Form 8-K/A date of report 06-30-23

true

0000098222

0000098222

2023-06-30

2023-06-30

0000098222

tdw:CommonStockCustomMember

2023-06-30

2023-06-30

0000098222

tdw:WarrantsToPurchaseSharesOfCommonStockCustomMember

2023-06-30

2023-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 5, 2023 (June 30, 2023)

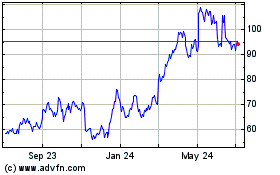

TIDEWATER INC.

(Exact name of Registrant as specified in its charter)

|

Delaware

|

|

1-6311

|

|

72-0487776

|

|

(State or Other Jurisdiction of

|

|

(Commission File Number)

|

|

(I.R.S. Employer

|

|

Incorporation)

|

|

|

|

Identification No.)

|

842 West Sam Houston Parkway North, Suite 400, Houston, Texas 77024

(Address of principal executive offices) (zip code)

Registrant’s telephone number, including area code: (713) 470-5300

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common stock, $0.001 par value per share

|

|

TDW

|

|

New York Stock Exchange

|

|

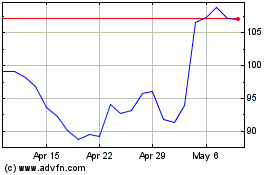

Warrants to purchase shares of common stock

|

|

TDW.WS

|

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

This Current Report on Form 8-K/A (this “Amendment”) amends the Current Report on Form 8-K (the “Original 8-K”) filed by Tidewater Inc. (the “Company”) with the Securities and Exchange Commission on July 6, 2023 reporting that the Company completed its acquisition of Solstad Offshore vessels on July 5, 2023. The Company is filing this Amendment solely to amend and supplement the Original 8-K to provide certain financial information required by Item 9.01 of Form 8-K, which is permitted to be filed by amendment no later than 71 days after the due date of the Original 8-K. Except as set forth herein, no other amendments to the Original 8-K are being made by this Amendment.

Item 9.01. Financial Statements and Exhibits.

(a) Financial Statements of Business Acquired

The audited combined carve-out financial statements of Solstad Offshore PSV for the years ended December 31, 2022 and 2021, as well as the accompanying notes thereto, are attached as Exhibit 99.1 to this Amendment and are incorporated herein by reference; and the unaudited interim condensed combined carve-out financial statements of Solstad Offshore PSV for three and six months ended June 30, 2023 and 2022, as well as the accompanying notes thereto, are attached as Exhibit 99.2 to this Amendment and are incorporated herein by reference.

(b) Pro Forma Financial Information

The unaudited pro forma combined financial information of the Company as of and for the six months ended June 30, 2023 and for the year ended December 31, 2022, giving effect to the acquisition of Solstad Vessels is attached as Exhibit 99.3 to this Amendment and is incorporated herein by reference.

(d) Exhibits

The following exhibits are filed herewith:

|

Exhibit No.

|

Description

|

|

23.1

|

|

|

99.1

|

|

|

99.2

|

|

|

99.3

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: September 15, 2023

|

|

| |

TIDEWATER INC.

|

| |

By:

|

/s/ Daniel A. Hudson

|

| |

|

Daniel A. Hudson

|

| |

|

Executive Vice President, General Counsel and

Corporate Secretary

|

Exhibit 23.1

CONSENT OF INDEPENDENT AUDITORS

We consent to the incorporation by reference in the Registration Statements on Form S-3 (Nos. 333-228029, 333-264476 and 333-273950) and on Form S-8 (Nos. 333-219793, 333-228401, 333-227111 and 333-257072) of Tidewater Inc. of our report dated May 16, 2023, relating to the combined carve-out financial statements of Solstad Platform Supply Vessels (Solstad PSV) as of and for the years ended December 31, 2022 and 2021 appearing in this Current Report on Form 8-K/A of Tidewater Inc.

/s/ Ernst & Young AS

Bergen, Norway

September 15, 2023

Exhibit 99.1

Report of Independent Auditors

To the board of directors of Solstad Rederi AS

Qualified Opinion

We have audited the combined carve-out financial statements of Solstad Offshore PSV (Solstad PSV), which comprise the combined statements of financial position as of December 31, 2022 and 2021, and the related combined statements of comprehensive income, changes in equity and cash flow for the years then ended, and the related notes (collectively referred to as the “financial statements”).

In our opinion, except for the matter described in the Basis for Qualified Opinion section of our report, the accompanying financial statements present fairly, in all material respects, the financial position of Solstad PSV at December 31, 2022 and 2021, and the results of its operations and its cash flows for the years then ended in accordance with International Financial Reporting Standards promulgated by the International Accounting Standards Board (IASB).

Basis for Qualified Opinion

As discussed in Note 1, the accompanying combined financial statements of Solstad PSV are presented solely to comply with Rule 3-05 of Regulation S-X and are not presented in accordance with International Financial Reporting Standard 1, First-time adoption of International Financial Reporting Standards (IFRS), as they do not include an opening statement of financial position nor the corresponding notes for that statement of financial position, which constitute a departure from International Financial Reporting Standards as issued by the IASB.

We conducted our audits in accordance with auditing standards generally accepted in the United States of America (GAAS). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of Solstad PSV and to meet our other ethical responsibilities in accordance with the relevant ethical requirements relating to our audits. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our qualified audit opinion.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance with International Financial Reporting Standards promulgated by the International Accounting Standards Board, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free of material misstatement, whether due to fraud or error. In preparing the financial statements, management is responsible for assessing Solstad PSV’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate Solstad PSV or to cease operations, or has no realistic alternative but to do so.

2

Auditor’s Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free of material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements.

In performing an audit in accordance with GAAS, we:

| |

●

|

Exercise professional judgment and maintain professional skepticism throughout the audit.

|

| |

●

|

Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements.

|

| |

●

|

Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of Solstad PSV’s internal control. Accordingly, no such opinion is expressed.

|

| |

●

|

Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements.

|

| |

●

|

Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about Solstad PSV’s ability to continue as a going concern for a reasonable period of time.

|

We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit.

