As filed with the Securities and Exchange Commission on August 15, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

JUMIA TECHNOLOGIES AG

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | |

| The Federal Republic of Germany | | N/A |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

Skalitzer Straße 104

10997 Berlin, Germany

+49 (30) 398 20 34 54

(Address, including zip code and telephone number, including area code, of registrant’s principal executive offices)

Virtual Restricted Stock Unit Program 2023

(Full titles of the plans)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, Delaware 19711

+1 (302) 738 6680

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Krystian M. Czerniecki

Sullivan & Cromwell LLP

Neue Mainzer Straße 52

60311 Frankfurt, Germany

+49 (69) 4272 5200

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☑ Accelerated filer ☐

Non-accelerated filer ☐ (Do not check if a smaller reporting company) Smaller reporting company ☐

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The information specified in Part I of Form S-8 is omitted from this Registration Statement on Form S-8 (the “Registration Statement”) in accordance with the provisions of Rule 428 under the Securities Act of 1933 (the “Securities Act”), and the introductory note to Part I of Form S-8.

The documents containing the information specified in this Part I will be provided separately to the participants in the Plans as specified by Rule 428(b)(1) under the Securities Act. Such documents are not required to be, and are not, filed with the Securities and Exchange Commission (the “Commission”) either as part of this Registration Statement or as a prospectus or prospectus supplement pursuant to Rule 424 under the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents submitted to the Commission by Jumia Technologies AG (the “Registrant”) pursuant to the Securities Act and the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are hereby incorporated by reference in this Registration Statement:

•The Registrant’s annual report (“Annual Report”) on Form 20-F for the fiscal year ended December 31, 2022 filed on May 16, 2023; and

•The Registrant’s Reports of Foreign Issuer on Form 6-K furnished to the SEC on May 16, 2023, May 23, 2023, July 5, 2023, August 14, 2023 and August 15, 2023.

All documents filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act and, to the extent designated therein, certain Reports of Foreign Private Issuer on Form 6-K, furnished by the Registrant, after the date of this Registration Statement and prior to the filing of a post-effective amendment to this Registration Statement indicating that all securities offered have been sold or which deregisters all securities then remaining unsold shall be deemed to be incorporated by reference into this Registration Statement and to be a part hereof from the date of filing of such documents.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers.

Under German law, we may not, as a general matter, indemnify members of our management board and supervisory board. Certain limited exceptions may apply if the indemnification is in the legitimate interest of our Company. We will indemnify our management board and supervisory board members, to the extent permissible under German law, from and against any liabilities arising out of or in connection with their services to us.

We provide directors’ and officers’ liability insurance for the members of our management and supervisory boards against civil liabilities, which they may incur in connection with their activities on behalf of our company, including against liabilities under the Securities Act.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

See exhibits listed in the Exhibit Index below, which is incorporated into this item by reference.

Item 9. Undertakings.

(a)The undersigned Registrant hereby undertakes:

(1)To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement;

(i)to include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii)to reflect in the prospectus any facts or events arising after the effective date of this Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in this Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii)to include any material information with respect to the plan of distribution not previously disclosed in this Registration Statement or any material change to such information in this Registration Statement;

provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in this Registration Statement.

(2)That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3)To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b)The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in this Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c)Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act, and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

EXHIBIT INDEX

| | | | | |

Exhibit

Number | Description of Exhibit |

| 3.1 | |

| 4.1 | |

| 4.2 | |

| 5.1* | |

| 10.1 | |

| 23.1* | |

| 23.2* | |

| 24.1* | |

| 107* | |

| |

| * Filed herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Berlin, the Federal Republic of Germany, on August 15, 2023.

