0001497253true00014972532023-08-162023-08-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 16, 2023 |

Organovo Holdings, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-35996 |

27-1488943 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

|

|

11555 Sorrento Valley Rd Suite 100 |

|

San Diego, California |

|

92121 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (858) 224-1000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, $0.001 par value |

|

ONVO |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

This Amendment No. 1 to the Current Report on Form 8-K/A is being filed to amend the Current Report on Form 8-K, filed by Organovo Holdings, Inc. (the “Company”) with the Securities and Exchange Commission on August 22, 2023 (the “Original Report”) in order to update the Company’s disclosures under Item 2.05 and Item 5.02 of the Original Report.

Item 2.05. Costs Associated with Exit or Disposal Activities.

As previously disclosed in the Original Report, on August 18, 2023, the Company announced to its employees a plan to reduce the Company’s workforce, effective August 25, 2023, by approximately six employees, which represented approximately 24% of its employees as of August 18, 2023. At the time of filing the Original Report, the Company was unable to estimate the amount and timing of the reduction in force charges due to the fact that severance packages to be provided to certain affected employees were still being negotiated and finalized at the time of the filing of the Original Report.

The Company now estimates that it will incur approximately $0.5 million of cash expenditures in connection with the reduction in force, which relate to severance pay, and are expected to be incurred through the quarter ending June 30, 2024. The Company anticipates annual cost savings of $1.5 million resulting from the reduction in force. The charges the Company expects to incur and anticipated cost savings are subject to assumptions, and actual charges may differ from the amount disclosed in this Current Report on Form 8-K/A.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

As previously disclosed in the Original Report, as part of the reduction in force discussed in Item 2.05 above, on August 16, 2023, Jeffrey Miner, Ph.D., the Company’s former Chief Scientific Officer, was notified that his employment with the Company would be terminated. Dr. Miner’s last day of employment was August 25, 2023.

On September 19, 2023, in connection with Dr. Miner’s termination, the Company entered into a Separation Agreement and General Release (the “Separation Agreement”) with Dr. Miner, to be effective as of September 27, 2023. Pursuant to the Separation Agreement, Dr. Miner released any claims against the Company and the Company will (i) provide Dr. Miner a consulting contract for a period of six months, pursuant to which the Company will pay Dr. Miner an aggregate of $169,250 for his consulting services, and (ii) subject to approval by the Company’s Board of Directors, grant Dr. Miner a stock option to purchase 40,000 shares of common stock of the Company (the “Option”). The Option will vest as follows: 13,000 shares will be vested immediately upon issuance, 13,500 shares will vest on the one year anniversary of the Separation Agreement and 13,500 shares will vest on the two year anniversary of the Separation Agreement. The exercise price will be equal to the closing price of a share of Common Stock on the date the Option is approved by the Company’s Board of Directors.

The foregoing description of the Separation Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Separation Agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Forward-Looking Statements

This Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Exchange Act, which are subject to the “safe harbor” created by those sections. Forward-looking statements can be identified by words such as “expects,” “projects,” “may,” “will,” “could,” “would,” “should,” “believes,” “anticipates,” “estimates,” “intends,” “plans,” “potential,” “promise” or similar references to future periods. Examples of forward-looking statements in this Form 8-K include, without limitation, statements regarding the reduction in force, the Company’s operational focus on FXR314, the effect of the reduction in force, anticipated charges and any anticipated cost savings associated therewith and the consulting arrangement with Jeff Miner. Forward-looking statements are statements that are not historical facts, nor assurances of future performance. Instead, they are based on the Company’s current beliefs, expectations and projections regarding any strategic transaction process, the ability to advance its research and development activities and pursue development of any of its pipeline products, its technology, its product and service development opportunities and timelines, its business strategies, customer acceptance and the market potential of its technology, products and services, its future capital requirements, its future financial performance and other matters. These risks and uncertainties and other factors are identified and described in more detail in the Company’s filings with the SEC, including its Annual Report on Form 10-K filed with the SEC on July 14, 2023, as such risk factors are updated in its most recently filed Quarterly Report on Form 10-Q filed with the SEC on August 10, 2023. As a result, you should not place undue reliance on any forward-looking statements. Except to the limited extent required by applicable law, the Company does not intend to update any of the forward-looking statements to conform these statements to reflect actual results, later events or circumstances or to reflect the occurrence of unanticipated events.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

