Filed

Pursuant to Rule 424(b)(5)

Registration

Statement No. 333-272432

PROSPECTUS

SUPPLEMENT

(To

Prospectus dated June 20, 2023)

Bluejay

Diagnostics, Inc.

216,000

Shares of Common Stock

We

are offering 216,000 shares of our common stock, par value $0.0001 per share (“Common Stock”), directly to several

institutional investors pursuant to this prospectus supplement and the accompanying prospectus.

In

a concurrent private placement to the same investors, we are also issuing unregistered warrants to purchase up to 216,000 shares of Common

Stock (the “Common Warrants”). For each share of Common Stock issued in this offering, an accompanying Common Warrant

will be issued to the purchasers thereof, respectively. Each Common Warrant will be exercisable for one share of Common Stock at an exercise

price of $7.24 per share, will be immediately exercisable and will expire five years from the date of issuance.

The

Common Warrants and the shares of Common Stock issuable upon the exercise of the Common Warrants (the “Common Warrant Shares”)

are not being registered under the Securities Act of 1933, as amended (the “Securities Act”), nor are they being offered

pursuant to this prospectus supplement and accompanying prospectus. The Common Warrants and the Common Warrant Shares are being offered

pursuant to the exemption provided in Section 4(a)(2) of the Securities Act and Rule 506(b) promulgated thereunder. The purchasers will

each be an “accredited investor” as such term is defined in Rule 501(a) under the Securities Act.

The

offering price is $7.365 per share of Common Stock.

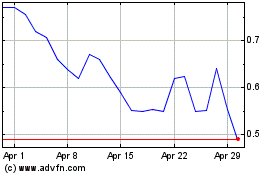

Our

Common Stock is listed on The Nasdaq Capital Market under the symbol “BJDX.” The closing price of our Common Stock on August

23, 2023, as reported by Nasdaq, was $7.21 per share. The Common Warrants are not and will not be listed on any national securities exchange

or other trading market.

Pursuant

to General Instruction I.B.6 of Form S-3, in no event will we sell the securities described in this prospectus in a public primary offering

with a value exceeding more than one-third (1/3) of the aggregate market value of our Common Stock held by non-affiliates in any twelve

(12)-calendar month period, so long as the aggregate market value of our outstanding Common Stock held by non-affiliates remains below

$75,000,000. Calculated in accordance with General Instruction I.B.6 of Form S-3, the aggregate market value of our outstanding Common

Stock held by non-affiliates, or our public float, was approximately $4,783,729 based upon 542,373 shares of our Common Stock held by

non-affiliates at the per-share price of $8.82 on August 8, 2023, which was the highest closing price within the last 60 days prior to

the date of this offering. One-third of our public float, calculated in accordance with General Instruction I.B.6 of Form S-3 as of August

24, 2023, was approximately $1,594,576. During the twelve calendar months prior to and including the date of this prospectus supplement

(but excluding this offering), we have not offered or sold any securities pursuant to General Instruction I.B.6 of Form S-3.

We

have engaged H.C. Wainwright & Co., LLC to act as our exclusive placement agent in connection with the shares of Common Stock offered

by this prospectus supplement and the accompanying prospectus. The placement agent is not purchasing or selling any of the shares of

Common Stock offered pursuant to this prospectus supplement and the accompanying prospectus and the placement agent is not required to

arrange the purchase or sale of any specific number of shares of Common Stock or dollar amount, the placement agent has agreed to use

its reasonable best efforts to sell the securities offered by this prospectus supplement and the accompanying prospectus. We have agreed

to pay the placement agent the placement agent certain cash fees set forth in the table below, which assumes that we sell all of the

securities we are offering. See “Plan of Distribution” for additional information with respect to the compensation we will

pay the placement agent.

Investing

in our shares of Common Stock involves a high degree of risk. Before making any investment in these shares of Common Stock, you

should consider carefully the risks and uncertainties in the section entitled “Risk Factors” beginning on page S-7 of

this prospectus supplement and page 4 of the accompanying prospectus, and in the other documents that are incorporated by reference

and any related free writing prospectus.

Neither

the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the

accuracy or adequacy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

| | |

Per Share

of Common

Stock | | |

Total | |

| Offering Price | |

$ | 7.365 | | |

$ | 1,590,840.00 | |

| Placement Agent Fees (1) | |

$ | 0.516 | | |

$ | 111,358.80 | |

| Proceeds, before expenses, to us (2) | |

$ | 6.849 | | |

$ | 1,479,481.20 | |

| (1) | Consists

of a cash fee of 7.0% of the aggregate gross proceeds in this offering. In addition, we have agreed to pay a management fee of 1.0% of

the aggregate gross proceeds raised in this offering, pay $45,000 for non-accountable expenses, and issue warrants to purchase shares

of Common Stock. See “Plan of Distribution” beginning on page S-10 of this prospectus supplement for additional information

with respect to the compensation we will pay the placement agent. |

| (2) | The

amount of the offering proceeds to us presented in this table does not include proceeds from the exercise of the Common Warrants in cash,

if any. |

Delivery

of the shares of Common Stock being offered pursuant to this prospectus supplement and the accompanying prospectus is expected to be

made on or about August 28, 2023, subject to satisfaction of customary closing conditions.

H.C.

Wainwright & Co.

The

date of this prospectus supplement is August 24, 2023

TABLE

OF CONTENTS

Prospectus Supplement

Prospectus

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement and the accompanying prospectus form part of a registration statement on Form S-3 that we filed with the Securities

and Exchange Commission (the “SEC”), under the Securities Act, using a “shelf” registration or continuous

offering process. This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of

this offering and certain other matters and may add, update or change information in the accompanying prospectus, including the documents

incorporated by reference into this prospectus supplement. The second part is the accompanying prospectus, dated June 5, 2023, including

the documents incorporated by reference therein, which provides you with general information about securities we may offer from time

to time, some of which may not apply to this offering. Generally, when we refer to this prospectus, we are referring to both parts of

this document combined. To the extent there is a conflict between the information contained in this prospectus supplement, on the one

hand, and the information contained in the accompanying prospectus, on the other hand, you should rely on the information in this prospectus

supplement. These documents contain important information you should consider when making your investment decision.

You

should rely only on the information provided in this prospectus supplement and the accompanying prospectus, including any information

incorporated by reference, and in any free writing prospectus that we have authorized for use in connection with this offering. We have

not, and the placement agent has not, authorized anyone to provide you with any other information and neither we nor the placement agent

take any responsibility for any other information that others may give you. The information contained in this prospectus supplement and

the accompanying prospectus speaks only as of the date set forth on the cover page and may not reflect subsequent changes in our business,

financial condition, results of operations and prospects. We may authorize one or more “free writing prospectuses” (i.e.

written communications concerning the offering that are not part of this prospectus supplement) that may contain certain material information

relating to this offering.

