UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE 13D

Under

the Securities Exchange Act of 1934

(Amendment

No. )*

Titan

Pharmaceuticals, Inc.

(Name

of Issuer)

Common

Stock, par value $0.001 per share

(Title

of Class of Securities)

888314

(CUSIP

Number)

Seow

Gim Shen

The

Sire Group Ltd.

No.

4, Franky Building, Providence Industrial Estate, Mahe, Seychelles]

Tel

No.: +6012 484 4444

(Name,

Address and Telephone Number of Person

Authorized

to Receive Notices and Communications)

September 13,

2023

(Date

of Event which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box: ☐

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7

for other parties to whom copies are to be sent.

|

* |

The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page. |

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

| 1. |

Names

of Reporting Persons.

The

Sire Group Ltd.

|

| 2. |

Check

the Appropriate Box if a Member of a Group (See Instructions)

(a)

☐

(b)

☒

|

| 3. |

SEC

Use Only

|

| 4. |

Source

of Funds (See Instructions)

WC,

SC

|

| 5. |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐

|

| 6. |

Citizenship

or Place of Organization

Republic

of Seychelles

|

Number

of

Shares

Beneficially

Owned

by

Each

Reporting

Person

With |

7. |

Sole

Voting Power

3,001,757* |

| 8. |

Shared

Voting Power

|

| 9. |

Sole

Dispositive Power

3,001,757* |

| 10. |

Shared

Dispositive Power

|

| 11. |

Aggregate

Amount Beneficially Owned by Each Reporting Person

3,001,757*

|

| 12. |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

☐

|

| 13. |

Percent

of Class Represented by Amount in Row (11)

16.7%*

|

| 14. |

Type

of Reporting Person (See Instructions)

CO

|

| |

|

|

|

|

* |

Shares

issuable upon conversion of Series AA Convertible Preferred Stock (“Preferred Stock”).. Amounts determined in accordance

with Rule 13d-3, based upon 15,016,295 shares stated to be outstanding and conversion limitations included in Preferred Stock. |

| 1. |

Names

of Reporting Persons.

Seow

Gim Shen

|

| 2. |

Check

the Appropriate Box if a Member of a Group (See Instructions)

(a)

☐

(b)

☒

|

| 3. |

SEC

Use Only

|

| 4. |

Source

of Funds (See Instructions)

OO

|

| 5. |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐

|

| 6. |

Citizenship

or Place of Organization

Malaysia

|

Number

of

Shares

Beneficially

Owned

by

Each

Reporting

Person

With |

7. |

Sole

Voting Power

3,001,757* |

| 8. |

Shared

Voting Power

|

| 9. |

Sole

Dispositive Power

3,001,757* |

| 10. |

Shared

Dispositive Power

|

| 11. |

Aggregate

Amount Beneficially Owned by Each Reporting Person

3,001,757*

|

| 12. |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

☐

|

| 13. |

Percent

of Class Represented by Amount in Row (11)

16.7*

|

| 14. |

Type

of Reporting Person (See Instructions)

IN

|

| |

|

|

|

|

* |

Shares

issuable upon conversion of Series AA Convertible Preferred Stock (“Preferred Stock”).. Amounts determined in accordance

with Rule 13d-3, based upon 15,016,295 shares stated to be outstanding and conversion limitations included in Preferred Stock. |

Item 1.

Security and Issuer.

This

statement relates to the Common Stock of Titan Pharmaceuticals, Inc. (the “Issuer”) issuable upon conversion of 950,000

shares of the Issuer’s Series AA Convertible Preferred Stock (“Preferred Stock,” and, with the Common Stock,

the “Securities”). The address of the Issuer’s principal executive offices is 400 Oyster Point Blvd., Suite

505, South San Francisco CA 94080.

Item 2.

Identity and Background.

The

persons filing this statement are The Sire Group, Ltd. (“Sire”), a Republic of Seychelles corporation, the principal

business of which is investment holdings and information technology services, and Seow Gim Shen, Sire’s founder, sole shareholder,

and Chief Executive Officer. Seow Gim Shen is a .citizen of Malaysia. Sire has no other executive officers or directors. The business

address of the reporting persons is No. 4, Franky Building, Providence Industrial Estate, Mahe, Seychelles.

During

the last five years, none of the person identified above has been (i) convicted in a criminal proceeding (excluding traffic violations

or similar misdemeanors) or (ii) a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as

a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or

mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

Item 3.

Source and Amount of Funds or Other Consideration.

The

source of funds used for the purchase of the Securities was $5,000,000 of Sire’s cash and a $4,500,000 principal amount promissory

note payable to the Issuer.

