true0001498382S-1/A0001498382dei:BusinessContactMember2023-01-012023-06-3000014983822023-01-012023-06-30

As filed with the Securities and Exchange Commission on October 27, 2023

Registration No. 333-274864

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

KINTARA THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Nevada |

|

2834 |

|

99-0360497 |

(State or other jurisdiction of incorporation or organization) |

|

(Primary Standard Industrial Classification Code Number) |

|

(I.R.S. Employer Identification Number) |

9920 Pacific Heights Blvd, Suite 150

San Diego, CA 92121

(858) 350-4364

(Address, including zip code, and telephone number, including

area code, of registrant’s principal executive offices)

Robert E. Hoffman

Chief Executive Officer

Kintara Therapeutics, Inc.

9920 Pacific Heights Blvd, Suite 150

San Diego, CA 92121

(858) 350-4364

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

|

Michael J. Lerner, Esq. Steven M. Skolnick, Esq. Lowenstein Sandler LLP 1251 Avenue of the Americas New York, New York 10020 (212) 262-6700 |

Ron Ben-Bassat, Esq. Eric Victorson, Esq. Sullivan & Worcester LLP 1633 Broadway

New York, New York 10019

(212) 660-3000 |

Approximate date of commencement of proposed sale to public:

As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

Large accelerated filer ☐ |

|

Accelerated filer ☐ |

Non-accelerated filer ☒ |

|

Smaller reporting company ☒ |

|

|

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

|

|

|

|

|

PRELIMINARY PROSPECTUS |

|

SUBJECT TO COMPLETION |

|

DATED OCTOBER 27, 2023 |

Up to 2,331,002 Shares of Common Stock

Pre-Funded Warrants to Purchase up to 2,331,002 Shares of Common Stock

Common Warrants to Purchase up to 2,331,002 Shares of Common Stock

Up to 2,331,002 Shares of Common Stock Underlying the Pre-Funded Warrants

Up to 2,331,002 Shares of Common Stock Underlying the Common Warrants

We are offering 2,331,002 shares of common stock, par value $0.001 per share (the “common stock”), together with common warrants (the “Common Warrants”) to purchase up to 2,331,002 shares of common stock. Each share of our common stock, or pre-funded warrant (the “Pre-Funded Warrant”) in lieu thereof, is being sold together with a Common Warrant to purchase up to 2,331,002 shares of our common stock. The shares of common stock and Common Warrants are immediately separable and will be issued separately in this offering, but must be purchased together in this offering.

We are also offering Pre-Funded Warrants to purchase up to 2,331,002 shares of common stock to those purchasers whose purchase of shares of common stock in this offering would result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately following the consummation of this offering, in lieu of shares of common stock that would result in beneficial ownership in excess of 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock. Each Pre-Funded Warrant is exercisable for one share of our common stock and has an exercise price of $0.0001 per share. Each Pre-Funded Warrant is being offered together with the Common Warrants. The Pre-Funded Warrants and Common Warrants are immediately separable and will be issued separately in this offering but must be purchased together in this offering. For each Pre-Funded Warrant that we sell, the number of shares of common stock we are offering will be reduced on a one-for-one basis.

Pursuant to this prospectus, we are also offering the shares of common stock issuable upon the exercise of Pre-Funded Warrants and Common Warrants offered hereby. These securities are being sold in this offering to certain purchasers under a securities purchase agreement dated , 2023 between us and such purchasers.

The shares of our common stock, Pre-Funded Warrants and Common Warrants being offered will be sold in a single closing. The shares issuable upon exercise of the Pre-Funded Warrants or Common Warrants will be issued upon the exercise thereof. Because there is no minimum number of securities or minimum aggregate amount of proceeds for this offering to close, we may sell fewer than all of the securities offered hereby, and investors in this offering will not receive a refund in the event that we do not sell an amount of securities sufficient to pursue the business goals outlined in this prospectus. Because there is no escrow account and there is no minimum offering amount, investors could be in a position where they have invested in our company, but we are unable to fulfill our objectives due to a lack of interest in this offering. Also, any proceeds from the sale of securities offered by us will be available for our immediate use, despite uncertainty about whether we would be able to use such funds to effectively implement our business plan. The offering of the shares of our common stock, Pre-Funded Warrants and Common Warrants will terminate no later than December 31, 2023; however, the shares of our common stock underlying the Pre-Funded Warrants and the Common Warrants will be offered on a continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”).

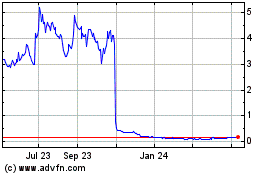

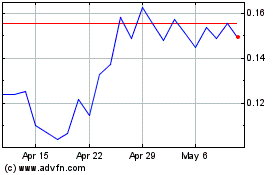

Our common stock is listed on the Nasdaq Capital Market, or Nasdaq, under the symbol “KTRA.” The closing price of our common stock on Nasdaq on October 19, 2023 was $4.29 per share. There is no established public trading market for the Pre-Funded Warrants and the Common Warrants, and we do not expect a market to develop.

Without an active trading market, the liquidity of the Pre-Funded Warrants and the Common Warrants will be limited. In addition, we do not intend to apply for a listing of the Pre-Funded Warrants or the Common Warrants on any national securities exchange or other nationally recognized trading system.

Certain information in this prospectus is based on an assumed combined public offering price of $4.29 per share and accompanying Common Warrant (the last reported sale price of our common stock on Nasdaq on October 19, 2023). The actual combined public offering price per share and accompanying Common Warrant will be determined between us and prospective investors in consultation with A.G.P./Alliance Global Partners (“A.G.P.” or the “Placement Agent”), as the placement agent, based on market conditions at the time of pricing, and may be at a discount to the current market price of our common stock. The Placement Agent is not required to buy or sell any specific number or dollar amount of the securities offered hereby, but they will use their reasonable best efforts to solicit offers to purchase the securities offered by this prospectus. See the section entitled “Plan of Distribution” on page 20 of this prospectus.

You should read this prospectus carefully, together with additional information described under the heading “Where You Can Find More Information,” before you invest in any of our securities.

Investing in our securities is highly speculative and involves a high degree of risk. See “Risk Factors” beginning on page 4 of this prospectus and in the documents incorporated by reference into this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per Share and Related Warrant |

|

|

Per Pre-

Funded

Warrant and Related Warrant |

|

|

Total |

|

Public offering price |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

Placement agent fees(1) |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

Proceeds to us, before expenses(2) |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

|

(1) |

We have agreed to pay the Placement Agent a cash placement commission equal to 7.0% of the aggregate gross proceeds from this offering. We have also agreed to reimburse the Placement Agent for certain out-of-pocket expenses, including the fees and disbursements of their counsel. In addition, we have agreed to issue the Placement Agent or its designees warrants (the “Placement Agent Warrants”) to purchase a number of shares of common stock equal to 5% of the shares of common stock sold in this offering (including the shares of common stock issuable upon the exercise of the Pre-Funded Warrants), at an exercise price of $ per share, which represents 125% of the assumed combined public offering price per share and accompanying Common Warrant. See “Plan of Distribution” for additional information regarding the compensation payable to the Placement Agent. |

(2) |

The amount of the offering proceeds to us presented in this table does not give effect to any exercise of the Pre-Funded Warrants or Common Warrants being issued in this offering. |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Delivery of the securities being offered pursuant to this prospectus is expected to be made on or about , 2023, subject to the satisfaction of certain closing conditions.

