As

filed with the Securities and Exchange Commission on October 6, 2023

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-3

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

AMERICAN

REBEL HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

47-3892903 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

Number) |

909

18th Avenue South, Suite A

Nashville,

Tennessee 37212

(833)

267-3235

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Charles

A. Ross, Jr.

Chief

Executive Officer

909

18th Avenue South, Suite A

Nashville,

Tennessee 37212

Telephone:

(833) 267-3235

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Joseph

M. Lucosky, Esq.

Scott

E. Linsky, Esq.

Lucosky

Brookman LLP

101

Wood Avenue South, 5th Floor

Iselin,

NJ 08830

(732)

395-4400

APPROXIMATE

DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: From time to time after the effective date of this registration statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

on filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large

accelerated filer |

☐ |

|

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

|

Smaller

reporting company |

☒ |

| |

|

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date

as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY

NOTE

This

registration statement contains a resale prospectus to be used for the resale by the selling stockholders, pursuant to General Instruction

I.B.3 to Form S-3, of up to 5,977,374 shares of our common stock issuable upon exercise of common stock purchase warrants held by such

selling stockholders.

We

intend for the offering and sale of shares pursuant to this prospectus to be a secondary offering of our shares in accordance with General

Instruction I.B.3 of Form S-3, which allows outstanding securities to be offered for the account of any person other than the registrant.

The

information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement

filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek

an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject

to Completion, dated October 6, 2023

PROSPECTUS

AMERICAN

REBEL HOLDINGS, INC.

5,977,374

Shares of Common Stock

This

prospectus relates to the resale, from time to time, of up to 5,977,374 shares (the “Shares”) of our common stock, par value

$0.001 per share (“Common Stock”), by the selling stockholders identified in this prospectus under “Selling Stockholders”

(the “Offering”) pursuant to an inducement offer letter agreement the Company entered into and closed on with the Selling

Stockholders on September 8, 2023 (collectively, the “Inducement Letter”), which includes up to 2,988,687 shares of the Company’s

common stock at a reduced exercise price of $1.10 per share in consideration for the Company’s agreement to issue two new common

stock purchase warrants (the “New Warrant A” and the “New Warrant B” and, together, the “New Warrants”),

to purchase, in the aggregate, up to 5,977,374 shares of the Company’s common stock (the “New Warrant Shares”).

We are not selling any shares of our Common Stock under this prospectus and will not receive any proceeds from the sale of the Shares.

We will, however, receive proceeds from any warrants that are exercised through the payment of the exercise price in cash, in a maximum

amount of up to approximately $6,575,111.40. The Selling Stockholders will bear all commissions and discounts, if any, attributable

to the sale of the Shares. We will bear all costs, expenses and fees in connection with the registration of the Shares.

No

securities may be sold without delivery of this prospectus and the applicable prospectus supplement describing the method and terms of

the offering of such securities.

INVESTING

IN OUR SECURITIES INVOLVES RISKS. SEE THE “RISK FACTORS” ON PAGE 6 OF THIS PROSPECTUS AND ANY SIMILAR SECTION CONTAINED

IN THE APPLICABLE PROSPECTUS SUPPLEMENT CONCERNING FACTORS YOU SHOULD CONSIDER BEFORE INVESTING IN OUR SECURITIES.

Our

Common Stock and certain existing warrants (the “Existing Warrants”) are traded on the Nasdaq Capital Market under the symbols

“AREB” and “AREBW,” respectively. On October 5, 2023, the last reported sale price of our Common Stock on The

NASDAQ Capital Market was $0.62 per share.

Investing

in our securities involves a high degree of risk. See “Risk Factors” beginning on page 6 in this prospectus for a discussion

of information that should be considered in connection with an investment in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is October 6, 2023

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-3 that we filed with the U.S. Securities and Exchange Commission (the “SEC”).

You should read this prospectus and the information and documents incorporated by reference carefully. Such documents contain important

information you should consider when making your investment decision. See “Where You Can Find More Information” and “Incorporation

of Certain Information by Reference” in this prospectus.

This

prospectus may be supplemented from time to time to add, to update or change information in this prospectus. Any statement contained

in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained

in a prospectus supplement modifies or supersedes such statement. Any statement so modified will be deemed to constitute a part of this

prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus. You may only

rely on the information contained in this prospectus or that we have referred you to. We have not authorized anyone to provide you with

different information. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other

than the securities offered by this prospectus. This prospectus and any future prospectus supplement do not constitute an offer to sell

or a solicitation of an offer to buy any securities in any circumstances in which such offer or solicitation is unlawful. Neither the

delivery of this prospectus or any prospectus supplement nor any sale made hereunder shall, under any circumstances, create any implication

that there has been no change in our affairs since the date of this prospectus or such prospectus supplement or that the information

contained by reference to this prospectus or any prospectus supplement is correct as of any time after its date.

This

prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the

actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some

of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration

statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You

Can Find More Information.”

The

Selling Stockholders are offering the Shares only in jurisdictions where such offer is permitted. The distribution of this prospectus

and the sale of the Shares in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession

of this prospectus must inform themselves about, and observe any restrictions relating to, the distribution of this prospectus and the

sale of the Shares outside the United States. This prospectus does not constitute, and may not be used in connection with, an offer to

sell, or a solicitation of an offer to buy, the Shares by any person in any jurisdiction in which it is unlawful for such person to make

such an offer or solicitation. If there is any inconsistency between the information in this prospectus and the applicable prospectus

supplement, you should rely on the prospectus supplement. Before purchasing any securities, you should carefully read both this prospectus

and the applicable prospectus supplement, together with the additional information described under the heading “Where You Can Find

More Information; Incorporation by Reference.”

We

have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent

information, you should not rely on it. We will not make an offer to sell these securities in any jurisdiction where the offer or sale

is not permitted. You should assume that the information appearing in this prospectus and the applicable prospectus supplement to this

prospectus is accurate as of the date on its respective cover, and that any information incorporated by reference is accurate only as

of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations

and prospects may have changed since those dates.

