0001397047

false

0001397047

2023-08-14

2023-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 14, 2023

FlexShopper, Inc.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

001-37945 |

|

20-5456087 |

| (State or other jurisdiction |

|

(Commission File Number) |

|

(IRS Employer |

| of incorporation) |

|

|

|

Identification No.) |

| 901 Yamato Road, Suite 260 |

|

|

| Boca Raton, Florida |

|

33431 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (855) 353-9289

(Former Name or Former Address, if Changed Since

Last Report)

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

FPAY |

|

The Nasdaq Stock Market LLC |

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

CURRENT REPORT ON FORM 8-K

FlexShopper, Inc. (the “Company”)

August 14, 2023

Item 2.02. Results of Operations and Financial Condition.

FlexShopper, Inc. (Nasdaq:FPAY)

(“FlexShopper”), a leading national online lease-to-own (“LTO”) retailer and payment solution provider for underserved

consumes, today announced its financial results for the quarter ended June 30, 2023. A copy of the press release is furnished with this

report as Exhibit 99.1. Such information, including the Exhibit attached hereto, shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), nor shall it be deemed incorporated by reference

in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

| |

(a) |

Exhibits. The exhibit listed in the following Exhibit Index is filed as part of this current report. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

FLEXSHOPPER, INC. |

| |

|

|

| Date: August 14, 2023 |

By: |

/s/ H. Russell Heiser, Jr. |

| |

|

H. Russell Heiser, Jr. |

| |

|

Chief Executive Officer |

2

Exhibit 99.1

FlexShopper, Inc. Reports Second Quarter 2023

Financial Results

BOCA RATON, Fla., Aug 14, 2023 (GLOBE NEWSWIRE)

-- FlexShopper, Inc. (Nasdaq:FPAY) (“FlexShopper”), a leading national online lease-to-own (“LTO”) retailer and

payment solution provider for underserved consumers, today announced its financial results for the quarter ended June 30, 2023.

Results for Quarter Ended June 30, 2023 vs.

Quarter Ended June 30, 2022:

| |

● |

Total fundings decreased 11.0% to $27.5 million from $30.9 million

consisting of gross lease originations decreasing 32.7% from $19.9 to $13.4 million, loan participations decreasing 99.1% from $11.0 million

to $0.1 million, and loan originations increasing from $0 to $14.0 million |

| |

|

|

| |

● |

Total net lease and loan revenues and fees decreased 32.9% to $24.5 million from $36.5 million |

| |

|

|

| |

● |

Gross profit decreased 52.0% to $8.4 million from $17.5 million |

| |

|

|

| |

● |

Adjusted EBITDA1 decreased 95.3% to $0.3 million compared to 6.4 million |

| |

|

|

| |

● |

Net loss of $5.3 million compared with net income of $14.4 million |

| |

|

|

| |

● |

Net loss attributable to common stockholders of $(6.3) million, or $(0.22) per diluted share, compared to net income attributable to common stockholders of $13.8 million, or $0.51 per diluted share |

Results for Six Months Ended June 30, 2023

vs. Six Months Ended June 30, 2022:

| |

● |

Total fundings increased 6.8% to $54.9 million from $51.4 million consisting

of gross lease originations decreasing 26,5% from $36.2 million to $26.6 million, loan participations decreased 98.0% from $15.2 million

to $0.3 million, and loan originations increasing from $0 to $28 million |

| |

|

|

| |

● |

Total net lease and loan revenues and fees decreased 15.6% to $55.3 million from $65.5 million |

| |

|

|

| |

● |

Gross profit decreased 18.2.% to $22.0 million from $26.9 million |

| |

|

|

| |

● |

Adjusted EBITDA1 increased 6.3% to $6.7 million compared

to 6.3 million |

| |

|

|

| |

● |

Net loss of $5.5 million compared with net income of $12 million |

| |

|

|

| |

● |

Net loss attributable to common stockholders of $(7.5) million, or $(0.34) per diluted share, compared to net income attributable to common stockholders of $10.8 million, or $0.42 per diluted share |

| ¹ |

Adjusted EBITDA is a non-GAAP financial measure. Refer to the definition and reconciliation of this measure under “Non-GAAP Measures”. |

Conference Call and Webcast Details

Conference call

Date: Monday August 14, 2023

Time: 8:30 a.m. Eastern Time

Participant Dial-In Numbers:

Domestic callers: (877) 407-2988

International callers: +1 (201) 389-0923

Webcast: https://event.choruscall.com/mediaframe/webcast.html?webcastid=dtM9EZ6E

The call will also be simultaneously webcast over

the Internet via the “Investor” section of the Company’s website at www.flexshopper.com or by clicking on the conference

call link:

https://hd.choruscall.com/InComm/?callme=true&passcode=13730035&h=true&info=company&r=true&B=6

An audio replay of the call will be archived on the Company’s

website.

