporation’s stockholders of a plan of merger or share exchange is not required if:

(i) the corporation will survive the merger or is the acquiring corporation in a share exchange;

(ii) its articles of incorporation will not be changed, other than certain permitted amendments;

(iii) each stockholder of the corporation whose shares were outstanding immediately before the effective date of the merger or share exchange will hold the same number of shares, with identical preferences, limitations, and relative rights, immediately after the effective date of change.

A sale, lease, exchange, or other disposition of a corporation’s assets requires stockholder approval if the disposition would leave the corporation without a significant continuing business activity. If a corporation retains a business activity that represented at least 25% of total assets at the end of the most recent fiscal year, and 25% of either income from continuing operations or revenues from continuing operations for that fiscal year, the corporation will be deemed to have retained a significant continuing business activity and no stockholder approval will be required.

|

|

Directors’ Standard of Conduct

|

Directors standards of conduct are governed by case law that hold that directors of Delaware corporations are subject to the fiduciary duties of care and loyalty (which include the subsidiary duties of good faith, oversight and disclosure).

The duty of care requires informed, deliberative decision-making based on all material information reasonably available.

The duty of loyalty requires acting (including deciding not to act) on a disinterested and independent basis, in good faith, with an honest belief that the action is in the best interests of the corporation and its stockholders.

|

Under the WBCA, a director, when discharging his or her duties, must act in good faith and in a manner he or she reasonably believes to be in or at least not opposed to the best interests of the corporation. The members of the board or a committee of the board, when becoming informed in connection with their decision-making function or devoting attention to their oversight function, are required to discharge their duties with the care that a person in a like position would reasonably believe appropriate under similar circumstances.

|

|

Limitations on Director Liability; Exculpation

|

Under the DGCL, if a corporation’s certificate of incorporation so provides, the personal liability of a director for monetary damages for breach of fiduciary duty as a director may be eliminated or limited. A corporation’s certificate of incorporation, however, may not limit or eliminate a director’s personal liability (a) for any breach of the director’s duty of loyalty to the corporation or its stockholders, (b) for acts or omissions not in good faith or involving intentional misconduct or a knowing violation of law, (c) for the payment of unlawful dividends, stock repurchases or redemptions, or (d) for any transaction in which the director received an improper personal benefit.

The Delaware Charter contains a provision eliminating the personal liability of directors for monetary damages to the fullest extent permitted by law.

|

The WBCA provides generally that a director shall not be liable to the corporation or its stockholders for any decision to take or not to take action, or any failure to take any action including abstaining from voting after full disclosure, as a director, unless the party asserting liability in a proceeding establishes the following: (i) that certain enumerated defenses to liability were not asserted, including a provision in the articles of incorporation limiting liability in the manner allowed by Wyoming law; and (ii) the challenged conduct consisted or was the result of (a) an action not in good faith, (b) a decision which the director did not reasonably believe to be in or at least not opposed to the best interests of the corporation, (c) lack of objectivity or lack of independence, due to familial, financial, or business relationships, (d) failure to devote timely attention to the business and affairs of the corporation, or (e) receipt of an improper financial benefit.

The WBCA provides that directors shall not be personally liable to a corporation or its stockholders for monetary damages for breach of fiduciary duty as a director except for liability (i) for receipt of a financial benefit to which he is not entitled, (ii) for an intentional infliction of harm on the corporation or its stockholders, (iii) for participating in unlawful distributions to stockholders, or (iv) for an intentional violation of criminal law. Such provision protects directors against personal liability for monetary damages for breaches of their duty of care.

The Wyoming Charter and the Wyoming Bylaws contain provisions eliminating the personal liability of directors for monetary damages to the fullest extent permitted by law.

|

|

Indemnification

|

Under the DGCL, a corporation may indemnify any person who was or is a party or is threatened to be made a party to a proceeding (other than an action by or in the right of the corporation) by reason of the fact that the person is or was a director, officer, employee or agent of the corporation against amounts reasonably incurred by the person in connection with such proceeding if the person acted in good faith and in a manner the person reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe their conduct was unlawful. Unless judicially authorized, corporations may not indemnify a person in connection with a proceeding by or in the right of the corporation in which the person was adjudged liable to the corporation. However, a corporation must indemnify an officer or director “to the extent” the person is successful on the merits or otherwise in defending himself or herself.