When

we refer to “American Rebel,” “we,” “our,” “us” and the “Company” in this

prospectus, we mean American Rebel Holdings, Inc., unless otherwise specified. When we refer to “you,” we mean the holders

of the applicable series of securities.

SPECIAL

NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains forward-looking statements. These forward-looking statements contain information about our expectations, beliefs

or intentions regarding our product development and commercialization efforts, business, financial condition, results of operations,

strategies or prospects, and other similar matters. These forward-looking statements are based on management’s current expectations

and assumptions about future events, which are inherently subject to uncertainties, risks and changes in circumstances that are difficult

to predict. These statements may be identified by words such as “expects,” “plans,” “projects,” “will,”

“may,” “anticipates,” “believes,” “should,” “intends,” “estimates,”

and other words of similar meaning.

These

statements relate to future events or our future operational or financial performance, and involve known and unknown risks, uncertainties

and other factors that may cause our actual results, performance or achievements to be materially different from any future results,

performance or achievements expressed or implied by these forward-looking statements. Factors that may cause actual results to differ

materially from current expectations include, among other things, those listed under the section titled “Risk Factors” and

elsewhere in this prospectus, in any related prospectus supplement and in any related free writing prospectus.

Any

forward-looking statement in this prospectus, in any related prospectus supplement and in any related free writing prospectus reflects

our current view with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to our

business, results of operations, industry and future growth. Given these uncertainties, you should not place undue reliance on these

forward-looking statements. No forward-looking statement is a guarantee of future performance. You should read this prospectus, any related

prospectus supplement and any related free writing prospectus and the documents that we reference herein and therein and have filed as

exhibits hereto and thereto completely and with the understanding that our actual future results may be materially different from any

future results expressed or implied by these forward-looking statements. Except as required by law, we assume no obligation to update

or revise these forward-looking statements for any reason, even if new information becomes available in the future.

This

prospectus, any related prospectus supplement and any related free writing prospectus also contain or may contain estimates, projections

and other information concerning our industry, our business and the markets for our products, including data regarding the estimated

size of those markets and their projected growth rates. Information that is based on estimates, forecasts, projections or similar methodologies

is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances reflected

in this information. Unless otherwise expressly stated, we obtained these industry, business, market and other data from reports, research

surveys, studies and similar data prepared by third parties, industry and general publications, government data and similar sources.

In some cases, we do not expressly refer to the sources from which these data are derived.

PROSPECTUS

SUMMARY

This

summary highlights certain information about us, this offering and information appearing elsewhere in this prospectus and in the

documents we incorporate by reference. This summary is not complete and does not contain all of the information that you should

consider before investing in our securities. To fully understand this offering and its consequences to you, you should read this

entire prospectus carefully, including the information referred to under the heading “Risk Factors” in this prospectus

beginning on page 6, the financial statements and other information incorporated by reference in this prospectus when making an

investment decision. This is only a summary and may not contain all the information that is important to you. You should carefully

read this prospectus, including the information incorporated by reference therein, and any other offering materials, together with

the additional information described under the heading “Where You Can Find More Information.”

THE

COMPANY

Corporate

Summary

American

Rebel Holdings, Inc. was incorporated on December 15, 2014, in the State of Nevada and is authorized to issue 600,000,000 shares of $0.001

par value common stock (“Common Stock”) and 10,000,000 shares of $0.001 par value preferred stock (“Preferred Stock”).

The

Company operates primarily as a designer, manufacturer and marketer of branded safes and personal security and self-defense products.

Additionally, the Company designs and produces branded apparel and accessories and intends to enter the beverage industry in early

2024.

We

believe that when it comes to their homes, consumers place a premium on their security and privacy. Our products are designed to offer

our customers convenient, efficient and secure home and personal safes from a provider that they can trust. We are committed to offering

products of enduring quality that allow customers to keep their valuable belongings protected and to express their patriotism and style,

which is synonymous with the American Rebel brand.

Our

safes and personal security products are constructed primarily of U.S.-made steel. We believe our products are designed to safely store

firearms, as well as store our customers’ priceless keepsakes, family heirlooms and treasured memories and other valuables, and

we aim to make our products accessible at various price points for home and office use. We believe our products are designed for safety,

quality, reliability, features and performance.

To

enhance the strength of our brand and drive product demand, we work with our manufacturing facilities and various suppliers to emphasize

product quality and mechanical development in order to improve the performance and affordability of our products while providing support

to our distribution channel and consumers. We seek to sell products that offer features and benefits of higher-end safes at mid-line

price ranges.

We

believe that safes are becoming a ‘must-have appliance’ in a significant portion of households. We believe our current safes

provide safety, security, style and peace of mind at competitive prices.

In

addition to branded safes, we offer an assortment of personal security products as well as apparel and accessories for men and women

under the Company’s American Rebel brand. Our backpacks utilize what we believe is a distinctive sandwich-method concealment pocket,

which we refer to as Personal Protection Pocket, to hold firearms in place securely and safely. The concealment pockets on our Freedom

2.0 Concealed Carry Jackets incorporate a silent operation opening and closing with the use of a magnetic closure.

We

believe that we have the potential to continue to create a brand community presence around the core ideals and beliefs of America, in

part through our Chief Executive Officer, Charles A. “Andy” Ross, who has written, recorded and performs a number of songs

about the American spirit of independence. We believe our customers identify with the values expressed by our Chief Executive Officer

through the “American Rebel” brand.

Through

our growing network of dealers, we promote and sell our products in select regional retailers and local specialty safe, sporting goods,

hunting and firearms stores, as well as online, including our website and e-commerce platforms such as Amazon.com.

