UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C INFORMATION

Information

Statement Pursuant to Section 14(c) of the Securities Exchange Act of 1934

Check

the appropriate box:

| ☐ |

Preliminary

Information Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| ☒ |

Definitive

Information Statement |

LIBERTY

STAR URANIUM & METALS CORP.

(Name

of Registrant As Specified In Its Charter)

Payment

of Filing Fee (Check the Appropriate Box):

| ☒ |

No

fee required |

| ☐ |

$125.00

per Exchange Act Rule 0-11(c)(1)(ii) or 14c-5(g) and 0-11 |

| ☐ |

Fee

computed on table below per Exchange Act Rules 14c-5(g) and 0-11 |

| 1. |

Title

of each class of securities to which transaction applies: |

|

| |

|

|

| |

|

|

| 2. |

Aggregate

number of securities to which transaction applies: |

|

| |

|

|

| |

|

|

| 3. |

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 |

|

| |

|

|

| |

|

|

| 4. |

Proposed

maximum aggregate value of transaction |

|

| |

|

|

| |

|

|

| 5. |

Total

fee paid |

|

| |

|

|

☐

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

LIBERTY

STAR URANIUM & METALS CORP.

701

S Carson St., Ste 200

Carson

City, NV 89701

INFORMATION

STATEMENT

WE

ARE NOT ASKING YOU FOR A PROXY, AND YOU ARE REQUESTED NOT TO SEND US A PROXY

NOTICE

OF ACTION BY WRITTEN CONSENT OF MAJORITY OF STOCKHOLDERS

THIS

IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDER’S MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN

This

Information Statement is being furnished to the stockholders of Liberty Star Uranium & Metals Corp., a Nevada corporation (hereinafter

referred to as “we,” “us,” “our,” or the “Company”), on or around October 19, 2023 (the

“Mailing Date”), pursuant to Section 14 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and Regulation 14C and Schedule 14C thereunder, in connection with the approval by written consent of the holders of a majority of the

issued and outstanding voting power of the Company’s common stock stockholders (the “Written Consent”), to elect the

Board of Directors candidates incorporated herein. The Board of Directors will be effective no sooner than twenty (20) days after the

Mailing Date (the “Effective Date”).

The

Written Consent we received constitutes the only stockholder approval required for the election of new Board of Directors under Article

1, Section 7 of the Company’s Bylaws (the “Bylaws”) and Nevada Revised Statute (“NRS”) 78.320(2), and,

as a result, no further action by any other stockholder is required to approve the election of new Board of Directors and we have not

and will not be soliciting your approval of the actions set forth in the Written Consent (the “Election”). This Information

Statement and the documents incorporated herein by reference shall constitute notice to you of the action by Written Consent in accordance

with Nevada law and the Exchange Act.

Statements

Regarding Forward Looking Information

This

Information Statement and the documents incorporated into this document by reference contain forward-looking statements within the “safe

harbor” provisions of the Private Securities Litigation Reform Act of 1995 with respect to our financial condition and results

of operations and business. Words such as “anticipates,” “expects,” “intends,” “plans,”

“believes,” “seeks,” “estimates” and similar expressions identify forward-looking statements. These

forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties that could cause actual

results to differ materially from the results contemplated by the forward-looking statements.

General

Information

This

Information Statement has been prepared by our management, and the entire cost of furnishing this Information Statement will be borne

by us. We will request brokerage houses, nominees, custodians, fiduciaries, and other like parties to forward this Information Statement

to the beneficial owners of our voting securities held of record by them and we will reimburse such persons for out-of-pocket expenses

incurred in forwarding such material.

The

Company is registered under Section 12(g) of the Exchange Act and is subject to the reporting obligations under Section 13 of the Exchange

Act. The Company’s common stock trades publicly on the OTC Market under the symbol “LBSR.”

Summary

of the Election

Liberty

Star announces the newly elected Board of Directors: Pete O’Heeron, Nicholas Hemmerly and Saleem Elmasri.

Questions

and Answers About the Election

Q.

Why did I receive this Information Statement?

A.

Applicable laws and regulations require us to provide you information regarding the Election.

Q.

Why am I not being asked to vote?

A.

The holders of a majority of the voting power amongst the issued and outstanding shares of Common Stock have already approved the Election

pursuant to the Written Consent. Such approval is sufficient under Nevada law, and no further approval by our stockholders is required.

Q.

What do I need to do now?

A.

Nothing. This information statement is purely for your information and does not require or request you to do anything.

Q.

Whom can I contact with questions?

A.

If you have any questions about any of the actions to be taken by the Company, please contact the Company.

Actions

by the Board of Directors and Consenting Shareholders

On

October 12, 2023, a majority of the Company’s stockholders (the “Majority”) approved, Pete O’Heeron, Nick Hemmerly

and Saleem Elmasri to the new Board of Directors. The record date established by the Board

for purposes of determining the number of outstanding shares of voting stock entitled to vote on the Election was October 12, 2023 (the

“Record Date”).