The Delaware Charter contains a provision requiring indemnification of directors, officers, employees or agents to the fullest extent permitted by law and advancement of expenses, if requested. The Delaware Bylaws also require the Company to indemnify employees and to advance expenses to any person entitled to indemnification upon request.

|

Under the WBCA, a corporation may indemnify an individual who is a party to a proceeding because the individual is a director against liability incurred in the proceeding if: (a)(i)(A) The director conducted himself in good faith; and (B) He reasonably believed that his conduct was in or at least not opposed to the corporation’s best interests; and (C) In the case of any criminal proceeding, the director had no reasonable cause to believe his conduct was unlawful; or (ii) the director engaged in conduct for which broader indemnification has been made permissible or obligatory under a provision of the articles of incorporation, as authorized by the WBCA.

(b) Unless ordered by a court, a corporation may not indemnify a director under this section: (i) In connection with a proceeding by or in the right of the corporation, except for reasonable expenses incurred in connection with the proceeding if it is determined that the director has met the standard of conduct under the WBCA (described above under the heading “Limitations on Director Liability; Exculpation”); or (ii) In connection with any proceeding with respect to conduct for which he was adjudged liable on the basis that he received a financial benefit to which he was not entitled, whether or not involving action in the director’s capacity.

The Wyoming Charter and Wyoming Bylaws contain provisions requiring the Company to indemnify directors and officers to the fullest extent permitted by law.

|

|

Business Opportunities

|

The DGCL does not codify standards of conduct with respect to the business or corporate opportunities, rather, such standards are described in court opinions. As described by the Delaware Supreme Court, the corporate opportunity doctrine “holds that a corporate officer or director may not take a business opportunity for his own if: (1) the corporation is financially able to exploit the opportunity; (2) the opportunity is within the corporation’s line of business; (3) the corporation has an interest or expectancy in the opportunity; and (4) by taking the opportunity for his own, the corporate fiduciary will thereby be placed in a position inimical to his duties to the corporation.

|

Under the WBCA, a director’s taking advantage, directly or indirectly, of a business opportunity may not be the subject of equitable relief, or give rise to an award of damages or other relief against the director, in a proceeding by or in the right of the corporation on the ground that the opportunity should have first been offered to the corporation, if before becoming legally obligated respecting the opportunity the director brings it to the attention of the corporation and: (i) action by qualified directors disclaiming the corporation’s interest in the opportunity is taken in compliance with the procedures set forth in the WBCA as if the decision being made concerned a director’s conflicting interest transaction; or (ii) stockholders’ action disclaiming the corporation’s interest in the opportunity is taken in compliance with the procedures set forth in the WBCA, as if the decision being made concerned a director’s conflicting interest transaction, except that, rather than making required disclosure, in each case the director shall have made prior disclosure to those acting on behalf of the corporation of all material facts concerning the business opportunity that are then known to the director.

|

|

Appraisal Rights

|

Under the DGCL, stockholders of record who follow certain procedures are generally entitled to appraisal rights only in the case of certain mergers or consolidations.

However, appraisal rights are generally not available under the DGCL with respect to shares of any class or series of stock that is listed on a national securities exchange or held of record by more than 2,000 stockholders unless the shares are entitled to receive in the merger or consolidation anything other than:

(a) shares of stock of the corporation surviving or resulting from such merger or consolidation,

(b) shares of stock of any other corporation which at the effective date of the merger of consolidation will be either listed on a national securities exchange or held of record by more than 2,000 stockholders,

(c) cash in lieu of fractional shares of the corporation described in the foregoing clauses (a) and (b), or

(d) any combination of clauses (a), (b), or (c).

