0001580262false--03-31FY202300.0010.001120000000000.0011000000050000000.001100000005000000P1Y56001014700000000873410.2100015802622022-04-012023-03-310001580262rton:DeferredTaxAssetsLiabilitiesMember2021-04-012022-03-310001580262rton:DeferredTaxAssetsLiabilitiesMember2022-04-012023-03-310001580262rton:DeferredTaxAssetsLiabilitiesMember2023-03-310001580262rton:DeferredTaxAssetsLiabilitiesMember2022-03-310001580262rton:EffectiveTaxRateFederalIncomeTaxesMember2022-04-012023-03-310001580262rton:EffectiveTaxRateFederalIncomeTaxesMember2021-04-012022-03-3100015802622021-03-1700015802622020-04-012021-03-310001580262srt:ChiefExecutiveOfficerMember2021-04-012022-03-310001580262rton:ChiefFinanciaslOfficerMember2021-04-012022-03-310001580262rton:SubscriptionAgreementMemberus-gaap:InvestorMember2019-04-012020-03-310001580262us-gaap:InvestorMember2019-04-012020-03-310001580262rton:SubscriptionAgreementMemberus-gaap:InvestorMember2020-03-310001580262rton:SubscriptionAgreementMemberus-gaap:InvestorMember2019-10-310001580262rton:ChiefFinancialOfficersMember2018-11-190001580262rton:ChiefFinancialOfficersMember2018-11-012018-11-190001580262rton:SubscriptionAgreementMemberus-gaap:InvestorMember2022-04-012023-03-310001580262rton:SubscriptionAgreementMemberus-gaap:InvestorMember2021-04-012022-03-310001580262rton:AshokPatelMember2022-06-012022-06-300001580262rton:AshokPatelMember2017-12-310001580262rton:NoteholderThreeMember2020-03-310001580262rton:NoteholderThreeMember2019-04-012020-03-310001580262rton:VendorsMember2021-06-012021-06-300001580262rton:BridgePartnersLLCMember2022-08-012022-08-220001580262rton:NoteholderMember2023-03-012023-03-3100015802622021-08-012021-08-3000015802622022-12-012022-12-310001580262us-gaap:ConvertibleDebtMember2021-04-012022-03-310001580262us-gaap:ConvertibleDebtMember2022-04-012023-03-310001580262rton:OptionsMember2021-04-012022-03-310001580262rton:OptionsMember2022-04-012023-03-310001580262rton:WarrantsMember2021-04-012022-03-310001580262rton:WarrantsMember2022-04-012023-03-310001580262rton:PreferredsStocksMember2021-04-012022-03-310001580262rton:PreferredsStocksMember2022-04-012023-03-310001580262rton:DooreLlcMember2018-03-310001580262rton:SpringHillWaterCompanyMember2018-03-310001580262rton:SpringHillWaterCompanyMember2017-04-012018-03-310001580262rton:BottlingFacilityAndEquipmentMember2017-04-012018-03-310001580262rton:BottlingFacilityAndEquipmentMember2018-03-310001580262rton:SpringHillWaterCompanyMember2022-03-310001580262rton:SpringHillWaterCompanyMember2023-03-310001580262us-gaap:ConvertibleDebtMember2016-10-022016-10-310001580262rton:AgreementElevenAugustTwoThousandTwentyTwoMember2022-08-110001580262rton:NoteholderTenMember2023-05-152023-07-150001580262rton:PaycheckProtectionProgramMember2020-05-012020-05-090001580262rton:NoteholderTenMember2022-11-152023-04-150001580262rton:NoteholderTenMember2022-05-152022-10-150001580262rton:NoteholderTenMember2022-04-180001580262rton:NoteholderTenMember2022-04-150001580262rton:FebruaryTwoThousandTwentyMemberrton:NoteholderOneMember2016-10-022016-10-310001580262rton:FebruaryTwoThousandTwentyMemberrton:NoteholderOneMember2021-06-012021-06-280001580262rton:FebruaryTwoThousandTwentyMemberrton:NoteholderOneMember2019-03-310001580262rton:AgreementElevenAugustTwoThousandTwentyTwoMember2022-08-012022-08-110001580262rton:FebruaryTwoThousandTwentyMemberrton:NoteholderOneMember2019-02-012019-02-120001580262rton:FebruaryTwoThousandTwentyMemberrton:NoteholderOneMember2019-02-120001580262rton:FebruaryTwoThousandTwentyMemberrton:NoteholderOneMember2020-04-012021-03-3100015802622023-12-310001580262rton:FebruaryTwoThousandTwentyMemberrton:NoteholderOneMember2016-12-310001580262rton:AgreementFourAugustTwoThousandTwentyTwoMember2022-08-012022-08-040001580262us-gaap:IndividualMemberrton:PromissoryNoteMember2021-06-012021-06-280001580262rton:AgreementTwentyOneJulyMember2022-04-012023-03-310001580262rton:AgreementTwentyOneJulyMember2022-08-012022-08-110001580262us-gaap:IndividualMemberrton:PromissoryNoteMember2019-11-220001580262rton:AgreementThirtyOneJanMember2022-01-310001580262us-gaap:ConvertibleDebtMember2016-10-310001580262us-gaap:IndividualMemberrton:PromissoryNoteMember2021-06-280001580262us-gaap:IndividualMemberrton:PromissoryNoteMember2019-11-012019-11-220001580262rton:NoteholderThreeMember2016-10-310001580262rton:FebruaryTwoThousandTwentyMemberrton:NoteholderOneMember2020-03-3100015802622022-07-012022-07-210001580262rton:AgreementFourAugustTwoThousandTwentyTwoMember2023-03-310001580262rton:AgreementElevenAugustTwoThousandTwentyTwoMember2023-03-310001580262rton:AgreementTwentyOneJulyMember2022-07-012022-07-210001580262rton:AgreementThirtyOneJanMember2022-01-012022-01-310001580262rton:TwoThousandTwentyFourMember2022-03-310001580262rton:NoteholderThirteenMember2022-03-310001580262us-gaap:SeriesAPreferredStockMember2022-03-310001580262rton:NoteholderTenMember2022-03-310001580262rton:NoteholderSeventeenMember2023-03-310001580262rton:NoteholderThirteenMember2023-03-310001580262us-gaap:SeriesAPreferredStockMember2023-03-310001580262rton:NoteholderThirteenMember2021-04-012022-03-310001580262rton:NoteholderTenMember2021-04-012022-03-310001580262rton:NoteholderSeventeenMember2022-04-012023-03-310001580262rton:NoteholderThirteenMember2022-04-012023-03-310001580262us-gaap:SeriesAPreferredStockMember2021-04-012022-03-310001580262us-gaap:SeriesAPreferredStockMember2022-04-012023-03-310001580262rton:DepreciationexpensesMember2022-03-310001580262rton:DepreciationexpensesMember2023-03-310001580262srt:OtherPropertyMember2022-03-310001580262srt:OtherPropertyMember2023-03-310001580262rton:IntangibleAssetsMember2022-03-310001580262rton:IntangibleAssetsMember2023-03-310001580262rton:TenantImprovementsMember2022-03-310001580262rton:TenantImprovementsMember2023-03-310001580262rton:StudioAndOfficeEquipmentMember2022-03-310001580262rton:StudioAndOfficeEquipmentMember2023-03-310001580262rton:AutomobileMember2022-03-310001580262rton:AutomobileMember2023-03-310001580262rton:WebsiteDevelopmentMember2022-03-310001580262rton:WebsiteDevelopmentMember2023-03-310001580262us-gaap:InventoriesMember2022-03-310001580262us-gaap:InventoriesMember2023-03-310001580262rton:DerivativeLiabilityConvertibleNoteMember2022-03-310001580262rton:DerivativeLiabilityConvertibleNoteMember2021-04-012022-03-310001580262us-gaap:FairValueInputsLevel3Member2021-04-012022-03-310001580262us-gaap:FairValueInputsLevel3Member2022-04-012023-03-310001580262rton:SpringHillWaterCompanyLLCMember2023-03-310001580262rton:EndoAndCentreVentureLLCMember2023-03-310001580262rton:CommonStockPayableMember2023-03-310001580262us-gaap:NoncontrollingInterestMember2023-03-310001580262us-gaap:RetainedEarningsMember2023-03-310001580262us-gaap:AdditionalPaidInCapitalMember2023-03-310001580262us-gaap:CommonStockMember2023-03-310001580262rton:PreferredStocksMember2023-03-310001580262rton:CommonStockPayableMember2022-04-012023-03-310001580262us-gaap:NoncontrollingInterestMember2022-04-012023-03-310001580262us-gaap:RetainedEarningsMember2022-04-012023-03-310001580262us-gaap:AdditionalPaidInCapitalMember2022-04-012023-03-310001580262us-gaap:CommonStockMember2022-04-012023-03-310001580262rton:PreferredStocksMember2022-04-012023-03-310001580262rton:CommonStockPayableMember2022-03-310001580262us-gaap:NoncontrollingInterestMember2022-03-310001580262us-gaap:RetainedEarningsMember2022-03-310001580262us-gaap:AdditionalPaidInCapitalMember2022-03-310001580262us-gaap:CommonStockMember2022-03-310001580262rton:PreferredStocksMember2022-03-310001580262rton:CommonStockPayableMember2021-04-012022-03-310001580262us-gaap:NoncontrollingInterestMember2021-04-012022-03-310001580262us-gaap:RetainedEarningsMember2021-04-012022-03-310001580262us-gaap:AdditionalPaidInCapitalMember2021-04-012022-03-310001580262us-gaap:CommonStockMember2021-04-012022-03-310001580262rton:PreferredStocksMember2021-04-012022-03-3100015802622021-03-310001580262rton:CommonStockPayableMember2021-03-310001580262us-gaap:NoncontrollingInterestMember2021-03-310001580262us-gaap:RetainedEarningsMember2021-03-310001580262us-gaap:AdditionalPaidInCapitalMember2021-03-310001580262us-gaap:CommonStockMember2021-03-310001580262rton:PreferredStocksMember2021-03-3100015802622021-04-012022-03-3100015802622022-03-3100015802622023-03-3100015802622023-07-1800015802622022-09-30iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