* * *

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

Organovo Holdings, Inc. |

|

|

Date: September 22, 2023 |

By: |

/s/ Keith Murphy |

|

|

|

Name: Keith Murphy |

|

|

|

Title: Executive Chairman |

|

Exhibit 10.1

Separation Agreement and General Release

This Separation Agreement and General Release (“Agreement”) is entered into by and between Jeff Miner (Employee) and Organovo, Inc. (“Company”). The Employee’s Company employment ended on August 25, 2023 (Separation Date). The “Effective Date” of this Agreement will be the eighth day following the date that the Employee signs and returns this Agreement to the Company provided the Employee does not rescind this Agreement in the seven days following the date that the Employee signs it.

1. Consideration: In exchange for this Agreement and conditioned on the occurrence of the Effective Date, the Employee shall be entitled to receive the benefits set forth in this Section 1 (collectively, the “Consideration”), which benefits the Employee is not otherwise entitled to receive and which will not be taken into account when determining the Employee’s rights or benefits under any employee benefit plan, program, or policy, notwithstanding anything in it to the contrary.

Consulting Agreement: The Company will provide Employee a consulting contract for a period of six months, with a first month payment of Sixty-Nine Thousand Eight Hundred Seventy-Five Dollars and No Cents ($69,875), and five subsequent regular monthly payments of Nineteen Thousand Eight Hundred Seventy-Five Dollars and No Cents ($19,875) each. Total consideration in cash will amount to One Hundred Sixty-Nine Thousand Two Hundred Fifty Dollars and No Cents ($169,250) in six (6) payments.

Equity: Subject to the approval of the Company’s Board of Directors, the Company will provide Employee with 40,000 stock options, priced at close on the date approved by the Board of Directors, with a vesting schedule consisting of: 13,000 options vested immediately, 13,500 additional vesting on the one year anniversary of this agreement, and 13,500 vesting on the two-year anniversary of this agreement.

2. Compensation and Benefit Plans: As of the Separation Date, the Employee ceased to be eligible to participate under any stock option, bonus, incentive compensation, commission, medical, dental, disability, life insurance, retirement, or other compensation or benefit plans of the Company or any affiliate.

3. Tax Reporting and Withholding: The Company will report the payment due under this Agreement to tax authorities, and withhold taxes and other amounts from them, as it determines is consistent with applicable law.

4. Release: The Employee releases (i.e., gives up) all known and unknown claims that the Employee owns or holds as of the date the Employee signs this Agreement against the Company, all current and former, direct and indirect parents, subsidiaries, brother-sister companies, and all other affiliates and related partnerships, joint ventures, or other entities, and, with respect to each of them, their predecessors and successors; and, with respect to each such entity, all of its past, present, and future employees, officers, directors, stockholders, owners, representatives, assigns, attorneys, agents, insurers, employee benefit programs (and the trustees, administrators, fiduciaries, and insurers of such programs), and any other persons acting by, through, under or in concert with any of the persons or entities listed in this section, and their successors (Released Parties and each a Released Party). For

example, the Employee is releasing all common law contract, tort, or other claims the Employee has or might have, as well as all claims the Employee has or might have under the Age Discrimination in Employment Act (ADEA), the Worker Adjustment & Retraining Notification Act (the WARN Act), the Family and Medical Leave Act (FMLA), Title VII of the Civil Rights Act of 1964, Sections 1981 and 1983 of the Civil Rights Act of 1866, the Americans With Disabilities Act (ADA), the Employee Retirement Income Security Act of 1974 (ERISA), and any similar domestic or foreign laws, such as the California Fair Employment and Housing Act, California Labor Code Section 200 et seq., California Business and Professions Code Section 17200, et seq., and any applicable California Industrial Welfare Commission order. However, the Employee is not releasing (i) any of the few claims that the law does not permit the Employee to release by private agreement; (ii) vested benefits (except already-denied benefits) under any employee-benefit plan governed by ERISA; (iii) any right the Employee has to be indemnified by the Company; or (iv) the Employee’s right to enforce this Agreement.

The Employee expressly waives the protection of Section 1542 of the Civil Code of the State of California and any analogous rule or principle of any other jurisdiction. Section 1542 provides:

A general release does not extend to claims that the creditor or releasing party does not know or suspect to exist in his or her favor at the time of executing the release and that, if known by him or her, would have materially affected his or her settlement with the debtor or released party.

