0001450704

false

0001450704

2023-11-01

2023-11-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 1, 2023

VIVAKOR, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-41286 |

|

26-2178141 |

| (State

or other jurisdiction of |

|

(Commission |

|

(IRS

Employer |

| incorporation

or organization) |

|

File

Number) |

|

Identification

No.) |

4101 North Thanksgiving Way

Lehi,

UT 84043

(Address

of principal executive offices)

(949)

281-2606

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

VIVK |

|

The

Nasdaq Stock Market LLC (Nasdaq Capital Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

7.01 Regulation FD Disclosure.

On November 1, 2023,

Vivakor, Inc., a Nevada corporation (the “Company”), published via press release a Shareholder Letter wherein CEO James Ballengee

discussed the Company’s recent history as well as its vision and strategy for the future (the “Letter”). The Letter

furnished hereto as Exhibit 99.1, incorporated herein by reference.

The Letter can also

be found on the Company’s website at www.vivakor.com/

The

information in Item 7.01 and Item 8.01 to this Current Report on Form 8-K, including Exhibit 99.1 is being furnished and shall not be

deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the

liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended,

except as expressly set forth by specific reference in such filing.

Item

8.01 Other Events

The

information set forth in Item 7.01 of this Current Report on Form 8-K is incorporated by reference into this Item 8.01.

Forward-Looking

Statements

This

Current Report on Form 8-K includes information that may constitute forward-looking statements. These forward-looking statements are

based on the Company’s current beliefs, assumptions and expectations regarding future events, which in turn are based on information

currently available to the Company. By their nature, forward-looking statements address matters that are subject to risks and uncertainties.

Forward looking statements include, without limitation, statements relating to projected industry growth rates, the Company’s current

growth rates and the Company’s present and future cash flow position. A variety of factors could cause actual events and results,

as well as the Company’s expectations, to differ materially from those expressed in or contemplated by the forward-looking statements.

Risk factors affecting the Company are discussed in detail in the Company’s filings with the Securities and Exchange Commission.

The Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information,

future events or otherwise, except to the extent required by applicable securities laws.

Item

9.01. Financial Statements and Exhibits

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

VIVAKOR,

INC. |

| |

|

|

| Dated:

November 1, 2023 |

By: |

/s/

James Ballengee |

| |

|

Name:

James Ballengee |

| |

|

Title:

Chief Executive Officer |

Exhibit 99.1

Vivakor

Issues Shareholder Update

Revenue

Increased to $29.1 Million and Operating Loss Decreased to $2.0 Million for the First Half 2023

Evaluating

Several Strategic Acquisitive and Organic Growth Opportunities

Lehi, UT – Accesswire – November

1, 2023 -Vivakor, Inc. (Nasdaq: VIVK) (“Vivakor” or the “Company”), a

socially responsible operator, acquirer and developer of clean energy technologies and environmental solutions, is pleased to

provide a Shareholder Update, from its Chairman and Chief Executive Officer James Ballengee.

To

the Shareholders of Vivakor, Inc.:

I

write to you today with gratitude, pride and excitement. Gratitude and pride for the dedication and support of our employees, partners

and shareholders in our accomplishments to date, and great excitement for the value I see for us in the path ahead.

Since

our strategic acquisition in Q3 2022 of our two gathering facilities, Silver Fuels Delhi in Louisiana and Colorado City close to Midland,

Texas, the Company has had several significant milestones in the growth of our business.

In

Q4 of 2022, I was appointed as Chairman and CEO of the Company. I am an established energy industry entrepreneur having successfully

sold three oil and gas companies over the past several years for an aggregate value of approximately $1 billion. With my relationships

and track record, I believe I am well-positioned to maximize the value of Vivakor’s patented technologies and business opportunities.

In Q1 of 2023, we

added two new independent members to the Company’s Board of Directors that also have oil and gas experience to support our Company’s

endeavors, namely John R. Harris and Albert Johnson . In addition, we added an additional independent

member to our Board of Directors, David Natan to chair our Audit Committee, and added Tyler Nelson, our Chief Financial Officer, to our

Board of Directors both of which strengthen the accounting experience on our Board of Directors.

