0000849636

false

0000849636

2023-09-26

2023-09-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

Current

Report

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): September 26, 2023

RESPIRERX

PHARMACEUTICALS INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

1-16467 |

|

33-0303583 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S

Employer

Identification

No.) |

126

Valley Road, Suite C

Glen

Rock, New Jersey |

|

07452 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (201) 444-4947

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

September 26, 2023, RespireRx Pharmaceuticals Inc. (the “Company” or the “Corporation”) entered into a Settlement

and Exchange Agreement (“Settlement Agreement”) with DNA Healthlink, Inc. (“DNA Healthlink”), a vendor that provides

the Company with the services of our Senior Vice President of Research and Development, Richard Purcell. Also on September 26, 2023,

the Company and DNA Healthlink entered into the Second Amendment to Consulting Agreement (“Amendment”).

Pursuant

to the terms of the Settlement Agreement, the parties agreed that the Company owed DNA Healthlink $394,000 and that in settlement of

$50,000 of the $394,000 owed, DNA Healthlink would be issued 250 shares of Series I 8% Redeemable Preferred Stock (“Series I Preferred

Stock”) and 250 shares of Series J 8% Voting, Participating, Redeemable Preferred Stock (“Series J Preferred Stock”)

and the amount owed would be reduced to $344,000. The remaining amount of $344,000 is payable upon the completion of an Eligible Payment

Event as defined in the Certificate of Designation, Preferences, Rights and Limitations of the Series I Preferred Stock. If no Eligible

Payment Event has occurred by May 31, 2025, then the remaining amount of $344,000 less any amounts previously paid will be due

and payable in seven equal monthly installments beginning June 1, 2025.

Pursuant

to the terms of the Amendment, the Company and DNA Healthlink agreed to amend the First Amendment to the Consulting Agreement dated October

15, 2014 by replacing Section 3. Compensation with a new Section 3 that calls for the Company to prepay on a cash retainer basis,

in installments of $5,000 or other amounts agreed by both parties, against invoices to be rendered for work performed. An hourly rate of $250 per hour is to be invoiced by DNA Healthlink

no less frequently than monthly at which time such invoices will be deemed paid in whole or in part, as appropriate, until the $5,000

prepayment has been applied against such invoices at which time an additional $5,000 retainer will be remitted by the Company and the

process will repeat.

The

scope of the work is to be mutually agreed in advance in writing on a regular and as needed basis.

In

addition, the Amendment contained a new Section 7(a). Term which defined the term to be one-year and shall be automatically renewed for

one-year renewal periods unless notice of cancellation is provided by either party within 30 days of September 26, 2024 or within 30

days of the end of any renewal period.

The

foregoing descriptions of the Settlement Agreement and the Amendment do not purport to be complete and are qualified in their

entirety by reference to the Settlement and Exchange Agreement and the Second Amendment to Consulting Agreement, copies of which are

attached to this Current Report on Form 8-K as Exhibit 99.1 and Exhibit 99.2 respectively.

The

information set forth in Item 3.02 herein is incorporated into this Item 1.01 by reference.

Item

3.02. Unregistered Sales of Equity Securities.

The

information provided in Item 1.01 and Item 7.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.02.

This

Current Report on Form 8-K shall not constitute an offer to sell or a solicitation of an offer to buy, nor shall such securities be offered

or sold in the United States absent registration or an applicable exemption from the registration requirements.

Item

7.01. Regulation FD Disclosure.

ResolutionRx

Ltd establishes stock registry services agreement with Registry Direct Pty Limited in Australia

Effective

as of September 27, 2023, ResolutionRx Ltd (“ResolutionRx”), a wholly-owned subsidiary of the Company entered into a Registry

Service Agreement with Registry Direct Pty Limited (“Registry Direct”), an Australian company. The services are analogous

to stock transfer agent services in the United States. The services to be provided by Registry Direct include but are not limited to:

(i) general and maintenance services such as maintaining records of each holding and managing requests, (ii) transaction services such

as registering changes with respect to holdings and processing elections, (iii) various dividend distribution services, (iv) provision

of standard reports, (iv) processing payments, transfers and other similar activities, (v) certain meeting services and (vi) processing

applications for and issuing shares.

This

is another step taken by ResolutionRx to ensure the processing and issuance of securities associated with its current securities offering

in Australia and with respect to other matters associated with having outside shareholders.

The

information set forth in Item 3.02 herein is incorporated into this Item 7.01 by reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

A list of exhibits that are filed as part of this

report is set forth in the Exhibit Index, which follows, and is incorporated herein by reference.

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

October 2, 2023 |

RESPIRERX

PHARMACEUTICALS INC. |

| |

(Registrant) |

| |

|

|

| |

By: |

/s/

Jeff E. Margolis |

| |

|

Jeff

E. Margolis |

| |

|

SVP,

CFO, Secretary and Treasurer |

Exhibit

99.1

SETTLEMENT

AND EXCHANGE AGREEMENT

AGREEMENT

made this 26th day of September 2023 by and between DNA Healthlink, Inc. (“DNA Healthlink”) and RespireRx Pharmaceuticals

Inc. (RespireRx”). DNA Healthlink and RespireRx are referred to herein individually as “Party” and together as “Parties.”

