UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2023

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES AND EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 000-27873

America Great Health

(Exact name of registrant as specified in its charter)

| Wyoming (State or other jurisdiction of incorporation or organization) | 98-0178621 (I.R.S. Employer Identification No.) |

| | |

| 1609 W Valley Blvd Unit 338A, Alhambra, CA (Address of principal executive offices) | 91803 (Zip Code) |

Registrant’s telephone number, including area code: (888) 988-1333

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, no par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Yes ☐ No ☒

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☐ No ☒

Indicate by check mark if disclosure of delinquent filers pursuant to item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Yes ☒ No ☐

Indicate by check mark whether the registrant is large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definition of “large accelerated filer,” accelerated filer” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer ☐ | | Accelerated filer ☐ |

| | | |

| Non-accelerated filer ☒ | | Smaller Reporting Company ☒ |

| | | |

| | | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ☐ No ☒

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. The number of shares outstanding of the registrant’s common stock as of August 31, 2023 was 21,107,018,148.

FORM 10-K

For the Year Ended June 30, 2023

TABLE OF CONTENTS

In this annual report the words "we," "us," "our," and the "Company" refer to America Great Health and subsidiaries.

FORWARD LOOKING STATEMENTS

When used in this report, the words “may,” “will,” “expect,” “anticipate,” “continue,” “estimate,” “project,” “intend,” and similar expressions are intended to identify forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 regarding events, conditions, and financial trends that may affect the Company’s future plans of operations, business strategy, operating results, and financial position. Persons reviewing this report are cautioned that any forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties and that actual results may differ materially from those included within the forward-looking statements as a result of various factors.

Statements made in this Form 10-K that are not historical or current facts are "forward-looking statements" made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We wish to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Any forward-looking statements represent our best judgment as to what may occur in the future. These forward-looking statements include our plans and objectives for our future growth, including plans and objectives related to the consummation of acquisitions and future private and public issuances of our equity and debt securities. The forward-looking statements included herein are based on current expectations that involve numerous risks and uncertainties. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Although we believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could be inaccurate and, therefore, there can be no assurance that the forward-looking statements included in this Form 10-K will prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, you should not regard the inclusion of such information as our representation or the representation of any other person that we will achieve our objectives and plans. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statement or to reflect the occurrence of anticipated or unanticipated events.

PART I

ITEM 1. BUSINESS

Historical Development

America Great Health, formerly Crown Marketing, is a Wyoming corporation (the "Company"). A change of control of the Company was completed on January 19, 2017 from Jay Hooper, the former officer and director of the Company and its former majority shareholder. Control was obtained by the sale of 16,155,746,000 shares of Company common stock from Mr. Hooper to an investor group led by Mike Q. Wang. In connection with the change of control, the Company sold to its former majority shareholder a subsidiary for $100 and another subsidiary in exchange for the cancellation of all payables and accrued expenses. After December 31, 2016, the Company’s operations are determined and structured by the new investor group. As such, the Company accounted for all of its assets, liabilities and results of operations up to January 1, 2017 as discontinued operations.

On March 1, 2017, the Company filed with the Secretary of State of the State of Wyoming an Articles of Amendment to change the corporate name from Crown Marketing to America Great Health.

On March 9, 2017, the Company formed a wholly owned subsidiary, America Great Health, under the laws of the State of California.

On June 24, 2019, the Company registered a wholly owned subsidiary in China, Meizhong Health Industry Development Co., Ltd. The subsidiary is mainly engaged in mergers and acquisitions, investments and financings, and marketing of medical equipment and health products in China.

On June 30, 2020, the Company and Purecell Group (“Purecell”), a leading anti-aging medical institution in Australia, entered into a Cooperation Agreement, in which the Company agreed to acquire 51% of the equity of Purecell. On April 6, 2021, the Company issued 510,000,000 shares of common stock to Purecell’s nominated trustee. Upon completion of the acquisition transaction, Purecell shall remain autonomous in its day-to-day operations, including recruiting and retaining management team members. Because the Company does not have significant control over Purecell, the acquisition is accounted for as an equity investment. This transaction was completed in May 2021.

On December 7, 2020, the Company’s wholly owned Californian subsidiary, America Great Health, entered into a Cooperation Agreement with Brilliant Healthcare Limited (“Brilliant”) pursuant to which the parties will establish a joint venture in China (the “JV Company”) for the purpose of promoting and developing stem cell related product’s R&D, production, sales, raw material procurement, mergers and acquisitions, and consulting services. After the formation of the JV company is completed, the Company shall invest US$4.2 million in the JV Company within the next 24 months for a 60% equity ownership in the JV Company. Brilliant shall transfer its patented technology to the JV Company as its capital contribution, to account for a 40% equity interest in the JV Company. In June 2021, the JV Company was established in Hainan, China as “Sijinsai (Hainan) Biological Tech Ltd.” On July 9, 2021, the Company paid its first investment of $50,000.

On May 18 , 2021, the Company and David Tsai (“Dr. Tsai”), a pioneer in anti-cancer peptide research and invention in the United States, entered into a Cooperation Agreement, in which Dr. Tsai shall provide to the Company theories, technologies, methods, sources of raw materials, processing and production techniques, quality standards, quality control methods and other information and details related to his anti-cancer protein peptides, oral insulin and activation technology. Dr. Tsai shall also be responsible for the whole process of technology and product production, application and implementation, as well as professional technical support, consultation and cooperation in the process of product verification, publicity, promotion and sales. Currently, several patents are in the application process, and several products are in the process of getting ready for production.

On September 3, 2021, the Company entered into an Assets Acquisition Agreement with Wang’s Property Investment & Management LLC to purchase 53 units in 19 real estate properties appraised at $7,626,286.37 for a purchase price of $7,000,000, The purchase price shall be paid as follows (i) 1,000,000 on execution of the Agreement, (ii) $2,000,000 within 60 days thereof and (iii) the remainder by April 10, 2022. The Agreement is subject to customary closing conditions, including, satisfactory due diligence. On September 9, 2021, the Company entered into a Supplemental Assets Acquisition Agreement with Wang’s Property Investment & Management LLC to amend and clarify that (i) it was purchasing 19 real estate properties which includes 53 units appraised at $7,626,286.37 for a purchase price of $7,000,000 and (ii) that it will waive and not conduct due diligence in order for the transaction to proceed. The acquisition had been ceased by both sides without any liabilities and obligations to the Company and Wang’s Property Investment & Management LLC.