Sole Placement Agent

A.G.P.

The date of this prospectus is , 2023.

TABLE OF CONTENTS

i

ABOUT THIS PROSPECTUS

We incorporate by reference important information into this prospectus. You may obtain the information incorporated by reference without charge by following the instructions under “Where You Can Find More Information.” You should carefully read this prospectus as well as additional information described under “Incorporation of Certain Information By Reference,” before deciding to invest in our securities.

Neither we nor A.G.P. have authorized anyone to provide you with information different from or inconsistent with the information contained in or incorporated by reference in this prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. You should assume that the information appearing in this prospectus and the documents incorporated by reference in this prospectus is accurate only as of the date of those respective documents, regardless of the time of delivery of those respective documents. Our business, financial condition, results of operations and prospects may have changed since those dates.

The information incorporated by reference or provided in this prospectus contains statistical data and estimates, including those relating to market size and competitive position of the markets in which we participate, that we obtained from our own internal estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Industry publications, studies and surveys generally state that they have been obtained from sources believed to be reliable. While we believe our internal company research is reliable and the definitions of our market and industry are appropriate, neither this research nor these definitions have been verified by any independent source.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference into this prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreement, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The distribution of this prospectus and the offering of our common stock in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our common stock and the distribution of this prospectus outside the United States. This prospectus does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

Kintara Therapeutics, Inc. and its consolidated subsidiaries are referred to herein as “Kintara,” “the Company,” “we,” “us” and “our,” unless the context indicates otherwise.

This prospectus contains, or incorporates by reference, trademarks, tradenames, service marks and service names of Kintara Therapeutics, Inc. and its subsidiaries.

ii

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before deciding to invest in our securities. You should read this entire prospectus carefully, including the “Risk Factors” section in this prospectus and under similar captions in the documents incorporated by reference into this prospectus. If any of the risks materialize, our business, financial condition, operating results, and prospects could be materially and adversely affected. In that event, the price of our securities could decline, and you could lose part or all of your investment. In this prospectus, unless otherwise stated or the context otherwise requires, references to “Kintara”, “Company”, “we”, “us”, “our” or similar references mean Kintara Therapeutics, Inc. and its subsidiaries on a consolidated basis.

The Company

We are a clinical stage, biopharmaceutical company focused on the development and commercialization of new cancer therapies. We are dedicated to the development of novel cancer therapies for patients with unmet medical needs. Our mission is to benefit patients by developing and commercializing anti-cancer therapies for patients whose solid tumors exhibit features that make them resistant to, or unlikely to respond to, currently available therapies, with particular focus on orphan cancer indications.

Our two lead candidates are VAL-083, a novel, validated, DNA-targeting agent, for the treatment of drug-resistant solid tumors such as glioblastoma (“GBM”) and potentially other solid tumors, including ovarian cancer, non-small cell lung cancer (“NSCLC”), and diffuse intrinsic pontine glioma (“DIPG”) and REM-001, a late-stage photodynamic therapy (“PDT”) for the treatment of cutaneous metastatic breast cancer (“CMBC”). PDT is a treatment that uses light sensitive compounds, or photosensitizers, that, when exposed to specific wavelengths of light, act as a catalyst to produce a form of reactive oxygen that induces local tumor cell death. We are in the process of reinitiating our REM-001 program and expect to start enrolling patients in the fourth quarter of calendar year 2023.

Corporate Information

Our address is 9920 Pacific Heights Blvd, Suite 150, San Diego, CA 92121 and our telephone number is (858) 350-4364. Our corporate website is: www.kintara.com. Our website and the information contained on, or that can be accessed through, our website shall not be deemed to be incorporated by reference in, and are not considered part of, this prospectus. You should not rely on any such information in making your decision whether to purchase our securities.

1

THE OFFERING

2

|

|

|

Common Stock Offered: |

|

2,331,002 shares. |

|

|

|

Pre-Funded Warrants Offered: |

|

We are offering to certain purchasers whose purchase of shares of common stock in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% of our outstanding shares of common stock immediately following the closing of this offering, the opportunity to purchase, if such purchasers so choose, Pre-Funded Warrants, in lieu of shares of common stock that would otherwise result in any such purchaser’s beneficial ownership, together with its affiliates and certain related parties, exceeding 4.99% (or, at the election of such purchaser, 9.99%) of our outstanding shares of common stock immediately following the consummation of this offering. The purchase price of each Pre-Funded Warrant is equal to the purchase price of the shares of common stock in this offering minus $0.0001, the exercise price of each Pre-Funded Warrant. Each Pre-Funded Warrant is immediately exercisable and may be exercised at any time until it has been exercised in full. For each Pre-Funded Warrant we sell, the number of shares of common stock we are offering will be decreased on a one-for-one basis. This offering also relates to the shares of common stock issuable upon exercise of any Pre-Funded Warrants sold in this offering. |

|

|

|

Common Stock Outstanding after this Offering: |

|

Up to 4,077,410 shares of common stock, assuming no sales of Pre-Funded Warrants which, if sold, would reduce the number of shares of common stock that we are offering on a one-for-one basis. |

|

|

|

Common Warrants: |

|

Each share of common stock will be sold together with one Common Warrant. Each Common Warrant has an exercise price per share equal to 100% of the combined public offering price per share and accompanying Common Warrant in this offering and expires on the fifth anniversary of the original issuance date. Because we will issue a Common Warrant for each share of common stock and for each Pre-Funded Warrant sold in this offering, the number of Common Warrants sold in this offering will not change as a result of a change in the mix of shares of common stock and Pre-Funded Warrants sold. This offering also relates to the shares of Common Warrants sold in this offering, and the shares of common stock issuable upon exercise of any Common Warrants sold in this offering. |

|

|

|

Reasonable Best Efforts: |

|

We have agreed to issue and sell the securities offered hereby to the purchasers through the Placement Agent. The Placement Agent is not required to buy or sell any specific number or dollar amount of the securities offered hereby, but they will use their reasonable best efforts to solicit offers to purchase the securities offered by this prospectus. See the section entitled “Plan of Distribution” on page 20 of this prospectus. |