We

are offering to sell, and are seeking offers to buy, securities only in jurisdictions where such offers and sales are permitted. We are

not, and the placement agent is not, making offers to sell these securities in any jurisdiction in which an offer or solicitation is

not authorized or permitted or in which the person making such offer or solicitation is not qualified to do so or to any person to whom

it is unlawful to make such an offer or solicitation. You should read this prospectus supplement, the accompanying prospectus, including

any information incorporated by reference, and any free writing prospectus that we have authorized for use in connection with this offering,

in their entirety before making an investment decision. You should also read and consider the information in the documents to which we

have referred you in the sections entitled “Where You Can Find More Information” and “Incorporation of Certain Information

by Reference.”

Unless

the context otherwise requires, references in this prospectus to “Bluejay,” “the Company,” “we,”

“us” and “our” refer to Bluejay Diagnostics, Inc. Our logo and all product names are our common law trademarks.

Solely for convenience, trademarks and tradenames referred to in this prospectus may appear without the ® or ™ symbols, but

such references are not intended to indicate in any way that we will not assert, to the fullest extent under applicable law, our rights,

or that the applicable owner will not assert its rights, to these trademarks and tradenames.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement, accompanying prospectus and the documents incorporated herein by reference contain forward-looking statements

which are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E

of the Securities Exchange Act of 1934, as amended, or the Exchange Act. In some cases, you can identify these statements by forward-looking

words such as “may,” “might,” “should,” “would,” “could,” “expect,”

“plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,”

“potential” or “continue,” and the negative of these terms and other comparable terminology. These forward-looking

statements, which are subject to known and unknown risks, uncertainties and assumptions about us, may include projections of our future

financial performance based on our growth strategies and anticipated trends in our business. These statements are only predictions based

on our current expectations and projections about future events. There are important factors that could cause our actual results, level

of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed

or implied by the forward-looking statements.

While

we believe we have identified material risks, these risks and uncertainties are not exhaustive. Other sections of this prospectus, the

related prospectus supplement and the documents incorporated herein by reference may describe additional factors that could adversely

impact our business and financial performance. Moreover, we operate in a very competitive and rapidly changing environment. New risks

and uncertainties emerge from time to time, and it is not possible to predict all risks and uncertainties, nor can we assess the impact

of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially

from those contained in any forward-looking statements.

Although

we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of

activity, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy or completeness

of any of these forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. We are

under no duty to update any of these forward-looking statements after the date of this prospectus supplement to conform our prior statements

to actual results or revised expectations, and we do not intend to do so.

We

caution you not to place undue reliance on the forward-looking statements, which speak only as of the date of this prospectus supplement

in the case of forward-looking statements contained in this prospectus supplement.

You

should not rely upon forward-looking statements as predictions of future events. Our actual results and financial condition may differ

materially from those indicated in the forward-looking statements. We qualify all of our forward-looking statements by these cautionary

statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee

future results, levels of activity, performance or achievements. Therefore, you should not rely on any of the forward-looking statements.

In addition, with respect to all of our forward-looking statements, we claim the protection of the safe harbor for forward-looking statements

contained in the Private Securities Litigation Reform Act of 1995.

PROSPECTUS

SUPPLEMENT SUMMARY

The

following summary highlights certain information contained elsewhere or incorporated by reference in this prospectus supplement and the

accompanying prospectus. This summary provides an overview of selected information and does not contain all of the information you should

consider in making your investment decision. Therefore, you should read the entire prospectus supplement and the accompanying prospectus,

and the documents incorporated by reference herein carefully before investing in our shares of Common Stock. Investors should carefully

consider the information set forth under “Risk Factors” beginning on page S-7 of this prospectus supplement and the financial

statements and other information incorporated by reference in this prospectus.

Overview

We

are a medical diagnostics company developing rapid tests using whole blood on our Symphony technology platform, or Symphony, to improve

patient outcomes in critical care settings. Our Symphony platform is a combination of our intellectual property, or IP, and exclusively

licensed and patented IP that consists of a mobile device and single-use test cartridges that if cleared, authorized, or approved by

the U.S. Food and Drug Administration, or the FDA, can provide a solution to a significant market need in the United States. Clinical

trials indicate the Symphony device produces laboratory-quality results in less than 20 minutes in critical care settings, including

intensive care units and emergency rooms where rapid and reliable results are required.

Our

first product, the Symphony IL-6 test, is for the monitoring of disease progression in critical care settings. IL-6 is a clinically established

inflammatory biomarker, and is considered a ‘first-responder,’ for assessment of severity of infection and inflammation across

many disease indications, including sepsis. A current challenge of healthcare professionals is the excessive time and cost associated

determining a patient’s level of severity at triage and our Symphony IL-6 test has the ability to consistently monitor this critical

care biomarker with rapid results.

In

the future we plan to develop additional tests for Symphony including two cardiac biomarkers (hsTNT and NT pro-BNP) as well as other

tests using the Symphony platform. We do not yet have regulatory clearance for our Symphony products, and our Symphony products will

need to receive regulatory authorization from the FDA in order to be marketed as a diagnostic product in the United States.

Our

operations to date have been funded primarily through the proceeds of our initial public offering in November 2021. We were incorporated

under the laws of Delaware on March 20, 2015. Our headquarters is located in Acton, Massachusetts.

Our

Market

The

Symphony platform and our initial biomarker test, Symphony IL-6 test, is well suited to address a subset of the global in vitro

diagnostics devices, or IVDs, market, including sepsis, cardio-metabolic diseases, cancer and other diseases that require rapid tests.

Symphony targets critical care markets where physicians must quickly determine patient acuity to identify optimal treatment regimens.

Our

Business Model

Our

goal is to become the first provider of rapid tests for infectious, inflammatory and metabolic diseases by leveraging the strengths of

our Symphony platform. We intend to target our sales and marketing of Symphony to the largest critical care facilities in the United

States. Our business model includes the following:

| ● | Attractive

Financing Model. We intend to offer various financing options for the device itself. As such, our business model should not require customers

to incur a significant capital outlay. |

| ● | Recurring

Revenue. We intend to sell single-use diagnostic test cartridges. We believe that our cartridges can create a growing and recurring revenue

stream, as adoption and utilization increases, and as we develop tests for additional indications. We expect the sale of test cartridges

to generate the majority of our revenue and gross profit. |

| ● | Expand

our Menu of Diagnostic Products. As adoption increases, the average customer use of the Symphony platform should also increase. As we

expand our test menu, we hope to be able to increase our annual revenue per customer through the resulting increase in utilization. |

The

Symphony Platform

The

Symphony platform is an innovative and proprietary technology platform that provides rapid and accurate measurements of key diagnostic

biomarkers found in whole blood. Symphony is compact and can be deployed mobile as compared to current laboratory diagnostic platforms.

Symphony incorporates a user-friendly interface where all sample preparation and reagents are integrated into disposable Symphony cartridges.

Symphony only requires a few drops of blood to provide a measurement in less than 20 minutes.

