Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

October 19 2023 - 6:06AM

Edgar (US Regulatory)

|

|

|

|

|

|

|

Issuer Free Writing Prospectus

Filed by Mitsubishi UFJ Financial Group, Inc. |

|

|

|

|

Pursuant to Rule 433

Reg-Statement No. 333-273681

October 18, 2023 |

$750,000,000 8.2% Fixed Rate Resetting Perpetual Subordinated Debt Securities

|

|

|

| Issuer: |

|

Mitsubishi UFJ Financial Group, Inc. (the “Company”) |

|

|

| Size: |

|

U.S.$750,000,000 |

|

|

| Issuer Ratings (Moody’s / S&P / Fitch)*: |

|

A1 / A- / A- |

|

|

| Expected Security Ratings (Moody’s /S&P / Fitch)*: |

|

Baa3 / BB+ / BB+ |

|

|

| Security Type: |

|

Fixed Rate Resetting Perpetual Subordinated Debt Securities (the “Securities”) |

|

|

| Ranking: |

|

The Securities, when issued, will constitute direct and unsecured obligations of the Company that are conditional and perpetual and, in the event of liquidation of the Company, will be subordinated to all of the Company’s

existing and future obligations other than liabilities under the Securities and the Company’s liabilities that rank effectively pari passu with or subordinate to the Securities as to liquidation distributions of the Company (including

any other series of perpetual subordinated debt securities), will rank pari passu with the Company’s liabilities that rank effectively pari passu with the Securities as to liquidation distributions of the Company, and will rank

senior in priority only to any payments to holders of common shares of the Company, subject to a principal write-down. The Securities will be structurally subordinated to the liabilities of the Company’s subsidiaries. |

|

|

| Currency: |

|

U.S.$ |

|

|

| Trade Date: |

|

October 18, 2023 |

|

|

| Settlement Date: |

|

October 26, 2023 (the “Issue Date”) |

|

|

| Maturity: |

|

Perpetual, with no fixed maturity or fixed redemption date |

|

|

| Coupon: |

|

From (and including) the Issue Date to (but excluding) the first Reset Date (as defined below), the interest rate on the Securities will be

8.2% per annum From (and including) each Reset Date to (but excluding) the next

following Reset Date (each, a “reset fixed rate period”), the Securities will bear interest at a fixed per annum rate (the “Reset Fixed Rate”) equal to the applicable U.S. Treasury Rate (as defined below) as determined by the

Calculation Agent (as defined below) on the applicable Reset Determination Date (as defined below), plus 3.294% |

|

|

| Reset Date: |

|

January 15, 2029 and each fifth year anniversary thereafter (each, a “Reset Date”) |

|

|

| Reset Determination Date: |

|

The second Business Day (as defined in the Preliminary Prospectus (as defined below)) immediately preceding the applicable Reset Date |

1

|

|

|

| Interest Payment Dates: |

|

Semi-annually in arrears on January 15 and July 15 of each year |

|

|

| First Interest Payment Date: |

|

January 15, 2024 (short first coupon) |

|

|

| Benchmark Treasury: |

|

4.625% due 9/2028 4.625% due

9/2030 |

|

|

| Benchmark Treasury Spot (Price/Yield): |

|

98-252 / 4.903% 98-08+ / 4.922% |

|

|

| Interpolated Treasury Yield: |

|

4.906% |

|

|

| Spread to Benchmark Treasury: |

|

329.4 basis points |

|

|

| Determination of the Reset Fixed Rate and the U.S. Treasury Rate: |

|

The Reset Fixed Rate and the U.S. Treasury Rate in respect of each reset fixed rate period shall be determined by The Bank of New York Mellon

as calculation agent (the “Calculation Agent”) as soon as practicable after 5.00 p.m. (New York City time) on the Reset Determination Date.

