US index futures are up on Friday, with Wall Street looking for

a rebound after recent declines. Investors are keeping an eye on

quarterly results from major oil companies such as Exxon Mobil

(NYSE:XOM) and Chevron (NYSE:CVX). In addition, Amazon

(NASDAQ:AMZN) and Intel (NASDAQ:INTC) boosted technology stocks

with their strong results.

At 06:49 AM, Dow Jones futures (DOWI:DJI) were up 43 points, or

0.13%. S&P 500 futures were up 0,51%, and Nasdaq-100 futures

increased by 0.96%. The 10-year Treasury bond yield stood at

4.868%.

In the commodities market, West Texas Intermediate crude oil for

December rose 2.14%, trading at $84.99 per barrel. Brent crude for

December went up 2.13%, nearing $89.80 per barrel. The 62%

concentrated iron ore, traded on the Dalian exchange, rose by

2.12%, priced at $121.51, continuing its strong uptrend that marked

the week.

On the economic agenda for Friday, investors await the September

Personal Consumption Expenditures (PCE) price index at 08:30 AM. At

09:00 AM, the Vice Chairman for Supervision of the Fed, Michael

Barr, will speak at an event. At 10:00 AM, the University of

Michigan will release the final October consumer sentiment index.

At 13:00 PM, Baker Hughes data for operational oil wells is

expected.

European stocks opened with mixed results, with investors

focused on corporate earnings and the state of the global economy,

maintaining a balanced sentiment. The benchmark Stoxx 600 index saw

a slight drop of 0.1%. Though the week has been relatively stable

overall, the index is on track to record its worst monthly

performance since September 2022, according to LSEG data.

Asian markets showed a mix of performances, with gains in the

Hong Kong and Japanese stock exchanges standing out. Chinese stocks

rose following industrial profit data, albeit with slightly weaker

growth. The yen remained stable after an unexpected rise in Tokyo

inflation.

Investors are closely monitoring geopolitical events in the

Middle East. The Israeli military forces claimed to have eliminated

the deputy chief of Hamas’s intelligence services, accused of

planning attacks in October. Additionally, Israel carried out a

limited ground attack north of Gaza. At the same time, Iran has

ramped up its rhetoric against the United States, which is closely

watched by financial markets.

U.S. stock markets closed sharply lower in Thursday’s session,

primarily due to disappointments with recent corporate financial

reports. The Dow Jones dropped 251.63 points or 0.76% to 32,784.30

points. The S&P 500 declined by 49.54 points or 1.18% to

4,137.23 points. The Nasdaq Composite fell 225.62 points or 1.76%

to 12,595.61 points.

However, economic indicators acted as a counterbalance,

minimizing the declines, highlighted by the U.S. GDP figures for Q3

2023. The U.S. GDP grew by 4.9% compared to the previous quarter,

surpassing the 4.5% forecast. Nevertheless, the core GDP deflator

showed a significant decrease, leading to an adjustment in the

Treasury yield curve. Thus, economic performance in the third

quarter revealed higher than expected growth with a decline in

prices, representing an ideal situation for the Federal

Reserve.

On Thursday’s corporate earnings front, investors will be

watching reports from Exxon Mobil (NYSE:XOM), Chevron (NYSE:CVX),

Abbvie (NYSE:ABBV), Charter Communications (NASDAQ:CHTR), Phillips

66 (NYSE:PSX), AutoNation (NYSE:AN), Colgate-Palmolive (NYSE:CL),

among others.

Wall Street Corporate Highlights for Today

Apple (NASDAQ:AAPL) – The U.S. International

Trade Commission (ITC) has issued an order that might ban the

import of Apple’s Apple Watches for infringing on

Masimo’s (NASDAQ:MASI) blood oxygen technology

patents. The decision awaits presidential review and possible

appeals, leaving an uncertain impact on future sales. Masimo shares

have risen by 10.2% in Friday’s pre-market trading.

