SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ |

|

Preliminary Proxy Statement |

| ¨ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x |

|

Definitive Proxy Statement |

| ¨ |

|

Definitive Additional Materials |

| ¨ |

|

Soliciting Material Pursuant to 240.14a-11(c) or 240.14a-12 |

PRO-DEX, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other

than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| |

1. |

Title of each class of securities to which transaction applies: |

| |

2. |

Aggregate number of securities to which transaction applies: |

| |

3. |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

4. |

Proposed maximum aggregate value of transaction: |

| ¨ |

|

Fees paid previously with preliminary materials. |

| ¨ |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

1. |

Amount Previously Paid: |

| |

2. |

Form, Schedule or Registration Statement No.: |

To

Our Shareholders,

Fiscal

year 2023 was another successful year for Pro-Dex as we continue to challenge ourselves and grow the business. The team was able to achieve

10% in top line sales growth, including a record $13M quarter, while completing the launch of our second facility. This added capacity,

along with a record backlog, are great foundations to build on. In FY2024 we will increase our investment and focus on the sales process

and new products to continue the company trajectory.

I

remain grateful to the team here at Pro-Dex. The company’s success is a result of their efforts. We also appreciate and enjoy our

shareholders. Thank you for your interest and support.

As

always, we are excited about the future at Pro-Dex. I look forward to hearing from you with any questions or feedback that you have.

You can reach me or the Board at (949) 769-3200 or investor.relations@pro-dex.com.

Sincerely,

/s/

Rick Van Kirk

Rick Van Kirk

President

and Chief Executive Officer

2361

McGaw Avenue

Irvine, California 92614

NOTICE OF ANNUAL

MEETING OF SHAREHOLDERS

TO BE HELD DECEMBER

14 ,2023

To the Shareholders

of Pro-Dex, Inc.:

The

Annual Meeting of Shareholders (“Annual Meeting”) of Pro-Dex, Inc. (“Pro-Dex”, the “Company”, “we”,

“us” or “our”) will be held at our assembly facility, 14401 Franklin Avenue, Tustin, California on December 14,

2023, at 9:30 a.m. Pacific Standard Time, for the following purposes:

| 1. | To

elect seven directors to serve until our 2024 annual meeting of shareholders or until their

successors are duly elected and qualified. The nominees for election to our Board of Directors

are named in the attached Proxy Statement, which is part of this Notice. |

| 2. | To

ratify the appointment of Moss Adams, LLP as our independent registered public accounting

firm for the fiscal year ending June 30, 2024. |

| 3. | To

amend the 2014 Employee Stock Purchase Plan in order to extend its term for an additional

ten years. |

| 4. | To

hold an advisory vote to approve the compensation of our Named Executive Officers. |

| 5. | To

transact such other business as may properly come before the Annual Meeting or any adjournments

or postponements thereof. |

Only

shareholders of record at the close of business on October 18, 2023, are entitled to notice of and to vote at the Annual Meeting and

at any adjournments or postponements of the Annual Meeting.

All

shareholders are cordially invited to attend the Annual Meeting in person. Whether or not you plan to attend the Annual Meeting, your

vote is important. In an effort to facilitate the voting process, we are pleased to avail ourselves of Securities and Exchange Commission,

or SEC, rules that allow proxy materials to be furnished to shareholders on the Internet. You can vote by proxy over the Internet by

following the instructions provided in the Notice of Internet Availability of Proxy Materials that was mailed to you on or about October 31,

2023, or, if you request printed copies of the proxy materials by mail, you can also vote by mail or by telephone. Your promptness in

voting by proxy will assist in its expeditious and orderly processing and will assure that you are represented at the Annual Meeting.

If you vote by proxy, you may nevertheless attend the Annual Meeting and vote your shares in person.

TO

ENSURE YOUR REPRESENTATION AT THE ANNUAL MEETING, YOU ARE URGED TO READ THIS PROXY STATEMENT AND SUBMIT YOUR PROXY OR VOTING INSTRUCTIONS

AS SOON AS POSSIBLE BY FOLLOWING THE INSTRUCTIONS IN THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS, WHICH WAS MAILED TO YOU

ON OR ABOUT OCTOBER 31, 2023, OR, IF YOU REQUEST PRINTED COPIES OF THE PROXY MATERIALS BY MAIL, YOU CAN ALSO VOTE BY MAIL OR BY TELEPHONE.

OUR

BOARD OF DIRECTORS RECOMMENDS: A VOTE “FOR” EACH OF THE SEVEN DIRECTOR NOMINEES NAMED IN THE PROXY STATEMENT; A VOTE “FOR”

EACH OF PROPOSALS 2 THROUGH 4.

By Order

of the Board of Directors,

PRO-DEX,

INC.

/s/ Alisha

K. Charlton

Corporate

Secretary

2361 McGaw Avenue

Irvine, California 92614

ANNUAL MEETING

OF SHAREHOLDERS

TO BE HELD DECEMBER

14, 2023

PROXY STATEMENT

SOLICITATION

OF PROXIES

The

Board of Directors (“Board”) of Pro-Dex, Inc. (“Pro-Dex”, the “Company”, “we”, “us”

or “our”) has made these materials available to you on the Internet, or, upon your request, has delivered printed versions

of these materials to you by mail, in connection with the Board’s solicitation of proxies for use at our Annual Meeting of Shareholders

(“Annual Meeting”) to be held at Pro-Dex’s assembly facility, 14401 Franklin Avenue, Tustin, California, on Thursday,

December 14, 2023, at 9:30 a.m. Pacific Standard Time, and at any and all adjournments or postponements thereof. Shareholders are requested

to promptly vote by proxy over the Internet by following the instructions provided in the Notice of Internet Availability of Proxy Materials,

which was mailed to you on or about October 31, 2023. If you request printed copies of the proxy materials by mail, you can also

vote by mail or by telephone. All shares represented by each properly submitted and unrevoked proxy received on the Internet or by telephone

prior to 11:59 p.m. Eastern Standard Time on Wednesday, December 13, 2023, or by proxy card prior to or at the Annual Meeting, will be

voted in the manner specified therein, and if no direction is indicated (except in the case of broker non-votes), “for” each

of the seven director nominees named under Proposal No. 1 and “for” each of Proposal Nos. 2 through 4.

Any

shareholder has the power to revoke his or her proxy at any time before it is voted. A proxy may be revoked by delivering a written notice

of revocation to our Secretary prior to or at the Annual Meeting, by voting again on the Internet or by telephone (only your latest Internet

or telephone proxy submitted prior to 11:59 p.m. Eastern Standard Time on Wednesday, December 13, 2023, will be counted), by submitting

prior to or at the Annual Meeting a later dated proxy card executed by the person executing the prior proxy, or by attendance at the

Annual Meeting and voting in person by the person submitting the prior proxy.

Any

shareholder who owns shares in street name and would like to vote in person at the Annual Meeting should inform his or her broker of

such plans and request a legal proxy from the broker. Such shareholders will need to bring the legal proxy with them to the Annual Meeting

and valid picture identification, such as a driver’s license or passport, in addition to documentation indicating share ownership.

Such shareholders who do not receive the legal proxy in time should bring with them to the Annual Meeting their most recent brokerage

account statement showing that they owned our stock as of the record date. Upon submission of proper identification and ownership documentation,

we will be able to admit the shareholder to the Annual Meeting; however, such shareholder will not be able to vote his or her shares

at the Annual Meeting without a legal proxy. Shareholders are advised that if they own shares in street name and request a legal proxy,

any previously executed proxy will be revoked, and such shareholder’s vote will not be counted unless he or she appears at the

Annual Meeting and votes in person.

Our

Board does not presently intend to bring any business before the Annual Meeting other than the proposals referred to in this proxy statement

and specified in the accompanying Notice of Annual Meeting. So far as is known to our Board, no other matters are to be brought before

the Annual Meeting. However, if any other matters are presented properly for action at the Annual Meeting or at any adjournments or postponements

thereof, it is intended that the proxies will be voted with respect thereto by the proxy holders in accordance with the instructions

and at the discretion of our Board or a properly authorized committee thereof.

