UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

| Filed by the Registrant |

☑ |

| Filed by a Party other than the Registrant |

☐ |

Check the appropriate box:

☐

Preliminary Proxy Statement

☐

Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2))

☑ Definitive

Proxy Statement

☐ Definitive

Additional Materials

☐ Soliciting

Material Pursuant to §240.14a-12

DOLPHIN ENTERTAINMENT, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other

Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| |

| ☑ |

No fee required. |

| ☐ |

Fee paid previously with preliminary materials: |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a–6(i)(1) and 0–11 |

————————————————————————————

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

————————————————————————————

October 10, 2023

Dear Shareholder:

It is my pleasure to invite you to attend the annual

meeting of shareholders (the “Annual Meeting”) of Dolphin Entertainment, Inc., a Florida corporation (the “Company”).

The Annual Meeting will be held on November 20, 2023 at 9:00 a.m. Eastern Standard Time at 200 South Biscayne Boulevard, 39th

Floor, Miami, Florida 33131. The Annual Meeting will be held for the following purposes:

| |

1. |

To elect seven directors to hold office until the 2024 annual meeting of shareholders or until their respective successors are duly elected and qualified; |

| |

2. |

To ratify the appointment of Grant Thornton LLP as the Company’s independent registered public accountants for the fiscal year ending December 31, 2023; |

| |

3. |

To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement of the Annual Meeting. |

The Company’s Board of Directors recommends

that you vote in favor of proposals 1 and 2.

Only shareholders of record as of the close of business

on September 25, 2023 may attend and vote at the Annual Meeting.

WHETHER OR NOT YOU EXPECT TO BE PRESENT AT THE MEETING,

PLEASE VOTE YOUR SHARES, SO THAT A QUORUM WILL BE PRESENT AND A MAXIMUM NUMBER OF SHARES MAY BE VOTED. IT IS IMPORTANT AND IN YOUR INTEREST

FOR YOU TO VOTE. WE ENCOURAGE YOU TO VOTE YOUR PROXY BY MAILING IN YOUR ENCLOSED PROXY CARD IN THE ENCLOSED POSTAGE PAID ENVELOPE, OR

VOTE ONLINE OR OVER THE TELEPHONE ACCORDING TO THE INSTRUCTIONS IN THE PROXY CARD.

THE PROXY IS REVOCABLE AT ANY TIME PRIOR TO ITS

USE.

| |

|

| |

BY ORDER OF THE BOARD OF DIRECTORS |

| |

|

| |

/s/ William O’Dowd, IV |

| |

William O’Dowd, IV |

| |

Chief Executive Officer |

————————————————————————————

TABLE

OF CONTENTS

————————————————————————————

DOLPHIN ENTERTAINMENT, INC.

150 Alhambra Circle, Suite 1200

Coral Gables, Florida 33134

————————————————————————————

PROXY STATEMENT

————————————————————————————

Proxy Statement for Annual Meeting of Shareholders

to be held on November 20, 2023

You are receiving this proxy statement because as of

September 25, 2023 (the “Record Date”), you owned shares of common stock of Dolphin Entertainment, Inc., a Florida

corporation (referred to as “we”, “us” or the “Company”), entitling you to vote

at the Annual Meeting. Our Board of Directors (the “Board”) is soliciting proxies from shareholders as of the Record

Date who wish to vote at the meeting. By use of a proxy, you can vote even if you do not attend the Annual Meeting. This proxy statement

describes the matters on which you are being asked to vote and provides information on those matters so that you can make an informed

decision.

————————————————————————————

QUESTIONS AND ANSWERS ABOUT OUR

ANNUAL MEETING

————————————————————————————

Q: When and where will the Annual Meeting take place?

A: The Annual Meeting will be held on November 20, 2023 at 9:00 a.m., EST,

at 200 South Biscayne Blvd., 39th Floor, Miami, FL 33131.

Q: Who may vote at the Annual Meeting?

A: Only holders of record of shares of our common stock at the close of

business on September 25, 2023 (the “Record Date”), are entitled to notice of and to vote at the Annual Meeting or

any adjournment or postponement of the Annual Meeting. On the Record Date, we had 14,216,720 shares of our common stock outstanding and

entitled to be voted at the Annual Meeting.

Q: How many votes do I have?

A: You may cast one vote for each share of our common stock held by you

as of the Record Date on all matters presented at the Annual Meeting. Holders of our common stock do not possess cumulative voting rights.

Q: How do I vote?

A: If you are a shareholder of record as of the Record Date, you may vote:

| |

· |

via Internet at www.proxyvote.com (see your proxy card for additional instructions); |

| |

|

|

| |

· |

by telephone at 1-800-690-6903; |

| |

|

|

| |

· |

by mail, by signing and returning the proxy card provided; or |

| |

|

|

| |

· |

in person during the Annual Meeting. |

If your shares are held in “street name,” meaning that they

are held of record by your brokerage firm, bank, broker-dealer or other nominee, then you will receive voting instructions from the holder

of record. You must follow those instructions in order for your shares to be voted. Your broker is required to vote your shares in accordance

with your instructions. If your shares are held by an intermediary and you intend to vote your shares in person at the Annual Meeting,

please bring with you evidence of your ownership as of the record date (such as a recent brokerage statement showing your ownership of

the shares as of the record date or a letter from the broker or nominee confirming such ownership), and a form of personal photo identification.

Q: What is the difference between a shareholder of

record and a beneficial owner?

A: If your shares are registered directly in your name with our transfer

agent, Nevada Agency and Transfer Company, then you are considered the “shareholder of record” with respect to those shares.

If your shares are held in street name by a brokerage firm, bank, trustee

or other agent, which we refer to as a nominee, then you are considered the “beneficial owner” of the shares held in street

name. As the beneficial owner, you have the right to direct your nominee on how to vote your shares by following the instructions provided

to you by your nominee.

Q: What constitutes a quorum,

and why is a quorum required?

A: We are required to have a quorum of shareholders present to conduct

business at the Annual Meeting. The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of our shares

of common stock entitled to vote as of the record date will constitute a quorum, permitting us to conduct the business of the Annual Meeting.

Proxies received but marked as “ABSTAIN” or “WITHHOLD”, if any, and broker non-votes (described below), if applicable,

will be included in the calculation of the number of shares considered to be present at the Annual Meeting for quorum purposes. If a quorum

is not present, we will be required to reconvene the Annual Meeting at a later date.

Q: What am I being asked to vote on?

A: At the Annual Meeting you will be asked to vote on the following two

proposals. Our Board recommendation for each of these proposals is set forth below.

| |

|

| Proposal |

Board Recommendation |

| 1. |

Election of Directors |

FOR each director nominee |

| 2. |

Ratification of the appointment of Grant Thornton, LLP (“GT”) as our independent registered public accounting firm for the year ending December 31, 2023 |

FOR |

Q: What happens if additional matters are presented

at the Annual Meeting?

A: Other than the items of business described in this proxy statement,

we are not aware of any other business to be acted upon at the Annual Meeting. If you grant a proxy, the proxy holders, William O’Dowd,

IV and Mirta Negrini, will have the discretion to vote your shares on any additional matters properly presented for a vote at the meeting

in accordance with Florida law and our Bylaws.

