Filed

pursuant to Rule

424(b)(5) Registration No. 333-255544

PROSPECTUS

SUPPLEMENT

(To

Prospectus dated May 4, 2021)

Biotricity

Inc.

220

Shares of Series B Convertible Preferred Stock

Up

to 1,704,593 Shares of Common Stock Underlying the Series B Convertible Preferred Stock

Biotricity

Inc. is offering 220 shares of our Series B Convertible Preferred Stock, par value $0.001, or the Series B Preferred Stock, to an institutional

investor. We are also offering up to 1,704,593 shares of our common stock, par value $0.001, that are issuable upon conversion of, or

as dividends on, the Series B Preferred Stock being offered in this prospectus supplement and the accompanying prospectus.

Shares

of Series B Preferred Stock have a stated value of $10,000 per share, are entitled to cumulative dividends, payable in cash or shares

of common stock, at the annual rate of 8% (or 15% in the event of and during certain triggering events) of the stated value and are convertible

into shares of common stock in an amount determined by dividing the stated value being converted, plus any accrued but unpaid dividends

and other amounts due, by the conversion price. The initial conversion price is $3.50, subject to adjustment, or at the election of an

holder, an alternative conversion price of 80% (or 70% if our common stock is suspended from trading on or delisted from a principal

trading market or if we have effected a subsequent reverse split of our common stock) of the lowest daily volume weighed average price

of our common stock during the Alternate Conversion Measuring Period (as defined in the Certificate of Designations of the Series B Preferred

Stock of the Company). Shares of Series B Preferred Stock may be redeemed at any time by the Company. See “Description of the Securities

We are Offering.”

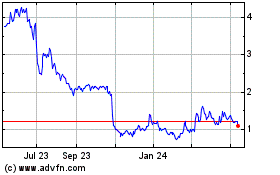

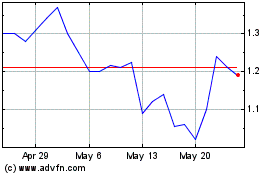

Our

common stock is traded on the Nasdaq Capital Market under the symbol “BTCY”. On September 18, 2023, the last reported

sales price of our common stock on the Nasdaq Capital Market was $2.16 per share. There is no established trading market for the

Series B Preferred Stock and we do not intend to list the Series B Preferred Stock on any securities exchange or nationally recognized

trading system. As of September 19, 2023, the aggregate market value of our outstanding common stock held by non-affiliates, or the public

float, was $24,189,065, which was calculated based on 7,630,620 shares of our outstanding common stock held by non-affiliates

at a price of $3.17 per share, the closing price of our common stock on July 24, 2023. During the 12 calendar months prior to, and including,

the date of this prospectus, we have sold $123,347 in securities pursuant to General Instruction I.B.6 of Form S-3.

In

addition, this prospectus supplement amends and supplements the information in the prospectus, dated April 27, 2021, as supplemented

by our prospectus supplement dated March 22, 2022, and the prospectus supplement dated July 20, 2023, or the Prior Prospectus. This prospectus

supplement should be read in conjunction with the Prior Prospectus, and is qualified by reference thereto, except to the extent that

the information herein amends or supersedes the information contained in the Prior Prospectus. This prospectus supplement is not complete

without, and may only be delivered or utilized in connection with, the Prior Prospectus, and any future amendments or supplements thereto.

We

filed the Prior Prospectus to register the offer and sale of our common stock, from time to time pursuant to the terms of that certain

At The Market Offering Agreement, or the Sales Agreement, between H.C. Wainwright & Co., LLC, or Wainwright, acting as the agent,

and us. Through the date hereof, we have sold $123,347 under the Sales Agreement pursuant to the Prior Prospectus.

In

addition to the offering of the Series B Preferred Stock and underlying common stock being made pursuant to this prospectus supplement,

we are filing this prospectus supplement to amend the Prior Prospectus to update the amount of shares we may sell under the Prior Prospectus.

As a result of the offering of the Series B Preferred Stock and the underlying common stock being made pursuant to this prospectus supplement,

and in accordance with the terms of the Sales Agreement, we may offer and sell shares of our common stock having an aggregate offering

price of up to $2,873,599 from time to time through Wainwright pursuant to the Prior Prospectus.

Investing

in our securities involves significant risks. See “Risk Factors” beginning on page S-3 of this prospectus supplement and

in the documents incorporated by reference into this prospectus supplement.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the accuracy or adequacy of this prospectus supplement. Any representation to the contrary is a criminal offense.

| | |

Per Share | | |

Total | |

| Offering price | |

$ | 9,090.91 | | |

$ | 2,000,000 | |

| Proceeds to us, before expenses | |

$ | 9,090.91 | | |

$ | 2,000,000 | |

Delivery

of the securities being offered pursuant to this prospectus supplement and the accompanying prospectus is expected to be occur on or

about September 19, 2023.

The

date of this prospectus supplement is September 19, 2023.

TABLE

OF CONTENTS

PROSPECTUS

You

should rely only on the information incorporated by reference or provided in this prospectus supplement and the accompanying prospectus.

We have not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information,

you should not rely on it. This prospectus supplement and the accompanying prospectus do not constitute an offer to sell, or a solicitation

of an offer to purchase, the securities offered by this prospectus supplement and the accompanying prospectus in any jurisdiction where

it is unlawful to make such offer or solicitation. You should assume that the information contained in this prospectus supplement or

the accompanying prospectus, or any document incorporated by reference in this prospectus supplement or the accompanying prospectus,

is accurate only as of the date of those respective documents. Neither the delivery of this prospectus supplement nor any distribution

of securities pursuant to this prospectus supplement shall, under any circumstances, create any implication that there has been no change

in the information set forth or incorporated by reference into this prospectus supplement or in our affairs since the date of this prospectus

supplement. Our business, financial condition, results of operations and prospects may have changed since that date.

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of securities.

The second part is the accompanying prospectus, which provides more general information, some of which may not apply to this offering.

The information included or incorporated by reference in this prospectus supplement also adds to, updates and changes information contained

or incorporated by reference in the accompanying prospectus. If information included or incorporated by reference in this prospectus

supplement is inconsistent with the accompanying prospectus or the information incorporated by reference therein, then this prospectus

supplement or the information incorporated by reference in this prospectus supplement will apply and will supersede the information in

the accompanying prospectus and the documents incorporated by reference therein.

This

prospectus supplement is part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, using

a “shelf” registration process, under the Securities Act of 1933, as amended (the “Securities Act”).

Under

the shelf registration process, we may from time to time offer and sell any combination of the securities described in the accompanying

prospectus up to a total dollar amount of $100,000,000, of which this offering is a part.

In

this prospectus supplement and the accompanying prospectus, unless the context otherwise requires, references to “Biotricity,”

the “Company,” “we,” “our,” or “us,” refer to Biotricity Inc. and its subsidiaries, unless

the context suggests otherwise.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights selected information about our company, this offering and information appearing elsewhere in this prospectus supplement,

in the accompanying prospectus, and in the documents we incorporate by reference. This summary is not complete and does not contain all

the information that you should consider before investing in our securities. You should read this entire prospectus supplement and the

accompanying prospectus carefully, including the “Risk Factors” contained in this prospectus supplement beginning on page

S-3, and the risk factors, financial statements and notes incorporated by reference herein, before making an investment decision. This

prospectus supplement may add to, update or change information in the accompanying prospectus.

