0001549084false00015490842023-08-172023-08-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

August 17, 2023

Date of Report (date of earliest event reported)

Ekso Bionics Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

Nevada | 001-37854 | 99-0367049 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| |

101 Glacier Point, Suite A | San Rafael | California | 94901 |

(Address of Principal Executive Offices) | (Zip Code) |

(510) 984-1761

Registrant's telephone number, including area code

Not Applicable

________________________

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | EKSO | Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 1.01 Entry Into A Material Definitive Agreement.

On August 17, 2023, Ekso Bionics Holdings, Inc. (the “Company”), Ekso Bionics, Inc., the Company’s wholly owned subsidiary (“Ekso Bionics” and, together with the Company, the “Borrower”) and Pacific Western Bank (the “Lender”), entered into the Fifth Amendment to Loan and Security Agreement (the “Amendment”). Unless otherwise indicated, the terms used below have the meanings ascribed in the Amendment.

The Amendment amends that certain Loan and Security Agreement dated as of August 13, 2020, by and between the Borrower and the Lender to, among other things, (i) have daily borrowings under the Term Loan bear interest at a variable annual rate equal to the greater of (A) the Lender’s “prime rate” then in effect and (B) 4.50%, (ii) cause the Borrower to maintain all of its depository, operating, and investment accounts with Lender and (iii) extend the Term Loan Maturity Date to August 13, 2026.

This description of the Amendment is only a summary thereof and is qualified in its entirety by reference to the copy of the Amendment, which is filed as Exhibit 10.1 to this current report on Form 8-K and incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information included in Item 1.01 above is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit Number | | Description |

| | |

| | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

EKSO BIONICS HOLDINGS, INC.

By: /s/ Jerome Wong

Name: Jerome Wong

Title: Chief Financial Officer

Dated: August 18, 2023

FIFTH AMENDMENT

TO

LOAN AND SECURITY AGREEMENT

This Fifth Amendment to Loan and Security Agreement (the “Amendment”), is entered into as of August 17, 2023, by and among PACIFIC WESTERN BANK, a California state-chartered bank (the “Bank”), EKSO BIONICS, INC., and EKSO BIONICS HOLDINGS, INC. (individually and collectively referred to as “Borrower”).

RECITALS

Borrower and Bank are parties to that certain Loan and Security Agreement dated as of August 17, 2020 (as amended from time to time, the “Agreement”). The parties desire to amend the Agreement in accordance with the terms of this Amendment.

NOW, THEREFORE, the parties agree as follows:

1)Section 2.3(a)(i) of the Agreement is hereby amended and restated as follows:

(i)Term Loan. Except as set forth in Section 2.3(b), the Term Loan shall bear interest, on the outstanding daily balance thereof, at a variable annual rate equal to the greater of: (A) the Prime Rate then in effect; or (B) 4.50%.

2)Section 6.6 of the Agreement is hereby amended and restated as follows:

6.6 Primary Depository. Beginning on the date occurring 30 days after the Fifth Amendment Date and continuing at all times thereafter, Borrower shall maintain, and shall cause all of its Subsidiaries to maintain, all depository, operating, and investment accounts with Bank. On or before the date occurring 30 days after the Fifth Amendment Date, Borrower shall deliver evidence satisfactory to Bank that Borrower has closed its account(s) at JPMorgan Chase. Notwithstanding the foregoing, Borrower’s Subsidiaries domiciled outside the United States may maintain up to an aggregate of $1,000,000 (or its USD equivalent) in accounts outside of Bank.

3)The following definition is hereby added (in alphabetical order) to Exhibit A to the Agreement, as follows:

“Fifth Amendment Date” means August 17, 2023.

4)The following term and its definition are hereby amended and restated in Exhibit A to the Agreement, as follows:

“Term Loan Maturity Date” means August 13, 2026.

5)No course of dealing on the part of Bank or its officers, nor any failure or delay in the exercise of any right by Bank, shall operate as a waiver thereof, and any single or partial exercise of any such right shall not preclude any later exercise of any such right. Bank's failure at any time to require strict performance by Borrower of any provision shall not affect any right of Bank thereafter to demand strict compliance and performance. Any suspension or waiver of a right must be in writing signed by an officer of Bank.

