US index futures are down in the premarket on Wednesday, in a

day full of economic indicators, when some data may give signals

about the Federal Reserve’s monetary policy.

By 6:51 AM, Dow Jones (DOWI:DJI) futures were up 15 points,

or 0.04%. S&P 500 futures were down 0.07% and Nasdaq-100

futures were down 0.16%. The 10-year Treasury yield was at

4.153%.

On Wednesday’s US economic agenda, investors await, at 7:00 AM,

last week’s MBA 30-year mortgage rate, while at 8:15 AM the ADP

releases the private employment variation for August, which has a

consensus of 195,000 new jobs. As of 8:30 AM, in turn, the

market will look with a magnifying glass at the second reading of

the American Gross Domestic Product (GDP). At 10:00 AM the

Pending Home Sales Change for July will be released, while at 10:30

AM the Department of Energy releases the weekly oil inventory.

In the Eurozone, consumer sentiment dropped 16 points in August,

in line with forecasts. Investor confidence, scoring 93.3

points, also failed to meet expectations. In Germany, there

was a reduction of 13.25% in imports and 3.2% in exports in July,

compared to the previous month.

These numbers intensify the scenario of discouragement in

relation to the European economy. High inflation and interest

rates continue to affect the economy, complicating the situation

for the European Central Bank regarding monetary policy. Later

today, the August inflation index for Germany will be

announced.

In Asia, markets had a mixed close on the lookout for the

Federal Reserve to pause monetary tightening, especially after

recent disappointing data on US jobs and consumer

confidence. Asian markets are also focused on US Commerce

Secretary Gina Raimondo’s visit to China.

Raimondo reported that US companies are increasingly reluctant

to invest in China, due to fines and regulatory actions that create

obstacles to business operations.

In commodities markets, West Texas Intermediate crude for

October was up 0.70% to trade at $81.72 a barrel. Brent crude

for October was up 0.63% at $86.03 a barrel. Iron ore futures

traded in Dalian, China, rose 1.97% to $113.53 a tonne.

At Tuesday’s close, Dow Jones advanced 292.69 points or 0.85% to

34,852.67 points. The S&P 500 jumped 64.32 points or 1.45%

to 4,497.63 points. The Nasdaq Composite rose 238.63 points or

1.74% to 13,943.76 points. Economic data released yesterday

indicated a deterioration in the US job market, as evidenced by the

JOLTS report on new job openings. The projection was 9.5

million vacancies available, but only 8.8 million were

reported. Furthermore, the June figures have been revised

downwards.

The Consumer Confidence Index, as measured by the Conference

Board, also contributed to a more negative view of the economy,

coming in at just 106.1 points compared to the expected 116

points. This was also a decline from the previous value, which

was adjusted downwards to 144 points. As a result, there was a

significant increase in US Treasury yields.

The focus now turns to the PCE inflation index on Thursday and

the employment (Payroll) data on Friday.

On the corporate earnings front for Wednesday, traders are

watching reports from Patterson Companies (NASDAQ:PDCO),

Brown-Forman (NYSE:BF.B), Vera Bradley (NASDAQ:VRA), BioLineRx

(NASDAQ:BLRX), among others. After close, reports from

Crowdstrike (NASDAQ:CRWD), Salesforce (NYSE:CRM), Okta

(NASDAQ:OKTA), Chewy (NYSE:CHWY), Pure Storage (NYSE:PSTG), Five

Below (NASDAQ:FIVE), Express (NYSE:EXPR), and more, are

expected.

Wall Street Corporate Highlights for Today

Apple (NASDAQ:AAPL) – Apple has announced

an event for September 12 where it is expected to launch new

iPhones and smartwatches.

Nvidia (NASDAQ:NVDA) – The valuation of Nvidia

has been remarkable this year, more than tripling due to optimism

around AI. However, only 15% of mutual funds outperformed their

benchmarks due to an underweight in the company, according to

Morningstar data. Many investors remain cautious due to the high

valuation and uncertainty in the semiconductor sector.

Alphabet (NASDAQ:GOOGL) – Google announced

a series of enterprise-focused AI initiatives at the Google Next

conference. New additions include new customers

like General Motors (NYSE:GM)

and Estée Lauder (NYSE:EL), as well as

improvements to AI chips and security tools. Offering its AI

tools to enterprise customers was priced at $30 per monthly

user.

Meta Platforms (NASDAQ:META) – Meta’s

blocking of news on Facebook by Meta in Canada did not

significantly affect usage of the platform, according to

data. The move comes as Meta faces pressure from the Canadian

government over a new law demanding payment to news editors for

shared content. At the same time, Meta identified and removed

7,700 accounts linked to the “Spamouflage” influence operation,

linked to Chinese authorities. The campaign, active since

2018, aimed to promote China and criticize the West. Meta

considers “Spamouflage” to be the biggest cross-platform influencer

operation to date.