Item 4.

Purpose of Transaction.

On

September 13, 2023, Sire and the Issuer entered into a Securities Purchase Agreement (the “Purchase Agreement”),

pursuant to which Sire purchased 950,000 shares of the Preferred Stock from the Issuer, at a price of $10.00 per share, for an aggregate

purchase price of $9,500,000. The purchase price consists of (i) $5 million in cash at closing and (ii) $4.5 million in the form of a

promissory note from Sire, personally guaranteed by Seow Gim Shen, due and payable on September 23, 2023, subject to two 10-day

extensions, which include additional payments of $50,000 for each extension. The terms, rights, obligations and preferences of the Preferred

Stock are set forth in a Certificate of Designations, Preferences and Rights of Series AA Convertible Preferred Stock of the Company

(the “Certificate of Designations”), filed with the Secretary of State of the State of Delaware on September 13,

2023.

Under

the Certificate of Designations, each share of Preferred Stock will be convertible, at the holder’s option, at any time, into shares

of Common Stock at a conversion rate equal to the quotient of (i) the stated value of such share divided by (ii) the initial conversion

price of $0.466, subject to specified adjustments as set forth in the Certificate of Designations. Based on the initial conversion rate,

approximately 20,386,266 shares of the Company’s common stock would be issuable upon conversion of all the shares of Preferred

Stock, when issued, assuming the absence of in-kind dividends. The Preferred Stock contains limitations that prevent Sire from acquiring

the lesser of (i) the maximum percentage of Common Stock permissible under the rules and regulations of The Nasdaq Stock Market without

first obtaining shareholder approval or (ii) 3,001,757 shares, being 19.99% of the number of shares outstanding immediately before issuance

of the Preferred Stock.

A

holder of Preferred Stock is entitled to receive dividends equal (on an as-if-converted-to-Common-Stock basis) to and in the same form

as dividends actually paid on the Common Stock. No other dividends will be paid on the Preferred Stock. At the option of the holder,

shares of Preferred Stock may be converted at any time into that number of shares of Common Stock at the conversion price set forth above.

Without approval of holders of a majority of the outstanding Preferred Stock, the Issuer may not alter or change adversely the powers,

preferences or rights given to the Preferred Stock, (b) amend its certificate of incorporation or other charter documents in any manner

that adversely affects any rights of the holders of Preferred Stock, (c) increase the number of authorized shares of Preferred Stock,

(d) enter into or consummate any Fundamental Transaction, as defined in the Certificate of Designations, or (e) enter into any agreement

with respect to any of the foregoing. In the event of any liquidation, dissolution or winding up of the Issuer, a holder of the Preferred

Stock will be entitled to receive the same amount that the holder would receive if the holder had converted the Preferred Stock to Common

Stock, which amounts shall be paid pari passu with all holders of Common Stock.

Pursuant

to the Purchase Agreement, directors David Lazar and Peter Chasey submitted their resignations from the Issuer’s Board of Directors,

to be effective immediately upon the appointment of two replacement directors designated by Sire to fill the vacancies and to be appointed

to the Board’s nominating committee; and the Company will hold its annual meeting for the election of directors by April 30,

2024. Mr. Lazar will remain as the Company’s Chief Executive Officer. The purpose of the purchase of the Securities is with a view

to a business combination between the Issuer and a company deemed suitable by Sire. The reporting persons have discussed the feasibility

of such a transaction with the Issuer and Choong Choon Hau, who filed a Schedule 13D on July 21, 2023, with respect to the

Issuer’s common stock.

Item 5.

Interest in Securities of the Issuer.

| |

(a)

- (b) |

The

responses of the reporting persons with respect to Rows 11 and 13 on the cover pages of this

Statement that relate to the aggregate number and percentage of shares of Common Stock are

incorporated herein by reference.

The

responses of the reporting persons with respect to Rows 7, 8, 9, and 10 of the cover pages of this Statement that relate to the

amount of Common Stock as to which the reporting persons have sole or shared power to vote or to direct the vote and sole or

shared power to dispose or to direct the disposition of are incorporated herein by reference. |

| |

(c) |

Except

as set forth in this Statement, the reporting persons have not engaged in any transaction with respect to the Common Stock during

the sixty days prior to the date of filing this Statement. |

| |

(d) |

No

person other than Sire has the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale

of, the shares of the Common Stock beneficially owned by Sire, as reported in this Statement. |

Item 6.

Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer.

