0001471781

false

0001471781

2023-08-17

2023-08-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the Securities and Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 17, 2023

GBT

TECHNOLOGIES INC.

(Exact

name of small business issuer as specified in its charter)

| Nevada |

000-54530 |

27-0603137 |

| (State or other jurisdiction

of incorporation or organization) |

Commission File Number |

(I.R.S. Employer Identification

No.) |

2450

Colorado Ave., Suite 100E, Santa Monica, CA 90404

(Address

of principal executive offices) (Zip code)

Registrant’s

telephone number including area code: 888-685-7336

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instructions A.2. below):

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities

registered pursuant to Section 12(b) of the Act: Not applicable.

| Title

of each class |

Trading

Symbol |

Name

of each exchange on which registered |

| Not

applicable. |

|

|

Item 1.01 Entry Into a Material Definitive Agreement

On August

17, 2023, GBT Tokenize Corp. (‘Tokenize’), which is 50% owned of GBT Technologies, Inc (‘GBT’ or the ‘Company’),

which provided its consent, entered into a Representation Agreement (the ‘RA’) with IDL Concepts, LLC (the ‘Agent’)

, to represent Tokenize in a potential purchase transaction facilitated by the Agent transferring all of Tokenize’s right,

title, and interest in certain Assigned Patent Rights, as defined in the RA, free and clear of any restrictions, liens, claims,

and encumbrances, and may include rights to technology and software developed by Tokenize.

Tokenize owns certain provisional patent applications,

patent applications, patents, and/or related foreign patents and applications, and wishes potentially to sell all right, title,

and interest in such patents and applications and the causes of action to sue for infringement thereof and other enforcement rights.

Tokenize will pay Agent a commission of 20%

of any proceeds of any closed transaction under this RA, including all cash, equity payments and any other form of consideration

upon a sale, or any monetization activity under the RA.

The RA carved out certain intellectual properties

held by Tokenize that Tokenize is in active negotiation with third parties.

The foregoing description of the terms of the

above transactions do not purport to be complete and are qualified in their entirety by reference to the provisions of such agreements,

the forms of which are filed as exhibits to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are filed with this Form 8-K:

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

GBT TECHNOLOGIES INC. |

| |

|

|

| |

By: |

/s/ Mansour Khatib |

| |

Name: |

Mansour Khatib |

| |

Title: |

Chief Executive Officer |

| Date: |

August 21, 2023 |

|

|

EXHIBIT 10.1

REPRESENTATION AGREEMENT

This REPRESENTATION AGREEMENT

(this “Agreement”) is entered into, as of the Effective Date (defined below), by and between GBT Tokenize Corp., Inc.

a Nevada corporation with an address at c/o GBT Technologies Inc. 2450 Colorado Ave. Suite 100ESanta Monica, CA 90404 ,

(“Seller”) and IDL Concepts, LLC, a California limited liability company, with an

address at 276 State Street, Los Altos, CA 94022 (“Agent”), (individually “Party” and collectively, “Parties”).

The Parties hereby agree as follows:

1. Background

1.1 Seller owns certain

provisional patent applications, patent applications, patents, and/or related foreign patents and applications.

1.2 Seller wishes to sell all right,

title, and interest in such patents and applications and the causes of action to sue for infringement thereof and other enforcement

rights.

1.3 Agent wishes to represent the

Seller in a purchase transaction facilitated by the Agent transferring all of Seller’s right, title, and interest in the

Assigned Patent Rights (defined below), free and clear of any restrictions, liens, claims, and encumbrances, and may include rights

to technology and software developed by Seller.

2. Definitions

“Assigned Patent Rights”

means the Patents and the additional rights set forth in paragraph 4.2.

“Effective Date”

means the date set forth as the Effective Date on the signature page of this Agreement.

