UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under the Securities Exchange Act of 1934

(Amendment

No. 5)*

DAWSON

GEOPHYSICAL COMPANY

(Name

of Issuer)

Common

Stock, par value $0.01 per share

(Title

of Class of Securities)

239360100

(CUSIP

Number)

Javier

Rocha

Wilks

Brothers, LLC

17010

IH 20

Cisco,

Texas 76437

Telephone:

(817)-850-3600

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications)

September

19, 2023

(Date

of Event Which Requires Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7

for other parties to whom copies are to be sent.

*

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

SCHEDULE

13D

CUSIP

No. 239360100

| 1. |

NAMES

OF REPORTING PERSONS

Matthew

D. Wilks |

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

(a)

☒ (b) ☐

|

| 3. |

SEC

USE ONLY

|

| 4. |

SOURCE

OF FUNDS (see instructions)

OO |

| 5. |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

| 6. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States |

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7. |

SOLE

VOTING POWER

0 |

| 8. |

SHARED

VOTING POWER

0 |

| 9. |

SOLE

DISPOSITIVE POWER

0 |

| 10. |

SHARED

DISPOSITIVE POWER

0 |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

0 |

| 12. |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

☐ |

| 13. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0 |

| 14. |

TYPE

OF REPORTING PERSON (see instructions)

IN |

| |

|

|

|

SCHEDULE

13D

CUSIP

No. 239360100

| 1. |

NAMES

OF REPORTING PERSONS

Sergei

Krylov |

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

(a)

☒ (b) ☐

|

| 3. |

SEC

USE ONLY

|

| 4. |

SOURCE

OF FUNDS (see instructions)

OO |

| 5. |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

| 6. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States |

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7. |

SOLE

VOTING POWER

0 |

| 8. |

SHARED

VOTING POWER

0 |

| 9. |

SOLE

DISPOSITIVE POWER

0 |

| 10. |

SHARED

DISPOSITIVE POWER

0 |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

0 |

| 12. |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

☐ |

| 13. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0 |

| 14. |

TYPE

OF REPORTING PERSON (see instructions)

IN |

| |

|

|

|

SCHEDULE

13D

CUSIP

No. 239360100

| 1. |

NAMES

OF REPORTING PERSONS

Dan

Wilks |

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

(a)

☒ (b) ☐

|

| 3. |

SEC

USE ONLY

|

| 4. |

SOURCE

OF FUNDS (see instructions)

OO |

| 5. |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

| 6. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States |

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7. |

SOLE

VOTING POWER

0 |

| 8. |

SHARED

VOTING POWER

24,659,095 |

| 9. |

SOLE

DISPOSITIVE POWER

0 |

| 10. |

SHARED

DISPOSITIVE POWER

24,659,095 |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

24,659,095 |

| 12. |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

☐ |

| 13. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

80.03%

(1) |

| 14. |

TYPE

OF REPORTING PERSON (see instructions)

IN |

| (1) |

Percent

of class based on (i) 25,000,564 shares of Common Stock of Issuer issued and outstanding as of July 26, 2023, as reported in the

Issuer’s Quarterly Report filed with the SEC on July 31, 2023 plus (ii) 5,811,765 newly issued shares of Common Stock of Issuer

issued pursuant to the Convertible Note as reported in the Issuer’s Form 8-K filed with the SEC on September 19, 2023. |

| |

|

|

|

SCHEDULE

13D

CUSIP

No. 239360100

| 1. |

NAMES

OF REPORTING PERSONS

Staci

Wilks |

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

(a)

☒ (b) ☐

|

| 3. |

SEC

USE ONLY

|

| 4. |

SOURCE

OF FUNDS (see instructions)

OO |

| 5. |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

| 6. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States |

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7. |

SOLE

VOTING POWER

0 |

| 8. |

SHARED

VOTING POWER

349 |

| 9. |

SOLE

DISPOSITIVE POWER

0 |

| 10. |

SHARED

DISPOSITIVE POWER

349 |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

349 |

| 12. |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

☐ |

| 13. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.0%

(1) |

| 14. |

TYPE

OF REPORTING PERSON (see instructions)