American

Rebel is boldly positioning itself as “America’s Patriotic Brand” in a time when national spirit and American values

are being rekindled and redefined. American Rebel is an advocate for the 2nd Amendment and conveys a sense of responsibility to teach

and preach good common practices of gun ownership. American Rebel products keep you concealed and safe inside and outside the home. American

Rebel Safes protect your firearms and valuables from children, theft, fire and natural disasters inside the home; and American Rebel

Concealed Carry Products provide quick and easy access to your firearm utilizing American Rebel’s Proprietary Protection Pocket

in its backpacks and apparel outside the home. The initial company product releases embrace the “concealed carry lifestyle”

with a focus on concealed carry products, apparel, personal security and defense. “There’s a growing need to know how to

protect yourself, your family, your neighbors or even a room full of total strangers,” says American Rebel’s Chief Executive

Officer, Andy Ross. “That need is in the forethought of every product we design.”

The

“concealed carry lifestyle” refers to a set of products and a set of ideas around the emotional decision to carry a gun everywhere

you go. The American Rebel brand strategy is similar to the successful Harley-Davidson Motorcycle philosophy, referenced in this quote

from Richard F. Teerlink, Harley’s chairman and former chief executive, “It’s not hardware; it is a lifestyle, an emotional

attachment. That’s what we have to keep marketing to.” As an American icon, Harley has come to symbolize freedom, rugged

individualism, excitement and a sense of “bad boy rebellion.” American Rebel – America’s Patriotic Brand has

significant potential for branded products as a lifestyle brand. Its innovative Concealed Carry Product line and Safe line serve a large

and growing market segment; but it is important to note we have product opportunities beyond Concealed Carry Products and Safes.

Recent

Developments

Armistice

Agreement and Private Placement

On

June 27, 2023, the Company entered into a securities purchase agreement (the “Purchase Agreement”) with Armistice Capital

Master Fund Ltd. (“Armistice”) for the purchase and sale of, subject to customary closing conditions, (i) an aggregate of

71,499 shares (the “Common Shares”) of the Company’s common stock, par value $0.001 per share (the “Common Stock”),

(ii) prefunded warrants (the “Prefunded Warrants”) that are exercisable into 615,000 shares of Common Stock (the “Prefunded

Warrant Shares”) and (iii) warrants (the “Warrants”) to initially acquire up to 686,499 shares of Common Stock (the

“Warrant Shares”) (representing 100% of the Common Shares and Prefunded Warrant Shares) in a private placement offering (the

“Private Placement”) for gross proceeds of $3 million. The Private Placement closed on June 30, 2023.

The

aggregate purchase price for the Common Shares, Prefunded Warrants and the Warrants purchased by Armistice was equal to (i) $4.37 for

each Common Share (and related Warrants) purchased by Armistice, or (ii) $4.36 for each Prefunded Warrant (and related Warrants) purchased

by Armistice, which Prefunded Warrants are exercisable into Prefunded Warrant Shares at the initial Exercise Price (as defined in the

Prefunded Warrant) of $0.01 per Prefunded Warrant Share in accordance with the Prefunded Warrant.

The

Warrant has an exercise price of $4.24 per share, subject to adjustment for any stock dividend, stock split, stock combination, reclassification

or similar transaction occurring after the date of the Purchase Agreement. The Warrant will be exercisable commencing on the date of

issuance, and will expire five years from the date of issuance.

The

Prefunded Warrant has an initial exercise price of $0.01 per Prefunded Warrant Share, is to be pre-funded to the Company on or prior

to the initial exercise date of the Prefunded Warrant and, consequently, no additional consideration (other than the nominal exercise

price of $0.01 per Prefunded Warrant Share) is required to be paid by the Buyer to exercise the Prefunded Warrant.

The

Company also entered into a registration rights agreement (the “Registration Rights Agreement”) with Armistice to register

the Common Shares and the shares of Common Stock underlying the Warrants issued in the Private Placement for resale. The registration

statement to which this prospectus relates is being filed pursuant to the Registration Rights Agreement.

The

Company engaged EF Hutton, division of Benchmark Investments, LLC (“EF Hutton” or the “Placement Agent”), as

the Company’s placement agent for the Private Placement. The Placement Agent was paid a cash fee equal to an aggregate of ten percent

(10.0%) of the aggregate gross proceeds raised in the Private Placement.

Amendment

to the Articles of Incorporation and Reverse Stock Split

On

November 28, 2022, the stockholders of the Company approved a Certificate of Amendment to the Company’s Second Amended and Restated

Articles of Incorporation (the “Certificate of Amendment”) to effect a reverse stock split of the Company’s shares

of common stock, par value $0.001 per share at a ratio of up to 1-for-25 (the “Reverse Stock Split”). Thereafter, on June

23, 2023, the Board set the Reverse Stock Split ratio at 1-for-25 and approved and authorized the filing of the Certificate of Amendment

on June 23, 2023. The Certificate of Amendment became effective on June 27, 2023.

The

Reverse Stock Split was intended for the Company to regain compliance with the minimum bid price requirement of $1.00 per share of Common

Stock (the “Minimum Bid Price Requirement”) for continued listing on the Nasdaq Capital Market (“Nasdaq”). The

Reverse Stock Split began trading on a Reverse Stock Split-adjusted basis on Nasdaq at the opening of the market on June 27, 2023. On

July 12, 2023, the Company received a written notification from the staff of The Nasdaq Stock Market LLC indicating that, as of July

11, 2023, the Company had regained compliance with the Minimum Bid Price Requirement.

Sponsorship

Agreement

Effective

July 1, 2023, in connection with establishing a vendor relationship with Menards to sell the Company’s safes and ammo lockers,

the Company entered into a Sponsorship Agreement (the “Sponsorship Agreement”) with Tony Stewart Racing Nitro, LLC, d/b/a

TSR Nitro (the “TSRN”), a race team operating a Funny Car Team competing full time with the NHRA (the “Series”).

