0001552189

false

--12-31

Q2

http://fasb.org/us-gaap/2023#RelatedPartyMember

http://fasb.org/us-gaap/2023#RelatedPartyMember

http://fasb.org/us-gaap/2023#RelatedPartyMember

http://fasb.org/us-gaap/2023#RelatedPartyMember

http://fasb.org/us-gaap/2023#RelatedPartyMember

http://fasb.org/us-gaap/2023#RelatedPartyMember

P5Y

P5Y

P5Y

0001552189

2023-01-01

2023-06-30

0001552189

2023-08-02

0001552189

2023-06-30

0001552189

2022-12-31

0001552189

us-gaap:SeriesAPreferredStockMember

2023-06-30

0001552189

us-gaap:SeriesAPreferredStockMember

2022-12-31

0001552189

PLSH:SeriesB1PreferredStockMember

2023-06-30

0001552189

PLSH:SeriesB1PreferredStockMember

2022-12-31

0001552189

PLSH:SeriesB2PreferredStockMember

2023-06-30

0001552189

PLSH:SeriesB2PreferredStockMember

2022-12-31

0001552189

us-gaap:SeriesCPreferredStockMember

2023-06-30

0001552189

us-gaap:SeriesCPreferredStockMember

2022-12-31

0001552189

PLSH:SeriesC1PreferredStockMember

2023-06-30

0001552189

PLSH:SeriesC1PreferredStockMember

2022-12-31

0001552189

PLSH:SeriesC2PreferredStockMember

2023-06-30

0001552189

PLSH:SeriesC2PreferredStockMember

2022-12-31

0001552189

us-gaap:SeriesDPreferredStockMember

2023-06-30

0001552189

us-gaap:SeriesDPreferredStockMember

2022-12-31

0001552189

2023-04-01

2023-06-30

0001552189

2022-04-01

2022-06-30

0001552189

2022-01-01

2022-06-30

0001552189

us-gaap:PreferredStockMember

2022-12-31

0001552189

us-gaap:CommonStockMember

2022-12-31

0001552189

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001552189

us-gaap:RetainedEarningsMember

2022-12-31

0001552189

us-gaap:PreferredStockMember

2023-03-31

0001552189

us-gaap:CommonStockMember

2023-03-31

0001552189

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001552189

us-gaap:RetainedEarningsMember

2023-03-31

0001552189

2023-03-31

0001552189

us-gaap:PreferredStockMember

2021-12-31

0001552189

us-gaap:CommonStockMember

2021-12-31

0001552189

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001552189

us-gaap:RetainedEarningsMember

2021-12-31

0001552189

2021-12-31

0001552189

us-gaap:PreferredStockMember

2022-03-31

0001552189

us-gaap:CommonStockMember

2022-03-31

0001552189

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001552189

us-gaap:RetainedEarningsMember

2022-03-31

0001552189

2022-03-31

0001552189

us-gaap:PreferredStockMember

2023-01-01

2023-06-30

0001552189

us-gaap:CommonStockMember

2023-01-01

2023-06-30

0001552189

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-06-30

0001552189

us-gaap:RetainedEarningsMember

2023-01-01

2023-06-30

0001552189

us-gaap:PreferredStockMember

2023-04-01

2023-06-30

0001552189

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001552189

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0001552189

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0001552189

us-gaap:PreferredStockMember

2022-01-01

2022-06-30

0001552189

us-gaap:CommonStockMember

2022-01-01

2022-06-30

0001552189

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-06-30

0001552189

us-gaap:RetainedEarningsMember

2022-01-01

2022-06-30

0001552189

us-gaap:PreferredStockMember

2022-04-01

2022-06-30

0001552189

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0001552189

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2022-06-30

0001552189

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0001552189

us-gaap:PreferredStockMember

2023-06-30

0001552189

us-gaap:CommonStockMember

2023-06-30

0001552189

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001552189

us-gaap:RetainedEarningsMember

2023-06-30

0001552189

us-gaap:PreferredStockMember

2022-06-30

0001552189

us-gaap:CommonStockMember

2022-06-30

0001552189

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001552189

us-gaap:RetainedEarningsMember

2022-06-30

0001552189

2022-06-30

0001552189

PLSH:TwentySecondCenturyGroupIncMember

2023-06-30

0001552189

PLSH:QuintelMCIncMember

2023-06-30

0001552189

PLSH:LeslieButtorffMember

2023-06-30

0001552189

PLSH:MarketableSecuritiesMember

2023-06-30

0001552189

srt:MinimumMember

2023-06-30

0001552189

srt:MaximumMember

2023-06-30

0001552189

PLSH:PhoenixLifeSciencesIncMember

2017-10-31

0001552189

PLSH:PhoenixLifeSciencesIncMember

2023-06-30

0001552189

PLSH:PhoenixLifeSciencesIncMember

2022-12-31

0001552189

us-gaap:GeneralAndAdministrativeExpenseMember

2023-01-01

2023-06-30

0001552189

us-gaap:GeneralAndAdministrativeExpenseMember

2022-01-01

2022-06-30

0001552189

PLSH:MarketableSecuritiesMember

2023-06-30

0001552189

PLSH:MarketableSecuritiesMember

us-gaap:FairValueInputsLevel1Member

2023-06-30

0001552189

PLSH:MarketableSecuritiesMember

us-gaap:FairValueInputsLevel2Member

2023-06-30

0001552189

PLSH:MarketableSecuritiesMember

us-gaap:FairValueInputsLevel3Member

2023-06-30

0001552189

PLSH:MarketableSecuritiesMember

2022-12-31

0001552189

PLSH:MarketableSecuritiesMember

us-gaap:FairValueInputsLevel1Member

2022-12-31

0001552189

PLSH:MarketableSecuritiesMember

us-gaap:FairValueInputsLevel2Member

2022-12-31

0001552189

PLSH:MarketableSecuritiesMember

us-gaap:FairValueInputsLevel3Member

2022-12-31

0001552189

us-gaap:FairValueInputsLevel1Member

2023-06-30

0001552189

us-gaap:FairValueInputsLevel2Member

2023-06-30

0001552189

us-gaap:FairValueInputsLevel3Member

2023-06-30

0001552189

us-gaap:FairValueInputsLevel1Member

2022-12-31

0001552189

us-gaap:FairValueInputsLevel2Member

2022-12-31

0001552189

us-gaap:FairValueInputsLevel3Member

2022-12-31

0001552189

PLSH:PhoenixLifeSciencesIncMember

2023-01-01

2023-06-30

0001552189

2022-01-01

2022-12-31

0001552189

PLSH:OptionsMember

2023-01-01

2023-06-30

0001552189

PLSH:OptionsMember

2022-01-01

2022-06-30

0001552189

us-gaap:WarrantMember

2023-01-01

2023-06-30

0001552189

us-gaap:WarrantMember

2022-01-01

2022-06-30

0001552189

PLSH:SeriesBOneConvertiblePreferredStockMember

2023-01-01

2023-06-30

0001552189

PLSH:SeriesBOneConvertiblePreferredStockMember

2022-01-01

2022-06-30

0001552189

PLSH:SeriesBTwoConvertiblePreferredStockMember

2023-01-01

2023-06-30

0001552189

PLSH:SeriesBTwoConvertiblePreferredStockMember

2022-01-01

2022-06-30

0001552189

PLSH:SeriesCConvertiblePreferredStockMember

2023-01-01

2023-06-30

0001552189

PLSH:SeriesCConvertiblePreferredStockMember

2022-01-01

2022-06-30

0001552189

PLSH:SeriesC1ConvertiblePreferredStockMember

2023-01-01

2023-06-30

0001552189

PLSH:SeriesC1ConvertiblePreferredStockMember

2022-01-01

2022-06-30

0001552189

PLSH:SeriesDConvertiblePreferredStockMember

2023-01-01

2023-06-30

0001552189

PLSH:SeriesDConvertiblePreferredStockMember

2022-01-01

2022-06-30

0001552189

us-gaap:ConvertibleNotesPayableMember

2023-01-01

2023-06-30

0001552189

us-gaap:ConvertibleNotesPayableMember

2022-01-01

2022-06-30

0001552189

srt:MinimumMember

us-gaap:ComputerEquipmentMember

2023-06-30

0001552189

srt:MaximumMember

us-gaap:ComputerEquipmentMember

2023-06-30

0001552189

srt:MinimumMember