Alphabet (NASDAQ:GOOGL) – Sundar Pichai, CEO of

Alphabet and Google, will testify on Monday in a major antitrust

case challenging Google’s dominance in search and advertising. He

will answer questions regarding investments to maintain

competitiveness and payment agreements to establish Google as the

default on smartphones.

Western Digital (NASDAQ:WDC) – Western Digital

and Kioxia Holdings have discontinued merger discussions due to

disagreements over terms. Kioxia investor SK Hynix also opposed the

deal. Both companies remain interested in continuing negotiations

but have encountered obstacles, including SK Hynix’s opposition and

issues with Kioxia’s main shareholder, Bain

Capital (NYSE:BCSF). The potential merger has raised

antitrust and regulatory concerns, including scrutiny from Chinese

regulators.

Netflix (NASDAQ:NFLX), Disney

(NYSE:DIS) – Striking Hollywood actors have approved a

comprehensive counterproposal to AMPTP, representing media

companies like Disney and Netflix. Negotiations are set to continue

on Friday.

RTX Corporation (NYSE:RTX) – U.S. RTX and

Israel’s Rafael Advanced Defense Systems plan to construct a

missile manufacturing facility in East Camden, Arkansas, to produce

Tamir missiles, utilized in the Iron Dome system and its SkyHunter

variant. Production is slated to commence in 2025.

Embraer (NYSE:ERJ) – Embraer has announced that

its firm order backlog has reached US$17.8 billion at the end of

the third quarter, bolstered by a recent order from SkyWest for 19

E175 jets. The portfolio has expanded by US$500 million compared to

the previous quarter. Embraer has delivered 43 aircraft in the

third quarter, totaling 105 for the year to date. SkyWest has

placed an order for 19 E175 jets at $1.1 billion, with deliveries

scheduled to start in the final quarter of 2024, operating under a

capacity purchase agreement (CPA) for United

Airlines (NASDAQ:UAL).

Boeing (NYSE:BA) – Boeing’s defense division is

grappling with significant challenges, including supplier errors

and high manufacturing costs, resulting in a $1.7 billion loss in

2023. This includes projects such as Air Force One and NASA’s

Starliner capsule. The company is actively seeking improvements but

remains under fixed-price contracts, forcing it to absorb excessive

costs. Analysts are questioning Boeing’s management, and shares

have declined by 6% this year, in contrast to the S&P 500. The

company is now concentrating on future contracts for

next-generation fighter jets and advanced drones.

General Motors (NYSE:GM) – General Motors’

Cruise has suspended operations nationwide after California

regulators highlighted public safety risks. This move aims to

rebuild public trust following previous incidents, unrelated to new

problems. U.S. authorities are investigating reports of sudden

braking in Cruise self-driving cars.

Tesla (NASDAQ:TSLA) – BP’s

(NYSE:BP) electric vehicle charger unit has ordered $100 million

worth of Tesla’s ultra-fast chargers for deployment in the United

States. This is part of BP Pulse’s plans to invest up to $1 billion

in charging infrastructure in the U.S. by 2030, thereby expanding

Tesla’s revenue streams. The chargers will be installed at BP

locations and third-party sites, including car rental companies

such as Hertz (NASDAQ:HTZ). Additionally, Tesla

has increased the price of the Model Y high-performance SUV in

China by US$1,913.88, according to a company statement on social

media.

BHP (NYSE:BHP) – Approximately 350 BHP rail

workers in Australia have voted in favor of industrial action,

which could include strikes of up to 24 hours, due to disputes over

pay and conditions. These disruptions could impact BHP’s iron ore

operations in Port Hedland, the world’s largest iron ore export

hub.