The Company agreed to be the primary sponsor of TSRN’s Funny Car Team and Driver participation in the Series on a full-time basis

as the “Official Gun Safe Supplier” of “Tony Steward Racing Nitro.” Under the terms of the Sponsorship Agreement,

the Company agreed to a sponsorship fee in the total amount of up to $800,000. The initial term of the Sponsorship Agreement runs through

December 31, 2023 and shall automatically renew through July 31, 2025 (or after ten (10) 2025 season races, whichever comes first)

unless TSRN elects in writing to terminate following the 2023 season.

The

Sponsorship Agreement contains, among other provisions, certain representations and warranties by the parties, intellectual property

protection covenants, certain indemnification rights in favor of each party and customary confidentiality provisions.

American

Rebel Beer

On

August 9, 2023, the Company entered into a Master Brewing Agreement with Associated Brewing Company. Under the terms of the Brewing Agreement,

Associated Brewing has been appointed as the exclusive producer and seller of American Rebel branded spirits, with the initial product

being American Rebel Light Beer. American Rebel Light Beer will launch regionally in early 2024.

Inducement

Letter

On

September 8, 2023 (the “Effective Date”), the Company entered into and closed a securities purchase agreement (the “Inducement

Letter”) with certain accredited investors (the “Holders”), whereby the Holders of existing common stock purchase warrants

(the “Existing Warrants”) agreed to purchase shares of common stock of the Company. The Existing Warrants were issued

on July 8, 2022 and June 28, 2023 and had an exercise price of $4.37 and $4.24, respectively per share.

Pursuant

to the Inducement Letter, the Holders agreed to exercise for cash their Existing Warrants to purchase an aggregate of 2,988,687 shares

of the Company’s common stock at a reduced exercise price of $1.10 per share in consideration for the Company’s agreement

to issue two new common stock purchase warrants (the “New Warrant A” and the “New Warrant B” and, together, the

“New Warrants”), as described below, to purchase, in the aggregate, up to 5,977,374 shares of the Company’s

common stock (the “New Warrant Shares”). The Company expects to receive aggregate gross proceeds of approximately

$3,287,555.70 from the exercise of the Existing Warrants by the Holders. Prior to the foregoing transaction, the Company had 3,151,883

shares of common stock outstanding.

The

closing of the transactions contemplated pursuant to the Inducement Letter occurred on September 8, 2023 (the “Closing Date”),

Each

New Warrant will have an exercise price equal to $1.10 per share. The New Warrants will be immediately exercisable from the date of issuance

until the five-year anniversary of the date of issuance.

The

representations and warranties contained in the Inducement Letter were made by the parties to, and solely for the benefit of, the other

in the context of all of the terms and conditions of the Inducement Letter and in the context of the specific relationship between the

parties. The provisions of the agreement, including the representations and warranties contained therein, are not for the benefit of

any party other than the parties to the Inducement Letter. The Inducement Letter is not intended for investors and the public to obtain

factual information about the current state of affairs of the parties.

Background

of the Offering

See

– “Recent Developments – Inducement Letter”

THE

OFFERING

| Issuer |

|

American

Rebel Holdings, Inc. |

| |

|

|

| Shares

of Common Stock offered by us |

|

None |

| |

|

|

| Shares

of Common Stock offered by the Selling Stockholders |

|

5,977,374

shares (1) |

| |

|

|

| Shares

of Common Stock outstanding before the Offering |

|

4,272,291

shares (2) |

| |

|

|

| Shares

of Common Stock outstanding after completion of this offering, assuming the sale of all shares offered hereby |

|

10,249,665

shares (2) |

| |

|

|

| Use

of proceeds |

|

We

will not receive any proceeds from the resale of the common stock by the Selling Stockholders. |

| |

|

|

| Market

for Common Stock |

|

Our

common stock and certain existing warrants are listed on The Nasdaq Capital Market under the symbols “AREB” and “AREBW,”

respectively. |

| |

|

|

| Risk

Factors |

|

Investing

in our securities involves a high degree of risk. See the “Risk Factors” section of this prospectus on page 6 and in

the documents we incorporate by reference in this prospectus for a discussion of factors you should consider carefully before deciding

to invest in our securities. |

| (1) |

This

amount consists of an agreement between the Company and Holders of the Inducement Letter to exercise 2,988,687 shares of the Company’s

common stock at a reduced exercise price of $1.10 per share in consideration for the Company’s agreement to issue two new common

stock purchase warrants to purchase, in the aggregate, up to 5,977,374 shares of the Company’s common stock, issued pursuant

to the Inducement Letter. |

| (2) |

The

number of shares of Common Stock outstanding before and after the Offering is based on 4,272,291 shares outstanding as of

October 6, 2023 and excludes the following: |

| ● |

0 shares

of Common Stock issuable upon the exercise of outstanding stock options having a weighted average exercise price of $0 per

share; |

| ● |

9,603,950 shares

of common stock issuable upon the exercise of outstanding warrants having a weighted average exercise price of $17.40 per

share; |

| ● |

0 shares

of common stock issuable upon the conversion of convertible promissory notes having a conversion price of $0 per share. |

RISK

FACTORS

Our

business, financial condition, results of operations, and cash flows may be impacted by a number of factors, many of which are beyond

our control, including those set forth in our most recent Annual Report on Form 10-K for the year ended December 31, 2022, the occurrence

of any one of which could have a material adverse effect on our actual results. There have been no material changes to the Risk Factors

previously disclosed in our Annual Report on Form 10-K for the year ended December 31, 2022.

USE

OF PROCEEDS

We

are not selling any securities in this prospectus. All proceeds from the resale of the shares of our Common Stock offered by this

prospectus will belong to the Selling Stockholders. We will not receive any proceeds from the resale of the shares of our Common Stock

by the Selling Stockholders. We may receive proceeds from the cash exercise of the Warrants, which, if exercised in cash at the current

exercise price with respect to all 5,977,374 shares of Common Stock, would result in gross proceeds of approximately $6,575,111.40

to us.