5. Ownership of Claims: The Employee has not assigned or given away any of the claims the Employee is releasing.

6. Applicable Law: To the extent federal law does not apply, this Agreement is governed by the internal laws (and not the conflicts of law rules) of California.

7. Covenants: The Employee acknowledges and agrees that:

(a) Promise Not to Sue: The Employee promises not to sue any Released Party with respect to any claim released by this Agreement. If the Employee does sue any Released Party in breach of this promise, the Employee will pay the Released Party for its attorneys’ fees and costs in defending against such a claim. The Employee understands that the Employee may challenge the Employee’s release of claims under the ADEA without breaching this promise.

(b) Return of Company Property: Within 5 days of Company providing Employee with pre-paid FedEx appropriate packaging, the Employee promises to return to the Company all files, memoranda, documents, records, copies of the foregoing, Company-provided credit cards, keys, building passes, security passes, access or identification cards, mobile devices, laptops, thumb drives, and any other property of the Company or any Released Party in the Employee’s possession or control. The Employee promises to clear all expense accounts, repay all debts owed to the Company or any Released Party, pay all amounts owed on Company-provided credit cards or accounts (such as cell phone accounts), and cancel or personally assume any such credit cards or accounts. The Employee agrees not to incur any expenses, obligations, or liabilities on behalf of the Company.

(c) Nondisparagement: To the maximum extent permitted by applicable law, the Employee agrees not to criticize, denigrate, or otherwise disparage the Company, with respect to statements pertaining or relating to the Company’s business or any of Company’s products, processes, experiments, policies, practices, standards of business conduct, or areas or techniques of research.

(d) Cooperation: For a period of 12 months from the Separation Date, the Employee agrees that, as requested by the Company, the Employee will fully cooperate with the Company with respect to any current or future investigation or the defense or prosecution of any claims, proceedings, arbitrations or other actions. For example, as requested by the Company, the Employee will promptly and fully respond to all inquiries from the Company relating to any lawsuit or arbitration and testify truthfully on behalf of the Company in connection with any such lawsuit or arbitration. The Employee further agrees that, as requested by the Company, the Employee will cooperate fully with the Company in any investigation, proceeding, administrative review, or litigation brought against the Company or any Released Party by any government agency or private party pertaining to matters occurring during the Employee’s employment with the Company When requesting cooperation, Company shall make all reasonable efforts to minimize disruption to Employee’s other engagements and activities. Company will pay in advance for all expenses associated with the Employee assisting the Company at its request. The Company shall compensate the Employee at an hourly rate to be agreed to in the future for all time spent engaged in said requested cooperation.

Employee agrees to sign and return to the Company the Change in Relationship Form, Invention Assignment Agreement and Termination Certificate sent to him by Peter Kane on August 22, 2023.

8. Nondisparagement: The Company agrees that Keith Murphy shall not criticize, denigrate, or otherwise disparage the Employee and agrees to instruct the following individuals not to criticize, denigrate, or otherwise disparage the Employee: Tom Hess, Curtis Tyree, Alison Milhous, Doug Cohen, David Gobel, Adam Stern, and Vaidehi Joshi.

9. Unemployment Insurance (UI): The Company agrees that it will not contest Employee’s claim for unemployment insurance.

10. Consideration of Agreement: If initially the Employee did not think any representation made in this Agreement was true or if initially the Employee felt uncomfortable in making it, the Employee has resolved all the Employee’s doubts and concerns before signing this Agreement. The Employee has carefully read this Agreement, the Employee fully understands what it means, the Employee is entering into it knowingly and voluntarily, and all the Employee’s representations in it are true. The consideration period described in the box above the Employee’s signature began when the Employee first was given this Agreement.

11. Additional Representations: The Employee has not suffered any job-related wrongs or injuries, such as any type of discrimination and the Employee has no occupational diseases. The Employee has properly reported all hours that the Employee has worked and the Employee has been paid all compensation, benefits, and other amounts that the Company or any Released Party owed the Employee. The Employee has submitted a request for reimbursement for all amounts that the Employee is entitled to receive reimbursement from any of the Released Parties. The Employee understands that the Company in the future may improve employee benefits or pay. The Employee understands that the Employee’s former job may be refilled.

12. Fees and Costs: In the event of litigation relating to this Agreement or its subject matter, the prevailing party shall be entitled to recover its reasonable attorneys’ fees and costs.