Company

Overview

Biotricity

is a medical technology company focused on biometric data monitoring solutions. Our aim is to deliver innovative, remote monitoring solutions

to the medical, healthcare, and consumer markets, with a focus on diagnostic and post-diagnostic solutions for lifestyle and chronic

illnesses. We approach the diagnostic side of remote patient monitoring by applying innovation within existing business models where

reimbursement is established. We believe this approach reduces the risk associated with traditional medical device development and accelerates

the path to revenue. In post-diagnostic markets, we intend to apply medical grade biometrics to enable consumers to self-manage, thereby

driving patient compliance and reducing healthcare costs. We intend to first focus on a segment of the diagnostic mobile cardiac telemetry

market, otherwise known as COM, while providing our chosen markets with the capability to also perform other cardiac studies.

THE

OFFERING

| Securities

we are offering |

|

220

shares of Series B Preferred Stock. Shares of Series B Preferred Stock have a stated value of $10,000 per share, are entitled to

cumulative dividends, payable in cash or shares of common stock, at the annual rate of 8% (or 15% in the event of and during certain

triggering events) of the stated value, and are convertible into shares of common stock in an amount determined by the stated value

being converted, plus any accrued but unpaid dividends and other amounts due, by the conversion price. The initial conversion price

is $3.50, subject to adjustment, or at the election of the holder, an alternative conversion price of 80% (or 70% if our common stock

is suspended from trading on or delisted from a principal trading market or if we have effected a reverse split of the common stock)

of the lowest daily volume weighed average price of our common stock during the Alternate Conversion Measuring Period (as defined

in the Certificate of Designations of the Series B Preferred Stock of the Company). Shares of Series B Preferred Stock may be redeemed

at any time by the Company. See “Description of the Securities We are Offering.” |

| |

|

|

| |

|

We

are also offering up to 1,704,593 shares of our common stock issuable upon conversion of, or as dividends, on the Series B Preferred

Stock. |

| |

|

|

| Offering

price |

|

$9,090.91

per share of Series B Preferred Stock. |

| |

|

|

| Use

of proceeds |

|

We

estimate the net proceeds to us from this offering will be approximately $1,870,000 after deducting estimated offering expenses payable

by us. We intend to use the net proceeds from the sale of the securities offered by this prospectus for working capital and general

corporate purposes. |

| |

|

|

| Common

stock to be outstanding after the offering assuming conversion of the Series B Preferred Stock |

|

9,194,366,

assuming conversion of the Series B Preferred Stock at the initial conversion price of $3.50. |

| |

|

|

| Nasdaq

Capital Market symbol for common stock |

|

Our

common stock is traded on the Nasdaq Capital Market under the symbol “BTCY”. There is no established trading market for

the Series B Preferred Stock and we do not intend to list the Series B Preferred Stock on any securities exchange or nationally recognized

trading system. |

| |

|

|

| Risk

factors |

|

Investing

in our securities involves significant risks. See “Risk Factors” beginning on page S-3 of this prospectus supplement. |

The

number of shares of common stock outstanding after the offering is based on 8,565,795 shares of common stock outstanding as of September

19, 2023 and excludes, as of such date (assuming a conversion or exercise price, as applicable, of $2.10 (based on the closing

price of our common stock on September 15, 2023) with respect to certain notes, warrants, and shares of Series A Preferred Stock, whose

conversion or exercise price is variable or has not yet been set)):

| ● | 2,974,843

shares of common issuable upon conversion of $4,685,379 in outstanding convertible notes; |

| | | |

| ● | 3,531,653

shares of common issuable on conversion of 6,304 Series A Preferred Stock; |

| | | |

| ● | 1,573,608

shares of common issuable upon exercise of outstanding warrants with a weighted average exercise

price of $6.52; and |

| | | |

| ● | 1,258,540

shares of common stock issuable upon exercise of outstanding options with a weighted average

exercise price of $9.29. |

RISK

FACTORS

Any

investment in our securities involves a high degree of risk. Investors should carefully consider the risks described below, and all of

the information contained or incorporated by reference in this prospectus supplement, including the risk factors described in the accompanying

prospectus and in our Annual Report on Form 10-K for the year ended March 31, 2023, before deciding whether to purchase the securities

offered hereby. Our business, financial condition, results of operations and prospects could be materially and adversely affected by

these risks.

Because

we will have broad discretion and flexibility in how we use the net proceeds from this offering, we may use the net proceeds in ways

in which you disagree.

We

currently intend to use the net proceeds from this offering for working capital and general corporate purposes. See “Use of Proceeds.”

Our management will have significant discretion and flexibility in applying the net proceeds of this offering. You will be relying on

the judgment of our management with regard to the use of these net proceeds, and you will not have the opportunity, as part of your investment

decision, to assess whether the net proceeds are being used appropriately. The failure of our management to use such funds effectively

could have a material adverse effect on our business, financial condition, operating results and cash flow.

Additional

stock offerings in the future may dilute then existing stockholders’ percentage ownership of our company.

Given

our plans and expectations that we will need additional capital, we anticipate that we will need to issue additional shares of common

stock or securities convertible or exercisable for shares of common stock, including convertible preferred stock, convertible notes,

stock options or warrants. The issuance of additional securities in the future will dilute the percentage ownership of then existing

stockholders.

There

is no established public trading market for the Series B Preferred Stock being offered in this offering.

There

is no established public trading market for the Series B Preferred Stock being offered in this offering, and we do not expect a market

to develop. In addition, we do not intend to apply to list the Series B Preferred Stock on any national securities exchange or other

nationally recognized trading system. Without an active market, the liquidity of the Series B Preferred Stock will be limited.

Our

issuance of common stock upon conversion of, or as dividends on the Series B Preferred Stock may dilute then existing stockholders’

ownership percentage of the Company.

The

Series B Preferred Stock is convertible into shares of common stock of the Company, and dividends on the Series B Preferred Stock may

be payable in shares of common stock, subject to the terms and conditions of the Certificate of Designations (see “Description

of the Securities We are Offering”). Our issuance of common stock upon conversion of, or as dividends on the Series B Preferred

Stock, if it occurs, would dilute then-existing stockholders.

The

Series B Preferred Stock may be redeemed at any time by the Company.

The

Company will have the right at any time to redeem all or any portion of the Series B Preferred Stock then outstanding at a price equal

to 110% of the stated value plus any accrued but unpaid dividends. Such redemption, if it occurs, may reduce the return on the Series

B Preferred Stock, as redeemed shares will no longer be entitled to further dividends.

FORWARD-LOOKING

INFORMATION

This

prospectus supplement, the accompanying prospectus and the information incorporated by reference herein and therein contain or incorporate

forward-looking statements. These forward-looking statements reflect management’s beliefs and assumptions. In addition, these forward-looking

statements reflect management’s current views with respect to future events or our financial performance, and involve certain known

and unknown risks, uncertainties and other factors, including those identified below, which may cause our or our industry’s actual

or future results, levels of activity, performance or achievements to differ materially from those expressed or implied by any forward-looking

statements or from historical results. Forward-looking statements include information concerning our possible or assumed future results

of operations and statements preceded by, followed by, or that include the words “may,” “will,” “could,”

“would,” “should,” “believe,” “expect,” “plan,” “anticipate,”

“intend,” “estimate,” “predict,” “potential” or similar expressions.