This

proxy statement, the accompanying shareholder letter, the accompanying proxy card, and our Annual Report on Form 10-K are being made

available to our shareholders on the Internet at www.proxyvote.com through the notice and access process on or about October 31, 2023.

We will bear the cost of soliciting proxies pursuant to this proxy statement. The solicitation will be made through the Internet

and expenses will include reimbursement paid to brokerage firms and others for their expenses in forwarding solicitation material regarding

the Annual Meeting to beneficial owners of our common stock, no par value per share (“Common Stock”). Further solicitation

of proxies may be made by mail upon request, and by telephone or oral communications with some shareholders. Our regular employees, who

will not receive additional compensation for the solicitation, or a compensated proxy solicitation firm, will make such further solicitations.

OUTSTANDING SHARES

AND VOTING RIGHTS

Only

holders of record of the 3,547,330 shares of our Common Stock outstanding at the close of business on October 18, 2023, are entitled

to notice of and to vote at the Annual Meeting or any adjournment or postponement thereof. Under Colorado law, our Articles of Incorporation,

and our Bylaws, the holders of a majority of the total shares entitled to vote at the Annual Meeting, as of the record date, represented

in person or by proxy, will constitute a quorum for the transaction of business at the Annual Meeting. If a quorum is not present, the

Annual Meeting may be postponed or adjourned to allow additional time for obtaining additional proxies or votes. At any subsequent reconvening

of the Annual Meeting, all proxies will be voted in the same manner as the proxies would have been voted at the original convening of

the Annual Meeting, except for any proxies that have been effectively revoked or withdrawn prior to the reconvening of the Annual Meeting.

Shares of our Common Stock represented in person or by proxy (regardless of whether the proxy has authority to vote on all matters),

as well as abstentions and broker non-votes, will be counted for purposes of determining whether a quorum is present at the Annual Meeting.

An

“abstention” is the voluntary act of not voting by a shareholder who is represented in person or by proxy at a meeting and

entitled to vote. “Broker non-votes” are shares of voting stock held in record name by brokers and nominees concerning which:

(i) the broker or nominee does not have discretionary voting power under applicable rules or the instruments under which it serves

in such capacity and instructions have not been received from the beneficial owners or persons entitled to vote; or (ii) the record

holder has indicated on the proxy or has executed a proxy and otherwise notified us that it does not have authority to vote such shares

on that matter.

For

Proposal No. 1 (the election of directors), assuming that a quorum is present, the seven nominees for director receiving the highest

number of affirmative votes will be elected; votes withheld and broker non-votes have no practical effect.

For

Proposal No. 2 (to ratify the appointment of Moss Adams, LLP as our independent registered public accounting firm for the fiscal year

ending June 30, 2024), Proposal No. 3 (amend the 2014 Employee Stock Purchase Plan), and Proposal 4 (advisory vote to approve the

compensation of our Named Executive Officers), assuming that a quorum is present, the matter will be approved if the votes cast in favor

of the matter exceed the votes cast opposing the matter. In such matters, abstentions and broker non-votes will not be included in the

vote totals and, therefore, will have no effect on the vote.

Each

shareholder will be entitled to one vote, in person or by proxy, for each share of Common Stock held of record on the record date. Votes

cast at the Annual Meeting will be tabulated by the person or persons appointed by us to act as inspectors of election for the Annual

Meeting.

Recommendations

of our Board

Our

Board recommends that our shareholders vote “for” each of the seven director nominees named under Proposal No. 1; and “for”

each of Proposal Nos. 2 through 4.

THE

PROPOSALS TO BE VOTED UPON AT THE ANNUAL MEETING ARE DISCUSSED IN DETAIL IN THIS PROXY STATEMENT. YOU ARE STRONGLY URGED TO READ AND

CONSIDER CAREFULLY THIS PROXY STATEMENT IN ITS ENTIRETY.

ECURITY OWNERSHIP

OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth information concerning the beneficial ownership of our Common Stock as of October 18, 2023 by:

| • | each

member of the Board; |

| • | each of our Named Executive

Officers listed in the “Summary Compensation Table” included in the “Executive

Compensation” section of this proxy statement; |

| • | all

of our directors and Named Executive Officers as a group; and |

| • | each person or entity known

to us that beneficially owns more than five percent of our Common Stock. |

Beneficial

ownership is determined in accordance with the rules of the SEC. Unless otherwise indicated below, the address of each beneficial owner

is c/o Pro-Dex, Inc., 2361 McGaw Avenue, Irvine, California, 92614. Unless otherwise indicated below, we believe that each of the persons

listed in the table (subject to applicable community property laws) has the sole power to vote and to dispose of the shares listed opposite

the shareholder’s name.

The

percentages of Common Stock beneficially owned are based on 3,547,330 shares of Common Stock outstanding at October 18, 2023.

| | |

Number of | |

Percent of |

| | |

Shares of Common | |

Common Stock |

| | |

Stock Beneficially | |

Beneficially |

| Name

and Address of Beneficial Owner | |

Owned | |

Owned(1) |

Nicholas

J. Swenson, AO Partners I, L.P.; and AO Partners, LLC; (2), (4) 5000

West 36th Street, Suite 130 | |

| | | |

| | |

| Minneapolis,

MN 55416 | |

| 1,026,343 | | |

| 28.9 | % |

| Raymond E. Cabillot; Farnam

Street Partners, L.P.; | |

| | | |

| | |

Farnam

Street Capital, Inc.; and Peter O. Haeg(3), (4) 3033

Excelsior Blvd., Suite 560 | |

| | | |

| | |

| Minneapolis, MN 55416 | |

| 364,846 | | |

| 10.3 | % |

| Richard

L. Van Kirk(4) | |

| 107,216 | | |

| 3.0 | % |

| Katrina

M.K. Philp(4), (5) | |

| 18,696 | | |

| * | |

| Angelita

R. Domingo(4) | |

| 14,973 | | |

| * | |

| Alisha

K. Charlton(4) | |

| 13,727 | | |

| * | |

| William

J. Farrell III(4) | |

| 9,100 | | |

| * | |

| David

C. Hovda(4) | |

| 6,300 | | |

| * | |

All

Directors, Director Nominees and Named Executive Officers as a group (8

persons)(4) | |

| 1,561,201 | | |

| 42.6 | % |

____________

| * | Indicates less than 1 percent

of outstanding shares of Common Stock. |

| (1) | Applicable

percentage ownership is based on 3,547,330 shares of Common Stock outstanding as of October

18, 2023. Any securities not outstanding but subject to options exercisable as of October18,

2023, or exercisable within 60 days after such date, are deemed to be outstanding for the

purpose of computing the percentage of outstanding Common Stock beneficially owned by the

person holding such options, but are not deemed to be outstanding for the purpose of computing

the percentage of Common Stock beneficially owned by any other person. |

| (2) | AO

Partners, LLC is the General Partner of AO Partners I, L.P. Nicholas J. Swenson (“Nick”)

is the Managing Member of AO Partners, LLC, and, in such capacity, has the power to direct

the affairs of AO Partners, LLC, including the voting and disposition of shares of our Common

Stock held by AO Partners I, L.P. As such, AO Partners I, L.P., AO Partners, LLC and Nick

may be deemed to share voting and dispositive power with regard to the 926,730 shares of

our Common Stock held by AO Partners I, L.P. The remaining 95,613 shares are owned by Nick

directly. AO Partners I, L.P.’s holdings of 926,730 shares of our Common Stock, plus

additional securities and collateral owned by AO Partners I, L.P., are pledged to secure

a bank loan to AO Partners I, L.P. |

| (3) | Farnam

Street Partners, L.P., Farnam Street Capital, Inc., Raymond E. Cabillot (“Ray”),

and Peter O. Haeg claim shared voting power and shared dispositive power of 360,846 shares

of our Common Stock held by Farnam Street Partners, L.P. |

| (4) | Includes

shares of Common Stock issuable upon the exercise of options that were exercisable as of

October 18, 2023, or exercisable within 60 days after October 18, 2023, as follows:

Nick, 4,000 shares; Ray, 4,000 shares; Richard L. Van Kirk (“Rick”), 18,000 shares;

Katrina M.K. Philp (“Katrina”), 4,000 shares; Angelita R. Domingo (“Angel”),

4,250 shares; Alisha K. Charlton (“Alisha”), 4,250 shares; William J. Farrell

III (“Bill”), 4,000 shares; David C. Hovda (“Dave”), 4,000 shares;

and all directors, director nominees and Named Executive Officers as a group, 46,500 shares. |

| (5) | Of

these shares, 14,696 are owned by Katrina’s spouse and both individuals claim shared

voting power and shared dispositive power with regard to such shares. Of these shares, 7,496

are pledged as collateral for a loan. |

Proposal No. 1

ELECTION OF

DIRECTORS

Current Board Structure and Director

Terms

Our

Board is currently composed of seven members. All directors or their successor nominees stand for election each year at our annual meeting

of shareholders.

