UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO

Tender Offer Statement Pursuant to Section 14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

BSQUARE CORPORATION

(Name of Subject Company)

KONTRON MERGER SUB., INC.

(Offeror)

A Wholly Owned Subsidiary of

KONTRON AMERICA, INCORPORATED

(Offeror)

COMMON STOCK, NO PAR VALUE

(Title of Class of Securities)

11776U300

(CUSIP Number of Class of Securities)

Philipp Schulz

President

Kontron Merger Sub., Inc.

Industriezeile 35

4020 Linz

Austria

+43 664 60191 1075

(Name, address and telephone number of person authorized to receive notices and communications on behalf of filing persons)

with copies to:

Jay H. Knight

Taylor K. Wirth

Barnes & Thornburg LLP

827 19th Avenue South, Suite 930

Nashville, Tennessee 37203-3447

(615) 621-6100

|

☐

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

Check the appropriate boxes below to designate any transactions to which the statement relates:

| |

☒

|

third-party tender offer subject to Rule 14d-1.

|

| |

☐

|

issuer tender offer subject to Rule 13e-4.

|

| |

☐

|

going-private transaction subject to Rule 13e-3.

|

| |

☐

|

amendment to Schedule 13D under Rule 13d-2.

|

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☐

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

| |

☐

|

Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

|

| |

☐

|

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

|

This Tender Offer Statement on Schedule TO (this “Schedule TO”) relates to the tender offer by Kontron Merger Sub., Inc., a Delaware corporation (“Merger Sub”) and wholly owned subsidiary of Kontron America, Incorporated, a Delaware corporation

(“Kontron”), for all of the outstanding shares of common stock, no par value per share (“Shares”), of Bsquare Corporation, a Washington corporation (“BSQR”), at a price of $1.90 per Share, net to the seller in cash, without interest and less any

applicable withholding taxes, upon the terms and subject to the conditions set forth in the offer to purchase dated October 24, 2023 (the “Offer to Purchase”), a copy of which is attached as Exhibit (a)(1)(A), and in the related letter of transmittal

(the “Letter of Transmittal”), a copy of which is attached as Exhibit (a)(1)(B), which, as each may be amended or supplemented from time to time, collectively constitute the “Offer.” This Schedule TO is being filed on behalf of Merger Sub and Parent.

All the information set forth in the Offer to Purchase, including Schedule I thereto, is incorporated by reference herein in response to Items 1 through 9 and Item 11 of this Schedule TO, and is supplemented by the information specifically

provided in this Schedule TO.

Item 1. Summary Term Sheet.

Regulation M-A Item 1001

The information set forth in the Offer to Purchase under the caption SUMMARY TERM SHEET is incorporated herein by reference.

Item 2. Subject Company Information.

Regulation M-A Item 1002

(a) Name and Address. The name, address, and telephone number of the subject company’s principal executive offices are as follows:

Bsquare Corporation

PO Box 59478

Renton, Washington 98058

(425) 519-5900

(b)-(c) Securities; Trading Market and Price. The information set forth in the Offer to Purchase under the following captions is incorporated herein by reference:

INTRODUCTION

THE TENDER OFFER — Section 6 (“Price Range of Shares; Dividends”)

Item 3. Identity and Background of Filing Person.

Regulation M-A Item 1003

(a)-(c) Name and Address; Business and Background of Entities; and Business and Background of Natural Persons. The information set forth in the Offer to Purchase under the following captions is

incorporated herein by reference:

SUMMARY TERM SHEET

THE TENDER OFFER — Section 8 (“Certain Information Concerning Kontron, Parent and Merger Sub”)

SCHEDULE I — Information Relating to Kontron, Parent and Merger Sub

Item 4. Terms of the Transaction.

Regulation M-A Item 1004

(a) Material Terms. The information set forth in the Offer to Purchase is incorporated herein by reference.

Item 5. Past Contacts, Transactions, Negotiations and Agreements.

Regulation M-A Item 1005

(a) Transactions. The information set forth in the Offer to Purchase under the following captions is incorporated herein by reference:

SUMMARY TERM SHEET

THE TENDER OFFER — Section 10 (“Background of the Offer; Past Contacts or Negotiations with BSQR”)

(b) Significant Corporate Events. The information set forth in the Offer to Purchase under the following captions is incorporated herein by reference:

SUMMARY TERM SHEET

THE TENDER OFFER — Section 10 (“Background of the Offer; Past Contacts or Negotiations with BSQR”)

THE TENDER OFFER — Section 11 (“The Merger Agreement; Other Agreements”)

THE TENDER OFFER — Section 12 (“Purpose of the Offer; Plans for BSQR”)

Item 6. Purposes of the Transaction and Plans or Proposals.

Regulation M-A Item 1006

(a) Purposes. The information set forth in the Offer to Purchase under the following caption is incorporated herein by reference:

THE TENDER OFFER — Section 12 (“Purpose of the Offer; Plans for BSQR”)

(c) (1)-(7) Plans. The information set forth in the Offer to Purchase under the following captions is incorporated herein by reference:

SUMMARY TERM SHEET

THE TENDER OFFER — Section 9 (“Source and Amount of Funds”)

THE TENDER OFFER — Section 10 (“Background of the Offer; Past Contacts or Negotiations with BSQR”) THE TENDER OFFER — Section 11 (“The Merger Agreement; Other Agreements”)

THE TENDER OFFER — Section 12 (“Purpose of the Offer; Plans for BSQR”)

THE TENDER OFFER — Section 13 (“Certain Effects of the Offer”)

THE TENDER OFFER — Section 14 (“Dividends and Distributions”)

Item 7. Source and Amount of Funds or Other Consideration.

Regulation M-A Item 1007

(a) Source of Funds. The information set forth in the Offer to Purchase under the following captions is incorporated herein by reference:

SUMMARY TERM SHEET

THE TENDER OFFER — Section 9 (“Source and Amount of Funds”)

(b) Conditions. The information set forth in the Offer to Purchase under the following captions is incorporated herein by reference:

SUMMARY TERM SHEET

THE TENDER OFFER — Section 9 (“Source and Amount of Funds”)

THE TENDER OFFER — Section 10 (“Background of the Offer; Past Contacts or Negotiations with BSQR”) THE TENDER OFFER — Section 11 (“The Merger Agreement; Other Agreements”)

THE TENDER OFFER — Section 12 (“Purpose of the Offer; Plans for BSQR”)

THE TENDER OFFER — Section 15 (“Conditions of the Offer”)

(d) Borrowed Funds. The information set forth in the Offer to Purchase under the following captions is incorporated herein by reference:

SUMMARY TERM SHEET

THE TENDER OFFER — Section 9 (“Source and Amount of Funds”)

Item 8. Interest in Securities of the Subject Company.

Regulation M-A Item 1008

(a) Securities Ownership. The information set forth in the Offer to Purchase under the following captions is incorporated herein by reference:

INTRODUCTION

THE TENDER OFFER — Section 8 (“Certain Information Concerning Kontron, Parent and Merger Sub”)

THE TENDER OFFER — Section 11 (“The Merger Agreement; Other Agreements”)

THE TENDER OFFER — Section 12 (“Purpose of the Offer; Plans for BSQR”)

SCHEDULE I — Information Relating to Kontron, Parent and Merger Sub

(b) Securities Transactions. None.

Item 9. Persons/Assets Retained, Employed, Compensated or Used.

Regulation M-A Item 1009

(a) Solicitations or Recommendations. The information set forth in the Offer to Purchase under the following captions is incorporated herein by reference:

SUMMARY TERM SHEET

THE TENDER OFFER — Section 3 (“Procedures for Accepting the Offer and Tendering Shares”)

THE TENDER OFFER — Section 10 (“Background of the Offer; Past Contacts or Negotiations with BSQR”)

THE TENDER OFFER — Section 18 (“Fees and Expenses”)

Item 10. Financial Statements.

Regulation M-A Item 1010

(a) Financial Information. Not Applicable. In accordance with the instructions to Item 10 of the Schedule TO, the financial statements are not considered material because: (i) the consideration offered

consists solely of cash; (ii) the Offer is not subject to any financing condition; and (iii) the Offer is for all outstanding securities of the subject class.

(b) Pro Forma Information. Not Applicable.

Item 11. Additional Information.