us-gaap:FurnitureAndFixturesMember

2023-06-30

0001552189

srt:MaximumMember

us-gaap:FurnitureAndFixturesMember

2023-06-30

0001552189

srt:MinimumMember

us-gaap:MachineryAndEquipmentMember

2023-06-30

0001552189

srt:MaximumMember

us-gaap:MachineryAndEquipmentMember

2023-06-30

0001552189

us-gaap:LeaseholdImprovementsMember

2023-06-30

0001552189

us-gaap:ComputerEquipmentMember

2023-06-30

0001552189

us-gaap:ComputerEquipmentMember

2022-12-31

0001552189

us-gaap:FurnitureAndFixturesMember

2023-06-30

0001552189

us-gaap:FurnitureAndFixturesMember

2022-12-31

0001552189

us-gaap:MachineryAndEquipmentMember

2023-06-30

0001552189

us-gaap:MachineryAndEquipmentMember

2022-12-31

0001552189

us-gaap:LandMember

2023-06-30

0001552189

us-gaap:LandMember

2022-12-31

0001552189

us-gaap:LeaseholdImprovementsMember

2022-12-31

0001552189

us-gaap:AccountingStandardsUpdate201602Member

2023-06-30

0001552189

PLSH:SecuritiesPurchaseAgreementMember

PLSH:LincolnParkCapitalFundLLCMember

2021-11-18

0001552189

PLSH:SecuritiesPurchaseAgreementMember

PLSH:LincolnParkCapitalFundLLCMember

2021-11-17

2021-11-18

0001552189

PLSH:SecuritiesPurchaseAgreementMember

PLSH:LincolnParkCapitalFundLLCMember

srt:MinimumMember

2021-11-17

2021-11-18

0001552189

PLSH:SecuritiesPurchaseAgreementMember

PLSH:LincolnParkCapitalFundLLCMember

srt:MaximumMember

2021-11-17

2021-11-18

0001552189

PLSH:ExchangeAgreementMember

us-gaap:InvestorMember

2022-03-03

0001552189

PLSH:ExchangeAgreementMember

us-gaap:InvestorMember

2022-06-30

0001552189

PLSH:ExchangeAgreementMember

us-gaap:InvestorMember

us-gaap:SeriesAPreferredStockMember

2022-03-03

0001552189

PLSH:ExchangeAgreementMember

us-gaap:InvestorMember

2023-06-30

0001552189

PLSH:ExchangeAgreementMember

us-gaap:InvestorMember

2023-03-31

0001552189

PLSH:ExchangeAgreementMember

us-gaap:InvestorMember

2023-04-01

2023-06-30

0001552189

PLSH:ExchangeAgreementMember

us-gaap:InvestorMember

2023-01-01

2023-06-30

0001552189

PLSH:ExchangeAgreementMember

us-gaap:InvestorMember

2022-04-01

2022-06-30

0001552189

PLSH:ExchangeAgreementMember

us-gaap:InvestorMember

2022-01-01

2022-06-30

0001552189

PLSH:NotesPayableMember

PLSH:USSmallBusinessAdministrationMember

2020-05-28

0001552189

PLSH:NotesPayableMember

PLSH:USSmallBusinessAdministrationMember

2020-05-27

2020-05-28

0001552189

PLSH:EconomicInjuryDisasterLoanMember

2020-05-27

2020-05-28

0001552189

PLSH:EconomicInjuryDisasterLoanMember

2022-06-30

0001552189

PLSH:QuintelNoteMember

srt:ChiefExecutiveOfficerMember

us-gaap:RelatedPartyMember

2023-06-30

0001552189

PLSH:QuintelNoteMember

srt:ChiefExecutiveOfficerMember

2023-06-30

0001552189

PLSH:ButtorffNoteMember

srt:ChiefExecutiveOfficerMember

2021-06-30

0001552189

PLSH:ButtorffNoteMember

2021-07-01

0001552189

PLSH:ButtorffNoteMember

2021-07-01

2021-07-01

0001552189

PLSH:ButtorffNoteMember

2021-06-30

0001552189

PLSH:ButtorffNoteMember

2023-01-01

2023-06-30

0001552189

PLSH:FixedAssetLoanMember

2023-06-30

0001552189

PLSH:FixedAssetLoanMember

2022-12-31

0001552189

PLSH:FixedAssetLoanMember

2023-06-30

0001552189

PLSH:FixedAssetLoanMember

2022-12-31

0001552189

PLSH:JNBuildingLoanMember

2020-12-31

0001552189

PLSH:QuintelNoteMember

us-gaap:RelatedPartyMember

2023-06-30

0001552189

PLSH:QuintelNoteMember

us-gaap:RelatedPartyMember

2022-12-31

0001552189

PLSH:CEONoteMember

us-gaap:RelatedPartyMember

2023-06-30

0001552189

PLSH:CEONoteMember

us-gaap:RelatedPartyMember

2022-12-31

0001552189

us-gaap:RelatedPartyMember

2023-06-30

0001552189

us-gaap:RelatedPartyMember

2022-12-31

0001552189

PLSH:CEONoteMember

2023-06-30

0001552189

PLSH:CEONoteMember

2022-12-31

0001552189

PLSH:JNBuildingLoanMember

2023-06-30

0001552189

PLSH:JNBuildingLoanMember

2022-12-31

0001552189

PLSH:VendorMember

2023-01-01

2023-06-30

0001552189

us-gaap:CommonStockMember

us-gaap:InvestorMember

2023-01-01

2023-06-30

0001552189

PLSH:TwoThousandTwentyOnePlanMember

2021-06-30

0001552189

PLSH:TwoThousandTwentyOnePlanMember

2021-06-01

2021-06-30

0001552189

PLSH:SecuritiesPurchaseAgreementMember

PLSH:LincolnParkCapitalFundMember

2021-11-18

0001552189

PLSH:SecuritiesPurchaseAgreementMember

PLSH:LincolnParkCapitalFundMember

PLSH:StockWarrantsMember

2021-11-18

0001552189

PLSH:StockWarrantsMember

2023-06-30

0001552189

PLSH:EmployeesandDirectorsMember

2023-04-01

2023-06-30

0001552189

PLSH:EmployeesandDirectorsMember

2023-01-01

2023-06-30

0001552189

us-gaap:SubsequentEventMember

2023-07-01

2023-07-31

0001552189

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

PLSH:OneCustomerMember

2023-04-01

2023-06-30

0001552189

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

PLSH:TwoCustomerMember

2023-04-01

2023-06-30

0001552189

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

PLSH:OneCustomerMember

2023-01-01

2023-06-30

0001552189

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

PLSH:TwoCustomerMember

2023-01-01

2023-06-30

0001552189

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

PLSH:ThreeCustomerMember

2023-01-01

2023-06-30

0001552189

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

PLSH:ThreeCustomerMember

2023-01-01

2023-06-30

0001552189

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

srt:MinimumMember

PLSH:CustomerReceivableMember

2023-01-01

2023-06-30

0001552189

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

PLSH:CustomerReceivableMember

srt:MaximumMember

2023-01-01

2023-06-30

0001552189

PLSH:RelatedPartyLoanJAndNRealEstateMember

2023-06-30

0001552189

PLSH:RelatedPartyLoanJAndNRealEstateMember

2022-12-31

0001552189

PLSH:RelatedPartyLoanCEOLoanMember

2023-06-30

0001552189

PLSH:RelatedPartyLoanCEOLoanMember

2022-12-31

0001552189

PLSH:RelatedPartyLoanLineOfCreditMember

2023-06-30

0001552189

PLSH:RelatedPartyLoanLineOfCreditMember

2022-12-31

0001552189

PLSH:RelatedPartyLoanJAndNRealEstateMember

2023-04-01

2023-06-30

0001552189

PLSH:RelatedPartyLoanJAndNRealEstateMember

2023-01-01

2023-06-30

0001552189

PLSH:RelatedPartyLoanJAndNRealEstateMember

2022-04-01

2022-06-30

0001552189

PLSH:RelatedPartyLoanJAndNRealEstateMember

2022-01-01

2022-06-30

0001552189

PLSH:RelatedPartyLoanCEOLoanMember

2023-04-01

2023-06-30

0001552189

PLSH:RelatedPartyLoanCEOLoanMember

2023-01-01

2023-06-30

0001552189

PLSH:RelatedPartyLoanCEOLoanMember

2022-04-01

2022-06-30

0001552189

PLSH:RelatedPartyLoanCEOLoanMember

2022-01-01

2022-06-30

0001552189

PLSH:RelatedPartyLoanLineOfCreditMember

2023-04-01

2023-06-30

0001552189

PLSH:RelatedPartyLoanLineOfCreditMember

2023-01-01

2023-06-30

0001552189

PLSH:RelatedPartyLoanLineOfCreditMember

2022-04-01

2022-06-30

0001552189

PLSH:RelatedPartyLoanLineOfCreditMember

2022-01-01

2022-06-30

0001552189

PLSH:XXIICommonStockMember

2023-06-30

0001552189

PLSH:LargoFloridaMember

2022-01-01

2022-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

utr:sqft

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

(Mark

One)

