0000880242

BIOLARGO, INC.

false

--12-31

Q2

2023

0.00067

0.00067

50,000,000

50,000,000

0

0

0

0

0.00067

0.00067

550,000,000

550,000,000

287,220,661

278,462,706

39

77

35

10

27

10

17

10

10

10

10

11

10

31

10

15

0

0

0

0

0

0

0

0

0

6

18

0

9

6

5

5

154,000

4

1

10

178,000

4

0.28

0.28

0.28

0.35

0.35

6

5

6

5

5

3

161,000

51,571

1,352

66,000

5

5

0

135,000

5

4

10

3

00008802422023-01-012023-06-30

xbrli:shares

00008802422023-08-11

thunderdome:item

iso4217:USD

00008802422023-06-30

00008802422022-12-31

0000880242blgo:EntitiesExcludingPartiallyOwnedSubsidiaryMember2023-06-30

0000880242blgo:EntitiesExcludingPartiallyOwnedSubsidiaryMember2022-12-31

0000880242blgo:PartiallyOwnedSubsidiaryMember2023-06-30

0000880242blgo:PartiallyOwnedSubsidiaryMember2022-12-31

iso4217:USDxbrli:shares

0000880242us-gaap:ProductMember2023-04-012023-06-30

0000880242us-gaap:ProductMember2022-04-012022-06-30

0000880242us-gaap:ProductMember2023-01-012023-06-30

0000880242us-gaap:ProductMember2022-01-012022-06-30

0000880242us-gaap:ServiceMember2023-04-012023-06-30

0000880242us-gaap:ServiceMember2022-04-012022-06-30

0000880242us-gaap:ServiceMember2023-01-012023-06-30

0000880242us-gaap:ServiceMember2022-01-012022-06-30

00008802422023-04-012023-06-30

00008802422022-04-012022-06-30

00008802422022-01-012022-06-30

0000880242us-gaap:CommonStockMember2022-12-31

0000880242us-gaap:AdditionalPaidInCapitalMember2022-12-31

0000880242us-gaap:RetainedEarningsMember2022-12-31

0000880242us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-31

0000880242us-gaap:NoncontrollingInterestMember2022-12-31

0000880242us-gaap:CommonStockMember2023-01-012023-03-31

0000880242us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-31

0000880242us-gaap:RetainedEarningsMember2023-01-012023-03-31

0000880242us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-31

0000880242us-gaap:NoncontrollingInterestMember2023-01-012023-03-31

00008802422023-01-012023-03-31

0000880242blgo:ClyraMedicalTechnologiesMemberus-gaap:CommonStockMember2023-01-012023-03-31

0000880242blgo:ClyraMedicalTechnologiesMemberus-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-31

0000880242blgo:ClyraMedicalTechnologiesMemberus-gaap:RetainedEarningsMember2023-01-012023-03-31

0000880242blgo:ClyraMedicalTechnologiesMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-31

0000880242blgo:ClyraMedicalTechnologiesMemberus-gaap:NoncontrollingInterestMember2023-01-012023-03-31

0000880242blgo:ClyraMedicalTechnologiesMember2023-01-012023-03-31

0000880242blgo:BiolargoEnergyTechnologiesIncBETIMemberus-gaap:CommonStockMember2023-01-012023-03-31

0000880242blgo:BiolargoEnergyTechnologiesIncBETIMemberus-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-31

0000880242blgo:BiolargoEnergyTechnologiesIncBETIMemberus-gaap:RetainedEarningsMember2023-01-012023-03-31

0000880242blgo:BiolargoEnergyTechnologiesIncBETIMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-31

0000880242blgo:BiolargoEnergyTechnologiesIncBETIMemberus-gaap:NoncontrollingInterestMember2023-01-012023-03-31

0000880242blgo:BiolargoEnergyTechnologiesIncBETIMember2023-01-012023-03-31

0000880242us-gaap:CommonStockMember2023-03-31

0000880242us-gaap:AdditionalPaidInCapitalMember2023-03-31

0000880242us-gaap:RetainedEarningsMember2023-03-31

0000880242us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-31

0000880242us-gaap:NoncontrollingInterestMember2023-03-31

00008802422023-03-31

0000880242us-gaap:CommonStockMember2023-04-012023-06-30

0000880242us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-30

0000880242us-gaap:RetainedEarningsMember2023-04-012023-06-30

0000880242us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-30

0000880242us-gaap:NoncontrollingInterestMember2023-04-012023-06-30

0000880242us-gaap:CommonStockMember2023-06-30

0000880242us-gaap:AdditionalPaidInCapitalMember2023-06-30

0000880242us-gaap:RetainedEarningsMember2023-06-30

0000880242us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-30

0000880242us-gaap:NoncontrollingInterestMember2023-06-30

0000880242us-gaap:CommonStockMember2021-12-31

0000880242us-gaap:AdditionalPaidInCapitalMember2021-12-31

0000880242us-gaap:RetainedEarningsMember2021-12-31

0000880242us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-31

0000880242us-gaap:NoncontrollingInterestMember2021-12-31

00008802422021-12-31

0000880242us-gaap:CommonStockMember2022-01-012022-03-31

0000880242us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-31

0000880242us-gaap:RetainedEarningsMember2022-01-012022-03-31

0000880242us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-31

0000880242us-gaap:NoncontrollingInterestMember2022-01-012022-03-31

00008802422022-01-012022-03-31

0000880242blgo:ClyraMedicalTechnologiesMemberus-gaap:CommonStockMember2022-01-012022-03-31

0000880242blgo:ClyraMedicalTechnologiesMemberus-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-31

0000880242blgo:ClyraMedicalTechnologiesMemberus-gaap:RetainedEarningsMember2022-01-012022-03-31

0000880242blgo:ClyraMedicalTechnologiesMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-31

0000880242blgo:ClyraMedicalTechnologiesMemberus-gaap:NoncontrollingInterestMember2022-01-012022-03-31

0000880242blgo:ClyraMedicalTechnologiesMember2022-01-012022-03-31

0000880242us-gaap:CommonStockMember2022-03-31

0000880242us-gaap:AdditionalPaidInCapitalMember2022-03-31

0000880242us-gaap:RetainedEarningsMember2022-03-31

0000880242us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-31

0000880242us-gaap:NoncontrollingInterestMember2022-03-31

00008802422022-03-31

0000880242us-gaap:CommonStockMember2022-04-012022-06-30

0000880242us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-30

0000880242us-gaap:RetainedEarningsMember2022-04-012022-06-30

0000880242us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-30

0000880242us-gaap:NoncontrollingInterestMember2022-04-012022-06-30

0000880242us-gaap:CommonStockMember2022-06-30

0000880242us-gaap:AdditionalPaidInCapitalMember2022-06-30

0000880242us-gaap:RetainedEarningsMember2022-06-30

0000880242us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-30

0000880242us-gaap:NoncontrollingInterestMember2022-06-30

00008802422022-06-30

0000880242blgo:EntitiesExcludingPartiallyOwnedSubsidiaryMember2023-01-012023-06-30

0000880242blgo:EntitiesExcludingPartiallyOwnedSubsidiaryMember2022-01-012022-06-30

0000880242blgo:PartiallyOwnedSubsidiaryMember2023-01-012023-06-30

0000880242blgo:PartiallyOwnedSubsidiaryMember2022-01-012022-06-30

0000880242blgo:BetiCommonStockMember2023-01-012023-06-30

0000880242blgo:BetiCommonStockMember2022-01-012022-06-30

0000880242blgo:ConversionOfIntercompanyReceivableIntoClyraSharesMember2023-01-012023-06-30

0000880242blgo:ConversionOfIntercompanyReceivableIntoClyraSharesMember2022-01-012022-06-30

0000880242blgo:ConversionOfClyraCommonStockToBiolargoCommonStockMember2023-01-012023-06-30

0000880242blgo:ConversionOfClyraCommonStockToBiolargoCommonStockMember2022-01-012022-06-30

xbrli:pure

0000880242blgo:BiolargoEngineeringScienceTechnologiesLLCMemberblgo:ApproximationMember2023-06-30

0000880242blgo:ClyraMedicalTechnologiesMember2023-06-30

0000880242blgo:BiolargoEnergyTechnologiesIncBETIMember2023-06-30

0000880242blgo:LincolnParkCapitalFundLLCMember2023-01-012023-06-30

0000880242blgo:The2020UnitOfferingMember2023-01-012023-06-30

0000880242blgo:ClyraMedicalTechnologiesMember2023-01-012023-06-30

0000880242blgo:BiolargoEnergyTechnologiesIncBETIMember2023-01-012023-06-30

0000880242blgo:VehicleLoanMember2023-06-30

0000880242blgo:SBACARESActPaycheckProtectionProgramMember2023-06-30

0000880242blgo:EconomicInjuryDisasterLoanMember2023-06-30

0000880242blgo:ClyraMedicalTechnologiesMemberblgo:InventoryLineOfCreditMember2023-06-30