13. Nondisclosure of Trade Secrets and Business Information and Other Restrictive Covenants: The Employee acknowledges that the Employee possesses secret, confidential, or proprietary information or trade secrets concerning the operations, future plans, or business methods of the Company and its affiliates (“Business Information”). The Employee agrees that the Company and its affiliates would be severely damaged and irreparably harmed if the Employee used or disclosed this Business Information. To prevent this harm, the Employee has made the following promises; they only supersede other similar promises the Employee may have made to the extent these promises are more protective of the Company’s interests, as it determines:

(a) Promise Not to Disclose: The Employee promises never to use or disclose any such Business Information before it has become generally known within the relevant industry through no fault of the Employee’s own. The Employee agrees that this promise will never expire.

The Employee further agrees that the Company would be irreparably harmed by any actual or threatened violation of this section, and that the Company will be entitled to an injunction prohibiting the Employee from committing any such violation.

Notwithstanding the Employee’s confidentiality obligations set forth in this Agreement, the Employee understands that, pursuant to the Defend Trade Secrets Act of 2016, the Employee will not be held criminally or civilly liable under any Federal or State trade secret law for the disclosure of a trade secret that: (A) is made (i) in confidence to a Federal, State, or local government official, either directly or indirectly, or to an attorney; and (ii) solely for the purpose of reporting or investigating a suspected violation of law; or (B) is made in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal. The Employee also understands that if the Employee files a lawsuit for retaliation by the Company for reporting a suspected violation of law, the Employee may disclose the trade secret to the Employee’s attorney and use the trade secret information in the court proceeding, if the Employee (A) files any document containing the trade secret under seal; and (B) does not disclose the trade secret, except pursuant to court order. The Employee understands that in the event it is determined that disclosure of Company trade secrets was not done in good faith pursuant to the above, the Employee may be subject to substantial damages under federal criminal and civil law, including punitive damages and attorneys’ fees.

14. Disclosure of Information, Government and Agency Communication, Testimony, Charges, etc.: Nothing in this Agreement prevents Employee from disclosing information about unlawful acts in the workplace, including but not limited to information pertaining to harassment or discrimination or any other conduct Employee has reasonable cause to believe is unlawful. Nothing in this Agreement prevents the Employee from giving truthful testimony or truthfully responding to a valid subpoena, or communicating, testifying before or filing a charge with government or regulatory entities (such as the U.S. Equal Employment Opportunity Commission (EEOC), National Labor Relations Board (NLRB), U.S. Department of Labor (DOL), or U.S. Securities and Exchange Commission (SEC)), subject to any obligation the Employee may have to take steps to protect confidential information from public disclosure. However, the Employee promises never to seek or accept any compensatory damages, back pay, front pay, or reinstatement remedies for Employee personally with respect to any claims released by this Agreement.

15. Miscellaneous:

(a) Complete Agreement: This Agreement is the entire agreement relating to any claims or future rights that the Employee has or might have with respect to the Company and the Released Parties. Once in effect, this Agreement is a legally admissible and binding agreement. It will not be construed strictly for or against the Employee, the Company, or any other Released Party. The headings contained in this Agreement are for convenience and shall not affect the meaning or interpretation of this Agreement.

(b) Counterparts: This Agreement may be signed in one or more counterparts or multiple originals, each of which shall be an original but all of which together shall constitute one and the same document. The parties agree that facsimile and electronic signatures have the same force and effect as original signatures.

(c) Waiver: No waiver of any provision of this Agreement shall be binding unless reduced to writing and signed by the waiving party. No such waiver of any provision of this Agreement shall waive of any other provision of this Agreement or constitute a continuing waiver.

(d) Amendments: This Agreement only may be amended by a written agreement that the Company and the Employee both sign.

(e) Effect of Void Provision: If the Company or the Employee successfully asserts that any provision in this Agreement is void, the rest of the Agreement will remain valid and enforceable unless the other party to this Agreement elects to cancel it; provided, however, that if the Company asks the Employee to sign a new document containing a legal and enforceable replacement provision in lieu of canceling the Agreement, the Employee promises that the Employee will do so. If this Agreement is canceled, the Employee will repay any payments or benefits the Employee received for signing it.

(f) No Wrongdoing: This Agreement is not an admission of wrongdoing by the Company or any other Released Party; neither it nor any drafts will be admissible evidence of wrongdoing.

