0001414382false--07-31FY2023false0.001100000000140278341402783414027834062750151390.072500014143822022-08-012023-07-310001414382clev:StockholdersMemberclev:BetweenAugustTwoThousandEighteenAndJulyTwoThousandTwentyThreeMember2022-07-310001414382clev:StockholdersMemberclev:BetweenAugustTwoThousandEighteenAndJulyTwoThousandTwentyThreeMember2023-07-310001414382clev:BetweenNovemberTwoThousandTwelveAndDecemberTwoThousandTwentyMemberclev:StockholdersMember2020-12-012020-12-310001414382srt:MaximumMemberclev:StockholdersMember2010-07-312012-07-310001414382srt:MinimumMemberclev:StockholdersMember2010-07-312012-07-3100014143822010-07-312012-07-310001414382clev:BetweenNovemberTwoThousandTwelveAndDecemberTwoThousandTwentyMemberclev:StockholdersMember2023-07-310001414382clev:JulyThurtyFirstTwoThousandTenThroughTwoThousandTwelevenMemberclev:StockholdersMember2023-07-310001414382clev:BetweenNovemberTwoThousandTwelveAndDecemberTwoThousandTwentyMemberclev:StockholdersMember2022-07-310001414382clev:JulyThurtyFirstTwoThousandTenThroughTwoThousandTwelevenMemberclev:StockholdersMember2022-07-310001414382clev:ChiefExecutiveOfficersMember2022-08-012023-07-310001414382clev:ChiefExecutiveOfficersMember2018-08-012018-08-130001414382clev:ChiefExecutiveOfficersMember2018-08-130001414382clev:SecretaryMember2023-07-310001414382clev:ChiefExecutiveOfficersMember2023-07-310001414382clev:PresidentsMember2023-07-310001414382clev:PresidentsMember2017-07-310001414382clev:JerichoAssociatesIncMember2017-03-240001414382clev:JerichoAssociatesIncMember2022-08-012023-07-310001414382us-gaap:RetainedEarningsMember2023-07-310001414382us-gaap:AdditionalPaidInCapitalMember2023-07-310001414382us-gaap:CommonStockMember2023-07-310001414382us-gaap:RetainedEarningsMember2022-08-012023-07-310001414382us-gaap:AdditionalPaidInCapitalMember2022-08-012023-07-310001414382us-gaap:CommonStockMember2022-08-012023-07-310001414382us-gaap:RetainedEarningsMember2022-07-310001414382us-gaap:AdditionalPaidInCapitalMember2022-07-310001414382us-gaap:CommonStockMember2022-07-310001414382us-gaap:RetainedEarningsMember2021-08-012022-07-310001414382us-gaap:AdditionalPaidInCapitalMember2021-08-012022-07-310001414382us-gaap:CommonStockMember2021-08-012022-07-3100014143822021-07-310001414382us-gaap:RetainedEarningsMember2021-07-310001414382us-gaap:AdditionalPaidInCapitalMember2021-07-310001414382us-gaap:CommonStockMember2021-07-3100014143822021-08-012022-07-3100014143822022-07-3100014143822023-10-3000014143822023-07-31iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

For the year ended July 31, 2023

☐ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE EXCHANGE ACT |

| |

For the transition period from ______________ to ______________

Commission file number 000-53048

Concrete Leveling Systems, Inc. |

(Exact name of registrant as specified in its charter) |

Nevada | | 26-0851977 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

5046 E. Boulevard, NW, Canton, OH | | 44718 |

(Address of principal executive offices) | | (Zip Code) |

(330) 966-8120

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Trading Symbol(s) | | Name of exchange on which registered |

| | | | |

Common Stock | | CLEV | | OTC |

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.001 per share par value

Indicate by check mark whether the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | | Accelerated filer ☐ |

Non-Accelerated filer ☒ | Smaller reporting company ☒ | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of July 31, 2023, the last day of registrant’s fiscal year, the aggregate market value of the registrant’s common stock, $0.001 par value, held by non-affiliates, computed by reference to the price at which the common equity was last sold prior to July 31, 2023, was approximately $12,038,522. For purposes of the above statement only, all directors, executive officers and 10% shareholders are assumed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

APPLICABLE ONLY TO CORPORATE ISSUERS:

As of October 30, 2023, the registrant had 14,027,834 shares of common stock issued and outstanding. Market value based on a closing price of $1.10 is $15,430,617.

DOCUMENTS INCORPORATED BY REFERENCE

None.

CONCRETE LEVELING SYSTEMS, INC.

Index

For purposes of this report, unless otherwise indicated or the context otherwise requires, all references herein to “Concrete Leveling Systems”, “CLEV”, “the Company”, “we,” “us,” and “our,” refer to Concrete Leveling Systems, Inc., a Nevada corporation.

The following discussion and analysis was prepared to supplement information contained in the accompanying financial statements and is intended to provide certain details regarding the Company’s financial condition as of July 31, 2023 and 2022 and the results of operations for the years ended July 31, 2023 and 2022.

PART I

ITEM 1. DESCRIPTION OF BUSINESS

General Information about Our Company

Concrete Leveling Services, Inc. (“we”, “us”, “our” or the “Company”) was incorporated on August 28, 2007 in the State of Nevada. The Company’s principal offices are located at 5046 East Boulevard Northwest, Canton, Ohio 44718. In Ohio, the Company does business under the trade name of CLS Fabricating, Inc. On March 24, 2017, we entered into an Equity Purchase Agreement, whereby we will acquire all of the outstanding common stock of Jericho Associates, Inc. (“Jericho”), a company operating in the gaming, hospitality and entertainment industries, in exchange for 7,151,416 shares of our common stock which were contingently issued to the shareholders of Jericho. In July 2017, an additional 481,000 shares were issued to shareholders of Jericho under the same contingencies as the original shares. The Equity Purchase Agreement provided that by September 24, 2017, if the management of Jericho does not identify at least one entity or business opportunity for acquisition, in order to supplement the Company’s current business operations, the shares issued as part of the agreement shall be returned to the Company and the transaction will be nullified. On September 22, 2017, the Company and Jericho mutually agreed to extend the performance requirement until December 24, 2017. On November 9, 2017, the Company and Jericho mutually agreed to extend the performance requirement until March 1, 2018.

On February 25, 2018, Jericho identified the acquisition of 50% interests in two LLCs (the “LLCs”). The LLCs have a Term Sheet agreement to develop a casino and hotel resort, and provide certain gaming equipment on a shared profit basis. The contemplated over $300 million project, is in the process of regulatory review, finalization of closing documents, and completion of financing. In December 2019, the World Health Organization declared the COVID-19 pandemic officially begun. With this event, many U.S. Government agencies shut down many of their services. The pandemic was declared officially ended on March 11, 2023. On March 14, 2023, the Company and Jericho announced the relationship with Mr. Ray Brown to assist in finalizing regulatory review of current events to close the terms of the March 24, 2017 PA agreement with Jericho. Notwithstanding the identification of the business opportunity the shares issued to Jericho remain contingent upon the regulatory review, the finalization of closing documentation, and the completion of financing arrangements for the project.

