UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

| Filed

by the registrant ☒ |

Filed

by a Party other than the Registrant ☐ |

Check

the appropriate box:

| ☒ |

Preliminary

Proxy Statement |

☐ |

Confidential,

For Use of the Commission Only |

| ☐ |

Definitive

Proxy Statement |

|

(as

permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive

Additional Materials |

|

|

| ☐ |

Soliciting

Material under Rule 14a-12 |

|

|

GT

BIOPHARMA, INC.

(Name

of Registrant as Specified in Its Charter)

N/A

(Name

of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No

Fee Required |

| |

|

| ☐ |

Fee

paid previously with preliminary materials |

| |

|

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

PRELIMINARY PROXY STATEMENT,

DATED OCTOBER 27, 2023,

SUBJECT TO COMPLETION

GT

BIOPHARMA, INC.

8000

Marina Boulevard, Suite 100

Brisbane,

California 94005

(415)

919-4040

TO

THE STOCKHOLDERS OF GT BIOPHARMA, INC.:

We

are pleased to invite you to attend a Special Meeting of Stockholders (the “Special Meeting”) of GT Biopharma, Inc., a Delaware

corporation (the “Company”). The Special Meeting will be held on December 18, 2023, at 11:00 A.M., Pacific time via

live webcast. You will be able to attend the Special Meeting, vote, and submit your questions during the meeting via live webcast through

the link www.virtualshareholdermeeting.com/GTBP2023SM and entering your control number, which can be found on your proxy card.

We

have adopted this technology to expand access to the meeting, improve communications and impose lower costs on our stockholders, the

company and the environment. We believe virtual meetings enable increased stockholder participation from locations around the world.

Enclosed

are the following:

| |

● |

Our

Notice of Special Meeting of Stockholders (the “Notice”), and proxy statement; and |

| |

● |

A

proxy card with a return envelope to record your vote. |

The

Notice lists the matters to be considered at the Special Meeting, and the proxy statement describes the matters listed in the Notice.

We

intend to mail these proxy materials on or about November 7, 2023 to all stockholders of record entitled to vote at the Special Meeting.

Your

vote at the Special Meeting is important. Whether or not you plan to attend the Special Meeting, we ask that you submit your proxy to

vote as soon as possible so that your shares are represented at the Special Meeting. We appreciate your participation and your interest

in GT Biopharma, Inc.

| October

27, 2023 |

|

By

Order of the Board of Directors |

| |

|

|

| |

|

Michael

Breen

Executive

Chairman of the Board and

Interim Chief Executive Officer |

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

To

our Stockholders:

A

Special Meeting of Stockholders of GT Biopharma, Inc. (the “Special Meeting”) will be held on December 18, 2023, at 11:00

AM, Pacific time via live webcast, for the following purposes:

| 1. | To

approve an amendment to our second restated certificate of incorporation, as amended (the

“Charter”), in the form attached to the proxy statement as Annex A, to, at the

discretion of our Board of Directors (the “Board”) in the event they deem it necessary, effect a reverse stock split

with respect to our issued and outstanding common stock, par value $0.001 per share (“Common

Stock”), including any Common Stock held by the Company as treasury shares, at any

time prior to February 20, 2024, at a ratio of 1-for-5 to 1-for-30 (the “Range”),

with the ratio within such Range to be determined at the discretion of the Board without

further approval or authorization of our stockholders (the “Reverse Stock Split”)

and included in a public announcement. |

| 2. | To

consider and vote upon an adjournment of the Special Meeting from time to time to a later date or dates, if necessary, to establish

a quorum and/or solicit additional proxies if there are not sufficient votes in favor of

Proposal No. 1. |

These

items of business are more fully described in the proxy statement accompanying this notice. The record date for the Special Meeting is

October 23, 2023. Only stockholders holding shares of our Common Stock as of the close of business on the record date are entitled to

notice of, and to vote at, the Special Meeting or any adjournments thereof.

We

will begin mailing printed copies of our proxy materials to stockholders of record as of the record date on or about November 7, 2023.

WHETHER

OR NOT YOU PLAN TO ATTEND THE SPECIAL MEETING VIA THE LIVE WEBCAST AND REGARDLESS OF THE NUMBER OF SHARES YOU OWN, YOUR VOTE IS VERY

IMPORTANT. PLEASE COMPLETE, SIGN AND SUBMIT YOUR PROXY AS SOON AS POSSIBLE SO THAT YOUR SHARES CAN BE VOTED AT THE SPECIAL MEETING IN

ACCORDANCE WITH YOUR INSTRUCTIONS.

| October

27, 2023 |

|

By

Order of the Board of Directors |

| |

|

|

| |

|

Michael

Breen

Executive

Chairman of the Board and

Interim Chief Executive Officer |

Important

Notice Regarding the Internet Availability of Proxy Materials for the Company’s Special Meeting of Stockholders to Be Held on December

18, 2023: The Notice of Special Meeting of Stockholders and proxy statement are each available at www.proxyvote.com.

This

proxy statement is also available on the SEC’s website at www.sec.gov.

TABLE

OF CONTENTS

PROXY

STATEMENT FOR THE SPECIAL MEETING OF STOCKHOLDERS

TO

BE HELD ON DECEMBER 18, 2023

QUESTIONS

AND ANSWERS ABOUT THE SPECIAL MEETING OF STOCKHOLDERS

PROXY

STATEMENT — SPECIAL MEETING OF STOCKHOLDERS

This

proxy statement contains information about the Special Meeting of Stockholders (the “Special Meeting”) of GT Biopharma, Inc.,

a Delaware corporation, including any postponements or adjournments of the Special Meeting. The Special Meeting will be held on December

18, 2023, at 11:00 AM Pacific time via live webcast. The proxy materials can be accessed by following the instructions in the

Notice (www.proxyvote.com) as well as online at our Investor Relations website at https://ir.gtbiopharma.com.

In

this proxy statement, we sometimes refer to GT Biopharma, Inc. and its subsidiaries as “GT Biopharma,” the “Company,”

“we,” “us,” or “our.” In addition, unless the context otherwise requires, references to “stockholders”

are to the holders of our common stock, par value $0.001 per share (“Common Stock”).

This

proxy statement contains important information for you to consider when deciding how to vote on the matters for which we are soliciting

proxies. Please read it carefully.

What

Proposals Will Be Presented at the Special Meeting and What Are the Voting Recommendations of the Board of Directors?

The

proposals that will be presented at the Special Meeting and the voting recommendations of our Board of Directors (the “Board”)

are set forth in the table below:

| Proposal |

|

Board’s

Voting

Recommendation |

| (1) |

|

Approve

an amendment to our second restated certificate of incorporation, as amended (the “Charter”), in the form attached

to the proxy statement as Annex A, to, at the discretion of the Board in the event they deem it necessary, effect a

reverse stock split with respect to our issued and outstanding Common Stock, including any Common Stock held by the Company as treasury

shares, at any time prior to February 20, 2024, at a ratio of 1-for-5 to 1-for-30 (the “Range”), with the ratio

within such Range to be determined at the discretion of the Board without further approval or authorization of our stockholders and

included in a public announcement (such action, the “Reverse Stock Split” and such proposal is referred to herein as

the “Reverse Stock Split Proposal”). |

|

FOR

approval |

| |

|

|

| (2) |

|

To

consider and vote upon an adjournment of the Special Meeting from time to time to a later date or dates, if necessary,

to establish a quorum and/or solicit additional proxies if there are not sufficient votes in favor of Proposal No. 1 (the

“Adjournment Proposal”). |

|

FOR

approval |

Other

than these proposals, no other proposals will be presented for a vote at the Special Meeting.

