SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE

13D

(Rule 13d-101)

INFORMATION

TO BE INCLUDED IN STATEMENTS FILED PURSUANT TO RULE 13d-1(a)

AND AMENDMENTS THERETO FILED PURSUANT TO RULE 13d-2(a)

Under the Securities Exchange Act of 1934

(Amendment No. ___)*

| Monogram Orthopaedics Inc. |

(Name of Issuer)

|

| Common Stock, $0.001 par value per share |

|

(Title of Class of Securities)

|

| 609786108 |

|

(CUSIP Number)

|

|

Alisha Charlton

c/o Pro-Dex, Inc.

2361 McGaw Avenue

Irvine, CA 92614

949-769-3231 |

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications) |

| |

| October 6, 2023 |

| (Date of Event Which Requires Filing of this Statement) |

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§

240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7 for other parties to whom

copies are to be sent.

_______________

* The remainder of this cover page shall be filled

out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes)

| CUSIP Number

609786108 |

SCHEDULE

13D |

Page

2 of 7 |

| 1 |

NAME OF REPORTING PERSON

Pro-Dex, Inc. |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS

WC |

|

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d)

or 2(e)

|

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Colorado |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

1,828,551 |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

1,828,551 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

1,828,551 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.9% (1) |

|

| 14 |

TYPE OF REPORTING PERSON

CO |

|

| (1) | Percentage calculated on the basis of 31,131,191 shares of common stock,

par value $0.001 per share (“Common Stock”), of Monogram Orthopaedics Inc., a Delaware corporation (the “Issuer”),

outstanding as of October 2, 2023, as reported by the Issuer on its Definitive Proxy Statement on Schedule 14A filed with the Securities

and Exchange Commission (“SEC”) on October 6, 2023. |

| CUSIP Number

609786108 |

SCHEDULE

13D |

Page

3 of 7 |

| Item 1. |

Security and Issuer. |

This Statement of Beneficial Ownership

on Schedule 13D (this “Statement”) relates to the Common Stock of the Issuer. The address of the Issuer's principal executive

offices is 3919 Todd Lane, Austin, TX 78744.

| Item 2. |

Identity and Background. |

This Statement is filed by Pro-Dex,

Inc., a Colorado corporation (the “Reporting Person”). The Investment Committee of the Reporting Person exercises voting and

dispositive power with respect to the Common Stock subject to this Statement. The Investment Committee of the Reporting Person consists

of Raymond E. Cabillot, Nicholas J. Swenson and Richard L. Van Kirk. Since the Investment Committee of the Reporting Person exercises

voting and dispositive power with respect to the shares, each of the foregoing individuals disclaims any beneficial ownership of the shares

held by the Reporting Person.

The principal business of the

Reporting Person is the design, development, and manufacture of autoclavable, battery-powered and electric, multi-function surgical drivers

and shavers used primarily in the orthopedic, thoracic, and craniomaxillofacial (“CMF”) markets.

The principal business address

of the Reporting Person is 2361 McGaw Avenue, Irvine, California 92614.

The following table sets forth

the name and present principal occupation or employment and the name, principal business and address of any corporation or other organization

in which such employment is conducted of each director and executive officer of the Reporting Person (each of such directors and officers,

a “Covered Person” and collectively, the “Covered Persons”). The business address of each such person is c/o Pro-Dex,

Inc., 2361 McGaw Avenue, Irvine, California, 92614. Each Covered Person is a citizen of the United States of America.

| Name |

Principal Occupation |

| Raymond E. Cabillot |

Director of the Reporting Person

Chief Executive Officer and Director of Farnam

Street Capital, Inc., the general partner of Farnam Street Partners L.P., a private investment partnership

Farnam Street Capital, Inc.

3033 Excelsior Boulevard, Suite 560

Minneapolis, MN 55426

Director of Air T, Inc., a provider of air cargo services

and ground equipment sales and support services

Air T, Inc.

11020 David Taylor Drive, Suite 305

Charlotte, North Carolina 28262 |

| Angelita R. Domingo |

Director of Quality Systems and Regulatory Affairs

and Director of the Reporting Person

|

| William J. Farrell III |

Director of the Reporting Person

SVP of Business Services at Gundersen Health System,

an integrated healthcare organization

Gundersen Health System

1900 South Ave.

La Crosse, WI 54601

Chief Executive Officer of Viszy Inc., a company developing

software and services for the consumer market

Viszy Inc.

2919 Hennepin Avenue

Minneapolis, MN 55408 |

| CUSIP Number

609786108 |

SCHEDULE

13D |

Page

4 of 7 |

| David C. Hovda |

Director of the Reporting Person

Founder of MedTech Advisors LLC |

| Katrina M.K. Philp |

Director of the Reporting Person

Chief of Staff of Air T, Inc., a provider of air cargo

services and ground equipment sales and support services

Air T, Inc.

