UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________

SCHEDULE TO

(RULE 14d-100)

Tender Offer Statement under Section 14(d)(1)

or 13(e)(1)

of the Securities Exchange Act of 1934

(Amendment No. 2)

_______________________________________

Performance

Shipping Inc.

(Name of Subject Company (Issuer))

_______________________________________

Sphinx

Investment Corp.

(Offeror)

Maryport

Navigation Corp.

(Parent of Offeror)

George

Economou

(Affiliate of Offeror)

(Names of Filing Persons)

_______________________________________

Common

shares, $0.01 par value

(including

the associated Preferred stock purchase rights)

(Title of Class of Securities)

Y67305105

(CUSIP Number of Class of Securities)

_______________________________________

Kleanthis Spathias

c/o Levante Services Limited

Leoforos Evagorou 31, 2nd Floor,

Office 21

1066 Nicosia, Cyprus

+35 722 010610

(Name, address and telephone number of person authorized

to receive notices and communications on behalf of filing persons)

_______________________________________

With a copy to:

Richard M. Brand

Kiran S. Kadekar

Cadwalader, Wickersham & Taft LLP

200 Liberty Street

New York, NY 10281

(212) 504-6000

_______________________________________

| |

¨ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate

any transactions to which the statement relates:

| |

x |

third-party tender offer subject to Rule 14d-1. |

| |

¨ |

issuer tender offer subject to Rule 13e-4. |

| |

¨ |

going-private transaction subject to Rule 13e-3. |

| |

x |

amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment

reporting the results of the tender offer: ¨

If applicable, check the appropriate box(es) below

to designate the appropriate rule provision(s) relied upon:

| |

¨ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| |

¨ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

As permitted by General Instruction G to Schedule

TO, this Schedule TO is also Amendment No. 7 to the Schedule 13D filed by Sphinx Investment Corp. (the “Offeror”),

Maryport Navigation Corp. and Mr. George Economou on August 25, 2023 (and amended on August 31, 2023, September 4, 2023, September 15,

2023, twice on October 11, 2023, and on October 30, 2023) in respect of the Common Shares of the Company.

| |

| |

| |

1. |

Names of Reporting Persons

Sphinx Investment Corp. |

| |

|

|

| |

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

|

(a) |

o |

| |

|

(b) |

x |

| |

|

|

| |

3. |

SEC Use Only |

| |

|

|

| |

4. |

Source of Funds (See Instructions)

WC |

| |

|

|

| |

5. |

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

| |

|

|

| |

6. |

Citizenship or Place of Organization

Republic of the Marshall Islands |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

1,033,859* |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

1,033,859* |

| |

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,033,859* |

| |

12. |

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o |

| |

13. |

Percent of Class Represented by Amount in Row (11)

8.5%** |

| |

14. |

Type of Reporting Person (See Instructions)

CO |

| |

|

|

|

|

|

* All reported Common Shares are held by Sphinx

Investment Corp. Sphinx Investment Corp. is a wholly-owned subsidiary of Maryport Navigation Corp., which is a Liberian company controlled

by Mr. Economou.

** Based on the 12,152,559

Common Shares stated by the Issuer as being outstanding as at October 24, 2023 in its Solicitation/Recommendation

Statement on Schedule 14D-9, filed with the United States Securities and Exchange Commission (the “SEC”) on

October 25, 2023 (the “Schedule 14D-9”).

| |

| |

| |

1. |

Names of Reporting Persons

Maryport Navigation Corp. |

| |

|

|

| |

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

|

(a) |

o |

| |

|

(b) |

x |

| |

|

|

| |

3. |

SEC Use Only |

| |

|

|

| |

4. |

Source of Funds (See Instructions)

AF |

| |

|

|

| |

5. |

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

| |

|

|

| |

6. |

Citizenship or Place of Organization

Liberia |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

1,033,859* |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

1,033,859* |

| |

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,033,859* |

| |

12. |

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o |

| |

13. |

Percent of Class Represented by Amount in Row (11)

8.5%** |

| |

14. |

Type of Reporting Person (See Instructions)

CO |

| |

|

|

|

|

|

* All reported Common Shares are held by Sphinx

Investment Corp. Sphinx Investment Corp. is a wholly-owned subsidiary of Maryport Navigation Corp., which is a Liberian company controlled

by Mr. Economou.