☒ | Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| |

For the Fiscal Year Ended March 31, 2023 |

| |

☐ | Transition Report pursuant to 13 or 15(d) of the Securities Exchange Act of 1934 |

| |

For the transition period from __________ to __________ |

| |

Commission File Number: 000-55704 |

Right On Brands, Inc. |

(Exact name of registrant as specified in its charter) |

Nevada | | 45-1994478 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

6501 Dalrock Road, Suite 100, Rowlett, TX 75089 |

(Address of principal executive offices) |

(214) 736-7252 |

(Registrant's telephone number) |

|

N/A |

(Former name, former address and former fiscal year, if changed since last report) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

None | N/A | N/A |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicated by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

☐ | Large accelerated filer | ☐ | Accelerated filer |

☐ | Non-accelerated filer | ☒ | Smaller reporting company |

| | ☐ | Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

As of August 16, 2023, there were 6,374,516,097 shares of common stock, par value $0.001 per share, outstanding.

TABLE OF CONTENTS

PART I

Item 1. Business

Forward-Looking Statements

Certain statements, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives, and expected operating results, and the assumptions upon which those statements are based, are "forward-looking statements." These forward-looking statements generally are identified by the words "believes," "project," "expects," "anticipates," "estimates," "intends," "strategy," "plan," "may," "will," "would," "will be," "will continue," "will likely result," and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on our operations and future prospects on a consolidated basis include, but are not limited to: changes in economic conditions, legislative/regulatory changes, availability of capital, interest rates, competition, and generally accepted accounting principles. These risks and uncertainties should also be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements.

Overview

Our business is conducted through our wholly-owned subsidiaries, Endo Brands, Endo Wellness Centers, and Humble Water Company, which is dormant and not operating. The Company creates and markets a line of CBD consumer products. Right on Brands creates lasting brands with emerging functional ingredients, and our focus right now is industrial hemp, hemp derived cannabinoids, and high alkaline water.

PRODUCT LINE

ENDO BRANDS

ENDO Drops

The easiest and most effective way to get your daily CBD, CBN or Delta-8 supplementation. These daily drops are blended with amazing essential oils for a great taste. You can take them either directly or mix them into your favorite beverage. There is even a peanut butter flavored drop for your pet. We recently introduced “Endo on the Go” Delta-8 drops that you can slip into your pocket and purse and take with you just about anywhere!

ENDO Ease

Topical Pain relief product, it is our Endo Select Hemp Oil used as either a warming lotion, cooling lotion or salve.

ENDO Tokes

Our ENDO Tokes products are a range of products made for people who would rather smoke their CBD or Delta-8. The original ENDO Toke is a pre-rolled CBD flower that comes in the shape of a cigarette. The product is, however, tobacco free and has less than 0.30% THC so it won’t get you high, but it is a quick delivery system for CBD. In addition, in 2021, the company has introduced a line of Delta-8 infused disposable and rechargeable vape pens as well as Delta-8 flower in jars or pre-rolled for quick consumption. All of these products are designed to give multiple choices to our customers who like to consume CBD and Delta-8 by smoking something.

ENDO Gummies

For people that don’t like to ingest CBD or Delta-8 by smoking, we have a line of gummies. Currently, we sell three different types of gummies: 1) CBD; 2) CBD & Melatonin; and 3) Delta-8.

Competition & our Advantages

In the market we are going to occupy, we face the following major competitors:

| · | Manitoba Hemp Foods: Based in Canada, Manitoba looks to be the industry leader in this market. They have been selling hemp products since 1998 and have created a strong brand. They carry Hemp Hearts, Hemp Heart Bars, Hemp protein smoothies, Hemp protein powder, and Hemp oil. |

| | |

| · | Evo Hemp: Evo is a boulder-based Hemp bar company. They are one of the newer hemp brands in the market. They only offer bars in their product line. |

| | |

| · | Nutiva: Nutiva is an organic superfood brand. They offer a wide range of products with chia, red palm, coconut, and hemp. |

| | |

| · | Naturally Splendid: Naturally Splendid is a multifaceted biotechnology company developing, commercializing, producing, selling, and licensing an entirely new generation of hemp-derived, high quality, nutrient-dense Omega foods, nutritional food enhancers, and related products. |

| | |

| · | CBD MD: CBD MD is a manufacturer of CBD infused products. CBD MD has a full line of CBD infused products. |

Our Potential Advantages

ENDO Brands advantage in the market is our unique formulation, price point and high quality. We work closely with our manufacturers to tailor our products to consumer demand.