On November 4, 2021, the Company set up a 100% owned subsidiary Nutrature Health LLC. On November 11, 2021, America Great Health (the “Company”) entered into an Advisory Committee Member Consulting Agreement with Dr. Kevin Buckman MD (“Consultant”). Pursuant to the Agreement, Consultant is to provide advisory services, as a member to the Advisory Committee to the Board of Directors of the Company, including without limitation, assisting GOF Biotechnologies Inc. in its new drug approval process for oral insulin and Amylase X. Consultant shall be compensated with a warrant to purchase 500,000 shares of the Company at $0.01 per share within 24 months and a warrant at each of the following stages: IND application, Phase I clinical trials, Phase II clinical trials, Phase III clinical trials and the sale of GOF Biotechnologies Inc. the license of oral insulin and Amylase X at Phase I or Phase II clinical trials stages. This Agreement shall be for an initial one year term and shall renew automatically for successive one-year terms up to a maximum of three (3) years unless terminated by either party pursuant to the Agreement. The Company issued 500,000 shares to Dr. Kevin Buckman MD on April 20, 2022.

On November 15, 2021, the Company set up a 100% owned subsidiary GOF Biotechnologies Inc. GOF is 75% majority owned (60,000,000 shares of common stock) by the Company and the remaining 25% of its issued and outstanding shares (20,000,000 shares of common stock) are held by Men Hwei, Tsai. On December 31, 2021, the Company entered into a Supplementary Agreement with Zhigong Lin to amend his prior employment agreement with the Company dated August 31, 2021. The Supplement Agreements provides, inter alia, that Zhigong Lin would be appointed Chief Executive Officer of GOF. The employment agreement and the supplement agreement had both been terminated without any liabilities and obligation to the Company and Zhigong Lin.

On February 4, 2021, the Company set up a 100% owned subsidiary International Institute of Great Health, Inc. (IIGH) under the laws of the State of California. The Company wholly owned research institute will bring together doctors and professor-level experts from different countries and regions in the world. The research fields involve biomedicine, clinical medicine, health management, information technology, data analysis, software development, artificial intelligence, industrial planning, financial investment, etc.

Our Business

Prior to the change in control on January 19, 2017, the Company sold consumer products. It acquired electronic products from manufacturers and then sold them directly to consumers so as to be more competitive in price. As of December 31, 2016, the Company ceased operations in this line of business.

The Company under the new management has focused its business in the health industry. With the asset acquisition from Wang’s Property Investment &Management LLC, the Company attempted diversify its business into property investment and management. By the early May 2022, the acquisition had been ceased by both sides.

Apart from the acquisition of Purecell and the setting up of the JV Company, the Company is planning to make additional acquisitions. We have approached several health related companies in Asia Pacific and met the management of potential acquisition targets. Rapid economic advances in Asia Pacific in the last 20 years have greatly improved the living standards in Asia Pacific. This in turn brings demand in healthcare products and services. The Company feels strongly that despite the challenges of cross border business, it might be able to acquire some good growth companies and bring good values to our stockholders.

Our mission is to invest in innovative technologies integrated with business development in the healthcare ecosystem.

We are focused on protein and peptide small molecular drugs research and development, diagnostic and medical devices with AI cloud computing, cell therapy, and re-generational medicine and supplements manufacturing and sales.

Employees and Outside Services

The company has 7 full-time employees as of report date. Remaining administrative (non-policy making) officers and consultants and technical personnel such as marketing specialists are being compensated as independent contractors. We pay these persons on a contract basis as required.

ITEM 1A. RISK FACTORS

This item is inapplicable because we are a “smaller reporting company” as defined in Exchange Act Rule 12b-2.

ITEM 1B. UNRESOLVED STAFF COMMENTS

This item is inapplicable because we are a “smaller reporting company” as defined in Exchange Act Rule 12b-2.

ITEM 2. PROPERTIES

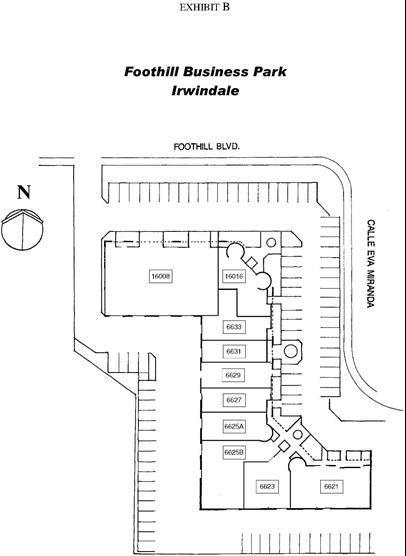

The Company currently is leasing an office building property in Los Angeles County California. The Company has entered into an operating leases agreement with GKT, Alhambra, LP. The lease term of the office space is from December 1, 2020 to November 30, 2023. The current monthly rent including monthly management fee is $4,655.64.

The Company has entered into an operating lease agreement with SoCal Industrial LLC, Irwindale. The lease term of the office space is from June 1, 2023 to May 31, 2024, after the prior lease expired on May 31, 2023. The current monthly rent including monthly management fee is $1,764.00.

ITEM 3. LEGAL PROCEEDINGS

No legal proceedings are threatened or pending against us or any of our officers or directors. Further, none of our officers, directors or affiliates are parties against us or have any material interests in actions that are averse to the Company’s interests.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

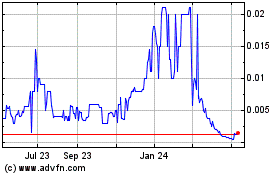

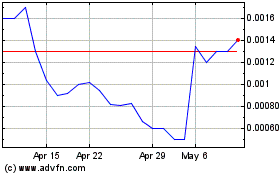

Our common stock is currently listed on the OTC Bulletin Board under the symbol “AAGH”. There has been limited trading of the common stock from December 2, 2013 (Inception) through June 30, 2023. The last sale price of our common stock on June 30, 2023, was 0.0139 per share.