|

|

|

Use of Proceeds: |

|

We estimate that the net proceeds of this offering, after deducting estimated placement agent fees and estimated offering expenses, will be approximately $9.0 million if all of the securities offered hereby are sold in this offering. We intend to use all of the net proceeds we receive from this offering for working capital and other general corporate purposes, which may include funding acquisitions or investments in businesses, products or technologies that are complementary to our own. However, this is a reasonable best efforts offering with no minimum number of securities or amount of proceeds as a condition to closing, and we may not sell all or any of the securities offered pursuant to this prospectus; and, as a result, we may receive significantly less in net proceeds in this offering. For example, if we sell only 10%, 25%, 50% or 75% of the maximum amount offered, our net proceeds will be approximately $640,000, $2,035,000, $4,360,000 or $6,685,000, respectively. We will only receive additional proceeds from the exercise of the Common Warrants issuable in connection with this offering if such Common Warrants are exercised at their assumed exercise price of $4.29 (100% of the assumed combined public offering price per share of our common stock and accompanying Common Warrant). See “Use of Proceeds.” |

|

|

|

3

|

|

|

Lock-up: |

|

All of our directors and executive officers have agreed with the Placement Agent, subject to certain exceptions, not to sell, transfer or dispose of, directly or indirectly, any of our common stock or securities convertible into or exercisable or exchangeable for our common stock for a period of 90 days after the date of this prospectus. In addition, we have agreed that, subject to certain exceptions, we will not conduct any issuances of our common stock for a period of 60 days following closing of this offering. See “Plan of Distribution” for more information. |

|

|

|

Placement Agent Warrants |

|

We have agreed to issue to the Placement Agent or its designees, warrants, or the Placement Agent Warrants, to purchase up to 5% of the aggregate number of shares of common stock sold in this offering (including the shares of common stock issuable upon the exercise of the Pre-Funded Warrants) at an exercise price equal to 125% of the assumed combined public offering price per share and accompanying Common Warrant to be sold in this offering. The Placement Agent Warrants will be exercisable upon issuance and will expire five years from the commencement of sales under this offering. See “Plan of Distribution” for additional information. |

|

|

|

Amendment to outstanding common warrants |

|

In connection with this offering, we may amend the terms of outstanding common warrants to purchase up to 706,463 shares of our common stock, which were previously issued to reduce the exercise price of such warrants to equal the exercise price of the Common Warrants sold in this offering, and to extend the term during which those warrants could remain exercisable to the term of the Common Warrants sold in this offering. |

|

|

|

Risk Factors: |

|

Investment in our securities involves a high degree of risk and could result in a loss of your entire investment. See “Risk Factors” beginning on page 4, and the other information included and incorporated by reference in this prospectus for a discussion of the factors you should consider carefully before deciding to invest in our securities. |

|

|

|

Nasdaq Capital Market Symbol: |

|

KTRA |

The above discussion is based on 1,746,408 shares of our common stock outstanding as of October 19, 2023, does not give effect to the shares of common stock issuable upon exercise of the Pre-Funded Warrants and Common Warrants issued in this offering, and excludes, as of such date:

4

|

|

|

|

● |

275,016 shares of our common stock issuable upon the exercise of stock options, with a weighted-average exercise price of $33.76 per share; |

|

|

|

|

● |

706,463 shares of our common stock issuable upon the exercise of outstanding common stock warrants with a weighted-average exercise price of $43.12 per share; |

|

|

|

|

● |

243,761 shares of our common stock issuable upon the conversion of outstanding Series C Convertible Stock (the “Series C Stock”); |

|

|

|

|

● |

87,306 shares of our common stock reserved for future issuance under our 2017 Omnibus Equity Incentive Plan; |

|

|

|

|

● |

69,403 shares of our common stock reserved for future issuance upon the vesting of outstanding restricted stock units (“RSUs”); |

|

|

|

|

● |

42,037 shares of our common stock issuable upon the conversion of Series C Stock underlying outstanding warrants with a weighted-average exercise conversion price of $58.18 per share; and |

|

|

|

|

● |

170,602 shares of our common stock reserved for future issuance under our purchase agreement, dated as of August 2, 2022 (the “Purchase Agreement”), with Lincoln Park Capital Fund, LLC (“Lincoln Park”). As of October 19, 2023, the sales made under the Purchase Agreement are the maximum amounts available due to ownership limitations under Nasdaq rules. |

Unless expressly indicated or the context requires otherwise, all information in this prospectus assumes (i) no investor elects to purchase Pre-Funded Warrants and (ii) no exercise of the Common Warrants offered hereby.

5

RISK FACTORS

An investment in our common stock involves a high degree of risk. Before deciding whether to invest in our securities, you should carefully consider the risks and uncertainties described below, together with the information under the heading “Risk Factors” in our most recent Annual Report on Form 10-K for the fiscal year ended June 30, 2023 filed with the Securities and Exchange Commission, all of which are incorporated herein by reference, as updated or superseded by the risks and uncertainties described under similar headings in the other documents that are filed after the date hereof and incorporated by reference into this prospectus, together with all of the other information contained or incorporated by reference in this prospectus, and any free writing prospectus that we have authorized for use in connection with this offering before you make a decision to invest in our securities. The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our operations. Past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods. If any of these risks actually occurs, our business, business prospects, financial condition or results of operations could be seriously harmed. This could cause the trading price of our common stock to decline, resulting in a loss of all or part of your investment. Please also read carefully the section below entitled “Cautionary Note Regarding Forward-Looking Statements.”

Risks Related to This Offering

Management will have broad discretion as to the use of the proceeds from this offering, and we may not use the proceeds effectively.

Our management will have broad discretion in the application of the net proceeds from this offering, including for any of the purposes described in the section entitled “Use of Proceeds,” and could spend the proceeds in ways that do not improve our results of operations or enhance the value of our common stock. Our failure to apply these funds effectively could have a material adverse effect on our business and cause the price of our common stock to decline.

You will experience immediate and substantial dilution in the net tangible book value per share of the common stock you purchase.

Based on an assumed combined public offering price of $4.29 per share and accompanying Common Warrant (the last reported sales price of our common stock on Nasdaq on October 19, 2023), if you purchase shares of our common stock and related warrants in this offering, you will suffer immediate and substantial dilution of $1.87 per share with respect to the net tangible book value of the common stock. See the section entitled “Dilution” below for a more detailed discussion of the dilution you will incur if you purchase common stock in this offering.

You may experience future dilution as a result of future equity offerings and other issuances of our common stock or other securities. In addition, this offering and future equity offerings and other issuances of our common stock or other securities may adversely affect our common stock price.

In order to raise additional capital, we may in the future offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock at prices that may not be the same as the price per share in this offering. We may not be able to sell shares or other securities in any other offering at a price per share that is equal to or greater than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of our common stock or securities convertible into common stock in future transactions may be higher or lower than the price per share in this offering. You will incur dilution upon exercise of any outstanding stock options, warrants or upon the issuance of shares of common stock under our stock incentive programs. In addition, the sale of shares in this offering and any future sales of a substantial number of shares of our common stock in the public market, or the perception that such sales may occur, could adversely affect the price of our common stock. We cannot predict the effect, if any, that market sales of those shares of common stock or the availability of those shares of common stock for sale will have on the market price of our common stock.