6)Unless otherwise defined, all initially capitalized terms in this Amendment shall be as defined in the Agreement. The Agreement, as amended hereby, shall be and remain in full force and effect in accordance with its respective terms and hereby is ratified and confirmed in all respects. Except as expressly set forth herein, the execution, delivery, and performance of this Amendment shall not operate as a waiver of, or as an amendment of, any right, power, or remedy of Bank under the Agreement, as in effect prior to the date hereof. Borrower

ratifies and reaffirms the continuing effectiveness of all agreements entered into in connection with the Agreement.

7)Each Borrower represents and warrants that the representations and warranties contained in the Agreement are true and correct as of the date of this Amendment, and that no Event of Default has occurred and is continuing.

8)This Amendment may be executed in any number of counterparts and by different parties on separate counterparts, each of which, when executed and delivered, shall be deemed to be an original, and all of which, when taken together, shall constitute but one and the same Amendment. Executed copies of this Amendment or the signature pages of this Amendment sent by facsimile or transmitted electronically in Portable Document Format (“PDF”) or any similar format, or transmitted electronically by digital image, DocuSign, or other means of electronic transmission, shall be treated as originals, fully binding and with full legal force and effect, and the parties waive any rights they may have to object to such treatment. The words “execution,” “signed,” “signature,” “delivery,” and words of like import in or relating to this Amendment and/or any document to be signed in connection with this Amendment and the transactions contemplated hereby shall be deemed to include Electronic Signatures (as defined below), deliveries or the keeping of records in electronic form, each of which shall be of the same legal effect, validity or enforceability as a manually executed signature, physical delivery thereof or the use of a paper-based recordkeeping system, as the case may be. As used herein, “Electronic Signatures” means any electronic symbol or process attached to, or associated with, any contract or other record and adopted by a person with the intent to sign, authenticate or accept such contract or record.

9)As a condition to the effectiveness of this Amendment, Bank shall have received, in form and substance satisfactory to Bank, the following:

a)this Amendment, duly executed by Borrower;

b)an officer’s certificate of Borrower with respect to incumbency and resolutions authorizing the execution and delivery of this Amendment;

c)payment of a $2,000 facility fee, which may be debited from any of Borrower’s accounts at Bank;

d)payment of all Bank Expenses, including Bank’s expenses for the documentation of this amendment and any related documents, and any UCC, good standing or intellectual property search or filing fees, which may be debited from any of Borrower's accounts; and

e)such other documents and completion of such other matters, as Bank may reasonably deem necessary or appropriate.

[Signatures appear on the following page.]

IN WITNESS WHEREOF, the undersigned have executed this Amendment as of the first date above written.

| | | | | |

| EKSO BIONICS, INC. | PACIFIC WESTERN BANK |

By: /s/ Jerome Wong Name: Jerome Wong Title: CFO & Corporate Secretary | By: /s/ Steve Kent Name: Steve Kent Title: Vice President |

| |

| |

| EKSO BIONICS HOLDINGS, INC. | |

By: /s/ Jerome Wong Name: Jerome Wong Title: CFO & Corporate Secretary | |

v3.23.2

Document and Entity Information Document

|

Aug. 17, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 17, 2023

|

| Entity Registrant Name |

Ekso Bionics Holdings, Inc.

|

| Entity Central Index Key |

0001549084

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity File Number |

001-37854

|

| Entity Tax Identification Number |

99-0367049

|

| Entity Address, Address Line One |

101 Glacier Point, Suite A

|

| Entity Address, City or Town |

San Rafael

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94901

|

| City Area Code |

510

|

| Local Phone Number |

984-1761

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value per share

|

| Trading Symbol |

EKSO

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

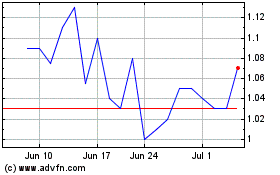

Ekso Bionics (NASDAQ:EKSO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ekso Bionics (NASDAQ:EKSO)

Historical Stock Chart

From Apr 2023 to Apr 2024