0000889971false--06-30FY20230.0150000000000.014450000037344739270467905500000550000073000129100040000125000138260396202P7YP10M24DP10M24D8973987760000.0825430000000008899712022-07-012023-06-300000889971us-gaap:SubsequentEventMember2023-07-012023-07-310000889971us-gaap:SubsequentEventMember2023-07-310000889971lpth:EuropeAsiaMemberlpth:AnnualRevenueMember2021-07-012022-06-300000889971lpth:EuropeAsiaMemberlpth:AnnualRevenueMember2022-07-012023-06-300000889971lpth:ForeignSalesMemberlpth:RevenuesMember2022-07-012023-06-300000889971lpth:CustomerTwoMemberus-gaap:AccountsReceivableMember2021-07-012022-06-300000889971lpth:CustomerTwoMemberus-gaap:AccountsReceivableMember2022-07-012023-06-300000889971lpth:CustomerOneMemberus-gaap:AccountsReceivableMember2021-07-012022-06-300000889971lpth:CustomerOneMemberus-gaap:AccountsReceivableMember2022-07-012023-06-300000889971lpth:CustomerThreeMemberus-gaap:AccountsReceivableMember2021-07-012022-06-300000889971lpth:CustomerThreeMemberus-gaap:AccountsReceivableMember2022-07-012023-06-300000889971lpth:CustomerThreeMemberlpth:RevenuesMember2021-07-012022-06-300000889971lpth:CustomerThreeMemberlpth:RevenuesMember2022-07-012023-06-300000889971lpth:CustomerTwoMemberlpth:RevenuesMember2021-07-012022-06-300000889971lpth:CustomerTwoMemberlpth:RevenuesMember2022-07-012023-06-300000889971lpth:CustomerOneMemberlpth:RevenuesMember2021-07-012022-06-300000889971lpth:CustomerOneMemberlpth:RevenuesMember2022-07-012023-06-3000008899712020-07-012021-06-300000889971us-gaap:UnsecuredDebtMember2021-07-012022-06-300000889971lpth:EquipmentLoanMember2021-09-012021-09-300000889971lpth:EquipmentLoanMember2023-05-012023-05-310000889971lpth:EquipmentLoanMember2020-12-012020-12-310000889971lpth:EquipmentLoanMember2023-05-310000889971lpth:FourthAmendementLoanAgreementMemberlpth:DecemberThirtFirstTwentyTwentyThreeMember2023-02-012023-02-070000889971lpth:FourthAmendementLoanAgreementMemberlpth:DecemberThirtFirstTwentyTwentyThreeMember2021-02-070000889971lpth:FourthAmendementLoanAgreementMemberlpth:DecemberThirtFirstTwentyTwentyThreeMember2023-06-300000889971us-gaap:UnsecuredDebtMember2019-02-260000889971lpth:BankUnitedMember2023-06-300000889971us-gaap:UnsecuredDebtMember2022-07-012023-06-300000889971lpth:BankUnitedMember2019-02-260000889971lpth:BankUnitedRevolvingLineMember2022-02-260000889971lpth:MayElevenTwoThousandTwentyTwoMemberlpth:ThirdAgreementMember2021-09-012021-09-300000889971lpth:NovemberFiveTwoThousandTwentyOneMemberlpth:SecondLetterAgreementMember2023-05-012023-05-310000889971lpth:PurchaseAgreementMember2023-01-120000889971lpth:PurchaseAgreementMember2023-01-012023-01-1200008899712023-05-012023-05-090000889971lpth:FifthAmendementLoanAgreementMember2023-05-012023-05-090000889971us-gaap:UnsecuredDebtMember2023-06-300000889971lpth:EquipmentLoanMember2023-06-300000889971country:LV2022-06-300000889971country:LV2023-06-300000889971country:US2022-06-300000889971country:CN2022-06-300000889971country:US2023-06-300000889971country:CN2023-06-300000889971lpth:RestofworldMember2022-07-012023-06-300000889971lpth:OtherAsiancountriesMember2022-07-012023-06-300000889971lpth:OtherEuropeancountriesMember2022-07-012023-06-300000889971country:CN2022-07-012023-06-300000889971lpth:RestofworldMember2021-07-012022-06-300000889971lpth:OtherAsiancountriesMember2021-07-012022-06-300000889971lpth:OtherEuropeancountriesMember2021-07-012022-06-300000889971country:CN2021-07-012022-06-300000889971lpth:ZhenjiangLease2Member2022-07-012023-06-300000889971lpth:LeaseArrangementRigaMember2022-07-012023-06-300000889971lpth:ManufacturingFacility3Member2023-06-300000889971us-gaap:ManufacturingFacilityMember2022-07-012023-06-300000889971us-gaap:ManufacturingFacilityMember2023-06-300000889971lpth:LeaseArrangementRigaMember2023-06-300000889971lpth:ManufacturingFacility1Member2022-06-300000889971us-gaap:ManufacturingFacilityMember2021-04-300000889971us-gaap:CommonClassAMember2022-07-012023-06-300000889971us-gaap:StockOptionMember2022-07-012023-06-300000889971us-gaap:StockOptionMember2021-07-012022-06-300000889971us-gaap:RestrictedStockUnitsRSUMember2021-06-300000889971lpth:StockOptionsMember2023-06-300000889971lpth:StockOptionsMember2021-07-012022-06-300000889971lpth:StockOptionsMember2022-07-012023-06-300000889971lpth:StockOptionsMember2021-06-300000889971lpth:StockOptionsMember2022-06-300000889971lpth:RestrictedStockAwardRSAMember2023-06-300000889971lpth:TwentyTwentySixMember2023-06-300000889971lpth:TwentyTwentyFiveMember2023-06-300000889971lpth:TwentyTwentyFourMember2023-06-300000889971us-gaap:RestrictedStockUnitsRSUMember2022-06-300000889971us-gaap:RestrictedStockUnitsRSUMember2023-06-300000889971us-gaap:EmployeeStockOptionMember2022-06-300000889971us-gaap:EmployeeStockOptionMember2023-06-300000889971us-gaap:EmployeeStockOptionMember2021-07-012022-06-300000889971us-gaap:EmployeeStockOptionMember2022-07-012023-06-300000889971lpth:RestrictedStockAwardRSAMember2021-07-012022-06-300000889971lpth:RestrictedStockAwardRSAMember2022-07-012023-06-300000889971us-gaap:RestrictedStockUnitsRSUMember2021-07-012022-06-300000889971us-gaap:RestrictedStockUnitsRSUMember2022-07-012023-06-300000889971lpth:SICPOrOmnibusPlanMember2023-06-300000889971lpth:ESPPMember2023-06-300000889971us-gaap:ResearchMember2022-07-012023-06-300000889971us-gaap:ResearchMember2023-06-300000889971country:LV2021-07-012022-06-300000889971lpth:LPOIZMembercountry:CN2022-06-300000889971lpth:LPOIZMembercountry:CN2023-06-300000889971country:LV2022-07-012023-06-300000889971lpth:LPOIZMembercountry:CN2022-07-012023-06-300000889971lpth:ForeignMember2021-07-012022-06-300000889971country:US2021-07-012022-06-300000889971lpth:ForeignMember2022-07-012023-06-300000889971country:US2022-07-012023-06-300000889971lpth:ClassE3CommonStockMember2023-06-300000889971lpth:ClassE1CommonStockMember2023-06-300000889971lpth:ClassE2CommonStockMember2023-06-300000889971us-gaap:CommonClassAMember2023-06-300000889971us-gaap:SeriesFPreferredStockMember2023-06-300000889971us-gaap:SeriesDPreferredStockMember2023-06-300000889971us-gaap:SeriesCPreferredStockMember2023-06-300000889971us-gaap:SeriesBPreferredStockMember2023-06-300000889971us-gaap:SeriesAPreferredStockMember2023-06-300000889971us-gaap:FiniteLivedIntangibleAssetsMember2022-06-300000889971us-gaap:TradeNamesMember2022-07-012023-06-300000889971us-gaap:TradeSecretsMember2022-07-012023-06-300000889971us-gaap:CustomerRelationshipsMember2022-07-012023-06-300000889971us-gaap:TradeNamesMember2023-06-300000889971us-gaap:TradeNamesMember2022-06-300000889971us-gaap:TradeSecretsMember2023-06-300000889971us-gaap:TradeSecretsMember2022-06-300000889971us-gaap:CustomerRelationshipsMember2023-06-300000889971us-gaap:CustomerRelationshipsMember2022-06-300000889971us-gaap:LeaseholdImprovementsMembersrt:MaximumMember2021-07-012022-06-300000889971us-gaap:LeaseholdImprovementsMembersrt:MinimumMember2021-07-012022-06-300000889971us-gaap:FurnitureAndFixturesMember2021-07-012022-06-300000889971us-gaap:ComputerEquipmentMembersrt:MaximumMember2021-07-012022-06-300000889971us-gaap:ComputerEquipmentMembersrt:MinimumMember2021-07-012022-06-300000889971us-gaap:MachineryAndEquipmentMembersrt:MaximumMember2021-07-012022-06-300000889971us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2021-07-012022-06-300000889971us-gaap:ConstructionInProgressMember2023-06-300000889971us-gaap:LeaseholdImprovementsMember2023-06-300000889971us-gaap:FurnitureAndFixturesMember2023-06-300000889971us-gaap:ComputerEquipmentMember2023-06-300000889971us-gaap:MachineryAndEquipmentMember2023-06-300000889971us-gaap:ConstructionInProgressMember2022-06-300000889971us-gaap:LeaseholdImprovementsMember2022-06-300000889971us-gaap:FurnitureAndFixturesMember2022-06-300000889971us-gaap:ComputerEquipmentMember2022-06-300000889971us-gaap:MachineryAndEquipmentMember2022-06-300000889971lpth:ToolingRawMaterialsMember2023-06-300000889971lpth:ToolingRawMaterialsMember2022-06-300000889971lpth:SpecialityProductsMember2022-07-012023-06-300000889971lpth:InfraredProductsMember2022-07-012023-06-300000889971lpth:InfraredProductsMember2021-07-012022-06-300000889971lpth:SpecialityProductsMember2021-07-012022-06-300000889971lpth:PMOMember2021-07-012022-06-300000889971lpth:PMOMember2022-07-012023-06-300000889971us-gaap:RetainedEarningsMember2023-06-300000889971us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300000889971us-gaap:AdditionalPaidInCapitalMember2023-06-300000889971lpth:ClassACommonStockMember2023-06-300000889971us-gaap:RetainedEarningsMember2022-07-012023-06-300000889971us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012023-06-300000889971us-gaap:AdditionalPaidInCapitalMember2022-07-012023-06-300000889971lpth:ClassACommonStockMember2022-07-012023-06-300000889971us-gaap:RetainedEarningsMember2022-06-300000889971us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300000889971us-gaap:AdditionalPaidInCapitalMember2022-06-300000889971lpth:ClassACommonStockMember2022-06-300000889971us-gaap:RetainedEarningsMember2021-07-012022-06-300000889971us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-07-012022-06-300000889971us-gaap:AdditionalPaidInCapitalMember2021-07-012022-06-300000889971lpth:ClassACommonStockMember2021-07-012022-06-3000008899712021-06-300000889971us-gaap:RetainedEarningsMember2021-06-300000889971us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-06-300000889971us-gaap:AdditionalPaidInCapitalMember2021-06-300000889971lpth:ClassACommonStockMember2021-06-3000008899712021-07-012022-06-3000008899712022-06-3000008899712023-06-3000008899712023-09-1200008899712022-12-31iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pureutr:sqft

