0001132509false--12-312023-06-30Q220230.0015000000001776875351966651270.001175000000113500001111111100011325092023-01-012023-06-300001132509nnax:MajorvendorMember2023-04-012023-06-300001132509nnax:MajorvendorMember2022-01-012022-06-300001132509nnax:MajorvendorMember2023-01-012023-06-300001132509nnax:MajorvendorMember2022-04-012022-06-300001132509nnax:MajorCustomersMember2023-04-012023-06-300001132509nnax:MajorCustomersMember2023-01-012023-06-300001132509nnax:MajorvendorMember2022-06-300001132509nnax:MajorvendorMember2023-06-300001132509nnax:MajorCustomersMember2023-06-300001132509nnax:MajorCustomersMember2022-04-012022-06-300001132509nnax:MajorCustomersMember2022-06-300001132509nnax:MajorCustomersMember2022-01-012022-06-300001132509nnax:ShareholderMember2023-04-012023-06-300001132509srt:DirectorMember2023-04-012023-06-300001132509srt:DirectorMember2023-01-012023-06-300001132509nnax:ShareholderMember2022-01-012022-06-300001132509nnax:ShareholderMember2023-01-012023-06-300001132509nnax:ShareholderMember2022-04-012022-06-300001132509srt:DirectorMember2022-04-012022-06-300001132509srt:DirectorMember2022-01-012022-06-300001132509nnax:SinceFebruaryOneTwoZeroOneSixMembernnax:CooperationPartnershipWithJjExplorerMember2023-06-300001132509nnax:SinceFebruaryOneTwoZeroOneSixMembernnax:CooperationPartnershipWithJjExplorerMember2023-01-012023-06-300001132509country:HK2023-01-012023-06-300001132509country:SG2023-01-012023-06-300001132509country:SG2022-12-310001132509country:SG2023-06-300001132509country:HK2022-12-310001132509country:HK2023-06-300001132509country:US2022-12-310001132509country:US2023-06-300001132509nnax:HongKongsMember2022-01-012022-06-300001132509nnax:HongKongsMember2023-01-012023-06-300001132509nnax:SingapooreMember2022-01-012022-06-300001132509nnax:SingapooreMember2023-01-012023-06-300001132509country:US2022-01-012022-06-300001132509country:US2023-01-012023-06-300001132509nnax:StockIncentiveOptionPlanMember2023-01-012023-06-300001132509nnax:StockIncentiveOptionPlanMember2020-10-140001132509nnax:StockIncentiveOptionPlanMember2022-12-310001132509nnax:StockIncentiveOptionPlanMember2023-06-300001132509nnax:SecuritiesPurchaseAgreementMember2023-01-012023-06-300001132509nnax:SecuritiesPurchaseAgreementMember2022-09-012022-09-020001132509nnax:SecuritiesPurchaseAgreementMember2022-08-012022-08-040001132509nnax:SecuritiesPurchaseAgreementMember2022-09-012022-09-200001132509nnax:SecuritiesPurchaseAgreementMember2022-05-012022-05-180001132509nnax:SecuritiesPurchaseAgreementMember2022-05-180001132509nnax:SecuritiesPurchaseAgreementMember2022-08-040001132509nnax:SecuritiesPurchaseAgreementMember2022-09-020001132509nnax:SecuritiesPurchaseAgreementMember2023-06-300001132509nnax:SecuritiesPurchaseAgreementMember2022-09-2000011325092023-06-012023-06-0900011325092023-03-012023-03-2100011325092023-03-012023-03-1500011325092023-01-012023-01-0600011325092022-11-302022-12-0100011325092023-06-0900011325092023-01-0600011325092022-12-0100011325092023-03-1500011325092023-03-210001132509nnax:JPOPCOINLimitedMember2023-01-012023-06-300001132509nnax:NewMomentumAsiaPteLtdMember2023-01-012023-06-300001132509nnax:BeyondBlueLimitedMember2023-01-012023-06-300001132509nnax:GagfareLimitedMember2023-01-012023-06-300001132509nnax:NemoHoldingCompanyalimitedMember2023-01-012023-06-300001132509us-gaap:RetainedEarningsMember2023-06-300001132509us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001132509us-gaap:AdditionalPaidInCapitalMember2023-06-300001132509us-gaap:CommonStockMember2023-06-300001132509nnax:SeriesAPreferredStocksMember2023-06-300001132509us-gaap:RetainedEarningsMember2023-04-012023-06-300001132509us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001132509us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001132509us-gaap:CommonStockMember2023-04-012023-06-300001132509nnax:SeriesAPreferredStocksMember2023-04-012023-06-3000011325092023-03-310001132509us-gaap:RetainedEarningsMember2023-03-310001132509us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001132509us-gaap:AdditionalPaidInCapitalMember2023-03-310001132509us-gaap:CommonStockMember2023-03-310001132509nnax:SeriesAPreferredStocksMember2023-03-3100011325092023-01-012023-03-310001132509us-gaap:RetainedEarningsMember2023-01-012023-03-310001132509us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001132509us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001132509us-gaap:CommonStockMember2023-01-012023-03-310001132509nnax:SeriesAPreferredStocksMember2023-01-012023-03-310001132509us-gaap:RetainedEarningsMember2022-12-310001132509us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001132509us-gaap:AdditionalPaidInCapitalMember2022-12-310001132509us-gaap:CommonStockMember2022-12-310001132509nnax:SeriesAPreferredStocksMember2022-12-310001132509us-gaap:RetainedEarningsMember2022-06-300001132509us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300001132509us-gaap:AdditionalPaidInCapitalMember2022-06-300001132509us-gaap:CommonStockMember2022-06-300001132509nnax:SeriesAPreferredStocksMember2022-06-300001132509us-gaap:RetainedEarningsMember2022-04-012022-06-300001132509us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-300001132509us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300001132509us-gaap:CommonStockMember2022-04-012022-06-300001132509nnax:SeriesAPreferredStocksMember2022-04-012022-06-3000011325092022-03-310001132509us-gaap:RetainedEarningsMember2022-03-310001132509us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310001132509us-gaap:AdditionalPaidInCapitalMember2022-03-310001132509us-gaap:CommonStockMember2022-03-310001132509nnax:SeriesAPreferredStocksMember2022-03-3100011325092022-01-012022-03-310001132509us-gaap:RetainedEarningsMember2022-01-012022-03-310001132509us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-310001132509us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310001132509us-gaap:CommonStockMember2022-01-012022-03-310001132509nnax:SeriesAPreferredStocksMember2022-01-012022-03-310001132509us-gaap:RetainedEarningsMember2021-12-310001132509us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001132509us-gaap:AdditionalPaidInCapitalMember2021-12-310001132509us-gaap:CommonStockMember2021-12-310001132509nnax:SeriesAPreferredStocksMember2021-12-3100011325092022-06-3000011325092021-12-3100011325092022-01-012022-06-3000011325092022-04-012022-06-3000011325092023-04-012023-06-300001132509nnax:ClassAPreferredStockMember2023-06-300001132509nnax:ClassAPreferredStockMember2022-12-3100011325092022-12-3100011325092023-06-3000011325092023-08-09iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:purennax:integer

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(MARK ONE)

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the quarterly period ended June 30, 2023 |

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the transition period from ____________ to ___________ |

Commission File No. 000-52273

NEW MOMENTUM CORPORATION |

(Exact name of registrant as specified in its charter) |

Nevada | | 88-0435998 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

150 Cecil Street #08-01 Singapore 069543

(Address of principal executive offices, zip code)

+65 3105 1428

(Registrant’s telephone number, including area code)

___________________________________________________________

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Indicate by check mark whether the issuer (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (check one):

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated Filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2 of the Exchange Act): Yes ☐ No ☒

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

APPLICABLE ONLY TO CORPORATE ISSUERS

As of August 9, 2023, there were 203,972,819 shares of common stock, $0.001 par value per share, outstanding.