The

Symphony analyzer orchestrates whole blood processing, biomarker isolation, and immunoassay preparation using non-contact centrifugal

force. All necessary reagents and components are integrated into the Symphony cartridges. Utilizing precision microchannel technology

and high specificity antibodies, whole blood is processed, and the biomarker is isolated within the Symphony cartridge. Intermitted centrifugation

cycles enable complex fluid movements, allowing sequential reagent additions and independent reaction steps inside the hermitically sealed

Symphony cartridge. At the conclusion of the test, the Symphony analyzer measures the fluorescence signature correlating to a highly

sensitive quantitation of the biomarker.

To

perform a Symphony test, the test operator adds three drops of blood to the Symphony cartridge. After scanning in the patient ID, the

Symphony cartridge is inserted into the Symphony analyzer and the test runs automatically. Each analyzer can run up to six cartridges

simultaneously, either with six different patient samples or six different tests, in less than 20 minutes, providing quantitative measurements

used for improved patient management and clinical decision-making.

Manufacturing

We

plan to manufacture both our devices and cartridges through Contract Manufacturing Organizations, or CMOs. We have contracts with Toray

Industries, Inc, or Toray, to manufacture our cartridges and Sanyoseiko Co. Ltd., or Sanyoseiko, to manufacture both our device and cartridges.

Each of our partners are well-established global manufacturing companies with capabilities to scale up, re-design and supply our devices

and cartridges.

Sanyoseiko

had been selected as our CMO, though in the near-term Toray will continue to develop, validate and manufacture our IL-6 cartridges as

our pilot-manufacturing partner. We expect to meet the demands of our global market. Both Toray’s and Sanyoseiko’s facilities

are located in Japan. We license the technology for the Symphony cartridges from Toray. Our license grants us exclusive global use with

the exception of Japan.

FDA

Regulatory Strategy

Our

current regulatory strategy is designed to support commercialization of Symphony in the United States pending marketing authorization

from the FDA. We have shifted our focus away from COVID-19 patients due to a significant decline in the number of COVID-19 related hospitalizations.

Based on this revised strategy, we plan to conduct a clinical study to support an FDA regulatory submission with an initial indication

for risk stratification of hospitalized sepsis patients. We submitted a pre-submission application to the FDA presenting the new study

design in May 2023 and participated in a pre-submission meeting on August 11, 2023. At the meeting, the FDA provided feedback on the

new study design, determined that the submission of a 510(k) is the appropriate premarket submission pathway, and requested that certain

data be provided in the 510(k). Based on this feedback, we intend to proceed as planned while taking into account the FDA’s feedback.

We believe that we will maintain the previously disclosed Symphony IL-6 regulatory submission timeline of the first half of 2024.

We

have targeted large, well-known medical and academic institutions for our study, which we believe will help support initial commercialization

and market penetration. We believe that this clinical trial expansion could also support additional indications, but that any such expansion

also could delay obtaining marketing authorization for the product. Based on the pre-submission meeting with the FDA, the focus of the

clinical trial will be the risk stratification of hospitalized sepsis patients.

Sales

and Marketing

Until

Symphony products are authorized by the FDA, we expect to focus our sales and marketing efforts on brand awareness and market education

to potential customers, emphasizing the value of monitoring a critical care patient’s IL-6 levels to improve decision making and

patient outcomes. If cleared or approved by the FDA, we intend to target sales to ERs and ICUs at United States hospitals, as well as

to long-term acute care facilities. We plan to establish a market presence by selling Symphony devices and tests both directly and through

various distribution channels to maximize sales volume and market penetration.

License

Agreement

On

October 6, 2020, we entered into a License and Supply Agreement, as amended, or the License Agreement, with Toray, providing us with

an exclusive global license with Toray, excluding Japan, to use their patents and know-how related to the Symphony detection cartridges

for the manufacturing, marketing and sale of the products (as defined in the License Agreement). We also have a nonexclusive license

for the same purposes in Japan. The agreement terminates in 2029 upon expiration of the last of the patents included in the license.

In

connection with entering into the License Agreement, we are required to pay a 15% royalty fee for the period that any underlying patents

exist or for five years after the first sale for the licensed technology after obtaining regulatory approval based on a percentage of

our “Net Sales” of products using these technologies (as defined in the License Agreement) with a minimum royalty of $60,000

for the initial year that royalties are payable increasing to a minimum of $100,000 thereafter.

Intellectual

Property, Proprietary Technology

We

do not currently hold any patents directly. We rely on a combination either directly or through the License Agreement with Toray of patent,

copyright, trade secret, trademark, confidentiality agreements, and contractual protection to establish and protect our proprietary rights.

Competition

Our

primary competition in the IL-6 market is laboratory size equipment including the Roche Cobas®, Siemens ADVIA Centaur®

and Beckman Coulter Access 2®, which require pre-processing of whole blood prior to performing their test. We believe

that our technology, which uses whole blood, provides us with a substantial competitive advantage over our existing competition that

will sustain through commercialization, despite the major life science companies and consistent entry of innovative start-ups that define

our competitive landscape.

Employees

As

of June 5, 2023, we have 14 full-time employees. We also contract with several consultants and contractors performing regulatory advisory,

investor relations and manufacturing scale-up support. None of our employees are represented by labor unions or covered by collective

bargaining agreements.

Available

Information

Our

principal executive offices are located at 360 Massachusetts Avenue, Suite 203, Acton, MA 01720 and our telephone number is (844) 327-7078.

Our website address is www.bluejaydx.com. Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K

and all amendments to those reports, proxy statements and other information about us are made available, free of charge, through the

SEC Filings section of our website at www.ir.bluejaydx.com/financial-information/sec-filings and at the SEC’s website at www.sec.gov

as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. We include our website address

in this prospectus only as an inactive textual reference and do not intend it to be an active link to our website. The contents of our

website are not incorporated into this prospectus.

In

addition, our Board of Directors has adopted a written Code of Business Conduct and Ethics applicable to all officers, directors and

employees, which is available through the “Governance Overview” section of our website at www.ir.bluejaydx.com/corporate-governance/governance-overview.

We intend to satisfy the disclosure requirement under Item 5.05 of Form 8-K regarding amendment to, or waiver from, a provision of the

Code of Business Conduct and Ethics and by posting such information on the website address and location specified above.