Forward-looking

statements are inherently subject to risks and uncertainties, many of which we cannot predict with accuracy and some of which we might

not even anticipate. Although we believe that the expectations reflected in the forward-looking statements are based upon reasonable

assumptions at the time made, we can give no assurance that the expectations will be achieved. Future events and actual results, financial

and otherwise, may differ materially from the results discussed in the forward-looking statements. Readers are cautioned not to place

undue reliance on these forward-looking statements.

The

factors described under “Risk Factors” in this prospectus supplement and the accompanying prospectus and in any documents

incorporated by reference herein, and other factors could cause our or our industry’s future results to differ materially from

historical results or those anticipated or expressed in any of our forward-looking statements.

Forward-looking

statements are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake

no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except

as may be required by applicable law. Although we believe that the expectations reflected in the forward-looking statements are reasonable,

we cannot guarantee future results, levels of activity, performance or achievements.

USE

OF PROCEEDS

We

estimate that the net proceeds from this offering, after deducting estimated offering expenses payable by us, will be approximately $1,870,000.

We

currently intend to use the net proceeds from this offering for working capital and general corporate purposes. We have not yet determined

the amount or timing of the expenditures for the categories listed above, and these expenditures may vary significantly depending on

a variety of factors. As a result, we will retain broad discretion over the use of the net proceeds from this offering.

CAPITALIZATION

The

following table sets forth our consolidated cash and cash equivalents and capitalization as of June 30, 2023. Such information is set

forth on the following basis:

| ● | on

an actual basis, after giving effect to the Company’s six-for-one reverse split of

its common stock that occurred on July 3, 2023; and |

| | | |

| ● | on

an as adjusted basis, giving effect to the sale of the 220 shares of Series B Preferred Stock

at the offering price of $9,090.91 per share, after deducting estimated offering expenses. |

You

should read this table together with the section of this prospectus supplement entitled “Use of Proceeds” and with the financial

statements and related notes and the other information that we incorporate by reference into this prospectus supplement and the accompanying

prospectus.

| | |

As of June 30, 2023 | |

| | |

Actual | | |

As Adjusted | |

| Cash | |

$ | 51,433 | | |

$ | 1,921,433 | |

| | |

| | | |

| | |

| Total liabilities | |

| 29,555,737 | | |

$ | 29,555,737 | |

| Stockholders’ deficiency: | |

| | | |

| | |

| Preferred Stock, $0.001 par value, 9,980,000 shares authorized, 1 share issued and outstanding | |

| 1 | | |

| 1 | |

| Series A Preferred Stock, $0.001 par value, 20,000 shares authorized, 6,304 shares issued and outstanding | |

| 6 | | |

| 6 | |

| Series B Preferred Stock, 0 shares authorized, actual, 600 shares authorized, as adjusted; 0 shares issued and outstanding, actual, 220 shares issued and outstanding, as adjusted | |

| 0 | | |

| 220 | |

| Common Stock, par value $0.001 per share; 125,000,000 shares authorized; 8,507,977 shares issued and outstanding | |

| 52,514 | | |

| 52,514 | |

| Shares to be issued, 3,954 shares of common stock | |

| 24,999 | | |

| 24,999 | |

| Additional paid-in capital | |

| 93,011,897 | | |

| 94,881,677 | |

| Accumulated other comprehensive loss | |

| (328,627 | ) | |

| (328,627 | ) |

| Accumulated deficit | |

| (116,172,404 | ) | |

| (116,172,404 | ) |

| Total stockholders’ deficiency | |

$ | (23,411,614 | ) | |

$ | (21,541,614 | ) |

The

information above is as of June 30, 2023 and excludes, as of that date (assuming a conversion or exercise price, as applicable, of $2.10

(based on the closing price of our common stock on September 15, 2023) with respect to certain notes, warrants, and shares of Series

A Preferred Stock, whose conversion or exercise price is variable or has not yet been set)):

| ● | 2.974,843

shares of common issuable upon conversion of $4,685,379 in outstanding convertible notes; |

| | | |

| ● | 3,531,653

shares of common issuable on conversion of 6,304 Series A Preferred Stock; |

| | | |

| ● | 1,566,941

shares of common issuable upon exercise of outstanding warrants with a weighted average exercise

price of $6.54; and |

| | | |

| ● | 1,258,540

shares of common stock issuable upon exercise of outstanding options with a weighted average

exercise price of $9.29. |

DESCRIPTION

OF THE SECURITIES WE ARE OFFERING

In

this offering, we are offering 220 shares of our Series B Preferred Stock. This prospectus supplement also includes the offering of up

to 1,704,593 shares of common stock issuable upon conversion of, or as dividends on, the Series B Preferred Stock.

Common

Stock

The

material terms and provisions of our common stock are described under the caption “Description of Common Stock” beginning

on page 5 of the accompanying prospectus.

Series

B Preferred Stock

The

following is a brief summary of certain terms and conditions of the Series B Preferred Stock and is subject in all respects to the provisions

contained in the Certificate of Designation of Series B Preferred Stock of the Company, or the Certificate of Designations. You should

review the Certificate of Designations, filed as an exhibit to the Company’s Current Report on Form 8-K filed with the SEC in connection

with this offering, for a complete description of the terms and conditions applicable to the Series B Preferred Stock. The following

brief summary of the material terms and provisions of the Series B Preferred Stock offered pursuant to this prospectus is subject to,

and qualified in its entirety by, the Certificate of Designations.

General

Pursuant

to the Certificate of Designations, the Company has designated 600 shares of its preferred stock as Series B Convertible Preferred Stock,

par value $0.001. At the consummation of this offering, we will issue 220 shares of our Series B Preferred Stock. The Series B Preferred

Stock has a stated value of $10,000 per share.

Ranking

The

Series B Preferred Stock, with respect to the payment of dividends, distributions and payments upon the liquidation, dissolution and

winding up of the Company, ranks senior to all capital stock of the Company unless the holders of the majority of the outstanding shares

of Series B Preferred Stock consent to the creation of other capital stock of the Company that is senior or equal in rank to the Series

B Preferred Stock.

Dividends

Holders

of Series B Preferred Stock will be entitled to receive cumulative dividends (“Dividends”), in shares of common stock or

cash on the stated value at an annual rate of 8% (which will increase to 15% if a Triggering Event (as defined in the Certificate of

Designations)) occurs. Dividends will be payable upon conversion of the Series B Preferred Stock, upon any redemption, or upon any required

payment upon any Bankruptcy Triggering Event (as defined in the Certificate of Designations).

Conversion

Holders

of Series B Preferred Stock will be entitled to convert shares of Series B Preferred Stock into a number of shares of common stock determined

by dividing the stated value (plus any accrued but unpaid dividends and other amounts due) by the conversion price. The initial conversion

price is $3.50, subject to adjustment in the event the Company sells common stock at a price lower than the then-effective conversion

price. Holders may not convert the Series B Preferred Stock to common stock to the extent such conversion would cause such holder’s

beneficial ownership of common stock to exceed 4.99% of the outstanding common stock. In addition, the Company will not issue shares

of common stock upon conversion of the Series B Preferred Stock in an amount exceeding 19.9% of the outstanding common stock as of the

initial issuance date unless the Company receives shareholder approval for such issuances.