/s/ Ernst & Young AS

Bergen, Norway

May 16, 2023

Exhibit 99.2

Exhibit 99.3

UNAUDITED PRO FORMA COMBINED FINANCIAL INFORMATION

The accompanying unaudited pro forma combined financial statements have been prepared in accordance with Article 11 of Regulation S-X and reflect the impact on the historical financial statements of Tidewater Inc. (“Tidewater”) of the acquisition of 37 platform supply vessels (the “Solstad Vessels” or “Vessels”) from a Norwegian seller and the incurrence of long term debt in the form of a $325.0 million term loan from DnB Bank ASA (“DnB Term Loan”) and a $250 million aggregate principal amount of senior unsecured bonds placed in the Nordic bond market (“the 2028 Notes”) to finance the acquisition. On March 7, 2023, we entered into an Agreement for the Sale and Purchase of Vessels, Charter Parties and Other Assets, with certain subsidiaries of Solstad Offshore ASA, a Norwegian public limited company (collectively, the “Sellers”), pursuant to which we agreed to acquire from the Sellers (the “Solstad Acquisition”): (i) the Solstad Vessels; and (ii) the charter parties governing certain of the Solstad Vessels. On July 5, 2023, we closed the Solstad Acquisition with the Sellers for an aggregate cash purchase price of approximately $596.2 million, consisting of the previously disclosed $577.0 million base purchase price along with an initial $3.0 million purchase price adjustment upon the terms and subject to the conditions set forth in the Sale and Purchase Agreement (the “Transaction”) and $3.2 million for working capital items comprised of fuel and lubricants plus estimated transaction costs, consisting primarily of advisory and legal fees, of $13.0 million. Refer to Note 3 of these unaudited pro forma combined financial statements for the terms and purchase price consideration provided in connection with the asset acquisition.

The unaudited pro forma combined balance sheet and statement of operations were derived from Tidewater's and Solstad's historical financial statements, and give effect to the following:

| |

●

|

the acquisition of the Solstad Vessels and the impact of preliminary asset acquisition accounting for the acquired assets and assumed liabilities;

|

| |

●

|

the incurrence of $325.0 million in borrowings under the DnB Term Loan that are due in quarterly or annual installments with a final maturity of June 2026

|

| |

●

|

the issuance of $250.0 million 2028 Notes with a coupon rate of 10.375% due at maturity in 2028.

|

The unaudited pro forma combined financial statements should be read in conjunction with the following:

| |

●

|

Tidewater’s most recently filed Form 10-K, filed on February 28, 2023;

|

| |

●

|

Tidewater’s second quarter Form 10-Q, filed on August 7, 2023; and

|

| |

●

|

Solstad’s audited financial statements related to the Solstad Vessels for the years ended December 31, 2022 and 2021, included elsewhere in this Form 8-K.

|

Additional information about the basis of presentation of this information is provided in Note 1 to these unaudited pro forma combined financial statements.

These unaudited pro forma combined financial statements, which are referred to individually as the “unaudited pro forma combined balance sheet”, the “unaudited pro forma combined statements of operations”, and collectively as the “unaudited pro forma combined financial statements”, were prepared using the acquisition of assets method of accounting in accordance with Accounting Standard Codification (“ASC”) 805 – Business Combinations under generally accepted accounting principles used in the United States (“U.S. GAAP”). Under the provisions of ASC 805, Tidewater is designated as the accounting acquirer of the Vessels. In addition, under ASC 805, if substantially all of the fair value of the gross assets acquired is concentrated in a group of identifiable assets, it is not considered a business. Accordingly, the assets acquired and liabilities assumed are measured by the amount of cash paid and direct transaction costs. The cost of a group of assets acquired in an asset acquisition are allocated to the individual assets acquired or liabilities assumed based on their relative fair values and does not give rise to goodwill.

The unaudited pro forma adjustments to the historical financial statements are based on currently available information, and in many cases are based on estimates and management’s preliminary valuation of the fair value of tangible assets acquired and liabilities assumed. The assumptions underlying the pro forma adjustments are described in the accompanying notes to these unaudited pro forma combined financial statements. Tidewater believes such assumptions are reasonable under the circumstances and reflect the best currently available estimates and judgments. The actual asset acquisition accounting assessment may vary based on final analyses of the valuation of assets acquired and liabilities assumed, which variances could be material.

The unaudited pro forma combined financial statements may not be indicative of Tidewater’s future performance and do not necessarily reflect what Tidewater’s financial position and results of operations would have been had these transactions occurred as of or at the beginning of the period presented, respectively. Further, the unaudited pro forma combined financial statements do not purport to project the future operating results or financial position of Tidewater following the completion of the Transaction. Additionally, the unaudited pro forma combined financial statements do not reflect any revenue enhancements, anticipated synergies, operating efficiencies, or cost savings that may be achieved related to the Transaction, nor do they reflect any costs or expenditures that may be required to achieve any possible synergies.

|

UNAUDITED PRO FORMA COMBINED BALANCE SHEET

|

|

As of June 30, 2023

(In Thousands)

|

| |

|

Historical

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Solstad

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Vessels

|

|

|

Transaction

|

|

|

|

|

|

|

| |

|

|

|

|

|

(As Translated

|

|

|

Accounting

|

|

|

|

|

|

|

| |

|

|

|

|

|

and Adjusted)

|

|

|

Adjustments

|

|

|

|

Pro Forma

|

|

| |

|

Tidewater Inc.

