0001444192false0001444192dei:OtherAddressMember2023-10-062023-10-0600014441922023-10-062023-10-060001444192dei:BusinessContactMember2023-10-062023-10-06

As filed with the Securities and Exchange Commission on October 6, 2023

Registration Statement No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

ACASTI PHARMA INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Quebéc, Canada |

|

|

|

98-1359336 |

(State or other jurisdiction of incorporation or organization) |

|

|

|

(I.R.S. Employer Identification Number) |

Acasti Pharma Inc.

2572 boul. Daniel-Johnson, 2nd Floor

Laval, Québec, Canada H7T 2R3

(450) 686-4555

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Brian Ford

Interim Chief Financial Officer

2572 boul. Daniel-Johnson, 2nd Floor

Laval, Québec, Canada

(450) 686-4555

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

|

|

Jason Comerford |

Steven J. Abrams Hogan Lovells US LLP 1735 Market Street, 23rd Floor Philadelphia, PA 19103 (267) 675-4600 |

François Paradis Matthew Oliver Osler, Hoskin & Harcourt LLP 1000 rue De La Gauchetière Ouest, Suite 2100 Montréal, Québec H3B 4W5 (514) 904-8100 |

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

|

|

|

|

|

Non-accelerated filer |

☒ |

|

Smaller reporting company |

☒ |

|

|

|

|

|

Emerging growth company |

☐ |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a), may determine.

The information contained in this preliminary prospectus is not complete and may be changed. The selling shareholders listed herein may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED OCTOBER 6, 2023

PRELIMINARY PROSPECTUS

|

|

6,594,615 Common Shares |

The selling shareholders (the “Selling Shareholders”) named in this prospectus may use this prospectus to offer and resell from time to time up to 6,594,615 of our common shares, no par value per share, which are comprised of (i) 1,951,371 common shares (the “Shares”), (ii) 2,106,853 common shares (the “Pre-Funded Warrant Shares”) issuable upon the exercise of pre-funded warrants (the “Pre-Funded Warrants”), and (iii) 2,536,391 common shares (the “Common Warrant Shares” and together with the Pre-Funded Warrant Shares, the “Warrant Shares”) issuable upon the exercise of common warrants (“Common Warrants” and together with the Pre-Funded Warrants, the “Warrants”), each issued in a private placement that closed on September 25, 2023 (the “Private Placement Offering”), pursuant to that certain Securities Purchase Agreement by and between us and the Selling Shareholders, dated as of September 24, 2023 (the “Securities Purchase Agreement”).

The Shares and the Warrants were issued to the Selling Shareholders in reliance upon the exemption from the registration requirements in Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), and Rule 506 of Regulation D promulgated thereunder. We are registering the offer and resale of the Shares and Warrant Shares to satisfy the provisions of the Securities Purchase Agreement pursuant to which we agreed to register the resale of the Shares and the Warrant Shares.

We are not selling any of our common shares under this prospectus and will not receive any of the proceeds from the sale of the Shares and Warrant Shares by the Selling Shareholders. We will, however, receive the net proceeds of any Warrants exercised for cash.

The Selling Shareholders may sell or otherwise dispose of our common shares covered by this prospectus in a number of different ways and at varying prices. We provide more information about how the Selling Shareholders may sell or otherwise dispose of our common shares covered by this prospectus in the section entitled “Plan of Distribution” on page 13. Discounts, concessions, commissions and similar selling expenses attributable to the sale of our common shares covered by this prospectus will be borne by the Selling Shareholders. We will pay all expenses (other than discounts, concessions, commissions and similar selling expenses) relating to the registration of our common shares with the Securities and Exchange Commission (the “SEC”).

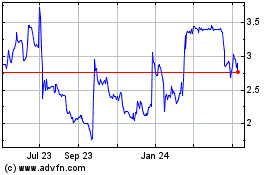

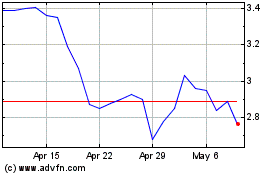

Our common shares are traded on The Nasdaq Capital Market under the symbol “ACST.” On October 5, 2023, the last reported sale price of our common shares on The Nasdaq Capital Market was $2.58 per share.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 6 of this prospectus and under similar headings in the documents incorporated by reference into this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2023

TABLE OF CONTENTS

i

ABOUT THIS PROSPECTUS

This prospectus relates to the resale by the Selling Shareholders identified in this prospectus under the caption “Selling Shareholders,” from time to time, of up to an aggregate of 6,594,615 of our common shares. We are not selling any of our common shares under this prospectus, and we will not receive any proceeds from the sale of our common shares offered hereby by the Selling Shareholders, although we will receive the net proceeds of any Warrants exercised for cash.

You should rely only on the information contained in this prospectus. We have not, and the Selling Shareholders have not, authorized anyone to provide you with information other than the information that has been provided or incorporated by reference in this prospectus and your reliance on any unauthorized information or representation is at your own risk. This prospectus may be used only in jurisdictions where offers and sales of these securities are permitted. You should assume that the information appearing in this prospectus is accurate only as of the date of this prospectus and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus, or any sale of our securities. Our business, financial condition and results of operations may have changed since those dates.

The information appearing in this prospectus, the documents incorporated by reference in this prospectus and any free writing prospectus authorized for use in connection with this offering is accurate only as of its respective date, regardless of the time of delivery of the respective document or of any sale of securities covered by this prospectus. You should not assume that the information contained in or incorporated by reference in this prospectus, or in any free writing prospectus that authorized for use in connection with this offering, is accurate as of any date other than the respective dates thereof.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

To the extent there is a conflict between the information contained in this prospectus, on the one hand, and the information contained in any document incorporated by reference filed with the SEC before the date of this prospectus, on the other hand, you should rely on the information in this prospectus. If any statement in a document incorporated by reference is inconsistent with a statement in another document incorporated by reference having a later date, the statement in the document having the later date modifies or supersedes the earlier statement.

Neither we nor the Selling Shareholders have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons who come into possession of this prospectus and any free writing prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus and any free writing prospectus applicable to that jurisdiction.

Industry and Market Data

This prospectus and the documents incorporated by reference include statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe that these industry publications and third-party research, surveys and studies are reliable, we have not independently verified such data and we do not make any representation as to the accuracy of the information.

ii

PROSPECTUS SUMMARY

This summary highlights information contained in greater detail elsewhere in this prospectus. This summary is not complete and does not contain all of the information you should consider in making your investment decision. You should read the entire prospectus carefully before making an investment in our securities. You should carefully consider, among other things, our financial statements and the related notes and the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in, or incorporated by reference into, this prospectus.

When we refer to Acasti Pharma Inc., and its subsidiaries, we use the terms “Acasti,” “the Company,” “us,” “we” and “our.”