NEW MOMENTUM CORPORATION

QUARTERLY REPORT ON FORM 10-Q

FOR THE PERIOD ENDED JUNE 30, 2023

INDEX

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q of New Momentum Corporation, a Nevada corporation (the “Company”), contains “forward-looking statements,” as defined in the United States Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by terminology such as “may”, “will”, “should”, “could”, “expects”, “plans”, “intends”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of such terms and other comparable terminology. These forward-looking statements include, without limitation, statements about our market opportunity, our strategies, competition, expected activities and expenditures as we pursue our business plan, and the adequacy of our available cash resources. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Actual results may differ materially from the predictions discussed in these forward-looking statements. The economic environment within which we operate could materially affect our actual results. Additional factors that could materially affect these forward-looking statements and/or predictions include, among other things to product demand, market and customer acceptance, competition, pricing, the exercise of the control over us by Leung Tin Lung David, the Company’s sole director and majority shareholder, and development difficulties, as well as general industry and market conditions and growth rates and general economic conditions; and other factors discussed in the Company’s filings with the Securities and Exchange Commission (“SEC”).

Our management has included projections and estimates in this Form 10-Q, which are based primarily on management’s experience in the industry, assessments of our results of operations, discussions and negotiations with third parties and a review of information filed by our competitors with the SEC or otherwise publicly available. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS.

NEW MOMENTUM CORPORATION

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

AS OF JUNE 30, 2023 AND DECEMBER 2022

(Currency expressed in United States Dollars (“US$”), except for number of shares)

| | As of June 30, | | | As of December 31, | |

| | 2023 | | | 2022 | |

| | | | | (Audited) | |

ASSETS | | | | | | |

Current assets: | | | | | | |

Cash and cash equivalents | | $ | 37,627 | | | $ | 59,247 | |

Accounts receivable | | | 5,132 | | | | 24,205 | |

Deposits, prepayments and other receivables | | | 19,549 | | | | 31,657 | |

| | | | | | | | |

Total current assets | | | 62,308 | | | | 115,109 | |

| | | | | | | | |

Non-current asset: | | | | | | | | |

Right-of-use assets | | | 40,038 | | | | - | |

| | | | | | | | |

TOTAL ASSETS | | $ | 102,346 | | | $ | 115,109 | |

| | | | | | | | |

LIABILTIES AND SHAREHOLDERS’ DEFICIT | | | | | | | | |

Current liabilities: | | | | | | | | |

Accounts payable | | $ | 10,626 | | | $ | 17,191 | |

Accrued liabilities and other payables | | | 108,406 | | | | 87,232 | |

Amount due to a director | | | 305,289 | | | | 231,223 | |

Amount due to a shareholder | | | 75,859 | | | | 54,259 | |

Lease liabilities | | | 26,683 | | | | - | |

Convertible promissory notes, net | | | 167,789 | | | | 209,652 | |

| | | | | | | | |

Total current liabilities | | | 694,652 | | | | 599,557 | |

| | | | | | | | |

Non-Current liabilities: | | | | | | | | |

Lease liabilities | | | 13,849 | | | | - | |

| | | | | | | | |

TOTAL LIABILITIES | | | 708,501 | | | | 599,557 | |

| | | | | | | | |

Commitments and contingencies | | | - | | | | - | |

| | | | | | | | |

SHAREHOLDERS’ DEFICIT | | | | | | | | |

Preferred stock, Class A, $0.001 par value; 175,000,000 shares authorized; 1 share issued and outstanding as at June 30, 2023 and December 31, 2022 respectively | | | - | | | | - | |

Common stock, $0.001 par value; 500,000,000 shares authorized; 196,665,127 shares and 177,687,535 shares issued and outstanding as at June 30, 2023 and December 31, 2022, respectively | | | 196,665 | | | | 177,688 | |

Additional paid in capital | | | 4,400,116 | | | | 4,369,093 | |

Accumulated other comprehensive income | | | 632 | | | | 232 | |

Accumulated deficit | | | (5,203,568 | ) | | | (5,031,461 | ) |

| | | | | | | | |

Shareholders’ deficit | | | (606,155 | ) | | | (484,448 | ) |

| | | | | | | | |

TOTAL LIABILITIES AND SHAREHOLDERS’ DEFICIT | | $ | 102,346 | | | $ | 115,109 | |

See accompanying notes to unaudited condensed consolidated financial statements.

NEW MOMENTUM CORPORATION

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2023 AND 2022

(Currency expressed in United States Dollars (“US$”))

| | Three Months ended June 30, | | | Six Months ended June 30, | |

| | 2023 | | | 2022 | | | 2023 | | | 2022 | |

| | | | | | | | | | | | |

Revenue, net | | $ | 56,286 | | | $ | 299,068 | | | $ | 180,767 | | | $ | 299,070 | |

| | | | | | | | | | | | | | | | |

Cost of revenue | | | (56,045 | ) | | | (297,891 | ) | | | (180,438 | ) | | | (297,891 | ) |

| | | | | | | | | | | | | | | | |

Gross profit | | | 241 | | | | 1,177 | | | | 329 | | | | 1,179 | |

| | | | | | | | | | | | | | | | |

Operating expenses: | | | | | | | | | | | | | | | | |

General and administrative expenses | | | (30,741 | ) | | | (25,025 | ) | | | (58,645 | ) | | | (51,355 | ) |

Legal and professional fee | | | (45,340 | ) | | | (5,406 | ) | | | (98,447 | ) | | | (11,490 | ) |

Total operating expenses | | | (76,081 | ) | | | (30,431 | ) | | | (157,092 | ) | | | (62,485 | ) |

| | | | | | | | | | | | | | | | |

Other (expense) income: | | | | | | | | | | | | | | | | |

Interest expense | | | (7,649 | ) | | | (1,115 | ) | | | (15,527 | ) | | | (1,115 | ) |

Interest income | | | 135 | | | | 1 | | | | 183 | | | | 1 | |

Sundry income | | | - | | | | 1,244 | | | | - | | | | 14,057 | |

Total other (expense) income | | | (7,514 | ) | | | 130 | | | | (15,344 | ) | | | 12,943 | |

| | | | | | | | | | | | | | | | |

LOSS BEFORE INCOME TAXES | | | (83,354 | ) | | | (29,124 | ) | | | (172,107 | ) | | | (48,723 | ) |

| | | | | | | | | | | | | | | | |

Income tax expense | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | |

NET LOSS | | | (83,354 | ) | | | (29,124 | ) | | | (172,107 | ) | | | (48,723 | ) |

| | | | | | | | | | | | | | | | |

Other comprehensive income: | | | | | | | | | | | | | | | | |

Foreign currency translation (loss) gain | | | (475 | ) | | | (5 | ) | | | 400 | | | | 1,104 | |

| | | | | | | | | | | | | | | | |

COMPREHENSIVE LOSS | | $ | (83,829 | ) | | $ | (29,129 | ) | | $ | (171,707 | ) | | $ | (47,619 | ) |

| | | | | | | | | | | | | | | | |

Weighted average shares outstanding – Basic and diluted | | | 187,400,150 | | | | 219,614,098 | | | | 187,400,150 | | | | 219,614,098 | |

| | | | | | | | | | | | | | | | |

Net loss per share – Basic and diluted | | $ | (0.00 | ) | | $ | (0.00 | ) | | $ | (0.00 | ) | | $ | (0.00 | ) |

See accompanying notes to unaudited condensed consolidated financial statements.