Certain

information with respect to each of the nominees who will be presented at the Annual Meeting by our Board for election as a director

is set forth below. Although it is anticipated that each nominee will be available to serve as a director, should a nominee become unavailable

to serve, proxies will be voted for such other person as may be designated by our Board.

Unless

the authority to vote for directors has been withheld in the proxy, the person named in the accompanying proxy intends to vote at the

Annual Meeting for the election of each of the nominees presented below. In the election of directors, assuming a quorum is present,

the seven nominees for director receiving the highest number of votes cast at the Annual Meeting will be elected as our directors.

DIRECTORS

Set

forth below is certain information with respect to our directors.

| Name | |

Age | |

Position With Company | |

Audit | |

Compensation | |

Nominating and Governance | |

Investment |

| Raymond E. Cabillot | |

| 60 | | |

Director | |

| X | | |

| X | | |

C | |

| X | |

| Angelita R. Domingo | |

| 51 | | |

Director | |

| | | |

| | | |

| |

| | |

| William J. Farrell III | |

| 50 | | |

Director | |

| | | |

| X | | |

X | |

| | |

| David C. Hovda | |

| 61 | | |

Director | |

| C | | |

| | | |

| |

| | |

| Katrina M.K. Philp | |

| 38 | | |

Director | |

| X | | |

| X | | |

| |

| | |

| Nicholas J. Swenson | |

| 55 | | |

Director, Chairman of the Board | |

| | | |

| C | | |

X | |

| C | |

| Richard L. Van Kirk | |

| 63 | | |

Director, Chief Executive Officer, and President | |

| | | |

| | | |

| |

| X | |

____________________________

| (X) |

Member of the Committee |

| (C) |

Chairman of the Committee |

Ray,

Bill, Dave, Nick and Katrina currently each qualify as an “independent director” as such term is defined in Rule 5605(a)(2)

of the Nasdaq Listing Rules and we expect that each will continue to qualify as an “independent director” if elected.

Our

Board is of the opinion that the election to our Board of the director nominees identified herein, each of whom has consented to serve

if elected, would be in our shareholders’ best interests.

OUR BOARD

RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF THE

NOMINEES NAMED BELOW.

Ray

(60), current director and nominee, has, from January 1998 until the present, served as Chief Executive Officer and a director of Farnam

Street Capital, Inc., the general partner of Farnam Street Partners L.P., a private investment partnership located in Minneapolis, MN. Ray

was a Senior Research Analyst at Piper Jaffray, Inc. from 1990 to 1998. Prior to that, Ray worked for Prudential Capital Corporation

from 1987 to 1990 as an Associate Investment Manager and as an Investment Manager. Ray has served on the board of directors

of Oxbridge Re Holdings Limited, a specialty and casualty reinsurer, from 2013 to 2023 and Air T, Inc. (Nasdaq: AIRT), a provider of

air cargo services and ground equipment sales and support services since November 2016. Ray was a director of O.I. Corporation, a former

Nasdaq listed company, from 2006 to 2010. He served as chairman of the board of O.I. Corporation from 2007 through 2010 and during 2010

served as co-chairman of the board of O.I. Corporation. Ray has a B.A. degree with a double major in Economics and Chemistry from Saint

Olaf College and an M.B.A. from the University of Minnesota. Ray has been a director of ours since January 2013.

Ray brings the following

experience, qualifications, attributes, and skills to our Board:

| · | More than 25 years of experience as a financial analyst and investment

manager; |

| · | Years of public company board experience, including three years

as chairman and one year as co-chairman; and |

| · | Independent of our management. |

Angel

(51), current director and nominee, has served as our Director of Quality Systems and Regulatory Affairs since 2014. Angel joined the

Company in February 2005. Angel’s responsibilities include ensuring that the Company’s Quality Management System and products

consistently meet industry and regulatory standards and customer requirements. This encompasses compliance requirements of local, state,

federal and OUS authorities. Angel holds a B.S. in Biology/Human Physiology and Chemistry minor from California State University, Long

Beach. Angel has been a director of ours since December 2021.

Angel

brings the following experience, qualifications, attributes, and skills to our Board:

| · | Multidisciplinary

business experience within scientific industries; |

|

· | Senior-level

management experience in Regulatory Affairs and Quality Management Systems; |

| · | Operational

and customer project management including customer strategic alliance; and |

| · | Over

15 years of management in the areas of product design, production and quality controls, risk

assessment and risk mitigation, quality management and regulatory compliance. |

Bill

(50), current director and nominee, has from October 2017 until the present, served as SVP of Business Services at Gundersen Health System,

an integrated healthcare organization serving counties in Wisconsin, Iowa, and Minnesota. Bill is co-founder of FreshRealm, LLC, a developer

of new technologies to streamline fresh food distribution, and served as its Chief Operating Officer from January 2013 through September

2017. In addition, from January 2011 until the present, he has served as Chief Executive Officer of Viszy Inc., a company developing

software and services for the consumer market. Bill is also Chief Executive Officer of B ō biam, LLC, a company that turns youth

art into apparel and other products, which it merchandises through its retail store and wholesale channels. From April 1998 to January

2011, Bill held various senior management roles at Medtronic, Inc. (NYSE: MDT), a multi-national medical technology company. Bill’s

engineering career began with eight years in production support, process development and operations. Bill then worked 10 years in product

development for Medtronic, during which time Bill led management teams in program, product and process development. At the end of his

tenure with Medtronic, Bill was Senior Director of Product Development and led corporate-wide initiatives to improve design, reliability

and manufacturability practices. Bill has a B.S. degree in Mechanical Engineering from the University of Minnesota (1996). Bill has been

a director of ours since January 2013.

Bill

brings the following experience, qualifications, attributes, and skills to our Board:

| · | Current

senior-level management, operating and board experience; |

| · | More

than 12 years of experience in engineering and management roles in the medical device industry,

our primary target market; and |

| · | Independent

of our management. |

Dave

(61), current director and nominee, is Founder of MedTech Advisors LLC, a medical device consulting company, and a member of the Board

of Directors of Curvafix, Inc., a privately held medical device company that has developed a pelvic fracture fixation device, since April

2021. Previously, Dave was CEO of Innovein, Inc., a vascular company focused on treating deep venous reflux disease, a position he held

from January 2022 to August 2023. The company developed the ElevateTM Endovenous Valve replacement for treating deep vein

reflux. Prior to Innovein, Inc., Dave served as Chief Executive Officer and a member of the Board of Directors of Simplify Medical, Inc.,

a privately held medical device company that has developed a cervical artificial disc replacement optimized for MRI imaging from 2013

to 2021. Simplify Medical was acquired by Nuvasive in February 2021, the largest spine-focused company in the world. Prior to Dave’s

tenure with Simplify Medical, Dave was President, Chief Executive Officer and a member of the Board of Directors of SpinalMotion, Inc.,

a privately held medical device company that designed, developed and marketed artificial discs for use in the spine, from 2004 to 2013.