“Patents”

means, excluding the Abandoned Assets, all (a) Live Assets; (b) patents or patent applications (i) to which any

of the Live Assets directly or indirectly claims priority, (ii) for which any of the Live Assets directly or indirectly forms

a basis for priority, and/or (iii) that were commonly-owned applications that incorporate by reference, or are incorporated by

reference into, the Live Assets; (c) reissues, reexaminations, extensions, continuations, continuations in part, continuing

prosecution applications, requests for continuing examinations, divisions, and registrations of any item in any of the foregoing

categories (a) and (b); (d) foreign patents, patent applications and counterparts relating to any item in any of the foregoing

categories (a) through (c), including, without limitation, certificates of invention, utility models, industrial design protection,

design patent protection, and other governmental grants or issuances; and (e) any items in any of the foregoing categories

(b) through (d) whether or not expressly listed as Live Assets and whether or not claims in any of the foregoing

have been rejected, withdrawn, cancelled, or the like.

“Primary Warranties”

means, collectively, the representations and warranties of Seller set forth in paragraphs 6.1, 6.2, 6.3, 6.4, and 6.5 hereof.

“Patent Purchaser”

means the company that Agent negotiated with on behalf of the Seller, and Seller agreed to sell the Patents to.

“Transmitted Copy”

has the meaning set forth in paragraph 8.13.

3. Fees

and Payments

3.1 Commission. Seller will

pay Agent a commission of 20% of any proceeds of any closed transaction under this Agreement, including all cash, equity payments,

and any other form of consideration. Upon a sale, or any monetization activity under this Agreement, funds will be designated to

be deposited in a bank escrow account, which will be disbursed in accordance with this Section 3.1. Payment of commission is due

within 15 days of closing such transaction payable by wire transfer into the following account:

Bank Name:

Account Name: IDL Concepts, LLC

Account Number:

ABA/Routing Number:

3.2 Revenue Generation. At

Agent’s sole and exclusive discretion, Agent shall pursue activities involving any patents (if any) that issue from Patents,

including, but not limited to, licensing the Patents and/or selling the Patents.

3.3 THE PARTIES ACKNOWLEDGE, UNDERSTAND

AND AGREE THAT NO MINIMUM REVENUE HAS BEEN REPRESENTED OR PROMISED. SELLER UNDERSTANDS AND AGREES THAT ANY RECEIPT OR AMOUNT OF

REVENUE IS ENTIRELY UNCERTAIN AND SPECULATIVE. SELLER FURTHER ACKNOWLEDGES THAT AGENT HAS MADE NO ASSURANCE OR PROMISE THAT ANY

REVENUE WILL EVER BE DUE OR OWED, AND THAT AGENT HAS NO OBLIGATION, AND HAS MADE NO PROMISE OR REPRESENTATION, TO DELIVER ANY SALE

OR LICENSING ACTIVITIES.

3.4 Exclusivity Period. This

Representation Agreement shall be exclusive for a period of six (6) months commencing from the Effective Date (the “Exclusivity

Period”). During the Exclusivity Period, the Seller agrees not to engage, contract, or utilize the services of any

third-party broker or intermediary for the purposes that are the subject of this Representation Agreement. Thereafter, this Agreement

will continue on a non-exclusive basis (the “Renewal Period”). Section 8.5 shall survive expiration of

the Exclusivity Period, the Renewal Period or the termination of this Agreement. Nevertheless, the Seller can represent itself

and negotiate with third parties as wishes. Seller discloses to Agent that it commenced negotiations with a third-party group based

in Texas – Mallick Group, regarding EDA patents and potential sale or joint

venture. As such if a deal will be structured with Mallick Group or any of their affiliate,

Agent is not entitled to any fee.

3.5 Termination and Survival.

After the Exclusivity Period, either Party will have the right to terminate this Agreement by written notice to Seller in the event

that no sale contract has been presented to Seller. Upon termination, Agent will return or destroy all documents in Agent’s

possession. The provisions of Section 8 will survive any termination.