|

|

|

(Note 2)

|

|

|

(Note 4)

|

|

Notes

|

|

Combined

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

171,261 |

|

|

|

— |

|

|

|

(35,700 |

) |

A

|

|

|

135,561 |

|

|

Restricted cash

|

|

|

1,242 |

|

|

|

— |

|

|

|

— |

|

|

|

|

1,242 |

|

|

Trade and other receivables, net

|

|

|

195,906 |

|

|

|

48,408 |

|

|

|

(48,408 |

) |

B

|

|

|

195,906 |

|

|

Marine operating supplies

|

|

|

22,495 |

|

|

|

1,833 |

|

|

|

67 |

|

B, C

|

|

|

24,395 |

|

|

Assets held for sale

|

|

|

630 |

|

|

|

— |

|

|

|

— |

|

|

|

|

630 |

|

|

Prepaid expenses and other current assets

|

|

|

18,958 |

|

|

|

— |

|

|

|

— |

|

|

|

|

18,958 |

|

|

Total current assets

|

|

|

410,492 |

|

|

|

50,241 |

|

|

|

(84,041 |

) |

|

|

|

376,692 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net properties and equipment

|

|

|

784,873 |

|

|

|

484,167 |

|

|

|

118,833 |

|

D

|

|

|

1,387,873 |

|

|

Deferred drydocking and survey costs

|

|

|

92,481 |

|

|

|

44,389 |

|

|

|

(44,389 |

) |

D

|

|

|

92,481 |

|

|

Indemnification assets

|

|

|

22,678 |

|

|

|

— |

|

|

|

— |

|

|

|

|

22,678 |

|

|

Other assets

|

|

|

33,640 |

|

|

|

206 |

|

|

|

(206 |

) |

B

|

|

|

33,640 |

|

|

Total assets

|

|

|

1,344,164 |

|

|

|

579,003 |

|

|

|

(9,803 |

) |

|

|

|

1,913,364 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

|

69,822 |

|

|

|

12,668 |

|

|

|

(12,668 |

) |

B

|

|

|

69,822 |

|

|

Accrued expenses

|

|

|

91,875 |

|

|

|

— |

|

|

|

— |

|

|

|

|

91,875 |

|

|

Current portion of long-term debt

|

|

|

2,441 |

|

|

|

507,318 |

|

|

|

(407,318 |

) |

B, E

|

|

|

102,441 |

|

|

Other current liabilities

|

|

|

42,305 |

|

|

|

13,981 |

|

|

|

(7,781 |

) |

B, F

|

|

|

48,505 |

|

|

Total current liabilities

|

|

|

206,443 |

|

|

|

533,967 |

|

|

|

(427,767 |

) |

|

|

|

312,643 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-term debt

|

|

|

179,573 |

|

|

|

— |

|

|

|

460,500 |

|

E

|

|

|

640,073 |

|

|

Other liabilities

|

|

|

65,621 |

|

|

|

— |

|

|

|

3,800 |

|

F

|

|

|

69,421 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholder's equity:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock

|

|

|

51 |

|

|

|

— |

|

|

|

— |

|

|

|

|

51 |

|

|

Additional paid-in capital

|

|

|

1,554,793 |

|

|

|

— |

|

|

|

— |

|

|

|

|

1,554,793 |

|

|

Accumulated deficit

|

|

|

(666,327 |

) |

|

|

45,036 |

|

|

|

(46,336 |

) |

G

|

|

|

(667,627 |

) |

|

Accumulated other comprehensive income

|

|

|

4,566 |

|

|

|

— |

|

|

|

— |

|

|

|

|

4,566 |

|

|

Total stockholder's equity

|

|

|

893,083 |

|

|

|

45,036 |

|

|

|

(46,336 |

) |

|

|

|

891,783 |

|

|

Noncontrolling interests

|

|

|

(556 |

) |

|

|

— |

|

|

|

— |

|

|

|

|

(556 |

) |

|

Total equity

|

|

|

892,527 |

|

|

|

45,036 |

|

|

|

(46,336 |

) |

|

|

|

891,227 |

|

|

Total liabilities and equity

|

|

|

1,344,164 |

|

|

|

579,003 |

|

|

|

(9,803 |

) |

|

|

|

1,913,364 |

|

See accompanying notes to unaudited pro forma combined financial information.

|

UNAUDITED PRO FORMA COMBINED STATEMENT OF OPERATIONS

|

|

For the Year ended December 31, 2022

(In Thousands, except per share data)

|

| |

|

Historical

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Solstad

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Vessels

|

|

|

Transaction

|

|

|

|

|

|

|

| |

|

|

|

|

|

(As Translated

|

|

|

Accounting

|

|

|

|

|

|

|

| |

|

|

|

|

|

and Adjusted)

|

|

|

Adjustments

|

|

|

|

Pro Forma

|

|

| |

|

Tidewater Inc.

|

|

|

(Note 2)

|

|

|

(Note 4)

|

|

Notes

|

|

Combined

|

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vessel revenues

|

|

$ |

641,404 |

|

|

$ |

173,628 |

|

|

$ |

6,200 |

|

AA

|

|

$ |

821,232 |

|

|

Other operating revenues

|

|

|

6,280 |

|

|

|

1,986 |

|

|

|

— |

|

|

|

|

8,266 |

|

|

Total revenues

|

|

|

647,684 |

|

|

|

175,614 |

|

|

|

6,200 |

|

|

|

|

829,498 |

|

|

Costs and expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vessel operating costs

|

|

|

397,301 |

|

|

|

129,312 |

|

|

|

1,300 |

|

BB

|

|

|

527,913 |

|

|

Costs of other operating revenues

|

|

|

2,130 |

|

|

|

— |

|

|

|

— |

|

|

|

|

2,130 |

|

|

General and administrative

|

|

|

101,921 |

|

|

|

17,738 |

|

|

|

— |

|

|

|

|

119,659 |

|

|

Depreciation and amortization

|

|

|

119,160 |

|

|

|

33,039 |

|

|

|

27,019 |

|

CC

|

|

|

179,218 |

|

|

Gain on asset dispositions, net

|

|

|

(250 |

) |

|

|

— |

|

|

|

— |

|

|

|

|

(250 |

) |

|

Long lived asset impairments and other

|

|

|

714 |

|

|

|

2,163 |

|

|

|

(2,163 |

) |

DD

|

|

|

714 |

|

|

Total operating expenses

|

|

|

620,976 |

|

|

|

182,252 |

|

|

|

26,156 |

|

|

|

|

829,384 |

|

|

Operating income (loss)

