0000910267

false

0000910267

2023-08-25

2023-08-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report: August 25, 2023

(Date of earliest event reported)

TITAN PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-13341 |

|

94-3171940 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

400 Oyster Point Blvd., Suite 505, South San Francisco, CA 94080

(Address of principal executive offices, including zip code)

650-244-4990

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

TTNP |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

Asset Purchase Agreement

On August 25, 2023, Titan Pharmaceuticals, Inc. (the “Titan” or the “Company”) entered into an Amendment and Extension Agreement (the “Amendment”) with respect to that certain asset purchase agreement dated as of July 26, 2023 (the “Asset Purchase Agreement”) with Fedson, Inc., a Delaware corporation (“Fedson”) relating to the sale of certain ProNeura assets including Titan’s portfolio of drug addiction products, in addition to other early development programs based on the ProNeura drug delivery technology (the “ProNeura Assets”).

Under the terms of the Amendment, Fedson will purchase the ProNeura Assets from the Company for a purchase price of $2 million, consisting of (i) $500,000 in readily available funds, to be paid in full on the Closing Date (the “Closing Cash”), (ii) $500,000 in the form of a promissory note due and payable on October 1, 2023 (the “Cash Note”) and (iii) $1,000,000 in the form of a promissory note due and payable on January 1, 2024 (the “Escrow Note”, and together with the Closing Cash and the Cash Note, the “Closing Consideration”). On the Closing Date, Fedson will deliver to the Company a written guaranty by a principal of Fedson of all of Fedson’s obligations under both the Cash Note and Escrow Note. The Amendment extends the Closing Date to September 1, 2023. In consideration for such extension, Fedson paid the Company an advance of $250,000 against the Closing Consideration.

The foregoing description of the Amendment does not purport to be complete and is qualified in its entirety by the terms and conditions of the Amendment, a copy of which is filed as Exhibit 10.1 hereto.

Item 9.01. Financial Statements and Exhibits.

|

* |

Certain identified information has been excluded (denoted by the symbol “[****]”) from the exhibit because such information is both (i) not material and (ii) would likely cause competitive harm to the Company if publicly disclosed. Certain schedules and exhibits to this Exhibit have been omitted pursuant to Item 601(a)(5) or Item 601(b)(10)(iv), as applicable, of Regulation S-K. The Registrant agrees to furnish supplemental copies of all omitted exhibits and schedules to the Securities and Exchange Commission upon its request. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

TITAN PHARMACEUTICALS, INC. |

| |

|

|

| |

By: |

/s/ David E. Lazar |

| |

|

David E. Lazar

Chief Executive Officer |

Date: August 30, 2023

Exhibit 10.1

*** Certain identified information has been excluded (denoted by the symbol “[****]”) from the exhibit

because such information is both (i) not material and (ii) would likely cause competitive harm to the

Company if publicly disclosed.

AMENDMENT AND EXTENSION AGREEMENT

THIS AMENDMENT AND EXTENSION AGREEMENT (the “Agreement”) is made and entered into as of August 25, 2023, by and between Fedson, Inc., a Delaware corporation (“Buyer”), and Titan Pharmaceuticals, Inc., a Delaware corporation (“Seller”).

WHEREAS, Buyer and Seller entered into an Asset Purchase Agreement, dated July 26, 2023 (the “Purchase Agreement”). Capitalized terms not otherwise defined in this Agreement have the meanings ascribed to them in the Purchase Agreement.

WHEREAS,

Section 3.1 of the Purchase Agreement states, in its entirety, “In consideration for the purchase and assignment of the

Acquired Assets, the assumption of the Assumed Liabilities, the grant of the Granted Licenses, and the indemnification for the D. Leslie

Legal Matter, at Closing, Buyer shall pay Seller an amount in cash, of USD 2,000,000 (Two Million United States Dollars), as follows:

(i) At Closing, USD 1,000,000 (One Million United States Dollars) in readily available funds shall be placed by Buyer in an escrow account

(together with any interest accrued thereon, the “Escrow Amount”) in accordance with the terms of an escrow agreement

by and among Seller, Buyer, and the Escrow Agent in the form of Exhibit C (the “Escrow Agreement”). (ii)

The remaining USD 1,000,000 (One Million United States Dollars) (the “Closing Consideration”) shall be paid by Buyer

to Seller at Closing, in readily available funds.”

WHEREAS, Section 2.6 of the Purchase Agreement states, in relevant part, “the closing of the Transaction … without prejudice to those certain extension rights as set forth in Section 8.1(b)- (c), in any event shall be no later than 10 Business Days following the Execution Date (such date referred to herein as the “Closing Date”)”.

WHEREAS, in contemplation of a prior extension effected by the Parties in accordance with Section 8.1(b) of the Purchase Agreement, as of immediately prior to the date hereof, the Closing Date shall be deemed to fall on August 23, 2023.

WHEREAS, the Parties desire to amend and restate Section 3.1(a) of the Purchase Agreement as set forth herein and to further extend the Closing Date to September 1, 2023.

NOW, THEREFORE, in consideration of the premises and mutual covenants contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

|

1. |

Amendment and Restatement. Paragraphs (i) and (ii) of Section 3.1(a) of the Purchase Agreement are each hereby replaced by the following language: |

|

(i) |

At Closing, USD 1,000,000 (One Million United States Dollars) shall be paid by Buyer to Seller via a promissory note (in form and substance agreed upon in writing by the Parties) which shall become due and payable on January 1, 2024 (the “Escrow Note”). Upon maturity, Buyer shall pay the unpaid principal and accrued interest under the Escrow Note in an escrow account (together with any interest accrued thereon, the “Escrow Amount”) in accordance with the terms of an escrow agreement by and among Seller, Buyer, and the Escrow Agent, in the form of Exhibit C (the “Escrow Agreement”). |

|

(ii) |

The remaining USD 1,000,000 (One Million United States Dollars) (the “Closing Consideration”) shall be paid by Buyer to Seller as follows: |

|

(A) |

at Closing, Buyer shall pay to Seller USD 500,000 (Five Hundred Thousand United States Dollars) in readily available funds; |