6

In connection with this offering, we may amend the terms of outstanding common warrants to purchase up to 706,463 shares of our common stock, which were previously issued to reduce the exercise price of such warrants to equal the exercise price of the Common Warrants sold in this offering, and to extend the term during which those warrants could remain exercisable to the term of the Common Warrants sold in this offering.

There is no public market for the Pre-Funded Warrants and Common Warrants being offered in this offering.

There is no established public trading market for the Pre-Funded Warrants and Common Warrants being offered in this offering, and we do not expect a market to develop. In addition, we do not intend to apply to list the Pre-Funded Warrants and Common Warrants on any securities exchange or nationally recognized trading system. Without an active market, the liquidity of the Pre-Funded Warrants and Common Warrants will be limited.

Holders of our Pre-Funded Warrants and Common Warrants will have no rights as common stockholders until they acquire our common stock.

Until you acquire shares of common stock upon exercise of your Pre-Funded Warrants or the Common Warrants, you will have no rights with respect to the shares of common stock issuable upon exercise of your Common Warrants. Upon exercise of your Pre-Funded Warrants or the Common Warrants, you will be entitled to exercise the rights of a holder of shares only as to matters for which the record date occurs after the exercise date.

If we do not maintain a current and effective prospectus relating to the common stock issuable upon exercise of the Pre-Funded Warrants and Common Warrants, holders will only be able to exercise such Pre-Funded Warrants and Common Warrants on a “cashless basis.”

If we do not maintain a current and effective prospectus relating to the shares of common stock issuable upon exercise of the Pre-Funded Warrants or the Common Warrants at the time that holders wish to exercise such warrants, they will only be able to exercise them on a “cashless basis,” and under no circumstances would we be required to make any cash payments or net cash settle such warrants to the holders. As a result, the number of shares of common stock that holders will receive upon exercise of the Pre-Funded Warrants or the Common Warrants will be fewer than it would have been had such holders exercised their Pre-Funded Warrants or the Common Warrants for cash. Under the terms of the Pre-Funded Warrants or the Common Warrants, we have agreed to use our reasonable best efforts to maintain a current and effective prospectus relating to the shares of common stock issuable upon exercise of such warrants until the expiration of such warrants. However, we cannot assure you that we will be able to do so. If we are unable to do so, the potential “upside” of the holder’s investment in our company may be reduced.

The Pre-Funded Warrants and the Common Warrants are speculative in nature.

The Pre-Funded Warrants and Common Warrants offered hereby do not confer any rights of common stock ownership on their holders, such as voting rights or the right to receive dividends, but rather merely represent the right to acquire shares of common stock at a fixed price. Specifically, commencing on the date of issuance, holders of the Pre-Funded Warrants may acquire the common stock issuable upon exercise of such warrants at an exercise price of $0.0001 per share and holders of the Common Warrants may acquire the common stock issuable upon exercise of such warrants at an exercise price per share equal to the combined public offering price per share and accompanying Common Warrant in this offering. Moreover, following this offering, the market value of the Pre-Funded Warrants and the Common Warrants is uncertain, and there can be no assurance that the market value of the Pre-Funded Warrants or the Common Warrants will equal or exceed their public offering price.

The Common Warrants may not have any value.

Each Common Warrant has an exercise price per share equal to the combined public offering price per share of common stock and accompanying Common Warrant in this offering and expires on the fifth anniversary of its original issuance date. In the event the market price per share of common stock does not exceed the exercise price of the Common Warrants during the period when the Common Warrants are exercisable, the Common Warrants may not have any value.

7

This is a reasonable best efforts offering, in which no minimum number or dollar amount of securities is required to be sold, and we may not raise the amount of capital we believe is required for our business plans.

The Placement Agent has agreed to use its reasonable best efforts to solicit offers to purchase the securities in this offering. The Placement Agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of the securities. There is no required minimum number of securities that must be sold as a condition to completion of this offering. Because there is no minimum offering amount required as a condition to the closing of this offering, the actual offering amount, placement agent fees and proceeds to us are not presently determinable and may be substantially less than the maximum amounts set forth herein. We may sell fewer than all of the securities offered hereby, which may significantly reduce the amount of proceeds received by us, and investors in this offering will not receive a refund in the event that we do not sell an amount of securities sufficient to support our operations. Thus, we may not raise the amount of capital we believe is required for our operations in the short-term and may need to raise additional funds to complete such short-term operations. Such additional fundraises may not be available or available on terms acceptable to us.

Certain provisions of the Pre-Funded Warrants and Common Warrants could discourage an acquisition of us by a third party.

Certain provisions of the Pre-Funded Warrants and Common Warrants could make it more difficult or expensive for a third party to acquire us. The Pre-Funded Warrants and Common Warrants prohibit us from engaging in certain transactions constituting “fundamental transactions” unless, among other things, the surviving entity assumes our obligations under the Pre-Funded Warrants and Common Warrants. Further, the Common Warrants provide that, in the event of certain transactions constituting “fundamental transactions,” with some exception, holders of such warrants will have the right, at their option, to require us to repurchase such Common Stock Warrants at a price described in such warrants. These and other provisions of the Pre-Funded Warrants and Common Warrants could prevent or deter a third party from acquiring us even where the acquisition could be beneficial to you.

8

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This prospectus and any documents we incorporate by reference, contain certain forward-looking statements that involve substantial risks and uncertainties. All statements contained in this prospectus and any documents we incorporate by reference, other than statements of historical facts, are forward-looking statements including statements regarding our strategy, future operations, future financial position, future revenue, projected costs, prospects, plans, objectives of management and expected market growth. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

The words “anticipate”, “believe”, “estimate”, “expect”, “intend”, “may”, “plan”, “predict”, “project”, “target”, “potential”, “will”, “would”, “could”, “should”, “continue” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements include, among other things, statements about:

•our ability to raise funds for general corporate purposes and operations, including our research activities and clinical studies;

•our ability to recruit qualified management and technical personnel;

•the cost, timing, scope and results of our clinical studies;

•our ability to expand our international business;

•our ability to obtain and maintain required regulatory approvals for our products;

•our expectations regarding the use of our existing cash;

•our ability to realize the anticipated benefits from the acquisition of Adgero Biopharmaceuticals Holdings, Inc.;

•our ability to obtain or maintain patents or other appropriate protection for the intellectual property utilized in our current and planned products;

•our ability to develop and commercialize products without infringing the intellectual property rights of third parties;

•our ability to regain compliance with the stockholders’ equity requirement and meet the other continuing listing requirements of Nasdaq and remain listed on the Nasdaq Capital Market;

•other risks and uncertainties, including those listed in the “Risk Factors” section of this prospectus and the documents incorporated by reference herein; and

•our use of proceeds from this offering.