The following table sets forth the high and low transaction price for each quarter within the fiscal years ended June 30, 2023 and 2022, as provided by the NASDAQ Stock Markets, Inc. The information reflects prices between dealers, and does not include retail markup, markdown, or commissions, and may not represent actual transactions.

|

Fiscal Year Ended

|

|

|

|

Bid Prices

|

|

|

June 30,

|

|

Period

|

|

High

|

|

|

Low

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

2023

|

|

First Quarter

|

|

$ |

0.0238 |

|

|

$ |

0.0065 |

|

| |

|

Second Quarter

|

|

$ |

0.0100 |

|

|

$ |

0.0006 |

|

| |

|

Third Quarter

|

|

$ |

0.0120 |

|

|

$ |

0.0011 |

|

| |

|

Fourth Quarter

|

|

$ |

0.0250 |

|

|

$ |

0.0011 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

2022

|

|

First Quarter

|

|

$ |

0.1850 |

|

|

$ |

0.0300 |

|

| |

|

Second Quarter

|

|

$ |

0.2299 |

|

|

$ |

0.1010 |

|

| |

|

Third Quarter

|

|

$ |

0.1649 |

|

|

$ |

0.0010 |

|

| |

|

Fourth Quarter

|

|

$ |

0.0800 |

|

|

$ |

0.0002 |

|

Our shares are subject to Section 15(g) and Rule 15g-9 of the Securities and Exchange Act, commonly referred to as the “penny stock” rule. The rule defines penny stock to be any equity security that has a market price less than $5.00 per share, subject to certain exceptions. The rule provides that any equity security is considered to be a penny stock unless that security is:

| |

-

|

registered and traded on a national securities exchange meeting specified criteria set by the SEC;

|

| |

-

|

issued by a registered investment company;

|

| |

-

|

excluded from the definition on the basis of price (at least $5.00 per share) or the issuer’s net tangible assets.

|

Trading in the penny stocks is subject to additional sales practice requirements on broker-dealers who sell penny stocks to persons other than established customers and accredited investors. Accredited investors, in general, include certain institutional investors and individuals with assets in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 together with their spouse.

For transactions covered by these rules, broker-dealers must make a special suitability determination for the purchase of our securities and must have received the purchaser’s written consent to the transaction prior to the purchase. Additionally, for any transaction involving a penny stock, the rules require the delivery, prior to the first transaction, of a risk disclosure document relating to the penny stock. A broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative, and current quotations for the security. Finally, monthly statements must be sent to the purchaser disclosing recent price information for the penny stocks. Consequently, these rules may restrict the ability of broker-dealers to trade or maintain a market in our common stock and may affect the ability of shareholders to sell their shares.

Holders

As of June 30, 2023, there were approximately 917 shareholders of record holding 21,107,018,148 shares of common stock. The holders of common stock are entitled to one vote for each share held of record on all matters submitted to a vote of stockholders. Holders of the common stock have no preemptive rights and no right to convert their common stock into any other securities. There are no redemption or sinking fund provisions applicable to the common stock.

Dividends

The Company has not paid any dividends on its common stock. The Company current intends to retain any earnings for use in its business, and therefore does not anticipate paying cash dividends in the foreseeable future.

Securities Authorized Under Equity Compensation Plans

The following table lists the securities authorized for issuance under any equity compensation plans approved by our shareholders and any equity compensation plans not approved by our shareholders as of June 30, 2023. This chart also includes individual compensation agreements.

EQUITY COMPENSATION PLAN INFORMATION

| |

|

|

|

|

|

|

|

|

|

Number of securities

|

|

| |

|

|

|

|

|

|

|

|

|

remaining available for

|

|

| |

|

Number of securities

|

|

|

|

|

|

|

future issuance under

|

|

| |

|

to be issued

|

|

|

Weighted-average

|

|

|

equity compensation

|

|

| |

|

upon exercise

|

|

|

exercise price of

|

|

|

plans (excluding

|

|

| |

|

of outstanding options,

|

|

|

outstanding options,

|

|

|

securities reflected

|

|

| |

|

warrants and rights

|

|

|

warrants and rights

|

|

|

in column (a))

|

|

|

Plan category

|

|

(a)

|

|

|

(b)

|

|

|

(c)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity compensation plans approved by security holders

|

|

|

0 |

|

|

$ |

0.00 |

|

|

|

0 |

|

|

Equity compensation plans not approved by security holders

|

|

|

0 |

|

|

$ |

0.00 |

|

|

|

0 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

0 |

|

|

$ |

0.00 |

|

|

|

0 |

|

Company repurchases of common stock during the year ended June 30, 2023

None

Performance Graphic

This item is not required to provide a performance graph since it is a “smaller reporting company” as defined in Exchange Act Regulation S-K Rule 10(f).

Share issuances in year ended June 30, 2023

All share issuances have been previously reported.

ITEM 6. [Reserved]

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

Forward Looking Statement Notice

This Current Report on Form 10-K contains forward-looking statements within the meaning of the federal securities laws. These include statements about our expectations, beliefs, intentions or strategies for the future, which we indicate by words or phrases such as “anticipate,” “expect,” “intend,” “plan,” “will,” “we believe,” “believes,” “management believes” and similar language. Except for the historical information contained herein, the matters discussed in this “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and elsewhere in this report are forward-looking statements that involve risks and uncertainties. The factors listed in the section captioned “Risk Factors,” as well as any cautionary language in this report; provide examples of risks, uncertainties and events that may cause our actual results to differ materially from those projected. Except as may be required by law, we undertake no obligation to update any forward-looking statement to reflect events after the date of this Form 10-K.

Overview of Business

Our mission is to invest in innovative technologies, integrated with business development in the healthcare ecosystem.

We are focused on protein and peptide small molecular drugs research and development, diagnostic and medical devices with AI cloud computing, cell therapy and regenerational medicine and supplements manufacturing and sales.

On September 3, 2021, the Company entered into an Assets Acquisition Agreement with Wang’s Property Investment & Management LLC to purchase 53 units in 19 real estate properties appraised at $7,626, 286.37 for a purchase price of $7,000,000, The purchase price shall be paid as follows: (i) $1,000,000 on execution of the Agreement, (ii) $2,000,000 within 60 days thereof and (iii) the remainder by April 10, 2022. The Agreement is subject to customary closing conditions, including, satisfactory due diligence. On September 9, 2021, the Company entered into a Supplemental Assets Acquisition Agreement with Wang’s Property Investment & Management LLC to amend and clarify that (i) it was purchasing 19 real estate properties which includes 53 units appraised at $7,626,286.37 for a purchase price of $7,000,000 and (ii) that it will waive and not conduct due diligence in order for the transaction to proceed. The acquisition has not been consummated. With the asset acquisition from Wang’s Property Investment & Management LLC, the Company will diversify its business into property investment and management. By the end of May 2022, the Company ceased the acquisition of Wang’s Property Investment & Management LLC.

Results of Operations

Results of Operations for the year ended June 30, 2023 compared to the year ended June 30, 2022.

Sales amounted to $204,309 and $104,648 for the years ended June 30, 2023 and 2022, respectively.

Cost of goods sold amounted to $35,720 and $1,588,453 for the years ended June 30, 2023 and 2022, respectively.

Gross profit/(loss) amounted to $168,588 and ($1,483,805) for the years ended June 30, 2023 and 2022, respectively.

Operating expenses for the year ended June 30, 2023 and 2022 were $661,232 and $3,250,293, respectively. The decrease was mainly due to reduced payroll expenses, rent expenses, advertising, and professional expenses.

Our net loss for the year ended June 30, 2023 and 2022 was $777,341 and $4,924,936, respectively. The decrease in net loss was mainly due to the decreased cost of goods sold and operating expenses.

Liquidity and Capital Resources

Liquidity is the ability of a company to generate funds to support its current and future operations, satisfy its obligations, and otherwise operate on an ongoing basis. Significant factors in the management of liquidity are funds generated by operations, levels of accounts receivable and accounts payable and capital expenditures.

The accompanying Consolidated Financial Statements (“CFS”) were prepared on a going concern basis, which contemplates the realization of assets and the settlement of liabilities and commitments in the normal course of business. As reflected in the accompanying CFS, the Company has incurred recurring net losses. For the year ended June 30, 2023 the Company recorded a net loss of $777,341, used cash to fund operating activities of $752,902 and at June 30, 2023, had a shareholders’ deficit of $4,525,835. For the year ended June 30, 2023, the Company recorded a net loss of $4,924,936, used cash to fund operating activities of $1,479,859, and on June 30, 2022, had a shareholders’ deficit of $3,860,481. These factors create substantial doubt about the Company’s ability to continue as a going concern. The financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

The Company is raising the additional capital to achieve profitable operations.

Our cash needs for the year ended June 30, 2023 were primarily met by loans and advances from our current majority shareholder. As of June 30, 2023, we had a cash balance of $54,150. Our future majority shareholders will need to provide all of our working capitals going forward.

Primarily as a result of our recurring losses and our lack of liquidity, we received a report from our independent registered public accounting firm for our financial statements for the year ended June 30, 2023 that includes an explanatory paragraph describing the uncertainty as to our ability to continue as a going concern.

Financial Position

As of June 30, 2023, we had $54,150 in cash, a working capital deficit of $2,912,469 and an accumulated deficit of $9,183,110.

Critical Accounting Policies and Estimates

Estimates

The preparation of these consolidated financial statements (“CFS”) in accordance with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the dates of the consolidated financial statements and the reported amounts of net sales and expenses during the reported periods. Actual results may differ from those estimates and such differences may be material to the financial statements. The more significant estimates and assumptions by management include among others, the fair value of shares of common stock issued for services. The current economic environment has increased the degree of uncertainty inherent in these estimates and assumptions.

Revenues

Revenue from sale of goods under Topic 606, Revenue from Contracts with Customers, is recognized in a manner that reasonably reflects the delivery of the Company’s products and services to customers in return for expected consideration and includes the following elements:

| |

●

|

executed contract(s) with customers that the Company believes is legally enforceable;

|

| |

●

|

identification of performance obligation in the respective contract;

|

| |

●

|

determination of the transaction price for each performance obligation in the respective contract;

|

| |

●

|

allocation of the transaction price to each performance obligation; and

|

| |

●

|

recognition of revenue only when the Company satisfies each performance obligation.

|

Inventories

Inventories are stated at the lower of cost (first-in, first-out) or net realizable value. Adjustments to reduce the cost of inventory to its net realizable value are made, if required, for estimated excess, obsolescence, or impaired balances.

Fair Value Measurements

Fair value measurements are determined using authoritative guidance issued by the FASB, with the exception of the application of the guidance to non-recurring, non-financial assets and liabilities as permitted. Fair value is defined in the authoritative guidance as the price that would be received to sell an asset or paid to transfer a liability in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants at the measurement date. A fair value hierarchy was established, which prioritizes the inputs used in measuring fair value into three broad levels as follows:

Level 1—Quoted prices in active markets for identical assets or liabilities.

Level 2—Inputs, other than the quoted prices in active markets, are observable either directly or indirectly.

Level 3—Unobservable inputs based on the Company’s assumptions.

The Company is required to use observable market data if available without undue cost and effort.

The Company’s financial instruments include cash and accounts payable. Management has estimated that the carrying amounts approximate their fair value due to the short-term nature.

Loss Per Share

Basic earnings (loss) per share are computed by dividing income available to common shareholders by the weighted-average number of common shares available. Diluted earnings (loss) per share is computed similar to basic earnings per share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potential common shares had been issued and if the additional common shares were dilutive. The Company’s diluted loss per share is the same as the basic loss per share for the years ended June 30, 2023 and 2022, as there are no potential shares outstanding that would have a dilutive effect.