In

addition to the disclosures in Item 4, pursuant to the Purchase Agreement, Sire and the Issuer entered into a Registration Rights

Agreement, in which the Issuer agreed, upon the occurrence of certain events set forth therein, to register, for resale, the Common Stock

beneficially owned by Sire, as reported in this Statement.

Item 7.

Material to be Filed as Exhibits.

| Exhibit

No. |

|

Description |

| 1 |

|

Certificate

of Designations (incorporated by reference to Exhibit 4.1 to the Issuer’s current report

on Form 8-K, dated September 18, 2023) |

| |

|

|

| 2 |

|

Securities

Purchase Agreement, dated September 13, 2023, Sire and the Issuer (incorporated by reference to Exhibit 10.1 to the Issuer’s

current report on Form 8-K, dated September 18, 2023). |

| |

|

|

| 3 |

|

Registration

Rights Agreement, dated September 13, 2023, Sire and the Issuer (incorporated by reference

to Exhibit 10.2 to the Issuer’s current report on Form 8-K, dated September 18,

2023). |

| |

|

|

| 4 |

|

Promissory Note, dated September 13, 2023, made by Sire to the Issuer. |

| |

|

|

| 5 |

|

Joint Filing Agreement, dated September 25, 2023, between Sire and Seow Gim Shen. |

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

| Date:

October 4, 2023 |

THE

SIRE GROUP LTD. |

| |

|

|

| |

By: |

/s/

Seow Gim Shen |

| |

|

Seow

Gim Shen |

| |

|

Chief

Executive Officer |

| |

|

|

| |

|

/s/

Seow Gim Shen |

| |

|

Seow

Gim Shen |

Exhibit 4

PROMISSORY NOTE

FOR VALUE RECEIVED, and subject to the terms and

conditions set forth herein, Purchaser (as defined in the Purchase Agreement) (“Maker”), hereby unconditionally promises

to pay to the order of TITAN PHARMACEUTICALS, INC., a Delaware corporation (“Holder,” and together with Maker, the “Parties”),

the principal amount of USD $4,500,000 (Four Million Five Hundred Thousand United States Dollars) (the “Loan”), together

with all accrued interest thereon, as provided in this Promissory Note (the “Note,” as the same may be amended, restated,

supplemented, or otherwise modified from time to time in accordance with its terms).

1. Definitions.

Capitalized terms used herein shall have the meanings set forth in this Section 1.

“Affiliate”

of any particular Person means any other Person controlling, controlled by or under common control with such particular Person, where

“control” means the possession, directly or indirectly, of the power to direct the management and policies of a Person whether

through the ownership of voting securities, contract or otherwise.

“Applicable

Rate” means the rate equal to 5%.

“Business

Day” means a day other than a Saturday, Sunday, or other day on which commercial banks in New York City authorized or required

by law to close.

“Default”

means any of the events specified in Section 5 which constitute an Event of Default or which, upon the giving of notice, the lapse of

time, or both, pursuant to Section 5 would, unless cured or waived, become an Event of Default.

“Default

Rate” means, at any time, the Applicable Rate plus 15%

“Event of

Default” has the meaning set forth in Section 5.

“Governmental

Authority” means the government of any nation or any political subdivision thereof, whether at the national, state, territorial,

provincial, municipal, or any other level, and any agency, authority, instrumentality, regulatory body, court, central bank, or other

entity exercising executive, legislative, judicial, taxing, regulatory, or administrative powers or functions of, or pertaining to, government

(including any supranational bodies, such as the European Union or the European Central Bank).

“Guaranty” means an

unconditional guaranty, in substantially the form of Exhibit F to the Purchase Agreement.

“Guarantor”

means Seow Gim Shen.

“Law”

as to any Person, means the certificate of incorporation and by-laws or other organizational or governing documents of such Person, and

any law (including common law), statute, ordinance, treaty, rule, regulation, order, decree, judgment, writ, injunction, settlement agreement,

requirement or determination of an arbitrator or a court or other Governmental Authority, in each case applicable to or binding upon such

Person or any of its property or to which such Person or any of its property is subject.

“Maturity

Date” means the earlier of (a) September 23, 2023, provided that Maker shall have the right, in its sole discretion, to

extend this date up to two times for a period of 10 days each, by making a non-refundable payment of $50,000 to Holder for each

extension and provide written notice to Holder at least one calendar day prior to the then-current Maturity Date, and (b) the date on

which all amounts under this Note shall become due and payable pursuant to Section 6.

“Order”

as to any Person, means any order, decree, judgment, writ, injunction, settlement agreement, requirement, or determination of an arbitrator

or a court or other Governmental Authority, in each case, applicable to or binding on such Person or any of its properties or to which

such Person or any of its properties is subject.