IN |

| (1) |

Percent

of class based on (i) 25,000,564 shares of Common Stock of Issuer issued and outstanding as of July 26, 2023, as reported in the

Issuer’s Quarterly Report filed with the SEC on July 31, 2023 plus (ii) 5,811,765 newly issued shares of Common Stock of Issuer

issued pursuant to the Convertible Note as reported in the Issuer’s Form 8-K filed with the SEC on September 19, 2023. |

| |

|

|

|

SCHEDULE

13D

CUSIP

No. 239360100

| 1. |

NAMES

OF REPORTING PERSONS

Wilks

Brothers, LLC |

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

(a)

☒ (b) ☐

|

| 3. |

SEC

USE ONLY

|

| 4. |

SOURCE

OF FUNDS (see instructions)

WC |

| 5. |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

| 6. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Texas |

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7. |

SOLE

VOTING POWER

0 |

| 8. |

SHARED

VOTING POWER

24,659,095 |

| 9. |

SOLE

DISPOSITIVE POWER

0 |

| 10. |

SHARED

DISPOSITIVE POWER

24,659,095 |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

24,659,095 |

| 12. |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

☐ |

| 13. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

80.03%

(1) |

| 14. |

TYPE

OF REPORTING PERSON (see instructions)

OO |

| (1) |

Percent

of class based on (i) 25,000,564 shares of Common Stock of Issuer issued and outstanding as of July 26, 2023, as reported in the

Issuer’s Quarterly Report filed with the SEC on July 31, 2023 plus (ii) 5,811,765 newly issued shares of Common Stock of Issuer

issued pursuant to the Convertible Note as reported in the Issuer’s Form 8-K filed with the SEC on September 19, 2023. |

| |

|

|

|

SCHEDULE

13D

CUSIP

No. 239360100

| 1. |

NAMES

OF REPORTING PERSONS

Farris

Wilks |

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

(a)

☒ (b) ☐

|

| 3. |

SEC

USE ONLY

|

| 4. |

SOURCE

OF FUNDS (see instructions)

OO |

| 5. |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

| 6. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States |

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7. |

SOLE

VOTING POWER

0 |

| 8. |

SHARED

VOTING POWER

24,659,095 |

| 9. |

SOLE

DISPOSITIVE POWER

0 |

| 10. |

SHARED

DISPOSITIVE POWER

24,659,095 |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

24,659,095 |

| 12. |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

☐ |

| 13. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

80.03%

(1) |

| 14. |

TYPE

OF REPORTING PERSON (see instructions)

IN |

| (1) |

Percent

of class based on (i) 25,000,564 shares of Common Stock of Issuer issued and outstanding as of July 26, 2023, as reported in the

Issuer’s Quarterly Report filed with the SEC on July 31, 2023 plus (ii) 5,811,765 newly issued shares of Common Stock of Issuer

issued pursuant to the Convertible Note as reported in the Issuer’s Form 8-K filed with the SEC on September 19, 2023. |

| |

|

|

|

SCHEDULE

13D

CUSIP

No. 239360100

| 1. |

NAMES

OF REPORTING PERSONS

WB

Acquisitions Inc. |

|

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

(a)

☒ (b) ☐

|

|

| 3. |

SEC

USE ONLY

|

|

| 4. |

SOURCE

OF FUNDS (see instructions)

OO |

|

| 5. |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

|

| 6. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware |

|

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7. |

SOLE

VOTING POWER

0 |

|

| 8. |

SHARED

VOTING POWER

15,547,010 |

|

| 9. |

SOLE

DISPOSITIVE POWER

0 |

|

| 10. |

SHARED

DISPOSITIVE POWER

15,547,010 |

|

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

15,547,010 |

|

| 12. |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

☐ |

|

| 13. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

50.46%

(1) |

|

| 14. |

TYPE

OF REPORTING PERSON (see instructions)

