000133161210-Kfalse--06-30FY202305000000000.0000013675003675003675001300000000.0000012115732721157327211573270.0000017780300013316122022-07-012023-06-300001331612us-gaap:SubsequentEventMemberimth:CreditorNotePayableMember2023-08-012023-08-210001331612srt:BoardOfDirectorsChairmanMember2021-09-012021-09-080001331612srt:BoardOfDirectorsChairmanMember2021-09-012021-09-280001331612srt:BoardOfDirectorsChairmanMember2022-03-012022-03-250001331612srt:BoardOfDirectorsChairmanMember2022-05-012022-05-050001331612srt:BoardOfDirectorsChairmanMember2022-03-310001331612srt:BoardOfDirectorsChairmanMember2022-06-300001331612imth:OfficeLeaseTwoMember2022-07-012023-06-300001331612imth:OfficeLeaseOneMember2022-07-012023-06-300001331612imth:JacksonOhioMemberimth:HarborLeaseMemberimth:SarahAdultDayCentersIncMember2022-07-012023-06-300001331612imth:StephenCircleNWCantonOHMemberimth:HarborLeaseMemberimth:SarahAdultDayCentersIncMember2022-07-012023-06-300001331612imth:DarrowRoadStowOhioMemberimth:HarborLeaseMemberimth:SarahAdultDayCentersIncMember2022-07-012023-06-300001331612imth:StephenCircleNWCantonOHMemberimth:HarborLeaseMemberimth:SarahAdultDayCentersIncMember2023-06-300001331612imth:JacksonOhioMemberimth:HarborLeaseMemberimth:SarahAdultDayCentersIncMember2023-06-300001331612imth:DarrowRoadStowOhioMemberimth:HarborLeaseMemberimth:SarahAdultDayCentersIncMember2023-06-300001331612imth:FinanceLeasestMember2023-06-300001331612imth:SFrankProfessionalLeaseMember2023-06-300001331612imth:SFrankProfessionalLeaseMember2022-06-300001331612imth:HarborLeasesMember2023-06-300001331612imth:HarborLeasesMember2022-06-300001331612imth:OperatingLeaseLiabilityMember2022-06-300001331612imth:OperatingLeaseLiabilityMember2023-06-300001331612imth:SFrankProfessionalLeasesMember2022-06-300001331612imth:SFrankProfessionalLeasesMember2023-06-300001331612imth:HarborLeaseMember2022-06-300001331612imth:HarborLeaseMember2023-06-300001331612imth:StowProfessionalCenterLeaseMember2022-06-300001331612imth:StowProfessionalCenterLeaseMember2023-06-300001331612imth:January12025toDecember312025Member2022-07-012023-06-300001331612imth:January12024toDecember312024Member2022-07-012023-06-300001331612imth:January12023toDecember312023Member2022-07-012023-06-300001331612imth:January12022toDecember312022Member2022-07-012023-06-300001331612imth:May12021ToDecember312021Member2022-07-012023-06-300001331612imth:April12021Member2022-07-012023-06-300001331612imth:AprilTwentyOneTwoThousandTwentyOneMember2022-07-012023-06-300001331612imth:SarahCaresCorporateMember2022-07-012023-06-300001331612imth:SarahCaresCorporateTwoMember2022-07-012023-06-300001331612imth:SarahCaresCorporateOneMember2022-07-012023-06-300001331612imth:TruCashGroupofCompaniesIncMember2022-03-012022-03-310001331612imth:TruCashGroupofCompaniesIncMember2022-03-310001331612imth:SeriesAAndBPreferredStockMember2020-12-012020-12-210001331612imth:SeriesAAndBPreferredStockMember2022-07-012023-06-300001331612imth:SeriesAAndBPreferredStockMember2022-04-012022-04-260001331612imth:CommonStockCommonMember2021-09-150001331612imth:SeriesAAndBPreferredCertificateofDesignationStockMember2023-06-300001331612imth:SeriesAAndBPreferredStockMember2022-04-260001331612imth:SeriesAAndBPreferredCertificateofDesignationStockMember2022-07-012023-06-300001331612imth:ConvertibleSeriesAPreferredStockMember2020-12-012020-12-210001331612imth:SeriesAAndBPreferredStockMember2020-12-210001331612imth:ConvertibleSeriesAPreferredStockMember2021-02-012021-02-190001331612imth:ConvertibleSeriesAPreferredStockMember2021-02-190001331612imth:SeriesAAndBPreferredStockMember2023-06-3000013316122022-04-012022-04-260001331612imth:CommonStockCommonMember2021-02-190001331612imth:CommonStockCommonMember2022-04-2600013316122022-04-260001331612imth:ConversionNotesPayableCommonSharesMember2021-03-012021-03-190001331612imth:ConversionNotesPayableCommonSharesMemberimth:ElevenNoteholderMember2021-02-012021-02-020001331612imth:ConversionNotesPayableCommonSharesMemberimth:ThreeNoteholderMember2020-12-012020-12-310001331612imth:TwoBoardOfDirectorMemberimth:ConversionNotesPayableCommonSharesMember2020-12-012020-12-310001331612imth:ConversionNotesPayableCommonSharesMember2020-12-012020-12-310001331612imth:ConversionNotesPayableCommonSharesMember2020-12-310001331612srt:MaximumMember2021-07-012022-06-300001331612srt:MinimumMember2021-07-012022-06-300001331612srt:MaximumMember2022-07-012023-06-300001331612srt:MinimumMember2022-07-012023-06-300001331612srt:MaximumMemberimth:InceptionMember2022-07-012023-06-300001331612srt:MinimumMemberimth:InceptionMember2022-07-012023-06-300001331612imth:InceptionMember2022-07-012023-06-300001331612imth:InceptionMember2023-06-300001331612imth:CompoundembeddedderivativeMember2022-06-300001331612imth:CompoundembeddedderivativeMember2023-06-300001331612imth:SBALoanMember2022-01-012022-01-060001331612imth:SBALoanMember2023-06-300001331612imth:SBALoanMember2022-06-300001331612imth:SBALoanMember2022-07-012023-06-300001331612imth:SBALoanMember2020-06-012020-06-250001331612imth:ConvertibleNotesPayableThirteenMember2022-06-300001331612imth:ConvertibleNotesPayableThirteenMember2023-06-300001331612imth:ConvertibleNotesPayableTwelveMember2022-06-300001331612imth:ConvertibleNotesPayableTwelveMember2023-06-300001331612imth:ConvertibleNotesPayableElevenMember2022-06-300001331612imth:ConvertibleNotesPayableElevenMember2023-06-300001331612imth:ConvertibleNotesPayableTenMember2022-06-300001331612imth:ConvertibleNotesPayableTenMember2023-06-300001331612imth:ConvertibleNotesPayableNineMember2022-06-300001331612imth:ConvertibleNotesPayableNineMember2023-06-300001331612imth:ConvertibleNotesPayableEightMember2022-06-300001331612imth:ConvertibleNotesPayableEightMember2023-06-300001331612imth:ConvertibleNotesPayableSevenMember2022-06-300001331612imth:ConvertibleNotesPayableSevenMember2023-06-300001331612imth:ConvertibleNotesPayableSixMember2022-06-300001331612imth:ConvertibleNotesPayableSixMember2023-06-300001331612imth:ConvertibleNotesPayableFiveMember2022-06-300001331612imth:ConvertibleNotesPayableFiveMember2023-06-300001331612imth:ConvertibleNotesPayableFourMember2022-06-300001331612imth:ConvertibleNotesPayableFourMember2023-06-300001331612imth:ConvertibleNotesPayableThreeMember2022-06-300001331612imth:ConvertibleNotesPayableThreeMember2023-06-300001331612imth:ConvertibleNotesPayableTwoMember2022-06-300001331612imth:ConvertibleNotesPayableTwoMember2023-06-300001331612imth:ConvertibleNotesPayableOneMember2022-06-300001331612imth:ConvertibleNotesPayableOneMember2023-06-300001331612imth:ConvertibleNotesPayableThirteenMember2022-07-012023-06-300001331612imth:ConvertibleNotesPayableTwelveMember2022-07-012023-06-300001331612imth:ConvertibleNotesPayableElevenMember2022-07-012023-06-300001331612imth:ConvertibleNotesPayableTenMember2022-07-012023-06-300001331612imth:ConvertibleNotesPayableNineMember2022-07-012023-06-300001331612imth:ConvertibleNotesPayableEightMember2022-07-012023-06-300001331612imth:ConvertibleNotesPayableSevenMember2022-07-012023-06-300001331612imth:ConvertibleNotesPayableSixMember2022-07-012023-06-300001331612imth:ConvertibleNotesPayableFiveMember2022-07-012023-06-300001331612imth:ConvertibleNotesPayableFourMember2022-07-012023-06-300001331612imth:ConvertibleNotesPayableThreeMember2022-07-012023-06-300001331612imth:ConvertibleNotesPayableTwoMember2022-07-012023-06-300001331612imth:ConvertibleNotesPayableOneMember2022-07-012023-06-300001331612imth:CharlesEverhardtMember2023-01-170001331612imth:CharlesEverhardtMember2023-02-080001331612imth:RelatedPartMemberimth:NotesPayableEightMember2022-07-012023-06-300001331612imth:RelatedPartMemberimth:NotesPayableEightMember2022-06-300001331612imth:RelatedPartMemberimth:NotesPayableEightMember2023-06-300001331612imth:RelatedPartMemberimth:NotesPayableTenMember2022-06-300001331612imth:RelatedPartMemberimth:NotesPayableNineMember2022-06-300001331612imth:RelatedPartMemberimth:NotesPayableTenMember2023-06-300001331612imth:RelatedPartMemberimth:NotesPayableNineMember2023-06-300001331612imth:RelatedPartMemberimth:NotesPayableTenMember2022-07-012023-06-300001331612imth:RelatedPartMemberimth:NotesPayableNineMember2022-07-012023-06-300001331612imth:RelatedPartMemberimth:NotesPayableSevenMember2022-07-012023-06-300001331612imth:RelatedPartMemberimth:NotesPayableSevenMember2022-06-300001331612imth:RelatedPartMemberimth:NotesPayableSevenMember2023-06-300001331612imth:RelatedPartMemberimth:NotesPayableSixMember2022-07-012023-06-300001331612imth:RelatedPartMemberimth:NotesPayableSixMember2022-06-300001331612imth:RelatedPartMemberimth:NotesPayableSixMember2023-06-300001331612imth:NotesPayableFiveMemberimth:RelatedPartMember2022-07-012023-06-300001331612imth:NotesPayableFiveMemberimth:RelatedPartMember2022-06-300001331612imth:NotesPayableFiveMemberimth:RelatedPartMember2023-06-300001331612imth:NotesPayableFourMemberimth:RelatedPartMember2022-07-012023-06-300001331612imth:NotesPayableFourMemberimth:RelatedPartMember2022-06-300001331612imth:NotesPayableFourMemberimth:RelatedPartMember2023-06-300001331612imth:NotesPayableThreeMemberimth:RelatedPartMember2022-07-012023-06-300001331612imth:NotesPayableThreeMemberimth:RelatedPartMember2022-06-300001331612imth:NotesPayableThreeMemberimth:RelatedPartMember2023-06-300001331612imth:NotesPayableTwoMemberimth:RelatedPartMember2022-07-012023-06-300001331612imth:NotesPayableTwoMemberimth:RelatedPartMember2022-06-300001331612imth:NotesPayableTwoMemberimth:RelatedPartMember2023-06-300001331612imth:NotesPayableOneMemberimth:RelatedPartMember2022-07-012023-06-300001331612imth:NotesPayableOneMemberimth:RelatedPartMember2022-06-300001331612imth:NotesPayableOneMemberimth:RelatedPartMember2023-06-300001331612imth:RefNoFiveMember2022-06-300001331612imth:RefNoFiveMember2023-06-300001331612imth:RefNoFourMember2022-06-300001331612imth:RefNoFourMember2023-06-300001331612imth:RefNoThreeMember2022-06-300001331612imth:RefNoThreeMember2023-06-300001331612imth:RefNoTwoMember2022-06-300001331612imth:RefNoTwoMember2023-06-300001331612imth:RefNoOneMember2022-06-300001331612imth:RefNoOneMember2023-06-300001331612imth:RefNoFiveMember2022-07-012023-06-300001331612imth:RefNoFourMember2022-07-012023-06-300001331612imth:RefNoThreeMember2022-07-012023-06-300001331612imth:RefNoTwoMember2022-07-012023-06-300001331612imth:RefNoOneMember2022-07-012023-06-300001331612us-gaap:FurnitureAndFixturesMember2022-06-300001331612us-gaap:FurnitureAndFixturesMember2023-06-300001331612us-gaap:ComputerEquipmentMember2022-06-300001331612us-gaap:ComputerEquipmentMember2023-06-300001331612us-gaap:VehiclesMember2022-06-300001331612us-gaap:VehiclesMember2023-06-300001331612us-gaap:LeaseholdImprovementsMember2022-06-300001331612us-gaap:LeaseholdImprovementsMember2023-06-300001331612imth:MarchTwoThousandTwentyTwoMember2022-06-300001331612imth:MarchTwoThousandTwentyThreeMember2022-06-300001331612imth:MarchTwoThousandTwentyTwoMember2023-06-300001331612imth:MarchTwoThousandTwentyThreeMember2023-06-300001331612imth:FranchiseAgreementsMember2022-07-012023-06-300001331612us-gaap:TrademarksMember2022-07-012023-06-300001331612imth:CARFAccreditationMember2022-07-012023-06-300001331612imth:NonCompeteAgreementMember2022-07-012023-06-300001331612imth:CustomerRelationshipMember2022-07-012023-06-300001331612us-gaap:RetainedEarningsMember2023-06-300001331612us-gaap:AdditionalPaidInCapitalMember2023-06-300001331612us-gaap:CommonStockMember2023-06-300001331612imth:SeriesAPreferredStocksMember2023-06-300001331612us-gaap:RetainedEarningsMember2022-07-012023-06-300001331612us-gaap:AdditionalPaidInCapitalMember2022-07-012023-06-300001331612us-gaap:CommonStockMember2022-07-012023-06-300001331612imth:SeriesAPreferredStocksMember2022-07-012023-06-300001331612us-gaap:RetainedEarningsMember2022-06-300001331612us-gaap:AdditionalPaidInCapitalMember2022-06-300001331612us-gaap:CommonStockMember2022-06-300001331612imth:SeriesAPreferredStocksMember2022-06-300001331612us-gaap:RetainedEarningsMember2021-07-012022-06-300001331612us-gaap:AdditionalPaidInCapitalMember2021-07-012022-06-300001331612us-gaap:CommonStockMember2021-07-012022-06-300001331612imth:SeriesAPreferredStocksMember2021-07-012022-06-3000013316122021-06-300001331612us-gaap:RetainedEarningsMember2021-06-300001331612us-gaap:AdditionalPaidInCapitalMember2021-06-300001331612us-gaap:CommonStockMember2021-06-300001331612imth:SeriesAPreferredStocksMember2021-06-3000013316122021-07-012022-06-3000013316122022-06-3000013316122023-06-3000013316122023-10-0900013316122022-12-31iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pureutr:sqft