Prior to joining SpinalMotion, he held leadership positions with Arthrocare, Inc. (Nasdaq: ARTC), a developer and manufacturer of surgical

devices, instruments, and implants focused on enhancing surgical techniques and patient outcomes, serving as the Vice President/General

Manager of its Spine Division from 1999 to 2004, and as the Managing Director of its ENT Division from 1997 to 1999. From 1992 to 1997,

Dave served in financial analysis and product management positions with Medtronic, Inc. (NYSE: MDT), a multi-national medical technology

company, which culminated in his service as the European Business Manager of its Upper Airway Venture from 1995 to 1997. He holds more

than 40 patents related to radio frequency ablation technology, specific clinical applications, and artificial disc replacement designs

and implantation methods. Dave served for five years with the United States Navy, achieving the rank of Lieutenant. Dave received a Bachelor

of Science degree in Civil Engineering from Northwestern University and an M.B.A. from the Harvard Graduate School of Business Administration.

Dave has been a director of ours since January 2013.

Dave

brings the following experience, qualifications, attributes, and skills to our Board:

| · | Current

senior-level management, operating and board experience based on more than 20 years of participation

in the medical device industry, our primary target market, twelve years of which are specifically

with medical devices to treat disorders of the spine, a sector within the medical device

industry that we believe represents potential for future revenue growth; |

| · | Core

management and leadership skills gained through experience overseeing and managing operations

at the manager and chief executive officer levels, including experience in medical device

intellectual property, product development, clinical testing and marketing; |

| · | Experience

in financial analysis, including operational restructuring, acquisition opportunities, raising

capital, budgeting and forecasting, and market entry feasibility; and |

| · | Independent

of our management. |

Katrina

(38), current director and nominee, has, from January 2014 until the present, served in various capacities at Air T, Inc. (Nasdaq: AIRT),

and most recently as its Chief of Staff from October 2017 to present. Katrina is co-founder of Fox Lake Capital, LLC, where Katrina worked

full time from November 2012 until January 2014, a consulting firm offering financial analysis and investment expertise. Katrina was

a Senior Investment Analyst at Whitebox Advisors, LLC, a multi-strategy hedge fund, from 2007 to 2012. Katrina has a B.A. degree in Business

Administration, Finance and Management from Northwestern College. Katrina has been a director of ours since December 2019.

Katrina

brings the following experience, qualifications, attributes, and skills to our Board:

| · | Current

senior-level management and operating experience; |

| · | Experience

as a financial analyst, and |

| · | Independent

of our management. |

Nick

(55), current Chairman of the Board, director and nominee, is an executive, investor and research analyst. Since January 2012, Nick has

served as the managing partner of AO Partners, LLC, the general partner of AO Partners I, L.P.,

a private investment partnership located in Minneapolis, MN. Nick has served as President and Chief Executive Officer of Air T,

Inc. (Nasdaq: AIRT), since October 2013, as chairman of AIRT’s board since August 2013, and as a member of AIRT’s board of

directors since August 2012. Nick serves as a director of several private companies as well. Nick has a B.A. degree in History from Middlebury

College and an M.B.A. from the University of Chicago. Nick has been a director of ours since January 2013.

Nick

brings the following experience, qualifications, attributes and skills to our Board:

| · | 27

years of experience as a financial analyst and investment manager; |

| · | Public

company C-suite roles, including operating and board experience; and |

| · | Independent

of our management. |

Rick

(63), current director and nominee, has served as our Chief Executive Officer and President since January 2015, in addition to his position

as Chief Operating Officer, which Rick has held since April 2013. Rick joined the Company as Director of Manufacturing in 2006 and was

our Vice President of Operations from 2007 to 2013. Rick has served on the board of directors of Monogram Orthopaedics, Inc. (Nasdaq:

MGRM), a company working to develop a product solution architecture with the long-term goal to enable patient-optimized orthopaedic implants

economically at scale by linking 3D printing and robotics with advanced pre-operative imaging, since April 2017. Prior to joining the

Company, Rick served as Manufacturing Manager and Manager of Product Development for the ChargeSource division of Comarco, Inc., a provider

of power and charging functionality for popular electronic devices and wireless accessories, and as General Manager at Dynacast, a leader

in precision die casting. Rick holds a B.A. in Business Administration from California State University, Fullerton and an M.B.A. from

Claremont Graduate School. Rick has been a director of ours since January 2015.

Rick

brings the following experience, qualifications, attributes, and skills to our Board:

| · | Current

senior-level management experience as our Chief Executive Officer; and |

| · | Over

15 years of senior-level management in the areas of manufacturing, operations, supply chain,

distribution and logistics including over 10 years of experience in our operations management. |

BUSINESS EXPERIENCE

OF KEY MANAGEMENT

Set

forth below is information concerning our other non-director key management personnel.

Alisha

(54), was appointed as our Chief Financial Officer in January 2015. Alisha joined the Company in January 2014 as Senior Director of Finance.

Prior to joining the Company, Alisha held various accounting positions at Comarco, Inc., a provider of wireless test solutions for the

cellular industry, emergency call boxes and power adapters for rechargeable consumer electronic devices, from October 2000 to January

2014, culminating in Alisha’s appointment as Chief Accounting Officer in April 2011. Prior to her 13-year tenure at Comarco, Alisha

held various accounting and finance positions with CKE Restaurants, Inc., an owner, operator, and franchisor of quick-service restaurants,

from February 1995 to October 2000. Alisha began her career in July 1991 with KPMG Peat Marwick (now KPMG LLP) and was formerly a certified

public accountant. Alisha holds a B.A. in Business Economics from the University of California, Santa Barbara with high honors and a

CPA license (inactive) from the California State Board of Accountancy.

BOARD MEETINGS AND

RELATED MATTERS

During

the fiscal year ended June 30, 2023, our Board held four meetings and acted once by unanimous written consent. The independent directors

held two executive sessions during the fiscal year ending June 30, 2023. The independent directors consist of all non-employee, “independent

directors” (as defined in Rule 5605(a)(2) of the Nasdaq Listing Rules). No director, other than Bill, attended less than 75% of

the aggregate of all meetings of our Board and all meetings of committees of our Board upon which Bill serves. Bill attended 50% of the

aggregate of all meetings on which Bill was scheduled to attend.

Audit

Committee

Our

Board has an Audit Committee that consists of three Board members, Dave (Chairman), Ray, and Katrina. Nick was a member of the Audit

Committee during the majority of the fiscal year ended June 30, 2023 and resigned from the Audit Committee on June 28, 2023. Katrina

was appointed to the Audit Committee on November 17, 2022. The Audit Committee is comprised entirely of non-employee, “independent

directors” (as defined in Rule 5605(a)(2) of the Nasdaq Listing Rules) that satisfy the additional requirements of Rule 5605(c)(2)

of the Nasdaq Listing Rules and operates under a written charter adopted by our Board. The duties of the Audit Committee include meeting

with our independent registered public accounting firm to review the scope of the annual audit and to review our quarterly and annual

financial statements before the statements are released to our shareholders. The Audit Committee also evaluates the independent public

accounting firm’s performance and appoints or replaces the independent public accounting firm subject, if applicable, to the consideration

of shareholder ratification for the ensuing fiscal year. A copy of the Audit Committee’s current charter may be found at https://www.pro-dex.com/investors/governance.

The Audit Committee and Board have confirmed that the Audit Committee does and will continue to include at least three independent directors

and has confirmed that Dave, Ray, Nick, and Katrina each meet applicable SEC regulations for designation as an “Audit Committee

Financial Expert” based upon their respective experience noted elsewhere in this proxy statement. The Audit Committee held seven

meetings during the fiscal year ended June 30, 2023 and acted once by unanimous written consent.

Nominating/Corporate

Governance Committee

Our

Board has a Nominating/Corporate Governance Committee (“Nominating Committee”) that consists of three Board members, Ray

(Chairman), Bill and Nick. The Nominating Committee is comprised entirely of non-employee, “independent directors” (as defined

in Rule 5605(a)(2) of the Nasdaq Listing Rules) and operates under a written charter adopted by our Board, a copy of which may be found

at https://www.pro-dex.com/investors/governance. In such capacity, the Nominating Committee identifies and reviews the qualifications

of candidate nominees to our Board. During the fiscal year ended June 30, 2023, the Nominating Committee held no meetings and the

full Board carried out the duties ascribed to the Nominating Committee.