Holders

may elect to convert shares of Series B Preferred Stock to common stock at an alternate conversion price equal to 80% (or 70% if the

common stock is suspended from trading on or delisted from a principal trading market or if the Company has effected a reverse split

of the common stock) of the lowest daily volume weighed average price of the common stock during the Alternate Conversion Measuring Period

(as defined in the Certificate of Designations). In the event the Company receives a conversion notice that elects an alternate conversion

price, the Company may, at its option, elect to satisfy its obligation under such conversion with payment in cash in an amount equal

to 110% of the conversion amount.

The

Series B Preferred Stock will automatically convert to common stock upon the 24-month anniversary of the initial issuance date of the

Series B Preferred Stock.

Redemption

At

any time after the earlier of a holder’s receipt of a Triggering Event notice and such holder becoming aware of a Triggering Event

and ending on the 20th trading day after the later of (x) the date such Triggering Event is cured and (y) such holder’s

receipt of a Triggering Event notice, such holder may require the Company to redeem such holder’s shares of Series B Preferred

Stock.

Upon

any Bankruptcy Triggering Event (as defined in the Certificate of Designations), the Company will be required to immediately redeem all

of the outstanding shares of Series B Preferred Stock.

The

Company will have the right at any time to redeem all or any portion of the Series B Preferred Stock then outstanding at a price equal

to 110% of the stated value plus any accrued but unpaid dividends and other amounts due.

In

the event of a Change of Control (as defined in the Certificate of Designations) a holder may require the Company to redeem all or any

portion of such holder’s shares of Series B Preferred Stock.

Voting

Holders

of the Series B Preferred Stock will have the right to vote on an as-converted basis with the common stock, subject to the beneficial

ownership limitation set forth in the Certificate of Designations.

PLAN

OF DISTRIBUTION

We

have entered into a securities purchase agreement with an institutional investor for the sale of the securities offered hereby. We will

only sell to an institutional investor who has entered into such securities purchase agreement.

Delivery

of the Series B Preferred Stock offered hereby is expected to occur on or about September 19, 2023, subject to satisfaction of

certain closing conditions.

We

estimate the total expenses of this offering paid or payable by us will be approximately $130,000.

LEGAL

MATTERS

The

validity of the securities being offered under this prospectus by us will be passed upon for us by Sichenzia Ross Ference LLP, New York,

New York.

EXPERTS

The

financial statements incorporated by reference into this prospectus have been so included in reliance on the report of SRCO Professional

Corporation, an independent registered public accounting firm, related to the consolidated financial statements as of March 31, 2023

and 2022 and for the years then ended, given on the authority of said firm as experts in auditing and accounting.

WHERE

YOU CAN FIND MORE INFORMATION

We

are subject to the reporting requirements of the Exchange Act and file annual, quarterly and current reports, and other information with

the SEC. These reports, proxy statements and other information are available at the SEC’s website at http://www.sec.gov.

This

prospectus supplement and the accompanying prospectus are only part of a registration statement on Form S-3 that we have filed with the

SEC under the Securities Act and therefore omit certain information contained in the registration statement. We have also filed exhibits

and schedules with the registration statement that are excluded from this prospectus supplement and the accompanying prospectus, and

you should refer to the applicable exhibit or schedule for a complete description of any statement referring to any contract or other

document. The registration statement, including the exhibits and schedules, without charge, are available at the SEC’s website.

We

also maintain a website at www.biotricity.com, through which you can access our SEC filings. The information set forth on our

website is not part of this prospectus supplement or the accompanying prospectus.

INCORPORATION

OF DOCUMENTS BY REFERENCE

The

SEC allows us to “incorporate by reference” the information contained in documents that we file with them, which means that

we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered

to be part of this prospectus supplement and the accompanying prospectus. Information in the accompanying prospectus supersedes information

incorporated by reference that we filed with the SEC before the date of the prospectus, and information in this prospectus supplement

supersedes information incorporated by reference that we filed with the SEC before the date of this prospectus supplement, while information

that we file later with the SEC will automatically update and supersede the information in this prospectus supplement and the accompanying

prospectus or incorporated by reference. We incorporate by reference the following documents that have been filed with the SEC (other

than information furnished under Item 2.02 or Item 7.01 of Form 8-K and all exhibits related to such items):

| ● | Our

Annual Report on Form 10-K for the fiscal year ended March 31, 2023, filed with the SEC on

June 29, 2023; |

| | | |

| ● | Our

Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2023, filed with the

SEC on August 14, 2023; |

| | | |

| ● | Our

Current Reports on Form 8-K and 8-K/A filed with the SEC on April 3, 2023, May 18, 2023,

July 5, 2023, July 20, 2023, and August 4, 2023; |

| | | |

| ● | the

description of our common stock contained in registration statement on Form 8-A filed with

the SEC on August 25, 2021; and |

| | | |

| ● | all

reports and other documents subsequently filed by us pursuant to Sections 13(a), 13(c), 14

and 15(d) of the Exchange Act after the date of this prospectus and prior to the termination

of this offering. |

The

information about us contained in this prospectus should be read together with the information in the documents incorporated by reference.

You may request a copy of any or all of these filings, at no cost, by writing or telephoning us at: Waqaas Al-Siddiq, Biotricity Inc.,

203 Redwood Shores Parkway, Suite 600, Redwood City, CA 94065, telephone number (650) 832-1626.

$100,000,000

BIOTRICITY

INC.

Common

Stock

Preferred

Stock

Warrants

Units

We

may from time to time, in one or more offerings at prices and on terms that we will determine at the time of each offering, sell common

stock, preferred stock, warrants, or a combination of these securities, or units, for an aggregate initial offering price of up to $100,000,000.

This prospectus describes the general manner in which our securities may be offered using this prospectus. Each time we offer and sell

securities, we will provide you with a prospectus supplement that will contain specific information about the terms of that offering.

Any prospectus supplement may also add, update, or change information contained in this prospectus. You should carefully read this prospectus

and the applicable prospectus supplement as well as the documents incorporated or deemed to be incorporated by reference in this prospectus

before you purchase any of the securities offered hereby.

Our

common stock is currently traded on the OTCQB under the symbol “BTCY.” On April 23, 2021, the last reported sales price for

our common stock was $2.1900 per share. The prospectus supplement will contain information, where applicable, as to any other listing

of the securities on the OTCQB or any other securities market or exchange covered by the prospectus supplement.

The

aggregate market value of our outstanding common stock held by non-affiliates was approximately $77, 106,884, which was calculated based

on 28,038,867 shares of outstanding common stock held by non-affiliates as of March 3, 2021, and a price per share of $2.75, the closing

price of our common stock on that same date.

The

securities offered by this prospectus involve a high degree of risk. See “Risk Factors” beginning on page 5, in addition

to Risk Factors contained in the applicable prospectus supplement.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We

may offer the securities directly or through agents or to or through underwriters or dealers. If any agents or underwriters are involved

in the sale of the securities their names, and any applicable purchase price, fee, commission or discount arrangement between or among

them, will be set forth, or will be calculable from the information set forth, in an accompanying prospectus supplement. We can sell

the securities through agents, underwriters or dealers only with delivery of a prospectus supplement describing the method and terms

of the offering of such securities. See “Plan of Distribution.”