THE

OFFERING

| Common stock offered: |

|

216,000 shares of Common Stock. |

| |

|

|

| Offering price: |

|

$7.365 per share of Common Stock. |

| |

|

|

| Concurrent private placement: |

|

In a concurrent private placement, we are also selling Common Warrants to purchase up to 216,000 shares of Common Stock at a purchase price of $0.125 per underlying Common Warrant Share, which purchase price is included in the offering price of shares of Common Stock issued pursuant to this prospectus supplement and accompanying prospectus. The Common Warrants will be exercisable for one share of Common Stock at an exercise price of $7.24 per share, will be immediately exercisable upon issuance and will expire five years from the date of issuance. For each share of Common Stock issued in this offering, an accompanying Common Warrant will be issued to the purchaser thereof, respectively. The Common Warrants and the Common Warrant Shares have not been registered under the Securities Act and are being offered pursuant to the exemption provided in Section 4(a)(2) of the Securities Act and Rule 506(b) promulgated thereunder. The Common Warrants are not and will not be listed for trading on any national securities exchange. Each purchaser will be an “accredited investor” as such term is defined in Rule 501(a) under the Securities Act. See “Concurrent Private Placement” on page S-11 of this prospectus supplement. |

| |

|

|

| Common stock outstanding after this offering: 1 |

|

1,239,345 shares (assuming none of the Common Warrants issued in the concurrent private placement are exercised). |

| |

|

|

| Use of proceeds: |

|

We intend to use the proceeds from this offering to fund matters related to obtaining FDA approval (including clinical studies related thereto), as well as for other research and development activities, and for general working capital needs. See “Use of Proceeds” on page S-8 of this prospectus supplement. |

| |

|

|

| Risk factors: |

|

You should read the “Risk Factors” section of this prospectus supplement and the accompanying prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our securities. |

| |

|

|

| Nasdaq Capital Market symbol: |

|

“BJDX.” |

| 1 | The

number of shares of Common Stock to be outstanding after this offering is based on 1,023,345 shares of Common Stock outstanding as of

August 4, 2023, and excludes: |

| ● | 35,858

shares of Common Stock issuable upon the exercise of stock options outstanding as of June 30, 2023 at a weighted-average exercise price

of $37.67 per share; |

| ● | 40,594

shares of Common Stock issuable upon the exercise of Common Stock warrants outstanding as of June 30, 2023 at a weighted average exercise

price of $64.80 per share; |

| ● | 124,200

shares of Common Stock issuable upon the exercise of Class A warrants outstanding as of June 30, 2023 at a weighted average exercise

price of $140.00; |

| ● | 3,770

shares of Common Stock issuable upon the exercise of Class B warrants outstanding as of June 30, 2023 at a weighted average exercise

price of $200.00; |

| ● | 13,113

shares of Common Stock available for future issuance under our 2018 Stock Incentive Plan as of June 30, 2023; and |

| ● | 40,377

shares of Common Stock available for grant under the 2021 Stock Incentive Plan as of June 30, 2023. |

Unless

otherwise indicated, all information in this prospectus supplement assumes (i) no exercise of options issued under our stock incentive

plans, (ii) no exercise of warrants, (iii) no exercise of the Common Warrants to be issued to the investors in the concurrent private

placement and (iv) no exercise of the warrants to be issued as compensation to the placement agent (or its designees) for this offering.

RISK

FACTORS

Investing

in our Common Stock involves a high degree of risk. Before investing in our Common Stock, you should carefully consider the risks, uncertainties

and assumptions described below and in the accompanying prospectus, in the section under the heading “Risk Factors” included

in our Annual Report on Form 10-K for our most recent fiscal year, subsequent Quarterly Reports on Form 10-Q, any

amendment or updates thereto reflected in subsequent filings with the SEC, and in other reports we file with the SEC that are incorporated

by reference herein, before making an investment decision. Our business, financial condition, results of operations and future

growth prospects could be materially and adversely affected by any of these risks. In these circumstances, the market price of our Common

Stock could decline, and you may lose all or part of your investment.

Risks

Related to this Offering

We

have broad discretion in how we use the net proceeds of this offering, and we may not use these proceeds effectively or in ways with

which you agree.

Our

management will have broad discretion as to the application of the net proceeds of this offering and could use them for purposes other

than those contemplated at the time of the offering. We intend to use the net proceeds, if any, from this offering for general corporate

purposes, which may include, among other things, the development of the Company’s product candidates, other research and development

activities and for general working capital needs. Our stockholders may not agree with the manner in which our management chooses to allocate

and spend the net proceeds. Moreover, our management may use the net proceeds for corporate purposes that may not increase the market

price of our Common Stock.

You

may experience further dilution if we issue additional equity securities in future fundraising transactions.

To

raise additional capital, we may in the future offer additional shares of our Common Stock or other securities convertible into or exchangeable

for our Common Stock at prices that may not be the same as the price per share in this offering. We may sell shares or other securities

in any other offering at a price per share that is less than the price per share paid by investors in this offering, and investors purchasing

shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional

shares of our Common Stock, or securities convertible or exchangeable into Common Stock, in future transactions may be higher or lower

than the price per share paid by investors in this offering. Further, the exercise of outstanding warrants and equity awards may result

in further dilution of your investment.

A

substantial number of shares of our Common Stock may be sold in this offering and the concurrent private placement, which could cause

the price of our Common Stock to decline.

In

this offering we are selling 216,000 shares of Common Stock. In addition, in the concurrent private placement, we are also selling Common

Warrants to purchase up to 216,000 shares of Common Stock. In the aggregate, excluding the shares of Common Stock issuable pursuant to

the Common Warrants, the shares issued in this offering represent approximately 17.4% of our outstanding Common Stock as of August 4,

2023 after giving effect to the sale of the shares of Common Stock in this offering. This sale and any future sales of a substantial

number of shares of our Common Stock in the public market, or the perception that such sales may occur, could adversely affect the price

of our Common Stock on the Nasdaq Capital Market. We cannot predict the effect, if any, that market sales of those shares of Common Stock

or the availability of those shares of Common Stock for sale will have on the market price of our Common Stock.

We

have no history of paying dividends on our Common Stock, and we do not anticipate paying dividends in the foreseeable future.

We

have not previously paid dividends on our Common Stock. We currently anticipate that we will retain all of our available cash, if any,

for purposes, which may include, among other things, the development of the Company’s product candidates, other research and development

activities and for general working capital needs. Any payment of future dividends will be at the discretion of our board of directors

and will depend upon, among other things, our earnings, financial condition, capital requirements, level of indebtedness, statutory and

contractual restrictions applicable to the payment of dividends and other considerations that our board of directors deems relevant.

Investors must rely on sales of their Common Stock after price appreciation, which may never occur, as the only way to realize a return

on their investment.

USE

OF PROCEEDS

We

estimate that we will receive net proceeds of approximately $1,350,000 from this offering, after deducting the placement agent fees and

estimated offering expenses payable by us and excluding any proceeds we may receive upon exercise of the Common Warrants being offered

in the concurrent private placement and the exercise of the warrants to be issued as compensation to the placement agent for this offering.

We

intend to use the net proceeds from this offering to fund matters related to obtaining FDA approval (including clinical studies related

thereto), as well as for other research and development activities, and for general working capital needs. We may also use a portion

of the net proceeds to acquire or invest in complementary businesses, products and technologies or to fund the development of any such

complementary businesses, products or technologies. We currently have no plans for any such acquisitions.

DIVIDEND

POLICY

We

have never declared or paid any cash dividends on our capital stock. We currently intend to retain earnings, if any, to finance the growth

and development of our business. We do not expect to pay any cash dividends on our common stock in the foreseeable future. Payment of

future dividends, if any, will be at the discretion of our Board of Directors and will depend on our financial condition, results of

operations, capital requirements, restrictions contained in any financing instruments, provisions of applicable law and other factors

our Board of Directors deems relevant.