The

Nominating Committee works with our Board to determine the appropriate characteristics, skills and experiences for our Board as a whole

and its individual members with the objective of having a Board with diverse experience. The Nominating Committee believes that it is

desirable that directors possess an understanding of our business environment and have the requisite ethical standards, knowledge, skills,

expertise and diversity of experience such that our Board’s ability to manage and direct our affairs and business is enhanced.

Additional considerations may include an individual’s capacity to enhance the ability of committees of our Board to fulfill their

duties and/or satisfy any independence requirements imposed by law, regulation or listing requirements. The Nominating Committee may

receive candidate nomination suggestions from current Board members, our executive officers, our shareholders or other sources, which

may be either unsolicited or in response to requests from our Board for such candidates. The Nominating Committee may also, from time

to time, engage firms that specialize in identifying director candidates. Once a person has been identified by the Nominating Committee

as a potential candidate, the Nominating Committee may collect and review publicly available information regarding the person to assess

whether the person should be considered further. If the Nominating Committee determines that the candidate warrants further consideration,

a member of the Nominating Committee may contact the person. Generally, if the person expresses a willingness to be considered and to

serve on our Board, the Nominating Committee may request information from the candidate, review the person’s accomplishments and

qualifications and may conduct one or more interviews with the candidate. The Nominating Committee may consider all such information

in light of information regarding any other candidates that it might be evaluating for nomination to our Board. The Nominating Committee

or other Board members may also contact one or more references provided by the candidate or may contact other members of the business

community or other persons that may have greater first-hand knowledge of the candidate’s qualifications and accomplishments. With

the candidate’s consent, the Nominating Committee may also engage an outside firm to conduct background checks on the candidate

as part of the evaluation process. The Nominating Committee’s evaluation process does not vary based on the source of the recommendation.

Shareholder

nominations for director should be sent to our Secretary and should include the candidate’s name and qualifications and a statement

from the candidate that he or she consents to being named in the proxy statement and will serve as a director if elected. In order for

any such candidate to be considered for nomination and, if nominated, to be included in our proxy statement, such recommendation must

satisfy the requirements discussed later in this proxy statement under the heading “Proposals of Shareholders.”

In

compiling the list of our Board nominees appearing in this proxy statement, nominee referrals as well as nominee recommendations were

received from existing directors and members of management—both solicited and unsolicited. No paid consultants were engaged by

us, our Board or any of our Board’s committees for the purposes of identifying qualified, interested Board candidates.

Compensation

Committee

Our

Board has a Compensation Committee that consists of four Board members, Nick (Chairman), Ray, Bill and Katrina. Katrina was appointed

to the Compensation Committee on November 17, 2022. The Compensation Committee is comprised entirely of non-employee, “independent

directors” (as defined in Rule 5605(a)(2) of the Nasdaq Listing Rules) and operates under a written charter adopted by our Board.

A copy of the Compensation Committee’s current charter may be found at https://www.pro-dex.com/investors/governance. The Compensation

Committee establishes compensation policies applicable to our executive officers and directors. During the fiscal year ended June 30,

2023, the Compensation Committee held no meetings and acted twice by unanimous written consent.

From time

to time, various members of management and other employees, as well as outside advisors or consultants, may be invited by the Compensation

Committee to make presentations, provide financial or other background information or advice, or otherwise participate in Compensation

Committee meetings or executive sessions of the Board. Among other things, the charter of the Compensation Committee grants the Compensation

Committee authority to obtain, at our expense, advice and assistance from internal and external legal, accounting or other advisors and

consultants and other external resources that the Compensation Committee considers necessary or appropriate in the performance of its

duties. In particular, the Compensation Committee has the sole authority to retain compensation consultants to assist in its evaluation

of executive and director compensation, including the authority to approve the consultant’s reasonable fees and other retention

terms.

Investment Committee

The Investment

Committee was formed in April 2013 and is currently comprised of one management director, Rick, and two non-management directors, Ray

and Nick, who chairs the committee. The purpose of the Investment Committee is to administer and invest surplus capital from time to

time, in such amounts as approved by our Board, in authorized investments. During the fiscal year ended June 30, 2023, the Investment

Committee acted twice by unanimous written consent.

FAMILY RELATIONSHIPS

There

are no family relationships among our executive officers and directors.

BOARD LEADERSHIP

STRUCTURE

Our

Board has separated the roles of Chairman of the Board and Chief Executive Officer. Nick, an independent director, serves as Chairman

of our Board and presides at all Board and shareholder meetings. Rick, our Chief Executive Officer, serves as our primary spokesperson

and supervises our business, subject to the direction of our Board. The independent Board members annually assess Rick’s performance

as Chief Executive Officer. We believe that an independent Chairman of the Board is better able to provide oversight and guidance to

management, especially in relation to the Board’s essential role in risk management oversight, and to ensure the efficient use

and accountability of resources. Furthermore, this separation provides for focused engagement between these two roles in their respective

areas of responsibility, while still providing for collaborative participation. The separation of the Chairman of the Board and Chief

Executive Officer roles, together with our other comprehensive corporate governance practices, are designed to establish and preserve

management accountability, provide a structure that allows the Board to set objectives and monitor performance, and enhance shareholder

value.

BOARD’S ROLE

IN RISK OVERSIGHT

Our

Board has an active role, as a whole and also at the committee level, in overseeing management of our risks. Our Board regularly reviews

information regarding our credit, liquidity and operations, as well as the risks associated with each. The Compensation Committee is

responsible for overseeing the management of risks relating to our executive compensation plans and arrangements. The Audit Committee

oversees management of financial risks. The Nominating Committee manages risks associated with the independence of our Board and potential

conflicts of interest. While each committee is responsible for evaluating certain risks and overseeing the management of such risks,

the entire Board is regularly informed through committee and management reports about such risks and their mitigation. Our Board believes

the division of risk management responsibilities described above is an effective approach for evaluating and addressing the risks we

face and that the structure allows our Board to exercise effective oversight of the actions of management.

BOARD DIVERSITY

The

Nominating Committee believes that diversity is one of many factors to be considered when selecting candidates for nomination to serve

as one of our directors. While the Nominating Committee carefully considers diversity, among other factors, when evaluating nominees

for director, the Nominating Committee has not established a formal policy regarding diversity in identifying director nominees.

The table below summarizes

the composition of our Board pursuant to a confidential survey:

| Board Diversity Matrix (as of October 18, 2023) |

| Total Number of Directors: | |

| 7 | | |

| | | |

| | | |

| | |

| Gender: | |

| Female | | |

| Male | | |

| Non-Binary | | |

| Gender Undisclosed | |

| Directors | |

| 2 | | |

| 3 | | |

| — | | |

| 2 | |

| Demographic Background | |

| | | |

| | | |

| | | |

| | |

| African American or Black | |

| — | | |

| — | | |

| — | | |

| — | |

| Alaskan Native or American Indian | |

| — | | |

| — | | |

| — | | |

| — | |

| Asian | |

| 1 | | |

| — | | |

| — | | |

| — | |

| Hispanic or Latinx | |

| — | | |

| — | | |

| — | | |

| — | |

| Native Hawaiian or Pacific Islander | |

| — | | |

| — | | |

| — | | |

| — | |

| White | |

| 1 | | |

| 3 | | |

| — | | |

| — | |

| Two or More Races or Ethnicities | |

| — | | |

| — | | |

| — | | |

| 1 | |

| LGBTQ+ | |

| — | | |

| — | | |

| — | | |

| — | |

| Demographic Background Undisclosed | |

| | | |

| | | 1 |

| | | |

| | |

COMPENSATION

OF EXECUTIVE OFFICERS AND MANAGEMENT

Compensation

Committee Procedures

The

Compensation Committee makes its most significant determinations with respect to annual compensation, bonus awards, and new financial

and other corporate performance objectives for executive compensation purposes, at one or more meetings held during the fiscal year for

which the targets and compensation levels are applicable. At various meetings throughout the year, the Compensation Committee also considers

matters related to individual compensation, such as compensation for new executive hires, as well as high-level strategic issues, such

as the efficacy of, and any risks relating to, our compensation strategies, policies and practices, potential modifications to those

strategies, policies and practices, and new trends, plans or approaches to compensation.