Who

Can Vote?

The

record date to determine the stockholders entitled to notice of and to vote at the Special Meeting is the close of business on October

23, 2023. On the record date, 41,477,120 shares of Common Stock were issued and outstanding and entitled to vote.

Holders

of record of our Common Stock as of the close of business on the record date will be entitled to notice of and to vote at the Special

Meeting and at any adjournments or postponements thereof.

Holders

of record of shares of Common Stock have the right to vote on all matters brought before the Special Meeting and at any adjournments

or postponements thereof.

You

do not need to attend the Special Meeting to vote your shares. Instead, you may submit a proxy to vote your shares by marking, signing,

dating and returning the enclosed proxy card or submitting your proxy through the Internet.

Stockholder

of Record: Shares Registered in Your Name

If,

on the record date, your shares were registered directly in your name with our transfer agent, Computershare Trust Company, N.A.,

then you are a stockholder of record, and you can vote your shares at the Special Meeting by one of the methods described below in

the section entitled “How Do I Vote and When is the Deadline for Voting?”

Beneficial

Owner: Shares Registered in the Name of a Broker or Bank

If,

on the record date, your shares were held in an account at a brokerage firm, bank, dealer or other similar organization, then you are

the beneficial owner of shares held in “street name” and you may vote your shares at the Special Meeting by one of the methods

described below in the section entitled “How Do I Vote and When is the Deadline for Voting?”

How

Many Votes do I Have?

Each

holder of record of our Common Stock is entitled to one vote per share of Common Stock on each matter to be acted upon at the Special

Meeting.

How

Will I Receive Proxy Materials?

On

or about November 7, 2023, we will mail proxy materials to holders of record of our Common Stock as of the close of business on the record

date.

How

Do I Vote and When is the Deadline for Voting?

Whether

you plan to attend the Special Meeting or not, we urge you to submit your proxy to vote. Submitting a proxy to vote your shares will

not affect your right to attend the Special Meeting.

Stockholder

of Record

If

your shares are registered directly in your name, you may vote or submit your proxy to vote:

| |

● |

By

mail. Complete and mail the enclosed proxy card in the enclosed postage prepaid envelope. Your proxy will be voted in accordance

with your instructions. If you sign the proxy card but do not specify how you want your shares voted, they will be voted as recommended

by our Board. Your proxy card must be received on or before 11:59 P.M. Eastern time on December 17, 2023, the day before the Special

Meeting, to be counted. |

| |

● |

In

attendance at the Special Meeting. You may vote during the virtual meeting through www.virtualshareholdermeeting.com/GTBP2023SM.

To be admitted to the Special Meeting and vote your shares, you must provide the control

number as described in the proxy card mailed to you. |

| |

● |

By

telephone. You may vote over the telephone by following the instructions in the proxy card that accompanies this proxy statement.

Please have your proxy card available when you call. Your vote must be received prior to 11:59 P.M. Eastern time on December 17,

2023, the day before the Special Meeting, to be counted. |

| |

|

|

| |

● |

Over

the Internet. You may submit your proxy to vote via the Internet by going to www.virtualshareholdermeeting.com/GTBP2023SM and

following the on-screen instructions. Please have your proxy card available when you access the webpage. Your proxy to vote must

be received prior to 11:59 P.M. Eastern time on December 17, 2023, the day before the Special Meeting, to be counted. |

Hold

Shares in Street Name

If

you hold shares in street name, the organization holding your account is considered the stockholder of record for purposes of voting

at the Special Meeting. The stockholder of record will provide you with instructions on how to direct your bank, broker or other financial

intermediary on how to vote your shares. Internet and telephone instructions will be offered to stockholders owning shares through most

banks and brokers. Additionally, if you would like to vote at the Special Meeting via live webcast, you must contact the broker or other

nominee who holds your shares and obtain a signed broker’s proxy card giving you the right to vote the shares, and bring it with

you to the Special Meeting. You will not be able to vote at the Special Meeting unless you have a signed proxy card from your broker.

What

If I Return a Proxy Card But Do Not Make Specific Choices?

If

you return a signed and dated proxy card without marking any voting selections, your shares will be voted on the matters as recommended

by our Board.

Will

My Shares Be Voted if I Do Not Return My Proxy Card or Vote by the Deadline?

If

you are a stockholder of record, your shares will not be voted if you do not vote using one of the methods described in the section above

entitled “How Do I Vote and When is the Deadline for Voting?” in advance of the deadline.

If

your shares are held in street name, and you do not provide voting instructions to the bank, broker or other nominee that holds your

shares as described above under “How Do I Vote and When is the Deadline for Voting?,” the bank, broker or other nominee may

exercise discretionary authority to vote on routine proposals, but may not vote on non-routine proposals. If your bank, broker or nominee

votes on a routine proposal, the shares that cannot be voted on non-routine matters by the bank, broker or nominee that holds your shares

are called broker non-votes. Broker non-votes will be deemed present at the Special Meeting for purposes of determining whether a quorum

exists for the Special Meeting.

We

encourage you to provide voting instructions to the bank, broker or other nominee that holds your shares. This ensures your shares will

be voted at the Special Meeting in the manner you desire.

May

I Revoke My Proxy?

If

you give a proxy, you may revoke your proxy at any time before the Special Meeting in any one of the following ways:

| |

● |

signing

a new proxy card, and submitting it as instructed above in advance of the deadline; |

| |

● |

notifying

the Company’s Secretary in writing before the Special Meeting that you have revoked your proxy; or |

| |

● |

attending

the Special Meeting via the live webcast and voting if you are a stockholder of record (attending the Special Meeting via the live

webcast will not in and of itself revoke a previously submitted proxy unless you specifically request it). |

What

If I Receive More Than One Proxy Card?

You

may receive more than one proxy card or voting instruction form if you hold your shares in more than one account, which may be in registered

form or held in street name. Please vote in the manner described under “How Do I Vote and When is the Deadline for Voting?”

for each account to ensure that all of your shares are voted.

What

Vote is Required to Approve Each Proposal?

Proposal

1, the Reverse Stock Split Proposal: The approval of the Reverse Stock Split Proposal requires the affirmative vote of the majority

of votes cast by the holders of our Common Stock present in person (via live webcast) or represented by proxy at the Special Meeting

and entitled to vote on the proposal, assuming the presence of a quorum and if the shares of Common Stock meet the listing requirements

of the Nasdaq Stock Market relating to the minimum number of holders immediately after the Reverse Stock Split becomes effective.

Proposal

2, the Adjournment Proposal: The approval of the Adjournment Proposal requires the affirmative vote of the majority of the votes

cast by the holders of our Common Stock present in person (via live webcast) or represented by proxy at the Special Meeting and entitled

to vote on the proposal.

What

is a Quorum and How are Votes Counted?