CO |

|

| (1) |

Percent

of class based on (i) 25,000,564 shares of Common Stock of Issuer issued and outstanding as of July 26, 2023, as reported in the

Issuer’s Quarterly Report filed with the SEC on July 31, 2023 plus (ii) 5,811,765 newly issued shares of Common Stock of Issuer

issued pursuant to the Convertible Note as reported in the Issuer’s Form 8-K filed with the SEC on September 19, 2023. |

| |

|

|

|

|

Explanatory

Note

This

Amendment No. 5 (this “Amendment”) amends and supplements the Schedule 13D originally filed by Dan Wilks, Staci Wilks,

Wilks Brothers, LLC (“Wilks”) and Farris Wilks with the Securities and Exchange Commission (the “SEC”)

on January 19, 2021, as amended by Amendment No. 1 thereto filed on October 25, 2021, Amendment No. 2 thereto filed on January 14, 2022,

Amendment No. 3 thereto filed on January 28, 2022, and Amendment No. 4 thereto filed on June 26, 2023 (collectively, the “Schedule

13D”), relating to shares of common stock, par value $0.01 per share (“Common Stock”), of Dawson Geophysical

Company (the “Issuer”).

Information

reported in the Schedule 13D remains in effect except to the extent that it is amended, restated or superseded by information contained

in this Amendment. Capitalized terms used but not defined in this Amendment have the respective meanings set forth in the Schedule 13D.

Item

4. Purpose of the Transaction.

Item

4 of the Schedule 13D is hereby amended and supplemented by adding the following:

On

September 13, 2023, Dawson held a virtual special meeting of its stockholders (the “Special Meeting”). At the Special

Meeting, Dawson’s stockholders voted and approved the issuance of 5,811,765

shares of Common Stock of Issuer to Wilks upon conversion of the Convertible Note. Upon such approval,

the Convertible Note automatically converted into the Conversion Shares upon such approval.

Item

5. Interest in Securities of the Issuer.

Item

5 of the Schedule 13D is hereby amended by amending and replacing in their entirety each of Items 5(a), 5(b) and 5(c) as follows:

(a)–(b) Each

Reporting Person’s beneficial ownership of the Common Stock as of the date of this Amendment is reflected on that Reporting Person’s

cover page. The Reporting Persons may be deemed to be the beneficial owners of an aggregate of 24,659,095 shares of the Common Stock,

representing 80.03% of the Common Stock of the Issuer representing the aggregate of (i) 25,000,564 shares of Common Stock issued and

outstanding as of July 26, 2023, as reported in the Issuer’s Quarterly Report on Form 10-Q filed with the SEC on July 31, 2023

and (ii) 5,811,765 newly issued shares of Common Stock of Issuer issued pursuant to the Convertible Note as reported in the Issuer’s

Form 8-K filed with the SEC on September 19, 2023.

Wilks

beneficially owns 24,659,095 shares of Common Stock, representing 80.03% of the issued and outstanding Common Stock, consisting of (i)

9,111,736 shares of Common Stock directly owned by Wilks, (ii) 15,547,010 shares

of Common Stock directly owned by WBA, which is a subsidiary of Wilks, and (iii) 349 shares of Common Stock directly owned by Staci

Wilks. Wilks is a manager-managed limited liability company, managed by Dan Wilks and Farris Wilks.

Dan Wilks and Farris Wilks are brothers and may be deemed to indirectly beneficially own the shares of Common Stock directly beneficially

owned by each of Wilks and WBA.

Dan Wilks and Staci Wilks

are husband and wife and share the same household, and Dan H. Wilks may be deemed to indirectly beneficially own the shares of Common

Stock directly owned by Staci Wilks.

Sergei Krylov is a Director

of Issuer and an Investment Partner and Chief Financial Officer of Wilks. Matthew D. Wilks is the Chairman of Issuer and is the Vice President

of Investment of Wilks and a Director of WBA. Matthew D. Wilks is the son of Dan Wilks.