PRIVATE

PLACEMENT OF DEBENTURES AND WARRANTS

On

September 8, 2023, the Company entered into the Inducement Letter with certain accredited investors, the Holders, of existing warrants,

made up of common stock purchase warrants, to purchase shares of common stock of the Company. The Existing Warrants were issued on July

8, 2022 and June 28, 2023 and had an exercise price of $4.37 and $4.24, respectively per share.

Pursuant

to the Inducement Letter, the Holders agreed to exercise for cash their Existing Warrants to purchase an aggregate of 2,988,687 shares

of the Company’s common stock at a reduced exercise price of $1.10 per share in consideration for the Company’s agreement

to issue two new common stock purchase warrants (the “New Warrant A” and the “New Warrant B” and, together, the

“New Warrants”), as described below, to purchase, in the aggregate, up to 5,977,374 shares of the Company’s common

stock (the “New Warrant Shares”). The Company expects to receive aggregate gross proceeds of approximately $3,287,555.70

from the exercise of the Existing Warrants by the Holders. Prior to the foregoing transaction, the Company had 3,151,883 shares of common

stock outstanding.

Each

New Warrant will have an exercise price equal to $1.10 per share. The New Warrants will be immediately exercisable from the date of issuance

until the five-year anniversary of the issuance date. The exercise price and number of shares of common stock issuable

upon exercise is subject to appropriate adjustment in the event of stock dividends, stock splits, subsequent rights offerings, pro rata

distributions, reorganizations, or similar events affecting the Company’s common stock and the exercise price.

The

New Warrants will be exercisable, at the option of each holder, in whole or in part, by delivering to the Company a duly executed exercise

notice accompanied by payment in full, within one Trading Day of such exercise of the New Warrant, for the number of shares of the Company’s

common stock purchased upon such exercise (except in the case of a cashless exercise as discussed below). A holder (together with its

affiliates) may not exercise any portion of such holder’s New Warrants to the extent that the holder would own more than 4.99%

(or, at the election of the holder, 9.99%) of the outstanding common stock immediately after exercise, except that upon prior notice

from the holder to the Company, the holder may increase or decrease the amount of ownership of outstanding stock after exercising the

holder’s New Warrants up to 9.99% of the number of shares of the Company’s common stock outstanding immediately after giving

effect to the exercise, as such percentage ownership is determined in accordance with the terms of the New Warrants, provided that any

increase will not be effective until 61 days following notice to us.

New

Warrant A is subject to anti-dilution adjustment to its exercise price in the event of certain issuances of shares of the Company’s

common stock.

There

is no established trading market for the New Warrants, and the Company does not expect an active trading market to develop. The Company

does not intend to apply to list the New Warrants on any securities exchange or other trading market. Without a trading market, the liquidity

of the New Warrants will be extremely limited.

Except

as otherwise provided in the New Warrants or by virtue of the holder’s ownership of shares of the Company’s common stock,

such holder of New Warrants does not have the rights or privileges of a holder of the Company’s common stock, including any voting

rights, until such holder exercises such holder’s New Warrants. The New Warrants will provide that the holders of the New Warrants

have the right to participate in distributions or dividends paid on the Company’s shares of common stock.

If

at any time the New Warrants are outstanding, the Company, either directly or indirectly, in one or more related transactions effects

a Fundamental Transaction (as defined in the New Warrant), a Holder of New Warrants will be entitled to receive, upon exercise of the

New Warrants, the kind and amount of securities, cash or other property that such holder would have received had they exercised the New

Warrants immediately prior to the Fundamental Transaction. As an alternative, and at the Holder’s option in the event of a Fundamental

Transaction, exercisable at the earliest to occur of (i) the public disclosure of any Change of Control, (ii) the consummation of any

Change of Control, and (iii) the Holder first becoming aware of any Change of Control through the date that is 90 days after the public

disclosure of the consummation of such Change of Control by the Company pursuant to a Current Report on Form 8-K filed with the SEC ,

the Company shall purchase the unexercised portion of the Warrant from the holder by paying to the holder an amount of cash equal to

the Black Scholes Value (as defined in the Warrant) of the remaining unexercised portion of the New Warrant on the date of the consummation

of such Fundamental Transaction.

The

New Warrants may be modified or amended or the provisions of the New Warrants waived with the Company’s and the holder’s

written consent.

The

above disclosure contains only a brief description of the material terms of the Inducement Letter and does not purport to be a complete

description of the rights and obligations of the parties thereunder, and such description is qualified in its entirety by reference to

the full text of the form of the Inducement Letter, the form of which is attached as Exhibits 10.1 to the Current Report on Form 8-K

filed with the SEC on September 8, 2023, and is incorporated herein by reference.

SELLING

STOCKHOLDERS

The

5,977,374 shares of our Common Stock being offered by the Selling Stockholder include two new common stock purchase warrants (described

as the “New Warrant A” and the “New Warrant B” and, together, the “New Warrants”), to purchase

issued by the Company to the Holders as part of the Inducement Letter which was agreed upon on or about September 8, 2023. For additional

information regarding the issuance of the securities, see “Inducement Agreement above. We are registering the shares of

our Common Stock in order to permit the Selling Stockholder to offer the shares for resale from time to time. Except as otherwise described

in the footnotes to the table below and for the ownership of the registered shares issued pursuant to the Purchase Agreement, neither

the Selling Stockholder nor any of the persons that control them has had any material relationships with us or our affiliates within

the past three (3) years.

The

table below lists the Selling Stockholder and other information regarding the beneficial ownership (as determined under Section 13(d)

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (and the rules and regulations thereunder) of the

shares of our Common Stock by the Selling Stockholder.

The

second column lists the number of shares of our Common Stock beneficially owned by each Selling Stockholder before this Offering (including

shares which the Selling Stockholder has the right to acquire within 60 days, including upon conversion of any convertible securities).

The

third column lists the shares of our Common Stock being offered by this prospectus by each Selling Stockholder.