Income Taxes

Income tax expense is based on pretax financial accounting income. Deferred tax assets and liabilities are recognized for the expected tax consequences of temporary differences between the tax bases of assets and liabilities and their reported amounts. Valuation allowances are recorded to reduce deferred tax assets to the amount that will more likely than not be realized. The Company recorded a valuation allowance against its deferred tax assets as of June 30, 2023 and 2022.

The Company accounts for uncertainty in income taxes using a two-step approach to recognizing and measuring uncertain tax positions. The first step is to evaluate the tax position for recognition by determining if the weight of available evidence indicates that it is more likely than not that the position will be sustained on audit, including resolution of related appeals or litigation processes, if any. The second step is to measure the tax benefit as the largest amount that is more than 50% likely of being realized upon settlement. The Company classifies the liability for unrecognized tax benefits as current to the extent that the Company anticipates payment (or receipt) of cash within one year. Interest and penalties related to uncertain tax positions are recognized in the provision for income taxes.

Recent Accounting Pronouncements

See Footnote 2 of the financial statements for a discussion of recently issued accounting standards.

Contractual Obligations and Off-Balance Sheet Arrangements

We do not have any contractual obligations or off-balance sheet arrangements.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Our financial statements appear beginning on page F-1 in this Form 10-K.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

None.

ITEM 9A. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

Based upon an evaluation of the effectiveness of our disclosure controls and procedures performed by our Chief Executive Officer as of the end of the period covered by this report, our Chief Executive Officer concluded that our disclosure controls and procedures have not been effective as a result of a weakness in the design of internal control over financial reporting identified below.

As used herein, “disclosure controls and procedures” mean controls and other procedures of our company that are designed to ensure that information required to be disclosed by us in the reports that we file or submit under the Securities Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the Commission’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by us in the reports that we file or submit under the Securities Exchange Act is accumulated and communicated to our management, including our principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure.

Management’s Annual Report on Internal Control over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over financial reporting (“ICFR”), as such term is defined in Exchange Act Rule 13a-15(f) under the Securities Exchange Act of 1934. Our Chief Executive Officer/Chief Accounting Officer conducted an evaluation of the effectiveness of our ICFR based on the framework in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO 2013”). Based on management’s evaluation under the framework, management has concluded that our ICFR was not effective as of June 30, 2023.

We identified material weaknesses in our ICFR primarily attributable to (i) lack of segregation of incompatible duties; and (ii) insufficient Board of Directors representation. These weaknesses are due to our inadequate staffing during the period covered by this report and our lack of working capital to hire additional staff. Management has retained an outside, independent financial consultant to record and review all financial data, as well as prepare our financial reports, in order to mitigate this weakness. Although management will periodically re-evaluate this situation, at this point it considers that the risk associated with such lack of segregation of duties and the potential benefits of adding employees to segregate such duties are not cost justified. We intend to hire additional accounting personnel to assist with financial reporting as soon as our finances will allow.

This annual report does not include an attestation report of our registered public accounting firm regarding ICFR. Management’s report was not subject to attestation by our registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit us to provide only management’s report in this annual report.

ITEM 9B. OTHER INFORMATION

None.

ITEM 9C. DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS

None.

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Set forth below are the names of our directors, executive officers and significant employees of our company as of the date of this Form 10-K, their ages, all positions and offices that they hold with us, the periods during which they have served as such, and their business experience during at least the last five years.

|

Name

|

|

Position with the Company

|

|

Age |

|

Period

|

| |

|

|

|

|

|

|

|

Mike Wang

|

|

Chairman of the Board of Directors, President, Chief Executive Officer

|

|

68

|

|

2017 - Present

|

| |

|

|

|

|

|

|

|

Rex Chang

|

|

Director

|

|

72

|

|

2018 - Present

|

| |

|

|

|

|

|

|

|

Aihua Guo

|

|

Director

|

|

49

|

|

2020 - Present

|

| |

|

|

|

|

|

|

|

Peter Britton

|

|

Director

|

|

71

|

|

2020 - Present

|

| |

|

|

|

|

|

|

|

Jiaxin Xue

|

|

Director

|

|

47

|

|

2018 - Present

|

| |

|

|

|

|

|

|

|

Quinn Chen

|

|

Chief Financial Officer

|

|

60

|

|

2022 - Present

|

|

Name

|

|

Position with the Company and Principal Occupations

|

| |

|

|

|

Mike Wang

|

|

Chairman of the Board of Directors, President, Chief Executive Officer and Chief Financial Officer since 2017. Mr. Wang has served as the Chief Financial Officer of our company since 2017. He has been working in the health supplements business for about 20 years. From 2012 to present, he worked as the vice-president of the American Nutrition and Health Association. From 2013 to present, he worked as the president of the Health & Beauty Group Inc. From 2016 to present, he worked as our President, Chief Executive Officer and Chief Financial Officer.

|

| |

|

|

|

Rex Chang

|

|

Director Mr. Rex Chang is an experienced GPA Consultant and an international trade specialist. He started in manufacturing facilities, well-trained in commercial and industrial, import-export, QC/QA, marketing development and government procurement. Mr. Chang served as Chief Executive Officer in U. S. Asia Chamber of Commerce, and Chief Executive Officer- Asian Marketing in U.S. Foods International. He also served as Chief Executive Officer of New Cathay International Development Corp. Mr. Chang is consultant to the Center for International Trade Development and Taiwan Trade Center.

|

| |

|

|

|

Aihua Guo

|

|

Director Ms. Aihua Guo is an entrepreneur and founder of Hong Kong-based Brilliant Health Co., Ltd., which she founded in 2018. She has been the standing editor of Chinese Journals of Tissue Engineering and Aesthetic Plastic Surgery since 2018. She has also been the visiting professor of Galway Institute of Regenerative Medicine in Ireland and CEO of Pure Athesthetic Co., Ltd. of Hong Kong since 2017. From 2016 to 2018, Ms. Guo served as the business director of China Regenerative Medicine International Co., Ltd. She has been the members of British Blood Transfusion Association, Illouz Foundation France and China Plastic Surgery Association since 2015. Ms. Guo obtained her MD of Plastic Surgery in 2012 and PhD of Immunology of Transplantation and Ophthalmology in 2007.