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

Mark One

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: June 30, 2023

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to _________

Commission File No. 000-51390

INNOVATIVE MEDTECH, INC. |

(Exact name of registrant as specified in its charter) |

Delaware | | 1000 | | 33-1130446 |

(State or Other Jurisdiction of Incorporation or Organization) | | (Primary Standard Industrial Classification Number) | | (IRS Employer Identification Number) |

2310 York Street, Suite 200 Blue Island, IL 60406

Telephone: (708) 925-9424

(Address and telephone number of principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Not applicable. | | | | |

Securities registered under Section 12(g) of the Act:

Common Stock, $0.000001 par value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

On December 31, 2022, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $6,653,949, based upon the closing price on that date of the common stock of the registrant on the OTC Link alternative trading system (ATS) of $1.23. For purposes of this response, the registrant has assumed that its directors, executive officers and beneficial owners of 5% or more of its common stock are deemed to be affiliates of the registrant.

The number of the registrant’s shares of common stock outstanding was 21,157,327 as of October __, 2023.

TABLE OF CONTENTS

FORWARD LOOKING STATEMENTS

Unless stated otherwise or the context otherwise requires, the words “we,” “us,” “our,” the “Company,” “Innovative MedTech” or “Innovative” in this “Annual Report” on Form 10-K collectively refers to Innovative MedTech, Inc., a Delaware corporation (the “Company”), and its subsidiaries.

The information in this Annual Report on Form 10-K contains “forward-looking statements” relating to the Company, within the meaning of Rule 175 and Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Sections 3b-6 and 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

This report contains information that may be deemed forward-looking, that is based largely on the Company’s current expectations, and is subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those anticipated.

Among such risks, trends and other uncertainties, which in some instances are beyond its control, may be the Company’s ability to generate cash flows and maintain liquidity sufficient to service its debt, and comply with or obtain amendments or waivers of the financial covenants contained in its credit facilities, if necessary. Other risks and uncertainties include the impact of continuing adverse economic conditions, potential changes in the adult day care industry, energy costs, interest rates and the availability of credit, labor costs, legislative and regulatory rulings and other results of operations or financial conditions, increased capital and other costs, competition and other risks detailed from time to time in the Company’s publicly filed documents.

The words “may”, “will”, “would”, “could”, “believes”, “expects”, “anticipates”, “intends”, “plans”, “projects”, “considers” and similar expressions generally identify forward-looking statements. Readers are cautioned not to place undue reliance on such forward-looking statements, which are made as of the date of this report. The Company does not undertake to publicly update or revise its forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. You should not place undue reliance on these forward-looking statements, which apply only as of the date of this Form 10-K. Investors should carefully consider all of such risks before making an investment decision with respect to the Company’s stock. The following discussion and analysis should be read in conjunction with our financial statements for Innovative MedTech, Inc. Such discussion represents only the best present assessment from our Management.

PART I

Item 1. Description of Business

Corporate Background

Innovative MedTech, Inc. (the “Company”) was originally formed on April 21, 2005, in New Jersey as “Serino 1, Corp.,”. On December 16, 2005, the Company merged with Fresh Harvest Products, Inc., and then changed its name to Fresh Harvest Products, Inc., and began operating as a natural and organic food and beverage company. In 2012, the Company began focusing its efforts on developing software and mobile application development and video production and developing an e-book company, and in the intervening years, expanded its technology development and development efforts, creating a revenue sharing partnership with a mobile app, TreatER (available for free on the Apple App Store) in 2017 and in 2018, focusing on building a software program for financially valuing a film concept and mapping the predicted human behavior by region to films using a combination of geographical based social sentiment and the distribution data and financial performance of historically released films. On November 4, 2017, the Company redomiciled from New Jersey to Delaware, and changed its fiscal year end from October 31st to June 30th. On March 9, 2021, the Company effectuated a 10,000:1 reverse split, changed its stock symbol from “FRHV” to “IMTH,” and changed its name to Innovative MedTech, Inc. On March 25, 2021, the Company acquired two companies, Sarah Adult Day Services, Inc., and Sarah Day Care Centers, Inc. (collectively “SarahCare”), an adult day care center franchisor and provider. With 25 centers (2 corporate and 23 franchise locations) located in 13 states, SarahCare offers seniors daytime care and activities focusing on meeting their physical and medical needs on a daily basis, and ranging from nursing care to salon services and providing meals, to offering engaging and enriching activities to allow them to continue to lead active and engaged lives.

The Company has also been working on launching an RX Vitality wallet digital offering and mobile app which, once implemented and live, the Company’s digital healthcare wallet will be able to be accessed by customers via mobile wallet on both the Apple iOS and Android App Stores.

On April 1, 2022, the Company partnered with TruCash Group of Companies Inc. (“TruCash”), a leading global payments provider, to launch an all-in-one Super Healthcare App, called RX Vitality Wallet, that will be designed to cater to consumers, patients, hospitals, seniors, and governments, with a solid platform of benefits and online banking. The RX Vitality digital healthcare wallet is being designed to offer 20%-75% pharmaceutical discounts at 65,000 pharmacies across the United States, including Walgreens and CVS. In addition, we plan to offer health and wellness discounts at 500+ online merchants, as well as earning points on our Loyalty Program. On June 15, 2022, the Company’s RX Vitality digital healthcare wallet became for download at the Apple iOS App store for Apple iPhone users. The Company’s app has also been approved and is available on the Google Play Store. On June 30, 2023 this agreement was canceled.

On April 5, 2022, the Company engaged mPulse Mobile, a leader in conversational AI and digital engagement solutions for the healthcare industry, to drive engagement with the Company’s digital app and wallet (currently under development).

On April 28, 2022, the Company entered into a share exchange agreement with RX Vitality, Inc. (“RX Vitality”), a media and finance advisory company.

On May 13, 2022, the Company entered into a partnership with VSUSA Corp. (“VSUSA”), a non-profit organization that empowers Veterans and Seniors by offering services designed to build successful life transitions with access to workforce and independent housing; health services; and social service programs in communities across the United States. The partnership will permit the Company to use the VSUSA logo on the back of its Vitality Debit Card. For this, the Company agreed to pay 1% of its revenue generated from its Vitality Debit Card to VSUSA. The Company’s Chairman is a principal and co-Founder of VSUSA. On June 30, 2023, this agreement was canceled.

On June 1, 2022, the Company announced that Dr. Merle Griff, SarahCare’s Founder and CEO, would also be CEO of the Company.

General Overview

Description of Business

The Company is a provider of health and wellness services, and has two divisions: the RX Vitality digital wallet and health care app (available on both the iOS and Google Play App Stores), and the company’s wholly owned subsidiary SarahCare, an adult day care center franchisor with 2 corporate owned centers and 24 franchise locations across the United States. SarahCare offers seniors daytime care and activities ranging from exercise and medical needs daily to nursing care and salon services. On March 25, 2021, the Company acquired SarahCare for a total of $3,718,833; $2,000,110 was paid in cash and the Company assumed approximately $393,885 in debt due to sellers, and the remaining is payable through a royalty fee liability due in the amount of $1,500,000. With 25 centers (2 corporate and 23 franchise locations) located in 13 states, SarahCare offers seniors daytime care and activities focusing on meeting their physical and medical needs on a daily basis, and ranging from nursing care to salon services and providing meals, to offering engaging and enriching activities to allow them to continue to lead active and engaged lives.

On April 1, 2022, the Company partnered with TruCash Group of Companies Inc. (“TruCash”), a leading global payments provider, to launch an all-in-one Super Healthcare App, called RX Vitality Wallet, that will be designed to cater to consumers, patients, hospitals, Seniors, and governments, with a solid platform of benefits and online banking. The RX Vitality digital healthcare wallet is being designed to offer 20%-75% pharmaceutical discounts at 65,000 pharmacies across the United States, including Walgreens and CVS. In addition, we plan to offer health and wellness discounts at 500+ online merchants, as well as earning points on our Loyalty Program. On June 15, 2022, the Company’s RX Vitality digital healthcare wallet became available for download at the Apple iOS App store for Apple iPhone users. The Company’s app has also been approved and is available on the Google Play Store. On June 30, 2023, this agreement was canceled.

Overview and Mission

Our mission is to be one of the market leaders in the adult day care center market and to be a leader in related technologies in the health and wellness category. We believe that this is a fragmented market, and this is an opportune time to consolidate and grow our SarahCare brand. We have an experienced management team of adult day care industry and financial markets executives that have strong relationships in the industry.