We

need a quorum of stockholders to hold our Special Meeting. The presence, in person (via live webcast) or by proxy, of the holders of

a majority of the outstanding shares of Common Stock entitled to vote at the Special Meeting is necessary to constitute a quorum to transact

business. Your shares will be counted towards the quorum only if a valid proxy or vote is submitted with respect to such shares or you

attend the meeting in person (via live webcast). Shares represented by abstentions and broker non-votes, if any, will be counted

in determining whether there is a quorum for the Special Meeting.

An

abstention is (i) the voluntary act of not voting by a stockholder who is present at a meeting and entitled to vote, or (ii) selecting,

or authoring a proxy holder to select, “abstain” with respect to a proposal submitted at the Special Meeting. A broker “non-vote”

occurs when a proxy submitted by a broker does not indicate a vote for some or all of the proposals because the broker does not have

discretionary voting authority on certain types of proposals that are non-routine matters and has not received instructions from its

customer regarding how to vote on a particular proposal. Brokers that hold shares of common stock in “street name” for customers

that are the beneficial owners of those shares may generally vote on routine matters. However, brokers generally do not have discretionary

voting power (i.e., they cannot vote) on non-routine matters without specific instructions from their customers. Each of the Reverse

Stock Split Proposal and the Adjournment Proposal constitutes a routine matter for which brokers have discretionary voting power.

Votes

will be counted by Broadridge Financial Solutions, Inc., the inspector of election appointed for the Special Meeting, who will separately

count “For” and “Against” votes, abstentions and broker non-votes, if any. Abstentions and broker non-votes

will not be counted towards the vote total for any proposal. Because abstentions and broker non-votes are not counted as votes cast,

they will not affect the outcome of the vote on Proposal 1 or Proposal 2.

Will

choosing not to vote my shares have the same effect as casting a vote against the Reverse Stock Split Proposal or the Adjournment

Proposal?

No.

If you prefer that the Reverse Stock Split Proposal or any Adjournment Proposal not be approved, you should cast your vote against the

proposal. Approval of each of the Reverse Stock Split Proposal and the Adjournment Proposal requires the affirmative vote

of the majority of votes cast by the holders of our Common Stock present in person (via live webcast) or represented by proxy

at the Special Meeting and entitled to vote on the proposal, assuming a quorum is present.

How

is the Company soliciting proxies?

We

are soliciting proxies on behalf of our Board of Directors and will pay all expenses associated with this solicitation. In addition to

mailing these proxy materials, certain of our officers and other employees may, without compensation other than their regular compensation,

solicit proxies through further mailing or personal conversations, or by telephone, facsimile or other electronic means. We will also,

upon request, reimburse brokers and other persons holding stock in their names, or in the names of nominees, for their reasonable out-of-pocket

expenses for forwarding proxy materials to the beneficial owners of our stock and to obtain proxies.

How

Can I Find Out the Results of the Voting at the Special Meeting?

Preliminary

voting results will be announced at the Special Meeting. Final voting results will be published in a Current Report on Form 8-K to be

filed with the SEC within four business days after the Special Meeting.

Attending

the Special Meeting

The

Special Meeting will be held on December 18, 2023 at 11:00 AM Pacific time via live webcast. We adopted a virtual format for our

Special Meeting to make participation more convenient, safe and accessible for our stockholders regardless of their location.

You

are entitled to participate in the Special Meeting if you were a stockholder as of the close of business on our record date of October

23, 2023 or hold a valid proxy for the meeting. To be admitted to the Special Meeting’s live webcast, you must enter your control

number.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth certain information known to us regarding beneficial ownership of our capital stock as of October 23,

2023 by:

| |

● |

each

person, or group of affiliated persons, known by us to be the beneficial owner of more than 5% of our capital stock; |

| |

|

|

| |

● |

our

named executive officers; |

| |

|

|

| |

● |

each

of our directors; and |

| |

|

|

| |

● |

all

of our executive officers and directors as a group. |

Beneficial

ownership is determined in accordance with the rules of the SEC. A person is deemed to be a beneficial holder of our capital stock if

that person has or shares voting power, which includes the power to vote or direct the voting of our capital stock, or investment power,

which includes the power to dispose of or to direct the disposition of such capital stock. Except as noted by footnote, and subject to

community property laws where applicable, we believe based on the information provided to us that the persons and entities named in the

table below have sole voting and investment power with respect to all capital stock shown as beneficially owned by them.

The

table lists applicable percentage ownership based on 41,477,120 shares of common stock outstanding as of October 23, 2023. Unless

otherwise noted below, the address of each person listed on the table is c/o GT Biopharma, Inc., 8000 Marina Boulevard, Suite 100, Brisbane,

California 94005.

In

computing the number of shares of common stock beneficially owned by a person and the percentage ownership of that person, we deemed

outstanding shares of common stock subject to preferred stock, options and warrants held by that person that are currently exercisable

or exercisable within 60 days after October 23, 2023. We did not deem these shares outstanding, however, for the purpose of computing

the percentage ownership of any other person.

| Name of Beneficial Owner | |

Number of Shares Beneficially Owned | | |

Percentage of Shares Outstanding | |

| Greater than 5% Stockholders: | |

| | | |

| | |

Cytovance Biologics, Inc.

800 Research Parkway,

Suite 200

Oklahoma City, OK 73104 | |

| 2,755,817 | | |

| 6.6 | % |

| Executive Officers and Directors: | |

| | | |

| | |

| Michael

Breen (1) | |

| 1,364,551 | | |

| 3.3 | % |

| Manu Ohri

(2) | |

| 941,666 | | |

| 2.2 | % |

| Charles

J. Casamento (3) | |

| 291,666 | | |

| *

| |

| Rajesh Shrotriya, M.D. (4) | |

| 919,809 | | |

| 2.2 | % |

| Bruce Wendel (5) | |

| 910,988 | | |

| 2.2 | % |

| Directors and officers as a group (5 persons) (6) | |

| 4,428,680 | | |

| 10.0 | % |

| * |

Represents

beneficial ownership of less than one percent of our outstanding Common Stock. |

| (1) |

Includes

shares underlying options to purchase 508,333 shares of common stock. |

| (2) |

Includes

shares underlying options to purchase 591,666 shares of common stock. |

| (3) |

Consists

of options to purchase 291,666 shares of common stock. |

| (4) |

Consists

of shares options to purchase 919,809 shares of common stock. |

| (5) |

Includes

shares underlying options to purchase 558,333 shares of common stock. |

| (6) |

Includes

shares underlying options to purchase 2,869,807 shares of common stock. |

PROPOSAL

1

APPROVAL

OF AN AMENDMENT TO OUR SECOND RESTATED CERTIFICATE OF INCORPORATION, AS AMENDED, TO EFFECT THE REVERSE STOCK SPLIT

Our

second restated certificate of incorporation, as amended (the “Charter”), currently authorizes the Company to issue

a total of 250,000,000 shares of Common Stock and 15,000,000 shares of Preferred Stock. On October 23, 2023, subject to stockholder

approval, our Board approved an amendment to our Charter to, at the discretion of the Board in the event they deem it necessary,

effect the Reverse Stock Split of our Common Stock at a ratio of 1-for-5 to 1-for-30, including any shares held by the Company

as treasury shares, at any time prior to February 20, 2024, with the exact ratio within such Range to be determined by our Board at its

discretion without further approval or authorization of our stockholders and included in a public announcement. The primary goal of the

Reverse Stock Split is to increase the per share market price of our Common Stock to meet the minimum per share bid price requirements

for continued listing on The Nasdaq Capital Market. We believe that a range of Reverse Stock Split ratios provides us with the most flexibility

to achieve the desired results of the Reverse Stock Split. The Reverse Stock Split is not intended as, and will not have the effect of,

a “going private transaction” covered by Rule 13e-3 promulgated under the Securities Exchange Act of 1934, as amended

(the “Exchange Act”). The Reverse Stock Split is not intended to modify the rights of existing stockholders in any material

respect.

