false000160616300016061632023-11-012023-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 1, 2023

LIMBACH HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-36541 | 46-5399422 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

797 Commonwealth Drive, Warrendale, Pennsylvania 15086

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (412) 359-2100

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.0001 par value | LMB | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| | | | | |

| Item 7.01 | Regulation FD Disclosure |

On November 1, 2023, Limbach Holdings, Inc. issued a press release announcing the closing of the acquisition of Greensboro, NC-based specialty mechanical contractor, Industrial Air, LLC (“Industrial Air”), for a purchase price at closing of $13.5 million in cash. The transaction also provides for an earnout of up to $6.5 million.

The information in this Current Report on Form 8-K and the exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | LIMBACH HOLDINGS, INC. | |

| | | | |

| | | | |

| | By: | /s/ Jayme L. Brooks | |

| | | Name: Jayme L. Brooks | |

| | | Title: Executive Vice President and Chief Financial Officer | |

Dated: November 2, 2023

FOR IMMEDIATE RELEASE

Limbach Holdings, Inc. Acquires Greensboro, NC – Based Specialty Mechanical Contractor Industrial Air, LLC

WARRENDALE, PA – November 2, 2023 – Limbach Holdings, Inc. (Nasdaq: LMB) (“Limbach” or the “Company”) today announced the closing of the acquisition of Industrial Air, LLC (“IA”), a specialty mechanical contractor based in Greensboro, North Carolina, for an initial enterprise value of $13.5 million in an all-cash transaction.

Transaction Highlights

•IA provides environmental mechanical and air filtration solutions and custom air handling equipment to industrial customers, with a particular expertise in serving the mission critical needs of leading businesses in the textile industry.

•Headquartered in Greensboro, North Carolina, IA establishes Limbach’s presence in a diversified and fast-growing geographic market from which the Company can continue to expand in the industrial and institutional sectors.

•IA’s business model aligns well with Limbach’s focus on executing on ODR opportunities and providing critical solutions to owners of sophisticated manufacturing and process facilities.

•IA expects to contribute on average an estimated $30.0 million in revenue and $4.0 million in EBITDA annually.

•Total consideration paid by Limbach at closing was $13.5 million (subject to typical working capital adjustments), sourced from available cash, with performance-based, contingent earn-outs totaling $6.5 million potentially being paid over the next two years.

Background on Industrial Air, Inc.

Founded in 1964 and led by second generation President Allen R. Hunter, Jr., IA serves industrial customers throughout the Southeast United States and along the Eastern Seaboard. IA focuses on delivering engineered air handling systems, including air condition and air filtration, along with controls systems and maintenance work.

Management Comments

Michael McCann, Limbach’s President and Chief Executive Officer, said, "As we continue to carve our path in the industry, our growth strategy unfolds through three critical pillars. We seek culturally compatible firms, encompassing small 'tuck-in' deals and larger opportunities that will enable us to enter new geographies as we look to fill out our footprint east of the Mississippi river. Acquiring IA presents an exciting frontier, allowing us to continue to complete acquisitions that meet our geographic expansion objectives. The Carolinas offer a growing and diversified market well-represented by leading companies operating mission-critical facilities within our six core verticals. Serving as an indispensable provider of mechanical solutions to textile and other industries, IA functions as a solutions expert in their niche market sector. Additionally, IA's 'ODR-heavy' model aligns seamlessly with our own, promising an exciting synergy. They have also demonstrated alignment with our culture, strong leadership, and unique strengths, all critical when acquiring a new firm. With the acquisition closing yesterday, we expect that IA's impact on Limbach's revenue and earnings in 2023 will be minimal. However, we anticipate a more substantial

contribution in our full-year 2024 results. More generally, we continue to view the acquisition environment favorably and remain committed to executing additional transactions that meet our acquisition criteria."

IA’s President Allen R. Hunter, Jr. added, “After multiple generations of family ownership during which IA became a leading, solutions-oriented provider of mechanical services and fabricated equipment, we’re excited to join the Limbach family. I’m most excited about our firms’ cultural compatibility and Limbach’s intention to create long-term career opportunities for IA team members. In addition, we are looking forward to leveraging Limbach’s engineering and design capabilities and corporate services platform to maximize the opportunities in our market. I am looking forward to continuing to lead the IA business unit, and to growing our presence in mission critical markets.”

About Limbach

Limbach is a building systems solutions firm with expertise in the design, prefabrication, installation, management and maintenance of heating, ventilation, air-conditioning ("HVAC"), mechanical, electrical, plumbing and controls systems. With over 1,500 team members and 19 offices located throughout the United States, we partner with institutions with mission-critical infrastructures, such as data centers and healthcare, industrial & light manufacturing, cultural & entertainment, higher education, and life science facilities. With Limbach's full life-cycle capabilities, from concept design and engineering through system commissioning and recurring 24/7 service and maintenance, Limbach is positioned as a value-added and indispensable partner for building owners, construction managers, general contractors, and energy service companies.

Forward-Looking Statements

We make forward-looking statements in this press release within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements relate to expectations or forecasts for future events, including, without limitation, the expected contribution from and related to our acquisition of IA (including estimated revenue and EBITDA projections), our earnings, Adjusted EBITDA, revenues, expenses, backlog, capital expenditures or other future financial or business performance or strategies, results of operations or financial condition, and in particular statements regarding the impact of the COVID-19 pandemic on the construction industry in future periods, timing of the recognition of backlog as revenue, the potential for recovery of cost overruns, and the ability of Limbach to successfully remedy the issues that have led to write-downs in various business units. These statements may be preceded by, followed by or include the words “may,” “might,” “will,” “will likely result,” “should,” “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek,” “continue,” “target” or similar expressions. These forward-looking statements are based on information available to us as of the date they were made and involve a number of risks and uncertainties which may cause them to turn out to be wrong. Some of these risks and uncertainties may in the future be amplified by the COVID-19 outbreak and there may be additional risks that we consider immaterial or which are unknown. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Please refer to our most recent annual report on Form 10-K, as well as our subsequent filings on Form 10-Q and Form 8-K, which are available on the SEC’s website (www.sec.gov), for a full discussion of the risks and other factors that may impact any forward-looking statements in this press release.

Investor Relations

The Equity Group, Inc.

Jeremy Hellman, CFA

Vice President

(212) 836-9626 / jhellman@equityny.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

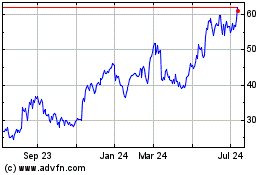

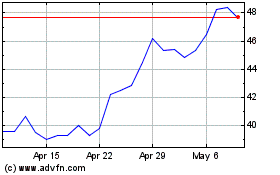

Limbach (NASDAQ:LMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Limbach (NASDAQ:LMB)

Historical Stock Chart

From Apr 2023 to Apr 2024