☒

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the quarterly period ended: June 30, 2023

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from _____________ to _____________

Commission

File Number: 001-38190

Panacea

Life Sciences Holdings, Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

27-1085858 |

| (State

or another jurisdiction of |

|

(I.R.S.

Employer |

| incorporation

or organization) |

|

Identification

No.) |

5910

S University Blvd, C18-193, Greenwood Village, CO 80121

(Address

of principal executive offices, Zip Code)

800-985-0515

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934

during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject

to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large, accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large, accelerated filer,” “accelerated filer”,

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large

Accelerated Filer ☐ |

Accelerated

Filer ☐ |

| |

Non-Accelerated

Filer ☒ |

Smaller

reporting company ☒ |

| |

|

Emerging

growth company ☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

State

the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 17,645,352

shares of common stock, par value $0.0001 per share, outstanding as August 2, 2023.

TABLE

OF CONTENTS

PART

I. FINANCIAL INFORMATION

ITEM

1. Financial Statements.

Panacea Life Sciences Holdings, Inc.

and Subsidiary

Unaudited

Condensed Consolidated Balance Sheets

| | |

June 30, 2023 | | |

December 31, 2022 | |

| ASSETS | |

| | | |

| | |

| CURRENT ASSETS: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 8,190 | | |

$ | 6,951 | |

| Accounts receivable, net | |

| 272,090 | | |

| 206,127 | |

| Other receivables, related party | |

| 500,000 | | |

| 500,000 | |

| Inventory | |

| 4,357,733 | | |

| 4,448,725 | |

| Marketable securities related party | |

| 460,388 | | |

| 1,107,362 | |

| Prepaid expenses and other current assets | |

| 149,295 | | |

| 113,098 | |

| TOTAL CURRENT ASSETS | |

| 5,747,696 | | |

| 6,382,263 | |

| | |

| | | |

| | |

| Operating lease right-of-use asset, net, related party | |

| 3,062,090 | | |

| 3,242,381 | |

| Property and equipment, net | |

| 6,855,283 | | |

| 7,675,995 | |

| Goodwill | |

| 2,188,810 | | |

| 2,188,810 | |

| TOTAL ASSETS | |

$ | 17,853,879 | | |

$ | 19,489,449 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| CURRENT LIABILITIES: | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 3,677,546 | | |

$ | 2,666,076 | |

| Operating lease liability, current portion, related party | |

| 2,325,808 | | |

| 2,090,271 | |

| Note payable-current, related party | |

| 10,829,779 | | |

| 9,871,803 | |

| Convertible note payable, net | |

| 115,000 | | |

| 346,671 | |

| Paycheck protection loan, SBA Loan | |

| 99,100 | | |

| 99,100 | |

| TOTAL CURRENT LIABILITIES: | |

| 17,047,233 | | |

| 15,073,921 | |

| | |

| | | |

| | |

| Operating lease liability, long-term portion, related party | |

| 2,800,766 | | |

| 2,987,208 | |

| Other long-term liabilities, related party | |

| 3,572,864 | | |

| 3,572,864 | |

| TOTAL LIABILITIES | |

| 23,420,863 | | |

| 21,633,993 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| - | | |

| - | |

| | |

| | | |

| | |

| STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Series A Preferred Stock: $0.0001 Par Value, 1,000 shares designated; 0 and 350 shares

issued and outstanding on June 30, 2023 and December 31, 2022 respectively. | |

| - | | |

| - | |

| Series B-1 Preferred: $0.0001 Par Value, 32,000,000 shares designated; 1,500,000 and 1,500,000 shares issued and outstanding on June 30, 2023 and December 31, 2022 respectively. | |

| 150 | | |

| 150 | |

| Series B-2 Preferred: $0.0001 Par Value, 6,000,000 shares designated; 6,000,000 and 6,000,000 shares issued and outstanding on June 30, 2023 and December 31, 2022 respectively. | |

| 600 | | |

| 600 | |

| Series C Preferred: $0.0001 Par Value, 1,000,000 shares designated; 1,000,000 and 1,000,000 shares issued and outstanding on June 30, 2023 and December 31, 2022 respectively. | |

| 100 | | |

| 100 | |

| Series C-1 Preferred: $0.0001 Par Value, 10,000 shares designated and 10,000 and 10,000 shares issued and outstanding on June 30, 2023 and December 31, 2022 respectively. | |

| 1 | | |

| 1 | |

| Series C-2 Preferred: $0.0001 Par Value, 100 and 0 shares designated and 100 and 0 shares issued and outstanding

on June 30, 2023 and December 31, 2022 respectively. | |

| - | | |

| - | |

| Series D Preferred: $0.0001 Par Value, 10,000 shares designated and 10,000 and 10,000 shares issued and outstanding on June 30, 2023 and December 31, 2022 respectively. | |

| 1 | | |

| 1 | |

| Preferred Stock, Value | |

| | | |

| | |

| Common Stock: $0.0001 Par Value, 650,000,000 shares authorized; 17,645,352 and 14,965,317 shares issued and outstanding on June 30, 2023 and December 31, 2022 respectively. | |

| 1,765 | | |

| 1,497 | |

| Additional paid in capital | |

| 23,993,533 | | |

| 23,760,704 | |

| Accumulated deficit | |

| (29,563,134 | ) | |

| (25,907,597 | ) |

| TOTAL STOCKHOLDERS’ EQUITY | |

| (5,566,984 | ) | |

| (2,144,544 | ) |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | |

$ | 17,853,879 | | |

$ | 19,489,449 | |

The

accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Panacea

Life Sciences Holdings, Inc. and Subsidiary

Unaudited Condensed Consolidated Statements

of Operations

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| REVENUE | |

| 399,128 | | |

$ | 469,472 | | |

$ | 1,076,609 | | |

$ | 935,946 | |

| COST OF SALES | |

| 196,314 | | |

| 331,500 | | |

| 648,186 | | |

| 697,591 | |

| GROSS PROFIT | |

| 202,814 | | |

| 137,972 | | |

| 428,423 | | |

| 238,355 | |

| | |

| | | |

| | | |

| | | |

| | |

| OPERATING EXPENSES | |

| | | |

| | | |

| | | |

| | |

| Production related operating expenses | |

| 1,131,711 | | |

| 1,173,296 | | |

| 2,399,870 | | |

| 2,461,111 | |

| General and administrative expenses | |

| 145,213 | | |

| 204,678 | | |

| 392,626 | | |

| 665,230 | |

| TOTAL OPERATING EXPENSES | |

| 1,276,924 | | |

| 1,377,974 | | |

| 2,792,496 | | |

| 3,126,341 | |

| | |

| | | |

| | | |

| | | |

| | |

| LOSS FROM OPERATIONS | |

| (1,074,110 | ) | |

| (1,240,002 | ) | |

| (2,364,073 | ) | |

| (2,887,986 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| OTHER INCOME (EXPENSES) | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (366,944 | ) | |