In cases where appraisal rights are available, the DGCL permits a stockholder who has received notice of appraisal rights, and who has not voted in favor of the merger (i.e., the stockholder can either vote against or abstain from voting) and who has submitted a timely written demand for appraisal, to file a petition with the Court of Chancery of the State of Delaware to demand a determination of the fair value of such stockholders’ shares. Such petition must be filed within 120 days after the effective date of a merger or consolidation.

|

Under the WBCA, stockholders of record who follow specified procedures are generally entitled to appraisal rights in the event of any of the following corporate actions: (i) consummation of a plan of merger or consolidation in which stockholder approval is required or where the corporation is a subsidiary that is merged with its parent; (ii) consummation of a share exchange to which the corporation is a party as the corporation whose shares will be acquired, if the stockholder is entitled to vote on the exchange; (iii) certain dispositions of assets if the stockholder is entitled to vote on such disposition; (iv) certain amendments to the articles of incorporation; (v) any amendment to the articles of incorporation, merger, share exchange, or disposition of assets if specifically provided for in the articles of incorporation, bylaws, or resolution of the board of directors; (vi) a transfer or domestication if the stockholder does not receive shares in the foreign corporation resulting from the transfer or domestication that have terms as favorable to the stockholder in all material respects, and represent at least the same percentage interest of the total voting rights of the outstanding shares of the corporation, as the shares held by the stockholder before the transfer or domestication; (vii) a conversion of the corporation to nonprofit status; or (viii) a conversion of the corporation to an unincorporated entity.

However, appraisal rights are generally not available under the WBCA with respect to shares of any class or series of stock that is listed on a national securities exchange or held of record by more than 2,000 stockholders and a market value of at least $20,000,000.

In cases where appraisal rights are available, if a stockholder who has conformed to required procedures is not satisfied with the fair value of the shares proposed by the corporation to be paid to stockholders asserting their appraisal rights, such stockholder may make a demand for payment and if such demand remains unsettled, the corporation is required to commence a proceeding within 60 days after receiving the payment demand and petition the court to determine the fair value of the shares and accrued interest. If the corporation does not commence the proceeding within the 60-day period, it must pay each stockholder demanding appraisal rights whose demand remains unsettled the amount demanded plus interest.

Under the WBCA, a court in an appraisal proceeding may assess the costs of the proceeding against the corporation, except that the court may assess costs against all or some of the stockholders demanding appraisal, in amounts the court finds equitable, to the extent the court finds the stockholders demanding appraisal rights acted arbitrarily or not in good faith.

Neither the Wyoming Charter nor the Wyoming Bylaws modify the statutory appraisal rights provided under the WBCA.

|

|

Stockholder Right to Inspect Stockholder List

|

Under the DGCL, any stockholder may upon making a demand under oath stating the purpose thereof, inspect the stockholders’ list for any purpose reasonably related to the person’s interest as a stockholder. In addition, for at least 10 days prior to each stockholder meeting, a Delaware corporation must make available for examination a list of stockholders entitled to vote at the meeting.

|

Under the WBCA, a stockholder is entitled to inspect and copy the stockholders list and certain other corporate records if the stockholder gives the corporation written notice of the stockholder’s demand at least 5 days before the date on which the stockholder wishes to inspect and copy. In addition, for at least 2 business days after notice of the meeting is given for which the list was prepared and continuing through the meeting, a Wyoming corporation must make available for inspection and copy a list of stockholders entitled to vote at the meeting.

|

|

Business Combinations with Interested Stockholders

|

Under the DGCL, subject to certain exceptions specified therein, a corporation is prohibited from engaging in any “business combination” with any “interested stockholder” for a three-year period following the date that such stockholder becomes an interested stockholder unless:

(a) prior to such date, the board of directors of the corporation approved either the business combination or the transaction which resulted in the stockholder becoming an interested stockholder;

(b) upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced (excluding shares held by directors who are also officers and employee stock purchase plans in which employee participants do not have the right to determine confidentially whether plan shares will be tendered in a tender or exchange offer); or

(c) on or subsequent to such date, the business combination is approved by the board of directors of the corporation and by the affirmative vote at an annual or special meeting, and not by written consent, of at least 66 2/3% of the outstanding voting stock which is not owned by the interested stockholder.

An “interested stockholder” under the DGCL is any person other than the corporation and its majority-owned subsidiaries who owns at least 15% of the outstanding voting stock, or who is an affiliate or associate of the corporation and owned at least 15% within the preceding three years.

