0001698113

false

0001698113

2023-10-04

2023-10-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 4, 2023

PARTS ID, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-38296 |

|

81-3674868 |

| (State or other jurisdiction |

|

(Commission File Number) |

|

(IRS Employer |

| of incorporation) |

|

|

|

Identification No.) |

1 Corporate Drive

Suite C

Cranbury, New Jersey 08512

(Address of principal executive offices, including

zip code)

609-642-4700

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A Common Stock |

|

ID |

|

NYSE American |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry Into a Material Definitive Agreement.

On October 6, 2023, PARTS iD, Inc., a Delaware

corporation (the “Company”) and its subsidiary, PAARTS iD, LLC, a Delaware limited liability company, entered into a definitive

Restructuring Support Agreement (the “RSA”) to restructure the Company’s indebtedness with certain of its trade vendors

(the “Consenting Vendors”).

Pursuant to the terms and conditions of the RSA,

the Company agreed to pay to each holder of a (i) Vendor Claim (as defined in the RSA), an amount equal to 55% of such total Vendor Claim

consisting of (A) 12.5% of such Vendor Claim (the “Initial Payment”) on the earlier to occur of (X) two business days following

the Company’s receipt of the Restructuring Funds (as defined in the RSA) and (Y) December 15, 2023, and (B) the remaining 42.5%

of such Vendor Claim paid monthly over 36 months; and (ii) a Convenience Claim (as defined in the RSA), an amount equal to 65% of such

Convenience Claim (A) with respect to a Consenting Vendor, no later than two business days after the Company makes the Initial Payment

and (B) with respect to an Additional Consenting Vendor (as defined in the RSA), on the later of (X) two business days after the Company

makes the Initial Payment and (Y) five business days after such Additional Consenting Vendor’s execution of an Accession Letter

(as defined in the RSA).

The RSA contains customary representations, warranties

and covenants that are standard for agreements of this type.

The RSA will terminate automatically upon the earliest

occur of (i) payment of the full amount of the Agreed Vendor Claim (as defined in the RSA) to each Consenting Vendor and (ii) the mutual

written consent of the Company and the Consenting Vendors holding at least 80% of the Total Vendor Claim Amount (as defined in the RSA).

The foregoing description of the RSA is not complete

and is subject to, and qualified in its entirety by reference to, the form of the RSA, of which is included as Exhibit 10.1 to this

Current Report on Form 8-K and is incorporated herein by reference.

Item 5.02 Departure of Directors or Certain Officers; Election of

Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On October 4, 2023,

James Doss, the Company’s Chief Financial Officer (“CFO”) notified the Company that he will be resigning as the CFO

and principal financial officer of the Company for personal reasons, effective November 20, 2023. The Company has initiated the process

of identifying a qualified individual to assume the role of CFO and is actively seeking

a suitable candidate to fill the vacancy.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following

exhibits are filed as part of this report:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: October 11, 2023

| |

PARTS ID, INC. |

| |

|

|

| |

By: |

/s/ Lev Peker |

| |

|

Name: |

Lev Peker |

| |

|

Title: |

Chief Executive Officer |

2

Exhibit

10.1

Nothing

contained in thIS RESTRUCTURING SUPPORT AGREEMENT shall be an admission of fact or liability OR, UNTIL THE OCCURRENCE OF THE SUPPORT

EFFECTIVE DATE ON THE TERMS DESCRIBED IN THIS RESTRUCTURING SUPPORT AGREEMENT, DEEMED BINDING ON ANY OF THE PARTIES HEREto.

THIS

RESTRUCTURING SUPPORT AGREEMENT IS THE PRODUCT OF SETTLEMENT DISCUSSIONS AMONG THE PARTIES THERETO. ACCORDINGLY, THIS RESTRUCTURING SUPPORT

AGREEMENT IS PROTECTED BY RULE 408 OF THE FEDERAL RULES OF EVIDENCE AND ANY OTHER APPLICABLE STATUTES OR DOCTRINES PROTECTING THE USE

OR DISCLOSURE OF CONFIDENTIAL SETTLEMENT DISCUSSIONS.

RESTRUCTURING

SUPPORT AGREEMENT

by

and among

PARTS

ID, INC.

PARTS

ID, LLC

and

EACH

CONSENTING VENDOR PARTY HERETO

dated

as of October 6, 2023

PREAMBLE

This

Restructuring Support Agreement, together with all exhibits, schedules, and attachments hereto, as may be amended, supplemented, or otherwise

modified from time to time in accordance with the terms hereof, (the “Agreement”), is made and entered into as of

October 6, 2023, by and among: (1) Parts iD, Inc., (2) PARTS iD, LLC (together with Parts iD, Inc., the “Company”)

and (3) the undersigned vendors, severally and not jointly, identified on the signature pages hereto (together with each of their respective

successors and permitted assigns under this Agreement, each a “Consenting Vendor” and collectively, the “Consenting

Vendors”). The Company and each Consenting Vendor, and any subsequent person or entity that becomes a party to this Agreement

in accordance with the terms of this Agreement, are referred to in this Agreement as the “Parties” and each a “Party.”

RECITALS

WHEREAS,

to address the Company’s liquidity issues, the Company and an ad hoc Committee of vendors (the “Committee”)

have been engaged in good faith, arm’s-length negotiations with the objective of reaching an agreement to restructure the Company’s

indebtedness to trade vendors (the “Restructuring”).

WHEREAS,

the Parties have now agreed to support and facilitate the implementation of the Restructuring in accordance with the terms and conditions

set forth in this Agreement.

WHEREAS,

the Parties have agreed to take certain actions in furtherance of the Restructuring and desire to express to each other their mutual

support and commitments as set forth in this Agreement.