0000880242srt:ParentCompanyMember2023-06-30

0000880242srt:ParentCompanyMember2022-12-31

0000880242us-gaap:NoncontrollingInterestMember2023-06-30

0000880242us-gaap:NoncontrollingInterestMember2022-12-31

0000880242us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMemberblgo:CustomerAMember2023-04-012023-06-30

0000880242us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMemberblgo:CustomerAMember2022-04-012022-06-30

0000880242us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMemberblgo:CustomerAMember2023-01-012023-06-30

0000880242us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMemberblgo:CustomerAMember2022-01-012022-06-30

0000880242us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMemberblgo:CustomerBMember2023-04-012023-06-30

0000880242us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMemberblgo:CustomerBMember2022-04-012022-06-30

0000880242us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMemberblgo:CustomerBMember2023-01-012023-06-30

0000880242us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMemberblgo:CustomerBMember2022-01-012022-06-30

0000880242us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMemberblgo:CustomerCMember2023-04-012023-06-30

0000880242us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMemberblgo:CustomerCMember2022-04-012022-06-30

0000880242us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMemberblgo:CustomerCMember2023-01-012023-06-30

0000880242us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMemberblgo:CustomerCMember2022-01-012022-06-30

0000880242us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-06-30

0000880242us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberblgo:OneCustomerMember2023-01-012023-06-30

0000880242us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-31

0000880242us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberblgo:ThreeCustomersMember2022-01-012022-12-31

0000880242us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberblgo:CustomerAMember2023-01-012023-06-30

0000880242us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberblgo:CustomerAMember2022-01-012022-06-30

0000880242us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberblgo:CustomerBMember2023-01-012023-06-30

0000880242us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberblgo:CustomerBMember2022-01-012022-06-30

0000880242us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberblgo:CustomerDMember2023-01-012023-06-30

0000880242us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberblgo:CustomerDMember2022-01-012022-06-30

0000880242us-gaap:PatentsMember2021-01-22

0000880242blgo:OdinCoLtdMember2020-03-202020-03-20

0000880242blgo:TomorrowWaterMemberblgo:OdinCoLtdMember2020-03-202020-03-20

0000880242blgo:BktAndTomorrowWaterMemberblgo:OdinCoLtdMember2020-03-202020-03-20

0000880242blgo:OdinCoLtdMember2023-01-012023-06-30

0000880242blgo:OdinCoLtdMember2023-04-012023-06-30

0000880242blgo:OdinCoLtdMember2022-04-012022-06-30

0000880242blgo:OdinCoLtdMember2022-01-012022-06-30

0000880242blgo:NonPlanMembersrt:MinimumMember2023-01-012023-06-30

0000880242blgo:NonPlanMembersrt:MaximumMember2023-01-012023-06-30

0000880242blgo:EquityIncentivePlan2018Membersrt:MinimumMember2023-01-012023-06-30

0000880242blgo:EquityIncentivePlan2018Membersrt:MaximumMember2023-01-012023-06-30

0000880242blgo:NonPlanMembersrt:MinimumMember2022-01-012022-06-30

0000880242blgo:NonPlanMembersrt:MaximumMember2022-01-012022-06-30

0000880242blgo:EquityIncentivePlan2018Membersrt:MinimumMember2022-01-012022-06-30

0000880242blgo:EquityIncentivePlan2018Membersrt:MaximumMember2022-01-012022-06-30

0000880242blgo:NonPlanMember2023-01-012023-06-30

0000880242blgo:EquityIncentivePlan2018Member2023-01-012023-06-30

0000880242blgo:NonPlanMember2022-01-012022-06-30

0000880242blgo:EquityIncentivePlan2018Member2022-01-012022-06-30

utr:Y

utr:M

0000880242blgo:CanadianGovernmentGrantsMembersrt:MinimumMember2023-01-012023-06-30

0000880242blgo:CanadianGovernmentGrantsMembersrt:MaximumMember2023-01-012023-06-30

0000880242srt:MinimumMember2023-06-30

0000880242srt:MaximumMember2023-06-30

0000880242blgo:LincolnParkCapitalFundLLCMember2022-12-31

0000880242blgo:LincolnParkCapitalFundLLCMember2023-04-012023-06-30

0000880242blgo:LincolnParkCapitalFundLLCMember2022-04-012022-06-30

0000880242blgo:LincolnParkCapitalFundLLCMember2022-01-012022-06-30

0000880242blgo:The2020UnitOfferingMember2023-04-012023-06-30

0000880242blgo:WarrantsIssuedWith2020UnitOfferingMembersrt:MinimumMember2023-06-30

0000880242blgo:WarrantsIssuedWith2020UnitOfferingMembersrt:MaximumMember2023-06-30

0000880242blgo:PaycheckProtectionProgramCaresActMember2023-06-30

0000880242blgo:PaycheckProtectionProgramCaresActMember2022-12-31

0000880242blgo:VehicleLoanMember2023-06-30

0000880242blgo:VehicleLoanMember2022-12-31

0000880242blgo:ConvertibleNoteMaturingOnMarch12023Member2023-06-30

0000880242blgo:ConvertibleNoteMaturingOnMarch12023Member2022-12-31

0000880242blgo:EconomicInjuryDisasterLoanMember2022-12-31

0000880242blgo:VehicleLoanMember2023-02-07

0000880242blgo:VehicleLoanMember2023-02-072023-02-07

0000880242blgo:ConversionOfNoteIntoBetiCommonSharesMember2023-03-062023-03-06

0000880242blgo:WarrantIssuedWithConversionOfNoteMember2023-03-06

0000880242blgo:PaycheckProtectionProgramCaresActMemberblgo:ONMMember2022-02-072022-02-07

0000880242blgo:PaycheckProtectionProgramCaresActMemberblgo:ONMMember2023-06-30

0000880242blgo:PaycheckProtectionProgramCaresActMemberblgo:BELSTMember2022-05-122022-05-12

0000880242blgo:EconomicInjuryDisasterLoanMemberblgo:ONMMember2020-07-31

0000880242blgo:EconomicInjuryDisasterLoanMemberblgo:ONMMember2020-04-012020-07-31

0000880242srt:OfficerMember2023-04-012023-06-30

0000880242srt:OfficerMember2023-06-30

0000880242srt:OfficerMember2023-01-012023-03-31

0000880242srt:OfficerMember2023-03-31

0000880242srt:OfficerMember2022-01-012022-06-30

0000880242srt:OfficerMember2022-06-30

0000880242srt:OfficerMember2023-01-012023-06-30

0000880242blgo:ConsultantsMember2023-04-012023-06-30

0000880242blgo:ConsultantsMember2023-06-30

0000880242blgo:ConsultantsMember2023-03-312023-03-31

0000880242blgo:ConsultantsMember2023-03-31

0000880242blgo:ConsultantsMember2022-04-012022-06-30

0000880242blgo:ConsultantsMember2022-06-30

0000880242blgo:ConsultantsMember2022-03-312022-03-31

0000880242blgo:ConsultantsMember2022-03-31

0000880242us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-04-012023-06-30

0000880242us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-06-30

0000880242us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-04-012022-06-30

0000880242us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-06-30

0000880242us-gaap:EmployeeStockOptionMemberblgo:ClyraMedicalTechnologiesMember2023-04-012023-06-30

0000880242us-gaap:EmployeeStockOptionMemberblgo:ClyraMedicalTechnologiesMember2023-01-012023-06-30

0000880242us-gaap:EmployeeStockOptionMemberblgo:ClyraMedicalTechnologiesMember2022-04-012022-06-30

0000880242us-gaap:EmployeeStockOptionMemberblgo:ClyraMedicalTechnologiesMember2022-01-012022-06-30

0000880242blgo:EquityIncentivePlan2018Member2018-06-222018-06-22

0000880242blgo:EquityIncentivePlan2018Member2018-06-22

0000880242blgo:EquityIncentivePlan2018Member2023-06-30

0000880242blgo:EquityIncentivePlan2018Member2022-12-31

0000880242blgo:EquityIncentivePlan2018Membersrt:MinimumMember2022-12-31

0000880242blgo:EquityIncentivePlan2018Membersrt:MaximumMember2022-12-31

0000880242blgo:EquityIncentivePlan2018Membersrt:WeightedAverageMember2022-12-31

0000880242blgo:EquityIncentivePlan2018Membersrt:WeightedAverageMember2023-01-012023-06-30

0000880242blgo:EquityIncentivePlan2018Membersrt:MinimumMember2023-06-30

0000880242blgo:EquityIncentivePlan2018Membersrt:MaximumMember2023-06-30

0000880242blgo:EquityIncentivePlan2018Membersrt:WeightedAverageMember2023-06-30

0000880242blgo:EquityIncentivePlan2018Member2021-12-31

0000880242blgo:EquityIncentivePlan2018Membersrt:MinimumMember2021-12-31

0000880242blgo:EquityIncentivePlan2018Membersrt:MaximumMember2021-12-31

0000880242blgo:EquityIncentivePlan2018Membersrt:WeightedAverageMember2021-12-31

0000880242blgo:EquityIncentivePlan2018Membersrt:WeightedAverageMember2022-01-012022-06-30