This

prospectus is dated May 4, 2021

TABLE

OF CONTENTS

You

should rely only on the information contained or incorporated by reference in this prospectus or any prospectus supplement. We have not

authorized anyone to provide you with information different from that contained or incorporated by reference into this prospectus. If

any person does provide you with information that differs from what is contained or incorporated by reference in this prospectus, you

should not rely on it. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained

in this prospectus. You should assume that the information contained in this prospectus or any prospectus supplement is accurate only

as of the date on the front of the document and that any information contained in any document we have incorporated by reference is accurate

only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any prospectus

supplement or any sale of a security. These documents are not an offer to sell or a solicitation of an offer to buy these securities

in any circumstances under which the offer or solicitation is unlawful.

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or SEC, using a “shelf”

registration process. Under this shelf registration process, we may sell any combination of the securities described in this prospectus

in one of more offerings up to a total dollar amount of proceeds of $100,000,000. This prospectus describes the general manner in which

our securities may be offered by this prospectus. Each time we sell securities, we will provide a prospectus supplement that will contain

specific information about the terms of that offering. The prospectus supplement may also add, update or change information contained

in this prospectus or in documents incorporated by reference in this prospectus. The prospectus supplement that contains specific information

about the terms of the securities being offered may also include a discussion of certain U.S. Federal income tax consequences and any

risk factors or other special considerations applicable to those securities. To the extent that any statement that we make in a prospectus

supplement is inconsistent with statements made in this prospectus or in documents incorporated by reference in this prospectus, you

should rely on the information in the prospectus supplement. You should carefully read both this prospectus and any prospectus supplement

together with the additional information described under “Where You Can Find More Information” before buying any securities

in this offering.

Unless

otherwise noted, references in this prospectus to “Biotricity,” the “Company,” “we,” “our,”

or “us” means Biotricity Inc., the registrant, and, unless the context otherwise requires, together with its subsidiaries,

including iMedical Innovation Inc., a Canadian corporation (“iMedical”). References to iMedical refer to such company prior

to its acquisition by the Company on February 2, 2016.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents and information incorporated by reference in this prospectus include forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act

of 1934, as amended, or the Exchange Act. These statements are based on our management’s beliefs and assumptions and on information

currently available to our management. Forward-looking statements include statements concerning:

| |

● |

our

possible or assumed future results of operations; |

| |

|

|

| |

● |

our

business strategies; |

| |

|

|

| |

● |

our

ability to attract and retain customers; |

| |

|

|

| |

● |

our

ability to sell additional products and services to customers; |

| |

|

|

| |

● |

our

cash needs and financing plans; |

| |

|

|

| |

● |

our

competitive position; |

| |

|

|

| |

● |

our

industry environment; |

| |

|

|

| |

● |

our

potential growth opportunities; |

| |

|

|

| |

● |

expected

technological advances by us or by third parties and our ability to leverage them; |

| |

|

|

| |

● |

the

effects of future regulation; and |

| |

|

|

| |

● |

the

effects of competition. |

All

statements in this prospectus and the documents and information incorporated by reference in this prospectus that are not historical

facts are forward-looking statements. We may, in some cases, use terms such as “anticipates,” “believes,” “could,”

“estimates,” “expects,” “intends,” “may,” “plans,” “potential,”

“predicts,” “projects,” “should,” “will,” “would” or similar expressions

or the negative of such items that convey uncertainty of future events or outcomes to identify forward-looking statements.

Forward-looking

statements are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake

no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except

as may be required by applicable law. Although we believe that the expectations reflected in the forward-looking statements are reasonable,

we cannot guarantee future results, levels of activity, performance or achievements.

ABOUT

BIOTRICITY

Our

Business

Biotricity

Inc. is a medical technology company focused on biometric data monitoring solutions. Our aim is to deliver innovative, remote monitoring

solutions to the medical, healthcare, and consumer markets, with a focus on diagnostic and post-diagnostic solutions for lifestyle and

chronic illnesses. We approach the diagnostic side of remote patient monitoring by applying innovation within existing business models

where reimbursement is established. We believe this approach reduces the risk associated with traditional medical device development

and accelerates the path to revenue. In post-diagnostic markets, we intend to apply medical grade biometrics to enable consumers to self-manage,

thereby driving patient compliance and reducing healthcare costs. We intend to first focus on a segment of the diagnostic mobile cardiac

telemetry market, otherwise known as MCT, while providing our chosen markets with the capability to also perform other cardiac studies.

We

developed our FDA-cleared Bioflux® MCT technology, comprised of a monitoring device and software components, which we made

available to the market under limited release on April 6, 2018, in order to assess, establish and develop sales processes and market

dynamics. The fiscal year ended March 30, 2020 marked the Company’s first year of expanded commercialization efforts, focused on

sales growth and expansion. We have expanded our sales efforts to 20 states, with intention to expand further and compete in the broader

US market using an insourcing business model. Our technology has a large potential total addressable market, which can include hospitals,

clinics and physicians’ offices, as well as other IDTFs. We believe our solution’s insourcing model, which empowers physicians

with state-of-the-art technology and charges technology service fees for its use, has the benefit of a reduced operating overhead for

the Company, and enables a more efficient market penetration and distribution strategy. This, when combined with the value the Company’s

solution in the diagnosis of cardiac arrhythmias, enhancement of patient outcomes, improved patient compliance, and the corresponding

reduction of healthcare costs, is driving growth and increasing revenues.

We

are a technology company focused on earning utilization-based recurring technology fee revenue. The Company’s ability to grow this

type of revenue is predicated on the size and quality of its sales force and their ability to penetrate the market and place devices

with clinically focused, repeat users of its cardiac study technology. The Company plans to grow its sales force in order to address

new markets and achieve sales penetration in the markets currently served. The Company has also developed or is developing several other

ancillary technologies, which will require application for further FDA clearances, which the Company anticipates applying for within

the next twelve months. Among these are:

| |

● |

advanced

ECG analysis software that can analyze and synthesize patient ECG monitoring data with the purpose of distilling it down to the important

information that requires clinical intervention, while reducing the amount of human intervention necessary in the process; |

| |

|

|

| |

● |

the

Biotres patch solution, which will be a novel product in the field of Holter monitoring; |

| |

|

|

| |

● |

the

Bioflux® 2.0, which is the next generation of our award winning Bioflux® |

During

the nine months ended December 31, 2020, the Company announced that it received a 510(k) clearance from the FDA for its Bioflux Software

II System, engineered to improve workflows and reduce estimated analysis time from 5 minutes to 30 seconds. ECG monitoring requires significant

human oversight to review and interpret incoming patient data to discern actionable events for clinical intervention, highlighting the

necessity of driving operational efficiency. This improvement in analysis time reduces operational costs and allows the company to continue

to focus on excellent customer service and industry-leading response times to physicians and their at-risk patients. Additionally, these

advances mean we can focus our resources on high-level operations and sales to help drive greater revenue.

Corporate

Overview

Our

Company was incorporated on August 29, 2012 in the State of Nevada. At the time of incorporation, the name of our company was Metasolutions,

Inc. Our name was changed to Biotricity Inc. on January 27, 2016.