** Based on the 12,152,559

Common Shares stated by the Issuer as being outstanding as at October 24, 2023 in its Schedule

14D-9.

| |

| |

| |

1. |

Names of Reporting Persons

George Economou |

| |

|

|

| |

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

|

(a) |

o |

| |

|

(b) |

x |

| |

|

|

| |

3. |

SEC Use Only |

| |

|

|

| |

4. |

Source of Funds (See Instructions)

AF |

| |

|

|

| |

5. |

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

| |

|

|

| |

6. |

Citizenship or Place of Organization

Greece |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

1,033,859* |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

1,033,859* |

| |

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,033,859* |

| |

12. |

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o |

| |

13. |

Percent of Class Represented by Amount in Row (11)

8.5%** |

| |

14. |

Type of Reporting Person (See Instructions)

IN |

| |

|

|

|

|

|

* All reported Common Shares are held by Sphinx

Investment Corp. Sphinx Investment Corp. is a wholly-owned subsidiary of Maryport Navigation Corp., which is a Liberian company controlled

by Mr. Economou.

** Based on the 12,152,559

Common Shares stated by the Issuer as being outstanding as at October 24, 2023 in its Schedule

14D-9.

This Amendment No. 2 (this

“Amendment No. 2”) is filed by the Offeror (as defined below), Maryport (as defined below) and Mr. George Economou

and amends and supplements the Tender Offer Statement on Schedule TO originally filed with the Securities and Exchange Commission (the

“SEC”) on October 11, 2023 and amended and supplemented pursuant to Amendment No. 1 on October 30, 2023 (such original

Tender Offer Statement on Schedule TO as so amended and supplemented (including any exhibits and annexes attached thereto), the “Original

Schedule TO”), and as hereby amended and supplemented (including by the exhibits and annexes hereto), together with any subsequent

amendments and supplements thereto, this “Schedule TO”) by Sphinx Investment Corp., a corporation organized under the

laws of the Republic of the Marshall Islands (the “Offeror”), Maryport Navigation Corp., a corporation organized under

the laws of the Republic of Liberia that is the direct parent of the Offeror (“Maryport”), and Mr. George Economou,

who directly owns Maryport and controls each of the Offeror and Maryport. This Schedule TO relates to the tender offer by the Offeror

to purchase all of the issued and outstanding common shares, par value $0.01 per share (the

“Common Shares”), of Performance Shipping Inc., a corporation organized under the laws of the

Republic of the Marshall Islands (the “Company”) (including the associated preferred stock purchase rights (the

“Rights”, and together with the Common Shares, the “Shares”) issued pursuant to the Stockholders’

Rights Agreement, dated as of December 20, 2021, between the Company and Computershare

Inc. as Rights Agent (as it may be amended from time to time)), for $3.00 per Share in cash, without interest, less any applicable

withholding taxes, upon the terms and subject to the conditions set forth in (a) the Amended and Restated Offer to Purchase, dated October

30, 2023, a copy of which is attached to the Schedule TO as Exhibit (a)(1)(G) (the “Offer to Purchase”), (b) the related

revised Letter of Transmittal, a copy of which is attached to the Schedule TO as Exhibit (a)(1)(H) (the “Letter of Transmittal”),

and (c) the related revised Notice of Guaranteed Delivery, a copy of which is attached to the Schedule TO as Exhibit (a)(1)(I) (the “Notice

of Guaranteed Delivery”) (which three documents, including any amendments or supplements thereto, collectively constitute the

“Offer”).