“U.S. Treasury Rate” means, with respect to a reset fixed rate period, the rate per annum equal to: (1) the arithmetic average, as determined by

the Calculation Agent, of the yields on actively traded U.S. Treasury securities adjusted to constant maturity for the maturity of five years (“Yields”) for the five consecutive New York Business Days (as defined below) immediately prior

to the Reset Determination Date based on information appearing in the statistical release designated “H.15” (or any successor publication that reports Yields) most recently published by the Board of Governors of the U.S. Federal Reserve

System as of 5:00 p.m. (New York City time) on the Reset Determination Date; provided that if the Yield is not available through such release (or any successor publication) for any relevant New York Business Day, then the arithmetic average will be

determined based on the Yields for the remaining New York Business Days during the five New York Business Day period described above (provided further that if the Yield is available for only a single New York Business Day during such five New York

Business Day period, then “U.S. Treasury Rate” will mean the single-day Yield for such day); or (2) if no information is available to determine the U.S. Treasury Rate in accordance with the

method set forth in (1) above by using the Yield for at least a single New York Business Day during the five New York Business Day period described above, then the annualized yield to maturity of the Comparable Treasury Issue (as defined below)

calculated using a price for the Comparable Treasury Issue (expressed as a percentage of its principal amount) equal to the Comparable Treasury Price (as defined below) as of the Reset Determination Date.

If the U.S. Treasury Rate cannot be determined, for whatever reason, as described under

(1) or (2) above, “U.S. Treasury Rate” means the rate per annum equal to the last reported Yield, as determined by the Calculation Agent, based on information appearing in the statistical release designated “H.15” (or any

successor publication that reports Yields) last published by the Board of Governors of the U.S. Federal Reserve System as of 5:00 p.m. (New York City time) on the Reset Determination Date.

For purposes of determining the U.S. Treasury Rate, “New York Business Day”

means a day which is not a day on which banking institutions in New York City are authorized by law or regulation to close, regardless of whether the over-the-counter

market for actively traded U.S. Treasury securities is open or closed. |

|

|

|

|

“Comparable Treasury Issue” means, with respect to a reset fixed rate period, the U.S. Treasury security that is selected by the Company (and notified to the Calculation Agent) with a maturity date on or about (but not

more than 30 calendar days before or after) the Reset Date immediately after the last day of the reset fixed rate period and that would be utilized, at the time of selection and in accordance with customary financial practice, in pricing new issues

of corporate debt securities denominated in U.S. dollars and having a maturity of five years; provided, however, that the selection of the Comparable Treasury Issue shall be at the sole discretion and judgement of the Company, and that such

determination shall be final and conclusive for all purposes and binding on the Calculation Agent, the trustee, the paying agent and the holders of the Securities. |

2

|

|

|

|

|

“Comparable Treasury Price” means, with respect to a Reset Determination Date, (i) the arithmetic average, as determined by the Calculation Agent, of the Reference Treasury Dealer Quotations (as defined below) for the

Comparable Treasury Issue as of the Reset Determination Date, after excluding the highest and lowest of such Reference Treasury Dealer Quotations, or (ii) if fewer than five such Reference Treasury Dealer Quotations are received, the arithmetic

average, as determined by the Calculation Agent, of all such quotations, or (iii) if fewer than two such Reference Treasury Dealer Quotations are received, then the Reference Treasury Dealer Quotation as quoted by a Reference Treasury Dealer

(as defined below). |

|

|

|

|

“Reference Treasury Dealer” means each of up to five banks selected by the Company (and notified to the Calculation Agent), or the affiliates of such banks, which are (i) primary U.S. Treasury securities dealers, and

their respective successors, or (ii) market makers in pricing corporate bond issues denominated in U.S. dollars; provided, however, that the selection of the Reference Treasury Dealers shall be at the sole discretion and judgement of the

Company, and that such determination shall be final and conclusive for all purposes and binding on the Calculation Agent, the trustee, the paying agent and the holders of the Securities. |

|

|

|

|

“Reference Treasury Dealer Quotation” means, with respect to each Reference Treasury Dealer and a Reset Determination Date, the arithmetic average, as determined by the Calculation Agent, of the bid and asked prices quoted

to the Company (and notified to the Calculation Agent) by such Reference Treasury Dealer for the Comparable Treasury Issue, expressed in each case as a percentage of its principal amount, approximately at 11:00 a.m. (New York City time), on the

Reset Determination Date. |

|

|

| Optional Cancellation of Interest Payments: |

|

If the Company determines that it is necessary to cancel payment of the interest on the Securities at any time and in its sole discretion,

the Company may cancel payment of all or part of the interest accrued on the Securities on an interest payment date.