Generally,

the Compensation Committee’s process consists of three related elements: (i) the determination of compensation levels, (ii) the

approval of discretionary cash bonus awards based upon company and personal performance, and (iii) the review and determination of equity

incentive awards. For executive officers other than our CEO, the Compensation Committee solicits and considers evaluations and recommendations

submitted to the Compensation Committee by our CEO. In the case of our CEO, the evaluation of his performance is conducted by the Compensation

Committee, which determines any adjustments to his compensation. Our CEO may not participate in, or be present during, any deliberations

or determinations of the Compensation Committee regarding his compensation. For all executive officers and directors, as part of its

deliberations, the Compensation Committee may review and consider, as appropriate, materials such as financial reports and projections,

operational data, tax and accounting information, tally sheets that set forth the total compensation that may become payable to executive

officers in various hypothetical scenarios, our stock performance data, and analyses of historical executive compensation levels and

our current compensation levels. Periodically, the Compensation Committee reviews all of our incentive compensation plans in order to

evaluate the level of risk that such plans may encourage and, along with management’s report concerning such matters and their

mitigation, to ensure that each plan is properly monitored and evaluated.

Compensation

Committee Philosophy

Our

compensation philosophy is predicated upon the following concepts:

| · | We

pay competitively. We are committed to providing a pay program that helps attract and retain

highly qualified people in the industry. To ensure that pay is competitive, we compare our

pay practices with those of other leading companies of similar size and location(s) and set

our pay parameters based on this review. |

| · | We

pay for sustained performance. Executive officers are rewarded based upon corporate performance

and individual performance. Corporate performance is evaluated by the Compensation Committee

by reviewing the extent to which strategic and business plan goals are met, including such

factors as revenues, operating profit, cash flow, and stock price. |

| · | We

strive for fairness in the administration of pay and to achieve a balance of the compensation

paid to a particular individual as compared to the compensation paid to both our executives

and executives at comparable companies. |

| · | We

believe that employees should understand the performance evaluation and pay administration

process. |

The

Compensation Committee believes that it is important that our executives be compensated in a manner that closely links compensation with

performance and yet does not incent excessive risk-taking. To that end, the Compensation Committee has developed a comprehensive and

balanced compensation plan that includes a base salary; discretionary bonuses upon evaluation of Company and personal performance; performance

awards generally payable in shares of Common Stock upon the satisfaction of various service periods and the market price of our Common

Stock achieving certain pre-determined prices; stock options; and, a package of benefits similar in scope and nature to those offered

to all our other employees. Additionally, all employees, including the Named Executive Officers, are eligible to participate in our 2014

Employee Stock Purchase Plan (the “ESPP”), which allows employees to purchase shares of Common Stock from us at 15% discount

from the applicable market price as calculated under the terms of the ESPP.

The

Compensation Committee believes that there are no risks related to our compensation plans that would result in a material adverse impact

on us. This conclusion is based upon management’s risk analysis and the Compensation Committee’s belief that the following

mitigating factors also serve to reduce such risks:

| · | Incentives

are capped at a maximum amount regardless of the degree to which objectives may be exceeded. |

| · | Bonus

payments are based upon audited year end results. |

| · | Multiple

objectives are used as performance targets. |

| · | Computations

are reviewed at regular intervals during the year and are subject to multiple levels of review

at the management, committee, and full Board level. |

Compensation of Executive Officers

The

following table sets forth certain compensation information for the fiscal years ended June 30, 2023 and 2022, for our Chief Executive

Officer and our Chief Financial Officer, who were the only executive officers during the fiscal year ended June 30, 2023 (collectively,

the “Named Executive Officers”).

Summary

Compensation Table (“SCT”)

Name

and | |

| |

Salary | |

Bonus(1) | |

Stock

Awards(2) | |

All

Other Compensation(3) | |

Total |

| Principal

Position | |

Year | |

($) | |

($) | |

($) | |

($) | |

($) |

| Richard L.

Van Kirk | |

| 2023 | | |

$ | 305,000 | | |

$ | 70,114 | | |

$ | — | | |

$ | 43,491 | | |

$ | 418,605 | |

| Director, CEO, President and COO | |

| 2022 | | |

$ | 305,000 | | |

$ | 70,362 | | |

$ | — | | |

$ | 41,020 | | |

$ | 416,382 | |

| Alisha K. Charlton | |

| 2023 | | |

$ | 240,000 | | |

$ | 50,114 | | |

$ | — | | |

$ | 7,499 | | |

$ | 297,613 | |

| Chief Financial Officer | |

| 2022 | | |

$ | 232,500 | | |

$ | 60,362 | | |

$ | 132,670 | | |

$ | 7,357 | | |

$ | 432,889 | |

(1)

The Bonus amount for fiscal 2023 includes bonuses awarded to Rick and Alisha in the amount of $70,000 and $50,000, respectively, which

were accrued for during fiscal 2023 but paid during fiscal 2024.The Bonus amount for fiscal 2022 includes bonuses awarded to Mr. Van

Kirk and Ms. Charlton in the amount of $70,000 and $60,000, respectively, which were accrued for during fiscal 2022 but paid during fiscal

2023.

(2)

The amounts reported above under the heading “Stock Awards” represent the aggregate grant date value of awards under Accounting

Standards Codification Topic 718, Compensation - Stock Compensation. The assumptions used in calculating the fair value of these

stock awards can be found under Note 11 to the Financial Statements in the Company’s Annual Report on Form 10-K for the year

ended June 30, 2022 and have no relation to amounts or periods in which earnings may be reported in the Named Executive Officer’s

W-2.

(3)

The amounts reported above under the heading “All Other Compensation” consist of the following:

| |

|

|

|

All Other Compensation

($) |

| | |

| |

Insurance | |

Car | |

401K Matching | |

Imputed | |

|

| Name and | |

| |

Premiums | |

Allowance | |

Contributions | |

Earnings | |

Total |

| Principal

Position | |

Year | |

($) | |

($) | |

($) | |

($) | |

($) |

| Richard L.

Van Kirk | |

| 2023 | | |

$ | 24,767 | | |

$ | 10,000 | | |

$ | 5,160 | | |

$ | 3,564 | | |

$ | 43,491 | |

| Director, CEO, President, and COO | |

| 2022 | | |

$ | 23,531 | | |

$ | 10,000 | | |

$ | 3,788 | | |

$ | 3,701 | | |

$ | 41,020 | |

| Alisha K. Charlton | |

| 2023 | | |

$ | 2,966 | | |

$ | — | | |

$ | 3,346 | | |

$ | 1,187 | | |

$ | 7,499 | |

| Chief Financial Officer | |

| 2022 | | |

$ | 2,901 | | |

$ | — | | |

$ | 3,274 | | |

$ | 1,182 | | |

$ | 7,357 | |

Employment

Agreements with Named Executive Officers

Employment Arrangement with

Richard L. Van Kirk

On

January 12, 2015, Rick began service as our Chief Executive Officer, President and Director, in addition to continuing to serve as our

Chief Operating Officer, a position Rick has held since April 23, 2013. In connection with that appointment, Rick continues his at-will

employment arrangement with the Company. Rick’s compensation consists of the following:

| • | A

base annual salary of $305,000. |

| • | An

annual car allowance of $10,000. |

| • | Rick

is eligible to participate in any program of stock options or other equity grants that we

provide key employees from time to time, including our 2016 Equity Incentive Plan and ESPP. |

| • | Health,

dental, disability and life insurance, qualified retirement plans, and optional employee

benefits on the same terms as other employees. |

Employment Arrangement with Alisha K.