| | | | | | | | | | | | | | |

| Jumia Technologies AG |

| | | | |

| By | | /s/ Francis Dufay |

| | Name: | | Francis Dufay |

| | Title: | | Chief Executive Officer and Member of the Management Board |

| | | | | | | | | | | | | | |

| | |

| By | | /s/ Antoine Maillet-Mezeray |

| | Name: | | Antoine Maillet-Mezeray |

| | Title: | | Executive Vice President, Finance & Operations and

Member of the Management Board |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below does hereby constitute and appoint Francis Dufay and Antoine Maillet-Mezeray, and each of them, as his or her true and lawful attorneys-in-fact and agents, each with the full power of substitution and re-substitution, for and in such person’s name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this registration statement and sign any registration statement for the same offering covered by the registration statement that is to be effective upon filing pursuant to Rule 462(b) promulgated under the Securities Act of 1933, as amended, and all post-effective amendments thereto, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith and about the premises, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or any of them, or their or his substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

| | | | | | | | | | | | | | |

| | | | |

| Signature | | Title | | Date |

| | |

/s/ Francis Dufay Francis Dufay | | Chief Executive Officer and Member of the Management Board | | August 15, 2023 |

| | |

/s/ Antoine Maillet-Mezeray Antoine Maillet-Mezeray | | Executive Vice President, Finance & Operations and Member of the Management Board | | August 15, 2023 |

SIGNATURE OF AUTHORIZED REPRESENTATIVE IN THE UNITED STATES

Pursuant to the Securities Act of 1933, as amended, the undersigned, the duly appointed representative in the United States of Jumia Technologies AG has signed this registration statement or amendment thereto in the city of Newark, State of Delaware on August 15, 2023.

| | | | | | | | | | | | | | |

| Puglisi & Associates |

| |

| By | | /s/ Donald J. Puglisi |

| | Name: Donald J. Puglisi | | |

| | Title: Managing Director | | |

Exhibit 107

Calculation of Filing Fee Tables

Form S-8

(Form Type)

Jumia Technologies AG

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities and Carry Forward Securities

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Security Type | Security Class Title | Fee Calculation or Carry Forward Rule | Amount Registered (1) | Proposed Maximum Offering Price Per Unit | Maximum Aggregate Offer Price | Fee Rate | Amount of Registration Fee | Carry Forward Form Type | Carry Forward File Number | Carry Forward Initial Effective Date | Filing Fee Previously Paid in Connection with Unsold Securities to be Carried Forward |

| Newly Registered Securities | | | | |

| Fees to be Paid | Equity | Ordinary shares, no par value(1) | Other | 6,500,000(2) | $1.92(3) | $12,480,000(3) | $110.20 per million | $1,375.30 | | | | |

| Total Offering Amounts | | | | $1,375.30 | | | | |

| Total Fees Previously Paid | | | | – | | | | |

| Total Fee Offsets(4) | | | | $1,375.30 | | | | |

| Net Fee Due | | | | $0.00 | | | | |

(1) American Depositary Shares (“ADS”) evidenced by American Depositary Receipts (“ADRs”) issuable upon deposit of ordinary shares have been registered pursuant to a separate registration statement on Form F-6 (File No. 333-230534).

(2) Pursuant to Rule 416 under the Securities Act of 1933, as amended, the ordinary shares being registered hereunder include such indeterminate number of additional ordinary shares as may be issuable as a result of stock splits, stock dividends or similar transactions with respect to the shares being registered hereunder.

(3) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933. The proposed maximum offering price per unit and maximum aggregate offering price are calculated on the basis of $3.83, the average of the high and low sale price of ADSs of the registrant on the New York Stock Exchange on August 11, 2023, which is within five business days prior to the filing of this registration statement, divided by two, the then ordinary share-to-ADS ratio.

(4) See table titled “Fee Offset Claims and Sources.”