|

| |

|

|

|

Peter Britton

|

|

Director. Mr. Peter Britton is the founder and board chairman of Purecell Group, co-inventor of UCF (Umbilical Cord Factors) global patent, and international expert on translational cellular regenerative medicine. He is the director and chief scientist of Purcell in the development, commercialization and multiple medical applications of Purecell patented anti-aging products and technologies including UCF, Exosome, NAD+, SKQ1 and Liposome. He currently serves as the chief scientist and director of the joint-venture between Purecell and BoaoYiling Life Care Center in China, which leads the world-first officially-approved medical application and commercialization of UCF technology in the field of degenerative joint disease. He is also the founder of Hong Kong-based N Cell, a leading provider of proteomic analysis for Asian market since 2016, and has been the founding member of the Sino-Australian Stem Cell Centre of Excellence with Peking University since 2015. Mr. Peter Britton graduated with a bachelor's degree from the University of Sydney, and obtained post graduate work at the University of Bern in Switzerland.

|

|

Jiaxin Xue

|

|

Director. Mr. Jiaxin Xue is graduate of Henan Medical University. He also obtain Doctor degree in Natural Medicine from American Naturopathic University, Master's degree in Social Medicine and Health Management from Peking Union Medical College, Mr. Xue obtained PhD degree in Social Economics, School of Philosophy and Sociology from Beijing Normal University. He is an experienced specialist involves comprehensive fields such as medical treatment, medicine, health, rehabilitation, and elderly care. From 2007 to 2008, Mr. Xue was the Deputy Director of the Chinese Red Cross Rescue Training Department, Vice President of the Business Development Department of Haihong Pharmaceutical Holdings; in 2009 Mr. Xue founded Mai Dingsheng International Medical Investment Service Agency. From 2014 to the present, Mr. Xue is the Deputy Dean of the International College of Natural Therapy, Executive Vice President of the Zhongguancun Industry Integration and Transformation Promotion Association and Chairman of the International Medical Care Industry Committee, Deputy Director of the Chronic Disease Prevention Fund Management Committee of the China Medical and Health Development Foundation, Chinese Nationality Deputy Director of the Internet + Medical Work Committee of the Health Association, Deputy Director of the Clinical Medicine Center of the Research Institute of the National Health Commission.

|

| |

|

|

|

Quinn Chen

|

|

CFO. Mr. Quinn Chen has more than two decades of practice experience in public and private accounting where he specialized in both private and public company financial audits, oversight over financial reporting, cash management, tax compliance, and mergers and acquisitions. From October 2018 through present date, Mr. Chen was the Chief Financial Officer of NuOrganic Cosmetics. From September 2014 –July 2019, he was a financial controller at Gardiner & Theobald, an independent global consultancy to the construction and property industry. At the same time, he served as the chief tax consultant of real estate investments at 42nd Street Realty, a well- known Times Square Realty Company of New York City, and provided consulting service in asset management and tax planning of trusts and estates to high-profile. Prior to that, Mr. Chen spent about ten years as an auditor and tax accountant with several public accounting firms in the New York City metropolitan area. Mr. Chen holds a Master of Business Administration from Baruch College, Zicklin School of Business.

|

All our directors hold office until the next annual meeting of our shareholders or until their successors have been elected and qualified. The executive officers of our company are appointed by our board of directors and hold office until their death, resignation, or removal from office.

Family Relationships

There is no family relationship among any of our officers or directors.

Code of Ethics

The Company has not adopted a code of ethics which applies to the chief executive officer, or principal financial and accounting officer, because of our current low level of operations as a public entity. The Company intends to adopt a code of ethics in the near future.

Audit Committee Financial Expert

The Company does not have either an Audit Committee or a financial expert on the BOD. The BOD believes that obtaining the services of an audit committee financial expert is not economically rational at this time in light of the costs associated with identifying and retaining an individual who would qualify as an audit committee financial expert, the limited scope of our operations and the relative simplicity of our financial statements and accounting procedures.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our executive officers and directors and persons who own more than 10% of a registered class of our equity securities to file with the SEC initial statements of beneficial ownership, reports of changes in ownership and annual reports concerning their ownership of our common stock and other equity securities, on Form 3, 4 and 5 respectively. Executive officers, directors and greater than 10% shareholders are required by the SEC regulations to furnish our Company with copies of all Section 16(a) reports they file.

Based solely on our review of the copies of such reports received by us and on written representations by our officers and directors regarding their compliance with the applicable reporting requirements under Section 16(a) of the Exchange Act, On the fiscal year ended June 30, 2023, two new board members, Mr. Peter Britton, Ms. Aihua Guo did not file Forms 3.

ITEM 11. EXECUTIVE COMPENSATION

Executive Officers and Directors

The following tables set forth certain information about compensation paid, earned or accrued for services by (i) the Company’s Chief Executive Officer and Chief Financial Officer in the years ended June 30, 2023 and 2022 (“Named Executive Officers”):

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-Equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Incentive

|

|

|

Nonqualified |

|

|

|

|

|

|

|

|

|

| Name and |

|

|

|

|

|

|

|

|

|

|

|

Stock |

|

|

Option |

|

|

Plan

|

|

|

Deferred

|

|

|

All Other |

|

|

|

|

|

|

Principal

|

|

|

|

Salary |

|

|

Bonus |

|

|

Awards |

|

|

Awards

|

|

|

Compensation

|

|

|

Compensation

|

|

|

Compensation

|

|

|

Total |

|

|

Position

|

|

Year |

|

($)

|

|

|

($) |

|

|

($) |

|

|

($) |

|

|

($) |

|

|

($) |

|

|

($) |

|

|

($) |

|

|

Mike Q. Wang

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

President/Executive

|

|

2023

|

|

$ |

43,800 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

$ |

43,8001 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2022 |

|

$ |

40,711 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

$ |

40,711 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quinn Chen

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CFO

|

|

2023

|

|

$ |

8,308 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

$ |

8,308 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2022 |

|

$ |

13,846 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

$ |

13,846 |

|

Employment Contracts

We currently do not have any written employment agreements with our executive officers.

