0001487197

false

--12-31

Q3

0001487197

2023-01-01

2023-09-30

0001487197

2023-10-25

0001487197

2023-09-30

0001487197

2022-12-31

0001487197

2023-07-01

2023-09-30

0001487197

2022-07-01

2022-09-30

0001487197

2022-01-01

2022-09-30

0001487197

2021-12-31

0001487197

2022-09-30

0001487197

us-gaap:CustomerConcentrationRiskMember

BRFH:VendorMember

BRFH:ManufacturerAMember

2023-07-01

2023-09-30

0001487197

us-gaap:CustomerConcentrationRiskMember

BRFH:VendorMember

BRFH:ManufacturerAMember

2022-07-01

2022-09-30

0001487197

us-gaap:CustomerConcentrationRiskMember

BRFH:VendorMember

BRFH:ManufacturerAMember

2023-01-01

2023-09-30

0001487197

us-gaap:CustomerConcentrationRiskMember

BRFH:VendorMember

BRFH:ManufacturerAMember

2022-01-01

2022-09-30

0001487197

us-gaap:CustomerConcentrationRiskMember

BRFH:VendorMember

BRFH:ManufacturerBMember

2023-07-01

2023-09-30

0001487197

us-gaap:CustomerConcentrationRiskMember

BRFH:VendorMember

BRFH:ManufacturerBMember

2022-07-01

2022-09-30

0001487197

us-gaap:CustomerConcentrationRiskMember

BRFH:VendorMember

BRFH:ManufacturerBMember

2023-01-01

2023-09-30

0001487197

us-gaap:CustomerConcentrationRiskMember

BRFH:VendorMember

BRFH:ManufacturerBMember

2022-01-01

2022-09-30

0001487197

us-gaap:CustomerConcentrationRiskMember

BRFH:VendorMember

BRFH:ManufacturerCMember

2023-07-01

2023-09-30

0001487197

us-gaap:CustomerConcentrationRiskMember

BRFH:VendorMember

BRFH:ManufacturerCMember

2022-07-01

2022-09-30

0001487197

us-gaap:CustomerConcentrationRiskMember

BRFH:VendorMember

BRFH:ManufacturerCMember

2023-01-01

2023-09-30

0001487197

us-gaap:CustomerConcentrationRiskMember

BRFH:VendorMember

BRFH:ManufacturerCMember

2022-01-01

2022-09-30

0001487197

us-gaap:CustomerConcentrationRiskMember

BRFH:VendorMember

BRFH:ManufacturerDMember

2023-07-01

2023-09-30

0001487197

us-gaap:CustomerConcentrationRiskMember

BRFH:VendorMember

BRFH:ManufacturerDMember

2022-07-01

2022-09-30

0001487197

us-gaap:CustomerConcentrationRiskMember

BRFH:VendorMember

BRFH:ManufacturerDMember

2023-01-01

2023-09-30

0001487197

us-gaap:CustomerConcentrationRiskMember

BRFH:VendorMember

BRFH:ManufacturerDMember

2022-01-01

2022-09-30

0001487197

us-gaap:CustomerConcentrationRiskMember

BRFH:VendorMember

BRFH:ManufacturerEMember

2023-07-01

2023-09-30

0001487197

us-gaap:CustomerConcentrationRiskMember

BRFH:VendorMember

BRFH:ManufacturerEMember

2022-07-01

2022-09-30

0001487197

us-gaap:CustomerConcentrationRiskMember

BRFH:VendorMember

BRFH:ManufacturerEMember

2023-01-01

2023-09-30

0001487197

us-gaap:CustomerConcentrationRiskMember

BRFH:VendorMember

BRFH:ManufacturerEMember

2022-01-01

2022-09-30

0001487197

srt:ScenarioPreviouslyReportedMember

2022-12-31

0001487197

srt:RestatementAdjustmentMember

2022-12-31

0001487197

srt:ScenarioPreviouslyReportedMember

2022-07-01

2022-09-30

0001487197

srt:RestatementAdjustmentMember

2022-07-01

2022-09-30

0001487197

srt:ScenarioPreviouslyReportedMember

2022-01-01

2022-09-30

0001487197

srt:RestatementAdjustmentMember

2022-01-01

2022-09-30

0001487197

BRFH:ManufacturingEquipmentMember

2023-09-30

0001487197

BRFH:ManufacturingEquipmentMember

2022-12-31

0001487197

BRFH:CustomerEquipmentMember

2023-09-30

0001487197

BRFH:CustomerEquipmentMember

2022-12-31

0001487197

2022-01-01

2022-12-31

0001487197

2021-01-01

2021-12-31

0001487197

us-gaap:RelatedPartyMember

2022-07-31

0001487197

2023-07-31

0001487197

us-gaap:SubsequentEventMember

2023-10-31

0001487197

us-gaap:CommonStockMember

2021-12-31

0001487197

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001487197

us-gaap:RetainedEarningsMember

2021-12-31

0001487197

us-gaap:CommonStockMember

2022-01-01

2022-09-30

0001487197

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-09-30

0001487197

us-gaap:RetainedEarningsMember

2022-01-01

2022-09-30

0001487197

us-gaap:CommonStockMember

2022-09-30

0001487197

us-gaap:AdditionalPaidInCapitalMember

2022-09-30

0001487197

us-gaap:RetainedEarningsMember

2022-09-30

0001487197

us-gaap:CommonStockMember

2022-12-31

0001487197

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001487197

us-gaap:RetainedEarningsMember

2022-12-31

0001487197

us-gaap:CommonStockMember

2023-01-01

2023-09-30

0001487197

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-09-30

0001487197

us-gaap:RetainedEarningsMember

2023-01-01

2023-09-30

0001487197

us-gaap:CommonStockMember

2023-09-30

0001487197

us-gaap:AdditionalPaidInCapitalMember

2023-09-30

0001487197

us-gaap:RetainedEarningsMember

2023-09-30

0001487197

BRFH:TwoThousandAndTwentyThreePlanMember

2023-09-30

0001487197

us-gaap:PerformanceSharesMember

2023-02-01

2023-02-28

0001487197

2023-02-01

2023-02-28

0001487197

us-gaap:PerformanceSharesMember

2023-01-01

2023-09-30

0001487197

us-gaap:PerformanceSharesMember

BRFH:TimeBasedVestingMember

2023-01-01

2023-09-30

0001487197

us-gaap:PerformanceSharesMember

BRFH:TwoThousandAndTwentyThreePlanMember

2023-04-01

2023-04-30

0001487197

us-gaap:PerformanceSharesMember

BRFH:TwoThousandAndTwentyThreePlanMember

2023-09-01

2023-09-30

0001487197

us-gaap:PerformanceSharesMember

2023-07-01

2023-09-30

0001487197

us-gaap:PerformanceSharesMember

2022-12-31

0001487197

us-gaap:PerformanceSharesMember

2023-09-30

0001487197

BRFH:TheNasdaqStockMarketLLCMember

2023-05-05

0001487197

BRFH:TheNasdaqStockMarketLLCMember

2023-05-05

2023-05-05

0001487197

BRFH:TheNasdaqStockMarketLLCMember

2023-03-31

0001487197

us-gaap:SubsequentEventMember

BRFH:SubscriptionAgreementsMember

2023-10-23

0001487197

us-gaap:SubsequentEventMember

BRFH:SubscriptionAgreementsMember

2023-10-23

2023-10-23

0001487197

us-gaap:SubsequentEventMember

BRFH:SubscriptionAgreementsMember

us-gaap:CommonStockMember

2023-10-23

2023-10-23

0001487197

BRFH:SubscriptionAgreementsMember

2023-09-30

0001487197

BRFH:ConvertibleDebtDrawdownMember

2023-09-30

0001487197

BRFH:ConversionOfDebtToEquityMember

2023-09-30

0001487197

srt:ProFormaMember

2023-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

| ☒ |

QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the quarterly period ended September 30, 2023

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from ________________ to ___________________

Commission

File Number: 001-41228

BARFRESH

FOOD GROUP INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

27-1994406 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

No.) |

| |

|

|

3600

Wilshire Blvd., Suite 1720,

Los

Angeles, California |

|

90010 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

310-598-7113

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name, former address and former fiscal year, if changed since last report)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, $0.000001 par value |

|

BRFH |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated

filer ☐ |

Smaller

reporting company ☒ |

| |

Emerging

growth company ☒ |

If

an emerging growth company, indicate by the check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate

the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 13,924,774

shares as of October 25, 2023.