4. Transfer

of Patents and Additional Rights, in the event of a Sale

4.1 Assignment of Patents.

It is contemplated that in the event of a sale, Seller shall sell, assign, transfer, and convey to Patent Purchaser all right,

title, and interest in and to the Assigned Patent Rights. Seller understands and acknowledges that, if any of the Patents are assigned

to Seller’s affiliates or subsidiaries, Seller may be required prior to the Closing to perform certain actions to establish

that Seller is the assignee and to record such assignments. On or before Closing, Seller will execute and deliver to Agent the

Assignment of Patent Rights to be provided by the Patent Purchaser.

4.2 Assignment of Additional Rights.

In the event of a sale, it is also contemplated that Seller also sells, assigns, transfers, and conveys to Patent Purchaser all

right, title and interest in and to all

(a) inventions, invention

disclosures, and discoveries described in any of the Patents or Abandoned Assets that (i) are included in any claim in the Patents

or Abandoned Assets, (ii) are subject matter capable of being reduced to a patent claim in a reissue or reexamination proceeding

brought on any of the Patents or Abandoned Assets, and/or (iii) could have been included as a claim in any of the Patents or Abandoned

Assets;

(b) rights to apply in any

or all countries of the world for patents, certificates of invention, utility models, industrial design protections, design patent

protections, or other governmental grants or issuances of any type related to any of the Patents and the inventions, invention

disclosures, and discoveries therein;

(c) causes of action (whether

known or unknown or whether currently pending, filed, or otherwise) and other enforcement rights under, or on account of, any of

the Patents and/or the rights described in subparagraph 4.2(b), including, without limitation, all causes of action and other enforcement

rights for (i) damages, (ii) injunctive relief, and (iii) any other remedies of any kind for past, current and future

infringement; and – For removal of any doubt and even though not relevant to this agreement, Seller disclose to Agent

that potentially Apple infringed some of its patents, and Seller consider its action

if at all, which being carved out from this agreement.

(d) rights to collect royalties

or other payments under or on account of any of the Patents and/or any of the foregoing.

5. Additional

Obligations

5.1 Further Cooperation.

(a) At the reasonable request of

Agent, Seller will execute and deliver such other instruments and do and perform such other acts and things as may be necessary

or desirable for effecting completely the consummation of the transactions contemplated hereby, including, without limitation,

execution, acknowledgment, and recordation of other such papers, and using commercially reasonable efforts to obtain the same from

the respective inventors, as necessary or desirable for fully perfecting and conveying the benefit of the transactions contemplated

hereby.

(b) To the extent any attorney-client

privilege or the attorney work-product doctrine applies to any portion of the Prosecution History Files and that is retained after

Closing under Seller’s or Seller’s representatives’ normal document retention policy, Seller will ensure that,

if any such portion of the Prosecution History File remains under Seller’s possession or control after Closing, it is not

disclosed to any third party unless (a) disclosure is ordered by a court of competent jurisdiction, after all appropriate appeals

to prevent disclosure have been exhausted, and (b) Seller gave Agent prompt notice upon learning that any third party sought or

intended to seek a court order requiring the disclosure of any such portion of the Prosecution History File. In addition, Seller

will continue to prosecute, maintain, and defend the Patents at its sole expense until the Closing.

(c) Seller will also, at the reasonable

request of Agent after Closing, assist Agent and in providing, and obtaining, from the respective inventors, prompt production

of pertinent facts and documents, otherwise giving of testimony, execution of petitions, oaths, powers of attorney, specifications,

declarations or other papers and other assistance reasonably necessary for filing patent applications, enforcement or other actions

and proceedings with respect to the claims under the Patents.

5.2 Payment of Fees. Seller

will pay any maintenance fees, annuities, and the like due or payable on the Patents until the Closing. For the avoidance of doubt,

Seller shall pay any maintenance fees for which the fee is payable (e.g., the fee payment window opens) on or prior to the Closing

even if the surcharge date or final deadline for payment of such fee would be after the Closing. Seller hereby gives Agent power-of-attorney

to (a) execute documents in the name of Seller in order to effectuate the recordation of the transfers of any portion of the Patents

in an governmental filing office in the world and (b) instruct legal counsel to take steps to pay maintenance fees and annuities

that Seller declines to pay and to make filings on behalf of Seller prior to Closing and otherwise preserve the assets through

Closing.