Overview

We are focused on developing and commercializing products for rare and orphan diseases that have the potential to improve clinical outcomes by using our novel drug delivery technologies. We seek to apply new proprietary formulations to approved and marketed pharmaceutical compounds to achieve enhanced efficacy, faster onset of action, reduced side effects, more convenient drug delivery and increased patient compliance; all of which could result in improved patient outcomes. The active pharmaceutical ingredients used in the drug candidates under development by us may be already approved in a target indication or could be repurposed for use in new indications.

The existing well understood efficacy and safety profiles of these marketed compounds provides the opportunity for us to utilize the Section 505(b)(2) regulatory pathway under the Federal Food, Drug and Cosmetic Act for the development of our reformulated versions of these drugs, and therefore may provide a potentially shorter path to regulatory approval. Under Section 505(b)(2), if sufficient support of a product’s safety and efficacy either through previous U.S. Food and Drug Administration (“FDA”) experience or sufficiently within the existing and accepted scientific literature, can be established, it may eliminate the need to conduct some of the pre-clinical studies and clinical trials that new drug candidates might otherwise require.

Our therapeutic pipeline consists of three unique clinical stage and multiple pre-clinical stage assets supported by an intellectual property portfolio of more than 40 granted and pending patents in various jurisdictions worldwide. These drug candidates aim to improve clinical outcomes in the treatment of rare and orphan diseases by applying proprietary formulation and drug delivery technologies to existing pharmaceutical compounds to achieve improvements over the current standard of care, or to provide treatment for diseases with no currently approved therapies.

We believe that rare disorders represent an attractive area for drug development, and there remains an opportunity for us to utilize already approved drugs that have established safety profiles and clinical experience to potentially address significant unmet medical needs. A key advantage of pursuing therapies for rare disorders is the potential to receive orphan drug designation (“ODD”) from the FDA. Our three drug candidates currently in clinical development (or currently deferred, as described below) have received ODD status, provided certain conditions are met at new drug application (“NDA”) approval. ODD provides for seven years of marketing exclusivity in the United States post-launch, provided certain conditions are met, and the potential for faster regulatory review. ODD status can also result in tax credits of up to 50% of clinical development costs conducted in the United States upon marketing approval and a waiver of the NDA fees, which we estimate can translate into savings of approximately $3.2 million for our lead drug candidate, GTX-104. Developing drugs for rare diseases can often allow for clinical trials that are more manageably scaled and may require a smaller, more targeted commercial infrastructure.

The specific diseases targeted for drug development by us are well understood, although the patient populations suffering from such diseases may remain poorly served by available therapies or in some cases, approved therapies do not yet exist. We aim to effectively treat debilitating symptoms that result from these underlying diseases.

Our lead drug candidate:

•GTX-104 is a clinical stage, novel, injectable formulation of nimodipine being developed for intravenous infusion (IV) in aneurysmal subarachnoid hemorrhage (aSAH) patients to address significant unmet medical needs. The unique nanoparticle technology of GTX-104 facilitates aqueous formulation of insoluble nimodipine for a standard peripheral IV infusion. GTX-104 provides a convenient IV delivery of nimodipine in the Intensive Care Unit eliminating the need for nasogastric tube administration in unconscious or dysphagic patients. Intravenous delivery of GTX-104 also has the potential to lower food effects, drug-to-drug interactions, and eliminate potential dosing errors. Further, GTX-104 has the potential to better manage hypotension in aSAH patients. GTX-104 has been administered in over 150 healthy volunteers and was well tolerated with significantly lower inter- and intra-subject pharmacokinetic variability compared to oral nimodipine. The pivotal PK bridging study was successfully completed in May 2022.

1

Other pipeline drug candidates:

•GTX-102, an oral-mucosal betamethasone spray for the treatment of Ataxia Telangiectasia (“A-T”), a complex orphan pediatric genetic neurodegenerative disorder usually diagnosed in young children, for which no FDA approved treatment currently exists.

•GTX-101, a topical bioadhesive film-forming bupivacaine spray for Postherpetic Neuralgia (“PHN”), which can be persistent and often causes debilitating pain following infection by the shingles virus. We believe that GTX-101 could be administered to patients with PHN to treat pain associated with the disease.

In May 2023, we announced the strategic decision to prioritize development of GTX-104 with a goal to advance the product candidate to commercialization, while conserving resources as much as possible to complete development efficiently. Accordingly, we have elected to defer further clinical development of GTX-102 and GTX-101. We estimate that the deferral of GTX-102 and GTX-101 clinical development could be approximately three years given the timeline to complete the development and potential commercial launch of GTX-104. Further development of GTX-102 and GTX-101 will occur at such time as we obtain additional funding or enter into strategic partnerships for license or sale with third parties.

Our management team possesses significant experience in drug formulation and drug delivery research and development, clinical and pharmaceutical development and manufacturing, regulatory affairs, and business development, as well as being well-versed in late-stage drug development and commercialization. Importantly, our team is comprised of industry professionals with deep expertise and knowledge, including a world-renowned practicing neurosurgeon-scientist and respected authority in aSAH, as well as product development, chemistry, manufacturing and controls (“CMC”), planning, implementation, management, and execution of global Phase 2 and Phase 3 trials for a drug candidate for aSAH.

Recent Developments

September 2023 Private Placement Offering

On September 24, 2023, we entered into the Securities Purchase Agreement with the Selling Shareholder named herein in connection with the Private Placement Offering of our securities.

Pursuant to the Securities Purchase Agreement, we agreed to offer and sell the Shares, at a purchase price of $1.848 per Share and the Pre-Funded Warrants at a purchase price equal to the purchase price per Share less $0.0001. Each Pre-Funded Warrant is exercisable for one Pre-Funded Warrant Share at an exercise price of $0.0001 per Pre-Funded Warrant Share, are immediately exercisable and will expire once exercised in full. Pursuant to the Securities Purchase Agreement, we also issued to such Selling Shareholders the Common Warrants exercisable for the Common Warrant Shares. Under the terms of the Securities Purchase Agreement, for each Common Share and each Pre-Funded Warrant issued in the Private Placement Offering, an accompanying five-eighths (0.625) of a Common Warrant was issued to the purchaser thereof. Each whole Common Warrant is exercisable for one Common Warrant Share at an exercise price of $3.003 per Common Warrant Share, are immediately exercisable and will expire on the earlier of (i) the 60th day after the date of the acceptance by the U.S. Food and Drug Administration of a New Drug Application for the Company's product candidate GTX-104 or (ii) five years from the date of issuance. The Common Warrants were offered and sold at a purchase price of $0.125 per whole underlying Common Warrant Share, which purchase price was included in the offering price per Common Share and Pre-Funded Warrant issued in the Private Placement Offering.