Operational Overview – SarahCare, our wholly owned subsidiary

SarahCare has been providing health-care related services and companionship for older adults, aged 60 and above, and for adults aged 18-60 who are in need of health-related care and supervision (a “SARAH Business”) since February 1985. In 1985, the very first SarahCare Center opened its doors in Canton, Ohio. Originally called S.A.R.A.H. (Senior Adult Recreation and Health), the facility was one of the first intergenerational sites in the U.S. The senior adult day care center was located next to a child day care center and served as a training and research site for the development of other unique intergenerational programs across the country. Eventually, directors transitioned S.A.R.A.H.’s name to Sarah Center and, finally, to SarahCare demonstrating the philosophy of care administered to our seniors and their families.

We grant franchises for the operation of a SARAH Business. A SARAH Business provides non-medical care for elderly individuals and others in need of health-related care and supervision who desire compassionate care and stimulating activity in a secure, structured environment. We provide service that offers an effective solution for individuals who are in need of support services in order to continue living in their communities.

Currently, SarahCare operates 25 unique locations in the United States (23 franchised locations and 2 corporate owned centers) and internationally in the United Arab Emirates and Saudi Arabia. Center members who visit any one of our locations across 13 states are offered daytime care and activities ranging from exercise and health-care related needs on a daily basis to nursing care and salon services. Visitors benefit from additional services that include specialized dietary menus and engaging social activities allowing them to continue to lead active and enriched lives.

Accreditation

SarahCare’s two corporate-owned centers have achieved accreditation through the Aging Services division of CARF, an independent, non-profit accreditor of health and human services. Through accreditation, CARF assists service providers in improving the quality of their services, demonstrating value, and meeting internationally recognized organizational and program standards. The accreditation process applies sets of standards to service areas and business practices during an on-site survey. Accreditation, however, is an ongoing process, signaling to the public that a service provider is committed to continuously improving services, encouraging feedback, and serving the center. Accreditation also demonstrates a provider’s commitment to enhance its performance, manage its risk, and distinguish its service delivery.

Who We Care For

We have trained staff including nurses who specialize in caring for those with various impairments and health related problems, including but not limited to: frailty and physical dependence, memory impairment, stroke and Parkinson’s disease, chronic diseases, and isolation and depression.

Nursing assistants and other trained staff are always there to assist participants in ambulating and moving through all of our activities throughout the day. Activities are adapted for specific physical challenges so that no one ever feels left out. Yes, seniors who are wheelchair bound are very welcome in our centers. We handle a loved one’s challenging issues with care and consideration. If a loved one is wheelchair bound, multiple staff members are available at any given time if they need the assistance of more than one person. If a loved one needs help with toileting and/or bathing, we have specially trained staff to assist them. Our bathing areas are designed to give them as much privacy and dignity as possible.

Activities - Our centers offer versatile daily services and activities. Some of the benefits included in our daily fee are:

| · | NURSING - licensed nursing staff under the supervision of an RN for better care of chronic diseases |

| | |

| · | FOOD - delicious catered meals with special diets accommodated |

| | |

| · | ACTIVITIES - customized to your loved one’s interests and abilities |

| | |

| · | SOCIALIZATION - be with friends, remain active, and enjoy the day |

Nursing Services - While our participants enjoy their day at SarahCare, our center nurses provide the care and monitoring they need on a regular basis. Care is provided in the privacy of our nurse’s clinic. Our centers are staffed with qualified Registered and/or Licensed nurses. They are often specially certified and trained to work with issues related to aging and the elderly and are passionate about caring for seniors. Nursing services that are offered include:

| · | Medication administration and oversight |

| | |

| · | Weight and vital signs monitored and recorded regularly |

| | |

| · | Diabetic care |

| | |

| · | Care of feeding tubes and ostomies |

| | |

| · | Dressing changes |

| | |

| · | Other services needed by you or your loved one or as ordered by a physician |

Meals – We offer delicious and nutritious meals at no extra cost. Meals are the perfect time for friends to socialize and celebrate, sharing memories and exchanging jokes. Our beautiful dining rooms and delicious food help turn each meal into a special event. A light breakfast, a delicious catered lunch, and afternoon snack are all included in the daily rate. Special diets are easily accommodated and assistance at meal time is always available.

Intergenerational - Our intergenerational program brings together seniors and children in a safe and engaging environment. ‘Grandparents’ and ‘grandchildren’ have so much to share and can be a great source of joy to each other, yet they rarely have these opportunities. SarahCare intergenerational programs bring both generations together in a structured environment where they can learn from each other – sharing their feelings, ideas, skills, and affection. Unlike other informal and casual get-togethers, our intergenerational program was scientifically designed and researched to encourage these interactions and allow our seniors to participate fully – from disabled and frail elders to sufferers of dementia and Parkinson’s.

Customized Programs - Home Care - A participant’s time with SarahCare’s specially-trained staff doesn’t have to stop at the end of the day. Some seniors who are still living independently at home may require assistance during evenings and weekends, when they can’t spend time at the center. Or, if a loved one resides with their family, occurrences may come up that require the family to be away from home during an evening or weekend when your senior requires care.

Franchisees - Our franchisees pay us a variety of royalties and fees. Typical locations are commercial or professional office locations convenient to working caregivers. The approximate size of a SARAH Business facility is 5,000-6,000 square feet. Rent is estimated to be $96,000-$140,000 annually depending on size, condition and location of leased premises.

State and Federal Licenses. Both the company owned centers and the franchise centers acquire the required licenses prior to opening in their respective states. Not all states, such as Ohio, require a license to operate an ADHC (Adult Day Health Center), while other states, such as Pennsylvania, have strict licensing regulations. If a center wants to accept Medicaid participants, then they must complete the Medicaid certification process. The VA (Veterans Affairs) has their own standards and survey process in order to obtain an agreement/contract with the VA. All of these programs are administered by individual states. Every center follows the regulations as interpreted by the VA center in the specific area in which their center is located.

The federal program the Child Adult Food Care Program (CACFP) is for the reimbursement of food, and is administered by the Department of Agriculture. If a center wants to utilize CACFP, then they must complete the Department of Agriculture’s application and survey process.

All centers are surveyed annually by their state licensing department (if applicable), Medicaid, the VA, the CACFP (if applicable) and any additional funding source they may be using. In addition, most centers are surveyed by their local Health and Fire Departments annually.

Goods and Services One Must Acquire From An Approved Supplier Or In Accordance With Our Standards and Specifications

The trademarks, trade names, service marks, and logos must be properly depicted on any brochures, business cards and stationery, signage, forms, and public relations materials you purchase for use in your operation of the SARAH Business. These items, and other products, supply items and services, may be purchased from any source; however, we retain the right to, at any time in the future, condition the right to buy or lease goods and/or services on their meeting minimum standards and specifications and/or being acquired from suppliers we specifically designate or approve. We may issue and modify standards from time to time and enumerate them in our Operations Manual or other communications.

A Franchisee must purchase software to be used in the operation of the SARAH Business from a designated supplier. They may acquire certain pre-approved social media channels and online content for the SARAH Business only through us or our designated supplier. (Currently our System standards include Facebook, YouTube, Twitter, Instagram, Pinterest, and LinkedIn and no other channels, as approved social media outlets through which SARAH Businesses may be promoted.) A Franchisee must use the e-mail accounts we provide to you. We also currently recommend that they use our approved suppliers for: real estate site selection services; furniture, fixtures and equipment; marketing materials; computer software, and printing services. Otherwise, there currently are no goods, services, supplies, fixtures, equipment, inventory, computer hardware, real estate, or comparable items related to establishing or operating the SARAH Business that you must buy from us, our affiliate, or an approved supplier. None of our officers currently owns an interest in any supplier to SARAH Businesses.

If a Franchisee wants to purchase or lease any product, supply, item or service from a supplier or provider that we have not already approved, they must first obtain our approval. They may request our approval by providing us with a sample of the item they would like us to approve. We will use commercially reasonable efforts to notify the Franchisee within 30 days after receiving all samples and any other requested information or specifications, whether they are authorized to purchase or lease the product or service from that supplier or provider. We do not charge a fee for engaging in this approval process.