Q: How many votes are needed to approve each proposal?

| |

|

| Proposal |

Description of Votes Needed |

| 1. |

Election of Directors |

The seven nominees for election as directors will be elected by a “plurality” of the votes cast at the Annual Meeting. This means that the seven nominees who receive the highest number of “FOR” votes will be elected as the directors to serve until the next annual meeting of shareholders or until their respective successors are duly elected and qualified. Abstentions and broker non-votes (as described below) will not have any effect on the election of directors. |

| |

|

|

| 2. |

Ratification of our appointment of GT as our independent registered public accounting firm |

Ratification of our appointment of GT as our independent registered public accounting firm for the year ending December 31, 2023 will be approved if the number of votes cast “FOR” the proposal exceeds the number of votes cast “AGAINST” the proposal. Abstentions will not have any effect on whether this proposal is approved. The ratification of accountants is a routine proposal on which a broker or other nominee is generally empowered to vote in the absence of voting instructions from the beneficial owner, so broker non-votes are unlikely to result from this proposal. |

Q: What if I sign and return my proxy without making

any selections?

A: If you sign and return your proxy without making any selections, your

shares will be voted “FOR” the director nominees in Proposal 1 and “FOR” ratification of the appointment of GT

in Proposal 2. If other matters properly come before the meeting, the proxy holders will have the authority to vote on those matters for

you at the proxy holders’ discretion.

Q: What if I am a beneficial shareholder and I do

not give the nominee voting instructions?

A: If you are a beneficial shareholder and your shares are held in street

name with a broker, the broker has the authority to vote shares for which you do not provide voting instructions only with respect to

certain “routine” matters. A broker non-vote occurs when a nominee who holds shares for a beneficial owner does not vote on

a particular matter because the nominee does not have discretionary voting authority for that matter and has not received instructions

from the beneficial owner of the shares. Broker non-votes are included in the calculation of the number of votes considered to be present

at the Annual Meeting for purposes of determining the presence of a quorum but are not counted as votes cast with respect to a matter

on which the nominee has expressly not voted. Proposal 1 is deemed to be a “non-routine” matter, and as a result, your broker

or nominee may not vote your shares on Proposal 1 in the absence of your instruction. Proposal 2 is considered to be a “routine”

matter, and as a result, your broker or nominee may vote your shares in its discretion either for or against Proposal 2 even in the absence

of your instruction. If you are a beneficial owner and want to ensure that all of the shares you beneficially own are voted for or against

Proposal 2, you must give your broker or nominee specific instructions to do so.

The table below sets forth, for each proposal on the ballot, whether a

broker can exercise discretion and vote your shares absent your instructions and if not, the impact of such broker non-vote on the approval

of the proposal.

| |

|

|

|

|

| Proposal |

|

Can Brokers Vote

Absent Instructions? |

|

Impact of

Broker Non-Vote |

| 1. |

Election of Directors |

|

No |

|

No effect |

| 2. |

Ratification of GT as our independent registered public accounting firm |

|

Yes |

|

Not Applicable |

Q: Are there any appraisal rights or dissenters’

rights?

A: Under the Florida Business Corporation Act, our shareholders are not

entitled to dissenters’ rights or appraisal rights with respect to any of the proposals.

Q: Can I change my vote after I have delivered my

proxy?

A: Yes. If you are a shareholder of record, you may revoke your proxy at

any time before its exercise at the Annual Meeting by:

| |

· |

delivering written notice to Mirta A. Negrini at Dolphin Entertainment, Inc., 150 Alhambra Circle, Suite 1200, Coral Gables, FL 33134; |

| |

|

|

| |

· |

properly submitting a proxy with a later date (which may be done by Internet, telephone or mail); or |

| |

|

|

| |

· |

attending the Annual Meeting and voting in person. |

If you are a beneficial shareholder, you must contact your nominee to change

your vote or obtain a proxy to vote your shares if you wish to cast your vote in person at the Annual Meeting.

Q: What does it mean if I receive more than one proxy

card?

A: If you receive more than one proxy card, it means that you hold shares

of common stock in more than one account. To ensure that all your shares are voted, sign and return each proxy card. Alternatively, if

you vote by Internet or telephone, you will need to vote once for each proxy card you receive.

Q: Who can attend the Annual Meeting?

A: Only shareholders of record as of the Record Date, individuals holding

a valid proxy from a record holder and our invited guests may attend the Annual Meeting.

Q: If I plan to attend the Annual Meeting, should

I still vote by proxy?

A: Yes. Casting your vote in advance does not affect your right to attend

the Annual Meeting.

Q: Where can I find voting results of the Annual

Meeting?

A: We will announce the results for the proposals voted upon at the Annual

Meeting and publish final detailed voting results in a Form 8-K filed within four business days after the Annual Meeting.

Q: Who should I call with other questions?

A: If you have additional questions about this proxy statement or the Annual

Meeting or would like additional copies of this proxy statement or the enclosures herein, please contact: Dolphin Entertainment, Inc.,

150 Alhambra Circle, Suite 1200, Coral Gables, Florida 33134, Attention: Mirta A. Negrini, Telephone: (305) 774-0407.

PROPOSAL 1—ELECTION OF DIRECTORS

————————————————————————————

Under our Bylaws, each of our directors is elected

for a term expiring at the next annual meeting of shareholders following his or her election or until his or her successor is duly elected

and qualified. The Board is currently comprised of seven (7) directors. Our current directors are William O’Dowd, IV, Michael Espensen,

Nelson Famadas, Mirta A. Negrini, Anthony Leo, Nicholas Stanham and Claudia Grillo. Our Board has nominated the current directors for

re-election at the Annual Meeting.

Our directors standing for re-election, their age,

positions held, and duration of such, are as follows:

| | |

| |

| |

|

| Name | |

Position | |

Age | |

First appointed |

| William O’Dowd, IV | |

Chief Executive Officer, Chairman, President | |

| 54 | | |

Chief Executive Officer and Chairman: June 2008; President: 1996 |

| Mirta A. Negrini | |

Chief Financial Officer, Chief Operating Officer, Director | |

| 59 | | |

Chief Financial Officer and Chief Operating Officer: October 2013; Director: December 2014 |

| Michael Espensen | |

Director | |

| 73 | | |

June 2008 |

| Nelson Famadas | |

Director | |

| 50 | | |

December 2014 |

| Anthony Leo | |

Director | |

| 46 | | |

September 2018 |

| Nicholas Stanham, Esq. | |

Director | |

| 55 | | |

December 2014 |

| Claudia Grillo | |

Director | |

| 64 | | |

June 2019 |

Business Experience

The following is a brief account of the education and

business experience of directors and executive officers during at least the past five years, indicating their principal occupation during

the period, and the name and principal business of the organization by which they were employed.

William O’Dowd, IV. Mr. O’Dowd has served as our Chief

Executive Officer and Chairman of our Board since June 2008. Mr. O’Dowd founded Dolphin Entertainment, LLC in 1996 and has served

as its President since that date. Mr. O’Dowd enjoys a solid reputation as an Emmy-nominated producer, international distributor,

and financier of quality entertainment content. Some of Mr. O’Dowd’s notable credits include: Executive Producer of Nickelodeon’s

hit series, Zoey 101 (Primetime Emmy Award-nominated); Executive Producer of Raising Expectations, starring Molly Ringwald and Jason Priestley

(winner of 2017’s KidScreen Award for Best Global Kids Show); Producer of the feature film Max Steel (based on a top-selling Mattel

action figure in Latin America); and, in the digital arena, Executive Producer of H+, which premiered on YouTube and won multiple Streamy

Awards.

Mr. O’Dowd has served on the Leadership Council of United Way Worldwide

since its inception in 2012, as well as on the Board of Directors of United Way United Kingdom since its inception in 2014, and has previously

served on the Board of Directors of the Miami-Dade County Public School System Foundation, among other charities. Furthermore, Mr. O’Dowd

has taught one course a year as an adjunct professor at the University of Miami School of Communication for the past 25 years.

Qualifications. The Board nominated Mr. O’Dowd to serve as

a director because of his current and prior senior executive and management experience at our Company and his significant industry experience,

including having founded Dolphin Entertainment LLC, a leading entertainment company specializing in children’s and young adult’s

live-action programming.