|

(B) |

at Closing, Buyer shall pay to Seller the remaining Closing Consideration of USD 500,000 (Five Hundred Thousand United States Dollars) via a promissory note (in form and substance agreed upon in writing by the Parties) which shall become due and payable on October 1, 2023, unless extended by the Parties pursuant to the terms thereunder (the “Cash Note”). Upon maturity, Buyer shall pay the unpaid principal and accrued interest under the Cash Note to Seller in readily available funds. |

|

(iii) |

At Closing, Buyer shall deliver to Seller, a Guaranty or Guarantees (in form and substance agreed upon in writing by the Parties) executed by [****] (the “Guarantor”) in which the Guarantor has unconditionally guaranteed all obligations of Buyer under this Agreement with respect to each of the Escrow Note and the Cash Note. |

|

2. |

Promissory Notes; Guaranties. The Parties agree that (i) the terms of the Escrow Note, including the Guaranty with respect thereto executed by the Guarantor, shall be substantially in the form of Exhibit A attached hereto, and (ii) the terms of the Cash Note, including the Guaranty with respect thereto executed by the Guarantor, shall be substantially in the form of Exhibit B attached hereto. |

|

3. |

Extension of Closing Date. The Closing Date, as defined in the Purchase Agreement, is hereby extended to September 1, 2023. |

|

4. |

Advancement of Closing Consideration. As consideration for the extension of the Closing Date, Buyer agrees to pay to Seller an advance of $250,000 (“Advance”) against the Closing Consideration payable by Buyer to Seller in accordance with Section 3.1(a)(ii)(A) of the Purchase Agreement (as amended herein), within one (1) business day from the date hereof, in readily available funds to be directed to a bank account as instructed by Seller in writing. |

|

5. |

Treatment. The Advance shall be treated as an advance of Closing Consideration subject to the terms of the Purchase Agreement (including without limitation the right to set off granted to Buyer under Section 7.6 thereof), and shall not be construed as a penalty or as additional consideration under the Purchase Agreement; provided, however, that in the event Seller terminates the Purchase Agreement after the Closing Date (as extended hereunder) in accordance with Section 8.1(b) of the Purchase Agreement, and as a consequence, Buyer becomes obligated to pay the Termination Fee in accordance with Section 8.2(d) of the Purchase Agreement, then the Advance shall be treated as the Termination Fee, and no other amounts shall be payable by Buyer. |

|

6. |

Office Space. As additional consideration hereunder (and for no additional cost), and subject to the approval of the Seller’s landlord, at such landlord’s sole and absolute discretion, Seller shall grant Buyer the exclusive right to use two (2) offices in the premises located at 400 Oyster Point Blvd., Suite 505, South San Francisco, CA 94080, for the period commencing two weeks following the Closing Date and ending on January 1, 2024. Furthermore, Seller shall grant Buyer access to the main conference room located in the same office, as reasonably requested and subject to availability, during normal business hours throughout the aforementioned term. All use of the said offices and conference rooms shall be in accordance with the rules and regulations as may be established by the landlord of the premises and provided to the Buyer in writing. |

|

7. |

Effect of Agreement. Except as expressly set forth in Sections 1 to 6 of this Agreement, nothing herein shall be deemed to amend or modify any of the terms or conditions of the Purchase Agreement, all of which remain in full force and effect. |

|

8. |

Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed an original and all of which together shall constitute one and the same instrument. |

|

9. |

Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Delaware, without regard to its conflict of laws principles. |

|

10. |

Interpretation. The terms of this Agreement shall be subject to the provisions set forth in Article IX (General) of the Purchase Agreement, and such provisions are incorporated herein by this reference, mutatis mutandis. |

(Signatures Follow)

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the day and year first written above.

| |

SELLER |

| |

TITAN PHARMACEUTICALS, INC. |

| |

|

|

| |

By: |

|

| |

Name: |

|

| |

Title: |

|

| |

|

|

| |

BUYER |

| |

FEDSON, INC. |

| |

|

|

| |

By: |

|

| |

Name: |

Alan Garvin |

| |

Title: |

President |

Exhibit

A

Escrow

Note

(see

attached)

PROMISSORY

NOTE

FOR VALUE RECEIVED, and subject to the terms and conditions set forth herein, Fedson, Inc. a Delaware corporation (“Maker”), hereby unconditionally promises to pay to the order of Titan Pharmaceuticals, Inc., a Delaware corporation (“Holder,” and together with Maker, the “Parties”), the principal amount of USD $1,000,000 (One Million United States Dollars) (the “Loan”), together with all accrued interest thereon, as provided in this Promissory Note (the “Note,” as the same may be amended, restated, supplemented, or otherwise modified from time to time in accordance with its terms).

1. Definitions. Capitalized terms used herein shall have the meanings set forth in this Section 1.

“Affiliate” of any particular Person means any other Person controlling, controlled by or under common control with such particular Person, where “control” means the possession, directly or indirectly, of the power to direct the management and policies of a Person whether through the ownership of voting securities, contract or otherwise.

“Applicable Rate” means the rate equal to [****]%.

“Business Day” means a day other than a Saturday, Sunday, or other day on which commercial banks in New York City authorized or required by law to close.

“Default” means any of the events specified in Section 5 which constitute an Event of Default or which, upon the giving of notice, the lapse of time, or both, pursuant to Section 5 would, unless cured or waived, become an Event of Default.

“Default Rate” means, at any time, the Applicable Rate plus [****]%

“Event of Default” has the meaning set forth in Section 5.

“Governmental Authority” means the government of any nation or any political subdivision thereof, whether at the national, state, territorial, provincial, municipal, or any other level, and any agency, authority, instrumentality, regulatory body, court, central bank, or other entity exercising executive, legislative, judicial, taxing, regulatory, or administrative powers or functions of, or pertaining to, government (including any supranational bodies, such as the European Union or the European Central Bank).

“Guaranty” means an unconditional guaranty, in substantially the form of Exhibit A.

“Guarantor” means [****].