Regulation M-A Item 1011

(a) Agreements, Regulatory Requirements and Legal Proceedings. The information set forth in the Offer to Purchase under the following captions is incorporated herein by reference:

SUMMARY TERM SHEET

THE TENDER OFFER — Section 10 (“Background of the Offer; Past Contacts or Negotiations with BSQR”) THE TENDER OFFER — Section 11 (“The Merger Agreement; Other Agreements”)

THE TENDER OFFER — Section 12 (“Purpose of the Offer; Plans for BSQR”)

THE TENDER OFFER — Section 13 (“Certain Effects of the Offer”)

THE TENDER OFFER — Section 16 (“Certain Legal Matters; Regulatory Approvals”)

(c) Other Material Information. The information set forth in the Offer to Purchase and the Letter of Transmittal is incorporated herein by reference.

Item 12. Exhibits.

Regulation M-A Item 1016

|

Exhibit No.

|

Description

|

| |

|

|

|

Offer to Purchase, dated October 24, 2023.

|

| |

|

|

|

Letter of Transmittal.

|

| |

|

|

|

Notice of Guaranteed Delivery.

|

| |

|

|

|

Letter from the Information Agent to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees.

|

| |

|

|

|

Letter to Clients for Use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees.

|

| |

|

|

|

Summary Advertisement as published in The New York Times on October 24, 2023.

|

| |

|

|

|

Joint Press Release issued by Kontron America, Incorporated and Bsquare Corporation on October 11, 2023 (incorporated by reference to Exhibit 99.1 to the Schedule TO-C filed by Kontron Merger Sub., Inc. with the Securities and Exchange

Commission on October 11, 2023).

|

| |

|

|

(b)

|

Not applicable.

|

| |

|

|

|

Agreement and Plan of Merger, dated as of October 11, 2023, by and among Bsquare Corporation, Kontron America, Incorporated and Kontron Merger Sub., Inc. (incorporated by reference to Exhibit 2.1 to the Current Report on Form 8-K filed by

Bsquare Corporation with the Securities and Exchange Commission on October 11, 2023).

|

| |

|

|

|

Confidentiality Agreement, effective June 12, 2023, by and between Bsquare Corporation and Kontron AG.

|

| |

|

|

|

Tender and Support Agreement, dated October 11, 2023, by and among Kontron America, Incorporated, Kontron Merger Sub., Inc., and each of the persons set forth on Schedule A thereto (incorporated by reference to Exhibit 99.2 to the Current

Report on Form 8-K filed by Bsquare Corporation with the Securities and Exchange Commission on October 11, 2023).

|

| |

|

|

(g)

|

Not applicable.

|

| |

|

|

(h)

|

Not applicable.

|

| |

|

|

|

Filing Fee Table.

|

Item 13. Information Required by Schedule 13E-3.

Not applicable.

SIGNATURES

After due inquiry and to the best of their knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated: October 24, 2023

|

KONTRON AMERICA, INCORPORATED

|

|

| |

|

|

|

By:

|

/s/ Ted Christiansen

|

|

|

Name:

|

Ted Christiansen

|

|

|

Title:

|

General Manager

|

|

| |

|

|

| |

|

|

|

KONTRON MERGER SUB., INC.

|

|

| |

|

|

|

By:

|

/s/ Ted Christiansen

|

|

|

Name:

|

Ted Christiansen

|

|

|

Title:

|

Director and Secretary

|

|

Exhibit (a)(1)(A)

Offer to Purchase for Cash

All Outstanding Shares of Common Stock

of

BSQUARE CORPORATION

at

$1.90 Per Share

by

KONTRON MERGER SUB., INC.

a wholly owned subsidiary of

KONTRON AMERICA, INCORPORATED

THE OFFER AND WITHDRAWAL RIGHTS WILL EXPIRE AT THE END OF THE DAY, ONE MINUTE AFTER 11:59 P.M. EASTERN TIME, ON NOVEMBER 21, 2023, UNLESS THE OFFER IS EXTENDED OR EARLIER TERMINATED.

Kontron Merger Sub., Inc., a Delaware corporation (which we refer to as “Merger Sub”) and a wholly owned subsidiary of Kontron America, Incorporated, a Delaware corporation (which we refer to as “Parent”), is offering to purchase all outstanding shares of common stock, no par value per share (the “Shares”), of Bsquare Corporation, a Washington corporation (which we refer to as “BSQR” or the “Company”), at a price of $1.90 per Share, net to the seller in cash (the “Offer Price”), without interest and less any applicable withholding taxes, upon the terms and subject to the conditions set forth in this Offer to Purchase (the “Offer to Purchase”) and in the related Letter of Transmittal (the “Letter of Transmittal” which, together with this Offer to Purchase and other related materials, as each may be amended or supplemented from time to time, constitutes the “Offer”).

The Offer is being made pursuant to the Agreement and Plan of Merger, dated as of October 11, 2023 (as it may be amended from time to time, the “Merger Agreement”), by and among Parent, Merger Sub and BSQR. The Merger Agreement provides, among other things, that following the consummation of the Offer and subject to the satisfaction or waiver of certain conditions, Merger Sub will be merged with and into BSQR (the “Merger”) as soon as practicable without a vote of the shareholders of BSQR in accordance with Section 23B.11.030(9) of the Business Corporation Act of the State of Washington (“WBCA”), with BSQR continuing as the surviving corporation (which we refer to as the “Surviving Corporation”) in the Merger and thereby becoming a wholly owned subsidiary of Parent. In the Merger, each Share outstanding immediately prior to the effective time of the Merger (the “Effective Time”) (other than Shares held (i) by Parent, Merger Sub or any of Parent’s other subsidiaries, which Shares will be cancelled and will cease to exist or (ii) by shareholders who validly exercise dissenters’ rights under Washington law with respect to such Shares) will be automatically cancelled and converted into the right to receive the Offer Price, net to the seller in cash, without interest and less any applicable withholding taxes. As a result of the Merger, BSQR will cease to be a publicly traded company and will become wholly owned by Parent. Under no circumstances will interest be paid on the Offer Price, regardless of any extension of the Offer or any delay in making payment for Shares.

The Offer is conditioned upon, among other things, (a) the absence of a termination of the Merger Agreement in accordance with its terms (the “Termination Condition”) and (b) the satisfaction of:

• | the Minimum Condition (as described below); |

• | the Governmental Impediment Condition (as described below); and |

• | the CFIUS Approval Condition (as described below). |

The Offer is not subject to a financing condition. The Minimum Condition requires that the number of Shares validly tendered in accordance with the terms of the Offer and not validly withdrawn on or prior to the end of the day, one minute after 11:59 P.M., on November 21, 2023 (the “Expiration Date”, unless Merger Sub shall have extended the period during which the Offer is open in accordance with the Merger Agreement, in which event “Expiration Date” shall mean the latest time and date at which the Offer, as so extended by Merger

Sub, will expire), together with all other Shares (if any) beneficially owned by Parent and its affiliates, equals one Share more than 66 2/3% of the sum of (i) the total number of Shares outstanding at the time of the expiration of the Offer, plus (ii) the total number of Shares that the Company is required to issue upon conversion, settlement, exchange or exercise of all options, warrants, rights or securities for which the holder has, by the time of the expiration of the Offer, elected to convert, settle, exchange or exercise or for which the conversion, settlement, exchange or exercise date has already occurred (but without duplication).

The Governmental Impediment Condition requires that there has not been any judgment, order, injunction, decree or ruling, which remains in effect, by any governmental body, restraining, enjoining or otherwise preventing the acquisition of or payment for Shares pursuant to the Offer or the execution and delivery of the Merger Agreement, and all of the transactions contemplated by the Merger Agreement, including the Offer and the Merger (the “Transactions”), nor has there been any law promulgated, enacted, issued or deemed applicable to any of the Transactions by any governmental body which prohibits or makes illegal the acquisition of or payment for Shares pursuant to the Offer or the consummation of the Merger.