AGREEMENT

NOW,

THEREFORE, in consideration of the promises and mutual covenants and agreements set forth in this Agreement, and for other good and

valuable consideration, the receipt and sufficiency of which are hereby acknowledged, each of the Parties hereby agrees as follows:

Section

1. Definitions. In this Agreement:

“Accession

Date” has the meaning set forth in Section 3(a)(i).

“Accession

Letter” means an accession letter substantially in the form set out in Schedule 1 (Additional Consenting Vendor Accession

Letter).

“Additional

Consenting Vendor” means any Vendor that becomes a Party as a Consenting Vendor after the Support Effective Date in accordance

with Section 3 (Accessions to the Agreement).

“Additional

Consenting Vendor Payment Date” means, in relation to each Additional Consenting Vendor, the later to occur of (a) the Initial

Payment Date, and (b) five (5) Business Days after its Accession Date.

“Affiliate”

means, with respect to a person, any other person who, directly or indirectly, is in control of, or controlled by, or is under common

control with, such person and, for the purposes of this definition, “control” shall mean the power, direct or indirect,

to (a) vote on more than fifty percent (50%) of the securities having ordinary voting power for the election of directors of such person,

or (b) direct or cause the direction of the management and policies of such person whether by contract or otherwise.

“Agreed

Vendor Claim” has the meaning set forth in Section 4(a).

“Agreement”

has the meaning given to this term in the Preamble.

“Alternative

Restructuring” has the meaning given to this term in the definition of the term “Restricted Action.”

“Bankruptcy

Code” means title 11 of the United States Code, 11 U.S.C. §§ 101-1532, as amended.

“Business

Day” means a day (other than a Saturday or Sunday) on which banks are open for general business in New York.

“Claim”

has the meaning set forth in section 101(5) of the Bankruptcy Code.

“Committee”

has the meaning given to this term in the Recitals.

“Committee

Counsel” means Cole Schotz P.C.

“Committee

Representative” means the individual so designated from time to time by (i) a vote of at least 50.1% of the aggregate amount

of the Claims against the Company held by the Committee, including the vote of the Committee Representative, or (ii) such other vote

as shall be determined by the Committee.

“Company”

has the meaning given to this term in the Preamble.

“Connected

Persons” means with respect to a person, (a) its Affiliates; (b) its partners, directors, officers, employees, legal and other

professional advisors (including auditors), agents and representatives; and (c) its Affiliates’ partners, directors, officers,

employees, legal and other professional advisors (including auditors) agents and representatives.

“Consenting

Vendor” and “Consenting Vendors” have the meanings given to these terms in the Preamble.

“Convenience

Claim” means the aggregate Claims of a Vendor against the Company for past due invoices as of the Support Effective Date when

such Claims total an amount that is equal to or less than $10,000.

“Event

of Default” has the meaning set forth in Section 12(a) (Events of Default and Remedies).

“Initial

Payment” means, with respect to each holder of a Vendor Claim, an amount equal to 12.5% of the total amount of such Vendor

Claim.

“Initial

Payment Date” means the earlier to occur of (i) two (2) Business Days following the Company’s receipt of the Restructuring

Funds, and (ii) December 15, 2023.

“Insolvency

Proceeding” means any voluntary or involuntary corporate or third party action, legal proceeding or other procedure or step

in relation to any suspension of payments or moratorium of any indebtedness, the winding up, bankruptcy (including any proceeding under

chapters 7 or 11 of the Bankruptcy Code), liquidation, provisional liquidation, dissolution, administration, receivership, administrative

receivership, judicial composition or reorganization of or in relation to the Company, assignment for the benefit of creditors, or any

analogous procedure or step in any other jurisdiction.

“Law”

means any federal, state, local, or foreign law, statute, code, ordinance, rule, regulation, order, ruling, or judgment, in each case,

that is validly adopted, promulgated, issued, or entered by a governmental authority of competent jurisdiction.

“Material

Adverse Effect” means a material adverse effect impeding the ability of the Company to implement or consummate the Restructuring.

“Monthly

Vendor Claim Payment” means an amount equal to forty-two and one-half percent (42.5%) of the total Vendor Claim divided by

thirty-six (36).

“Party”

and “Parties” have the meanings given to these terms in the Preamble.

“Requisite

Consenting Vendors” means, as of the Support Effective Date, Consenting Vendors holding at least eighty percent (80%) of the

Total Vendor Claim Amount.

“Restricted

Actions” means, except with respect to the exercise or enforcement of any rights and claims under this Agreement, during the

Support Period:

(a)

the acceleration, enforcement, collection or recovery of, or the taking of any steps to accelerate, enforce collect or recover, a Vendor

Claim or Convenience Claim against the Company;

(b)

the suing for, commencing, supporting, and/or joining of any legal or arbitration proceedings against the Company with respect to the

Restructuring;

(c)

the petitioning, applying, or voting for, or supporting of, any Insolvency Proceeding against the Company;

(d)

filing any motion, pleading, or other document with any court (including any modifications or amendments thereof) that, in whole or in

part, is not consistent with this Agreement;

(e)

objecting to, delaying, impeding, or taking any other action with respect to a Vendor Claim or Convenience Claim that would reasonably

be expected to interfere with the ownership and possession by the Company of its assets, wherever located;

(f)

taking, encouraging, assisting, or supporting any action that would, or would reasonably be expected to, frustrate, delay, impede, interfere

with, or prevent the Restructuring or that is in any way inconsistent with this Agreement, including (without limitation):

(i)

through any person or entity, directly or indirectly, encouraging, seeking, procuring, proposing, soliciting, assisting, participating,

filing, prosecuting, engaging in negotiations in connection with or otherwise supporting, plan, plan proposal, restructuring proposal,

Insolvency Proceeding, offer of dissolution, winding up, liquidation, receivership, sale or disposition, refinancing, recapitalization,

reorganization, merger or any alternative proposal or offer from any person or entity in respect of a restructuring of the financial

indebtedness of the Company other than the Restructuring as contemplated under this Agreement (each, an “Alternative Restructuring”);

and

(ii)

challenging or objecting, or supporting or procuring any challenge or objection to, any aspect of the Restructuring.