Mirta A. Negrini. Ms. Negrini has served on our Board since December

2014 and as our Chief Financial and Operating Officer since October 2013. Ms. Negrini has over thirty years of experience in both private

and public accounting. Immediately prior to joining us, she served since 1996 as a named partner in Gilman & Negrini, P.A., an accounting

firm of which we were a client. Prior to that, Ms. Negrini worked at several multinational corporations and she began her career at Arthur

Andersen LLP in 1986. Ms. Negrini serves on the Board of Directors of St. Brendan High School and on the Finance Committee of the Board

of Directors of RCMA. She is a Certified Public Accountant licensed in the State of Florida.

Qualifications. The Board nominated Ms. Negrini to serve as a director

because of her significant accounting experience gained as a named partner at an accounting firm and her current experience as a senior

executive at our Company.

Michael Espensen. Mr. Espensen has served on

our Board since June 2008. From 2009 to 2014, Mr. Espensen served as Chief Executive Officer of Keraplast Technologies, LLC, a private

multimillion-dollar commercial-stage biotechnology company, from where he retired. From 2009 to present, Mr. Espensen has also served

as Chairman of the Board of Keraplast. While serving as Chief Executive Officer, Mr. Espensen was responsible for overseeing and approving

Keraplast’s annual budgets and financial statements. Mr. Espensen is also a producer and investor in family entertainment for television

and feature films. Between 2006 and 2009, Mr. Espensen was Executive or Co-Executive Producer of twelve made-for-television movies targeting

children and family audiences. As Executive Producer, he approved production budgets and then closely monitored actual spending to ensure

that productions were not over budget. Mr. Espensen has also been a real estate developer and investor for over thirty years.

Qualifications. The Board nominated Mr. Espensen

to serve as a director because of his business management and financial oversight experience both as the current Chairman and former Chief

Executive Officer of a multimillion-dollar company and as a former Executive Producer in the made-for-television movie industry, as well

as his valuable knowledge of our industry.

Nelson Famadas. Mr. Famadas has served on our

Board since December 2014. He is Managing Partner and Chief Operating Officer of Carver Road Capital, a hospitality private equity fund.

Previously, he owned and served as President of Cien, a Hispanic marketing firm. Prior to Cien from 2011 to 2015, Mr. Famadas served as

Senior Vice President of National Latino Broadcasting (“NLB”), an independent Hispanic media company that owns and

operates two satellite radio channels on SiriusXM. From 2010 to 2012, Mr. Famadas served as our Chief Operating Officer, where he was

responsible for daily operations including public filings and investor relations. From 2002 through

2010, he served as President of Gables Holding Corp., a real estate development company based in Puerto Rico. Mr. Famadas began

his career at MTV Networks, specifically MTV Latin America, ultimately serving as New Business Development Manager. From 1995 through

2001, he co-founded and managed Astracanada Productions, a television production company that catered mostly to the Hispanic audience,

creating over 1,300 hours of programming. As Executive Producer, he received a Suncoast EMMY in 1997 for Entertainment Series for A

Oscuras Pero Encendidos. Mr. Famadas has over 20 years of experience in television and radio production, programming, operations,

sales and marketing.

Qualifications. The Board nominated Mr. Famadas

to serve as a director because of his significant prior management experience as a co-founder and former manager of a television production

company and senior vice president of a broadcasting firm, as well as his current management experience with a marketing firm.

Anthony Leo. Mr. Leo has served on our Board

since September 2018. He is the co-founder of Aircraft Picture, a leading independent production company that produces scripted content

for kids, families and young adult audiences, at which he has served as Co-President since 2005. He was the Artistic Producer of Resurgence

Theatre Company, a non-profit arts organization he co-founded, and has produced over twenty-five professional theatre productions. Mr.

Leo also held the position of Professor at Ryerson University where he taught Theatre Entrepreneurship. He is a member of the Academy

of Motion Picture Arts & Sciences.

Qualifications. The Board nominated Mr. Leo to serve as a director

because of his vast experience in the production of scripted content for children, families and young adult audiences.

Nicholas Stanham, Esq. Mr. Stanham has served

on our Board since December 2014. Mr. Stanham is a founding partner of R&S International Law Group, LLP in Miami, Florida, which was

founded in January 2008. His practice is focused primarily in real estate and corporate structuring for high net worth individuals. Mr.

Stanham has over 25 years of experience in real estate purchases and sales of residential and commercial properties. Since 2004, Mr. Stanham

has been a member of the Christopher Columbus High School board of directors. In addition, he serves as a director of ReachingU, a foundation

that promotes initiatives and supports organizations that offer educational opportunities to Uruguayans living in poverty.

Qualifications. The Board nominated Mr. Stanham to serve as a director

because of his experience as a founding partner at a law firm as well as his business management experience at that firm.

Claudia Grillo. Ms. Grillo has served on our

Board since June of 2019. Ms. Grillo has served as Associate Vice President of Strategic Philanthropy for the University of Miami since

April of 2018. Prior to joining the University of Miami, Ms. Grillo served as the Chief Operating Officer at the United Way of Miami-Dade

where she was responsible for securing gifts from individuals, families and corporations. She has been an active member of the South Florida

community through her involvement as a board member of the International Women’s Forum, The Children’s Trust and Achieve Miami.

Qualifications. The Board nominated Ms. Grillo

to serve a director because of her experience serving as Chief Operating Officer of an organization.

Vote Required

The election of directors requires the approval of

a plurality of the votes cast at the Meeting. Abstentions and broker non-votes will have no effect on Proposal 1.

Recommendation of the Board of Directors

Our Board recommends a vote “FOR”

each of the director nominees.

————————————————————————————

CORPORATE GOVERNANCE

————————————————————————————

Board Leadership Structure and Role in Risk Oversight

Our Board has not adopted a formal policy regarding

the need to separate or combine the offices of Chairman of the Board and Chief Executive Officer and instead our Board remains free to

make this determination in a manner it deems most appropriate for our Company. Currently, we combine the positions of Chief Executive

Officer and Chairman of the Board. We believe that the combined role of Chief Executive Officer and Chairman of the Board promotes strategy

development and execution. Mr. O’Dowd currently serves as Chief Executive Officer and Chairman of the Board. We believe Mr. O’Dowd

is suited to serve both roles, because he is the director most familiar with our business and industry, and most capable of effectively

identifying strategic priorities and leading the discussion and execution of strategy. Currently, our Board does not perform a risk oversight

function.

Meetings

During 2022, our Board held a total of four meetings.

Each incumbent director attended at least 75% of the aggregate of (1) the total number of meetings of our Board during the period in which

he or she was a director and (2) 75% of the total number of meetings of all committees on which he served during the period in which he

was a director. It is the policy of our Board to encourage its members to attend our annual meeting of shareholders.

Family Relationships

There are no family relationships between any director

or executive officer.

Involvement in Certain Legal Proceedings

There are no material proceedings to which any director

or executive officer or any associate of any such director or officer is a party adverse to our Company or has a material interest adverse

to our Company.

No director or executive officer has been involved

in any of the following events during the past ten years:

1. any bankruptcy petition filed by or against any

business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior

to that time;

2. any conviction in a criminal proceeding or being

subject to a pending criminal proceeding (excluding traffic violations and other minor offenses);

3. being subject to any order, judgment, or decree,

not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring,

suspending or otherwise limiting his involvement in any type of business, securities or banking activities;

4. being found by a court of competent jurisdiction

(in a civil action), the Securities and Exchange Commission or the Commodity Futures Trading Commission to have violated a federal or

state securities or commodities law, and the judgment has not been reversed, suspended, or vacated;

5. being the subject of, or a party to, any federal

or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to

an alleged violation of: (i) any federal or state securities or commodities law or regulation; or (ii) any law or regulation respecting

financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement

or restitution, civil money penalty or temporary or permanent cease- and- desist order, or removal or prohibition order; or (iii) any

law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or

6. being the subject of, or a party to, any sanction

or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the

Exchange Act), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act), or any equivalent exchange, association,

entity or organization that has disciplinary authority over its members or persons associated with a member.