TABLE

OF CONTENTS

Item

1. Financial Statements.

Barfresh

Food Group Inc.

Condensed

Consolidated Balance Sheets

| | |

September 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

(unaudited) | | |

(restated) | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash | |

$ | 1,011,000 | | |

$ | 2,808,000 | |

| Restricted cash | |

| - | | |

| 211,000 | |

| Trade accounts receivable, net | |

| 1,159,000 | | |

| 126,000 | |

| Other receivables | |

| 116,000 | | |

| 101,000 | |

| Inventory, net | |

| 748,000 | | |

| 1,048,000 | |

| Prepaid expenses and other current assets | |

| 167,000 | | |

| 79,000 | |

| Total current assets | |

| 3,201,000 | | |

| 4,373,000 | |

| Property, plant and equipment, net of depreciation | |

| 487,000 | | |

| 801,000 | |

| Operating lease right-of-use assets, net | |

| - | | |

| 18,000 | |

| Intangible assets, net of amortization | |

| 258,000 | | |

| 306,000 | |

| Deposits | |

| 7,000 | | |

| 7,000 | |

| Total assets | |

$ | 3,953,000 | | |

$ | 5,505,000 | |

| | |

| | | |

| | |

| Liabilities and Stockholders’ Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 1,692,000 | | |

$ | 1,534,000 | |

| Disputed co-manufacturer accounts payable (Note 5) | |

| 499,000 | | |

| 499,000 | |

| Accrued expenses | |

| 229,000 | | |

| 286,000 | |

| Accrued payroll and employee related | |

| 240,000 | | |

| 233,000 | |

| Lease liability | |

| - | | |

| 20,000 | |

| Total current liabilities | |

| 2,660,000 | | |

| 2,572,000 | |

| Total liabilities | |

| 2,660,000 | | |

| 2,572,000 | |

| | |

| | | |

| | |

| Commitments and contingencies (Note 5) | |

| - | | |

| - | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred stock, $0.000001 par value, 400,000 shares authorized, none issued or outstanding | |

| - | | |

| - | |

| Common stock, $0.000001 par value; 23,000,000 shares authorized; 13,104,614 and 12,934,741 shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively | |

| - | | |

| - | |

| Additional paid in capital | |

| 61,388,000 | | |

| 60,905,000 | |

| Accumulated deficit | |

| (60,095,000 | ) | |

| (57,972,000 | ) |

| Total stockholders’ equity | |

| 1,293,000 | | |

| 2,933,000 | |

| Total liabilities and stockholders’ equity | |

$ | 3,953,000 | | |

$ | 5,505,000 | |

See

the accompanying notes to the consolidated financial statements

Barfresh

Food Group Inc.

Condensed

Consolidated Statements of Operations

For

the three and nine months ended September 30, 2023 and 2022

(Unaudited)

| | |

2023 | | |

2022

(restated) | | |

2023 | | |

2022

(restated) | |

| | |

For the three months ended September 30, | | |

For the nine months ended September 30, | |

| | |

2023 | | |

2022

(restated) | | |

2023 | | |

2022

(restated) | |

| Revenue | |

$ | 2,603,000 | | |

$ | 2,406,000 | | |

$ | 6,205,000 | | |

$ | 7,731,000 | |

| Cost of revenue | |

| 1,690,000 | | |

| 3,129,000 | | |

| 3,963,000 | | |

| 6,807,000 | |

| Gross profit | |

| 913,000 | | |

| (723,000 | ) | |

| 2,242,000 | | |

| 924,000 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Selling, marketing and distribution | |

| 697,000 | | |

| 860,000 | | |

| 1,990,000 | | |

| 2,236,000 | |

| General and administrative | |

| 578,000 | | |

| 1,013,000 | | |

| 2,065,000 | | |

| 2,637,000 | |

| Depreciation and amortization | |

| 114,000 | | |

| 91,000 | | |

| 310,000 | | |

| 327,000 | |

| Total operating expenses | |

| 1,389,000 | | |

| 1,964,000 | | |

| 4,365,000 | | |

| 5,200,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (476,000 | ) | |

$ | (2,687,000 | ) | |

$ | (2,123,000 | ) | |

$ | (4,276,000 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Per share information - basic and fully diluted: | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares outstanding | |

| 13,036,000 | | |

| 12,931,000 | | |

| 13,005,000 | | |

| 12,920,000 | |

| Net loss per share | |

$ | (0.04 | ) | |

$ | (0.21 | ) | |

$ | (0.16 | ) | |

$ | (0.33 | ) |

See

the accompanying notes to the consolidated financial statements

Barfresh

Food Group Inc.

Consolidated

Statements of Cash Flows

For

the nine months ended September 30, 2023 and 2022

| | |

2023 | | |

2022

(restated) | |

| Net loss | |

$ | (2,123,000 | ) | |

$ | (4,276,000 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities | |

| | | |

| | |

| Depreciation and amortization | |

| 325,000 | | |

| 344,000 | |

| Stock-based compensation | |

| 496,000 | | |

| 211,000 | |

| Stock and options issued for services | |

| 11,000 | | |

| 173,000 | |

| Changes in assets and liabilities | |

| | | |

| | |

| Accounts receivable | |

| (1,033,000 | ) | |

| 81,000 | |

| Other receivables | |

| (15,000 | ) | |

| (77,000 | ) |

| Inventories | |

| 300,000 | | |

| 103,000 | |

| Prepaid expenses and other assets | |

| (27,000 | ) | |

| (78,000 | ) |

| Accounts payable | |

| 195,000 | | |

| 828,000 | |

| Accrued expenses | |

| (137,000 | ) | |

| 72,000 | |

| Net cash used in operating activities | |

| (2,008,000 | ) | |

| (2,619,000 | ) |

| | |

| | | |

| | |

| Investing activities | |

| | | |

| | |

| Purchase of property and equipment | |

| - | | |

| (13,000 | ) |

| Net cash used in investing activities | |

| - | | |

| (13,000 | ) |

| | |

| | | |

| | |

| Financing activities | |

| | | |

| | |

| Proceeds from issuance of stock | |

| - | | |

| 5,000 | |

| Net cash provided by financing activities | |

| - | | |

| 5,000 | |

| Net decrease in cash and restricted cash | |

| (2,008,000 | ) | |

| (2,627,000 | ) |

| Cash and restricted cash, beginning of period | |

| 3,019,000 | | |

| 5,675,000 | |

| Cash and restricted cash, end of period | |

$ | 1,011,000 | | |

$ | 3,048,000 | |

| | |

| | | |

| | |

| Cash paid during the year for: | |

| | | |

| | |

| Amounts included in the measurement of lease liabilities | |

$ | 20,000 | | |

$ | 60,000 | |

| | |

| | | |

| | |

| Non-cash financing and investing activities: | |

| | | |

| | |

| Value of shares relinquished in modification of stock-based compensation awards (Note 7) | |

$ | 24,000 | | |

$ | - | |

See

the accompanying notes to the consolidated financial statements

Barfresh

Food Group Inc.

Notes

to Condensed Consolidated Financial Statements

September

30, 2023

(Unaudited)

Note

1. Description of the Business, Basis of Presentation, and Summary of Significant Accounting Policies

Barfresh

Food Group Inc., (“we,” “us,” “our,” and the “Company”) was incorporated on February

25, 2010 in the State of Delaware. The Company is engaged in the manufacturing and distribution of ready-to-drink and ready-to-blend

beverages, particularly, smoothies, shakes and frappes.