Also, upon the regulatory review, the finalization of closing documentation, and the completion of financing arrangements for the project, the Company’s President will cancel all shares of common stock held (879,167 shares as of October 24, 2023), the Company’s Chief Executive Officer will cancel all but 550,000 shares of her common stock held (2,951,667 shares as of October 24, 2023), and the Company’s Secretary will cancel all but 45,000 shares of common stock held (185,000 shares as of October 24, 2023).

We have never declared bankruptcy, have never been in receivership, and have never been involved in any legal action or proceedings.

Principal Services

If the transaction with Jericho finalizes, the Company will operate two business divisions, which will be operated simultaneously and consist of the following:

The concrete leveling division of the business will fabricate and market a concrete leveling service unit utilized in the concrete leveling industry. This unit secures to the back of a truck and consists of a mixing device to mix lime with water and a pumping device capable of pumping the mixture under pressure into pre-drilled holes in order to raise the level of any flat concrete surface.

The gaming and hospitality division of the business will focus on casino gaming, hospitality, entertainment and leisure time industries, and will pursue opportunities in the tribal and commercial casino gaming industries, both in California and Nevada. The Company will also operate in the casino gaming technology industry, and is seeking opportunities to partner, joint venture, or acquire companies developing casino games that combine traditional casino games with the challenge of video games and the playability of social games, meaning games that pit the player’s skill against the skill of another player as opposed to the casino itself.

Organization

As of October 24, 2023 we were comprised of the parent company Concrete Leveling Systems, Inc. Upon the closing of the acquisition of Jericho, Jericho will become a wholly owned subsidiary of the Company.

Strategy

Structured as a concrete leveling services provider, as well as a casino gaming, hospitality, and entertainment company, our business model is designed to partner with third parties in the casino and hospitality industries, which will also allow us to further develop and utilize our concrete leveling division if we are able to enter into agreements that will result in the construction of any “brick and mortar” structures.

Backlog

As of July 31, 2023, we had no backlog.

Employees

As of July 31, 2023, we have 0 full time employees and 0 part time employees.

Proprietary Information

We own no proprietary information.

Government Regulation

We are currently not subject to material governmental regulation. However, it is our policy to fully comply with all governmental regulation and regulatory authorities. If we are able to engage in the casino gaming and hospitality industry, we may become subject to both federal and state regulation related to the operation of our business, which would require us to comply with additional government regulation.

How to Obtain our SEC Filings

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and any amendments to these reports, are available on our website at clsfabricating.com, as soon as reasonably practicable after we file these reports electronically with, or furnish them to, the Securities and Exchange Commission (“SEC”). Except as otherwise stated in these reports, the information contained on our website or available by hyperlink from our website is not incorporated into this Annual Report on Form 10-K or other documents we file with, or furnish to, the SEC.

Our investor relations department can be contacted at our principal executive office located at our principal office, 5046 E. Boulevard NW, Canton, OH 44718. Our telephone number is (330)-966-8120.

ITEM 1A. RISK FACTORS

Not required for a Smaller Reporting Company.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. DESCRIPTION OF PROPERTY

The Company’s operations are currently being conducted out of the Company office located at 5046 E. Boulevard, NW Canton, OH 44718, and consists of approximately 2,500 square feet. The Company is provided with this commercial location rent-free from the Company’s President, Edward A. Barth. The Company considers that the current principal office space arrangement is adequate and will reassess its needs based upon the future growth of the Company.

ITEM 3. LEGAL PROCEEDINGS

None.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

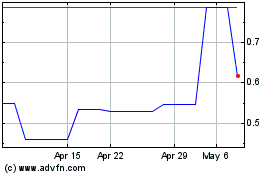

Since June 25, 2010, our common stock has been quoted on the OTC Pink marketplace, under the trading symbol CLEV. Prior to June 25, 2010, our common stock was not quoted on any stock exchange. The following table sets forth, for the calendar periods indicated, the range of the high and low prices reported for our common stock. The quotations represent inter-dealer prices without retail mark- ups, mark-downs, or commissions, and may not necessarily represent actual transactions. The quotations may be rounded for presentation.

Fiscal year ended July 31, 2023 | | High | | | Low | |

| | | | | | |

First Quarter | | | 3.87 | | | | 2.43 | |

Second Quarter | | | 3.20 | | | | 1.51 | |

Third Quarter | | | 3.05 | | | | 1.54 | |

Fourth Quarter | | | 3.54 | | | | 1.80 | |

Fiscal year ended July 31, 2022 | | High | | | Low | |

| | | | | | |

First Quarter | | | 2.50 | | | | 0.83 | |

Second Quarter | | | 2.05 | | | | 0.60 | |

Third Quarter | | | 3.96 | | | | 0.66 | |

Fourth Quarter | | | 4.13 | | | | 2.50 | |

Holders

As of October 24, 2023, there were 36 recorded holders of our common stock, and there were 14,027,834 shares of our common stock outstanding.

The Securities Enforcement and Penny Stock Reform Act of 1990

The Securities and Exchange Commission has also adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the Nasdaq system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system).

A purchaser is purchasing penny stock which limits the ability to sell the stock. The Company’s shares constitute penny stock under the Securities and Exchange Act. The shares will remain penny stocks for the foreseeable future. The classification of penny stock makes it more difficult for a broker-dealer to sell the stock into a secondary market, which makes it more difficult for a purchaser to liquidate his/her investment. Any broker-dealer engaged by the purchaser for the purpose of selling his or her shares in us will be subject to Rules 15g-1 through 15g-10 of the Securities and Exchange Act. Rather than creating a need to comply with those rules, some broker-dealers will refuse to attempt to sell penny stock.

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, to deliver a standardized risk disclosure document prepared by the Commission, which:

| · | contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; |

| | |

| · | contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of the Securities Act of 1934, as amended; |

| | |

| · | contains a brief, clear, narrative description of a dealer market, including "bid" and "ask" prices for penny stocks and the significance of the spread between the bid and ask price; |

| | |

| · | contains a toll-free telephone number for inquiries on disciplinary actions; |

| | |

| · | defines significant terms in the disclosure document or in the conduct of trading penny stocks; and |

| | |

| · | contains such other information and is in such form (including language, type, size and format) as the Securities and Exchange Commission shall require by rule or regulation; |

| | |

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, to the customer:

| · | the bid and offer quotations for the penny stock; |

| | |

| · | the compensation of the broker-dealer and its salesperson in the transaction; |

| | |

| · | the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and |

| | |

| · | monthly account statements showing the market value of each penny stock held in the customer’s account. |

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitability statement. These disclosure requirements will have the effect of reducing the trading activity in the secondary market for our stock because it will be subject to these penny stock rules. Therefore, stockholders may have difficulty selling their securities.

Dividend Policy

We have not previously declared or paid any dividends on our common stock and do not anticipate declaring any dividends in the foreseeable future. The payment of dividends on our common stock is within the discretion of our board of directors. We intend to retain any earnings for use in our operations and the expansion of our business. Payment of dividends in the future will depend on our future earnings, future capital needs and our operating and financial condition, among other factors that our board of directors may deem relevant. We are not under any contractual restriction as to our present or future ability to pay dividends.