Our

principal executive office is located at 275 Shoreline Drive, Redwood City, California, and our telephone number is (650) 832-1626. Our

website address is www.biotricity.com. The information on our website is not part of this prospectus.

The

Acquisition Transaction

On

February 2, 2016 we completed our acquisition of iMedical through our indirect subsidiary 1062024 B.C. LTD., a company existing under

the laws of the Province of British Columbia (“Exchangeco”) (collectively referred to as the “Acquisition Transaction”).

In connection with the closing of the Acquisition Transaction, the former shareholders of iMedical entered into a transaction whereby

their existing common shares of iMedical were exchanged for either: (a) shares in the capital of Exchangeco that are exchangeable for

shares of our common stock at the same ratio as if the shareholders exchanged their common shares in iMedical at the consummation of

the Acquisition Transaction for our common stock (the “Exchangeable Shares”); or (b) shares of our common stock, which (assuming

exchange of all such Exchangeable Shares) would equal in the aggregate a number of shares of our common stock that constitute 90% of

our issued and outstanding shares as of the date of the closing date of the Acquisition Transaction.

On

February 2, 2016, we also entered into an Exchange Agreement with 1061806 BC LTD. (“Callco”), a British Columbia corporation

and our wholly owned subsidiary, Exchangeco, iMedical and the former shareholders of iMedical (the “Exchange Agreement”),

whereby Exchangeco acquired 100% of the outstanding common shares of iMedical, taking into account the Exchangeable Share Transaction

(as defined below). After giving effect to this transaction, we commenced operations through iMedical, as facilitated by our 100% ownership

of Exchangeco (other than the Exchangeable Shares) and Callco. Effective on the closing of the Acquisition Transaction, (a) the Company

issued approximately 1.197 shares of its common stock in exchange for each common share of iMedical held by iMedical shareholders who

in general terms, are not residents of Canada, and (b) shareholders of iMedical who in general terms, are Canadian residents (for the

purposes of the Income Tax Act (Canada)) (the “Eligible Holders”) received approximately 1.197 Exchangeable Shares

in the capital of Exchangeco in exchange for each common share of iMedical held (collectively, (a) and (b) being, the “Exchangeable

Share Transaction”). As part of the Exchangeable Share Transaction, we entered into a Voting and Exchange Trust Agreement (the

“Trust Agreement”) with Exchangeco, Callco and Computershare Trust Company of Canada (the “Trustee”).

RISK

FACTORS

Investing

in our securities involves a high degree of risk. Before making an investment decision, you should consider carefully the risks, uncertainties

and other factors described in our most recent Annual Report on Form 10-K, as supplemented and updated by subsequent quarterly reports

on Form 10-Q and current reports on Form 8-K that we have filed or will file with the SEC, which are incorporated by reference into this

prospectus. Our business, affairs, prospects, assets, financial condition, results of operations and cash flows could be materially and

adversely affected by these risks. For more information about our SEC filings, please see “Where You Can Find More Information”.

USE

OF PROCEEDS

Unless

otherwise indicated in a prospectus supplement, we intend to use the net proceeds from the sale of the securities under this prospectus

for general corporate purposes, including working capital.

DESCRIPTION

OF COMMON STOCK

General

Our

authorized capital stock consists of 125,000,000 shares of common stock, with a par value of $0.001 per share, and 10,000,000 shares

of preferred stock, with a par value of $0.001 per share. As of April 26, 2021, there were 36,124,964 shares of Common Stock issued and

outstanding, and 2,889,978 Exchangeable Shares issued and outstanding that convert directly into common shares, which when combined with

Common Stock produce an amount equivalent to 39,014,942 outstanding shares upon the exchange of Exchangeable Shares.

Common

Stock

Pursuant

to Article II of the Amended and Restated By-laws of the Company, each holder of Common Stock and securities exchangeable into Common

Stock that vote with the Common Stock are entitled to one vote for each share of Common Stock held of record by such holder with respect

to all matters to be voted on or consented to by our stockholders, except as may otherwise be required by applicable Nevada law. Unless

the vote of a greater number or voting by classes is required by Nevada statute, the Company’s Articles of Incorporation or its

bylaws, in all matters other than the election of directors, the affirmative vote of a majority of the voting power of the capital stock

(or securities exchangeable in accordance with their terms into capital stock of the Company) present in person or represented by proxy

at the meeting and entitled to vote on the subject matter shall be the act of the shareholders. Furthermore, except as otherwise required

by law, the Company’s Articles of Incorporation or its bylaws, directors shall be elected by a plurality of the voting power of

the capital stock (or securities exchangeable in accordance with their terms into capital stock of the Company) present in person or

represented by proxy at the meeting and entitled to vote on the election of directors.

The

stockholders do not have pre-emptive rights under our Certificate of Incorporation to acquire additional shares of Common Stock or other

securities. The Common Stock is not being subject to redemption rights and carries no subscription or conversion rights. In the event

of liquidation of the Company, the stockholders will be entitled to share in corporate assets on a pro rata basis after the Company satisfies

all liabilities and after provision is made for each class of capital stock having preference over the Common Stock (if any). Subject

to the laws of the State of Nevada, if any, of the holders of any outstanding series of preferred stock, the Board of Directors will

determine, in their discretion, to declare dividends advisable and payable to the holders of outstanding shares of Common Stock. Shares

of our Common Stock are subject to transfer restrictions.

Transfer

Agent and Registrar

Action

Stock Transfer Corporation is the transfer agent for our shares of common stock. Its address is 2469 E. Fort Union Blvd., Suite 214,

Salt Lake City, UT 84121; Telephone: (801) 274-1088.

Listing

Our

common stock is currently quoted on the OTCQB under the symbol “BTCY”.

DESCRIPTION

OF PREFERRED STOCK

Blank-Check

Preferred Stock

We

are currently authorized to issue up to 10,000,000 shares of blank check preferred stock, $0.001 par value per share, of which one share

has currently been designated as the Special Voting Preferred Stock (as described below). The Board of Directors has the discretion to

issue shares of preferred stock in series and, by filing a Preferred Stock Designation or similar instrument with the Nevada Secretary

of State, to establish from time to time the number of shares to be included in each such series, and to fix the designation, power,

preferences and rights of the shares of each such Series and the qualifications, limitations and restrictions thereof.

Preferred

stock is available for possible future financings or acquisitions and for general corporate purposes without further authorization of

stockholders unless such authorization is required by applicable law, the rules of the securities exchange or market on which our stock

is then listed or admitted to trading.

Our

board of directors may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect the voting

power or other rights of the holders of common stock. The issuance of preferred stock, while providing flexibility in connection with

possible acquisitions and other corporate purposes could, under some circumstances, have the effect of delaying, deferring or preventing

a change in control of the Company.