“Restructuring”

has the meaning given to this term in the Recitals.

“Restructuring

Funds” means an amount not less than $10 million in capital, including debt, equity or any other capital raised by the Company.

“Support

Effective Date” has the meaning given to this term in Section 5 (Conditions to Support Effective Date).

“Support

Period” means the period commencing on the Support Effective Date and ending the date the Company is placed into an Insolvency

Proceeding or the date on which this Agreement is terminated in accordance with Section 13 (Termination), whichever

occurs first.

“Total

Vendor Claim Amount” means, no more than $27,368,133.57, which the Company represents is the aggregate amount of all Claims

owed to vendors for past due invoices as of the date of this Agreement.

“Transfer”

has the meaning given to this term in Section 11 (Transfers) of this Agreement.

“Vendor”

means a vendor that sells products or SKUs on any of the Company’s platforms;

“Vendor

Claim” means the aggregate Claims of a Vendor against the Company for past due invoices as of the Support Effective Date when

such Claims total an amount greater than $10,000.

Section

2. Certain Interpretations. For purposes

of this Agreement:

(a)

when a reference is made in this Agreement to the Preamble, a Recital, Section, Exhibit, or Schedule, such reference shall be to the

Preamble, Recital, Section, Exhibit or Schedule, respectively, of or attached to this Agreement unless otherwise indicated; and

(b)

unless the context of this Agreement otherwise requires, (i) words using the singular or plural also include the plural or singular,

respectively, (ii) the terms “hereof,” “herein,” “hereby” and derivative or similar words refer

to this entire Agreement, (iii) the words “include,” “includes” and “including” when used herein

shall be deemed in each case to be followed by the words “without limitation,” (iv) the word “or” shall not be

exclusive and shall be read to mean “and/or” and (v) any reference to dollars or “$” shall be to United States

dollars; and

(c)

capitalized terms defined only in the plural or singular form shall nonetheless have their defined meanings when used in the opposite

form.

Section

3. Accessions to the Agreement.

(a)

Any Vendor that holds a Claim against the Company who is not a Party as of the Support Effective Date may become a Consenting Vendor

under and a Party to this Agreement by delivering to the Company a duly completed and executed Accession Letter. On delivery of such

fully executed Accession Letter:

(i)

this Agreement shall be read and construed as if such acceding entity was a Party to this Agreement from the date of the relevant Accession

Letter (the “Accession Date”); and

(ii)

the acceding Vendor agrees to be bound by the terms of this Agreement.

(b)

The Vendor Claim or Convenience Claim of each Additional Consenting Vendor shall receive the treatment set forth in Section 4

(Treatment of Claims), unless:

(i)

a dispute exists between the Company and such Additional Consenting Vendor regarding the amount of its Claim, in which case the Parties

shall work in good faith to confirm and agree the amount of such Claim; or

(ii)

at least five (5) Business Days prior to the Accession Date, the Company has provided written notice (e-mail being sufficient) to the

Committee Representative of a proposal for separate treatment of such Vendor Claim; and

(iii)

the Committee Representative has confirmed to the Company in writing (e-mail being sufficient) that the terms of such treatment are acceptable.

Section

4. Treatment of Claims.

(a)

The Company shall pay to each holder of a Vendor Claim an amount equal to 55% of such total Vendor Claim (such amount, the “Agreed

Vendor Claim”), as follows:

(i)

on the Initial Payment Date or the Additional Consenting Vendor Payment Date, as applicable, the Initial Payment;

(ii)

until the Company has made all Monthly Vendor Claim Payments (such that each holder of a Vendor Claim has been paid an additional 42.5%

of its total Vendor Claim, exclusive of any default interest paid under section 12(b)), commencing on the first Business Day of the month

following the Initial Payment Date or Additional Consenting Vendor Payment Date, as applicable, and continuing on the first Business

Day of each month thereafter, such Vendor’s Monthly Vendor Claim Payment; and

(iii)

subject only to Section 12(c) (Events of Default and Remedies), upon receipt by a Vendor of the full amount of its Agreed Vendor

Claim, such Vendor shall be deemed to have irrevocably forgiven, released, and discharged the balance of its Vendor Claim against the

Company.

Unless

an Event of Default has occurred and is continuing, each Agreed Vendor Claim shall not bear interest.

(b)

Each holder of a Convenience Claim shall receive in full and complete settlement, release and discharge of its Convenience Claim, an

amount equal to 65% of its Convenience Claim no later than:

(i)

with respect to a Consenting Vendor as of the Support Effective Date, two (2) Business Days after the Company makes the Initial Payment

required by Section 4(a)(i); and

(ii)

with respect to an Additional Consenting Vendor, the later of (A) two (2) Business Days after the Company makes the Initial Payment required

by Section 4(a)(i) and (B) five (5) Business Days after such Additional Consenting Vendor’s execution of an Accession Letter.

Section

5. Conditions to Support Effective Date.

This Agreement shall become effective upon the satisfaction or waiver of the following conditions (the Business Day immediately following

the date upon which such conditions are satisfied or waived, the “Support Effective Date”):

(a)

The Requisite Consenting Vendors have executed this Agreement; and

(b)

The Committee Representative has been designated and the contact details of the Committee Representative have been provided to the Company.

The

Company shall provide the Consenting Vendors with written notice of the occurrence of the Support Effective Date within three (3) Business

Days thereof. Unless the Company and the Committee Representative agree otherwise, if the Support Effective Date does not occur within

thirty (30) days of the Company’s execution of the Agreement, the Agreement shall become null and avoid and without any effect.