0000880242blgo:EquityIncentivePlan2018Member2022-06-30

0000880242blgo:EquityIncentivePlan2018Membersrt:MinimumMember2022-06-30

0000880242blgo:EquityIncentivePlan2018Membersrt:MaximumMember2022-06-30

0000880242blgo:EquityIncentivePlan2018Membersrt:WeightedAverageMember2022-06-30

0000880242blgo:OfficerBoardOfDirectorsEmployeesAndAConsultantMember2023-01-012023-06-30

0000880242blgo:OfficerBoardOfDirectorsEmployeesAndAConsultantMember2023-01-012023-03-31

0000880242blgo:OfficerBoardOfDirectorsEmployeesAndAConsultantMember2023-04-012023-06-30

0000880242blgo:BoardOfDirectorsMember2023-01-012023-06-30

0000880242blgo:EmployeeRetentionProgramMember2023-01-012023-06-30

0000880242blgo:EquityIncentivePlan2018Memberblgo:EmployeesMember2023-01-012023-06-30

0000880242blgo:EquityIncentivePlan2018Memberblgo:ConsultantsMember2023-01-012023-06-30

0000880242blgo:EquityIncentivePlan2018Membersrt:ChiefFinancialOfficerMember2023-01-012023-06-30

0000880242blgo:EquityIncentivePlan2018Membersrt:ChiefFinancialOfficerMember2022-03-222022-03-22

0000880242blgo:OfficersBoardMembersAndVendorsMember2022-01-012022-06-30

0000880242blgo:ChiefFinancialOfficerAndPresidentMember2022-01-012022-06-30

0000880242srt:ChiefFinancialOfficerMember2022-01-012022-06-30

0000880242blgo:BoardOfDirectorsMember2022-01-012022-06-30

0000880242srt:MinimumMemberblgo:BoardOfDirectorsMember2022-01-012022-06-30

0000880242srt:MaximumMemberblgo:BoardOfDirectorsMember2022-01-012022-06-30

0000880242blgo:EmployeeRetentionProgramMember2022-01-012022-06-30

0000880242blgo:EmployeeRetentionProgramMembersrt:MinimumMember2022-01-012022-06-30

0000880242blgo:EmployeeRetentionProgramMembersrt:MaximumMember2022-01-012022-06-30

0000880242blgo:ConsultantsMember2022-01-012022-06-30

0000880242blgo:The2007EquityIncentivePlanMember2017-09-072017-09-07

0000880242blgo:The2007EquityIncentivePlanMember2022-12-31

0000880242blgo:The2007EquityIncentivePlanMembersrt:MinimumMember2022-12-31

0000880242blgo:The2007EquityIncentivePlanMembersrt:MaximumMember2022-12-31

0000880242blgo:The2007EquityIncentivePlanMember2023-01-012023-06-30

0000880242blgo:The2007EquityIncentivePlanMember2023-06-30

0000880242blgo:The2007EquityIncentivePlanMembersrt:MinimumMember2023-06-30

0000880242blgo:The2007EquityIncentivePlanMembersrt:MaximumMember2023-06-30

0000880242blgo:The2007EquityIncentivePlanMember2021-12-31

0000880242blgo:The2007EquityIncentivePlanMembersrt:MinimumMember2021-12-31

0000880242blgo:The2007EquityIncentivePlanMembersrt:MaximumMember2021-12-31

0000880242blgo:The2007EquityIncentivePlanMember2022-01-012022-06-30

0000880242blgo:The2007EquityIncentivePlanMember2022-06-30

0000880242blgo:The2007EquityIncentivePlanMembersrt:MinimumMember2022-06-30

0000880242blgo:The2007EquityIncentivePlanMembersrt:MaximumMember2022-06-30

0000880242blgo:NonPlanMember2022-12-31

0000880242blgo:NonPlanMembersrt:MinimumMember2022-12-31

0000880242blgo:NonPlanMembersrt:MaximumMember2022-12-31

0000880242blgo:NonPlanMembersrt:WeightedAverageMember2022-12-31

0000880242blgo:NonPlanMembersrt:WeightedAverageMember2023-01-012023-06-30

0000880242blgo:NonPlanMember2023-06-30

0000880242blgo:NonPlanMembersrt:MinimumMember2023-06-30

0000880242blgo:NonPlanMembersrt:MaximumMember2023-06-30

0000880242blgo:NonPlanMembersrt:WeightedAverageMember2023-06-30

0000880242blgo:NonPlanMember2021-12-31

0000880242blgo:NonPlanMembersrt:MinimumMember2021-12-31

0000880242blgo:NonPlanMembersrt:MaximumMember2021-12-31

0000880242blgo:NonPlanMembersrt:WeightedAverageMember2021-12-31

0000880242blgo:NonPlanMembersrt:WeightedAverageMember2022-01-012022-06-30

0000880242blgo:NonPlanMember2022-06-30

0000880242blgo:NonPlanMembersrt:MinimumMember2022-06-30

0000880242blgo:NonPlanMembersrt:MaximumMember2022-06-30

0000880242blgo:NonPlanMembersrt:WeightedAverageMember2022-06-30

0000880242blgo:NonPlanMemberblgo:VendorsMember2023-01-012023-06-30

0000880242blgo:NonPlanMembersrt:MinimumMemberblgo:VendorsMember2023-01-012023-06-30

0000880242blgo:NonPlanMembersrt:MaximumMemberblgo:VendorsMember2023-01-012023-06-30

0000880242blgo:NonPlanMemberblgo:VendorsMember2022-01-012022-06-30

0000880242srt:MinimumMember2022-12-31

0000880242srt:MaximumMember2022-12-31

0000880242srt:WeightedAverageMember2022-12-31

0000880242srt:MinimumMember2023-01-012023-06-30

0000880242srt:MaximumMember2023-01-012023-06-30

0000880242srt:WeightedAverageMember2023-01-012023-06-30

0000880242srt:WeightedAverageMember2023-06-30

0000880242srt:MinimumMember2021-12-31

0000880242srt:MaximumMember2021-12-31

0000880242srt:WeightedAverageMember2021-12-31

0000880242srt:MinimumMember2022-01-012022-06-30

0000880242srt:MaximumMember2022-01-012022-06-30

0000880242srt:WeightedAverageMember2022-01-012022-06-30

0000880242srt:MinimumMember2022-06-30

0000880242srt:MaximumMember2022-06-30

0000880242srt:WeightedAverageMember2022-06-30

0000880242blgo:SixMonthWarrantsInConnectionWithThe2020UnitOfferingMember2023-06-30

0000880242blgo:FiveyearWarrantsInConnectionWithThe2020UnitOfferingMember2023-06-30

0000880242blgo:SixMonthWarrantsInConnectionWithThe2020UnitOfferingMember2022-06-30

0000880242blgo:SixMonthWarrantsInConnectionWithThe2020UnitOfferingMembersrt:MinimumMember2022-06-30

0000880242blgo:SixMonthWarrantsInConnectionWithThe2020UnitOfferingMembersrt:MaximumMember2022-06-30

0000880242blgo:FiveyearWarrantsInConnectionWithThe2020UnitOfferingMember2022-06-30

0000880242blgo:FiveyearWarrantsInConnectionWithThe2020UnitOfferingMembersrt:MinimumMember2022-06-30

0000880242blgo:FiveyearWarrantsInConnectionWithThe2020UnitOfferingMembersrt:MaximumMember2022-06-30

0000880242blgo:NotePayableMaturingMarch82023Member2023-03-06

0000880242blgo:WarrantsIssuedInConnectionWithConversionOfInterestOnNotePayableMaturingMarch82023Member2023-03-06

0000880242us-gaap:MeasurementInputRiskFreeInterestRateMembersrt:MinimumMember2023-06-30

0000880242us-gaap:MeasurementInputRiskFreeInterestRateMembersrt:MaximumMember2023-06-30

0000880242us-gaap:MeasurementInputRiskFreeInterestRateMembersrt:MinimumMember2022-12-31

0000880242us-gaap:MeasurementInputRiskFreeInterestRateMember2022-12-31

0000880242us-gaap:MeasurementInputPriceVolatilityMembersrt:MinimumMember2023-06-30

0000880242us-gaap:MeasurementInputPriceVolatilityMembersrt:MaximumMember2023-06-30

0000880242us-gaap:MeasurementInputPriceVolatilityMember2022-12-31

0000880242us-gaap:MeasurementInputExpectedTermMembersrt:MinimumMember2023-06-30

0000880242us-gaap:MeasurementInputExpectedTermMembersrt:MaximumMember2023-06-30

0000880242us-gaap:MeasurementInputExpectedTermMembersrt:MinimumMember2022-12-31

0000880242us-gaap:CorporateNonSegmentMember2023-06-30

0000880242us-gaap:OperatingSegmentsMemberblgo:OdorNoMoreMember2023-06-30

0000880242us-gaap:OperatingSegmentsMemberblgo:BLESTMember2023-06-30

0000880242us-gaap:OperatingSegmentsMemberblgo:BiolargoWaterMember2023-06-30

0000880242us-gaap:OperatingSegmentsMemberblgo:BiolargoEnergyTechnologiesIncBETIMember2023-06-30