Recent Sales of Unregistered Securities

None.

ITEM 6. SELECTED FINANCIAL DATA

A smaller reporting company is not required to provide the information in this Item.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Cautionary Statement Concerning Forward-Looking Statements

This report contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are subject to risks and uncertainties and are based on the beliefs and assumptions of management and information currently available to management. The use of words such as “believes”, “expects”, “anticipates”, “intends”, “plans”, “estimates”, “should”, “likely” or similar expressions, indicates a forward-looking statement.

The identification in this report of factors that may affect our future performance and the accuracy of forward-looking statements is meant to be illustrative and by no means exhaustive. All forward-looking statements should be evaluated with the understanding of their inherent uncertainty.

Factors that could cause our actual results to differ materially from those expressed or implied by forward-looking statements include, but are not limited to:

| · | Trends affecting the Company’s financial condition, results of operations, or future prospects; |

| | |

| · | The Company’s business and growth strategies; |

| | |

| · | The Company’s financing plans and forecasts; |

| | |

| · | The factors that we expect to contribute to our success and the Company’s ability to be successful in the future; |

| | |

| · | The Company’s business model and strategy for realizing positive results as sales increase; |

| | |

| · | Competition, including the Company’s ability to respond to such competition and its expectations regarding continued competition in the market in which the Company competes; |

| | |

| · | Expenses; |

| | |

| · | The Company’s ability to meet its projected operating expenditures and the costs associated with development of new projects; |

| | |

| · | The Company’s ability to pay dividends or to pay any specific rate of dividends, if declared; |

| | |

| · | The impact of new accounting pronouncements on its financial statements; |

| | |

| · | That the Company’s cash flows from operating activities will be sufficient to meet its projected operating expenditures for the next twelve months; |

| | |

| · | The Company’s market risk exposure and efforts to minimize risk; |

| | |

| · | Development opportunities and its ability to successfully take advantage of such opportunities; |

| | |

| · | Regulations, including anticipated taxes, tax credits or tax refunds expected; |

| | |

| · | The outcome of various tax audits and assessments, including appeals thereof, timing of resolution of such audits, the Company’s estimates as to the amount of taxes that will ultimately be owed and the impact of these audits on the Company’s financial statements; |

| | |

| · | The Company’s overall outlook including all statements under Management’s Discussion and Analysis or Plan of Operation; |

| | |

| · | That estimates and assumptions made in the preparation of financial statements in conformity with US GAAP may differ from actual results; and |

| | |

| · | Expectations, plans, beliefs, hopes or intentions regarding the future. |

Management has concluded that the COVID-19 outbreak in 2020 may have a significant impact on business in general, but the potential impact on the Company is not currently measurable. Due to the level of risk this virus may have on the global economy, it is at least reasonably possible that it could have an impact on the operations of the Company in the near term that could materially impact the Company’s financials. Management has not been able to measure the potential financial impact on the Company but will review commercial and federal financing options should the need arise.

The following discussion of our financial condition and results of operations should be read in conjunction with our financial statements and the related notes included in this report.

The following table provides selected financial data about us for the fiscal years ended July 31, 2023 and 2022. For detailed financial information, see the audited Financial Statements included in this report.

Years Ended July, 31 | | 2023 | | | 2022 | |

| | | | | | |

Cash | | $ | 682 | | | $ | 747 | |

Total Assets | | | 25,444 | | | | 25,738 | |

Total Liabilities | | | 519,718 | | | | 466,282 | |

Stockholders’ Deficit | | | 494,274 | | | | 440,544 | |

| | | | | | | | |

Operating Data | | | | | | | | |

Revenues | | | 870 | | | | 1,082 | |

Cost of Sales | | | 320 | | | | 397 | |

Operating Expenses | | | 44,043 | | | | 39,763 | |

Net Loss | | | (53,730 | ) | | | (48,967 | ) |

Overview

Concrete Leveling Services, Inc. (“we”, “us”, “our” or the “Company”) was incorporated on August 28, 2007 in the State of Nevada. The Company’s principal offices are located at 5046 East Boulevard Northwest, Canton, Ohio 44718. In Ohio, the Company does business under the trade name of CLS Fabricating, Inc. On March 24, 2017, we entered into an Equity Purchase Agreement, whereby we will acquire all of the outstanding common stock of Jericho Associates, Inc. (“Jericho”), a company operating in the gaming, hospitality and entertainment industries, in exchange for 7,151,416 shares of our common stock which were contingently issued to the shareholders of Jericho. In July 2017, an additional 481,000 shares were issued to shareholders of Jericho under the same contingencies as the original shares. The Equity Purchase Agreement provided that by September 24, 2017, if the management of Jericho does not identify at least one entity or business opportunity for acquisition, in order to supplement the Company’s current business operations, the shares issued as part of the agreement shall be returned to the Company and the transaction will be nullified. On September 22, 2017, the Company and Jericho mutually agreed to extend the performance requirement until December 24, 2017. On November 9, 2017, the Company and Jericho mutually agreed to extend the performance requirement until March 1, 2018.

On February 25, 2018, Jericho identified the acquisition of 50% interests in two LLCs (the “LLCs”). The LLCs have a Term Sheet agreement to develop a casino and hotel resort, and provide certain gaming equipment on a shared profit basis. The contemplated over $300 million project, is in the process of regulatory review, finalization of closing documents, and completion of financing. In December of 2019, the World Health Organization declared the COVID-19 pandemic officially begun. With this event, many U.S. Government agencies shut down many of their services. The pandemic was declared officially ended on March 11, 2023. On March 14, 2023, the Company and Jericho announced the relationship with Mr. Ray Brown to assist in finalizing regulatory review of current events to close the terms of the March 24, 2017 PA agreement with Jericho. Notwithstanding the identification of the business opportunity the shares issued to Jericho remain contingent upon the regulatory review, the finalization of closing documentation, and the completion of financing arrangements for the project.

Also, upon the regulatory review, the finalization of closing documentation, and the completion of financing arrangements for the project, the Company’s President will cancel all shares of common stock held (879,167 shares as of October 24, 2023), the Company’s Chief Executive Officer will cancel all but 550,000 shares of her common stock held (2,951,667 shares as of October 24, 2023), and the Company’s Secretary will cancel all but 45,000 shares of common stock held (185,000 shares as of October 24, 2023).

We have never declared bankruptcy, have never been in receivership, and have never been involved in any legal action or proceedings.

If the transaction with Jericho finalizes, the Company will operate two business divisions, which will be operated simultaneously and consist of the following:

The concrete leveling division of the business will fabricate and market a concrete leveling service unit utilized in the concrete leveling industry. This unit secures to the back of a truck and consists of a mixing device to mix lime with water and a pumping device capable of pumping the mixture under pressure into pre-drilled holes in order to raise the level of any flat concrete surface.