Marketing, Sales, and Distribution Strategies

Marketing Plan

| · | Multi-Channel Marketing: We promote through multiple channels to build awareness of our products. |

| | |

| · | Online Marketing: Most major online platform do not allow the advertising of CBD or Delta-8 infused products for sale so we are limited in what we can promote. As such, we use our internal email list to promote our products to people who have previously shown an interest. We are constantly working on expanding the size of this list. |

| | |

| · | Instagram: Our goal on IG for our brands is to build an obsessed fan base and an engaged community. Hemp education is a vital part of these channels, we will utilize this channel to show the “lifestyle” using our products as well as unique info on our products to drive traffic to our online and retail stores. |

| | |

| · | Twitter and Facebook: We use Twitter and Facebook to inform our customers and investors about the company and to drive traffic to our website that will convert into purchases. |

| | |

| · | Consumer Outreach & Education: The most important factor in the marketing of our products will be consumer education on the benefits of hemp derived products. |

Sales Plan

| · | Retail Store: In 2021 the company opened its first retail store just outside Dallas, Texas. The company is looking at opening up additional company owned stores in the Dallas area as well as licensed stores in other cities. |

| | |

| · | Retail Distribution: The company did not find working with large distributors and retailer as too profitable. As such, it is selling directly to a few retail locations across the continental U.S. |

| | |

| · | Online Sales: We currently sell our “ENDO” line of products through the following website: EndoBrands.com. |

| | |

| · | Branded Stores: We currently sell our “ENDO” line of products to branded stores through agreements requiring the branded stores to purchase from us a set percentage of their inventory for the right to use our name and products. |

Manufacturing and Distribution

Endo Brands

We use various manufacturers and co-packers to create our Endo branded products.

Item 1A. Risk Factors

Risks Related to Our Company and Business

If we do not obtain additional financing, our business development plans will be delayed, and we may not achieve profitable operations.

We will require significant additional capital to execute on our business development plans. We intend to seek additional funds through private placements of our common stock or other securities as well as public sale of our stock to the public. Our business plan calls for incurring expenses for the purchase of products, website maintenance, and expenses for salary, legal, and administration. If no additional financing is secured, we may have to significantly curtail our plan of operations. If that is the case, our business will not grow as desired. Our ability to raise additional financing is unknown. We do not have any formal commitments or arrangements for the advancement of funds. Consequently, there can be no assurance that we will be able to obtain access to capital as and when needed or, if so, that the terms of any available financing will be commercially reasonable. If we are unable to raise suitable financing, our business development plans may be delayed, and we may be unable to achieve profitable operations.

Since we have limited operating history and limited revenues to date, we may be unable to achieve or maintain profitability. The likelihood of our success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered by a newer enterprise.

We have limited financial resources and have generated limited revenues to date in our business. The likelihood of our success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered by a company starting a new business enterprise and the highly competitive environment in which we will operate. Since we have a limited operating history and lack a track record of consistent revenues, we cannot assure you that our business will be profitable or that we will ever generate sufficient revenues to fully meet our expenses and totally support our anticipated activities.

Our ability to continue as a business and implement our business plan will depend on our ability to raise sufficient funds. There is no assurance that any debt or equity offerings will be successful or that we will remain in business or be able to implement our business plan if the offerings are not successful.

If we are unable to develop a reliable system for outside manufacturing and fulfillment, our ability to grow our business and achieve profitability will be severely adversely affected.

We currently do not manufacture any of the products that we sell. If our current manufacturers and/or co-packers do not continue to work with us in the future, we may be unable to produce any more product. Our ability to grow our business and customer base will depend upon smoothly functioning relationships with our manufacturing and fulfillment partners and our ability to integrate their roles with our sales, marketing and customer service operations. If we are unable to smoothly integrate these third-party operations into our business, or if we are unable to establish and maintain strong relationships with these key outside parties, our ability to successfully deliver quality products to our customer in a timely manner will be adversely affected, and our ability to achieve profitability will be severely impaired.

If we are unable to successfully market our products or our products do not perform as expected, our business and financial condition will be adversely affected.

We are subject to the risks generally associated with new product introductions and applications, including lack of market acceptance and failure of products to perform as expected. There can be no assurance that we will be successful in marketing our products to the public. Our success will depend on our ability to grow our wholesale distribution network and to develop additional sales channels on cost-effective terms. Our marketing efforts may not be sufficient to generate significant and ongoing sales. Further, if our products do not perform as expected by consumers, either in terms of flavor or perceived performance, our ability to expand our product distribution and grow overall sales will be severely impaired.

Because consumer preferences change frequently, if we fail to innovate, our business and financial condition will be adversely affected.

As a result of changing consumer preferences, most new products are successfully marketed for a limited period of time. Even if our products show early signs of promise, there can be no assurance that our products will continue to be popular for an extended period of time. Our success will be dependent upon our ability to address the changing needs and tastes of the consumer market. Our failure to innovate over time and to adjust to consumer preferences on a regular basis could cause us to fail to achieve and sustain ongoing market acceptance could have a material adverse effect on our financial condition and results of operations.

Because of pressures from competitors with more resources, we may fail to implement our business strategy profitably.

The market for our products is intensely competitive and we expect competition to increase in the future. We will compete with larger and more established companies that have longer operating histories, greater name recognition, access to larger customer bases and distribution networks, and significantly greater financial, technical and marketing resources than we do. As a result, they may be able to adapt more quickly to changes in customer preferences and to devote greater resources to the promotion and sale of their products than we will. In addition, they may have more firmly established financial, manufacturing, distribution, and sales relationships in the industry. Therefore, we cannot be sure that we will be able to successfully implement our business strategy in the face of such competition. If we cannot compete effectively, we may experience future price reductions, reduced gross margins and loss of market share, any of which will materially adversely affect our business, operating results and financial condition.

If we are unable to manage growth, our operations could be adversely affected.

Our progress is expected to require the full utilization of our management, financial and other resources, which to date has occurred with limited working capital. Our ability to manage growth effectively will depend on our ability to improve and expand operations, including our financial and management information systems, and to recruit, train and manage sales, management, and technical personnel. There can be no assurance that management will be able to manage growth effectively.

If we do not properly manage the growth of our business, we may experience significant strains on our management and operations and disruptions in our business. Various risks arise when companies grow quickly. If our business or industry grows too quickly, our ability to meet customer demand in a timely and efficient manner could be challenged. We may also experience development delays as we seek to meet increased demand for our products. Our failure to properly manage the growth we might experience could negatively impact our ability to execute on our operating plan and, accordingly, could have an adverse impact on our business, our cash flow and results of operations, and our reputation with our current or potential customers.

Our business and growth may suffer if we are unable to attract and retain key employees.

Our success depends on the expertise and continued service of my different persons. If one of them leaves the company, it may be difficult to find a sufficiently qualified and motivated individual to replace him/her and it may result in our being unable to implement our business plan and even a complete cessation of our operations, which would likely result in the total loss of an investor's investment.