Table 2: Fee Offset Claims and Sources

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Registrant or Filer Name | Form or Filing Type | File Number | Initial Filing Date | Filing Date | Fee Offset Claimed | Security Type Associated with Fee Offset Claimed | Security Title Associated with Fee Offset Claimed | Unsold Securities Associated with Fee Offset Claimed | Unsold Aggregate Offering Amount Associated with Fee Offset Claimed | Fee Paid with Fee Offset Source |

| Rule 457(p) |

| Fee Offset Claims | Jumia Technologies AG | F-3 | 333-240016 | July 22, 2020 | N/A | $1,375.30 | Equity | Ordinary shares, no par value(1) | (2) | $10,595,531.59 | |

| Fee Offset Sources | Jumia Technologies AG | F-3 | 333-240016 | | July 22, 2020 | | | | | | $1,375.30 |

(1) ADS evidenced by ADRs issuable upon deposit of ordinary shares have been registered pursuant to a separate registration statement on Form F-6 (File No. 333-230534).

(2) The registrant previously filed a registration statement on Form F-3 (File No. 333-240016), initially filed on July 22, 2020 and declared effective on July 30, 2020 (“Prior Registration Statement”), which registered (i) 36,000,000 ordinary shares, with no par value for issuance by the registrant in connection with the exercise or conversion of certain of its securities (the “Primary Shares”) for a proposed maximum aggregate offering price of $154,440,000.00 and (ii) and 29,702,544 ordinary shares, with no par value for resale by the applicable selling shareholder (the “Secondary Shares”) for a proposed maximum aggregate offering price of $127,423,913.76. The Prior Registration Statement was not fully used and 29,702,544 Secondary Shares were not sold, resulting in unsold aggregate offering amounts of $127,423,913.76. The registrant has terminated any offerings that included the unsold securities under the Prior Registration Statement. Pursuant to Rule 457(p) under the Securities Act, the registrant offset $8,559.73 of the total registration fees due under its registration statement on Form F-3 (File No. 333-274004), filed with the SEC on August 15, 2023, against the fees previously paid in connection with the Prior Registration Statement, leaving a remaining fee balance of $7,979.89 under the Prior Registration Statement available for future fee offsets by the registrant. Pursuant to Rule 457(p) under the Securities Act, the registrant hereby offsets the total registration fee of $1,375.30 due under this registration statement from the fees previously paid by the registrant in connection with the Prior Registration Statement, with $6,604.59 remaining to be potentially applied to future filings. Accordingly, no additional registration fee is being paid in connection with the filing of this registration statement.

Noerr Partnerschaftsgesellschaft mbB / Börsenstraße 1 / 60313 Frankfurt am Main

Jumia Technologies AG

Skalitzer Straße 104

10997 Berlin

Federal Republic of Germany

Dr. Julian Schulze De la Cruz

Rechtsanwalt

Noerr

Partnerschaftsgesellschaft mbB

Rechtsanwälte Steuerberater Wirtschaftsprüfer

Börsenstraße 1

60313 Frankfurt am Main

Germany

noerr.com

Assistant Carolin Herrmann

T +49 69 971477231 (ext.)

T +49 69 9714770

F +49 69 971477100

Julian.SchulzeDelaCruz@noerr.com

Our Ref: F-0674-2023

JSCH/CHE

Noerr Partnerschaftsgesellschaft mbB has its registered office in Munich, Germany, and is entered in the partnership register of the Local Court in Munich, Germany (Amtsgericht Muenchen) under no. PR 512.

For further information, please refer to noerr.com. For information on data protection at Noerr, please refer to noerr.com/data-protection.

Further details overleaf

Frankfurt am Main, August 15, 2023

Dear Sir or Madam,

We are acting as German counsel to Jumia Technologies AG, Berlin, ("Company") a stock corporation organized under the laws of the Federal Republic of Germany ("Germany"), as to matters of German law in connection with the filing with the Securities and Exchange Commission of a registration statement on Form S-8 (the Registration Statement) on August 15, 2023. The purpose of the Registration Statement is to register under the Securities Act of 1933, as amended ("Securities Act"), 6,500,000 ordinary shares with no-par value, which, upon a potential future conversion into American Depositary Shares evidenced by American depositary receipts ("ADSs"), will represent 3,250,000 ADSs, each representing an ownership interest in two ordinary bearer shares of the Company with a notional amount attributable to each ordinary bearer share of € 1.00 per share ("Shares"). These Shares are or may become issuable under the Virtual Restricted Stock Unit Program 2023 ("Plan").

