Form 8-K - Current report

September 27 2023 - 4:46PM

Edgar (US Regulatory)

false000146715400014671542023-09-252023-09-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): September 25, 2023

_____________________

Novan, Inc.

(Exact name of registrant as specified in its charter)

_____________________

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Delaware | | 001-37880 | | 20-4427682 | |

| (State or other jurisdiction of

incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) | |

4020 Stirrup Creek Drive, Suite 110, Durham, North Carolina 27703

(Address of principal executive offices) (Zip Code)

(919) 485-8080

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

_____________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock, $0.0001 par value | NOVNQ | NONE |

(1) Novan, Inc. Common Stock was previously traded on the Nasdaq Capital Market under the symbol “NOVN.” On July 26, 2023, Novan, Inc. Common Stock began trading exclusively on the over-the-counter (“OTC”) market under the symbol “NOVNQ.” On September 8, 2023, Nasdaq filed a Form 25 with the United States Securities and Exchange Commission to complete the delisting of Novan, Inc. Common Stock from Nasdaq, and the delisting became effective ten days after the Form 25 was filed.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.01. Completion of Acquisition or Disposition of Assets.

Sale of RHOFADE

As previously disclosed, on July 17, 2023, Novan, Inc. (the “Company”) and its wholly owned subsidiary, EPI Health, LLC (“EPI Health”) filed voluntary petitions for relief under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”). The cases are being administered jointly under the caption In re: Novan, Inc. et al, Case No. 23-10937 (the “Chapter 11 Case”).

As previously disclosed, on August 31, 2023, the Company and EPI Health entered into an asset purchase agreement with Mayne Pharma LLC (“Mayne Pharma”) for the purchase of the assets related to RHOFADE® (oxymetazoline hydrochloride) cream 1% and assumption of certain related liabilities for $8 million in cash at closing plus associated cure costs not to exceed $1.5 million (the “Asset Purchase Agreement”). A copy of the Asset Purchase Agreement was filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the Securities Exchange Commission on September 7, 2023, which is incorporated herein by reference. On September 12, 2023, the Bankruptcy Court entered an order approving the Asset Purchase Agreement, including the assignment and assumption of certain contracts, as provided for in the Asset Purchase Agreement.

On September 25, 2023, the Company and Mayne Pharma consummated the transactions contemplated by the Asset Purchase Agreement, thereby completing the disposition of the aforementioned assets.

Cautionary Information Regarding Trading in the Company’s Securities

The Company cautions that trading in the Company’s securities (including, without limitation, the Company’s common stock) during the pendency of the Chapter 11 Case is highly speculative and poses substantial risks. The Company expects that the currently outstanding shares of its common stock will be eventually cancelled and extinguished by the Bankruptcy Court. The holders of the Company’s common stock are not expected to receive any proceeds from the sale of substantially all of the Company’s assets due to the Company’s obligations to creditors and others. As a result, the Company expects that its currently outstanding stock may have little or no value. Trading prices for the Company’s common stock may bear little or no relation to actual recovery, if any, by holders thereof in the Chapter 11 Case. Accordingly, the Company urges extreme caution with respect to existing and future investments in its common stock.

Cautionary Statement Regarding Forward-Looking Statements

This Form 8-K includes statements that are, or may be deemed, “forward-looking statements.” In some cases, these forward-looking statements can be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,” “anticipates,” “expects,” “plans,” “intends,” “may,” “could,” “might,” “will,” “should,” “approximately” or, in each case, their negative or other variations thereon or comparable terminology, although not all forward-looking statements contain these words. These forward-looking statements reflect the current beliefs and expectations of management made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to significant risks, uncertainties and assumptions that are difficult to predict and could cause actual results to differ materially and adversely from those expressed or implied in the forward-looking statements. Forward-looking statements are also subject to the risk factors and cautionary language described from time to time in the reports the Company files with the SEC, including in the Company’s most recent Annual Report on Form 10-K for the year ended December 31, 2022 and any updates thereto in the Company’s Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. These risks and uncertainties may cause actual future results to be materially different than those expressed in such forward-looking statements. Any forward-looking statements that we make in this Form 8-K speak only as of the date of such statement, and we undertake no obligation to update such statements to reflect events or circumstances after the date of this Form 8-K or to reflect the occurrence of unanticipated events.

Item 9.01. Financial Statements and Exhibits.

EXHIBIT INDEX

| | | | | | | | |

| | |

| Exhibit No. | | Description |

| |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | Novan, Inc. |

| | | |

Date: September 27, 2023 | | | | By: | | /s/ Paula Brown Stafford |

| | | | | | Paula Brown Stafford |

| | | | | | Chairman, President and Chief Executive Officer |

v3.23.3

Cover

|

Sep. 25, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 25, 2023

|

| Entity Registrant Name |

Novan, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-37880

|

| Entity Tax Identification Number |

20-4427682

|

| Entity Address, Address Line One |

4020 Stirrup Creek Drive, Suite 110

|

| Entity Address, City or Town |

Durham

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

27703

|

| City Area Code |

919

|

| Local Phone Number |

485-8080

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value

|

| Trading Symbol |

NOVNQ

|

| Security Exchange Name |

NONE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001467154

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

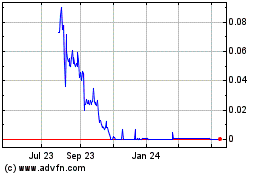

NVN Liquidation (CE) (USOTC:NOVNQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

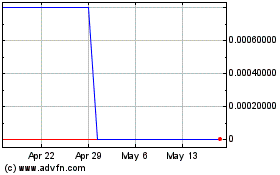

NVN Liquidation (CE) (USOTC:NOVNQ)

Historical Stock Chart

From Apr 2023 to Apr 2024