The CFIUS Approval Condition provides that, to the extent required: (i) the parties shall have received written notice from the Committee on Foreign Investment in the United States and each member agency thereof, acting in such capacity (“CFIUS”), that review or investigation under the Defense Production Act of 1950, as amended and codified at 50 U.S.C. § 4565, including all implementing regulations thereof (the “DPA”), of the Transactions has been concluded, and CFIUS shall have determined that there are no unresolved national security concerns with respect to the Transactions, and advised that action under the DPA, and any investigation related thereto, has been concluded with respect to the Transactions; (ii) CFIUS shall have concluded that the Transactions are not a covered transaction and not subject to review under the DPA; or (iii) CFIUS has sent a report to the President of the United States requesting the President’s decision on the joint voluntary notice with respect to the Transactions prepared by the parties and submitted to CFIUS in accordance with the requirements of the DPA (the “CFIUS Notice”) and either (a) the period under the DPA during which the President may announce his decision to take action to suspend or prohibit the Transactions shall have elapsed without any such action being announced or taken, or (b) the President shall have announced a decision to take no action to suspend or prohibit the Transactions. See Section 15 — “Conditions to the Offer.”

The board of directors of BSQR (which we refer to as the “BSQR Board”), among other things, has (i) determined that the Merger Agreement and transactions contemplated thereby are fair to and in the best interest of BSQR and its shareholders, (ii) declared it advisable to enter into the Merger Agreement, (iii) approved the execution, delivery and performance by BSQR of the Merger Agreement and the consummation of the transactions contemplated thereby, including the Offer and the Merger, (iv) resolved that the Merger be effected under Section 23B.11.030(9) of the WBCA and (v) resolved to recommend that the shareholders of BSQR accept the Offer and tender their Shares to Merger Sub pursuant to the Offer.

A summary of the principal terms of the Offer appears under the heading “Summary Term Sheet.” You should read this entire Offer to Purchase carefully before deciding whether to tender your Shares pursuant to the Offer.

October 24, 2023

IMPORTANT

If you desire to tender all or any portion of your Shares to Merger Sub pursuant to the Offer, you should either (a) complete and sign the Letter of Transmittal for the Offer, which is enclosed with this Offer to Purchase, in accordance with the instructions contained in the Letter of Transmittal, and mail or deliver the Letter of Transmittal (or a manually executed facsimile thereof) and any other required documents to Broadridge Corporate Issuer Solutions, LLC, in its capacity as depositary and paying agent for the Offer (which we refer to as the “Depositary”), and either deliver the certificates for your Shares to the Depositary along with the Letter of Transmittal (or a manually executed facsimile thereof) or tender your Shares by book-entry transfer by following the procedures described in Section 3 — “Procedures for Accepting the Offer and Tendering Shares,” in each case prior to the Expiration Date, or (b) request that your broker, dealer, commercial bank, trust company or other nominee effect the transaction for you. If you hold Shares registered in the name of a broker, dealer, commercial bank, trust company or other nominee, you must contact that institution in order to tender your Shares to Merger Sub pursuant to the Offer. If you are a record holder but your stock certificate is not available or you cannot deliver it to the Depositary before the Offer expires, you may be able to tender your Shares using the enclosed Notice of Guaranteed Delivery (See Section 3 — “Procedures for Accepting the Offer and Tendering Shares” for further details).

* * * * *

Questions and requests for assistance should be directed to the Information Agent (as described herein) at its address and telephone numbers set forth below and on the back cover of this Offer to Purchase. Additional copies of this Offer to Purchase, the related Letter of Transmittal and other materials related to the Offer may also be obtained for free from the Information Agent. Additionally, copies of this Offer to Purchase, the related Letter of Transmittal and any other material related to the Offer may be obtained at the website maintained by the Securities and Exchange Commission (the “SEC”) at www.sec.gov. You may also contact your broker, dealer, commercial bank, trust company or other nominee for assistance.

This Offer to Purchase and the related Letter of Transmittal contain important information and you should read both carefully and in their entirety before making a decision with respect to the Offer.

The Offer has not been approved or disapproved by the SEC or any state securities commission, nor has the SEC or any state securities commission passed upon the fairness or merits of or upon the accuracy or adequacy of the information contained in this Offer to Purchase. Any representation to the contrary is unlawful.

The Information Agent for the Offer is:

D.F. King & Co., Inc.

48 Wall Street, 22nd Floor

New York, NY 10005

Email: BSQR@dfking.com

Shareholders may call toll free: (800) 967-5084

Banks and Brokers may call collect: (212) 269-5550

October 24, 2023

TABLE OF CONTENTS

| | | |

| | | |

| | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | |

| | | |

The information contained in this summary term sheet is a summary only and is not meant to be a substitute for the more detailed description and information contained in the Offer to Purchase, the Letter of Transmittal and other related materials. You are urged to read carefully the Offer to Purchase, the Letter of Transmittal and other related materials in their entirety. Parent and Merger Sub have included cross-references in this summary term sheet to other sections of the Offer to Purchase where you will find more complete descriptions of the topics mentioned below. The information concerning BSQR contained herein and elsewhere in the Offer to Purchase has been provided to Parent and Merger Sub by BSQR or has been taken from or is based upon publicly available documents or records of BSQR on file with the United States Securities and Exchange Commission (“SEC”) (or other public sources at the time of the Offer). Parent and Merger Sub have not independently verified the accuracy and completeness of such information.

Securities Sought | | | All issued and outstanding shares of common stock, no par value per share, of Bsquare Corporation (the “Shares”). See Section 1 — “Terms of the Offer.” |

| | | |

Price Offered Per Share | | | $1.90 per Share, net to the seller in cash (the “Offer Price”), without interest and less any applicable withholding taxes. As a result of the Merger, BSQR will cease to be a publicly traded company and will become a wholly owned subsidiary of Parent. Under no circumstances will interest be paid on the Offer Price, regardless of any extension of the Offer or any delay in making payment for Shares. See Section 1 — “Terms of the Offer.” |

| | | |

Scheduled Expiration of Offer | | | End of the day, one minute after 11:59 P.M., Eastern Time, on November 21, 2023, unless the offer is extended or terminated. See Section 1 — “Terms of the Offer.” |

| | | |

Merger Sub | | | Kontron Merger Sub., Inc., a Delaware corporation and a wholly owned subsidiary of Kontron America, Incorporated, a Delaware corporation. See the “Introduction” and Section 8 — “Certain Information Concerning Kontron AG, Parent and Merger Sub.” |

Who is offering to purchase my shares?

Kontron Merger Sub., Inc., or “Merger Sub”, a wholly owned subsidiary of Kontron America, Incorporated, or “Parent”, is offering to purchase for cash all of the issued and outstanding Shares. Merger Sub is a Delaware corporation that was formed for the sole purpose of making the Offer and completing the process by which Merger Sub will be merged with and into BSQR. See the “Introduction” and Section 8 — “Certain Information Concerning Kontron AG, Parent and Merger Sub.”

Unless the context indicates otherwise, in this Offer to Purchase, we use the terms “us”, “we” and “our” to refer to Merger Sub and, where appropriate, Parent. We use the term “Parent” to refer to Kontron America, Incorporated alone, the term “Merger Sub” to refer to Kontron Merger Sub., Inc. alone and the terms “BSQR” and the “Company” to refer to Bsquare Corporation alone.

What are the classes and amounts of securities sought in the Offer?

We are offering to purchase all of the outstanding Shares of BSQR on the terms and subject to the conditions set forth in this Offer to Purchase. Unless the context otherwise requires, in this Offer to Purchase we use the term “Offer” to refer to this offer and the term “Shares” to refer to Shares of BSQR common stock.

See the “Introduction” to this Offer to Purchase and Section 1 — “Terms of the Offer.”

Why are you making the Offer?

We are making the Offer because we want to acquire the entire equity interest in BSQR. If the Offer is consummated, pursuant to the Merger Agreement (as defined below), Parent intends immediately thereafter to cause Merger Sub to consummate the Merger (as described below). Upon consummation of the Merger, BSQR would cease to be a publicly traded company and would be a wholly owned subsidiary of Parent.

How much are you offering to pay and what is the form of payment? Will I have to pay any fees or commissions?

We are offering to pay $1.90 per Share net to the seller in cash, without interest and less any applicable withholding taxes. If you are the record owner of your Shares and you tender your Shares to us in the Offer, you will not have to pay brokerage fees, commissions or similar expenses. If you own your Shares through a broker or other nominee and your broker or other nominee tenders your Shares on your behalf, your broker or nominee may charge you a fee for doing so. You should consult your broker or nominee to determine whether any charges will apply.