0000880242srt:ConsolidationEliminationsMember2023-06-30

0000880242us-gaap:CorporateNonSegmentMember2022-12-31

0000880242us-gaap:OperatingSegmentsMemberblgo:OdorNoMoreMember2022-12-31

0000880242us-gaap:OperatingSegmentsMemberblgo:BLESTMember2022-12-31

0000880242us-gaap:OperatingSegmentsMemberblgo:BiolargoWaterMember2022-12-31

0000880242srt:ConsolidationEliminationsMember2022-12-31

0000880242blgo:ClyraMedicalMemberus-gaap:NotesPayableOtherPayablesMember2022-04-08

0000880242us-gaap:RevolvingCreditFacilityMemberblgo:InventoryLineOfCreditMemberblgo:ClyraMedicalMemberblgo:VernalBayCapitalGroupLLCMember2020-06-30

0000880242us-gaap:RevolvingCreditFacilityMemberblgo:InventoryLineOfCreditMemberblgo:ClyraMedicalMemberblgo:VernalBayCapitalGroupLLCMember2020-06-302020-06-30

0000880242us-gaap:RevolvingCreditFacilityMemberblgo:InventoryLineOfCreditMemberblgo:ClyraMedicalMemberblgo:VernalBayCapitalGroupLLCMember2022-12-31

0000880242us-gaap:RevolvingCreditFacilityMemberblgo:InventoryLineOfCreditMemberblgo:ClyraMedicalMemberblgo:VernalBayCapitalGroupLLCMember2022-01-012022-12-31

0000880242blgo:ConversionOfClyraMedicalStockIntoBiolargoCommonStockMemberblgo:VernalBayCapitalGroupLLCMember2023-01-012023-03-31

0000880242us-gaap:RevolvingCreditFacilityMemberblgo:InventoryLineOfCreditMemberblgo:ClyraMedicalMemberblgo:VernalBayCapitalGroupLLCMember2023-06-30

0000880242blgo:ClyraMedicalMember2023-06-30

0000880242blgo:ClyraMedicalMemberus-gaap:SeriesAPreferredStockMember2023-06-30

0000880242blgo:ClyraMedicalMember2022-12-31

0000880242blgo:ClyraMedicalMemberus-gaap:SeriesAPreferredStockMember2022-12-31

0000880242us-gaap:CommonStockMemberblgo:ClyraMedicalMember2022-12-31

0000880242us-gaap:CommonStockMemberblgo:ClyraMedicalMember2023-06-30

0000880242blgo:PreferredStockSeriesAMemberblgo:ClyraMedicalMember2022-12-31

0000880242blgo:PreferredStockSeriesAMemberblgo:ClyraMedicalMember2023-06-30

0000880242blgo:SharesIssuedForDebtOwedToBiolargoMemberblgo:ClyraMedicalMember2022-03-022022-03-02

0000880242blgo:ClyraMedicalMemberus-gaap:SeriesAPreferredStockMember2023-04-012023-06-30

0000880242blgo:ClyraMedicalMemberus-gaap:SeriesAPreferredStockMember2023-01-012023-06-30

0000880242blgo:WarrantsIssuedInConjunctionWithTheSaleOfSeriesAPreferredStockMemberblgo:ClyraMedicalMember2022-12-20

0000880242blgo:ClyraMedicalMemberus-gaap:SeriesAPreferredStockMember2022-12-20

0000880242blgo:WarrantsIssuedInConjunctionWithTheSaleOfSeriesAPreferredStockMemberblgo:ClyraMedicalMember2023-06-30

0000880242blgo:ClyraMedicalMemberus-gaap:SeriesAPreferredStockMember2022-12-202022-12-20

0000880242blgo:ClyraMedicalMember2022-12-20

0000880242blgo:ClyraMedicalMembersrt:MinimumMember2022-12-31

0000880242blgo:ClyraMedicalMembersrt:MaximumMember2022-12-31

0000880242blgo:ClyraMedicalMember2023-01-012023-06-30

0000880242blgo:ClyraMedicalMembersrt:MinimumMember2023-01-012023-06-30

0000880242blgo:ClyraMedicalMembersrt:MaximumMember2023-01-012023-06-30

0000880242blgo:ClyraMedicalMembersrt:MinimumMember2023-06-30

0000880242blgo:ClyraMedicalMembersrt:MaximumMember2023-06-30

0000880242blgo:ClyraMedicalMember2021-12-31

0000880242blgo:ClyraMedicalMember2022-01-012022-06-30

0000880242blgo:ClyraMedicalMember2022-06-30

0000880242us-gaap:EmployeeStockOptionMemberblgo:ClyraMedicalMemberblgo:VendorsAndEmployeesMember2023-04-012023-06-30

0000880242us-gaap:EmployeeStockOptionMemberblgo:ClyraMedicalMemberblgo:VendorsAndEmployeesMember2023-01-012023-06-30

0000880242us-gaap:EmployeeStockOptionMemberblgo:ClyraMedicalMemberblgo:VendorsAndEmployeesMember2022-04-012022-06-30

0000880242us-gaap:EmployeeStockOptionMemberblgo:ClyraMedicalMemberblgo:VendorsAndEmployeesMember2022-01-012022-06-30

0000880242blgo:TheRemainingOptionsMemberblgo:ClyraMedicalMemberblgo:EmployeesAndConsultantsMember2023-01-012023-06-30

0000880242us-gaap:EmployeeStockOptionMemberblgo:ClyraMedicalMemberblgo:EmployeesAndConsultantsMember2023-01-012023-06-30

0000880242blgo:ClyraMedicalMemberblgo:NonPlanMembersrt:MinimumMemberblgo:VendorsAndEmployeesMember2023-01-012023-06-30

0000880242blgo:ClyraMedicalMembersrt:MaximumMemberblgo:VendorsAndEmployeesMember2023-01-012023-06-30

0000880242blgo:ClyraMedicalMemberblgo:VendorsAndEmployeesMember2022-01-012022-12-31

0000880242blgo:ClyraMedicalMemberblgo:VendorsAndEmployeesMember2023-01-012023-06-30

0000880242blgo:BiolargoEngineeringScienceTechnologiesLLCMember2017-09-30

0000880242blgo:SevenEmployeesWorkingAtBiolargoEngineeringScienceTechnologiesLLCMember2017-09-012017-09-30

0000880242blgo:SevenEmployeesWorkingAtBiolargoEngineeringScienceTechnologiesLLCMember2017-09-30

0000880242blgo:NonqualifiedStockOptionMemberblgo:SevenEmployeesWorkingAtBiolargoEngineeringScienceTechnologiesLLCMember2017-09-012017-09-30

0000880242blgo:NonqualifiedStockOptionMemberblgo:SevenEmployeesWorkingAtBiolargoEngineeringScienceTechnologiesLLCMember2017-09-012019-09-30

0000880242blgo:SevenEmployeesWorkingAtBiolargoEngineeringScienceTechnologiesLLCMember2021-12-31

0000880242blgo:SevenEmployeesWorkingAtBiolargoEngineeringScienceTechnologiesLLCMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2021-01-012021-12-31

0000880242blgo:SevenEmployeesWorkingAtBiolargoEngineeringScienceTechnologiesLLCMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2021-01-012021-12-31

0000880242blgo:SevenEmployeesWorkingAtBiolargoEngineeringScienceTechnologiesLLCMember2021-01-012021-12-31

0000880242blgo:SevenEmployeesWorkingAtBiolargoEngineeringScienceTechnologiesLLCMember2022-12-31

0000880242blgo:SevenEmployeesWorkingAtBiolargoEngineeringScienceTechnologiesLLCMember2022-01-012022-12-31

0000880242blgo:BiolargoEngineeringScienceTechnologiesLLCMember2023-06-30

0000880242blgo:BiolargoEnergyTechnologiesIncBETIMember2017-09-30

0000880242blgo:BiolargoEnergyTechnologiesIncBETIMember2023-04-012023-06-30

0000880242blgo:BiolargoEnergyTechnologiesIncBETIMember2023-01-012023-06-30

0000880242blgo:BiolargoEnergyTechnologiesIncBETIMemberblgo:BiolargoMember2023-01-012023-06-30

0000880242blgo:BiolargoEnergyTechnologiesIncBETIMember2023-06-30

0000880242blgo:BiolargoEnergyTechnologiesIncBETIMember2023-06-30

0000880242us-gaap:CorporateNonSegmentMember2023-04-012023-06-30

0000880242us-gaap:CorporateNonSegmentMember2022-04-012022-06-30

0000880242us-gaap:CorporateNonSegmentMember2023-01-012023-06-30

0000880242us-gaap:CorporateNonSegmentMember2022-01-012022-06-30

0000880242us-gaap:OperatingSegmentsMemberblgo:OdorNoMoreMember2023-04-012023-06-30