Delinquent Section 16(a) Reports

Under Section 16(a) of the Exchange Act (“Section

16(a)”), our executive officers, directors, and persons who own more than 10% of a registered class of the Company’s equity

securities are required to file with the Securities and Exchange Commission initial statements of beneficial ownership, reports of changes

in ownership and annual reports concerning their ownership of our common stock and other equity securities, on Forms 3, 4 and 5 respectively.

Executive officers, directors, and persons who own more than 10% of a registered class of the Company’s equity securities are required

by Securities and Exchange Commission regulations to furnish us with copies of all Section 16(a) reports that they file.

Based solely on the copies of such reports and amendments

thereto received by us, or written representations that no filings were required, we believe that all Section 16(a) filing requirements

applicable to our executive officers and directors and 10% shareholders were met for the year ended December 31, 2022.

Code of Ethics

Our Board has adopted a Code of Ethics for Senior Financial

Officers (our “Code of Ethics”). Our Code of Ethics sets forth standards of conduct applicable to our Chief Executive

Officer and our Chief Financial and Operating Officer to promote honest and ethical conduct, proper disclosure in our periodic filings,

and compliance with applicable laws, rules and regulations. In addition, our Board adopted a Code of Conduct for Directors, Officers and

Employees (“Code of Conduct”). Our Code of Ethics and Code of Conduct are available to view at our website, www.dolphinentertainment.com

by clicking on Investor Relations. We intend to provide disclosure of any amendments or waivers of our Code of Ethics on our website within

four business days following the date of the amendment or waiver.

Board Committees

Our Board currently has a standing Audit Committee

and Compensation Committee. Each of the Board’s committees operates under a written charter adopted by our Board which addresses

the purpose, duties and responsibilities of such committee. A current copy of each committee charter can be found on our website at www.dolphinentertainment.com

by clicking on Investor Relations. Information contained on or accessible through our website is not part of, and is not incorporated

by reference in, this Proxy Statement.

Audit Committee and Audit Committee

Financial Experts

The Audit Committee consists of Messrs. Famadas, Stanham

and Espensen, who serves as Chairman. In 2022, the Audit Committee held six meetings. All members of the Audit Committee were present

at each meeting except for two meetings which Mr. Stanham was unable to attend.

Among its responsibilities, the Audit Committee assists

the Board in overseeing: our accounting and financial reporting practices and policies; systems of internal controls over financial reporting;

the integrity of our consolidated financial statements and the independent audit thereof; our compliance with legal and regulatory requirements;

and the performance of our independent registered public accounting firm and assessment of the auditor’s qualifications and independence.

In addition, the Audit Committee selects and appoints

our independent registered public accounting firm and reviews and approves related party transactions. The Audit Committee Chairman reports

on Audit Committee actions and recommendations at Board meetings. The Audit Committee may, in its discretion, delegate its duties and

responsibilities to a subcommittee of the Audit Committee as it deems appropriate. Our Board has determined that each member of the Audit

Committee meets the independence requirements under Nasdaq’s listing standards and the enhanced independence standards for audit

committee members required by the SEC. In addition, our Board has determined that Mr. Espensen meets the requirements of an audit committee

financial expert under the rules of the SEC and Nasdaq.

Director Nominations

Our Board currently does not have a standing nominating

committee or committee performing similar functions. In accordance with Nasdaq rules, a majority of the Board’s independent directors

recommend director nominees for selection by the Board. Our Board believes that our independent directors can satisfactorily carry out

the responsibility of properly selecting, approving and recommending director nominees without the formation of a standing nominating

committee. The directors who participate in the consideration and recommendation of director nominees are those independent directors

of the Board identified above. As there is no standing nominating committee, we do not have a nominating committee charter in place.

The Board will also consider director candidates recommended

for nomination by our shareholders during such times as it is seeking proposed nominees to stand for election at the next annual meeting

of shareholders (or, if applicable, a special meeting of shareholders). All shareholder nominations and recommendations for nominations

to the Board must be addressed to the Chairman of the Audit Committee who will submit such nominations to the Board. Our Board currently

does not have a written policy with regard to the nomination process, or a formal policy with respect to the consideration of director

candidates. In addition, we have not formally established any specific, minimum qualifications that must be met or skills that are necessary

for directors to possess. In general, in identifying and evaluating nominees for director, the Board considers educational background,

diversity of professional experience, knowledge of our businesses, integrity, professional reputation, independence, and the ability to

represent the best interests of our shareholders. The Board will evaluate the suitability of potential candidates nominated by shareholders

in the same manner as other candidates recommended to the Board.

Compensation Committee

The Compensation Committee consists of Messrs. Stanham

and Famadas, who serves as Chairman. In 2022, the Compensation Committee held one meeting, which both members attended.

Among its responsibilities, the Compensation Committee:

establishes salaries, incentives and other forms of compensation for executive officers and directors; reviews and approves any proposed

employment agreement with any executive officer and any proposed modification or amendment thereof; and maintains and administers our

equity incentive plan.

The Compensation Committee Chairman reports on Compensation

Committee actions and recommendations at Board meetings. The Compensation Committee has the authority to engage the services of outside

legal or other experts and advisors as it determines in its sole discretion; however, in 2022 the Compensation Committee did not engage

an independent compensation consultant because it did not believe one was necessary. Our Chief Executive Officer may recommend compensation

levels for executive officers (other than his own) to the Compensation Committee. The Compensation Committee may form and delegate authority

to subcommittees as appropriate and in accordance with applicable law, regulation and the Nasdaq rules.

————————————————————————————

EXECUTIVE COMPENSATION

————————————————————————————

Our executive compensation program is designed to balance

the goals of attracting and retaining talented executives who are motivated to achieve our annual and long-term strategic goals while

keeping the program affordable and appropriately aligned with shareholder interests. We believe that our executive compensation program

accomplishes these goals in a way that is consistent with our purpose and core values and the long-term interests of the Company and its

shareholders.

The following table sets forth information concerning

all cash and non-cash compensation awarded to, earned by or paid to (i) all individuals serving as the Company’s principal executive

officers or acting in a similar capacity during the last two completed fiscal years, regardless of compensation level, and (ii) the Company’s

two most highly compensated executive officers other than the principal executive officer serving at the end of the last two completed

fiscal years (collectively, the “Named Executive Officers”).

Summary Compensation Table

| Name and Principal Position | |

Year | | |

Salary ($) | | |

Equity Awards ($)(1) | | |

Bonus ($) | | |

All Other Compensation ($) | | |

Total ($) | |

| William O’Dowd, IV, | |

| 2022 | | |

| 400,000 | | |

| 1,951 | | |

| — | | |

| 282,878 | (2) | |

| 684,829 | |

| Chairman and Chief Executive Officer | |

| 2021 | | |

| 400,000 | | |

| — | | |

| — | | |

| 282,880 | (3) | |

| 682,880 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Mirta A. Negrini, | |

| 2022 | | |

| 300,000 | | |

| 1,951 | | |

| — | | |

| — | | |

| 301,951 | |

| Chief Financial and Operating Officer | |

| 2021 | | |

| 300,000 | | |

| — | | |

| — | | |

| — | | |

| 300,000 | |

| |

(1) |

Equity awards comprise of 296 restricted stock units granted and vested in 2022. |

|

|

(2) |

This amount includes life insurance in the amount of $20,380 and interest accrued on accrued and unpaid compensation in the amount of $262,498 (see Certain Relationship and Related Party Transactions). This amount does not include interest payments on promissory notes from related party transactions. |

| |

(3) |

This amount includes life insurance in the amount of $20,380 and interest accrued on accrued and unpaid compensation in the amount of $262,500 (see Certain Relationship and Related Party Transactions). This amount does not include interest payments on promissory notes from related party transactions. |

Employment Arrangements

Mirta A. Negrini. On October 21, 2013, we appointed

Ms. Negrini as our Chief Financial and Operating Officer. The terms of Ms. Negrini’s employment arrangement do not provide for any

payments in connection with her resignation, retirement or other termination, or a change in control, or a change in her responsibilities

following a change in control. On May 17, 2021, the Compensation Committee of the Board approved an increase in the base salary of Ms.