The gaming and hospitality division of the business will focus on casino gaming, hospitality, entertainment and leisure time industries, and will pursue opportunities in the tribal and commercial casino gaming industries, both in California and Nevada. The Company will also operate in the casino gaming technology industry, and is seeking opportunities to partner, joint venture, or acquire companies developing casino games that combine traditional casino games with the challenge of video games and the playability of social games, meaning games that pit the player’s skill against the skill of another player as opposed to the casino itself.

Results of Operations

For the Year Ended July 31, 2023 Compared to the Year Ended July 31, 2022

The Company generated $870 in revenue for the year ended July 31, 2023, which compares to revenue of $1,082 for the year ended July 31, 2022. Our revenues decreased during the year ended July 31, 2023 due to decreased sales of our concrete leveling parts due to a decrease in demand in this area.

Cost of sales for the year ended July 31, 2023 was $320, which compares to cost of sales of $397 for the year ended July 31, 2022. Our revenues decreased during the year ended July 31, 2023, which resulted in a similar decrease in our cost of sales during the period.

Operating expenses, which consisted of legal and professional fees and selling, general and administrative expenses for the year ended July 31, 2023, were $44,043. This compares with operating expenses for the year ended July 31, 2022 of $39,763. Our operating expenses increased during the year ended July 31, 2023 due to an increase in our legal and professional fees resulting from higher accounting fees.

As a result of the foregoing, we had a net loss of $53,730 for the year ended July 31, 2023. This compares with a net loss of $48,967 for the year ended July 31, 2022.

In its audited financial statements as of July 31, 2023, the Company was issued an opinion by its auditors that raised substantial doubt about the ability to continue as a going concern based on the Company’s current financial position. Our ability to achieve and maintain profitability and positive cash flow is dependent upon our ability to successfully develop and market our products and our ability to generate revenues.

Liquidity and Capital Resources

As of July 31, 2023, we had cash or cash equivalents of $682. As of July 31, 2022, we had cash or cash equivalents of $747.

We believe that with our existing cash flows, we do not have sufficient cash to meet our operating requirements for the next twelve months. We believe that with the addition of our gaming and hospitality business, we will begin to generate increased revenue over the 2024 fiscal year. However, if our revenue is not sufficient to allow us to meet our cash requirements during the next twelve months, the Company may need to raise additional funds through the sale of debt or equity securities. We cannot guarantee that we will be successful in generating sufficient revenues or other funds in the future to cover these operating costs. Failure to generate sufficient revenues or additional financing when needed could cause us to go out of business.

Net cash used in operating activities for the year ended July 31, 2023 was $44,433. This compares to net cash used in operating activities of $39,684 for the year ended July 31, 2022. This change is primarily due to an increase in net losses during the year ended July 31, 2023.

Cash flows provided by financing activities were $44,368 for the year ended July 31, 2023 which compares to cash flows provided by financing activities of $39,616 for the year ended July 31, 2022. The change in cash flows provided by financing activities is due to a decrease in advances from stockholders during the year ended July 31, 2023. We anticipate significant increases in cash flows provided by financing activities during the next 12 months, as we intend to raise capital through either debt or equity securities to fund our business.

As of July 31, 2023, our total assets were $25,444 and our total liabilities were $519,718. As of July 31, 2022, our total assets were $25,738 and our total liabilities were $466,282.

Critical Accounting Policies and Estimates

We believe that the following critical policies affect our more significant judgments and estimates used in preparation of our financial statements.

We disclose those accounting policies that we consider to be significant in determining the amounts to be utilized for communicating our financial position, results of operations and cash flows in the first note to our financial statements included elsewhere herein. Our discussion and analysis of our financial condition and results of operations are based on our financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of financial statements in conformity with these principles requires management to make estimates and assumptions that affect amounts reported in the financial statements and accompanying notes. Actual results are likely to differ from these estimates, but management does not believe such differences will materially affect our financial position or results of operations.

We believe that the following accounting policies are the most critical because they have the greatest impact on the presentation of our financial condition and results of operations.

Use of Estimates

The preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the period. Actual results could differ from those estimates.

Going Concern

The Company was formed on August 28, 2007 and was in the development stage through July 31, 2009. The year ended July 31, 2010 was the first year during which it was considered an operating company. The Company has sustained substantial operating losses since its inception. In addition, the Company has used substantial amounts of working capital in its operations. Further, at July 31, 2023, our liabilities exceed our assets by $494,274.

Success will be dependent upon management’s ability to obtain future financing and liquidity, and success of its future operations. These factors raise substantial doubt about the Company’s ability to continue as a going concern. These financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Off-Balance Sheet Arrangements

The Company does not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on its financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Foreign Currency Transactions

None.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

A smaller reporting company is not required to provide the information in this Item.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and

Stockholders of Concrete Leveling Systems, Inc.

Opinion on the Financial Statements

We have audited the accompanying balance sheets of Concrete Leveling Systems, Inc. (the “Company”) as of July 31, 2023 and 2022, and the related statements of operations, stockholders’ deficit, and cash flows for each of the years in the two-year period ended July 31, 2023, and the related notes (collectively referred to as the financial statements). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of July 31, 2023 and 2022, and the results of its operations and its cash flows for each of the years in the two-year period ended July 31, 2023, in conformity with accounting principles generally accepted in the United States of America.

Substantial Doubt about the Company’s Ability to Continue as a Going Concern

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company has sustained substantial operating losses since its inception. This factor, and the need for additional financing in order for the Company to meet its business plans raises substantial doubt about the Company’s ability to continue as a going concern. Our opinion is not modified with respect to that matter.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Critical Audit Matters

Critical audit matters are matters arising from the current period audit of the financial statements that were communicated or required to be communicated to the audit committee and that: (1) relate to accounts or disclosures that are material to the financial statements and (2) involved our especially challenging, subjective, or complex judgments. We determined that there were no critical audit matters.

/s/ Accell Audit and Compliance, P.A.

We have served as the Company’s auditor since 2017.