See the “Introduction,” Section 1 — “Terms of the Offer” and Section 2 — “Acceptance for Payment and Payment for Shares.”

Is there an agreement governing the Offer?

Yes. Parent, Merger Sub and BSQR have entered into an Agreement and Plan of Merger, dated as of October 11, 2023 (as it may be amended from time to time, the “Merger Agreement”). The Merger Agreement provides, among other things, for the terms and conditions to the Offer and the subsequent merger of Merger Sub with and into BSQR (the “Merger”). If the Minimum Condition (as defined below) is satisfied and we consummate the Offer, we intend to effect the Merger as promptly as practicable without any vote by the shareholders of BSQR pursuant to Section 23B.11.030(9) of the Business Corporation Act of the State of Washington (“WBCA”).

See Section 11 — “The Merger Agreement; Other Agreements” and Section 15 — “Conditions to the Offer.”

Will you have the financial resources to make payment?

Yes. Consummation of the Offer is not subject to any financing condition. The total amount of funds required by Parent and Merger Sub to consummate the Offer and purchase all outstanding Shares in the Offer, provide funding for the Merger, provide funding for the payment in respect of outstanding In The Money Options (as defined below), vested Company RSUs (as defined below) and vested Company PSUs (as defined below), is approximately $38 million, plus related fees and expenses. Parent anticipates funding such cash requirements from its cash on hand.

See Section 9 — “Source and Amount of Funds.”

Is your financial condition relevant to my decision to tender my Shares in the Offer?

No. We do not think our or Merger Sub’s financial condition is relevant to your decision whether to tender Shares and accept the Offer because:

• | the Offer is not subject to any financing condition; |

• | if Merger Sub consummates the Offer, it will acquire all remaining Shares for the same consideration in the Merger; |

• | the Offer is being made for all outstanding Shares solely for cash; and |

• | Parent and/or one or more of its affiliates has, and will arrange for Merger Sub to have, sufficient funds available to pay the Offer Price in respect of all Shares validly tendered in the Offer, and not properly withdrawn, prior to the Expiration Date (as defined below) and to acquire the remaining outstanding Shares in the Merger. |

How long do I have to decide whether to tender my Shares in the Offer?

You will have until the end of the day, one minute after 11:59 P.M., Eastern Time, on November 21, 2023, unless we extend the Offer pursuant to the terms of the Merger Agreement (such date and time, as it may be extended in accordance with the terms of the Merger Agreement, the “Expiration Date”) or the Offer is earlier terminated. If you cannot deliver everything required to make a valid tender to the Depositary (as described below) prior to such time, you may be able to use a guaranteed delivery procedure, which is described in Section 3 — “Procedures for Accepting the Offer and Tendering Shares.” Please give your broker, dealer, commercial bank, trust company or other nominee instructions with sufficient time to permit such nominee to tender your Shares by the Expiration Date.

Acceptance and payment for Shares pursuant to and subject to the conditions to the Offer is referred to as the “Offer Closing,” and the date and time at which such Offer Closing occurs is referred to as the “Offer Acceptance Time.” The date and time at which the Merger becomes effective is referred to as the “Effective Time.”

See Section 1 — “Terms of the Offer” and Section 3 — “Procedures for Accepting the Offer and Tendering Shares.”

Can the Offer be extended and under what circumstances?

Yes, the Offer can be extended. In certain circumstances, we are required to extend the Offer beyond the initial Expiration Date, but we will not be (i) required to extend the Offer beyond the earliest to occur of (A) the valid termination of the Merger Agreement and (B) April 10, 2024 (the “Extension Deadline”) or (ii) permitted to extend the Offer beyond the Extension Deadline without the Company’s prior written consent.

We have agreed in the Merger Agreement that, subject to our rights to terminate the Merger Agreement in accordance with its terms, (i) if, as of the then-scheduled Expiration Date, any Offer Condition (as defined below) has not been satisfied or waived (to the extent waivable by Merger Sub or Parent), Merger Sub or Parent may, in their sole discretion, extend the Offer on one or more occasions, for an additional period of up to ten (10) business days per extension, in order to permit the satisfaction of such Offer Condition; (ii) Merger Sub will, and Parent will cause Merger Sub to, extend the Offer for: (A) any period required by applicable securities law, rule or regulation, any interpretation or position of the SEC or its staff or The NASDAQ Stock Market LLC (“NASDAQ”) applicable to the Offer; and (B) periods of not more than ten (10) business days per extension, until any waiting period (and any extension thereof) applicable to the consummation of the Offer under any applicable antitrust or competition-related law has expired or been terminated; and (iii) if, as of the then-scheduled Expiration Date, any Offer Condition has not been satisfied or waived, at the request of BSQR, Merger Sub will, and Parent will cause Merger Sub to, extend the Offer for an additional period of not more than ten (10) business days per extension, in order to permit the satisfaction of such Offer Condition. However, Parent or Merger Sub is not required to extend the Offer beyond the Extension Deadline and may not extend the Offer beyond the Extension Deadline without BSQR’s consent. If we extend the Offer, such extension will extend the time that you will have to tender (or withdraw) your Shares.

See Section 1 — “Terms of the Offer” of this Offer to Purchase for more details on our obligation and ability to extend the Offer.

How will I be notified if the Offer is extended?

If we extend the Offer, we will inform Broadridge Corporate Issuer Solutions, LLC which is the depositary and paying agent for the Offer (the “Depositary”), of any extension and will issue a press release announcing the extension not later than 9:00 A.M., Eastern Time, on the next business day after the previously scheduled Expiration Date.

See Section 1 — “Terms of the Offer.”

Will there be a subsequent offering period?

No. The Merger Agreement does not contemplate a subsequent offering period for the Offer and we expect the Merger to occur as promptly as practicable after the consummation of the Offer and we acquire more than 66 2/3% of the Shares in the Offer, without a subsequent offering period.

What are the conditions to the Offer?

The Offer is conditioned upon the satisfaction or waiver of the following conditions (the “Offer Conditions”):

• | the number of Shares validly tendered in accordance with the terms of the Offer and not validly withdrawn on or prior to one minute after 11:59 P.M., Eastern Time on the Expiration Date, together with all other Shares (if any) beneficially owned by Parent and its affiliates, equals one Share more than 66 2/3% of the sum of (i) the total number of Shares outstanding at the time of the expiration of the Offer, plus (ii) the total number of Shares that the Company is required to issue upon conversion, |

settlement, exchange or exercise of all options, warrants, rights or securities for which the holder has, at the time of the expiration of the Offer, elected to convert, settle, exchange or exercise or for which the conversion, settlement, exchange or exercise date has already occurred (but without duplication) (the “Minimum Condition”);

• | there has not been any judgment, temporary restraining order, preliminary or permanent injunction or other order, decree or ruling, which remains in effect, by any governmental body of competent jurisdiction restraining, enjoining or otherwise preventing the acquisition of or payment for Shares pursuant to the Offer or the consummation of any of the execution and delivery of the Merger Agreement, and all of the transactions contemplated by the Merger Agreement and the Tender and Support Agreements, dated as of October 11, 2023, among Parent, Merger Sub and the BSQR shareholders party thereto (the “Support Agreements”), including the Offer and the Merger (the “Transactions”), nor has there been any law promulgated, enacted, issued or deemed applicable to any of the Transactions by any governmental body which prohibits or makes illegal the acquisition of or payment for Shares pursuant to the Offer or the consummation of the Merger (the “Governmental Impediment Condition”); |

• | the Merger Agreement has not been terminated in accordance with its terms (the “Termination Condition”); |

• | the accuracy of the representations and warranties made by BSQR in the Merger Agreement, subject to the materiality and other qualifications set forth in the Merger Agreement (the “Representations Condition”); |

• | the performance or compliance of BSQR in all material respects with all of the obligations, agreements and covenants required to be performed or complied with by it under the Merger Agreement (the “Covenants Condition”); |

• | since the date of the Merger Agreement, there has not occurred any event, occurrence, circumstance, change or effect which, individually or in the aggregate, has had, or would reasonably be expected to have, a Material Adverse Effect (as described below) (the “Material Adverse Effect Condition”); |