|

|

|

26,708 |

|

|

|

(6,638 |

) |

|

|

(19,956 |

) |

|

|

|

114 |

|

|

Other income (expense)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign exchange gain (loss)

|

|

|

(2,827 |

) |

|

|

(42,435 |

) |

|

|

42,113 |

|

EE

|

|

|

(3,149 |

) |

|

Equity in net losses of unconsolidated companies

|

|

|

(221 |

) |

|

|

— |

|

|

|

— |

|

|

|

|

(221 |

) |

|

Interest income and other, net

|

|

|

5,397 |

|

|

|

— |

|

|

|

— |

|

|

|

|

5,397 |

|

|

Loss on warrants

|

|

|

(14,175 |

) |

|

|

— |

|

|

|

— |

|

|

|

|

(14,175 |

) |

|

Interest and other debt costs, net

|

|

|

(17,189 |

) |

|

|

(35,578 |

) |

|

|

(24,798 |

) |

FF

|

|

|

(77,565 |

) |

|

Total other expense

|

|

|

(29,015 |

) |

|

|

(78,013 |

) |

|

|

17,315 |

|

|

|

|

(89,713 |

) |

|

Loss before income taxes

|

|

|

(2,307 |

) |

|

|

(84,651 |

) |

|

|

(2,641 |

) |

|

|

|

(89,599 |

) |

|

Income tax expense

|

|

|

19,886 |

|

|

|

442 |

|

|

|

— |

|

|

|

|

20,328 |

|

|

Net loss

|

|

|

(22,193 |

) |

|

|

(85,093 |

) |

|

|

(2,641 |

) |

|

|

|

(109,927 |

) |

|

Net loss attributable to noncontrolling interests

|

|

|

(444 |

) |

|

|

— |

|

|

|

— |

|

|

|

|

(444 |

) |

|

Net loss attributable to Tidewater Inc.

|

|

|

(21,749 |

) |

|

|

(85,093 |

) |

|

|

(2,641 |

) |

|

|

|

(109,483 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

(0.49 |

) |

|

|

|

|

|

|

|

|

|

|

$ |

(2.48 |

) |

|

Diluted

|

|

$ |

(0.49 |

) |

|

|

|

|

|

|

|

|

|

|

$ |

(2.48 |

) |

|

Weighted average shares:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

44,132 |

|

|

|

|

|

|

|

|

|

|

|

|

44,132 |

|

|

Diluted

|

|

|

44,132 |

|

|

|

|

|

|

|

|

|

|

|

|

44,132 |

|

|

See accompanying notes to unaudited pro forma combined financial information.

|

Unless stated otherwise in the body of these notes, all dollar value references in the tables of these notes are stated in thousands of dollars.

|

UNAUDITED PRO FORMA COMBINED STATEMENT OF OPERATIONS

|

|

For the Six Months ended June 30, 2023

(In Thousands, except per share data)

|

| |

|

Historical

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Solstad

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Vessels

|

|

|

Transaction

|

|

|

|

|

|

|

| |

|

|

|

|

|

(As Translated

|

|

|

Accounting

|

|

|

|

|

|

|

| |

|

|

|

|

|

and Adjusted)

|

|

|

Adjustments

|

|

|

|

Pro Forma

|

|

| |

|

Tidewater Inc.

|

|

|

(Note 2)

|

|

|

(Note 4)

|

|

Notes

|

|

Combined

|

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vessel revenues

|

|

$ |

401,503 |

|

|

$ |

102,325 |

|

|

$ |

2,400 |

|

AAA

|

|

$ |

506,228 |

|

|

Other operating revenues

|

|

|

6,562 |

|

|

|

1,659 |

|

|

|

— |

|

|

|

|

8,221 |

|

|

Total revenues

|

|

|

408,065 |

|

|

|

103,984 |

|

|

|

2,400 |

|

|

|

|

514,449 |

|

|

Costs and expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vessel operating costs

|

|

|

233,723 |

|

|

|

66,282 |

|

|

|

— |

|

|

|

|

300,005 |

|

|

Costs of other operating revenues

|

|

|

1,524 |

|

|

|

— |

|

|

|

— |

|

|

|

|

1,524 |

|

|

General and administrative

|

|

|

49,558 |

|

|

|

11,223 |

|

|

|

— |

|

|

|

|

60,781 |

|

|

Depreciation and amortization

|

|

|

63,434 |

|

|

|

13,043 |

|

|

|

16,986 |

|

BBB

|

|

|

93,463 |

|

|

Gain on asset dispositions, net

|

|

|

(3,620 |

) |

|

|

— |

|

|

|

— |

|

|

|

|

(3,620 |

) |

|

Long lived asset impairments and other

|

|

|

— |

|

|

|

(17,756 |

) |

|

|

17,756 |

|

CCC

|

|

|

— |

|

|

Total operating expenses

|

|

|

344,619 |

|

|

|

72,792 |

|

|

|

34,742 |

|

|

|

|

452,153 |

|

|

Operating income (loss)

|

|

|

63,446 |

|

|

|

31,192 |

|

|

|

(32,342 |

) |

|

|

|

62,296 |

|

|

Other income (expense)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign exchange gain (loss)

|

|

|

(1,471 |

) |

|

|

(34,075 |

) |

|

|

33,793 |

|

DDD

|

|

|

(1,753 |

) |

|

Equity in net losses of unconsolidated companies

|

|

|

25 |

|

|

|

— |

|

|

|

— |

|

|

|

|

25 |

|

|

Interest income and other, net

|

|

|

2,920 |

|

|

|

— |

|

|

|

— |

|

|

|

|

2,920 |

|

|

Interest and other debt costs, net

|

|

|

(8,921 |

) |

|

|

(24,239 |

) |

|

|

(6,075 |

) |

EEE

|

|

|

(39,235 |

) |

|

Total other expense

|

|

|

(7,447 |

) |

|

|

(58,314 |

) |

|

|

27,718 |

|

|

|

|

(38,043 |

) |

|

Income (loss) before income taxes

|

|

|

55,999 |

|

|

|

(27,122 |

) |

|

|

(4,624 |

) |

|

|

|

24,253 |

|

|

Income tax expense

|

|

|

23,255 |

|

|

|

265 |

|

|

|

— |

|

|

|

|

23,520 |

|

|

Net income (loss)

|

|

|

32,744 |

|

|

|

(27,387 |

) |

|

|

(4,624 |

) |

|

|

|

733 |

|

|

Net income attributable to noncontrolling interests

|

|

|

(578 |

) |

|

|

— |

|

|

|

— |

|

|

|

|

(578 |

) |

|

Net income (loss) attributable to Tidewater Inc.