Furthermore, our ability to expand operations to accommodate our anticipated growth will also depend on our ability to attract and retain qualified media, management, finance, marketing, sales and technical personnel. However, competition for these types of employees is intense due to the limited number of qualified professionals. Our ability to meet our business development objectives will depend in part on our ability to recruit, train and retain top quality people with advanced skills who understand our business. We hope that we will be able to attract competent employees, but no assurance can be given that we will be successful in this regard. If we are unable to engage and retain the necessary personnel, our business may be materially and adversely affected.

The coronavirus outbreak may adversely affect our business.

In December 2019, a strain of coronavirus was reported to have surfaced in Wuhan, China, and has reached multiple other countries, resulting in government-imposed quarantines, travel restrictions and other public health safety measures in affected countries. The continued outbreak and spreading of the coronavirus has and may continue to adversely impact our business, as our operations are based in the United States which has been severely affected by the outbreak. The various precautionary measures taken by many governmental authorities around the world in order to limit the spread of the coronavirus has had and may continue to have an adverse effect on the global markets and global economy, including on the availability and pricing of employees, resources, materials, manufacturing and delivery efforts and other aspects of the global economy. The financial downturn has affected the working hours or availability of staff and third-party contractors, and our clients may encounter cash-flow issues that will delay their payments to us. We also rely on third-party professionals to provide services such as the preparation of our financial statements and to conduct audits, and many of these parties have been affected by government-imposed precautionary measures, thereby delaying our receipt of these services. Therefore, the coronavirus has and could continue to disrupt production and cause delays in the supply and delivery of our products, may continue to affect our operation and disrupt the marketplace in which we operate and may have a material adverse effect on our operations. The extent to which the coronavirus impacts our results will depend on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of the coronavirus and the actions to contain the coronavirus or treat its impact, among others. The development of the coronavirus outbreak could materially disrupt our business and operations, hamper our ability to raise additional funds or sell our securities, continue to slow down the overall economy, curtail consumer spending, interrupt our sources of supply, and make it hard to adequately staff our operations.

Risks Related to Legal Uncertainty

If we are the subject of significant future product liability or related lawsuits, our business will likely fail.

Like all sellers of products for human consumption, we cannot eliminate the risk that our products may be subjection to contamination during the manufacturing or distribution process. Although we currently maintain product liability and general liability insurance, we may not be able to obtain such coverage in the future or such coverage may not be adequate to cover all potential claims. Moreover, even if we are able to maintain sufficient insurance coverage in the future, any successful claim could significantly harm our business, financial condition and results of operations.

The legal status of the main ingredient in our products is uncertain.

Currently, even though many companies are selling items enhanced with Cannabidiol (CBD), the legal status of CBD for use in food is uncertain. For example, in July 2018, the Department of Public Health of the State of California issued a directive stating that CBD derived from industrial hemp, as is used in products like our ENDO Gummy line, is not approved for use in human or pet food. The State of New York has taken a similar position. The FDA has taken a similar position. If this position is adopted by many other states in the future, it could significantly harm our business, financial condition, and results of operations. Furthermore, the Food and Drug Administration has also not declared CBD Generally Recognized As Safe (GRAS) and, as such, it could issue a directive similar to the one issued by the State of California.

In addition, although we believe that Delta-8-Tetrahydrocannabinol is federally legal under the Farm Bill, certain states have moved to outlaw Delta-8 or have it regulated as Marijuana. A recent bill to outlaw Delta-8 was recently defeated in the Texas Legislature.

Risks Related to Our Common Stock

Because we do not expect to pay dividends for the foreseeable future, investors seeking cash dividends should not purchase our common stock.

We have never declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future. Our payment of any future dividends will be at the discretion of our Board of Directors after taking into account various factors, including but not limited to our financial condition, operating results, cash needs, growth plans and the terms of any credit agreements that we may be a party to at the time. Accordingly, investors must rely on sales of their own common stock after price appreciation, which may never occur, as the only way to realize their investment. Investors seeking cash dividends should not purchase our common stock.

If we undertake future offerings of our common stock, shareholders will experience dilution of their ownership percentage.

Generally, existing shareholders will experience dilution of their ownership percentage in the company if and when additional shares of common stock are offered and sold. In the future, we may be required to seek additional equity funding in the form of private or public offerings of our common stock and/or use convertible debt. In the event that we undertake subsequent offerings of common stock, or raise money using convertible debentures, your ownership percentage, voting power as a common shareholder, and earnings per share, if any, will be proportionately diluted. This may, in turn, result in a substantial decrease in the per-share value of your common stock.

Because FINRA sales practice requirements may limit a stockholder's ability to buy and sell our stock, investors may not be able to sell their stock should they desire to do so.

In addition to the "penny stock" rules described below, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may have the effect of reducing the level of trading activity in our common stock. As a result, fewer broker-dealers may be willing to make a market in our common stock, reducing a stockholder's ability to resell shares of our common stock.

Because we are subject to the "Penny Stock" rules, the level of trading activity in our stock may be reduced.

Broker-dealer practices in connection with transactions in "penny stocks" are regulated by penny stock rules adopted by the Securities and Exchange Commission. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on some national securities exchanges or quoted on Nasdaq). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and, if the broker-dealer is the sole market maker, the broker-dealer must disclose this fact and the broker-dealer's presumed control over the market, and monthly account statements showing the market value of each penny stock held in the customer's account. In addition, broker-dealers who sell these securities to persons other than established customers and "accredited investors" must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. Consequently, these requirements may have the effect of reducing the level of trading activity in the secondary market for a security subject to the penny stock rules, and investors in our common stock may find it difficult to sell their shares.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

Our corporate headquarters are at 6501 Dalrock Road, Suite 100, Rowlett, TX 75089.

The property is sufficient for our current business size.

Item 3. Legal Proceedings

None.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

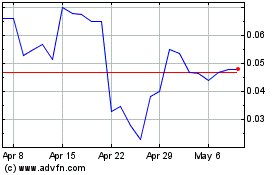

Our common stock is quoted under the symbol "RTON" on the OTCQB tier of the over-the-counter electronic quotation system operated by OTC Markets Group, Inc. The following tables set forth the range of high and low prices for our common stock for the each of the periods indicated as reported by the OTC Markets quotation system. These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

Fiscal Year Ended March 31, 2023

Quarter Ended | | High $ | | | Low $ | |

March 31, 2023 | | $ | 0.0003 | | | $ | 0.0001 | |

December 31, 2022 | | $ | 0.0006 | | | $ | 0.0001 | |

September 30, 2022 | | $ | 0.0008 | | | $ | 0.0004 | |

June 30, 2022 | | $ | 0.0009 | | | $ | 0.0003 | |

Fiscal Year Ended March 31, 2022

Quarter Ended | | High $ | | | Low $ | |

March 31, 2022 | | $ | 0.0010 | | | $ | 0.0005 | |

December 31, 2021 | | $ | 0.0023 | | | $ | 0.0006 | |

September 30, 2021 | | $ | 0.0043 | | | $ | 0.0013 | |

June 30, 2021 | | $ | 0.0055 | | | $ | 0.0013 | |

On August 15, 2023, the last sales price per share of our common stock was $0.0001.

Penny Stock

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a market price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (b) contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties or other requirements of the securities laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such other information and is in such form, including language, type size and format, as the SEC shall require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statement showing the market value of each penny stock held in the customer's account. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement as to transactions involving penny stocks, and a signed and dated copy of a written suitability statement.