Charlton

On

January 12, 2015, Alisha began service as our Chief Financial Officer. In connection with that appointment, Alisha continued her at-will

employment arrangement with the Company. Alisha’s compensation consists of the following:

| • | A

base annual salary of $240,000 (previously $225,000 through December 13, 2021). |

| • | Alisha

is eligible to participate in any program of stock options or other equity grants that we

provide key employees from time to time, including our 2016 Equity Incentive Plan and ESPP. |

| • | Health,

dental, disability and life insurance, qualified retirement plans, and optional employee

benefits on the same terms as other employees. |

Outstanding Equity Awards at Fiscal Year

End

The

following table sets forth information about outstanding equity awards held by our Named Executive Officers as of June 30, 2023.

| | |

Option

Awards |

| | |

Number

of Securities Underlying Unexercised

Options | |

Option | |

Option |

Name | |

Exercisable (#) | |

Unexercisable (#)(1) | |

Exercise

Price ($) | |

Expiration Date |

| Richard L.

Van Kirk | |

| 18,000 | | |

| — | | |

$ | 27.50 | | |

07/01/2031 |

| | |

| | | |

| 4,500 | | |

$ | 39.00 | | |

07/01/2032 |

| | |

| | | |

| 18,000 | | |

$ | 42.00 | | |

07/01/2034 |

| | |

| | | |

| 18,000 | | |

$ | 45.00 | | |

07/01/2036 |

| | |

| | | |

| 18,000 | | |

$ | 47.50 | | |

07/01/2038 |

| | |

| | | |

| 18,000 | | |

$ | 50.00 | | |

07/01/2040 |

| Alisha K. Charlton | |

| 4,250 | | |

| — | | |

$ | 27.50 | | |

07/01/2031 |

| | |

| | | |

| 1,063 | | |

$ | 39.00 | | |

07/01/2032 |

| | |

| | | |

| 5,250 | | |

$ | 42.00 | | |

07/01/2034 |

| | |

| | | |

| 5,250 | | |

$ | 45.00 | | |

07/01/2036 |

| | |

| | | |

| 5,250 | | |

$ | 47.50 | | |

07/01/2038 |

| | |

| | | |

| 5,250 | | |

$ | 50.00 | | |

07/01/2040 |

| (1) | | Whether any of the unexercisable options vest, and the amount

that does vest, is tied to various service periods corresponding to future testing dates and the achievement of our Common Stock trading

at or above the exercise price. In the event that the market price of our Common Stock does not reach or exceed the exercise price during

the 60 days immediately preceding the three testing dates of the unexercisable options, a fraction, either 50%, 75% or 100% of the above-mentioned

unexercisable stock options will expire. Accordingly, the number of unexercisable options with a strike price of $39.00 represents 25%

of the original award. |

| | |

| Stock Awards | |

Name | |

| Equity

Incentive Plan Awards: Number of Unearned Shares That Have Not Vested (#)(1) | | |

| Equity

Incentive Plan Awards: Market Value of Unearned Shares That Have Not Vested ($)(2) | |

| Richard L.

Van Kirk | |

| 29,600 | | |

$ | 565,360 | |

| Alisha K. Charlton | |

| 19,600 | | |

$ | 374,360 | |

| (1) | | Represents performance awards which, upon vesting, will generally

be paid in shares of our Common Stock. Whether any performance awards vest, and the amount that does vest, is tied to the completion

of various service periods that range from July 1, 2024 to July 1, 2027 and the achievement of our Common Stock trading at certain pre-determined

prices. |

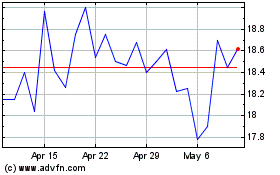

| (2) | | The payout value of unearned shares is based upon the closing

market price of our Common Stock on June 30, 2023, on the Nasdaq Capital Market of $19.10 per share. |

Pay Versus Performance

As

required by the SEC’s new pay versus performance (“PvP”) disclosure rules as set forth in Item 402(v) of Regulation

S-K, we are providing the following information regarding the relationship between executive compensation actually paid and certain financial

performance of the Company for the last two fiscal years. Under the PvP rules, the SEC has developed a new definition of executive “compensation

actually paid” (“CAP”), which requires us to make various adjustments to amounts reported in the Summary Compensation

Table (“SCT”). As required by SEC rules, the table presented below discloses CAP for (i) the Company’s principal executive

officer (“PEO”), Rick Van Kirk, and (ii) the Company’s Named Executive Officers other than Rick Van Kirk (collectively,

“Non-PEO NEOs”), on an average basis. Note that as a smaller reporting company we only have one Non-PEO NEO, Alisha Charlton,

and as a result, the CAP for Non-PEO NEOs just reflects CAP for Alisha Charlton. Due to the valuation component of CAP, the dollar amounts

do not reflect the actual amount of compensation earned or paid during the year.

The

PvP table below provides compensation values reported in our current and prior SCTs, as well as the CAP amounts required in this section

for the fiscal years ending June 30, 2022 and 2023.

Pay Versus

Performance Table (“PvP”)

| | |

| |

| |

| |

| |

| |

|

Year | |

SCT

for PEO(1) | |

CAP

for PEO(2) | |

SCT

for Non-PEO NEO(3) | |

CAP

for Non-PEO NEO(4) | |

Fixed

$100 Investment Based on TSR(5) | |

Net

Income (in

000’s)(6) |

| (a) | |

(b) | |

(c) | |

(d) | |

(e) | |

(f) | |

(g) |

| | 2023 | | |

$ | 418,605 | | |

$ | 632,137 | | |

$ | 297,613 | | |

$ | 424,446 | | |

$ | 60.49 | | |

$ | 7,074 | |

| | 2022 | | |

$ | 416,382 | | |

$ | (445,055 | ) | |

$ | 432,889 | | |

$ | 145,410 | | |

$ | 50.96 | | |

$ | 4,572 | |

| (1) | The

dollar amounts reported in column (b) are the amounts of total compensation reported for

Rick Van Kirk, our Chief Executive Officer, for each corresponding year in the “Total”

column of the SCT. Refer to “Executive Compensation – Summary Compensation Table.” |

| (2) | The

dollar amounts reported in column (c) represent the amount of CAP to Rick Van Kirk, as computed

in accordance with Item 402(v) of Regulation S-K. The dollar amounts do not reflect the actual

amount of compensation earned by or paid to Rick Van Kirk during the applicable year. In

accordance with the requirements of Item 402(v) of Regulation S-K, the following adjustments

were made to Rick Van Kirk’s total compensation as reported in the SCT for each year

to determine the compensation actually paid: |

Year | |

SCT

Total for PEO | |

SCT

Reported Equity Award Value for PEO | |

Equity

Award Adjustments for

PEO(A) | |

CAP

to PEO |

| | 2023 | | |

$ | 418,605 | $ | |

| — | | |

$ | 213,532 | | |

$ | 632,137 | |

| | 2022 | | |

$ | 416,382 | $ | |

| — | | |

$ | (861,437 | ) | |

$ | (445,055 | ) |

| (A) | Represents

the year-over-year change in the fair value of equity awards to Rick Van Kirk as summarized

below: |

Year | |

Less:

grant date fair value of awards granted during FY | |

Change

in fair value of awards granted in any PY unvested at end of FY | |

Add

for awards granted and vested in the same FY the fair value as of vesting date | |

Change

in fair value as of vesting date of any awards from a PY vested in CY | |

Subtract:

Awards granted in any PY fail to meet vesting conditions during the year; value at end of