Director Compensation

None of our directors was compensated for their services to the board other than Mr. Rex Chang who was paid $- and $50,935 respectively for the years ended June 30, 2023 and 2022.

Director Qualifications

Directors are responsible for overseeing the Company’s business consistent with their fiduciary duty to the shareholders. This significant responsibility requires highly skilled individuals with various qualities, attributes and professional experience. Our BOD believes that there are general requirements for service on the BOD that are applicable to directors and that there are other skills and experience that should be represented on the BOD as a whole but not necessarily by each director. The BOD considers the qualifications of director and director candidates individually and in the broader context of the BOD’s overall composition and the Company’s current and future needs.

Qualifications, Attributes, Skills and Experience to be Represented on the Board as a Whole

The BOD has identified particular qualifications, attributes, skills and experience that are important to be represented on the board as a whole, in light of the Company’s current needs and its business priorities. The BOD believes that it should include some directors with a high level of financial literacy and some directors who possess relevant business experience as a Chief Executive Officer or a President or like position. Marketing is the core focus of our business, and the Company seeks to develop and deploy the world’s most innovative and effective marketing and technology. Therefore, the Board believes that marketing and technology experience should be represented on the BOD. Since the Company is involved in the healthcare business, the Company’s business also requires compliance with a variety of regulatory requirements and relationships with various governmental entities. Therefore, the BOD believes that governmental, political, or diplomatic expertise should be represented on the Board.

Set forth below are a chart and a narrative disclosure that summarize the specific qualifications, attributes, skills and experiences described above. An “X” in the chart below indicates that the item is a specific reason that the director has been nominated to serve on the Company’s Board. The lack of an “X” for a particular qualification does not mean that the director does not possess that qualification or skill. Rather, an “X” indicates a specific area of focus or expertise of a director on which the BOD currently relies.

|

High level of financial literacy

|

|

Mike Q. Wang

|

|

Quinn Chen

|

|

|

| |

|

|

|

X

|

|

|

|

Extensive knowledge of the Company’s business

|

|

X

|

|

X

|

|

|

|

Marketing/Marketing related technology experience

|

|

X

|

|

|

|

|

|

Relevant Chief Executive/President or like experience

|

|

X

|

|

X

|

|

|

|

Corporate Governance expertise

|

|

X

|

|

X

|

|

|

Directors or Executive Officers involved in Bankruptcy or Criminal Proceedings

To our knowledge, during the last ten years, none of our directors and executive officers (including those of our subsidiaries), has:

| |

●

|

Had a bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time.

|

| |

●

|

Been convicted in a criminal proceeding or been subject to a pending criminal proceeding, excluding traffic violations and other minor offenses.

|

| |

●

|

Been subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities.

|

| |

●

|

Been found by a court of competent jurisdiction (in a civil action), the SEC, or the Commodities Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended or vacated.

|

| |

●

|

Been the subject to, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization, any registered entity, or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

|

Board Meetings

The BOD held no meetings during FY 2023.

Material Changes to the Procedures by which Security Holders May Recommend Nominees to the Board of Directors

There have been no material changes to the procedures by which security holders may recommend nominees to the BOD.

Board Leadership Structure and Role in Risk Oversight

Mr. Mike Q. Wang is our Chairman, Chief Executive Officer. As a main officer and director, Mr. Wang, by default, serves as our business and industry leader most capable of identifying strategic priorities and executing our business strategy. In addition, having a single leader eliminates the potential for confusion and provides clear leadership for the Company. We believe that this leadership structure has served the Company well. The Board’s role in the risk oversight of the Company includes, among other things:

| |

●

|

appointing, retaining and overseeing the work of the independent auditors, including resolving disagreements between the management and the independent auditors relating to financial reporting;

|

| |

●

|

approving all auditing and non-auditing services permitted to be performed by the independent auditors;

|

| |

●

|

reviewing annually the independence and quality control procedures of the independent auditors;

|

| |

●

|

reviewing and approving all proposed related party transactions;

|

| |

●

|

discussing the annual audited financial statements with the management; and

|

| |

●

|

meeting separately with the independent auditors to discuss critical accounting policies, management letters, recommendations on internal controls, the auditor’s engagement letter and independence letter and other material written communications between the independent auditors and the management.

|

Our BOD is responsible for approving all related party transactions. We have not adopted written policies and procedures specifically for related person transactions.

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

Beneficial Ownership

The following table sets forth, as of the date of this report the outstanding common stock of the Company owned of record or beneficially by each person who owned of record, or was known by the Company to own beneficially, more than 5% of the Company’s 21,107,081,148 shares of common stock issued and outstanding, and the name and shareholdings of each director and all of the executive officers and directors as a group.

Unless otherwise indicated in the footnotes to the following table, each person named in the table has sole voting and investment power and that person’s address is c/o 1609 W Valley Blvd., Unit 338A, Alhambra, CA 91803:

CERTAIN BENEFICIAL OWNERS

| |

|

|

|

|

Amount and

|

|

|

|

|

|

| |

|

|

|

|

nature of

|

|

|

|

|

|

| |

|

|

|

|

beneficial

|

|

|

Percent

|

|

|

Name

|

|

Office

|

|

|

owner (1)

|

|

|

of class

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Mike Q. Wang

|

|

Chief Executive Officer, Director

|

|

|

|

999,171,990 |

|

|

|

4.73 |

% |

|

Rex Chang

|

|

Director

|

|

|

|

200,000,000 |

|

|

|

0.95 |

% |

|

Aihua Guo

|

|

Director

|

|

|

|

311,797,747 |

|

|

|

1.48 |

% |

|

Peter Britton

|

|

Director

|

|

|

|

-- |

|

|

|

-- |

|

|

Jianxin Xue

|

|

Director

|

|

|

|

627,000,000 |

|

|

|

2.97 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

All officer and directors as a group (5 person)

|

|

N/A |

|

|

|

2,137,969,737 |

|

|

|

10.13 |

% |

| |

(1)

|

Except as otherwise noted, shares are owned beneficially and of record, and such record shareholder has sole voting, investment, and dispositive power.

|

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

During the year ended June 30, 2023, the Company's current majority shareholder advanced $224,423 to the Company as working capital and the Company repaid $373,140 to the shareholder. As of June 30, 2023 and 2022, the Company owed its current majority shareholder and other related $425,142 and $573,859 respectively. The advances are non-interest bearing and are due on demand.