“Law” as to any Person, means the certificate of incorporation and by-laws or other organizational or governing documents of such Person, and any law (including common law), statute, ordinance, treaty, rule, regulation, order, decree, judgment, writ, injunction, settlement agreement, requirement or determination of an arbitrator or a court or other Governmental Authority, in each case applicable to or binding upon such Person or any of its property or to which such Person or any of its property is subject.

“Maturity Date” means the earlier of (a) January 1, 2024, and (b) the date on which all amounts under this Note shall become due and payable pursuant to Section 6.

“Order” as to any Person, means any order, decree, judgment, writ, injunction, settlement agreement, requirement, or determination of an arbitrator or a court or other Governmental Authority, in each case, applicable to or binding on such Person or any of its properties or to which such Person or any of its properties is subject.

“Person” means any individual, corporation, limited liability company, trust, joint venture, association, company, limited or general partnership, unincorporated organization, Governmental Authority, or other entity.

“Purchase Agreement” means that certain Asset Purchase Agreement, dated as of July 26, 2023, among the Parties, as amended by that certain Amendment and Extension Agreement dated as of August 25, 2023, as the same may be amended, restated supplemented or otherwise modified from time to time by the Parties.

2. Final Payment Date; Optional Prepayments.

2.1 Final Payment Date. The aggregate unpaid principal amount of the Loan, all accrued and unpaid interest, and all other amounts payable under this Note shall be due and payable on the Maturity Date, unless otherwise provided in Section 6.

2.2 Optional Prepayment. Maker may prepay the Loan in whole or in part at any time or from time to time without penalty or premium by paying the principal amount to be prepaid together with accrued interest thereon to the date of prepayment.

3. Interest.

3.1 Interest Rate. Except as otherwise provided herein, the outstanding principal amount of the Loan made hereunder shall bear simple interest at the Applicable Rate from the date the Loan was made until the Loan is paid in full, whether at maturity, upon acceleration, by prepayment, or otherwise.

3.2 Interest Payment Dates. Interest shall be payable in a lump sum, in arrears to Holder on the Maturity Date.

3.3 Default Interest. If any amount payable hereunder is not paid when due (without regard to any applicable grace periods), whether at stated maturity, by acceleration, or otherwise, such overdue amount shall bear interest at the Default Rate from the date of such non-payment until such amount is paid in full.

3.4 Computation of Interest. All computations of interest shall be made on the basis of 365 or 366 days, as the case may be and the actual number of days elapsed. Interest shall accrue on the Loan on the day on which such Loan is made, and shall not accrue on the Loan on the day on which it is paid.

3.5 Interest

Rate Limitation. If at any time and for any reason whatsoever, the interest rate payable on the Loan shall exceed the maximum

rate of interest permitted to be charged by Holder to Maker under applicable Law, such interest rate shall be reduced automatically

to the maximum rate of interest permitted to be charged under applicable Law.

4. Payment Mechanics.

4.1 Manner of Payment. All payments of interest and principal shall be made in lawful money of the United States of America on the date on which such payment is due by wire transfer of immediately available funds to the bank account of the Escrow Agent as specified in the Escrow Agreement (each term as defined in the Purchase Agreement), and such money shall be subject to the terms thereof.

4.2 Application of Payments. All payments made hereunder shall be applied first to the payment of any fees or charges outstanding hereunder, second to accrued interest, and third to the payment of the principal amount outstanding under the Note.

4.3 Business Day Convention. Whenever any payment to be made hereunder shall be due on a day that is not a Business Day, such payment shall be made on the next succeeding Business Day and such extension will be taken into account in calculating the amount of interest payable under this Note.

5. Events of Default. The occurrence of any of the following shall constitute an Event of Default hereunder:

5.1 Failure to Pay. Maker fails to pay (a) any principal amount of the Loan when due; or (b) interest or any other amount when due and such failure continues for 5 Business Days after written notice to Maker.

5.2 Bankruptcy.

(a) Maker commences any case, proceeding, or other action (i) under any existing or future Law relating to bankruptcy, insolvency, reorganization, or other relief of debtors, seeking to have an order for relief entered with respect to it, or seeking to adjudicate it as bankrupt or insolvent, or seeking reorganization, arrangement, adjustment, winding-up, liquidation, dissolution, composition, or other relief with respect to it or its debts, or (ii) seeking appointment of a receiver, trustee, custodian, conservator, or other similar official for it or for all or any substantial part of its assets, or Maker makes a general assignment for the benefit of its creditors; or

(b) there is commenced against Maker any case, proceeding, or other action of a nature referred to in Section 5.2(a) above which (i) results in the entry of an order for relief or any such adjudication or appointment or (ii) remains undismissed, undischarged, or unbonded for a period of 60 days;

6. Remedies. Upon the occurrence of an Event of Default and at any time thereafter during the continuance of such Event of Default, Holder may at its option, by written notice to Maker (a) declare the entire principal amount of this Note, together with all accrued interest thereon and all other amounts payable hereunder, immediately due and payable and/or (b) exercise any or all of its rights, powers, or remedies under applicable Law; provided, however that, if an Event of Default described in Section 5.2 shall occur, the principal of and accrued interest on the Loan shall become immediately due and payable without any notice, declaration, or other act on the part of Holder.

7. Right of Set-Off. Notwithstanding anything to the contrary herein, Maker is hereby authorized at any time and from time to time, to the fullest extent permitted by Law, to set off and apply any and all of the payments, obligations and/or other liabilities of Holder owing at any time under the Purchase Agreement to Maker or any of its Affiliates or other Buyer Indemnified Parties (as defined in the Purchase Agreement) against any and all of Maker’s payments, obligations or other liabilities owing at any time hereunder to Holder.

8. Guaranty. As security for payment of any and all of Maker’s payments, obligations or other liabilities owing at any time hereunder to Holder, Maker shall lodge with Holder, at the time of Closing of the Purchase Agreement, the Guaranty executed by the Guarantor.

9. Miscellaneous.

9.1 Notices. All notices required or allowed under this Note shall be given in the manner provided for notice under the Purchase Agreement.