During the first six months of 2023 the Company

has executed on the gathering centers and has achieved better than expected revenues than was projected at the time of the acquisition.

The Company projected revenue of $26.4 million from the acquired companies for the six months ended June 30, 2023, and the acquired companies

realized approximately $29.1 million in revenue during this period, representing a 10.2% increase over projections. This included

revenues for the second quarter of this year of $13.6 million with a slightly positive adjusted EBITDA when we add back non-cash

charges for stock-based compensation. These assets are essential to the long term vision of the Company as both locations have added

strategic relationships to enable future growth and expected future profitability of the Company.

Our legacy technology, the Remediation Processing

Center (RPC) soil extraction technology has had many updates to note. Our initial RPC that is located in Kuwait has been redeployed to

a project for Kuwait Oil Company (KOC) in partnership with Al Dai International Co. (DIC) for the Kuwait Environmental Remediation Project

(KERP), which is a multi-billion dollar project funded by the United Nations (UN) to clean up the oil that was spilled during the Gulf

Wars and still polluting the desert. This RPC also was used for trials to show the effectiveness of the RPC technology. The polluted

material that was used in the trials had a contamination range between 7% and 18% oil by weight. All trials were overseen by Enshaat,

the main contractor with KOC for the project, and KOC itself. In all of the trials, the RPC successfully reduced the oil content in the

soil to as little as 0.02% which led to us receiving a Category A approval, the highest possible KOC approval rating. It is our understanding

that we are the only technology that has been able to remediate contaminated soil with 18% oil by weight to less than 1% oil by weight

and receive a Category A certification.

Due

to our successful trial results, the Company was able to borrow $1.9 million USD from DIC to move the RPC that was originally located

in Utah (RPC II) to Kuwait so that both RPCs may work on the project in Kuwait. RPC II is currently en route to Kuwait and is expected

to arrive before the end of the year. The Company is expecting to receive a license fee of $20 per ton and operational costs of the RPC

are expected to be covered by DIC. Management is expecting the RPCs to process as much as 40 tons per hour based on the volume of feedstock

supplied. Overall, we believe that the KERP project contains as much as 26 million tons of contaminated material. We plan to maximize

the RPC technology with partners and capital from the Middle East for the purpose of creating a low-risk revenue and profit stream for

the Company. With the successful trials, and the movement of RPCII to Kuwait, we believe the first steps have been accomplished in this

endeavor.

The

RPCs have been financed via Special Purpose Vehicles (SPVs) that were structured to allow the SPV investors of the RPCs to take

advantage of the depreciation and participate in the gross revenue from oil sales. Currently, the SPV participants receive up to 25%

of the gross revenues from oil sales. Management feels that in the current financial market it would make sense to continue these types of

financings to accelerate the Company’s expansion of RPCs for current and future projects. This enables the Company to have

access to capital that will be less dilutive in nature to the Company shareholders and decrease the need for capital from the

current markets that tends to be very dilutive in nature and, together with extreme warrant coverage, has negatively impacted many

companies’ market capitalizations. At such time, when the Company has sufficient cashflows or access to less dilutive capital,

it can then exercise its right to buy out the SPV investors, if one exists, and collect all of the revenues being generated from the

RPCs.

The

Company has moved RPC II from the Utah site but still maintains the lease for the property in Utah. We believe this is still an opportunity

for the Company and plan to explore it at a later date.

The

RPC Houston project has hit many significant milestones. In Q4 of 2022, the Company finalized the lease of approximately three acres close

to Lake Houston. In Q1 of 2023 an SPV closed its offering, netting approximately $13.7 million for the manufacture of facilities to process

up to 40 tons of material at the Houston site. We were able to prepare the facility to process and store both the tank bottom sludge

and other contaminated soil that it will be receiving along with the cleaned soil and recovered oil from its remediation process.

