0001043000FALSE00010430002023-10-102023-10-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) October 10, 2023

_________________________________

Sonida Senior Living, Inc.

(Exact name of registrant as specified in its charter)

_________________________________

Delaware

(State or other jurisdiction of incorporation)

| | | | | | | | |

| 1-13445 | 75-2678809 |

| (Commission File Number) | (IRS Employer Identification No.) |

| |

| 14755 Preston Road | |

| Suite 810 | |

| Dallas, | Texas | 75254 |

| (Address of principal executive offices) | (Zip Code) |

(972) 770-5600

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

_________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | SNDA | | New York Stock Exchange |

Item 2.02 Results of Operations and Financial Condition.

On October 10, 2023, Sonida Senior Living, Inc. (the “Company”) issued a press release announcing its occupancy for September 2023 and certain other information regarding the quarter ended September 30, 2023. A copy of the press release is furnished herewith as Exhibit 99.1.

The information furnished pursuant to this Current Report on Form 8-K (including the exhibit hereto) shall not be considered “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into any filing by the Company under the Securities Act of 1933, as amended, or under the Securities Exchange Act of 1934, as amended, unless the Company expressly sets forth by specific reference in such filing that such information is to be considered "filed" or incorporated by reference therein.

Item 7.01 Regulation FD Disclosure.

The information set forth in Item 2.02 of this report is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

| | | | | |

| *99.1 | |

| 104 | Cover Page Interactive Date File-formatted as Inline XBRL. |

*These exhibits to this Current Report on Form 8-K are not being filed but are being furnished pursuant to Item 9.01.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Date: October 10, 2023 | Sonida Senior Living, Inc. |

| | |

| By: | /s/ KEVIN J. DETZ |

| Name: | Kevin J. Detz |

| Title: | Executive Vice President and Chief Financial Officer |

Sonida Senior Living Announces Completion of Loan Modifications with Fannie Mae

and Updated Performance Highlights Through Q3

DALLAS, Texas – October 10, 2023, Sonida Senior Living, Inc. (the “Company,” “Sonida,”) (NYSE: SNDA), a leading owner-operator of communities and services for seniors, announced the execution of its loan modifications with Fannie Mae in tandem with strong September and Q3 2023 occupancy growth.

As previously announced on June 29, 2023, Sonida entered into a comprehensive forbearance agreement with Fannie Mae as the first of a two-step process to modify all existing mortgage agreements with Fannie Mae.

On October 2, 2023, Sonida and Fannie Mae entered into loan modification agreements covering all 37 Fannie Mae mortgaged communities, which finalizes the previously announced comprehensive restructuring. The terms of the Fannie Mae loan modifications were consistent with those set forth in the June 29, 2023 forbearance agreement.

Key elements of the loan modification include:

•All maturities under the 37 Fannie Mae loans have been extended to December 2026 or later.

•All contractually required principal payments under the 37 Fannie Mae loans have been deferred for three years or waived until maturity, resulting in $33.0 million of cash flow savings through maturity.

•Sonida received near-term interest rate reduction on all 37 assets, resulting in $6.1 million in cash interest savings from June 2023 through May 2024.

•Sonida to provide two $5 million principal payments to be applied against the loan balances. The first paydown was funded in June 2023 and the second will be funded in June 2024.

As previously announced, Conversant Capital committed to purchase up to $13.5 million of common equity at $10 per share over an 18-month period following the date of its commitment. Sonida shall have the right, but not the obligation, to utilize Conversant’s equity commitment and may draw on the commitment in whole or in part. The Company drew $6.0 million in July, in conjunction with the first $5.0 million principal payment to Fannie Mae. The remaining funds may be drawn as needed for general working capital needs or to fund the second $5.0 million loan paydown due to Fannie Mae.

Also, as previously announced, in connection with the Fannie loan modifications and the Conversant equity commitment, Ally Bank agreed to temporarily reduce the minimum liquidity requirement under its $88.1 million facility with the Company for 18 months (effective June 1, 2023), subject to certain conditions that the Company expects to meet.

The loan modification agreements along with the modified liquidity requirements with Ally Bank will contribute significantly to the Company’s ongoing financial stability.

The Company continues to engage in dialogue with its other significant lending partner, Protective Life, regarding potential modifications or repurchases, among other possibilities. The Company remains optimistic for positive near-term outcomes.

Q3 Performance

Spot occupancy ended September at 86.8% for the Company’s owned communities, and average occupancy for Q3 increased approximately 100 basis points from Q2 2023. Average rate continues to be a significant component of the Company’s 2023 NOI margin expansion with a year-over-year increase in average rate of 9.8% through the first nine months of the year.