Tampa, Florida

October 30, 2023

PCAOB ID# 3289

3001 N. Rocky Point Dr. East, Suite 200 • Tampa, Florida 33607 • 813.367.3527 |

Concrete Leveling Systems, Inc. |

Balance Sheets |

July 31, 2023 and 2022 |

| | | | | | |

| | 2023 | | | 2022 | |

Assets | | | | | | |

| | | | | | |

Current Assets | | | | | | |

Cash | | $ | 682 | | | $ | 747 | |

Inventory | | | 23,862 | | | | 24,182 | |

Prepaid expenses | | | 900 | | | | 809 | |

Total Current Assets | | | 25,444 | | | | 25,738 | |

| | | | | | | | |

Property, Plant and Equipment | | | | | | | | |

Equipment | | | 700 | | | | 700 | |

Less: Accumulated depreciation | | | (700 | ) | | | (700 | ) |

Total Property, Plant and Equipment | | | - | | | | - | |

| | | | | | | | |

Total Assets | | $ | 25,444 | | | $ | 25,738 | |

| | | | | | | | |

Liabilities and Stockholders’ Deficit | | | | | | | | |

| | | | | | | | |

Current Liabilities | | | | | | | | |

Accounts payable and accrued expenses | | $ | 25,403 | | | $ | 25,341 | |

Accrued interest - stockholders | | | 38,404 | | | | 29,398 | |

Advances - stockholders | | | 268,944 | | | | 223,326 | |

Notes payable - stockholders | | | 186,967 | | | | 188,217 | |

Total Current Liabilities | | | 519,718 | | | | 466,282 | |

| | | | | | | | |

Commitments and Contingencies (Note 4) | | | | | | | | |

| | | | | | | | |

Stockholders’ Deficit | | | | | | | | |

Common stock (par value $0.001) | | | | | | | | |

100,000,000 shares authorized: | | | | | | | | |

14,027,834 shares issued and outstanding | | | 14,027 | | | | 14,027 | |

Additional paid-in capital | | | 433,209 | | | | 433,209 | |

Accumulated deficit | | | (941,510 | ) | | | (887,780 | ) |

Total Stockholders’ Deficit | | | (494,274 | ) | | | (440,544 | ) |

| | | | | | | | |

Total Liabilities and Stockholders’ Deficit | | $ | 25,444 | | | $ | 25,738 | |

See notes to financial statements and report of independent registered accounting firm.

Concrete Leveling Systems, Inc. |

Statements of Operations |

For the Years Ended July 31, 2023 and 2022 |

| | | | | | |

| | | | | | |

| | | | | | |

| | 2023 | | | 2022 | |

| | | | | | |

Equipment and parts sales | | $ | 870 | | | $ | 1,082 | |

| | | | | | | | |

Cost of sales | | | 320 | | | | 397 | |

| | | | | | | | |

Gross margin | | | 550 | | | | 685 | |

| | | | | | | | |

Operating expenses | | | | | | | | |

Legal and professional fees | | | 35,050 | | | | 32,220 | |

Selling, general and administration | | | 8,993 | | | | 7,543 | |

Total expenses | | | 44,043 | | | | 39,763 | |

| | | | | | | | |

Loss from Operations | | | (43,493 | ) | | | (39,078 | ) |

| | | | | | | | |

Other income (expense) | | | | | | | | |

Interest expense | | | (10,237 | ) | | | (9,889 | ) |

Total other expense | | | (10,237 | ) | | | (9,889 | ) |

| | | | | | | | |

Net loss before income taxes | | | (53,730 | ) | | | (48,967 | ) |

| | | | | | | | |

Provision for Income Taxes | | | - | | | | - | |

| | | | | | | | |

Net loss | | $ | (53,730 | ) | | $ | (48,967 | ) |

| | | | | | | | |

Net loss per share - basic and fully diluted | | $ | (0.00 | ) | | $ | (0.00 | ) |

| | | | | | | | |

Weighted average number of common | | | | | | | | |

shares outstanding - basic and fully diluted | | | 14,027,834 | | | | 14,027,834 | |

See notes to financial statements and report of independent registered accounting firm.

Concrete Leveling Systems, Inc. |

Statements of Stockholders’ Deficit |

For the Years Ended July 31, 2023 and 2022 |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | Common Stock | | | Additional | | | | | | Total | |

| | Issued | | | Par | | | Paid-in | | | Accumulated | | | Stockholders’ | |

| | Shares | | | Value | | | Capital | | | Deficit | | | Deficit | |

| | | | | | | | | | | | | | | |

Balance July 31, 2021 | | | 14,027,834 | | | $ | 14,027 | | | $ | 433,209 | | | $ | (838,813 | ) | | $ | (391,577 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net loss | | | - | | | | - | | | | - | | | | (48,967 | ) | | | (48,967 | ) |

| | | | | | | | | | | | | | | | | | | | |

Balance July 31, 2022 | | | 14,027,834 | | | | 14,027 | | | | 433,209 | | | | (887,780 | ) | | | (440,544 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net loss | | | - | | | | - | | | | - | | | | (53,730 | ) | | | (53,730 | ) |

| | | | | | | | | | | | | | | | | | | | |

Balance July 31, 2023 | | | 14,027,834 | | | $ | 14,027 | | | $ | 433,209 | | | $ | (941,510 | ) | | $ | (494,274 | ) |

See notes to financial statements and report of independent registered public accounting firm.

Concrete Leveling Systems, Inc. |

Statements of Cash Flows |

For the Years Ended July 31, 2023 and 2022 |

| | | | | | |

| | 2023 | | | 2022 | |

| | | | | | |

Cash Flows from Operating Activities | | | | | | |

| | | | | | |

Net loss | | $ | (53,730 | ) | | $ | (48,967 | ) |

Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | | |

Accounts receivable | | | - | | | | 295 | |

Inventory | | | 320 | | | | 46 | |

Prepaid expenses | | | (91 | ) | | | 26 | |

Accounts payable and accrued expenses | | | 62 | | | | (90 | ) |

Accrued interest - stockholders | | | 9,006 | | | | 9,006 | |

Net cash from operating activities | | | (44,433 | ) | | | (39,684 | ) |

| | | | | | | | |

Cash Flows from Financing Activities | | | | | | | | |

Advances from stockholders | | | 44,368 | | | | 39,616 | |

Net cash from financing activities | | | 44,368 | | | | 39,616 | |

| | | | | | | | |

Change in cash | | | (65 | ) | | | (68 | ) |

Cash - beginning | | | 747 | | | | 815 | |

Cash - ending | | $ | 682 | | | $ | 747 | |

| | | | | | | | |

Supplemental Disclosure of Cash Flows Information | | | | | | | | |

Cash paid for interest | | $ | 1,231 | | | $ | 884 | |

Cash paid for income taxes | | $ | - | | | $ | - | |

See notes to financial statements and report of independent registered public accounting firm.

CONCRETE LEVELING SYSTEMS, INC.

NOTES TO FINANCIAL STATEMENTS

JULY 31, 2023 AND 2022

NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

This summary of significant accounting policies of Concrete Leveling Systems, Inc. (hereinafter the “Company”), is presented to assist in understanding the financial statements. The financial statements and notes are representations of the Company’s management, which is responsible for their integrity and objectivity. These accounting policies conform to accounting principles generally accepted in the United States of America (“GAAP”) and have been consistently applied in the preparation of the financial statements.

Nature of Operations

The Company manufactures for sale specialized equipment for use in the concrete leveling industry. The Company’s product is sold primarily to end users.

On March 24, 2017, the Company entered into an agreement with Jericho Associates, Inc. (“Jericho”), a start-up company which plans to operate in the gaming, hospitality and entertainment industries. The Company issued Jericho 7,151,416 shares of the Company’s common stock, subject to a performance requirement, which provides that by March 1, 2018, if the management of Jericho does not identify at least one entity or business opportunity for acquisition, in order to supplement the Company’s current business operations, the shares issued as part of the agreement shall be returned to the Company. In July 2017, an additional 481,000 shares were issued to shareholders of Jericho under the same contingencies as the original shares. On September 22, 2017, the Company and Jericho mutually agreed to extend the performance requirement until December 24, 2017. On November 9, 2017, the Company and Jericho mutually agreed to extend the performance requirement to March 1, 2018.