In the event we receive rebates from any suppliers to our franchisees, these funds will be used for marketing and promotional purposes. We estimate that, collectively, the purchases and leases you obtain according to our specifications or from approved or designated suppliers represent between 2.5%-7.5% of your total purchases and leases in connection with the establishment and operation of the SARAH Business. During the fiscal year ending June 30, 2023, we did not receive any rebates or other payments from suppliers based on their sales to franchisees and neither we nor our affiliates sold or leased any products or services to franchisees.

Insurance

Besides these purchases or leases, a potential Franchisee must obtain and maintain, at their own expense, the insurance coverage that we periodically require and satisfy other insurance-related obligations. They currently must obtain the following insurance: (i) comprehensive commercial general liability insurance, including bodily injury, property damage, personal injury, products and completed operations liability coverage with a combined single limit of not less than $1,000,000 per occurrence for bodily injuries, $1,000,000 per occurrence for property damage and $2,000,000 annual aggregate, (ii) workers’ compensation and employer’s liability insurance to meet statutory requirements of that of operation where the SARAH Business is located; (iii) commercial property insurance at replacement value, including fire, vandalism, and extended coverage insurance with primary and excess limits of not less than the full replacement value of the SARAH Business and its furniture, fixtures and equipment; (iv) automobile liability insurance for all owned, non-owned and hired automobiles with a single coverage limit of not less than $1,000,000; (v) other insurance as may be required by the state or locality in which the SARAH Business is located and operated; and (vi) professional liability insurance of not less than $1,000,000. All of the policies they maintain must contain the minimum coverage described above and must have deductibles not to exceed the amounts we specify. Each of the insurance policies must be issued by an insurance company of recognized responsibility and satisfactory to us. We may periodically increase the amounts of coverage required under these insurance policies and/or require different or additional insurance coverages at any time. The commercial general liability, automobile, and umbrella insurance policies must list us as additional insured parties and provide for 30 days’ prior written notice to us in the event of a policy’s material modification, cancellation, or expiration. They must furnish us with a copy of your Certificate of Insurance within 10 business days upon receipt of your Occupancy Permit for the SARAH Business. If they fail or refuse to obtain or maintain the insurance we specify, in addition to our other remedies including termination, we may obtain such insurance for you and the SARAH Business, on the potential Franchisee’s behalf, in which event they must cooperate with us and reimburse us for all premiums, costs and expenses we incur in obtaining and maintaining the insurance, plus a reasonable fee for our time incurred in obtaining such insurance.

Advertising Materials

Before a potential Franchisee uses them, they must send to us for review samples of all advertising, promotional and marketing materials which we have not prepared or previously approved. They must not use any advertising, promotional, or marketing materials that we have not approved or have disapproved. During approximately the first 3 months of operating the SARAH Business, we will use the Marketing Deposit to pay vendors selected to provide advertising and related services for the promotion of the SARAH Business, which may include, for example, arranging online Internet advertising and marketing content, including Facebook, YouTube, Twitter, Instagram, Pinterest, LinkedIn or other social media outlets and paying click-through charges to search engines, banner advertising sources, and advertising host sites to promote the SARAH Business. We may develop certain promotional materials and/or designate or approve specific suppliers of promotional materials during the franchise term that we may require them to purchase and use. All online marketing activities you conduct for the SARAH Business must meet our then-current guidelines for franchisee use of social media that we include as part of the Operations Manual or otherwise communicate as part of our System standards.

Development of Your SARAH Business

A potential Franchisee is responsible for locating, obtaining, and developing a site for the SARAH Business within the Territory. They must submit a proposed site for the SARAH Business for our approval in a form we specify that includes detailed construction drawings and other site-specific information. After we approve a site for the SARAH Business, they are responsible for constructing and equipping the SARAH Business at that site. They may not begin developing any site or constructing or remodeling any structures or fixtures before we have approved the site. They may consult with real estate and other professionals of their choosing, and we may also assist you in the development of the SARAH Business. They must submit to us for our approval detailed plans and specifications adopting our then-current plans and specifications for SARAH Businesses.

SarahCare, as the franchisor, supplies the Franchisee’s with initial assistance and approval with the following:

| 1. | Give you our site selection criteria for the SARAH Business and, upon a potential Franchisee’s request, provide input regarding possible sites. We do not own and lease any site to franchisees. After they select and we approve a site, we will designate the geographic area within which they may establish the SARAH Business. |

| 2. | Approve the signage. |

| 3. | Identify the standards and specifications for products, services, and materials that comply with the System, and, if we require, the approved suppliers of these items. We will furnish a potential Franchisee with the listing of the package of initial franchise items as detailed in the Operations Manual. Neither we nor our affiliate provide, deliver, or install any of these items. |

| 4. | Provide an Initial Training Program. |

| 5. | Provide an Operations Training Program. |

Once the Franchisee’s SarahCare business is operational, we will:

| 1. | Issue and modify System standards for SARAH Businesses. |

| 2. | Provide access to a copy of our Operations Manual as we make available through our intranet. The Operations Manual contains mandatory and suggested specifications, standards and operating procedure. |

| 3. | Give you additional or special guidance and assistance and training as we deem appropriate and for which a potential Franchisee are financially responsible. |

| 4. | Inspect and observe the operation of the SARAH Business to help a potential Franchisee comply with the Franchise Agreement and all System standards. |

| 5. | Let you use the confidential information. |

| 6. | Let you use the Marks. |

Opening

We estimate that a potential Franchisee will open the SARAH Business within 8 to 10 months after they sign the Franchise Agreement. The interval between signing the Franchise Agreement and opening the SARAH Business depends on the site’s location and condition, the construction schedule for the SARAH Business, the extent to which they must upgrade or remodel an existing location, the delivery schedule for equipment and supplies, securing financing arrangements, completing training, and complying with local laws and regulations.

Current Locations

Below is a list of our current franchised (23) locations:

California - 450 Marathon Dr., Campbell, CA 95008

Connecticut - 870 Burnside Avenue, East Hartford, CT 06108

Florida - 1504 S. Harbor City Blvd., Melbourne, FL 32901

1200 N. University Dr., Pembroke Pines, FL 33024

754 Riverside Drive, Coral Springs, FL 33071

Georgia - 801 Oakhurst Drive, Evans, GA 30808

286 SW Highway, 138 Riverdale, GA 30078

Idaho - 1655 S. Vinnell, Boise, ID 83709

Indiana - 2805 E. 96th, Indianapolis, IN 46240

Massachusetts - 1225 Dorchester Avenue, Dorchester, MA 02125

1217 Grafton St. Worcester, MA 01604

Michigan - 2211 E. Beltline Ave. NE Suites B & C, Grand Rapids, MI 49525

13425 19 Mile Rd., Suite 500, Sterling Heights, MI 49519

2024 Health Dr., Suite B, Wyoming, MI 49519

New Jersey – 1115 Glove Avenue, Mountainside, NJ 07092

North Carolina - 2245 Gateway Access Pt. Suite 101, Raleigh, NC 27607

Ohio - 10901 Prospect Road, Strongsville, OH 44149

Pennsylvania - 7010 Snowdrift Rd., Allentown, PA 18106

261 Old York Rd., Suite A51, Jenkintown, PA 19046

425 Technology Dr., Malvern, PA 19355

2030 Ardmore Blvd., Pittsburgh, PA 15221

Texas - 157 Nursery Road, The Woodlands, TX 77380

23972 Highway 59 N., Kingwood, TX 77339

During the second half of our fiscal 2023 year, 2 new franchise agreements have been signed, but exact locations of the franchises have not been determined. However, one will be based in Massachusetts and one will be based in Texas.

We have two international centers in the United Arab Emirates and Saudi Arabia that are franchised, but are not yet open. We do not have an expected date as to when they will be open, if ever.