9.2 Governing Law. This Note shall be governed by and construed in accordance with the laws of the State of Delaware, without regard to its conflict of laws principles.

9.3 Venue. Each Party irrevocably and unconditionally waives, to the fullest extent permitted by applicable Law, any objection that it may now or hereafter have to the laying of venue of any action or proceeding arising out of or relating to this Note in any court referred to in Section 8.2.

9.4 Counterparts. This Note may be executed in one or more counterparts, each of which shall be deemed an original and all of which together shall constitute one and the same instrument.

9.5 Successors and Assigns. Neither Party may transfer or assign this Note or any portion hereof or pledge, encumber or transfer its rights or interest in and to this Note or any portion hereof, except with the prior written consent of the other Party in its sole discretion.

9.6 Amendments and Waivers. No term of this Note may be waived, modified, or amended except by an instrument in writing signed by both Parties. Any waiver of the terms hereof shall be effective only in the specific instance and for the specific purpose given.

9.7 Headings. The headings of the various Sections and subsections herein are for reference only and shall not define, modify, expand, or limit any of the terms or provisions hereof.

9.8 No

Waiver; Cumulative Remedies. No failure to exercise and no delay in exercising, on the part of a Party, of any right, remedy,

power, or privilege hereunder shall operate as a waiver thereof; nor shall any single or partial exercise of any right, remedy,

power, or privilege hereunder preclude any other or further exercise thereof or the exercise of any other right, remedy, power, or

privilege. The rights, remedies, powers, and privileges herein provided are cumulative and not exclusive of any rights, remedies,

powers, and privileges provided by Law.

9.9 Severability. If any term or provision of this Note is invalid, illegal, or unenforceable in any jurisdiction, such invalidity, illegality, or unenforceability shall not affect any other term or provision of this Note or invalidate or render unenforceable such term or provision in any other jurisdiction.

9.10 Conflicts. In the event of any conflict between the terms of the Purchase Agreement and this Note, the terms of the Purchase Agreement will control.

(SIGNATURES FOLLOW)

IN WITNESS WHEREOF, Maker has executed this Note as of [DATE].

| |

FEDSON, INC. |

| |

|

| |

By |

|

| |

Name: |

Alan Garvin |

| |

Title: |

President |

EXHIBIT A

PERSONAL GUARANTY

(see attached)

GUARANTY

This Guaranty (“Guaranty”), dated as of [DATE], is made by [****] (“Guarantor”), an individual who resides at [****], in favor and for the benefit of Titan Pharmaceuticals, Inc. with a business address located at 400 Oyster Point Blvd., Suite 505, South San Francisco, CA 94080 (“Holder”).

1. Guaranty. In consideration of the substantial direct and indirect benefits derived by Guarantor from the loans made by Holder to Fedson, Inc., a Delaware corporation (“Maker”) under that certain Promissory Note, dated as of the date hereof, by and between Holder and Maker (the “Note”), the parties hereby agree as follows:

1.1 Guarantor absolutely, unconditionally, and irrevocably guarantees, as primary obligor and not merely as surety, the punctual payment, when due, whether at stated maturity, by acceleration, or otherwise, of all present and future obligations, liabilities, covenants, and agreements required to be observed, performed, or paid by Maker whether for principal, interest or penalties under the Note (collectively, the “Obligations”), and agrees to pay any and all reasonable expenses (including reasonable legal expenses and reasonable attorneys’ fees) incurred by Holder in successfully enforcing any rights under this Guaranty.

1.2 Notwithstanding any provision herein contained to the contrary, Guarantor’s liability with respect to the Obligations shall be limited to an amount not to exceed, as of any date of determination, the amount that could be claimed by Holder from Guarantor without rendering such claim voidable or avoidable under Section 548 of the Bankruptcy Code or under any applicable state Uniform Fraudulent Transfer Act, Uniform Fraudulent Conveyance Act, or similar statute or common law.

2. Unconditional Guaranty. The obligation of Guarantor under this Guaranty shall be primary, direct, immediate, unconditional and absolute and, without limiting the generality of the foregoing, shall in no way be released, discharged or otherwise affected by:

2.1 any extension of time for the payment of the Obligations, modification or amendment of the terms of the Purchase Agreement or any Ancillary Agreement or any forbearance as to time or performance or failure by Holder to proceed promptly with respect to the Obligations or this Guaranty; or

2.2 any insolvency, bankruptcy, arrangement, assignment for the benefit of creditors or other similar proceeding against Guarantor or his assets or any resulting release or discharge of any of the Obligations.

3. Guaranty of Payment. Guarantor guarantees that the Obligations will be paid strictly in accordance with the terms of the Note, regardless of any law, regulation, or order now or hereafter in effect in any jurisdiction affecting any of such terms or the rights of Holder with respect thereto. In the event of a default by Maker under the Note, Holder shall have the right to proceed immediately thereafter against Guarantor for payment or performance, as applicable, of the Obligations without being required to make any demand upon, bring any proceeding, exhaust any remedies against or take any other action of any kind against Maker or any Affiliate thereof. Guarantor hereby waives notice of acceptance of this Guaranty, presentment, demand of payment, protest and notice and any right or claim of right to cause a marshaling of the assets of Maker or any Affiliate thereof. The obligations of Guarantor under this Guaranty are independent of the Obligations, and a separate action or actions may be brought and prosecuted against Maker or any other guarantors, or Maker or any other guarantor may be joined in any such action or actions. The liability of Guarantor under this Guaranty constitutes a primary obligation and not a contract of surety.

4. Waiver. Guarantor hereby unconditionally and irrevocably waives:

4.1 any right to revoke this Guaranty and acknowledges that this Guaranty is continuing in nature and applies to all presently existing and future Obligations;

4.2 diligence, presentment, demand for payment or performance, protest and notice of nonpayment or dishonor and all other notices and demands whatsoever relating to the Obligations or the requirement that Holder proceed first against Guarantor’s Affiliates, or any other Person to collect payment or enforce performance of the Obligations or otherwise exhaust any right, power or remedy under the Purchase Agreement, any Ancillary Agreement or any other agreement giving rise to any such Obligations to collect payment or enforce performance of the Obligations before proceeding hereunder; and

4.3 all suretyship defenses including all defenses based upon any statute or rule of law that provides that the obligation of a surety must be neither larger in amount nor in other respects more burdensome than that of the principal.