As permitted by General Instruction

G to Schedule TO, this Schedule TO is also Amendment No. 7 to the Schedule 13D filed by the Offeror, Maryport and Mr. Economou on August

25, 2023 (and amended on August 31, 2023, September 4, 2023, September 15, 2023, twice on October 11, 2023, and on October 30, 2023) in

respect of the Common Shares.

This Amendment No. 2 is being

filed to amend and supplement the Schedule TO. Except as amended hereby to the extent specifically provided herein, all terms of the Offer

and all other disclosures set forth in the Schedule TO and the Exhibits thereto remain unchanged and are hereby expressly incorporated

into this Amendment No. 2 by reference. Capitalized terms used and not otherwise defined in this Amendment No. 2 shall have the meanings

assigned to such terms in the Schedule TO and the Offer to Purchase.

Items 1 through 9 and Item 11

The Offer to Purchase and Items

1 through 9 and Item 11 of the Schedule TO, to the extent such Items 1 through 9 and Item 11 incorporate by reference the information

contained in the Offer to Purchase, are hereby amended and supplemented by adding the following paragraph thereto:

“On October 30, 2023,

the Offeror announced that it has extended the Expiration Date and Time to 11:59 p.m., New York City time, on November 15, 2023. The Offer

was previously scheduled to expire at 11:59 p.m., New York City time, on November 8, 2023. The Tender Offer Agent has advised the Offeror

that as of 5:00 p.m., New York City time, on October 27, 2023, the last full trading day prior to the announcement of the extension of

the Offer, no Shares had been validly tendered into the Offer and not validly withdrawn. The press release announcing the extension of

the Offer is attached hereto as Exhibit (a)(1)(M) and is incorporated herein by reference.”

Item 12. Exhibits.

Item 12 of the Schedule TO

is hereby amended and supplemented by adding the following exhibit thereto:

SIGNATURES

After due inquiry and to the

best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: October 30, 2023

| |

SPHINX INVESTMENT CORP. |

| |

|

| |

By: Levante Services Limited |

| |

|

| |

By: /s/ Kleanthis Costa Spathias |

| |

Kleanthis Costa Spathias |

| |

Director |

| |

|

| |

MARYPORT NAVIGATION CORP. |

| |

|

| |

By: Levante Services Limited |

| |

|

| |

By: /s/ Kleanthis Costa Spathias |

| |

Kleanthis Costa Spathias |

| |

Director |

| |

|

| |

George Economou |

| |

|

| |

/s/ George Economou |

| |

George Economou |

Exhibit (a)(1)(M)

SPHINX INVESTEMENT CORP. ANNOUNCES EXTENSION

OF TENDER OFFER TO PURCHASE ALL OUTSTANDING COMMON SHARES AND ASSOCIATED RIGHTS OF PERFORMANCE SHIPPING INC.

NEW YORK, Oct. 30, 2023 /PRNewswire/

-- Sphinx Investment Corp. ("Sphinx") today announced that it has extended the expiration date of

its previously announced offer to purchase all of the issued and outstanding common shares, par value $0.01 per share

(the "Common Shares"), of Performance Shipping Inc. ("Performance") (including the associated preferred

stock purchase rights (the "Rights", and together with the Common Shares, the "Shares") for $3.00 per

Share in cash, without interest, less any applicable withholding taxes (the "Offer").

The expiration date of the Offer has been

extended to 11:59 p.m., New York City time, on November 15, 2023.

Continental Stock Transfer &Trust Company, the

tender offer agent for the Offer, has advised Sphinx that as of 5:00 p.m., New York City time, on October 27,

2023, the last business day prior to the announcement of the extension of the Offer, no Shares had been validly tendered into the Offer

and not validly withdrawn.

The Offer is being made pursuant to the terms

and conditions described in the Amended and Restated Offer to Purchase (the "Offer to Purchase"), dated October

30, 2023, the related revised Letter of Transmittal (the "Letter of Transmittal"), dated October 30, 2023 and

certain other Offer documents, copies of which are attached to the Tender Offer Statement on Schedule TO originally filed by Sphinx, Maryport

Navigation Corp. and Mr. George Economou with the United States Securities and Exchange Commission (the "SEC")

on October 11, 2023 and amended by Amendment No. 1 thereto on October 30, 2023. Consummation of the Offer continues

to be subject to satisfaction or waiver of all of the conditions referred to in Section 14 — "Conditions of the Offer"

of the Offer to Purchase.