These forward-looking statements are only predictions and we may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, so you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our business, financial condition and operating results. We have included important factors in the cautionary statements included in this prospectus, as well as certain information incorporated by reference into this prospectus, that could cause actual future results or events to differ materially from the forward-looking statements that we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

Discussions containing these forward-looking statements may be found, among other places, in the sections titled “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” incorporated by reference from our most recent Annual Report on Form 10-K for the fiscal year ended June 30, 2023, as well as any amendments thereto, filed with the SEC. Additional factors are discussed under the caption “Risk Factors” in this prospectus and any free writing prospectus and under similar headings in the other documents that are incorporated by reference into this prospectus. New risks and uncertainties arise from time to time,

9

and it is impossible for us to predict these events or how they may affect us. We disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law.

You should read this prospectus and the documents that we incorporate by reference in this prospectus and have filed as exhibits to the registration statement of which this prospectus is a part completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

10

USE OF PROCEEDS

We estimate that the net proceeds from this offering will be approximately $9.0 million, assuming the number of shares of common stock and Pre-Funded Warrants offered by us, as set forth on the cover page of this prospectus, remains the same, assuming no exercise of the Common Warrants issued in connection with this offering, and after deducting the placement agent fees and estimated offering expenses payable to us. However, this is a reasonable best efforts offering with no minimum number of securities or amount of proceeds as a condition to closing, and we may not sell all or any of the securities offered pursuant to this prospectus; and, as a result, we may receive significantly less in net proceeds from this offering. For example, if we sell only 10%, 25%, 50% or 75% of the maximum amount offered, our net proceeds will be approximately $640,000, $2,035,000, $4,360,000 or $6,685,000, respectively. We will only receive additional proceeds from the exercise of the Common Warrants issuable in connection with this offering if such Common Warrants are exercised at their assumed exercise price of $4.29 (100% of the assumed combined public offering price per share of our common stock and accompanying Common Warrant).

We intend to use the net proceeds from the offering for working capital and other general corporate purposes, which may include funding acquisitions or investments in businesses, products or technologies that are complementary to our own. We have no specific acquisition contemplated at this time. As of the date of this prospectus, we cannot specify with certainty all of the particular uses for the net proceeds from this offering. The amounts and timing of our actual expenditures will depend on numerous factors, including factors described under “Risk Factors” in this prospectus and the documents incorporated by reference herein. Pending our use of the net proceeds from this offering, we intend to invest the net proceeds in a variety of capital preservation investments, including short-term, investment-grade, interest-bearing instruments and U.S. government securities.

We will receive additional gross proceeds of approximately $1,000,000, $2,500,000, $5,000,000, $7,500,000 or $10,000,000 if all of the Common Warrants issued in connection with this offering are exercised for cash, assuming no exercise of the Placement Agent Warrants, and assuming the sale of 10%, 25%, 50%, 75%, and 100% of the securities offered hereby, respectively. We intend to use any such proceeds for working capital and general corporate purposes.

MARKET PRICE OF OUR COMMON STOCK

Our common stock is presently listed on the Nasdaq Capital Market under the symbol “KTRA”. On October 19, 2023, the last reported sale price of our common stock on Nasdaq was $4.29 per share.

As of October 19, 2023, there were approximately 453 holders of record of our common stock.

11

DILUTION

If you invest in our securities in this offering, assuming no sale of any Pre-Funded Warrants and no exercise of the Common Warrants issued in connection with this offering, your ownership interest will be immediately diluted to the extent of the difference between the assumed combined public offering price per share of our common stock and accompanying Common Warrant and the as adjusted net tangible book value per share of our common stock immediately after this offering.

The net tangible book value of our common stock as of June 30, 2023, was approximately $730,986, or approximately $0.43 per share of common stock based on 1,692,175 shares of common stock outstanding at that time. “Net tangible book value” is the amount of our total tangible assets minus our total liabilities. “Net tangible book value per share” is net tangible book value divided by the total number of shares outstanding as of June 30, 2023.

After giving effect to the sale of 2,331,002 shares of common stock in this offering at an assumed combined public offering price of $4.29 per share and accompanying Common Warrant (the last reported sale price of our common stock on Nasdaq on October 19, 2023), assuming no sale of any Pre-Funded Warrants and no exercise of the Common Warrants issued in connection with this offering, and after deducting placement agent fees and expenses and estimated offering expenses payable by us, our as adjusted net tangible book value as of June 30, 2023 would have been approximately $9.74 million, or approximately $2.42 per share of common stock.

This represents an immediate increase in net tangible book value of approximately $1.99 per share to existing shareholders and an immediate dilution of approximately $1.87 per share to new investors. If we sell only 10%, 25%, 50%, or 75% of the maximum amount offered at the assumed combined public offering price of $4.29 per share of our common stock and accompanying Common Warrant (based upon the last reported sale of our common stock on Nasdaq on October 19, 2023) and after deducting estimated offering expenses payable by us, our pro forma as adjusted net tangible book value as of June 30, 2023 would have been approximately $1.37 million, or approximately $0.71 per share of common stock, approximately $2.76 million, or approximately $1.22 per share of common stock, approximately $5.09 million, or approximately $1.78 per share of common stock, or approximately $7.42 million, or approximately $2.16 per share of common stock, respectively.

Our net tangible book value calculations assume no exercise of the Common Warrants offered hereby. The information discussed above is illustrative only and will adjust based on the actual public offering price, the actual number of shares that we offer in this offering, and other terms of this offering determined at pricing.

The following table illustrates this calculation on a per share basis assuming sale of all securities offered hereby:

|

|

|

|

|

|

|

|

|

Assumed combined public offering price per share and accompanying Common Warrant |

|

|

|

|

|

$4.29 |

|

|

Net tangible book value per share of common stock as of June 30, 2023 |

|

$ |

0.43 |

|

|

|

|

|

Increase in net tangible book value per share attributable to this offering |

|

$ |

1.99 |

|

|

|

|

|

As adjusted, net tangible book value per share after this offering |

|

|

|

|

|

$2.42 |

|

|

Dilution per share to new investors purchasing shares in this offering |

|

|

|

|

|

$1.87 |

|

|

The following table illustrates this calculation on a per share basis assuming sale of 10% of securities offered hereby:

|

|

|

|

|

|

|

|

|

Assumed combined public offering price per share and accompanying Common Warrant |

|

|

|

|

|

$4.29 |

|

|

Net tangible book value per share of common stock as of June 30, 2023 |

|

$ |

0.43 |

|

|

|

|

|

Increase in net tangible book value per share attributable to this offering |

|

$ |

0.28 |

|

|

|

|

|

As adjusted, net tangible book value per share after this offering |

|

|

|

|

|

$0.71 |

|

|

Dilution per share to new investors purchasing shares in this offering |

|

|

|

|

|

$3.58 |

|

|

The following table illustrates this calculation on a per share basis assuming sale of 25% of securities offered hereby:

12

|

|

|

|

|

|

|

|

|

Assumed combined public offering price per share and accompanying Common Warrant |

|

|

|

|

|

$4.29 |

|

|

Net tangible book value per share of common stock as of June 30, 2023 |

|

$ |

0.43 |

|

|

|

|

|

Increase in net tangible book value per share attributable to this offering |

|

$ |

0.79 |

|

|

|

|

|

As adjusted, net tangible book value per share after this offering |

|

|

|

|

|

$1.22 |

|

|

Dilution per share to new investors purchasing shares in this offering |

|

|

|

|

|

$3.07 |

|

|

The following table illustrates this calculation on a per share basis assuming sale of 50% of securities offered hereby:

|

|

|

|

|

|

|

|

|

Assumed combined public offering price per share and accompanying Common Warrant |

|

|

|

|

|

$4.29 |

|

|

Net tangible book value per share of common stock as of June 30, 2023 |

|

$ |

0.43 |

|

|

|

|

|

Increase in net tangible book value per share attributable to this offering |

|

$ |

1.35 |

|

|

|

|

|

As adjusted, net tangible book value per share after this offering |

|

|

|

|

|

$1.78 |

|

|

Dilution per share to new investors purchasing shares in this offering |

|

|

|

|

|

$2.51 |

|

|

The following table illustrates this calculation on a per share basis assuming sale of 75% of securities offered hereby:

|

|

|

|

|

|

|

|

|

Assumed combined public offering price per share and accompanying Common Warrant |

|

|

|

|

|

$4.29 |

|

|

Net tangible book value per share of common stock as of June 30, 2023 |

|

$ |

0.43 |

|

|

|

|

|

Increase in net tangible book value per share attributable to this offering |

|

$ |

1.73 |

|

|

|

|

|

As adjusted, net tangible book value per share after this offering |

|

|

|

|

|

$2.16 |

|

|

Dilution per share to new investors purchasing shares in this offering |

|

|

|

|

|

$2.13 |

|

|

Each $1.00 increase or decrease in the assumed combined public offering price of $4.29 per share and accompanying Common Warrant, which was the last reported sale price of our common stock on Nasdaq on October 19, 2023, would increase or decrease the as adjusted net tangible book value per share by $0.54 per share and the dilution per share to investors participating in this offering by $0.54 per share, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same, assuming no sale of any Pre-Funded Warrants and no exercise of the Common Warrants issued in connection with this offering, and after deducting placement agent fees and estimated offering expenses payable by us.

We may also increase or decrease the number of shares we are offering. A 100,000 share increase in the number of shares offered by us, as set forth on the cover page of this prospectus, would increase the as adjusted net tangible book value per share by approximately $0.04 and decrease the dilution per share to new investors participating in this offering by approximately $0.04, based on an assumed combined public offering price of $4.29 per share and accompanying Common Warrant, which was the last reported sale price of our common stock on Nasdaq on October 19, 2023, remaining the same, assuming no sale of any Pre-Funded Warrants and no exercise of the Common Warrants issued in connection with this offering, and after deducting placement agent fees and expenses and estimated offering expenses payable by us. Similarly, a 100,000 share decrease in the number of shares offered by us, as set forth on the cover page of this prospectus, would decrease the as adjusted net tangible book value per share by approximately $0.04 and increase the dilution per share to new investors participating in this offering by approximately $0.04, based on an assumed combined public offering price of $4.29 per share and accompanying Common Warrant, which was the last reported sale price of our common stock on Nasdaq on October 19, 2023, remaining the same, assuming no sale of any Pre-Funded Warrants and no exercise of the Common Warrants issued in connection with this offering, and after deducting placement agent fees and expenses and estimated offering expenses payable by us.

The table and discussion above are based on 1,692,175 shares of our common stock outstanding as June 30, 2023 and assumes the exercise of the Pre-Funded Warrants. The number of shares outstanding as of June 30, 2023 excludes, as of such date, the following:

13

•197,930 shares of our common stock issuable upon the exercise of stock options, with a weighted-average exercise price of $51.71 per share;

•713,303 shares of our common stock issuable upon the exercise of outstanding common stock warrants with a weighted-average exercise price of $43.55 per share;

•244,631 shares of our common stock issuable upon the conversion of outstanding Series C Stock;

•42,037 shares of our common stock issuable upon the conversion of Series C Stock underlying outstanding warrants with a weighted-average exercise conversion price of $58.18 per share;

•116,550 shares of our common stock issuable upon exercise of warrants to be issued to the Placement Agent in connection with this offering based upon the sale of all of the securities offered hereby, and approximately 11,655 shares of our common stock, 29,137 shares of our common stock, 58,275 shares of our common stock, and 87,412 shares of our common stock, assuming the sale of 10%, 25%, 50%, and 75% of the maximum amount, respectively;

•2,331,002 shares of our common stock issuable upon exercise of outstanding warrants sold in this offering, based upon the sale of all of the securities offered hereby, and 233,100 shares of our common stock, 582,750 shares of our common stock, 1,165,501 shares of our common stock, and 1,748,251 shares of our common stock, assuming the sale of 10%, 25%, 50%, and 75% of the maximum amount, respectively;

•160,799 shares of our common stock reserved for future issuance under our 2017 Omnibus Equity Incentive Plan; and

•170,602 shares of our common stock reserved for future issuance under the Purchase Agreement with Lincoln Park.

To the extent that outstanding exercisable options or warrants are exercised, you may experience further dilution. In addition, we may need to raise additional capital and to the extent that we raise additional capital by issuing equity or convertible debt securities your ownership will be further diluted.

The information discussed above is illustrative only and will adjust based on the actual public offering price and other terms of this offering determined at pricing.

14

CAPITALIZATION

The following table sets forth our cash and cash equivalents, as well as our capitalization, as of June 30, 2023, as follows:

|

|

|

|

● |

on an actual basis; and |

|

|

● |

on an as adjusted basis to give further effect to the sale by us of all 2,331,002 shares of our common stock and Pre-Funded Warrants to purchase up to all 2,331,002 shares of common stock in this offering at the public offering price of $4.29 per share of common stock and accompanying Common Warrant, and $4.29 per Pre-Funded Warrant and accompanying Common Warrant, assuming the immediate full exercise for cash of the Pre-Funded Warrants sold in this offering, no exercise of the Common Warrants being sold in this offering and after deducting the placement agent fees and estimated offering expenses payable by us. |

You should consider this table in conjunction with “Use of Proceeds” above as well as our “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the notes to those financial statements for the year ended June 30, 2023 incorporated by reference into this prospectus.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of June 30, 2023