5. Subrogation. Guarantor will not exercise any rights that he may now or hereafter acquire against Maker or other guarantors (if any) that arise from the existence, payment, performance, or enforcement of such Guarantor’s obligations under this Guaranty, including, without limitation, any right of subrogation, reimbursement, exoneration, contribution, or indemnification, whether or not such claim, remedy, or right arises in equity or under contract, statute, or common law, including, without limitation, the right to take or receive from Maker or any other guarantor, directly or indirectly, in cash or other property. or by set- off or in any other manner, payment or security solely on account of such claim, remedy. or right, unless and until all of the Obligations and all other amounts payable under this Guaranty shall have been indefeasibly paid in full.

6. Representations and Warranties. Guarantor represents and warrants that the following are true and correct and that Guarantor:

6.1 Is an adult individual and is sui juris.

6.2 Is not under any restraint and is not in any respect incompetent to enter into this Guaranty.

6.3 Does not, by the execution, delivery, and performance of this Guaranty, contravene or cause a default under (a) any contractual restriction binding on or affecting Guarantor, (b) any court decree or order binding on or affecting Guarantor, or (c) any requirement of binding on or affecting Guarantor.

6.4 Has received and reviewed the Note.

7. Reinstatement of Guarantor’s Obligations. If at any time any payment of any of the Obligations is rescinded or is otherwise required by applicable law to be returned by Holder upon the insolvency, bankruptcy, reorganization, dissolution, liquidation, arrangement, assignment for the benefit of creditors or other similar proceeding of Maker or any Affiliate thereof, or otherwise, then Guarantor’s obligations under this Guaranty with respect to such payment shall be reinstated as though such payment had been due but not been made.

8. Miscellaneous. The Parties further agree as follows:

8.1 Waivers, Amendments, Remedies. No course of dealing by Holder and no failure by Holder to exercise, or delay by Holder in exercising, any right, remedy, or power hereunder shall operate as a waiver thereof, and no single or partial exercise thereof shall preclude any other or further exercise thereof or the exercise of any other right, remedy, or power of Holder. No amendment, modification, or waiver of any provision of this Guaranty and no consent to any departure by Guarantor therefrom, shall, in any event, be effective unless contained in a writing signed by Holder, and then such waiver or consent shall be effective only in the specific instance and for the specific purpose for which given. The rights, remedies, and powers of Holder, not only hereunder, but also under any instruments and agreements evidencing or securing the Obligations and under applicable law, are cumulative and may be exercised by Holder from time to time in such order as Holder may elect.

8.2 Notices. All notices or other communications given or made hereunder shall be in writing and shall be personally delivered or deemed delivered the first business day after being delivered by electronic means to the party to receive the same at its address set forth in the preamble herein or to such other address as either party shall hereafter give to the other by notice duly made under this Section.

8.3 Term; Binding Effect. This Guaranty shall (a) remain in full force and effect until payment and satisfaction in full of all of the Obligations; (b) be binding upon Guarantor and its successors and permitted assigns; and (c) inure to the benefit of Holder and its successors and assigns. Upon the payment in full of the Obligations (x) this Guaranty shall terminate and (z) Holder will execute and deliver to Guarantor such documents as Guarantor shall reasonably request to evidence such termination.

8.4 Satisfaction of Obligations. For all purposes of this Guaranty, the payment in full of the Obligations shall be conclusively deemed to have occurred when the Obligations shall have been paid.

8.5 Counterparties. This Guaranty may be executed in one or more counterparts, each of which shall be deemed an original and all of which together shall constitute one and the same instrument.

8.6 Governing Law. This Guaranty shall be governed by and construed in accordance with the laws of the State of Delaware, without regard to its conflict of laws principles.

8.7 Waiver of Venue. Each party herein irrevocably and unconditionally waives, to the fullest extent permitted by applicable law, any objection that it may now or hereafter have to the laying of venue of any action or proceeding arising out of or relating to this Guaranty in any court referred to in Section 6.6.

(SIGNATURES FOLLOW)

IN WITNESS WHEREOF, the parties hereto have executed this Guaranty as of the date first above written.

| [****] |

| |

| |

|

| |

|

|

|

ACCEPTED AND AGREED TO: |

| TITAN PHARMACEUTICALS, INC. |

| |

|

|

|

By |

|

|

|

Name: |

|

|

| Title: |

|

|

Exhibit

B

Cash

Note

(see

attached)

PROMISSORY

NOTE

FOR VALUE RECEIVED, and subject to the terms and conditions set forth herein, Fedson, Inc. a Delaware corporation (“Maker”), hereby unconditionally promises to pay to the order of Titan Pharmaceuticals, Inc., a Delaware corporation (“Holder,” and together with Maker, the “Parties”), the principal amount of USD $500,000 (Five Hundred Thousand United States Dollars) (the “Loan”), together with all accrued interest thereon, as provided in this Promissory Note (the “Note,” as the same may be amended, restated, supplemented, or otherwise modified from time to time in accordance with its terms).

1. Definitions. Capitalized terms used herein shall have the meanings set forth in this Section 1.

“Affiliate” of any particular Person means any other Person controlling, controlled by or under common control with such particular Person, where “control” means the possession, directly or indirectly, of the power to direct the management and policies of a Person whether through the ownership of voting securities, contract or otherwise.

“Applicable Rate” means the rate equal to [****]%.

“Business Day” means a day other than a Saturday, Sunday, or other day on which commercial banks in New York City authorized or required by law to close.

“Default” means any of the events specified in Section 5 which constitute an Event of Default or which, upon the giving of notice, the lapse of time, or both, pursuant to Section 5 would, unless cured or waived, become an Event of Default.

“Default Rate” means, at any time, the Applicable Rate plus [****]%

“Event of Default” has the meaning set forth in Section 5.