Among other circumstances, the Company will make a determination to cancel interest payments if and to the extent the Company fails to meet the applicable

regulatory capital buffer requirements and implements a capital distribution constraints plan submitted to the FSA (as defined in the Preliminary Prospectus) pursuant to an order of the FSA under the Japanese capital distribution constraints system.

Notwithstanding the foregoing, the Company may determine that it is necessary to cancel payments of interest on the Securities due to other factors in its sole discretion. |

|

|

| Mandatory Cancellation of Interest Payments: |

|

The Company will be prohibited from paying, and shall cancel, all or part of the interest on the Securities on an interest payment date, if

and to the extent that the interest payable on the Securities on such interest payment date exceeds the Interest Payable Amount.

“Interest Payable Amount” means, in respect of any interest payment date, the product of the Adjusted Distributable Amounts on such interest payment

date and a ratio, the numerator of which is the amount of interest (including additional amounts with respect thereto, if any) that should have been paid on the Securities on such interest payment date, and the denominator of which is the aggregate

amount of interest (including additional amounts with respect thereto, if any) that should have been paid on the Securities on such interest payment date and dividends or interest (including any amounts with respect thereto substantially similar to

additional amounts, if any) that should have been paid in respect of any Senior Dividend Preferred Shares (as defined in the Preliminary Prospectus) and any Parity Securities (as defined in the Preliminary Prospectus) on the same date as such

interest payment date (rounding any amount less than a whole cent down to the nearest whole cent). |

3

|

|

|

|

|

“Adjusted Distributable Amounts” means, in respect of any date, the distributable amounts of the Company on such date calculated in accordance with the Company Law (as defined in the Preliminary Prospectus), after

deducting the sum of any dividend or interest (including additional amounts with respect thereto, or any amounts with respect thereto substantially similar to additional amounts, as applicable, if any) that has been paid in respect of the

Securities, any Parity Securities and any Junior Securities (as defined in the Preliminary Prospectus) from the beginning of the fiscal year of the Company in which such date falls until the date immediately preceding such date. |

|

|

| Agreement to Interest Cancellation: |

|

By subscribing for, purchasing or otherwise acquiring the Securities, holders of the Securities acknowledge and agree to a cancellation of interest payments under the terms of the Securities. |

|

|

| Principal Write-Down Upon a Capital Ratio Event: |

|

If a Capital Ratio Event (as defined in the Preliminary Prospectus) occurs, on a Going Concern Write-Down Date (as defined below), the

principal amount of the Securities will be written down by an amount equal to the relevant Going Concern Write-Down Amount (as defined in the Preliminary Prospectus), and holders of the Securities will be deemed to have irrevocably waived their

right to claim or receive payments of the principal of the Securities to the extent of the relevant Going Concern Write-Down Amount or interest on the relevant Going Concern Write-Down Amount.

A “Capital Ratio Event” will be deemed to have occurred when the

Company’s consolidated Common Equity Tier 1 ratio that the Company has reported or publicly announced in a manner set forth in the Preliminary Prospectus, declines below 5.125%, with certain exceptions set forth in the Preliminary

Prospectus. “Going Concern Write-Down Date” means the date that is

determined by the Company after consultation with the FSA or any other relevant Japanese supervisory authority and shall be no later than fifteen Business Days following the date of the relevant Going Concern Write-Down Notice (as defined in the

Preliminary Prospectus). Following any write-down of principal amount upon a

Capital Ratio Event, the Securities may be subject to a write-up in certain limited circumstances. |

|

|

| Principal Write-Down and Cancellation Upon a Non-Viability

Event: |

|

If a Non-Viability Event (as defined below) occurs, on a Write-Down and Cancellation Date (as defined

below), the full principal amount of the Securities will be permanently written down to nil, the Securities will be cancelled, and holders of the Securities will be deemed to have irrevocably waived their right to claim or receive any payment of

principal of or interest on the Securities. A

“Non-Viability Event” will be deemed to have occurred at the time that the Prime Minister of Japan confirms (nintei) that any measures (tokutei dai nigo sochi) set forth in Article 126-2, Paragraph 1, Item 2 of the Deposit Insurance Act of Japan (or any successor provision thereto) need to be applied to the Company. |