If

the Reverse Stock Split Proposal is approved by our stockholders and the Reverse Stock Split is effected, there will be no fractional

shares issued as a result of the Reverse Stock Split. In lieu thereof, the aggregate of all fractional shares otherwise issuable to the

holders of record of old common stock will be issued to the Company’s transfer agent, as exchange agent, for the accounts

of all holders of record of old common stock otherwise entitled to have a fraction of a share issued to them. The sale of all fractional

interests will be effected by the exchange agent as soon as practicable after the effective time of the Reverse Stock Split on

the basis of prevailing market prices of the applicable new common stock. After such sale, the exchange agent will pay to such

holders of record their pro rata share of the net proceeds derived from the sale of the fractional interests.

The

Reverse Stock Split, if effected, will not change the number of authorized shares of our Common Stock or Preferred Stock, or the par

value of our Common Stock or Preferred Stock.

The

actual timing for implementation of the Reverse Stock Split would be determined by the Board based upon its evaluation as to when such

action would be most advantageous to the Company and its stockholders, but must be implemented before February 20, 2024. Notwithstanding

approval of the Reverse Stock Split Proposal by our stockholders, the Board will have the sole authority to elect whether or not and

when to amend our Charter to effect the Reverse Stock Split. If the Reverse Stock Split Proposal is approved by our stockholders, the

Board will make a determination as to whether effecting the Reverse Stock Split is in the best interests of the Company and its stockholders

in light of, among other things, our ability to increase the trading price of our Common Stock to meet the minimum bid price standards

of The Nasdaq Capital Market without effecting the Reverse Stock Split, the per share price of the Common Stock immediately prior to

the Reverse Stock Split and the expected stability of the per share price of the Common Stock following the Reverse Stock Split. If the

Board determines that it is in the best interests of the Company and its stockholders to effect the Reverse Stock Split, it will hold

a Board meeting to determine the ratio of the Reverse Stock Split. For additional information concerning the factors the Board will consider

in deciding whether to effect the Reverse Stock Split, see “— Determination of the Reverse Stock Split Ratio”

and “— Board Discretion to Effect the Reverse Stock Split.”

The

text of the proposed amendment to our Charter to effect the Reverse Stock Split is included as Annex A to this proxy statement

(the “Reverse Stock Split Charter Amendment”). If the Reverse Stock Split Proposal is approved by our stockholders, we will

have the authority to file the Reverse Stock Split Charter Amendment with the Secretary of State of the State of Delaware, which will

become effective upon its filing or the effective time set forth in the Reverse Stock Split Charter Amendment. The Board has determined

that the amendment is advisable and in the best interests of the Company and its stockholders and has submitted the amendment for consideration

by our stockholders at the Special Meeting.

Reasons

for the Reverse Stock Split

We

are submitting this proposal to our stockholders for approval in order to increase the trading price of our Common Stock to meet the

minimum per share bid price requirement for continued listing on The Nasdaq Capital Market. We believe increasing the trading price of

our Common Stock may also assist in our capital-raising efforts by making our Common Stock more attractive to a broader range of investors.

Accordingly, we believe that the Reverse Stock Split is in our stockholders’ best interests.

We

believe that the Reverse Stock Split, if necessary, is our best option to meet the criteria to satisfy the minimum per share bid price

requirement for continued listing on The Nasdaq Capital Market. The Nasdaq Capital Market requires, among other criteria, that the Company

maintain of a continued price of at least $1.00 per share. On the record date, the last reported sale price of our Common Stock on The

Nasdaq Capital Market was $0.242 per share. A decrease in the number of outstanding shares of our Common Stock resulting from

the Reverse Stock Split should, absent other factors, assist in ensuring that the per share market price of our Common Stock remains

above the requisite price for continued listing. However, we cannot provide any assurance that our minimum bid price would remain over

the minimum bid price requirement of The Nasdaq Capital Market following the Reverse Stock Split.

In

addition, as noted above, we believe that the Reverse Stock Split and the resulting increase in the per share price of our Common Stock

could encourage increased investor interest in our Common Stock and promote greater liquidity for our stockholders. A greater price per

share of our Common Stock could allow a broader range of institutions to invest in our Common Stock (namely, funds that are prohibited

or discouraged from buying stocks with a price below a certain threshold), potentially increasing marketability, trading volume and liquidity

of our Common Stock. Many institutional investors view stocks trading at low prices as unduly speculative in nature and, as a result,

avoid investing in such stocks. We believe that the Reverse Stock Split will provide flexibility to make our Common Stock a more attractive

investment for these institutional investors, which we believe will enhance the liquidity for the holders of our Common Stock and may

facilitate future sales of our Common Stock. The Reverse Stock Split could also increase interest in our Common Stock for analysts and

brokers who may otherwise have policies that discourage or prohibit them in following or recommending companies with low stock prices.

Additionally, because brokers’ commissions on transactions in low-priced stocks generally represent a higher percentage of the

stock price than commissions on higher-priced stocks, the current average price per share of our Common Stock can result in individual

stockholders paying transaction costs representing a higher percentage of their total share value than would be the case if the share

price were substantially higher.

Risks

Associated with the Reverse Stock Split

The

Reverse Stock Split May Not Increase the Price of our Common Stock over the Long-Term. As noted above, the principal purpose

of the Reverse Stock Split is to increase the trading price of our Common Stock to meet the minimum stock price standards of The Nasdaq

Capital Market. However, the effect of the Reverse Stock Split on the market price of our Common Stock cannot be predicted with any certainty,

and we cannot assure you that the Reverse Stock Split will accomplish this objective for any meaningful period of time, or at all. While

we expect that the reduction in the number of outstanding shares of Common Stock will proportionally increase the market price of our

Common Stock, we cannot assure you that the Reverse Stock Split will increase the market price of our Common Stock by a multiple of the

Reverse Stock Split ratio, or result in any permanent or sustained increase in the market price of our Common Stock. The market price

of our Common Stock may be affected by other factors which may be unrelated to the number of shares outstanding, including our business

and financial performance, general market conditions, and prospects for future success.

The

Reverse Stock Split May Decrease the Liquidity of our Common Stock. The Board believes that the Reverse Stock Split may result

in an increase in the market price of our Common Stock, which could lead to increased interest in our Common Stock and possibly promote

greater liquidity for our stockholders. However, the Reverse Stock Split will also reduce the total number of outstanding shares of Common

Stock, which may lead to reduced trading and a smaller number of market makers for our Common Stock, particularly if the price per share

of our Common Stock does not increase as a result of the Reverse Stock Split.