“The debt restructuring along with strong Q3 occupancy gains have created significant momentum for us as we move into the final quarter of the year,” said Kevin Detz, Chief Financial Officer. “Our strong results and sequential improvement throughout the first nine months of the year are a testament to our ongoing focus on operational excellence and our team’s dedication to providing high-quality care and personalized service that enhances our residents’ quality of life.”

“We are very pleased with the Company’s strong operating results and the completion of the loan modifications with Fannie Mae. Our performance throughout the year, coupled with the ongoing support from our investors and lenders, remains a key point of differentiation in the current economic climate,” said Brandon Ribar, President and CEO. “We believe Sonida is at an exciting inflection point with our balance sheet repositioning nearly behind us and continued portfolio performance improving, allowing us to pivot our focus towards growth. Many owners, operators and lenders across senior living are actively identifying strategic alternatives for their existing assets; our goal this year has been to make the needed improvements to our balance sheet, organizational structure and operations to position Sonida to be the consolidator of choice in the industry as it continues to evolve.”

Safe Harbor

This release contains forward-looking statements which are subject to certain risks and uncertainties that could cause our actual results and financial condition of Sonida Senior Living, Inc. (the “Company,” “we,” “our” or “us”) to differ materially from those indicated in the forward-looking statements, including, among others, the risks, uncertainties and factors set forth under “Item. 1A. Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the Securities and Exchange Commission (the “SEC”) on March 30, 2023, and “Item. 1A. Risk Factors” in our Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2023, filed with the SEC on August 14, 2023, and also include the following: the impact of COVID-19, including the actions taken to prevent or contain the spread of COVID-19, the transmission of its highly contagious variants and sub-lineages and the development and availability of vaccinations and other related treatments, or another epidemic, pandemic or other health crisis; the Company’s ability to generate sufficient cash flows from operations, additional proceeds from debt financings or refinancings, and proceeds from the sale of assets to satisfy its short- and long-term debt obligations and to make capital improvements to the Company’s communities; increases in market interest rates that increase the cost of certain of our debt obligations; increased competition for, or a shortage of, skilled workers, including due to the COVID-19 pandemic or general labor market conditions, along with wage pressures resulting from such increased competition, low unemployment levels, use of contract labor, minimum wage increases and/or changes in overtime laws; the Company’s ability to obtain additional capital on terms acceptable to it; the Company’s ability to extend or refinance its existing debt as such debt matures, including the Company’s ability to complete

the modifications to its loan agreements; the Company’s compliance with its debt agreements, including certain financial covenants and the risk of cross-default in the event such non-compliance occurs; the Company’s ability to complete acquisitions and dispositions upon favorable terms or at all; the risk of oversupply and increased competition in the markets which the Company operates; the Company’s ability to improve and maintain controls over financial reporting and remediate the identified material weakness discussed in its recent Quarterly and Annual Reports filed with the SEC; the departure of the Company’s key officers and personnel; the cost and difficulty of complying with applicable licensure, legislative oversight, or regulatory changes; risks associated with current global economic conditions and general economic factors such as inflation, the consumer price index, commodity costs, fuel and other energy costs, competition in the labor market, costs of salaries, wages, benefits, and insurance, interest rates, and tax rates; and changes in accounting principles and interpretations.

About Sonida

Dallas-based Sonida Senior Living, Inc. is a leading owner-operator of independent living, assisted living and memory care communities and services for senior adults. The Company provides compassionate, resident-centric services and care as well as engaging programming operating 71 senior housing communities in 18 states with an aggregate capacity of approximately 8,000 residents, including 61 communities which the Company owns and 10 communities that the Company manages on behalf of third parties. For more information, visit www.sonidaseniorliving.com or connect with the Company on Facebook, Twitter or LinkedIn.

Sonida Investor and Media Contact

Kevin Detz

kdetz@sonidaliving.com

v3.23.3

Cover

|

Oct. 10, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 10, 2023

|

| Entity Registrant Name |

Sonida Senior Living, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-13445

|

| Entity Tax Identification Number |

75-2678809

|

| Entity Address, Address Line One |

14755 Preston Road

|

| Entity Address, Address Line Two |

Suite 810

|

| Entity Address, State or Province |

TX

|

| Entity Address, City or Town |

Dallas,

|

| Entity Address, Postal Zip Code |

75254

|

| City Area Code |

(972)

|

| Local Phone Number |

770-5600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

SNDA

|

| Security Exchange Name |

NYSE

|

| Entity Central Index Key |

0001043000

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

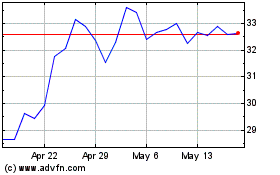

Sonida Senior Living (NYSE:SNDA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sonida Senior Living (NYSE:SNDA)

Historical Stock Chart

From Apr 2023 to Apr 2024