(in thousands) |

|

|

|

|

Actual |

|

|

As Adjusted |

|

Cash and cash equivalents |

|

|

|

$ |

1,535 |

|

|

|

|

$ |

10,545 |

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock, par value $0.001; 75,000,000 shares authorized; 1,692,175 shares issued and outstanding as of June 30, 2023 (as adjusted, 4,023,177 shares issued and outstanding as of June 30, 2023) |

|

|

|

|

2 |

|

|

|

|

|

2 |

|

|

Additional paid-in capital |

|

|

|

|

141,438 |

|

|

|

|

|

150,448 |

|

|

Accumulated deficit |

|

|

|

|

(151,375) |

|

|

|

|

|

(151,375) |

|

|

Total capitalization |

|

|

|

$ |

(8,400) |

|

|

|

|

$ |

9,620 |

|

|

The information above is based on 1,692,175 shares of our common stock outstanding as of June 30, 2023, and excludes as of such date, the following:

15

|

|

|

|

● |

197,930 shares of our common stock issuable upon the exercise of stock options, with a weighted-average exercise price of $51.71 per share; |

|

|

● |

713,303 shares of our common stock issuable upon the exercise of outstanding common stock warrants with a weighted-average exercise price of $43.55 per share; |

|

|

|

|

● |

244,631 shares of our common stock issuable upon the conversion of outstanding Series C Stock; |

|

|

|

|

● |

42,037 shares of our common stock issuable upon the conversion of Series C Stock underlying outstanding warrants with a weighted-average exercise conversion price of $58.18 per share; |

|

|

|

|

● |

116,550 shares of our common stock issuable upon exercise of warrants to be issued to the Placement Agent in connection with this offering based upon the sale of all of the securities offered hereby, and approximately 11,655 shares of our common stock, 29,137 shares of our common stock, 58,275 shares of our common stock, and 87,412 shares of our common stock, assuming the sale of 10%, 25%, 50%, and 75% of the maximum amount, respectively; |

|

|

|

|

● |

2,331,002 shares of our common stock issuable upon exercise of outstanding warrants sold in this offering, based upon the sale of all of the securities offered hereby, and 233,100 shares of our common stock, 582,750 shares of our common stock, 1,165,501 shares of our common stock, and 1,748,251 shares of our common stock, assuming the sale of 10%, 25%, 50%, and 75% of the maximum amount, respectively; |

|

|

|

|

● |

160,799 shares of our common stock reserved for future issuance under our 2017 Omnibus Equity Incentive Plan; and |

|

|

|

|

● |

170,602 shares of our common stock reserved for future issuance under the Purchase Agreement with Lincoln Park. |

The information discussed above is illustrative only and assumes the sale of all shares of common stock and Common Warrants in this offering and receipt of the full amount of net proceeds from the sale of such securities and will adjust based on the actual public offering price and other terms of this offering determined at pricing.

16

DESCRIPTION OF CAPITAL STOCK

Authorized Stock

The following summary of the material terms of our capital stock is not intended to be a complete summary of the rights and preferences of such securities. We urge you to read our Articles of Incorporation in its entirety for a complete description of the rights and preferences of our securities.

We have 80,000,000 shares of capital stock authorized under our articles of incorporation, as amended (the “Articles of Incorporation”), consisting of 75,000,000 shares of common stock with a par value of $0.001 per share and 5,000,000 shares of preferred stock with a par value of $0.001 per share.

The additional shares of our authorized stock available for issuance may be issued at times and under circumstances so as to have a dilutive effect on earnings per share and on the equity ownership of the holders of our common stock. The ability of our board of directors to issue additional shares of stock could enhance the board’s ability to negotiate on behalf of the stockholders in a takeover situation but could also be used by the board to make a change-in-control more difficult, thereby denying stockholders the potential to sell their shares at a premium and entrenching current management.

Common Stock

Each outstanding share of common stock entitles the holder to one vote, either in person or by proxy, on all matters submitted to a vote of stockholders, including the election of directors. There is no cumulative voting in the election of directors. All actions required or permitted to be taken by stockholders at an annual or special meeting of the stockholders must be effected at a duly called meeting, with a quorum present of a majority in voting power of the shares entitled to vote thereon. Special meetings of the stockholders may only be called by our board of directors acting pursuant to a resolution approved by the affirmative majority of the entire board of directors, certain officers or any stockholder holding at least 20% of the stock issued and outstanding and entitled to vote thereat. Stockholders may not take action by written consent. A vote by the holders of a majority of our outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment to our Articles of Incorporation.

Subject to preferences which may be applicable to any outstanding shares of preferred stock from time to time, holders of our common stock have equal ratable rights to such dividends as may be declared from time to time by our board of directors out of funds legally available therefor. In the event of any liquidation, dissolution or winding-up of our affairs, holders of common stock will be entitled to share ratably in our remaining assets after provision for payment of amounts owed to creditors and preferences applicable to any outstanding shares of preferred stock. All outstanding shares of common stock are fully paid and nonassessable. Holders of common stock do not have preemptive rights.

Preferred Stock

Our board of directors is authorized to issue up to 5,000,000 shares of preferred stock, par value $0.001 per share, in one or more series, 3,693,070 of which shares are undesignated, with such designations, rights and preferences as may be determined from time to time by our board of directors. Accordingly, our board of directors is empowered, without stockholder approval, to issue preferred stock with dividend, liquidation, conversion, voting, or other rights that could adversely affect the voting power or other rights of the holders of our common stock. The issuance of preferred stock could have the effect of decreasing the market price of the common stock, impeding or delaying a possible takeover and adversely affecting the voting and other rights of the holders of our common stock.

Series A Preferred Stock

Our board of directors previously established a series of preferred stock designated as Series A Preferred Stock (“Series A Preferred Stock”), comprising 278,530 shares of preferred stock, of which all shares remain outstanding as of June 30, 2023. Subject to superior rights of any other outstanding preferred stock from time to time

17

each outstanding share of Series A Preferred Stock is entitled to receive, in preference to our common stock, cumulative dividends, payable quarterly in arrears, at an annual rate of 3% of $1.00 per share (the “Series A Stated Value”). We have never paid dividends on shares of our common stock and we do not intend to do so for the foreseeable future. Series A Preferred Stock does not have any voting rights. In the event of liquidation, each share of Series A Preferred Stock is entitled to receive, in preference to our common stock and pari passu with the Series B Preferred Stock and Series C Preferred Stock, a liquidation payment equal to the Series A Stated Value (as adjusted for stock splits, stock dividends, combinations or other recapitalizations of the Series A Preferred Stock), plus any accrued and unpaid dividends. If there are insufficient funds to permit full payment, the assets legally available for distribution will be distributed pro rata among the holders of the Series A Preferred Stock, Series B Preferred Stock and Series C Preferred Stock. The Series A Preferred Stock cannot be transferred without our prior written consent.