Basis

of Presentation

The

accompanying condensed consolidated financial statements are unaudited. These unaudited interim condensed consolidated financial statements

have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”) and

applicable rules and regulations of the U.S. Securities and Exchange Commission (“SEC”) regarding interim financial reporting.

Certain information and footnote disclosures normally included in the financial statements prepared in accordance with GAAP have been

condensed or omitted pursuant to such rules and regulations. Accordingly, these interim condensed consolidated financial statements should

be read in conjunction with the audited consolidated financial statements for the fiscal year ended December 31, 2022 included in the

Company’s Annual Report on Form 10-K, as filed with the SEC on March 2, 2023. In management’s opinion, the unaudited interim

condensed consolidated financial statements reflect all adjustments, which are of a normal and recurring nature, that are necessary for

a fair presentation of financial results for the interim periods presented. Operating results for any quarter are not necessarily indicative

of the results for the full fiscal year.

Principles

of Consolidation

The

consolidated financial statements include the financial statements of the Company and our wholly owned subsidiaries, Barfresh Inc. and

Barfresh Corporation Inc. (formerly known as Smoothie, Inc.). All inter-company balances and transactions among the companies have been

eliminated upon consolidation.

Use

of Estimates

The

preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities in the balance sheets and revenues and expenses during the years reported. Actual results may differ

from these estimates.

Vendor

Concentrations

The

Company is exposed to supply risk as a result of concentrations in its vendor base resulting from the use of a limited number of contract

manufacturers. Purchases from the Company’s significant contract manufacturers as a percentage of all finished goods purchased

were as follows:

Schedule of Company’s Contract Manufacturers of Finished Goods

| | |

For the three months ended September 30, | | |

For the nine months ended September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Manufacturer A | |

| 55 | % | |

| 0 | % | |

| 47 | % | |

| 0 | % |

| Manufacturer B | |

| 37 | % | |

| 31 | % | |

| 44 | % | |

| 28 | % |

| Manufacturer C | |

| 8 | % | |

| 6 | % | |

| 9 | % | |

| 6 | % |

| Manufacturer D | |

| 0 | % | |

| 54 | % | |

| 0 | % | |

| 58 | % |

| Manufacturer E | |

| 0 | % | |

| 9 | % | |

| 0 | % | |

| 8 | % |

Summary

of Significant Accounting Policies

There

have been no changes to our significant accounting policies described in our Annual Report on Form 10-K for the year ended December 31,

2022, as filed with the SEC on March 2, 2023 that have had a material impact on our condensed consolidated financial statements and related

notes.

Fair

Value Measurement and Financial Instruments

Financial

Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 820, Fair Value Measurements

and Disclosures (“ASC 820”), requires the valuation of assets and liabilities permitted to be either recorded or disclosed

at fair value based on a hierarchy of available inputs as follows:

Level

1 – Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or

liabilities;

Level

2 – Quoted prices for similar assets and liabilities in active markets, quoted prices for identical assets and liabilities in markets

that are not active, or inputs that are observable, either directly or indirectly, for substantially the full term of the asset or liability;

and

Level

3 – Prices or valuation techniques that require inputs that are both significant to the fair value and unobservable (i.e., supported

by little or no market activity).

The

Company’s financial instruments consist of cash, restricted cash, accounts receivable and accounts payable. The carrying value

of the Company’s financial instruments approximates their fair value.

Restricted

Cash

At

December 31, 2022, the Company had approximately $211,000 in restricted cash related to a co-packing agreement. The restrictions were

released in June 2023.

Accounts

Receivable and Allowances

Accounts

receivable are recorded and carried at the original invoiced amount less allowances for credits and for any potential uncollectible amounts

due to credit losses. We make estimates of the expected credit and collectability trends for the allowance for credit losses based on

our assessment of various factors, including historical experience, the age of the accounts receivable balances, credit quality of our

customers, current economic conditions, and other factors that may affect our ability to collect from our customers. Expected credit

losses are recorded as general and administrative expenses on our condensed consolidated statements of operations. As of September 30,

2023 and December 31, 2022, there was no allowance for expected credit losses.

Other

Receivables

Other

receivables consist of the Company’s 2021 Employer Retention Tax Credit claim, amounts due from vendors for materials acquired

on their behalf for use in manufacturing the Company’s products, vendor rebates and freight claims.

Revenue

Recognition

In

accordance with ASC 606, Revenue from Contracts with Customers, revenue is recognized when a customer obtains ownership of promised goods.

The amount of revenue recognized reflects the consideration to which the Company expects to be entitled to receive in exchange for these

goods. The Company applies the following five steps:

| |

1) |

Identify

the contract with a customer |

| |

|

|

| |

|

A

contract with a customer exists when (I) the Company enters into an enforceable contract with a customer that defines each party’s

rights, (ii) the contract has commercial substance and, (iii) the Company determines that collection of substantially all consideration

for goods or services that are transferred is probable. For the Company, the contract is the approved sales order, which may also

be supplemented by other agreements that formalize various terms and conditions with customers. |

| |

|

|

| |

2) |

Identify

the performance obligation in the contract |

| |

|

|

| |

|

Performance

obligations promised in a contract are identified based on the goods or services that will be transferred to the customer. For the

Company, this consists of the delivery of frozen beverages, which provide immediate benefit to the customer. |

| |

|

|

| |

3) |

Determine

the transaction price |

| |

|

|

| |

|

The

transaction price is determined based on the consideration to which the Company will be entitled in exchange for transferring goods

and is generally stated on the approved sales order. Variable consideration, which typically includes rebates or discounts, are estimated

utilizing the most likely amount method. Provisions for refunds are generally provided for in the period the related sales are recorded,

based on management’s assessment of historical and projected trends. |

| |

|

|

| |

4) |

Allocate

the transaction price to performance obligations in the contract

Since

the Company’s contracts contain a single performance obligation, delivery of frozen beverages, the transaction price is allocated

to that single performance obligation. |

| |

|

|

| |

5) |

Recognize

revenue when or as the Company satisfies a performance obligation |

| |

|

|

| |

|

The

Company recognizes revenue from the sale of frozen beverages when title and risk of loss

passes and the customer accepts the goods, which generally occurs at the time of delivery

to a customer warehouse. Customer sales incentives such as volume-based rebates or discounts

are treated as a reduction of sales at the time the sale is recognized. Shipping and handling

costs are treated as fulfilment costs and presented in distribution, selling and administrative

costs.

Payments

that are received before performance obligations are recorded are shown as current liabilities. |

| |

|

|

| |

|

The

Company evaluated the requirement to disaggregate revenue and concluded that substantially all of its revenue comes from a single

product, frozen beverages. |

Storage

and Shipping Costs

Storage

and outbound freight costs are included in selling, marketing and distribution expense. For the three months ending September 30, 2023

and 2022, storage and outbound freight totaled approximately $370,000 and $273,000, respectively. For the nine months ending September

30, 2023 and 2022, storage and outbound freight totaled approximately $932,000 and $1,040,000, respectively.

Research

and Development

Expenditures

for research activities relating to product development and improvement are charged to expense as incurred. The Company incurred approximately

$32,000 and $220,000, in research and development expense for the three months ending September 30, 2023 and 2022, respectively. For

the nine months ending September 30, 2023 and 2022, the Company incurred approximately $88,000 and $347,000, respectively.

Loss

Per Share

For

the three and nine months ended September 30, 2023 and 2022 common stock equivalents have not been included in the calculation of net

loss per share as their effect is anti-dilutive as a result of losses incurred.

Reclassifications

Certain

reclassifications have been made to the 2022 financial statements to conform to the 2023 presentation, namely the presentation of selling,

marketing and distribution expense apart from general and administrative expense in the consolidated statement of operations, the reclassification

of materials shipping from selling, marketing and distribution to cost of revenue, and the presentation of the components of cash used

in operations.