The

fourth and fifth columns list the number of shares of Common Stock beneficially owned by each Selling Stockholder and their percentage

ownership after the Offering (including shares which the Selling Stockholder has the right to acquire within 60 days, including upon

conversion of any convertible securities), assuming the sale of all of the shares offered by each Selling Stockholder pursuant to this

prospectus.

Under

the terms of the Inducement Agreement, a Selling Stockholder may not exercise the Warrants to the extent such conversion or exercise

would cause such Selling Stockholder, together with any other person with which the Selling Stockholder is considered to be part of a

group under Section 13 of the Exchange Act or with which the Selling Stockholder otherwise files reports under Section 13 and/or 16 of

the Exchange Act, to beneficially own a number of shares of Common Stock which exceeds 4.99% or 9.99%, as applicable, of the Equity Interests

of a class that is registered under the Exchange Act that is outstanding at such time. The number of shares in the third column does

not reflect this limitation.

The

amounts and information set forth below are based upon information provided to us by the Selling Stockholder as of October 6, 2023, except

as otherwise noted below. The Selling Stockholder may sell all or some of the shares of Common Stock it is offering, and may sell, unless

indicated otherwise in the footnotes below, shares of our Common Stock otherwise than pursuant to this prospectus. The tables below assume

the Selling Stockholder sell all of the shares offered by them in offerings pursuant to this prospectus, and do not acquire any additional

shares. We are unable to determine the exact number of shares that will actually be sold or when or if these sales will occur.

| Selling Stockholder |

|

Number of

Shares

Owned

Before

Offering |

|

|

Shares

Offered

Hereby |

|

|

Number of

Shares

Owned

After

Offering |

|

|

Percentage of Shares

Beneficially

Owned After

Offering |

|

| Armistice Capital, LLC |

|

|

0(1) |

|

|

|

5,977,374 |

(2) |

|

|

0 |

(3) |

|

|

0 |

%(1)(3) |

| (1) |

The

Selling Stockholder holds 2,358,000 shares of common stock presently held in abeyance, available for issuance upon request (the “Abeyance

Shares”) and 5,996,652 warrants (the “Registered Warrants”). Both the Abeyance Shares and the Registered Warrants

are subject to 9.99% and 4.99% beneficial ownership limitations, respectively, that prohibit such holder from exercising any portion

of them if, following such exercise, the holder’s ownership of our Common Stock would exceed the ownership limitation. |

| |

|

| (2) |

The

securities are directly held by Armistice Capital Master Fund Ltd., a Cayman Islands exempted company (the “Master Fund”),

and may be deemed to be beneficially owned by: (i) Armistice Capital, LLC (“Armistice Capital”), as the investment manager

of the Master Fund; and (ii) Steven Boyd, as the Managing Member of Armistice Capital. The warrants are subject to a beneficial

ownership limitation of 4.99%, which such limitation restricts the Selling Stockholder from exercising that portion of the warrants

that would result in the Selling Stockholder and its affiliates owning, after exercise, a number of shares of common stock in excess

of the beneficial ownership limitation. The address of Armistice Capital Master Fund Ltd. is c/o Armistice Capital, LLC, 510 Madison

Avenue, 7th Floor, New York, NY 10022. |

| |

|

| (3) |

Assumes

that all securities registered within this offering will be sold. |

LEGAL

MATTERS

Lucosky

Brookman LLP will pass upon certain legal matters relating to the issuance and sale of the securities offered hereby on behalf of American

Rebel Holdings, Inc.

EXPERTS

Our

consolidated balance sheets as of December 31, 2022 and 2021, and the related consolidated statements of operations, stockholders’

equity (deficit), and cash flows for each of those two years have been audited by BF Borgers CPA, P.C., an independent registered public

accounting firm, as set forth in its report incorporated by reference and are included in reliance upon such report given on the authority

of such firm as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

Available

Information

We

file reports, proxy statements and other information with the SEC. Information filed with the SEC by us can be inspected and copied at

the Public Reference Room maintained by the SEC at 100 F Street, N.E., Washington, D.C. 20549. You may also obtain copies of this information

by mail from the Public Reference Room of the SEC at prescribed rates. Further information on the operation of the SEC’s Public

Reference Room in Washington, D.C. can be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains a web site that contains

reports, proxy and information statements and other information about issuers, such as us, who file electronically with the SEC. The

address of that website is http://www.sec.gov.

Our

website address is https://americanrebel.com. The information on our website, however, is not, and should not be deemed to be, a part

of this prospectus.

This

prospectus and any prospectus supplement are part of a registration statement that we filed with the SEC and do not contain all of the

information in the registration statement. The full registration statement may be obtained from the SEC or us, as provided below. Forms

of the documents establishing the terms of the offered securities are or may be filed as exhibits to the registration statement. Statements

in this prospectus or any prospectus supplement about these documents are summaries and each statement is qualified in all respects by

reference to the document to which it refers. You should refer to the actual documents for a more complete description of the relevant

matters. You may inspect a copy of the registration statement at the SEC’s Public Reference Room in Washington, D.C. or through

the SEC’s website, as provided above.

INCORPORATION

BY REFERENCE

The

SEC’s rules allow us to “incorporate by reference” information into this prospectus, which means that we can disclose

important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference

is deemed to be part of this prospectus, and subsequent information that we file with the SEC will automatically update and supersede

that information. Any statement contained in a previously filed document incorporated by reference will be deemed to be modified or superseded

for purposes of this prospectus to the extent that a statement contained in this prospectus modifies or replaces that statement.

We

incorporate by reference our documents listed below and any future filings made by us with the SEC under Sections 13(a), 13(c), 14 or

15(d) of the Securities Exchange Act of 1934, as amended, which we refer to as the “Exchange Act” in this prospectus, between

the date of this prospectus and the termination of the offering of the securities described in this prospectus. We are not, however,

incorporating by reference any documents or portions thereof, whether specifically listed below or filed in the future, that are not

deemed “filed” with the SEC, including any information furnished pursuant to Items 2.02 or 7.01 of Form 8-K or related exhibits

furnished pursuant to Item 9.01 of Form 8-K.