The Information Agent for the Offer is Innisfree

M&A Incorporated. The Offer materials may be obtained at no charge by calling Innisfree toll free at (877) 800-5190, and may

also be obtained at no charge at the website maintained by the SEC at www.sec.gov.

Additional Information about the Offer

and Where to Find It

The tender offer referenced herein commenced

on October 11, 2023. This press release is neither an offer to purchase nor a solicitation of an offer to sell any Shares or

any other securities, nor is it a substitute for the tender offer materials attached to the Tender Offer Statement on Schedule TO filed

by Sphinx, Maryport Navigation Corp. and Mr. George Economou with the SEC on Schedule TO on October 11, 2023 and amended

pursuant to Amendment No. 1 thereto on October 30, 2023 (including the Offer to Purchase and the Letter of Transmittal)

(the "Tender Offer Materials"). A solicitation and offer to purchase outstanding Shares is only being made pursuant

to the Tender Offer Materials. Performance filed a Solicitation/Recommendation Statement on Schedule 14D-9 (the "Solicitation/

Recommendation Statement") with respect to the Offer with the SEC ON OCTOBER 25, 2023. INVESTORS AND Performance shareholders

ARE STRONGLY ADVISED TO READ THE TENDER OFFER MATERIALS (INCLUDING THE OFFER to Purchase AND the Letter of Transmittal) AND THE SOLICITATION/RECOMMENDATION

STATEMENT, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, BECAUSE THEY CONTAIN IMPORTANT INFORMATION THAT SHOULD BE CONSIDERED

BY INVESTORS AND Performance shareholders BEFORE MAKING ANY DECISION WITH RESPECT TO THE OFFER. The Tender Offer Materials

may be obtained at no charge at the website maintained by the Securities and Exchange Commission at www.sec.gov.

Important Cautions Regarding Forward-Looking

Statements

Certain statements contained in this press

release are forward-looking statements, including, but not limited to, statements that are predications of or indicate future events,

trends, plans or objectives. These statements, which sometimes use words such as "anticipate," "believe,"

"intend," "estimate," "expect," "project," "strategy," "opportunity," "future,"

"plan," "will likely result," "will," "shall," "may," "aim," "predict,"

"should," "would," "continue," and words of similar meaning and/or other similar expressions that are predictions

of or indicate future events and/or future trends, reflect the beliefs and expectations of the applicable of the Offeror, Maryport and

Mr. George Economou at the date of this press release and involve a number of risks, uncertainties and assumptions that could cause

actual results and performance to differ materially from any expected future results or performance expressed or implied by the forward-looking

statement.

About Sphinx:

Sphinx Investment Corp. is a corporation

organized under the laws of the Republic of the Marshall Islands. The principal business of the Sphinx is the making of investments

in securities. Sphinx is controlled by Mr. George Economou.

Media Contact:

Innisfree M&A Incorporated

Jonathan Kovacs / Arthur Crozier / Scott Winter

jkovacs@innisfreema.com; acrozier@innisfreema.com; swinter@innisfreema.com

212-750-5833

SOURCE Sphinx Investment Corp

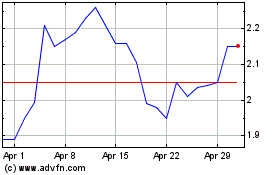

Performance Shipping (NASDAQ:PSHG)

Historical Stock Chart

From Apr 2024 to May 2024

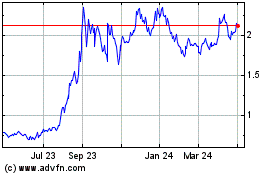

Performance Shipping (NASDAQ:PSHG)

Historical Stock Chart

From May 2023 to May 2024