11020 David Taylor Drive, Suite 305

Charlotte, North Carolina 28262 |

| Nicholas J. Swenson |

Director and Chairman of the Board of the Reporting

Person

Managing partner of AO Partners, LLC, the general

partner of AO Partners I, L.P., a private investment partnership

AO Partners, LLC

5000 West 36th Street, Suite 130

Minneapolis, MN 55416

President, Chief Executive Officer Director and Chairman

of the Board of Air T, Inc., a provider of air cargo services and ground equipment sales and support services

Air T, Inc.

11020 David Taylor Drive, Suite 305

Charlotte, North Carolina 28262 |

| Richard L. Van Kirk |

Director, Chief Executive Officer, President and Chief

Operating Officer of the Reporting Person

Director of the Issuer

Monogram Orthopaedics Inc.

3919 Todd Lane

Austin, TX 78744 |

| Alisha K. Charlton |

Chief Financial Officer of the Reporting Person |

Each of the Reporting Person and,

to the Reporting Person’s knowledge, the Covered Persons have not, during the last five years, been convicted in a criminal proceeding

(excluding traffic violations or similar misdemeanors).

Each of the Reporting Person and,

to the Reporting Person’s knowledge, the Covered Persons have not, during the last five years, been a party to a civil proceeding

of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree

or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or

finding any violation with respect to such laws.

| CUSIP Number

609786108 |

SCHEDULE

13D |

Page

5 of 7 |

| Item 3. |

Source and Amount of Funds or Other Consideration. |

On December 20, 2018, the Reporting

Person was issued a warrant from the Issuer (the “Warrant”) to purchase (collectively, the “Warrant Shares”):

(i) shares of each class or series of preferred stock of the Issuer outstanding on the date or dates of exercise (“Preferred Stock”),

up to an aggregate amount for each such class or series equal to five percent (5%) (calculated on a post-exercise basis) of the total

issued and outstanding number of Preferred Stock of such class or series; plus (ii) shares of Common Stock equal to five percent

(5%) (calculated on a post-exercise basis) of the fully-diluted capitalization as of the date or dates of exercise; provided, that any

shares of Preferred Stock that the Warrant has been or may be exercised for, as of the time of calculation, shall be excluded for purposes

of determining fully-diluted capitalization. The aggregate exercise price for the Warrant Shares equaled $1,250,000.

The Reporting Person and the Issuer

subsequently entered into a letter agreement (the “Exercise Letter”), with an effective date of October 2, 2023, pursuant

to which the Reporting Person agreed to exercise the Warrant in exchange for, among other things, a contingent right to receive additional

warrants (each, an “Additional Warrant”) to purchase five percent (5%) (calculated on a post-exercise basis) of certain Qualified

Future Issuances (as defined below) of securities by the Issuer. “Qualified Future Issuances” means any and all issuances

of securities by the Issuer during the period between October 2, 2023 to December 31, 2025 (other than securities issued under the

Issuer’s equity incentive plans), which during a Warrant Coverage Measurement Period (as defined in the Exercise Letter, and which

generally represent staggered six-month periods) results in the Issuer receiving, or having the right to receive, gross proceeds of $5,000,000

or more during the Warrant Coverage Measurement Period. Any Additional Warrant will have a term of six (6) months from the date of issuance

and an aggregate exercise price equal to the total gross proceeds received by the Issuer over the Warrant Coverage Measurement Period

divided by the number of securities issued by the Issuer during the Warrant Coverage Measurement Period. The Exercise Letter also grants

the Reporting Person “piggyback” registration rights for all securities of the Issuer from time to time owned by the Reporting

Person on terms at least as favorable to the Reporting Person as the Issuer may at any time grant “piggyback” (or equivalent)

registration rights to any other holder of securities of the Issuer. The foregoing description of the Exercise Letter does not purport

to be complete and is qualified in its entirety by reference to the Exercise Letter filed as Exhibit 99.1 to this Statement, which is incorporated by reference herein.

Upon its exercise of the Warrant

pursuant to the Exercise Letter, the Reporting Person was issued 1,828,551 shares of Common Stock of the Issuer (with an issuance effective

date of October 2, 2023) for payment of the $1,250,000 exercise price to the Issuer. The funds for payment of the exercise price

were from the Reporting Person’s working capital.

| CUSIP Number

609786108 |

SCHEDULE

13D |

Page

6 of 7 |

| Item 4. |

Purpose of Transaction. |

The Reporting Person acquired

the Common Stock to which this Statement relates in the ordinary course of business for investment purposes.

The Reporting Person’s response

to Item 3 of this Statement is incorporated by reference into this Item 4.