“Person”

means any individual, corporation, limited liability company, trust, joint venture, association, company, limited or general partnership,

unincorporated organization, Governmental Authority, or other entity.

“Purchase

Agreement” means that certain Securities Purchase Agreement, dated as of September 13, 2023, among the Parties, as the same

may be amended, restated supplemented or otherwise modified from time to time by the Parties.

2. Final

Payment Date; Optional Prepayments.

2.1 Final

Payment Date. The aggregate unpaid principal amount of the Loan, all accrued and unpaid interest, and all other amounts

payable under this Note shall be due and payable on the Maturity Date, unless otherwise provided in Section 6.

2.2 Optional

Prepayment. Maker may prepay the Loan in whole or in part at any time or from time to time without penalty or premium by

paying the principal amount to be prepaid together with accrued interest thereon to the date of prepayment.

3. Interest.

3.1 Interest

Rate. Except as otherwise provided herein, the outstanding principal amount of the Loan made hereunder shall bear simple

interest at the Applicable Rate from the date the Loan was made until the Loan is paid in full, whether at maturity, upon

acceleration, by prepayment, or otherwise.

3.2 Interest

Payment Dates. Interest shall be payable in a lump sum, in arrears to Holder on the Maturity Date.

3.3 Default

Interest. If any amount payable hereunder is not paid when due (without regard to any applicable grace periods), whether

at stated maturity, by acceleration, or otherwise, such overdue amount shall bear interest at the Default Rate from the date of such

non-payment until such amount is paid in full.

3.4 Computation

of Interest. All computations of interest shall be made on the basis of 365 or 366 days, as the case may be and the

actual number of days elapsed. Interest shall accrue on the Loan on the day on which such Loan is made, and shall not accrue on the

Loan on the day on which it is paid.

3.5

Interest Rate Limitation. If at any time and for any reason whatsoever, the interest rate payable on the Loan shall exceed

the maximum rate of interest permitted to be charged by Holder to Maker under applicable Law, such interest rate shall be reduced automatically

to the maximum rate of interest permitted to be charged under applicable Law.

4.

Payment Mechanics.

4.1

Manner of Payment. All payments of interest and principal shall be made in lawful money of the United States of America

on the date on which such payment is due by wire transfer of immediately available funds to the bank account of Holder as specified by

Holder in writing.

4.2

Application of Payments. All payments made hereunder shall be applied first to the payment of any fees or charges outstanding

hereunder, second to accrued interest, and third to the payment of the principal amount outstanding under the Note.

4.3

Business Day Convention. Whenever any payment to be made hereunder shall be due on a day that is not a Business Day, such

payment shall be made on the next succeeding Business Day and such extension will be taken into account in calculating the amount of

interest payable under this Note.

5.

Events of Default. The occurrence of any of the following shall constitute

an Event of Default hereunder:

5.1

Failure to Pay. Maker fails to pay (a) any principal amount of the Loan when due; or (b) interest or any other amount when

due and such failure continues for 5 Business Days after written notice to Maker.

5.2

Bankruptcy.

(a) Maker

commences any case, proceeding, or other action (i) under any existing or future Law relating to bankruptcy, insolvency, reorganization,

or other relief of debtors, seeking to have an order for relief entered with respect to it, or seeking to adjudicate it as bankrupt or

insolvent, or seeking reorganization, arrangement, adjustment, winding-up, liquidation, dissolution, composition, or other relief with

respect to it or its debts, or (ii) seeking appointment of a receiver, trustee, custodian, conservator, or other similar official for

it or for all or any substantial part of its assets, or Maker makes a general assignment for the benefit of its creditors; or

(b) there

is commenced against Maker any case, proceeding, or other action of a nature referred to in Section 5.2(a) above which (i) results in

the entry of an order for relief or any such adjudication or appointment or (ii) remains undismissed, undischarged, or unbonded for a

period of 60 days;

6. Remedies.

Upon the occurrence of an Event of Default and at any time thereafter during the continuance of such Event of Default, Holder may at its

option, by written notice to Maker (a) declare the entire principal amount of this Note, together with all accrued interest thereon and

all other amounts payable hereunder, immediately due and payable and/or (b) exercise any or all of its rights, powers, or remedies under

applicable Law; provided, however that, if an Event of Default described in Section 5.2 shall occur, the principal of and accrued

interest on the Loan shall become immediately due and payable without any notice, declaration, or other act on the part of Holder.

