Form 8-K - Current report

September 28 2023 - 4:00PM

Edgar (US Regulatory)

0000788920

false

0000788920

2023-09-27

2023-09-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 27, 2023

PRO-DEX, INC.

(Exact name of registrant as specified in charter)

| Colorado |

0-14942 |

84-1261240 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification Number) |

2361 McGaw Avenue

Irvine, California 92614

(Address of principal executive offices, zip

code)

(949) 769-3200

(Registrant’s telephone number including

area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Exchange Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, no par value |

PDEX |

NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

| Emerging growth company ☐ |

|

If an emerging growth company, indicate by checkmark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 4.02

Non-Reliance on Previously Issued Financial Statement or a related Audit Report or Completed Interim Review.

On

September 27, 2023, Pro-Dex, Inc.’s (the “Company”) management and Audit Committee, in consultation with Moss Adams,

LLP, the Company’s independent registered public accounting firm, determined that the Company’s unaudited interim consolidated

financial statements for the quarters ended September 30, 2020, December 31, 2020, March 31, 2021, September 30, 2021, December 31, 2021

March 31, 2022, September 30, 2022, December 31, 2022, March 31, 2023, and its audited annual consolidated financial statements for the

years ended June 30, 2020, June 30, 2021 and June 30, 2022, and accompanying audit reports, each as previously filed with the Securities

and Exchange Commission (“SEC”) (collectively, the “Restated

Periods”), should no longer be relied upon and will be restated as a result of the Company’s calculation of the estimated

fair value of the Monogram Warrant (defined below) being materially understated for fiscal years ended June 30, 2020, 2021 and 2022 and

all interim periods commencing with the quarter ended September 30, 2020 through the quarter ended March 31, 2023. The estimated

impact of these restatements on the Company’s consolidated financial statements is expected to increase unrealized gains on marketable

securities shown on the consolidated income statement, but is not expected to impact reported revenues, operating income, cash or cash

flows.

The

warrant (the “Monogram Warrant”) represents the Company’s right to purchase up to 5% of the outstanding stock of Monogram

Orthopaedics Inc. (“Monogram”), calculated on a fully diluted basis, which the Company was granted on December 20, 2018. The

Company initially invested in Monogram, a medical device start-up specializing in precision, patient specific implants, in fiscal 2017

by making an $800,000 loan to Monogram (the “Monogram Loan”) pursuant to a promissory note in the same amount. The Company

impaired its entire $800,000 investment in the Monogram Loan in the quarter ended June 30, 2018, due to indications that Monogram had

exhausted its cash and had been unable to obtain additional financing to enable continued research to commercialize their technology.

During the quarter ended December 31, 2018, the Company modified the promissory note to allow Monogram more time to re-pay the Monogram

Loan and, concurrently, was issued the Monogram Warrant, which the Company deemed of de minimis value. During the quarter ended June 30,

2020, Monogram repaid the Monogram Loan with interest, but at that time and through the quarter ended March 31, 2023, the Company continued

to consider the Monogram Warrant to be of little value and therefore did not record it as an investment on the Company’s consolidated

balance sheet. In May of 2023, Monogram raised funds through a Regulation A+ offering filed with the SEC and contemporaneously converted

all of its outstanding preferred stock to common shares and publicly listed its common shares on the NASDAQ under the ticker symbol “MGRM.”

During

the preparation of the Company’s consolidated financial statements for the fiscal year ended June 30, 2023, the Company re-evaluated

the guidance in ASC Topic 815, Derivatives and Hedging and determined that the estimated fair value of the Monogram Warrant was

approximately $718,000 on June 30, 2020, $1.4 million at June 30, 2021, and $2.4 million at June 30, 2022. The preliminary evaluation

described above is subject to the completion of the Company’s restatement analysis and financial close and reporting process, as

well as the financial statement audits and reviews for the Restated Periods. While the Company believes that the foregoing description

fairly represents the expected impact of the restatement on the Company’s prior financial statements, further adjustments may arise,

such as the impact on income tax expense and deferred tax liabilities, and the restated financial statements for the Restated Periods

will reflect any such additional adjustments.

As

a result of the information described above, the Company’s management has concluded that the Company’s disclosure controls

and procedures were not effective at a reasonable assurance level and the Company’s internal control over financial reporting was

not effective as of the end of each of the Restated Periods. In connection with the restatement, the Company has identified a material

weakness in internal control over financial reporting related to its application of ASC 815 to the Monogram Warrant.

The

Company currently plans to complete the restatement analysis and file its Annual Report on Form 10-K for the year ended June 30, 2023,

which the Company anticipates will restate the audited and unaudited consolidated financial statements for the Restated Periods,

as soon as reasonably practical.

The

Audit Committee has discussed the matters described in this Form 8-K with its independent registered accounting firm, Moss Adams LLP.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: September 27, 2023 |

Pro-Dex, Inc. |

| |

|

| |

|

|

| |

By: |

/s/ Alisha K. Charlton |

| |

|

Alisha K. Charlton |

| |

|

Chief Financial Officer |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

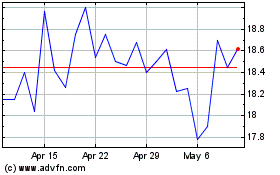

ProDex (NASDAQ:PDEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

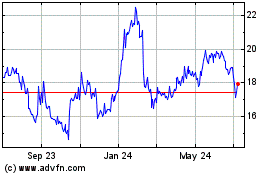

ProDex (NASDAQ:PDEX)

Historical Stock Chart

From Apr 2023 to Apr 2024