| (569,985 | ) | |

| (747,101 | ) | |

| (1,071,280 | ) |

| Unrealized gain (loss) on marketable securities, net | |

| (464,719 | ) | |

| (260,273 | ) | |

| (646,974 | ) | |

| (1,205,077 | ) |

| Realized gain on sale of securities | |

| - | | |

| 22,816 | | |

| - | | |

| 22,816 | |

| Other income (loss) | |

| - | | |

| 27,598 | | |

| - | | |

| 27,598 | |

| Employer retention credit | |

| - | | |

| - | | |

| - | | |

| 253,791 | |

| Rental Income | |

| 41,531 | | |

| 58,045 | | |

| 101,863 | | |

| 116,091 | |

| Gain on extinguishment of debt | |

| - | | |

| - | | |

| 748 | | |

| - | |

| TOTAL OTHER INCOME (EXPENSE) | |

| (790,132 | ) | |

| (721,799 | ) | |

| (1,291,464 | ) | |

| (1,856,061 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| TAXES | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| NET INCOME (LOSS) | |

| (1,864,242 | ) | |

$ | (1,961,801 | ) | |

$ | (3,655,537 | ) | |

$ | (4,744,047 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Per-share data | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted loss per share | |

| (0.11 | ) | |

$ | (0.13 | ) | |

$ | (0.21 | ) | |

$ | (0.32 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common shares outstanding | |

| 17,645,352 | | |

| 14,965,317 | | |

| 17,645,352 | | |

| 14,965,317 | |

The

accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

PANACEA LIFE SCIENCES HOLDINGS, INC. AND SUBSIDIARY

CONDENSED

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' (DEFICIT) EQUITY

(unaudited)

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

Six Months Ended June 30, 2023 | |

| | |

Preferred Stock | | |

Common Stock | | |

Additional Paid-in | | |

Accumulated | | |

Total Stockholder’s | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Equity | |

| Balance as of December 31, 2022 | |

| 8,530,000 | | |

$ | 853 | | |

| 14,965,317 | | |

$ | 1,497 | | |

$ | 23,760,704 | | |

$ | (25,907,597 | ) | |

$ | (2,144,544 | ) |

| Sale of shares to investors | |

| - | | |

| - | | |

| 454,545 | | |

| 46 | | |

| 74,955 | | |

| | | |

| 75,000 | |

| Issuance of common shares for services | |

| | | |

| | | |

| 275,490 | | |

| 28 | | |

| 23,069 | | |

| | | |

| 23,097 | |

| Issuance of restricted shares to employees | |

| | | |

| | | |

| 1,410,000 | | |

| 141 | | |

| (141 | ) | |

| | | |

| - | |

| Shares issued in settlement of convertible note | |

| - | | |

| - | | |

| 540,000 | | |

| 54 | | |

| 134,946 | | |

| | | |

| 135,000 | |

| Net Loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (3,655,537 | ) | |

| (3,655,537 | ) |

| Balance as of June 30, 2023 | |

| 8,530,000 | | |

$ | 853 | | |

| 17,645,352 | | |

$ | 1,765 | | |

$ | 23,993,532 | | |

$ | (29,563,134 | ) | |

$ | (5,566,984 | ) |

| | |

Three Months Ended June 30, 2023 | |

| | |

Preferred Stock | | |

Common Stock | | |

Additional Paid-in | | |

Accumulated | | |

Total Stockholder’s | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Equity | |

| Balance as of March 31, 2023 | |

| 8,530,350 | | |

$ | 853 | | |

| 15,505,317 | | |

$ | 1,550 | | |

$ | 23,895,650 | | |

$ | (27,698,892 | ) | |

$ | (3,800,839 | ) |

| Sale of shares to investors | |

| - | | |

| - | | |

| 454,545 | | |

| 46 | | |

| 74,955 | | |

| | | |

| 75,000 | |

| Issuance of common shares for services | |

| - | | |

| - | | |

| 275,490 | | |

| 28 | | |

| 23,069 | | |

| | | |

| 23,097 | |

| Issuance of restricted shares to employees | |

| | | |

| - | | |

| 1,410,000 | | |

| 141 | | |

| (141 | ) | |

| | | |

| - | |

| Net Income (Loss) | |

| - | | |

| - | | |

| - | | |

| - | | |

| | | |

| (1,864,242 | ) | |

| (1,864,242 | ) |

| Balance as of June 30, 2023 | |

| 8,530,000 | | |

$ | 853 | | |

| 17,645,352 | | |

$ | 1,765 | | |

$ | 23,993,532 | | |

$ | (29,563,134 | ) | |

$ | (5,566,984 | ) |

The

accompanying notes are an integral part of these financial statements

| | |

Six Months Ended June 30, 2022 | |

| | |

Preferred Stock | | |

Common Stock | | |

Additional Paid-in | | |

Accumulated | | |

Total Stockholder’s | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Equity | |

| Balance as of December 31, 2021 | |

| 8,530,350 | | |

$ | 853 | | |

| 14,073,708 | | |

$ | 1,407 | | |

$ | 23,865,155 | | |

$ | (16,765,013 | ) | |

$ | 7,102,402 | |

| Shares issued in respect of the merger | |

| - | | |

| - | | |

| 834,331 | | |

| 83 | | |

| (83 | ) | |

| - | | |

| - | |

| Issuance of common shares for services | |

| | | |

| | | |

| 57,278 | | |

| 6 | | |

| 54,994 | | |

| | | |

| 55,000 | |

| Conversion of Series A Preferred to convertible debt and warrants | |

| (350 | ) | |

| | | |

| | | |

| | | |

| (159,362 | ) | |

| | | |

| (159,362 | ) |

| Net Loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (4,744,047 | ) | |

| (4,744,047 | ) |

| Balance as of June 30, 2022 | |

| 8,530,000 | | |

$ | 853 | | |

| 14,965,317 | | |

$ | 1,497 | | |

$ | 23,760,704 | | |

$ | (21,509,060 | ) | |

$ | 2,253,993 | |

| | |

Three Months Ended June 30, 2022 | |

| | |

Preferred Stock | | |

Common Stock | | |

Additional Paid-in | | |

Accumulated | | |

Total Stockholder’s | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Equity | |

| Balance as of March 31, 2022 | |

| 8,530,000 | | |

$ | 853 | | |

| 14,762,342 | | |

$ | 1,476 | | |

$ | 23,725,724 | | |

$ | (19,547,259 | ) | |

$ | 4,180,794 | |

| Shares issued for acquisition | |

| - | | |

| - | | |

| 154,637 | | |

| 15 | | |

| (15 | ) | |

| - | | |

| - | |

| Issuance of common shares for services | |

| | | |

| | | |

| 48,338 | | |

| 5 | | |

| 34,955 | | |

| | | |

| 35,000 | |

| Net Income (Loss) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,961,801 | ) | |

| (1,961,801 | ) |

| Balance as of June 30, 2022 | |

| 8,530,000 | | |

$ | 853 | | |

| 14,965,317 | | |

$ | 1,497 | | |

$ | 23,760,704 | | |

$ | (21,509,060 | ) | |

$ | 2,253,993 | |

The

accompanying notes are an integral part of these unaudited condensed consolidated financial statements

Panacea Life Sciences, Inc.