(c) The

information set forth in Item 4 of this Amendment is incorporated by reference into this Item 6. None of the other the Reporting

Persons effected any transaction in the Common Stock during the past 60 days.

Item 6. Contracts, Arrangements,

Understandings or Relationships with Respect to Securities of the Issuer.

Item 6 of the Schedule 13D is hereby

amended and supplemented by adding the following:

The

information set forth in Item 4 of this Amendment is incorporated by reference into this Item 6.

Item

7. Material to Be Filed as Exhibits.

| Exhibit

No. |

|

Description |

| 1 |

|

Asset Purchase Agreement, dated March 24, 2023, by and among Dawson Geophysical Company, Wilks Brothers, LLC, for the limited purposes set forth therein, and Breckenridge Geophysical, LLC, a Texas limited liability company and a wholly-owned subsidiary of Wilks Brothers, LLC (incorporated by reference to Exhibit 2.1 to Issuer’s Current Report on Form 8-K filed with the SEC on March 24, 2023). |

| 2 |

|

Convertible Promissory Note, dated March 24, 2023, by and among Dawson Geophysical Company and Wilks Brothers, LLC (incorporated by reference to Exhibit 10.1 to Issuer’s Current Report on Form 8-K filed with the SEC on March 24, 2023). |

| 3 |

|

Voting Agreement, dated March 24, 2023, by and between Dawson Geophysical Company and Wilks Brothers, LLC (incorporated by reference to Exhibit 10.2 to Issuer’s Current Report on Form 8-K filed with the SEC on March 24, 2023). |

| 4 |

|

Joint

Filing Agreement by and among the Reporting Persons, dated as of October 30, 2023. |

| 5 |

|

Power

of Attorney – Sergei Krylov, dated as of October 30, 2023. |

| 6 |

|

Power

of Attorney – Matthew D. Wilks, dated as of October 30, 2023. |

| 7 |

|

Power

of Attorney – Dan Wilks, dated as of October 30, 2023. |

| 8 |

|

Power

of Attorney – Staci Wilks, dated as of October 30, 2023. |

| 9 |

|

Power

of Attorney – Wilks Brothers, LLC, dated as of October 30, 2023. |

| 10 |

|

Power

of Attorney – Farris Wilks, dated as of October 30, 2023. |

| 11 |

|

Power

of Attorney – WB Acquisitions Inc., dated as of October 30, 2023. |

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

Dated:

October 30, 2023

| |

* |

| |

Sergei

Krylov |

| |

|

| |

* |

| |

Matthew

D. Wilks |

| |

|

| |

* |

| |

Dan

Wilks |

| |

|

| |

* |

| |

Staci

Wilks |

| |

|

| |

* |

| |

Farris

Wilks |

| |

|

| |

Wilks

Brothers, LLC |

| |

|

| |

By: |

/s/

Javier Rocha |

| |

|

Name:

Javier Rocha |

| |

|

Title:

Attorney-in-Fact |

| |

|

|

| |

WB

Acquisitions Inc. |

| |

|

| |

By: |

/s/

Javier Rocha |

| |

|

Name:

Javier Rocha |

| |

|

Title:

Attorney-in-Fact |

| *By: |

/s/

Javier Rocha |

|

| |

Javier

Rocha, as Attorney-in-Fact |

|

Wilks SC 13D/A

Exhibit

99.4

JOINT

FILING AGREEMENT

Pursuant

to Rule 13d-1(k)(1) promulgated under the Securities Exchange Act of 1934, as amended, each of the undersigned acknowledges

and agrees that the foregoing statement on this Schedule 13D is filed on behalf of the undersigned and that all subsequent amendments

to this statement on Schedule 13D shall be filed on behalf of the undersigned without the necessity of filing additional joint acquisition

statements. Each of the undersigned acknowledges that it shall be responsible for the timely filing of such amendments, and for the completeness

and accuracy of the information concerning it contained therein, but shall not be responsible for the completeness and accuracy of the

information concerning the others, except to the extent that he or it knows or has reason to believe that such information is inaccurate.