Recent

Pronouncements

From

time to time, new accounting pronouncements are issued that we adopt as of the specified effective date. We have not determined if the

impact of recently issued standards that are not yet effective will have an impact on our results of operations and financial position.

Note

2. Restatement of Prior Financial Information

This

Company’s previously filed unaudited statement of operations and cash flow statement and audited balance sheets have been restated

to correct errors in calculating depreciation. From a quantitative and qualitative perspective, the Company determined that correcting

the previously filed financial statements would not require amendment to its previously filed reports on Form 10-Q and 10-K. The effect

of the correction of previously issued financial statements is summarized below:

Schedule of Prior Financial Information

| | |

As Previously Reported | | |

Adjustment | | |

Restated | |

| | |

December 31, 2022 | |

| | |

As Previously Reported | | |

Adjustment | | |

Restated | |

| Consolidated Balance Sheet | |

| | | |

| | | |

| | |

| Property, plant and equipment, net of depreciation | |

$ | 389,000 | | |

$ | 412,000 | | |

$ | 801,000 | |

| Total assets | |

$ | 5,093,000 | | |

$ | 412,000 | | |

$ | 5,505,000 | |

| Accumulated deficit | |

$ | (58,384,000 | ) | |

$ | 412,000 | | |

$ | (57,972,000 | ) |

| Total stockholders’ equity | |

$ | 2,521,000 | | |

$ | 412,000 | | |

$ | 2,933,000 | |

| Total liabilities and stockholders’ equity | |

$ | 5,093,000 | | |

$ | 412,000 | | |

$ | 5,505,000 | |

| | |

As Previously Reported | | |

Adjustment | | |

Restated | |

| | |

Three-months ended September 30, 2022 | |

| | |

As Previously Reported | | |

Adjustment | | |

Restated | |

| Consolidated Statement of Operations | |

| | | |

| | | |

| | |

| Depreciation and amortization | |

$ | 112,000 | | |

$ | (21,000 | ) | |

$ | 91,000 | |

| Total operating expenses | |

$ | 1,985,000 | | |

$ | (21,000 | ) | |

$ | 1,964,000 | |

| Net loss | |

$ | (2,708,000 | ) | |

$ | 21,000 | | |

$ | (2,687,000 | ) |

| | |

As Previously Reported | | |

Adjustment | | |

Restated | |

| | |

Nine-months ended September 30, 2022 | |

| | |

As Previously Reported | | |

Adjustment | | |

Restated | |

| Consolidated Statement of Operations | |

| | | |

| | | |

| | |

| Depreciation and amortization | |

$ | 390,000 | | |

$ | (63,000 | ) | |

$ | 327,000 | |

| Total operating expenses | |

$ | 5,263,000 | | |

$ | (63,000 | ) | |

$ | 5,200,000 | |

| Net loss | |

$ | (4,339,000 | ) | |

$ | 63,000 | | |

$ | (4,276,000 | ) |

| | |

| | | |

| | | |

| | |

| Consolidated Statement of Cash Flows | |

| | | |

| | | |

| | |

| Net loss | |

$ | (4,339,000 | ) | |

$ | 63,000 | | |

$ | (4,276,000 | ) |

| Depreciation and amortization | |

$ | 407,000 | | |

$ | (63,000 | ) | |

$ | 344,000 | |

| Net cash used in operating activities | |

$ | (2,619,000 | ) | |

$ | - | | |

$ | (2,619,000 | ) |

Note

3. Inventory

Inventory

consists of the following:

Schedule of Inventory

| | |

September 30,

2023 | | |

December 31,

2022 | |

| Raw materials | |

$ | 28,000 | | |

$ | 65,000 | |

| Finished goods | |

| 720,000 | | |

| 983,000 | |

| Inventory, net | |

$ | 748,000 | | |

$ | 1,048,000 | |

Note

4. Property Plant and Equipment

Property

and equipment, net consist of the following:

Schedule of Property and Equipment, Net

| | |

September 30,

2023 | | |

December 31,

2022 | |

| Manufacturing equipment | |

$ | 1,546,000 | | |

$ | 1,618,000 | |

| Customer equipment | |

| 1,410,000 | | |

| 1,417,000 | |

| Property and equipment, gross | |

| 2,956,000 | | |

| 3,035,000 | |

| Less: accumulated depreciation | |

| (2,469,000 | ) | |

| (2,234,000 | ) |

| Property and equipment, net of depreciation | |

$ | 487,000 | | |

$ | 801,000 | |

Depreciation

expense related to these assets was approximately $102,000 and $85,000 each of the three months ended September 30, 2023 and 2022, respectively,

and $277,000 and $297,000, respectively, for the nine months ended September 30, 2023 and 2022. Depreciation expense in cost of revenue

was $4,000 and $10,000 for the three months ended September 30, 2023 and 2022, respectively, and $13,000 and $19,000 for the nine months

ended September 30, 2023 and 2022, respectively.

Note

5. Commitments and Contingencies

Lease

Commitments

The

Company leases office space under a non-cancellable operating lease which expired on March

31, 2023, and was extended

in a series of amendments through March 31, 2024. The Company’s periodic lease cost was approximately $20,000

for each of the three months ended September 30, 2023 and 2022 and $60,000

for each of the nine months ended September 30, 2023 and 2022.

Legal

Proceedings

Schreiber

Dispute

The

Company’s products are produced to its specifications through several contract manufacturers. One of the Company’s contract

manufacturers (the “Manufacturer”) provided approximately 52% and 42% of the Company’s products in the years ended

December 31, 2022 and 2021, respectively, under a Supply Agreement with an initial term through September 2025.

Over

the course of 2022, the Company experienced numerous quality issues with the case packaging utilized by the Manufacturer. In addition,

in July of 2022, the Company began receiving customer complaints about the texture of the Company’s smoothie products produced

by the Manufacturer. In response, the Company withdrew product from the market and destroyed on-hand inventory, withholding $499,000

in payments due to the Manufacturer.

The

Company attempted to resolve the issues based on the contractual procedures described in the Supply Agreement. However, on November 4,

2022, in response to a formal proposal of alternate resolutions, the Company received notification from the Manufacturer that it was

denying any responsibility for the defective manufacture of the product. In response, on November 10, 2022, the Company filed a complaint

in the United States District Court for the Central District of California, Western Division (the “Complaint”), claiming

that the Manufacturer had not met its obligations under the Supply Agreement, and seeking economic damages. In response, the Manufacturer

terminated the Supply Agreement. On January 20, 2023, the Company filed a voluntary dismissal of the Complaint which allowed the parties

to reach a potential resolution outside of the court system. However, as the parties were once again unable to come to an agreement,

the Company re-filed the Complaint in California State Court in August 2023.

Due

to the uncertainties surrounding the claim, the Company is not able to predict either the outcome or a range of reasonably possible recoveries

that could result from its actions against the Manufacturer, and no gain contingencies have been recorded. The disruption in its supply

resulting from the dispute has and will continue to adversely impact the Company’s results of operations and cash flow until a

suitable resolution is reached or new sources of reliable supply at sufficient volume can be identified and developed, the timing of

which is uncertain. The Company has mitigated the impact of the supply disruption with the introduction of its single-serve smoothie

cartons; however the product format has not been accepted by some customers or as a substitute for the bottle product in all use cases.

Other

legal matters

From

time to time, various lawsuits and legal proceedings may arise in the ordinary course of business. However, litigation is subject to

inherent uncertainties and an adverse result in these or other matters may arise from time to time that may harm our business. We are

currently the defendant in one legal proceeding for an amount less than $100,000. Our legal counsel and management believe the probability

of a material unfavorable outcome is remote.

Note

6. Convertible Debt Subscriptions

From July to October of 2023, the

Company executed subscription agreements for $1,880,000 of a $2,000,000

privately placed convertible debt offering. The

debt may be drawn in 25% increments, matures on the anniversary of the draw, bears interest at 10% per annum for the term,

regardless of earlier payment or conversion, and is mandatorily convertible as to principal and interest into shares of the

Company’s common stock at any time prior to maturity at the greater of $1.20 or 85% of the volume-weighted average price of

the common stock for the ten trading days immediately preceding the written notice of the conversion (the “Conversion

Price”). If the Company has not exercised the mandatory conversion, the holder of the debt has the option after six

months and on up to four occasions to convert all or any portion of the principal and interest into shares of the Company’s

common stock at the Conversion Price. The Company made its initial drawdown on the convertible debt on October 23, 2023, as described in Note 10.