A

prospectus supplement relating to any series of preferred stock being offered will include specific terms relating to the offering. Such

prospectus supplement will include:

| |

● |

the

title and stated or par value of the preferred stock; |

| |

|

|

| |

● |

the

number of shares of the preferred stock offered, the liquidation preference per share and the offering price of the preferred stock; |

| |

|

|

| |

● |

the

dividend rate(s), period(s) and/or payment date(s) or method(s) of calculation thereof applicable to the preferred stock; |

| |

|

|

| |

● |

whether

dividends shall be cumulative or non-cumulative and, if cumulative, the date from which dividends on the preferred stock shall accumulate; |

| |

|

|

| |

● |

the

provisions for a sinking fund, if any, for the preferred stock; |

| |

|

|

| |

● |

any

voting rights of the preferred stock; |

| |

|

|

| |

● |

the

provisions for redemption, if applicable, of the preferred stock; |

| |

|

|

| |

● |

any

listing of the preferred stock on any securities exchange; |

| |

|

|

| |

● |

the

terms and conditions, if applicable, upon which the preferred stock will be convertible into our common stock, including the conversion

price or the manner of calculating the conversion price and conversion period; |

| |

|

|

| |

● |

if

appropriate, a discussion of Federal income tax consequences applicable to the preferred stock; and |

| |

|

|

| |

● |

any

other specific terms, preferences, rights, limitations or restrictions of the preferred stock. |

The

terms, if any, on which the preferred stock may be convertible into or exchangeable for our common stock will also be stated in the preferred

stock prospectus supplement. The terms will include provisions as to whether conversion or exchange is mandatory, at the option of the

holder or at our option, and may include provisions pursuant to which the number of shares of our common stock to be received by the

holders of preferred stock would be subject to adjustment.

Special

Voting Preferred Stock

The

Board authorized the designation of a class of the Special Voting Preferred Stock, with the rights and preferences specified below. For

purposes of deferring Canadian tax liabilities that would be incurred by certain of our shareholders, iMedical and its shareholders have

entered into a transaction pursuant to which the eligible holders, who would have otherwise received shares of common stock of the Company

pursuant to the Acquisition Transaction, received Exchangeable Shares. The right to vote the Common Stock equivalent of such Exchangeable

Shares shall be conducted by the vote of the Special Voting Preferred Stock issued to the Trustee.

In

that regard, we have designated one share of preferred stock as the Special Voting Preferred Stock with a par value of $0.001 per share.

The rights and preferences of the Special Voting Preferred Stock entitle the holder (the Trustee and, indirectly, the holders of the

Exchangeable Shares) to the following:

●

the right to vote in all circumstances in which holders of our common stock have the right to vote, with the common stock as one class;

●

an aggregate number of votes equal to the number of shares of our common stock that are issuable to the holders of the outstanding Exchangeable

Shares;

●

the same rights as the holders of our common stock as to notices, reports, financial statements and attendance at all stockholder meetings;

●

no entitlement to dividends; and

●

a total sum of $1.00 upon windup, dissolution or liquidation of the Company.

The

Company may cancel the Special Voting Preferred Stock when there are no Exchangeable Shares outstanding and no option or other commitment

of iMedical of its affiliates, which could require iMedical or its affiliates to issue more Exchangeable Shares.

As

set forth above, the holders of the Exchangeable Shares, through the Special Voting Preferred Stock, have voting rights and other attributes

corresponding to the Common Stock. The Exchangeable Shares provide an opportunity for Eligible Holders to obtain a full deferral of taxable

capital gains for Canadian federal income tax purposes in specified circumstances.

Series

A Preferred Stock

On

December 19, 2019, the Company entered into a Securities Purchase Agreement with one accredited investor. Pursuant to the SPA, the company

sold 6,000 Shares of its Series A convertible Preferred Stock at a per share price of $1,000 per preferred share and received gross proceeds

of $6,000,000.

The

Company filed the Certificate of Designations with the Secretary of State of Nevada a Certificate of Designation of Rights, Powers, Preferences,

Privileges and Restrictions of Series A Convertible Preferred Stock (the “Certificate of Designations) with the Sectary of State

of the State of Nevada.

Pursuant

to the Certificate of Designations the Company designated 20,000 shares of preferred stock as Series A Convertible Preferred Stock (the

“Series A Preferred”). The Series A Preferred will not be entitled to any voting rights except as may be required by applicable

law.

Commencing

24 months after the issuance date of the Series A Preferred subject to the beneficial ownership limitations in the Certificate of Designations

and the Company’s right of redemption, and the holder of Series A Preferred may convert the Series A Preferred into shares of the

Company’s common stock on a monthly basis up to 5% of the aggregate amount of the e aggregate amount of the purchase price of the

Series A Convertible Preferred purchased by such Holder as adjusted (reduced) to reflect any Series A Convertible Preferred that the

Holder has previously converted or no longer owns at a conversion price equal to the greater of $.001 or a 15% discount to the VWAP (as

defined in the Certificate of Designations) for the (Company’s Common Stock) five Trading Days immediately prior to the conversion

date (the “Conversion Rate”). Additionally, the Company and the Holder may agree to exchange such Holder’s outstanding

Preferred Shares for shares of common stock in any common stock financing being conducted by the Company at a 15% discount to the pricing

of that financing. Except as required by law the Preferred Shares shall not have any liquidation rights.

From

and after the first date of issuance of any Preferred Shares (the “Initial Issuance Date”), dividends shall be paid at the

rate of 12% per annum of the amount of the Holder’s (each a “Holder” and collectively the “Holders”) purchase

price for the Preferred Shares pursuant to the Securities Purchase Agreement (or similar agreement) between the Company and the Purchaser

as adjusted (reduced) to reflect any Series Convertible Preferred That the Holder has previously converted or no longer owns and such

dividend shall be paid quarterly provided that the Holder and the Company may mutually agree to accrue and defer any such dividend

The

Company may redeem all or part of the outstanding Preferred Shares (i) pursuant to Section 4(c) of the Certificate of Designations and/or

(ii) after one year from the date of issuance of such Preferred Shares, by paying an amount equal to the aggregate purchase price paid

by the Holder for the Preferred Shares as adjusted (reduced) to reflect any Preferred Shares that the Holder no longer owns multiplied

by 110% plus accrued dividends. The Company may exercise its right to redemption by giving notice to the Holders whose Preferred Shares

it is seeking to redeem along with the terms and the amounts of such redemption and at such time as the Holder receives a notice of such

redemption then the Holder may no longer convert such Preferred Shares and such Preferred Shares shall be deemed to no longer be outstanding.

The

Series A Convertible Preferred were offered and sold pursuant to an exemption from the registration requirements under Section 4(a)(2)

of the Securities Act since, among other things, the transactions did not involve a public offering.

Under

the Certificate of Designations no time may all or a portion of the Series A Convertible Preferred Stock be converted if the number of

shares of Common Stock to be issued pursuant to such conversion would exceed, when aggregated with all other shares of Common Stock owned

by the Holder at such time, the number of shares of Common Stock that would result in the Holder beneficially owning (as determined in

accordance with Section 13(d) of the 1934 Act and the rules thereunder) more than 4.99% of all of the Common Stock outstanding at such

time (the “4.99% Beneficial Ownership Limitation”); provided, however, that, upon the Holder providing the

Company with sixty-one (61) days’ advance notice (the “4.99% Waiver Notice”) that the Holder would like to waive this

Section 4(e) with regard to any or all shares of Common Stock issuable upon conversion of the Preferred Shares, this Section 4(e) will

be of no force or effect with regard to all or a portion of the Series A Convertible Preferred Stock referenced in the 4.99% Waiver Notice

but shall in no event waive the 9.99% Beneficial Ownership Limitation.