Under the terms of the Warrants, a Selling Shareholder may not exercise Warrants held by such Selling Shareholder to the extent such exercise would cause such Selling Shareholder, together with its affiliates and attribution parties, to beneficially own a number of our common shares which would exceed 4.99% (or, at a Selling Shareholder’s election, 9.99% or up to 19.99% as described below), of our then outstanding common shares following such exercise, excluding for purposes of such determination common shares issuable upon exercise of such Warrants which have not been exercised, provided, however, such Selling Shareholder may increase or decrease such percentage to any other percentage not in excess of 19.99%, provided that any increase in such percentage shall not be effective until 61 days after such notice is delivered to us.

Shore Pharma LLC, an entity controlled by Vimal Kavuru, the Chair of our board of directors, and SS Pharma LLC, the beneficial owner of 5.5% of our common shares prior to the Private Placement Offering, each a related party of ours, participated in the Private Placement Offering.

The net proceeds to us from the Private Placement Offering was approximately $7.3 million, after deducting fees and expenses. The Common Shares, the Warrants, and the Warrant Shares were not registered under the Securities Act.

Pursuant to the terms of the Securities Purchase Agreement, we agreed to register for resale the Common Shares and the Warrant Shares. We are required to use our best efforts to cause the registration statement covering the securities described above to be declared effective as promptly as possible after the filing thereof, but in any event no later the 60th calendar day following the date of the Securities

2

Purchase Agreement. Failure by us to meet the filing deadlines and other requirements set forth in the Securities Purchase Agreement may subject us to certain liquidated damages.

The Private Placement Offering closed on September 25, 2023.

Risks Associated with Our Business

Our business is subject to a number of risks of which you should be aware before making an investment decision. These risks are discussed more fully in the “Risk Factors” section of this prospectus immediately following this prospectus summary and in Part I, Item 1A “Risk Factors” of our Annual Report on Form 10-K filed with the SEC on June 23, 2023 and our other SEC filings, which are incorporated by reference in this prospectus. These risks include, but are not limited to, the following:

•We are dependent on the success of our lead drug candidate, GTX-104.

•Clinical development is a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials may not be predictive of future trial results. Failure can occur at any stage of clinical development.

•We are subject to uncertainty relating to healthcare reform measures and reimbursement policies which, if not favorable to our drug candidates, could hinder or prevent our drug candidates’ commercial success.

•If we are unable to establish sales and marketing capabilities or enter into agreements with third parties to market and sell our drug products, if approved, we may be unable to generate any revenue.

•If we are unable to differentiate our drug products from branded reference drugs or existing generic therapies for similar treatments, or if the FDA or other applicable regulatory authorities approve products that compete with any of our drug products, our ability to successfully commercialize our drug products would be adversely affected.

•Our success depends in part upon our ability to protect our intellectual property for our drug candidates.

•Intellectual property rights do not necessarily address all potential threats to our competitive advantage.

•We do not have internal manufacturing capabilities, and if we fail to develop and maintain supply relationships with various third-party manufacturers, we may be unable to develop or commercialize our drug candidates.

•The design, development, manufacture, supply, and distribution of our drug candidates are highly regulated and technically complex.

Corporate Information

We were incorporated on February 1, 2002 under Part 1A of the Companies Act(Québec) under the name “9113-0310 Québec Inc.” On February 14, 2011, the Business Corporations Act (Québec), or QBCA, came into effect and replaced the Companies Act (Québec). We are now governed by the QBCA. On August 7, 2008, pursuant to a Certificate of Amendment, we changed our name to “Acasti Pharma Inc.” We became a reporting issuer in the Province of Québec on November 17, 2008. On August 27, 2021, Acasti completed its acquisition of Grace Therapeutics Inc. via a merger. Following completion of the merger, Grace Therapeutics Inc. became our wholly owned subsidiary and was renamed Acasti Pharma U.S. Inc.

Our principal executive offices are located at 2572 boul. Daniel-Johnson, 2nd Floor, Laval, Québec, Canada H7E 2R3, and our telephone number is (450)-686-4555. Our website address is www.acasti.com. We do not incorporate the information on, or accessible through, our website into this prospectus, and you should not consider any information on, or accessible through, our website as part of this prospectus.

3

THE OFFERING

|

|

|

|

|

|

|

|

|

Common shares to be offered by the Selling Shareholders |

Up to 6,594,615 common shares. |

|

|

Common shares outstanding prior to this offering |

7,448,033 common shares |

|

|

Common shares to be outstanding after this offering |

14,042,648 common shares |

|

|

Use of proceeds |

We will not receive any proceeds from the sale of our common shares offered hereby by the Selling Shareholders, although we will receive the net proceeds of any Warrants exercised for cash. |

|

|

Risk Factors |

An investment in our securities involves a high degree of risk. See “Risk Factors” beginning on page 6 of this prospectus and the similarly titled sections in the documents incorporated by reference into this prospectus. |

|

|

Nasdaq Capital Market symbol |

Our common shares are listed on The Nasdaq Capital Market under the symbol “ACST.” We do not intend to apply for listing of the Warrants on any securities exchange or nationally recognized trading system. |

|

Outstanding Shares

The number of our common shares to be outstanding after this offering is based on 7,448,033 common shares outstanding as of September 24, 2023, plus 1,951,371 Shares and 4,643,244 Warrant Shares issued in the Private Placement Offering, and excludes:

•561,365 common shares issuable upon the exercise of stock options outstanding as of October 5, 2023 at a weighted-average exercise price of $4.14 per share; and

•921,775 common shares available for future issuance under our Stock Option Plan and Equity Incentive Plan as of October 5, 2023.

4

Share Consolidation Summary Data

On July 4, 2023, we filed Articles of Amendment to our Articles of Incorporation, as amended, with the Registraire des entreprises du Québec to implement a 1-for-6 reverse stock split of our then-outstanding common shares (the “Share Consolidation”). Our common shares began trading on the Nasdaq on a consolidated basis on July 10, 2023. The summary data in the following table presents a reconciliation of data derived from the consolidated financial statements for the years ended March 31, 2023 and 2022 as revised to reflect the impact of the Share Consolidation.