0000880242us-gaap:OperatingSegmentsMemberblgo:OdorNoMoreMember2022-04-012022-06-30

0000880242us-gaap:OperatingSegmentsMemberblgo:OdorNoMoreMember2023-01-012023-06-30

0000880242us-gaap:OperatingSegmentsMemberblgo:OdorNoMoreMember2022-01-012022-06-30

0000880242us-gaap:OperatingSegmentsMemberblgo:BiolargoEngineeringScienceTechnologiesLLCMember2023-04-012023-06-30

0000880242us-gaap:OperatingSegmentsMemberblgo:BiolargoEngineeringScienceTechnologiesLLCMember2022-04-012022-06-30

0000880242us-gaap:OperatingSegmentsMemberblgo:BiolargoEngineeringScienceTechnologiesLLCMember2023-01-012023-06-30

0000880242us-gaap:OperatingSegmentsMemberblgo:BiolargoEngineeringScienceTechnologiesLLCMember2022-01-012022-06-30

0000880242us-gaap:OperatingSegmentsMemberblgo:BiolargoEnergyTechnologiesIncBETIMember2023-04-012023-06-30

0000880242us-gaap:OperatingSegmentsMemberblgo:BiolargoEnergyTechnologiesIncBETIMember2022-04-012022-06-30

0000880242us-gaap:OperatingSegmentsMemberblgo:BiolargoEnergyTechnologiesIncBETIMember2023-01-012023-06-30

0000880242us-gaap:OperatingSegmentsMemberblgo:BiolargoEnergyTechnologiesIncBETIMember2022-01-012022-06-30

0000880242us-gaap:OperatingSegmentsMemberblgo:BiolargoWaterMember2023-04-012023-06-30

0000880242us-gaap:OperatingSegmentsMemberblgo:BiolargoWaterMember2022-04-012022-06-30

0000880242us-gaap:OperatingSegmentsMemberblgo:BiolargoWaterMember2023-01-012023-06-30

0000880242us-gaap:OperatingSegmentsMemberblgo:BiolargoWaterMember2022-01-012022-06-30

0000880242us-gaap:OperatingSegmentsMemberblgo:ClyraSegmentMember2023-04-012023-06-30

0000880242us-gaap:OperatingSegmentsMemberblgo:ClyraSegmentMember2022-04-012022-06-30

0000880242us-gaap:OperatingSegmentsMemberblgo:ClyraSegmentMember2023-01-012023-06-30

0000880242us-gaap:OperatingSegmentsMemberblgo:ClyraSegmentMember2022-01-012022-06-30

0000880242srt:ConsolidationEliminationsMember2023-04-012023-06-30

0000880242srt:ConsolidationEliminationsMember2022-04-012022-06-30

0000880242srt:ConsolidationEliminationsMember2023-01-012023-06-30

0000880242srt:ConsolidationEliminationsMember2022-01-012022-06-30

0000880242us-gaap:IntersegmentEliminationMember2023-04-012023-06-30

0000880242us-gaap:IntersegmentEliminationMember2022-04-012022-06-30

0000880242us-gaap:IntersegmentEliminationMember2023-01-012023-06-30

0000880242us-gaap:IntersegmentEliminationMember2022-01-012022-06-30

0000880242us-gaap:OperatingSegmentsMemberblgo:ClyraMedicalMember2023-06-30

0000880242us-gaap:CorporateNonSegmentMemberblgo:InvestmentInSouthKoreanJointVentureMember2023-06-30

0000880242us-gaap:OperatingSegmentsMemberblgo:InvestmentInSouthKoreanJointVentureMemberblgo:OdorNoMoreMember2023-06-30

0000880242us-gaap:OperatingSegmentsMemberblgo:InvestmentInSouthKoreanJointVentureMemberblgo:ClyraMedicalMember2023-06-30

0000880242us-gaap:OperatingSegmentsMemberblgo:InvestmentInSouthKoreanJointVentureMemberblgo:BLESTMember2023-06-30

0000880242us-gaap:OperatingSegmentsMemberblgo:InvestmentInSouthKoreanJointVentureMemberblgo:BiolargoWaterMember2023-06-30

0000880242us-gaap:OperatingSegmentsMemberblgo:InvestmentInSouthKoreanJointVentureMemberblgo:BiolargoEnergyTechnologiesIncBETIMember2023-06-30

0000880242srt:ConsolidationEliminationsMemberblgo:InvestmentInSouthKoreanJointVentureMember2023-06-30

0000880242blgo:InvestmentInSouthKoreanJointVentureMember2023-06-30

0000880242us-gaap:OperatingSegmentsMemberblgo:ClyraMedicalMember2022-12-31

0000880242us-gaap:CorporateNonSegmentMemberblgo:InvestmentInSouthKoreanJointVentureMember2022-12-31

0000880242us-gaap:OperatingSegmentsMemberblgo:InvestmentInSouthKoreanJointVentureMemberblgo:OdorNoMoreMember2022-12-31

0000880242us-gaap:OperatingSegmentsMemberblgo:InvestmentInSouthKoreanJointVentureMemberblgo:ClyraMedicalMember2022-12-31

0000880242us-gaap:OperatingSegmentsMemberblgo:InvestmentInSouthKoreanJointVentureMemberblgo:BLESTMember2022-12-31

0000880242us-gaap:OperatingSegmentsMemberblgo:InvestmentInSouthKoreanJointVentureMemberblgo:BiolargoWaterMember2022-12-31

0000880242srt:ConsolidationEliminationsMemberblgo:InvestmentInSouthKoreanJointVentureMember2022-12-31

0000880242blgo:InvestmentInSouthKoreanJointVentureMember2022-12-31

0000880242blgo:WestminsterCaliforniaFacilityLeaseMember2023-06-30

0000880242blgo:OakRidgeTennesseeFacilityLeaseMember2022-09-30

0000880242blgo:LincolnParkCapitalFundLLCMemberus-gaap:SubsequentEventMember2023-07-012023-08-10

0000880242blgo:ClyraMedicalMemberus-gaap:SeriesAPreferredStockMemberus-gaap:SubsequentEventMember2023-07-012023-08-10

0000880242us-gaap:WarrantMemberblgo:ClyraMedicalMemberus-gaap:SubsequentEventMember2023-08-10

0000880242blgo:BiolargoEnergyTechnologiesIncBETIMemberus-gaap:SubsequentEventMember2023-07-012023-08-10

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2023.

or

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 000-19709

BIOLARGO, INC.

(Exact name of registrant as specified in its charter)

| Delaware | | 65-0159115 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

14921 Chestnut St.

Westminster, CA 92683

(Address of principal executive offices)

(888) 400-2863

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

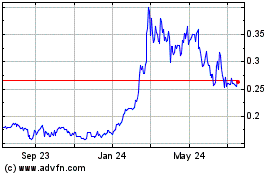

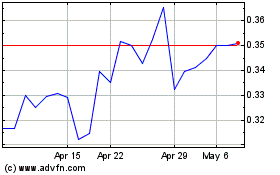

| Common stock | BLGO | OTC Markets (OTCQB) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| | |

| Non-accelerated filer ☒ | Smaller reporting company ☒ |

| | |

| | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares of the Registrant’s Common Stock outstanding as of August 11, 2023 was 288,073,533 shares.

BIOLARGO, INC.

FORM 10-Q

INDEX

PART I

PART II

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements

BIOLARGO, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

AS OF JUNE 30, 2023 AND DECEMBER 31, 2022

(in thousands, except for share and per share data)

| | | JUNE 30, | | | DECEMBER 31, | |

| | | 2023 (unaudited) | | | 2022 | |

| | | | | | | | | |

| Assets | |

| Current assets: | | | | | | | | |

| Cash and cash equivalents | | $ | 3,575 | | | $ | 1,851 | |

| Accounts receivable, net of allowance | | | 1,037 | | | | 1,064 | |

| Inventories, net of allowance | | | 127 | | | | 120 | |

| Prepaid expenses and other current assets | | | 108 | | | | 118 | |

| Total current assets | | | 4,847 | | | | 3,153 | |

| | | | | | | | | |

| Property and equipment, net of depreciation | | | 542 | | | | 287 | |

| Other non-current assets | | | 69 | | | | 124 | |

| Investment in South Korean joint venture | | | 21 | | | | 33 | |

| Right of use, operating lease, net of amortization | | | 807 | | | | 867 | |

| Clyra Medical prepaid marketing | | | 394 | | | | 394 | |

| Total assets | | $ | 6,680 | | | $ | 4,858 | |

| | | | | | | | | |

| Liabilities and stockholders’ equity | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Accounts payable and accrued expenses | | $ | 720 | | | $ | 940 | |