These disclosure requirements may have the effect of reducing the trading activity for our common stock. Therefore, stockholders may have difficulty selling our securities.

Holders of Our Common Stock

As of August 15, 2023, we had 6,374,516,097 shares of our common stock issued and outstanding, held by approximately 125 shareholders of record.

Dividends

There are no restrictions in our articles of incorporation or bylaws that prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where after giving effect to the distribution of the dividend:

| 1. | We would not be able to pay our debts as they become due in the usual course of business; or |

| | |

| 2. | Our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving the distribution. |

We have not declared any dividends and we do not plan to declare any dividends in the foreseeable future.

Item 6. Selected Financial Data

A smaller reporting company is not required to provide the information required by this Item.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

Fiscal Year Ended March 31, 2023 Compared to Fiscal Year Ended March 31, 2022

During the year ended March 31, 2023, we generated revenue of $1,135,939. Our cost of goods sold was $530,474, resulting in gross margin of $605,465. We incurred total operating expenses of $741,378, consisting of general and administrative expenses of $562,888, legal and professional fees of $149,066, advertising and promotion costs of $23,824 and depreciation and amortization of $5,600. In addition, we incurred interest expense of $11,750, amortization of debt discount of $16,509, a gain on the change in fair value of derivative liabilities of $51,994, financing costs of $4,250, a loss on the settlement of dispute of $15,143, and a gain on the settlement of liabilities of $140,297. Our net income for the year ended March 31, 2023, was $8,726.

During the year ended March 31, 2022, we generated revenue of $997,100. Our cost of goods sold was $557,088, resulting in gross margin of $440,012. We incurred total operating expenses of $495,697, consisting of general and administrative expenses of $349,980, legal and professional fees of $111,599, advertising and promotion costs of $28,518 and depreciation and amortization of $5,600. In addition, we incurred interest expense of $25,636, amortization of debt discount of $966, a gain on the change in fair value of derivative liabilities of $100,209 and a loss on the settlement of liabilities of $274,938. Our net loss for the year ended March 31, 2022, was $257,016.

Our revenues increased during the year ended March 31, 2023, as compared to the prior year, largely as a result of the performance of our store in Rowlett, Texas, along with the Company beginning to sell to other stores on a bulk basis, which we hope expands in the future. Our gross margins increased significantly in 2023 as we increased prices and lowered our acquisition costs. Our operating expenses were relatively consistent as compared to the prior year. Over the last two years, the Company settled much of its debt obligations resulting in a decrease in interest expenses and derivative liabilities. As we continue with the development and marketing of our new products, we expect that our operating expenses, as well as our revenues, will increase significantly over the current fiscal year.

Liquidity and Capital Resources

As of March 31, 2023, we had current assets in the amount of $154,456, consisting of cash in the amount of $33,322, accounts receivable of $1,798, inventory of $116,115 and other current assets of $3,221.

As of March 31, 2023, we had current liabilities of $684,788, consisting of notes payable, net of discounts, of $257,077, convertible debts, net of discounts, in the amount of $182,051, unearned revenue of 12,500, accounts payable of $77,388, accrued interest of $28,236, accrued expenses of $104,148, and current portion of lease liability of $23,388.

We have funded our operations to date through the issuance of common stock in offerings exempt under Rule 506, as well as through the issuance of notes payable and convertible notes payable.

Our ability to successfully execute our business plan is contingent upon us obtaining additional financing and/or upon realizing sales revenue sufficient to fund our ongoing expenses. Until we are able to sustain our ongoing operations through sales revenue, we intend to fund operations through debt and/or equity financing arrangements, which may be insufficient to fund our capital expenditures, working capital, or other cash requirements. We do not have any formal commitments or arrangements for the sales of stock or the advancement or loan of funds at this time. There can be no assurance that such additional financing will be available to us on acceptable terms, or at all.

Off Balance Sheet Arrangements

As of March 31, 2023, there were no off-balance sheet arrangements.

Going Concern

We have experienced recurring losses from operations and had an accumulated deficit of $15,761,241 as of March 31, 2023. To date, we have not been able to produce sufficient sales to become cash flow positive and profitable on a consistent basis. The success of our business plan during the next 12 months and beyond will be contingent upon generating sufficient revenue to cover our costs of operations and/or upon obtaining additional financing. If the Company raises additional funds through the issuance of equity, the percentage ownership of current shareholders could be reduced, and such securities might have rights, preferences or privileges senior to the rights, preferences and privileges of the Company’s common stock. Additional financing may not be available upon acceptable terms, or at all. If adequate funds are not available or are not available on acceptable terms, the Company may not be able to take advantage of prospective business endeavors or opportunities, which could significantly and materially restrict its future plans for developing its business and achieving commercial revenues. If the Company is unable to obtain the necessary capital, the Company may have to cease operations.

Critical Accounting Policies

In December 2001, the SEC requested that all registrants list their most "critical accounting polices" in the Management Discussion and Analysis. The SEC indicated that a "critical accounting policy" is one which is both important to the portrayal of a company's financial condition and results, and requires management's most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain. We do not believe that the following accounting policies currently fit this definition.

Principles of Consolidation

The consolidated financial statements of the Company include the accounts of Right On Brands, Inc. and its wholly owned subsidiaries. Intercompany accounts and transactions have been eliminated upon consolidation.

Cash and Cash Equivalents

The Company considers all highly liquid debt instruments purchased with an original maturity of three months or less to be cash equivalents.

Property and Equipment

Property and equipment are stated at cost. Depreciation is provided by the straight-line method over the useful lives of the related assets, from three to five years.

Inventory

Inventories are stated at the lower of cost (average cost) or market (net realizable value).

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Long-lived Assets

The Company's long-lived assets and other assets (consisting of property and equipment) are reviewed for impairment in accordance with the guidance of the FASB ASC 360, “Property, Plant, and Equipment”.

The Company tests for impairment losses on long-lived assets used in operations whenever events or changes in circumstances indicate that the carrying amount of the asset may not be recoverable. Recoverability of an asset to be held and used is measured by a comparison of the carrying amount of an asset to the future undiscounted cash flows expected to be generated by the asset. If such asset is considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the asset exceeds its fair value. Impairment evaluations involve management's estimates on asset useful lives and future cash flows. Actual useful lives and cash flows could be different from those estimated by management which could have a material effect on our reporting results and financial positions. Fair value is determined through various valuation techniques including discounted cash flow models, quoted market values and third-party independent appraisals, as considered necessary.

Stock-Based Compensation

The Company accounts for equity instruments issued in exchange for the receipt of goods or services from other than employees in accordance with FASB ASC 505-50, “Equity-Based Payments to Non-Employees”. Costs are measured at the estimated fair market value of the consideration received or the estimated fair value of the equity instruments issued, whichever is more reliably measurable. The value of equity instruments issued for consideration other than employee services is determined on the earliest of a performance commitment or completion of performance by the provider of goods or services as defined by FASB ASC 505-50, “Equity-Based Payments to Non-Employees”.