Director Independence

Currently, the Company does not have any independent directors. Since the Company’s common stock is not currently listed on a national securities exchange, we have used the definition of “independence” of The NASDAQ Stock Market to make this determination.

Under NASDAQ Listing Rule 5605(a)(2), an "independent director" is a "person other than an officer or employee of the company or any other individual having a relationship which, in the opinion of the company's board of directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director."

We do not currently have a separately designated audit, nominating or compensation committee. However, we do intend to comply with the independent director and committee composition requirements in the future.

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES

The following table sets forth the fees paid by the Company for professional services rendered for the audits of the annual financial statements and fees billed for other services rendered by its prior principal accountant, WWC, P.C. and by its current principal accountant, Gries & Associates LLC:

|

Type of Services Rendered

|

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

Audit Fees

|

|

$ |

36,500 |

|

|

$ |

120,158 |

|

|

Audit-Related Fees

|

|

$ |

- |

|

|

$ |

- |

|

|

Tax Fees

|

|

$ |

- |

|

|

$ |

- |

|

|

All Other Fees

|

|

$ |

- |

|

|

$ |

- |

|

Pre-approval Policies

We do not have a standing audit committee currently serving and as a result our BOD performs the duties of an audit committee. Our BOD evaluates and approves, in advance, the scope and cost of the engagement of an accounting firm before the accounting firm renders audit and non-audit services. We do not rely on pre-approval policies and procedures.

PART IV

ITEM 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

(a) (1) Financial Statements.

| Gries & Associates, LLC Certified Public Accountants 501 S. Cherry Street, Suite 1100 Denver, Colorado 80246 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders

American Great Health and Subsidiaries

Opinion on the Financial Statements

We have audited the accompanying balance sheet of American Great Health and Subsidiaries. (the Company) as of June 30, 2023, and the related statement of operations, stockholders’ deficit and cash flows for the period then ended and the related notes (collectively referred to as the financial statements). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of June 30, 2023, and the results of its operations and its cash flows for each of the period then ended in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Going Concern Uncertainty

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in note 1 to the financial statements, the Company has incurred losses since inception of $9,183,110 and a net loss of $777,341. These factors create an uncertainty as to the Company’s ability to continue as a going concern. Management’s plans in regard to these matters are also described in note 3. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Emphasis of Matters-Risks and Uncertainties

The Company is not able to predict the ultimate impact that COVID -19 will have on its business. However, if the current economic conditions continue, the pandemic could have an adverse impact on the economies and financial markets of many countries, including the geographical area in which the Company plans to operate.

We have served as the Company’s auditor since 2023.

blaze@griesandassociates.com

400 South Colorado Blvd, Suite 870, Denver, Colorado 80246

(O)720-464-2875 (M)773-255-5631 (F)720-222-5846

Denver, Colorado

October 12, 2023

PCAOB ID: 6778

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders

America Great Health and Subsidiaries

Opinion on the Consolidated Financial Statements

We have audited the accompanying consolidated balance sheet of America Great Health and Subsidiaries (the “Company”) as of June 30, 2021, and the related statements of operations, stockholders' deficit, and cash flows for the year then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of June 30, 2021, and the results of its operations and its cash flows for the year then ended, in conformity with accounting principles generally accepted in the United States.

Going Concern Matter

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company has suffered recurring losses from operations that raises substantial doubt about its ability to continue as a going concern. Management's plans in regard to these matters are also described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company's financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. Our audits included performing procedures to assess the risks of material misstatement, whether due to error fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements.

Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

Critical Audit Matters

The critical audit matters communicated below are matters arising from the current period audit of the consolidated financial statements that were communicated or required to be communicated to the audit committee and that (i) relate to accounts or disclosures that are material to the consolidated financial statements and (ii) involved our especially challenging, subjective, or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the consolidated financial

Investment in Purecell Group (“Purecell”)

As described in Note 1,8 and 9 to the consolidated financial statements, the Company issued 545,000,000 shares to acquire 51% of Purecell’s equity interest. Management reviews its equity investment in Purecell and accounted for under the equity methods because the Company does not have significant control over Purecell. The Company hired an external valuation firm to perform 409A valuation as of the acquisition date to determine the fair value of the Company’s common share. The share was valued at $0.00001 per share.

The principal considerations for our determination that performing procedures relating to the fair value of the investment in Purecell is a critical audit matter are there was significant judgment by management. This in turn led to a high degree of auditor judgment, subjectivity and effort in performing procedures.

Addressing the matter involved performing procedures and evaluating audit evidence in connection with forming our overall opinion on the consolidated financial statements. These procedures included(i) evaluating the appropriateness of comparable market value and (ii) evaluating the reasonableness of cost to recreate a similar company.

/s/ TAAD, LLP

We have served as the Company’s auditor from 2020 through 2022, and we previously served as the Company’s auditor from 2016 through 2018

Diamond Bar, California

January 20, 2022

America Great Health and Subsidiaries

Consolidated Balance Sheets

| |

|

As of June 30,

|

|

|

As of June 30,

|

|

|

ASSETS

|

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

CURRENT ASSETS

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$ |

54,150 |

|

|

$ |

62,643 |

|

|

Account receivable, net

|

|

|

- |

|

|

|

918 |

|

|

Inventory

|

|

|

108,351 |

|

|

|

116,060 |

|

|

Other receivable

|

|

|

- |

|

|

|

- |

|

|

Advance to supplier

|

|

|

16,964 |

|

|

|

16,964 |

|

|

TOTAL CURRENT ASSETS

|

|

|

179,465 |

|

|

|

196,585 |

|

| |

|

|

|

|

|

|

|

|

|

Right-of-use asset, net

|

|