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2023

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 000-27548

LIGHTPATH TECHNOLOGIES, INC. |

(Exact name of registrant as specified in its charter) |

Delaware | | 86-0708398 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No) |

| | |

http://www.lightpath.com |

| |

2603 Challenger Tech Court, Suite 100 Orlando, Florida 32826 | | (407) 382-4003 |

(Address of principal executive offices, including zip code) | | (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

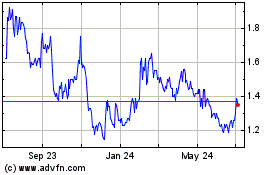

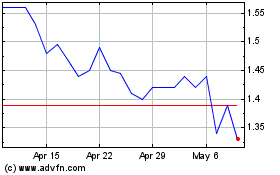

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Class A Common Stock, par value $0.01 | | LPTH | | The Nasdaq Stock Market, LLC |

Securities registered pursuant to Section 12(g) of the Act:

Series D Participating Preferred Stock Purchase Rights

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities and Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ NO ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “non-accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 in the Exchange Act). YES ☐ NO ☒.

The aggregate market value of the registrant’s voting stock held by non-affiliates (based on the closing sale price of the registrant’s Class A Common Stock on The NASDAQ Capital Market) was approximately $31,945,187 as of December 31, 2022.

As of September 12, 2023, the number of shares of the registrant’s Class A Common Stock outstanding was 37,455,438.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the Fiscal 2023 Annual Meeting of Stockholders are incorporated by reference in Part II and Part III.

LightPath Technologies, Inc.

Form 10-K

Table of Contents

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

Certain statements and information in this Annual Report on Form 10-K may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, without limitation, statements concerning plans, objectives, goals, projections, strategies, future events, or performance, related to the actual and potential effects on our business from the coronavirus (“COVID-19”) pandemic, and underlying assumptions and other statements, which are not statements of historical facts. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” or “continue,” or other comparable terminology. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. While management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting us will be those that we anticipate. Forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Forward-looking statements represent management’s beliefs and assumptions only as of the date of this Annual Report on Form 10-K. You should read this Annual Report on Form 10-K completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update these forward-looking statements, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

PART I

Item 1. Business.

General

Our Company

LightPath Technologies, Inc. (“LightPath”, the “Company”, “we”, “our”, or “us”) was incorporated under Delaware law in 1992 as the successor to LightPath Technologies Limited Partnership, a New Mexico limited partnership formed in 1989, and its predecessor, Integrated Solar Technologies Corporation, a New Mexico corporation formed in 1985. Today, LightPath is a global company with major facilities in the United States, the People’s Republic of China and the Republic of Latvia. Our corporate headquarters is located in Orlando, Florida.

Subsidiaries

In November 2005, we formed LightPath Optical Instrumentation (Shanghai) Co., Ltd (“LPOI”), a wholly-owned subsidiary, located in Jiading, People’s Republic of China, which is primarily engaged in sales and support functions.

In December 2013, we formed LightPath Optical Instrumentation (Zhenjiang) Co., Ltd. (“LPOIZ”), a wholly-owned subsidiary located in the New City district, of the Jiangsu province, of the People’s Republic of China. LPOIZ’s manufacturing facility (the “Zhenjiang Facility”) serves as our primary manufacturing facility in China and provides a lower cost structure for production of larger volumes of optical components and assemblies.