|

|

|

33,322 |

|

|

|

(27,387 |

) |

|

|

(4,624 |

) |

|

|

|

1,311 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

0.66 |

|

|

|

|

|

|

|

|

|

|

|

$ |

0.03 |

|

|

Diluted

|

|

$ |

0.64 |

|

|

|

|

|

|

|

|

|

|

|

$ |

0.03 |

|

|

Weighted average shares:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

50,731 |

|

|

|

|

|

|

|

|

|

|

|

|

50,731 |

|

|

Diluted

|

|

|

51,991 |

|

|

|

|

|

|

|

|

|

|

|

|

51,991 |

|

|

See accompanying notes to unaudited pro forma combined financial information.

|

Unless stated otherwise in the body of these notes, all dollar value references in the tables of these notes are stated in thousands of dollars.

Note 1. Basis of Presentation

The unaudited pro forma combined financial information and related notes are prepared in accordance with regulations of the Securities and Exchange Commission (SEC) and are intended to show how the transaction might have affected the historical financial statements.

The accompanying unaudited pro forma combined financial statements are based on the historical financial statements of Tidewater and the Solstad Vessels after giving effect to the Transaction using the asset acquisition method of accounting, as well as certain reclassification and pro forma adjustments. In accordance with the asset acquisition method of accounting, the assets acquired and the liabilities assumed are recorded as of the Transaction Date at their cost, which is measured by the amount of cash paid including transaction costs. The cost of the acquisition is then allocated to the assets acquired and liabilities assumed based on their relative fair values and does not give rise to goodwill.

Tidewater’s historical financial statements were prepared in accordance with U.S. GAAP and presented in U.S. dollars. The historical financial information of the Solstad Vessels was prepared in accordance with International Accounting Standards Board (“IFRS”), and presented in Norwegian Kroners (“NOK”). For purposes of these pro forma combined financial statements, Tidewater has translated the Solstad Vessels historical financial statements to U.S. Dollars as described in “Note 2 – Accounting Policies and Reclassifications of Solstad Vessels Historical Financial Statements”. In addition, Tidewater performed a preliminary assessment of the adjustments necessary to conform the Solstad Vessels’ historical IFRS financial statements to a U.S. GAAP presentation. Based on this assessment, Tidewater management did not note any material differences between the amounts and balances reported by Solstad under IFRS and how such amounts and balances would have been reported under U.S. GAAP, except for property and equipment balances. While there are significant differences between U.S. GAAP and IFRS in accounting for property and equipment, particularly impairment of long-lived assets, our pro forma adjustments state the pro forma property and equipment balances at their relative fair value which includes netting of any adjustments for differences in U.S. GAAP and IFRS. As such, no adjustments were made to the Solstad Vessels’ historical IFRS financial statements to conform them to U.S. GAAP.

In addition, certain reclassifications have been made to the Solstad Vessels historical financial information to conform to Tidewater’s financial statement presentation. Such reclassifications had no effect on the Solstad Vessels’ previously reported financial results. Management may identify differences between the accounting policies of the two companies that, when conformed, could have a material impact on Tidewater’s combined financial statements. See “Note 2 – Accounting Policies and Reclassifications of the Solstad Vessels Historical Financial Statements” herein for additional information on the reclassifications.

The pro forma adjustments presented in these unaudited pro forma combined financial statements represent management’s estimates based on information available as of the date of this Form 8-K and such estimates are subject to revision as further information is obtained. Accordingly, the pro forma adjustments for the acquisition of assets are preliminary and subject to further adjustment as additional information becomes available and the various analyses and other valuations are performed. Any adjustments may have a significant effect on total assets, total liabilities, operating expenses, and depreciation expenses and such results may be significant.

The Transaction is reflected in the unaudited pro forma combined financial statements as follows:

| |

●

|

The unaudited pro forma combined balance sheet of Tidewater as of June 30, 2023, includes the effects of the acquisition of assets as if it had occurred on June 30, 2023.

|

| |

●

|

The unaudited pro forma combined statements of operations of Tidewater for the year ended December 31, 2022 and the six months ended June 30, 2023, respectively, include the effects of the acquisition of assets as if it had occurred on January 1, 2022.

|

Note 2. Accounting Policies and Reclassification of Solstad Vessels Historical Financial Statements

The historical financial statement information of the Solstad Vessels' was derived from the Solstad Vessels consolidated IFRS financial statements for the year ended December 31, 2022 and as of and for the six-month period ended June 30, 2023. As noted above, Tidewater made no adjustments to conform the IFRS financial statements to U.S. GAAP (“See Note 1”). Accounting policies used in the preparation of these unaudited pro forma combined financial statements are those set out in Tidewater’s audited financial statements as of and for the year ended December 31, 2022.

Reclassification adjustments have been made to the historical presentation of Solstad to conform to the financial statement presentation of Tidewater for the unaudited pro forma combined financial statements as noted below.