“Business combinations” under the DGCL include, subject to certain exceptions specified therein, mergers and consolidations between corporations or with an interested stockholder; sales, leases, mortgages or other dispositions to an interested stockholder of assets of the corporation or one of its majority-owned subsidiaries with an aggregate market value which either equals 10% or more of the corporation’s consolidated assets or outstanding stock; issuances and transfers to an interested stockholder of stock; any transaction with an interested stockholder that would increase the proportionate stock ownership of an interested stockholder; and the receipt by an interested stockholder of any benefit from loans, guarantees, pledges or other financial benefits provided by the corporation.

A Delaware corporation may elect to waive the above restriction in its certificate of incorporation.

The Delaware Charter does not exclude DelCo from the restrictions imposed under Section 203 of the DGCL.

|

Under the WBCA, a “qualified corporation” is prohibited from engaging in a “combination” with an “interested stockholder” for 3 years following the date that such person becomes an interested stockholder and places certain restrictions on such combinations even after the expiration of the three-year period. A “qualified corporation” is large publicly traded corporation (i.e. more than $10 million in assets), incorporated in Wyoming and which has “substantial business operations” in Wyoming (as set forth in the Wyoming Statutes) With certain exceptions, an interested stockholder is a person or group that owns fifteen-percent (15%) or more of the corporation’s outstanding voting power (including stock with respect to which the person has voting rights and any rights to acquire stock pursuant to an option, warrant, agreement, arrangement, or understanding or upon the exercise of conversion or exchange rights) or is an affiliate or associate of the corporation and was the owner of fifteen-percent (15%) or more of such voting stock at any time within the previous two years. A Wyoming corporation may elect not to be governed by this provision by either a specific provision in in its articles of incorporation or a statement in its bylaws that it elects not to be subject to these restrictions. Our bylaws include a statement that we elect not to be subject to these restrictions.

|

|

Transactions with Officers and Directors

|

Under the DGCL, a contract or transaction between a corporation and one or more of its officers or directors or an entity in which they have an interest is not void or voidable solely because of such interest or the participation of the director or officer in a meeting of the board of directors or a committee which authorizes the contract or transaction if:

(a) the material facts as to the relationship or interest and as to the contract or transaction are disclosed or are known to the board of directors or the committee, and the board of directors or committee in good faith authorizes the contract or transaction by the affirmative votes of a majority of disinterested directors, even though the disinterested directors are less than a quorum;

(b) the material facts as to the relationship or interest and as to the contract or transaction are disclosed or are known to the stockholders entitled to vote thereon, and the contract or transaction is specifically approved in good faith by vote of the stockholders; or

(c) the contract or transaction is fair as to the corporation as of the time it is authorized, approved or ratified by the board of directors, a committee thereof or the stockholders.

|

Under the WBCA, a transaction between a corporation and a director may not be the subject of equitable relief, or give rise to an award of damages on the ground that the director has an interest in the transaction, if it is not a director’s “conflicting interest transaction.”

A “director’s conflicting interest transaction” is a transaction: (A) to which the director is a party; or (B) respecting which the director had knowledge and a material financial interest known to the director; or (C) respecting which the director knew that a related person was a party or had a material financial interest.

A transaction is not a director’s conflicting interest transaction if: (i)(A) the director’s action respecting the transaction was approved by a majority of the disinterested directors or the holders of a majority of the outstanding shares, excluding the shares held by the interested director but only if the stockholders were provided with all material information relating to the transaction, including the existence and nature of the director’s conflicting interest; and (B) all facts known to the director respecting the subject matter of the transaction that a director free of such conflicting interest would reasonably believe to be material in deciding whether to proceed with the transaction, or (ii) The transaction, judged according to the circumstances at the relevant time, is established to have been fair to the corporation, meaning that it was fair in terms of the director’s dealings with the corporation and comparable to what might have been obtainable in an arm’s length transaction, given the consideration paid or received by the corporation..