Below is a list of our current corporate (2) locations:

SarahCare of Belden - 6199 Frank Ave NW, North Canton, OH 44720

SarahCare of Stow - 4472 Darrow Road, Stow, OH 44224

Our Growth Strategy

Our sales and marketing teams intend to leverage our value proposition and strong participant satisfaction to promote our brand and attract new participants to our centers. The size of our centers depends on the size of the addressable population within each service area. We first determine whether we can fill a center’s expected participant census, then, as a center reaches its initial capacity, we plan to increase its size through pre-planned facility expansions. Once we have reached planned capacity, we intend to expand to other locations.

Our growth strategy includes renewing our current franchised locations. Recently, SarahCare renewed its agreements regarding two SarahCare franchised locations, one in The Woodlands, Texas, and one in Kingwood, Texas. Both renewals are for five years.

Leasing New Market Space

We plan to build new centers or lease from existing market space to enter new markets for our daycare centers into adjacent or new geographies.

The placement of our centers in attractive locations is critical to our success. We regularly conduct zip code level analyses and convene small focus groups with potential participants and caregivers to identify service areas with attractive concentrations of seniors eligible for our daycare services and select optimal sites for our centers. We prioritize service areas with populations that include more than 4,000 potential participants within a 60-minute drive of a center. Our approach to building new daycare centers or leasing space in favorable market areas is based on our experience-based specifications, with flexibility for future center expansion factored into the blueprints where possible.

On April 21, 2021, the Company, through ten newly-formed, wholly-owned limited liability companies, entered into lease agreements with entities controlled by our Chairman, Charles Everhardt, for ten additional SarahCare locations to be operated by the Company. All of the leases are for a ten-year period beginning on July 1, 2021, and ending on June 30, 2031, with a 5-year renewal option. The rent for each location is $7,500 per month. The commencement of the leases have been amended several times to delay the start date, and the remaining leases are scheduled to commence on November 1, 2023. On August 19, 2022, the Company and landlord mutually agreed to terminate the Austin lease. As of November 1, 2022, the Company amended the leases to delay commencement until May 1, 2023. As of May 1, 2023, the Company and landlord mutually agreed to terminate the Houston, TX, Jackson, MS and Trenton, NJ leases, and also agreed to amend the remaining leases to delay commencement until November 1, 2023.

The six locations are as follows:

Ohio – 33 East 5th Street, Dayton, OH 45402 – approximately 8,500 sq. ft.

Georgia – 1775 Parkway Place SE, Marietta, GA 30067 – approximately 8,500 sq. ft.

Tennessee – 2625 Thousand Oaks, Memphis, TN 38118 – approximately 8,500 sq. ft.

Florida – 3835 McCoy Road, Orlando, FL 32812 – approximately 8,500 sq. ft.

Pennsylvania – 1741 Papermill Road, Wyomissing, PA 19610 – approximately 8,500 sq. ft.

Oklahoma – 7902 South Lewis Avenue, Tulsa, OK 74136 – approximately 8,500 sq. ft.

Potential Acquisitions

We believe we are the logical acquiror in a fragmented market made up of mostly small independent local operators. We are looking for potential acquisitions in new geographic markets along with existing markets that meet certain criteria. We maintain discipline in our approach in regards to purchase price for acquisitions. We consider many factors in determining the purchase price that include potential market expansion, healthcare employee base, demographics of our target market of seniors, daycare demand both future and present is also considered along with other factors before a decision is made to acquire a potential acquisition target. We work closely with key constituencies, including local governments, health systems and senior housing providers, to ensure participants continue to receive the high quality care we demand in our operations and that potential acquisition targets can achieve our important quality standards.

Reinvest in our Technology

We are continuing to examine ways to improve and enhance our technology offerings to improve efficiencies in our operations. Further, we are evaluating new software and medical device technology to use at our centers to help with our participants who are experiencing chronic conditions. We believe placing new technologies at our centers to further meet the needs of our participants will help us to stand out in the daycare market and attract further participants to our centers. As we continue to evaluate new ways of bringing new technologies and efficiencies to our operations, we believe we will be able to attract new participants and potentially reduce medical costs.

Industry Overview

Healthcare spending in the United States has grown at approximately 4.3% from 2023 and in 2022 the projected expenditures were $4.4 trillion, or 17.39% of U.S. GDP. The overall growth rate of healthcare spending is expected to accelerate due to the aging population. Furthermore, the government’s share of total healthcare spend through programs such as Medicare and Medicaid is expected to grow from approximately 37% today to more than 40% as early as 2025, indicating faster growth in government-sponsored healthcare than the overall market. There are approximately 7,500 senior daycare centers across the United States. The industry market size is approximately $6.5 billion and expected to rise 25% over the next five years. Each senior daycare center has an average of 60 participants with daily participants of 351,900 using senior daycare services.

Employees

As of June 30, 2023, the Company had 40 employees. This does not include the employees of the independently owned and run franchise locations.

Intellectual Property

The Company owns the following intellectual property (trademarks): SarahCare and Sarah Adult Day Services.

Competition

There are approximately 4,600 adult day care centers (from the CDC) in the U.S. may be part of stand-alone adult centers specifically set up to provide day care to seniors, 70 percent are affiliated with or operate within senior centers, churches, medical centers or residential care facilities. Two of our larger competitors include Active Day, with approximately 100 locations, and Easter Seals, a non-profit with 69 affiliates. Programs run from several hours to a full day. Participants may attend daily, a few times a week, weekly, or just for special activities. Weekend and evening care are less common, although this is changing as demand for adult day care rises. We also compete with home care and in-home medical care professionals and enterprises.

Governmental Regulations

We will be governed by government laws and regulations governing adult day care facilities. We believe that we are currently in compliance with all laws which govern our operations and have no current liabilities thereunder. Our intent is to maintain strict compliance with all relevant laws, rules and regulations.

Reports to Security Holders

We intend to furnish our shareholders annual reports containing financial statements audited by our independent registered public accounting firm and to make available quarterly reports containing unaudited financial statements for each of the first three quarters of each year. We file Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K and Current Reports on Form 8-K with the Securities and Exchange Commission in order to meet our timely and continuous disclosure requirements. We may also file additional documents with the Commission if they become necessary in the course of our company’s operations.

The public may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that site is www.sec.gov.

Environmental Regulations

We do not believe that we are or will become subject to any environmental laws or regulations of the United States. While our products and business activities do not currently violate any laws, any regulatory changes that impose additional restrictions or requirements on us or on our products or potential customers could adversely affect us by increasing our operating costs or decreasing demand for our products or services, which could have a material adverse effect on our results of operations.

Item 1A. Risk Factors

As a smaller reporting company, we are not required to provide the information required by this item.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties

As of June 30, 2023, the Company maintains its corporate address at 2310 York Street, Suite 200, Blue Island, IL, 60406. This space is provided by the Company’s Chairman, Charles Everhardt, a related party, on a rent free basis at the present time. The Company does not currently have a lease for this space at this time but expects to enter into a month-to-month office lease for this space.

SarahCare leases three properties for its corporate office and its two corporate owned centers. SarahCare’s corporate office is approximately 3,470 square feet and is located at 4580 Stephen Circle NW, Canton, Ohio, 44718. The lease began in 2017 and ends in 2023. In September 2023, SarahCare moved its corporate headquarters to 4942 Higbee Ave NW, Unit H, Canton, OH 44718.

SarahCare’s lease for its first corporate-owned SarahCare location is for approximately 5,300 square feet located at 6199 Frank Ave. NW, North Canton, Ohio, 44720. The lease began in 2018 and ends in 2026.

SarahCare’s lease for its second corporate-owned SarahCare location is for approximately 6,000 square feet located at SarahCare of Stow, 4472 Darrow Road, Stow, Ohio, 44224. The lease began in 2018 and ends in 2026.