The Company accounts for equity instruments issued in exchange for the receipt of goods or services from other than employees in accordance with FASB ASC 718, “Compensation – Stock Compensation”. Costs are measured at the estimated fair value of the consideration received or the estimated fair value of the equity instruments issued, whichever is more reliably measurable. The value of equity instruments issued for consideration other than employee services is determined on the earliest of a performance commitment or completion of performance by the provider of goods or services as defined by FASB ASC 718, “Compensation – Stock Compensation”.

Revenue Recognition

We recognize revenue when our performance obligation is satisfied. Our primary performance obligation (the distribution and sales of hemp products) is satisfied upon the shipment or delivery of products to our customers, which is also when control is transferred. The transfer of control of products to our online customers is typically based on sales terms that do not allow for a right of return after 7 days from the date of purchase. The transfer of control of products to our in-store customers is typically based on sales terms that do not allow for a right of return.

Our products are sold for cash with payments received at pickup or before shipping.

Income Taxes

The Company is subject to income taxes in the U.S. Significant judgment is required in evaluating our uncertain tax positions and determining our provision for income taxes. In accordance with FASB ASC 740, "Income Taxes," the Company provides for the recognition of deferred tax assets if realization of such assets is more likely than not. The Company accounts for income tax under the provisions of FASB ASC 740, "Income Taxes", which requires recognition of deferred tax assets and liabilities for the expected future tax consequences of the events that have been included in the financial statements or tax returns. Deferred income taxes are recognized for all significant temporary differences between tax and financial statements bases of assets and liabilities. Valuation allowances are established against net deferred tax assets when it is more likely than not that some portion or all of the deferred tax asset will not be realized.

Fair Value of Financial Instruments

The Company applies the provisions of accounting guidance, FASB ASC 825, “Financial Instruments”, that requires all entities to disclose the fair value of financial instruments, both assets and liabilities recognized and not recognized on the balance sheet, for which it is practicable to estimate fair value, and defines fair value of a financial instrument as the amount at which the instrument could be exchanged in a current transaction between willing parties.

Convertible Instruments

The Company evaluates and account for conversion options embedded in convertible instruments in accordance with ASC 815 “Derivatives and Hedging Activities".

Applicable GAAP requires companies to bifurcate conversion options from their host instruments and account for them as free standing derivative financial instruments according to certain criteria. The criteria include circumstances in which (a) the economic characteristics and risks of the embedded derivative instrument are not clearly and closely related to the economic characteristics and risks of the host contract, (b) the hybrid instrument that embodies both the embedded derivative instrument and the host contract is not re-measured at fair value under other GAAP with changes in fair value reported in earnings as they occur and (c) a separate instrument with the same terms as the embedded derivative instrument would be considered a derivative instrument.

The Company accounts for convertible instruments (when it has been determined that the embedded conversion options should not be bifurcated from their host instruments) as follows: The Company records when necessary, discounts to convertible notes for the intrinsic value of conversion options embedded in debt instruments based upon the differences between the fair value of the underlying common stock at the commitment date of the note transaction and the effective conversion price embedded in the note. Debt discounts under these arrangements are amortized over the term of the related debt to their stated date of redemption.

Recently Issued Accounting Pronouncements

Our management has considered all recent accounting pronouncements issued since the last audit of our financial statements. Our management believes that these recent pronouncements will not have a material effect on our financial statements.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

A smaller reporting company is not required to provide the information required by this Item.

Item 8. Financial Statements and Supplementary Data

Index to Financial Statements Required by Article 8 of Regulation S-X:

Audited Financial Statements:

Your Vision Our Focus

Report of Independent Registered Public Accounting Firm

Board of Directors and Shareholders of Right On Brands, Inc.

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets of Right On Brands, Inc. as of March 31, 2023 and 2022, and the related consolidated statements of operations, stockholders’ deficit, and cash flows for each of the two years in the period ended March 31, 2023, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of Right On Brands, Inc. as of March 31, 2023 and 2022, and the results of its operations and its cash flows for each of the two years in the period ended March 31, 2023, in conformity with accounting principles generally accepted in the United States of America.

Going Concern

The accompanying financial statements have been prepared assuming that the entity will continue as a going concern. As discussed in Note 2 to the financial statements, the entity has suffered recurring losses from operations since inception and has a net capital deficiency that raise substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility of the entity’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to Right On Brands, Inc. in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Right On Brands, Inc. is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the entity's internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Turner, Stone & Company, L.L.P. Accountants and Consultants 12700 Park Central Drive, Suite 1400 Dallas, Texas 75251 Telephone: 972-239-1660 ⁄ Facsimile: 972-239-1665 Toll Free: 877-853-4195 Web site: turnerstone.com |

INTERNATIONAL ASSOCIATION OF ACCOUNTANTS AND AUDITORS |

Critical Audit Matters

The critical audit matters communicated below are matters arising from the current period audit of the financial statements that were communicated or required to be communicated to the audit committee and that: (1) relate to accounts or disclosures that are material to the financial statements and (2) involved our especially challenging, subjective, or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the financial statements, taken as a whole, and we are not, by communicating the critical audit matters below, providing separate opinions on the critical audit matters or on the accounts or disclosures to which they relate.

Convertible notes payable

As discussed in Note 6 to the financial statements, the Company entered into certain financing transactions which included the issuance of notes payable which were convertible into common stock of the Company.

We identified the accounting evaluation of the conversion feature with each note payable to be a critical audit matter because the evaluation of the appropriate accounting treatment for this area involved a high degree of auditor judgment and an increased extent of effort to evaluate the Company’s conclusions.

How the Matter Was Addressed in the Audit

Our audit procedures related to the conclusions associated with the presentation and accounting for the conversion features involved the following procedures, among others:

| - | We obtained management’s analysis of the conversion feature within each note payable. |

| | |

| - | We analyzed the conversion feature to identify and assess the reasonableness of management’s accounting treatment for this feature and how it impacted both the accounting and presentation in the financial statements. |

/s/ Turner, Stone & Company, L.L.P.

We have served as Right On Brands, Inc.'s auditor since 2019.

Dallas, Texas

August 16, 2023

RIGHT ON BRANDS, INC. | |

CONSOLIDATED BALANCE SHEETS | |

| | | | | | |

| | March 31, | | | March 31, | |

| | 2023 | | | 2022 | |

| | | | | | |

Assets | |

Current assets | | | | | | |

Cash | | $ | 33,322 | | | $ | 28,056 | |

Accounts receivable | | | 1,798 | | | | - | |

Prepaid expenses | | | - | | | | 6,000 | |

Inventory | | | 116,115 | | | | 114,944 | |

Other current assets | | | 3,221 | | | | 3,221 | |

Total current assets | | | 154,456 | | | | 152,221 | |

| | | | | | | | |

Non-current assets | | | | | | | | |

Property and equipment, net of depreciation | | | 9,885 | | | | 15,485 | |

Right of use asset | | | 42,488 | | | | 66,425 | |

Total non-current assets | | | 52,373 | | | | 81,910 | |

| | | | | | | | |

Total assets | | $ | 206,829 | | | $ | 234,131 | |

| | | | | | | | |

Liabilities and Stockholders' Deficit |

| | | | | | | | |

Current liabilities | | | | | | | | |

Accounts payable | | $ | 77,388 | | | $ | 56,723 | |

Accrued interest payable | | | 28,236 | | | | 32,883 | |

Accrued expenses | | | 104,148 | | | | 93,189 | |

Unearned revenue | | | 12,500 | | | | - | |

Lease liability, current portion | | | 23,388 | | | | 23,937 | |

Notes payable, net of discount | | | 257,077 | | | | 94,945 | |

Convertible debt, net of discount | | | 182,051 | | | | 296,788 | |

Derivative liability | | | - | | | | 159,106 | |

Total current liabilities | | | 684,788 | | | | 757,571 | |

| | | | | | | | |

Lease liability, non-current | | | 19,100 | | | | 42,488 | |

| | | | | | | | |

Total liabilities | | | 703,888 | | | | 800,059 | |

| | | | | | | | |

Commitments and contingencies (Note 11) | | | | | | | | |

| | | | | | | | |

Stockholders' deficit | | | | | | | | |

Series A Preferred stock; 10,000,000 shares authorized of $.001 par value; 5,000,000 shares issued, respectively | | | 5,000 | | | | 5,000 | |