5.3 Foreign Assignments. To

the extent the Patents include non-United States patents and patent applications, Seller will deliver to Agent executed documents

in a form as may be required in the non-U.S jurisdiction in order to perfect the assignment to Patent Purchaser of the non-U.S.

patents and patent applications.

6. Representations

and Warranties of Seller

Seller hereby represents and warrants

to Agent as follows that, as of the Effective Date and as of the Closing:

6.1 Authority. Seller is a

company duly formed, validly existing, and in good standing under the laws of the jurisdiction of its formation. Seller has the

full power and authority and has obtained all third-party consents, approvals, and/or other authorizations required to enter into

this Agreement and to carry out its obligations hereunder.

6.2 Title and Contest. Seller

owns all right, title, and interest to the Assigned Patent Rights, including, without limitation, all right, title, and interest

to sue for infringement of the Patents. Seller has obtained and properly recorded previously executed assignments for the Patents

as necessary to fully perfect its rights and title therein in accordance with governing law and regulations in each respective

jurisdiction. The Assigned Patent Rights are free and clear of all liens, claims, mortgages, security interests or other encumbrances,

and restrictions. There are no actions, suits, investigations, claims, or proceedings threatened, pending, or in progress relating

in any way to the Assigned Patent Rights. There are no existing contracts, agreements, options, commitments, proposals, bids, offers,

or rights with, to, or in any person to acquire any of the Assigned Patent Rights.

6.3 Existing Licenses and Obligations.

There is no obligation imposed by a standards-setting organization to license any of the Patents on particular terms or conditions.

No licenses under the Patents have been granted or retained by Seller, any prior owners, or inventors. After Closing, none of Seller,

any prior owner, or any inventor retain any rights or interest in the Assigned Patent Rights.

6.4 Validity and Enforceability.

None of the Patents or the Abandoned Assets (other than Abandoned Assets for which abandonment resulted solely from unpaid fees

and/or annuities) has ever been found invalid, unpatentable, or unenforceable for any reason in any administrative, arbitration,

judicial or other proceeding, and Seller does not know of and has not received any notice or information of any kind from any source

suggesting that the Patents may be invalid, unpatentable, or unenforceable. If any of the Patents are terminally disclaimed to

another patent or patent application, all patents and patent applications subject to such terminal disclaimer are included in this

transaction. To the extent “small entity” fees were paid to the United States Patent and Trademark Office for any Patent,

such reduced fees were then appropriate because the payor qualified to pay “small entity” fees at the time of such

payment and specifically had not licensed rights in any of the Patents to an entity that was not a “small entity.”

6.5 Conduct. None of Seller,

prior owner or their respective agents or representatives have engaged in any conduct, or omitted to perform any necessary act,

the result of which would invalidate any of the Patents or hinder their enforcement, including, without limitation, misrepresenting

the Patents to a standard-setting organization.

6.6 Enforcement. Seller has

not put a third party on notice of actual or potential infringement of any of the Patents or the Abandoned Assets. Seller has not

invited any third party to enter into a license under any of the Patents or the Abandoned Assets. Seller has not initiated any

enforcement action with respect to any of the Patents or the Abandoned Assets.

6.7 Patent Office Proceedings.

None of the Patents or the Abandoned Assets has been or is currently involved in any reexamination, reissue, interference proceeding,

or any similar proceeding, and no such proceedings are pending or threatened.

6.8 Fees. All maintenance

fees, annuities, and the like due or payable on the Patents have been timely paid. For the avoidance of doubt, such timely payment

includes payment of any maintenance fees for which the fee is payable (e.g., the fee payment window opens) even if the surcharge

date or final deadline for payment of such fee would be in the future.

6.9 Abandoned Assets. According

to each applicable patent office, each of the Abandoned Assets has expired, lapsed, or been abandoned or deemed withdrawn.