|

|

|

|

|

|

|

|

|

|

Year ended March 31, 2023 |

|

|

Year ended March 31, 2022 |

As Originally filed |

|

|

|

|

|

|

Basic and diluted loss per share ($) |

|

$ |

(0.95) |

|

$ |

(0.27) |

Weighted average number of common shares, basic and diluted (#) |

|

|

44,612,831 |

|

|

36,841,762 |

Common Shares |

|

|

44,612,831 |

|

|

44,288,183 |

Stock Options |

|

|

4,445,492 |

|

|

2,989,381 |

Stock Options strike price |

|

$ |

2.27 |

|

$ |

2.98 |

May 2018 Canadian public offering warrants |

|

|

824,218 |

|

|

824,218 |

May 2018 Canadian public offering warrants strike price |

|

$ |

10.48 |

|

$ |

10.48 |

December 2017 U.S. public offering warrants |

|

|

- |

|

|

884,120 |

December 2017 U.S. public offering warrants strike price |

|

$ |

- |

|

$ |

10.08 |

December 2017 US public offering broker warrants |

|

|

- |

|

|

32,390 |

December 2017 US public offering broker warrants strike price |

|

$ |

- |

|

$ |

10.10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As Revised With Impact of Share Consolidation |

|

|

|

|

|

|

Basic and diluted loss per share ($) |

|

$ |

(5.70) |

|

$ |

(1.62) |

Weighted average number of common shares, basic and diluted (#) |

|

|

7,435,472 |

|

|

6,140,294 |

Common Shares |

|

|

7,435,533 |

|

|

7,381,425 |

Stock Options |

|

|

740,957 |

|

|

498,231 |

Stock Options strike price |

|

$ |

13.60 |

|

$ |

17.88 |

May 2018 Canadian public offering warrants |

|

|

137,370 |

|

|

137,370 |

May 2018 Canadian public offering warrants strike price |

|

$ |

62.88 |

|

$ |

62.88 |

December 2017 U.S. public offering warrants |

|

|

- |

|

|

147,354 |

December 2017 U.S. public offering warrants strike price |

|

$ |

- |

|

$ |

60.48 |

December 2017 US public offering broker warrants |

|

|

- |

|

|

5,399 |

December 2017 US public offering broker warrants strike price |

|

$ |

- |

|

$ |

60.60 |

5

RISK FACTORS

An investment in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should carefully consider the risks discussed under the section captioned “Risk Factors” contained in our Annual Report on Form 10-K for the fiscal year ended March 31, 2023 and other documents that we file with the SEC, which are incorporated by reference in this prospectus, together with the information included in this prospectus and documents incorporated by reference herein, and in any free writing prospectus that we have authorized for use in connection with this offering. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be harmed. In such case, the trading price of our common shares could decline, and our shareholders may lose all or part of their investment in the shares of our common shares. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also adversely affect our business.

6

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference contain forward-looking statements that involve substantial risks and uncertainties. All statements, other than statements of historical facts, included in this prospectus or the documents incorporated herein by reference regarding our strategy, future operations, future product research or development, future financial position, future revenues, projected costs, prospects, plans and objectives of management, are forward-looking statements. The words “anticipate,” “believe,” “goals,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “predict,” “project,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words.

The forward-looking statements in this prospectus and the documents incorporated by reference include, among other things, statements about:

•our clinical trials, including expected costs, goals, timing and other expectations related thereto;

•our ability to build a premier, late-stage specialty pharmaceutical company focused in rare and orphan disease and, on developing and commercializing products that improve clinical outcomes using our novel drug delivery technologies;

•our ability to apply new proprietary formulations to existing pharmaceutical compounds to achieve enhanced efficacy, faster onset of action, reduced side effects, and more convenient drug delivery that can result in increased patient compliance;

•the potential for our drug candidates to receive orphan drug designation from the FDA or regulatory approval under the Section 505 (b)(2) regulatory pathway under the Federal Food, Drug and Cosmetic Act;

•the future prospects of our GTX-104, GTX-102 and GTX-101 drug candidates;

•our plan to prioritize the development of GTX-104;

•our plan to maximize the value of our de-prioritized drug candidates, GTX-102 and GTX-101, including through potential development, out-licensing or sale of those drug candidates;

•the quality of our clinical data, the cost and size of our development programs, expectations and forecasts related to our target markets and the size of our target markets; the cost and size of our commercial infrastructure and manufacturing needs in the United States, European Union, and the rest of the world; and our expected use of a range of third-party contract research organizations and contract manufacturing organizations at multiple locations;

•expectations and forecasts related to our intellectual property portfolio, including but not limited to the probability of receiving orphan drug designation from the FDA for our leading pipeline products; our patent portfolio strategy; and outcomes of our patent filings and extent of patent protection;

•our strategy, future operations, prospects and the plans of our management with a goal to enhance shareholder value;

•our intellectual property position and duration of our patent rights;

•our need for additional financing, and our estimates regarding our operating runway and timing for future financing and capital requirements;

•our expectation regarding our financial performance, including our costs and expenses, liquidity, and capital resources;

•our projected capital requirements to fund our anticipated expenses; and

•our ability to establish strategic partnerships or commercial collaborations or obtain non-dilutive funding.

We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have included important factors in the cautionary statements included in this prospectus, particularly under “Risk Factors” on page 6 of this prospectus and the documents incorporated herein that we believe could cause actual results or events to differ materially from the forward-looking statements that we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, collaborations or investments we may make. The following are some of the factors that could cause actual results to differ materially from the anticipated results or other expectations expressed, anticipated or implied in our forward-looking statements:

•we are dependent on the success of our lead drug candidate, GTX-104;

•clinical development is a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials may not be predictive of future trial results. Failure can occur at any stage of clinical development;

•we are subject to uncertainty relating to healthcare reform measures and reimbursement policies which, if not favorable to our drug candidates, could hinder or prevent our drug candidates’ commercial success;

7

•if we are unable to establish sales and marketing capabilities or enter into agreements with third parties to market and sell our drug products, if approved, we may be unable to generate any revenue;

•if we are unable to differentiate our drug products from branded reference drugs or existing generic therapies for similar treatments, or if the U.S. Food and Drug Administration (“FDA”) or other applicable regulatory authorities approve products that compete with any of our drug products, our ability to successfully commercialize our drug products would be adversely affected;

•our success depends in part upon our ability to protect our intellectual property for our drug candidates;

•intellectual property rights do not necessarily address all potential threats to our competitive advantage;

•we do not have internal manufacturing capabilities, and if we fail to develop and maintain supply relationships with various third-party manufacturers, we may be unable to develop or commercialize our drug candidates;

•the design, development, manufacture, supply, and distribution of our drug candidates are highly regulated and technically complex; and

•the other risks and uncertainties identified in Item 1A. Risk Factors included in our Annual Report on Form 10-K for the year ended March 31, 2023.

You should read this prospectus, the documents that we have incorporated by reference into this prospectus, and the documents that we have filed as exhibits to this prospectus completely and with the understanding that our actual future results may be materially different from what we expect.

Except as required by law, we undertake no obligation to update or revise any forward-looking statements to reflect new information or future events or developments. You should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements. Before deciding to purchase our securities, you should carefully consider the risk factors discussed and incorporated by reference in this prospectus and the documents incorporated herein.