WHEREAS,

the Parties entered into a Settlement Agreement dated the 14th day of September 2021 (“Prior Settlement Agreement”)

and wish to amend, replace and supersede the Prior Settlement Agreement with this Settlement and Exchange Agreement (“Settlement

and Exchange Agreement”); and

WHEREAS

the Parties agree that RespireRx owes DNA Healthlink $394,000 (after payment of $16,000 against the $410,000 amount owed and agreed in

the Prior Settlement Agreement) pursuant to a consulting agreement among the parties dated October 15, 2014 (“October 2014 Agreement”);

and

WHEREAS

the Parties agree that this settlement and exchange agreement (“Settlement and Exchange Agreement”) does not amend the October

2014 Agreement other than as to a payment schedule and that any other amendment to the October 2014 Agreement would be in writing agreed

and executed by the Parties; and

WHEREAS

the Parties have reached an agreement regarding payment and satisfaction of the $394,000 amount owed under the October 2014 Agreement;

NOW,

THEREFORE, AND INTENDING TO BE LEGALLY BOUND, IT IS HEREBY STIPULATED AND AGREED between the Parties that:

1.

RespireRx will pay a total of Three Hundred and Ninety-four Thousand dollars ($394,000.00) (the “Settlement Amount”) to DNA

Health, $50,000 of which is deemed exchanged and settled as of the date of this Settlement and Exchange Agreement upon the issuance of

250 shares of Series I 8% Redeemable Preferred Stock (“Series I Preferred Stock”) plus 250 shares of Series J 8% Voting,

Participating, Redeemable Preferred Stock (“Series J Preferred Stock”) with the remaining amount of $344,000 being payable

upon the completion of an Eligible Payment Event as defined in the Certificate of Designation, Preferences, Rights and Limitations of

Series I Preferred Stock OR Series J Preferred Stock. If no Eligible Payment Event has occurred by May 31, 2025, then the remaining amount

of $344,000 less any amounts previously paid, will be due and payable in seven equal monthly installments beginning on June 1, 2025.

2.

The payment, other than those made with Series I Preferred Stock OR Series J Preferred Stock called for in Paragraph 1 shall be made

by wire transfer or ACH transfer or such other form of electronic payment, as arranged by the Parties in accordance with the following

electronic funds transfer information

| |

DNA

Healthlink, Inc. |

| |

TD

Bank |

| |

Routing

#

Account # |

3.

If any payment called for herein is more than ten (10) days late and such late payment is not cured within ten (10) days of written notice,

an Event of Default will be deemed to have occurred under this Agreement. “Written notice” for the purposes of this paragraph

shall mean notice provided by email to Jeff Eliot Margolis, RespireRx Pharmaceutical Inc., SVP, CFO, Treasurer and Secretary at jmargolis@respirerx.com.

4.

Upon the occurrence of an Event of Default under this Agreement, DNA Healthlink shall have the right to enforce the terms of this Agreement

and shall be entitled to reimbursement of any fees and costs associated with any such enforcement (including, but not limited to, DNA

Healthlink’s reasonable attorney’s fees), without further notice.

5.

Within ten (10) days of full performance of the terms herein, DNA Healthlink shall provide a general release for the benefit of RespireRx

releasing RespireRx from any and all obligations, past, present and future pursuant to this Settlement and Exchange Agreement. For purposes

of this Paragraph, “full performance of the terms herein” shall be deemed to have occurred when all payments called for by

Paragraph 1 have cleared into the account of DNA Healthlink.

6.

No failure of any Party to exercise any of its rights hereunder shall be a waiver of the right to exercise that or any other right at

any other time and from time to time thereafter.

7.

This Settlement and Exchange Agreement shall be governed by, construed and interpreted in accordance with the laws of the State of New

Jersey, without regard to the conflicts of laws doctrine of such state.

8.

This Settlement and Exchange Agreement represents a compromise of disputed claims, achieved as a result of negotiations, and shall not

be construed or regarded as an admission of liability or fault by or in favor of either Party.

9.

This Settlement and Exchange Agreement shall not be construed for or against either of the Parties, whether based on any rule of construction

relating to the drafting of a document or otherwise, but rather shall be given a fair and reasonable interpretation based upon the plain

language of this Settlement and Exchange Agreement and the expressed intent of the Parties, without regard to which of the Parties prepared

this Settlement and Exchange Agreement.

10.

The Parties acknowledge that the covenants contained in this Settlement and Exchange Agreement provide good and sufficient consideration

for every promise, duty, release, obligation, agreement and right contained in this Settlement and Exchange Agreement.

11.

Each party to this Settlement and Exchange Agreement acknowledges that it has had the benefit of advice from competent legal counsel

with respect to the decision to enter into this Settlement and Exchange Agreement.

12.

Each Party to this Settlement and Exchange Agreement represents that it is duly authorized to execute this Settlement and Exchange Agreement

having obtained all approvals and consents necessary to take said actions. Each Party to this Settlement and Exchange Agreement represents

that it is not breaching or interfering with any agreement, right or obligation to any person, entity, party or non-party by entering

into the settlement described herein.