Dated:

October 30, 2023

| |

* |

| |

Sergei

Krylov |

| |

|

| |

* |

| |

Matthew

D. Wilks |

| |

|

| |

* |

| |

Dan

Wilks |

| |

|

| |

* |

| |

Staci

Wilks |

| |

|

| |

* |

| |

Farris

Wilks |

| |

|

| |

Wilks

Brothers, LLC |

| |

|

| |

By: |

/s/

Javier Rocha |

| |

|

Name:

Javier Rocha |

| |

|

Title:

Attorney-in-Fact

|

| |

WB

Acquisitions Inc. |

| |

|

| |

By: |

/s/

Javier Rocha |

| |

|

Name:

Javier Rocha |

| |

|

Title:

Attorney-in-Fact |

| |

|

|

| *By: |

/s/

Javier Rocha |

|

| |

Javier

Rocha, as Attorney-in-Fact |

|

Wilks SC 13D/A

Exhibit

99.5

POWER

OF ATTORNEY

I,

Sergei Krylov, hereby confirm that I have authorized and designated Javier Rocha to execute and file on my behalf all SEC forms (including

any amendments thereto) that I may be required to file with the United States Securities and Exchange Commission and to perform any other

actions in connection with the above, as a result of my position with, or my direct or indirect ownership of, or transaction in securities

of, Dawson Geophysical Company. The authority of such individual under this Statement shall continue for as long as I am required to

file such forms, unless earlier terminated by my delivery of a written revocation of this authorization to Javier Rocha. I hereby acknowledge

that such individual is not assuming any of my responsibilities to comply with any of the requirements of the Securities Exchange Act

of 1934, as amended.

| |

By: |

/s/

Sergei Krylov |

| |

|

Sergei

Krylov |

Wilks SC 13D/A

Exhibit

99.6

POWER

OF ATTORNEY

I,

Matthew D. Wilks, hereby confirm that I have authorized and designated Javier Rocha to execute and file on my behalf all SEC forms (including

any amendments thereto) that I may be required to file with the United States Securities and Exchange Commission and to perform any other

actions in connection with the above, as a result of my position with, or my direct or indirect ownership of, or transaction in securities

of, Dawson Geophysical Company. The authority of such individual under this Statement shall continue for as long as I am required to

file such forms, unless earlier terminated by my delivery of a written revocation of this authorization to Javier Rocha. I hereby acknowledge

that such individual is not assuming any of my responsibilities to comply with any of the requirements of the Securities Exchange Act

of 1934, as amended.

| |

By: |

/s/

Matthew D. Wilks |

| |

|

Matthew

D. Wilks |

Wilks SC 13D/A

Exhibit

99.7

POWER

OF ATTORNEY

I,

Dan Wilks, hereby confirm that I have authorized and designated Javier Rocha to execute and file on my behalf all SEC forms (including

any amendments thereto) that I may be required to file with the United States Securities and Exchange Commission and to perform any other

actions in connection with the above, as a result of my position with, or my direct or indirect ownership of, or transaction in securities

of, Dawson Geophysical Company. The authority of such individual under this Statement shall continue for as long as I am required to

file such forms, unless earlier terminated by my delivery of a written revocation of this authorization to Javier Rocha. I hereby acknowledge

that such individual is not assuming any of my responsibilities to comply with any of the requirements of the Securities Exchange Act

of 1934, as amended.

| |

By: |

/s/

Dan Wilks |

| |

|

Dan

Wilks |

Wilks SC 13D/A

Exhibit

99.8

POWER

OF ATTORNEY

I,

Staci Wilks, hereby confirm that I have authorized and designated Javier Rocha to execute and file on my behalf all SEC forms (including

any amendments thereto) that I may be required to file with the United States Securities and Exchange Commission and to perform any other

actions in connection with the above, as a result of my position with, or my direct or indirect ownership of, or transaction in securities

of, Dawson Geophysical Company. The authority of such individual under this Statement shall continue for as long as I am required to

file such forms, unless earlier terminated by my delivery of a written revocation of this authorization to Javier Rocha. I hereby acknowledge

that such individual is not assuming any of my responsibilities to comply with any of the requirements of the Securities Exchange Act

of 1934, as amended.