Additionally, the unaudited pro forma combined financial statements reflect adjustments to conform Solstad’s accounting policies to Tidewater’s accounting policies as noted below. These adjustments have been reflected in the Solstad Vessels (as adjusted) column within the unaudited pro forma combined financial statements. These policy adjustments were to adjust Solstad’s historical treatment of lubricants inventory. Solstad has historically capitalized lubricants into inventory, but such lubricants have historically been expensed by Tidewater. Total inventories on the Solstad Vessels June 30, 2023 historical balance sheet as presented was $2.6 million, including $0.8 million (8.7 million Norwegian Kroner) of lubricants inventory which was written off as an income statement adjustment to the “vessel operating costs” line item in the Solstad Vessels as translated and adjusted statement of operations for the six-months ended June 30, 2023. Total inventories as of December 31, 2022 included $3.0 million (29.0 million Norwegian Kroner) of lubricants inventory which was written off as an income statement adjustment to the “vessel operating costs” line in the Solstad Vessels as translated and adjusted statement of operations for the year ended December 31, 2022.

Balance sheet reclassifications and accounting policy adjustments – The reclassification adjustments and accounting policy adjustments to conform the Solstad Vessels balance sheet presentation to Tidewater’s balance sheet presentation are summarized below (in thousands). The presentation currency of Solstad is the Norwegian Kroner (NOK) and the amounts are converted to USD based on the June 30, 2023 conversion rate between NOK and USD.

| |

|

Solstad Vessels (Historical)

|

|

|

As of June 30, 2023 Reclassification adjustment to conform the Solstad Vessels to Tidewater Inc. presentation

|

|

|

Accounting policy adjustment to conform the Solstad Vessels to Tidewater Inc. presentation

|

|

|

NOK to USD Conversion

|

|

|

Solstad Vessels (As Translated and Adjusted)

|

|

|

Financial Statement Line Items

|

|

(NOK)

|

|

|

(NOK)

|

|

|

(NOK)

|

|

|

Rate

|

|

|

(USD)

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Account receivables

|

|

|

363,485 |

|

|

|

(363,485 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Other short term receivables

|

|

|

157,593 |

|

|

|

(157,593 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Trade and other receivables

|

|

|

— |

|

|

|

521,078 |

|

|

|

— |

|

|

|

0.093 |

|

|

|

48,408 |

|

|

Inventory

|

|

|

28,420 |

|

|

|

(28,420 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Marine operating supplies

|

|

|

— |

|

|

|

28,420 |

|

|

|

(8,688 |

) |

|

|

0.093 |

|

|

|

1,833 |

|

|

Non-current assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vessels and new build contracts

|

|

|

5,211,701 |

|

|

|

(5,211,701 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Net properties and equipment

|

|

|

— |

|

|

|

5,211,701 |

|

|

|

— |

|

|

|

0.093 |

|

|

|

484,167 |

|

|

Capitalized periodic maintenance

|

|

|

477,820 |

|

|

|

(477,820 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Deferred drydocking and survey costs

|

|

|

— |

|

|

|

477,820 |

|

|

|

— |

|

|

|

0.093 |

|

|

|

44,389 |

|

|

Other long-term receivables

|

|

|

2,216 |

|

|

|

(2,216 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Other assets

|

|

|

— |

|

|

|

2,216 |

|

|

|

— |

|

|

|

0.093 |

|

|

|

206 |

|

|

LIABILITIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

|

136,363 |

|

|

|

— |

|

|

|

— |

|

|

|

0.093 |

|

|

|

12,668 |

|

|

Other current liabilities

|

|

|

150,495 |

|

|

|

— |

|

|

|

— |

|

|

|

0.093 |

|

|

|

13,981 |

|

|

Current interest bearing liabilities

|

|

|

5,460,904 |

|

|

|

(5,460,904 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Current portion of long-term debt

|

|

|

— |

|

|

|

5,460,904 |

|

|

|

— |

|

|

|

0.093 |

|

|

|

507,318 |

|

|

EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other equity

|

|

|

493,474 |

|

|

|

(493,474 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Accumulated deficit

|

|

|

— |

|

|

|

493,474 |

|

|

|

(8,688 |

) |

|

|

0.093 |

|

|

|

45,036 |

|

Income statement reclassifications and accounting policy adjustments – The reclassification adjustments and accounting policy adjustments to conform the Solstad Vessels statement of operations presentation to Tidewater’s statement of operations are summarized below (in thousands). The presentation currency of the Solstad Vessels is the NOK and the amounts are converted to the USD based on the average conversion rate between NOK and USD for the year ended December 31, 2022.

For the Solstad financial year ended December 31, 2022

| |

|

Solstad (Historical)

|

|

|

As of December 31, 2022 Reclassification adjustment to conform the Solstad Vessels to Tidewater Inc. presentation

|

|

|

Accounting policy adjustment to conform the Solstad Vessels to Tidewater Inc. presentation

|

|

|

NOK to USD Conversion

|

|

|

Solstad Vessels (As Translated and Adjusted)

|

|

|

Financial Statement Line Items

|

|

(NOK)

|

|

|

(NOK)

|

|

|

(NOK)

|

|

|

Rate

|

|

|

(USD)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Freight income

|

|

|

1,669,501 |

|

|

|

(1,669,501 |

) |

|

|

— |

|

|

|

— |

|

|

$ |

— |

|

|

Vessel revenues

|

|

|

— |

|

|

|

1,669,501 |

|

|

|

— |

|

|

|

0.104 |

|

|

|

173,628 |

|

|

Other operating income

|

|

|

19,097 |

|

|

|

(19,097 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Other operating revenue

|

|

|

— |

|

|

|

19,097 |

|

|

|

— |

|

|

|

0.104 |

|

|

|

1,986 |

|

|

Personnel costs

|

|

|

840,643 |

|

|

|

(840,643 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Other operating expenses

|

|

|

373,728 |

|

|

|

(373,728 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Vessel operating costs

|

|

|

— |

|

|

|

1,214,371 |

|

|

|

29,010 |

|

|

|

0.104 |

|

|

|

129,312 |

|

|

Administrative expenses

|

|

|

170,553 |

|

|

|

(170,553 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

General and administrative

|

|

|

— |

|

|

|

170,553 |

|

|

|

— |

|

|

|

0.104 |

|

|

|

17,738 |

|

|

Depreciation

|

|

|

221,504 |

|

|

|

(221,504 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Depreciation capitalized periodic maintenance

|

|

|

96,178 |

|

|

|

(96,178 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Depreciation and amortization