|

|

Exclusive Forum

|

As permitted under the DGCL, the Delaware Bylaws provide that unless the Company consents in writing to the selection of an alternative forum, (a) the Court of Chancery of the State of Delaware shall be the sole and exclusive forum for (i) any derivative action or proceeding brought on behalf of the Corporation, (ii) any action asserting a claim of breach of a fiduciary duty owed by any director, officer or other employee of the Corporation to the Corporation or the Corporation’s stockholders, (iii) any action asserting a claim arising pursuant to any provision of the DGCL, the Delaware Charter or the Delaware Bylaws, (iv) any action to interpret, apply, enforce or determine the validity of the Delaware Charter or the Delaware Bylaws, or (v) any action asserting a claim governed by the internal affairs doctrine (or, if the Court of Chancery does not have jurisdiction, then the Superior Court of the State of Delaware, or if no state court in Delaware has jurisdiction, the federal district court for the District of Delaware); and (b) the federal district courts of the United States shall be the exclusive forum for the resolution of any complaint asserting a cause of action arising under the Securities Act.

|

The WBCA does not have a corresponding provision regarding forum exclusivity.

|

|

Amendments to Charter

|

Under the DGCL, except for certain ministerial changes, and except where a greater stockholder vote is required by a certificate of incorporation, a corporation’s certificate of incorporation may be amended only if the board adopts a resolution setting forth the proposed amendment and deeming it advisable and such proposed amendment is approved by the holders of a majority of the outstanding stock entitled to vote on such amendment.

However, wherever the certificate of incorporation requires action by the board or the holders of securities having voting power that is greater than is required by law, such provision may not be altered, amended or repealed except by such greater vote.

Additionally, the DGCL provides that the holders of the outstanding shares of a class shall be entitled to vote as a class on any amendment, whether or not entitled to vote thereon by the certificate of incorporation, to increase or decrease the aggregate number of authorized shares of such class (unless the certificate of incorporation provides otherwise), increase or decrease the par value of the shares of such class, or alter or change the powers, preferences, or special rights of the shares of such class so as to affect them adversely (provided that in the case of any such amendment that adversely affects the powers, preferences or special rights of one or more series of any class but does not so affect the entire class, then only the shares of the series so affected shall be considered a separate class for this purpose)..

|

Under the WBCA, except where a greater stockholder vote is required by the articles of incorporation, a corporation’s articles of incorporation may be amended only if the board adopts a resolution setting forth the proposed amendment and deeming it advisable and such proposed amendment is approved by the holders of a majority of the outstanding stock entitled to vote on such amendment.

However, wherever the certificate of incorporation requires action by the board or the holders of securities having voting power that is greater than is required by law, such provision may not be altered, amended or repealed except by such greater vote.

The WBCA further provides that the holders of the outstanding shares of a class shall be entitled to vote as a class on any amendment, whether or not entitled to vote thereon by the certificate of incorporation, if the amendment would: (i) effect an exchange or reclassification of all or part of the shares of the class into shares of another class; (ii) effect an exchange or reclassification, or create the right of exchange, of all or part of the shares of another class into shares of the class; (iii) change the rights, preferences, or limitations of all or part of the shares of the class; (iv) change the shares of all or part of the class into a different number of shares of the same class; (v) create a new class of shares having rights or preferences with respect to distributions or to dissolution that are prior or superior to the shares of the class; (vi) increase the rights, preferences, or number of authorized shares of any class that, after giving effect to the amendment, have rights or preferences with respect to distributions or to dissolution that are prior or superior to the shares of the class; (vii) limit or deny any existing preemptive right of all or part of the shares of the class; or (viii) cancel or otherwise affect rights to distributions that have accumulated but not yet been authorized on all or part of the shares of the class.

|

|

Amendment of Bylaws

|

Under the DGCL, the vote of a majority of the shares cast at a meeting of the stockholders is required to adopt, amend or repeal the by-laws, unless the certificate of incorporation or by-laws provide otherwise. If permitted under the corporation’s certificate of incorporation, the board of directors may also take such action.

Under the Delaware Bylaws, stockholders may amend the bylaws by the vote of 66⅔% of the outstanding shares of the Company entitled to vote thereon. The Delaware Charter also provides that the Board may amend the Delaware By-laws without stockholder approval, however, any bylaw adopted by the Board may be amended or repealed by stockholders.

|

Under the WBCA, a corporation’s board of directors may amend or repeal the corporation’s bylaws unless: (i) the articles of incorporation reserves this power exclusively to the stockholders in whole or part; or (ii) the stockholders in amending, repealing, or adopting a bylaw provide expressly that the board of directors may not amend, repeal, or reinstate the bylaw.