Common stock; par value $.001; 12,000,000,000 authorized, 6,374,516,097 and 5,924,801,561 shares issued, respectively | | | 6,374,517 | | | | 5,924,802 | |

Additional paid-in capital | | | 8,845,228 | | | | 9,197,980 | |

Common stock payable | | | 15,000 | | | | 51,820 | |

Accumulated deficit | | | (15,761,241 | ) | | | (15,769,967 | ) |

Total Right On Brands stockholders' deficit | | | (521,496 | ) | | | (590,365 | ) |

Noncontrolling interest | | | 24,437 | | | | 24,437 | |

Total stockholders' deficit | | | (497,059 | ) | | | (565,928 | ) |

| | | | | | | | |

Total liabilities and stockholders' deficit | | $ | 206,829 | | | $ | 234,131 | |

The accompanying notes are an integral part of these consolidated financial statements.

RIGHT ON BRANDS, INC. |

CONSOLIDATED STATEMENTS OF OPERATIONS |

| | | | | | |

| | For the years ended | |

| | March 31, | |

| | 2023 | | | 2022 | |

| | | | | | |

Revenues | | $ | 1,135,939 | | | $ | 997,100 | |

Cost of goods sold | | | 530,474 | | | | 557,088 | |

Gross profit | | | 605,465 | | | | 440,012 | |

| | | | | | | | |

Operating expenses | | | | | | | | |

General and administrative | | | 562,888 | | | | 349,980 | |

Advertising and promotion | | | 23,824 | | | | 28,518 | |

Legal and professional | | | 149,066 | | | | 111,599 | |

Depreciation and amortization | | | 5,600 | | | | 5,600 | |

Total operating expenses | | | 741,378 | | | | 495,697 | |

| | | | | | | | |

Loss from operations | | | (135,913 | ) | | | (55,685 | ) |

| | | | | | | | |

Other income and (expense) | | | | | | | | |

Interest expense | | | (11,750 | ) | | | (25,636 | ) |

Amortization of debt discount | | | (16,509 | ) | | | (966 | ) |

Change in fair value of derivative liability | | | 51,994 | | | | 100,209 | |

Financing costs | | | (4,250 | ) | | | - | |

Loss on settlement of liabilities | | | 140,297 | | | | (274,938 | ) |

Loss on settlement of dispute | | | (15,143 | ) | | | - | |

Total other income (expense) | | | 144,639 | | | | (201,331 | ) |

| | | | | | | | |

Net income (loss) including noncontrolling interest | | $ | 8,726 | | | $ | (257,016 | ) |

Net income (loss) attributable to noncontrolling interest | | | - | | | | - | |

Net income (loss) attributable to Right on Brands, Inc. | | $ | 8,726 | | | $ | (257,016 | ) |

| | | | | | | | |

Income (loss) per share - basic | | $ | 0.00 | | | $ | (0.00 | ) |

Income (loss) per share - diluted | | $ | 0.00 | | | | | |

| | | | | | | | |

Weighted average shares outstanding - basic | | | 5,888,244,296 | | | | 5,922,572,597 | |

Weighted average shares outstanding - diluted | | | 6,093,337,629 | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

RIGHT ON BRANDS, INC. |

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' DEFICIT |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Preferred Stock | | | Common Stock | | | Additional | | | Common Stock | | | Accumulated | | | Noncontrolling | | | | |

| | Shares | | | Amount | | | Shares | | | Amount | | | Paid in Capital | | | Payable | | | Deficit | | | Interest | | | Total | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balances, March 31, 2021 | | | 5,000,000 | | | $ | 5,000 | | | | 5,474,978,826 | | | $ | 5,474,979 | | | $ | 8,546,492 | | | $ | 51,820 | | | $ | (15,512,951 | ) | | $ | 24,437 | | | $ | (1,410,223 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Issuance of common stock for cash | | | - | | | | - | | | | 299,999,999 | | | | 300,000 | | | | (211,000 | ) | | | - | | | | - | | | | - | | | | 89,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Issuance of common stock for services | | | - | | | | - | | | | 1,500,000 | | | | 1,500 | | | | 1,500 | | | | - | | | | - | | | | - | | | | 3,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Settlement of accounts payable | | | - | | | | - | | | | 13,000,000 | | | | 13,000 | | | | 16,900 | | | | - | | | | - | | | | - | | | | 29,900 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Settlement of warrant dispute | | | - | | | | - | | | | 38,114,035 | | | | 38,114 | | | | 41,886 | | | | - | | | | - | | | | - | | | | 80,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Settlement of debt | | | - | | | | - | | | | 309,243,333 | | | | 309,243 | | | | 590,168 | | | | - | | | | - | | | | - | | | | 899,411 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Correction of shares issued in prior period | | | - | | | | - | | | | (212,034,632 | ) | | | (212,034 | ) | | | 212,034 | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (257,016 | ) | | | - | | | | (257,016 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balances, March 31, 2022 | | | 5,000,000 | | | $ | 5,000 | | | | 5,924,801,561 | | | $ | 5,924,802 | | | $ | 9,197,980 | | | $ | 51,820 | | | $ | (15,769,967 | ) | | | 24,437 | | | $ | (565,928 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Issuance of common stock payable | | | - | | | | - | | | | 1,400,000 | | | | 1,400 | | | | 35,420 | | | | (36,820 | ) | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Recission of shares | | | - | | | | - | | | | (153,114,035 | ) | | | (153,114 | ) | | | 153,114 | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Issuance of common stock for cash | | | - | | | | - | | | | 450,000,000 | | | | 450,000 | | | | (405,000 | ) | | | - | | | | - | | | | - | | | | 45,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Shares to settle dispute | | | - | | | | - | | | | 151,428,571 | | | | 151,429 | | | | (136,286 | ) | | | - | | | | - | | | | - | | | | 15,143 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 8,726 | | | | - | | | | 8,726 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balances, March 31, 2023 | | | 5,000,000 | | | $ | 5,000 | | | | 6,374,516,097 | | | $ | 6,374,517 | | | $ | 8,845,228 | | | $ | 15,000 | | | $ | (15,761,241 | ) | | $ | 24,437 | | | $ | (497,059 | ) |

The accompanying notes are an integral part of these consolidated financial statements.

