Gold Closes Higher, With Strong Retreat In Treasury Interest Rates And Dollar Low

August 29 2023 - 2:20PM

IH Market News

The price of gold (CCOM:GOLD) closed with a high in NY and

reached a three-week high on Tuesday, supported by the sharp

decline in Treasury interest rates and the general low of the

dollar, after weak data from the US labor market.

The Jolts report showed that open job openings in the country

are at the lowest level since March 2021, after three consecutive

monthly declines.

The data, plus the drop in American consumer confidence measured

by the Conference Board, raised the bet that the Fed will no longer

touch interest rates this year. On the Comex, the December contract

was up 0.94% to trade at USD1,965.10 a troy ounce.

Investors are now looking to the US Consumer Expenditure Price

Index, which is due out on Thursday, and the Non-Farm Payrolls, on

Friday, for more clues on the path in interest rates.

According to the CME FedWatch tool, traders now see an 86%

chance the Fed will keep rates unchanged at its September meeting,

up from 78% prior to the data.

Higher interest rates increase the opportunity cost of holding

precious metals without yield.

Reflecting the sentiment, SPDR Gold Trust (AMEX:GLD), the

world’s largest gold-backed exchange-traded fund, said its holdings

were up 0.3% on Monday.

“The fact that the price has been recovering since the middle of

last week suggests that the selling pressure exerted by speculative

financial investors has eased,” wrote Carsten Fritsch, an analyst

at Commerzbank, in a note.

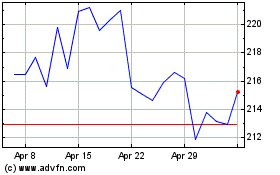

SPDR Gold (AMEX:GLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

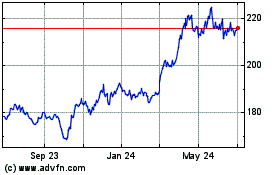

SPDR Gold (AMEX:GLD)

Historical Stock Chart

From Apr 2023 to Apr 2024