7. Representations

and Warranties of Agent

Agent hereby represents and warrants

to Seller as follows that, as of the Effective Date:

7.1 Agent is a limited liability

company duly formed, validly existing, and in good standing under the laws of the jurisdiction of its formation.

7.2 Agent has all requisite power

and authority to (i) enter into, execute, and deliver this Agreement and (ii) perform fully its obligations hereunder.

8. Miscellaneous

8.1 Limitation of Liability.

EXCEPT IN THE EVENT OF BREACH OF ANY OF THE PRIMARY WARRANTIES BY SELLER OR SELLER’S INTENTIONAL MISREPRESENTATION, AGENT’S

TOTAL LIABILITY UNDER THIS AGREEMENT WILL NOT EXCEED ONE HUNDRED DOLLARS. THE PARTIES ACKNOWLEDGE THAT THE LIMITATIONS ON POTENTIAL

LIABILITIES SET FORTH IN THIS PARAGRAPH 8.1 WERE AN ESSENTIAL ELEMENT IN SETTING CONSIDERATION UNDER THIS AGREEMENT.

8.2 Limitation on Consequential

Damages. EXCEPT IN THE EVENT OF SELLER’S INTENTIONAL MISREPRESENTATION, NEITHER PARTY WILL HAVE ANY OBLIGATION OR LIABILITY

(WHETHER IN CONTRACT, WARRANTY, TORT (INCLUDING NEGLIGENCE)) OR OTHERWISE, AND NOTWITHSTANDING ANY FAULT, NEGLIGENCE (WHETHER ACTIVE,

PASSIVE OR IMPUTED), REPRESENTATION, STRICT LIABILITY OR PRODUCT LIABILITY, FOR COVER OR FOR ANY INCIDENTAL, INDIRECT OR CONSEQUENTIAL,

MULTIPLIED, PUNITIVE, SPECIAL, OR EXEMPLARY DAMAGES OR LOSS OF REVENUE, PROFIT, SAVINGS OR BUSINESS ARISING FROM OR OTHERWISE RELATED

TO THIS AGREEMENT, EVEN IF A PARTY OR ITS REPRESENTATIVES HAVE BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES. THE PARTIES ACKNOWLEDGE

THAT THESE EXCLUSIONS OF POTENTIAL DAMAGES WERE AN ESSENTIAL ELEMENT IN SETTING CONSIDERATION UNDER THIS AGREEMENT.

8.3 Compliance With Laws.

Notwithstanding anything contained in this Agreement to the contrary, the obligations of the parties with respect to the consummation

of the transactions contemplated by this Agreement shall be subject to all laws, present and future, of any government having jurisdiction

over the parties and this transaction, and to orders, regulations, directions or requests of any such government.

8.4 Confidentiality of Terms.

The Parties hereto will keep the terms and existence of this Agreement and the identities of the Parties hereto and their affiliates

confidential and will not now or hereafter divulge any of this information to any third party except (a) with the prior written

consent of the other Party; (b) as otherwise may be required by law or legal process; (c) during the course of litigation,

so long as the disclosure of such terms and conditions is restricted in the same manner as is the confidential information of other

litigating parties; (d) in confidence to its legal counsel, accountants, banks, and financing sources and their advisors solely

in connection with complying with or administering its obligations with respect to this Agreement; (e) by Agent, to potential

purchasers or licensees of the Patents; provided that, in (b) and (c) above, (i) to the extent permitted by law, the disclosing

Party will use all legitimate and legal means available to minimize the disclosure to third parties, including, without limitation,

seeking a confidential treatment request or protective order whenever appropriate or available; and (ii) the disclosing Party will

provide the other Party with at least ten (10) days’ prior written notice of such disclosure. Without limiting the

foregoing, Seller will cause its agents involved in this transaction to abide by the terms of this paragraph, including, without

limitation, ensuring that such agents do not disclose or otherwise publicize the existence of this transaction with actual or potential

clients in marketing materials, or industry conferences.