Section

6. Representations and Warranties of Consenting Vendors. Each

Consenting Vendor hereby severally and not jointly represents and warrants to the Company that the following statements are true and

correct as of the Support Effective Date or, in relation to Additional Consenting Vendors only, the date of that Additional Consenting

Vendor’s Accession Letter:

(a)

it has all necessary power and authority to execute and deliver this Agreement, to carry out the transactions contemplated by this Agreement,

and to perform its obligations under this Agreement. The execution and delivery of this Agreement by it and the performance of its obligations

hereunder have been duly authorized by all necessary actions on the part of the Consenting Vendor;

(b)

this Agreement has been duly and validly executed and delivered by it. This Agreement constitutes the valid and binding obligation of

it, enforceable against it in accordance with its terms, except that (i) such enforcement may be subject to applicable bankruptcy, reorganization,

insolvency, moratorium or other similar Law affecting creditors’ rights generally and (ii) the remedy of specific performance and

injunctive and other forms of equitable relief may be subject to equitable defenses and to the discretion of the court before which any

proceeding therefor may be brought; and

(c)

it has made no Transfer of its Claim.

Section

7. Representations, Warranties and Covenants of the Company.

The Company hereby represents and warrants to each Consenting Vendor that the following statements are true and correct as of the Company’s

execution of this Agreement:

(a)

the board of directors, special committee of the board of directors, board of managers, or such similar governing body of the Company

has determined, after consulting with counsel, that (i) proceeding with the Restructuring is consistent with the exercise of its fiduciary

duties or applicable Law and (ii) and is valid exercise of its fiduciary duties;

(b)

it has all necessary power and authority to execute and deliver this Agreement, to carry out the transactions contemplated by this Agreement,

and to perform its obligations hereunder. The execution and delivery of this Agreement by it and the performance of its obligations hereunder

have been duly authorized (or will be duly authorized through ratification) by all necessary action on the part of the Company;

(c)

this Agreement has been duly and validly executed and delivered by the Company. This Agreement constitutes the valid and binding obligation

of the Company, enforceable against it in accordance with its terms, except that (i) such enforcement may be subject to applicable bankruptcy,

reorganization, insolvency, moratorium or other similar Law affecting creditors’ rights generally and (ii) the remedy of specific

performance and injunctive and other forms of equitable relief may be subject to equitable defenses and to the discretion of the court

before which any proceeding therefor may be brought;

(d)

the execution, delivery or performance of this Agreement by the Company, and its compliance with the provisions hereof, will not (with

or without notice or lapse of time, or both) conflict with or violate any provision of the organizational or governing documents of the

Company or any of its subsidiaries; and

(e)

Absent prior written consent of the Committee Representative, the Company shall not provide any Vendor higher or otherwise better treatment

of such claim than as provided to such claim holders set forth in Section 4 (Treatment of Claims).

(f)

it will provide all information reasonably requested by the Committee Representative or the Committee Counsel (i) to assist with the

implementation of the Restructuring, (ii) related to payments to Vendors hereunder and (iii) related to the financial information of

the Company; and

(g)

the Company has acted diligently and in good faith as would be reasonably required to procure financing and has identified one or more

sources that are prepared to fund the Restructuring Funds.

(h)

in the event the Company breaches any covenant, undertaking or representation made in this Agreement, the Company shall report such breach

to the Committee Representative promptly upon the occurrence of such breach;

(i)

it will, to the extent any impediment arises that would prevent, hinder, or delay the consummation of the Restructuring and full payment

of the Agreed Vendor Claims, negotiate in good faith with the Committee, or following the Support Effective Date, the Committee Representative

to address any such impediments.

Section

8. All Parties Undertakings. During

the Support Period, each Party shall:

(a)

support and cooperate with each other Party in good faith and otherwise use its commercially reasonable efforts to support and consummate

the Restructuring as soon as reasonably practicable;

(b)

as soon as reasonably practicable take all actions reasonably necessary to support, facilitate, implement, consummate, or otherwise give

effect to all or any part of the Restructuring and the transactions contemplated in this Agreement, provided that such actions are consistent

with this Agreement, including (but not limited to) executing and delivering any document, giving any notice, confirmation, consent or

direction; and

(c)

not take, direct, encourage, assist or support (or procure that any other person takes, directs, encourages, assist or supports) any

action which would, or would reasonably be expected to, breach or be inconsistent with this Agreement or the Restructuring, or delay,

impede, or prevent the implementation or consummation of the Restructuring.

Section

9. Additional Consenting Vendor Undertakings. During

the Support Period, unless there is an occurrence of an Event of Default described in Section 12(c), each Consenting Vendor hereby severally

and not jointly irrevocably undertakes in favor of the other Parties that:

(a)

it will provide all information reasonably requested by the Company to assist with the implementation of the Restructuring;

(b)

it will not perform (or direct, request, instruct, encourage or procure that any other person performs) any Restricted Action; and

(c)

it will (or, as applicable, will procure that a duly authorized representative will):

(i)

work in good faith with the Company and its advisors to implement the Restructuring as soon as possible in a manner consistent with the

terms of this Agreement;

(ii)

to the extent any impediment arises that would prevent, hinder, or delay the consummation of the Restructuring, negotiate in good faith

to address any such impediments;

(iii)

not support any party or person from taking any unauthorized Restricted Actions; and

(iv)

timely vote against or otherwise oppose any Alternative Restructuring.

For

the avoidance of doubt, notwithstanding any term or provision of this Agreement which may be construed otherwise, nothing in this Agreement

is intended to alter, prevent or restrict, or shall alter, prevent or restrict, a Consenting Vendor’s rights and ability to (a)

to fully participate in any Insolvency Proceeding filed by or against the Company, including, e.g., by filing a claim (for the

full balance of its Vendor Claim), motion, or seeking any relief against the Company; and (b) pursue, enforce, or take any actions with

respect to a Claim against the Company that first accrued or arose after the Consenting Vendor’s execution of this Agreement.