| |

By: |

/s/

Staci Wilks |

| |

|

Staci

Wilks |

Wilks SC 13D/A

Exhibit

99.9

POWER

OF ATTORNEY

Wilks

Brothers, LLC (“Wilks”), incorporated and existing under the laws of Texas, with filing number 801427642, having its

registered address at PO Box 984, Cisco, Texas 76437, represented by Dan Wilks, Manager, hereby authorizes Javier Rocha to represent

Wilks to execute and file on Wilks’s behalf all SEC forms (including any amendments thereto) that Wilks may be required to file

with the United States Securities and Exchange Commission and any other actions in connection with the above, as a result of Wilks’s

position with, or direct or indirect ownership of, or transactions in securities by or on behalf of Wilks.

The authority of such individual under this Statement shall continue for as long as Wilks is required

to file such forms, unless earlier terminated by my delivery of a written revocation of this authorization to Wilks. I hereby acknowledge

that such individual is not assuming any of Wilks’s responsibilities to comply with any of the requirements of the Securities Exchange

Act of 1934, as amended.

| |

By: |

/s/

Dan Wilks |

| |

|

Dan

Wilks, Manager |

Wilks SC 13D/A

Exhibit

99.10

POWER

OF ATTORNEY

I,

Farris Wilks, hereby confirm that I have authorized and designated Javier Rocha to execute and file on my behalf all SEC forms (including

any amendments thereto) that I may be required to file with the United States Securities and Exchange Commission and to perform any other

actions in connection with the above, as a result of my position with, or my direct or indirect ownership of, or transaction in securities

of, Dawson Geophysical Company. The authority of such individual under this Statement shall continue for as long as I am required to

file such forms, unless earlier terminated by my delivery of a written revocation of this authorization to Javier Rocha. I hereby acknowledge

that such individual is not assuming any of my responsibilities to comply with any of the requirements of the Securities Exchange Act

of 1934, as amended.

| |

By: |

/s/

Farris Wilks |

| |

|

Farris

Wilks |

Wilks SC 13D/A

Exhibit

99.11

POWER

OF ATTORNEY

WB

Acquisitions Inc. (“WBA”), incorporated and existing under the laws of Delaware, having its address at 17018 IH 20, Cisco,

TX 76437, represented by Matthew D. Wilks, Director, hereby authorizes Javier Rocha to represent WBA to execute and file on WBA’s

behalf all SEC forms (including any amendments thereto) that WBA may be required to file with the United States Securities and Exchange

Commission and any other actions in connection with the above, as a result of WBA’s position with, or direct or indirect ownership

of, or transactions in securities by or on behalf of WBA with Dawson Geophysical Company. The authority of such individual under this

Statement shall continue for as long as WBA is required to file such forms, unless earlier terminated by my delivery of a written revocation

of this authorization to WBA. I hereby acknowledge that such individual is not assuming any of WBA’s responsibilities to comply

with any of the requirements of the Securities Exchange Act of 1934, as amended.

| |

By: |

/s/

Matthew D. Wilks |

| |

|

Matthew

D. Wilks, Director |

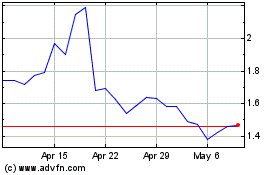

Dawson Geophysical (NASDAQ:DWSN)

Historical Stock Chart

From Apr 2024 to May 2024

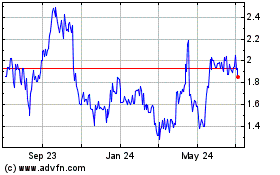

Dawson Geophysical (NASDAQ:DWSN)

Historical Stock Chart

From May 2023 to May 2024