0001031093

false

0001031093

2023-09-04

2023-09-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

| Date of Report

(Date of earliest event reported): |

September 4, 2023 |

Silver

bull resources, inc.

(Exact name of registrant

as specified in its charter)

| Nevada |

|

001-33125 |

|

91-1766677 |

| (State or other jurisdiction of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification Number) |

| |

|

|

|

|

777

Dunsmuir Street, Suite

1605

Vancouver BC,

Canada |

|

V7Y

1K4 |

| (Address of principal executive offices) |

|

(Zip Code) |

| Registrant’s telephone number, including area code: |

604-687-5800 |

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o |

Written communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425) |

| o |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b)) |

| o |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

| Item 1.01 | Entry into a Material Definitive Agreement. |

On September 4, 2023,

Silver Bull Resources, Inc. (the “Company”) entered into a Litigation Funding Agreement (the “Funding Agreement”)

with Bench Walk 23P, L.P., a Delaware limited partnership (the “Funder”), for the primary purpose of funding certain legal

costs to be incurred by the Company in connection with its previously announced claim (the “Claim”) against the United Mexican

States (Mexico) commenced by a Request for Arbitration for breaches of the North American Free Trade Agreement (NAFTA) by way of arbitration

under the rules of the World Bank’s International Centre for Settlement of Investment Disputes (ICSID) tribunal.

Pursuant to the Funding

Agreement, the Funder agreed to pay up to an aggregate of $9.5 million to fund legal costs and other expenses incurred by the Company

in connection with the Claim, including an amount for reasonably incurred day-to-day operating expenses of the Company of between $2.3 million

and $3.7 million (depending on the level of expenses incurred in the Claim).

The Company agreed that

the Funder shall be entitled to receive a share of any proceeds arising from the Claim (the “Claim Proceeds”) of up to 3.5x

the Funder’s capital outlay (or, if greater, a return of 1.0x the Funder’s capital outlay plus 30% of the Claim Proceeds).

The actual return to the Funder may be lower than the foregoing amounts depending on how quickly the Claim is resolved.

As security for the Funder’s

entitlement to receive a share of the Claim Proceeds under the Funding Agreement, the Company granted to the Funder a security interest

in the Claim Proceeds, the Claim, all documents of title pertaining to the Claim, rights under any appeal bond or similar instrument posted

by any of the defendants in the Claim, and all proceeds of any of the foregoing.

Pursuant to the Funding

Agreement, the Company is required to promptly inform the Funder of any significant developments in the Claim and to take and follow the

legal advice of Boies Schiller Flexner (UK) LLP and any replacement or additional solicitor appointed by the Company in respect of the

Claim (the “Solicitor”) and counsel at all times (or obtain the consent of the Funder to depart from any such advice), including

whether to make or accept any offer to settle the Claim.

The Funding Agreement may

be terminated under certain standard and customary circumstances, including (i) if the Funder is not satisfied as to the merits of

the Claim or believes the Claim is not commercially viable, in each case as determined in good faith but otherwise in its sole discretion;

(ii) if the Company or the Solicitor has made a misrepresentation or is otherwise in breach of any term of the Transaction Documents

(as defined in the Funding Agreement) and that misrepresentation or other breach is not reasonably capable of remedy or has not been remedied

to the satisfaction of the Funder within 10 business days of that party’s becoming aware of the breach or the Company, or any of

its agents or employees, is the subject of a formal finding by a relevant tribunal of dishonesty or corrupt practices in connection with

the events giving rise to the Claim; or (iii) if any specified conditions precedent have not been satisfied.

The Funding Agreement

also contains other customary terms and conditions, including customary representations, warranties, and covenants from both parties.

| Item 7.01 | Regulation FD Disclosure. |

On September 6, 2023,

the Company issued a press release regarding the Funding Agreement. A copy of the press release is furnished as Exhibit 99.1 hereto

and is incorporated herein by reference.

The information set forth

in this Item 7.01, including the information set forth in Exhibit 99.1, is being furnished and shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be

deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be

expressly set forth by specific reference in such a filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

2

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

|

|

| |

|

|

| |

Silver Bull resources, inc. |

| |

|

|

| |

|

|

| Date: September 8, 2023 |

By: |

/s/ Christopher Richards |

| |

Name: |

Christopher Richards |

| |

Title: |

Chief Financial Officer |

3

Exhibit 99.1

| September 6, 2023 |

OTCQB: SVBL, TSX: SVB |

SILVER

BULL SECURES US$9.5M LITIGATION FUNDING TO PURSUE DAMAGES CLAIM AGAINST THE MEXICAN GOVERNMENT

VANCOUVER,

British Columbia – Silver Bull Resources Inc. (“Silver Bull” or the “Company”) is pleased to announce

that it has secured funding for its international arbitration proceedings against the United Mexican States (“Mexico”) under

the Agreement between the United States of America, Mexico, and Canada (the “USMCA”) and the North American Free Trade Agreement

(“NAFTA”).