NEW MOMENTUM CORPORATION

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE SIX MONTHS ENDED JUNE 30, 2023 AND 2022

(Currency expressed in United States Dollars (“US$”))

| | Six months ended June 30, | |

| | 2023 | | | 2022 | |

| | | | | | |

Cash flows from operating activities: | | | | | | |

Net loss | | $ | (172,107 | ) | | $ | (48,723 | ) |

Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | | |

Amortization of convertible note discount | | | 8,137 | | | | 452 | |

Depreciation of right-of-use assets | | | 13,338 | | | | - | |

Non-cash lease expense | | | 1,201 | | | | (304 | ) |

Non-cash financing cost | | | 7,390 | | | | 663 | |

| | | | | | | | |

Change in operating assets and liabilities: | | | | | | | | |

Accounts receivable | | | 19,073 | | | | 14,938 | |

Deposits, prepayments and other receivables | | | 12,108 | | | | (14,096 | ) |

Accounts payable | | | (6,565 | ) | | | 18,455 | |

Accrued liabilities and other payables | | | 13,784 | | | | 8,679 | |

Net cash used in operating activities | | | (103,641 | ) | | | (19,936 | ) |

| | | | | | | | |

Cash flows from financing activities: | | | | | | | | |

Advance from a director | | | 74,066 | | | | 8,733 | |

Advance from a shareholder | | | 21,600 | | | | - | |

Proceed from issuance of convertible note | | | - | | | | 65,000 | |

Payment of lease liabilities | | | (14,044 | ) | | | - | |

| | | | | | | | |

Net cash provided by financing activities | | | 81,622 | | | | 73,733 | |

| | | | | | | | |

Effect on exchange rate change on cash and cash equivalents | | | 399 | | | | 1,101 | |

| | | | | | | | |

Net change in cash and cash equivalents | | | (21,620 | ) | | | 54,898 | |

| | | | | | | | |

BEGINNING OF PERIOD | | | 59,247 | | | | 15,609 | |

| | | | | | | | |

END OF PERIOD | | $ | 37,627 | | | $ | 70,507 | |

| | | | | | | | |

SUPPLEMENTAL DISCLOSURE OF CASH FLOWS INFORMATION | | | | | | | | |

Cash paid for tax | | $ | - | | | $ | - | |

Cash paid for interest | | $ | - | | | $ | - | |

See accompanying notes to unaudited condensed consolidated financial statements.

NEW MOMENTUM CORPORATION

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ DEFICIT

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2023 AND 2022

(Currency expressed in United States Dollars (“US$”), except for number of shares)

| | Preferred Stock Class A | | | Common Stock | | | Additional paid | | | Accumulated other comprehensive | | | Accumulated | | | Total shareholders’ | |

| | No. of shares | | | Amount | | | No. of shares | | | Amount | | | in capital | | | losses | | | deficit | | | deficit | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Balance as at January 1, 2022 | | | 1 | | | $ | - | | | | 176,168,548 | | | $ | 176,169 | | | $ | 4,358,612 | | | $ | (272 | ) | | $ | (4,842,608 | ) | | $ | (308,099 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Foreign currency translation adjustment | | | - | | | | - | | | | - | | | | - | | | | - | | | | 1,109 | | | | - | | | | 1,109 | |

Net loss for the period | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (19,599 | ) | | | (19,599 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance as at March 31, 2022 | | | 1 | | | $ | - | | | | 176,168,548 | | | $ | 176,169 | | | $ | 4,358,612 | | | $ | 837 | | | $ | (4,862,207 | ) | | $ | (326,589 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Foreign currency translation adjustment | | | - | | | | - | | | | - | | | | - | | | | - | | | | (5 | ) | | | - | | | | (5 | ) |

Net loss for the period | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (29,124 | ) | | | (29,124 | ) |

Balance as at June 30, 2022 | | | 1 | | | $ | - | | | | 176,168,548 | | | $ | 176,169 | | | $ | 4,358,612 | | | $ | 832 | | | $ | (4,891,331 | ) | | $ | (355,718 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance as at January 1, 2023 | | | 1 | | | $ | - | | | | 177,687,535 | | | $ | 177,688 | | | $ | 4,369,093 | | | $ | 232 | | | $ | (5,031,461 | ) | | $ | (484,448 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Shares issued on convertible notes | | | - | | | | - | | | | 13,095,239 | | | | 13,095 | | | | 26,905 | | | | - | | | | - | | | | 40,000 | |

Foreign currency translation adjustment | | | - | | | | - | | | | - | | | | - | | | | - | | | | 875 | | | | - | | | | 875 | |

Net loss for the period | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (88,753 | ) | | | (88,753 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance as at March 31, 2023 | | | 1 | | | $ | - | | | | 190,782,774 | | | $ | 190,783 | | | $ | 4,395,998 | | | $ | 1,107 | | | $ | (5,120,214 | ) | | $ | (532,326 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Shares issued on convertible notes | | | - | | | | - | | | | 5,882,353 | | | | 5,882 | | | | 4,118 | | | | - | | | | - | | | | 10,000 | |

Foreign currency translation adjustment | | | - | | | | - | | | | - | | | | - | | | | - | | | | (475 | ) | | | - | | | | (475 | ) |

Net loss for the period | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (83,354 | ) | | | (83,354 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance as at June 30, 2023 | | | 1 | | | $ | - | | | | 196,665,127 | | | $ | 196,665 | | | $ | 4,400,116 | | | $ | 632 | | | $ | (5,203,568 | ) | | $ | (606,155 | ) |

See accompanying notes to unaudited condensed consolidated financial statements.

NEW MOMENTUM CORPORATION

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED JUNE 30, 2023 AND 2022

(Currency expressed in United States Dollars (“US$”), except for number of shares)

1. DESCRIPTION OF BUSINESS AND ORGANIZATION

New Momentum Corporation (the “Company”) was incorporated under the law of the State of Nevada on July 1, 1999. The Company, through its subsidiaries, mainly operates a smartphone application to provide the online platform with “Book Now, Pay Later” flight booking service for travelers among over 500 airlines worldwide to search and secure their tickets. With a simple, user-friendly interface, the Company enables customers to arrange and book the multiple-stop itineraries, and to check their bookings through official airline websites using the Gagfare booking reference number on http://presscentre.asia/gagfare.html. The Company will also become the driving force behind a bold new hospitality concept that takes nature lovers and intrepid travelers to exciting new and established destinations. The curated collection of boutique properties, each with a focus on diving, sustainability, conservation, and cultural authenticity, offers a thoroughly contemporary travel experience that is intrinsically linked to the destination, its heritage and its culture.

Description of subsidiaries

Name | | Place of incorporation and kind of legal entity | | Principal activities | | Particulars of registered/ paid up share capital | | Effective interest held |

| | | | | | | | |

NEMO Holding Company Limited | | British Virgin Islands | | Investment holding | | 10,000 ordinary shares at par value of US$1 | | 100% |

| | | | | | | | |

Gagfare Limited | | Hong Kong | | Travel agency | | 500,000 ordinary shares for HK$500,000 | | 100% |

| | | | | | | | |

Beyond Blue Limited | | Hong Kong | | Event organizer | | 1 ordinary share for HK$1 | | 100% |

| | | | | | | | |

New Momentum Asia Pte. Ltd. | | Singapore | | Investment holding | | 1 ordinary share of SGD 1 | | 100% |

| | | | | | | | |

JPOPCOIN Limited | | Hong Kong | | Administrative service | | 5 ordinary shares for HK$5 | | 100% |

The Company and its subsidiaries are hereinafter referred to as (the “Company”).

2. GOING CONCERN UNCERTAINTIES

The accompanying unaudited condensed consolidated financial statements have been prepared using the going concern basis of accounting, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business.

The Company has reported continuous accumulated losses of $5,203,568 and net current liabilities of $632,344 at June 30, 2023. The continuation of the Company as a going concern through the next twelve months is dependent upon the continued financial support from its shareholders. The Company is currently pursuing additional financing for its operations and future expansion. However, there is no assurance that the Company will be successful in securing sufficient funds to sustain the operations.

These raise substantial doubt about the Company’s ability to continue as a going concern. These unaudited condensed consolidated financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets and liabilities that may result in the Company not being able to continue as a going concern.

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The accompanying unaudited condensed consolidated financial statements reflect the application of certain significant accounting policies as described in this note and elsewhere in the accompanying unaudited condensed consolidated financial statements and notes.