DESCRIPTION

OF SECURITIES

Common

Stock

We

are offering shares of Common Stock in this offering. As of August 8, 2023, there were 1,023,345 shares of Common Stock issued and outstanding,

held of record by approximately 15 stockholders. See “Description of Our Capital Stock” in our prospectus for more information

regarding our shares of Common Stock. The actual number of stockholders is greater than this number of record holders, and includes stockholders

who are beneficial owners, but whose shares are held in street name by brokers and other nominees.

PLAN

OF DISTRIBUTION

Pursuant

to an engagement letter agreement dated as of August 7, 2023, we have engaged H.C. Wainwright & Co., LLC (“Wainwright”)

to act as our exclusive placement agent in connection with this offering. Under the terms of the engagement letter agreement, Wainwright

has agreed to act as our exclusive placement agent, on a reasonable best efforts basis, in connection with the issuance and sale of our

shares of Common Stock. Therefore, we may not sell the entire amount of shares of Common Stock

being offered. The terms of this offering were subject to market conditions and negotiations between us, Wainwright and prospective investors.

The engagement letter agreement does not give rise to any commitment by Wainwright to purchase or sell any of our shares of Common

Stock, and Wainwright will have no authority to bind us by virtue of the engagement letter agreement. Wainwright may engage sub-agents

or selected dealers to assist with the offering.

Wainwright

proposes to arrange for the sale of the shares of Common Stock we are offering pursuant to this prospectus supplement and accompanying

prospectus to one or more institutional or accredited investors through securities purchase agreements directly between the purchasers

and us. We will only sell to such investors who have entered into the securities purchase agreement with us.

We

expect to deliver the shares of Common stock being offered pursuant to this prospectus supplement and accompanying prospectus on or about

August 28, 2023, subject to satisfaction of customary closing conditions.

Pursuant

to the terms of the securities purchase agreement and subject to certain exceptions, we are prohibited from entering into any agreement

to issue or announcing the issuance or proposed issuance of any shares of Common Stock or securities convertible or exercisable into

Common Stock for a period commencing on the date of this prospectus supplement and expiring 15 days from the closing date of this offering.

Furthermore, we are also prohibited from entering into any agreement to issue Common Stock or Common Stock Equivalent (as defined in

the securities purchase agreement) involving a Variable Rate Transaction (as defined in the securities purchase agreement), subject to

certain exceptions, for a period commencing on the date

of this prospectus supplement and expiring one year from the closing date of this offering. In

addition, our executive officers and directors have agreed to a 15-day “lock-up” with respect to shares of our common stock

and other securities beneficially owned, including securities that are convertible into, or exchangeable or exercisable for, shares of

our common stock. Subject to certain exceptions, during the such lock-up period, our executive officers and directors may not offer,

sell, pledge or otherwise dispose of these securities.

We

have agreed to pay Wainwright a total cash fee equal to 7.0% of the gross proceeds of this offering. We will also pay Wainwright in connection

with this offering a management fee equal to 1.0% of the gross proceeds raised in the offering, $45,000 for non-accountable expenses,

and $15,950 for clearing fees. We estimate the total offering expenses of this offering that will be payable by us, including the cash

fee equal to 7.0% of the gross proceeds of this offering payable to Wainwright, but excluding the other placement agent fees and expenses,

will be approximately $130,000. In addition, we have agreed to issue to Wainwright, or its designees, placement agent warrants to purchase

up to 15,120 shares of Common Stock, which represents 7.0% of the aggregate number of shares of Common Stock purchased in this offeeing.

The placement agent warrants will have substantially the same terms as the Common Warrants, except that the placement agent warrants

will have an exercise price equal to $9.2063 per share, or 125% of the offering price per share, and will have a term of five years from

the commencement of the sales pursuant to this offering.

We

have granted Wainwright a right of first refusal for a period of twelve-months following the closing of this offering to act as our sole

book-running manager, sole underwriter or sole placement agent for any further capital raising transactions undertaken by us.

We

also have granted Wainwright a tail cash fee equal to 7% of the gross proceeds and warrants to purchase shares of Common Stock equal

to 7% of the aggregate number of shares of Common Stock sold in any offering, within twelve months following the termination or expiration

of the engagement letter agreement, to investors whom the placement agent contacted or introduced to us directly or indirectly in connection

with this offering.

We

have agreed to indemnify Wainwright and specified other persons against certain liabilities relating to or arising out of Wainwright’s

activities under the engagement letter agreement and to contribute to payments that Wainwright may be required to make in respect of

such liabilities.

Wainwright

may be deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received by it and

any profit realized on the resale of the securities sold by it while acting as principal might be deemed to be underwriting discounts

or commissions under the Securities Act. As an underwriter, Wainwright would be required to comply with the requirements of the Securities

Act and the Exchange Act, including, without limitation, Rule 415(a)(4) under the Securities Act and Rule 10b-5 and Regulation M under

the Exchange Act. These rules and regulations may limit the timing of purchases and sales of shares of securities by Wainwright acting

as principal. Under these rules and regulations, Wainwright:

| ● | may

not engage in any stabilization activity in connection with our securities; and |

| ● | may

not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other than as permitted

under the Exchange Act, until it has completed its participation in the distribution. |

From

time to time, Wainwright may provide in the future various advisory, investment and commercial banking and other services to us in the

ordinary course of business, for which they have received and may continue to receive customary fees and commissions. However, except

as disclosed in this prospectus, we have no present arrangements with Wainwright for any further services.

Our

Common Stock is listed on The Nasdaq Capital Market under the symbol “BJDX.”

CONCURRENT

PRIVATE PLACEMENT

In

a concurrent private placement, we are selling Common Warrants to purchase up to 216,000 shares of Common Stock. For each share of Common

Stock sold in this offering, an accompanying Common Warrant will be issued to the purchaser thereof, respectively. Each Common Warrant

will be exercisable for one share of Common Stock at an exercise price of $7.24 per share, will be immediately exercisable upon issunace

and will expire five years from the date of issuance. The Common Warrants are being offered for an aggregate purchase price of $27,000,

which amount is included in the aggregate gross proceeds for this offering set forth elsewhere in the prospectus supplement.

The

Common Warrants and the Common Warrant Shares issuable upon the exercise of the Common Warrants are not being registered under the Securities

Act, nor are they being offered pursuant to this prospectus supplement and accompanying prospectus. The Common Warrants and Common Warrant

Shares are being offered pursuant to the exemption provided in Section 4(a)(2) of the Securities Act and Rule 506(b) promulgated thereunder.

Accordingly,

the investors in the concurrent private placement may exercise the Common Warrants and sell the Common Warrant Shares issuable upon the

exercise of such security only pursuant to an effective registration statement under the Securities Act covering the resale of those

shares, an exemption under Rule 144 under the Securities Act or another applicable exemption under the Securities Act or, if and only

if there is no effective registration statement registering the resale of the Common Warrant Shares, or no current prospectus available

for such shares, the investors may exercise the Common Warrants by means of a “cashless exercise.”