In December 2016, we acquired ISP Optics Corporation, a New York corporation (“ISP”), and its wholly-owned subsidiary, ISP Optics Latvia, SIA, a limited liability company founded in 1998 under the Laws of the Republic of Latvia (“ISP Latvia”). ISP is a vertically integrated manufacturer offering a full range of infrared products from custom infrared optical elements to catalog and high-performance lens assemblies. Since June 2019, ISP’s manufacturing operation has been located at our corporate headquarters facility in Orlando, Florida (the “Orlando Facility”). ISP Latvia is a manufacturer of high precision optics and offers a full range of infrared products, including catalog and custom infrared optics. ISP Latvia’s manufacturing facility is located in Riga, Latvia (the “Riga Facility”).

In July 2023, we acquired Liebert Consulting, LLC, dba Visimid Technologies (“Visimid”), an engineering and design firm, specializing in thermal imaging, night vision and internet of things (“IOT”) applications. Visimid provides design and consulting services for Department of Defense (“DoD”) contractors, commercial and industrial customers, and original equipment manufacturers (“OEMs”) for original new products. Visimid’s core competency is developing and producing custom thermal and night vision cores. Visimid’s facility is located in Plano, Texas.

Industry

We and our customers support a wide range of industries, including automotive, telecommunications, defense, medical, bio-technology, industrial, consumer goods and more. A commonality among these industries is the use of photonics as an enabling technology in their products.

Over the last ten years we have witnessed a pivotal shift in the adoption of photonics in new applications. In the early days of the photonics industry the technology was a specialty, which was both expensive and required highly specialized technical knowledge, leading to low adoption of the technology into industries other than defense and high-end medical applications. Starting with the commercialization of fiber optic communication, and further driven by significant cost reduction in key technologies such as sensors and lasers, the adoption of the technology into more industries and applications began rapidly growing.

The accelerated rate of adoption and highly diversified industries and applications utilizing an expanding array of photonics technologies brought a change in both the needs of the customers and the supply chain, to support those needs. In the past, we and other component suppliers mostly served customers that specialized in photonics. The large OEMs focused on component companies as a significant supply source for optical parts and minor fabrication and assemblies. OEMs typically produced their own designs and relied on their suppliers to fulfill their needs without any strategic product planning, investment or collaboration. This supply chain was fragmented and consisted of a large number of small companies, many of which had particular specialties in the fabrication process. Often times these types of activities are referred to as build-to-print, as the OEM customer would design the lens down to the final manufacturing prints and the vendor would focus on producing according to those prints.

As the industry has evolved and sensory, visualization and imaging capabilities have become differentiators among suppliers and a necessity for delivery of an expanding array of products in a myriad of industries where the specialized requirements of customers are no longer being adequately addressed. As photonics technology continues to develop, leading to broader adaptation and application across more industries, and with customers now possessing expertise in different technologies, customers’ supply chain needs have evolved. In our case, the change has created opportunities to now serve OEM customers for which photonics is only one of several technologies they embed into their products. While in the past our typical customer viewed optics as their specialty and hence they designed all aspects of their systems and outsourced only the component fabrication, this is not the case with our newer customers. Many of our current and potential customers do not wish or do not have the capability to design and build the optical portion of their products in-house. As such, the fragmented supply chain that existed in our industry in order to serve customers on the component level, is not relevant for customers that view optics as only a part of their system, and not a core capability or function. For these customers, LightPath is well positioned to become their solutions partner for their optics needs. By tapping into the domain knowledge and design, assembly and testing capabilities of solutions providers like LightPath, the customer can avoid making the large investment needed for them to develop those capabilities in-house. We refer to this ecosystem as “optical engineered solutions,” and believe we are positioned to serve as a single source, global provider of optical solutions with leading engineering and manufacturing capabilities. This has led to our development of a new strategy and organizational alignment which is further discussed below.

Growth Strategy

Historically, we operated with a focus on optical component manufacturing, and specifically on our leadership position as a precision molded lens manufacturer for visual light applications. While still positioned as a component provider, we expanded our addressable market with the acquisition of ISP, a manufacturer of infrared optical components, in December 2016. Collectively, our operations lacked synergies, maintained a high cost structure, and lacked a defined path for capitalizing on the industry’s evolution and growth opportunities.

In March 2020, our Board of Directors (our “Board”) recruited Mr. Sam Rubin, an industry veteran with a proven track record for delivering high growth through organic and inorganic means, to assume the role of Chief Executive Officer and to develop and implement a new strategy going forward. In the fall of 2020, Mr. Rubin led our Board and the leadership team in collaborative discussions with the purpose of defining a new comprehensive strategy for our business. The collaborative strategic planning process included leaders from across the organization, detailed dialogs with customers, vendors and partners, and an in-depth analysis of the environment we are in, changes and trends in and around the use of photonics, and an analysis of our capabilities, strengths and weaknesses. Throughout the process, we focused on developing a strategy that creates a unique and long-lasting value to our customers, and utilizes our unique capabilities and differentiators, both existing capabilities and differentiators, as well as new capabilities we acquire and develop organically.

Understanding the shifts that are happening in the marketplace and the changes that come when a technology, like photonics, moves from being a specialty to being integrated into mainstream industries and applications, we redefined our strategic direction to provide our wide customer base with domain expertise in optics, and became their partner for the optical engine of their systems. In our view, as the use of photonics evolves, so do customer needs. The industry is transforming from a fragmented industry with a component oriented supply chain, into a solution-focused industry with the potential for partnerships for solution development and production. Over the last couple of years we have worked to align our organization to this strategy, and leverage our in-house domain expertise in photonics, knowledge and experience in advanced optical technologies, and the necessary manufacturing techniques and capabilities. We have been developing these partnerships by working closely with our customers throughout their design process, designing optical solutions that are tailored to their needs, often times using unique technologies that we own, and supplying the customer with a complete optical subsystem to be integrated into their product. Such an approach builds on our unique, value-added technologies that we currently own, such as infrared materials, optical molding, fabrication, system design, and proprietary manufacturing technologies, along with other technologies that we may acquire or develop in the future, to create tailored solutions for our customers.

Our domain expertise and the extensive “know how” in optical design, fabrication, production and testing technologies will allow our customers to focus on their own development efforts, freeing them from the need to develop subject matter expertise in optics. By providing the bridge into the optical solution world, we are able to partner with our customers on a long-term basis, create value for our customers, and capture that value through the long-term supply relationships we seek to develop.

Organizational Alignment

Along with the development of a new strategic direction, we are focused on the execution of a complementary strategic plan. First, we have taken steps to align the organization at all levels with the strategic plan. Starting with a new leadership team that was recruited and put in place following Mr. Rubin’s appointment as president and Chief Executive Officer (“CEO”), continuing with operational activities, such as refocusing our investments and expansion from a China focus to prioritizing the growth and development of our U.S. and Latvia operations. In furtherance of our strategic plan, we recently acquired Visimid in Texas resulting in immediate growth of our development and engineering team and capabilities through the addition of the Visimid team.