“Governmental Authority” means the government of any nation or any political subdivision thereof, whether at the national, state, territorial, provincial, municipal, or any other level, and any agency, authority, instrumentality, regulatory body, court, central bank, or other entity exercising executive, legislative, judicial, taxing, regulatory, or administrative powers or functions of, or pertaining to, government (including any supranational bodies, such as the European Union or the European Central Bank).

“Guaranty” means an unconditional guaranty, in substantially the form of Exhibit A.

“Guarantor” means [****].

“Law” as to any Person, means the certificate of incorporation and by-laws or other organizational or governing documents of such Person, and any law (including common law), statute, ordinance, treaty, rule, regulation, order, decree, judgment, writ, injunction, settlement agreement, requirement or determination of an arbitrator or a court or other Governmental Authority, in each case applicable to or binding upon such Person or any of its property or to which such Person or any of its property is subject.

“Maturity Date” means the earlier of (a) October 1, 2024, provided that Maker shall have the right, in its sole discretion, to extend this date up to two times for a period of 30 days each, by making a non-refundable payment of $5,000 to Holder for each extension and provide written notice to Holder at least one calendar day prior to the then-current Maturity Date, and (b) the date on which all amounts under this Note shall become due and payable pursuant to Section 6.

“Order” as to any Person, means any order, decree, judgment, writ, injunction, settlement agreement, requirement, or determination of an arbitrator or a court or other Governmental Authority, in each case, applicable to or binding on such Person or any of its properties or to which such Person or any of its properties is subject.

“Person” means any individual, corporation, limited liability company, trust, joint venture, association, company, limited or general partnership, unincorporated organization, Governmental Authority, or other entity.

“Purchase Agreement” means that certain Asset Purchase Agreement, dated as of July 26, 2023, among the Parties, as amended by that certain Amendment and Extension Agreement dated as of August 25, 2023, as the same may be amended, restated supplemented or otherwise modified from time to time by the Parties.

2. Final Payment Date; Optional Prepayments.

2.1 Final Payment Date. The aggregate unpaid principal amount of the Loan, all accrued and unpaid interest, and all other amounts payable under this Note shall be due and payable on the Maturity Date, unless otherwise provided in Section 6.

2.2 Optional Prepayment. Maker may prepay the Loan in whole or in part at any time or from time to time without penalty or premium by paying the principal amount to be prepaid together with accrued interest thereon to the date of prepayment.

3. Interest.

3.1 Interest Rate. Except as otherwise provided herein, the outstanding principal amount of the Loan made hereunder shall bear simple interest at the Applicable Rate from the date the Loan was made until the Loan is paid in full, whether at maturity, upon acceleration, by prepayment, or otherwise.

3.2 Interest Payment Dates. Interest shall be payable in a lump sum, in arrears to Holder on the Maturity Date.

3.3 Default Interest. If any amount payable hereunder is not paid when due (without regard to any applicable grace periods), whether at stated maturity, by acceleration, or otherwise, such overdue amount shall bear interest at the Default Rate from the date of such non-payment until such amount is paid in full.

3.4 Computation of Interest. All computations of interest shall be made on the basis of 365 or 366 days, as the case may be and the actual number of days elapsed. Interest shall accrue on the Loan on the day on which such Loan is made, and shall not accrue on the Loan on the day on which it is paid.

3.5 Interest Rate Limitation. If at any time and for any reason whatsoever, the interest rate payable on the Loan shall exceed the maximum rate of interest permitted to be charged by Holder to Maker under applicable Law, such interest rate shall be reduced automatically to the maximum rate of interest permitted to be charged under applicable Law.

4. Payment Mechanics.

4.1 Manner of Payment. All payments of interest and principal shall be made in lawful money of the United States of America on the date on which such payment is due by wire transfer of immediately available funds to the bank account of Holder as specified by Holder in writing.

4.2 Application of Payments. All payments made hereunder shall be applied first to the payment of any fees or charges outstanding hereunder, second to accrued interest, and third to the payment of the principal amount outstanding under the Note.

4.3 Business Day Convention. Whenever any payment to be made hereunder shall be due on a day that is not a Business Day, such payment shall be made on the next succeeding Business Day and such extension will be taken into account in calculating the amount of interest payable under this Note.

5. Events of Default. The occurrence of any of the following shall constitute an Event of Default hereunder:

5.1 Failure to Pay. Maker fails to pay (a) any principal amount of the Loan when due; or (b) interest or any other amount when due and such failure continues for 5 Business Days after written notice to Maker.

5.2 Bankruptcy.

(a) Maker commences any case, proceeding, or other action (i) under any existing or future Law relating to bankruptcy, insolvency, reorganization, or other relief of debtors, seeking to have an order for relief entered with respect to it, or seeking to adjudicate it as bankrupt or insolvent, or seeking reorganization, arrangement, adjustment, winding-up, liquidation, dissolution, composition, or other relief with respect to it or its debts, or (ii) seeking appointment of a receiver, trustee, custodian, conservator, or other similar official for it or for all or any substantial part of its assets, or Maker makes a general assignment for the benefit of its creditors; or

(b) there is commenced against Maker any case, proceeding, or other action of a nature referred to in Section 5.2(a) above which (i) results in the entry of an order for relief or any such adjudication or appointment or (ii) remains undismissed, undischarged, or unbonded for a period of 60 days;

6. Remedies. Upon the occurrence of an Event of Default and at any time thereafter during the continuance of such Event of Default, Holder may at its option, by written notice to Maker (a) declare the entire principal amount of this Note, together with all accrued interest thereon and all other amounts payable hereunder, immediately due and payable and/or (b) exercise any or all of its rights, powers, or remedies under applicable Law; provided, however that, if an Event of Default described in Section 5.2 shall occur, the principal of and accrued interest on the Loan shall become immediately due and payable without any notice, declaration, or other act on the part of Holder.

7. Right of Set-Off. Notwithstanding anything to the contrary herein, Maker is hereby authorized at any time and from time to time, to the fullest extent permitted by Law, to set off and apply any and all of the payments, obligations and/or other liabilities of Holder owing at any time under the Purchase Agreement to Maker or any of its Affiliates or other Buyer Indemnified Parties (as defined in the Purchase Agreement) against any and all of Maker’s payments, obligations or other liabilities owing at any time hereunder to Holder.