This legal opinion is being furnished to the Company in connection with the requirements of Item 601(b)(5) of Regulation S-K under the Securities Act, and no opinion is expressed herein as to any matter pertaining to the contents of the Registration Statement other than as expressly stated herein with respect to the Shares.

I.Scope of Inquiry

For the purpose of rendering this legal opinion, we have examined and relied exclusively on the following documents ("Documents"):

(1) a copy of the current articles of association (Satzung) of the Company with notarial certificate dated June 15, 2023 and as registered with the commercial register (Handelsregister) of the local court (Amtsgericht) of Charlottenburg, Germany ("Commercial Register") on June 20, 2023 ("Articles of Association");

(2)a copy of an electronic excerpt from the Commercial Register, docket number HRB 203542 B, relating to the Company dated August 15, 2023;

(3)a copy of the Plan;

(4)a copy of the minutes of the resolution of the management board dated August 14, 2023 on the adoption of the Virtual Restricted Stock Unit Program 2023;

(5)a copy of the minutes of the resolution of the supervisory board dated June 30, 2023 on the approval of the Virtual Restricted Stock Unit Program 2023;

(6)a copy of the minutes of the annual general shareholders’ meeting of the Company, held on August 14, 2023, which resolved on the creation of the Authorized Capital 2023/I (together with the resolutions under (4) and (5), "Resolutions"); and

(7)a copy of the Registration Statement.

II.Assumptions

For the purpose of rendering this legal opinion, we have assumed without further inquiry, investigations or searches of any facts to verify any of the following assumptions that:

(1)all documents submitted to us as a copy correspond to the respective original;

(2)all documents examined by us are within the power of, and have been or will be validly authorized and executed by all parties thereto other than the Company, which is acting on the basis of the Resolutions;

(3)all authorizations, other than those authorizing the Company with respect to which we have received copies of the Resolutions, have been or will be validly issued and that none of these authorizations has been revoked;

(4)all documents, including electronic excerpts from the Commercial Register, submitted to us and made as of a specific date, have not been amended, cancelled, or otherwise been altered since that date until the date hereof;

(5)all documents submitted to us in purported final draft form have been, or will be, executed in the form submitted,

(6)the Company will at all times have sufficient authorized or conditional share capital with the relevant authorization to waive any pre-emptive subscription rights;

(7)the management board and the supervisory board of the Company will duly pass the relevant resolutions for the issue of the Shares ("Board Resolutions") in accordance with the Articles of Association, the terms of the Plan, the Resolutions and applicable law;

(8)the Authorized Capital 2023/I, as resolved by the annual general shareholders’ meeting of the Company on August 14, 2023, will be registered with the Commercial Register;

(9)upon issue of any Shares, the Company will receive payment in cash and/or in kind of an issue price in accordance with the Plan, the Resolutions and applicable law; and

(10)that there will be no amendments to the authorized share capital of the Company which would adversely affect the issue of the Shares and the conclusions stated in this legal opinion.

III.Opinion

Based upon the review of the Documents and the assumptions referred to above and subject to (i) the qualifications, statements and limitations referred to below, and (ii) any facts, circumstances, events or documents not disclosed to us, and having regard to such legal considerations as we have deemed relevant, we are of the opinion that:

When the Company as a German stock corporation has issued the Shares against payment therefor under the circumstances contemplated by the Plan, assuming in each case that the individual issuances, grants or awards under the Plan are duly issued, granted or awarded and exercised or vested in accordance with the requirements of law, the Resolutions, the Board Resolutions, the Articles of Association, and the Plan (and the agreements and awards duly adopted thereunder and in accordance therewith), the Shares will be validly issued, fully paid and non-assessable.