Negrini from $250,000 to $300,000 per year. The increase was effective January 1, 2021.

Outstanding Equity Awards at Fiscal Year-End

None of the Named Executive Officers in the table above

had any outstanding equity awards as of December 31, 2022 and December 31, 2021.

Director Compensation

During the year ended December 31, 2022, we did not

pay compensation to any of our directors in connection with their service on our Board.

Information Concerning Executive Officers

Biographical information with respect to our current

executive officers, Mr. O’Dowd and Ms. Negrini, is set forth above under “Proposal 1—Election of Directors.”

2022 Pay versus Performance Table and Supporting Narrative

The following table and supporting narrative contain information

regarding “compensation actually paid” to our named executive officers and the relationship to company performance.

Pay Versus Performance Table and Supporting Narrative

The following table and supporting narrative contain information

regarding “compensation actually paid” to our named executive officers and the relationship to company performance.

| Year | | |

Summary Compensation Table Total for PEO ($) (1) | | |

Compensation Actually Paid to PEO ($) (1) | | |

Average Summary Compensation Table Total for Non-PEO Named Executive Officers ($) (2) | | |

Average Compensation Actually Paid to Non-PEO Named Executive Officers ($) (2) | | |

Value of $100 fixed investment

_____________

Total Shareholder Return ($) | | |

Net Income ($mm) | |

| | 2022 | | |

$ | 684,829 | | |

$ | 683,831 | | |

$ | 301,951 | | |

$ | 300,953 | | |

$ | 53 | | |

| — | | |

$ | 5 | |

| | 2021 | | |

$ | 682,880 | | |

$ | 682,880 | | |

$ | 300,000 | | |

$ | 300,000 | | |

$ | 251 | | |

| — | | |

$ | 6 | |

(1)

Reflects compensation for our Chief Executive Officer, William O’Dowd, IV, who served

as our Principal Executive Officer (PEO) in 2021 and 2022.

(2)

Reflects compensation for Mirta A. Negrini in 2021 and 2022, as shown in the Summary Compensation

Table for each respective year.

| Adjustments | |

PEO

- William O’Dowd, IV | |

Other

NEO Average |

| | |

| 2022 | | |

| 2021 | | |

| 2022 | | |

| 2021 | |

| Summary Compensation Table Total | |

$ | 684,829 | | |

$ | 682,880 | | |

$ | 301,951 | | |

$ | 300,000 | |

| Deduction for amounts reported in the “Stock

Awards” column in the SCT for applicable FY | |

($ | 1,951 | ) | |

$ | 0 | | |

($ | 1,951 | ) | |

$ | 0 | |

| Increase in fair value of awards granted during

applicable FY that vested during applicable FY, determined as of vesting date | |

$ | 953 | | |

$ | 0 | | |

$ | 953 | | |

$ | 0 | |

| Compensation Actually Paid | |

$ | 683,831 | | |

$ | 682,880 | | |

$ | 300,953 | | |

$ | 300,000 | |

To calculate “compensation actually paid”

for our PEO and other NEOs the following adjustments were made to Summary Compensation Table total pay.

The equity awards included

above comprise of restricted share units granted in 2022. Measurement date equity fair values are calculated with assumptions derived

on a basis consistent with those used for grant date fair value purposes. Restricted stock units are valued based on the stock price

on the relevant measurement date.

Compensation Actually Paid Versus Company Performance

The following charts provide a clear, visual

description of the relationships between “compensation actually paid” to our PEOs, and the average for our non-PEO NEOs, to

aspects of our financial performance.

————————————————————————————

PROPOSAL 2—RATIFICATION OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

————————————————————————————

Introduction

The Audit Committee has appointed Grant Thornton LLP

(“GT”) to serve as our independent registered public accounting firm for the 2023 fiscal year. GT has served as our

independent registered public accounting firm since June 3, 2022. In connection with the appointment of GT, the Audit Committee annually

reviews and negotiates the terms of the engagement letter entered into with GT. This letter sets forth important terms regarding the scope

of the engagement, associated fees, payment terms and responsibilities of each party.

The Audit Committee believes that the continued retention

of GT as our independent registered public accounting firm is in the best interest of us and our shareholders, and we are asking our shareholders

to ratify the appointment of GT as our independent registered public accounting firm for 2023. Although shareholder ratification of the

selection and appointment of our independent registered public accounting firm is not required by our Bylaws or otherwise, we are submitting

such appointment to our shareholders for ratification because we value our shareholders’ views on our independent registered public

accounting firm and as a matter of good corporate governance. The Audit Committee will consider the outcome of our shareholders’

vote in connection with the Audit Committee’s appointment of our independent registered public accounting firm in the next fiscal

year, but is not bound by the shareholders’ vote. Even if the selection is ratified, the Audit Committee may, in its discretion,

direct the appointment of a different independent registered public accounting firm at any time if it determines that a change would be

in the best interests of us and our shareholders.

We expect a representative of GT to attend the Annual

Meeting. The representative will have an opportunity to make a statement if he or she desires and will be available to respond to appropriate

questions.

Fees Paid to Our Independent Registered Public Accounting

Firm

The following table sets

forth the aggregate fees billed or expected to be billed to the Company for professional services rendered by our independent registered

public accounting firm, Grant Thornton LLP, for the fiscal year ended December 31, 2022.

| | |

Year Ended 12/31/2022 | | |

Year Ended 12/31/2021 | |

| Audit Fees(1) | |

$ | 776,000 | | |

$ | — | |

| Audit-Related Fees | |

| — | | |

| — | |

| Tax Fees | |

| — | | |

| — | |

| All Other Fees | |

| — | | |

| — | |

| Total | |

$ | 776,000 | | |

$ | — | |

The following table sets forth the aggregate fees

billed to the Company for professional services rendered by BDO USA LLP, our former independent registered accounting firm for the fiscal

year ended December 31, 2022 and 2021.

| | |

Year Ended 12/31/2022 | | |

Year Ended 12/31/2021 | |

| Audit Fees(1) | |

$ | — | | |

$ | 897,500 | |

| Audit-Related Fees | |

| — | | |

| — | |

| Tax Fees | |

| — | | |

| — | |

| All Other Fees | |

| — | | |

| — | |

| Total | |

$ | — | | |

$ | 897,500 | |

| |

(1) |

Audit Fees— this category consists of fees billed or expected to be billed for professional services rendered for the audits of our financial statements, reviews of our interim financial statements included in quarterly reports, services performed in connection with regular filings with the Securities and Exchange Commission and other services that are normally provided by our independent registered public accounting firm for the fiscal years ended December 31, 2022 and December 31, 2021. |

Policy on Pre-Approval by Audit Committee of Services

Performed by Independent Registered Public Accounting Firm

The Audit Committee reviews, and in its sole discretion

pre-approves, our independent auditors’ annual engagement letter including proposed fees and all auditing services provided by the

independent auditors. Accordingly, our Audit Committee approved all services rendered by our independent registered public accounting

firm, Grant Thornton, LLP, during fiscal year 2022, as described above. Our Audit Committee and Board has considered the nature and amount

of fees billed or expected to be billed by Grant Thornton, LLP and believes that the provision of services for activities unrelated to

the audit was compatible with maintaining Grant Thornton, LLP’s independence.