The

Reverse Stock Split May Result in Some Stockholders Owning “Odd Lots” That May Be More Difficult to Sell or Require Greater

Transaction Costs per Share to Sell. If the Reverse Stock Split is implemented, it will increase the number of stockholders who

own “odd lots” of less than 25 shares of Common Stock. A purchase or sale of less than 25 shares of Common Stock (an “odd

lot” transaction) may result in incrementally higher trading costs through certain brokers, particularly “full service”

brokers. Therefore, those stockholders who own fewer than 25 shares of Common Stock following the Reverse Stock Split may be required

to pay higher transaction costs if they sell their Common Stock.

The

Reverse Stock Split May Lead to a Decrease in our Overall Market Capitalization. The Reverse Stock Split may be viewed negatively

by the market and, consequently, could lead to a decrease in our overall market capitalization. If the per share market price of our

Common Stock does not increase in proportion to the Reverse Stock Split ratio, then the value of our Company, as measured by our market

capitalization, will be reduced. Additionally, any reduction in our market capitalization may be magnified as a result of the smaller

number of total shares of Common Stock outstanding following the Reverse Stock Split.

Effects

of the Reverse Stock Split

Effects

of the Reverse Stock Split on Issued and Outstanding Shares. If the Reverse Stock Split is effected, it will reduce the total

number of issued and outstanding shares of Common Stock, including any shares held by the Company as treasury shares, by a Reverse Stock

Split ratio of 1-for-5 to 1-for-30. Accordingly, each of our stockholders will own fewer shares of Common Stock as a result of

the Reverse Stock Split. If the Reverse Stock Split Proposal is approved by our stockholders and the Reverse Stock Split is effected,

there will be no fractional shares issued as a result of the Reverse Stock Split. In lieu thereof, the aggregate of all fractional shares

otherwise issuable to the holders of record of old common stock will be issued to the Company’s transfer agent, as exchange

agent, for the accounts of all holders of record of old common stock otherwise entitled to have a fraction of a share issued to them.

The sale of all fractional interests will be effected by the exchange agent as soon as practicable after the effective time of

the Reverse Stock Split on the basis of prevailing market prices of the applicable new common stock. After such sale, the exchange

agent will pay to such holders of record their pro rata share of the net proceeds derived from the sale of the fractional interests.

Common Stock issued pursuant to the Reverse Stock Split will remain fully paid and nonassessable, and the par value per share of common

stock will remain $0.001.

As

of the record date, 41,477,120 shares of our Common Stock were outstanding and no shares of our Preferred Stock were outstanding. For

purposes of illustration, if the Reverse Stock Split is effected at a ratio of 1-for-30, the number of issued and outstanding shares

of Common Stock after the Reverse Stock Split would be approximately 1,382,571 shares.

Effects

of the Reverse Stock Split on Outstanding Equity Awards and Plans. If the Reverse Stock Split is effected, the terms of equity

awards granted under our 2014 Stock Incentive Plan (the “2014 Plan”) and 2022 Omnibus Incentive Plan, (collectively the “Equity

Plans”), including the per share exercise price of options and the number of shares issuable under such options, will be proportionally

adjusted to maintain their economic value, subject to adjustments for any fractional shares as described herein. In addition, the total

number of shares of Common Stock that may be the subject of future grants under the Equity Plans, as well as any plan limits on the size

of such grants will be adjusted and proportionately decreased as a result of the Reverse Stock Split.

Effects

of the Reverse Stock Split on Voting Rights. Proportionate voting rights and other rights of the holders of Common Stock would

not be affected by the Reverse Stock Split (except for the effect of cash sale in lieu of fractional shares). For example, a holder of

1% of the voting power of the outstanding Common Stock immediately prior to the effective time of the Reverse Stock Split would continue

to hold 1% of the voting power of the outstanding Common Stock after the Reverse Stock Split (except for the effect of cash sale in lieu

of fractional shares).

Effects

of the Reverse Stock Split on Regulatory Matters. We are subject to the periodic reporting and other requirements of the Exchange

Act. The Reverse Stock Split will not affect our obligation to publicly file financial and other information with the SEC.

Effects

of the Reverse Stock Split on Authorized Share Capital. The total number of shares of capital stock that we are authorized to

issue will not be affected by the Reverse Stock Split and will remain at 265,000,000 shares, consisting of 250,000,000,000 shares

of Common Stock and 15,000,000,000 shares of Preferred Stock.

Effects

of the Reverse Stock Split on the Number of Shares of Common Stock Available for Future Issuance. By reducing the number of shares

outstanding without reducing the number of shares of available but unissued Common Stock, the Reverse Stock Split will increase the number

of authorized but unissued shares. The Board believes the increase is appropriate for use to fund the future operations of the Company.

Although the Company does not have any pending acquisitions for which shares are expected to be used, the Company may also use authorized

shares in connection with the financing of future acquisitions.

Although

the Reverse Stock Split would not have any dilutive effect on our stockholders, the Reverse Stock Split without a reduction in the number

of shares authorized for issuance would reduce the proportion of shares owned by our stockholders relative to the number of shares authorized

for issuance, giving the Board an effective increase in the authorized shares available for issuance, in its discretion. The Board from

time to time may deem it to be in the best interests of the Company to enter into transactions and other ventures that may include the

issuance of shares of our common stock. If the Board authorizes the issuance of additional shares subsequent to the Reverse Stock Split,

the dilution to the ownership interest of our existing stockholders may be greater than would occur had the Reverse Stock Split not been

effected.

Treatment

of Fractional Shares in the Reverse Stock Split

The

Company will not issue fractional shares for post-reverse stock split shares in connection with the Reverse Stock Split. In lieu

of issuing fractional shares, the aggregate of all fractional shares otherwise issuable to the holders of record of old common stock

will be issued to the Company’s transfer agent, as exchange agent, for the accounts of all holders of record of old common

stock otherwise entitled to have a fraction of a share issued to them. The sale of all fractional interests will be effected by the exchange

agent as soon as practicable after the effective time of the Reverse Stock Split on the basis of prevailing market prices of the

applicable new common stock. After such sale, the exchange agent will pay to such holders of record their pro rata share of the

net proceeds derived from the sale of the fractional interests.

Determination

of the Reverse Stock Split Ratio

The

Board believes that stockholder approval of a range of potential Reverse Stock Split ratios is in the best interests of our Company and

stockholders because it is not possible to predict market conditions at the time the Reverse Stock Split would be implemented. We believe

that a range of Reverse Stock Split ratios provides us with the most flexibility to achieve the desired results of the Reverse Stock

Split. The Reverse Stock Split ratio to be selected by our Board will be not more than 1-for-30.

The

selection of the specific Reverse Stock Split ratio will be based on several factors, including, among other things:

| |

● |

our

ability to maintain the listing of our Common Stock on The Nasdaq Capital Market; |

| |

|

|

| |

● |

the

per share price of our Common Stock immediately prior to the Reverse Stock Split; |

| |

|

|

| |

● |

the

expected stability of the per share price of our Common Stock following the Reverse Stock Split; |

| |

|

|

| |

● |

the

likelihood that the Reverse Stock Split will result in increased marketability and liquidity of our Common Stock; |

| |

|

|

| |

● |

prevailing

market conditions; |

| |

|

|

| |

● |

general

economic conditions in our industry; and |

| |

|

|

| |

● |

our

market capitalization before and after the Reverse Stock Split. |

We

believe that granting our Board the authority to set the ratio for the Reverse Stock Split is essential because it allows us to take

these factors into consideration and to react to changing market conditions. If the Board chooses to implement the Reverse Stock Split,

we will make a public announcement regarding the determination of the Reverse Stock Split ratio.