Other than as described

above, the Reporting Person does not currently have any plans or proposals that relate to, or would result in, any of the matters listed

in Items 4(a)-(j) of Schedule 13D, although, depending on the factors discussed herein, the Reporting Person may change its purpose or

formulate different plans or proposals with respect thereto at any time.

| Item 5. |

Interest in Securities of the Issuer. |

(a) The Reporting Person beneficially

holds in the aggregate 1,828,551 shares of Common Stock, which represents approximately 5.9% of the Issuer’s outstanding shares

of Common Stock. The Reporting Person directly holds the shares of Common Stock disclosed as beneficially owned by it in this Statement.

The percentage ownership of shares

of Common Stock set forth in this Statement is based on the 31,131,191 shares of Common Stock reported by the Issuer as outstanding as

of October 2, 2023 in the Issuer’s Definitive Proxy Statement on Schedule 14A filed with the SEC on October 6, 2023.

(b) The Reporting Person beneficially

owns, and has the sole power to direct the voting and disposition of, the shares of Common Stock disclosed as beneficially owned by Reporting

Person in this Statement.

(c) Except as disclosed herein,

the Reporting Person has not effected any other transactions in the securities of the Issuer during the past 60 days.

(d) No person other than the Reporting

Person is known to have the right to receive, or the power to direct the receipt of, dividends from, or proceeds from the sale of, the

Common Stock beneficially owned by the Reporting Person.

(e) Not applicable.

| Item 6. |

Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer. |

The Reporting Person’s response

to Item 3 of this Statement is incorporated by reference into this Item 6.

Richard L. Van Kirk, the Chief

Executive Officer, President, Chief Operating Officer and a director of the Reporting Person, is a director of the Issuer.

In conjunction with the Exercise

Letter, the Reporting Person and the Issuer entered into a supply agreement pursuant to which the Reporting Person will manufacture and

supply certain products to the Issuer.

Except as otherwise set forth

in this Statement, there are no contracts, arrangements, understandings or relationships among the Reporting Person or any of its directors

or executive officers or between such persons and any other person with respect to any securities of the Issuer.

| Item 7. |

Material to Be Filed as Exhibits. |

| CUSIP Number

609786108 |

SCHEDULE

13D |

Page

7 of 7 |

SIGNATURE

After reasonable inquiry and to

the best of the undersigned’s knowledge and belief, the undersigned certifies that the information set forth in this Statement is

true, complete and correct.

Dated: October 17, 2023

| PRO-DEX, INC. |

|

| |

|

| /s/ Alisha K. Charlton |

|

| Name: Alisha K. Charlton |

|

| Title: Chief Financial Officer |

Exhibit 99.1

Pro-Dex, Inc.

2361 McGaw Avenue

Irvine, CA 92614

October 2, 2023

Monogram Orthopaedics Inc.

3913 Todd Lane, Suite 307

Austin, TX 78744

Ladies and Gentlemen:

Reference is hereby made

to that certain Warrant to Purchase Stock, dated December 20, 2018 (the “Warrant”), made by Monogram Orthopaedics Inc.,

a Delaware corporation (“Monogram”), in favor of Pro-Dex, Inc., a Colorado corporation (“Pro-Dex”). Capitalized

terms that are used but not defined in this letter agreement shall have the meaning ascribed to them in the Warrant. The execution date

(“Effective Date”) of this letter agreement is October 3, 2023.

Certain Defined Terms

For purposes of this letter

agreement:

“Approved Incentive

Plan” means an equity incentive plan of Monogram that has been approved by both a majority of Monogram’s board of directors

and a majority of Monogram’s voting capital stock.

“Warrant Coverage

Issuance” means any and all issuances of securities by Monogram during a Warrant Coverage Measurement Period, whether as part of

a single offering or issuance or multiple offerings and issuances, and whether of a single or multiple types, series or classes of securities,

or any combination of any of the foregoing, but excluding in each instance any Excluded Securities.

“Warrant Coverage

Measurement Period” means (a) for the initial Warrant Coverage Measurement Period, the period commencing on the Effective Date

and ending on March 31, 2024, and (b) for each subsequent Warrant Coverage Measurement Period, the six month period following

the last day of the immediately preceding Warrant Coverage Measurement Period (with each such subsequent Warrant Coverage Measurement

Period ending on sequential March 31sts and September 30iths).

Agreement by Pro-Dex

Pro-Dex hereby agrees to

exercise the Warrant in full in cash for common stock of Monogram pursuant to Section 3(a) thereof within five (5) business days

after the Effective Date.