On February 25, 2018, Jericho identified the acquisition of 50% interests in two LLCs (the “LLCs”). The LLCs have a Term Sheet agreement to develop a casino and hotel resort, and provide certain gaming equipment on a shared profit basis. The project is in the process of regulatory review, finalization of closing documents, and completion of financing. In December of 2019, the World Health Organization declared the COVID-19 pandemic officially begun. With this event, many U.S. Government agencies shut down many of their services. The pandemic was declared officially ended on March 11, 2023. On March 14, 2023, the Company and Jericho announced the relationship with Mr. Ray Brown to assist in finalizing regulatory review of current events to close the terms of the March 24, 2017 PA agreement with Jericho. Notwithstanding the identification of the business opportunity, the shares issued to Jericho remain contingent upon the regulatory review, the finalization of closing documentation, and the completion of financing arrangements for the project. Also, upon the regulatory review, the finalization of closing documentation, and the completion of financing arrangements for the project, the Company’s President will cancel all shares of common stock held (879,167 shares as of July 31, 2023), the Company’s Chief Executive Officer will cancel all but 550,000 shares of common stock held (2,951,667 shares as of July 31, 2023), subject to an 18-month non-dilution right in order to maintain an ownership percentage of 4.99%, and the Company’s Secretary will cancel all but 45,000 shares of common stock held (185,000 shares as of July 31, 2023). Prior to the August 13, 2018 amendment to the agreement with Jericho, the Chief Executive Officer would cancel all but 523,000 shares of her common stock, subject to an 18-month non-dilution right in order to maintain an ownership percentage of 4.99%. The amendment provided that the Chief Executive Officer would retain an additional 27,000 shares of common stock and the non-dilution right was eliminated.

Principal Services

If the transaction with Jericho finalizes, the Company will operate two business divisions, which will be operated simultaneously and consist of the following:

The concrete leveling division of the business will fabricate and market a concrete leveling service unit utilized in the concrete leveling industry. This unit secures to the back of a truck and consists of a mixing device to mix lime with water and a pumping device capable of pumping the mixture under pressure into pre-drilled holes in order to raise the level of any flat concrete surface.

The gaming and hospitality division of the business will focus on casino gaming, hospitality, entertainment and leisure time industries, and will pursue opportunities in the tribal and commercial casino gaming industries, both in California and Nevada. The Company will also operate in the casino gaming technology industry, and is seeking opportunities to partner, joint venture, or acquire companies developing casino games that combine traditional casino games with the challenge of video games and the playability of social games, meaning games that pit the player’s skill against the skill of another player as opposed to the casino itself.

Basis of Presentation

The accompanying financial statements have been prepared in accordance with GAAP. The Company’s year-end is July 31.

Revenue Recognition

The Company recognizes revenue in accordance with Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") Topic 606, "Revenue from contracts with customers". Revenue is recognized when a customer obtains control of the promised goods or services. In addition, the standard requires disclosure of the nature, amount, timing, and uncertainty of revenue and cash flows arising from contracts with customers. The amount of revenue that is recorded reflects the consideration that the company expects to receive in exchange for those goods. The Company applies the following five-step model in order to determine this amount; (i) identification of the promised goods in the contract; (ii) determination of whether the promised goods are performance obligations, including whether they are distinct in the context of the contract; (iii) measurement of the transaction price, including the constraint on variable consideration; (iv) allocation of the transaction price to the performance obligations; and (v) recognition of revenue when (or as) the Company satisfies each performance obligation.

The Company only applies the five-step model to contracts when it is probable that the entity will collect the consideration it is entitled to in exchange for the goods or services it transfers to the customer. Once a contract is determined to be within the scope of FASB ASC Topic 606 at contract inception, the Company reviews the contract to determine which performance obligation the Company must deliver and which of these performance obligations are distinct. The Company recognizes as revenue the amount of the transaction price that is allocated to the respective performance obligation when the performance obligation is satisfied or as it is satisfied. Generally, the Company’s performance obligations are transferred to customers at a point in time, typically upon delivery.

Cash and Cash Equivalents

The Company considers all highly liquid investments with an original maturity of three months or less to be cash equivalents.

Accounts Receivable

The Company grants credit to its customers in the ordinary course of business. The Company provides for an allowance for uncollectable receivables based on prior experience. The allowance was $0 at July 31, 2023 and 2022.

Advertising and Marketing

Advertising and marketing costs are charged to operations when incurred. Advertising costs were $864 and $0 for the years ended July 31, 2023 and 2022, respectively.

Inventory

Inventories, which consist of parts and work in progress, are recorded at the lower of first-in first-out cost or net realizable value (estimated selling price less costs of completion, disposal and transportation). When an impairment suggests that the carrying amounts of inventories might not be recoverable, the Company reviews such carrying amounts and estimates the net realizable value based on the most reliable evidence available at that time. An impairment loss is recorded if the net realizable value is less than the carrying value. Impairment indicators considered for these purposes are, among others, obsolescence, decrease in market prices, damage and a firm commitment to sell.

Use of Estimates

The preparation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the period. Actual results could differ from those estimates.

Property, Plant, and Equipment

Property, plant, and equipment are recorded at cost. Depreciation is provided for by using the straight-line and accelerated methods over the estimated useful lives of the respective assets.

Maintenance and repairs are charged to expense as incurred. Major additions and betterments are capitalized. When items of property and equipment are sold or retired, the related cost and accumulated depreciation are removed from the accounts and any resulting gain or loss is included in the determination of net income.

Income taxes

Concrete Leveling Systems, Inc. recognizes deferred income tax assets and liabilities for the expected future tax consequences of temporary differences between the income tax and financial reporting carrying amount of the Company’s assets and liabilities. The Company monitors its deferred tax assets and evaluates the need for a valuation allowance based on the estimate of the amount of such deferred tax assets that it believes does not meet the more-likely-than-not recognition criteria. The Company also evaluates whether it has any uncertain tax positions and would record a reserve if management believes it is more-likely-than-not their position would not prevail with the applicable tax authorities. The Company’s assessment of tax positions as of July 31, 2023 and 2022, determined that there were no material uncertain tax positions.

Going Concern

The Company has sustained substantial operating losses since its inception. In addition, the Company has used substantial amounts of working capital in its operations. Further, at July 31, 2023, current liabilities exceed current assets by $494,274, and total liabilities exceed total assets by $494,274.

Success will be dependent upon management’s ability to obtain future financing and liquidity, and success of its future operations. These factors raise substantial doubt about the Company’s ability to continue as a going concern. These financial statements do not include any adjustments that might result from the outcome of this uncertainty.

NOTE 2 - INCOME TAXES

Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Additionally, the recognition of future tax benefits, such as net operating loss carry forwards, is required to the extent that realization of such benefits is more likely than not. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which the assets and liabilities are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income tax expense in the period that includes the enactment date.

In the event the future tax consequences of differences between the financial reporting bases and the tax bases of the Company’s assets and liabilities result in deferred tax assets, an evaluation of the probability of being able to realize the future benefits indicated by such asset is required. A valuation allowance is provided for the portion of the deferred tax asset when it is more likely than not that some or all of the deferred tax asset will not be realized. In assessing the realizability of the deferred tax assets, management considers the scheduled reversals of deferred tax liabilities, projected future taxable income, and tax planning strategies.