(g) This Agreement is intended to comply with or be exempt from Section 409A of the Internal Revenue Code and the regulations thereunder (Section 409A), and the Company shall have complete discretion to interpret and construe this Agreement in any manner that establishes an exemption from (or otherwise conforms to) the requirements of Section 409A. For purposes of Section 409A, each payment hereunder shall at all times be considered a separate and distinct payment. To the extent required under Section 409A, any payments to be made under this Agreement on a termination of employment only will be made upon a “separation from service” within the meaning of Section 409A and any payments that otherwise would be made to the Employee during the first six months following the Employee’s separation from service will instead be made to the Employee on the first day of the seventh month following the Employee’s separation from service. If the period the Employee has to consider and revoke this Agreement spans two calendar years, notwithstanding anything to the contrary in this Agreement, no payment will be made to the Employee prior to the second calendar year. The Company makes no guarantee as to any tax treatment relating to this Agreement and neither the Company, its employees, officers, directors, or attorneys shall have any liability to the Employee on account of any adverse tax or related consequences including but not limited to adverse consequences under Section 409A.

YOU MAY NOT MAKE ANY CHANGES TO THIS AGREEMENT. BEFORE SIGNING THIS AGREEMENT, READ IT CAREFULLY, AND THE COMPANY ADVISES YOU TO DISCUSS IT WITH YOUR ATTORNEY. YOU HAVE 21 DAYS FOLLOWING THE DATE ON WHICH YOU RECEIVED THIS AGREEMENT TO CONSIDER IT AND DELIVER A SIGNED COPY OF IT TO KEITH MURPHY AT KEMURPH@ORGANOVO.COM, ALTHOUGH YOU ARE FREE TO SIGN AND DELIVER IT ANYTIME WITHIN THAT PERIOD. BY SIGNING IT, YOU WILL BE WAIVING YOUR KNOWN AND UNKNOWN CLAIMS.

YOU MAY RESCIND THIS AGREEMENT. TO DO SO, YOU MUST DELIVER A WRITTEN NOTICE THAT YOU ARE RESCINDING THIS AGREEMENT TO KEITH MURPHY AT KEMURPH@ORGANOVO.COM BEFORE Seven DAYS EXPIRE FROM THE TIME YOU SIGNED IT. IF YOU RESCIND THIS AGREEMENT, IT WILL NOT GO INTO EFFECT AND YOU WILL NOT RECEIVE THE PAYMENTS OR BENEFITS DESCRIBED IN IT THAT ARE CONTINGENT ON YOUR ENTERING INTO AND NOT RESCINDING THIS AGREEMENT.

|

|

|

|

Date: |

9/19/2023 |

|

/s/ Jeff Miner |

|

|

|

Jeff Miner, Employee |

|

|

|

|

Date: |

9/19/2023 |

|

/s/ Keith Murphy |

|

|

|

Company. Keith Murphy, President |

v3.23.3

Document And Entity Information

|

Aug. 16, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K/A

|

| Amendment Flag |

true

|

| Document Period End Date |

Aug. 16, 2023

|

| Entity Registrant Name |

Organovo Holdings, Inc.

|

| Entity Central Index Key |

0001497253

|

| Entity Emerging Growth Company |

false

|

| Securities Act File Number |

001-35996

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

27-1488943

|

| Entity Address, Address Line One |

11555 Sorrento Valley Rd

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

San Diego

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92121

|

| City Area Code |

(858)

|

| Local Phone Number |

224-1000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

ONVO

|

| Security Exchange Name |

NASDAQ

|

| Amendment Description |

This Amendment No. 1 to the Current Report on Form 8-K/A is being filed to amend the Current Report on Form 8-K, filed by Organovo Holdings, Inc. (the “Company”) with the Securities and Exchange Commission on August 22, 2023 (the “Original Report”) in order to update the Company’s disclosures under Item 2.05 and Item 5.02 of the Original Report.

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

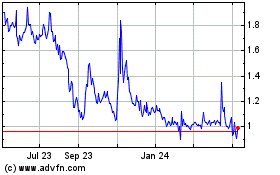

Organovo (NASDAQ:ONVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

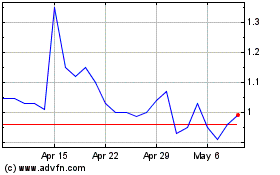

Organovo (NASDAQ:ONVO)

Historical Stock Chart

From Apr 2023 to Apr 2024