Series B Preferred Stock

Our board of directors previously established a series of preferred stock designated as Series B Preferred Stock (“Series B Preferred Stock”), comprising 1,000,000 shares of preferred stock, of which none are issued and outstanding as of June 30, 2023. Subject to superior rights of any other outstanding preferred our from time to time, each share of Series B Preferred Stock is entitled to receive, in preference to our common stock and pari passu with the Series A Preferred Stock and Series C Preferred Stock, annual cumulative dividends equal to 9% of $8.00 per share (the “Series B Stated Value”), accruing quarterly on the date of issue and payable quarterly in arrears on December 31, March 31, June 30 and September 30 of each year.

At the time shares of Series B Preferred Stock are converted into our common stock, any accrued and unpaid dividends will be paid in shares of our common stock. In the event we elect to declare any dividends on our common stock, the Series B Preferred Stock is entitled to participate in such dividends on an as-converted basis. We have never paid dividends on shares of our common stock and we do not intend to do so for the foreseeable future. Series B Preferred Stock is entitled to vote with our common stock, on an as-converted basis, as a single class. In the event of liquidation, each share of Series B Preferred Stock is entitled to receive, in preference to our common stock and pari passu with the Series A Preferred Stock and Series C Preferred Stock, a liquidation payment equal to the Series B Stated Value plus any accrued and unpaid dividends. If there are insufficient funds to permit full payment, the assets legally available for distribution will be distributed pro rata among the holders of the A Preferred Stock, Series B Preferred Stock and Series C Preferred Stock.

Series C Preferred Stock

Our board of directors previously established a series of preferred stock designated as Series C Preferred Stock (“Series C Preferred Stock”), comprising 28,400 shares of preferred stock, of which 14,208 are issued and outstanding as of June 30, 2023. The Series C Preferred Stock is comprised of three classes: 22,000 shares have been designated as Series C-1 Preferred Stock, 2,700 shares have been designated as Series C-2 Preferred Stock and 3,700 shares have been designated as Series C-3 Preferred Stock. Each class of Series C Preferred Stock has identical terms, except for the Conversion Price of the particular class of Series C Preferred Stock.

Dividends. The Series C Preferred Stock will be entitled to receive dividends, payable in shares our common stock at a rate of 10%, 15%, 20% and 25% of the number of shares our common stock issuable upon conversion of the Series C Preferred Stock, on the 12th, 24th, 36th and 48th month, anniversary of the initial closing of the private placement offering of the Series C Preferred Stock (the “Private Placement”), which occurred on August 19, 2020. Dividends will be payable in shares our common stock and will only be payable to those holders that continue to hold the Series C Preferred Stock on the respective anniversary dates of August 19, 2020. In addition, each holder of Series C Preferred Stock will be entitled to receive dividends equal, on an as-converted to shares of our common stock basis, to and in the same form as dividends actually paid on shares our common stock when, as, and if such dividends are paid on shares our common stock. We have never paid dividends on shares our common stock and we do not intend to do so for the foreseeable future.

Rank. The Series C Preferred Stock will rank pari passu with the shares of Series A Preferred Stock and Series B Preferred Stock.

Liquidation. Upon any dissolution, liquidation or winding up, whether voluntary or involuntary, holders of Series C Preferred Stock, together with the Series A Preferred Stock and Series B Preferred Stock, will be entitled

18

to receive distributions out of our assets in an amount per share equal to $1,000 with respect to the Series C Preferred Stock (and $1.00 and $8.00 per share, respectively, for the Series A Preferred Stock and Series B Preferred Stock) plus all accrued and unpaid dividends, whether capital or surplus before any distributions shall be made on any shares our common stock.

Conversion. Upon the earlier of (i) the four year anniversary of the initial closing of the Private Placement, which occurred on August 19, 2020, or (ii) the consent to conversion by holders of at least 50.1% of all of the then-outstanding shares of Series C Preferred Stock, without any action on the part of the holder, each share of Series C Preferred Stock will automatically convert into shares our common stock at the Conversion Price, as set forth below. In addition, each share of Series C Preferred Stock will be convertible, at any time and from time to time at the option of the holder, into that number of shares our common stock at the Conversion Price, subject to adjustment. The Conversion Price of the Series C Preferred Stock will equal the lesser of (i) the closing price of our common stock on Nasdaq on the date immediately preceding the signing of the applicable binding agreements for the applicable closing date of the Private Placement for which the Series C Preferred Stock is issued or (ii) the average closing price of our common stock on Nasdaq for the five trading days immediately preceding the signing of the applicable binding agreements for the applicable closing date of the Private Placement for which the Series C Preferred Stock is issued, subject to adjustment. The Conversion Prices for the Series C-1 Preferred Stock, Series C-2 Preferred Stock and Series C-3 Preferred Stock are $58.00, $60.70 and $57.50, respectively.

Conversion Price Adjustment:

Stock Dividends and Stock Splits. If we pay a stock dividend or otherwise make a distribution payable in shares our common stock on shares our common stock or any other common stock equivalents, subdivide or combine outstanding our common stock, or reclassify our common stock, the Conversion Price will be adjusted by multiplying the then conversion price by a fraction, the numerator of which shall be the number of shares our common stock outstanding immediately before such event, and the denominator of which shall be the number of shares outstanding immediately after such event.

Fundamental Transaction. If we effect a fundamental transaction, then upon any subsequent conversion of Series C Preferred Stock, the holder thereof shall have the right to receive, for each share our common stock that would have been issuable upon such conversion immediately prior to the occurrence of such fundamental transaction, the number of shares of the successor’s or acquiring corporation’s common stock or our common stock, if we are the surviving corporation, and any additional consideration receivable as a result of such fundamental transaction by a holder of the number of shares our common stock into which Series C Preferred Stock is convertible immediately prior to such fundamental transaction. A fundamental transaction means: (i) a merger or consolidation with or into another entity, (ii) any sale of all or substantially all of our assets in one transaction or a series of related transactions, or (iii) any reclassification our common stock or any compulsory share exchange by which our common stock is effectively converted into or exchanged for other securities, cash or property.

Voting Rights. Except as otherwise provided in the Certificate of Designation of Preferences, Rights and Limitations for the applicable class of Series C Preferred Stock (the “Certificate of Designation”) or required by law, Series C Preferred Stock shall have no separate class voting rights. The Certificate of Designation provides that each share of Series C Preferred Stock will entitle its holder to vote with our common stock on an as-converted basis. Notwithstanding certain protections in the Certificate of Designation, Nevada law also provides holders of preferred stock with certain rights. The holders of the outstanding shares of Series C Preferred Stock generally will be entitled to vote as a class upon a proposed amendment to our Articles of Incorporation if the amendment would:

• increase or decrease the aggregate number of authorized shares of Series C Preferred Stock;

• increase or decrease the par value of the shares of Series C Preferred Stock;

• authorize or issue an additional class or series of capital stock that ranks senior to the Series C Preferred Stock with respect to dividends, redemption or distribution of assets upon liquidation, dissolution or winding up of the Company or entering into any agreement with respect to the foregoing; or