The Audit Committee has not implemented a policy or

procedure which delegates the authority to approve, or pre-approve, audit or permitted non-audit services to be performed by Grant Thornton,

LLP. Our Board may not engage the independent auditors to perform the non-audit services proscribed by law or regulation.

Audit Committee Report

The Audit Committee oversees our accounting and financial

reporting processes on behalf of the Board. Management has primary responsibility for our financial statements, financial reporting process

and internal controls over financial reporting. The independent auditors are responsible for performing an independent audit of our financial

statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). The Audit Committee’s

responsibility is to select the independent auditors and monitor and oversee our accounting and financial reporting processes, including

our internal controls over financial reporting, and the audits of our financial statements.

In 2022, the Audit Committee met and held discussions

with management and the independent auditors. In the discussions related to our financial statements for fiscal year 2022, management

represented to the Audit Committee that such financial statements were prepared in accordance with U.S. generally accepted accounting

principles. The Audit Committee reviewed and discussed with management the financial statements for fiscal year 2022. In fulfilling its

responsibilities, the Audit Committee discussed with the independent auditors those matters required to be discussed by the applicable

requirements of the Public Company Accounting Oversight Board (the “PCAOB”) and the Securities and Exchange Commission. In

addition, the Audit Committee received from the independent auditors the written disclosures and letter required by applicable requirements

of the PCAOB regarding the independent auditor’s communications with the Audit Committee concerning independence, and the Audit

Committee discussed with the independent auditors that firm’s independence.

Based upon the Audit Committee’s discussions

with management and the independent auditors and the Audit Committee’s review of the representations of management and the written

disclosures and letter of the independent auditors provided to the Audit Committee, the Audit Committee recommended to the Board that

the audited consolidated financial statements for the year ended December 31, 2022 be included in our 2022 annual report on Form 10-K,

for filing with the SEC.

The Audit Committee:

Michael Espensen

Nelson Famadas

Nicholas Stanham

The immediately preceding report of the Audit Committee

does not constitute soliciting material and should not be deemed filed or incorporated by reference into any of previous filings under

the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that we specifically

incorporate such report by reference.

Vote Required

Proposal 2 shall be approved if the majority of votes

cast in person or by proxy are in favor of such action. Since Proposal 2 is considered a routine matter, we do not expect broker non-votes.

Abstentions will not be treated as votes cast and will have no impact on the proposal.

Recommendation of the Board of Directors

Our Board recommends a vote “FOR”

ratification of the appointment of Grant Thornton as our independent registered public accounting firm for the year ending December 31,

2023.

———————————————————————————

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

————————————————————————————

The table below shows the beneficial ownership as of

September 25, 2023 of our common stock and our Series C Convertible Preferred Stock (the “Series C”) held by each of

our incumbent directors, director nominees, named executive officers, all incumbent directors, director nominees and executive officers

as a group and each person known to us to be the beneficial owner of more than 5% of our outstanding common stock and 5% of our Series

C. The percentages in the table below are based on 14,216,720 shares of common stock outstanding and 50,000 shares of Series C outstanding

as of September 25, 2023. Shares of common stock issuable upon conversion of the Series C are not included in such calculation as a result

of the Stock Restriction Agreement entered into between the Company and the holder of the Series C pursuant to which the conversion of

the Series C is prohibited until such time as a majority of the independent directors of the Board approves the removal of the prohibition.

The Stock Restriction Agreement also prohibits the sale or other transfer of the Series C until such transfer is approved by a majority

of the independent directors of the Board. The Stock Restriction Agreement shall terminate upon a Change of Control (as such term is defined

in the Stock Restriction Agreement) of the Company.

Beneficial ownership is determined in accordance with

Rule 13d-3 promulgated under the Exchange Act. Except as indicated by footnote and subject to community property laws, where applicable,

to our knowledge the persons named in the table below have sole voting and investment power with respect to all shares of common stock

that are shown as beneficially owned by them. In computing the number of shares owned by a person and the percentage ownership of that

person, any such shares subject to warrants or other convertible securities held by that person that were exercisable as of September

25, 2023 or that will become exercisable within 60 days thereafter are deemed outstanding for purposes of that person’s percentage

ownership but not deemed outstanding for purposes of computing the percentage ownership of any other person.

Common Stock

| Name and Address of Owner(1) | |

# of Shares of

Common Stock | |

% of Class

(Common Stock) |

| Directors and Executive Officers | |

| | | |

| | |

| William O’Dowd, IV(2) | |

| 349,662 | | |

| 2.5 | % |

| Michael Espensen | |

| 56 | | |

| * | |

| Nelson Famadas | |

| 1,534 | | |

| * | |

| Mirta A. Negrini | |

| 296 | | |

| * | |

| Anthony Leo | |

| — | | |

| * | |

| Nicholas Stanham, Esq.(3) | |

| 8,443 | | |

| * | |

| Claudia Grillo | |

| 152 | | |

| * | |

| | |

| | | |

| | |

| All Directors and Executive Officers as a Group (7 persons) | |

| 360,143 | | |

| 2.5 | % |

| 5% Holder | |

| | | |

| | |

| Marvin Shanken(4) | |

| 1,120,000 | | |

| 7.9 | % |

Series C Convertible Preferred Stock

| Name and Address of Owner(1) |

|

# of Shares of

Preferred Stock |

|

|

% of Class

(Preferred Stock) |

|

| William O’Dowd, IV(5) |

|

|

50,000 |

(6) |

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

* Less than 1% of outstanding shares.

| (1) |

Unless otherwise indicated, the address of each shareholder is c/o Dolphin Entertainment, Inc., 150 Alhambra

Circle, Suite 1200, Coral Gables, Florida 33134. |

| (2) |

The amount shown includes (1) 124,210 shares of common stock held by Dolphin Digital Media Holdings LLC, which is wholly-owned by Mr. O’Dowd, (2) 109,068 shares of common stock held by Dolphin Entertainment, LLC, which is wholly-owned by Mr. O’Dowd and (3) 116,384 shares of common stock held by Mr. O’Dowd individually. The amount shown does not include shares of common stock issuable upon conversion of the Series C Convertible Preferred Stock as such series is not presently convertible. |

| |

|

| (3) |

Mr. Stanham shares voting and dispositive power with respect to all of the shares of common stock with his spouse. |

| |

|

| (4) |

This number does not include (i) 127,746 shares of common stock that are issuable to M. Shanken Communications, Inc. upon conversion of a senior convertible note and (ii) 20,000 shares of common stock of the Issuer that are issuable to Shanken Communications upon the exercise of warrants that are currently exercisable. The note and the warrants are each subject to a 4.99% beneficial ownership blocker and the number of shares of common stock set forth in the table above give effect to such blockers. |

| |

|

| (5) |

The Series C is held by Dolphin Entertainment, LLC, which is wholly-owned by Mr. O’Dowd. |

| |

|

| (6) |

The Series C is entitled to 23,694,699 votes and is entitled to vote together as a single class on all matters upon which common shareholders are entitled to vote. On November 12, 2020, we entered into a stock restriction agreement with Mr. O’Dowd that prohibits the conversion of Series C Convertible Preferred Stock into common stock unless the majority of the independent directors of the Board vote to remove the restriction. The stock restriction agreement will be immediately terminated upon a change of control as defined in the agreement. |

Change in Control

We are unaware of any contract or other arrangement

the operation of which may at a subsequent date result in a change of control of the Company.