As of July 31, 2023, the Company had net operating loss carry forwards of approximately $759,856 that may be available to reduce future years’ taxable income in varying amounts through 2042.

The Company’s income tax returns are subject to examination by tax authorities. Generally, the statute of limitations related to the Company’s federal and state income tax return is three years from the date of filing. The state impact of any federal changes of prior years remains subject to examination for a period of up to five years after formal notification to the states.

Management has evaluated tax positions in accordance with FASB ASC 740, Income Taxes, and has not identified any significant tax positions, other than those disclosed.

Income taxes on continuing operations include the following:

| | July 31, 2023 | | | July 31, 2022 | |

| | | | | | |

Currently payable | | $ | -0- | | | $ | -0- | |

Deferred | | | 0 | | | | 0 | |

| | | | | | | | |

Total | | $ | -0- | | | $ | -0- | |

A reconciliation of the effective tax rate with the statutory U.S. income tax rate is as follows:

| | July 31, 2023 | | | July 31, 2022 | |

| | | | | % of | | | | | | % of | |

| | | | | Pretax | | | | | | Pretax | |

| | Income | | | Amount | | | Income | | | Amount | |

| | | | | | | | | | | | |

Income taxes per statement of operations | | $ | -0- | | | | 0 | % | | $ | -0- | | | | 0 | % |

| | | | | | | | | | | | | | | | |

Loss for financial reporting purposes without tax expense or benefit | | | (9,400 | ) | | | (21 | ) | | | (8,400 | ) | | | (21 | ) |

| | | | | | | | | | | | | | | | |

Income taxes at statutory rate | | $ | (9,400 | ) | | | (21 | )% | | $ | (8,400 | ) | | | (21 | )% |

The components of and changes in the net deferred taxes were as follows:

Deferred tax assets: | | July 31, 2023 | | | July 31, 2022 | |

| | | | | | |

Net operating loss carryforwards | | $ | 159,600 | | | $ | 150,200 | |

| | | | | | | | |

Compensation and miscellaneous | | | 8,100 | | | | 6,200 | |

| | | | | | | | |

Deferred tax assets | | | 167,700 | | | | 156,400 | |

| | | | | | | | |

Valuation Allowance | | | (167,700 | ) | | | (156,400 | ) |

| | | | | | | | |

Net deferred tax assets: | | $ | -0- | | | $ | -0- | |

Tax periods ended July 31, 2019 through 2023 are subject to examination by major taxing authorities.

NOTE 3 - RELATED PARTIES

The Company uses warehouse and office space belonging to one of its stockholders. The stockholder does not charge the Company rent or other fees for the use of these facilities.

Four stockholders of the Company loaned a total of $62,750 to the Company at various times during the years ended July 31, 2010 through 2012. The loans carry interest rates from 8.00% to 12.00% and are due on demand. The balances on the loans are $62,750 at July 31, 2023 and 2022. Effective July 31, 2013, further interest accrual was waived by the noteholders. Accrued interest is $15,139 at July 31, 2023 and 2022 and is included within accrued interest - stockholders on the balance sheets.

One of the Company’s stockholders and a company owned by the stockholder advanced a total of $124,817 to the Company at various times between November 2012 and December 2020. On December 31, 2020, $124,217 of the balance of the advances was converted to a note payable to the stockholder. The note carries interest at a rate of 7.25% and is payable on demand. Accrued interest at July 31, 2023 and 2022 is $23,265 and $14,259, respectively and is included within accrued interest - stockholders on the balance sheets. The balances on the advances and note payable are $127,467 and $125,467 at July 31, 2023 and 2022, respectively. The advances carry no interest.

Another stockholder of the Company paid invoices of the Company at various times between August 2018 and July 2023. The balances on these advances are $265,694 and $223,326 at July 31, 2023 and 2022, respectively. The advances carry no interest.

NOTE 4 - COMMITMENTS AND CONTINGENCIES

During the normal course of business, the Company may be exposed to litigation. When the Company becomes aware of potential litigation, it evaluates the merits of the case in accordance with FASB ASC 450-20-50, Contingencies. The Company evaluates its exposure to the matter, possible legal or settlement strategies and the likelihood of an unfavorable outcome. If the Company determines that an unfavorable outcome is probable and can be reasonably estimated, it establishes the necessary accruals. As of July 31, 2023, the Company is not aware of any contingent liabilities that should be reflected in the financial statements.

NOTE 5 - SUBSEQUENT EVENTS

The Company has evaluated all subsequent events through October 30, 2023, the date the financial statements were available to be issued. There are no subsequent events to report.

ITEM 9. DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

We did not have any disagreements on accounting and financial disclosures with our present accounting firm during the reporting period.

ITEM 9A. CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

We maintain “disclosure controls and procedures”, as that term is defined in Rule 13a-15(e), promulgated by the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934, as amended. Disclosure controls and procedures include controls and procedures designed to ensure that information required to be disclosed in our company’s reports filed under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms, and that such information is accumulated and communicated to our management, including our principal executive officer and our principal financial officer, as appropriate, to allow timely decisions regarding required disclosure.

As required by paragraph (b) of Rules 13a-15 under the Securities Exchange Act of 1934, our management, with the participation of our principal executive officer and our principal financial officer, evaluated our company’s disclosure controls and procedures as of the end of the period covered by this annual report on Form 10-K. Based on this evaluation, our management concluded that as of the end of the period covered by this annual report on Form 10-K, our disclosure controls and procedures were not effective.

Management Report on Internal Control Over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over the Company’s financial reporting. In order to evaluate the effectiveness of internal control over financial reporting, as required by Section 404 of the Sarbanes-Oxley Act of 2002. Our management, with the participation of our principal executive officer and principal financial officer have conducted an assessment, including testing, using the criteria in Internal Control – Integrated Framework, issued by the Committee of Sponsoring Organizations of the Treadway Commission ("COSO") (2013). Our system of internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. This assessment included review of the documentation of controls, evaluation of the design effectiveness of controls, testing of the operating effectiveness of controls and a conclusion on this evaluation. Based on this evaluation, management concluded that our internal control over financial reporting was not effective as of July 31, 2023. The ineffectiveness of the Company’s internal control over financial reporting was due to the following material weaknesses, which are indicative of many small companies with small staff:

| · | inadequate segregation of duties consistent with control objectives; |

| | |

| · | lack of a code of ethics; |

| | |

| · | lack of a whistleblower policy; |

| | |

| · | lack of an independent board of directors or board committees related to financial reporting; and |

| | |

| · | lack of multiple levels of supervision and review. |

We believe that the weaknesses identified above have not had any material effect on our financial results. While not being legally obligated to have an audit committee, it is our management’s view that such a committee, including an independent financial expert member, is an utmost important entity level control over the Company’s financial statements. Currently, the board of directors acts in the capacity of the audit committee. However, we are currently reviewing our disclosure controls and procedures related to these material weaknesses and expect to implement changes in the 2024 fiscal year, including identifying specific areas within our governance, accounting and financial reporting processes to add adequate resources to potentially mitigate these material weaknesses.