• | to the extent required, the parties shall have received written notice from the Committee on Foreign Investment in the United States and each member agency thereof, acting in such capacity (“CFIUS”), that review or investigation under the Defense Production Act of 1950, as amended and codified at 50 U.S.C. § 4565, including all implementing regulations thereof (the “DPA”), of the Transactions has been concluded, and CFIUS shall have determined that there are no unresolved national security concerns with respect to the Transactions, and advised that action under the DPA, and any investigation related thereto, has been concluded with respect to the Transactions; (ii) CFIUS shall have concluded that the Transactions are not a covered transaction and not subject to review under the DPA; or (iii) CFIUS has sent a report to the President of the United States requesting the President’s decision on the joint voluntary notice with respect to the Transactions prepared by the parties and submitted to CFIUS in accordance with the requirements of the DPA (the “CFIUS Notice”) and either (a) the period under the DPA during which the President may announce his decision to take action to suspend or prohibit the Transactions shall have elapsed without any such action being announced or taken, or (b) the President shall have announced a decision to take no action to suspend or prohibit the Transactions (the “CFIUS Approval Condition”); and |

• | Parent and Merger Sub have received a certificate executed on behalf of the Company by the chief executive officer and the chief financial officer of the Company confirming that the Representations Condition, the Covenants Condition and the Material Adverse Effect Condition have been satisfied. |

Merger Sub expressly reserves the right to (i) increase the Offer Price, (ii) waive any Offer Condition, (iii) make any other changes in the terms and conditions to the Offer that are not inconsistent with the terms of the Merger Agreement and (iv) terminate the Offer if the conditions to the Offer are not satisfied and the Merger Agreement is terminated. However, without the prior written consent of BSQR, Parent and Merger Sub are not permitted to (i) decrease the Offer Price, (ii) change the form of consideration payable in the Offer, (iii) decrease the maximum number of Shares sought to be purchased in the Offer, (iv) impose conditions on or requirements to the Offer in addition to the Offer Conditions, (v) amend, modify or waive the Minimum Condition, Termination Condition, or the Government Impediment Condition, (vi) otherwise amend or modify any other

term of the Offer in a manner that adversely affects, or would reasonably be expected to adversely affect, any holder of Shares, (vii) terminate the Offer or accelerate, extend or otherwise change the Expiration Date, in each case, except as provided in the Merger Agreement or (viii) provide any “subsequent offering period” (or any extension thereof) within the meaning of Rule 14d-11 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Offer may not be withdrawn prior to the Expiration Date of the Offer unless the Merger Agreement is terminated in accordance with its terms.

See Section 15 — “Conditions to the Offer.”

Have any BSQR shareholders entered into agreements with Parent, Merger Sub or their affiliates requiring them to tender their Shares pursuant to the Offer?

Yes. In connection with the execution of the Merger Agreement, Parent entered into separate Support Agreements with certain shareholders of BSQR, as well as each director and executive officer of BSQR (the “Supporting Shareholders”). Subject to the terms and conditions of the Support Agreements, each of the Supporting Shareholders agreed, among other things, subject to certain exceptions, to tender his or her Shares (including any Shares acquired upon the exercise of Company Options (as defined below)), pursuant to the Offer, which Shares represent in the aggregate approximately 17.3% of BSQR’s total outstanding Shares as of October 6, 2023, and, subject to certain exceptions, not to transfer any of the Shares that are subject to the Support Agreements. See Section 11 — “The Merger Agreement; Other Agreements” in this Offer to Purchase for a description of the Support Agreements.

How do I tender my Shares?

If you hold your Shares directly as the registered owner, you can (i) tender your Shares in the Offer by delivering the certificates representing your Shares, together with a completed and signed Letter of Transmittal and any other documents required by the Letter of Transmittal, to the Depositary or (ii) tender your Shares by following the procedure for book-entry transfer set forth in Section 3 of this Offer to Purchase, no later than the Expiration Date. If you are the registered owner but your stock certificate is not available or you cannot deliver it to the Depositary before the Offer expires, you may have a limited amount of additional time by having a broker, a bank or other fiduciary that is an eligible institution guarantee that the missing items will be received by the Depositary within two (2) NASDAQ trading days. For the tender to be valid, however, the Depositary must receive the missing items within that two (2) trading-day period. See Section 3 — “Procedures for Accepting the Offer and Tendering Shares” for further details. The Letter of Transmittal is enclosed with this Offer to Purchase.

If you hold your Shares in street name through a broker, dealer, commercial bank, trust company or other nominee, you must contact the institution that holds your Shares and give instructions that your Shares be tendered. You should contact the institution that holds your Shares for more details.

See Section 3 — “Procedures for Accepting the Offer and Tendering Shares.”

Until what time may I withdraw previously tendered Shares?

You may withdraw your previously tendered Shares at any time until the Expiration Date. In addition, pursuant to Section 14(d)(5) of the Exchange Act, Shares may be withdrawn at any time after December 26, 2023, which is the first business day following the 60th day after the date of the commencement of the Offer, unless prior to that date Merger Sub has accepted for payment the Shares validly tendered in the Offer.

See Section 4 — “Withdrawal Rights.”

How do I withdraw previously tendered Shares?

To withdraw previously tendered Shares, you must deliver a written notice of withdrawal, or a facsimile of one, with the required information to the Depositary while you still have the right to withdraw Shares. If you tendered Shares by giving instructions to a broker, dealer, commercial bank, trust company or other nominee, you must instruct the broker, dealer, commercial bank, trust company or other nominee to arrange for the withdrawal of your Shares.

See Section 4 — “Withdrawal Rights.”

What does the BSQR board of directors think of the Offer?

The board of directors of BSQR (which we refer to as the “BSQR Board”), among other things, has (i) determined that the Merger Agreement and transactions contemplated thereby are fair to and in the best interest of BSQR and its shareholders, (ii) declared it advisable to enter into the Merger Agreement, (iii) approved the execution, delivery and performance by BSQR of the Merger Agreement and the consummation of the Transactions, including the Offer and the Merger, (iv) resolved that the Merger be effected under Section 23B.11.030(9) of the WBCA and (v) resolved to recommend that the shareholders of BSQR accept the Offer and tender their Shares to Merger Sub pursuant to the Offer.

See the “Introduction” and Section 10 — “Background of the Offer; Past Contacts or Negotiations with BSQR.” A more complete description of the reasons for the BSQR Board’s approval of the Offer and the Merger is set forth in a Solicitation/Recommendation Statement on Schedule 14D-9 that is being mailed to all BSQR shareholders together with this Offer to Purchase.

If the Offer is completed, will BSQR continue as a public company?

No. Immediately following consummation of the Offer, we expect to complete the Merger pursuant to applicable provisions of Delaware and Washington law, after which the Surviving Corporation will be a wholly owned subsidiary of Parent and the Shares will no longer be publicly traded.

See Section 13 — “Certain Effects of the Offer.”

Will the Offer be followed by the Merger if all of the Shares are not tendered in the Offer?

Pursuant to the Merger Agreement, if the Minimum Condition is not satisfied, we are not required (nor are we permitted) to accept the Shares for purchase in the Offer or to consummate the Merger. We may not waive the Minimum Condition without the consent of BSQR, and if BSQR provides such consent it would call a special meeting of shareholders to approve the Transaction. We are not required to request that BSQR waive the Minimum Condition.

If the Minimum Condition is satisfied and we have acquired more than 66 2/3% of outstanding Shares, then, in accordance with the terms of the Merger Agreement, we will complete the Merger without a vote of the shareholders of BSQR pursuant to Section 23B.11.030(9) of the WBCA. If Merger Sub acquires more than 66 2/3% of the Shares in the Offer, Merger Sub shall consummate the Merger under Section 23B.11.030(9) of the WBCA without a shareholders meeting and without action by the Company’s shareholders.

Under the applicable provisions of the Merger Agreement, the Offer and the WBCA, shareholders of BSQR (i) will not be required to vote on the Merger, (ii) will be entitled to dissenters’ rights under Washington law in connection with the Merger with respect to any Shares not tendered in the Offer and (iii) will, if they do not validly exercise dissenters’ rights under Washington law, receive the same Offer Price, without interest and less any applicable withholding taxes, for their Shares as was payable in the Offer (the “Merger Consideration”).

See Section 11 — “The Merger Agreement; Other Agreements,” Section 12 — “Purpose of the Offer; Plans for BSQR — Merger Without a Shareholder Vote” and Section 17 — “Dissenters’ Rights.”