8

USE OF PROCEEDS

The net proceeds from any disposition of our common shares covered hereby will be received by the Selling Shareholders. We will not receive any of the proceeds from any such common shares offered by this prospectus. We will, however, receive the net proceeds of any Warrants exercised for cash. We expect to use the net proceeds received from the exercise of the Warrants for cash, if any, for clinical trial expenses in connection with the anticipated completion of our Phase 3 clinical trial for GTX-104, working capital and other general corporate purposes.

9

DIVIDEND POLICY

We have never paid cash dividends on our common shares. Moreover, we do not anticipate paying periodic cash dividends on our common shares for the foreseeable future. We intend to use all available cash and liquid assets in the operation and expansion of our business. Any determination to pay dividends in the future will be at the discretion of our board of directors and will depend upon our results of operations, financial condition, contractual restrictions, restrictions imposed by applicable law and other factors our board of directors deems relevant.

10

SELLING SHAREHOLDERS

Our common shares being offered by the Selling Shareholders are those Shares previously issued to the Selling Shareholders in the Private Placement Offering, and those Warrant Shares issuable to the Selling Shareholders upon exercise of the Warrants sold to the Selling Shareholders in the Private Placement Offering. We are registering the Shares and Warrant Shares in order to permit the Selling Shareholders to offer the Shares and Warrant Shares for resale from time to time.

Shore Pharma LLC, an entity controlled by Vimal Kavuru, the Chair of our board of directors and the previous chairman of the Grace Therapeutics Inc. board of directors, prior to its acquisition by the Company; and SS Pharma LLC, the beneficial owner of 5.5% of our common shares prior to the Private Placement Offering, each a related party of ours, participated in the Private Placement Offering and are included as Selling Shareholders hereunder. Other than Shore Pharma LLC and SS Pharma LLC, none of the other Selling Shareholders, nor any person having control over the Selling Shareholders, have held any position or office with us or our affiliates within the last three years or have had a material relationship with us or any of our predecessors or affiliates within the past three years.

The Selling Shareholders may sell some, all or none of their Shares and Warrant Shares. We do not know how long the Selling Shareholders will hold the Warrants, whether any Warrants will be exercised, and upon such exercise, how long such Selling Shareholders will hold the Warrant Shares before selling them, and we currently have no agreements, arrangements or understandings with the Selling Shareholders regarding the sale of any of the Shares or Warrant Shares.

The following table presents information regarding the Selling Shareholders and the Shares and Warrant Shares that each may offer and sell from time to time under this prospectus. The table is prepared based on information supplied to us by the Selling Shareholders without regard to ownership limitations set forth in the applicable agreements or other documents relating to such Shares, Warrants and Warrant Shares, including (i) all of the Shares and Warrant Shares offered hereby, and (ii) to our knowledge, all other securities held by each of the Selling Shareholders as of the date hereof, and reflects their respective holdings as of October 5, 2023. Except as noted below, beneficial ownership is determined in accordance with Section 13(d) of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), and Rule 13d-3 thereunder.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares Beneficially Owned After this Offering |

|

Selling Shareholder |

|

Number of Shares Beneficially

Owned Before this

Offering(1) |

|

Number of Shares to be Sold in

this Offering |

|

Number of Shares |

|

Percentage of Total Outstanding Common Shares(1) |

|

ADAR1 Partners, LP (2) |

|

|

3,323,885 |

|

|

3,297,306 |

|

|

26,579 |

|

|

* |

|

Joseph F. Lawler (3) |

|

|

1,099,103 |

|

|

1,099,103 |

|

|

0 |

|

|

- |

|

SS Pharma LLC (4) |

|

|

1,505,846 |

|

|

1,099,103 |

|

|

406,743 |

|

|

2.896% |

|

Shore Pharma LLC(5) |

|

|

1,610,808 |

|

|

1,099,103 |

|

|

511,705 |

|

|

4% |

|

* Represents beneficial ownership of less than one percent.

(1)The ability to exercise the Warrants held by the Selling Shareholders is subject to a beneficial ownership limitation that, at the time of initial issuance of the Warrants, was capped at 4.99%, 9.99% or 19.99% (solely with respect to Shore Pharma LLC) beneficial ownership of our issued and outstanding common shares (post-exercise). These beneficial ownership limitations may be adjusted up or down (up to 19.99%), subject to providing advanced notice to us, provided, however, such Selling Shareholder may increase or decrease such percentage to any other percentage not in excess of 19.99%, provided that any increase in such percentage shall not be effective until 61 days after such notice is delivered to the Company. Beneficial ownership as reflected in the Selling Shareholder table reflects the total number of shares potentially issuable underlying the Warrants and does not give effect to these beneficial ownership limitations. Accordingly, actual beneficial ownership, as calculated in accordance with Section 13(d) and Rule 13d-3 thereunder may be lower than as reflected in the table.

(2)The address of ADAR1 Partners, LP is c/o ADAR1 Capital Management, LLC, 3503 Wild Cherry Drive, Building 9, Austin, TX 78738. The Warrants held by ADAR1 Partners, LP are subject to a beneficial ownership limitation of 4.99%, which limitation restricts ADAR1 Partners, LP from exercising that portion of the Warrants that would result in ADAR1 Partners, LP and its affiliates owning, after exercise, a number of common shares in excess of the beneficial ownership limitation. The amounts and percentages in the table do not give effect to the beneficial ownership limitation.

(3)The address of Joseph F. Lawler is 2110 Ranch Road 620 S, #341732, Lakeway, TX 78734. The Warrants held by Joseph F. Lawler are subject to a beneficial ownership limitation of 4.99%, which limitation restricts Joseph F. Lawler from exercising that portion of the Warrants that would result in Joseph F. Lawler and his affiliates owning, after exercise, a number of common shares in excess of the beneficial ownership limitation. The amounts and percentages in the table do not give effect to the beneficial ownership limitation.

11

(4)The address for SS Pharma LLC is 186 Princeton Hightsown Road, Building 3A, Suite 6, West Windsor, New Jersey 08550. The Warrants held by SS Pharma LLC are subject to a beneficial ownership limitation of 9.99%, which limitation restricts SS Pharma LLC from exercising that portion of the Warrants that would result in SS Pharma LLC and its affiliates owning, after exercise, a number of common shares in excess of the beneficial ownership limitation. The amounts and percentages in the table do not give effect to the beneficial ownership limitation.

(5)The securities are directly held by Shore Pharma LLC and may be deemed to be beneficially owned by Vimal Kavuru, the Chair of the Company’s board of directors, as the sole member of Shore Pharma LLC. The address of Shore Pharma LLC is 11 Maacka Drive, Holmdel, NJ 07733. The Warrants held by Shore Pharma LLC are subject to a beneficial ownership limitation of 19.99%, which limitation restricts Shore Pharma LLC from exercising that portion of the Warrants that would result in Shore Pharma LLC and its affiliates owning, after exercise, a number of common shares in excess of the beneficial ownership limitation. The amounts and percentages in the table do not give effect to the beneficial ownership limitation.