This

prospectus and any accompanying prospectus supplement incorporate by reference the documents set forth below that have previously been

filed with the SEC:

| ● |

Our

Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on April 14, 2023. |

| |

|

| ● |

Our

Quarterly Reports on Form 10-Q for the quarters ending March 31, 2023 and June 30, 2023, filed with the SEC on May 15, 2023 and August

14, 2023, respectively. |

| |

|

| ● |

Our

Current Reports on Form 8-K, filed with the SEC on May 1, 2023, May 16, 2023, May 25, 2023, June 26, 2023, June 28, 2023, July 11, 2023 (as amended), July 12, 2023, August 7, 2023, and September 8, 2023 (as amended). |

| |

|

| ● |

The

description of our Common Stock contained in our Registration Statement on Form 8-A, filed with the SEC on February 4, 2022, and

any amendment or report filed with the SEC for the purpose of updating the description. |

All

reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination

of this Offering, including all such documents we may file with the SEC after the date of the initial registration statement and prior

to the effectiveness of the registration statement, but excluding any information furnished to, rather than filed with, the SEC, will

also be incorporated by reference into this prospectus and deemed to be part of this prospectus from the date of the filing of such reports

and documents.

You

may request a free copy of any of the documents incorporated by reference in this prospectus (other than exhibits, unless they are specifically

incorporated by reference in the documents) by writing or telephoning us at the following address:

American

Rebel Holdings, Inc.

909

18th Avenue South, Suite A

Nashville,

Tennessee 37212

Telephone;

(833) 267-3235

Exhibits

to the filings will not be sent, however, unless those exhibits have specifically been incorporated by reference in this prospectus and

any accompanying prospectus supplement.

PART

II

INFORMATION

NOT REQUIRED IN PROSPECTUS

Item

14. Other Expenses of Issuance and Distribution.

The

following is an estimate of the expenses (all of which are to be paid by the registrant) that we may incur in connection with the securities

being registered hereby.

| SEC registration fee | |

$ | 564.65 | |

| Legal fees and expenses* | |

$ | 39,500.00 | |

| Accounting fees and expenses* | |

$ | 5,000.00 | |

| Total* | |

$ | 45,064.65 | |

| * |

These

fees are estimates. |

Item

15. Indemnification of Directors and Officers.

The

Nevada Revised Statutes limits or eliminates the personal liability of directors to corporations and their stockholders for monetary

damages for breaches of directors’ fiduciary duties as directors. Our Amended and Restated Bylaws include provisions that require

the company to indemnify our directors or officers against monetary damages for actions taken as a director or officer of our Company.

We are also expressly authorized to carry directors’ and officers’ insurance to protect our directors, officers, employees

and agents for certain liabilities. Our Second Amended and Restated Articles of Incorporation do not contain any limiting language regarding

director immunity from liability.

The

limitation of liability and indemnification provisions under the Nevada Revise Statutes and our Amended and Restated Bylaws may discourage

stockholders from bringing a lawsuit against directors for breach of their fiduciary duties. These provisions may also have the effect

of reducing the likelihood of derivative litigation against directors and officers, even though such an action, if successful, might

otherwise benefit us and our stockholders. However, these provisions do not limit or eliminate our rights, or those of any stockholder,

to seek non-monetary relief such as injunction or rescission in the event of a breach of a director’s fiduciary duties. Moreover,

the provisions do not alter the liability of directors under the federal securities laws. In addition, your investment may be adversely

affected to the extent that, in a class action or direct suit, we pay the costs of settlement and damage awards against directors and

officers pursuant to these indemnification provisions.

Item

16. Exhibits.

(a)

Exhibits

A

list of exhibits filed with this registration statement on Form S-3 is set forth on the Exhibit Index and is incorporated herein by reference.

Item

17. Undertakings.

The

undersigned registrant hereby undertakes:

| (1) |

To

file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement: |

| |

|

| (i) |

To

include any prospectus required by Section 10(a)(3) of the Securities Act of 1933; |

| |

|

| (ii) |

To

reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set

forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if

the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end

of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b)

if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering

price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and |

| |

|

| (iii) |

To

include any material information with respect to the plan of distribution not previously disclosed in the registration statement

or any material change to such information in the registration statement. |

| |

|

| (2) |

That

for the purpose of determining any liability under the Securities Act of 1933 each such post-effective amendment shall be deemed

to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall

be deemed to be the initial bona fide offering thereof. |

| |

|

| (3) |

To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering. |

| |

|

| (4) |

That,

for the purpose of determining liability under the Securities Act of 1933 to any purchaser, each prospectus filed pursuant to Rule

424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other

than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of

the date it is first used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus

that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration

statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior

to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the

registration statement or made in any such document immediately prior to such date of first use. |

| |

|

| (5) |

That,

for the purpose of determining liability of the registrant under the Securities Act of 1933

to any purchaser in the initial distribution of the securities:

The

undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration

statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold

to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and

will be considered to offer or sell such securities to such purchaser: |

| |

|

| (i) |

Any

preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule

424; |

| |

|

| (ii) |

Any

free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by

the undersigned registrant; |

| |

|

| (iii) |

The

portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant

or its securities provided by or on behalf of the undersigned registrant; and |

| |

|

| (iv) |

Any

other communication that is an offer in the offering made by the undersigned registrant to the purchaser. |

| |

|

| (6) |

The

undersigned Registrant hereby undertakes to provide to the underwriters at the closing specified in the underwriting agreement certificates

in such denominations and registered in such names as required by the underwriters to permit prompt delivery to each purchaser. |

| (7) |

Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons

of the Registrant pursuant to the provisions described in Item 14 above, or otherwise, the Registrant has been advised that in the

opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred

or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding)

is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will,

unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction

the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed

by the final adjudication of such issue. |

| (8) |

The

undersigned Registrant hereby undertakes: |

| (i) |

That

for purposes of determining any liability under the Securities Act, the information omitted from the form of prospectus filed as

part of this registration statement in reliance upon Rule 430A and contained in a form of prospectus filed by the Registrant pursuant

to Rule 424(b)(1) or (4), or 497(h) under the Securities Act shall be deemed to be part of this registration statement as of the

time it was declared effective. |

| (ii) |

That

for the purpose of determining any liability under the Securities Act, each post-effective amendment that contains a form of prospectus

shall be deemed to be a new registration statement relating to the securities offered therein, and this offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof. |