Section

10. Vendor Terms. Unless more favorable

terms are agreed with the Company, subject to the right of any Consenting Vendor to limit the quantum of credit exposure, during the

Support Period each Consenting Vendor shall conduct business with the Company on the following terms:

(a)

on or within thirty (30) days after the Company makes the Initial Payment required by Section 4(a)(i), the credit terms that were provided

to the Company as of the Support Effective Date shall be increased by at least seven (7) days. Within sixty (60) days thereafter, the

applicable credit terms shall be at least fourteen (14) days;

(b)

if after making the Initial Payment required by Section 4(a)(i), the Company makes an additional payment to Consenting Vendors in an

amount equal to the Initial Payment (i.e., 12.5% of the total Vendor Claim, which payment shall be separate and independent from

Company’s monthly payments under Section 4(a)(ii) but allocated towards payment of the Agreed Vendor Claim, the Consenting Vendors

shall provide to the Company the same terms that applied of June 2022; and

(c)

if the Company fails to make any payment to a Vendor required under Section 4(a) (Treatment of Claims), such Vendor shall

have the right to revert to less favorable terms of their choosing.

Section

11. Transfers. During the Support Period,

each Consenting Vendor agrees that it will not, directly or indirectly, sell, transfer or assign any Claim held by such Vendor to any

person or entity (each, a “Transfer”); provided, however, that any Consenting Vendor may Transfer its Claim (a) if

the transferee is a party to this Agreement, (b) if the transfer is the result of a merger or acquisition, or (c) if the transferee is

not a party to this Agreement prior to or upon the effectiveness of the Transfer, such transferee delivers to the Company, at or prior

to the time of the proposed Transfer, a fully executed Accession Letter pursuant to which the transferee shall assume all obligations

of the transferor hereunder in respect of the Claim being transferred. Any Transfer that does not comply with the foregoing shall be

deemed void ab initio.

Section

12. Events of Default and Remedies

(a)

The occurrence of any of the following specified events shall be an “Event of Default”:

(i)

the Company fails to make any scheduled payment to Vendors required under Section 4 (Treatment of Claims);

(ii)

the Company is in breach of a covenant, undertaking or representation made in this Agreement; or

(iii)

the Company becomes the subject of an Insolvency Proceeding.

(b)

Upon the occurrence of any Event of Default under Section 12(a)(i), interest on the remaining balance of each Agreed Vendor Claim

shall accrue at a rate of 8.00% per annum until the Company has made three (3) consecutive scheduled Monthly Vendor Claim Payments (inclusive

of the default rate interest that has accrued in that period), at which point such default shall be cured, interest shall cease to accrue

and timely Monthly Vendor Claim Payments shall continue, subject to the accrual of interest as set forth in this subparagraph upon the

occurrence of a subsequent Event of Default.

(c)

Upon the occurrence of (i) an Event of Default under Section 12(a)(iii), (ii) an Event of Default because the Initial Payment

is not made on the Initial Payment Date, (iii) an Event of Default under Section 12(a)(i) which the Company has failed to cure

under Section 12(b) for a period of four (4) months, (iv) an Event of Default under Section 12(a)(ii) that constitutes

Material Adverse Effect, or (v) the termination of this Agreement pursuant to section 13(b) or 13(c), each holder of an Agreed Vendor

Claim shall have the right to enforce the full balance of its Vendor Claim (notwithstanding Sections 8 and 9 of the Agreement or anything

in the Agreement that could be construed otherwise), which shall be calculated as the original amount of such Vendor Claim less

any payments made pursuant to Section 4(a).

Section

13. Termination.

(a)

This Agreement will terminate automatically on the earliest to occur of:

(i)

Payment of the full amount of the Agreed Vendor Claim to each Consenting Vendor; and

(ii)

the mutual written consent of the Company and the Requisite Consenting Vendors.

(b)

The Company may, by giving written notice to the other Parties, terminate this Agreement if:

(i)

if Consenting Vendors holding Claims in the aggregate amount of 25% of the Total Vendor Claim Amount breach any of its representations,

warranties, or undertakings in this Agreement, unless the failure to comply is capable of remedy and is remedied within five (5) Business

Days after the Company delivers a written notice to the relevant Consenting Vendor with a copy to the Committee Representative and Committee

Counsel, alleging such a failure to comply; or

(ii)

the board of directors, special committee of the board of directors, board of managers, or such similar governing body of the Company

determines, after consulting with counsel and obtaining a written opinion of counsel which shall be shared with the Committee Representative

and the Committee Counsel under a mutually acceptable non-disclosure and non- waiver of attorney -client privilege agreement, that (i)

proceeding with the Restructuring would be inconsistent with the exercise of its fiduciary duties or applicable Law or (ii) in the exercise

of its fiduciary duties, to pursue an Alternative Restructuring; or

(c)

This Agreement may be terminated by written notice to the Company at the election of the Committee Representative if the full amount

of the Initial Payment is not made, in good funds, on the Initial Payment Date or the Company breaches any of its representations, warranties,

payment obligations or undertakings in this Agreement and such breach has a Material Adverse Effect, unless the failure to comply is

capable of remedy and is remedied within ten (10) Business Days after notice of such breach is given to the Company by the Committee

Representative.