8.5 Non-Circumvent. Seller

agrees not to directly or indirectly contact, deal with, transact, or otherwise be involved with any companies, corporations, partnerships,

proprietorships, trust, individual investors, or other entities introduced or contacted by Agent under this Agreement without the

specific written permission of the Agent. Further, Seller agrees not to directly or indirectly circumvent Agent in pursuing deals

with entities contacted or introduced or meetings arranged by Agent or deny Agent any contingency fee payment under Section 3.1.

Any deal consummated with an entity contacted or introduced by Agent under this Agreement will be subject to Section 3.1, and the

commission will be owed thereupon.

8.6 Governing Law; Venue/Jurisdiction.

This Agreement will be interpreted, construed, and enforced in all respects in accordance with the laws of the State of Nevada,

without reference to its choice of law principles to the contrary. Seller will not commence or prosecute any action, suit, proceeding

or claim arising under or by reason of this Agreement other than in the state or federal courts located in California. Seller irrevocably

consents to the jurisdiction and venue of the courts identified in the preceding sentence in connection with any action, suit,

proceeding, or claim arising under or by reason of this Agreement.

8.7 Notices. All notices given

hereunder will be given in writing (in English or with an English translation), will refer to Agent and to this Agreement and will

be delivered to the address set forth below

by (i) personal delivery, (ii) delivery

postage prepaid by an internationally-recognized express courier service:

| |

If

to Agent |

If

to Seller |

| |

IDL Concepts, LLC

276 State Street

Los Altos, CA 94022

Attn: Managing Director |

GBT Tokenize Corp.

2450 Colorado Ave. Suite

100E, Santa Monica, CA

90404 Attn: Michael Murray |

Notices are deemed given on (a) the

date of receipt if delivered personally or by express courier or (b) if delivery is refused, the date of refusal. Notice given

in any other manner will be deemed to have been given only if and when received at the address of the person to be notified. Either

Party may from time to time change its address for notices under this Agreement by giving the other Party written notice of such

change in accordance with this paragraph.

8.8 Relationship of Parties.

Neither Party has any express or implied authority to assume or create any obligations on behalf of the other or to bind the other

to any contract, agreement or undertaking with any third party.

8.9 Equitable Relief. Seller

acknowledges and agrees that damages alone would be insufficient to compensate Agent for a breach by Seller of this Agreement and

that irreparable harm would result from a breach of this Agreement. Seller hereby consents to the entering of an order for injunctive

relief to prevent a breach or further breach, and the entering of an order for specific performance to compel performance of any

obligations under this Agreement.

8.10 Severability. If any

provision of this Agreement is found to be invalid or unenforceable, then the remainder of this Agreement will have full force

and effect, and the invalid provision will be modified, or partially enforced, to the maximum extent permitted to effectuate the

original objective.

8.11 Waiver. Failure by either

Party to enforce any term of this Agreement will not be deemed a waiver of future enforcement of that or any other term in this

Agreement or any other agreement that may be in place between the parties.

8.12 Miscellaneous. This Agreement,

including its exhibits, if any, constitutes the entire agreement between the parties with respect to the subject matter hereof

and merges and supersedes all prior and contemporaneous agreements, understandings, negotiations, and discussions. Neither of the

parties will be bound by any conditions, definitions, warranties, understandings, or representations with respect to the subject

matter hereof other than as expressly provided herein. The section headings contained in this Agreement are for reference purposes

only and will not affect in any way the meaning or interpretation of this Agreement. This Agreement is not intended to confer any

right or benefit on any third party (including, but not limited to, any employee or beneficiary of any party), and no action may

be commenced or prosecuted against a party by any third party claiming as a third-party beneficiary of this Agreement or any of

the transactions contemplated by this Agreement. No oral explanation or oral information by either party hereto will alter

the meaning or interpretation of this Agreement. No amendments or modifications will be effective unless in a writing signed by

authorized representatives of both parties. The terms and conditions of this Agreement will prevail notwithstanding any different,

conflicting or additional terms and conditions that may appear on any letter, email or other communication or other writing not

expressly incorporated into this Agreement. Exhibit A (entitled “Assigned Patent Rights “).