Note

7. Stockholders’ Equity

The

following are changes in stockholders’ equity for the nine months ended September 30, 2022 and 2023:

Schedule of Changes in Stockholders' Equity

| | |

Shares | | |

Amount | | |

Capital | | |

(Deficit) | | |

Total | |

| | |

| | |

| | |

Additional | | |

| | |

| |

| | |

Common Stock | | |

paid in | | |

Accumulated | | |

| |

| | |

Shares | | |

Amount | | |

Capital | | |

(Deficit) | | |

Total | |

| Balance December 31, 2021 | |

| 12,905,112 | | |

$ | - | | |

$ | 60,341,000 | | |

$ | (51,838,000 | ) | |

$ | 8,503,000 | |

| Shares issued for warrant exercise | |

| 986 | | |

| - | | |

| 5,000 | | |

| - | | |

| 5,000 | |

| Equity-based compensation | |

| 5,000 | | |

| - | | |

| 211,000 | | |

| - | | |

| 211,000 | |

| Cash settlement of equity-based compensation | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of stock and options for services | |

| 23,643 | | |

| - | | |

| 173,000 | | |

| - | | |

| 173,000 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| (4,276,000 | ) | |

| (4,276,000 | ) |

| Balance September 30, 2022 | |

| 12,934,741 | | |

$ | - | | |

$ | 60,730,000 | | |

$ | (56,114,000 | ) | |

$ | 4,616,000 | |

| | |

| | |

| | |

Additional | | |

| | |

| |

| | |

Common Stock | | |

paid in | | |

Accumulated | | |

| |

| | |

Shares | | |

Amount | | |

Capital | | |

(Deficit) | | |

Total | |

| Balance December 31, 2022 | |

| 12,934,741 | | |

$ | - | | |

$ | 60,905,000 | | |

$ | (57,972,000 | ) | |

$ | 2,933,000 | |

| Balance | |

| 12,934,741 | | |

$ | - | | |

$ | 60,905,000 | | |

$ | (57,972,000 | ) | |

$ | 2,933,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Equity-based compensation | |

| 165,779 | | |

| - | | |

| 496,000 | | |

| - | | |

| 496,000 | |

| Cash settlement of equity-based compensation | |

| - | | |

| - | | |

| (24,000 | ) | |

| - | | |

| (24,000 | ) |

| Issuance of stock and options for services | |

| 4,094 | | |

| - | | |

| 11,000 | | |

| - | | |

| 11,000 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| (2,123,000 | ) | |

| (2,123,000 | ) |

| Balance September 30, 2023 | |

| 13,104,614 | | |

$ | - | | |

$ | 61,388,000 | | |

$ | (60,095,000 | ) | |

$ | 1,293,000 | |

| Balance | |

| 13,104,614 | | |

$ | - | | |

$ | 61,388,000 | | |

$ | (60,095,000 | ) | |

$ | 1,293,000 | |

Warrants

During

the nine months ended September 30, 2023, 936,375 warrants at a weighted average exercise price of $6.00 per share expired.

Equity

Incentive Plan

Through

2022, the Company issued equity awards under the 2015 Equity Incentive Plan (the “2015 Plan”) and outside the Plan. In June

2023, the Company’s stockholders adopted the 2023 Equity Incentive Plan (the “2023 Plan”), reserving 650,000 shares

for future issuance. The Board of Directors discontinued further grants under the 2015 Plan.

As

of September 30, 2023, the Company has $153,000 of total unrecognized share-based compensation expense relative to unvested options,

stock awards and stock units, which is expected to be recognized over the remaining weighted average period of 1.5 years.

Stock

Options

The

following is a summary of stock option activity for the nine months ended September 30, 2023:

Summary of Stock Options Activity

| | |

Number of

Options | | |

Weighted

average

exercise price

per share | | |

Remaining

term in years | |

| Outstanding on December 31, 2022 | |

| 682,939 | | |

$ | 7.30 | | |

| 3.2 | |

| Issued | |

| 63,545 | | |

$ | 1.50 | | |

| 8.0 | |

| Cancelled/expired | |

| (109,388 | ) | |

$ | 8.48 | | |

| | |

| Outstanding on September 30, 2023 | |

| 637,096 | | |

$ | 6.54 | | |

| 3.6 | |

| | |

| | | |

| | | |

| | |

| Exercisable, September 30, 2023 | |

| 576,393 | | |

$ | 6.75 | | |

| 3.2 | |

The

fair value of the options issued was calculated using the Black-Scholes option pricing model, based on the following:

Summary of Fair Value of Options Using Black-Sholes Option Pricing Model

| | |

2023 | |

| Expected term (in years) | |

| 8.0 | |

| Expected volatility | |

| 84.4 | % |

| Risk-free interest rate | |

| 3.6 | % |

| Expected dividends | |

$ | - | |

| Weighted average grant date fair value per share | |

$ | 1.19 | |

Restricted

Stock

The

following is a summary of restricted stock award and restricted stock unit activity for the nine months ended September 30, 2023:

Summary of Restricted Stock Award and Restricted Stock Unit Activity

| | |

Number of

shares | | |

Weighted

average grant

date fair value | |

| Unvested at January 1, 2023 | |

| 41,923 | | |

$ | 4.92 | |

| Granted | |

| 5,000 | | |

$ | 1.25 | |

| Vested | |

| (4,386 | ) | |

$ | 5.06 | |

| Forfeited | |

| (9,931 | ) | |

$ | 3.33 | |

| Unvested at September 30, 2023 | |

| 32,606 | | |

$ | 4.82 | |

Performance

Share Units

During

2022 and 2023, the Company issued performance share units (“PSUs”) that represented shares potentially issuable based upon

Company and individual performance in the years of issuance.

The

following table summarizes the activity for the Company’s unvested PSUs for the nine months ended September 30, 2023:

Summary of Performance Stock Unit Activity

| | |

Number of shares | | |

Weighted

average grant

date fair value | |

| Unvested at January 1, 2023 | |

| 17,678 | | |

$ | 4.50 | |

| Cash settled | |

| (17,678 | ) | |

$ | 4.50 | |

| Granted | |

| 357,689 | | |

$ | 1.64 | |

| Vested | |

| (45,251 | ) | |

$ | 1.36 | |

| Unvested at September 30, 2023 | |

| 312,438 | | |

$ | 1.68 | |

In

February 2023, the unvested awards issued for individual performance and outstanding at January 1, 2023 were modified to cash-settle

the original grant-date fair value of approximately $80,000, resulting in incremental compensation of $56,000 after considering the $24,000

fair value of the vested shares at the date of the modification. Additionally, the Company performance targets were modified to allow

approximately 71,000 PSUs to vest, with an additional time-based vesting requirement for approximately 26,000 of the PSUs. Because the

awards did not vest based on the original terms, the modification was considered a new grant, resulting in $64,000 in compensation expense

in the nine-months ended September 30, 2023.

The

Company adopted a 2023 PSU program in April 2023, granting approximately 211,000 PSUs at target performance against company-wide metrics.

An additional 76,000 PSUs were granted in September 2023 for performance against individual goals, replacing the Company’s cash

bonus program. The results for the three and nine months ended September 30, 2023 include $84,000 in expense for the 2023 PSU program.

Estimates of expense associated with 2023 performance will be reassessed each quarter through the performance period.

Note

8. Income Taxes

ASC

740 requires a valuation allowance to reduce the deferred tax assets reported if, based on the weight of evidence, it is more than likely

than not that some portion or all the deferred tax assets will not be recognized. Accordingly, at this time the Company has placed a

valuation allowance on all tax assets. As of September 30, 2023, the estimated effective tax rate for 2023 was zero.