7. Right

of Set-Off. Notwithstanding anything to the contrary herein, Maker is hereby authorized at any time and from time to time, to the

fullest extent permitted by Law, to set off and apply any and all of the payments, obligations and/or other liabilities of Holder owing

at any time under the Purchase Agreement to Maker or any of its Affiliates or other Buyer Indemnified Parties (as defined in the Purchase

Agreement) against any and all of Maker’s payments, obligations or other liabilities owing at any time hereunder to Holder.

8.

Guaranty. As security for payment of any and all of Maker’s payments, obligations or other liabilities owing at any time

hereunder to Holder, the Maker shall lodge with the Holder, at the time of Closing of the Purchase Agreement, the Guaranty executed by

the Guarantor.

9.

Miscellaneous.

9.1

Notices. All notices required or allowed under this Note shall be given in the manner provided for notice under the Purchase

Agreement.

9.2

Governing Law. This Note shall be governed by and construed in accordance with the laws of the State of New York, without

regard to its conflict of laws principles.

9.3 Venue.

Each Party irrevocably and unconditionally waives, to the fullest extent permitted by applicable Law, any objection that it may now or

hereafter have to the laying of venue of any action or proceeding arising out of or relating to this Note in any court referred to in

Section 8.2.

9.4 Counterparts.

This Note may be executed in one or more counterparts, each of which shall be deemed an original and all of which together shall constitute

one and the same instrument.

9.5

Successors and Assigns. Neither Party may transfer or assign this Note or any portion hereof or pledge, encumber or transfer

its rights or interest in and to this Note or any portion hereof, except with the prior written consent of the other Party in its sole

discretion.

9.6

Amendments and Waivers. No term of this Note may be waived, modified, or amended except by an instrument in writing signed

by both Parties. Any waiver of the terms hereof shall be effective only in the specific instance and for the specific purpose given.

9.7

Headings. The headings of the various Sections and subsections herein are for reference only and shall not define, modify,

expand, or limit any of the terms or provisions hereof.

9.8

No Waiver; Cumulative Remedies. No failure to exercise and no delay in exercising, on the part of a Party, of any right,

remedy, power, or privilege hereunder shall operate as a waiver thereof; nor shall any single or partial exercise of any right, remedy,

power, or privilege hereunder preclude any other or further exercise thereof or the exercise of any other right, remedy, power, or privilege.

The rights, remedies, powers, and privileges herein provided are cumulative and not exclusive of any rights, remedies, powers, and privileges

provided by Law.

9.9 Severability.

If any term or provision of this Note is invalid, illegal, or unenforceable in any jurisdiction, such invalidity, illegality, or unenforceability

shall not affect any other term or provision of this Note or invalidate or render unenforceable such term or provision in any other jurisdiction.

9.10

Conflicts. In the event of any conflict between the terms of the Purchase Agreement and this Note, the terms of the Purchase

Agreement will control.

(Signatures Follow)

IN WITNESS WHEREOF, Maker has executed this Note

as of September 13, 2023.

| |

THE SIRE GROUP LTD. |

| |

|

|

| |

By |

/s/ Seo Gim Shen |

| |

Name: |

Seow Gim Shen |

| |

Title: |

Chief Executive Officer |

| ACCEPTED AND AGREED TO: |

|

| TITAN PHARMACEUTICALS, INC. |

|

| |

|

|

| By |

/s/ David Lazar |

|

| Name: |

David Lazar |

|

| Title: |

CEO |

|

Exhibit 5

JOINT

FILING AGREEMENT

In

accordance with Rule 13d-k(1) under the Securities Exchange Act of 1934, as amended, the persons named below agree to the joint

filing on behalf of each of them of a statement on Schedule 13D (including amendments thereto) with respect to the securities of

Titan Pharmaceuticals, Inc. and further agree that this Joint Filing Agreement be included as an Exhibit to such joint filings. In evidence

thereof, the undersigned, being duly authorized, have executed this Joint Filing Agreement this 25th day of September, 2023.

| |

/s/

Seow Gim Shen |

| |

Seow

Gim Shen |

| THE

SIRE GROUP LTD. |

|

| |

|

|

| By: |

/s/

Seow Gim Shen |

|

| |

Seow

Gim Shen |

|

| |

Chief

Executive Officer |

|

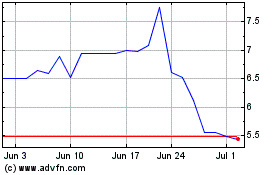

Titan Pharmaceuticals (NASDAQ:TTNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Titan Pharmaceuticals (NASDAQ:TTNP)

Historical Stock Chart

From Apr 2023 to Apr 2024