US index futures are up on Monday as investors brace for an

important week filled with crucial events, including Federal

Reserve rate decisions, job data releases, and Apple’s financial

results.

At 06:09 AM, Dow Jones futures (DOWI:DJI) rose 171 points or

0.53%. S&P 500 futures were up 0.65%, and Nasdaq-100 futures

increased by 0.76%. The yield on 10-year Treasury bonds stood at

4.871%.

In the commodities market, December West Texas Intermediate

crude oil fell 1.03% to $84.66 per barrel. Brent crude oil for

December dropped 0.85%, trading near $89.71 per barrel. Iron ore

with a 62% concentration traded on the Dalian Exchange increased by

0.15% to $119.85 per ton, with persistent fears of higher interest

rates in the U.S. limiting gains.

Asian markets closed with no clear trend, awaiting monetary

policy decisions in Japan and Malaysia, as well as inflation data

in South Korea and GDP figures in Taiwan and Hong Kong. The

Japanese Nikkei fell 0.95%, while the South Korean Kospi rose

0.34%. The Shanghai SE index advanced 0.12%, and the Australian ASX

200 retreated 0.79%. Shares of Chinese construction firm Evergrande

hit a historic low of 18.8 cents in Hong Kong due to the

postponement of the liquidation hearing by Judge Linda Chan. Shares

plunged over 20%, reaching their lowest point today. The hearing

was rescheduled for December 4th, with Evergrande required to

submit a restructuring proposal before that date to avoid

dissolution.

Despite Middle East volatility, European markets are trading

positively, driven by HSBC’s gains (NYSE:HSBC), while investors

closely monitor inflation data in Spain and Germany.

US stock markets closed sharply lower in Friday’s session as the

situation in the war in the Middle East worsened, with Israel

intensifying its operations in Gaza. The Dow Jones fell 366.71

points or 1.12% to 32,417.59 and the S&P 500 fell 19.86 points

or 0.48% to 4,117.37 points. The S&P 500 confirmed a 10.0%

drop from its peak in July and is heading for the third consecutive

month in the red. The Nasdaq Composite closed up 47.41 points

or 0.38% at 12,643.01, recovering from its lowest closing level in

five months.

With regard to commodities, the highlight was oil, which rose

again due to the increase in tensions in Gaza and the losses

recorded at the beginning of the week. In the economic

calendar, a consumer price index slightly above expectations did

not have a major impact on the markets, mainly because there was a

downward revision of September’s data and the core numbers were in

line with expectations. Data on short-term inflation

expectations, released alongside the University of Michigan

consumer confidence index, rose from 3.8% to 4.2%.

On Monday’s corporate earnings front, investors will be watching

reports from SoFi Technologies (NASDAQ:SOFI), McDonald’s

(NYSE:MCD), Western Digital (NASDAQ:WDC), HSBC (NYSE:HSBC),

Checkpoint (NASDAQ:CHKP), before the market opens. After the

closing, reports from Arista (NYSE:ANET), Pinterest (NYSE:PINS), VF

Corp (NYSE:VFC), Public Storage (NYSE:PSA), among others, will be

awaited.

Wall Street Corporate Highlights for Today

Alphabet (NASDAQ:GOOGL) – Google, a subsidiary

of Alphabet, plans to invest up to $2 billion in the artificial

intelligence company Anthropic. This follows Amazon.com’s

(NASDAQ:AMZN) announcement in September of an investment of up to

$4 billion in Anthropic, a competitor of OpenAI, the creator of

ChatGPT.

Apple (NASDAQ:AAPL), Goldman

Sachs (NYSE:GS) – The partnership between Apple and

Goldman Sachs, which produced the Apple Card and a savings account,

is facing financial challenges, costing Goldman more than $1

billion over three years. Apple seeks financial self-sufficiency

with Project Breakout, challenging traditional financial

institutions. Regulatory resistance and technical obstacles may be

challenges, but digital transformation indicates an inevitable

shift toward a technology-driven financial sector. Additionally,

Apple plans to capitalize on the resurgence of the computer market

with the launch of a new iMac and updates to the MacBook Pro. The

models are expected to benefit from the PC sector’s recovery

following demand during the pandemic.

HSBC (NYSE:HSBC) – HSBC announced a $3 billion

share buyback and reported a third-quarter profit that more than

doubled but fell short of expectations due to rising costs related

to salaries and technology. The bank reported a pre-tax profit of

$7.7 billion in the quarter, up from $3.2 billion a year earlier,

but the result lagged behind the average estimate of $8.1 billion

compiled by HSBC. The bank plans to increase costs by up to 5% this

year, excluding acquisitions, and offer a provisional dividend of

10 cents per share, raising the annual payout to 30 cents per

share. A $500 million impairment related to the commercial real

estate sector in China was highlighted, but the worst is believed

to be over for the sector.

JPMorgan Chase (NYSE:JPM) – JPMorgan

strategists recommended “short” positions in European banks and

changed their outlook for the sector from “neutral” to

“underweight” due to potential pressure on bond yields. Meanwhile,

they upgraded the healthcare sector from ‘neutral’ to ‘overweight’

due to exposure to the dollar and low volatility.