Pursuant

to the Company’s Articles of Incorporation, the Board of Directors must be approved by a majority of the Company’s stockholders.

In

order to obtain stockholder approval for the Election we could have convened a special meeting of the stockholders for the specific purpose

of voting on such matter. However, NRS 78.320(2) provides than any action required or permitted to be taken at a meeting of the stockholders

may be taken without a meeting if, before or after the action, a written consent thereto is signed by stockholders holding at least a

majority of the votes authorized to vote. In order to eliminate the costs and management time involved in holding a meeting and obtaining

proxies and in order to effect the Action as early as possible in order to accomplish the purposes of the Action, the Board elected to

utilize the written consent option of the holders of a majority of the outstanding shares of our common stock, as provided by Nevada

law.

The

Company has two classes of stock authorized, Class A Stock and Common Stock. As of the Record Date, the Company had 48,375,518 shares

of its Common Stock issued and outstanding and 500,000 shares of Class A common stock issued and outstanding. Each share of Common Stock

is entitled to 1 vote and each share of Class A Stock is entitled to 200 votes. On the Record Date, the holder of 25,006,067 issued and

outstanding shares of our Common Stock and 250,000 shares of our Class A Stock, representing 75,006,067 votes or equal to or more than

51% of the stockholder voting power, approved the Action. No further vote of our stockholders is required for the Company to effect the

Election.

Pursuant

to the rules and regulations promulgated by the SEC under the Exchange Act, an Information Statement must be sent to the holders of voting

stock who did not sign the Written Consent at least 20 days prior to the effective date of any corporate action taken or authorized pursuant

to the consent of the Company’s stockholders.

Dissenter’s

Rights

Stockholders

who do not consent to the proposals are not entitled to the dissenter’s or appraisal rights provided by the NRS.

Principal

Share Ownership

As

of the Record Date, the Company had a total of 48,375,518 shares of common stock and 500,000 shares of Class A common stock issued and

outstanding. The following table sets forth, as of the Record Date, the stock ownership of each executive officer and director of the

Company, of all executive officers and directors as a group.

| Name | |

Stock RS | | |

Options | | |

Warrants | | |

Common A x 200 | | |

Total | | |

Total | |

| Pete O’Heeron | |

| 25,006,067 | | |

| | | |

| 603,586 | | |

| | | |

| 25,859,653 | | |

| 17.36 | % |

| Pete O’Heeron Common A | |

| | | |

| | | |

| | | |

| 250,000 | | |

| 50,000,000 | | |

| 33.70 | % |

| Brett Gross | |

| 1,782,203 | | |

| | | |

| 810,210 | | |

| | | |

| 2,842,413 | | |

| 1.91 | % |

| Brett Gross Common A | |

| | | |

| | | |

| | | |

| 250,000 | | |

| 50,000,000 | | |

| 33.70 | % |

| Patricia Madaris | |

| 150,000 | | |

| | | |

| - | | |

| | | |

| 150,000 | | |

| * | % |

| Boyd Gordon | |

| 161,430 | | |

| | | |

| 43,215 | | |

| | | |

| 204,646 | | |

| * | % |

| Barney Guarnera | |

| 75,000 | | |

| | | |

| - | | |

| | | |

| 75,000 | | |

| * | % |

| Nicholas Hemmerly | |

| | | |

| 75,000 | | |

| | | |

| | | |

| | | |

| * | % |

| Saleem Elmasri | |

| | | |

| 75,000 | | |

| | | |

| | | |

| | | |

| * | % |

Unless

otherwise noted, each person listed is the sole beneficial owner of the shares and has sole investment and voting power of such shares,

to the best of the Company’s knowledge.

Directors

and Executive Officers

The

Company currently has three directors and three officers. The following table shows the current directors and officers of the Company:

| Name |

|

Age |

|

Position |

|

Date

first elected or appointed |

| Peter

O’Heeron |

|

60 |

|

Chairman

of the Board, Secretary & Treasurer |

|

September

6, 2012 |

| Nicholas

Hemmerly |

|

41 |

|

Director |

|

September

26, 2022 |

| Saleem

Elmasri |

|

38 |

|

Director |

|

August

14, 2023 |

| Patricia

Madaris |

|

72 |

|

Chief

Financial Officer, Vice-President |

|

May

8, 2015 |

Biographical

Information

Peter

O’Heeron. Mr. O’Heeron joined the board in 2012. Mr. O’Heeron leads an operational investment group which identifies

early-stage opportunities in the medical field with strong intellectual property positions. Pete O’Heeron is one of the most preeminent

biopharma inventors of his generation, with over 300+ patents issued and pending in the areas of biologics, cell therapy and medical

devices. Mr. O’Heeron is Chief Executive Officer of FibroBiologics and a seasoned leader in his field comprising over 25 years

of experience in medical technology and biotech development. As CEO, he has positioned FibroBiologics to become a global leader in fibroblast-based

cell therapies with the development and commercialization of therapies that can cure and treat patients suffering from chronic diseases.

