Form 8-K - Current report

September 01 2023 - 9:23AM

Edgar (US Regulatory)

0001476045false00014760452023-08-302023-08-300001476045us-gaap:CommonStockMember2023-08-302023-08-300001476045us-gaap:SeriesAPreferredStockMember2023-08-302023-08-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 30, 2023

CHATHAM LODGING TRUST

(Exact name of Registrant as specified in its charter)

| | | | | | | | |

| Maryland | 001-34693 | 27-1200777 |

(State or Other Jurisdiction

of Incorporation or Organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | |

| 222 Lakeview Avenue, Suite 200 | | |

| West Palm Beach, | Florida | 33401 |

| (Address of principal executive offices) | | (Zip Code) |

(561) 802-4477

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed from last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of Each Class | Trading Symbol | Name of Exchange on Which Registered |

| Common Shares of Beneficial Interest, $0.01 par value | CLDT | New York Stock Exchange |

| 6.625% Series A Cumulative Redeemable Preferred Shares | CLDT-PA | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b.2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

| | | | | |

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

On August 30, 2023, an indirect, wholly owned subsidiary of Chatham Lodging Trust (the "Company") closed on a $24.5 million loan that is secured by the Courtyard Dallas (TX) Downtown hotel. The loan carries an interest rate of 7.608 percent, is interest-only and matures in 2028.

On August 31, 2023, another two (2) indirect, wholly owned subsidiaries of the Company closed on (1) a $9.5 million loan that is secured by the Residence Inn in Summerville, SC and (2) a $9.0 million loan that is secured by the Courtyard Summerville, SC, respectively. Each loan carries an interest rate of 7.332 percent, is interest-only and matures in 2033.

All borrowings under each of the three loans are secured by a first mortgage lien on the respective hotel and its related equipment, fixtures, personal property and other assets. The loan agreements and related documents contain representations, warranties, covenants, conditions and events of default customary for single-property mortgage financings of this type.

On September 1, 2023, the Company issued a press release announcing entrance into the new loans. A copy of such press release is filed as Exhibit 99.1 to this report.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | Press release, dated September 1, 2023, announcing entrance into the new loans. |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | | | | | | | |

| | | | | |

| | | CHATHAM LODGING TRUST |

| | | | | |

| September 1, 2023 | | By: | | /s/ Jeremy B. Wegner |

| | | | | |

| | | | | Name: Jeremy B. Wegner |

| | | | | Title: Senior Vice President and Chief Financial Officer |

| | | | | |

| For Immediate Release | Exhibit 99.1 |

| Contact: | |

| Dennis Craven (Company) | Chris Daly (Media) |

| Chief Operating Officer | Daly Gray Public Relations |

| (561) 227-1386 | (703) 435-6293 |

Chatham Lodging Trust Debt Issuance Clears Path Through 2025

WEST PALM BEACH, Fla., September 1, 2023 —Chatham Lodging Trust (NYSE: CLDT), a hotel real estate investment trust (REIT) focused on investing in upscale extended-stay hotels and premium branded, select-service hotels, today announced that it has issued approximately $83 million of fixed-rate debt since mid-August, including $24.5 million maturing in five years and $58.4 million maturing in ten years. The debt issuance is comprised of five individual first mortgage loans.

“With these issuances and availability under our unsecured credit facility, we have the ability to repay all debt due through 2024 and will only have to address one $19 million maturing mortgage in 2025,” emphasized Dennis Craven, Chatham’s chief operating officer. “We have great freedom to create value for our shareholders, whether that is related to refinancing future debt, acquiring/developing hotels or making other hotel investments.”

On August 16, 2023, two 10-year loans aggregating $39.9 million were provided by Barclays Capital Real Estate and are secured by the Residence Inn and TownePlace Suites Austin Northwest / The Domain. The loans carry a fixed interest rate of 7.4 percent per annum and are interest only for the first five years before amortizing based upon a 30-year amortization schedule.

On August 30 and 31, 2023, respectively, a five-year, $24.5 million loan and two 10-year loans aggregating $18.5 million were provided by Wells Fargo Bank. The five-year loan is secured by the Courtyard by Marriott Dallas Downtown, carries a fixed interest rate of 7.6 percent per annum and is interest only for the duration of the loan. The 10-year loans are secured by the Courtyard by Marriott and Residence Inn Charleston Summerville, South Carolina. The 10-year loans carry a fixed interest rate of 7.3 percent per annum and are interest only for the duration of the loan.

A portion of the proceeds from the loans will be used to repay the approximate $41 million maturing mortgage on the Residence Inn Bellevue, Wash., which will be repaid in September. The remaining proceeds of approximately $42 million, combined with the full $260 million available on the unsecured credit facility, provide $302 million of proceeds to cover all 2024 maturing debt of $300 million.

“After reducing our net debt during the pandemic by approximately 40 percent, second most among lodging REITs, we have a great balance sheet that we were able to further solidify with these loans,” stated Jeremy Wegner, Chatham’s chief financial officer. “With encumbrances on only 14 of our 39 hotels after the Bellevue repayment, we have ample flexibility to appropriately address our maturities at the right time using the best capital source.”

About Chatham Lodging Trust

Chatham Lodging Trust is a self-advised, publicly traded real estate investment trust focused primarily on investing in upscale extended-stay hotels and premium-branded, select-service hotels. The company owns 39 hotels totaling 5,915 rooms/suites in 16 states and the District of Columbia. Additional information about Chatham may be found at chathamlodgingtrust.com.

This press release may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 about Chatham Lodging Trust, including those statements regarding acquisitions, capital expenditures, future operating results and the timing and composition of revenues, among others, and statements containing words such as “expects,” “believes” or “will,” which indicate that those statements are forward-looking. Except for historical information, the matters discussed in this press release are forward-looking statements that are subject to certain risks and uncertainties that could cause the actual results or performance to differ materially from those discussed in such statements. Additional risks are discussed in the company’s filings with the Securities and Exchange Commission.

v3.23.2

Cover Page Document

|

Aug. 30, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 30, 2023

|

| Entity Registrant Name |

CHATHAM LODGING TRUST

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-34693

|

| Entity Tax Identification Number |

27-1200777

|

| Entity Address, Address Line One |

222 Lakeview Avenue, Suite 200

|

| Entity Address, City or Town |

West Palm Beach,

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33401

|

| City Area Code |

561

|

| Local Phone Number |

802-4477

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001476045

|

| Amendment Flag |

false

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Shares of Beneficial Interest, $0.01 par value

|

| Trading Symbol |

CLDT

|

| Security Exchange Name |

NYSE

|

| Series A Preferred Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

6.625% Series A Cumulative Redeemable Preferred Shares

|

| Trading Symbol |

CLDT-PA

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesAPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

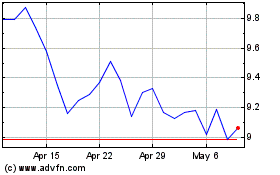

Chatham Lodging (NYSE:CLDT)

Historical Stock Chart

From Mar 2024 to Apr 2024

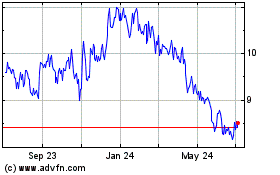

Chatham Lodging (NYSE:CLDT)

Historical Stock Chart

From Apr 2023 to Apr 2024