Santander (NYSE:SAN) – Santander is planning to

sell up to €5 billion in toxic real estate assets, including

non-performing loans backed by mortgage guarantees. Spanish banks

are repackaging loans to recover money due to economic slowdown and

the pandemic.

UBS (NYSE:UBS) – The sign at the Credit Suisse

headquarters in London, located at One Cabot Square in Canary

Wharf, has been removed, indicating the relocation of employees to

the UBS Group AG building. The transfer is part of the rescue

agreement for Credit Suisse, with the goal of moving all employees

by the end of the year.

Blackstone (NYSE:BX) – Blackstone will acquire

a majority stake in India’s Care Hospitals, investing $1 billion

and holding over 75% of the hospital network. Blackstone’s entry

into the healthcare sector follows increased demand for private

healthcare in India.

Blackrock (NYSE:BLK) – Investors are missing

opportunities in the energy transition due to outdated views of the

mining and metals industry, warns Evy Hambro, Global Head of

Thematic and Sector Investing at BlackRock. He highlights the focus

on emission reduction and financial discipline in the sector,

pointing to underestimated opportunities amid the transition to a

low-carbon economy. Hambro emphasizes that the story will unfold

over the next 10 to 15 years, and companies should invest in

decarbonization.

SoFi Technologies (NASDAQ:SOFI) – SoFi

Technologies, a fintech that began as a student debt refinancer, is

set to reveal its third-quarter results soon. Investors are

particularly interested in its student loan business following the

temporary payment suspension due to the pandemic.

Chevron (NYSE:CVX), Hess

(NYSE:HES) – Chevron’s acquisition of Hess could slightly increase

oil production in Bakken, North Dakota. However, a return to

pre-pandemic peaks is not expected, as higher costs and distance

from export terminals affect the region’s profitability. Chevron is

likely to follow Hess’s plans for the region. Bakken oil production

has declined from pre-pandemic peaks and faces challenges for a

significant increase.

Ford Motor (NYSE:F) – The United Auto Workers

approved a tentative agreement with Ford, increasing wages by 30%

and eliminating old concessions. Ford will invest $8.1 billion in

the industry and allow the replacement of older workers with new

ones.

Stellantis (NYSE:STLA) – The Canadian union

Unifor initiated strikes at all Stellantis facilities in Canada due

to a lack of agreement in contract negotiations. They are seeking

better wages, pensions, and support for the transition to electric

vehicles. Stellantis expressed disappointment, and negotiations

continue.

General Motors (NYSE:GM) – The United Auto

Workers expanded the strike to include the GM factory in Spring

Hill, Tennessee, disrupting pickup production. GM is the only

Detroit automaker without an agreement. The strike could cost GM

$400 million per week.

Toyota (NYSE:TM) – Toyota announced a 1.5%

increase in global vehicle production in September, driven by

demand in Japan, the U.S., and Europe. The Japanese automaker’s

domestic production grew by 12.8%, offsetting the decline in

overseas production.

Tesla (NASDAQ:TSLA), BYD

(USOTC:BYDDY) – Chinese company BYD is closing in on Tesla as the

largest global seller of electric vehicles, with rising stock

prices and optimistic projections. Its profitability and strong

sales set it apart, while Tesla faces challenges. BYD plans to

expand globally while maintaining profitability.

Walt Disney (NYSE:DIS) – Activist investor

Nelson Peltz, with the support of Isaac Perlmutter, former Marvel

president, is intensifying pressure on Disney. Peltz seeks seats on

the company’s board, with most of the ownership being Perlmutter’s

shares. The nomination window for Disney’s board opens in December,

suggesting a potential proxy battle.

Glencore (USOTC:GLNCY) – Glencore lowered its

nickel production forecast due to maintenance and strikes but

expects solid profits in the trading division. The company’s own

nickel production fell by 16% for the year. Projections for copper,

zinc, coal, and cobalt remain unchanged for 2023.

Intuitive Machines (NASDAQ:LUNR) – Intuitive

Machines’ stock rose by 11.6% due to the scheduling of its lunar

mission with SpaceX in January, a two-month delay from the

previously planned date.

ArcelorMittal (NYSE:MTCN) – Steel company

ArcelorMittal announced an agreement to transfer its operations in

Kazakhstan to the government, following a fatal incident at a coal

mine over the weekend.

Pearson (NYSE:PSO) – Pearson raised its

adjusted operating profit projection to up to $24.3 million, driven

by demand for assessments and qualifications. The CEO highlighted

the continued momentum of the group, with positive feedback on its

generative AI tools.

Coherus BioSciences (NASDAQ:CHRS) – Coherus

BioSciences’ shares rose by 15.15% in pre-market trading on Monday

after the FDA approved its treatment for nasopharyngeal cancer.

This treatment is used in combination with chemotherapy and is

manufactured in partnership with Shanghai Junshi Biosciences.

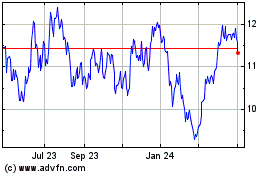

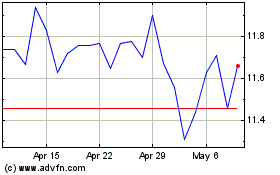

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Apr 2023 to Apr 2024