To execute our new strategic plan, we also need, among other things, a strong manufacturing and technical organization that provides the domain expertise in photonics from the design of an optical engineered solution tailored for the customer’s needs through the manufacturing, assembly and testing of such a sub-system. Given the fast pace of advancements in photonics technologies, achieving a sustainable advantage will also depend on having unique capabilities and technologies that allow our team to design and deliver the tailored solutions demanded by customers. To support those goals, we are pursuing several organization-wide efforts, including standardizing and optimizing our processes and systems, taking steps to realigning our organizational structure, such as breaking down our single combined engineering group into the separate engineering functions that are a part of and better support operations, and creating a new product development group that focuses on developing capabilities and technologies that allow us to design and deliver better solutions. By having a small, focused new product development group, we are able to develop unique technologies that allow us to design solutions that we believe are better than what is currently offered by other suppliers. Such unique technologies include developing tailored and optimized optical coatings, and advanced fabrication techniques such as freeform optical components, custom materials not available elsewhere, and cutting edge optical design capabilities.

In the longer term, we have identified capabilities and technologies that could be important differentiators, including, for example, optical detectors and active optical components such as lasers, motion systems, and more. The aggregation of such unique technologies will allow us to differentiate our optical solutions, and provide customers with products that are tailored exactly to their needs.

In addition to the organizational alignment initiatives we are implementing, we have also executed a leadership transition and operational enhancements at our Chinese subsidiaries as discussed in more detail in Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Technologies

We believe that to be the preferred partner to fulfill the photonics needs of our customers, domain expertise in photonics is the key element. Optics and photonics require multidisciplinary skills, including physics, mechanical engineering, material sciences, electrical engineering, and chemistry, among others. This is part of what makes using photonics so complicated, and at the same time part of what we see as the opportunity. Knowing what can and cannot be produced, designing the architecture and detailed design of the optical system, including electrical and mechanical interfaces, choosing and executing advanced manufacturing technologies, and delivering both the engineering prototypes that are needed, as well as producing a high volume of goods for the long-term, are all part of the domain expertise required. Additionally, to design the best solution for a customer, we not only need to know what can be produced and how to design it, we also must have unique capabilities that differentiate our solutions and allow us to design and produce a better solution that is more profitable than what may otherwise be available.

Along those lines, we continue to focus on developing new, innovative capabilities and technologies in all of our engineering and manufacturing groups, including systems design and testing, optical fabrication of components, material production, optical coatings, and electro mechanical design and production including the following:

| · | Materials. Materials play an important role in providing design flexibility and allow tradeoffs between optical performance, weight, and performance in varying conditions. Traditionally, infrared applications have only a small number of materials, all of which are crystal based, with Germanium being the most commonly used material. Over the last few years Lightpath has been investing in developing and commercializing our BlackDiamond glass as an alternative to using Germanium. BD2, our first glass, has been in production for nearly 15 years. BD6, our second glass, and our flagship material, is produced in volume and fielded in multiple products, both commercial and defense related. Additionally, in December 2021 we received an exclusive license from the U.S. government for the Chalcogenide materials that have been developed in the U.S. Naval Research Laboratories (“NRL”). In addition to providing alternative to the use of Germanium, the new materials from NRL, which we are now in the process of commercializing, have unique advantages such as enabling multispectral imaging (imaging in two or more wavebands with one camera), and thermal and mechanical characteristics that enable customers to build better, lighter and smaller systems. As the world looks to transition away from Germanium, in light of the supply chain liability coming from export restrictions and availability of Germanium, our exclusive family of BlackDiamond glass provides customers not only an alternative, but in fact significant advantages over using Germanium. We believe that this creates a distinctive competitive advantage, which we are leveraging to both enter markets in a more aggressive way (such as defense), and as a stepping stone for our transition from components to solutions. The importance of these materials and the role they play in providing an alternative to Germanium is also evident in the direct funding and support we are receiving from different government organizations. As announced on several separate occasions, LightPath has received fundings from the U.S. Department of Defense, Defense Logistics Agency, European Space Agency, and from the U.S. Army, to name a few. Those fundings are all aimed at accelerating the qualification of the materials for use in their respective applications. Lastly, the importance of the materials and how they align within our strategy can also be seen in our own products, with our first camera product, Mantis, being based on, and enabled by one of those exclusive and unique materials. |

| | |

| · | High precision molded lenses. Historically, precision molding of lenses is the key technology we have built upon. Precision molding of optics is a unique technology that is well suited for both high volume production of optical components, as well as production of optics with unique shapes, which otherwise would require a very lengthy and complex process to individually polish each lens to shape. Precision molded optics (“PMOs”) is a technology in which we continuously invest to pursue advancements in what materials can be molded and the shapes and sizes of the optics we can mold. Although there are several other competitors that can mold optical elements, we have an established leadership position in this area as the original developer of the technology, and we believe we are the preferred vendor for the most complex, high-end projects of many of our customers. Some recent advancements we have made in precision molded optics include molding of non-symmetric shapes such as freeform optical components, and qualifying new materials for availability as moldable materials. |

| | |

| · | Traditional polishing and diamond turned optics. Our capabilities include a wide range of traditional fabrication processes. These include CNC (computer numerical control) grinding and polishing of optical elements, traditional grinding and polishing of lenses, and diamond turning of infrared materials. |

| | |

| · | Optical coatings. Thin film coatings are designed to reduce losses and protect the optical material, which are a key part of any optical system. Through our recent investments, we have the ability to coat lenses in all of our facilities, providing efficient, high quality antireflective coatings, as well as reflective and protective coatings. Our coating facilities employ both physical vapor deposition techniques as well as chemical vapor deposition techniques. In addition to our library of dozens of standard coatings, our coating engineers often design coatings specific for an application, optimizing the performance of the system for a specific customer use. One of our most known advanced coatings is Diamond Like Carbon, which provides materials such as chalcogenide glass significant environmental protection. This coating is currently available only at a small number of vendors, and is an example of a capability that we believe gives us a competitive advantage by allowing us to design better optical solutions. |

| | |

| · | Optical assembly and testing. In recent years, we have invested significantly in capabilities for sub-system level lens assemblies and testing in two of our facilities. Even more recently, we have added capabilities of active alignment, and extended testing including environmental testing, to support our growing business of optical assemblies and engineered solutions. We expect to continue to invest in this area as activity grows, particularly in volume manufacturing and testing of assemblies. |

| | |

| · | Infrared Camera Cores: While the lens assemblies that are customized for specific use cases or customers are mounted in front of the optical detector, the electronics, hardware and software behind the detector often needs to be customized. Then all three (electronics, detector and optics) must be assembled and calibrated together to work properly. Through the acquisition of Visimid in July 2023, LightPath has added to its technology portfolio the capabilities to customize entire imaging cores for cameras. This includes designing the electronic hardware and software to specific form fit and function for the customer, assembling with LightPath lenses, and calibrating the entire camera core so it can ship ready for the customer to use. |

New Product Development

Consistent with our strategic plan, we have focused our development efforts in fiscal years 2022 and 2023 on products, technologies and capabilities that allow us to provide better solutions using the most fit technology for each customer and with alignment to customer product lifecycle. This includes developing unique materials, processing techniques, optical coating offerings and most recently, camera cores with unique capabilities. An example of such a development is our Mantis, a broadband multispectral camera, and uncooled infrared camera that can image a large range of wavelengths, covering both mid wave and long wave, two wavebands that today require two separate cameras. The advantage of a camera such as Mantis to the customer is the ability to do, in a cost-effective manner, imaging that today requires an expensive, cryogenically cooled camera. Mantis’s technology presents opportunities for customers in areas such as industrial process monitoring, flame and fire detection and more. The adoption rate of existing technology for many of those applications is more limited today because of its high cost. A new, more cost effective technology such as Mantis is a prime example of enabling a new market as opposed to competing with existing installed bases of competing technology. This innovation and leveraging our technologies is a pillar of our growth strategy and differentiation.