DESCRIPTION

OF WARRANTS

We

may issue warrants for the purchase of preferred stock or common stock. Warrants may be issued independently or together with any preferred

stock or common stock, and may be attached to or separate from any offered securities. Each series of warrants will be issued under a

separate warrant agreement to be entered into between a warrant agent specified in the agreement and us. The warrant agent will act solely

as our agent in connection with the warrants of that series and will not assume any obligation or relationship of agency or trust for

or with any holders or beneficial owners of warrants. This summary of some provisions of the securities warrants is not complete. You

should refer to the securities warrant agreement, including the forms of securities warrant certificate representing the securities warrants,

relating to the specific securities warrants being offered for the complete terms of the securities warrant agreement and the securities

warrants. The securities warrant agreement, together with the terms of the securities warrant certificate and securities warrants, will

be filed with the SEC in connection with the offering of the specific warrants.

The

applicable prospectus supplement will describe the following terms, where applicable, of the warrants in respect of which this prospectus

is being delivered:

| |

● |

the

title of the warrants; |

| |

|

|

| |

● |

the

aggregate number of the warrants; |

| |

|

|

| |

● |

the

price or prices at which the warrants will be issued; |

| |

|

|

| |

● |

the

designation, amount and terms of the offered securities purchasable upon exercise of the warrants; |

| |

|

|

| |

● |

if

applicable, the date on and after which the warrants and the offered securities purchasable upon exercise of the warrants will be

separately transferable; |

| |

|

|

| |

● |

the

terms of the securities purchasable upon exercise of such warrants and the procedures and conditions relating to the exercise of

such warrants; |

| |

|

|

| |

● |

any

provisions for adjustment of the number or amount of securities receivable upon exercise of the warrants or the exercise price of

the warrants; |

| |

● |

the

price or prices at which and currency or currencies in which the offered securities purchasable upon exercise of the warrants may

be purchased; |

| |

|

|

| |

● |

the

date on which the right to exercise the warrants shall commence and the date on which the right shall expire; |

| |

|

|

| |

● |

the

minimum or maximum amount of the warrants that may be exercised at any one time; |

| |

|

|

| |

● |

information

with respect to book-entry procedures, if any; |

| |

|

|

| |

● |

if

appropriate, a discussion of Federal income tax consequences; and |

| |

|

|

| |

● |

any

other material terms of the warrants, including terms, procedures and limitations relating to the exchange and exercise of the warrants. |

Warrants

for the purchase of common stock or preferred stock will be offered and exercisable for U.S. dollars only. Warrants will be issued in

registered form only.

Upon

receipt of payment and the warrant certificate properly completed and duly executed at the corporate trust office of the warrant agent

or any other office indicated in the applicable prospectus supplement, we will, as soon as practicable, forward the purchased securities.

If less than all of the warrants represented by the warrant certificate are exercised, a new warrant certificate will be issued for the

remaining warrants.

Prior

to the exercise of any securities warrants to purchase preferred stock or common stock, holders of the warrants will not have any of

the rights of holders of the common stock or preferred stock purchasable upon exercise, including in the case of securities warrants

for the purchase of common stock or preferred stock, the right to vote or to receive any payments of dividends on the preferred stock

or common stock purchasable upon exercise.

DESCRIPTION

OF UNITS

As

specified in the applicable prospectus supplement, we may issue units consisting of shares of common stock, shares of preferred stock

or warrants or any combination of such securities.

The

applicable prospectus supplement will specify the following terms of any units in respect of which this prospectus is being delivered:

| |

● |

the

terms of the units and of any of the common stock, preferred stock and warrants comprising the units, including whether and under

what circumstances the securities comprising the units may be traded separately; |

| |

|

|

| |

● |

a

description of the terms of any unit agreement governing the units; and |

| |

|

|

| |

● |

a

description of the provisions for the payment, settlement, transfer or exchange of the units. |

PLAN

OF DISTRIBUTION

We

may sell the securities offered through this prospectus (i) to or through underwriters or dealers, (ii) directly to purchasers, including

our affiliates, (iii) through agents, or (iv) through a combination of any these methods. The securities may be distributed at a fixed

price or prices, which may be changed, market prices prevailing at the time of sale, prices related to the prevailing market prices,

or negotiated prices. The prospectus supplement will include the following information:

| |

● |

the

terms of the offering; |

| |

|

|

| |

● |

the

names of any underwriters or agents; |

| |

|

|

| |

● |

the

name or names of any managing underwriter or underwriters; |

| |

● |

the

purchase price of the securities; |

| |

|

|

| |

● |

any

over-allotment options under which underwriters may purchase additional securities from us; |

| |

|

|

| |

● |

the

net proceeds from the sale of the securities |

| |

|

|

| |

● |

any

delayed delivery arrangements |

| |

|

|

| |

● |

any

underwriting discounts, commissions and other items constituting underwriters’ compensation; |

| |

|

|

| |

● |

any

initial public offering price; |

| |

|

|

| |

● |

any

discounts or concessions allowed or reallowed or paid to dealers; |

| |

|

|

| |

● |

any

commissions paid to agents; and |

| |

|

|

| |

● |

any

securities exchange or market on which the securities may be listed. |

Sale

Through Underwriters or Dealers

Only

underwriters named in the prospectus supplement are underwriters of the securities offered by the prospectus supplement.

If

underwriters are used in the sale, the underwriters will acquire the securities for their own account, including through underwriting,

purchase, security lending or repurchase agreements with us. The underwriters may resell the securities from time to time in one or more

transactions, including negotiated transactions. Underwriters may sell the securities in order to facilitate transactions in any of our

other securities (described in this prospectus or otherwise), including other public or private transactions and short sales. Underwriters

may offer securities to the public either through underwriting syndicates represented by one or more managing underwriters or directly

by one or more firms acting as underwriters. Unless otherwise indicated in the prospectus supplement, the obligations of the underwriters

to purchase the securities will be subject to certain conditions, and the underwriters will be obligated to purchase all the offered

securities if they purchase any of them. The underwriters may change from time to time any initial public offering price and any discounts

or concessions allowed or reallowed or paid to dealers.

If

dealers are used in the sale of securities offered through this prospectus, we will sell the securities to them as principals. They may

then resell those securities to the public at varying prices determined by the dealers at the time of resale. The prospectus supplement

will include the names of the dealers and the terms of the transaction.

Direct

Sales and Sales Through Agents

We

may sell the securities offered through this prospectus directly. In this case, no underwriters or agents would be involved. Such securities

may also be sold through agents designated from time to time. The prospectus supplement will name any agent involved in the offer or

sale of the offered securities and will describe any commissions payable to the agent. Unless otherwise indicated in the prospectus supplement,

any agent will agree to use its reasonable best efforts to solicit purchases for the period of its appointment.

We

may sell the securities directly to institutional investors or others who may be deemed to be underwriters within the meaning of the

Securities Act with respect to any sale of those securities. The terms of any such sales will be described in the prospectus supplement.

Delayed

Delivery Contracts

If

the prospectus supplement indicates, we may authorize agents, underwriters or dealers to solicit offers from certain types of institutions

to purchase securities at the public offering price under delayed delivery contracts. These contracts would provide for payment and delivery

on a specified date in the future. The contracts would be subject only to those conditions described in the prospectus supplement. The

applicable prospectus supplement will describe the commission payable for solicitation of those contracts.

Continuous

Offering Program

Without