There

are open statutes of limitations for taxing authorities in federal and state jurisdictions to audit our tax returns from 2018 through

the current period. Our policy is to account for income tax related interest and penalties in income tax expense in the statement of

operations.

For

the three and nine months ended September 30, 2023 and 2022, the Company did not incur any interest and penalties associated with tax

positions. As of September 30, 2023, the Company did not have any significant unrecognized uncertain tax positions.

Note

9. Liquidity

During

the nine months ended September 30, 2023, the Company used cash for operations of $2,008,000. The Company has a history of operating

losses and negative cash flow, which were expected to improve with growth, offset by working capital required to achieve such growth.

As described more fully in Note 5, the dispute and subsequent contract termination with the Manufacturer has resulted in limitations

in our ability to procure certain products, which has and may continue to inhibit our ability to achieve positive cash flow until we

are able to expand our manufacturing capacity. Additionally, management has considered that dispute resolution, including litigation,

is costly and will require the outlay of cash.

However,

as of September 30, 2023, the Company has $1,011,000 of cash and funding commitments of approximately $1,880,000, as more fully described

in Note 6. As such, even though management has identified certain indicators, these indicators do not raise substantial doubt regarding

the Company’s ability to continue as a going concern. However, management cannot predict, with certainty, the outcome of its potential

actions to generate liquidity, including the availability of additional financing, or whether such actions would generate the expected

liquidity as planned.

Note

10. Subsequent Event – Nasdaq Compliance

On

May 5, 2023, the Company received a notice letter from the Listing Qualifications Staff of The Nasdaq Stock Market, LLC (“Nasdaq”)

notifying the Company that it was not in compliance with the Listing Rule 5550(b) (the “Rule”), which requires listed companies

to maintain a minimum $2,500,000 stockholders’ equity, $35,000,000 market value of listed securities, or $500,000 net income from

continuing operations. In its quarterly report for the period ended March 31, 2023, the Company reported stockholders’ equity of

$1,845,000, and as a result, did not satisfy the Rule. On June 14, 2023, the Company received a letter from Nasdaq granting the Company

an extension through October 30, 2023 to regain compliance with the Rule.

On

October 23, 2023, the Company issued convertible notes in the amount of $1,390,000

pursuant to the subscription agreements described in Note 6. Note balances of $1,207,000

were immediately converted into approximately 820,000 shares of common stock. A pro-forma balance sheet giving effect to the transactions is

presented below:

Schedule of Pro-forma Balance Sheet

| | |

September 30,

2023

(unaudited) | | |

Convertible Debt

Drawdown | | |

Conversion of

Debt to Equity | | |

September 30, 2023

(proforma, unaudited) | |

| Assets | |

| | | |

| | | |

| | | |

| | |

| Current assets: | |

| | | |

| | | |

| | | |

| | |

| Cash | |

$ | 1,011,000 | | |

$ | 1,390,000 | | |

$ | - | | |

$ | 2,401,000 | |

| Trade accounts receivable, net | |

| 1,159,000 | | |

| | | |

| | | |

| 1,159,000 | |

| Other receivables | |

| 116,000 | | |

| | | |

| | | |

| 116,000 | |

| Inventory, net | |

| 748,000 | | |

| | | |

| | | |

| 748,000 | |

| Prepaid expenses and other current assets | |

| 167,000 | | |

| | | |

| | | |

| 167,000 | |

| Total current assets | |

| 3,201,000 | | |

| 1,390,000 | | |

| - | | |

| 4,591,000 | |

| Property, plant and equipment, net of depreciation | |

| 487,000 | | |

| | | |

| | | |

| 487,000 | |

| Intangible assets, net of amortization | |

| 258,000 | | |

| | | |

| | | |

| 258,000 | |

| Deposits | |

| 7,000 | | |

| | | |

| | | |

| 7,000 | |

| Total assets | |

$ | 3,953,000 | | |

$ | 1,390,000 | | |

$ | - | | |

$ | 5,343,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Liabilities and Stockholders’ Equity | |

| | | |

| | | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | | |

| | | |

| | |

| Accounts payable | |

$ | 1,692,000 | | |

$ | - | | |

$ | - | | |

$ | 1,692,000 | |

| Disputed co-manufacturer accounts payable | |

| 499,000 | | |

| | | |

| | | |

| 499,000 | |

| Accrued expenses | |

| 229,000 | | |

| | | |

| | | |

| 229,000 | |

| Accrued payroll and employee related | |

| 240,000 | | |

| | | |

| | | |

| 240,000 | |

| Convertible notes payable | |

| - | | |

| 1,390,000 | | |

| (1,207,000 | ) | |

| 183,000 | |

| Total current liabilities | |

| 2,660,000 | | |

| 1,390,000 | | |

| (1,207,000 | ) | |

| 2,843,000 | |

| Total liabilities | |

| 2,660,000 | | |

| 1,390,000 | | |

| (1,207,000 | ) | |

| 2,843,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | | |

| | | |

| | |

| Common stock | |

| - | | |

| | | |

| | | |

| - | |

| Additional paid in capital | |

| 61,388,000 | | |

| | | |

| | | |

| 61,388,000 | |

| Accumulated deficit | |

| (60,095,000 | ) | |

| | | |

| 1,207,000 | | |

| (58,888,000 | ) |

| Total stockholders’ equity | |

| 1,293,000 | | |

| - | | |

| 1,207,000 | | |

| 2,500,000 | |

| Total liabilities and stockholders’ equity | |

$ | 3,953,000 | | |

$ | 1,390,000 | | |

$ | - | | |

$ | 5,343,000 | |

Management

believes that taking into consideration the October 23, 2023 note issuance and conversion, the Company satisfies the

stockholders’ equity requirement on a pro-forma basis as of September 30, 2023 and as of October 26, 2023. Nasdaq will continue to monitor the

Company’s ongoing compliance with the Rule and, if at the time of its next periodic report the Company does not evidence

compliance, it may be subject to delisting.

Item

2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The

following discussion should be read in conjunction with the financial information included elsewhere in this Quarterly Report on Form

10-Q (this “Report”), including our unaudited condensed consolidated financial statements and the related notes and with

our audited consolidated financial statements and related notes included in our Annual Report on Form 10-K for the year ended December

31, 2022, as filed with the SEC on March 2, 2023, and other reports that we file with the SEC from time to time.

References

in this Quarterly Report on Form 10-Q to “us”, “we”, “our” and similar terms refer to Barfresh Food

Group Inc.

Cautionary

Note Regarding Forward-Looking Statements

This

discussion includes forward-looking statements, as that term is defined in the federal securities laws, based upon current expectations

that involve risks and uncertainties, such as plans, objectives, expectations, and intentions. Actual results and the timing of events

could differ materially from those anticipated in these forward-looking statements as a result of a number of factors. Words such as

“anticipate”, “estimate”, “plan”, “continuing”, “ongoing”, “expect”,

“believe”, “intend”, “may”, “will”, “should”, “could” and similar

expressions are used to identify forward-looking statements.

We

caution you that these statements are not guarantees of future performance or events and are subject to a number of uncertainties, risks

and other influences, many of which are beyond our control, which may influence the accuracy of the statements and the projections upon

which the statements are based. Any one or more of these uncertainties, risks and other influences could materially affect our results

of operations and whether forward-looking statements made by us ultimately prove to be accurate. Our actual results, performance and

achievements could differ materially from those expressed or implied in these forward-looking statements. We undertake no obligation

to publicly update or revise any forward-looking statements, whether from new information, future events or otherwise.

Critical

Accounting Policies

Our

consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States

of America (“GAAP”).