8.13 Counterparts; Electronic

Signature; Delivery Mechanics. This Agreement may be executed in counterparts, each of which will be deemed an original, and

all of which together constitute one and the same instrument. Each Party will execute and promptly deliver to the other parties

a copy of this Agreement bearing the original signature. Prior to such delivery, in order to expedite the process of entering into

this Agreement, the parties acknowledge that a Transmitted Copy of this Agreement will be deemed an original document. “Transmitted

Copy” means a copy bearing a signature of a Party that is reproduced or transmitted via email of a .pdf file, photocopy,

facsimile, or other process of complete and accurate reproduction and transmission.

In witness whereof,

intending to be legally bound, the parties have executed this Patent Purchase Agreement as of the Effective Date.

| SELLER: |

AGENT: |

| GBT TOKENIZE CORP. |

IDL

CONCEPTS, LLC |

| By: /s/Michael

D. Murray |

By: /s/Hannah

Tran |

| Name: Michael D.

Murray |

Name: Hannah Tran |

| Title: Chief Executive

Officer |

Title: Business

Development |

We give our consent

to this agreement:

| GBT TECHNOLOGIES,

INC. |

| By:

/s/Mansour Khatib |

| Name: Mansour

Khatib |

| Title: Chief

Executive Officer |

Effective Date:

August 17, 2023

EXHIBIT A

Assigned

Patent Rights

| Patent

or Application No. |

Country |

Filing

Date |

Title

of Patent and First Named Inventor |

| US

Patent 11,586,799 |

US |

8/3/2022 |

Systems

and methods of eliminating connectivity mismatches in a mask layout block, Danny Rittman |

| US

App 17/953,378 (allowed) |

US |

9/27/2022 |

Systems

and methods of automatic generation of integrated circuit IP blocks, Danny Rittman |

| US

App 17/391,292 (allowed) |

US |

8/2/2021 |

Systems

and methods for identification and elimination of geometrical design rule violations of a mask layout block, Danny Rittman |

| US

App 17/315,747 (allowed) |

US |

5/10/2021 |

Systems

and methods for eliminating electromigration and self-heat violations in a mask layout block, Danny Rittman |

| US

App 18/110,644 |

US |

2/16/2023 |

Systems

and methods of eliminating connectivity mismatches in a mask layout block, Danny Rittman |

| US

Prov 63/248,550 |

US |

9/27/2021 |

System

and method for automatic correction of electrical connectivity mismatches of a mask layout block, maintaining the process design

rules (DRC Clean), connectivity (LVS Clean) correctness, obeying Reliability Verification (RV) and DFM (Design for manufacturability)

constraints, Danny Rittman |

| US

Prov 63/249,150 |

US |

9/28/2021 |

System

and method for Automatic Generation of Integrated Circuits IP (Intellectual property) Layout Blocks, Danny Rittman |

| US

Prov 63/197,635 |

US |

6/7/2021 |

System

and method for automatic correction of geometrical design rule violations in integrated circuit mask layout data, maintaining

its electrical connectivity (LVS), reliability (RV) and design for manufacturing (DFM) structural correctness, Danny Rittman |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

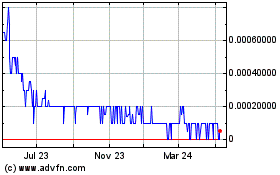

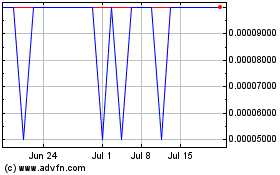

GBT Technologies (PK) (USOTC:GTCH)

Historical Stock Chart

From Mar 2024 to Apr 2024

GBT Technologies (PK) (USOTC:GTCH)

Historical Stock Chart

From Apr 2023 to Apr 2024