These accompanying unaudited condensed consolidated financial statements have been prepared in U.S. Dollars in conformity with generally accepted accounting principles in the United States of America (“U.S. GAAP”) for interim financial information pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”). Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary to make the financial statements not misleading have been included. Operating results for the period ended June 30, 2023 are not necessarily indicative of the results that may be expected for the fiscal year ending December 31, 2023. The information included in this Form 10-Q should be read in conjunction with Management’s Discussion and Analysis, and the financial statements and notes thereto included in the Company’s Form 10-K, as filed with the SEC on April 18, 2023.

· | Use of estimates and assumptions |

In preparing these unaudited condensed consolidated financial statements, management makes estimates and assumptions that affect the reported amounts of assets and liabilities in the balance sheet and revenues and expenses during the periods reported. Actual results may differ from these estimates.

The unaudited condensed consolidated financial statements include the financial statements of the Company and its subsidiaries. All significant inter-company balances and transactions within the Company have been eliminated upon consolidation.

· | Cash and cash equivalents |

Cash and cash equivalents are carried at cost and represent cash on hand, demand deposits placed with banks or other financial institutions and all highly liquid investments with an original maturity of three months or less as of the purchase date of such investments.

Accounts receivable are recorded at the invoiced amount and do not bear interest, which are due within contractual payment terms, generally 30 to 90 days from completion of service. Credit is extended based on evaluation of a customer’s financial condition, the customer credit-worthiness and their payment history. Accounts receivable outstanding longer than the contractual payment terms are considered past due. Past due balances over 90 days and over a specified amount are reviewed individually for collectability. At the end of fiscal year, the Company specifically evaluates individual customer’s financial condition, credit history, and the current economic conditions to monitor the progress of the collection of accounts receivables. The Company will consider the allowance for doubtful accounts for any estimated losses resulting from the inability of its customers to make required payments. For the receivables that are past due or not being paid according to payment terms, the appropriate actions are taken to exhaust all means of collection, including seeking legal resolution in a court of law. Account balances are charged off against the allowance after all means of collection have been exhausted and the potential for recovery is considered remote. The Company does not have any off-balance-sheet credit exposure related to its customers. As of June 30, 2023 and December 31, 2022, there was no allowance for doubtful accounts.

The Company recognizes revenue from its contracts with customers in accordance with Accounting Standards Codification (“ASC”) 606 – Revenue from Contracts with Customers (“ASC 606”). The Company recognizes revenues when satisfying the performance obligation of the associated contract that reflects the consideration expected to be received based on the terms of the contract.

Under ASC 606, a performance obligation is a promise within a contract to transfer a distinct good or service, or a series of distinct goods and services, to a customer. Revenue is recognized when performance obligations are satisfied and the customer obtains control of promised goods or services. The amount of revenue recognized reflects the consideration to which the Company expects to be entitled to receive in exchange for goods or services. Under the standard, a contract’s transaction price is allocated to each distinct performance obligation. To determine revenue recognition for arrangements that the Company determines are within the scope of ASC 606, the Company performs the following five steps:

| • | identify the contract with a customer; |

| • | identify the performance obligations in the contract; |

| • | determine the transaction price; |

| • | allocate the transaction price to performance obligations in the contract; and |

| • | recognize revenue as the performance obligation is satisfied. |

The Company records its revenue from booking income upon the ticket booking service being rendered to travelers. The Company also records its revenue from the sale of air tickets upon the confirmation and issuance of tickets to the travelers.

The Company follows the guidance provided in ASC 606, Revenue from Contracts with Customers, for determining whether the Company is the principal or an agent in arrangements with customers that involve another party that contributes to the provision of goods to a customer. In these instances, the Company determines whether it has promised to provide the goods itself (as principal) or to arrange for the specified goods to be provided by another party (as an agent). This determination is a matter of judgment that depends on the facts and circumstances of each arrangement. The Company recognizes revenue from the sale of its air tickets on a gross basis as the Company is responsible for the fulfillment, controls the delivery of the promised goods, and has full discretion in establishing prices and therefore is the principal in the arrangement.

The Company adopted the ASC 740 Income tax provisions of paragraph 740-10-25-13, which addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the condensed consolidated financial statements. Under paragraph 740-10-25-13, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the condensed consolidated financial statements from such a position should be measured based on the largest benefit that has a greater than fifty percent (50%) likelihood of being realized upon ultimate settlement. Paragraph 740-10-25-13 also provides guidance on de-recognition, classification, interest and penalties on income taxes, accounting in interim periods and requires increased disclosures. The Company had no material adjustments to its liabilities for unrecognized income tax benefits according to the provisions of paragraph 740-10-25-13.

The estimated future tax effects of temporary differences between the tax basis of assets and liabilities are reported in the accompanying balance sheets, as well as tax credit carry-backs and carry-forwards. The Company periodically reviews the recoverability of deferred tax assets recorded on its balance sheets and provides valuation allowances as management deems necessary.

The Company did not take any uncertain tax positions and had no adjustments to its income tax liabilities or benefits pursuant to the ASC 740 provisions of Section 740-10-25 for the six months ended June 30, 2023 and 2022.

· | Foreign currencies translation |

Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing at the dates of the transaction. Monetary assets and liabilities denominated in currencies other than the functional currency are translated into the functional currency using the applicable exchange rates at the balance sheet dates. The resulting exchange differences are recorded in the unaudited condensed consolidated statement of operations.

The reporting currency of the Company is United States Dollar (“US$”) and the accompanying unaudited condensed consolidated financial statements have been expressed in US$. In addition, the Company is operating in Hong Kong and Singapore and maintain its books and record in its local currency, Hong Kong Dollars (“HKD”) and Singapore Dollars (“SGD”), which are a functional currency as being the primary currency of the economic environment in which their operations are conducted. In general, for consolidation purposes, assets and liabilities of its subsidiary whose functional currency is not US$ are translated into US$, in accordance with ASC Topic 830-30, “ Translation of Financial Statement”, using the exchange rate on the balance sheet date. Revenues and expenses are translated at average rates prevailing during the period. The gains and losses resulting from translation of financial statements of foreign subsidiaries are recorded as a separate component of accumulated other comprehensive income within the statements of changes in shareholders’ equity.

Translation of amounts from HKD and SGD into US$ have been made at the following exchange rates for the six months ended June 30, 2023 and 2022:

| | June 30, 2023 | | | June 30, 2022 | |

Period-end HKD:US$ exchange rate | | | 0.12764 | | | | 0.12745 | |

Average HKD:US$ exchange rate | | | 0.12757 | | | | 0.12779 | |

Period-end SGD:US$ exchange rate | | | 0.73910 | | | | 0.73864 | |

Average SGD:US$ exchange rate | | | 0.74845 | | | | 0.73958 | |

ASC Topic 220, “Comprehensive Income”, establishes standards for reporting and display of comprehensive income, its components and accumulated balances. Comprehensive income as defined includes all changes in equity during a period from non-owner sources. Accumulated other comprehensive income, as presented in the accompanying condensed consolidated statements of changes in shareholders’ equity, consists of changes in unrealized gains and losses on foreign currency translation. This comprehensive income is not included in the computation of income tax expense or benefit.

The Company adopted Topic 842, Leases (“ASC 842”). At the inception of an arrangement, the Company determines whether the arrangement is or contains a lease based on the unique facts and circumstances present. Leases with a term greater than one year are recognized on the balance sheet as right-of-use (“ROU”) assets, lease liabilities and long-term lease liabilities. The Company has elected not to recognize on the balance sheet leases with terms of one year or less. Operating lease liabilities and their corresponding right-of-use assets are recorded based on the present value of lease payments over the expected remaining lease term. However, certain adjustments to the right-of-use asset may be required for items such as prepaid or accrued lease payments. The interest rate implicit in lease contracts is typically not readily determinable. As a result, the Company utilizes its incremental borrowing rates, which are the rates incurred to borrow on a collateralized basis over a similar term an amount equal to the lease payments in a similar economic environment.