Under the Wyoming Bylaws, the Board may alter, amend or repeal the bylaws and new bylaws may be adopted by a majority of the board. The Wyoming Bylaw provision does not effect the rights of stockholders to amend the Wyoming Bylaws under the WBCA.

|

|

Expiration of Proxies

|

Under the DGCL, a proxy executed by a stockholder will remain valid for a period of three years unless the proxy provides for a longer period.

|

Under the WBCA, a proxy is valid for a period of 11 months unless a longer time is stated therein.

|

Accounting Treatment of the Reorganization

The Reorganization would be accounted for as a reverse merger under which, for accounting purposes, DelCo would be considered the acquirer and would be treated as the successor to the Company’s historical operations. Accordingly, the Company’s historical financial statements would be treated as the financial statements of DelCo.

Certain U.S. Federal Income Tax Consequences of the Reorganization

The following is a brief summary of certain U.S. federal income tax consequences to holders of the Company’s common stock who receive common stock as a result of the Reorganization. The summary sets forth such consequences to the Company’s shareholders who hold their shares as a capital asset (generally, an asset held for investment).

This summary is for general information only and does not purport to be a complete discussion or analysis of all potential tax consequences that may apply to a shareholder. Shareholders are urged to consult their tax advisors to determine the particular tax consequences of the Reorganization, including the applicability and effect of federal, state, local or foreign tax laws. This summary is based on the Internal Revenue Code of 1986, as amended (the “Code”), the Treasury Regulations promulgated thereunder, and rulings and decisions in effect as of the date of this proxy statement, all of which are subject to change, possibly with retroactive effect, and to differing interpretations.

The Company has neither requested nor received a tax opinion from legal counsel with respect to the U.S. federal income tax consequences of the Reorganization. No rulings have been or will be requested from the Internal Revenue Service as to the federal income tax consequences of the Reorganization.

The Reorganization provided for in the Merger Agreement is intended to be treated as a “tax-free” reorganization as described in Section 368(a)(1)(F) of the Code. Assuming that the Reorganization qualifies as a “tax-free” reorganization, no gain or loss will be recognized to the holders of the Company’s Common Stock as a result of the consummation of the Reorganization, and no gain or loss will be recognized by the Company or DelCo. The basis of the acquired assets in the hands of DelCo will be the same as the Company's basis in such assets. Each former holder of the Company’s Common Stock will have the same basis in DelCo Common Stock received by that holder pursuant to the Reorganization as was the basis in the Company Common Stock held at the time the Reorganization was consummated. Each shareholder’s holding period with respect to the DelCo Common Stock will include the period during which that shareholder held the corresponding the Company’s Common Stock, provided the latter was held by such holder as a capital asset at the time the Reorganization was consummated.

II

REASONS FOR THE REVERSE STOCK SPLIT

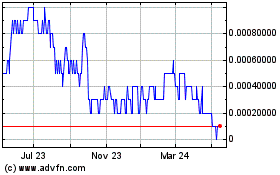

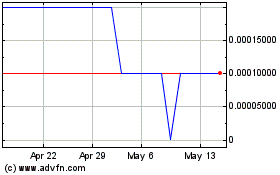

We are affecting a reverse stock split of one share for fifty, with fractional shares rounded up to the next whole number (the “Reverse Split”). We note that our share has traded below a penny and by reason of its low market price we are limited to the “PinkOTC” market even though we are a subject to the reporting requirements of the Exchange Act. Management believes that the Reverse Split will bring the stock price well above $0.01 and permit the Company to apply for inclusion on the OTCQB and, should our business grow, to apply for inclusion in higher level markets. Inclusion in the OTCQB should provide additional liquidity for our shareholders and may make it more likely that we can obtain financing. However, no assurance is given that we will be successful at moving to the OTCQB, that broker acceptance of our stock or trading levels or prices will improve or that we will receive any additional financing.