ConocoPhillips (NYSE:COP) – ConocoPhillips is

considering making an offer for CrownRock LP, a Texas energy

company in the Permian region, estimated to be worth between $10

billion and $15 billion. Other companies, such as

Diamondback Energy (NASDAQ:FANG), Devon

Energy (NYSE:DVN), and Marathon Oil

(NYSE:MRO), are also exploring bids for CrownRock.

Walmart (NYSE:WMT) – Chinese grocery chains are

struggling due to changing consumer preferences and the rise of

e-commerce. Supermarket sales fell 0.4% this year, while online

sales increased 11.6%. Companies face losses and challenges, with

Walmart and Sam’s Club seeking to

adapt to new consumer trends to stay relevant.

Chipotle Mexican Grill (NYSE:CMG),

McDonald’s (NYSE:MCD), Yum Brands

(NYSE:YUM) – Investors are paying attention to a possible shift in

fast-food consumption patterns in the U.S. due to the popularity of

weight-loss medications. Companies like Chipotle, McDonald’s, and

Yum Brands already face challenges due to inflation and could

suffer more due to this factor. While it’s too early to quantify

the impact, traffic at fast-food restaurants saw a significant drop

in the third quarter.

JPMorgan Chase (NYSE:JPM) – JPMorgan has

reached out to Venezuelan bondholders to discuss normalizing the

weighting of these bonds in its EMBI indexes following the lifting

of U.S. sanctions in response to a political settlement. The bank

reduced its weighting to zero in 2019 due to sweeping

sanctions.

Goldman Sachs (NYSE:GS) – Goldman Sachs

launched the Goldman Sachs Global Institute, led by Jared Cohen and

George Lee, to provide geopolitics and technology insights to

clients. Lazard also advises on geopolitical risks, highlighting

the importance of geopolitics for global companies.

Citigroup (NYSE:C) – The Federal Reserve has

closed its 2015 enforcement action against Citigroup resulting from

violations of U.S. antitrust laws related to exchange rate

manipulation.

Live Nation Entertainment (NYSE:LYV) – Live

Nation is forecast to benefit from growing demand for live shows

and entertainment despite regulatory and economic concerns.

Evercore ISI analyst Ashton Welles upgraded shares to Outperform

from In Line with a $100 price target on Thursday due to continued

consumer interest in live experiences. The company plans to release

its third-quarter results soon, with expectations of revenue growth

despite economic challenges. Although they face regulatory risks,

analysts consider these concerns to be less likely to

materialize.

Earnings

Amazon (NASDAQ:AMZN) – Shares of the leading

online commerce company rose more than 5% in pre-market trading on

Friday after it presented sales estimates for the final quarter

that ranged between $160 billion and $167 billion, while analysts

interviewed by LSEG predicted revenues of approximately US$166.6

billion. Amazon beat analysts’ expectations for earnings and

performance in the third quarter.

Intel (NASDAQ:INTC) – Shares posted a rise of

more than 7% in pre-market trading after the semiconductor chip

manufacturing company beat third-quarter earnings expectations.

Intel posted an adjusted profit of 41 cents per share on revenue of

$14.16 billion, while analysts surveyed by LSEG predicted a profit

of 22 cents per share on revenue of $13.53 billion.

Ford Motor (NYSE:F) – The automaker’s shares

suffered a 2.7% drop in pre-market trading after Ford missed

third-quarter profit expectations. Ford announced adjusted earnings

of 39 cents per share on revenue of $41.18 billion, falling short

of the 45 cents per share and $41.22 billion in revenue expected by

analysts surveyed by LSEG.

Mobileye Global (NASDAQ:MBLY) – Mobileye Global

beat quarterly profit estimates, driven by continued demand for its

autonomous driving technology. The company adjusted its annual

operating loss forecast, now expecting a loss of between $62

million and $79 million, instead of the previous $98 million to

$129 million.

Enphase Energy (NASDAQ:ENPH) – The value of

shares of solar energy companies fell more than 20% in pre-market

trading after Enphase Energy presented a pessimistic outlook. The

company projected fourth-quarter revenue in the range of $300

million to $350 million, while analysts surveyed by LSEG were

expecting $584 million.