We generally rely on trade secret protection for technology we develop, but do pursue patents for certain of such technology. In many cases the benefits of patent protection is offset by the requirement to disclose in detail the processes, and so we intend to apply for a patent only the case when we believe the patent is enforceable and does not compromise our trade secrets and intellectual properties developed over three decades.

We incurred expenditures for new product development of approximately $2.1 million during both fiscal years 2023 and 2022.

In some cases our product and technology development is supported through billing of engineering services, such as non-recurring engineering (“NRE”) fees. In other cases we receive external funding, such as our previously announced funding from Space Florida’s Space Foundation and Israel’s Ministry of Science, and the U.S. DoD (via the Defense Logistics Agency). Our efforts are self-funded in all other cases.

As part of our product development and research and development efforts, we have over 60 employees with engineering and related advanced degrees located in our facilities in the U.S., China and Latvia. Our facilities in Orlando, Florida, Dallas, Texas, and Zhenjiang, China are located in or near industrial technology campuses with substantial access to optical industry constituencies, including a major university. This enables us and our staff to remain on the cutting edge of industry design trends and to enter into collaborative engagements.

Product Groups and Markets

Overview

Our revenues are categorized into three product groups: PMOs, infrared products and specialty products. These product groups are supported by our major product capabilities: molded optics, thermal imaging optics, and custom designed optics, and the related assemblies.

Our PMO product group consists of visible precision molded optics with varying applications. Our infrared product group is comprised of infrared optics, both molded and diamond-turned, and thermal imaging assemblies. This product group also includes both conventional and CNC ground and polished lenses. Between these two product groups, we have the capability to manufacture lenses from very small (with diameters of sub-millimeter) to over 300 millimeters, and with focal lengths from approximately 0.4 millimeters to over 2000 millimeters. In addition, both product groups offer catalog and custom designed optics.

Our specialty product group is comprised of other value-added products, such as mounted lenses, optical assemblies, collimators, and NRE products, which consist of those products we develop pursuant to product development agreements that we enter into with customers. Typically, customers approach us and request that we develop new products or applications utilizing our existing products to fit their particular needs or specifications. The timing and extent of any such product development requests are outside of our control.

We are re-evaluating our product groups going into fiscal year 2024, with the addition of Visimid in July 2023. Visimid’s revenue is generally derived from engineering services and infrared camera cores and assemblies.

PMO Product Group. Aspheric lenses are known for their optimal performance. Aspheric lenses simplify and shrink optical systems by replacing several conventional lenses. However, aspheric lenses can be difficult and costly to machine. Our glass molding technology enables the production of both low and high volumes of aspheric optics, while still maintaining the highest quality at an affordable price. Molding is the most consistent and economical way to produce aspheres and we have perfected this method to offer the most precise molded aspheric lenses available.

Infrared Product Group. Our infrared product group is comprised of both molded and turned infrared lenses and assemblies using a variety of infrared glass materials. Advances in chalcogenide materials have enabled compression molding for mid-wave (“MWIR”) and long-wave (“LWIR”) optics in a process similar to precision molded lenses. Our molded infrared optics technology enables high performance, cost-effective infrared aspheric lenses that do not rely on traditional diamond turning or lengthy polishing methods. Utilizing precision molded aspheric optics significantly reduces the number of lenses required for typical thermal imaging systems and the cost to manufacture these lenses. Molding is an excellent alternative to traditional lens processing methods particularly where volume and repeatability is required.

Through ISP, our wholly-owned subsidiary, we also offer germanium, silicon or zinc selenide aspheres and spherical lenses, which are manufactured by diamond turning. This manufacturing technique allows us to offer larger lens sizes and the ability to use other optical materials that cannot be effectively molded. ISP’s capabilities increase our ability to meet complex optical challenges that demand more exotic optical substrate materials that are non-moldable, as well as larger size optics.

We also have the ability to manufacture chalcogenide glass from which we produce infrared lenses. We developed this glass and melt it internally to produce our Black Diamond glass, which has been trademarked, and is marketed as BD6. Historically, the majority of our thermal imaging products have been germanium-based, which is subject to market pricing and availability. BD6 offers a lower-cost alternative to germanium, which we expect will benefit the cost structure of some of our current infrared products and allow us to expand our product offerings in response to the markets’ increasing requirement for low-cost infrared optics applications.

Overall, we anticipate continued growth for our infrared optics, particularly as BD6 continues to be adopted into new applications and new designs. Infrared systems, which include thermal imaging cameras, temperature sensing, gas sensing devices, spectrometers, night vision systems, automotive driver awareness systems, such as blind spot detection, thermal weapon sights, and infrared counter measure systems, is an area that is growing rapidly and we are selling products that are utilized in a number of these applications. As infrared imaging systems become widely available, market demand will increase as the cost of components decreases. Our aspheric molding process is an enabling technology for the cost reduction and commercialization of infrared imaging systems utilizing smaller lenses because the aspheric shape of our lenses enables system designers to reduce the lens element in a system and provide similar performance at a lower cost. In addition, there is a trend toward utilizing smaller size sensors in these devices which require smaller size lenses and that fits well with our molding technology.

Specialty Product Group. We offer a group of custom specialty optics products and assemblies that take advantage of our unique technologies and capabilities. These products include custom optical designs, mounted lenses, optical assemblies, and collimator assemblies. Collimator assemblies are utilized in applications involving light detection and ranging (“LIDAR”) technology for advanced driver assistance systems and autonomous vehicles, such as forklifts and other automated warehouse equipment. This continues to be an emerging market with long-term growth potential for us. We also expect growth from medical programs and commercial optical sub-assemblies.

We design, build, and sell optical assemblies in markets for test and measurement, medical devices, military, industrial, and communications based on our proprietary technologies. Many of our optical assemblies consist of several products that we manufacture.

In connection with our new strategic direction and the expanding portfolio of products and services, we are evaluating the ways in which we may optimize the financial reporting of our product groups.

Sales and Marketing

Marketing. Extensive product diversity and varying levels of product maturity characterize the optics industry. Product verticals range from consumer (e.g., AR/VR headset, cameras, cell phones, gaming devices, and copiers) to industrial (e.g., lasers, data storage, and infrared imaging), from products where the lenses are the central feature (e.g., telescopes, microscopes, and lens systems) to products incorporating lens components (e.g., 3D printing, machine vision, LIDAR, robotics and semiconductor production equipment) and communications (e.g., fiber, 5G and satellite laser based). As a result, we market our products across a wide variety of customer groups, including laser systems manufacturers, laser OEM’s, infrared-imaging systems vendors, automotive OEMs, industrial laser tool manufacturers, telecommunications equipment manufacturers, medical instrumentation manufacturers and industrial measurement equipment manufacturers, government defense agencies, and research institutions worldwide. Our marketing efforts include a global unification of our messaging with the use of digital advertising, branding activities that utilize social media, our website and direct marketing activities. As our focus shifts from the sale of components and standard products to being a value-add supply partner for customized solutions, our marketing activities also shift from a focus on technical aspects of standard components to a focus on best practice use cases, the overall outcome from our solutions and end user benefit. Our market messaging will look to inspire interest and promote engagement.