Statements

of Cash Flows

| | |

2023 | | |

2022 | |

| | |

Six Months Ended June 30, | |

| | |

2023 | | |

2022 | |

| Cash flows from operating activities | |

| | | |

| | |

| Net income (loss) | |

$ | (3,655,537 | ) | |

$ | (4,744,047 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities | |

| | | |

| | |

| Depreciation | |

| 845,282 | | |

| 818,586 | |

| Realized gain on sale of securities | |

| - | | |

| (22,816 | ) |

| Unrealized (gain)/loss on marketable securities | |

| 646,974 | | |

| 1,205,077 | |

| Non cash settlement of convertible note and accrued interest | |

| 74,999 | | |

| - | |

| Amortization of intangible assets | |

| - | | |

| 30,700 | |

| Amortization of debt discount and non-cash interest expense | |

| 38,329 | | |

| 568,219 | |

| Changes in operating assets and liabilities | |

| | | |

| | |

| Accounts receivable | |

| (65,963 | ) | |

| 24,945 | |

| Inventory | |

| 90,992 | | |

| (216,202 | ) |

| Prepaid expense and other assets | |

| (36,197 | ) | |

| (41,823 | ) |

| Accounts payable and accrued expenses | |

| 1,034,568 | | |

| 982,474 | |

| Operating lease liability, net | |

| 229,386 | | |

| 229,387 | |

| Net cash used in operating activities | |

| (797,167 | ) | |

| (1,165,500 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities | |

| | | |

| | |

| Proceeds from sale of marketable securities | |

| - | | |

| 46,832 | |

| Net fixed asset acquisitions | |

| (24,570 | ) | |

| (17,604 | ) |

| Net Cash provided by (used in) investing activities | |

| (24,570 | ) | |

| 29,228 | |

| | |

| | | |

| | |

| Cash flows from financing activities | |

| | | |

| | |

| Repayment of notes payable | |

| (135,000 | ) | |

| - | |

| Payments of principal on notes payable | |

| (118,000 | ) | |

| (540,848 | ) |

| Proceeds from Notes payable - related party | |

| 1,075,976 | | |

| 1,693,875 | |

| Cash provided by financing activities | |

| 822,976 | | |

| 1,153,027 | |

| | |

| | | |

| | |

| Net increase (decrease) in Cash and Cash Equivalents | |

| 1,239 | | |

| 16,755 | |

| Cash and Cash Equivalents, Beginning of Period | |

| 6,951 | | |

| 19,774 | |

| Cash and Cash Equivalents, End of Period | |

$ | 8,190 | | |

$ | 36,529 | |

| | |

| | | |

| | |

| Supplemental Disclosure of Cash Flow Information | |

| | | |

| | |

| Cash paid for income taxes during the year | |

$ | - | | |

$ | - | |

| Interest payments during the year | |

$ | - | | |

$ | - | |

| | |

| | | |

| | |

| Noncash investing and financing activity | |

| | | |

| | |

| Conversion of Preferred A shares to Note Payable | |

$ | - | | |

$ | 385,000 | |

| Issuance of Common Stock for services | |

$ | - | | |

$ | 55,000 | |

| Capitalized assets purchased on account - related party | |

$ | - | | |

$ | 168,578 | |

The accompanying notes are an integral part of these financial statements.

PANACEA

LIFE SCIENCES HOLDINGS, INC. AND SUBSIDIARY

NOTES

TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

JUNE

30, 2023

NOTE

1 - NATURE OF ORGANIZATION

Organization

and Business Description

PANACEA

LIFE SCIENCES HOLDINGS, Inc. (the “Company”, “we”, “us”, “our”) was incorporated on January

18, 2008, in the State of Nevada. In January 2019, the Company added to the scope of its business activities, efforts to produce, market

and sell products made from industrial hemp containing cannabidiol (“CBD”). On June 30, 2021, the Company entered into a

Securities Exchange Agreement (the “Exchange Agreement”) with Panacea Life Sciences, Inc., (“Panacea”) a seed

to sale cannabinoid company and with the stockholders of Panacea. Pursuant to the Exchange Agreement, the former Panacea stockholders

assumed majority control of the Company and all operations are now operated by Panacea, which as a result of the share exchange, became

a wholly owned subsidiary of the Company. In October 2021, the Company changed its name from Exactus Inc. to Panacea Life Sciences Holdings,

Inc.

Panacea

Life Sciences Holdings, Inc. (PLSH) is currently a holding company structured to develop and facilitate manufacturing, research, product

development and distribution in the high-growth, natural human and animal health and wellness market segment. Its subsidiary, Panacea

Life Sciences, Inc. (PLS) is a woman-founded and led company dedicated to manufacturing, distribution, research and production of the

highest-quality nutraceutical, cannabinoid, mushroom, kratom and other natural, plant-based ingredients and products. PLS operates out

of a 51,000 square foot, state-of-the-art, cGMP facility in Golden, Colorado. PLS was founded by Leslie Buttorff in 2017 as a woman-owned

business, was formed to own and engage in creating disruptive healthcare and veterinary natural relief products to make a difference

in the lives of humans and pets.

NOTE

2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis

of presentation and principles of consolidation

The

Company’s consolidated financial statements include the financial statements of Panacea Life Sciences, Inc., a wholly owned subsidiary

acquired on June 30, 2021.

The

accompanying consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the

United States of America and the rules and regulations of the United States Securities and Exchange Commission (the “SEC”)

for interim financial information, which includes consolidated unaudited interim financial statements and present the consolidated unaudited

interim financial statements of the Company and its wholly-owned subsidiary as of June 30, 2023. Accordingly, they do not include all

of the information and notes required by accounting principles generally accepted in the United States of America. All intercompany transactions

and balances have been eliminated. In the opinion of management, all adjustments necessary to present fairly our financial position,

results of operations, stockholders’ equity and cash flows as of June 30, 2023, and 2022, and for the periods then ended, have

been made. Those adjustments consist of normal and recurring adjustments. Operating results for the three ended June 30, 2023 and 2022

are not necessarily indicative of the results that may be expected for any subsequent quarters or for the year ending December 31, 2023.

Certain information and note disclosures normally included in our annual financial statements prepared in accordance with generally accepted

accounting principles have been condensed or omitted.

Going

concern

These

unaudited condensed consolidated financial statements are presented on the basis that the Company will continue as a going concern. Panacea

has combined with Panacea Life Sciences Holdings, Inc. (formerly Exactus), so the below items reflect the consolidated company. The going

concern concept contemplates the realization of assets and satisfaction of liabilities in the normal course of business. Since our inception

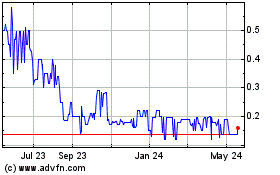

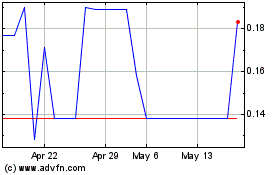

in later 2017, we have generated losses from operations. As of June 30, 2023, our accumulated deficit was $29.6 million, and we had $0.465

million in cash and liquid stock. As of June 30, 2023, the shares of common stock we hold in 22nd Century Group, Inc. (1,188,000

shares) (Nasdaq: XXII) (“XXII”) was valued at approximately $0.457 million. The XXII stock is pledged to secure a $4.063

million promissory note in favor of J&N Real Estate (“J&N”) and a $1.624 million promissory note in favor of Leslie

Buttorff, CEO of the Company. J&N is owned by the CEO. These items are shown on the balance sheet as related party loans. These factors

raise doubt about the Company’s ability to continue as a going concern for a period of 12 months from the issuance date of this

report. Management cannot provide assurance that the Company will ultimately achieve or maintain profitable operations or become cash

flow positive or raise additional debt and/or equity capital. In addition, due to insufficient revenue, we will need to obtain further

funding through public or private equity offerings, debt financing, collaboration arrangements or other sources in order to maintain

active business operations. We currently do not have sufficient cash flow to pay our ongoing financial obligations on a consistent basis.

The issuance of any additional shares of Common Stock, preferred stock or convertible securities could be substantially dilutive to our

shareholders. In addition, adequate additional funding may not be available to us on acceptable terms, or at all. These unaudited condensed

consolidated financial statements do not include any adjustments related to the recoverability and classification of assets or the amounts

and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

Use

of Estimates

The

Unaudited Condensed Consolidated Financial Statements have been prepared in conformity with US GAAP and required management of the Company

to make estimates and assumptions in preparation of these statements. Actual results may differ significantly from those estimates. Significant

estimates made by management include but are not limited to the useful life of property and equipment, incremental borrowing rate used

in the calculation of right of use asset and lease liability, reserves for inventory, allowance for doubtful accounts, revenue allocations,

valuation allowance on deferred tax assets, assumptions used in assessing impairment of long-term assets, assumptions used in the calculation

of net realizable value of inventory and fair value of non-cash equity transactions.

Cash

and Cash Equivalents

For

purposes of balance sheet presentation and reporting of cash flows, the Company considers all unrestricted demand deposits, money market

funds and highly liquid debt instruments with an original maturity of less than 90 days to be cash and cash equivalents. There were no

cash equivalents. The Company places its cash and cash equivalents with high-quality financial institutions. At times, balances in the

Company’s cash accounts may exceed the Federal Deposit Insurance Corporation (“FDIC”) limit. On June 30, 2023, the

Company’s cash balances did not exceed the FDIC limit.