12

PLAN OF DISTRIBUTION

We are registering the Shares and Warrant Shares on behalf of the Selling Shareholders named herein. The Selling Shareholders and any of their pledgees, assignees, and successors-in-interest may, from time to time, on a continuous or delayed basis, sell any or all of their securities covered hereby directly to one or more purchasers or through brokers, dealers, or underwriters who may act solely as agents at market prices prevailing at the time of sale, at prices related to the prevailing market prices, at negotiated prices, or at fixed prices, which may be changed on any stock exchange, market or trading facility on which our common shares are traded or in private transactions. The sale of the Selling Shareholders’ securities offered by this prospectus may be effected in one or more of the following methods:

•ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

•transactions involving cross or block trades;

•purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

•exchange distributions in accordance with the rules of the applicable exchange;

•privately negotiated transactions;

•short sales after the registration statement of which this prospectus forms a part becomes effective;

•transactions through broker-dealers to sell a specified number of such securities at a stipulated price per share;

•through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

•“at the market” into an existing market for our common shares;

•through the writing of options on the securities;

•a combination of any such methods of sale; and

•any other method permitted pursuant to applicable law.

In order to comply with the securities laws of certain states, if applicable, the securities of the Selling Shareholders may be sold only through registered or licensed brokers or dealers. In addition, in certain states, such securities may not be sold unless they have been registered or qualified for sale in the state or an exemption from the registration or qualification requirement is available and complied with.

The Selling Shareholders may also sell or transfer their securities pursuant to any available exemption from the registration requirements of the Securities Act, including under Rule 144 promulgated under the Securities Act, or Rule 144, if available, rather than under this prospectus. In addition, the Selling Shareholders may transfer their securities by other means not described in this prospectus.

The Selling Shareholders may also sell their securities directly to market makers acting as principals and/or broker-dealers acting as agents for themselves or their customers. Such broker-dealers may receive compensation in the form of discounts, concessions or commissions from the Selling Shareholders and/or the purchasers of such securities for whom such broker-dealers may act as agents or to whom they sell as principal or both, which compensation as to a particular broker-dealer might be in excess of customary commissions. Market makers and block purchasers purchasing the securities will do so for their own account and at their own risk. It is possible that the Selling Shareholders will attempt to sell their securities in block transactions to market makers or other purchasers at a price per share that may be below the then market price.

Brokers, dealers, underwriters, or agents participating in the distribution of the securities held by the Selling Shareholders as agents may receive compensation in the form of commissions, discounts, or concessions from the Selling Shareholders and/or purchasers of the securities for whom the broker-dealers may act as agent. The Selling Shareholders may agree to indemnify any agent, dealer or broker-dealer that participates in transactions involving sales of their securities if liabilities are imposed on that person under the Securities Act.

The Selling Shareholders have advised us that they have not entered into any agreements, understandings or arrangements with any underwriters or broker-dealers regarding the sale of their securities, nor is there an underwriter or coordinating broker acting in connection with a proposed sale of securities by the Selling Shareholders. If we are notified by the Selling Shareholders that any material arrangement has been entered into with a broker-dealer for the sale of securities if required, we will file a supplement to this prospectus.

In connection with the sale of the securities or interests therein, the Selling Shareholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they assume. The Selling Shareholders may also sell their securities short and deliver these securities to close out their short positions, or loan or pledge the securities to broker-dealers that in turn may sell these securities. The Selling Shareholders may also enter into option or other transactions with broker-dealers or other financial institutions or create one or more derivative securities that require the

13

delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

With regard only to any securities it sells for its own behalf, each Selling Shareholder may be deemed an “underwriter” within the meaning of the Securities Act. This offering as it relates to each Selling Shareholder will terminate on the date that all securities offered by the Selling Shareholder pursuant to this prospectus have been sold.

We may suspend the sale of securities by the Selling Shareholders pursuant to this prospectus for certain periods of time for certain reasons, including if the prospectus is required to be supplemented or amended to include additional material information.

If the Selling Shareholders use this prospectus for any sale of their securities, the Selling Shareholders will be subject to the prospectus delivery requirements of the Securities Act.

We will pay the expenses in connection with the registration of the securities being registered hereunder. We have agreed to indemnify the Selling Shareholders against certain losses, claims, damages and liabilities in accordance with the Securities Purchase Agreement.

We agreed to use commercially reasonable efforts to keep this registration statement continuously effective under the Securities Act, and prepare and file prospectus supplements that includes any information previously omitted from the prospectus filed as part of the initial registration statement and pre- and post-effective amendments as necessary, until the date that all of the securities have been sold thereunder or pursuant to Rule 144.

Regulation M

The anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of our common shares and activities of the Selling Shareholders.

While the Selling Shareholders are engaged in a distribution of the securities included in this prospectus they are required to comply with Regulation M promulgated under the Exchange Act. With certain exceptions, Regulation M precludes the Selling Shareholders, any affiliated purchasers, and any broker-dealer or other person who participates in the distribution from bidding for or purchasing, or attempting to induce any person to bid for or purchase any security that is the subject of the distribution until the entire distribution is complete. Regulation M also prohibits any bids or purchases made in order to stabilize the price of a security in connection with the distribution of that security. All of the foregoing may affect the marketability of the shares offered hereby this prospectus.

14

DESCRIPTION OF COMMON SHARES

The summary of general terms and provisions of our common stock set forth below does not purport to be complete and is subject to and qualified by reference to our Articles of Incorporation, as amended (the “Articles of Incorporation”) and Amended and Restated General By-laws (the “Bylaws,” and together with the Articles of Incorporation, the “Charter Documents”), each of which is included as an exhibit hereto or to our most recent Annual Report on Form 10-K filed with the SEC and incorporated by reference herein. For additional information, please read the Charter Documents and the applicable provisions of the QBCA.

Authorized Common Shares

We are authorized to issue an unlimited number of common shares, no par value per share. As of October 3, 2023, there were 9,399,404 common shares outstanding, held by 114 shareholders of record. This figure does not reflect the number of beneficial owners of common shares as a single shareholder of record often holds common shares in nominee name (also referred to as, in “street name”) on behalf of multiple beneficial owners.

Rights of Common Shares

Holders of common shares are entitled to receive notice of any meetings of shareholders, to attend and to cast one vote per common share at all such meetings. Holders of common shares do not have cumulative voting rights with respect to the election of directors and, accordingly, holders of a majority of the common shares entitled to vote in any election of directors may elect all directors standing for election.

Our common shares do not carry any pre-emptive, subscription, redemption, retraction, conversion or exchange rights, nor do they contain any cancellation, surrender, sinking or purchase fund provisions, nor provisions permitting or restricting the issuance of additional securities or requiring a holder of common shares to contribute additional capital.