Sales Model & Structure. To align the organization to better serve our new solution strategy and for accountability of our key corporate objectives, we have made organizational changes designed to ensure customer satisfaction and operational efficiency. Our organizational structure includes a product management function that enables the close coordination of supply with demand to help us leverage our core offerings and coordinate our engineering development efforts that will leverage and expand our portfolio of capabilities. We have also transitioned from a business unit focus to a unified global direct sales team that promotes the overall company portfolio and is standardized on a problem solving, needs analysis process. The team recently went through Sandler Training to help with this shift and to empower action with improved communication techniques. We have added technical program managers and product life cycle management (“PLCM”) to better support the new customized customer programs and the transition from prototype engineering to full scale manufacturing.

Sales Team & Channel. We have aligned our sales engineering efforts to be account based and application focused. We have taken a more proactive approach to our direct selling efforts to increase our customer engagement, especially within Europe, where we recently transitioned away from working exclusively through a distributor. We have expanded our standard product offerings with the top two catalog companies for optics and photonics in the world which increases our exposure to new revenue opportunities. In addition, we continue to enhance our website (www.lightpath.com), which is our main communication vehicle for broader promotion of our company, our value-add capabilities, our growing chalcogenide material portfolio, and similarly have optimized our social media assets. We make use of digital and print media plus participate in many key industry associations and global trade shows.

Trade Shows. We display our standard products, promote new innovative offerings and meet with industry influencers at a number of trade shows each year throughout North America, Europe and Asia. So far in 2023, we have participated in the SHOT Show in Las Vegas, the largest professional event for the sport shooting, hunting and outdoor industry in North America; SPIE Photonics West in San Francisco; SPIE DCS, AUVSI Xponential which promotes emerging technologies supporting autonomous vehicles, drones and robotics; and Laser World of Photonics in both Munich, Germany and Shanghai, China. These trade shows provide us an opportunity to further expand our brand, network to enhance business relationships and gain valuable insight into technology trends in our target markets.

Competition

The markets in which we compete in are generally highly competitive and highly fragmented. We compete with manufacturers of conventional spherical lenses and optical components, providers of aspheric lenses and optical components, and producers of optical quality glass. While the global market for component supply is fragmented and highly competitive, we maintain advantages through our unique technologies that often build on our leadership in precision molded optics, as well as our vertical integration in infrared optics, from raw materials through assemblies and engineered solutions.

Engineered Solutions

The market for non-captive optical engineered solutions is emerging and competition will increase as companies such as LightPath begin transitioning their offerings from components to engineered solutions:

| · | Engineered solutions companies. While there are not many, companies such as Excelitas Technologies Corp. and Jenoptik AG offer optical engineered solutions to the market, with a specific focus on solutions in visible and ultraviolet light bands, and with a vertical industry focus, such as life sciences and semiconductor systems. |

| · | Engineering firms. Though less popular, in some cases customers prefer to work with engineering firms that provide design services, which then the customer produces or sub-contracts to third-party component manufacturers. An example of such companies providing engineering services are Lighthouse Imaging, LLC, Optikos Corporation, and Photon Engineering, LLC. |

| · | In-house or captive design. The most common approach today is for customers to design the optical system internally by the OEM. This requires customers to have expertise in optical system and component design capabilities, along with knowledge of the most advanced available technologies, however limited the scope of their capabilities or the profitability of their solutions may be. |

We believe that one of our key differentiators is our unique technologies that allow us to design better solutions.

Optical Components

PMO Product Group. Our PMO products compete with conventional lenses and optical components manufactured from companies such as Asia Optical Co., Inc., Anteryon BV, Rochester Precision Optics, and Sunny Optical Technology (Group) Company Limited. Aspheric lens system manufacturers include Panasonic Corporation, Alps Electric Co., Ltd., Hoya Corporation, as well as other competitors from China and Taiwan, such as E-Pin Optical Industry Co., Ltd., and Kinik Company.

Our aspheric lenses compete with lens systems comprised of multiple conventional lenses. Machined aspheric lenses compete with our molded glass aspheric lenses. The use of aspheric surfaces provides the optical designer with a powerful tool in correcting spherical aberrations and enhancing performance in state-of-the-art optical products. However, we believe that our optical design expertise and our flexibility in providing custom high-performance optical components at a low price are key competitive advantages for us over competitors. An additional competitive advantage is our ability to switch production between different facilities on different continents. We do not depend on one facility and are able to move production in and out of China, which we believe creates a significant advantage by giving us supply chain continuity and an ability to adjust to customers’ geographical preferences.

Plastic molded aspheres and hybrid plastic/glass aspheric optics allow for high volume production, but primarily are limited to low-cost consumer products that do not place a high demand on performance (such as plastic lenses in disposable or mobile phone cameras). Molded plastic aspheres appear in products that stress cost or weight as their measure of success over performance and durability. Our low-cost structure allows us to compete with these lenses based on higher performance and durability from our glass lenses at only a small premium in price. We do not compete in the market for plastic lenses unless a glass substitution presents a viable alternative.

Infrared Product Group. Our infrared optical components compete with optical products produced by Janos Technology LLC, Ophir Optronics Solutions Ltd. (a subsidiary of MKS Instruments, Inc.), Clear Align, II-VI, Inc. and a variety of Eastern European and Asian manufacturers. Infrared optical components can be produced using several techniques. Historically, infrared optical components were produced only using traditional fabrication technologies, which later changed when diamond turning was introduced (a form of advanced CNC for optical materials), and most recently, with the adoption of synthetic chalcogenide glass, we began to precision mold infrared optical components, by leveraging our years of leadership and expertise in precision molding. Being synthetically produced, chalcogenide glass, such as our proprietary BD6 material, has an inherently lower cost than crystalline materials such as germanium. Additionally, glass such as our BD6 material provides further advantages, including a-thermal behavior, lower weight, and an ability to produce high-volumes through precision molding, something traditional infrared materials cannot achieve due to their crystal structure. In addition to molding lenses directly into finished form, we also developed and patented a process to mold large optical elements into near net shape, which offers a significant cost savings for components that cannot be produced directly from molding. All of this is related in part to our choice to vertically integrate, and produce our own chalcogenide glass, positioning us to create more technical advantages for our customers, by leveraging and optimizing our glass manufacturing to produce unique materials and better overall system performance.

We believe that the market shift towards the use of synthetic materials in infrared products represents a significant opportunity for us, and we continue to invest in further pushing the limits of both molding of infrared components, as well as the glass manufacturing technology and products. We believe this process will create significant differentiators and value in this industry segment, and will further change the dynamics of this industry segment.

Our molded infrared optics competes with products manufactured by Umicore N.V., Rochester Precision Optics, and a number of Asian and European manufacturers. We believe that leadership in glass molding technologies, our vertical integration by producing our own glass, and our continued investment in technology development in this area, coupled with our diverse manufacturing flexibility, and our manufacturing facilities located in Asia, Europe and North America are key advantages over the products manufactured by competitors.

Manufacturing

Facilities. Our manufacturing is largely performed in our combined 58,500 square feet of production facilities in Orlando, Florida, in LPOIZ’s combined 55,000 square feet of production facilities in Zhenjiang, China, and in ISP Latvia’s 29,000 square feet of production facilities in Riga, Latvia.

Our Orlando Facility and LPOIZ’s Zhenjiang Facility feature areas for each step of the manufacturing process, including coating work areas, diamond turning, manufacturing and a clean room for precision glass molding and integrated assembly. The Orlando and Zhenjiang Facilities include new product development laboratories and space that includes development and metrology equipment. The Orlando and Zhenjiang Facilities have anti-reflective and infrared coating equipment to coat our lenses in-house. ISP Latvia’s Riga Facility includes fully vertically integrated manufacturing processes to produce high precision infrared lenses and infrared lens assemblies, CNC grinding, conventional polishing, diamond turning, assemblies and state of the art metrology. During fiscal year 2021, we began adding infrared coating capabilities in the Riga Facility as well.