Results

of Operations

Results

of Operation for the Three Months Ended September 30, 2023 as Compared to the Three Months Ended September 30, 2022

Revenue

and cost of revenue

Revenue

increased $197,000, or 8%, from $2,406,000 in 2022 to $2,603,000 in 2023. Revenue in 2022 was negatively impacted by the $630,000 claims

estimate resulting from the market withdrawal of product purchased from the Manufacturer due to quality complaints. Excluding the refund

claims estimate, revenue was $3,036,000 in 2022 and therefore decreased by $433,000 in 2023, or 14% based on product shipped. Our revenues

have been adversely impacted as a result of lost customers and supply constraints resulting from the product issues and related dispute

with the Manufacturer. While the introduction of our carton packaging format has mitigated the loss of supply, the product offering has

not been accepted by some customers or as a substitute for the bottle product in all use cases. We have identified and are actively working

to develop additional smoothie bottle manufacturing capacity. We expect expanded capacity to become available in early 2024, subject

to the risks and uncertainties associated with contracting and pre-production activities.

Cost

of revenue for 2023 was $1,690,000 as compared to $3,129,000 in 2022. Cost of revenue in 2022 was negatively impacted by the $932,000

inventory write-off related to the product withdrawal. Excluding the inventory write-off, cost of revenue was $2,197,000 in 2022, and

therefore decreased by $507,000 in 2023, or 23% based on product shipped. Excluding the impact of the product withdrawal, cost of revenue

declined due to lower revenue, and lower product cost due to a shift in product mix resulting from the limited supply of smoothie bottles.

Our

gross profit was $913,000 (35%) and ($723,000) (-30%) for 2023 and 2022, respectively. Adjusted for the product withdrawal, our 2022

gross profit was $839,000 (28%). Adjusted comparative gross margin improvement is a result of favorable product mix, pricing actions,

and a slight improvement in the cost of supply chain components.

Selling,

marketing and distribution expense

Our

operations were primarily directed towards increasing sales and expanding our distribution network.

| | |

Three

months ended

September 30,

2023 | | |

Three

months ended

September 30,

2022 | | |

Change | | |

Percent | |

| Sales and marketing | |

$ | 327,000 | | |

$ | 410,000 | | |

$ | (83,000 | ) | |

| -20 | % |

| Storage and outbound freight | |

| 370,000 | | |

| 450,000 | | |

| (80,000 | ) | |

| -18 | % |

| Sales, marketing and distribution expense | |

$ | 697,000 | | |

$ | 860,000 | | |

$ | (163,000 | ) | |

| -19 | % |

Selling,

marketing and distribution expense decreased approximately $163,000 (-19%) from approximately $860,000 in 2022 to $697,000 in 2023.

Sales

and marketing expense decreased approximately $83,000 (-20%) from approximately $410,000 in 2022 to $327,000 in 2023. The decrease is

a result of headcount reductions and lower broker commissions due to lower revenue and product mix.

Storage

and outbound freight expense decreased approximately $80,000 (-18%) from approximately $450,000 in 2022 to $370,000 in 2023, primarily

as a result of the 14% decrease in product shipped as described in the discussion of revenue for the comparative quarters. The volume-related

decrease in expense was enhanced by freight efficiencies compared to 2022.

General

and administrative expense

| | |

Three

months ended

September 30,

2023 | | |

Three

months ended

September 30,

2022 | | |

Change | | |

Percent | |

| Personnel costs | |

$ | 196,000 | | |

$ | 336,000 | | |

$ | (140,000 | ) | |

| -42 | % |

| Stock-based compensation | |

| 240,000 | | |

| 156,000 | | |

| 84,000 | | |

| 54 | % |

| Legal, professional and consulting fees | |

| 61,000 | | |

| 98,000 | | |

| (37,000 | ) | |

| -38 | % |

| Director fees paid in cash | |

| (50,000 | ) | |

| 25,000 | | |

| (75,000 | ) | |

| -300 | % |

| Research and development | |

| 32,000 | | |

| 220,000 | | |

| (188,000 | ) | |

| -85 | % |

| Other general and administrative expenses | |

| 99,000 | | |

| 178,000 | | |

| (79,000 | ) | |

| -44 | % |

| General and administrative expense | |

$ | 578,000 | | |

$ | 1,013,000 | | |

$ | (435,000 | ) | |

| -43 | % |

General

and administrative expense decreased approximately $435,000 (-43%) from approximately $1,013,000 in 2022 to $578,000 in 2023.

Personnel

cost represents the cost of employees including salaries, bonuses, employee benefits and employment taxes. Personnel cost decreased by

approximately $140,000 (-42%) from approximately $336,000 to $196,000 and stock-based compensation increased by approximately $84,000

(54%) from $156,000 to $240,000. The decrease in personnel cost resulted from a reduction in headcount and the decision to issue stock-based

compensation in lieu of cash bonuses for a portion of the performance criteria in 2023, resulting in a year-to-date reduction of personnel

costs of $87,000, including a $60,000 reclassification of expense incurred in the first two quarters of 2023. Additionally, unpaid directors’

fees for 2023 that were expected to be paid in cash were also converted to stock-based compensation, resulting in a year-to-date reduction

in cash expense of $75,000, including a $50,000 reclassification of expense incurred in the first two quarters of 2023. Excluding the

impact of the compensation modifications for employees and directors, stock-based compensation decreased by $26,000 due to headcount

reductions and the non-recurrence of a one-time grant in 2022.

Legal,

professional and consulting fees decreased by $37,000 (-38%) as a result of a reduction in outside services in an effort to conserve

working capital.

Research

and development expense decreased approximately $188,000 (-85%) from approximately $220,000 in 2022 to $32,000 in 2023. Expense was elevated

in 2022 as we incurred pre-production expense related to the launch of our carton format, while 2023 expense was limited as activities

were minimized to conserve working capital.

Other

general and administrative expenses decreased by approximately $79,000 (-44%) due to a reduction in local non-income based taxes and

the timing of the Company’s annual meeting.

Net

loss

We

had net losses of approximately $476,000 and $2,687,000 for the three-month periods ended September 30, 2023 and 2022, respectively.

The decrease in net loss of approximately $2,211,000, was the result of the non-recurrence of the estimated refund claims and inventory

disposal costs associated with the product withdrawal, improved margins, and a reduction of approximately $575,000 in operating expenses

due to cost saving measures and to a lesser extent, reduced volume of product shipped.

Results

of Operation for the Nine Months Ended September 30, 2023 as Compared to the Nine Months Ended September 30, 2022

Revenue

and cost of revenue

Revenue

was $6,205,000 in 2023 compared to $7,731,000 in 2022, a decrease of $1,526,000, or 20%. Revenue in 2022 was negatively impacted by the

$630,000 claims estimate resulting from the market withdrawal of product purchased from the Manufacturer. Excluding the refund claims

estimate, revenue was $8,361,000 in 2022 and therefore decreased by $2,156,000 in 2023, or 26% based on product shipped. Our revenues

have been adversely impacted as a result of lost customers and supply constraints resulting from the product issues and related dispute

with the Manufacturer. While the introduction of our carton packaging format has mitigated the loss of supply, the product offering has

not been accepted by some customers or as a substitute for the bottle product in all use cases. We have identified and are actively working

to develop additional smoothie bottle manufacturing capacity. We expect expanded capacity to become available in early 2024, subject

to the risks and uncertainties associated with contracting and pre-production activities.

Cost

of revenue was $3,963,000 in 2023 compared to $6,807,000 in 2022, a decrease of $2,844,000, or 42%. Cost of revenue in 2022 was negatively

impacted by the $932,000 inventory write-off related to the product withdrawal. Excluding the inventory write-off, cost of revenue was

$5,875,000 in 2022, and therefore decreased by $1,912,000 in 2023, or 33% based on product shipped. Excluding the impact of the product

withdrawal, cost of revenue declined due to lower revenue, and lower product cost due to a shift in product mix resulting from the limited

supply of smoothie bottles.

Our

gross profit was $2,242,000 (36%) and $924,000 (12%) for 2023 and 2022, respectively. Adjusted for the product withdrawal, our 2022 gross

profit was $2,486,000 (30%). Adjusted comparative gross margin improvement is a result of favorable product mix, pricing actions, and

a slight improvement in the cost of supply chain components.