13.

This Settlement and Exchange Agreement represents the full agreement of the Parties with regard to the subject matter hereof and supersedes

any and all other agreements, whether oral or written with respect to the subject matter of this Settlement and Exchange Agreement.

14.

Whenever possible, each provision of this Settlement and Settlement Agreement shall be interpreted in such a manner as to be effective

and valid under applicable law; however, if any term or provision (including any paragraph, sentence, clause or word) of this Settlement

and Exchange Agreement shall be determined by the Court to be illegal, invalid or unenforceable for any reason, such determination shall

not affect the remaining terms or provisions of this Settlement and Exchange Agreement, which shall continue in full force and effect.

15.

This Settlement and Exchange Agreement may be executed in one or more counterparts, each of which shall be deemed an original, including

facsimile or scanned copies, but all of which together shall constitute one and the same instrument.

| DNA

HEALTHLINK, INC. |

|

RESPIRERX

PHARMACEUTICALS INC. |

| |

|

|

|

|

| BY:

|

/s/

Richard D. Purcell |

|

BY: |

/s/

Jeff Eliot Margolis |

| |

Richard

D. Purcell |

|

|

Jeff

Eliot Margolis |

| |

President |

|

|

SVP,

CFO, Treasurer, Secretary |

Exhibit

99.2

SECOND

AMENDMENT TO CONSULTING AGREEMENT

This

SECOND AMENDMENT TO CONSULTING AGREEMENT (“Second Amendment”) is made and entered into on 26 September 2023, by and among

RespireRx Pharmaceuticals Inc. (the ‘COMPANY’), a New Jersey corporation and DNA Healthlink, Inc., a New Jersey Corporation

together with its President, Richard Purcell (the ‘CONSULTANT’), who will serve as Senior Vice President Research and Development

for RespireRx, with responsibilities for such duties as are normally associated with the position.

The

COMPANY and CONSULTANT are parties to a Consulting Agreement dated as of October 15, 2014 (the ‘Consulting Agreement’) and

the First Amendment to Consulting Agreement dated effective as of September 14, 2021 (“First Amendment”).

The

parties desire to further amend the Consulting Agreement and supersede and replace the First Amendment with this Second Amendment as

set forth below.

NOW,

THEREFORE, the parties hereto, intending to be legally bound, hereby agree as follows:

Supersede

and replace the First Amendment with this Second Amendment.

Amendment

to Consulting Agreement Section 3. Compensation of the Consulting Agreement is hereby amended by deleting current Section 3.

Compensation and replacing in its entirety as follows:

Section

3. Compensation. You will be prepaid against invoices for work performed on a cash retainer basis, in installments of $5,000 or other

amounts as dually agreed by both parties. An hourly rate of $250 per hour will be invoiced no less frequently than monthly at which time

such invoices will be deemed paid in whole or in part, as appropriate, until the $5,000 prepayment has been applied against such invoices

at which time an additional $5,000 prepaid retainer will be remitted by the Company to DNA Healthlink and the process will be repeated.

Any invoices rendered that remain unpaid or partially paid will be deemed paid with the immediate next prepaid retainer. No work shall

commence prior to the payment of the first prepaid retainer.

The

scope of the work is to be mutually agreed upon in advance in writing on a regular and as needed basis. The CONSULTANT will provide detailed

line-item descriptions of work performed in their requisite invoices.

Subsection

7(a). Term. The term of this Agreement shall be for a period of one-year and shall automatically renew for one-year renewal periods

unless notice of cancellation is provided by either party within 30 days of September 26, 2024 or within 30 days of the end of any renewal

period.

Accepted

and Agreed:

COMPANY:

| By: |

|

|

| Name:

|

Arnold

Lippa, Ph.D. |

|

| Title: |

Chief Scientific Officer, Interim President and Interim Chief Executive Officer |

|

| |

Executive

Chairman, Board of Directors |

|

| |

RespireRx

Pharmaceuticals Inc. |

|

| Signed: |

/s/

Arnold Lippa |

|

| Dated: |

September 26, 2023 |

|

| |

|

|

| CONSULTANT:

DNA Healthlink, Inc. |

|

| |

|

|

| By:

|

Richard

Purcell |

|

| Title:

|

President |

|

| Signed: |

/s/

Richard Purcell |

|

| Dated: |

September 26, 2023 |

|

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

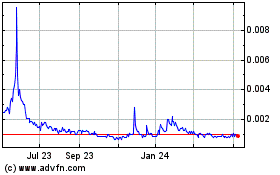

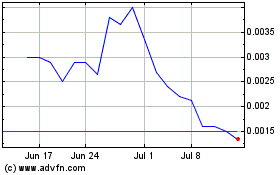

RespireRx Pharmaceuticals (PK) (USOTC:RSPI)

Historical Stock Chart

From Mar 2024 to Apr 2024

RespireRx Pharmaceuticals (PK) (USOTC:RSPI)

Historical Stock Chart

From Apr 2023 to Apr 2024