Dividends

Under the QBCA and our By-laws, dividends may be declared at the discretion of our board of directors. We may pay dividends unless there are reasonable grounds for believing that (i) we are insolvent, or (ii) the payment of the dividend would render us insolvent. The Articles of Incorporation provide that the holders of common shares shall be entitled to receive any dividends declared by our board of directors and we shall pay dividends thereon, as and when declared by our board of directors, according to the order of priority applicable to the classes of shares set out in the Articles of Incorporation.

Winding-up and Dissolution

In the event of our voluntary or involuntary winding-up or dissolution, or any other distribution of our assets among our shareholders for the purposes of winding up our affairs, the holders of common shares will be entitled to receive, after payment by us to the holders of preferred shares, if any, ranking prior to common shares regarding the distribution of our assets in the case of winding-up or dissolution, share for share, the remainder of our property, with neither preference nor distinction.

Outstanding Warrants

On September 25, 2023, we issued to the Selling Shareholders (i) Pre-Funded Warrants to purchase up to 2,106,853 Pre-Funded Warrant Shares and (ii) Common Warrants to purchase up to 2,536,391 Common Warrant Shares. Each Common Warrant will expire on the earlier of (i) the 60th day after the date of the acceptance by the U.S. Food and Drug Administration of a New Drug Application for the Company's product candidate GTX-104 or (ii) five years from the date of issuance, and may be exercised at an exercise price of $3.003 per Common Warrant Share. The Pre-Funded Warrants are exercisable immediately upon issuance, have an exercise price of $0.0001 per Pre-Funded Warrant Share and expire when exercised in full. Under the terms of the Warrants, a holder may not exercise the Warrants to the extent such exercise would cause such holder, together with its affiliates and attribution parties, to beneficially own a number of our common shares which would exceed 4.99%, 9.99% or 19.99%, at the holder’s election, of our then outstanding common shares following such exercise, excluding for purposes of such determination our common shares issuable upon exercise of such Warrants which have not been exercised, provided, however, such holder may increase or decrease such percentage to any other percentage not in excess of 19.99%, provided that any increase in such percentage shall not be effective until 61 days after such notice is delivered to us.

If a Fundamental Transaction (as defined in the Warrants) occurs, then the successor entity will succeed to, and be substituted for us, and may exercise every right and power that we may exercise and will assume all of our obligations under the Warrants with the same effect as if such successor entity had been named in the Warrants itself. If holders of common shares are given a choice as to the securities, cash or property to be received in such a Fundamental Transaction, then the holder shall be given the same choice as to the consideration it would receive upon any exercise of the Warrants following such a Fundamental Transaction. Additionally, as more fully

15

described in the Common Warrants, in the event of certain Fundamental Transactions, the holders of the Common Warrants will be entitled to receive cash consideration in an amount equal to the Black Scholes value of the Common Warrants.

Listing

Our common shares are traded on the Nasdaq Capital Market under the symbol “ACST.”

Transfer Agent and Registrar

The transfer agent and registrar for our common shares is Computershare Investor Services Inc.

MATERIAL DIFFERENCES BETWEEN THE BUSINESS CORPORATIONS ACT (QUÉBEC) AND THE DELAWARE GENERAL CORPORATION LAW

We are governed by the QBCA, which is generally similar to laws applicable to U.S. corporations. Significant differences between the QBCA and the Delaware General Corporation Law, or DGCL, which governs companies incorporated in the State of Delaware, include the differences summarized below. This summary is not an exhaustive review of the two statutes, and reference should be made to the full text of both statutes for particulars of the differences.

|

|

|

|

|

|

|

Delaware |

|

QBCA |

|

|

|

|

|

Number and Election of Directors |

|

Under the DGCL, the board of directors must consist of at least one director. The number of directors shall be fixed by the bylaws of the corporation, unless the certificate of incorporation fixes the number of directors, in which case a change in the number of directors shall only be made by an amendment of the certificate of incorporation. Under the DGCL, directors are elected at annual stockholder meetings by plurality vote of the stockholders, unless a shareholder- adopted bylaw prescribes a different required vote. |

|

Under the QBCA, the board of directors of a corporation must consist of at least three members, at least two of whom must not be officers or employees of the corporation or an affiliate of the corporation, so long as the corporation remains a “reporting issuer” for purposes of the QBCA, which includes a corporation that has made a distribution of securities to the public. Under the QBCA, directors are elected by the shareholders, in the manner and for the term, not exceeding three years, set out in the corporation’s bylaws. Our bylaws provide that our directors are elected at each annual meeting of shareholders at which such an election is required. |

|

|

|

|

|

Removal of Directors |

|

Under the DGCL, any director or the entire board of directors may be removed, with or without cause, by the holders of a majority of the shares then entitled to vote at an election of directors, except (i) unless the certificate of incorporation provides otherwise, in the case of a corporation whose board of directors is classified, stockholders may effect such removal only for cause, or (ii) in the case of a corporation having cumulative voting, if less than the entire board of directors is to be removed, no director may be removed without cause if the votes cast against his removal would be sufficient to elect him if then cumulatively voted at an election of the entire board of directors, or, if there are classes of directors, at an election of the class of directors of which he is a part. |

|

Under the QBCA, unless the articles of a corporation provide for cumulative voting (which is not the case for us), shareholders of the corporation may, by resolution passed by a majority of the vote cast thereon at a special meeting of shareholders, remove any or all directors from office and may elect any qualified person to fill the resulting vacancy. |

16

|

|

|

|

|

|

|

|

|

|

Vacancies on the Board of Directors |

|

Under the DGCL, vacancies and newly created directorships may be filled by a majority of the directors then in office (even though less than a quorum) or by a sole remaining director unless (i) otherwise provided in the certificate of incorporation or bylaws of the corporation or (ii) the certificate of incorporation directs that a particular class of stock is to elect such director, in which case a majority of the other directors elected by such class, or a sole remaining director elected by such class, will fill such vacancy. |

|

Under the QBCA, vacancies that exist on the board of directors may generally be filled by the board if the remaining directors constitute a quorum. In the absence of a quorum, the remaining directors shall call a meeting of shareholders to fill the vacancy. If the directors refuse or fail to call a meeting or if there are no directors then in office, the meeting may be called by any shareholder. |

|

|

|

|

|

Board of Director Quorum and Vote Requirements |

|

Under the DGCL, a majority of the total number of directors shall constitute a quorum for the transaction of business unless the certificate of incorporation or bylaws require a greater number. The bylaws may lower the number required for a quorum to one-third the number of directors, but no less. Under the DGCL, the board of directors may take action by the majority vote of the directors present at a meeting at which a quorum is present unless the certificate of incorporation or bylaws require a greater vote. |