Selling,

marketing and distribution expense

Our

operations were primarily directed towards increasing sales and expanding our distribution network.

| | |

Nine

months ended

September 30, | | |

Nine

months ended

September 30, | | |

| | |

| |

| | |

2023 | | |

2022 | | |

Change | | |

Percent | |

| Sales and marketing | |

$ | 1,058,000 | | |

$ | 1,019,000 | | |

$ | 39,000 | | |

| 4 | % |

| Storage and outbound freight | |

| 932,000 | | |

| 1,217,000 | | |

| (285,000 | ) | |

| -23 | % |

| Sales, marketing and distribution expense | |

$ | 1,990,000 | | |

$ | 2,236,000 | | |

$ | (246,000 | ) | |

| -11 | % |

Selling,

marketing and distribution expense decreased approximately $246,000 (-11%) from approximately $2,236,000 in 2022 to $1,990,000 in 2023.

Sales

and marketing expense increased approximately $39,000 (4%) from approximately $1,019,000 in 2022 to $1,058,000 in 2023. We incurred additional

expense for product sampling of smoothie carton products, equipment maintenance incurred to relaunch bulk product sales in locations

that had been non-operational as a result of COVID shutdowns and subsequent labor shortages, and broker commissions as we engaged numerous

regional K-12 specialists to expand our geographic reach in the third quarter of 2022. These increases were partially offset by a reduction

in personnel costs.

Storage

and outbound freight expense decreased approximately $285,000 (-23%) from approximately $1,217,000 in 2022 to $932,000 in 2023 primarily

as a result of the 26% decrease in product shipped as described in the discussion of revenue for the comparative year-to-date periods.

The volume-related decrease in expense was partially offset by higher costs resulting from product mix and inefficiencies due to production

transitions.

General

and administrative expense

| | |

Nine months

ended

September 30,

2023 | | |

Nine months

ended

September 30,

2022 | | |

Change | | |

Percent | |

| Personnel costs | |

$ | 929,000 | | |

$ | 1,006,000 | | |

$ | (77,000 | ) | |

| -8 | % |

| Stock based compensation | |

| 431,000 | | |

| 355,000 | | |

| 76,000 | | |

| 21 | % |

| Legal, professional and consulting fees | |

| 236,000 | | |

| 311,000 | | |

| (75,000 | ) | |

| -24 | % |

| Director fees paid in cash | |

| - | | |

| 75,000 | | |

| (75,000 | ) | |

| -100 | % |

| Research and development | |

| 88,000 | | |

| 347,000 | | |

| (259,000 | ) | |

| -75 | % |

| Other general and administrative expenses | |

| 381,000 | | |

| 543,000 | | |

| (162,000 | ) | |

| -30 | % |

| General and administrative expense | |

$ | 2,065,000 | | |

$ | 2,637,000 | | |

$ | (572,000 | ) | |

| -22 | % |

General

and administrative expense decreased approximately $572,000 (-22%) from approximately $2,637,000 in 2022 to $2,065,000 in 2023.

Personnel

cost represents the cost of employees including salaries, bonuses, employee benefits and employment taxes and continues to be our largest

cost. Personnel cost decreased by approximately $77,000 (-8%) from approximately $1,006,000 to $929,000. The decrease in personnel cost

resulted primarily from the confirmation and recognition of our 2021 COVID-related tax credit, partially offset by bonus expense from

the 2023 decision to cash settle a portion of the 2022 performance stock units.

Stock-based

compensation increased by approximately $76,000 (21%) from $355,000 to $431,000 because 2023 directors’ fees that were expected

to be paid in cash were converted to stock-based compensation.

Legal,

professional and consulting fees decreased by $75,000 (-24%). We reduced outside services in an effort to conserve working capital.

Research

and development expense decreased approximately $259,000 (-75%) from approximately $347,000 in 2022 to $88,000 in 2023. Expense was elevated

in 2022 as we incurred pre-production expense related to the launch of our carton format, while 2023 expense was limited as activities

were minimized to conserve working capital.

Other

general and administrative expenses decreased approximately $162,000 (-30%) from approximately $543,000 in 2022 to $381,000 in 2023 primarily

as a result of non-recurring costs related to our uplisting to the NASDAQ stock exchange in 2022, partially offset by legal costs related

by our dispute with the Manufacturer.

Net

loss

We

had net losses of approximately $2,123,000 and $4,276,000 for the nine-month periods ended September 30, 2023 and 2022, respectively.

The decrease in net loss of approximately $2,153,000, was the result of the non-recurrence of the estimated refund claims and inventory

disposal costs associated with the product withdrawal, improved margins, and a reduction of approximately $835,000 in operating expenses

due to cost saving measures, reduced volume of product shipped, and the recognition of our COVID-related tax credit.

Liquidity

and Capital Resources

As

of September 30, 2023, we had working capital of $541,000 compared with $1,801,000 at December 31, 2022. The decrease in working capital

is primarily due to the operating loss for the nine months ended September 30, 2023 as adjusted for non-cash depreciation, amortization

and stock-based compensation.

During

the nine months ended September 30, 2023, we used $2,008,000 in operations.

The

impact of COVID-19 on the Company is constantly evolving. The direct impact to our operations had begun to take effect at the close of

the first quarter ended March 31, 2020. Specifically, our business was impacted by dining bans targeted at restaurants to reduce the

size of public gatherings. Such bans precluded our single serve products from being served at those establishments for a number of weeks,

and in some instances, resulted in abandoned product launches. Furthermore, many school districts closed regular attendance for a period

of time thereby disrupting sales of product into that channel. More recently, we have experienced a disruption in the supply chain for

manufacturing our products due to COVID-19. While further developments surrounding COVID-19 may arise, the business climate appears to

have stabilized in 2023.

On

June 1, 2021, the Company completed a private placement of 1,282,051 shares of its common stock at $4.68 per share, resulting in gross

proceeds of $6,000,000. In addition, holders of debt converted a total of $399,000 in principal and $234,000 in interest into 133,991

shares of common stock and debt in the amount of $840,000 was retired, leaving the Company with no debt.

From

July to October 2023, the Company executed subscription agreements for $1,880,000 of a $2,000,000 privately placed convertible

debt offering. The debt may be drawn in 25% increments, matures on the anniversary of the draw, bears interest at 10% per annum for

the term, regardless of earlier payment or conversion, and is mandatorily convertible as to principal and interest into shares of

the Company’s common stock at any time prior to maturity at the greater of $1.20 or 85% of the volume-weighted average price

of the common stock for the ten trading days immediately preceding the written notice of the conversion (the “Conversion

Price”). If the Company has not exercised the mandatory conversion, the holder of the debt has the option after six months and

on up to four occasions to convert all or any portion of the principal and interest into shares of the Company’s common stock

at the Conversion Price. On October 23, 2023, the Company issued $1,390,000 of convertible notes pursuant to the subscription

agreements, and immediately converted $1,207,000 of principal and interest into approximately 820,000 shares of common

stock.

Our

liquidity needs will depend on how quickly we are able to profitably ramp up sales, as well as our ability to control and reduce variable

operating expenses, and to continue to control and reduce fixed overhead expense. Our current dispute with the Manufacturer and the resulting

loss of product supply and legal expense continue to negatively impact our financial position, results of operations and cash flow. While

the introduction of our carton packaging format has mitigated the loss of supply, the product offering has not been accepted by some

customers or as a substitute for the bottle product in all use cases. We have identified and are actively working to develop additional

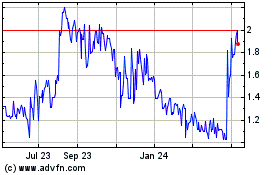

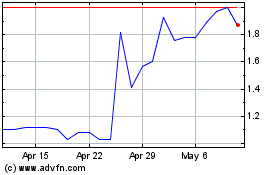

smoothie bottle manufacturing capacity. We expect expanded capacity to become available in early 2024, subject to the risks and uncertainties