Box (NYSE:BOX) – Box reported mixed

second-quarter results. The company reported revenue of $261

million, in line with Wall Street forecasts, as per Refinitiv

data. While it beat expectations for adjusted earnings per

share by 1 cent to 36 cents, Box released disappointing forecasts

for the next quarter and full fiscal year, according to

FactSet.

Ambarella (NASDAQ:AMBA) – Semiconductor

company Ambarella is down 20.6% in premarket trading on Wednesday,

due to a modest outlook for the next quarter, despite exceeding

forecasts in the second quarter. The firm anticipates

third-quarter revenue of $50 million, down from the $67.6 million

forecast by Refinitiv analysts.

Salesforce (NYSE:CRM) – Salesforce

prepares to report its earnings in a context of economic

uncertainty and cautious corporate spending. While it has

introduced new AI tools and boosted prices, the stock has dropped

after past results and the financial outlook remains

mixed. For the fiscal second quarter, Salesforce forecast

revenue of $8.51 billion to $8.53 billion, up 10% year-over-year,

while analyst consensus is at the top end of the range. In

other news, Marc Benioff, CEO of Salesforce, warned that the

Dreamforce conference in San Francisco may be the last due to local

issues of homelessness and drug use. The event is crucial to

the city’s economy, attracting around 40,000 people and generating

$57 million.

Texas Instruments (NASDAQ:TXN) – The

stock is down 2% premarket to $167.29 after the semiconductor

maker was downgraded to Underperform from Market Perform at

Bernstein with an unchanged price target of $ $145.

Disney (NYSE:DIS) – US Secretary of

Commerce Gina Raimondo concluded a four-day visit to China with

stops at Shanghai Disneyland and a Boeing facility

(NYSE:BA). The trip was aimed at strengthening Sino-US trade

ties and boosting bilateral tourism.

Walmart (NYSE:WMT) – Walmart has asked

some of its 16,000 US pharmacists to take voluntary pay cuts and

reduced hours to cut costs. The move comes amid financial

challenges, including a $3.1 billion opioid-related legal

settlement and reduced profit margins at its pharmacies.

PepsiCo (NASDAQ:PEP) – PepsiCo broke

ground on construction of a snack food factory in West Java,

Indonesia, marking its return to the country after dissolving a

joint venture in 2021. The factory is part of a US$200 million

investment and will begin production by 2025.

Tesla (NASDAQ:TSLA) – Elon Musk is

positioning Tesla as a serious competitor in AI, launching a $300

million AI computing cluster with

10,000 Nvidia GPUs

(NASDAQ:NVDA). The move is aimed at accelerating the

development of self-driving cars and bolstering Tesla’s ambitions

in AI.

Toyota (NYSE:TM) – In July, Toyota saw an

8% increase in global sales and a 15% increase in production,

marking its recovery from Covid-19 and supply chain

challenges. However, a recent production outage could impact

the August figures. As reported yesterday, Toyota was forced

to halt production at 14 Japanese factories due to a glitch in its

parts ordering system. The outage can significantly affect

production. The company stated that the issue was not caused

by a cyberattack.

Ford Motor (NYSE:F) – Canadian union

Unifor has chosen Ford Motor as a target for contract negotiations

with the Detroit Three automakers. Both Unifor and the UAW

union in the US have authorized strikes if a new agreement is not

reached before the current contract expires.

Nio (NYSE:NIO) – Chinese electric car

maker NIO plans to launch a smartphone in September to improve the

driver experience. CEO William Li emphasized that the focus is

not on competing with other phone manufacturers, but on improving

the integration between vehicle and mobile technology.

Rivian Automotive (NASDAQ:RIVN) – RJ

Scaringe, CEO of Rivian Automotive, received a significant pay

raise, with his annual salary rising from $650,000 to $1

million. Additionally, his annual incentive bonus target has

increased to 100% of base salary. Rivian also awarded him

around $15 million in stock awards.

Vinfast (NASDAQ:VFS) – Shares in electric

car start-up VinFast fell 44% on Tuesday, wiping about $90 billion

from its market value and costing majority shareholder Pham Nhat

Vuong $67 billion in paper wealth . Despite this, the company

maintains a market capitalization of over $100 billion. The

stock is up 8.4% in premarket trading on Wednesday.

Lyft (NASDAQ:LYFT) – Sean Aggarwal, an

independent director of Lyft, purchased $1 million worth of company

stock, following a similar purchase made by CEO David

Risher. Aggarwal was already an early investor in Lyft and

sees the current purchase as a significant new investment

opportunity.

Boeing (NYSE:BA) – The US Federal Aviation

Administration has issued an updated guidance on cracking issues on

Boeing 777 airplanes, citing new unsafe conditions. The move

was taken even as Boeing was still reviewing documentation due to

immediate public safety concerns.

Nasdaq (NASDAQ:NDAQ) – Nasdaq has named

Sarah Youngwood, a former executive at UBS

Group (NYSE:UBS), as its new chief financial officer,

replacing Ann Dennison. Youngwood will take over on Dec. 1 as

the company seeks to position itself as a major player in fintech

under CEO Adena Friedman.