|

Under the QBCA, subject to the corporation’s bylaws, a majority of the directors in office constitutes a quorum at any meeting of the board. Our bylaws also provide that a majority of the directors in office constitutes a quorum at any meeting of the board. Under the QBCA, a quorum of directors may exercise all the powers of the directors despite any vacancy on the board. |

|

|

|

|

|

Transactions with Directors and Officers |

|

The DGCL generally provides that no transaction between a corporation and one or more of its directors or officers, or between a corporation and any other corporation or other organization in which one or more of its directors or officers, are directors or officers, or have a financial interest, shall be void or voidable solely for this reason, or solely because the director or officer is present at or participates in the meeting of the board or committee which authorizes the transaction, or solely because any such director’s or officer’s votes are counted for such purpose, if (i) the material facts as to the director’s or officer’s interest and as to the transaction are known to the board of directors or the committee, and the board or committee in good faith authorizes the transaction by the affirmative votes of a majority of the disinterested directors, even though the disinterested directors be less than a quorum (ii) the material facts as to the director’s or officer’s interest and as to the transaction are disclosed or are known to the stockholders entitled to vote thereon, and the transaction is specifically approved in good faith by vote of the stockholders; or (iii) the transaction is fair as to the |

|

Under the QBCA, every director or officer of a corporation must disclose the nature and value of any interest he or she has in a contract or transaction to which the corporation is a party. For the purposes of this rule, “interest” means any financial stake in a contract or transaction that may reasonably be considered likely to influence decision-making. Furthermore, a proposed contract or a proposed transaction, including related negotiations, is considered a contract or transaction. In addition, a director or an officer must disclose any contract or transaction to which the corporation and any of the following are a party: (i) an associate of the director or officer; (ii) a group of which the director or officer is a director or officer; or (iii) a group in which the director or officer or an associate of the director or officer has an interest. Such disclosure is required even for a contract or transaction that does not require approval by the board of directors. If a director is required to disclose his or her interest in a contract or transaction, such director is not allowed to vote on any resolution to approve, amend or terminate the contract or transaction or be present during deliberations concerning the |

17

|

|

|

|

|

|

|

corporation as of the time it is authorized, approved or ratified, by the board of directors, a committee or the stockholders. |

|

approval, amendment or termination of such contract or transaction, unless the contract or transaction (i) relates primarily to the remuneration of the director or an associate of the director as a director, officer, employee or mandatory of the corporation or an affiliate of the corporation, (ii) is for indemnity or liability insurance under the QBCA, or (iii) is with an affiliate of the corporation, and the sole interest of the director is as a director or officer of the affiliate. If a director or officer does not disclose his or her interest in accordance with the QBCA, or (in the case of a director) votes in respect of a resolution on a contract or transaction in which he or she is interested contrary to the QBCA, the corporation or a shareholder may ask the court to declare the contract or transaction null and to require the director or officer to account to the corporation for any profit or gain realized on it by the director or officer or the associates of the director or officer, and to remit the profit or gain to the corporation, according to the conditions the court considers appropriate. However, the contract or transaction may not be declared null if it was approved by the board of directors and the contract or transaction was in the interest of the corporation when it was approved, nor may the director or officer concerned, in such a case, be required to account for any profit or gain realized or to remit the profit or gain to the corporation. In addition, the contract or transaction may not be declared null if it was approved by ordinary resolution by the shareholders entitled to vote who do not have an interest in the contract or transaction, the required disclosure was made to the shareholders in a sufficiently clear manner and the contract or transaction was in the best interests of the corporation when it was approved, and if the director or officer acted honestly and in good faith, he or she may not be required to account for the profit or gain realized and to remit the profit or gain to the corporation. |

18

|

|

|

|

|

|

|

|

|

|

Limitation on Liability of Directors |

|

Under the DGCL, a corporation’s certificate of incorporation may include a provision eliminating or limiting the personal liability of a director to the corporation and its stockholders for damages arising from a breach of fiduciary duty as a director. However, no provision can limit the liability of a director for: •breach of the director’s duty of loyalty to the corporation or its stockholders; •acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of the law; •intentional or negligent payment of unlawful dividends or stock purchases or redemptions; or •for any transaction from which the director derived an improper personal benefit. |

|

The QBCA does not permit the limitation of a director’s liability as the DGCL does. |

|

|

|

|

|

Indemnification of Directors and Officers |

|

The DGCL permits indemnification for derivative suits only for expenses (including legal fees) and only if the person is not found liable, unless a court determines the person is fairly and reasonably entitled to the indemnification. |

|

Under the QBCA, a corporation must indemnify a director or officer, a former director or officer or a person who acts or acted at the corporation’s request as a director or officer, or an individual acting in a similar capacity of another group (who is referred to in this document as an indemnifiable person) against all costs, charges and expenses, including an amount paid to settle an action or satisfy a judgment, reasonably incurred by the indemnifiable person on the exercise of the person’s functions or arising from any investigative or other proceeding in which the person is involved if: •the person acted honestly and loyally in the interest of the corporation or other group, and •in the case of a proceeding enforceable by a monetary penalty, the person had reasonable grounds for believing the person’s conduct was lawful. In the case of a derivative action, indemnity may be made only with court approval. |

|

|

|

|

|

Call and Notice of Shareholder Meetings |

|

Under the DGCL, an annual or special stockholder meeting is held on such date, at such time and at such place as may be designated by the board of directors or any other person authorized to call such meeting under the corporation’s certificate of incorporation or bylaws. If an annual |

|

Under the QBCA, an annual meeting of shareholders must be held no later than 15 months after holding the last preceding annual meeting. Under the QBCA, the directors of a corporation may call a special meeting at any time. In addition, holders of not less than 10% of the issued shares of a |

19

|

|

|

|

|

|

|

meeting for election of directors is not held on the date designated or an action by written consent to elect directors in lieu of an annual meeting has not been taken within 30 days after the date designated for the annual meeting, or if no date has been designated, for a period of 13 months after the later of the last annual meeting or the last action by written consent to elect directors in lieu of an annual meeting, the Delaware Court of Chancery may summarily order a meeting to be held upon the application of any stockholder or director. |

|

corporation that carry the right to vote at a meeting sought to be held may requisition the directors to call a meeting of shareholders for the purposes stated in the requisition. |

|

|

|

|

|

Shareholder Action by Written Consent |

|

Under the DGCL, a majority of the stockholders of a corporation may act by written consent without a meeting unless such action is prohibited by the corporation’s certificate of incorporation. |

|

Under the QBCA, a written resolution signed by all the shareholders of a corporation who would have been entitled to vote on the resolution at a meeting is effective to approve the resolution. |

|

|

|

|

|

Shareholder Nominations and Proposals |

|

Not applicable. |

|