If

a Fundamental Transaction (as defined in the Common Warrants) occurs, then the successor entity will succeed to, and be substituted for

us, and may exercise every right and power that we may exercise and will assume all of our obligations under the Common Warrants with

the same effect as if such successor entity had been named in the Common Warrant itself. If holders of shares of our Common Stock are

given a choice as to the securities, cash or property to be received in such a Fundamental Transaction, then the holder shall be given

the same choice as to the consideration it would receive upon any exercise of the Common Warrants following such a Fundamental Transaction.

Additionally, as more fully described in the Common Warrants, in the event of certain Fundamental Transactions, the holders of Common

Warrants will be entitled to receive consideration in an amount equal to the Black Scholes value of the Common Warrants on the date of

consummation of such Fundamental Transaction.

A

holder of Common Warrants will not have the right to exercise any portion thereof if the holder, together with its affiliates, would

beneficially own in excess of 4.99% (or, at the election of a holder prior to the date of issuance, 9.99%) of the number of shares of

our Common Stock outstanding immediately after giving effect to such exercise; provided, however, that upon notice to the Company, the

holder may increase or decrease such beneficial ownership limitation, provided that in no event shall such beneficial ownership limitation

exceed 9.99% and any increase in the beneficial ownership limitation will not be effective until 61 days following notice of such increase

from the holder to us.

Each

purchaser will be an “accredited investor” as such term is defined in Rule 501(a) under the Securities Act.

Except

as otherwise provided in the Common Warrants or by virtue of such holder’s ownership of shares of our Common Stock, the holders

of the Common Warrants do not have the rights or privileges of holders of our Common Stock, including any voting rights, until they exercise

their Common Warrants, as applicable.

The

Common Warrants are not and will not be listed for trading on any national securities exchange.

LEGAL

MATTERS

Certain

legal matters relating to the issuance of the securities offered hereby will be passed upon for us by Hogan Lovells US LLP.

EXPERTS

The

consolidated financial statements as of December 31, 2022 and 2021 and for the years then ended incorporated by reference in this prospectus

have been so incorporated in reliance on the report of Wolf & Company, P.C., an independent registered public accounting firm, as

stated in their report appearing elsewhere herein, and upon their authority as experts in accounting and auditing.

Where

You Can Find More Information

We

file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains an Internet website

at http://www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically

with the SEC. Our reports on Forms 10-K, 10-Q and 8-K, and amendments to those reports, are also available for download, free of charge,

as soon as reasonably practicable after these reports are filed with, or furnished to, the SEC, at our website at www.bluejaydx.com.

Information contained on or accessible through our website is not a part of this prospectus, and the inclusion of our website address

in this prospectus is an inactive textual reference only.

We

have filed a registration statement, of which this prospectus is a part, covering the securities offered hereby. As allowed by SEC rules,

this prospectus does not include all of the information contained in the registration statement and the included exhibits, financial

statements and schedules. You are referred to the registration statement, the included exhibits, financial statements and schedules for

further information. You should review the information

and exhibits in the registration statement for further information about us and our subsidiaries and the securities we are offering.

Statements in this prospectus concerning any document we filed as an exhibit to the registration statement or that we otherwise filed

with the SEC are not intended to be comprehensive and are qualified by reference to these filings. You should review the complete document

to evaluate these statements.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC allows us to “incorporate by reference” the information we have filed with them, which means that we can disclose important

information to you by referring you to those documents. The information we incorporate by reference is an important part of this prospectus

supplement, and information that we file later with the SEC will automatically update and supersede this information. The documents we

are incorporating by reference are:

| ● | our

Annual

Report on Form 10-K for the year ended December 31, 2022 (filed with the SEC on

March 20, 2023), as amended by Amendment No. 1 thereto (filed with the SEC on May 1, 2023); |

| ● | Our

Quarterly Reports on Form 10-Q for the quarter ended March

31, 2023 (filed with the SEC on May 11, 2023) and for the quarter ended June

30, 2023 (filed with the SEC on August 14, 2023); |

| ● | our

Current Reports on Form 8-K filed with the SEC on January 27, 2023, April 27, 2023, May 19, 2023, June 20, 2023, July 21, 2023 and August 10, 2023; |

| ● | The

description of our Common Stock, par value $0.0001 per share contained in its Registration

Statement on Form 8-A, dated and filed with the SEC on November 5, 2021, as amended by the

description of our common stock contained in Exhibit 4.6 to our Annual Report on Form 10-K for the year ended December 31,

2022, including all amendments and reports updating that description. |

We

are not, however, incorporating, in each case, any documents or information that we are deemed to furnish and not file in accordance

with SEC rules.

Any

statement contained in any document incorporated by reference herein will be deemed to be modified or superseded for purposes of this

prospectus to the extent that a statement contained in this prospectus or any prospectus supplement modifies or supersedes such statement.

Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

All

reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the

termination of this offering, including all such documents we may file with the SEC after the date of the initial registration statement

and prior to the effectiveness of the registration statement, but excluding any information furnished to, rather than filed with, the

SEC, will also be incorporated by reference into this prospectus and deemed to be part of this prospectus from the date of the filing

of such reports and documents.

We

will provide without charge to each person, including any beneficial owner, to whom this prospectus is delivered, upon written or oral

request, a copy of any or all documents that are incorporated by reference into this prospectus, but not delivered with the prospectus,

other than exhibits to such documents unless such exhibits are specifically incorporated by reference into the documents that this prospectus

incorporates. You should direct oral or written requests by one of the following methods. Attention: Investor Relations, Bluejay Diagnostics,

Inc., 360 Massachusetts Avenue, Suite 203, Acton, MA, 01720, (844) 327-7078. You may also access these documents, free of charge on the

SEC’s website at www.sec.gov or on the “Investors” page of our website at www.bluejaydx.com. The information found

on our website, or that may be accessed by links on our website, is not part of this prospectus. We have included our website address

solely as an inactive textual reference. Investors should not rely on any such information in deciding whether to purchase our Common

Stock.

PROSPECTUS

$25,000,000

Debt Securities

Common Stock

Preferred Stock

Depository Shares

Warrants

Rights

Units

We may offer and sell up to $25,000,000 in the

aggregate of the securities identified above from time to time in one or more offerings. This prospectus provides a general description

of the securities that we may offer. Each time that we offer securities under this prospectus, we will provide the specific terms of the

securities offered, including the public offering price, in a supplement to this prospectus. Any prospectus supplement may add to, update

or change information contained in this prospectus. You should read this prospectus and any applicable prospectus supplement together

with additional information described under the heading “Where You Can Find More Information” before you make your investment

decision.

The securities may be sold by us to or through

underwriters or dealers, directly to purchasers or through agents designated from time to time. For additional information on the methods

of sale, you should refer to the section entitled “Plan of Distribution” in this prospectus and the comparable section of

any applicable prospectus supplement. If any underwriters are involved in the sale of the securities with respect to which this prospectus

is being delivered, the names of such underwriters and any applicable discounts or commissions and over-allotment options will be set

forth in the applicable prospectus supplement. No securities may be sold without delivery of this prospectus and the applicable prospectus

supplement.