In

addition, the Company, in Q2 2023, closed on a $2.2 million debt financing to expand the Houston site to add a washout facility. The

addition of the washout capability will allow Vivakor’s Houston facility to offer a full-service remediation center for the producers

of the tank bottom sludge. With this addition of the wash plant, we anticipate customers will be able to drop off contaminated waste

for remediation into sellable, reclaimed oil, and have their trucks and containers cleaned for reuse in the same facility.

Construction

of the RPC in Houston is nearly complete and the wash plant is in the latter stages of construction. We are currently waiting on permits

from the Texas Railroad Commission and the EPA to allow us to operate the facility. We anticipate those to be approved in the near future

and to begin processing samples shortly after receiving the permits.

We

believe the Houston site provides a tremendous opportunity for the Company. The current, estimated going rate for accepting hazardous

waste such as tank bottom sludge is $400-$500 per ton and current wash fees can run as much as $2,000 per truck with all of its containers.

Once the waste is taken in, we believe that we will be able to recover and reuse at least 1.3 barrels of oil per ton of waste. It is

our goal to set up similar facilities in the years to come and reclaim and recycle millions of barrels of oil per year.

Overall,

management will endeavor to apply technologies to assist the world in its transition to green energy and in that process will deploy

different strategies and assets needed to accomplish this goal. If you have any questions please see our filings with the SEC.

Sincerely,

James

Ballengee

Chairman

and Chief Executive Officer

About

Vivakor, Inc.

Vivakor,

Inc. (NASDAQ:VIVK), is a clean energy technology company focused on the oil remediation and natural resources sectors. Vivakor’s

corporate mission is to create, acquire, accumulate, and operate distinct assets, intellectual properties, and exceptional technologies.

Its Silver Fuels Delhi, LLC, and White Claw Colorado City, LLC subsidiaries include crude oil gathering, storage, and transportation

facilities, which feature long-term ten year take-or-pay contracts.

The

Company’s patented Remediation Processing Centers allows for the environmentally-friendly recovery of bitumen (heavy crude) and

other hydrocarbons from the remediation of contaminated soils. It is believed to be the only remediation system that can clean soils

with more than 5% by weight oil contamination while recovering the oil and leaving the soil fully viable for reuse. Its Remediation Processing

Centers currently focus on extraction from shallow, oil-laden sands, along with generating petroleum-based remediation projects in Kuwait

and in Houston, Texas.

For

more information, please visit our website: http://vivakor.com

Forward-Looking

Statements

This

news release may contain forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities

Litigation Reform Act of 1995. Such statements are based upon our current expectations and speak only as of the date hereof. Our actual

results may differ materially and adversely from those expressed in any forward-looking statements as a result of various factors and

uncertainties, including economic slowdown affecting companies, our ability to successfully develop products, rapid change in our markets,

changes in demand for our future products, legislative, regulatory and competitive developments and general economic conditions. These

risks and uncertainties include, but are not limited to, risks and uncertainties discussed in Vivakor’s filings with the Securities

and Exchange Commission, which factors may be incorporated herein by reference. Forward-looking statements may be identified but not

limited by the use of the words “anticipates,” “expects,” “intends,” “plans,” “should,”

“could,” “would,” “may,” “will,” “believes,” “estimates,” “potential,”

or “continue” and variations or similar expressions. We undertake no obligation to revise or update publicly any forward-looking

statements for any reason.

Investors

Contact:

P:949-281-2606

info@vivakor.com

ClearThink

nyc@clearthink.capital

SOURCE: Vivakor

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

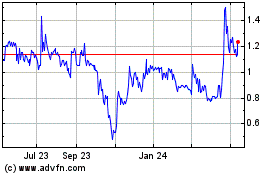

Vivakor (NASDAQ:VIVK)

Historical Stock Chart

From Mar 2024 to Apr 2024

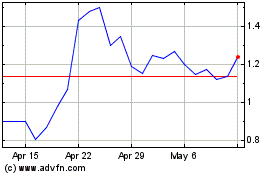

Vivakor (NASDAQ:VIVK)

Historical Stock Chart

From Apr 2023 to Apr 2024