We do not express any opinion on the Documents nor with respect to any other agreement or document or any matter unless specifically and expressly referred to in this section III. of this legal opinion.

IV.Qualifications

This legal opinion is subject to the following qualifications:

(1)As to any facts relevant to the opinions stated herein that we did not independently establish or verify, we have relied upon statements and representations of officers and other representatives of the Company and others and of public officials.

(2)This legal opinion speaks as of its date and is confined to, and is given on the basis of, the laws of Germany as they exist at the date hereof; it is governed by the laws of Germany. The exclusive place of jurisdiction for any disputes arising under or in connection with this legal opinion is Frankfurt am Main, Germany. We do not assume any obligation to update this legal opinion or to inform you of any changes to facts or laws. Please note that such changes may have retrospective or retroactive effect. We are expressing no opinion as to the effect of the laws of any other jurisdiction than the laws of Germany.

(3)This legal opinion expresses and describes German legal concepts in English and not in their original language and form. Therefore, it cannot be ruled out that due to differences of legal systems some words or phrases may have different connotations than the German words or phrases would have. Where English terms and expressions are used, the meaning to be attributed to such terms and expressions shall be the meaning to be attributed to the equivalent German concepts under German law. Where we have included the relevant German expressions, these shall prevail over their English translation.

(4)This legal opinion is addressed to and solely for the benefit of the Company and is not intended to create third party rights pursuant to Section 328 of the German Civil Code (Bürgerliches Gesetzbuch) (Vertrag zugunsten Dritter) or rights for all benefit of third parties (Vertrag mit Schutzwirkung zugunsten Dritter) and, except with our prior written consent, is not to be transmitted or disclosed to or used or relied upon by any other person, provided, however, that it may be relied upon by persons entitled to rely on it pursuant to applicable provisions of U.S. federal securities law.

(5)Pursuant to Sections 57 et seq. and 71a of the German Stock Corporation Act (Aktiengesetz) ("AktG"), except for dividends or unless explicitly permitted under the AktG, no payments, other distributions, financing arrangements, financial support, or other services of any kind may be made, directly or indirectly, by a stock corporation (Aktiengesellschaft) to current or future shareholders in their capacity as such.

(6)We have not verified, do not opine upon, and do not assume any responsibility for the accuracy, completeness, or reasonableness of any statement contained in the Registration Statement (including in documents incorporated into the Registration Statement by reference) or any documents provided to Plan participants with respect to the Shares or the Company.

(7)In this legal opinion, the phrase "non-assessable" means, with respect to the issuance of Shares, that a shareholder shall not, in respect of the relevant Shares, have any obligation to make further contributions to the Company’s assets (except in exceptional circumstances in which a court may be prepared to pierce or lift the corporate veil) (nicht nachschusspflichtig).

(8)We hereby consent to the filing of this legal opinion as an exhibit to the Registration Statement. In giving such consent, we do not admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act.

Yours sincerely,

Noerr Partnerschaftsgesellschaft mbB

/s/ Dr. Julian Schulze De la Cruz

Rechtsanwalt

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in the Registration Statement (Form S-8) pertaining to the Virtual Restricted Stock Unit Program 2023 of Jumia Technologies AG of our reports dated May 16, 2023, with respect to the consolidated financial statements of Jumia Technologies AG and the effectiveness of internal control over financial reporting of Jumia Technologies AG included in its Annual Report (Form 20-F) for the year ended December 31, 2022, filed with the Securities and Exchange Commission.

/s/ Ernst & Young S.A.

Luxembourg, Grand Duchy of Luxembourg

August 15, 2023

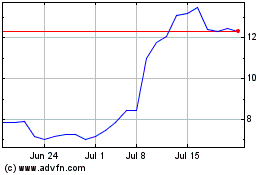

Jumia Technologies (NYSE:JMIA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Jumia Technologies (NYSE:JMIA)

Historical Stock Chart

From Apr 2023 to Apr 2024