HIGHLIGHTS

| ✔ | Litigation

Funding Agreement (“LFA”) signed with Bench Walk Advisors LLC (“Bench Walk”)

to pursue international arbitration claims against Mexico for breaches of its obligations

under NAFTA |

| ✔ | The

LFA facility is available for immediate draw down and provides funding to cover legal, tribunal

and external expert costs and corporate operating expenses associated with the Company. |

| ✔ | US$9.5

million is provided as a purchase of a contingent entitlement to damages in the event that

a damages award is recovered from Mexico. |

| ✔ | Legal

counsel for the claim is Boies Schiller Flexner (UK) LLP (“BSF”), an international

law firm with extensive experience in international investment arbitration concerning mining

and other natural resources, to act on its behalf. The BSF Team will be led by Timothy L.

Foden, a noted practitioner in the mining arbitration space. |

| ✔ | The

arbitration arises from Mexico’s unlawful expropriation and other unlawful treatment

of Silver Bull and its investments resulting from an illegal blockade of Silver Bull’s

Sierra Mojada project that began in September 2019 and continues to this day. |

Silver

Bull’s CEO, Mr. Tim Barry commented, “Whilst it had been Silver Bull’s intention to continue developing the Sierra

Mojada Project, an illegal blockade by a small group of local miners trying to extort and force an underserved royalty payment from the

Company began in September 2019 and continues to this day. Despite numerous requests to the Mexican Government to uphold the law and

end the illegal blockade, the Government failed to act, preventing Silver Bull from accessing the site for over four years and preventing

the Company from conducting its lawful business in Mexico. The direct actions and inactions by the Mexican Government has driven away

investors from the project and resulted in the expropriation of the Sierra Mojada project.

The

substantial litigation funding secured under the LFA is a testament to the strength of Silver Bull’s claims. The US$9.5 million

funding facility is non-dilutive to Silver Bull shareholders and will cover the full legal budget of the claim, expert, and ancillary

costs, as well as Silver Bull’s operating expenses. Bench Walk will have a contingent entitlement to damages in the event that

damages are awarded ”.

Mr.

Barry continued, “We note that other companies have successfully enforced their rights through international arbitration and received

substantial sums for damages. Recent examples of this include (i) a US$110 million award issued by the World Bank International Centre

for Settlement of Investment Disputes (“ICSID”) tribunal in August 2023 to Indiana Resources Ltd. regarding the revocation

of its mining license by the Tanzanian Government in 2018, which case was led by our legal counsel Tim Foden from BSF, and (ii) a US$5.8

billion award issued by the World Bank ICSID tribunal to Barrick Gold/Antofagasta regarding Pakistan’s unlawful denial of a mining

permit for the Reko Diq copper project”.

BACKGROUND

TO THE CLAIM: The arbitration has been initiated under the Convention on the Settlement of Investment Disputes between States and

Nationals of Other States process, which falls under the auspices of the World Bank’s International Centre for Settlement of Investment

Disputes (ICSID), to which Mexico is a signatory.

Silver

Bull officially notified Mexico on March 2, 2023 of its intention to initiate an arbitration owing to Mexico’s breaches of NAFTA

by unlawfully expropriating Silver Bull’s investments without compensation, failing to provide Silver Bull and its investments

with fair and equitable treatment or full protection and security, and not upholding NAFTA’s national treatment standard.

Silver

Bull held a meeting with Mexican government officials in Mexico City on May 30, 2023, in an attempt to explore amicable settlement options

and avoid arbitration. However, the 90-day period for amicable settlement under NAFTA expired on June 2, 2023, without a resolution.

Despite

repeated demands and requests for action by the Company, Mexico’s governmental agencies have allowed the unlawful blockade to continue,

thereby failing to protect Silver Bull’s investments. Consequently, Silver Bull will seek to recover an amount of approximately

US$178 million in damages that it has suffered due to Mexico’s breach of its obligations under NAFTA, which includes sunk costs

of approximately US$82.5 million, usually considered minimum damages in such cases.

THE

SIERRA MOJADA DEPOSIT: Silver Bull’s only asset is the Sierra Mojada deposit located in Coahuila, Mexico. Sierra Mojada is

an open pittable oxide deposit with a NI 43-101 compliant Measured and Indicated “global” Mineral Resource of 70.4 million

tonnes grading 3.4% zinc and 38.6 g/t silver for 5.35 billion pounds of contained zinc and 87.4 million ounces of contained silver. Included

within the “global” Mineral Resource is a Measured and Indicated “high grade zinc zone” of 13.5 million tonnes

with an average grade of 11.2% zinc at a 6% cutoff, for 3.336 billion pounds of contained zinc, and a Measured and Indicated “high

grade silver zone” of 15.2 million tonnes with an average grade of 114.9 g/t silver at a 50 g/t cutoff for 56.3 million contained

ounces of silver. Mineralization remains open in the east, west, and northerly directions.