| Clyra Medical accounts payable and accrued expenses | | | 288 | | | | 238 | |

| Debt obligations | | | 66 | | | | 100 | |

| Deferred revenue | | | 10 | | | | 17 | |

| Lease liability | | | 97 | | | | 97 | |

| Customer deposits | | | 113 | | | | 184 | |

| Total current liabilities | | | 1,294 | | | | 1,576 | |

| | | | | | | | | |

| Long-term liabilities: | | | | | | | | |

| Debt obligations, net of current | | | 299 | | | | 237 | |

| Lease liability, net of current | | | 721 | | | | 773 | |

| Clyra Medical debt obligations | | | 243 | | | | 261 | |

| Total long-term liabilities | | | 1,263 | | | | 1,271 | |

| Total liabilities | | | 2,557 | | | | 2,847 | |

| | | | | | | | | |

| COMMITMENTS AND CONTINGENCIES (Note 12) | | | | | | | | |

| | | | | | | | | |

| STOCKHOLDERS’ EQUITY: | | | | | | | | |

| Preferred Series A, $0.00067 Par Value, 50,000,000 Shares Authorized, -0- Shares Issued and Outstanding, at June 30, 2023 and December 31, 2022 | | | — | | | | — | |

| Common stock, $0.00067 Par Value, 550,000,000 Shares Authorized, 287,220,661 and 278,462,706 Shares Issued, at June 30, 2023 and December 31, 2022, respectively | | | 192 | | | | 186 | |

| Additional paid-in capital | | | 152,507 | | | | 148,435 | |

| Accumulated deficit | | | (145,169 | ) | | | (143,594 | ) |

| Accumulated other comprehensive loss | | | (162 | ) | | | (149 | ) |

| Total BioLargo Inc. and subsidiaries stockholders’ equity | | | 7,368 | | | | 4,878 | |

| Non-controlling interest | | | (3,245 | ) | | | (2,867 | ) |

| Total stockholders’ equity | | | 4,123 | | | | 2,011 | |

| Total liabilities and stockholders’ equity | | $ | 6,680 | | | $ | 4,858 | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

BIOLARGO, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2023 AND 2022

(in thousands, except for share and per share data)

(unaudited)

| | | THREE MONTHS | | | SIX MONTHS | |

| | | JUNE 30, 2023 | | | JUNE 30, 2022 | | | JUNE 30, 2023 | | | JUNE 30, 2022 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Revenues | | | | | | | | | | | | | | | | |

| Product revenue | | $ | 1,315 | | | $ | 707 | | | $ | 4,864 | | | $ | 1,317 | |

| Service revenue | | | 131 | | | | 616 | | | | 324 | | | | 970 | |

| Total revenue | | | 1,446 | | | | 1,323 | | | | 5,188 | | | | 2,287 | |

| | | | | | | | | | | | | | | | | |

| Cost of revenue | | | | | | | | | | | | | | | | |

| Cost of goods sold | | | (567 | ) | | | (364 | ) | | | (2,364 | ) | | | (659 | ) |

| Cost of service | | | (60 | ) | | | (336 | ) | | | (194 | ) | | | (487 | ) |

| Gross profit | | | 819 | | | | 623 | | | | 2,630 | | | | 1,141 | |

| | | | | | | | | | | | | | | | | |

| Selling, general and administrative expenses | | | 1,791 | | | | 1,589 | | | | 3,515 | | | | 3,425 | |

| Research and development | | | 587 | | | | 355 | | | | 1,152 | | | | 747 | |

| Operating loss: | | | (1,559 | ) | | | (1,321 | ) | | | (2,037 | ) | | | (3,031 | ) |

| Other (expense) income: | | | | | | | | | | | | | | | | |

| Interest expense | | | (12 | ) | | | (15 | ) | | | (60 | ) | | | (28 | ) |

| PPP loan forgiveness | | | — | | | | — | | | | — | | | | 174 | |

| Tax credit reversal | | | (55 | ) | | | — | | | | (55 | ) | | | — | |

| Grant income | | | — | | | | 3 | | | | 32 | | | | 8 | |

| Total other expense: | | | (67 | ) | | | (12 | ) | | | (83 | ) | | | 154 | |

| Net loss | | | (1,626 | ) | | | (1,333 | ) | | | (2,120 | ) | | | (2,877 | ) |

| | | | | | | | | | | | | | | | | |

| Net loss attributable to noncontrolling interest | | | (298 | ) | | | (105 | ) | | | (545 | ) | | | 3 | |

| Net loss attributable to common shareholders | | $ | (1,328 | ) | | $ | (1,228 | ) | | $ | (1,575 | ) | | $ | (2,880 | ) |

| | | | | | | | | | | | | | | | | |

| Net loss per share attributable to common shareholders: | | | | | | | | | | | | | | | | |

| Loss per share attributable to shareholders – basic and diluted | | $ | (0.01 | ) | | $ | (0.01 | ) | | $ | (0.01 | ) | | $ | (0.01 | ) |

| Weighted average number of common shares outstanding: | | | 284,944,366 | | | | 265,856,970 | | | | 282,839,515 | | | | 263,345,148 | |

| | | | | | | | | | | | | | | | | |

| Comprehensive loss: | | | | | | | | | | | | | | | | |

| Net loss | | $ | (1,626 | ) | | $ | (1,333 | ) | | $ | (2,120 | ) | | $ | (2,877 | ) |

| Foreign currency translation | | | (7 | ) | | | (3 | ) | | | (13 | ) | | | (11 | ) |

| Comprehensive loss | | | (1,633 | ) | | | (1,336 | ) | | | (2,133 | ) | | | (2,888 | ) |

| Comprehensive loss attributable to noncontrolling interest | | | (298 | ) | | | (105 | ) | | | (545 | ) | | | 3 | |

| Comprehensive loss attributable to common stockholders | | $ | (1,335 | ) | | $ | (1,231 | ) | | $ | (1,588 | ) | | $ | (2,891 | ) |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

BIOLARGO, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY (DEFICIT)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2023 AND 2022

(in thousands, except for share and per share data)

(unaudited)

| |

|

Common stock |

|

|

Additional paid-in |

|

|

Accumulated |

|

|

Accumulated other comprehensive |

|

|

Non- controlling |

|

|

Total stockholders’ |

|

| |

|

Shares |

|

|

Amount |

|

|

capital |

|

|

deficit |

|

|

Loss |

|

|

interest |

|

|

equity (deficit) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, December 31, 2022 |

|

|

278,462,706 |

|

|

$ |

186 |

|

|

$ |

148,435 |

|

|

$ |

(143,594 |

) |

|

$ |

(149 |

) |

|

$ |

(2,867 |

) |

|

$ |

2,011 |

|

| Sale of stock for cash |

|

|

4,201,402 |

|

|

|

3 |

|

|

|

797 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

800 |

|

| Issuance of common stock for services |

|

|

930,490 |

|

|

|

1 |

|

|

|

206 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

207 |

|

| Issuance of common stock in exchange for Clyra shares |

|

|

527,983 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Stock option compensation expense |

|

|

— |

|

|

|

— |

|

|

|

195 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

195 |

|

| Clyra Medical Technologies, Inc. (Clyra) stock options issued for services |

|

|

— |

|

|

|

— |

|

|

|

61 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

61 |

|

| Warrant issued for interest |

|

|

— |

|

|

|

— |

|

|

|

30 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

30 |

|

| Clyra – sales of Series A Preferred Stock |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

225 |

|

|

|

225 |

|

| Clyra – Series A Preferred Stock – dividend |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(27 |

) |

|

|

(27 |

) |

| Biolargo Energy Technology Inc. (BETI) offering |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

550 |

|

|

|

550 |

|

| Noncontrolling interest allocation |

|

|

— |

|

|

|

— |

|

|

|

467 |

|

|

|

— |

|

|

|

— |

|

|

|

(467 |

) |

|

|

— |

|

| Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(247 |

) |

|

|

— |

|

|

|

(247 |

) |

|

|

(494 |

) |

| Foreign currency translation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(6 |

) |

|

|

— |

|

|

|

(6 |

) |

| Balance, March 31, 2023 |

|

|

284,122,581 |

|

|

$ |

190 |

|

|

$ |

150,191 |

|

|

$ |

(143,841 |

) |

|

$ |

(155 |

) |

|

$ |

(2,833 |

) |

|

$ |

3,552 |

|

| Sale of stock for cash |

|

|

2,677,169 |

|

|

|

2 |

|

|

|

492 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

494 |

|

| Issuance of common stock for services |

|

|

420,911 |

|

|

|

— |

|

|

|

75 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

75 |

|

| Stock option compensation expense |

|

|

— |

|

|

|

— |

|

|

|

222 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

222 |

|

| Clyra Medical Technologies, Inc. (Clyra) stock options issued for services |

|

|

— |

|

|

|

— |

|

|

|

66 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

66 |

|

| Clyra – sales of Series A Preferred Stock |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,062 |

|

|

|

1,062 |

|

| Clyra – Series A Preferred Stock – dividend |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(45 |

) |

|

|

(45 |

) |

| Biolargo Energy Technology Inc. (BETI) offering |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

330 |

|

|

|

330 |

|

| Noncontrolling interest allocation |

|

|

— |

|

|

|

— |

|

|

|

1,461 |

|

|

|

— |

|

|

|

— |

|

|

|

(1,461 |

) |

|

|

— |

|

| Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,328 |

) |

|

|

— |

|

|

|

(298 |

) |

|

|

(1,626 |

) |

| Foreign currency translation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(7 |