|

|

|

— |

|

|

|

317,682 |

|

|

|

— |

|

|

|

0.104 |

|

|

|

33,039 |

|

|

Impairment fixed assets

|

|

|

20,797 |

|

|

|

(20,797 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Long-lived asset impairments and other

|

|

|

— |

|

|

|

20,797 |

|

|

|

— |

|

|

|

0.104 |

|

|

|

2,163 |

|

|

Interest charges

|

|

|

341,028 |

|

|

|

(341,028 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Interest and other debt costs, net

|

|

|

— |

|

|

|

341,028 |

|

|

|

— |

|

|

|

0.104 |

|

|

|

35,467 |

|

|

Net other finance costs

|

|

|

409,097 |

|

|

|

(409,097 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Foreign exchange loss

|

|

|

— |

|

|

|

408,033 |

|

|

|

— |

|

|

|

0.104 |

|

|

|

42,435 |

|

|

Interest and other debt costs, net

|

|

|

— |

|

|

|

1,064 |

|

|

|

— |

|

|

|

0.104 |

|

|

|

111 |

|

|

Tax on ordinary result

|

|

|

4,252 |

|

|

|

(4,252 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Income tax expense

|

|

|

— |

|

|

|

4,252 |

|

|

|

— |

|

|

|

0.104 |

|

|

|

442 |

|

Income statement reclassifications and accounting policy adjustments – The reclassification adjustments and accounting policy adjustments to conform the Solstad Vessels statement of operations presentation to Tidewater’s statement of operations are summarized below (in thousands). The presentation currency of the Solstad Vessels is the NOK and the amounts are converted to the USD based on the average conversion rate between NOK and USD for the six months ended June 30, 2023.

For the Solstad six months ended June 30, 2023

| |

|

Solstad (Historical)

|

|

|

As of June 30, 2023 Reclassification adjustment to conform the Solstad Vessels to Tidewater Inc. presentation

|

|

|

Accounting policy adjustment to conform the Solstad Vessels to Tidewater Inc. presentation

|

|

|

NOK to USD Conversion

|

|

|

Solstad Vessels (As Translated and Adjusted)

|

|

|

Financial Statement Line Items

|

|

(NOK)

|

|

|

(NOK)

|

|

|

(NOK)

|

|

|

Rate

|

|

|

(USD)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Freight income

|

|

|

1,070,341 |

|

|

|

(1,070,341 |

) |

|

|

— |

|

|

|

— |

|

|

$ |

— |

|

|

Vessel revenues

|

|

|

— |

|

|

|

1,070,341 |

|

|

|

— |

|

|

|

0.096 |

|

|

|

102,325 |

|

|

Other operating income

|

|

|

17,349 |

|

|

|

(17,349 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Other operating revenue

|

|

|

— |

|

|

|

17,349 |

|

|

|

— |

|

|

|

0.096 |

|

|

|

1,659 |

|

|

Personnel costs

|

|

|

446,431 |

|

|

|

(446,431 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Other operating expenses

|

|

|

238,208 |

|

|

|

(238,208 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Vessel operating costs

|

|

|

— |

|

|

|

684,639 |

|

|

|

8,688 |

|

|

|

0.096 |

|

|

|

66,282 |

|

|

Administrative expenses

|

|

|

117,395 |

|

|

|

(117,395 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

General and administrative

|

|

|

— |

|

|

|

117,395 |

|

|

|

— |

|

|

|

0.096 |

|

|

|

11,223 |

|

|

Depreciation

|

|

|

72,148 |

|

|

|

(72,148 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Depreciation capitalized periodic maintenance

|

|

|

64,287 |

|

|

|

(64,287 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Depreciation and amortization

|

|

|

— |

|

|

|

136,435 |

|

|

|

— |

|

|

|

0.096 |

|

|

|

13,043 |

|

|

Reversal of impairment fixed assets

|

|

|

(185,734 |

) |

|

|

185,734 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Long-lived asset impairments and other

|

|

|

— |

|

|

|

(185,734 |

) |

|

|

— |

|

|

|

0.096 |

|

|

|

(17,756 |

) |

|

Interest charges

|

|

|

253,541 |

|

|

|

(253,541 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Interest and other debt costs, net

|

|

|

— |

|

|

|

253,541 |

|

|

|

— |

|

|

|

0.096 |

|

|

|

24,239 |

|

|

Net other finance expenses

|

|

|

356,436 |

|

|

|

(356,436 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Foreign exchange loss

|

|

|

— |

|

|

|

356,436 |

|

|

|

— |

|

|

|

0.096 |

|

|

|

34,075 |

|

|

Tax on ordinary result

|

|

|

2,773 |

|

|

|

(2,773 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Income tax expense

|

|

|

— |

|

|

|

2,773 |

|

|

|

— |

|

|

|

0.096 |

|

|

|

265 |

|

Note 3. Acquisition Method of Accounting for Solstad Vessels

Purchase Price Consideration

Under the terms of the Sale and Purchase Agreement, Tidewater acquired 37 platform supply vessels and the charter parties governing certain of such Vessels for an aggregate purchase price of $596.2 million.

The total estimated purchase price consideration for the acquisition of assets is as follows:

|

Preliminary Purchase Consideration (in thousands)

|

|

|

|

|

| |

|

|

|

|

| |

|

Purchase Price Consideration

|

|

|

Cash (1)

|

|

$ |

583,200 |

|

|

Estimated transaction costs

|

|

|

13,000 |

|

|

Total purchase price

|

|

$ |

596,200 |

|

| |

|

|

|

|

| |

|

|

|

|

|

Total preliminary purchase consideration

|

|

|

596,200 |

|

| |

(1)

|

$577.0 million per the Sale and Purchase Agreement plus an initial purchase price adjustment of $3.0 million and a $3.2 million working capital adjustment for fuel and lubricants.

|

Allocation of Purchase Price Consideration to Asset Acquired and Liabilities Assumed

The purchase price allocation applied in these unaudited pro forma combined financial statements is preliminary and may not reflect final values that will be determined after the closing of the acquisition of assets. Such valuation assessments of specifically identifiable tangible and intangible assets, including any assessment of economic useful lives has not been completed and such valuation exercises are not expected to be completed until the final records and assumptions are closed and fully analyzed as of the transaction date. Additionally, due to normal pre-close commercial restrictions to books and records of Solstad, not all valuation assumptions can be fully confirmed as of the filing of this Form 8-K/A leaving such assumptions utilized in these pro forma adjustments as preliminary, tentative, and subject to change.