Board

Discretion to Effect the Reverse Stock Split

If

the Reverse Stock Split Proposal is approved by our stockholders, the Reverse Stock Split will only be effected upon a determination

by the Board, in its sole discretion in the event deemed necessary, that filing the Reverse Stock Split Charter Amendment to effect

the Reverse Stock Split is in the best interests of our Company and stockholders. This determination by the Board will be based upon

a variety of factors, including those discussed under “— Determination of the Reverse Stock Split Ratio” above.

We expect that the primary focus of the Board in determining whether or not to file the Reverse Stock Split Charter Amendment will be

whether we will be able to obtain and maintain of a continued price of at least $1.00 per share of our Common Stock on The Nasdaq Capital

Market without effecting the Reverse Stock Split.

Effective

Time of the Reverse Stock Split

If

the Reverse Stock Split Proposal is approved by our stockholders, the Reverse Stock Split would become effective, if at all, when the

Reverse Stock Split Charter Amendment is filed with the office of the Secretary of State of the State of Delaware or at the effective

time set forth in the Reverse Stock Split Charter Amendment. However, notwithstanding approval of the Reverse Stock Split Proposal by

our stockholders, the Board will have the sole authority to elect whether or not and when to amend our Charter to effect the Reverse

Stock Split; provided, however, the implementation of such amendment shall be before February 20, 2024.

Mechanics

of the Reverse Stock Split

If

the Reverse Stock Split is approved and effected, beginning on the effective date of the Reverse Stock Split, each certificate representing

pre-split shares will, until surrendered and exchanged as described below, for all corporate purposes, be deemed to represent, respectively,

only the number of post-split shares.

Exchange

of Stock Certificates

Shortly

after the Reverse Stock Split becomes effective, stockholders will be notified and offered the opportunity at their own expense to surrender

their current certificates to our stock transfer agent in exchange for the issuance of new certificates reflecting the Reverse Stock

Split in accordance with the procedures to be set forth in a letter of transmittal to be sent by our stock transfer agent. In connection

with the Reverse Stock Split, the CUSIP number for the common stock will change from its current CUSIP number. This new CUSIP number

will appear on any new stock certificates issued representing post-split shares. STOCKHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S)

AND SHOULD NOT SUBMIT ANY STOCK CERTIFICATE(S) UNLESS AND UNTIL REQUESTED TO DO SO FOLLOWING THE ANNOUNCEMENT OF THE COMPLETION OF THE

REVERSE STOCK SPLIT.

Effect

on Registered “Book-Entry” Holders of Common Stock

Holders

of Common Stock may hold some or all of their Common Stock electronically in book-entry form (“street name”) under the direct

registration system for securities. These stockholders will not have stock certificates evidencing their ownership. They are, however,

provided with a statement reflecting the number of shares of Common Stock registered in their accounts. If you hold registered Common

Stock in book-entry form, you do not need to take any action to receive your post-split shares, if applicable.

Appraisal

Rights

Under

the Delaware General Corporation Law, our stockholders are not entitled to appraisal or dissenter’s rights with respect to the

Reverse Stock Split, and we will not independently provide our stockholders with any such rights.

Regulatory

Approvals

The

Reverse Stock Split will not be consummated, if at all, until after approval of our stockholders is obtained. We are not obligated to

obtain any governmental approvals or comply with any state or federal regulations in order to effect the Reverse Stock Split other than

the filing of the Reverse Stock Split Charter Amendment with the Secretary of State of the State of Delaware.

Accounting

Treatment of the Reverse Stock Split

If

the Reverse Stock Split is effected, the par value per share of our Common Stock will remain unchanged at $0.001. Accordingly, on the

effective date of the Reverse Stock Split, the stated capital on our consolidated balance sheets attributable to our Common Stock will

be reduced in proportion to the size of the Reverse Stock Split ratio, and the additional paid-in-capital account will be increased by

the amount by which the stated capital is reduced. Our stockholders’ equity, in the aggregate, will remain unchanged. Per share

net income or loss will be increased because there will be fewer shares of Common Stock outstanding. Any Common Stock held in treasury

will be reduced in proportion to the Reverse Stock Split ratio. The Company does not anticipate that any other accounting consequences,

including changes to the amount of stock-based compensation expense to be recognized in any period, will arise as a result of the Reverse

Stock Split.

Certain

U.S. Federal Income Tax Consequences of the Reverse Stock Split

The

following discussion is a summary of certain material U.S. federal income tax considerations of the Reverse Stock Split applicable to

U.S. holders (as defined below). This discussion does not purport to be a complete analysis of all potential tax consequences that may

be relevant to a U.S. holder. The effects of U.S. federal tax laws other than U.S. federal income tax laws, such as estate and gift tax

laws, and any applicable state, local or non-U.S. tax laws are not discussed. This discussion is based on the U.S. Internal Revenue Code

of 1986, as amended (the “Code”), Treasury Regulations promulgated thereunder, judicial decisions, and published rulings

and administrative pronouncements of the IRS, in each case in effect as of the date hereof. These authorities may change or be subject

to differing interpretations. Any such change or differing interpretation may be applied retroactively in a manner that could adversely

affect a U.S. holder. We have not sought and do not intend to seek any rulings from the IRS regarding the matters discussed below. There

can be no assurance the IRS or a court will not take a position contrary to that discussed below regarding the tax consequences of the

Reverse Stock Split.

This

discussion is limited to U.S. holders that hold Common Stock as a “capital asset” within the meaning of Section 1221 of the

Code (generally, property held for investment). This discussion does not address all U.S. federal income tax consequences relevant to

a U.S. holder’s particular circumstances, including the impact of the alternative minimum tax, the rules related to “qualified

small business stock” within the meaning of Section 1202 of the Code or the Medicare contribution tax on net investment income.

In addition, it does not address consequences relevant to U.S. holders subject to special rules, including, without limitation:

| |

● |

U.S.

expatriates and former citizens or long-term residents of the United States; |

| |

|

|

| |

● |

U.S.

holders whose functional currency is not the U.S. dollar; |

| |

|

|

| |

● |

Persons

holding Common Stock as part of a hedge, straddle or other risk reduction strategy or as part of a conversion transaction or other

integrated investment; |

| |

|

|

| |

● |

banks,

insurance companies, and other financial institutions; |

| |

|

|

| |

● |

real

estate investment trusts or regulated investment companies; |

| |

|

|

| |

● |

brokers,

dealers or traders in securities; |

| |

|

|

| |

● |

corporations

that accumulate earnings to avoid U.S. federal income tax; |

| |

|

|

| |

● |

S

corporations, partnerships or other entities or arrangements treated as partnerships for U.S. federal income tax purposes (and investors

therein); |

| |

|

|

| |

● |

tax-exempt

organizations or governmental organizations; |

| |

|

|

| |

● |

persons deemed to sell Common Stock

under the constructive sale provisions of the Code; and |

| |

|

|

| |

● |

persons who hold or received Common

Stock pursuant to the exercise of any employee stock option or otherwise as compensation;

and tax-qualified retirement plans. |

If

an entity treated as a partnership for U.S. federal income tax purposes holds Common Stock, the tax treatment of a partner in the partnership

will generally depend on the status of the partner, the activities of the partnership and certain determinations made at the partner

level. Accordingly, partnerships holding Common Stock and the partners in such partnerships should consult their tax advisors regarding

the U.S. federal income tax consequences to them.