Accounts

Receivable

Accounts

receivable are generally unsecured. The Company establishes an allowance for doubtful accounts receivable based on the age of outstanding

invoices and management’s evaluation of collectability. Accounts are written off after all reasonable collection efforts have been

exhausted and management concludes that likelihood of collection is remote. Any future recoveries are applied against the allowance for

doubtful accounts. An allowance of $10,000 was taken at the beginning of 2022 to allow for any doubtful accounts to be expensed. As of

June 30, 2023, none of this allowance was expensed. The Company’s accounts receivable policy changed in 2021 to only provide larger,

well-established companies with Net 30 payment terms. For all other sales they are paid by credit card or wires received before the product

is shipped to the customer.

Inventory

Inventories

are stated at low of cost or net realizable value. Inventories of purchased materials are valuated using a moving average method and

managed by first in first out basis (FIFO). Inventories of internally manufactured materials are valuated using a standard costing method

and are also managed on a FIFO basis. Production related costs that are capitalized as inventory as part of the standard cost valuation

include the direct materials consumed, direct labor used, indirect labor used, and manufacturing overhead. Overhead is calculated based

on specific manufacturing process and allocated on an order-by-order basis. Production variances that occur between standard cost valuation

and actual costs are expensed as incurred in the income statement as part of cost of goods sold.

Marketable

securities

The

Company’s marketable securities consists of 1,188,000 shares of XXII which are classified as available-for-sale and included in

current assets as they are pledged to secure two promissory notes (see Note 2 – Going Concern). Securities are valued based

on market prices for identical assets using third party certified pricing sources. Available-for-sale securities are carried at fair

value with unrealized and realized gains and losses reported as a component of income (loss). Realized gains and losses, if any, are

calculated on the specific identification method and are included in other income in the condensed consolidated statements of operations.

Fair

Value Measurements

The

Company adopted the provisions of Accounting Standard Codification (“ASC”) Topic 820, “Fair Value Measurements and

Disclosures”, which defines fair value as used in numerous accounting pronouncements, establishes a framework for measuring fair

value, and expands disclosure of fair value measurements. The guidance prioritizes the inputs used in measuring fair value and establishes

a three-tier value hierarchy that distinguishes among the following:

| |

● |

Level

1—Valuations based on unadjusted quoted prices in active markets for identical assets or liabilities that the Company has the

ability to access. |

| |

|

|

| |

● |

Level

2—Valuations based on quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar

assets or liabilities in markets that are not active and models for which all significant inputs are observable, either directly

or indirectly. |

| |

|

|

| |

● |

Level

3—Valuations based on inputs that are unobservable and significant to the overall fair value measurement. |

The

following table shows, by level within the fair value hierarchy, the Company’s assets and liabilities at fair value on a recurring

basis as of June 30, 2023, and December 31, 2022:

SCHEDULE

OF FAIR VALUE ASSETS MEASURED ON RECURRING BASIS

| | |

June 30, 2023 | | |

December 31, 2022 | |

| | |

Total | | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | | |

Level 1 | | |

Level 2 | | |

Level 3 | |

| Marketable securities | |

$ | 460,388 | | |

$ | 460,388 | | |

$ | - | | |

| - | | |

$ | 1,107,362 | | |

$ | 1,107,362 | | |

$ | - | | |

$ | - | |

| Total | |

$ | 460,388 | | |

$ | 460,388 | | |

$ | - | | |

$ | - | | |

$ | 1,107,362 | | |

$ | 1,107,362 | | |

$ | - | | |

$ | - | |

The

following table is a schedule of the Company’s marketable securities. The following table is schedule of the Company’s marketable

securities:

SCHEDULE

OF MARKETABLE SECURITIES

| | |

June 30, 2023 | |

| Balance at beginning of year | |

$ | 1,107,362 | |

| Unrealized loss on marketable securities, net | |

| (646,974 | ) |

| Balance at end of period | |

$ | 460,388 | |

As

of June 30, 2023, the Company has no liabilities that are re-measured at fair value.

Property

and Equipment

Property

and equipment are stated at cost less accumulated depreciation. Depreciation is calculated using the straight-line method on the various

asset classes over their estimated useful lives, which range from 3 to 10 years when placed in service. The cost of repairs and maintenance

is expensed as incurred; major replacements and improvements are capitalized. When assets are retired or disposed of, the cost and accumulated

depreciation are removed from the accounts, and any resulting gains or losses are included in income in the year of disposition.

Intangible

Assets and Goodwill

The

Company has intangible assets. Goodwill is comprised of the purchase price of business combinations in excess of the fair market value

assigned at acquisition to the tangible and intangible assets acquired. Goodwill is not amortized. The Company tests goodwill for impairment

on an annual basis. The Company performed its most recent goodwill impairment using a discounted cash flow analysis and found that the

fair value exceeded the carrying value. It has $2.189 million of goodwill from the acquisition of the assets of Phoenix Life Sciences,

Inc. (“Phoenix”) in October 2017 and intangible assets of $0.030 million as of June 30, 2023, and $0.061 million for as of

December 31, 2022. In the acquisition of Phoenix, the Company acquired product formulas which is classified as an intangible asset.

The

following table is a schedule of the Company’s intangible assets and goodwill:

SCHEDULE

OF INTANGIBLE ASSETS AND GOODWILL

| | |

Estimated Life |

| Goodwill from Phoenix Acquisition | |

Tested Yearly for Impairment |

| Intangibles – Formulations | |

5 Years |

| | |

June 30, 2023 | | |

December 31, 2022 | |

| Goodwill | |

$ | 2,188,810 | | |

$ | 2,188,810 | |

Leases

The

Company determines if an arrangement is a lease at inception. Contracts containing a lease are further evaluated for classification as

an operating or finance lease. In determining the leases classification, the Company assesses among other criteria: (i) 75% or more of

the remaining economic life of the underlying asset is a major part of the remaining economic life of that underlying asset; and (ii)

90% or more of the fair value of the underlying asset comprises substantially all of the fair value of the underlying asset. Operating

leases are included in operating lease right-of-use (“ROU”) assets, other current liabilities and long-term operating lease

liabilities in the Company’s consolidated balance sheets. Finance leases are included in property, plant and equipment, net, other

current liabilities, and long-term finance lease liabilities in the Company’s consolidated balance sheets. ROU assets represent

the right to use an underlying asset for the lease term and lease liabilities represent the Company’s obligation to make lease

payments arising from the lease. For leases with terms greater than 12 months, the Company records the ROU asset and liability at commencement

date based on the present value of lease payments according to their term.

The

Company uses incremental borrowing rates based on the estimated rate of interest for collateralized borrowing over a similar term of

the lease payments at commencement date. The ROU asset also includes any lease payments made and excludes lease incentives. Lease terms

may include options to extend or terminate the lease when it is reasonably certain that the Company will exercise that option. Lease

expenses are recognized on a straight-line basis over the lease term or the useful life of the leased asset.

In

addition, the carrying amount of the ROU and lease liabilities are remeasured if there is a modification, a change in the lease term,

a change in the in-substance fixed lease payments or a change in the assessment to purchase the underlying asset.

Revenue

Recognition

The

Company accounts for revenue in accordance with ASC Topic 606, Revenue from Contracts with Customers.

The

Company accounts for a contract when it has been approved and committed to, each party’s rights regarding the goods or services

to be transferred have been identified, the payment terms have been identified, the contract has commercial substance, and collectability

is probable. Revenue is generally recognized net of allowances for returns and any taxes collected from customers and subsequently remitted

to governmental authorities. However, the Company’s sales are primarily through retail stores, purchase orders or ecommerce; thus,

currently contract liabilities are negligible. The Company does not have any multiple-element arrangements.

Some

of the Company’s contract liabilities consist of advance customer payments. Contract liability results from transactions in which

the Company has been paid for products by customers, but for which all revenue recognition criteria have not yet been met. Once all revenue

recognition criteria have been met, the contract liabilities are recognized. The Company recorded $330,499and $368,065 in advanced customer

payments as of June 30, 2023, and December 31, 2022, respectively and these amounts are included in the balance sheet line item of accounts

payable and accrued expenses.