Honeywell (NASDAQ:HON) – Honeywell

International beat estimates in the third quarter, with earnings of

$2.27 per share on sales of $9.3 billion. The company lowered its

2023 earnings per share forecast to $9.10 to $9.20 while

maintaining estimated sales of about $37 billion.

Ameriprise Financial (NYSE:AMP) – Ameriprise

Financial, despite a challenging environment, reported strong

growth in its wealth management unit in the third quarter, with

adjusted net revenues of $2.41 billion, an increase of 13%

year-on-year, driven by higher investment gains and client asset

growth. GAAP net income fell 18% to $872 million, reflecting a

decline in wealth management cash balances. Analysts highlight the

company’s “robust wealth management results.”

Capital One (NYSE:COF) – The financial services

company reported third-quarter results that exceeded expectations.

Earnings per share reached US$4.45, in contrast to the US$3.24 per

share predicted by analysts surveyed by FactSet. Furthermore, net

interest income reached US$9.37 billion, also exceeding the

consensus of US$7.28 billion.

Nomura Holdings (NYSE:NMR) – Nomura Holdings,

Japan’s largest brokerage, reported a doubled net profit in the

second quarter due to the domestic stock market and share

offerings. Profit was US$235 million, driven by the investment

banking sector.

Dexcom (NASDAQ:DXCM) – The company that makes

medical devices for diabetic patients beat profit forecasts in the

third quarter. Dexcom reported adjusted earnings per share of 50

cents on revenue of $975 million. That beat the expectations of

analysts surveyed by FactSet, who had expected earnings of 34 cents

per share on revenue of $939.6 million.

Sanofi (NASDAQ:SNY) – Shares of French

pharmaceutical company Sanofi fell 16.1% in pre-market trading

Friday after the company increased research and development

spending and anticipated higher taxes. Its “Earnings per Corporate

Share” is expected to fall to single digits next year due to rising

R&D costs and tax changes. The company also plans to spin off

its consumer healthcare business. Third-quarter results were

slightly below analyst estimates.

Kenvue (NYSE:KVUE) – Kenvue is facing declining

sales due to the delayed flu season, resulting in a downward

revision of its annual profit projections. The company’s value in

the third quarter exceeded analysts’ expectations. The company

lowered its upper full-year profit estimate to $1.28 per share,

keeping the lower bound at $1.26 per share, due to weak sales in

China and the strong dollar.

Chipotle Mexican Grill (NYSE:CMG) – The burrito

restaurant chain reported earnings results that exceeded Wall

Street expectations, according to an analyst survey conducted by

LSEG. Adjusted earnings per share were US$11.36, exceeding the

US$10.55 per share forecast, while revenue was in line with

expectations, totaling US$2.47 billion.

Deckers Outdoor (NYSE:DECK) – The company

behind the Ugg boot and Hoka sneaker brands projected full-year

earnings per share in the range of $22.90 to $23.25 on revenue of

$4.025 billion. This exceeded the forecasts of analysts surveyed by

LSEG, who expected a profit of US$22.64 per share and revenue of

US$4.015 billion. Furthermore, the company also surpassed Wall

Street’s expectations in terms of profit and performance in the

fiscal second quarter. Shares are flat in pre-market trading.

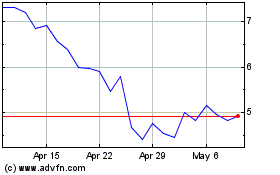

Hertz Global (NASDAQ:HTZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

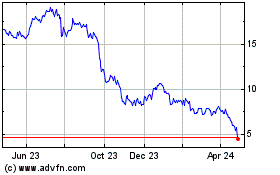

Hertz Global (NASDAQ:HTZ)

Historical Stock Chart

From Apr 2023 to Apr 2024