RIGHT ON BRANDS, INC. |

CONSOLIDATED STATEMENTS OF CASH FLOWS |

| | | | | | |

| | For the years ended | |

| | March 31, | |

| | 2022 | | | 2021 | |

OPERATING ACTIVITIES | | | | | | |

Net income (loss) | | $ | 8,726 | | | $ | (257,016 | ) |

Adjustments to reconcile net income (loss) to net cash used in operating activities: | | | | | | | | |

Depreciation and amortization | | | 5,600 | | | | 5,600 | |

Amortization of debt discount | | | 16,509 | | | | 966 | |

Financing costs | | | 4,250 | | | | - | |

Change in fair value of derivative liability | | | (51,994 | ) | | | (100,209 | ) |

(Gain) loss on settlement of liabilities | | | (140,297 | ) | | | 274,938 | |

Shares issued for services | | | - | | | | 3,000 | |

Loss on settlement of dispute | | | 15,143 | | | | - | |

Changes in operating assets and liabilities: | | | | | | | | |

Accounts receivable | | | (1,798 | ) | | | - | |

Prepaid expenses | | | 6,000 | | | | (6,000 | ) |

Inventory | | | (1,171 | ) | | | (41,391 | ) |

Accounts payable | | | 20,665 | | | | (62,075 | ) |

Accrued interest payable | | | 11,750 | | | | 25,636 | |

Accrued expenses | | | 28,010 | | | | 5,848 | |

Unearned revenue | | | 12,500 | | | | - | |

NET CASH USED IN OPERATING ACTIVITIES | | | (66,107 | ) | | | (150,703 | ) |

| | | | | | | | |

INVESTING ACTIVITIES | | | | | | | | |

NET CASH USED IN INVESTING ACTIVITIES | | | - | | | | - | |

| | | | | | | | |

FINANCING ACTIVITIES | | | | | | | | |

Proceeds from notes payable | | | 202,101 | | | | 65,000 | |

Repayment of notes payable | | | (175,728 | ) | | | (21,021 | ) |

Repayment of convertible debt | | | - | | | | - | |

Proceeds from issuance of common stock | | | 45,000 | | | | 89,000 | |

NET CASH PROVIDED BY FINANCING ACTIVITIES | | | 71,373 | | | | 132,979 | |

| | | | | | | | |

NET INCREASE (DECREASE) IN CASH | | $ | 5,266 | | | $ | (17,724 | ) |

CASH, BEGINNING OF YEAR | | | 28,056 | | | | 45,780 | |

CASH, END OF YEAR | | $ | 33,322 | | | $ | 28,056 | |

| | | | | | | | |

CASH PAID FOR INCOME TAXES | | $ | - | | | $ | - | |

CASH PAID FOR INTEREST | | $ | - | | | $ | - | |

| | | | | | | | |

SUPPLEMENTAL SCHEDULE OF NON-CASH INVESTING AND FINANCING ACTIVITIES | | | | | | | | |

Common stock issued for common stock payable | | $ | 36,820 | | | $ | - | |

Original issuance discount on note payable | | $ | 16,991 | | | $ | 8,450 | |

Convertible note payable issued for settlement of accrued expenses | | $ | 17,051 | | | $ | - | |

Recission of shares issued in prior period | | $ | 153,114 | | | $ | 212,034 | |

Common stock issued for settlement of liabilities | | $ | - | | | $ | 1,009,311 | |

The accompanying notes are an integral part of these consolidated financial statements.

RIGHT ON BRANDS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 – ORGANIZATION AND NATURE OF BUSINESS |

Formation and Business Activity

Right on Brands, Inc. (“we” or “the Company” or “Right on Brands”) was incorporated under the laws of the State of Nevada on April 1, 2011, as HealthTalk Live, Inc. On August 10, 2017, the Company amended is articles of incorporation and changed its name to Right On Brands, Inc. On August 31, 2017, the Company common shares commenced trading under the new stock symbol RTON. The Company’s primary business is the sale of health and wellness products.

The Company has the following wholly owned subsidiaries:

· | Endo Brands, Inc. |

| |

· | Humble Water Company |

The Company has the following partially owned subsidiaries:

· | Endo & Centre Venture LLC (51% owner) |

| |

· | Spring Hill Water Company, LLC (49% owner – see Note 7) |

The Company, through its subsidiaries Humble Water Company and Endo & Centre Venture LLC, had joint ventures with no activity. The Company has discontinued these joint ventures and Humble Water Company and Endo & Centre Venture LLC contain no assets, liabilities, or operations.

On April 16, 2018, the Company entered into an operating agreement with Centre Manufacturing, Inc. (“Centre”) and agreed to form an LLC. The LLC is owned 51% by the Company and 49% owned by Centre, but all income and losses will be split evenly. The owner of Centre is the former CEO of the Company. On June 19, 2018, the Company formed a majority owned subsidiary, Endo & Centre Venture LLC. No significant activity has occurred to date. At March 31, 2023 and 2022, the Company owed Centre $14,154, respectively, which is included in accounts payable on the accompanying condensed consolidated balance sheets.

The Company continues to sell health and wellness products focused in the hemp marketplace through online and in-person retail sales.

The accompanying consolidated financial statements have been prepared assuming the Company will continue as a going concern, which contemplates, among other things, the realization of assets and satisfaction of liabilities in the normal course of business. For the year ended March 31, 2023, the Company had an accumulated deficit of approximately $15,761,000, had a net loss from operations of approximately $136,000, and net cash used in operating activities of approximately $66,000, with approximately $1,136,000 revenue earned, and a lack of profitable operational history. These matters, among others, raise substantial doubt about the Company's ability to continue as a going concern.

While the Company is attempting to generate greater revenues, the Company's cash position may not be significant enough to support the Company's daily operations. Management intends to raise additional funds by way of additional public and/or private offerings of its stock. Management believes that the actions presently being taken to further implement its business plan and generate revenues provide the opportunity for the Company to continue as a going concern. While the Company believes in the viability of its strategy to generate revenues and in its ability to raise additional funds, there can be no assurances to that effect. The ability of the Company to continue as a going concern is dependent upon the Company's ability to further implement its business plan and generate revenues.

The consolidated financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

NOTE 3 – SIGNIFICANT ACCOUNTING POLICIES |

Principles of Consolidation

The consolidated financial statements of the Company include the accounts of Right On Brands, Inc. and its wholly owned subsidiaries and majority owned business (Endo Brands, Inc., Humble Water Company, Springhill Water Co, and Endo & Centre Venture LLC). Intercompany accounts and transactions have been eliminated upon consolidation.

RIGHT ON BRANDS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Use of Estimates

The preparation of consolidated financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Cash and Cash Equivalents

For purposes of reporting cash flows, the Company has defined cash and cash equivalents as all cash in banks and highly liquid investments available for current use with an initial maturity of three months or less to be cash equivalents. The Company had no cash equivalents at March 31, 2023, or March 31, 2022.

The Company maintains its cash balances at financial institutions that are insured by the Federal Deposit Insurance Corporation (“FDIC”). The FDIC provides coverage of up to $250,000 per depositor, per financial institution, for the aggregate total of depositors' interest and non-interest-bearing accounts. At March 31, 2023, none of the Company's cash balances were in excess of FDIC limits. The Company has not experienced any losses on these accounts and management does not believe that the Company is exposed to any significant risks.

Accounts Receivable