The

following table shows the Company’s advanced customer payments:

SCHEDULE

OF REVENUE FROM CONTRACT WITH CUSTOMER

| | |

June 30, 2023 | | |

December 31, 2022 | |

| Balance, beginning of period | |

$ | 368,065 | | |

$ | 24,585 | |

| Payments received for unearned revenue | |

| 214,498 | | |

| 412,891 | |

| Revenue earned | |

| 252,064 | | |

| 69,411 | |

| | |

| | | |

| | |

| Balance, end of period | |

$ | 330,499 | | |

$ | 368,065 | |

Revenue

is recognized when a customer obtains control of promised goods or services and is recognized in an amount that reflects the consideration

that an entity expects to receive in exchange for those goods or services. In addition, the standard requires disclosure of the nature,

amount, timing, and uncertainty of revenue and cash flows arising from contracts with customers. The amount of revenue that is recorded

reflects the consideration that the Company expects to receive in exchange for those goods. The Company applies the following five-step

model in order to determine this amount: (i) identification of the promised goods in the contract; (ii) determination of whether the

promised goods are performance obligations, including whether they are distinct in the context of the contract; (iii) measurement of

the transaction price, including the constraint on variable consideration; (iv) allocation of the transaction price to the performance

obligations; and (v) recognition of revenue when (or as) the Company satisfies each performance obligation.

Revenue

related to the sale of products is recognized once goods have been sold to the customer and the performance obligation has been completed.

In both contracted purchase and retail sales, we offer consumer products through our online stores. Revenue is recognized when control

of the goods is transferred to the customer. This generally occurs upon our delivery to a third-party carrier or, to the customer directly.

Revenue from tolling services is recognized when the performance obligation, such as processing of the material, has been completed and

output material has been transferred to the customer.

Revenue

is generally recognized net of allowances for returns and any taxes collected from customers and subsequently remitted to governmental

authorities. A contract liability results from transactions in which the Company has been paid for products by customers, but for which

all revenue recognition criteria have not yet been met. Once all revenue recognition criteria have been met, the contract liabilities

are recognized. The Company does not have any multiple-element arrangements.

The

Company also has recorded other income related to rental income it receives from leasing out space in the laboratory it occupies.

Shipping

and Handling Costs

The

Company accounts for shipping and handling fees in accordance with ASC 606. The amounts charged to customers for shipping products are

recognized as revenues and the related freight costs of shipping products are classified in general and administrative costs as incurred.

Shipping costs are included as a component of general and administrative expenses and were $43,001 and $17,965 for the six months ended

June 30, 2023, and 2022, respectively. Shipping costs were $32,633 and $3,782 for the three months ended June 30, 2023, and 2022, respectively.

Advertising

& Marketing

Advertising

costs are expensed when incurred and are included in advertising and promotional expense in the accompanying statements of operations.

Included in this category are expenses related to public relations, investor relations, new package design, website design, design of

promotional materials, cost of trade shows, cost of products given away as promotional samples, and paid advertising. The Company recorded

advertising and marketing costs in general and administrative expenses and were $18,193 and $98,108 for the six months ended June 30,

2023, and 2022, respectively. Advertising and marketing costs were $14,563 and $31,312 for the three months ended June 30, 2023, and

2022, respectively.

Segment

Information

The

Company follows the provisions of ASC 280-10 Segment Reporting. This standard requires that companies disclose operating segments

based on the manner in which management disaggregates the Company in making internal operating decisions. Segment identification and

selection is consistent with the management structure used by the Company’s chief operating decision maker to evaluate performance

and make decisions regarding resource allocation, as well as the materiality of financial results consistent with that structure. Based

on the Company’s management structure and method of internal reporting, the Company has one operating segment. The Company’s

chief operating decision maker does not review operating results on a disaggregated basis; rather, the chief operating decision maker

reviews operating results on an aggregate basis.

Stock-Based

Compensation

The

Company accounts for its stock compensation under the ASC 718-10-30, Compensation - Stock Compensation using the fair value-based

method. Under this method, compensation cost is measured at the grant date based on the value of the award and is recognized over the

service period, which is usually the vesting period. This guidance establishes standards for the accounting for transactions in which

an entity exchanges its equity instruments for goods or services. It also addresses transactions in which an entity incurs liabilities

in exchange for goods or services that are based on the fair value of the entity’s equity instruments or that may be settled by

the issuance of those equity instruments.

The

Company uses the Black-Scholes model for measuring the fair value of options and warrants. The stock based fair value compensation is

determined as of the date of the grant or the date at which the performance of the services is completed (measurement date) and is recognized

over the vesting periods. The Company recognizes forfeitures when they occur.

Earnings

per Share

The

Company computes basic and diluted earnings per share amounts in accordance with ASC Topic 260, “Earnings per Share”. Basic

earnings per share is computed by dividing net income (loss) available to common stockholders by the weighted average number of common

shares outstanding during the reporting period. Diluted earnings per share reflects the potential dilution that could occur if preferred

stock converted to common stock and warrants are exercised. Preferred stock and warrants are excluded from the diluted earnings per share

calculation if their effect is anti-dilutive.

The

following financial instruments were not included in the diluted loss per share calculation for the six months ended June 30, 2023 and

2022 because their effect was anti-dilutive:

SCHEDULE

OF ANTI-DILUTIVE DILUTED LOSS PER SHARE

| | |

2023 | | |

2022 | |

| | |

For the six months ended June 30, | |

| | |

2023 | | |

2022 | |

| Options to purchase common stock | |

| 551,854 | | |

| 277,705 | |

| Warrants to purchase common stock | |

| 1,117,092 | | |

| 1,117,092 | |

| Series B-1 Convertible Preferred | |

| 6,679 | | |

| 6,679 | |

| Series B-2 Convertible Preferred | |

| 26,786 | | |

| 26,786 | |

| Series C Convertible Preferred | |

| 2,289,220 | | |

| 2,289,220 | |

| Series C-1 Convertible Preferred | |

| 1,064,908 | | |

| 1,064,908 | |

| Series D Convertible Preferred | |

| 1,628,126 | | |

| 1,628,126 | |

| Convertible Notes | |

| - | | |

| - | |

| Total | |

| 6,684,665 | | |

| 6,410,516 | |

Income

Taxes

Income

taxes are accounted for under the asset and liability method prescribed by FASB ASC Topic 740. These standards require a company to determine

whether it is more likely than not that a tax position will be sustained upon examination based upon the technical merits of the position.

If the more likely than not threshold is met, a company must measure the tax position to determine the amount to recognize in the financial

statements. Deferred income taxes are recorded for temporary differences between financial statement carrying amounts and the tax basis

of assets and liabilities. Deferred tax assets and liabilities reflect the tax rates expected to be in effect for the years in which

the differences are expected to reverse. A valuation allowance is provided if it is more likely than not that some or all of the deferred

tax asset will not be realized.

Recently

Issued Accounting Standards

In

August 2020, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No.

2020-06, Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging-Contracts in Entity’s Own Equity

(Subtopic 815-40), Accounting for Convertible Instruments and Contract’s in an Entity’s Own Equity. The ASU simplifies accounting

for convertible instruments by removing major separation models required under current GAAP. Consequently, more convertible debt instruments

will be reported as a single liability instrument with no separate accounting for embedded conversion features. The ASU removes certain

settlement conditions that are required for equity contracts to qualify for the derivative scope exception, which will permit more equity

contracts to qualify for it. The ASU simplifies the diluted net income per share calculation in certain areas. The ASU is effective for

annual and interim periods beginning after December 31, 2021, and early adoption is permitted for fiscal years beginning after December

15, 2020, and interim periods within those fiscal years. The Company does not expect the adoption of ASU 2020-6 to have any material

impact on its consolidated financial statements.