In accordance with the guidance in ASC 842, components of a lease should be split into three categories: lease components (e.g. land, building, etc.), non-lease components (e.g. common area maintenance, consumables, etc.), and non-components (e.g. property taxes, insurance, etc.). Subsequently, the fixed and in-substance fixed contract consideration (including any related to non-components) must be allocated based on the respective relative fair values to the lease components and non-lease components.

Lease expense is recognized on a straight-line basis over the lease terms. Lease expense includes amortization of the ROU assets and accretion of the lease liabilities. Amortization of ROU assets is calculated as the periodic lease cost less accretion of the lease liability. The amortized period for ROU assets is limited to the expected lease term.

The Company has elected a practical expedient to combine the lease and non-lease components into a single lease component. The Company also elected the short-term lease measurement and recognition exemption and does not establish ROU assets or lease liabilities for operating leases with terms of 12 months or less.

Contributions to retirement plans (which are defined contribution plans) are charged to general and administrative expenses in the accompanying statements of operation as the related employee service is provided.

· | Share-based compensation |

The Company follows ASC 718, Compensation—Stock Compensation (“ASC 718”), which requires the measurement and recognition of compensation expense for all share-based payment awards, including restricted stock units, based on estimated grant date fair values. Restricted stock units are valued using the market price of the Company’s common shares on the date of grant. The Company records compensation expense, net of estimated forfeitures, over the requisite service period.

The Company follows the ASC 850-10, Related Party for the identification of related parties and disclosure of related party transactions.

Pursuant to section 850-10-20 the related parties include a) affiliates of the Company; b) entities for which investments in their equity securities would be required, absent the election of the fair value option under the Fair Value Option Subsection of section 825–10–15, to be accounted for by the equity method by the investing entity; c) trusts for the benefit of employees, such as pension and Income-sharing trusts that are managed by or under the trusteeship of management; d) principal owners of the Company; e) management of the Company; f) other parties with which the Company may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests; and g) other parties that can significantly influence the management or operating policies of the transacting parties or that have an ownership interest in one of the transacting parties and can significantly influence the other to an extent that one or more of the transacting parties might be prevented from fully pursuing its own separate interests.

The condensed consolidated financial statements shall include disclosures of material related party transactions, other than compensation arrangements, expense allowances, and other similar items in the ordinary course of business. However, disclosure of transactions that are eliminated in the preparation of condensed consolidated or combined financial statements is not required in those statements. The disclosures shall include: a) the nature of the relationship(s) involved; b) a description of the transactions, including transactions to which no amounts or nominal amounts were ascribed, for each of the periods for which income statements are presented, and such other information deemed necessary to an understanding of the effects of the transactions on the financial statements; c) the dollar amounts of transactions for each of the periods for which income statements are presented and the effects of any change in the method of establishing the terms from that used in the preceding period; and d) amount due from or to related parties as of the date of each balance sheet presented and, if not otherwise apparent, the terms and manner of settlement.

· | Commitments and contingencies |

The Company follows the ASC 450-20, Commitments to report accounting for contingencies. Certain conditions may exist as of the date the financial statements are issued, which may result in a loss to the Company but which will only be resolved when one or more future events occur or fail to occur. The Company assesses such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or un-asserted claims that may result in such proceedings, the Company evaluates the perceived merits of any legal proceedings or un-asserted claims as well as the perceived merits of the amount of relief sought or expected to be sought therein.

If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, then the estimated liability would be accrued in the Company’s condensed consolidated financial statements. If the assessment indicates that a potentially material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, and an estimate of the range of possible losses, if determinable and material, would be disclosed.

Loss contingencies considered remote are generally not disclosed unless they involve guarantees, in which case the guarantees would be disclosed. Management does not believe, based upon information available at this time that these matters will have a material adverse effect on the Company’s financial position, results of operations or cash flows. However, there is no assurance that such matters will not materially and adversely affect the Company’s business, financial position, and results of operations or cash flows.

· | Fair value of financial instruments |

The Company follows paragraph 825-10-50-10 of the FASB Accounting Standards Codification for disclosures about fair value of its financial instruments and has adopted paragraph 820-10-35-37 of the FASB Accounting Standards Codification (“Paragraph 820-10-35-37”) to measure the fair value of its financial instruments. Paragraph 820-10-35-37 of the FASB Accounting Standards Codification establishes a framework for measuring fair value in generally accepted accounting principles (GAAP), and expands disclosures about fair value measurements. To increase consistency and comparability in fair value measurements and related disclosures, paragraph 820-10-35-37 of the FASB Accounting Standards Codification establishes a fair value hierarchy which prioritizes the inputs to valuation techniques used to measure fair value into three (3) broad levels. The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. The three (3) levels of fair value hierarchy defined by paragraph 820-10-35-37 of the FASB Accounting Standards Codification are described below:

Level 1 | Quoted market prices available in active markets for identical assets or liabilities as of the reporting date. |

| |

Level 2 | Pricing inputs other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable as of the reporting date. |

| |

Level 3 | Pricing inputs that are generally observable inputs and not corroborated by market data. |

Financial assets are considered Level 3 when their fair values are determined using pricing models, discounted cash flow methodologies or similar techniques and at least one significant model assumption or input is unobservable.

The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. If the inputs used to measure the financial assets and liabilities fall within more than one level described above, the categorization is based on the lowest level input that is significant to the fair value measurement of the instrument.

The carrying amounts of the Company’s financial assets and liabilities, such as cash and cash equivalents, accounts receivable, deposits, prepayments and other receivables, amount due from a director and operating lease right-of-use assets, approximate their fair values because of the short maturity of these instruments.

· | Recent accounting pronouncements |

From time to time, new accounting pronouncements are issued by the Financial Accounting Standard Board (“FASB”) or other standard setting bodies and adopted by the Company as of the specified effective date. Unless otherwise discussed, the Company believes that the impact of recently issued standards that are not yet effective will not have a material impact on its financial position or results of operations upon adoption.

The Company has reviewed all recently issued, but not yet effective, accounting pronouncements and believe the future adoption of any such pronouncements may not be expected to cause a material impact on its financial condition or the results of its operations.

4. AMOUNTS DUE TO A DIRECTOR AND SHAREHOLDER

As of June 30, 2023 and December 31, 2022, the Company owed to its director an amount of $305,289 and $231,223, respectively. As of June 30, 2023 and December 31, 2022, the Company owed to a shareholder an amount of $75,859 and $54,259, respectively. The amounts are unsecured, non-interest bearing and repayable on demand.

5. CONVERTIBLE PROMISSORY NOTE

On May 18, 2022, the Company and 1800 Diagonal Lending LLC, (“1800”) entered into a Securities Purchase Agreement, whereby the Company issued a promissory note to 1800 (the “1800 Note”) in the original principal amount of $68,750. The 1800 Note contains an original issue discount of $3,750 which will be reflected as a debt discount and amortized over the twelve months Note term. The 1800 Note is convertible into shares of common stock of the Company at a price equal to 35% of the lowest trading price of the Company’s common stock for the twenty (20) consecutive trading days immediately preceding to the conversion date. The 1800 Note bears interest at 8% per annum and was due on May 18, 2023. As of June 30, 2023, a principal balance of $6,750 remained to be issued. This was subsequently settled via issuance of shares on August 2, 2023.

On August 4, 2022, the Company and 1800 Diagonal Lending LLC, (“1800”) entered into a Securities Purchase Agreement, whereby the Company issued another promissory note to 1800 (the “1800 Note”) in the original principal amount of $54,250. The 1800 Note contains an original issue discount of $4,250 which will be reflected as a debt discount and amortized over the twelve months Note term. The 1800 Note is convertible into shares of common stock of the Company at a price equal to 35% of the lowest trading price of the Company’s common stock for the twenty (20) consecutive trading days immediately preceding to the conversion date. The 1800 Note bears interest at 8% per annum and is due on August 4, 2023. As of today, no conversion has taken place.