PY | |

Total

Equity Award Adjustments |

| | 2023 | | |

$ | — | | |

$ | 288,017 | | |

$ | — | | |

$ | 140,840 | | |

$ | (215,325 | ) | |

$ | 213,532 | |

| | 2022 | | |

$ | — | | |

$ | (875,913 | ) | |

$ | — | | |

$ | 14,476 | | |

$ | — | | |

$ | (861,437 | ) |

| (3) | The

dollar amounts reported in column (d) of the PvP table represent the amounts reported for

the Non-PEO NEOs in the “Total” column of the SCT in each applicable year. The

Company only has one Non-PEO NEO, Alisha Charlton. |

| (4) | The

dollar amounts reported in column (e) represent the amount of CAP to Alisha Charlton, as

computed in accordance with Item 402(v) of Regulation S-K. The dollar amounts do not reflect

the actual amount of compensation earned by or paid to Alisha Charlton during the applicable

year. In accordance with the requirements of Item 402(v) of Regulation S-K, the following

adjustments were made to Alisha Charlton’s total compensation as reported in the SCT

for each year to determine the compensation actually paid: |

Year | |

SCT

for Alisha Charlton | |

SCT

Reported Equity Award Value for Alisha

Charlton | |

Equity

Award Adjustments for

Alisha Charlton(A) | |

Compensation

Actually Paid

to Alisha

Charlton |

| | 2023 | | |

$ | 297,613 | $ | |

| — | | |

$ | 126,833 | | |

$ | 424,446 | |

| | 2022 | | |

$ | 432,889 | $ | |

| (132,670 | ) | |

$ | (154,809 | ) | |

$ | 145,410 | |

| (A) | Represents

the year-over-year change in the fair value of equity awards to Alisha Charlton as summarized

below: |

Year | |

Less:

grant date fair value of awards granted during FY | |

Change

in fair value of awards granted in any PY unvested at end of FY | |

Add

for awards granted and vested in the same FY the fair value as of vesting date | |

Change

in fair value as of vesting date of any awards from a PY vested in CY | |

Subtract:

Awards granted in any PY fail to meet vesting conditions during the year; value at end of

PY | |

Total

Equity Award Adjustments |

| | 2023 | | |

$ | — | | |

$ | 92,897 | | |

$ | — | | |

$ | 88,184 | | |

$ | (54,248 | ) | |

$ | 126,833 | |

| | 2022 | | |

$ | 90,046 | | |

$ | (248,273 | ) | |

$ | — | | |

$ | 3,418 | | |

$ | — | | |

$ | (154,809 | ) |

| (5) | Cumulative

total shareholder return (“TSR”) assumes $100 is invested in Pro-Dex, Inc. common

stock as of July 1, 2021. The TSR represents the cumulative value of the $100 investment

as of the end of each fiscal year presented (each, a measurement period). TSR is calculated

by dividing the sum of the cumulative amount of dividends for the measurement period, assuming

dividend reinvestment, and the difference between the Company’s share price at the

end and the beginning of the measurement period by the Company’s share price at the

beginning of the measurement period. |

| (6) | The

dollar amounts reported represent the amount of net income reflected in the Company’s

audited financial statements for the applicable year. |

Analysis

of the Information Presented in the Pay versus Performance Table

Our

executive compensation program reflects a variable pay-for-performance philosophy, utilizing several performance measures to

align executive compensation with our performance. Moreover, we generally seek to incentivize long-term performance, and therefore do

not specifically align our performance measures with compensation that is actually paid (as computed in accordance with Item 402(v) of

Regulation S-K) for a particular year. In accordance with Item 402(v) of Regulation S-K, we are providing the following

descriptions of the relationships between information presented in the Pay versus Performance table.

CAP

and TSR

As

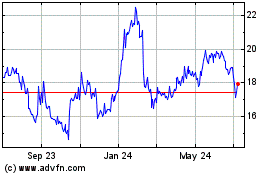

demonstrated by the following graph, the amount of compensation actually paid (‘CAP”) to Rick Van Kirk for 2023 and 2022

and the CAP to our Non-PEO NEO, Alisha Charlton, is generally aligned with our TSR over the two years presented in the table. The alignment

of CAP with our TSR over the period presented is because a significant portion of the CAP to Rick Van Kirk and to Alisha Charlton is

comprised of equity awards.

CAP and Net Income

As demonstrated by

the following graph, the amount of CAP to Rick Van Kirk for 2022 and 2023 and the CAP to our Non-PEO NEO, Alisha Charlton, is generally

aligned with our net income over the two years presented in the table. However, as noted above a significant portion of the CAP to Rick

Van Kirk and Alisha Charlton is comprised of equity awards, and therefore this will not always be the case.

Compensation of Directors

In

May 2016, our Board approved the following compensation plan for our non-employee directors:

| · | A

cash fee of $18,000 per fiscal year, paid quarterly in arrears; and |

| · | An

additional cash fee of $7,000 per fiscal year for the Audit Committee Chair, paid quarterly

in arrears. |

The following table details the fees earned

by our non-employee directors during fiscal 2023.

| Name | |

Fees

Earned or Paid in Cash(1)

($) | | |

Total

($) | |

| David C. Hovda | |

$ | 25,000 | | |

$ | 25,000 | |

| Raymond E. Cabillot | |

$ | 18,000 | | |

$ | 18,000 | |

| William J. Farrell III | |

$ | 18,000 | | |

$ | 18,000 | |

| Katrina M.K. Philp | |

$ | 18,000 | | |

$ | 18,000 | |

| Nicholas J. Swenson | |

$ | 18,000 | | |

$ | 18,000 | |

| (1) | The

cash amount reported in this column represents amounts earned during fiscal 2023. All amounts

were paid in fiscal 2023 except for the 4th quarter accrual, which was paid in

fiscal 2024. |

EQUITY COMPENSATION

PLAN INFORMATION

The following

table provides information as of June 30, 2023 with respect to shares of Common Stock that may be issued under the Company’s equity

compensation plans.

| Plan

Category | |

Number

of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights | | |

Weighted-Average

Exercise Price of Outstanding Options, Warrants and Rights | | |

Number

of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (excluding securities reflected in the first

column) | |

| Equity compensation

plans approved by Stockholders: | |

| | | |

| | | |

| | |

| 2016

Equity Incentive Plan | |

| 363,737 | (1) | |

$ | 42.19 | (2) | |

| 898,238 | |

| 2014 Employee

Stock Purchase Plan | |

| — | | |

| — | | |

| 672,217 | |

| (1) | Represents

both performance awards issued to employees (including the Named Executive Officers) as well

as nonqualified stock options issued to employees (including the Named Executive Officers)

and directors which, upon vesting, will generally be paid in shares of our Common Stock.

Whether any performance awards or options vest, and the amount that does vest, is tied to

the completion of various service periods that range from January 1, 2024 to July 1,

2031 and the achievement of our Common Stock trading at certain pre-determined prices. |

| (2) | Represents

the weighted average exercise price of the 298,937 non-qualified stock options included in

the “Number of Securities to be Issued Upon Exercise of Outstanding Options Warrants

and Rights” column. |

Options and Equity Awards Generally

2016 Equity Incentive Plan

Our

Compensation Committee, as the administrator of the 2016 Equity Incentive Plan listed above, has the discretion to accelerate the vesting

of any outstanding options or Stock Appreciation Rights (“SARs”) held by the employees, consultants and directors in the

event of an acquisition of us by a merger or asset sale in which the outstanding options and SARs under the plan are not to be assumed

by the successor corporation or substituted with options to purchase shares of such corporation.

In

the event of a change of control (as such term is defined in the 2016 Equity Incentive Plan, which definition includes, among other items,

(a) conditions under which a person or group becomes a beneficial owner of 50% or more of the voting power of our outstanding stock,

or (b) a majority change in the composition of our Board occurring within a one-year period, or (c) a change in the ownership of

more than 40% of the Company’s assets, or (d) a complete liquidation or dissolution of the Company), the Board has the discretion

to accelerate the vesting of any outstanding options or SARs. The number of shares subject to Restricted Shares and RSU awards would

be immediately delivered as a result of a change of control. All performance awards shall immediately become vested and payable to participants

within 30 days after a change of control.

AUDIT COMMITTEE

REPORT

The

Audit Committee reports to and acts on behalf of our Board in providing oversight to our financial management, independent registered

public accounting firm, and financial reporting procedures. Our management is responsible for preparing our financial statements and

the independent registered public accounting firm is responsible for auditing those statements. In this context, the Audit Committee

has reviewed and discussed the audited financial statements contained in our 2023 Annual Report on Form 10-K with management and Moss

Adams, LLP, the independent registered public accounting firm engaged to audit such financial statements.

The