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that

it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by

the undersigned, thereunto duly authorized, in the City of New York, State of New York, on October 6, 2023.

| American

Rebel Holdings, Inc. |

|

| |

|

|

| By: |

/s/

Charles A. Ross, Jr. |

|

| Name: |

Charles

A. Ross, Jr.

|

|

| Title: |

Chief

Executive Officer |

|

POWER

OF ATTORNEY: KNOW ALL PERSONS BY THESE PRESENTS that each individual whose signature appears below constitutes and appoints Charles A.

Ross, Jr. , his true and lawful attorneys-in-fact and agents with full power of substitution, for him and in his name, place and stead,

in any and all capacities, to sign any and all amendments (including post-effective amendments) to this Registration Statement, and to

sign any registration statement for the same offering covered by the Registration Statement that is to be effective upon filing pursuant

to Rule 462(b) promulgated under the Securities Act, and all post-effective amendments thereto, and to file the same, with all exhibits

thereto and all documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact

and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done

in and about the premises, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming

all that said attorneys-in-fact and agents or any of them, or his, her or their substitute or substitutes, may lawfully do or cause to

be done or by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities

and on the dates indicated:

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Charles A. Ross, Jr. |

|

Chief

Executive Officer and Director |

|

October

6, 2023 |

| Charles

A. Ross, Jr. |

|

(Principal

Executive Officer) |

|

|

| |

|

|

|

|

| /s/

Doug E. Grau |

|

President

and Director |

|

October

6, 2023 |

| Doug

E. Grau |

|

(Principal

Accounting Officer) |

|

|

| |

|

|

|

|

| /s/

Michael Dean Smith |

|

Director |

|

October

6, 2023 |

| Michael

Dean Smith |

|

|

|

|

| |

|

|

|

|

| /s/

Corey Lambrecht |

|

Director |

|

October

6, 2023 |

| Corey

Lambrecht |

|

|

|

|

| |

|

|

|

|

| /s/

C. Stephen Cochennet |

|

Director |

|

October

6, 2023 |

| C.

Stephen Cochennet |

|

|

|

|

EXHIBIT

INDEX

| |

* |

Filed

herewith. |

| |

+ |

To

be filed upon amendment. |

Exhibit

23.1

CONSENT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We

hereby consent to the incorporation in this Registration Statement on Form S-3 of our report dated April 14, 2023, relating to the consolidated

financial statements American Rebel Holdings, Inc. for the years ended December 31, 2022 and 2021 and to all references to our firm included

in this Registration Statement.

Certified

Public Accountants

Lakewood,

CO

October

6, 2023

Exhibit

107

Calculation

of Filing Fee Tables

Form

S-3

American

Rebel Holdings, Inc.

Table

1: Newly Registered and Carry Forward Securities

| |

|

Security

Type |

|

Security

Class

Title |

|

Fee

Calculation

or

Carry

Forward

Rule |

|

Amount

Registered

(1) |

|

|

Proposed

Maximum

Offering

Price

Per

Unit |

|

|

Maximum

Aggregate

Offering

Price |

|

|

Fee

Rate |

|

|

Amount

of

Registration

Fee |

|

|

Carry

Forward

Form

Type |

|

|

Carry

Forward

File

Number |

|

|

Carry

Forward

Initial

effective

date |

|

|

Filing

Fee

Previously

Paid

In

Connection

with

Unsold

Securities

to

be

Carried

Forward |

| Newly Registered

Securities |

|

Fees

to Be

Paid |

|

Equity |

|

Common

Stock, par value $0.001 per share |

|

Rule

457(c) |

|

|

5,977,374 |

(2) |

|

$ |

0.6

4 |

(3) |

|

$ |

3,825,519.36 |

|

|

$ |

0.000147600 |

|

|

$ |

564.65 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fees

Previously

Paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Carry Forward

Securities |

Carry

Forward

Securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Total

Offering Amounts |

|

|

|

|

|

|

$ |

3,825,519.36 |

|

|

|

|

|

|

$ |

564.65 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Total

Fees Previously Paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Total

Fee Offsets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Net

Fee Due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

564.65 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Pursuant to Rule 416 under

the Securities Act of 1933 (the “Securities Act”), the shares being registered hereunder include such indeterminate number

of shares of common stock as may be issuable with respect to the shares being registered hereunder as a result of stock splits, stock

dividends or similar transactions. |

| |

|

| (2) |

Represents an aggregate

of 5,977,374 shares of common stock, par value $0.001 per share (the “Common Stock”), issuable upon two new common stock

purchase warrants (the “New Warrant A” and the “New Warrant B” and, together, the “New Warrants”. |

| |

|

| (3) |

Estimated solely for the

purpose of calculating the amount of the registration fee pursuant to Rule 457(c) under the Securities Act, based on the average

of the high and low prices of the common stock as reported on The Nasdaq Capital Market on October 5, 2023, of $0.64 per share. |

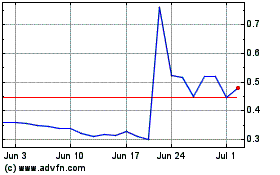

American Rebel (NASDAQ:AREB)

Historical Stock Chart

From Apr 2024 to May 2024

American Rebel (NASDAQ:AREB)

Historical Stock Chart

From May 2023 to May 2024