4

|

|

|

|

|

“Write-Down and Cancellation Date” means, upon the occurrence of a Non-Viability Event, the date that shall be determined by the Company after consultation with the FSA or any other

relevant Japanese supervisory authority and shall be no later than ten Business Days following the date of the Write-Down and Cancellation Notice (as defined in the Preliminary Prospectus). |

|

|

| Principal Write-Down and Cancellation Upon a Bankruptcy Event: |

|

Immediately upon the occurrence of a Bankruptcy Event (as defined in the Preliminary Prospectus), the full principal amount of the Securities will be permanently written down to nil, the Securities will be cancelled, and holders of

the Securities will be deemed to have irrevocably waived their right to claim or receive any payment of principal of or interest on the Securities. |

|

|

| Agreement to Write-Down and Cancellation: |

|

By subscribing for, purchasing or otherwise acquiring the Securities, holders of the Securities acknowledge and agree to a principal write-down under the terms of the Securities. |

|

|

| No Events of Default or Rights of Acceleration: |

|

Non-payment of principal of or interest on the Securities or breach of covenants in the Indenture or the Securities or any other event shall not constitute an event of default or an event of

acceleration under the Indenture or the Securities or give rise to any right of the holders or the trustee to declare the principal of or interest on the Securities to be due and payable or accelerate any payment of such principal or interest, and

there are no events of default or circumstances in respect of the Securities that entitle the holders of Securities or the trustee to require that the Securities become immediately due and payable. In addition, there is no right to require the

Company to redeem the Securities. |

|

|

| Optional Redemption: |

|

The Securities may, subject to prior confirmation of the FSA (if such confirmation is required under the Applicable Banking Regulations (as defined in the Preliminary Prospectus)), be redeemed at the option of the Company, in whole,

but not in part, on January 15, 2029 or any subsequent Reset Date occurring on each five-year anniversary thereafter, on not less than 25 days nor more than 60 days’ prior notice to the holder of Securities and the trustee, at a redemption

price equal to 100% of the principal amount at issuance of the Securities plus accrued and unpaid interest to (but excluding) the date fixed for redemption, on the condition that the principal amount of the Securities then outstanding equals

the principal amount at issuance of the Securities. |

|

|

| Optional Tax Redemption: |

|

The Securities may, subject to prior confirmation of the FSA (if such confirmation is required under the Applicable Banking Regulations), be redeemed at any time, at the option of the Company, in whole, but not in part, upon not

less than 30 nor more than 60 days’ prior notice, at a redemption price equal to 100% of the principal amount of the Securities on the date fixed for redemption plus accrued and unpaid interest to (but excluding) the date fixed for

redemption, if the Company determines that, as a result of any change in, or amendment to, the laws, regulations or rulings of Japan (or of any political subdivision or taxing authority thereof or therein) affecting taxation, or any change in the

official application or interpretation of such laws, regulations or rulings, which change or amendment becomes effective on or after the date of the final prospectus supplement relating to this offering, (i) the Company is, or on the next

interest payment date would be, required to pay any additional amounts in respect of Japanese taxes, or (ii) any interest on the Securities ceases to be treated as being a deductible expense for the purpose of the Company’s corporate tax,

and in each case of (i) or (ii) above, such event cannot be avoided by the Company taking reasonable measures available to it. |

5

|

|

|

|

|

In case of (i) above, no notice of redemption may be given earlier than 90 days prior to the earliest date on which the Company would be obligated to pay the additional amounts if a payment in respect of the Securities were

then due. |

|

|

| Optional Regulatory Redemption: |

|

The Securities may, subject to prior confirmation of the FSA (if such confirmation is required under the Applicable Banking Regulations), be redeemed at the option of the Company, in whole, but not in part, at any time, on not less

than 30 nor more than 60 days’ prior notice, at a redemption price equal to 100% of the principal amount of the Securities on the date fixed for redemption plus accrued and unpaid interest to (but excluding) the date fixed for

redemption, if the Company determines after consultation with the FSA that there is more than an insubstantial risk that the Securities may not be partially or fully included in the Company’s Additional Tier 1 Capital (as defined in the