) |

|

|

— |

|

|

|

(7 |

) |

| Balance, June 30, 2023 |

|

|

287,220,661 |

|

|

$ |

192 |

|

|

$ |

152,507 |

|

|

$ |

(145,169 |

) |

|

$ |

(162 |

) |

|

$ |

(3,245 |

) |

|

$ |

4,123 |

|

| |

|

Common stock |

|

|

Additional paid-in |

|

|

Accumulated |

|

|

Accumulated other comprehensive |

|

|

Non- controlling |

|

|

Total stockholders’ |

|

| |

|

Shares |

|

|

Amount |

|

|

capital |

|

|

deficit |

|

|

Loss |

|

|

interest |

|

|

equity (deficit) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, December 31, 2021 |

|

|

255,893,726 |

|

|

$ |

171 |

|

|

$ |

143,718 |

|

|

$ |

(139,121 |

) |

|

$ |

(115 |

) |

|

$ |

(3,720 |

) |

|

$ |

933 |

|

| Sale of stock for cash |

|

|

6,703,789 |

|

|

|

4 |

|

|

|

1,198 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,202 |

|

| Issuance of common stock for services |

|

|

86,752 |

|

|

|

— |

|

|

|

17 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

17 |

|

| Stock option compensation expense |

|

|

— |

|

|

|

— |

|

|

|

660 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

660 |

|

| Clyra Medical Technologies, Inc. (Clyra) stock options issued for services |

|

|

— |

|

|

|

— |

|

|

|

141 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

141 |

|

| Noncontrolling interest allocation |

|

|

— |

|

|

|

— |

|

|

|

(528 |

) |

|

|

— |

|

|

|

— |

|

|

|

528 |

|

|

|

— |

|

| Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,652 |

) |

|

|

— |

|

|

|

108 |

|

|

|

(1,544 |

) |

| Foreign currency translation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(8 |

) |

|

|

— |

|

|

|

(8 |

) |

| Balance, March 31, 2022 |

|

|

262,684,267 |

|

|

$ |

175 |

|

|

$ |

145,206 |

|

|

$ |

(140,773 |

) |

|

$ |

(123 |

) |

|

$ |

(3,084 |

) |

|

$ |

1,401 |

|

| Sale of stock for cash |

|

|

5,011,570 |

|

|

|

4 |

|

|

|

944 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

948 |

|

| Issuance of common stock for services |

|

|

340,891 |

|

|

|

— |

|

|

|

59 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

59 |

|

| Stock option compensation expense |

|

|

— |

|

|

|

— |

|

|

|

234 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

234 |

|

| Clyra Medical Technologies, Inc. (Clyra) stock options issued for services |

|

|

— |

|

|

|

— |

|

|

|

82 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

82 |

|

| Noncontrolling interest allocation |

|

|

— |

|

|

|

— |

|

|

|

(103 |

) |

|

|

— |

|

|

|

— |

|

|

|

103 |

|

|

|

— |

|

| Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,228 |

) |

|

|

— |

|

|

|

(105 |

) |

|

|

(1,333 |

) |

| Foreign currency translation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3 |

) |

|

|

— |

|

|

|

(3 |

) |

| Balance, June 30, 2022 |

|

|

268,036,728 |

|

|

$ |

179 |

|

|

$ |

146,422 |

|

|

$ |

(142,001 |

) |

|

$ |

(126 |

) |

|

$ |

(3,086 |

) |

|

$ |

1,388 |

|

The accompanying notes are an integral part of these unaudited consolidated financial statements.

BIOLARGO, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE SIX MONTHS ENDED JUNE 30, 2023 AND 2022

(in thousands, except for share and per share data)

(unaudited)

| | | JUNE 30, 2023 | | | JUNE 30, 2022 | |

| Cash flows from operating activities | | | | | | | | |

| Net loss | | $ | (2,120 | ) | | $ | (2,877 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | | |

| Stock option compensation expense | | | 544 | | | | 1,117 | |

| Common stock issued for services | | | 282 | | | | 76 | |

| Bad debt expense | | | 46 | | | | — | |

| Excess and obsolete inventory | | | 54 | | | | — | |

| Amortization of right-of-use operating lease assets | | | 60 | | | | — | |

| Interest expense related to amortization of the discount on note payable | | | 3 | | | | 8 | |

| Fair value of warrant issued for interest | | | 30 | | | | — | |

| PPP loan forgiveness | | | — | | | | (174 | ) |

| Loss on investment in South Korean joint venture | | | 12 | | | | 15 | |

| Depreciation expense | | | 48 | | | | 6 | |

| Changes in assets and liabilities: | | | | | | | | |

| Accounts receivable | | | (19 | ) | | | (66 | ) |

| Inventories | | | (63 | ) | | | (15 | ) |

| Prepaid expenses and other assets | | | 66 | | | | 4 | |

| Accounts payable and accrued expenses | | | (391 | ) | | | 105 | |

| Clyra accounts payable and accrued expenses | | | 51 | | | | (32 | ) |

| Deferred revenue | | | (7 | ) | | | (89 | ) |

| Lease liability, net | | | (52 | ) | | | — | |

| Customer deposits | | | (71 | ) | | | 58 | |

| Net cash used in operating activities | | | (1,527 | ) | | | (1,864 | ) |

| Cash flows from investing activities | | | | | | | | |

| Equipment purchases | | | (127 | ) | | | (101 | ) |

| Net cash used in investing activities | | | (127 | ) | | | (101 | ) |

| Cash flows from financing activities | | | | | | | | |

| Proceeds from sale of common stock | | | 1,294 | | | | 2,150 | |

| Proceeds from sale of BETI common stock | | | 880 | | | | — | |

| Repayment of note payable and vehicle loan | | | (52 | ) | | | — | |

| Repayment by Clyra on inventory line of credit | | | (18 | ) | | | (10 | ) |

| Proceeds from sale of Clyra Medical preferred stock | | | 1,287 | | | | — | |

| Proceeds from Clyra Medical convertible note | | | — | | | | 100 | |

| Net cash provided by financing activities | | | 3,391 | | | | 2,240 | |

| Net effect of foreign currency translation | | | (13 | ) | | | (11 | ) |

| Net change in cash | | | 1,724 | | | | 264 | |

| Cash at beginning of year | | | 1,851 | | | | 962 | |

| Cash at end of period | | $ | 3,575 | | | $ | 1,226 | |

| Supplemental disclosures of cash flow information | | | | | | | | |

| Cash paid during the year for: | | | | | | | | |

| Interest | | $ | 27 | | | $ | 7 | |

| Income taxes | | $ | 5 | | | $ | — | |

| Short-term lease payments not included in lease liability | | $ | 24 | | | $ | 78 | |

| Non-cash investing and financing activities | | | | | | | | |

| Equipment added via vehicle loan | | $ | 80 | | | $ | — | |

| Leasehold improvements included in accounts payable | | $ | 102 | | | $ | — | |

| Allocation of noncontrolling interest | | $ | 1,927 | | | $ | 631 | |

| Conversion of Clyra common stock to BioLargo common stock | | $ | 100 | | | $ | — | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

BIOLARGO, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 1. Business and Organization

Description of Business

BioLargo, Inc. (“BioLargo”, or the “Company”) invents, develops, and commercializes innovative platform technologies to solve challenging environmental problems like PFAS contamination (per- and polyfluoroalkyl substances), advanced water and wastewater treatment, industrial odor control, air quality control, infection control, and myriad environmental remediation challenges. Our business strategy is straightforward: we invent or acquire technologies that we believe have the potential to be disruptive in large commercial markets; we develop and validate these technologies to advance and promote their commercial success as we leverage our considerable scientific, engineering, and entrepreneurial talent; we then monetize these technical assets through a variety of business structures that may include licensure, joint venture, sale, spin off, or by deploying direct to market strategies.

Organization

We are a Delaware corporation formed in 1991. We have six wholly-owned subsidiaries: BioLargo Life Technologies, Inc., organized under the laws of the State of California in 2006; ONM Environmental, Inc., organized under the laws of the State of California in 2009; BioLargo Equipment and Technologies, Inc., organized under the laws of the State of California in 2022; BioLargo Water, Inc. (“Water”), organized under the laws of Canada in 2014; BioLargo Equipment and Solutions Technologies, Inc., organized under the laws of the State of California in 2022; and BioLargo Development Corp., organized under the laws of the State of California in 2016. Additionally, we own 82% (see Note 9) of BioLargo Engineering Science and Technologies, LLC (“BLEST”), organized under the laws of the State of Tennessee in 2017, 56% of Clyra Medical Technologies, Inc. (“Clyra” or “Clyra Medical”), organized under the laws of the State of California in 2012, and 96% of BioLargo Energy Technologies, Inc. (“BETI”) organized under the laws of the State of California in 2022. We consolidate the financial statements of our partially owned subsidiaries (see Note 2, subheading “Principles of Consolidation,” and Note 8).