On September 2, 2022, the Company and 1800 Diagonal Lending LLC, (“1800”) entered into a Securities Purchase Agreement, whereby the Company issued a further promissory note to 1800 (the “1800 Note”) in the original principal amount of $54,250. The 1800 Note contains an original issue discount of $4,250 which will be reflected as a debt discount and amortized over the twelve months Note term. The 1800 Note is convertible into shares of common stock of the Company at a price equal to 35% of the lowest trading price of the Company’s common stock for the twenty (20) consecutive trading days immediately preceding to the conversion date. The 1800 Note bears interest at 8% per annum and is due on September 2, 2023.

On September 20, 2022, the Company and 1800 Diagonal Lending LLC, (“1800”) entered into a Securities Purchase Agreement, whereby the Company issued yet another promissory note to 1800 (the “1800 Note”) in the original principal amount of $54,250. The 1800 Note contains an original issue discount of $4,250 which will be reflected as a debt discount and amortized over the twelve months Note term. The 1800 Note is convertible into shares of common stock of the Company at a price equal to 35% of the lowest trading price of the Company’s common stock for the twenty (20) consecutive trading days immediately preceding to the conversion date. The 1800 Note bears interest at 8% per annum and is due on September 20, 2023.

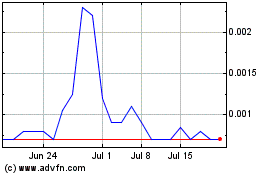

The terms of the 1800 Notes whereby conversion is only permissible after 180 days from the issue date and number of the shares held by the holder and its affiliates when converted, shall not to exceed 4.99% of issued and outstanding common stock of the Company. On December 1, 2022, principal of $12,000 was converted to 1,518,987 shares of common stock with conversion price of $0.0079. On January 6, 2023, principal of $20,000 was converted to 3,571,429 shares of common stock with conversion price of $0.0056. On March 15, 2023, principal of $10,000 was converted to 4,761,905 shares of common stock with conversion price of $0.0021. On March 21, 2023, principal of $10,000 was converted to 4,761,905 shares of common stock with conversion price of $0.0021. On June 9, 2023, principal of $10,000 was converted to 5,882,353 shares of common stock with conversion price of $0.0017. As of June 30, 2023, principal of $169,500 was not yet converted.

For the six months ended June 30, 2023 and 2022, the amortization of discount was $8,137 and $452, respectively.

As of June 30, 2023 and December 31, 2022, accrued interest amounted to $14,704 and $7,314, respectively.

6. SHAREHOLDERS’ DEFICIT

Preferred Stock

Authorized shares

The Company was authorized to issue 175,000,000 shares of Class A preferred stock at par value of $0.001. Any class of preferred stock may have preferential voting rights, liquidation rights or other rights with respect to the class of common stock. These preferential rights may have anti-takeover effects and may also result in the dilution of the common shareholders, equity interest and earnings per share.

Issued and outstanding shares

As of June 30, 2023 and December 31, 2022, 1 and 1 share of Class A preferred stock was issued and outstanding.

Common Stock

Authorized shares

The Company was authorized to issue 500,000,000 shares of common stock at par value of $0.001.

Issued and outstanding shares

On December 1, 2022, the Company issued 1,518,987 shares of its common stock to pay off the principal of $12,000 at the conversion price of $0.0079 per share.

On January 6, 2023, the Company issued 3,571,429 shares of its common stock to pay off the principal of $20,000 at the conversion price of $0.0056 per share.

On March 15, 2023, the Company issued 4,761,905 shares of its common stock to pay off the principal of $10,000 at the conversion price of $0.0021 per share.

On March 21, 2023, the Company issued 4,761,905 shares of its common stock to pay off the principal of $10,000 at the conversion price of $0.0021 per share.

On June 9, 2023, the Company issued 5,882,353 shares of its common stock to pay off the principal of $10,000 at the conversion price of $0.0017 per share.

As of June 30, 2023 and December 31, 2022, 196,665,127 and 177,687,535 shares of common stock were issued and outstanding respectively.

Stock Incentive Option Plan

On October 14, 2020, the Company approved a Share Incentive Option Plan whereby an aggregate of twenty million (20,000,000) shares of common stock were initially reserved for issuance upon exercise of stock options under the Plan. As of June 30, 2023, 19,650,000 stock of common shares have been issued under the Plan.

As of June 30, 2023 and December 31, 2022, 350,000 shares are reserved to be issued under the Plan respectively.

The Plan shall remain in effect for a period of ten (10) years from the effective date of October 14, 2020 for the granting of options and until all options granted under the Plan have been exercised or expired, or vested or forfeited.

7. INCOME TAX

The Company mainly operates in Hong Kong and is subject to taxes in the governing jurisdictions in which it operates. The effective tax rate in the period presented is the result of the mix of income earned in various tax jurisdictions that apply a broad range of income tax rate, as follows:

United States of America

NNAX is registered in the State of Nevada and is subject to US federal corporate income tax of 21%. The Company’s policy is to recognize accrued interest and penalties related to unrecognized tax benefits in its income tax provision. The Company has not accrued or paid interest or penalties as they were not material to its results of operations for the periods presented.

As of June 30, 2023, the operations in the United States of America incurred $4,801,333 of cumulative net operating losses which can be carried forward indefinitely to offset future taxable income. The Company has provided for a full valuation allowance against the deferred tax assets of $1,008,280 on the expected future tax benefits from the net operating loss carryforwards as the management believes it is more likely than not that these assets will not be realized in the future.

| | Six months ended June 30, | |

| | 2023 | | | 2022 | |

| | | | | | |

Loss before income taxes | | $ | (40,877 | ) | | $ | (24,507 | ) |

Statutory income tax rate | | | 21 | % | | | 21 | % |

Income tax expense at statutory rate | | | (8,584 | ) | | | (5,146 | ) |

Tax loss | | | 8,584 | | | | 5,146 | |

Income tax expense | | $ | - | | | $ | - | |

BVI

NHCL is considered to be an exempted British Virgin Islands Company and is presently not subject to income taxes or income tax filing requirements in the British Virgin Islands or the United States.

Singapore

NMAPL is registered in Republic of Singapore and is subject to the Singapore corporate income tax at a standard income tax rate of 17% on the assessable income arising in Singapore during its tax year. No assessable income was generated in Singapore during the six months ended June 30, 2023 and there was no provision for income tax.

As of June 30, 2023, the operation in Singapore incurred $3,648 of cumulative net operating losses which can be carried forward to offset future taxable income with no expiry. The Company has provided for a full valuation allowance against the deferred tax assets of $620 on the expected future tax benefits from the net operating loss carryforwards as the management believes it is more likely than not that these assets will not be realized in the future. The reconciliation of income tax rate to the effective income tax rate for the six months ended June 30, 2023 and 2022 are as follows:

| | Six months ended June 30, | |

| | 2023 | | | 2022 | |

| | | | | | |

Loss before income taxes | | $ | (361 | ) | | $ | (1,125 | ) |

Statutory income tax rate | | | 17 | % | | | 17 | % |

Income tax expense at statutory rate | | | (61 | ) | | | (191 | ) |

Tax loss | | | 61 | | | | 191 | |

Income tax expense | | $ | - | | | $ | - | |

Hong Kong

GL, BBL and JL are operating in Hong Kong and are subject to the Hong Kong Profits Tax at the two-tiered profits tax rates from 8.25% to 16.5% on the estimated assessable profits arising in Hong Kong during the current year, after deducting a tax concession for the tax year. The reconciliation of income tax rate to the effective income tax rate for the six months ended June 30, 2023 and 2022 are as follows:

| | Six months ended June 30, | |

| | 2023 | | | 2022 | |

| | | | | | |

Loss before income taxes | | $ | (69,551 | ) | | $ | (20,827 | ) |

Statutory income tax rate | | | 16.5 | % | | | 16.5 | % |

Income tax expense at statutory rate | | | (11,475 | ) | | | (3,436 | ) |

Tax effect of non-taxable items | | | (8 | ) | | | - | |

Tax effect of non-deductible items | | | 8,177 | | | | - | |

Tax loss | | | 3,306 | | | | 3,436 | |

Income tax expense | | $ | - | | | $ | - | |

As of June 30, 2023, the operation in Hong Kong incurred $313,859 of cumulative net operating losses which can be carried forward to offset future taxable income with no expiry. The Company has provided for a full valuation allowance against the deferred tax assets of $51,787 on the expected future tax benefits from the net operating loss carryforwards as the management believes it is more likely than not that these assets will not be realized in the future.