In

May 2021, the Financial Accounting Standards Board (“FASB”) issued ASU 2021-04 “Earnings Per Share (Topic 260), Debt—Modifications

and Extinguishments (Subtopic 470-50), Compensation— Stock Compensation (Topic 718), and Derivatives and Hedging—Contracts

in Entity’s Own Equity (Subtopic 815- 40) Issuer’s Accounting for Certain Modifications or Exchanges of Freestanding Equity-Classified

Written Call Options” which clarifies and reduces diversity in an issuer’s accounting for modifications or exchanges of freestanding

equity-classified written call options (for example, warrants) that remain equity classified after modification or exchange. An entity

should measure the effect of a modification or an exchange of a freestanding equity-classified written call option that remains equity

classified after modification or exchange as follows: i) for a modification or an exchange that is a part of or directly related to a

modification or an exchange of an existing debt instrument or line-of-credit or revolving-debt arrangements (hereinafter, referred to

as a “debt” or “debt instrument”), as the difference between the fair value of the modified or exchanged written

call option and the fair value of that written call option immediately before it is modified or exchanged; ii) for all other modifications

or exchanges, as the excess, if any, of the fair value of the modified or exchanged written call option over the fair value of that written

call option immediately before it is modified or exchanged. The amendments in this Update are effective for all entities for fiscal years

beginning after December 15, 2021, including interim periods within those fiscal years. An entity should apply the amendments prospectively

to modifications or exchanges occurring on or after the effective date of the amendments. The Company is currently evaluating the impact

of this standard on its consolidated financial statements.

The

Company does not discuss recent pronouncements that are not anticipated to have an impact on or are unrelated to its financial condition,

results of operations, cash flows or disclosures.

NOTE

3 – PROPERTY, EQUIPMENT, NET OF ACCUMULATED DEPRECIATION

Property

and equipment, net including any major improvements, are recorded at historical cost. The cost of repairs and maintenance is charged

against operations as incurred. Depreciation is calculated using the straight-line method over the estimated useful lives of the related

assets, generally as follows:

SCHEDULE

OF PROPERTY PLANT AND EQUIPMENT USEFUL LIVES

| | |

Estimated Life |

| Computers and technological assets | |

3 – 5 Years |

| Furniture and fixtures | |

3 – 5 Years |

| Machinery and equipment | |

5 – 10 Years |

| Leasehold improvement | |

10 Years |

Property

and equipment, net consists of the following:

SCHEDULE

OF PROPERTY AND EQUIPMENT

| | |

June 30, 2023 | | |

December 31, 2022 | |

| Computers and technological assets | |

$ | 3,776,320 | | |

$ | 3,776,320 | |

| Furniture and fixtures | |

| 55,950 | | |

| 55,950 | |

| Machinery and equipment | |

| 7,790,036 | | |

| 7,765,466 | |

| Land | |

| 92,222 | | |

| 92,222 | |

| Leasehold improvements | |

| 1,508,915 | | |

| 1,508,915 | |

| Total | |

| 13,223,443 | | |

| 13,198,873 | |

| Less accumulated depreciation | |

| (6,368,160 | ) | |

| (5,522,878 | ) |

| Total property and equipment, net | |

$ | 6,855,283 | | |

$ | 7,675,995 | |

Depreciation

expenses for the three and six month periods ended June 30, 2023 and 2022 were $422,728, 845,282, and 409,895, $818,586 respectively.

NOTE

4 - INVENTORY

Inventory

consists of the following components:

SCHEDULE

OF INVENTORY

| | |

June 30, 2023 | | |

December 31, 2022 | |

| Raw Materials | |

$ | 964,317 | | |

$ | 870,530 | |

| Semi-Finished | |

| 1,771,177 | | |

| 1,863,501 | |

| Finished Goods | |

| 1,598,280 | | |

| 1,694,574 | |

| Packaging | |

| 23,959 | | |

| 20,120 | |

| Trading | |

| | | |

| 0 | |

| Total | |

$ | 4,357,733 | | |

$ | 4,448,725 | |

Inventories

are stated at lower of cost or net realizable value using the standard costing method for its work in process and finished goods. For

its raw materials, trading goods, and packaging supplies, the Company utilizes the moving average method for costing purposes and FIFO.

At this time there are no inventory reserves required. Inventory includes all of our various storage locations: including inventory held

in our VICKI machines, other warehouses, and off-site trailers. It also includes inventory purchased for customer projects.

NOTE

5 –OPERATING LEASE RIGHT-OF-USE ASSETS AND OPERATING LEASE LIABILITIES – RELATED PARTY

Right

of Use

The

Company adopted Accounting Standards Update (“ASU”) No. 2016-02, “Leases” (“ASC 842”) on January

1, 2019, the start of our 2019 fiscal year. The Company has one lease arrangement with a related

party entered into on December 22, 2018, for 3-year term starting with January 1, 2019 for certain laboratory facilities, with a nine-year

extension option. This lease was extended and now expires on December 31, 2030. At inception, the Company recognized a Right of

Use Asset and a corresponding lease liability in the amount of $4,595,509. The Company’s lease arrangements may contain both lease

and non-lease components. The Company has elected to combine and account for lease and non-lease components as a single lease component.

The Company has incorporated residual value obligations in leases for which there is such occurrences. Regarding short-term leases, ASC

842-10-25-2 permits an entity to make a policy election not to apply the recognition requirements of ASC 842 to Short-term leases. The

Company has elected not to apply the ASC 842 recognition criteria to any leases that qualify as Short-Term Leases.

The

Company leases a portion of the property (formerly the Environmental Protection Agency building) in Golden, CO from J&N Real Estate,

owned by the CEO, a related party with a term expiring on December 31, 2030. The lease consists of all laboratory space including testing

facilities, water treatment, extraction and production. The lease of the property is based on the fair market rent and triple net lease

(NNN) values competitive in the marketplace for a cGMP facility. The Company also subleases some of its laboratory space to other CBD

companies. This income is presented under the Other Income line items of the statements of operations. The leases vary from short-term

monthly leases to 3-year leases but are all cancellable.

Below

is a summary of our right of use assets and liabilities as of June 30, 2023, and December 31, 2022:

SCHEDULE

OF RIGHT OF USE ASSET AND LIABILITY

| | |

June 30, 2023 | | |

December 31, 2022 | |

| Right-of-use assets | |

$ | 3,062,090 | | |

$ | 3,242,381 | |

| | |

| | | |

| | |

| Present value of operating lease liabilities | |

$ | 3,168,620 | | |

$ | 3,347,331 | |

| Less: Long-term portion of operating lease liability | |

| (2,800,766 | ) | |

| (2,987,208 | ) |

| Short-term portion of operating lease liability | |

| 367,854 | | |

| 360,123 | |

| Unpaid balances | |

| 1,957,947 | | |

| 1,730,136 | |

| Total short-term lease liability obligations | |

$ | 2,325,801 | | |

$ | 2,090,259 | |

| Weighted-average remaining lease term (Ends December 31, 2030) | |

| 7.5 years | | |

| 8 years | |

| | |

| | | |

| | |

| Weighted-average discount rate | |

| | | |

| 3.0 | % |

During

the three and six months ended June 30, 2023, and 2022, we recognized approximately $114,693 and $229,386 respectively in operating lease

costs. Operating lease costs are included in operating expenses in our consolidated statement of operations.

Approximate

future minimum lease payments for our right of use assets over the remaining lease periods as of June 30, 2023, are as follows:

SCHEDULE

OF MATURITY OF OPERATING LEASE LIABILITIES

| | |

| | |

| 2023 | |

| 227,811 | |

| 2024 | |

| 460,178 | |

| 2025 | |

| 464,780 | |

| 2026 | |

| 469,427 | |

| 2027 | |

| 474,122 | |

| Thereafter | |

| 1,451,002 | |

| Total undiscounted operating lease payments | |

| 3,547,320 | |

| Less: Imputed interest | |

| (378,700 | ) |

| Present value of operating lease liabilities | |

$ | 3,168,620 | |

NOTE

6 – NOTES PAYABLE

Convertible

Note Payable

On

November 18, 2021, the Company entered into a Securities Purchase Agreement (“SPA”) with Lincoln Park Capital Fund, LLC (the

“Purchaser”) pursuant to which the Company agreed to sell a 10% original issue discount senior convertible promissory note

in the principal amount of $1,100,000 (the “Convertible Note”) and five-year warrants to purchase 785,715 shares of the Company’s