false

0000007623

0000007623

2023-10-11

2023-10-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

Current Report Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 11, 2023

ART’S-WAY MANUFACTURING CO., INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

(State or other jurisdiction of incorporation)

|

| |

|

|

|

000-05131

|

|

42-0920725

|

|

(Commission File Number)

|

|

(IRS Employer

|

| |

|

Identification No.)

|

|

5556 Highway 9

Armstrong, Iowa 50514

|

|

(Address of principal executive offices) (Zip Code)

|

| |

|

(712) 208-8467

|

|

(Registrant’s telephone number, including area code)

|

| |

|

Not Applicable

|

|

(Former name or former address, if changed since last report.)

|

| |

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock $0.01 par value

|

ARTW

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02

|

Results of Operations and Financial Condition.

|

On October 11, 2023, Art’s-Way Manufacturing Co., Inc. (the “Company”) issued a press release announcing its financial results for the third quarter and first nine months of fiscal 2023. The full text of the press release is set forth in Exhibit 99.1 attached hereto and is incorporated by reference in this Current Report on Form 8-K as if fully set forth herein.

The information contained in this Current Report on Form 8-K, including Exhibit 99.1 attached hereto and incorporated herein, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section, and shall not be incorporated by reference into any registration statement pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

|

Item 9.01

|

Financial Statements and Exhibits.

|

| |

(a)

|

Financial statements: None

|

| |

(b)

|

Pro forma financial information: None

|

| |

(c)

|

Shell Company Transactions: None

|

| |

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: October 12, 2023

|

|

ART’S-WAY MANUFACTURING CO., INC.

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Michael W. Woods

|

|

|

|

Michael W. Woods

|

|

|

|

Chief Financial Officer

|

|

Exhibit 99.1

FOR IMMEDIATE RELEASE

October 11, 2023

ART’S WAY ANNOUNCES REVENUE GROWTH FOR Q3 AND FIRST NINE MONTHS OF FISCAL 2023, EARNINGS GROWTH FOR THE NINE MONTHS ENDED AUGUST 31, 2023

ARMSTRONG, IOWA, October 11, 2023 – Art’s Way Manufacturing Co., Inc. (Nasdaq: ARTW) (the “Company”), a diversified, international manufacturer and distributor of equipment serving agricultural and research industries, announces its financial results for the third quarter and year to date of fiscal 2023.

| |

|

For the Three Months Ended

|

|

| |

|

(Continuing Operations, Consolidated)

|

|

| |

|

August 31, 2023

|

|

|

August 31, 2022

|

|

|

Sales

|

|

$ |

8,117,000 |

|

|

$ |

7,476,000 |

|

|

Operating Income

|

|

$ |

468,000 |

|

|

$ |

500,000 |

|

|

Net Income

|

|

$ |

241,000 |

|

|

$ |

304,000 |

|

|

EPS (Basic)

|

|

$ |

0.05 |

|

|

$ |

0.06 |

|

|

EPS (Diluted)

|

|

$ |

0.05 |

|

|

$ |

0.06 |

|

| |

|

|

|

|

|

|

|

|

|

Weighted Average Shares Outstanding:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

5,009,041 |

|

|

|

4,700,422 |

|

|

Diluted

|

|

|

5,009,041 |

|

|

|

4,700,422 |

|

| |

|

For the Nine Months Ended

|

|

| |

|

(Continuing Operations, Consolidated)

|

|

| |

|

August 31, 2023

|

|

|

August 31, 2022

|

|

|

Sales

|

|

$ |

23,429,000 |

|

|

$ |

19,031,000 |

|

|

Operating Income

|

|

$ |

1,445,000 |

|

|

$ |

510,000 |

|

|

Net Income

|

|

$ |

921,000 |

|

|

$ |

191,000 |

|

|

EPS (Basic)

|

|

$ |

0.18 |

|

|

$ |

0.04 |

|

|

EPS (Diluted)

|

|

$ |

0.18 |

|

|

$ |

0.04 |

|

| |

|

|

|

|

|

|

|

|

|

Weighted Average Shares Outstanding:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

5,000,185 |

|

|

|

4,633,621 |

|

|

Diluted

|

|

|

5,000,185 |

|

|

|

4,633,621 |

|

Sales from Continuing Operations: Our consolidated corporate sales from continuing operations for the three- and nine-month periods ended August 31, 2023 were $ 8,117,000 and $23,429,000, respectively, compared to $7,476,000 and $19,031,000 during the same respective periods in fiscal 2022, a $641,000, or 8.6%, increase for the three months and a $4,398,000, or 23.1%, increase for the nine months.