———————————————————————————

CERTAIN RELATIONSHIPS AND RELATED

TRANSACTIONS, AND DIRECTOR INDEPENDENCE

————————————————————————————

Related Party Transaction Policy

Under applicable Nasdaq listing standards, all related

person transactions must be approved by our Audit Committee or another independent body of the Board. For smaller reporting companies,

current SEC rules define transactions with related persons to include any transaction, arrangement or relationship (i) in which we are

a participant, (ii) in which the amount involved exceeds the lesser of $120,000 or one percent of the average of our total assets at year-end

for the last two completed fiscal years, and (iii) in which any executive officer, director, director nominee, beneficial owner of more

than 5% of our common stock, or any immediate family member of such persons has or will have a direct or indirect material interest. All

directors must recuse themselves from any discussion or decision affecting their personal, business or professional interests. All related

person transactions will be disclosed in our applicable SEC filings as required under SEC rules.

Transactions with Related Persons

William O’Dowd, IV. Mr. O’Dowd is our Chief Executive Officer and the Chairman of

the Board. Dolphin Entertainment, LLC, an entity owned by Mr. O’Dowd, previously advanced funds for working capital to Dolphin Films,

Inc. (“Dolphin Films”), its former subsidiary, which we acquired in March 2016. During 2016, Dolphin Films entered

into a promissory note with Dolphin Entertainment, LLC (the “Original DE LLC Note”) in the principal amount of $1,009,624

for funds previously advanced. The Original DE LLC Note was payable on demand and accrued interest at a rate of 10% per annum. On November

29, 2017, the Audit Committee approved an amendment to the Original DE LLC Note to allow for additional advances and repayments on the

Original DE LLC Note up to a maximum principal balance of $5,000,000. On June 15, 2021 the Company exchanged the Original DE LLC Note

for a new note maturing on July 31, 2023 (“New DE LLC Note”). Other than the change in maturity date, there were no

other changes to the principal, interest or any other terms of the Original DE LLC Note. On June 30, 2022, the maturity date of the New

DE LLC Note was extended to December 31, 2026. As of December 31, 2022 and 2021, Dolphin Films owed Dolphin Entertainment, LLC $1,107,873

and $1,107,873, respectively, of principal, and $166,637 and $55,849, respectively, of accrued interest, that was recorded on the consolidated

balance sheets. Dolphin Films recorded interest expense of $110,787 for each of the years ended December 31, 2022 and 2021. During the

years ended December 31, 2022 and 2021, we did not repay any principal amount owed to Dolphin Entertainment, LLC. During the year ended

December 31, 2021 we paid $81,621 of interest payments to Dolphin Entertainment, LLC. There have not been any proceeds received, repayments

of principal or payments of interest related to this note for the period between January 1, 2023 and October 4, 2023. The largest aggregate

principal amount Dolphin Films owed Dolphin Entertainment, LLC during 2022, 2021 and as of October 4, 2023 was $1,107,873. The balance

of principal outstanding under the note as of October 4, 2023 was $1,107,873.

On September 7, 2012, we entered into an employment

agreement with Mr. O’Dowd, which was subsequently renewed for a period of two years, effective January 1, 2015. The agreement provided

for an annual salary of $250,000 and a one-time bonus of $1,000,000. Unpaid compensation accrues interest at a rate of 10% per annum.

As of each of December 31, 2022 and 2021, we had a balance of $2,625,000 of accrued compensation related to this agreement. As of December

31, 2022 and 2021, we had a balance of $1,578,088 and $1,565,588, respectively, of accrued interest related to this agreement. We recorded

$262,498 and $262,500, respectively, of interest expense for the years ended December 31, 2022 and 2021. During the years ended December

31, 2022 and 2021, we paid $250,000 and $453,345, respectively, of interest payments to Mr. O’Dowd and for the period between January

1, 2023 and October 4, 2023, we paid Mr. O’Dowd $400,000 of interest related to this employment agreement. The largest aggregate

balance we owed Mr. O’Dowd during 2022, 2021 and as of October 4, 2023 was $2,625,000. The balance of accrued compensation as of

October 4, 2023 was $2,625,000.

Charles Dougiello. Mr. Dougiello served as a

director of the Company from June of 2019 to September of 2021. On July 5, 2018, we purchased all of the membership interest of the sellers

of The Door Marketing Group, LLC, of which Mr. Dougiello owned 50%, for approximately $2 million in cash and $2 million in shares of common

stock (less certain working capital and closing adjustments, transaction expenses and payments of indebtedness), plus the potential to

earn up to an additional $7.0 million, of which the first $5 million is payable in shares of common stock and the last $2 million is payable

in cash, if certain financial targets are achieved over a four year period. For the year ended December 31, 2021, Mr. Dougiello met the

financial targets and on June 7, 2022, we issued him 139,781 shares of the Company’s common stock in satisfaction of our earn-out

obligation to him. In connection with our acquisition of The Door, we entered into an employment agreement with Mr. Dougiello for a four-year

term after the closing date of the acquisition, with an initial base salary of $240,000, subject to annual increases of 5% and annual

bonus provisions.

Leslee Dart. Ms. Dart served

as a director of the Company from June of 2020 to May of 2021. On March 30, 2017, we purchased all of the membership interests of the

sellers of 42West, of which Ms. Dart owned 31.67%, for approximately $18.7 million in shares of common stock (less certain working capital

and closing adjustments, transaction expenses and payments of indebtedness), using a stock price of $46.10 per share, plus the potential

to earn up to an additional $9.3 million in shares of common stock. During the year ended December 31, 2017, 42West achieved the required

financial performance targets, and the sellers, including Ms. Dart, earned the additional consideration, of which Ms. Dart was issued

68,868 shares in 2020. In connection with the 42West acquisition, we entered into an employment agreement with Ms. Dart for a three-year

term after the closing date of the acquisition, with an initial base salary of $400,000, subject to annual increases based on achievement

of certain EBITDA thresholds, and annual bonus provisions. On April 5, 2018, we amended Ms. Dart’s employment agreement to modify

the annual bonus provisions and eliminate her right (i) to be eligible to receive in accordance with the provisions of our incentive compensation

plan, a cash bonus for the calendar year 2017 if certain performance goals were achieved and (ii) to receive an annual bonus, for each

year during the term of her employment agreement, of $200,000 in shares of common stock based on the 30-day trading average market price

of such common stock. On April 1, 2020, we entered into a three-year employment agreement with Ms. Dart for an annual salary of $400,000,

with an option to renew for one additional year at the mutual agreement of Ms. Dart and the Company. The employment agreement expired

on March 31, 2023 and was not renewed. In connection with the 42West acquisition, we also entered into a put agreement with Ms. Dart,

pursuant to which we granted Ms. Dart the right, but not the obligation, to cause us to purchase up to an aggregate of 73,970 of her shares

of common stock received as consideration for a purchase price equal to $46.10 per share, during certain specified exercise periods up

until March 2021. As of October 4, 2023, we had purchased an aggregate of 73,970 shares of our common stock from Ms. Dart for an aggregate

purchase price of $3,410,000 pursuant to the put agreement. As of October 4, 2023, we did not owe Ms. Dart for any Put Rights.

Anthony Leo. Mr. Leo serves

as a director of the Company. For the period between October 5, 2021 and December 20, 2021, Aircraft Pictures Limited (“Aircraft”),

a company in which Mr. Leo was a shareholder, hired 42West to provide publicity for Aircraft in exchange for retainer fees of $8,500 per

month and made payments to the Company of $17,000 in the aggregate related to these services. During the year ended December 31, 2022,

the Company provided services to Aircraft amounting to $87,700 and Aircraft made payments to the Company amounting to $91,714.