We are routinely adding additional production equipment at our Orlando, Zhenjiang and Riga Facilities. In fiscal year 2021, we added additional space in our Riga Facility, and also executed a lease agreement for additional space at our Orlando Facility. We completed the build out of our additional Orlando Facility space in August 2023. In addition to adding equipment or space at our manufacturing facilities, we add work shifts, as needed, to increase capacity and meet forecasted demand. We intend to monitor the capacity at our facilities, and will increase such space as needed. We believe our facilities and planned expansions are adequate to accommodate our needs over the next year.

Production and Equipment. Our Orlando Facility contains glass melting capability for BD6 chalcogenide glass, a manufacturing area for our molded glass aspheres, multiple anti-reflective and wear resistant coating chambers, diamond turning machines and accompanying metrology equipment offering full scale diamond turning lens capability, a tooling and machine shop to support new product development, commercial production requirements for our machined parts, the fabrication of proprietary precision glass molding machines and mold equipment, and a clean room for our molding and assembly workstations and related metrology equipment.

LPOIZ’s Zhenjiang Facility features a precision glass molding manufacturing area, clean room, machine shop, dicing area, and thin film coating chambers for anti-reflective coatings on both visible and infrared optics and related metrology equipment.

ISP Latvia’s Riga Facility consists of crystal growth, grinding, polishing, diamond turning, quality control departments and a mechanical shop to provide the departments with the necessary tooling. The crystal growth department is equipped with multiple furnaces to grow water soluble crystals. The grind and polish department has modern CNC equipment, lens centering and conventional equipment to perform spindle, double sided and continuous polishing operations. The diamond turning department has numerous diamond-turning machines accompanied with the latest metrology tools. During fiscal year 2021, we began adding infrared coating capabilities at the Riga Facility, which was completed the second half of fiscal year 2022. The quality control department contains numerous inspection stations with various equipment to perform optical testing of finished optics.

The Orlando, Zhenjiang, and Riga Facilities are ISO 9001:2015 certified. The Zhenjiang Facility is also ISO/TS 1649:2009 automotive certified for manufacturing of optical lenses and accessories. The Orlando Facility is International Traffic in Arms Regulations (“ITAR”) compliant and registered with the U.S. Department of State. The Riga Facility has a DSP-5 ITAR license and Technical Assistance Agreement in place that allows this facility to manufacture items with ITAR requirements.

For more information regarding our facilities, please see Item 2. Properties in this Annual Report on Form 10-K.

Subcontractors and Strategic Alliances. We believe that low-cost manufacturing is crucial to our long-term success. In that regard, we generally use subcontractors in our production process to accomplish certain processing steps requiring specialized capabilities. For example, we presently use a number of qualified subcontractors for fabricating, polishing, and coating certain lenses, as necessary. We have taken steps to protect our proprietary methods of high-quality manufacturing by patent disclosures and internal trade secret controls.

Suppliers. We utilize a number of glass compositions in manufacturing our molded glass aspheres and lens array products. These glasses or equivalents are available from a large number of suppliers, including CDGM Glass Company Ltd., Ohara Corporation, and Sumita Optical Glass, Inc. Base optical materials, used in both infrared glass and collimator products, are manufactured and supplied by a number of optical and glass manufacturers. ISP utilizes major infrared material suppliers located around the globe for a broad spectrum of infrared crystal and glass. The development of our manufacturing capability for BD6 glass provides a low-cost internal source for infrared glass. We believe that a satisfactory supply of such production materials will continue to be available, at reasonable or, in some cases, increased prices, although there can be no assurance in this regard.

We also rely on local and regional vendors for component materials and services such as housings, fixtures, chemicals and inert gases, specialty ceramics, UV and AR coatings, and other specialty coatings. In addition, certain products require external processing, such as anodizing and metallization. To date, we are not dependent on any of these manufacturers and have found a suitable number of qualified vendors and suppliers for these materials and services.

We currently purchase a few key materials from single or limited sources. We believe that a satisfactory supply of production materials will continue to be available at competitive prices, although we are experiencing inflationary pricing pressure in the short term, however there can be no assurances in this regard.

Intellectual Property

Our policy is to protect our technology by, among other things, trade secret protection, patents, trademarks, and copyrights. We primarily rely upon trade secrets and unpatented proprietary know-how to protect certain process inventions, lens designs, and innovations. We have taken reasonable security measures to protect our trade secrets and proprietary know-how.

We are aggressively pursuing patents for new products that provide new features, capabilities or other advantages to our customers. Over the past year we have filed 5 new patent applications. The first filing uses a midwave thermal imaging camera with relay optics and a risley prism scanner for inspection of boilers and furnaces. The risley prism scanner gives the system the ability to steer the image area within the furnace. The second filing uses an uncooled broadband camera for flame detection coupled with detection of humans or other low temperature signals within the overall imaging area. The third filing is for an optical element formed from a moldable material, with a transparent layer of a different material applied to the optical surface for use in resistive heating of the element. This can be used to provide heating on an optic for de-icing or de-fogging. The fourth filing combines LWIR Imaging with an extended short wavelength infrared (“eSWIR”) light source to allow for IR imaging and illumination in the same image using a single detector. The fifth filing is for a single camera that can detect a signaling laser such as a beacon in one wavelength, while imaging the heat emitted from objects in another waveband.

Our means of protecting our proprietary rights may not be adequate and our competitors may independently develop technology or products that are similar to ours or that compete with ours. Patent, trademark, and trade secret laws afford only limited protection for our technology and products. The laws of many countries do not protect our proprietary rights to as great an extent as do the laws of the United States (“U.S.”). Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to obtain and use information that we regard as proprietary. Third parties may also design around our proprietary rights, which may render our protected technology and products less valuable, if the design around is favorably received in the marketplace. In addition, if any of our products or technology is covered by third-party patents or other intellectual property rights, we could be subject to various legal actions. We cannot assure you that our technology platform and products do not infringe patents held by others or that they will not in the future. Litigation may be necessary to enforce our intellectual property rights, to protect our trade secrets, to determine the validity and scope of the proprietary rights of others, or to defend against claims of infringement, invalidity, misappropriation, or other claims.

We own several registered and unregistered service marks and trademarks (collectively, “marks”) that are used in the marketing and sale of our products. The following table sets forth our registered and unregistered marks, and denotes whether each mark is registered, the country in which the mark is filed, and the renewal date for such mark.

Mark | | Type | | Registered | | Country | | | Renewal Date | |

LightPath® | | Service mark | | Yes | | United States | | | Pending | |

GRADIUM™ | | Trademark | | Yes | | United States | | | April 29, 2027 | |

Circulight | | Trademark | | No | | - | | | - | |

BLACK DIAMOND | | Trademark | | No | | - | | | - | |

GelTech | | Trademark | | No | | - | | | - | |

Oasis | | Trademark | | No | | - | | | - | |

LightPath® | | Service mark | | Yes | | People’s Republic of China | | | September 13, 2025 | |

ISP Optics® | | Trademark | | Yes | | United States | | | August 12, 2024 | |

Environmental and Governmental Regulation

Currently, emissions and waste from our manufacturing processes are at such low levels that no special environmental permits or licenses are required. In the future, we may need to obtain special permits for disposal of increased waste by-products. The glass materials we utilize contain some toxic elements in a stabilized molecular form. However, the high temperature diffusion process results in low-level emissions of such elements in gaseous form. If production reaches a certain level, we believe that we will be able to efficiently recycle certain of our raw material waste, thereby reducing disposal levels. We believe that we are presently in compliance with all material federal, state, and local laws and regulations governing our operations and have obtained all material licenses and permits necessary for the operation of our business.

