EuroDry Ltd. Announces Delivery of M/V YANNIS PITTAS, an Eco Ultramax Drybulk Carrier

October 13 2023 - 9:00AM

EuroDry Ltd. (NASDAQ: EDRY, the “Company” or “EuroDry”), an owner

and operator of drybulk vessels and provider of seaborne

transportation for drybulk cargoes, announced today that it took

delivery of the previously announced acquisition of M/V YANNIS

PITTAS (ex-GALLILEO), a 63,177 dwt Ultramax drybulk carrier built

in 2014, the first of three Ultramax carriers it agreed to acquire.

The consideration for the vessel was paid by cash at-hand; the

Company has arranged a sustainability-linked loan of $10.5 million

with Eurobank S.A. to partly finance the acquisition which is

expected to be drawn by October 16, 2023. The vessel is employed

under a time charter contract until December 2023 at $12,500 per

day.

Aristides Pittas, Chairman and CEO of

EuroDry commented: “We are pleased to

have taken delivery of M/V YANNIS PITTAS, the first of the three

Eco Ultramax drybulk vessels we recently announced we agreed to

acquire. The remaining two vessels are expected to be delivered

within October 2023. We believe our acquisition of the three

vessels took place at an opportune time in the market and, despite

the recently increased geopolitical uncertainties, we expect all

three vessels to make significant contributions to our EBITDA for

the benefit of our shareholders which remains the focus of our

strategy.

“In parallel to the above acquisitions, we

continue our share repurchase program to the maximum possible level

as we believe that investing in our shares at a significant

discount to our net asset value (“NAV”) represents a very

attractive opportunity for our shareholders. At the same time, we

have provided us -as we always do- flexibility and equipped the

Company with the option of an At-The-Market offering to be only

used if our share price increases near the NAV of our stock.”

Fleet Profile:

Assuming the delivery of the three Eco Ultramax drybulk vessels

described above, the EuroDry Ltd. fleet profile would be as

follows:

|

Name |

Type |

Dwt |

Year Built |

Employment(*) |

TCE Rate ($/day) |

|

Dry Bulk Vessels |

|

|

|

|

|

|

EKATERINI |

Kamsarmax |

82,000 |

2018 |

TC until Mar-25 |

Hire 105.5% of theAverage BalticKamsarmaxP5TC (**) index |

|

XENIA |

Kamsarmax |

82,000 |

2016 |

TC until Mar-24 |

Hire 105.5% of theAverage BalticKamsarmaxP5TC (**) index |

|

ALEXANDROS P. |

Ultramax |

63,500 |

2017 |

TC until Dec-23 |

$27,000 |

|

CHRISTOS K (ex - GIANTS CAUSEWAY)*** |

Ultramax |

63,197 |

2015 |

To be arranged |

|

|

YANNIS PITTAS |

Ultramax |

63,177 |

2014 |

TC until Dec-23 |

$12,500 |

|

MARIA (ex - SADLERS WELLS)*** |

Ultramax |

63,153 |

2015 |

To be arranged |

|

|

GOOD HEART |

Ultramax |

62,996 |

2014 |

TC until Nov-23 |

$11,900 |

|

MOLYVOS LUCK |

Supramax |

57,924 |

2014 |

TC until Oct-23 |

$8,000 |

|

EIRINI P |

Panamax |

76,466 |

2004 |

TC until Oct-23 |

$15,750 |

|

SANTA CRUZ |

Panamax |

76,440 |

2005 |

TC until Dec-23 |

$13,000 |

|

STARLIGHT |

Panamax |

75,845 |

2004 |

TC until Nov-23 |

$15,250 |

|

TASOS |

Panamax |

75,100 |

2000 |

TC until Dec-23 |

$8,000 |

|

BLESSED LUCK |

Panamax |

76,704 |

2004 |

TC until Jan-24 |

$15,800 |

|

Total Dry Bulk Vessels |

13 |

918,502 |

|

|

|

Note:

|

(*) |

Represents the earliest redelivery date. |

| (**) |

The average Baltic Kamsarmax P5TC

Index is an index based on five Panamax time charter routes. |

| (***) |

Expected to be delivered in

October 2023. |

| |

|

About EuroDry Ltd.

EuroDry Ltd. was formed on January 8, 2018 under

the laws of the Republic of the Marshall Islands to consolidate the

drybulk fleet of Euroseas Ltd. into a separate listed public

company. EuroDry was spun-off from Euroseas Ltd on May 30, 2018; it

trades on the NASDAQ Capital Market under the ticker

EDRY.

EuroDry operates in the dry cargo, drybulk

shipping market. EuroDry's operations are managed by Eurobulk Ltd.,

an ISO 9001:2008 and ISO 14001:2004 certified affiliated ship

management company and Eurobulk (Far East) Ltd. Inc., which are

responsible for the day-to-day commercial and technical management

and operations of the vessels. EuroDry employs its vessels on spot

and period charters and under pool agreements.

After the delivery of the remaining two vessels

agreed to be acquired, the Company would have a fleet of 13

vessels, including 2 Kamsarmax drybulk, 5 Panamax drybulk carriers,

5 Ultramax drybulk carriers, and 1 Supramax drybulk carrier.

EuroDry’s 13 drybulk carriers have a total cargo capacity of

918,502 dwt.

Forward Looking StatementThis

press release contains forward-looking statements (as defined in

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended) concerning

future events and the Company's growth strategy and measures to

implement such strategy; including expected vessel acquisitions and

entering into further time charters. Words such as "expects,"

"intends," "plans," "believes," "anticipates," "hopes,"

"estimates," and variations of such words and similar expressions

are intended to identify forward-looking statements. Although the

Company believes that the expectations reflected in such

forward-looking statements are reasonable, no assurance can be

given that such expectations will prove to have been correct. These

statements involve known and unknown risks and are based upon a

number of assumptions and estimates that are inherently subject to

significant uncertainties and contingencies, many of which are

beyond the control of the Company. Actual results may differ

materially from those expressed or implied by such forward looking

statements. Factors that could cause actual results to differ

materially include, but are not limited to changes in the demand

for dry bulk vessels, competitive factors in the market in which

the Company operates; risks associated with operations outside the

United States; and other factors listed from time to time in the

Company's filings with the Securities and Exchange Commission. The

Company expressly disclaims any obligations or undertaking to

release publicly any updates or revisions to any forward-looking

statements contained herein to reflect any change in the Company's

expectations with respect thereto or any change in events,

conditions or circumstances on which any statement is

based.

Visit our website www.eurodry.gr

|

Company Contact |

Investor Relations / Financial Media |

| Tasos AslidisChief Financial

OfficerEuroDry Ltd.11 Canterbury Lane,Watchung, NJ07069Tel. (908)

301-9091E-mail: aha@eurodry.gr |

Nicolas BornozisMarkella

KaraCapital Link, Inc.230 Park Avenue, Suite 1540New York,

NY10169Tel. (212) 661-7566E-mail: eurodry@capitallink.com |

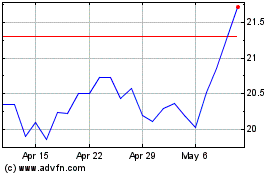

EuroDry (NASDAQ:EDRY)

Historical Stock Chart

From Apr 2024 to May 2024

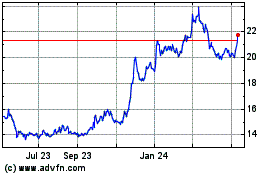

EuroDry (NASDAQ:EDRY)

Historical Stock Chart

From May 2023 to May 2024