JPMorgan explores digital token for international transactions

JPMorgan Chase (NYSE:JPM) is evaluating the creation of a

blockchain-based digital token to streamline cross-border

transactions and settlements. The infrastructure for this

innovation is already in place, awaiting regulatory

approval. Unlike JPM Coin, this token aims to simplify

interbank transfers and can be used for transactions of tokenized

digital assets. The initial implementation will be in US

dollars, with possible expansions to other currencies.

Mirae Asset and Polygon Labs join forces for asset tokenization

Mirae Asset Securities, the South Korean asset management giant,

has partnered with Polygon Labs to integrate Web3 and tokenize

assets into mainstream finance. Polygon Labs will assist in

creating an infrastructure for trading tokenized

securities. Ahn In-sung of Mirae Asset sees the collaboration

as a chance for global leadership in tokenized

securities. This move underscores a growing global trend, with

predictions pointing to a tokenization market worth $16.1 trillion

by 2030.

Ripple acquires Fortress Trust to expand regulatory footprint

Blockchain company Ripple has bought cryptocurrency and Web3

focused Fortress Trust in Nevada. Financial details remain

confidential, but sources indicate a price below $250

million. This acquisition adds Nevada to Ripple’s regulatory

portfolio, which already has licenses in several US

states. The move is seen as Ripple’s strategy to consolidate

itself as a complete solution for companies in the blockchain

sector.

Circle and OKX partnership extends usage of USDC on crypto

platforms

Stablecoin issuer Circle (COIN:USDCUSD) and crypto exchange OKX

have partnered to expand USDC capabilities in the OKX DEX wallet

and aggregator. The aggregator will be integrated with

Circle’s cross-chain transfer protocol, facilitating USDC exchanges

across multiple networks such as Ethereum and Avalanche. Also,

until October 5th, USDC transactions on OKX Wallet will be

fee-free.

Coinbase targets global expansion prioritizing licenses in key

jurisdictions

Coinbase (NASDAQ:COIN) plans to expand internationally, seeking

licenses in financial jurisdictions such as the European Union,

United Kingdom, Canada, Brazil, Singapore and Australia. While

CEO Brian Armstrong rules out moving the US headquarters, the

company is setting an EU hub ahead of the 2024 election.

Crypto rivalry leads to US investigations

Cameron Winklevoss, co-founder of Gemini, was recently

interviewed by federal authorities, including the FBI and SEC, in

connection with allegations of fraud against Barry Silbert, CEO of

DCG. Bloomberg noted that this interview is a continuation of

the investigation into DCG’s finances. While Silbert denies

the allegations, tension between the parties and regulatory

scrutiny continue to grow. The dispute between Cameron

Winklevoss, co-founder of cryptocurrency exchange Gemini, and the

CEO of Digital Currency Group (DCG), arose after the bankruptcy of

Genesis, a subsidiary of DCG, which affected Gemini, its largest

creditor. The Winklevoss accuse Genesis and Silbert of

fraudulent activities. Although DCG refutes the allegations,

the US Attorney’s Office is investigating Silbert. DCG claims to

maintain high ethical standards in its operations.

France requires influencer certification for financial advertising

French influencers, especially in the crypto industry, are now

required to obtain certification in the Responsible Influence in

Financial Advertising program before endorsing any financial

product. This certificate, introduced by the AMF and ARPP,

validates the influencer’s understanding of the new financial

advertising rules. The measure aims to professionalize the

industry and protect investors from misleading offers. This

initiative follows similar efforts in the UK, where crypto

advertising is also under strict regulation.

MTI ordered to pay $1.7B in Ponzi scheme with digital assets

The U.S. District Court for the Western District of Texas has

ruled that Mirror Trading International (MTI) must pay $1.7 billion

in restitution for a digital asset and forex fraud scheme. The

Commodity Futures Trading Commission (CFTC) revealed that MTI,

along with its CEO, Cornelius Steynberg, scammed approximately

23,000 Americans, collecting approximately 30,000 Bitcoins

(COIN:BTCUSD). MTI went into liquidation in 2020, and the

fraud is considered one of the largest Ponzi schemes involving

digital assets.

Thodex CEO sentenced to over 11,000 years in prison for crypto

fraud

Faruk Fatih Ozer, former CEO of Turkish crypto exchange Thodex,

was sentenced to 11,196 years in prison for crimes including fraud

and money laundering. After shutting down the exchange in

2021, leaving 400,000 users without access to their funds, Ozer

fled to Albania. Despite initial estimates of losses of around

US$ 24 million, subsequent analyzes point to a loss of US$ 2.52

billion. Ozer was extradited to Turkey in 2023.

Hackers use Windows tool to mine cryptocurrencies

Hackers are exploiting Windows’ “Advanced Installer” tool to

infect computers with cryptocurrency mining malware, according to

Cisco Talos Intelligence Group. Cyber criminals package

malicious code with installers of popular 3D modeling software such

as Adobe Illustrator and SketchUp Pro, targeting computers with

powerful GPUs. Affected industries, including architecture and

graphic design, are targeted due to the usefulness of GPUs in

cryptocurrency mining. The malicious activity has been

occurring since November 2021, with a focus on French-speaking

regions.

US still in digital currency research phase, says Federal Reserve

Vice Chair

Federal Reserve Vice Chairman Michael Barr stated that the US is

in the “basic research” phase regarding a central bank digital

currency (CBDC), being far from any concrete decision. He

reiterated that any action would require the “clear support of the

executive branch and authorization of legislation by

Congress.” Barr also expressed concerns about stablecoins,

highlighting the need for robust federal oversight to ensure

financial stability.

CFTC proposes regulatory sandbox for digital assets

CFTC Commissioner Caroline Pham has suggested a regulatory

sandbox for digital assets, citing U.S. delays in clear regulations

for blockchain and digital assets. The proposal aims to

promote compatible digital asset markets, with contributions from

interested parties. Meanwhile, three DeFi platforms settled

CFTC charges, paying fines for unregistered derivatives

trading. However, some question the CFTC’s current regulatory

approach.

Hong Kong advances Digital Yuan integration and strengthens its

crypto position

Hong Kong has stepped up testing of China’s digital yuan,

entering the second phase involving more local banks. The Hong

Kong Monetary Authority and the People’s Bank of China have

advanced cross-border payments using e-CNY. Furthermore, Hong

Kong aims to consolidate itself as a global crypto hub by updating

its regulatory rules and granting licenses to entities such as SEBA

Bank and OKX.

Ant Group launches ZAN to focus on Blockchain and Web3

Ant Group, owner of Alipay, launched the ZAN sub-brand, focused

on blockchain and Web3 services. The announcement details

solutions for Web3 companies such as real asset management,

electronic KYC checks and building DApps. In April, HashKey

DID aggregator adopted ZAN electronic KYC.

Weibo intensifies crackdown on cryptography

Chinese social media giant Weibo (NASDAQ:WB) has deleted 80

influential crypto accounts and taken down 17,000 posts deemed

illegal. The platform, which has 258 million daily users,

operates in a country where global social media is

blocked. Although China prohibits cryptocurrency trading,

several accounts persisted in posting related content.

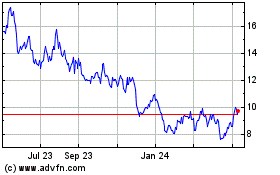

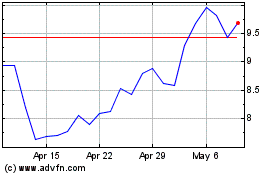

Weibo (NASDAQ:WB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Weibo (NASDAQ:WB)

Historical Stock Chart

From Apr 2023 to Apr 2024