Under the acquisition method of accounting in U.S. GAAP, the assets acquired and liabilities assumed are measured by the amount of cash paid and the direct transaction costs of the acquisition of assets. The cost of a group of assets acquired in an acquisition of assets is allocated to the individual assets acquired or liabilities assumed based on their relative fair values and does not give rise to goodwill.

This preliminary determination is subject to further assessment and adjustments pending additional information sharing between the parties, more detailed third-party appraisals, and other potential adjustments.

The preliminary cost of the assets acquired and liabilities assumed is as follows:

| |

|

Estimated Fair Value

|

|

|

Marine operating supplies

|

|

$ |

1,900 |

|

|

Net properties and equipment

|

|

|

603,000 |

|

|

Total assets

|

|

|

604,900 |

|

| |

|

|

|

|

|

Other current liabilities (1)

|

|

|

6,200 |

|

|

Other liabilities (1)

|

|

|

3,800 |

|

|

Total liabilities

|

|

|

10,000 |

|

| |

|

|

|

|

|

Net asset acquired

|

|

$ |

594,900 |

|

| |

|

|

|

|

|

Cost and expenses

|

|

|

|

|

|

Vessel operating costs (2)

|

|

|

1,300 |

|

|

Preliminary purchase consideration

|

|

$ |

596,200 |

|

| |

(1)

|

Below market existing charter contracts accompanying the acquired Solstad Vessels. |

| |

(2) |

The working capital adjustment included $1.3 million for lubricants which are expensed by Tidewater. |

Note 4. Acquisition of Assets Pro Forma Adjustments

Combined Balance Sheet

| |

A.

|

The adjustment to cash and cash equivalents reflects $596.2 million in cash consideration paid in connection with the acquisition of the Solstad Vessels including $13.0 million for estimated transaction costs offset by the $560.5 million in net proceeds from the issuance of the 2028 Notes and borrowings under the Term Loan obtained to finance this acquisition. |

| |

B.

|

Represents the elimination of assets not being acquired by Tidewater or liabilities not being assumed by Tidewater in connection with the acquisition of the Solstad Vessels. |

| |

C.

|

Reflects the purchase of an aggregate $1.9 million in fuel on board the 37 Solstad Vessels. |

| |

D.

|

Reflects the preliminary adjustment to net properties and equipment to adjust the value of the Solstad Vessels and the removal of previously capitalized drydock costs that have been factored into the cost of the Solstad Vessels. |

| |

E.

|

Reflects borrowings of $325.0 million under Term Loan from DnB and the issuance of a $250.0 million of the 2028 Notes, less the current maturities of $100.0 million and the estimated debt issuance costs of $14.5 million. |

| |

F.

|

Reflects the recording of below market contracts related to existing charter contracts accompanying the acquired Vessels that are below market charter contracts. A $6.2 million liability was recorded in other current liabilities and a $3.8 million liability was recorded in other liabilities which are being amortized over the term of the respective charter contracts which range from 2 to 3 years. |

| |

G.

|

Reflects the impact of the following:

Elimination of assets not being acquired or liabilities not being assumed by Tidewater - 483,520

Write down of remaining basis in Solstad fixed assets - (528,556)

Expensing of lubricants acquired by Tidewater - (1,300)

Total - (46,336)

|

Statements of Operations for the year ended December 31, 2022

| |

AA.

|

Reflects the amortization of the below market charter contract intangibles for the year ended December 31, 2022.

|

| |

BB.

|

Reflects the expensing of $1.3 million in lubricants purchased from Solstad. |

| |

CC.

|

Reflects the increase in depreciation and amortization expense of $27.0 million. This was comprised of an increase in depreciation expense for the Solstad Vessels of $37.0 million, partially offset by a reduction in amortization of dry dock costs of $10.0 million, which was based on the relative estimated fair value of the Solstad Vessels. The average estimated remaining useful lives of the Solstad Vessels were approximately 10.5 years. This estimate is based on Tidewater's current assessment of economic useful lives of these tangible assets. |

| |

DD.

|

Reflects the reversal of impairment recognized by Solstad because the Solstad Vessels are now recorded at their relative fair value.

|

| |

EE.

|

Reflects the reversal of $42.1 million in foreign exchange losses related to the Solstad debt resulting from the weakening of the NOK which is the reporting currency for the audited financial statements of the Solstad Vessels for the year ended December 31, 2022 because the debt associated with the Solstad Vessels is denominated in U.S. dollars and was assumed to be paid in full on January 1, 2022.

|

| |

FF.

|

To finance this asset acquisition, Tidewater entered into the $325.0 million DnB Term Loan and issued $250.0 million aggregate principal amount of the 2028 Notes. The $325.0 million DnB Term Loan is split into two tranches of $100.0 million and $225.0 million, respectively, both maturing in June 2026. The first tranche is payable in two $50.0 million payments due in June 2024 and June 2026. The second tranche is payable in eight quarterly installments of $12.5 million, three quarterly installments of $25.0 million and a final installment of $50.0 million due at maturity in June 2026. The first tranche bears interest at the Secured Overnight Financing Rate (SOFR) plus 5%, increasing to 8% over its term while the second tranche bears interest at SOFR plus 3.75%. The 2028 Notes are due at maturity in July 2028 and bear interest rate of 10.375%. This adjustment reflects additional interest expense of $60.4 million to be incurred on these debt agreements including $3.9 million in debt issue cost amortization partially offset by the reversal of interest expense on the Solstad debt ($35.6 million) that was paid in full by Solstad as a result of this acquisition. |

Statements of Operations for the six months ended June 30, 2023