Preliminary Prospectus) under the applicable standards set forth in the Applicable Banking Regulations. |

|

|

| Issue Price: |

|

100.000% of principal amount plus accrued interest, if any, from October 26, 2023 |

|

|

| Reoffer Yield: |

|

8.2% |

|

|

| Underwriting Discount: |

|

1% |

|

|

| Net Proceeds before Expenses: |

|

U.S.$742,500,000 |

|

|

| Day Count: |

|

30/360 |

|

|

| Business Days: |

|

New York and Tokyo |

|

|

| Business Day Convention: |

|

Following Business Day Convention |

|

|

| Denominations: |

|

U.S.$200,000 x U.S.$1,000 |

|

|

| Listing: |

|

Luxembourg Stock Exchange’s Euro MTF Market |

|

|

| Governing Law: |

|

New York law |

|

|

| Billing & Delivering: |

|

Morgan Stanley & Co. LLC |

|

|

| Joint Lead Managers and Joint Bookrunners: |

|

Morgan Stanley & Co. LLC

MUFG Securities Americas Inc. |

|

|

|

|

J.P. Morgan Securities LLC |

|

|

| Senior Co-Managers: |

|

Barclays Capital Inc.

BofA Securities, Inc.

Citigroup Global Markets Inc. |

|

|

| Co-Managers: |

|

BNP Paribas

HSBC Securities (USA) Inc.

TD Securities (USA) LLC

Crédit Agricole Corporate and Investment Bank

Natixis Securities Americas LLC

Société Générale

Nomura Securities International, Inc.

RBC Capital Markets, LLC

Wells Fargo Securities, LLC |

|

|

| Security Codes: |

|

CUSIP: 606822DD3

ISIN: US606822DD36

Common Code: 269743484 |

6

This communication is intended for the sole use of the person to whom it is provided by us. This

communication does not constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction or to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

The Issuer has filed a registration statement (including a prospectus dated August 4, 2023 (the “Base Prospectus”)) and a preliminary prospectus

supplement dated October 16, 2023 (the “Preliminary Prospectus Supplement,” and together with the Base Prospectus, the “Preliminary Prospectus”) with the U.S. Securities and Exchange Commission (“SEC”) for this

offering. Before you invest, you should read the Preliminary Prospectus for this offering, and other documents the Issuer has filed with the SEC and which are incorporated by reference therein for more complete information about the Issuer and this

offering. You may get these documents for free by searching the SEC online database (EDGAR®) at www.sec.gov.

Alternatively, the Issuer, any underwriter or any dealer participating in the transaction will arrange to send you the Preliminary Prospectus if you

request it by calling Morgan Stanley & Co. LLC toll-free at 1-866-718-1649 or MUFG Securities Americas Inc. toll-free at

1-877-649-6848.

Singapore

Securities and Futures Act Product Classification – Solely for the purposes of its obligations pursuant to sections 309B(1)(a) and 309B(1)(c) of the Securities and Futures Act 2001 of Singapore, as modified or amended from time to time (the

“SFA”), the issuer has determined, and hereby notifies all relevant persons (as defined in Section 309A of the SFA) that the securities are “prescribed capital markets products” (as defined in the Securities and Futures

(Capital Markets Products) Regulations 2018).

*Note: An issuer rating or a security rating is not a recommendation to buy, sell or hold securities

and may be subject to revision, suspension or withdrawal at any time.

7

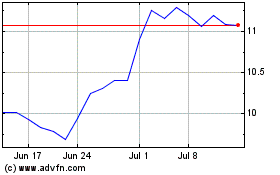

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

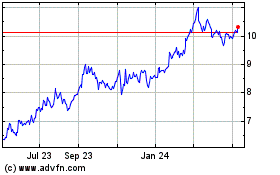

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Apr 2023 to Apr 2024