Our management will continue to monitor and evaluate the effectiveness of our internal controls and procedures and our internal controls over financial reporting on an ongoing basis and is committed to taking further action and implementing additional enhancements or improvements, as necessary and as funds allow.

Because of its inherent limitations, internal controls over financial reporting may not prevent or detect misstatements. Projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. All internal control systems, no matter how well designed, have inherent limitations. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation.

Management’s Remediation Plan

The weaknesses and their related risks are not uncommon in a company of our size because of the limitations in the size and number of staff. Due to our size and nature, segregation of all conflicting duties has not always been possible and may not be economically feasible.

However, we plan to take steps to enhance and improve the design of our internal control over financial reporting. During the period covered by this annual report on Form 10-K, we have not been able to remediate the material weaknesses identified above. To remediate such weaknesses, we plan to implement the following changes in the current fiscal year as resources allow:

| · | appoint additional qualified personnel to address inadequate segregation of duties and implement modifications to our financial controls to address such inadequacies; and |

| | |

| · | adopt a written whistleblower policy and code of ethics; and |

| | |

| · | appoint an independent board of directors, including board committees related to financial controls and reporting. |

The remediation efforts set out herein will be implemented in the 2024 fiscal year. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues, if any, within our company have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty and that breakdowns can occur because of simple error or mistake.

Management believes that despite our material weaknesses set forth above, our financial statements for the fiscal year ended July 31, 2023 are fairly stated, in all material respects, in accordance with U.S. GAAP.

Changes in Internal Control Over Financial Reporting

There were no changes to our internal control over financial reporting during the fiscal year ended July 31, 2023.

Attestation Report of the Registered Public Accounting Firm.

This annual report does not include an attestation report of our independent registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by our independent registered public accounting firm pursuant to temporary rules of the SEC that permit us to provide only management’s report in this annual report on Form 10-K.

ITEM 9B. OTHER INFORMATION

Nothing to report.

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Set forth below are the names of the directors and officers of the Company, all positions and offices with the Company held, the period during which they have served as such, and the business experience during at least the last five years:

Name | | Age | | | Positions and Offices Held | |

| | | | | | |

| | | | | Director | |

| | | | | Chief Executive Officer | |

Suzanne I. Barth | | | 62 | | | Chief Financial Officer | |

| | | | | | | |

| | | | | | Director | |

Edward A. Barth | | | 65 | | | President | |

| | | | | | | |

| | | | | | Director | |

Eugene H. Swearengin | | | 69 | | | Secretary | |

| | | | | | | |

Ronald J. Tassinari* | | | 79 | | | Director | |

* Mr. Tassinari will become a director and Chief Executive Officer upon the closing of the acquisition of Jericho Associates, Inc.

The above listed officers and directors are not involved, and have not been involved in the past five years, in any legal proceedings that are material to an evaluation of their ability or integrity.

DESCRIPTION

Background Information about Our Officers and Directors

Suzanne I. Barth, age 62, is the Founder, CEO, CFO and Director of CLS. Mrs. Barth received an AAS degree in Business Management from Stark Technical College in 1983. Over the past 31 years, Mrs. Barth has been involved as an office manager for various businesses in the construction industry.

Edward A. Barth, age 65 is the President. Mr. Barth received a Bachelor of Science degree in civil engineering technology from Youngstown State University in 1984. He has been employed by the City of North Canton, Ohio, Michael Baker Engineering Corporation and in 1990 returned to the family construction business where he served as President of Barth Construction Co., Inc. In August 2001 Mr. Barth changed the name of the corporation to Stark Concrete Leveling, Inc. and presides as President of the leveling and concrete rehabilitation business. Mr. Barth continues to be employed by Stark Concrete Leveling, Inc. He resides in Canton, Ohio.

Eugene H. Swearengin, age 69, is Secretary and Director of the Corporation. Mr. Swearengin started his career as an apprentice carpenter. He successfully obtained his journeyman’s card in 1977. In 1978 he purchased a 50% interest in Callahan Door Sales, Inc. Mr. Swearengin has managed a successful career in the garage and entrance door business for the past 42 years. He resides in North Canton, Ohio.

Ronald J. Tassinari, age 79, has been engaged in the gaming and hospitality industry for over thirty years. He has served as Chairman and Chief Executive Officer of a publicly traded company (“Company”) that operated in the Tribal casino, and commercial casino related industries.

Specific projects developed by Mr. Tassinari and his associates include Table Mountain Casino, located in Friant, (adjacent to Fresno) California. That Company developed, expanded (three times), managed (1989 – 2000) the casino property and upgraded it from a 1,600 Bingo hall into a major casino destination. Even today, that casino maintains a significant presence in Central California. It consists of a 250,000 square foot casino, 2,000 gaming machines, 50 table games, showroom, an 850-seat bingo hall, multiple restaurants, an Asian-game card room, and a Johnny Miller’s Signature 18-hole golf course, Eagle Springs; having gross revenues of over $300m.

Under Mr. Tassinari’s leadership, that Company also developed an expansion of a mid-size Tribal casino in northern California and provided casino gaming consulting services to that Tribe for three and a half years. Concurrently with those two projects, the Company provided an array of casino consulting services to many California Tribal casinos. Those services consisted of, but were not limited to: implementation of internal control systems, set up of casino security and surveillance and training of security personnel, casino floor planning, layout, and training of dealers and floor personnel, and also casino cage set up and training of casino cashiers and accounting personnel.

Mr. Tassinari also led the purchase of Royal Reservations, Inc. (“Royal”) a company that established a dominant market presence as a successful Las Vegas inbound tourist service provider. Unique to its services was the ability to manage the reservation and visitor amenity needs of incoming Las Vegas tourists. This was accomplished through that company’s developed relationships with Las Vegas hotels and casinos, tour operators, ground transportation operators and other service providers. The influence and effectiveness of Royal’s 24-hour visitor center was a landmark business model in Las Vegas, as many gaming and hospitality properties were encouraged to bid against each other by offering better room rates, special services, and unique amenities as incentives to Royal to steer targeted customers to their specific properties.

Presently, Mr. Tassinari is the CEO of Jericho Associates, Inc., and is conducting due diligence on a number of Tribal casino and commercial gaming projects. Jericho is also seeking companies developing new gaming technology and innovations.

Mr. Tassinari’s prior experience includes over a decade of service with the Wall Street firms of Merrill Lynch, Pierce, Fenner & Smith, and A G Becker Securities.

Family Relationships

Suzanne Barth and Edward Barth are spouses. No director or executive officer has been a director or executive officer of any business which has filed a bankruptcy petition or had a bankruptcy petition filed against it. No director or executive officer has been convicted of a criminal offense within the past five years or is the subject of a pending criminal proceeding. No director or executive officer has been the subject of any order, judgment or decree of any court permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities. No director or officer has been found by a court to have violated a federal or state securities or commodities law.

Committees of the Board of Directors

There are no committees of the Board of Directors.

Section 16(a) Beneficial Ownership Reporting Compliance