Liquidity / Going Concern

The accompanying consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the settlement of liabilities and commitments in the normal course of our business. For the six months ended June 30, 2023, we generated revenues of $5,188,000 through our business segments (see Note 11), had a net loss of $2,120,000, used $1,527,000 cash in operations, and at June 30, 2023, we had working capital of $3,553,000, and current assets of $4,847,000.

During the six months ended June 30, 2023, we (i) sold $299,000 of our common stock to Lincoln Park Capital Fund, LLC (“Lincoln Park”) (see Note 3), (ii) sold $995,000 of our common stock and warrants to accredited investors (see Notes 3 and 6), (iii) sold $1,287,000 of Clyra Medical Series A Preferred Stock (see Note 8), and (iv) sold $880,000 of BETI common stock (see Note 10). Subsequent to June 30, 2023, we continued these financing activities (see Note 13). As of June 30, 2023, our cash and cash equivalents totaled $3,575,000. Our total liabilities included a $75,000 vehicle loan, $140,000 due in U.S. Small Business Administration (SBA) loans issued pursuant to the Paycheck Protection Program (see Note 4), $150,000 due to the SBA issued pursuant to the Economic Injury Disaster program (see Note 4), and $243,000 owed by Clyra Medical due in 2024 (see Note 8). We have been, and anticipate that we will continue to be, limited in terms of our capital resources, and expect to continue to need further investment capital to fund operations. Such activities have continued subsequent to June 30, 2023.

If we are unable to rely on our current arrangement with Lincoln Park to fund our working capital requirements, we will have to rely on other forms of financing, and there is no assurance that we will be able to do so, or if we do so, it will be on favorable terms.

BIOLARGO, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

The foregoing factors raise substantial doubt about our ability to continue as a going concern, unless we are able to continue to raise funds through stock sales to Lincoln Park or other private financings, and in the long term, our ability to attain a reasonable threshold of operating efficiencies and achieve profitable operations by licensing or otherwise commercializing products incorporating our technologies. The consolidated financial statements do not include any adjustments that might be necessary if we are unable to continue as a going concern.

Note 2. Summary of Significant Accounting Policies

Principles of Consolidation

The consolidated financial statements include the accounts of the Company, its wholly owned subsidiaries, and partially owned subsidiaries BETI, BLEST and Clyra Medical. All intercompany accounts and transactions have been eliminated.

Foreign Currency

The Company has designated the functional currency of BioLargo Water, Inc., our Canadian subsidiary, to be the Canadian dollar. Therefore, translation gains and losses resulting from differences in exchange rates are recorded in accumulated other comprehensive income.

Cash and Cash Equivalents

The Company considers all highly liquid investments with maturities of three months or less when acquired to be cash equivalents. Substantially all cash equivalents are held in short-term money market accounts at one of the largest financial institutions in the United States, Bank of America. From time to time, our cash account balances are greater than the Federal Deposit Insurance Corporation insurance limit of $250,000 per owner per bank, and during such times, we are exposed to credit loss for amounts in excess of insured limits in the event of non-performance by the financial institution. We do not anticipate non-performance by our financial institution.

As of June 30, 2023, and December 31, 2022, our cash balances were made up of the following (in thousands):

| | | June 30, 2023 | | | December 31, 2022 | |

| BioLargo, Inc. and subsidiaries | | $ | 2,762 | | | $ | 1,681 | |

| Clyra Medical Technologies, Inc. | | | 813 | | | | 170 | |

| Total | | $ | 3,575 | | | $ | 1,851 | |

Accounts Receivable

In June 2016, the FASB issued ASU 2016-13, which sets out the principles for the recognition of measurement of credit losses on financial instruments, including trade receivables. The standard eliminates the probable initial recognition threshold and requires an entity to reflect its current estimate of all expected credit losses. The allowance for credit losses is a valuation account that is deducted from the amortized cost basis of the financial assets to present the net amount expected to be collected. The new standard was effective for the Company beginning January 1, 2023 and primarily impacted trade accounts receivable.

Accounts receivable are customer obligations that are unconditional. Accounts receivable are presented net of an allowance for doubtful accounts for expected credit losses, which represents an estimate of amounts that may not be collectible. The Company performs ongoing credit evaluations of its customers and, if necessary, provides an allowance for doubtful accounts and expected credit losses. A provision to the allowances for doubtful accounts for expected credit losses is recorded based on factors including the length of time the receivables are past due, the current business environment, and the Company’s historical experience. Provisions to the allowances for doubtful accounts for expected credit losses are recorded to general and administrative expenses. The Company writes off accounts receivable against the allowance when it determines a balance is uncollectible and no longer actively pursues collection of the receivable. The Company does not have any off-balance-sheet credit exposure related to customers. As of June 30, 2023, and December 31, 2022, the allowance for doubtful accounts for expected credit losses was $58,000 and $12,000.

BIOLARGO, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Credit Concentration

We have a limited number of customers that account for significant portions of our revenue. During the three and six months ended June 30, 2023, and 2022, the following customers accounted for more than 10% of consolidated revenues:

| | | Three Months | | | Six Months | |

| | | June 30, 2023 | | | June 30, 2022 | | | June 30, 2023 | | | June 30, 2022 | |

| | | | | | | | | | | | | | | | | |

| Customer A | | | 55 | % | | | 39 | % | | | 77 | % | | | 35 | % |

| Customer B | | <10 | % | | | 27 | % | | <10 | % | | | 17 | % |

| Customer C | | <10 | % | | <10 | % | | <10 | % | | | 10 | % |

At June 30, 2023, one customer accounted for more than 10% of consolidated accounts receivable, and at December 31, 2022, three customers accounted for more than 10% of consolidated accounts receivable:

| | | June 30, 2023 | | | December 31, 2022 | |

| Customer A | | | 49 | % | | | 11 | % |

| Customer B | | <10 | % | | | 31 | % |

| Customer D | | <10 | % | | | 15 | % |

Inventory

Inventories are stated at the lower of cost or net realizable value using the average cost method. The allowance for obsolete inventory as of June 30, 2023, and December 31, 2022, was $212,000 and $158,000. Inventories consisted of (in thousands):

| | | June 30, 2023 | | | December 31, 2022 | |

| Raw material | | $ | 83 | | | $ | 46 | |

| Finished goods | | | 44 | | | | 74 | |

| Total | | $ | 127 | | | $ | 120 | |

BIOLARGO, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Other Non-Current Assets

Other non-current assets consisted of (i) security deposits related to our business offices, (ii) three patents acquired on October 22, 2021, for $34,000, and (iii) tax credit receivables from the Canadian government related to a research and development credit from our Canadian subsidiary for which we’ve applied for and received in prior periods.

| | | June 30, 2023 | | | December 31, 2022 | |

| Patents | | $ | 34 | | | $ | 34 | |

| Security deposits | | | 35 | | | | 35 | |

| Tax credit receivable | | | -- | | | | 55 | |

| Total | | $ | 69 | | | $ | 124 | |

Equity Method of Accounting

On March 20, 2020, we invested $100,000 into a South Korean entity (Odin Co. Ltd., “Odin”) pursuant to a Joint Venture agreement we had entered into with BKT Co. Ltd. and its U.S. based subsidiary, Tomorrow Water. We received a 40% non-dilutive equity interest, and BKT and Tomorrow Water each received 30% equity interests for an aggregate $150,000 investment.

We account for our investment in the joint venture under the equity method of accounting. We have determined that while we have significant influence over the joint venture through our technology license and our position on the Board of Directors, we do not control the joint venture or are otherwise involved in managing the entity and we own less than a majority of the equity. Therefore, we record the asset on our consolidated balance sheet and record an increase or decrease of the recorded balance by our percentage ownership of the profits or losses in the joint venture. The joint venture has incurred a loss since inception and our 40% ownership share reduced our investment interest. For the three and six months ended June 30, 2023, the reduction of our investment interest totaled $6,000 and $12,000, respectively, and for the same periods in 2022, reduced our investment interest $8,000 and $15,000, respectively.

Impairment

Long-lived and definite lived intangible assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. If the sum of the expected future undiscounted cash flows from the use of the asset and its eventual disposition is less than the carrying amount of the asset, then an impairment loss is recognized. The impairment loss is measured based on the fair value of the asset. Any resulting impairment is recorded as a reduction in the carrying value of the related asset in excess of fair value and a charge to operating results. There were no impairment losses related to intangible assets during the three or six months ended June 30, 2023 or 2022.

Earnings (Loss) Per Share

We report basic and diluted earnings (loss) per share (“EPS”) for common and common share equivalents. Basic EPS is computed by dividing reported earnings by the weighted average shares outstanding. Diluted EPS is computed by adding to the weighted average shares the dilutive effect if convertible notes payable, stock options and warrants were exercised into common stock. For the three and six months ended June 30, 2023, and 2022, the denominator in the diluted EPS computation is the same as the denominator for basic EPS due to the Company’s net loss which creates an anti-dilutive effect of the convertible notes payable, warrants and stock options.

Use of Estimates