(d)

Upon any termination in accordance with this Section 13 (Termination) the relevant Party or Parties shall be immediately

released from all their obligations and shall have no rights under this Agreement; provided that such termination and release

shall not affect:

(i)

in the case of termination that applies solely in respect of an individual Consenting Vendor, the rights, obligations, and liabilities

of the other Consenting Vendors;

(ii)

in the case of termination of the Agreement other than pursuant to Section 13(a)(i), the rights of Vendors to assert, collect, and/or

pursue the full amount of their respective Vendor Claims;

(iii)

any accrued rights in respect of breaches of this Agreement that occurred before such termination; or

(iv)

the application of Section 13 (Termination), Section 15 (Waivers and Amendments), Section 16 (Confidentiality),

and Section 17 (Miscellaneous), and any defined terms used in the aforementioned Sections as defined in Section 1

(Definitions) will remain in full force and effect.

(e)

Notwithstanding anything to the contrary in this Agreement, nothing in this Agreement shall allow any Party to terminate this Agreement

as a result of its own breach of this Agreement.

Section

14. Releases.

(a)

Release by Company. As of the date of execution of this Agreement by each Consenting Vendor, the Company shall be deemed to have

irrevocably and unconditionally, fully, finally, and forever released, acquitted, and discharged the executing Consenting Vendors from

any and all demands, claims, actions, causes of action, rights, liabilities, obligations, liens, suits, losses, damages, attorney fees,

court costs, or any other form of claim whatsoever, of whatever kind or nature, whether known or unknown, suspected or unsuspected, in

law or equity, which the Company has, has had, may have or may claim to have against the Consenting Vendors arising on or prior to the

Support Effective Date; provided that the foregoing release shall limit or be deemed to limit or release or be deemed to release the

rights of the Company to enforce this Agreement in accordance with its terms.

(b)

Release by Consenting Vendors. Subject to, conditioned upon, and following receipt by Vendors of all payments, in good funds,

set forth in Section 4 (Treatment of Claims), the Consenting Vendors shall be deemed to have irrevocably and unconditionally,

fully, finally, and forever released, acquitted, and discharged the Company from any and all demands, claims, actions, causes of action,

rights, liabilities, obligations, liens, suits, losses, damages, attorney fees, court costs, or any other form of claim whatsoever, of

whatever kind or nature, whether known or unknown, suspected or unsuspected, in law or equity, which the Consenting Vendors have, have

had, may have or may claim to have against the Company arising on or prior to the date of the Consenting Vendors’ execution of

this Agreement; provided that the foregoing release shall not limit or be deemed to limit or release or be deemed to release the rights

of the Consenting Vendors to enforce this Agreement in accordance with its terms.

Section

15. Waivers and Amendments.

(a)

This Agreement may be amended, modified, altered, or supplemented only by a written instrument executed by the Company and the Requisite

Consenting Vendors.

(b)

No delay on the part of any Party in exercising any right, power or privilege under this Agreement will operate as a waiver thereof;

nor will any waiver on the part of any party to this Agreement of any right, power, or privilege under this Agreement operate as a waiver

of any other right, power, or privilege under this Agreement, nor will any single or partial exercise of any right, power, or privilege

under this Agreement preclude any other or further exercise thereof or the exercise of any other right, power or privilege under this

Agreement.

(c)

Notwithstanding paragraphs (a) to (b) above, upon obtaining written consent of the Committee Representative, the Company may amend this

Agreement to cure any defect or inconsistency, to make any amendment of a typographical nature or to make any other amendment that does

not adversely affect the interests of the Consenting Vendors.

Section

16. Confidentiality.

(a)

No Party may disclose confidential information about the Restructuring, this Agreement, or the identity of any Party to any such document

(collectively, the “Confidential Information”) to any person provided that:

(i)

the Company and its Connected Persons may disclose the existence of this Agreement or in any regulatory filings required by the Securities

and Exchange Commission or in submissions made to any court of competent jurisdiction in connection with the Restructuring;

(ii)

the Parties may disclose this Agreement to any of their Affiliates or Connected Persons, provided that prior to such disclosure, the

relevant Connected Person has agreed with the Company to keep the terms of this Agreement confidential (unless already bound by the confidentiality

agreement, law, regulation or professional duty to keep the same confidential); and

(iii)

this Agreement (and any related notices) may be disclosed:

(A)

to any Party’s regulator or as required by Law, regulation, governmental entity or court order; provided, that prior to

such disclosure, the Party making the disclosure provides notice in writing to the other Parties and makes reasonable efforts to obtain

the receiving party’s agreement to keep the terms of this Agreement confidential; and

(B)

by the Company and its Connected Persons, as part of the negotiation of any potential transaction involving the Company, including any

investment in the Company, in connection with settlement of any actual or potential lawsuit or other claims against the Company; provided,

that prior to such disclosure, the Company makes reasonable efforts to obtain the receiving party’s agreement to keep the terms

of this Agreement confidential.

Section

17. Miscellaneous.

(a)

Notices. Any notices or other communications required or permitted under, or otherwise given in connection with, this Agreement

will be in writing and will be deemed to have been duly given (i) when delivered or sent if delivered in person by courier service or

messenger or sent by e-mail or (ii) on the next Business Day if transmitted by international overnight courier, in each case as follows:

If

to the Company, addressed to it at:

Parts

iD, Inc.

Attn:

John B. Pendleton, General Counsel

1

Corporate Drive, Suite C

Cranbury,

New Jersey 08512

Email:

john.pendleton@corp.partsid.com

with

a copy to (for information purposes only):

DLA

Piper LLP (US)

Attn:

R. Craig Martin, Esq.

Kaitlin

MacKenzie

1201

North Market Street, Suite 2100

Wilmington, Delaware

19801

| Email: | craig.martin@us.dlapiper.com |

kaitlin.mackenzie@us.dlapiper.com

If

to a Consenting Vendor or the Committee Representative, addressed to it at the address set forth on the Consenting Vendor’s

and Committee Representative’s respective signature page(s) attached hereto with a copy to:

Cole

Schotz P.C.

| Attn: | Stuart

Komrower, Esq. and |

Mark

Tsukerman, Esq

25

Main Street

Hackensack,

New Jersey 07601

| Email: | skomrower@coleschotz.com |

mtsukerman@coleschotz.com

(b)

Governing Law. This Agreement will be governed by, and construed in accordance with, the Law of the State of Delaware, without

regard to Law that may be applicable under conflicts of laws principles (whether of the State of Delaware or any other jurisdiction)

that would cause the application of the Law of any jurisdiction other than the State of Delaware.