8. Guaranty. As security for payment of any and all of Maker’s payments, obligations or other liabilities owing at any time hereunder to Holder, Maker shall lodge with Holder, at the time of Closing of the Purchase Agreement, the Guaranty executed by the Guarantor.

9. Miscellaneous.

9.1 Notices. All notices required or allowed under this Note shall be given in the manner provided for notice under the Purchase Agreement.

9.2 Governing Law. This Note shall be governed by and construed in accordance with the laws of the State of Delaware, without regard to its conflict of laws principles.

9.3 Venue. Each Party irrevocably and unconditionally waives, to the fullest extent permitted by applicable Law, any objection that it may now or hereafter have to the laying of venue of any action or proceeding arising out of or relating to this Note in any court referred to in Section 8.2.

9.4 Counterparts. This Note may be executed in one or more counterparts, each of which shall be deemed an original and all of which together shall constitute one and the same instrument.

9.5 Successors and Assigns. Neither Party may transfer or assign this Note or any portion hereof or pledge, encumber or transfer its rights or interest in and to this Note or any portion hereof, except with the prior written consent of the other Party in its sole discretion.

9.6 Amendments and Waivers. No term of this Note may be waived, modified, or amended except by an instrument in writing signed by both Parties. Any waiver of the terms hereof shall be effective only in the specific instance and for the specific purpose given.

9.7 Headings. The headings of the various Sections and subsections herein are for reference only and shall not define, modify, expand, or limit any of the terms or provisions hereof.

9.8 No

Waiver; Cumulative Remedies. No failure to exercise and no delay in exercising, on the part of a Party, of any right, remedy,

power, or privilege hereunder shall operate as a waiver thereof; nor shall any single or partial exercise of any right, remedy,

power, or privilege hereunder preclude any other or further exercise thereof or the exercise of any other right, remedy, power, or

privilege. The rights, remedies, powers, and privileges herein provided are cumulative and not exclusive of any rights, remedies,

powers, and privileges provided by Law.

9.9 Severability. If any term or provision of this Note is invalid, illegal, or unenforceable in any jurisdiction, such invalidity, illegality, or unenforceability shall not affect any other term or provision of this Note or invalidate or render unenforceable such term or provision in any other jurisdiction.

9.10 Conflicts. In the event of any conflict between the terms of the Purchase Agreement and this Note, the terms of the Purchase Agreement will control.

(SIGNATURES FOLLOW)

IN WITNESS WHEREOF, Maker has executed this Note as of [DATE].

| |

FEDSON, INC. |

| |

|

| |

By |

|

| |

Name: |

Alan Garvin |

| |

Title: |

President |

EXHIBIT A

PERSONAL GUARANTY

(see attached)

GUARANTY

This Guaranty (“Guaranty”), dated as of [DATE], is made by [****] (“Guarantor”), an individual who resides at [****], in favor and for the benefit of Titan Pharmaceuticals, Inc. with a business address located at 400 Oyster Point Blvd., Suite 505, South San Francisco, CA 94080 (“Holder”).

1. Guaranty. In consideration of the substantial direct and indirect benefits derived by Guarantor from the loans made by Holder to Fedson, Inc., a Delaware corporation (“Maker”) under that certain Promissory Note, dated as of the date hereof, by and between Holder and Maker (the “Note”), the parties hereby agree as follows:

1.1 Guarantor absolutely, unconditionally, and irrevocably guarantees, as primary obligor and not merely as surety, the punctual payment, when due, whether at stated maturity, by acceleration, or otherwise, of all present and future obligations, liabilities, covenants, and agreements required to be observed, performed, or paid by Maker whether for principal, interest or penalties under the Note (collectively, the “Obligations”), and agrees to pay any and all reasonable expenses (including reasonable legal expenses and reasonable attorneys’ fees) incurred by Holder in successfully enforcing any rights under this Guaranty.

1.2 Notwithstanding any provision herein contained to the contrary, Guarantor’s liability with respect to the Obligations shall be limited to an amount not to exceed, as of any date of determination, the amount that could be claimed by Holder from Guarantor without rendering such claim voidable or avoidable under Section 548 of the Bankruptcy Code or under any applicable state Uniform Fraudulent Transfer Act, Uniform Fraudulent Conveyance Act, or similar statute or common law.

2. Unconditional Guaranty. The obligation of Guarantor under this Guaranty shall be primary, direct, immediate, unconditional and absolute and, without limiting the generality of the foregoing, shall in no way be released, discharged or otherwise affected by:

2.1 any extension of time for the payment of the Obligations, modification or amendment of the terms of the Purchase Agreement or any Ancillary Agreement or any forbearance as to time or performance or failure by Holder to proceed promptly with respect to the Obligations or this Guaranty; or

2.2 any insolvency, bankruptcy, arrangement, assignment for the benefit of creditors or other similar proceeding against Guarantor or his assets or any resulting release or discharge of any of the Obligations.

3. Guaranty of Payment. Guarantor guarantees that the Obligations will be paid strictly in accordance with the terms of the Note, regardless of any law, regulation, or order now or hereafter in effect in any jurisdiction affecting any of such terms or the rights of Holder with respect thereto. In the event of a default by Maker under the Note, Holder shall have the right to proceed immediately thereafter against Guarantor for payment or performance, as applicable, of the Obligations without being required to make any demand upon, bring any proceeding, exhaust any remedies against or take any other action of any kind against Maker or any Affiliate thereof. Guarantor hereby waives notice of acceptance of this Guaranty, presentment, demand of payment, protest and notice and any right or claim of right to cause a marshaling of the assets of Maker or any Affiliate thereof. The obligations of Guarantor under this Guaranty are independent of the Obligations, and a separate action or actions may be brought and prosecuted against Maker or any other guarantors, or Maker or any other guarantor may be joined in any such action or actions. The liability of Guarantor under this Guaranty constitutes a primary obligation and not a contract of surety.