He brings together multi-disciplinary teams and resources necessary to commercialize unique technologies and currently holds 250+ Patents

Issued/Pending.

Prior

to founding FibroBiologics/FibroGenesis, LLC, he founded an operational investment group, Advanced Medical Technologies, LLC, that identified

early-stage opportunities in the medical field with strong intellectual property potential. He also founded NeoSurg Technologies that

developed the T2000 Minimally Invasive Access System. The sale of NeoSurg Technologies to Cooper Surgical occurred in 2006.

He

brings decades of executive-level experience at Christus Health Care Corporation and strategic advisory to healthcare companies in the

areas of biologics, advanced surgical instrumentation, and telemedicine to his company along with an academic foundation rooted in healthcare

administration. He received his Bachelor’s Degree in Healthcare Administration at Texas State University, his Masters in Healthcare

Administration from the University of Houston Clear Lake, and his Executive Management Certification in Mergers and Acquisition from

University of Chicago.

Nicholas

Hemmerly. Appointed to the Board of Directors, September, 2022. Nicholas H. Hemmerly is a Partner

and Head of Investment Banking for Bridgeway Capital Partners LLC. Bridgeway Capital Partners together with its affiliates provides independent

investment banking, strategic capital, and advisory services to lower and middle market companies globally. Prior to joining Bridgeway

Mr. Hemmerly was at PricewaterhouseCoopers Corporate Finance LLC (PwC CF) focusing on M&A and capital raising. Prior to PwC CF, Mr.

Hemmerly worked at Jefferies LLC with a focus on executing M&A and financing transactions within the pharmaceutical and life sciences

sectors. Prior experience includes investment banking roles in JPMorgan’s Healthcare Group as well as JMP Securities Healthcare

Group. Mr. Hemmerly began his investment banking career as an analyst with Wachovia Securities.

Saleem

Elmasri. Appointed to the Board of Directors, August, 2023. Saleem Elmasri (CPA) is a seasoned

business professional with over 15 years of experience in financial and management consulting. He began his career at PricewaterhouseCoopers

and worked for several of the firm’s Fortune 500 clients. From PwC, he transitioned to lead advisory practices at boutique consulting

firms, specializing in transaction and complex accounting advisory. Saleem has helped his clients navigate transformational endeavors

such as acquisitions, divestitures, mergers, and restructurings. Focused primarily on the life sciences and technology sectors, Saleem

has augmented leadership teams in decision making roles to navigate transactions in the public markets, drive transformative business

development efforts, including acquisitions and divestitures, and various SEC or audit compliance matters. Saleem is an experienced investor

focused on early-stage companies addressing global scale challenges, having a large addressable market, and visionary founders. Beginning

in 2016, Saleem has served as the CEO advisor, CFO, or Board member at several early-stage companies and in 2020, launched Titan Advisory

Services to provide such services. In 2022, Saleem launched Titan Ventures, an eco-system driven venture capital firm, to allow colleagues

and friends to participate in early-stage and other private market investments. In 2023, Saleem launched Titan Strategic Partners to

help clients navigate project financing for ambitious infrastructure ventures.

Patricia

Madaris. Ms. Madaris has served as our VP Finance since May 2015. Prior to that time, Ms. Madaris served as the Executive Assistant

to our CEO and Board of Directors since 2011. Since beginning her work at our company, she has proven to be beneficial in facilitating

many areas of our public company, working to engage, negotiate, and close financings, and overseeing and working actively in financial

reporting, and projected budgeting for ongoing operations. She has also previously worked as an accountant/manager for corporations in

Arizona, Florida, and California from 2005. Ms. Madaris has a Bachelor of Science Degree from Indiana Wesleyan University, graduating

Summa Cum Laude. Ms. Madaris also holds an MBA graduating with highest honors in February 2017. Ms. Madaris was elected Chief Financial

Officer on January 11, 2019.

Financial

Information

Please

see the Company’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission on May 16, 2023, or the Company’s

Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission on September 14, 2023, for details regarding the Company’s

financial information. A copy of these reports, along with other Company filings, can be found at EDGAR Search Results (sec.gov)

| THE

BOARD OF DIRECTORS |

|

|

|

| |

|

|

|

| /s/

Peter O’Heeron |

|

October

12, 2023 |

|

| Peter

O’Heeron |

|

Date |

|

| |

|

|

|

| /s/

Nicholas Hemmerly |

|

October

12, 2023 |

|

| Nicholas

Hemmerly |

|

Date |

|

| |

|

|

|

| /s/

Saleem Elmasri |

|

October

12, 2023 |

|

| |

|

|

|

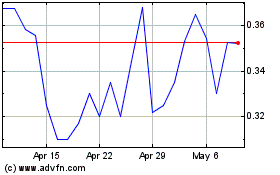

Liberty Star Uranium and... (QB) (USOTC:LBSR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Liberty Star Uranium and... (QB) (USOTC:LBSR)

Historical Stock Chart

From Apr 2023 to Apr 2024