The following table sets forth the significant components of the deferred tax assets of the Company as of June 30, 2023 and December 31, 2022:

| | As of | |

| | June 30, 2023 | | | December 31, 2022 | |

Deferred tax assets: | | | | | | |

Tax losses carryforwards | | | | | | |

- United States | | $ | 1,008,280 | | | $ | 999,696 | |

- Hong Kong | | | 51,787 | | | | 44,896 | |

- Singapore | | | 620 | | | | 559 | |

| | | 1,060,687 | | | | 1,045,150 | |

Less: valuation allowance | | | (1,060,687 | ) | | | (1,045,150 | ) |

Deferred tax assets, net | | $ | - | | | $ | - | |

8. NET LOSS PER SHARE

Basic net loss per share is computed using the weighted average number of common shares outstanding during the year. The following table sets forth the computation of basic and diluted net loss per share for the six months ended June 30, 2023 and 2022:

Schedule of computation of net loss per share | | | | | | |

| | Six months ended June 30, | |

| | 2023 | | | 2022 | |

| | | | | | |

Net loss attributable to common shareholders | | $ | (172,107 | ) | | $ | (48,723 | ) |

| | | | | | | | |

Weighted average common shares outstanding | | | | | | | | |

–Basic | | | 187,400,150 | | | | 219,614,098 | |

–Diluted | | | 187,400,150 | | | | 219,614,098 | |

| | | | | | | | |

Net loss per share | | | | | | | | |

–Basic | | $ | (0.00 | ) | | $ | (0.00 | ) |

–Diluted | | $ | (0.00 | ) | | $ | (0.00 | ) |

# less than $0.001

For the six months ended June 30, 2023 and 2022, despite potential conversion of promissory notes, diluted weighted-average common shares outstanding is equal to basic weighted-average common shares, due to the Company’s net loss position. No common stock equivalents were included in the computation of diluted net loss per share since such inclusion would have been antidilutive.

9. RELATED PARTY TRANSACTIONS

From time to time, the directors of the Company advanced funds to the Company for working capital purpose. Those advances are unsecured, non-interest bearing and had no fixed terms of repayment.

During the six months ended June 30, 2023 and 2022, the Company has been provided free office space by its shareholder. The management determined that such cost is nominal and did not recognize the rent expense in its unaudited condensed consolidated financial statements.

Since February 1, 2016, the Company was granted with the right of use to the website and mobile application platforms by JJ Explorer Tours Limited (“JJ Explorer”), which was also controlled by the director, Leung Tin Lung David of the Company. Also, the Company formed a cooperation partnership with JJ Explorer whereby JJ Explorer invested to develop and maintain the operations of the Gagfare web and mobile application platforms for an extended term of 10 years ending January 31,2026. JJ Explorer would share 50% of the net earnings generated by the Company from the use of its web and mobile application platforms during the cooperation period. The agreement however, was mutually terminated on February 28, 2022 and concurrently, the Company, through NMAPL entered into a Cooperation Agreement with JJ Explorer, whereby NMAPL was granted the right of use to the website and mobile application platform owned by JJ Explorer, for a term of 5 years. The Company would share 50% of its net earnings through the platform with JJ Explorer.

The agreement, nevertheless was also terminated on October 31, 2022.

For the three and six months ended June 30,2022, and for the period till termination on October 31,2022, the Company had not generated any earnings from the use of the web and mobile application platforms, and accordingly, there are no service charges and payables due to JJ Explorer that had arisen.

For the three months ended June 30, 2023 and 2022, the Company paid the allowance of $2,679 and $2,683 to certain shareholders for their service.

For the six months ended June 30, 2023 and 2022, the Company paid the allowance of $5,358 and $4,600 to certain shareholders for their services.

For the three months ended June 30, 2023 and 2022, the Company paid the allowance of $1,340 and $1,342 to the director for his service.

For the six months ended June 30, 2023 and 2022, the Company paid the allowance of $2,679 and $2,684 to the director for his service.

Apart from the transactions and balances detailed elsewhere in these accompanying unaudited condensed consolidated financial statements, the Company has no other significant or material related party transactions during the years presented.

10. CONCENTRATIONS OF RISK

The Company is exposed to the following concentrations of risk:

(a) Major customers

For the three months ended June 30, 2023, there is one single customer who accounts for 85% of the Company’s revenue totaling $47,571 with $0 accounts receivable at June 30, 2023.

For the six months ended June 30, 2023, there is one single customer who accounts for 81% of the Company’s revenue totaling $146,317 with $0 accounts receivable at June 30, 2023.

For the three months ended June 30, 2022, there was a single customer who accounted for 99% of the Company’s revenue totaling $299,066 with $0 accounts receivable at June 30, 2022.

For the six months ended June 30, 2022, there was a single customer who accounted for 99% of the Company’s revenue totaling $299,066 with $0 accounts receivable at June 30, 2022.

(b) Major vendors

For the three months ended June 30, 2023, there is one single vendor who accounts for 85% of the Company’s cost of revenue totaling $47,431, with $8,218 accounts payable at June 30, 2023.

For the six months ended June 30, 2023, there is one single vendor who accounts for 81% of the Company’s cost of revenue totaling $146,011, with $8,218 accounts payable at June 30, 2023.

For the three months ended June 30, 2022, there was a single vendor who accounted for 100% of the Company’s cost of revenue totaling $297,891, with $0 accounts payable at June 30, 2022.

For the six months ended June 30, 2022, there was a single vendor who accounted for 100% of the Company’s cost of revenue totaling $297,891 with $0 accounts payable at June 30, 2022.

(c) Economic and political risk

The Company’s major operations are conducted in Hong Kong. Accordingly, the political, economic, and legal environments in Hong Kong, as well as the general state of Hong Kong’s economy may influence the Company’s business, financial condition, and results of operations.

The present global economic climate with rising global tensions, rising costs and fuel shortage which potentially could escalate and result in global inflation may also impact the Company’s business, financial condition, and results of operations.

(d) Exchange rate risk

The Company cannot guarantee that the current exchange rate will remain steady; therefore there is a possibility that the Company could post the same amount of profit for two comparable periods and because of the fluctuating exchange rate actually post higher or lower profit depending on exchange rate of HKD and SGD converted to US$ on that date. The exchange rate could fluctuate depending on changes in political and economic environments without notice.

11. COMMITMENTS AND CONTINGENCIES

As of June 30, 2023, the Company has no material commitments or contingencies other than the following;-.

As of June 30, 2023, the operating lease payment of $26,683 and $13,849 will mature in the next 12 months and within one to two years respectively.

12. SUBSEQUENT EVENTS

In accordance with ASC Topic 855, “Subsequent Events”, which establishes general standards of accounting for and disclosure of events that occur after the balance sheet date but before condensed consolidated financial statements are issued, the Company has evaluated all events or transactions that occurred after June 30, 2023, up through the date the Company issued the unaudited condensed consolidated financial statements. The Company determined that there are no further events to disclose.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

The following information should be read in conjunction with (i) the financial statements of New Momentum Corporation, a Nevada corporation (the “Company”), and the notes thereto appearing elsewhere in this Form 10-Q together with (ii) the more detailed business information and the December 31, 2022 audited financial statements and related notes included in the Company’s Form 10-K (File No. 000-52273; the “Form 10-K”), as filed with the Securities and Exchange Commission on April 18, 2023. Statements in this section and elsewhere in this Form 10-Q that are not statements of historical or current fact constitute “forward-looking” statements.