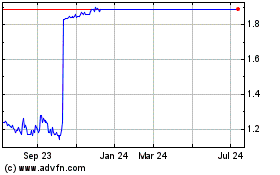

What is the market value of my Shares as of a recent date?

On October 10, 2023, the trading day before the public announcement of the execution of the Merger Agreement, the reported closing sales price of the Shares on NASDAQ was $1.19. On October 20, 2023, the reported closing sales price of the Shares on NASDAQ was $1.85. The Offer Price represents an approximately 63% premium over the closing price of the Shares on October 10, 2023, the last full trading day before the announcement of the Merger Agreement, and a 62% premium to the trailing 52-week volume weighted average of BSQR's closing stock prices as of October 10, 2023.

See Section 6 — “Price Range of Shares; Dividends.”

Will I be paid a dividend on my Shares during the pendency of the Offer?

No. The Merger Agreement provides that from the date of the Merger Agreement to the Effective Time, without the prior written consent of Parent, BSQR will not establish a record date for, declare, set aside or pay any dividend or make any other distributions (whether in cash, stock or property) on any shares of any BSQR securities (including the Shares).

See Section 6 — “Price Range of Shares; Dividends.”

Will I have dissenters’ rights in connection with the Offer or the Merger?

No dissenters’ rights will be available with respect to Shares tendered and accepted for purchase in the Offer or the Merger. However, if the Merger is consummated, shareholders who do not tender their Shares in the Offer will have certain rights under Chapter 23B.13 of the WBCA to dissent and demand appraisal of, and to receive payment in cash of the fair value of, their Shares. Such dissenters’ rights, if the statutory procedures are met, could lead to a judicial determination of the fair value of the Shares required to be paid in cash to such holders asserting dissenters’ rights for their Shares.

See Section 17 — “Dissenters’ Rights.”

What will happen to my stock options in the Offer?

Pursuant to the Merger Agreement, at the Effective Time, each stock option to purchase Shares (“Company Option”) that is outstanding and unexercised, whether or not vested and which has a per share exercise price that is less than the Offer Price (each, an “In The Money Option”) will be cancelled and converted into the right to receive a cash payment equal to (i) the excess, if any, of (x) the Offer Price over (y) the exercise price payable per Share under such In the Money Option, (ii) multiplied by the total number of Shares subject to such In the Money Option immediately prior to the Effective Time (without regard to vesting), subject to any applicable withholding or other taxes required by applicable law.

Each Company Option other than an In the Money Option that is outstanding and unexercised at the Effective Time, whether or not vested (each, an “Out of the Money Option”) will be cancelled without payment of consideration and all rights with respect to such Out of the Money Option will terminate as of the Effective Time.

Each of the restricted stock units with respect to Shares that is outstanding and vested at the Effective Time, which are not Company PSUs (as defined below) (each, a “Company RSU”), will be canceled and the holder thereof will be entitled to receive (a) a cash payment equal to the product of (i) the Offer Price and (ii) the number of Shares subject to such Company RSU. Each of the then outstanding and unvested Company RSUs shall be cancelled without payment of consideration, and all rights with respect to such unvested company RSUs shall terminate as of the Effective Time.

Each of the then outstanding performance vesting restricted stock units with respect to Shares that is outstanding and vested at the Effective Time (each, a “Company PSU”) will be canceled and the holder thereof will be entitled to receive (a) a cash payment equal to the product of (i) the Offer Price and (ii) the number of Shares subject to such Company PSU immediately prior to the Effective Time (which for clarity vest only upon satisfaction of minimum price and service requirements therein). Each of the then outstanding and unvested Company PSUs shall be cancelled without payment of consideration, and all rights with respect to such unvested company PSUs shall terminate as of the Effective Time.

See Section 11 — “The Merger Agreement; Other Agreements — Merger Agreement — Treatment of Equity Awards.”

What are the United States federal income tax consequences of the Offer and the Merger?

The receipt of cash in exchange for Shares pursuant to the Offer or the Merger will be a taxable transaction for U.S. federal income tax purposes.

We urge you to consult your own tax advisor as to the particular tax consequences to you of the receipt of cash in exchange for Shares pursuant to the Offer or the Merger.

See Section 5 — “Certain U.S. Federal Income Tax Considerations” for a more detailed discussion of the tax consequences of the Offer and the Merger.

Who should I call if I have questions about the Offer?

You may call D.F. King & Co., Inc. at (800) 967-5084. D.F. King & Co., Inc. is acting as the information agent (the “Information Agent”) for our tender offer. See the back cover of this Offer to Purchase for additional contact information.

To the Holders of Shares of Common Stock of Bsquare Corporation:

Kontron Merger Sub., Inc., a Delaware corporation (“Merger Sub”) and a wholly owned subsidiary of Kontron America, Incorporated, a Delaware corporation (“Parent”), is offering to purchase all of the outstanding shares of common stock, no par value per share (the “Shares”), of Bsquare Corporation, a Washington corporation (the “Company” or “BSQR”), upon the terms and subject to the conditions set forth in this Offer to Purchase (the “Offer to Purchase”) and in the related Letter of Transmittal (the “Letter of Transmittal” which, together with this Offer to Purchase and other related materials, as each may be amended or supplemented from time to time, constitutes the “Offer”).

The Offer is being made pursuant to the Agreement and Plan of Merger, dated as of October 11, 2023 (as it may be amended from time to time, the “Merger Agreement”), by and among Parent, Merger Sub and BSQR. The Merger Agreement provides, among other things, that following the consummation of the Offer and subject to the satisfaction or waiver of certain conditions, Merger Sub will be merged with and into BSQR (the “Merger”) as soon as practicable without a vote of the shareholders of BSQR in accordance with Section 23B.11.030(9) of the Business Corporation Act of the State of Washington (“WBCA”), with BSQR continuing as the surviving corporation (the “Surviving Corporation”) in the Merger and thereby becoming a wholly owned subsidiary of Parent. In the Merger, each Share outstanding immediately prior to the effective time of the Merger (“Effective Time”) (other than Shares held by Parent, Merger Sub or any other direct or indirect wholly owned subsidiary of Parent, which Shares will be cancelled and retired and will cease to exist, and other than Shares held by a holder who validly exercises dissenters’ rights in accordance with Washington law with respect to the Shares) will be automatically converted into the right to receive (a) $1.90 per Share, net to the seller in cash (the “Offer Price”), without interest and less any applicable withholding taxes. As a result of the Merger, BSQR will cease to be a publicly traded company and will become a wholly owned subsidiary of Parent. Under no circumstances will interest be paid on the Offer Price, regardless of any extension of the Offer or any delay in making payment for Shares. The Merger Agreement is more fully described in Section 11 — “The Merger Agreement; Other Agreements,” which also contains a discussion of the treatment of BSQR stock options in the Merger.

Tendering shareholders who are record owners of their Shares and who tender directly to Broadridge Corporate Issuer Solutions, LLC, the depositary and paying agent for the Offer (the “Depositary”), will not be obligated to pay brokerage fees or commissions or, except as otherwise provided in Instruction 6 of the Letter of Transmittal, stock transfer taxes with respect to the purchase of Shares by Merger Sub pursuant to the Offer. Shareholders who hold their Shares through a broker, dealer, commercial bank, trust company or other nominee should consult such institution as to whether it charges any service fees or commissions.

The Offer is conditioned upon, among other things, the satisfaction of (a) the absence of a termination of the Merger Agreement in accordance with its terms (the “Termination Condition”), (b) the Minimum Condition (as described below), (c) the Governmental Impediment Condition (as described below), and (d) if required, the CFIUS Approval Condition (as described below). The Minimum Condition requires that the number of Shares validly tendered in accordance with the terms of the Offer and not validly withdrawn on or prior to the end of the day, one minute after 11:59 P.M., Eastern Time, on the Expiration Date, together with all other Shares (if any) beneficially owned by Parent and its affiliates, equals one Share more than 66 2/3% of the sum of (i) the total number of Shares outstanding at the time of the expiration of the Offer, plus (ii) the total number of Shares that the Company is required to issue upon conversion, settlement, exchange or exercise of all options, warrants, rights or securities for which the holder has, by the time of the expiration of the Offer, elected to convert, settle, exchange or exercise (whether then outstanding or for which the conversion, settlement, exchange or exercise date has already occurred, (but without duplication).