(c)

Venue. By execution and delivery of this Agreement, each of the Parties irrevocably and unconditionally submits to the exclusive

jurisdiction of the courts of any Delaware state court or any federal court sitting in Wilmington, Delaware over any legal or other proceeding

arising out of, based upon or in connection with this Agreement or the transactions contemplated hereby. Each Party irrevocably waives

any objection it may have to service of process other than by compliance with the notice provision of this Agreement or the venue of

any action, suit, or proceeding brought in such courts or to the convenience of the fora.

(d)

WAIVER OF JURY TRIAL. EACH PARTY HEREBY IRREVOCABLY AND UNCONDITIONALLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE

LAW, ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN RESPECT OF ANY LITIGATION DIRECTLY OR INDIRECTLY ARISING OUT OF OR RELATING TO THIS

AGREEMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY (WHETHER BASED ON CONTRACT, TORT OR ANY OTHER THEORY).

(e)

Specific Performance. The Parties agree that irreparable damage may occur in the event any of the provisions of this Agreement

were not performed in accordance with their specific terms or were otherwise breached. It is accordingly agreed that the Parties will

be entitled to seek an injunction or injunctions to prevent breaches of this Agreement and to enforce specifically the terms and provisions

hereof in any court of appropriate jurisdiction, this being in addition to any other remedy to which they are entitled at law or in equity

(including attorneys’ fees and costs). Each Party also agrees that it will not seek, and will waive any requirement for, the securing

or posting of a bond in connection with any Party seeking or obtaining such relief.

(f)

Severability. If any term or other provision of this Agreement is determined to be invalid, illegal or incapable of being enforced

by any rule of law or public policy, all other conditions and provisions of this Agreement will nevertheless remain in full force and

effect so long as the economic or legal substance of the transactions contemplated hereby is not affected in any manner materially adverse

to any Party. Upon such determination that any term or other provision is invalid, illegal or incapable of being enforced, the Parties

will negotiate in good faith to modify this Agreement so as to effect the original intent of the Parties as closely as possible.

(g)

Assignment. This Agreement will not be assigned by any Party by operation of Law or otherwise without the prior written consent

of the other Parties. Subject to the preceding sentence, this Agreement will be binding upon, inure to the benefit of, and be enforceable

by the Parties and their respective permitted successors and assigns.

(h)

No Third-Party Beneficiaries. Unless expressly stated in this Agreement, this Agreement shall be solely for the benefit of the

Parties and no other person or entity shall be a third-party beneficiary of this Agreement.

(i)

Prior Agreements. This Agreement supersedes all prior negotiations and agreements among the Parties with respect to the matters

set forth herein, provided that nothing herein shall relieve the Consenting Vendors party to the confidentiality agreement from their

obligations thereunder.

(j)

Counterparts. This Agreement may be executed in one or more counterparts, each of which when executed will be deemed to be an

original but all of which taken together will constitute one and the same agreement.

(k)

Remedies Cumulative. Except as otherwise provided in this Agreement, any and all remedies in this Agreement expressly conferred

upon a Party will be deemed cumulative with and not exclusive of any other remedy conferred hereby, or by law or equity upon such Party,

and the exercise by a party of any one remedy will not preclude the exercise of any other remedy.

(l)

No Admissions; Reservation of Rights. Nothing herein shall be deemed an admission of any kind. The Parties acknowledge and agree

that this Agreement and all negotiations relating thereto shall not be admissible into evidence in any proceeding, other than a proceeding

to enforce the terms of this Agreement. Except as expressly provided in this Agreement, nothing herein is intended to, or does, in any

manner waive, limit, impair, or restrict any rights, remedies and interests of the Parties. Without limiting the foregoing sentence in

any way, if this Agreement is terminated for any reason, each of the Parties fully reserves any and all of its rights, remedies, and

interests.

(m)

Headings. The headings contained in this Agreement are for reference purposes only and will not affect in any way the meaning

or interpretation of this Agreement.

(n)

Limitations. Notwithstanding anything contained in this Agreement, nothing in this Agreement shall (i) require the Company or

any director or officer of the Company to take any action or to refrain from taking any action to the extent such person or persons determine,

based on the advice of counsel, that taking or failing to take such action would be inconsistent with applicable Law or its or their

fiduciary obligations under applicable Law; or (ii) prevent or otherwise restrict any action or inaction on the part of the Company or

any director or officer of the Company that the Company or such director or officer believes is, based on the advice of counsel, inconsistent

with applicable Law or its or their fiduciary obligations under applicable Law.

(o)

Interpretation. This Agreement is the product of negotiations among the Parties, each of which has been represented by legal counsel

during such negotiations and execution of this Agreement, and therefore in the enforcement or interpretation hereof, this Agreement is

to be interpreted in a neutral manner, and any presumption with regard to interpretation for or against any Party by reason of that Party

having drafted or caused to be drafted this Agreement, or any portion hereof, shall not be effective in regard to the interpretation

hereof.

(p)

Public disclosure. The Company shall not make any public filing relating to this Agreement prior to the execution by all members

of the Committee. No public disclosure or filing shall contain the name of any Vendor that is a member of the Committee absent written

consent of such Vendor.