Our third quarter sales in our Agricultural Products segment were $5,530,000 compared to $6,345,000 during the same period of fiscal 2022, a decrease of $815,000, or 12.8%. Our year-to-date agricultural product sales were $17,343,000 compared to $15,823,000 during the same period in fiscal 2022, an increase of $1,520,000, or 9.6%. We saw a decrease in revenue in Q3 of fiscal 2023 compared to 2022 due to the timing of our beet equipment production. We typically see a spike in sales during our beet run as it is our largest and most expensive equipment. We shipped the majority of our beet equipment during the second quarter of fiscal 2023 compared to Q3 of fiscal 2022. Despite the Q3 decrease, year to date sales in our Agricultural Products segment are up 9.6%. We've seen increased demand for our grinders, beet equipment and manure spreaders thus far in fiscal 2023. We released smaller versions of our manure spreader line in fiscal 2023 that have been well-received in the marketplace. We are continuing our focus on improving our dealer network by increasing the number of stocking dealers we work with. We are incentivizing our sales team to bring new dealers on board and are also offering favorable terms to new dealers to increase our reach. While some supply chain challenges still exist, proper planning has allowed us to overcome most of these issues. We are starting to see drops in commodity prices with the exception of sugar beets at this time. We do expect farmers to start to pull back on purchases if commodity prices continue to stay down. We are also observing that inventory is starting to pile up on dealer lots, which may indicate the supply chain is catching up and that demand may start to decrease in fiscal 2024.

Our third quarter sales in our Modular Buildings segment were $2,587,000 compared to $1,131,000 for the same period in fiscal 2022, an increase of $1,456,000, or 128.7%. Our year-to-date sales in our Modular Buildings segment were $6,086,000 compared to $3,208,000 for the same period in fiscal 2022, an increase of $2,878,000, or 89.7%. Progress on a large research project coupled with continued agricultural building demand drove the revenue increase for the three and nine months ended August 31, 2023.

As announced in a press release on June 7, 2023, we discontinued our Tools segment with the last day of normal operations on July 14, 2023. One employee was employed by the Tools segment as of August 31, 2023 with an anticipated termination date of October 2, 2023. This employee was overseeing the liquidation process, mainly the sale of remaining inventory and auctioning off machinery and equipment. The Company real estate is listed for sale at market value for the Canton, Ohio area. The Company's original estimated cash generation of approximately $950,000 from the liquidation of receivables, inventory and other assets (excluding real estate) to fund estimated liquidation costs of $200,000. These numbers assumed the majority of open sales orders at June 7, 2023 would be fulfilled before production ceased on July 14, 2023. These numbers will be updated as the liquidation finishes in Q4 of fiscal 2023. Our Tools segment had sales of $439,000 and $2,031,000 during the three- and nine-month periods ended August 31, 2023, respectively, compared to $664,000 and $1,998,000 for the same respective periods in fiscal 2022, a 33.8% decrease and a 1.6% increase, respectively. Management believes the liquidation of the Tools segment will allow for investment in technological advances that improve efficiency and margins in the Agricultural Products and Modular Buildings segments. We also expect to better be able to focus on the success of the continuing operations without devoting time to a business that has historically been unsuccessful in an industry that is not poised for growth.

Net Income from Continuing Operations: Consolidated net income from continuing operations was $241,000 for the three-month period ended August 31, 2023, compared to $304,000 for the same period in fiscal 2022. While our Modular Buildings segment was profitable in Q3 of fiscal 2023, our Agricultural Products segment incurred a loss for the quarter. While our revenues were strong in this segment, a large portion of our sales were from manure spreaders, which are lower margin sales as opposed to some of our other lines. In addition, we saw increasing component prices on our inventory items, inflationary effects on our overhead items and also incurred some large one-time expenses for recruitment of key employees and ERP conversion costs, which lead to the unprofitable quarter. Our consolidated net income from continuing operations for the nine months ended August 31, 2023, was $921,000 compared to $191,000 in the same period in fiscal 2022. We have continued to see success in our Agricultural Products segment due to favorable market conditions, revitalized corporate branding and improved customer service. Our Modular Buildings segment converted pent up demand from the COVID-19 pandemic into strong fiscal 2023 results. We attribute a good portion of the corporate success we have seen over the last two years to strong leadership and a focus on putting the right people in place in our business segments.