The Governmental Impediment Condition requires that there has not been any judgment, order, injunction, decree or ruling, which remains in effect, by any governmental body, restraining, enjoining or otherwise preventing the acquisition of or payment for Shares pursuant to the consummation of any of the Transactions and there has not been any law promulgated, enacted, issued or deemed applicable to any of the Transactions by any governmental body which prohibits or makes illegal the acquisition of or payment for Shares pursuant to the Offer or consummation of the Merger.

The CFIUS Approval Condition provides that, to the extent required: (i) the parties shall have received written notice from the Committee on Foreign Investment in the United States and each member agency thereof, acting in such capacity (“CFIUS”), that review or investigation under the Defense Production Act of 1950, as amended and codified at 50 U.S.C. § 4565, including all implementing regulations thereof (the “DPA”), of the Transactions has been concluded, and CFIUS shall have determined that there are no unresolved national security concerns with respect to the Transactions, and advised that action under the DPA, and any investigation related thereto, has been concluded with respect to the Transactions; (ii) CFIUS shall have concluded that the Transactions are not a covered transaction and not subject to review under the DPA; or (iii) CFIUS has sent a report to the President of the United States requesting the President’s decision on the joint voluntary notice with respect to the Transactions prepared by the parties and submitted to CFIUS in accordance with the requirements of the DPA (the “CFIUS Notice”) and either (a) the period under the DPA during which the President may announce his decision to take action to suspend or prohibit the Transactions shall have elapsed without any such action being announced or taken, or (b) the President shall have announced a decision to take no action to suspend or prohibit the Transactions (the foregoing (i)-(iii), “CFIUS Approval”).

The Offer is also subject to other conditions as described in this Offer to Purchase. See Section 15 — “Conditions to the Offer.” The Offer is not subject to any financing condition.

The BSQR Board, among other things, has (i) determined that the Merger Agreement and transactions contemplated thereby are fair to and in the best interest of BSQR and its shareholders, (ii) declared it advisable to enter into the Merger Agreement, (iii) approved the execution, delivery and performance by BSQR of the Merger Agreement and the consummation of the transactions contemplated thereby, including the Offer and the Merger, (iv) resolved that the Merger be effected under Section 23B.11.030(9) of the WBCA and (v) resolved to recommend that the shareholders of BSQR accept the Offer and tender their Shares to Merger Sub pursuant to the Offer.

A more complete description of the BSQR Board’s reasons for authorizing and approving the Merger Agreement and the transactions contemplated thereby, including the Offer and the Merger, is set forth in the Solicitation/Recommendation Statement on Schedule 14D-9 of BSQR (together with any exhibits and annexes attached thereto, the “Schedule 14D-9”), that is being furnished to shareholders in connection with the Offer, together with this Offer to Purchase. Shareholders should carefully read the information set forth in the Schedule 14D-9, including the information to be set forth under the sub-heading “Background and Reasons for the Company Board’s Recommendation.”

BSQR has advised Parent that, as of October 6, 2023, (i) 19,870,527 Shares were issued and outstanding, (ii) 1,183,972 Shares were subject to issuance pursuant to all options to purchase Shares (“Company Options”) granted and outstanding under the Bsquare Corporation Fourth Amended and Restated Stock Plan, as amended, the Bsquare Corporation 2011 Inducement Award Plan, and the Bsquare Corporation Executive Bonus Plan (the “Company Equity Plans”), (ii) 63,459 Shares were subject to issuance pursuant to Company restricted stock units with respect to Shares (“Company RSUs”) granted and outstanding under the Company Equity Plans, (iii) 250,000 Shares were subject to issuance pursuant to Company performance vesting restricted stock units with respect to Shares (“Company PSUs”) granted and outstanding under the Company Equity Plans, and (iv) 2,288,125 Shares were reserved for future issuance under Company Equity Plans. Based upon the foregoing and assuming (i) no additional Shares or Company Options are issued after October 6, 2023 and (ii) all Company Options are exercised in full prior to the Expiration Time, the minimum number of Shares that Merger Sub must acquire in the Offer in order to consummate the Merger under Section 23B.11.030(9) of the WBCA is 13,351,672 Shares validly tendered and not validly withdrawn prior to the expiration of the Offer.

In connection with the execution of the Merger Agreement, the Supporting Shareholders have entered into separate Tender and Support Agreements, dated as of October 11, 2023, with Parent and Merger Sub (the “Support Agreements”). Subject to the terms and conditions of the Support Agreements, each of the Supporting Shareholders agrees, among other things, subject to certain exceptions, to tender his or her Shares (including any Shares acquired upon the exercise of Company Options), pursuant to the Offer, which Shares represent in the aggregate approximately 17.3% of BSQR’s total outstanding Shares as of October 6, 2023, and, subject to certain exceptions, not to transfer any of the Shares that are subject to the Support Agreements.

Under the Merger Agreement, the board of directors and officers of the Surviving Corporation as of the Effective Time will be the members of the board of directors and officers, respectively, of Merger Sub as of immediately prior to the Effective Time, until their respective successors have been duly elected and qualified, or until their earlier death, resignation or removal.

This Offer to Purchase does not constitute a solicitation of proxies, and Merger Sub is not soliciting proxies in connection with the Offer or the Merger. If Merger Sub acquires more than 66 2/3% of the Shares in the Offer, Merger Sub shall consummate the Merger under Section 23B.11.030(9) of the WBCA without a shareholders meeting and without action by the Company’s shareholders.

Certain U.S. federal income tax considerations of the exchange of Shares for cash pursuant to the Offer or the Merger are described in Section 5 — “Certain U.S. Federal Income Tax Considerations.”

Under the applicable provisions of the Merger Agreement, the Offer and the WBCA, shareholders of BSQR will be entitled to dissenters’ rights under Washington law in connection with the Merger with respect to any Shares not tendered in the Offer, subject to and in accordance with the WBCA. Shareholders must properly perfect their right to seek appraisal under Washington law in connection with the Merger in order to exercise dissenters’ rights. See Section 17 — “Dissenters’ Rights.”

This Offer to Purchase and the related Letter of Transmittal contain important information that should be read carefully before any decision is made with respect to the Offer.

Upon the terms and subject to the conditions to the Offer (including, if the Offer is extended or amended, the terms and conditions of such extension or amendment), we will accept for payment and promptly pay for all Shares validly tendered prior to the Expiration Date and not properly withdrawn as permitted under Section 4 — “Withdrawal Rights.”

Acceptance and payment for Shares pursuant to and subject to the conditions to the Offer will occur on November 22, 2023 (the “Offer Closing”), unless we extend the Offer pursuant to the terms of the Merger Agreement. The date and time at which such Offer Closing occurs is referred to as the “Offer Acceptance Time”.

The Offer is conditioned upon, among other things, the absence of a termination of the Merger Agreement in accordance with its terms and the satisfaction of the Minimum Condition, the Governmental Impediment Condition and the other conditions described in Section 15 — “Conditions to the Offer.”

We have agreed in the Merger Agreement that, subject to our rights to terminate the Merger Agreement in accordance with its terms, Merger Sub must (and Parent must cause Merger Sub to) extend the Offer (i) for any period required by applicable securities law, rule or regulation, any interpretation or position of the SEC or its staff or The NASDAQ Stock Market LLC (“NASDAQ”) applicable to the Offer, (ii) for periods of up to ten (10) business days each until any waiting period (and extension thereof) applicable to consummation of the Offer under any applicable antitrust or competition-related law has expired or been terminated and (iii) for additional periods of up to ten (10) business days per extension at the request of BSQR if, as of the then scheduled Expiration Date, any Offer Condition has not been satisfied or waived, in order to permit the satisfaction of such Offer Condition. Additionally, Merger Sub may, in its discretion, extend the Offer on one or more occasions, if, as of the then scheduled Expiration Date, any Offer Condition has not been satisfied or waived, to the extent waivable by Merger Sub or Parent for an additional period of up to ten (10) business days per extension, in order to permit the satisfaction of such Offer Condition.

If we extend the Offer, such extension will extend the time that you will have to tender (or withdraw) your Shares. Merger Sub will not be required, or permitted without the Company’s consent, to extend the Offer beyond April 10, 2024 (the “End Date”). Except in the case of the valid termination of the Merger Agreement, Merger Sub may not terminate the Offer, or permit the Offer to expire, prior to the Extension Deadline without the prior written consent of BSQR.