We also utilize certain chemicals, solvents, and adhesives in our manufacturing process. We believe we maintain all necessary permits and are in full compliance with all applicable regulations.

To our knowledge, there are currently no U.S. federal, state, or local regulations that restrict the manufacturing and distribution of our products. Certain end-user applications require government approval of the complete optical system, such as U.S. Food and Drug Administration approval for use in endoscopy. In these cases, we will generally be involved on a secondary level and our OEM customer will be responsible for the license and approval process.

The Dodd-Frank Wall Street Reform and Consumer Protection Act imposes disclosure requirements regarding the use of “conflict minerals” mined from the Democratic Republic of Congo and adjoining countries in products, whether or not these products are manufactured by third parties. The conflict minerals include tin, tantalum, tungsten, and gold, and their derivatives. Pursuant to these requirements, we are required to report on Form SD the procedures we employ to determine the sourcing of such minerals and metals produced from those minerals. There are costs associated with complying with these disclosure requirements, including for diligence in regards to the sources of any conflict minerals used in our products, in addition to the cost of remediation and other changes to products, processes, or sources of supply as a consequence of such verification activities. In addition, the implementation of these rules could adversely affect the sourcing, supply, and pricing of materials used in our products. We strive to only use suppliers that source from conflict-free smelters and refiners; however, in the future, we may face difficulties in gathering information regarding our suppliers and the source of any such conflict minerals.

Concentration of Customer Risk

In fiscal year 2023, we had sales to three customers that comprised an aggregate of approximately 24% of our annual revenue with one customer at 11% of our sales, another customer at 7% of our sales, and the third customer at 6% of our sales. In fiscal year 2022, we had sales to three customers that comprised an aggregate of approximately 35% of our annual revenue with one customer at 19% of our sales, another customer at 9% of our sales, and the third customer at 7% of our sales. The loss of any of these customers, or a significant reduction in sales to any such customer, would adversely affect our revenues and profits. We continue to diversify our business in order to minimize our sales concentration risk.

In fiscal year 2023, 50% of our net revenue was derived from sales outside of the U.S., with 93% of our foreign sales derived from customers in Europe and Asia. In fiscal year 2022, 61% of our net revenue was derived from sales outside of the U.S., with 95% of our foreign sales derived from customers in Europe and Asia.

Employees

As of June 30, 2023, we had 327 employees, of which 320 were full-time equivalent employees, with 111 in the U.S., including 106 located in Orlando, Florida and 5 working remotely from various locations, 99 located in Riga, Latvia, and 117 located in Zhenjiang, China. Of our 320 full-time equivalent employees, we have 32 employees engaged in management, administrative, and clerical functions, 23 employees in new product development, 11 employees in sales and marketing, and 254 employees in production and quality control functions. Any employee additions or terminations over the next twelve months will be dependent upon the actual sales levels realized during fiscal year 2024. We have used and will continue utilizing part-time help, including interns, temporary employment agencies, and outside consultants, where appropriate, to qualify prospective employees and to ramp up production as required from time to time.

Item 1A. Risk Factors.

The following is a discussion of the primary factors that may affect the operations and/or financial performance of our business. Refer to the section entitled Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations of this Annual Report on Form 10-K for an additional discussion of these and other related factors that affect our operations and/or financial performance.

Risks Related to Our Business and Financial Results

We have a history of losses.We reported net losses of $4.0 million, $3.5 million and $3.2 million for fiscal years 2023, 2022 and 2021, respectively, and although we reported net income of $0.9 million for fiscal year 2020, we incurred a net loss of $2.7 million for fiscal year 2019. As of June 30, 2023, we had an accumulated deficit of approximately $207.8 million. We may incur losses in the future if we do not achieve sufficient revenue to maintain profitability, or if we continue to incur unusual costs. We expect revenue to grow by generating additional sales through promotion of our infrared products, with a focus on engineered solutions, and continued cost reduction efforts across all product groups, but we cannot guarantee such improvement or growth.

Factors which could adversely affect our future profitability, include, but are not limited to, a decline in revenue either due to lower sales unit volumes or decreasing selling prices, or both, our ability to order supplies from vendors, which, in turn, affects our ability to manufacture our products, and slow payments from our customers on accounts receivable.

Any failure to maintain profitability would have a materially adverse effect on our ability to implement our business plan, our results and operations, and our financial condition, and could cause the value of our Class A common stock to decline.

We are dependent on a few key customers, and the loss of any key customer could cause a significant decline in our revenues. In fiscal year 2023, we had sales to three customers that comprised an aggregate of approximately 24% of our annual revenue, with one customer at 11% of our sales, another customer at 7% of our sales, and the third customer at 6% of our sales. In fiscal year 2022, we had sales to three customers that comprised an aggregate of approximately 35% of our annual revenue, with one customer at 19% of our sales, another customer at 9% of our sales, and the third customer at 7% of our sales. Our current strategy of providing the domain expertise and the extensive “know how” in optical design, fabrication, production and testing technologies will allow our customers to focus on their own development efforts, without needing to develop subject matter expertise in optics. By providing the bridge into the optical solution world, we partner with our customers on a long term basis, create value to our customers, and capture that value through the long-term supply relationships we develop. However, the loss of any of these customers, or a significant reduction in sales to any such customer, would adversely affect our revenues.

We may be affected by political and other risks as a result of our sales to international customers and/or our sourcing of materials from international suppliers. In fiscal year 2023, 50% of our net revenue was derived from sales outside of the U.S., with 93% of our foreign sales derived from customers in Europe and Asia. In fiscal year 2022, 61% of our net revenue was derived from sales outside of the U.S., with 95% of our foreign sales derived from customers in Europe and Asia. Our international sales will be limited, and may even decline, if we cannot establish relationships with new international distributors, maintain relationships with our existing international distributions, maintain and expand our foreign operations, expand international sales, and develop relationships with international service providers. Additionally, our international sales may be adversely affected if international economies weaken. We are subject to the following risks, among others:

| · | greater difficulty in accounts receivable collection and longer collection periods; |

| · | potentially different pricing environments and longer sales cycles; |

| · | the impact of recessions in economies outside the U.S.; |

| · | the impact of high, sustained inflation; |

| · | unexpected changes in foreign regulatory requirements; |

| · | the burdens of complying with a wide variety of foreign laws and different legal standards; |

| · | certification requirements; |

| · | reduced protection for intellectual property rights in some countries; |

| · | difficulties in managing the staffing of international operations, including labor unrest and current and changing regulatory environments; |

| · | potentially adverse tax consequences, including the complexities of foreign value-added tax systems, restrictions on the repatriation of earnings, and changes in tax rates; |

| · | price controls and exchange controls; |

| · | government embargoes or foreign trade restrictions; |

| · | imposition of duties and tariffs and other trade barriers; |

| · | import and export controls; |

| · | transportation delays and interruptions; |

| · | terrorist attacks and security concerns in general; and |

| · | political, social, economic instability and disruptions. |