III

REASON FOR THE NAME CHANGE

While there may be historical reasons for our present corporate name, our business in primarily conducted through our wholly owned subsidiary Arowana Media, LLC. Management believes that it will be beneficial for our dealings with our customers if the parent company also employs the “Arowana name.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND

RELATED STOCKHOLDER MATTERS

At the record date of September 2023, there were outstanding shares of our common stock. The following table sets forth information regarding the beneficial ownership of our common stock as of the record date by:

|

|

●

|

each person whom we know beneficially owns more than 5% of our common stock;

|

|

|

●

|

each of our named executive officers and directors; and

|

|

|

●

|

all of our executive officers and directors as a group.

|

The number of shares of common stock beneficially owned by each person is determined under the rules of the Commission and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which such person has sole or shared voting power or investment power and also any shares which the individual has the right to acquire within 60 days after the date hereof, through the exercise of any stock option, warrant or other right. Unless otherwise indicated, each person has sole investment and voting power (or shares such power with his or her spouse) with respect to the shares set forth in the following table. The inclusion herein of any shares deemed beneficially owned does not constitute an admission of beneficial ownership of those shares.

The information presented below regarding beneficial ownership of our voting securities has been presented in accordance with the rules of the Securities and Exchange Commission and is not necessarily indicative of ownership for any other purpose. Under these rules, a person is deemed to be a “beneficial owner” of a security if that person has or shares the power to vote or direct the voting of the security or the power to dispose or direct the disposition of the security. A person is deemed to own beneficially any security as to which such person has the right to acquire sole or shared voting or investment power within 60 days through the conversion or exercise of any convertible security, warrant, option or other right. More than one person may be deemed to be a beneficial owner of the same securities. The percentage of beneficial ownership by any person as of a particular date is calculated by dividing the number of shares beneficially owned by such person, which includes the number of shares as to which such person has the right to acquire voting or investment power within 60 days, by the sum of the number of shares outstanding as of such date plus the number of shares as to which such person has the right to acquire voting or investment power within 60 days. Consequently, the denominator used for calculating such percentage may be different for each beneficial owner.

|

Name and Address(1)

|

|

Amount and

Nature of

Beneficial

Ownership

Common

|

|

|

Percentage of

Class Common

|

|

|

Amount of

Preferred

|

|

|

Percentage of

Preferred

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mark Newbauer

|

|

|

54,316,653 |

|

|

|

2.4 |

%

|

|

|

3,014,286 |

(2) |

|

|

88.4 |

%

|

|

James DiPrima

|

|

|

0 |

|

|

|

0 |

|

|

|

161,143 |

|

|

|

4.7 |

%

|

|

All Officers and Directors as a group (1 person)

|

|

|

54,316,653 |

|

|

|

2.4 |

%

|

|

|

3,175,429 |

|

|

|

93.1 |

%

|

(1) The address for the persons named in the table above is c/o the Company.

(2) On October 2, 2023, the Board of Directors authorized the issuance of an additional 1,000,000 shares of Series A Convertible Preferred to Mark Newbauer, our CFO and sole director. Without these additional shares, because of the increased number of common shares being issued, there was no assurance Mr. Newbauer would own enough Preferred A shares to maintain voting control.

This table is based upon information derived from our stock records. We believe that each of the shareholders named in this table has sole or shared voting and investment power with respect to the shares indicated as beneficially owned; except as set forth above, applicable percentages are based upon 2,382,642,000 shares of common stock issued and outstanding and 3,415,142 shares of Series A Convertible Preferred Stock issued and outstanding.

Each share of Preferred A has 1,000 votes for each share of Preferred held of record.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

None of the Company’s executive officers or directors has a substantial interest, direct or indirect, by security holdings or otherwise in the Reorganization which is not shared by all of the Company’s stockholders.

WHERE YOU CAN FIND MORE INFORMATION

The Company is subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and files reports and other information with the SEC. Such reports and other information filed by the Company may be inspected and copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the SEC’s public reference rooms. The SEC also maintains a website that contains reports, proxy statements and other information regarding registrants that file electronically with the SEC. The address of the SEC’s web site is http://www.sec.gov.