4. Waiver. Guarantor hereby unconditionally and irrevocably waives:

4.1 any right to revoke this Guaranty and acknowledges that this Guaranty is continuing in nature and applies to all presently existing and future Obligations;

4.2 diligence, presentment, demand for payment or performance, protest and notice of nonpayment or dishonor and all other notices and demands whatsoever relating to the Obligations or the requirement that Holder proceed first against Guarantor’s Affiliates, or any other Person to collect payment or enforce performance of the Obligations or otherwise exhaust any right, power or remedy under the Purchase Agreement, any Ancillary Agreement or any other agreement giving rise to any such Obligations to collect payment or enforce performance of the Obligations before proceeding hereunder; and

4.3 all suretyship defenses including all defenses based upon any statute or rule of law that provides that the obligation of a surety must be neither larger in amount nor in other respects more burdensome than that of the principal.

5. Subrogation. Guarantor will not exercise any rights that he may now or hereafter acquire against Maker or other guarantors (if any) that arise from the existence, payment, performance, or enforcement of such Guarantor’s obligations under this Guaranty, including, without limitation, any right of subrogation, reimbursement, exoneration, contribution, or indemnification, whether or not such claim, remedy, or right arises in equity or under contract, statute, or common law, including, without limitation, the right to take or receive from Maker or any other guarantor, directly or indirectly, in cash or other property. or by set- off or in any other manner, payment or security solely on account of such claim, remedy. or right, unless and until all of the Obligations and all other amounts payable under this Guaranty shall have been indefeasibly paid in full.

6. Representations and Warranties. Guarantor represents and warrants that the following are true and correct and that Guarantor:

6.1 Is an adult individual and is sui juris.

6.2 Is not under any restraint and is not in any respect incompetent to enter into this Guaranty.

6.3 Does not, by the execution, delivery, and performance of this Guaranty, contravene or cause a default under (a) any contractual restriction binding on or affecting Guarantor, (b) any court decree or order binding on or affecting Guarantor, or (c) any requirement of binding on or affecting Guarantor.

6.4 Has received and reviewed the Note.

7. Reinstatement of Guarantor’s Obligations. If at any time any payment of any of the Obligations is rescinded or is otherwise required by applicable law to be returned by Holder upon the insolvency, bankruptcy, reorganization, dissolution, liquidation, arrangement, assignment for the benefit of creditors or other similar proceeding of Maker or any Affiliate thereof, or otherwise, then Guarantor’s obligations under this Guaranty with respect to such payment shall be reinstated as though such payment had been due but not been made.

8. Miscellaneous. The Parties further agree as follows:

8.1 Waivers, Amendments, Remedies. No course of dealing by Holder and no failure by Holder to exercise, or delay by Holder in exercising, any right, remedy, or power hereunder shall operate as a waiver thereof, and no single or partial exercise thereof shall preclude any other or further exercise thereof or the exercise of any other right, remedy, or power of Holder. No amendment, modification, or waiver of any provision of this Guaranty and no consent to any departure by Guarantor therefrom, shall, in any event, be effective unless contained in a writing signed by Holder, and then such waiver or consent shall be effective only in the specific instance and for the specific purpose for which given. The rights, remedies, and powers of Holder, not only hereunder, but also under any instruments and agreements evidencing or securing the Obligations and under applicable law, are cumulative and may be exercised by Holder from time to time in such order as Holder may elect.

8.2 Notices. All notices or other communications given or made hereunder shall be in writing and shall be personally delivered or deemed delivered the first business day after being delivered by electronic means to the party to receive the same at its address set forth in the preamble herein or to such other address as either party shall hereafter give to the other by notice duly made under this Section.

8.3 Term; Binding Effect. This Guaranty shall (a) remain in full force and effect until payment and satisfaction in full of all of the Obligations; (b) be binding upon Guarantor and its successors and permitted assigns; and (c) inure to the benefit of Holder and its successors and assigns. Upon the payment in full of the Obligations (x) this Guaranty shall terminate and (z) Holder will execute and deliver to Guarantor such documents as Guarantor shall reasonably request to evidence such termination.

8.4 Satisfaction of Obligations. For all purposes of this Guaranty, the payment in full of the Obligations shall be conclusively deemed to have occurred when the Obligations shall have been paid.

8.5 Counterparties. This Guaranty may be executed in one or more counterparts, each of which shall be deemed an original and all of which together shall constitute one and the same instrument.

8.6 Governing Law. This Guaranty shall be governed by and construed in accordance with the laws of the State of Delaware, without regard to its conflict of laws principles.

8.7 Waiver of Venue. Each party herein irrevocably and unconditionally waives, to the fullest extent permitted by applicable law, any objection that it may now or hereafter have to the laying of venue of any action or proceeding arising out of or relating to this Guaranty in any court referred to in Section 6.6.

(SIGNATURES FOLLOW)

IN WITNESS WHEREOF, the parties hereto have executed this Guaranty as of the date first above written.

| [****] |

| |

| |

|

| |

|

|

|

ACCEPTED AND AGREED TO: |

| TITAN PHARMACEUTICALS, INC. |

| |

|

|

|

By |

|

|

|

Name: |

David Lazar |

|

| Title: |

CEO |

|

v3.23.2

Cover

|

Aug. 25, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 25, 2023

|

| Entity File Number |

001-13341

|

| Entity Registrant Name |

TITAN PHARMACEUTICALS, INC.

|

| Entity Central Index Key |

0000910267

|

| Entity Tax Identification Number |

94-3171940

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

400 Oyster Point Blvd.

|

| Entity Address, Address Line Two |

Suite 505

|

| Entity Address, City or Town |

South San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94080

|

| City Area Code |

650

|

| Local Phone Number |

244-4990

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

TTNP

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

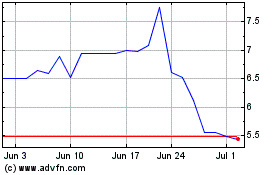

Titan Pharmaceuticals (NASDAQ:TTNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Titan Pharmaceuticals (NASDAQ:TTNP)

Historical Stock Chart

From Apr 2023 to Apr 2024