OVERVIEW

The Company was incorporated in the State of Nevada on July 1, 1999 and established a fiscal year end of December 31.

Going Concern

To date the Company has little operations or revenues and consequently has incurred recurring losses from operations. No revenues are anticipated until we complete the financing we endeavor to obtain, as described in the Form 10-K, and implement our initial business plan. The ability of the Company to continue as a going concern is dependent on raising capital to fund our business plan and ultimately to attain profitable operations. Accordingly, these factors raise substantial doubt as to the Company’s ability to continue as a going concern.

Our activities have been financed from related-party loans and the proceeds of convertible notes. During the year ended December 31, 2022, the Company issued promissory note of principal $215,000.

The Company plans to raise additional funds through debt or equity offerings. There is no guarantee that the Company will be able to raise any capital through this or any other offerings.

PLAN OF OPERATION

We generated revenues of $180,767 and $299,070 from our business for the six months ended June 30, 2023 and 2022, respectively. We operate an online ticketing platform named Gagfare.com, which provides a ticketing system for individuals and agencies to search, book and issue flight tickets and other services. During the 12 months following the date of filing of this Form 10-Q, we will be focused on attempting to raise $10,000,000 of funds to expand our business. We have no assurance that future financing will materialize. If that financing is not available, we may be unable to continue. However, if such public financing is not available, we could fail to satisfy our future cash requirements. We have no assurance that future financing will materialize. If that financing is not available, we may be unable to continue. Management believes that if subsequent private placements are successful, we will be able to generate sales revenue within the following twelve months thereof. However, additional equity financing may not be available to us on acceptable terms or at all, and thus we could fail to satisfy our future cash requirements.

If we are unsuccessful in raising the additional proceeds through a private placement offering we will then have to seek additional funds through debt financing, which would be highly difficult for an early-stage company to secure. Therefore, the Company is highly dependent upon the success of the anticipated private placement offering and failure thereof would result in the Company having to seek capital from other sources such as debt financing, which may not even be available to the Company. However, if such financing were available, because we are an early stage company, it would likely have to pay additional costs associated with high risk loans and be subject to an above market interest rate. At such time these funds are required, management would evaluate the terms of such debt financing and determine whether the business could sustain operations and growth and manage the debt load. If we cannot raise additional proceeds via a private placement of its common stock or secure debt financing it would be required to cease business operations. As a result, investors in our common stock would lose all of their investment.

The Company is operating a travel services businesses, which includes an online ticketing platform Gagfare, which provides to travelers a “Book Now, Pay Later” business model, for travelers to secure the best fares and reserve flights well ahead of time. The Company will also become the driving force behind a bold new hospitality concept that takes nature lovers and intrepid travelers to exciting new and established destinations. The curated collection of boutique properties, each with a focus on diving, sustainability, conservation, and cultural authenticity, offers a thoroughly contemporary travel experience that is intrinsically linked to the destination, its heritage and its culture.

RESULTS OF OPERATIONS

Comparison of the Three Months ended June 30, 2023 and 2022

As of June 30, 2023, we suffered from a working capital deficit of $632,344. As a result, our continuation as a going concern is dependent upon improving our profitability and the continuing financial support from our stockholders or other capital sources in the next twelve months. Management believes that the continuing financial support from the existing shareholders and external financing will provide the additional cash to meet our obligations as they become due. Our financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets and liabilities that may result in the Company not being able to continue as a going concern.

The following table sets forth certain operational data for the three months ended June 30, 2023 and 2022:

| | Three Months Ended June 30, | |

| | 2023 | | | 2022 | |

Revenues | | $ | 56,286 | | | $ | 299,068 | |

Cost of revenue | | | (56,045 | ) | | | (297,891 | ) |

Gross profit | | | 241 | | | | 1,177 | |

General and administrative expenses | | | (76,081 | ) | | | (30,431 | ) |

Other (expense) income | | | (7,514 | ) | | | 130 | |

Loss before income taxes | | | (83,354 | ) | | | (29,124 | ) |

Income tax expense | | | - | | | | - | |

Net loss | | | (83,354 | ) | | | (29,124 | ) |

Revenue. We generated revenues of $56,286 and $299,068 for the three months ended June 30, 2023 and 2022 respectively, due to the decreased transactions in ticket booking during 2023.

Cost of Revenue. Cost of revenue for the three months ended June 30, 2023 and 2022, was $56,045 and $297,891, respectively. Cost of revenue decreased primarily as a result of the decrease in our business volume.

Gross Profit. We achieved a gross profit of $241 and $1,177 for the three months ended June 30, 2023 and 2022, respectively, due to the decreased transactions in ticket booking during 2023.

Other (Expense) Income. We incurred other (expense) income of $(7,514) and $130 for the three months ended June 30, 2023 and 2022, respectively. The increase in other expense is primarily attributable to increase in amortization of convertible note discount and interest on convertible note as most of the promissory notes were issued subsequent to June 2022. Further, in the period ended June 2022, government subsidies were received due to covid 19 pandemic which ceased thereafter.

General and Administrative Expenses (“G&A”). We incurred G&A expenses of $76,081 and $30,431 for the three months ended June 30, 2023 and 2022, respectively. The increase in G&A is primarily attributable to increase in legal and professional fee related to business development during 2023, as compared to 2022.

Income Tax Expense. Our income tax expenses for the three months ended June 30, 2023 and 2022 were $0 and $0.

Net Loss. As a result of the above, during the three months ended June 30, 2023, we incurred a net loss of $83,354, as compared to $29,124 for the three months ended June 30, 2022.

Comparison of the Six Months ended June 30, 2023 and 2022

The following table sets forth certain operational data for the six months ended June 30, 2023 and 2022:

| | Six Months Ended June 30, | |

| | 2023 | | | 2022 | |

Revenues | | $ | 180,767 | | | $ | 299,070 | |

Cost of revenue | | | (180,438 | ) | | | (297,891 | ) |

Gross profit | | | 329 | | | | 1,179 | |

General and administrative expenses | | | (157,092 | ) | | | (62,845 | ) |

Other (expense) income | | | (15,344 | ) | | | 12,943 | |

Loss before income taxes | | | (172,107 | ) | | | (48,723 | ) |

Income tax expense | | | - | | | | - | |

Net loss | | | (172,107 | ) | | | (48,723 | ) |

Revenue. We generated revenues of $180,767 and $299,070 for the six months ended June 30, 2023 and 2022 respectively, due to the decreased transactions in ticket booking during 2023.

Cost of Revenue. Cost of revenue for the six months ended June 30, 2023 and 2022, was $180,438 and $297,891, respectively. Cost of revenue decreased primarily as a result of the decrease in our business volume.

Gross Profit. We achieved a gross profit of $329 and $1,179 for the six months ended June 30, 2023 and 2022, respectively, due to the decreased transactions in ticket booking during 2023 as the demand decreased.

Other (Expense) Income. We incurred other (expense) income of $(15,344) and $12,943 for the six months ended June 30, 2023 and 2022, respectively. The increase in other expense is primarily attributable to increase in amortization of convertible note discount and interest on convertible note as most of the promissory notes were issued subsequent to June 2022. Further, in the period ended June 2022, government subsidies were received due to covid 19 pandemic which ceased thereafter.

General and Administrative Expenses (“G&A”). We incurred G&A expenses of $157,092 and $62,845 for the six months ended June 30, 2023 and 2022, respectively. The increase in G&A is primarily attributable to increase in legal and professional fee related to business development during 2023, as compared to 2022.

Income Tax Expense. Our income tax expenses for the six months ended June 30, 2023 and 2022 were $0 and $0.

Net Loss. As a result of the above, during the six months ended June 30, 2023, we incurred a net loss of $172,107, as compared to $48,723 for the six months ended June 30, 2022.

Liquidity and Capital Resources