On April 21, 2021, the Company, through ten newly-formed, wholly-owned limited liability companies, entered into lease agreements with entities controlled by our Chairman, Charles Everhardt, for ten additional SarahCare locations to be operated by the Company. All of the leases are for a ten-year period beginning on July 1, 2021, and ending on June 30, 2031, with a 5-year renewal option. The rent for each location is $7,500 per month. As of the June 30, 2021, the Company amended the leases to delay commencement until November 1, 2021. As of November 1, 2021, the Company amended the leases to delay commencement until May 1, 2022. As of April 30, 2022 the Company amended the leases to delay commencement until November 1, 2022. On August 19, 2022, the Company and landlord mutually agreed to terminate the Austin lease. As of November 1, 2022, the Company amended the leases to delay commencement until May 1, 2023. As of May 1, 2023, the Company and landlord mutually agreed to terminate the Houston, TX, Jackson, MS and Trenton, NJ leases, and also agreed to amend the remaining leases to delay commencement until November 1, 2023.

The six locations are as follows:

Ohio – 33 East 5th Street, Dayton, OH 45402 – approximately 8,500 sq. ft.

Georgia – 1775 Parkway Place SE, Marietta, GA 30067 – approximately 8,500 sq. ft.

Tennessee – 2625 Thousand Oaks, Memphis, TN 38118 – approximately 8,500 sq. ft.

Florida – 3835 McCoy Road, Orlando, FL 32812 – approximately 8,500 sq. ft.

Pennsylvania – 1741 Papermill Road, Wyomissing, PA 19610 – approximately 8,500 sq. ft.

Oklahoma – 7902 South Lewis Avenue, Tulsa, OK 74136 – approximately 8,500 sq. ft.

Item 3. Legal Proceedings

From time to time, we may be involved in litigation relating to claims arising out of our operations in the normal course of business. Other than disclosed herein, there were no pending or threatened lawsuits that could reasonably be expected to have a material effect on the results of our operations.

As of June 30, 2023, we were not a party to any material legal proceedings. We currently have thirteen (13) convertible promissory notes that are in default, and we may be subject to legal proceedings or lawsuits from any number of those convertible noteholders, including the below.

On April 7, 2013, three note holders (Brook Hazelton, Benjamin M. Manalaysay, Jr., and Diego McDonald, the “Plaintiffs”), whom together invested a total principal amount of $45,000 in the form of Convertible Promissory Notes (the “Notes”) to the Company, together filed a “Notice of Commencement of Action Subject to Mandatory Electronic Filing” in the Supreme Count of the State of New York, County of New York. The Plaintiffs alleged that the Company breached their contracts with the Plaintiffs and included causes of action for unjust enrichment and related claims, seeking repayment of each of their respective convertible promissory notes plus interest. On or about February 24, 2014, the three Plaintiffs received judgment against the Company from the court in the amounts of $33,686.82, $8,546.87 and $33,696.69, respectively.

Our wholly owned subsidiary, SarahCare, is not involved in any legal proceedings at this time.

As of the date of this Annual Report, no director, officer or affiliate is (i) a party adverse to us in any legal proceeding, or (ii) has an adverse interest to us in any legal proceedings. Management is not aware of any other legal proceedings pending or that have been threatened against us or our properties.

Item 4. Mine Safety Disclosures

Not applicable to our Company.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

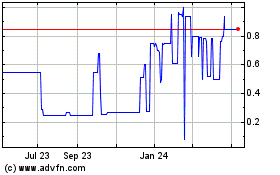

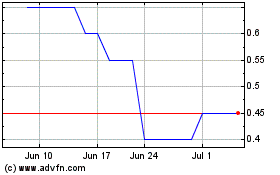

The Company’s common stock is traded on the OTC Link ATS (the alternative trading system operated by OTC Markets Group, Inc.) under the symbol “IMTH”. As of June 30, 2023, the Company’s common stock was held by 168 shareholders of record, which does not include shareholders whose shares are held in street or nominee name.

The following information reflects the high and low prices of the Company’s common stock, and the Company’s reverse stock split is reflected in the increase in the high and low bid prices for the fourth quarter of 2022. High and low prices are from prices reported by OTCMarkets.com.

Quarterly period | | High | | | Low | |

Fiscal year ended June 30, 2023: | | | | | | |

First Quarter | | $ | 3.49 | | | $ | 1.57 | |

Second Quarter | | $ | 2.00 | | | $ | 1.13 | |

Third Quarter | | $ | 1.47 | | | $ | 0.295 | |

Fourth Quarter | | $ | 0.74 | | | $ | 0.55 | |

| | | | | | | | |

Fiscal year ended June 30, 2022: | | | | | | | | |

First Quarter | | $ | 1.765 | | | $ | 0.35 | |

Second Quarter | | $ | 1.59 | | | $ | 0.28 | |

Third Quarter | | $ | 1.84 | | | $ | 0.53 | |

Fourth Quarter | | $ | 3.49 | | | $ | 0.80 | |

We have engaged Clear Trust Transfer as the Company’s transfer agent to serve as agent for shares of our common stock, Series A Convertible Preferred Stock, and Series B Convertible Preferred Stock. Our transfer agent’s contact information is as follows:

16540 Pointe Village Dr., Suite 205

Lutz, FL 33558

Telephone: (813) 235-4490

Dividend Distributions

We have not paid any cash dividends on our common stock and have no present intention of paying any dividends on the shares of our common stock. Our current policy is to retain earnings, if any, for use in our operations and in the development of our business. Our future dividend policy will be determined from time to time by our board of directors.

Securities authorized for issuance under equity compensation plans

The Company does not have a stock option plan.

Penny Stock

Our common stock is considered “penny stock” under the rules the Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of 1934. The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ Stock Market System, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or quotation system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the Commission, that:

| · | contains a description of the nature and level of risks in the market for penny stocks in both public offerings and secondary trading; |

| · | contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of Securities’ laws; contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; |

| · | contains a toll-free telephone number for inquiries on disciplinary actions; |

| · | defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and |

| · | contains such other information and is in such form, including language, type, size and format, as the Commission shall require by rule or regulation. |

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with:

| · | bid and offer quotations for the penny stock; |

| · | the compensation of the broker-dealer and its salesperson in the transaction; |

| · | the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the marker for such stock; and |

| · | monthly account statements showing the market value of each penny stock held in the customer’s account. |

In addition, the penny stock rules that require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgement of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitably statement.

These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our stock.

Related Stockholder Matters

None.

Purchase of Equity Securities

None.

Recent Sales of Unregistered Equity Securities

During the fiscal quarter ended June 30, 2023, the Company did not have any unregistered sales of any equity securities, except as described below.

On or about April 26, 2022, the Company issued the Sellers of Vitality RX, Inc. 5,500,000 common shares, par value, $0.000001 per share, valued at $5,500,000. These shares were issued pursuant to the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended, as there was no general solicitation, and the transaction did not involve a public offering.

On or about April 26, 2022, the Company issued the Sellers of Vitality RX, Inc. 50,000 shares of Series A Convertible Preferred Stock, par value, $0.000001 per share, valued at $5,000,000. These shares were issued pursuant to the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended, as there was no general solicitation, and the transaction did not involve a public offering.

Item 6. Selected Financial Data

As the Company is a “smaller reporting company,” this item is inapplicable.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Rule 175 of the Securities Act of 1933, as amended, and Rule 3b-6 of the Securities Act of 1934, as amended, that involve substantial risks and uncertainties. These forward-looking statements are not historical facts, but rather are based on current expectations, estimates and projections about our industry, our beliefs and our assumptions. Words such as “anticipate,” “expects,” “intends,” “plans,” “believes,” “seeks” and “estimates” and variations of these words and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. You should not place undue reliance on these forward-looking statements, which apply only as of the date of this Form 10-K. Investors should carefully consider all of such risks before making an investment decision with respect to the Company’s stock. The following discussion and analysis should be read in conjunction with our financial statements and summary of selected financial data for Innovative MedTech, Inc. Such discussion represents only the best present assessment from our Management.