Merger Sub expressly reserves the right to (i) increase the Offer Price, (ii) waive any Offer Condition, (iii) make any other changes in the terms and conditions to the Offer that are not inconsistent with the terms of the Merger Agreement and (iv) terminate the Offer if the conditions to the Offer are not satisfied and the Merger Agreement is terminated. However, without the consent of BSQR, Parent and Merger Sub may not (i) decrease the Offer Price, (ii) change the form of consideration payable in the Offer, (iii) decrease the maximum number of Shares sought to be purchased in the Offer, (iv) impose conditions or requirements to the Offer in addition to the Offer Conditions, (v) amend, modify or waive the Minimum Condition, the Termination Condition or the Governmental Impediment Condition, (vi) otherwise amend or modify any of the other terms of the Offer in a manner that adversely affects any holder of Shares in its capacity as such, (vii) terminate the Offer or accelerate, extend or otherwise change the Expiration Date except as provided in the Merger Agreement or (viii) provide any “subsequent offering period” (or any extension thereof) within the meaning of Rule 14d-11 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Any extension, delay, termination or amendment of the Offer will be followed as promptly by a public announcement in accordance with Rules 14d-3(b)(1), 14d-4(d)(1) and 14e-1(d) under the Exchange Act. Such announcement in the case of an extension will be made no later than 9:00 A.M., Eastern Time, on the next business day after the previously scheduled Expiration Date.

If we extend the Offer, are delayed in our acceptance for payment of or payment for Shares (whether before or after our acceptance for payment for Shares) or are unable to accept Shares for payment pursuant to the Offer for any reason, then, without prejudice to our rights under the Offer and the Merger Agreement, the Depositary may retain tendered Shares on our behalf, and such Shares may not be withdrawn except to the extent that tendering shareholders are entitled to withdrawal rights as described herein under Section 4 — “Withdrawal Rights.” However, our ability to delay the payment for Shares that we have accepted for payment is limited by

Rule 14e-1(c) under the Exchange Act, which requires us to pay the consideration offered or return the securities deposited by or on behalf of shareholders promptly after the termination or withdrawal of the Offer.

If we make a material change in the terms of the Offer or the information concerning the Offer or if we waive a material condition of the Offer, we will disseminate additional tender offer materials and extend the Offer if and to the extent required by Rules 14d-4(d)(1), 14d-6(c) and 14e-1 under the Exchange Act. The minimum period during which an offer must remain open following material changes in the terms of such offer or information concerning such offer, other than a change in price or a change in percentage of securities sought, will depend upon the facts and circumstances, including the relative materiality of the terms or information changes. We understand that in the SEC’s view, an offer should remain open for a minimum of five (5) business days from the date the material change is first published, sent or given to shareholders, and with respect to a change in price or a change in percentage of securities sought, a minimum ten (10) business day period generally is required to allow for adequate dissemination to shareholders and investor response.

If, on or before the Expiration Date, we increase the consideration being paid for Shares accepted for payment in the Offer, such increased consideration will be paid to all shareholders whose Shares are purchased in the Offer, whether or not such Shares were tendered before the announcement of the increase in consideration.

We expressly reserve the right, in our sole discretion, subject to the terms and conditions of the Merger Agreement and the applicable rules and regulations of the SEC, not to accept for payment any Shares if, at the Expiration Date, any of the Offer Conditions have not been satisfied. See Section 15 — “Conditions to the Offer.” Under certain circumstances, we may terminate the Merger Agreement and the Offer. See Section 11 — “The Merger Agreement; Other Agreements — Merger Agreement — Termination.”

As soon as practicable after we acquire more than 66 2/3% of the Shares in the Offer, we will complete the Merger without a vote of the shareholders of BSQR pursuant to Section 23B.11.030(9) of the WBCA.

BSQR has provided us with its shareholder list and security position listings for the purpose of disseminating this Offer to Purchase, the related Letter of Transmittal and other related materials to holders of Shares. This Offer to Purchase and the related Letter of Transmittal will be mailed to record holders of Shares whose names appear on the shareholder list of BSQR and will be furnished, for subsequent transmittal to beneficial owners of Shares, to brokers, dealers, commercial banks, trust companies and similar persons whose names, or the names of whose nominees, appear on the shareholder list or, if applicable, who are listed as participants in a clearing agency’s security position listing for subsequent transmittal to beneficial owners of Shares.

| Acceptance for Payment and Payment for Shares. |

Subject to the satisfaction or waiver of all the conditions to the Offer set forth in Section 15 — “Conditions to the Offer,” we will accept for payment and promptly pay for Shares validly tendered and not properly withdrawn pursuant to the Offer on or after the Expiration Date. Subject to compliance with Rule 14e-1(c) under the Exchange Act, we expressly reserve the right to delay payment for Shares in order to comply in whole or in part with any applicable law. See Section 16 — “Certain Legal Matters; Regulatory Approvals.”

In all cases, we will pay for Shares tendered and accepted for payment pursuant to the Offer only after timely receipt by the Depositary of (i) the certificates evidencing such Shares (the “Share Certificates”) or confirmation of a book-entry transfer of such Shares (a “Book-Entry Confirmation”) into the Depositary’s account at The Depository Trust Company (“DTC”) pursuant to the procedures set forth in Section 3 — “Procedures for Accepting the Offer and Tendering Shares,” (ii) the Letter of Transmittal (or a manually signed facsimile thereof), properly completed and duly executed, with any required signature guarantees or, in the case of a book-entry transfer, an Agent’s Message (as defined below) in lieu of the Letter of Transmittal and (iii) any other documents required by the Letter of Transmittal. Accordingly, tendering shareholders may be paid at different times depending upon when Share Certificates or Book-Entry Confirmations with respect to Shares are actually received by the Depositary.

The term “Agent’s Message” means a message, transmitted by DTC to and received by the Depositary and forming a part of a Book-Entry Confirmation, that states that DTC has received an express acknowledgment from the participant in DTC tendering the Shares that are the subject of such Book-Entry Confirmation, that such participant has received and agrees to be bound by the terms of the Letter of Transmittal and that Merger Sub may enforce such agreement against such participant.

On the terms of and subject to the Offer conditions and the Merger Agreement, Merger Sub shall, and Parent shall cause Merger Sub to, accept for payment all Shares validly tendered and not withdrawn pursuant to the Offer promptly after the Expiration Date, and to pay for such Shares promptly after the Offer Acceptance Time. For purposes of the Offer, we will be deemed to have accepted for payment, and thereby purchased, Shares validly tendered and not properly withdrawn, if and when we give oral or written notice to the Depositary of our acceptance for payment of such Shares pursuant to the Offer. Upon the terms and subject to the conditions to the Offer, payment for Shares accepted for payment pursuant to the Offer will be made by deposit of the aggregate Merger Consideration for such Shares with the Depositary, which will act as paying agent for tendering shareholders for the purpose of receiving payments from us and transmitting such payments to tendering shareholders whose Shares have been accepted for payment. If we extend the Offer, are delayed in our acceptance for payment of Shares or are unable to accept Shares for payment pursuant to the Offer for any reason, then, without prejudice to our rights under the Offer and the Merger Agreement, the Depositary may retain tendered Shares on our behalf, and such Shares may not be withdrawn except to the extent that tendering shareholders are entitled to withdrawal rights as described herein under Section 4 — “Withdrawal Rights” and as otherwise required by Rule 14e-1(c) under the Exchange Act. Under no circumstances will we pay interest on the Offer Price, regardless of any extension of the Offer or any delay in making payment for Shares.

If any tendered Shares are not accepted for payment for any reason pursuant to the terms and conditions to the Offer, or if Share Certificates are submitted evidencing more Shares than are tendered, Share Certificates evidencing unpurchased Shares will be returned, without expense to the tendering shareholder (or, in the case of Shares tendered by book-entry transfer into the Depositary’s account at DTC pursuant to the procedure set forth in Section 3 — “Procedures for Accepting the Offer and Tendering Shares,” such Shares will be credited to an account maintained at DTC), promptly following the expiration or termination of the Offer.

| Procedures for Accepting the Offer and Tendering Shares. |