THIS

DISCUSSION IS FOR INFORMATION PURPOSES ONLY AND IS NOT TAX ADVICE. HOLDERS SHOULD CONSULT THEIR TAX ADVISORS WITH RESPECT TO THE APPLICATION

OF THE U.S. FEDERAL INCOME TAX LAWS TO THEIR PARTICULAR SITUATIONS AS WELL AS ANY TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT ARISING

UNDER THE U.S. FEDERAL ESTATE OR GIFT TAX LAWS OR UNDER THE LAWS OF ANY STATE, LOCAL OR NON-U.S. TAXING JURISDICTION OR UNDER ANY APPLICABLE

INCOME TAX TREATY.

The

Reverse Stock Split should constitute a “recapitalization,” a form of nontaxable reorganization, for U.S. federal

income tax purposes. As a result, a U.S. holder of Common Stock generally should not recognize gain or loss with respect to shares

of Common Stock received in the Reverse Stock Split. A U.S. holder’s aggregate tax basis in the shares of Common Stock received

pursuant to the Reverse Stock Split should equal the aggregate tax basis of the shares of the Common Stock surrendered, and such U.S.

holder’s holding period in the shares Common Stock received should include the holding period in the shares of Common Stock surrendered.

Treasury Regulations provide detailed rules for allocating the tax basis and holding period of the shares of Common Stock surrendered

to the shares of Common Stock received in a recapitalization pursuant to the Reverse Stock Split. U.S. holders of shares of Common Stock

acquired on different dates and at different prices should consult their tax advisors regarding the allocation of the tax basis and holding

period of such shares.

As

noted above, we will not issue fractional shares in connection with the Reverse Stock Split. In lieu thereof, the aggregate of all fractional

shares otherwise issuable to the holders of record of old common stock will be issued to the Company’s transfer agent, as exchange

agent, for the accounts of all holders of record of old common stock otherwise entitled to have a fraction of a share issued to them.

The sale of all fractional interests will be effected by the exchange agent as soon as practicable after the effective time of

the Reverse Stock Split on the basis of prevailing market prices of the applicable new common stock. After such sale, the exchange

agent will pay to such holders of record their pro rata share of the net proceeds derived from the sale of the fractional interests.

A holder of record for whom the exchange agent sold fractional shares will have gain (or loss) in the amount that the net proceeds

of such a sale exceeds (or is less than) the holder’s adjusted tax basis in the shares sold.

Vote

Required

Pursuant

to the Delaware General Corporation Law and our organizational documents, the affirmative vote of the majority of votes cast by

the holders of our Common Stock present in person (via live webcast) or represented by proxy at the Special Meeting and

entitled to vote on the proposal is required to approve the Reverse Stock Split Proposal, assuming the presence of a quorum and if

the shares of Common Stock meet the listing requirements of the Nasdaq Stock Market relating to the minimum number of holders immediately

after the Reverse Stock Split becomes effective.

Our

Recommendation

THE

BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE PROPOSAL TO AMEND OUR SECOND RESTATED CERTIFICATE OF INCORPORATION, AS AMENDED,

TO EFFECT THE REVERSE STOCK SPLIT.

PROPOSAL

2

TO

APPROVE THE ADJOURNMENT OF THE SPECIAL MEETING, IF NECESSARY, TO ESTABLISH A QUORUM AND/OR SOLICIT ADDITIONAL PROXIES IF THERE

ARE INSUFFICIENT VOTES AT THE TIME OF THE

SPECIAL

MEETING TO APPROVE THE REVERSE STOCK SPLIT PROPOSAL

Background

of and Rationale for the Adjournment Proposal

In

the Adjournment Proposal, we are asking stockholders to authorize the holder of any proxy solicited by the Board to vote in favor of

adjourning the Special Meeting from time to time to a later date or dates if there are not sufficient votes at the Special

Meeting or any adjournment thereof to establish a quorum or approve the Reverse Stock Split Proposal. If our stockholders

approve this proposal, we could adjourn the Special Meeting, and any adjourned session of the Special Meeting, to use the additional

time to establish a quorum and/or solicit additional proxies in favor of the Reverse Stock Split Proposal.

Vote

Required

The

approval of the Adjournment Proposal requires the affirmative vote of the majority of the votes cast by the holders of our Common Stock

present in person (via live webcast) or represented by proxy at the Special Meeting and entitled to vote on the proposal.

Board

Recommendation

THE

BOARD RECOMMENDS A VOTE “FOR” THE ADJOURNMENT OF THE SPECIAL MEETING FROM TIME TO TIME TO A LATER DATE OR DATES, IF

NECESSARY, TO ESTABLISH A QUORUM AND/OR SOLICIT ADDITIONAL PROXIES IF THERE ARE INSUFFICIENT VOTES AT THE TIME OF THE SPECIAL

MEETING TO APPROVE THE REVERSE STOCK SPLIT PROPOSAL.

STOCKHOLDER

PROPOSALS AND NOMINATIONS

In

order for a stockholder proposal (other than nominations by stockholders of persons for election to our Board of Directors) to

be considered for inclusion in our Proxy Statement for our 2024 annual meeting of stockholders, the stockholder’s

written proposal must be received by us no earlier than February 29, 2024 but no later than March 30, 2024, and must

contain the information required by our Amended and Restated Bylaws. However, if the date of our 2024 annual meeting of

stockholders is more than 30 days before or after June 28, 2024, the first anniversary of this year’s Annual Meeting, stockholders

must give us notice of such stockholder proposals not earlier than the 120th day prior to such annual meeting and not later

than the close of business on the later of the 90th day prior to such annual meeting or, if the first public announcement

of the date of such annual meeting is less than 100 days prior to the date of such annual meeting, the 10th day following

the day on which we publicly announce the date of such annual meeting. In order for a stockholder proposal nominating persons for election

to our Board of Directors to be considered for inclusion in our Proxy Statement for our 2024 annual meeting of stockholders, the stockholder

must expressly elect at the time of providing notice of the proposal to have its nominee included in our proxy materials, and the stockholder’s

written proposal must be received by us no earlier than December 14, 2023 but no later than January 13, 2024, and should contain the

information required by our Amended and Restated Bylaws. If the date of next year’s annual meeting is moved more than 30 days

before or after June 28, 2024, the first anniversary of this year’s Annual Meeting, the deadline for inclusion of proposals

nominating persons for election to our Board of Directors in our Proxy Statement is not later than the close of business on the later

of 120 days in advance of such annual meeting or 10 days following the day on which we publicly disclose the date of such annual meeting.