INCORPORATON BY REFERENCE

The SEC allows the Company to “incorporate by reference” into the Proxy Statement document it files with the SEC. This means that the Company can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be a part of this Proxy Statement, and later information that the Company filed with the SEC as specified below will update and supersede that information. Except to the extent the information is deemed furnished and not filed pursuant to securities laws and regulations, the Company incorporates by reference the following filing:

| |

●

|

The Company’s Form 10 as amended to date, filed on August 23, 2023; and

|

| |

●

|

The Company’s Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023 and June 30, 2023, as filed on June 28, 2023 and August 22, 2023, respectively.

|

|

APPENDICES

|

| |

|

A.

|

Agreement and Plan of Merger

|

|

|

|

|

|

|

B.

|

Delaware Certificate of Incorporation and Certificate of Designation

|

|

|

|

|

|

|

C.

|

Delaware Bylaws

|

|

Appendix A

AGREEMENT AND PLAN OF MERGER

OF

MIKE THE PIKE PRODUCTIONS, INC.

(A Wyoming Corporation)

and

AROWANA MEDIA HOLDINGS, INC.

(A Delaware Corporation)

AGREEMENT AND PLAN OF MERGER, dated as of October ____, 2023, by and between Mike The Pike Productions, Inc. a Wyoming corporation ("MIKP"), and AROWANA MEDIA HOLDINGS, Inc., a Delaware corporation ("Surviving Corporation").

W I T N E S S E T H

MIKP is a corporation duly organized and existing under the laws of the State of Wyoming.

The Surviving Corporation is a corporation duly organized and existing under the laws of the State of Delaware.

The authorized number of shares of MIKP is Five Billion (5,000,000,000) shares of Common Stock, $0.0001 par value per share.

The authorized number of shares of Surviving Corporation is Five Hundred and Five Million (505,000,000) shares of which Five Hundred Million (500,000,000) shares are Common Stock, $.0001 par value per share and Five (5,000,000) Million shares are Preferred Shares, $.0001 par value per share.

The Boards of Directors of MIKP and the Surviving Corporation deem it advisable for the mutual benefit of MIKP, the Surviving Corporation, and their respective shareholders, that MIKP be merged with and into the Surviving Corporation and have approved this Agreement and Plan of Merger (the "Agreement").

NOW, THEREFORE, in consideration of the premises and of the mutual covenants, agreements and provisions hereinafter contained, the parties hereto agree that, in accordance with the applicable laws of the States of Wyoming and Delaware, MIKP shall be, at the Effective Date of the Merger (as hereinafter defined), merged with and into the Surviving Corporation, which shall be the surviving corporation, and that the terms and conditions of such merger and the mode of carrying it into effect shall be as follows:

ARTICLE I

Merger

1.1 On the Effective Date of the Merger, MIKP shall be merged with and into Surviving Corporation. The separate existence of MIKP shall cease and the Surviving Corporation shall continue in existence and, without other transfer, succeed to and posses all the properties, rights, privileges, immunities, powers, purposes and franchises, of a public, as well as of a private nature, and shall be subject to all of the obligations, liabilities, restrictions, disabilities and duties of MIKP and Surviving Corporation, all without further act or deed, as provided in Section 259 of the Delaware General Corporation Law.

1.2 All rights of creditors and all liens upon the property of either MIKP or Surviving Corporation shall be preserved unimpaired by the Merger, and all debts, liabilities, obligations and duties, including, but not limited to, the obligations of MIKP pursuant to any existing guarantees, leases, stock options or other contracts or agreements, of either MIKP or the Surviving Corporation shall, on the Effective Date of the Merger, become the responsibility and liability of Surviving Corporation, and may be enforced against it to the same extent as if said debts, liabilities, obligations and duties had been incurred or contracted by it. All corporate acts, plans (including but not limited to stock option plans), policies, arrangements, approvals and authorizations of MIKP, its shareholders, board of directors, officers and agents, which were valid and effective immediately prior to the Effective Date of the Merger, shall be taken for all purposes as the acts, plans, policies, arrangements, approvals and authorizations of the Surviving Corporation and shall be as effective and binding thereon as the same were with respect to MIKP.