Income per Share (Continuing Operations): Income per basic and diluted share for the third quarter of fiscal 2023 was $0.05, compared to income per basic and diluted share of $0.06 for the same period in fiscal 2022. Income per basic and diluted share for the first nine months of fiscal 2023 was $0.18, compared to loss per basic and diluted share of $0.04 for the same period in fiscal 2022.

“Overall market conditions remained favorable for both the Agricultural Products and Modular Building segments through the first nine months of fiscal 2023,” stated David King, Art’s Way’s Chief Executive Officer. “While we did see a reduction in revenue for the third quarter in our Agricultural Products segment due to the timing of beet equipment production, we have a strong order backlog that will continue to drive year-over-year growth. Our fall early order program is underway and is expected to add to our existing backlog.”

King added, “The Modular Buildings segment has seen significant growth in 2023 and we expect a strong finish to the year as the production schedule remains full. Looking forward, we anticipate healthy revenues for the segment in 2024 as we have been able to sign new rental agreements for existing research buildings and continue work through contract negotiations on several large building projects.”

Art’s-Way Manufacturing Co., Inc.

Art’s Way Manufacturing is a small, publicly traded company that specializes in equipment manufacturing. For over 65 years, it has been committed to designing and building high-quality machinery for all operations. It has approximately 125 employees across two branch locations: Art’s Way Manufacturing in Armstrong, Iowa and Art’s Way Scientific in Monona, Iowa. Art’s Way manure spreaders, grinder mixers, sugar beet harvesters, high dump carts, bale processors, graders, land planes, and forage boxes, are designed to optimize production, increase efficiency and meet the growing demands of customers. Art’s Way Manufacturing has two reporting segments: Agricultural Products and Modular Buildings.

For more information, contact: David King, Chief Executive Officer

712-208-8467

davidk@artsway.com

Or visit the Company’s website at www.artsway.com/

Cautionary Statements

This release includes "forward-looking statements" within the meaning of the federal securities laws. Statements made in this release that are not strictly statements of historical facts, including the Company’s expectations regarding: (i) the Company’s business position; (ii) demand and potential growth within the Company’s business segments; (iii) future results, including but not limited to, revenue and margin expectations, expectations with respect to the impact of price increases, and expectations with respect to backlog and product mix; (iv) the Company’s ability to increase production with capital investments and other activities, (v) future agricultural sales and plans to enter into building contracts; (vi) cash flows and plans to fund strategic initiatives and pay down debt; and (vii) the benefits of the Company’s business model and strategy, are forward-looking statements. Statements of anticipated future results are based on current expectations and are subject to a number of risks and uncertainties, including, but not limited to: customer demand for the Company’s products; credit-worthiness of the Company’s customers; the Company’s ability to operate at lower expense levels; the Company’s ability to complete projects in a timely and efficient manner in accordance with customer specifications; the Company’s ability to renew or obtain financing on reasonable terms; the Company’s ability to repay current debt, continue to meet debt obligations and comply with financial covenants; inflation and its effect on the Company’s supply chain and demand for its products, domestic and international economic conditions; the Company’s ability to attract and maintain an adequate workforce in a competitive labor market; any future COVID-19 setbacks; factors affecting the strength of the agricultural sector; the cost of raw materials; unexpected changes to performance by any of the Company’s operating segments; obstacles related to liquidation of product lines and segments; and other factors detailed from time to time in the Company’s Securities and Exchange Commission filings. Actual results may differ markedly from management's expectations. Readers are cautioned not to place undue reliance upon any such forward-looking statements. The Company does not intend to update forward-looking statements other than as required by law.

v3.23.3

Document And Entity Information

|

Oct. 11, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

ART’S-WAY MANUFACTURING CO., INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 11, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

000-05131

|

| Entity, Tax Identification Number |

42-0920725

|

| Entity, Address, Address Line One |

5556 Highway 9

|

| Entity, Address, City or Town |

Armstrong

|

| Entity, Address, State or Province |

IA

|

| Entity, Address, Postal Zip Code |

50514

|

| City Area Code |

712

|

| Local Phone Number |

208-8467

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock

|

| Trading Symbol |

ARTW

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000007623

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

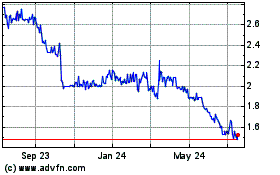

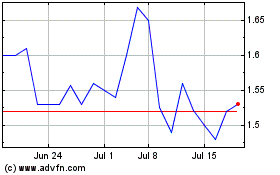

Arts Way Manufacturing (NASDAQ:ARTW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arts Way Manufacturing (NASDAQ:ARTW)

Historical Stock Chart

From Apr 2023 to Apr 2024