For

a full summary of the Sierra Mojada resource, please refer to Silver Bull’s news release located at the following link:

https://www.silverbullresources.com/news/silver-bull-resources-announces-5.35-billion-pounds-zinc-87.4-million-ounces-silver-in-updated-sierra-mojada-measured-and/

On

behalf of the Board of Directors

“Tim Barry”

Tim

Barry, CPAusIMM

Chief Executive Officer and Director

INVESTOR

RELATIONS:

1 604 687 5800 info@silverbullresources.com

Cautionary

Note to U.S. Investors concerning estimates of Measured, Indicated, and Inferred Mineral Resources: In October 2018, the U.S. Securities

and Exchange Commission (the “SEC”) approved final rules requiring comprehensive and detailed disclosure requirements for

issuers with material mining operations. The provisions in Industry Guide 7 and Item 102 of Regulation S-K have been replaced with a

new subpart 1300 of Regulation S-K (“S-K 1300”) under the Securities Act of 1933 (the “Securities Act”). The

Company will be required to comply with these new rules in its disclosures since the fiscal year ending October 31, 2022. The requirements

and standards under S-K 1300 differ from those under Canadian securities laws. This news release uses the terms “measured mineral

resources”, “indicated mineral resources”, and “inferred resources” which are defined in, and required

to be disclosed by, NI 43-101 under guidelines set out in the Definition Standards for Mineral Resources and Mineral Reserves adopted

by the Canadian Institute of Mining, Metallurgy and Petroleum Council. While the terms are substantially similar to the same terms defined

under S-K 1300, there are differences in the definitions. Accordingly, there is no assurance any mineral resources or mineral reserves

that the Company may report under NI 43-101 will be the same as resource or reserve estimates prepared under the standards adopted under

S-K 1300. The estimation of measured, indicated and inferred mineral resources involves greater uncertainty as to their existence and

economic feasibility than the estimation of proven and probable reserves. U.S. investors are cautioned not to assume that measured and

indicated mineral resources will be converted into reserves. The estimation of inferred mineral resources involves far greater uncertainty

as to their existence and economic viability than the estimation of other categories of mineral resources. U.S. investors are cautioned

not to assume that estimates of inferred mineral resources exist, are economically minable, or will be upgraded into measured or indicated

mineral resources. Under Canadian securities laws, estimates of inferred mineral resources may not form the basis of feasibility or other

economic studies.

Disclosure

of “contained ounces” in a resource is permitted disclosure under Canadian regulations, however the SEC normally only permits

issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without

reference to unit measures. Accordingly, the information contained in this news release may not be comparable to similar information

made public by U.S. companies that are not subject NI 43-101.

Cautionary

note regarding forward looking statements: This news release may contain certain information that is forward-looking and is

subject to important risks and uncertainties (such statements are usually accompanied by words such as "anticipate", "expect",

"believe", "may", "will", "should", "estimate", "intend" or other similar

words). Any forward-looking statements in this document are intended to provide Silver Bull security holders and potential investors

with information regarding Silver Bull, including management's assessment of Silver Bull’s future plans and financial outlook,

and the Company’s pursuit of international arbitration claims against Mexico. Any forward-looking statements reflect Silver Bull's

beliefs and assumptions based on information available at the time the statements were made and as such are not guarantees of future

performance. As actual results could vary significantly from the forward-looking information, you should not put undue reliance on forward-looking

information and should not use future-oriented information or financial outlooks for anything other than their intended purpose. There

is no guarantee that the Company will be successful in enforcing its rights with respect to Mexico through international arbitration

or in recovering any damage award in connection therewith. For additional information on the assumptions made, and the risks and uncertainties

which could cause actual results to differ from the anticipated results, refer to the Company’s filings under Silver Bull’s

profile on SEDAR at www.sedar.com and with the U.S. Securities and Exchange Commission at www.sec.gov. Readers are cautioned that forward-looking

statements are not guarantees of future performance and that actual results or developments may differ materially from those expressed

or implied in the forward-looking statements. Any forward-looking statement made by us in this news release is based only on information

currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking

statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or

otherwise.

v3.23.2

Cover

|

Sep. 04, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 04, 2023

|

| Entity File Number |

001-33125

|

| Entity Registrant Name |

Silver

bull resources, inc.

|

| Entity Central Index Key |

0001031093

|

| Entity Tax Identification Number |

91-1766677

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

777

Dunsmuir Street

|

| Entity Address, Address Line Two |

Suite

1605

|

| Entity Address, City or Town |

Vancouver BC

|

| Entity Address, State or Province |

NV

|

| Entity Address, Country |

CA

|

| Entity Address, Postal Zip Code |

V7Y

1K4

|

| City Area Code |

604

|

| Local Phone Number |

687-5800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

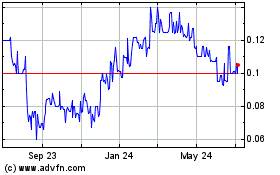

Silver Bull Resources (QB) (USOTC:SVBL)

Historical Stock Chart

From Mar 2024 to Apr 2024

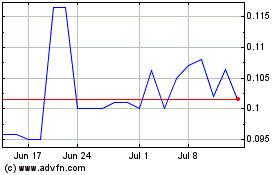

Silver Bull Resources (QB) (USOTC:SVBL)

Historical Stock Chart

From Apr 2023 to Apr 2024