Our common stock trades on the Nasdaq Capital

Market, or Nasdaq, under the ticker symbol “BJDX.” On June 5, 2023, the last reported sale price per share of our common stock

was $0.244 per share.

INVESTING IN OUR SECURITIES INVOLVES A HIGH

DEGREE OF RISK. RISKS ASSOCIATED WITH AN INVESTMENT IN OUR SECURITIES WILL BE DESCRIBED IN THE APPLICABLE PROSPECTUS SUPPLEMENT AND CERTAIN

OF OUR FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION INCORPORATED BY REFERENCE INTO THIS PROSPECTUS, AS DESCRIBED UNDER “RISK

FACTORS” ON PAGE 4.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus.

Any representation to the contrary is a criminal offense.

The date of this prospectus is June 20,

2023.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is a part of a registration statement

that we filed with the Securities and Exchange Commission, or the SEC, and that includes exhibits that provide more detail of the matters

discussed in this prospectus, using a “shelf” registration process. Under this shelf registration process, we may offer to

sell any of the securities, or any combination of the securities, described in this prospectus, in each case in one or more offerings,

up to a total dollar amount of $25,000,000. You should read this prospectus and the related exhibits filed with the SEC using a “shelf”

registration process, together with the additional information described under the headings “Where You Can Find More Information”

and “Incorporation by Reference” before making your investment decision.

You should rely only on the information provided

in this prospectus or in a prospectus supplement or any free writing prospectuses or amendments thereto. We have not authorized anyone

else to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely

on it. You should assume that the information in this prospectus is accurate only as of the date hereof. Our business, financial condition,

results of operations and prospects may have changed since that date.

We are not offering to sell or seeking offers

to purchase these securities in any jurisdiction where the offer or sale is not permitted. We have not done anything that would permit

this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than

in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and

observe any restrictions relating to, the offering of the securities as to distribution of the prospectus outside of the United States.

Unless the context otherwise requires, references

in this prospectus to “Bluejay,” “the Company,” “we,” “us” and “our” refer

to Bluejay Diagnostics, Inc. Our logo and all product names are our common law trademarks. Solely for convenience, trademarks and tradenames

referred to in this prospectus may appear without the ® or ™ symbols, but such references are not intended to indicate in any

way that we will not assert, to the fullest extent under applicable law, our rights, or that the applicable owner will not assert its

rights, to these trademarks and tradenames.

INDUSTRY AND MARKET DATA

This prospectus contains estimates, projections

and other information concerning our industry, our business, the science of our products and the markets for our products, including data

regarding the incidence of certain medical conditions and the scientific basis of our products. We obtained the industry, science, market

and similar data set forth in this prospectus from our internal estimates and research and from academic and industry research, publications,

surveys, and studies conducted by third parties.

The content of the above sources, except to the

extent specifically set forth in this prospectus, does not constitute a portion of this prospectus and is not incorporated herein. Information

that is based on estimates, forecasts, projections, market research, scientific research, or similar methodologies is inherently subject

to uncertainties and actual events or circumstances may differ materially from events and circumstances that are assumed in this information.

FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated

herein by reference contain forward-looking statements which are made pursuant to the safe harbor provisions of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. In some

cases, you can identify these statements by forward-looking words such as “may,” “might,” “should,”

“would,” “could,” “expect,” “plan,” “anticipate,” “intend,” “believe,”

“estimate,” “predict,” “potential” or “continue,” and the negative of these terms and

other comparable terminology. These forward-looking statements, which are subject to known and unknown risks, uncertainties and assumptions

about us, may include projections of our future financial performance based on our growth strategies and anticipated trends in our business.

These statements are only predictions based on our current expectations and projections about future events. There are important factors

that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity,

performance or achievements expressed or implied by the forward-looking statements.

While we believe we have identified material risks,

these risks and uncertainties are not exhaustive. Other sections of this prospectus and the documents incorporated herein by reference

may describe additional factors that could adversely impact our business and financial performance. Moreover, we operate in a very competitive

and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible to predict all risks and

uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors,

may cause actual results to differ materially from those contained in any forward-looking statements.

Although we believe the expectations reflected

in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance or achievements.

Moreover, neither we nor any other person assumes responsibility for the accuracy or completeness of any of these forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. We are under no duty to update any of these forward-looking

statements after the date of this prospectus to conform our prior statements to actual results or revised expectations, and we do not

intend to do so.

We caution you not to place undue reliance on

the forward-looking statements, which speak only as of the date of this prospectus in the case of forward-looking statements contained

in this prospectus.

You should not rely upon forward-looking statements

as predictions of future events. Our actual results and financial condition may differ materially from those indicated in the forward-looking

statements. We qualify all of our forward-looking statements by these cautionary statements. Although we believe that the expectations

reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

Therefore, you should not rely on any of the forward-looking statements. In addition, with respect to all of our forward-looking statements,

we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of

1995.

THE COMPANY

Overview

We are a medical diagnostics company developing

rapid tests using whole blood on our Symphony technology platform, or Symphony, to improve patient outcomes in critical care settings.

Our Symphony platform is a combination of our intellectual property, or IP, and exclusively licensed and patented IP that consists of

a mobile device and single-use test cartridges that if cleared, authorized, or approved by the U.S. Food and Drug Administration, or the

FDA, can provide a solution to a significant market need in the United States. Clinical trials indicate the Symphony device produces laboratory-quality

results in less than 20 minutes in critical care settings, including intensive care units and emergency rooms where rapid and reliable

results are required.

Our first product, the Symphony IL-6 test, is

for the monitoring of disease progression in critical care settings. IL-6 is a clinically established inflammatory biomarker, and is considered

a ‘first-responder,’ for assessment of severity of infection and inflammation across many disease indications, including sepsis.

A current challenge of healthcare professionals is the excessive time and cost associated determining a patient’s level of severity

at triage and our Symphony IL-6 test has the ability to consistently monitor this critical care biomarker with rapid results.

In the future we plan to develop additional tests

for Symphony including two cardiac biomarkers (hsTNT and NT pro-BNP) as well as other tests using the Symphony platform. We do not yet

have regulatory clearance for our Symphony products, and our Symphony products will need to receive regulatory authorization from the

FDA in order to be marketed as a diagnostic product in the United States.

Our operations to date have been funded primarily

through the proceeds of our initial public offering, or the IPO, in November 2021, or the IPO Date. We were incorporated under the laws

of Delaware on March 20, 2015. Our headquarters is located in Acton, Massachusetts.

Our Market

The Symphony platform and our initial biomarker

test, Symphony IL-6 test, is well suited to address a subset of the global in vitro diagnostics devices, or IVDs, market, including

sepsis, cardio-metabolic diseases, cancer and other diseases that require rapid tests. Symphony targets critical care markets where physicians

must quickly determine patient acuity to identify optimal treatment regimens.