In order for stockholders to give timely notice of nominations for directors, other than our nominees, for inclusion on a universal proxy

card in connection with the 2024 annual meeting of stockholders, notice must be submitted to us at our principal executive offices, located

at 8000 Marina Boulevard, Suite 100, Brisbane, California 94005, Attn: Corporate Secretary, no later than April 29, 2024, which is 60

calendar days prior to the one-year anniversary of the date of the Annual Meeting, and must comply with the requirements of Rule 14a-19.

Any proposals will also need to comply with Rules 14a-8 and 14a-19 of the rules and regulations promulgated

under the Exchange Act regarding the inclusion of stockholder proposals in company sponsored proxy materials.

Proposals should be addressed to our Secretary at our principal executive offices.

If

you intend to present a proposal at our 2024 annual meeting of stockholders and the proposal is not intended to be included in

our Proxy Statement relating to that meeting, you must give us advance notice of the proposal in accordance with our Amended and

Restated Bylaws. Pursuant to our Amended and Restated Bylaws, in order for a stockholder proposal to be deemed properly presented

in these circumstances, a stockholder must deliver notice of the proposal to our Secretary, at our principal executive offices, no earlier

than February 29, 2024 but no later than March 30, 2024. However, if the date of our 2024 annual meeting of stockholders

is more than 30 days before or after June 28, 2024, the first anniversary of this year’s Annual Meeting, stockholders must

give us notice of any stockholder proposals not earlier than the 120th day prior to such annual meeting and not later than

the close of business on the later of the 90th day prior to such annual meeting or, if the first public announcement of the

date of such annual meeting is less than 100 days prior to the date of such annual meeting, the 10th day following the day

on which we publicly announce the date of such annual meeting. If a stockholder does not provide us with notice of a stockholder

proposal in accordance with the deadlines described above, the stockholder will not be permitted to present the proposal to the stockholders

for a vote at the meeting. If the stockholder does not also comply with the requirements of Rule 14a-4(c)(2) under the Exchange

Act, we may exercise discretionary voting authority under proxies that we solicit to vote in accordance with our

best judgment on any such stockholder proposal or nomination.

OTHER

MATTERS

As

of the time of preparation of this proxy statement, neither the Board nor management intends to bring before the meeting any business

other than the matters referred to in the Notice of Special Meeting and this proxy statement. If any other business should properly come

before the meeting, or any adjournment thereof, the persons named in the proxy will vote on such matters according to their best judgment.

In addition, our Amended and Restated Bylaws permit the presiding officer at the Special Meeting to adjourn the meeting in his

or her sole discretion.

AVAILABILITY

OF CERTAIN DOCUMENTS

The

proxy materials for the Special Meeting are available via the Internet at www.proxyvote.com. Stockholders residing in the same household

who hold their stock through a bank or broker may receive only one set of proxy materials in accordance with a notice sent earlier by

their bank or broker unless we have received contrary instructions from one or more of the stockholders. This practice will continue

unless instructions to the contrary are received by your bank or broker from one or more of the stockholders within the household. We

will promptly deliver a separate copy of the proxy materials to such stockholders if you make a written or oral request to our corporate

secretary at the address above.

If

you hold your shares in “street name” and reside in a household that received only one copy of the proxy materials, you can

request to receive a separate copy in the future by following the instructions sent by your bank or broker. If your household is receiving

multiple copies of the proxy materials, you may request that only a single set of materials be sent by following the instructions sent

by your bank or broker by contacting us at the above address.

APPENDIX

A

CERTIFICATE

OF AMENDMENT

OF

SECOND

RESTATED

CERTIFICATE

OF INCORPORATION

OF

GT

BIOPHARMA, INC.

GT

Biopharma, Inc., a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the

“Corporation”), does hereby certify:

FIRST:

That the Board of Directors of the Corporation duly adopted a resolution by the unanimous written consent of its members proposing and

declaring fair, reasonable and advisable and in the best interest of the Company and its stockholders the following amendment to the

Second Restated Certificate of Incorporation of the Corporation (as amended, the “Certificate of Incorporation”) and

recommending that the stockholders of the Corporation consider and approve the resolution. The resolution setting forth the proposed

amendment is as follows:

RESOLVED,

that the Certificate of Incorporation be amended by replacing in its entirety the first paragraph of Article FOURTH so that, as amended,

the paragraph shall be and read as follows:

“I.

COMMON STOCK

Upon

this Certificate of Amendment becoming effective pursuant to the Delaware General Corporation Law (the “Effective Time”),

each [insert number between 5 and 30 inclusive, as approved by the Board] shares of Common Stock issued and outstanding (the “Old

Common Stock”) immediately prior to the Effective Time shall automatically without further action on the part of the Company or

any holder of Old Common Stock, be combined and changed into one (1) duly authorized, fully paid and non-assessable share of new common

stock (the “New Common Stock”) (the “Stock Combination”). From and after the Effective Time, certificates representing

Old Common Stock shall represent the number of whole shares of New Common Stock into which such Old Common Stock shall have been combined

pursuant to this Certificate of Amendment. There shall be no fractional shares issued with respect to New Common Stock. In lieu thereof,

the aggregate of all fractional shares otherwise issuable to the holders of record of Old Common Stock shall be issued to the Corporation’s

transfer agent (the “Exchange Agent”), as exchange agent, for the accounts of all holders of

record of Old Common Stock otherwise entitled to have a fraction of a share issued to them. The sale of all fractional interests will

be effected by the Exchange Agent as soon as practicable after the Effective Time on the basis of prevailing market prices of

the applicable New Common Stock at the time of sale. After such sale and upon the surrender of the stockholders’ stock certificates,

the Exchange Agent will pay to such holders of record their pro rata share of the net proceeds derived from the sale of the fractional

interests. After giving effect to the Stock Combination, the Company is authorized to issue a total of 250,000,000 shares of Common Stock,

$0.001 par value per share. Dividends may be paid on the Common Stock as, when and if declared by the Board of Directors, out

of any funds of the Company legally available for the payment of such dividends, and each share of Common Stock will be entitled to one

vote on all matters on which such stock is entitled to vote.”

SECOND: That thereafter pursuant to a resolution

of the Board of Directors of the Corporation, said amendment was submitted to the stockholders of the Corporation for their approval,

and was duly adopted in accordance with the provisions of Section 242 of the General Corporation Law of the State of Delaware.

IN

WITNESS WHEREOF, the undersigned authorized officer of the Corporation has executed this Certificate of Amendment to the Restated

Certificate of Incorporation as of [●], 202[●].

| |

GT

BIOPHARMA, INC. |

| |

|

|

| |

By: |

|

| |

Name: |

Michael

Breen |

| |

Title: |

Executive

Chairman of the Board and Interim Chief Executive Officer |

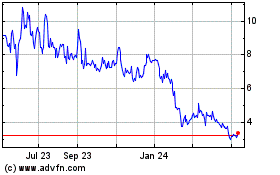

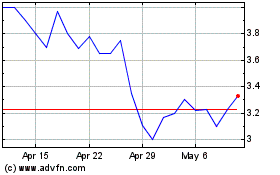

GT Biopharma (NASDAQ:GTBP)

Historical Stock Chart

From Mar 2024 to Apr 2024

GT Biopharma (NASDAQ:GTBP)

Historical Stock Chart

From Apr 2023 to Apr 2024