Agreement by Monogram

In consideration for Pro-Dex’s

agreement to exercise the Warrant on the terms set forth above:

(a) If

Monogram engages in or otherwise consummates a Warrant Coverage Issuance during a Warrant Coverage Measurement Period that results in

Monogram receiving, or having the right to receive, gross proceeds of $5,000,000 or more during such Warrant Coverage Measurement Period,

then Monogram shall issue Pro-Dex a warrant to be exercised in cash to purchase 5% (calculated after giving effect to such issuance to

Pro-Dex) of the types, series and classes of securities issued during such Warrant Coverage Measurement Period at a price equal to the

total gross proceeds received over the Warrant Coverage Measurement Period divided by the number of securities issues during that same

period, net of any Excluded Securities, and on terms at least as favorable to Pro-Dex as the most favorable terms pursuant to which any

such securities of such respective types, series and classes are acquired, or that may be acquired, by any investor or acquiror during

such Warrant Coverage Measurement Period (each, a “Coverage Warrant”). Each Coverage Warrant shall be issued to Pro-Dex within

ten (10) business day after the last day of the applicable Warrant Coverage Measurement Period, shall have a term of six (6) months from

the date of issuance and, unless otherwise agreed to in writing by Pro-Dex in its sole and absolute discretion, shall have other provisions

consistent with the provisions of the Warrant. Pro-Dex’s rights under this paragraph shall expire on December 31, 2025 and shall

apply to all Warrant Coverage Issuances conducted from time to time, and at any time, by Monogram prior to that date. Monogram shall not

structure any securities offering or take any other action with the purpose or intent of depriving, or otherwise engage in any plan or

scheme to deprive, Pro-Dex of its rights under this paragraph.

(b) Monogram

shall grant Pro-Dex piggyback registration rights for all Monogram securities from time to time owned by Pro-Dex on terms at least as

favorable to Pro-Dex as Monogram may at any time grant piggyback (or equivalent) registration rights to any other holder of Monogram securities.

Filings

The

parties understand and consent to this letter agreement being included as an exhibit, as required, to each party’s respective filings

with the Securities and Exchange Commission.

Miscellaneous

This letter agreement contains

the entire understanding between the parties relating to the subject matter hereof, and all prior or contemporaneous agreements, understandings,

representations, and statements, whether oral or written, concerning the subject matter hereof are merged herein, and shall be of no force

or effect. This letter agreement may only be amended, modified or supplemented by an agreement in writing signed by both parties. No waiver

by either party of any of the provisions hereof shall be effective unless explicitly set forth in writing and signed by the party so waiving.

Except as otherwise set forth in this letter agreement, no failure to exercise, or delay in exercising, any right, remedy, power or privilege

arising from this letter agreement shall operate or be construed as a waiver thereof; nor shall any single or partial exercise of any

right, remedy, power or privilege hereunder preclude any other or further exercise thereof or the exercise of any other right, remedy,

power or privilege.

The parties have participated

jointly in the negotiation and drafting of this letter agreement. In the event an ambiguity or question of intent or interpretation arises,

this letter agreement will be construed as if drafted jointly by the parties, and no presumption or burden of proof will arise favoring

or disfavoring either party by virtue of the authorship of any of the provisions of this letter agreement.

This letter agreement shall

be binding upon and inure to the benefit of the successors and permitted assigns of each of the parties. Monogram shall not assign any

benefit or delegate any obligation under this letter agreement without the prior written consent of Pro-Dex.

This letter will be governed

by and construed and enforced in accordance with the laws of the State of California without regard to principles of conflicts of law.

The exclusive jurisdiction and venue for all actions, suits or proceedings arising out of or based upon this letter or the subject matter

hereof shall be the state courts (or if the state courts do not have appropriate jurisdiction, then the federal courts) within the County

of Orange, California. In the event that any claim, suit, action, or proceeding is instituted or commenced by either party against the

other party arising out of or related to this letter agreement, the prevailing party will be entitled to recover its reasonable attorneys’

fees and arbitration or court costs from the non-prevailing party.

This letter agreement may

be executed in counterparts, each of which when so executed and delivered shall be deemed to be an original. This letter agreement may

be delivered by facsimile transmission or in .pdf or similar electronic format, and facsimile, .pdf, or other electronic copies of executed

signature pages shall be binding as originals.

[signature page follows]

IN WITNESS WHEREOF, the

parties have executed this letter agreement effective as of the day and year first written above.

| |

Pro-Dex, Inc.

By: /s/ Rick Van Kirk

Name: Rick Van Kirk

Title: CEO |

| |

Monogram Orthopaedics Inc.

By: /s/ Benjamin Sexson

Name: Benjamin Sexson

Title: CEO |

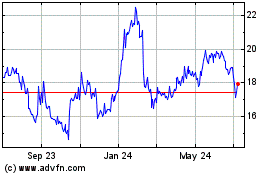

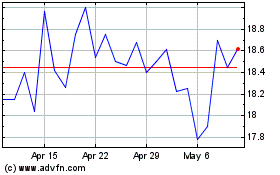

ProDex (NASDAQ:PDEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

ProDex (NASDAQ:PDEX)

Historical Stock Chart

From Apr 2023 to Apr 2024