(q)

Company’s Solicitation of Vendors this Agreement. In soliciting Vendors to become a party to this Agreement, the Company

shall provide each Vendor with a letter indicating, at a minimum, the amount of such Vendor’s Claim according to the Company’s

books and records as of the date of solicitation, which amount shall be deemed the amount each of such Vendor’s Claim for purposes

of this Agreement, unless resolved by the Company and the affected Vendor prior to the Vendor’s execution of the Agreement.

(r)

Committee Representative and Committee Counsel.

(i)

The Committee Representative shall have the authorization to undertake the items referenced herein as to him/her and to generally

act on behalf of the Committee to advance the objectives and intent of this Agreement. Each Consenting Vendor, Additional Consenting

Vendor and the Company agrees that any claims against, actions, rights to sue, other remedies or recourse to or against the

Committee Representative for or in connection with any action, decision or determination by the Committee Representative, whether

arising in Law or equity or created by rule of Law, contract (including this Agreement) or otherwise, are in each case expressly

released and waived by each such Consenting Vendor, Additional Consenting Vendor and the Company to the fullest extent permitted by

Law. To the maximum extent permitted by Law, the Committee Representative shall not be liable for, and will be indemnified by the

Company against, any losses, liabilities and reasonable expenses, including attorneys’ fees, arising from proceedings in which

the Committee Representative may be involved, as a part or otherwise, by reasons of its serving as the Committee Representative

under this Agreement, whether or not it continues to be such at the time any such loss, liability or expenses is paid or incurred,

except to the extent that any of the foregoing is determined by a final, non-appealable order of a court of competent jurisdiction

to have been causes by fraud, bad faith or willful misconduct of such person.

(ii)

The Committee Representative shall be represented by the Committee Counsel whose fees and expenses shall be paid by the Company pursuant

to the same terms and conditions as the Company’s existing agreement with Committee Counsel. Furthermore, the Company shall pay

the reasonable expenses of the Committee Representative incurred in the performance of the Committee Representative duties and obligations

under this Agreement. Committee Counsel shall use best efforts to perform only those services consistent with the foregoing and its fees

shall be capped at an amount to be agreed to by the Company by separate writing (e-mail being sufficient), as such amount may be modified

by the Company in its reasonable discretion.

[Signature

pages follow]

IN

WITNESS WHEREOF, the undersigned has executed this Agreement as of the date first set forth above.

| |

COMPANY |

| |

|

| |

PARTS ID, INC. |

| |

|

|

|

| |

By: |

|

| |

|

Name: |

|

| |

|

Title: |

|

| |

|

|

|

| |

PARTS ID, LLC |

| |

|

|

|

| |

By: |

|

| |

|

Name: |

|

| |

|

Title: |

|

[Signature

Page to Restructuring Support Agreement]

IN

WITNESS WHEREOF, the undersigned has executed this Agreement as of the date first set forth above.

| |

CONSENTING VENDOR PARTY |

| |

|

|

|

| |

[ ] |

|

|

| |

|

|

|

| |

By: |

|

| |

|

Name: |

[●] |

| |

|

Title: |

[●] |

| |

|

|

|

| |

|

Notice Address: |

|

| |

|

|

|

| |

|

Attention: |

|

| |

|

Email: |

|

[Signature

Page to Restructuring Support Agreement]

SCHEDULE

1

ADDITIONAL

CONSENTING VENDOR ACCESSION LETTER

TO: Parts

iD, Inc. and PARTS iD, LLC (together, the “Company”)

FROM:

[Name of Additional Consenting Vendor]

[By Email]

Amount

of Vendor Claim of Additional Consenting Vendor: $_______________

[●]

2023

Dear Madam/Sir,

Reference

is made to the Restructuring Support Agreement dated October 6, 2023, among the Company and certain vendors (each, a “Consenting

Vendor”) to the Company (as amended, amended and restated, supplemented or otherwise modified, the “RSA”).

This is an Accession Letter for the purposes of the RSA. Capitalized terms used but not defined in this letter shall have the same meaning

as in the RSA.

The

undersigned hereby:

| 1. | represents

that is the holder of a Claim against the Company in the amount of $[_______]. |

| 2. | is

entitled to receive the benefit of the Company’s obligations set forth in the RSA in

exchange for which it agrees to be bound by and to comply with all the terms of the RSA with

effect from the date of this Accession Letter as an Additional Consenting Vendor and hereafter

shall be a “Consenting Vendor” and a “Party” for all purposes under

the RSA; |

| 3. | gives

the representations, warranties, and undertakings required to be given by Consenting Vendors

under the RSA, including pursuant to Section 6 (Representations and Warranties of

Consenting Vendors), Section 8 (All Parties Undertakings) and Section 9 (Additional

Consenting Vendor Undertakings) of the RSA; and |

| 4. | agrees

that this Accession Letter is governed by, and construed in accordance with, the Law of the

State of Delaware, without regard to Law that may be applicable under conflicts of laws principles

(whether of the State of Delaware or any other jurisdiction) that would cause the application

of the Law of any jurisdiction other than the State of Delaware. |

Yours faithfully,

| ADDITIONAL CONSENTING VENDOR |

|

| |

|

|

|

| [Name] |

|

|

|

| |

|

|

|

| By: |

|

|

| |

Name: |

[●] |

|

| |

Title: |

[●] |

|

| |

|

|

|

| |

Notice Address: |

|

|

| |

|

|

|

| |

Attention: |

|

|

| |

Email: |

|

|

| |

Tel. No.: |

|

|

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

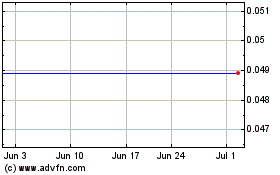

PARTS iD (AMEX:ID)

Historical Stock Chart

From Mar 2024 to Apr 2024

PARTS iD (AMEX:ID)

Historical Stock Chart

From Apr 2023 to Apr 2024