DESCRIPTION OF COMPANY

Innovative MedTech, Inc. (the “Company”) was originally formed on April 21, 2005, in New Jersey as “Serino 1, Corp.,”. On December 16, 2005, the Company merged with Fresh Harvest Products, Inc., and then changed its name to Fresh Harvest Products, Inc., and began operating as a natural and organic food and beverage company, changing its name to “Fresh Harvest Products, Inc.” In 2012, the Company redomiciled to Delaware and began focusing its efforts on developing software and mobile application development and video production and developing an e-book company, and in the intervening years, expanded its technology development and development efforts, creating a revenue sharing partnership with a mobile app, TreatER (available for free on the Apple App Store) in 2017, and in 2018, focusing on building a software program for financially valuing a film concept and mapping the predicted human behavior by region to films using a combination of geographical based social sentiment and the distribution data and financial performance of historically released films. On November 4, 2017, the Company redomiciled from New Jersey to Delaware, and changed its fiscal year end from October 31st to June 30th. On March 9, 2021, the Company effectuated a 10,000:1 reverse split, changed its stock symbol from “FRHV” to “IMTH,” and changed its name to Innovative MedTech, Inc. On March 25, 2021, the Company acquired two companies, Sarah Adult Day Services, Inc., and Sarah Day Care Centers, Inc. (collectively “SarahCare”), an adult day care center franchisor and provider. On March 25, 2021, the Company acquired two companies, Sarah Adult Day Services, Inc., and Sarah Day Care Centers, Inc. (collectively “SarahCare”), an adult day care center franchisor and provider. With 25 centers (2 corporate and 23 franchise locations) located in 13 states, SarahCare offers seniors daytime care and activities focusing on meeting their physical and medical needs on a daily basis, and ranging from nursing care to salon services and providing meals, to offering engaging and enriching activities to allow them to continue to lead active and engaged lives. We are now focusing all of our efforts on our senior care operations.

On April 1, 2022, the Company partnered with TruCash Group of Companies Inc. (“TruCash”), a leading global payments provider, to launch an all-in-one Super Healthcare App, called RX Vitality Wallet, that will be designed to cater to consumers, patients, hospitals, Seniors, and governments, with a solid platform of benefits and online banking. The RX Vitality digital healthcare wallet is being designed to offer 20%-75% pharmaceutical discounts at 65,000 pharmacies across the United States, including Walgreens and CVS. In addition, we plan to offer health and wellness discounts at 500+ online merchants, as well as earning points on our Loyalty Program. On June 15, 2022, the Company’s RX Vitality digital healthcare wallet became available for download at the Apple iOS App store for Apple iPhone users. The Company’s app has also been approved and is available on the Google Play Store. On June 30, 2023 this agreement was canceled.

On April 5, 2022, the Company engaged mPulse Mobile, a leader in conversational AI and digital engagement solutions for the healthcare industry, to drive engagement with the Company’s digital app and wallet (currently under development).

On April 28, 2022, the Company entered into a share exchange agreement to acquire RX Vitality, Inc. (“RX Vitality”), a media and finance advisory company.

On May 13, 2022, the Company entered into a partnership with VSUSA Corp. (“VSUSA”), a non-for-profit organization that empowers Veterans and Seniors by offering services designed to build successful life transitions with access to workforce and independent housing; health services; and social service programs in communities across the United States. The partnership will permit the Company to use the VSUSA logo on the back of its Vitality Debit Card. For this the Company will give up to 1% of its revenue generated from its Vitality Debit Card to VSUSA. The Company’s Chairman is a principal and co-Founder of VSUSA. On June 30, 2023 this agreement was canceled.

On June 1, 2022, the Company announced that Dr. Merle Griff, SarahCare’s Founder and CEO, will also be CEO of the Company.

The following Management Discussion and Analysis should be read in conjunction with the financial statements and accompanying notes included in this Form 10-K.

COMPARISON OF THE YEAR ENDED JUNE 30, 2023, TO THE YEAR ENDED JUNE 30, 2022

Results of Operations

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with the financial statements and notes thereto for the years ended June 30, 2023 and 2022, and related management discussion herein.

Our financial statements are stated in U.S. Dollars and are prepared in accordance with generally accepted accounting principles of the United States (“GAAP”).

Going Concern Qualification

Several conditions and events cast substantial doubt about the Company’s ability to continue as a going concern. The Company has incurred cumulative net losses of $36,622,313 since its inception and requires capital for its contemplated operational and marketing activities to take place. The Company’s ability to raise additional capital through debt or future issuances of capital stock is unknown. The obtainment of additional financing, the successful development of the Company’s contemplated plan of operations, and its transition, ultimately, to the attainment of profitable operations are necessary for the Company to continue operations. The ability to successfully resolve these factors raises substantial doubt about the Company’s ability to continue as a going concern.

Operating Results

Our operating results for the years ended June 30, 2023 and 2022, and the changes between those periods for the respective items, are summarized as follows:

| | Year Ended | | | | |

| | June 30 | | | Change | |

| | 2023 | | | 2022 | | | Amount | |

Operating loss | | $ | (3,624,245 | ) | | $ | (18,258,093 | ) | | $ | 14,633,848 | |

Other income (expense) | | | (23,702 | ) | | | 199,739 | | | | (223,441 | ) |

Net loss | | $ | (3,647,947 | ) | | $ | (18,058,354 | ) | | $ | 14,432,805 | |

Revenues

Our revenue increased to $1,724,843 for the year ended June 30, 2023, from revenue of $1,297,613 in the comparative year ended June 30, 2022. The following table presents revenue expenses for the years ended June 30, 2023 and 2022:

| | Year Ended | | | | |

| | June 30 | | | Change | |

| | 2023 | | | 2022 | | | Amount | |

Participant fees | | $ | 1,098,249 | | | $ | 794,027 | | | $ | 304,222 | |

Franchise fees | | | 626,594 | | | | 503,586 | | | | 123,008 | |

Total revenue | | $ | 1,724,843 | | | $ | 1,297,613 | | | $ | 427,230 | |

Operating Expenses

Our operating expenses decreased to $5,349,088 for the year ended June 30, 2023, from operating expenses of $19,555,706 in the comparative year ended June 30, 2022. The following table presents operating expenses for the years ended June 30, 2023 and 2022:

| | Year Ended | | | | | | | |

| | June 30, | | | Change | |

| | 2023 | | | 2022 | | | Amount | | | Percentage | |

General and administrative | | $ | 972,624 | | | $ | 933,268 | | | $ | 39,356 | | | | 4.22 | % |

Salaries and wages | | | 1,077,108 | | | | 921,022 | | | | 156,086 | | | | 16.95 | % |

Licensing fees | | | 3,000,000 | | | | 750,000 | | | | 2,250,000 | | | | 300 | % |

Consulting fees | | | 151,106 | | | | 16,838,885 | | | | (16,687,779 | ) | | | (99.10 | )% |

Legal and professional fees | | | 148,250 | | | | 112,531 | | | | 35,719 | | | | 31.74 | % |

Total operating expenses | | $ | 5,349,088 | | | $ | 19,555,706 | | | $ | (14,206,618 | ) | | | 254 | % |

The Company recorded $972,624 in general and administrative fees during the year ended June 30, 2023, as compared to $933,268 for the prior fiscal year, with the decrease primarily due to the Company’s decreased administrative expenses. We realized an increase of $35,719 in legal and professional fees during the year ended June 30, 2023, as compared to the same period in the prior fiscal year. We realized an increase of $156,086 in salaries and wages during the year ended June 30, 2023, as compared to the same period in the prior fiscal year, primarily due to increasing operations during the most recent fiscal year as compared to the prior fiscal year.

Other Income (Expense)

The following table presents other income and expenses for the year ended June 30, 2023 and 2022:

| | Year Ended | |

| | June 30 | |

| | 2023 | | | 2022 | |

Interest expense, related parties | | $ | (66,796 | ) | | $ | (8,972 | |

Interest expense | | | (155,005 | ) | | | (182,500 | ) |

Impairment of ROU asset | | | - | | | | (84,364 | |

Change in fair value of derivatives | | | 284,978 | | | | 28,115 | |