Our Business Model

Our goal is to become the first provider of rapid

tests for infectious, inflammatory and metabolic diseases by leveraging the strengths of our Symphony platform. We intend to target our

sales and marketing of Symphony to the largest critical care facilities in the United States. Our business model includes the following:

| ● | Attractive Financing Model. We intend to offer

various financing options for the device itself. As such, our business model should not require customers to incur a significant capital

outlay. |

| ● | Recurring Revenue. We intend to sell single-use

diagnostic test cartridges. We believe that our cartridges can create a growing and recurring revenue stream, as adoption and utilization

increases, and as we develop tests for additional indications. We expect the sale of test cartridges to generate the majority of our revenue

and gross profit. |

| ● | Expand our Menu of Diagnostic Products. As adoption

increases, the average customer use of the Symphony platform should also increase. As we expand our test menu, we hope to be able to increase

our annual revenue per customer through the resulting increase in utilization. |

The Symphony Platform

The Symphony platform is an innovative and proprietary

technology platform that provides rapid and accurate measurements of key diagnostic biomarkers found in whole blood. Symphony is compact

and can be deployed mobile as compared to current laboratory diagnostic platforms. Symphony incorporates a user-friendly interface where

all sample preparation and reagents are integrated into disposable Symphony cartridges. Symphony only requires a few drops of blood to

provide a measurement in less than 20 minutes.

The Symphony analyzer orchestrates whole blood

processing, biomarker isolation, and immunoassay preparation using non-contact centrifugal force. All necessary reagents and components

are integrated into the Symphony cartridges. Utilizing precision microchannel technology and high specificity antibodies, whole blood

is processed, and the biomarker is isolated within the Symphony cartridge. Intermitted centrifugation cycles enable complex fluid movements,

allowing sequential reagent additions and independent reaction steps inside the hermitically sealed Symphony cartridge. At the conclusion

of the test, the Symphony analyzer measures the fluorescence signature correlating to a highly sensitive quantitation of the biomarker.

To perform a Symphony test, the test operator

adds three drops of blood to the Symphony cartridge. After scanning in the patient ID, the Symphony cartridge is inserted into the Symphony

analyzer and the test runs automatically. Each analyzer can run up to six cartridges simultaneously, either with six different patient

samples or six different tests, in less than 20 minutes, providing quantitative measurements used for improved patient management and

clinical decision-making.

Manufacturing

We plan to manufacture both our devices and cartridges

through Contract Manufacturing Organizations, or CMOs. We have contracts with Toray Industries, Inc, or Toray, to manufacture our cartridges

and Sanyoseiko Co. Ltd., or Sanyoseiko, to manufacture both our device and cartridges. Each of our partners are well-established global

manufacturing companies with capabilities to scale up, re-design and supply our devices and cartridges.

Sanyoseiko had been selected as our CMO, though

in the near-term Toray will continue to develop, validate and manufacture our IL-6 cartridges as our pilot-manufacturing partner. We expect

to meet the demands of our global market. Both Toray’s and Sanyoseiko’s facilities are located in Japan. We license the technology

for the Symphony cartridges from Toray. Our license grants us exclusive global use with the exception of Japan.

Regulatory Strategy

Our current regulatory strategy is designed to

support commercialization of Symphony in the United States pending authorization from the FDA. The FDA has identified Symphony as a de

novo device, and we are subject to the de novo authorization regulatory pathway, which includes expansion of our clinical studies.

We have several clinical studies currently active, all designed to support our de novo FDA submission. We have targeted large,

well-known medical and academic institutions for our studies, which should also help support initial commercialization and market penetration.

This clinical trial expansion could also support additional indications. The expansion also could delay obtaining marketing authorization

for the product.

Sales and Marketing

Until Symphony products are authorized by the

FDA, we expect to focus our sales and marketing efforts on brand awareness and market education to potential customers, emphasizing the

value of monitoring a critical care patient’s IL-6 levels to improve decision making and patient outcomes. If cleared or approved

by the FDA, we intend to target sales to ERs and ICUs at United States hospitals, as well as to long-term acute care facilities. We plan

to establish a market presence by selling Symphony devices and tests both directly and through various distribution channels to maximize

sales volume and market penetration.

License Agreement

On October 6, 2020, we entered into a License

and Supply Agreement, as amended, or the License Agreement, with Toray, providing us with an exclusive global license with Toray, excluding

Japan, to use their patents and know-how related to the Symphony detection cartridges for the manufacturing, marketing and sale of the

products (as defined in the License Agreement). We also have a nonexclusive license for the same purposes in Japan. The agreement terminates

in 2029 upon expiration of the last of the patents included in the license.

In connection with entering into the License Agreement,

we are required to pay a 15% royalty fee for the period that any underlying patents exist or for five years after the first sale for the

licensed technology after obtaining regulatory approval based on a percentage of our “Net Sales” of products using these technologies

(as defined in the license Agreement) with a minimum royalty of $60,000 for the initial year that royalties are payable increasing to

a minimum of $100,000 thereafter.

Intellectual Property, Proprietary Technology

We do not currently hold any patents directly.

We rely on a combination either directly or through the License Agreement with Toray of patent, copyright, trade secret, trademark, confidentiality

agreements, and contractual protection to establish and protect our proprietary rights.

Competition

Our primary competition in the IL-6 market is

laboratory size equipment including the Roche Cobas®, Siemens ADVIA Centaur® and Beckman Coulter Access

2®, which require pre-processing of whole blood prior to performing their test. We believe that our technology, which uses

whole blood, provides us with a substantial competitive advantage over our existing competition that will sustain through commercialization,

despite the major life science companies and consistent entry of innovative start-ups that define our competitive landscape.

Employees

As of June 5, 2023, we have 14 full-time employees.

We also contract with several consultants and contractors performing regulatory advisory, investor relations and manufacturing scale-up

support. None of our employees are represented by labor unions or covered by collective bargaining agreements.

Available Information

Our principal executive offices are located at

360 Massachusetts Avenue, Suite 203, Acton, MA 01720 and our telephone number is (844) 327-7078. Our website address is www.bluejaydx.com.

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports, proxy

statements and other information about us are made available, free of charge, through the SEC Filings section of our website at www.ir.bluejaydx.com/financial-information/sec-filings

and at the SEC’s website at www.sec.gov as soon as reasonably practicable after such material is electronically filed with or furnished

to the SEC. We include our website address in this prospectus only as an inactive textual reference and do not intend it to be an active

link to our website. The contents of our website are not incorporated into this prospectus.

In addition, our Board of Directors has adopted

a written Code of Business Conduct and Ethics applicable to all officers, directors and employees, which is available through the “Governance

Overview” section of our website at www.ir.bluejaydx.com/corporate-governance/governance-overview. We intend to satisfy the disclosure

requirement under Item 5.05 of Form 8-K regarding amendment to, or waiver from, a provision of the Code of Business Conduct and Ethics

and by posting such information on the website address and location specified above.

RISK FACTORS

Our business is influenced by many factors that

are difficult to predict, and that involve uncertainties that may materially affect actual operating results, cash flows and financial

condition. Before making an investment decision, you should carefully consider these risks, including those set forth in the “Risk

Factors” section of our most recent Annual

Report on Form 10-K filed with the SEC, as revised or supplemented by our Quarterly Reports on Form 10-Q filed with the SEC since