Berkshire Hathaway (NYSE:BRK.A) –

Berkshire Hathaway has increased its exposure to the Florida

reinsurance market, betting on large premiums and minimal

losses. With Hurricane Idalia looming, the company faces a

risk test, potentially losing up to $15 billion in a major

storm.

Citigroup (NYSE:C) – The SEC has issued a

cease and desist order against Citigroup Global Markets for

violations of underwriting records. Without admitting guilt,

Citigroup agreed to pay a $2.9 million fine. The SEC claimed

that the company used unverified calculation methods for a

decade.

JPMorgan Chase (NYSE:JPM) – JPMorgan

raised its stake in Brazilian digital bank C6 from 40% to 46%,

broadening its engagement amid C6’s rapid growth, which now has 25

million customers. Financial terms were not disclosed.

Goldman Sachs (NYSE:GS) – Goldman Sachs

has agreed to pay a $5.5 million fine to the US Commodity Futures

Trading Commission (CFTC) for failing to keep adequate records of

employee calls and for violating a prior order. The case

resolves allegations related to the bank’s failure to record and

store calls.

UBS (NYSE:UBS) – UBS and financial blog

Inside Paradeplatz have settled a lawsuit originally filed by

Credit Suisse. The blog agreed to amend or delete certain

comments and posts, and the remaining claims were

dropped. This is the second Credit Suisse case that UBS has

resolved.

Coinbase (NASDAQ:COIN) – Coinbase is down

1.45% in premarket trading after rising 15% in the previous session

following an appeals court ruling that said the Securities and

Exchange Commission erred in rejecting Grayscale Investments’

application for a spot Bitcoin ETF.

FedEx (NYSE:FDX) – FedEx announced that it

will increase shipping and customs clearance fees on January 1,

2024 to improve profitability. Rates for US domestic, export

and import services will rise by an average of 5.9%.

Kenvue (NYSE:KVUE) – Kenvue, a spin-out

of Johnson & Johnson (NYSE:JNJ), has

become the 67th member of the S&P 500 Dividend Aristocrats

Index, which includes companies that have increased their dividends

for at least 25 consecutive years. The company, known for

brands like Tylenol and Band-Aid, was recently added after being

spun off from J&J. Both companies will continue to pay

dividends, maintaining their positions in the index.

Catalent (NYSE:CTLT) – Following agreement

with activist investor Elliott Investment Management,

pharmaceutical company Catalent has added four new directors and

will begin a strategic review. The company, which faces

production challenges and acquisition interest, also reported a 17%

decline in quarterly revenue. Despite this, it issued a more

optimistic outlook for fiscal 2024 above analysts’

expectations.

HP Inc (NYSE:HPQ) – HP saw its shares

decline 8.6% in premarket Wednesday after fiscal third-quarter

revenue missed Wall Street expectations. The company had

revenue of $13.2 billion, missing the $13.37 billion forecast by

analysts polled by Refinitiv. Earnings per share, after items,

was 86 cents, in line with projections.

Hewlett Packard Enterprise (NYSE:HPE) –

Shares of Hewlett Packard Enterprise are flat premarket even after

slightly beating forecasts for the fiscal third quarter. The

company had adjusted earnings of 49 cents per share and revenue of

$7 billion, while analysts at Refinitiv had expected 47 cents per

share and revenue of $6.99 billion.

Cleveland-Cliffs (NYSE:CLF) – Steel

producer Cleveland-Cliffs has reached an interim three-year

agreement with the United Steelworkers union for its Minnesota

Northshore mine. The agreement, which covers approximately 430

workers, is awaiting ratification by union members.

US Steel (NYSE:X) – US Steel is evaluating

unsolicited bids for partial or full acquisition and will share due

diligence information, according to a letter to

shareholders. The move follows a $7.3 billion offer by

Cleveland-Cliffs.

PVH Corp (NYSE:PVH) – Calvin Klein parent

company PVH reported solid financial results. The company

posted adjusted earnings of $1.98 per share and revenue of $2.21

billion, beating Refinitiv estimates of $1.76 per share and $2.19

billion in revenue. PVH also confirmed its full-year revenue

projections and raised its full-year earnings per share

forecast.

PDD Holdings (NASDAQ:PDD) – PDD Holdings,

formerly known as Pinduoduo, beat second-quarter expectations with

a 66% increase in revenue to $7.17 billion. Its Pinduoduo and

Temu platforms saw rapid growth, driven by consumers concerned

about prices and promotions.

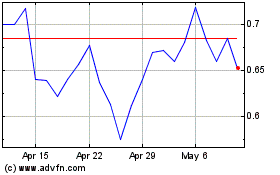

BioLineRx (NASDAQ:BLRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

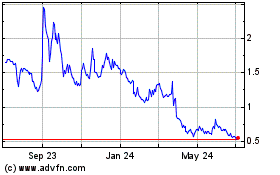

BioLineRx (NASDAQ:BLRX)

Historical Stock Chart

From Apr 2023 to Apr 2024