Director Independence

We deem that each of Michael Espensen, Nelson Famadas, Nicholas Stanham,

Esq., Anthony Leo and Claudia Grillo, are independent as that term is defined by NASDAQ 5605(a)(2).

———————————————————————————

BOARD DIVERSITY MATRIX (As of October

4, 2023)

———————————————————————————

| Total Number of Directors: 7 | |

| | | |

| | | |

| | | |

| | |

| | |

| Female | | |

| Male | | |

| Non-Binary | | |

| Did

Not Disclose Gender | |

| Directors’ Gender: | |

| 2 | | |

| 5 | | |

| — | | |

| — | |

| Number of Directors who identify in any of the categories below: |

| | |

| | | |

| | | |

| | | |

| | |

| African American or Black | |

| — | | |

| — | | |

| — | | |

| — | |

| Alaskan Native | |

| — | | |

| — | | |

| — | | |

| — | |

| Asian | |

| — | | |

| — | | |

| — | | |

| — | |

| Hispanic | |

| 1 | | |

| 2 | | |

| — | | |

| — | |

| Native Hawaiian or Pacific Islander | |

| — | | |

| — | | |

| — | | |

| — | |

| White | |

| 1 | | |

| 3 | | |

| — | | |

| — | |

| Two or More Races or Ethnicities | |

| — | | |

| — | | |

| — | | |

| — | |

| LGBTQ+ | |

| — | | |

| — | | |

| — | | |

| — | |

| Did Not Disclose Demographic Background | |

| — | | |

| — | | |

| — | | |

| — | |

———————————————————————————

OTHER MATTERS

————————————————————————————

Shareholder Proposals for 2024 Annual Meeting of

Shareholders and Proxies

Shareholder proposals

should be sent to us at the address set forth in the Notice. To be considered for inclusion in our proxy statement for the 2024 Annual

Meeting of Shareholders, the deadline for submission of shareholder proposals, pursuant to Rule 14a-8 of the Exchange Act is June 12,

2024. Any proposal with respect to our 2024 Annual Meeting of Shareholders that is submitted other than for inclusion in our proxy statement

for the 2024 Annual Meeting of Shareholders and otherwise outside of the requirements of Rule 14a-8 of the Exchange Act will be considered

timely if we receive written notice of that proposal on or before August 26, 2024 (the 45th

day preceding the one (1) year anniversary of the date on which we first sent this proxy statement for the

2023 Annual Meeting). However, if the date of our 2024 Annual Meeting is changed by more than 30 days from the date of our 2023 Annual

Meeting, then the notice and proposal will be considered untimely if it is not received at least a reasonable number of days prior to

the date on which we mail the proxy statement in respect of such meeting.

Pursuant to Rule 14a-4 under the Exchange Act, shareholder

proxies obtained by our Board in connection with our 2024 Annual Meeting of Shareholders will confer on the proxies and attorneys-in-fact

named therein discretionary authority to vote on any matters presented at such Annual Meeting which were not included in the Company’s

Proxy Statement in connection with such Annual Meeting, unless notice of the matter to be presented at the Annual Meeting is provided

to the Company’s Assistant Secretary before August 26, 2024, (the 45th day preceding the one (1) year anniversary of the date on

which we first sent this proxy statement for the 2023 Annual Meeting).

Transaction of Other Business

At the date of this proxy statement, the only

business which our Board intends to present or knows that others will present at the Annual Meeting is contained in this proxy statement.

If any other matter or matters are properly brought before the Annual Meeting, or an adjournment or postponement thereof, it is the intention

of the person named in the accompanying form of proxy to vote the proxy on such matters in accordance with his best judgment.

List of Shareholders Entitled to Vote at the Annual

Meeting

The names of shareholders of record entitled to

vote at the Annual Meeting will be available at our corporate office for a period of 10 days prior to the Annual Meeting and continuing

through the Annual Meeting.

Expenses Relating to this Proxy Solicitation

We will pay all expenses relating to this proxy

solicitation. In addition to this solicitation by mail, our officers, directors, and employees may solicit proxies by telephone or personal

call without extra compensation for that activity.

Interests of Officers and Directors in Matters

to Be Acted Upon

No person who has been a director or executive

officer of the Company at any time since the beginning of our fiscal year and no associate of any of the foregoing persons has any substantial

interest, direct or indirect, in any matter to be acted upon.

Communication with our Board of Directors

Shareholders may communicate with the Board by

directing their communications in a hard copy (i.e., non-electronic) written form to the following address: Board of Directors, Dolphin

Entertainment, Inc., 150 Alhambra Circle, Suite 1200, Coral Gables, FL 33134. A shareholder communication must include a statement that

the author of such communication is a beneficial or record owner of shares of our common stock. Our Corporate Secretary or one of our

officers will review all communications meeting the requirements discussed above and will remove any communications relating to (i) the

purchase or sale of products or services, (ii) communications from landlords relating to our obligations or the obligations of one of

our subsidiaries under a lease, (iii) communications from suppliers or vendors relating to our obligations or the obligations of one of

our subsidiaries to such supplier or vendor, (iv) communications from opposing parties relating to pending or threatened legal or administrative

proceedings regarding matters not related to securities law matters or fiduciary duty matters, and (v) any other communications that the

Corporate Secretary or officer deems, in his or her reasonable discretion, unrelated to our business. The Corporate Secretary or officer

will compile all communications not removed in accordance with the procedure described above and will distribute such qualifying communications

to the intended recipient(s). A copy of any qualifying communications that relate to our accounting and auditing practices will also be

sent directly to the Audit Committee whether or not it was directed to such persons.

Available Information

We maintain an internet website at www.dolphinentertainment.com.

Copies of the Audit Committee Charter, Compensation Committee Charter, Code of Ethics and Code of Conduct can be found on our website,

www.dolphinentertainment.com, by clicking on Investor Relations, and such information is also available in print to any shareholder who

requests it by writing to us at the address below.

We will furnish without charge to each person whose

proxy is being solicited, upon request of any such person, a copy of the 2022 annual report on Form 10-K as filed with the SEC, including

the financial statements and schedules thereto, but not the exhibits. In addition, such report is available, free of charge, through our

website, www.dolphinentertainment.com, by clicking on Investor Relations and then SEC Filings. A request for a copy of such report should

be directed to Dolphin Entertainment, Inc., 150 Alhambra Circle, Suite 1200, Coral Gables, FL 33134, Attention: Mirta A. Negrini, Telephone:

(305) 774-0407. A copy of any exhibit to the 2022 annual report on Form 10-K will be forwarded following receipt of a written request

to us.

Householding

We have adopted a procedure approved by the SEC called

“householding.” Under this procedure, shareholders of record who have the same address and last name will receive only one

copy of our proxy statement, unless one or more of these shareholders notifies us that they wish to continue receiving individual copies.

This procedure will reduce our printing costs and postage fees.

If you are eligible for householding, but you and other

shareholders of record with whom you share an address currently receive multiple copies of materials from us, or if you hold stock in

more than one account, and in either case you wish to receive only a single copy of materials from us for your household, please contact

our transfer agent, Nevada Agency and Transfer Company in writing at 50 West Liberty Street, Suite 880, Reno, Nevada 89501, or by telephone

at (775) 322-0626.

If you participate in householding and wish to receive

a separate copy of the proxy statement, or if you do not wish to participate in householding and prefer to receive separate copies of

materials from us in the future, please contact our transfer agent as indicated above. Beneficial shareholders can request information

about householding from their nominee.

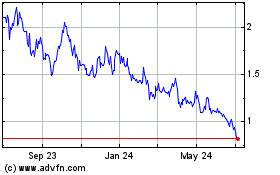

Dolphin Entertainment (NASDAQ:DLPN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dolphin Entertainment (NASDAQ:DLPN)

Historical Stock Chart

From Apr 2023 to Apr 2024