FLEXSHOPPER, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

| | |

For the three months ended

June 30, | | |

For the six months ended

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Revenues: | |

| | |

| | |

| | |

| |

| Lease revenues and fees, net | |

$ | 22,906,843 | | |

$ | 30,468,476 | | |

$ | 47,621,001 | | |

$ | 58,234,788 | |

| Loan revenues and fees, net of changes in fair value | |

| 1,625,193 | | |

| 6,079,675 | | |

| 7,696,810 | | |

| 7,268,599 | |

| Total revenues | |

| 24,532,036 | | |

| 36,548,151 | | |

| 55,317,811 | | |

| 65,503,387 | |

| | |

| | | |

| | | |

| | | |

| | |

| Costs and expenses: | |

| | | |

| | | |

| | | |

| | |

| Depreciation and impairment of lease merchandise | |

| 14,485,417 | | |

| 18,207,305 | | |

| 29,831,205 | | |

| 37,367,916 | |

| Loan origination costs and fees | |

| 1,655,424 | | |

| 804,228 | | |

| 3,489,051 | | |

| 1,229,741 | |

| Marketing | |

| 1,488,578 | | |

| 3,770,820 | | |

| 2,587,767 | | |

| 5,784,935 | |

| Salaries and benefits | |

| 2,976,008 | | |

| 3,014,920 | | |

| 5,702,898 | | |

| 5,979,362 | |

| Operating expenses | |

| 5,957,932 | | |

| 5,748,286 | | |

| 11,585,640 | | |

| 11,421,488 | |

| Total costs and expenses | |

| 26,563,359 | | |

| 31,545,559 | | |

| 53,196,561 | | |

| 61,783,442 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating (loss)/ income | |

| (2,031,323 | ) | |

| 5,002,592 | | |

| 2,121,250 | | |

| 3,719,945 | |

| | |

| | | |

| | | |

| | | |

| | |

| Interest expense including amortization of debt issuance costs | |

| (4,568,557 | ) | |

| (2,347,838 | ) | |

| (9,099,884 | ) | |

| (4,305,906 | ) |

| (Loss)/ income before income taxes | |

| (6,599,880 | ) | |

| 2,654,754 | | |

| (6,978,634 | ) | |

| (585,961 | ) |

| Benefit from income taxes | |

| 1,302,225 | | |

| 11,734,467 | | |

| 1,450,764 | | |

| 12,594,247 | |

| Net (loss)/ income | |

| (5,297,655 | ) | |

| 14,389,221 | | |

| (5,527,870 | ) | |

| 12,008,286 | |

| | |

| | | |

| | | |

| | | |

| | |

| Dividends on Series 2 Convertible Preferred Shares | |

| (992,493 | ) | |

| (609,777 | ) | |

| (1,964,726 | ) | |

| (1,219,554 | ) |

| Net (loss)/ income attributable to common and Series 1 Convertible Preferred shareholders | |

$ | (6,290,148 | ) | |

| 13,779,444 | | |

| (7,492,596 | ) | |

| 10,788,732 | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted (loss)/ income per common share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.22 | ) | |

$ | 0.63 | | |

$ | (0.34 | ) | |

$ | 0.49 | |

| Diluted | |

$ | (0.22 | ) | |

$ | 0.51 | | |

$ | (0.34 | ) | |

$ | 0.42 | |

| | |

| | | |

| | | |

| | | |

| | |

| WEIGHTED AVERAGE COMMON SHARES: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 28,923,393 | | |

| 21,605,234 | | |

| 21,751,807 | | |

| 21,576,312 | |

| Diluted | |

| 28,923,393 | | |

| 27,898,824 | | |

| 21,751,807 | | |

| 28,193,268 | |

FLEXSHOPPER, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

(unaudited) | | |

| |

| ASSETS | |

| | |

| |

| CURRENT ASSETS: | |

| | |

| |

| Cash | |

$ | 6,372,699 | | |

$ | 6,051,713 | |

| Restricted cash | |

| 6,285 | | |

| 121,636 | |

| Lease receivables, net | |

| 39,227,399 | | |

| 35,540,043 | |

| Loan receivables at fair value | |

| 25,105,046 | | |

| 32,932,504 | |

| Prepaid expenses and other assets | |

| 3,068,559 | | |

| 3,489,136 | |

| Lease merchandise, net | |

| 24,597,836 | | |

| 31,550,441 | |

| Total current assets | |

| 98,377,824 | | |

| 109,685,473 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 8,830,978 | | |

| 8,086,862 | |

| Right of use asset, net | |

| 1,324,953 | | |

| 1,406,270 | |

| Intangible assets, net | |

| 14,276,231 | | |

| 15,162,349 | |

| Other assets, net | |

| 1,832,175 | | |

| 1,934,728 | |

| Deferred tax asset, net | |

| 13,471,568 | | |

| 12,013,828 | |

| Total assets | |

$ | 138,113,729 | | |

$ | 148,289,510 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| CURRENT LIABILITIES: | |

| | | |

| | |

| Accounts payable | |

$ | 4,005,219 | | |

$ | 6,511,943 | |

| Accrued payroll and related taxes | |

| 299,741 | | |

| 310,820 | |

| Promissory notes to related parties, including accrued interest | |

| 1,207,798 | | |

| 1,209,455 | |

| Accrued expenses | |

| 2,386,547 | | |

| 3,988,093 | |

| Lease liability - current portion | |

| 228,358 | | |

| 208,001 | |

| Total current liabilities | |

| 8,127,663 | | |

| 12,228,312 | |

| Loan payable under credit agreement to beneficial shareholder, net of unamortized issuance costs of $211,516 at June 30, 2023 and $352,252 at December 31, 2022 | |

| 80,943,484 | | |

| 80,847,748 | |

| Promissory notes to related parties, net of unamortized issuance costs of $879,348 at June 30, 2023 and $0 at December 31, 2022 and net of current portion | |

| 9,870,652 | | |

| 10,750,000 | |

| Promissory note related to acquisition, net of discount of $1,046,551 at June 30, 2023 and $1,165,027 at December 31, 2022 | |

| 3,133,617 | | |

| 3,158,471 | |

| Loan payable under Basepoint credit agreement, net of unamortized issuance costs of $112,197 at June 30, 2023 | |

| 7,300,408 | | |

| - | |

| Purchase consideration payable related to acquisition | |

| - | | |

| 8,703,684 | |

| Lease liabilities, net of current portion | |

| 1,447,788 | | |

| 1,566,622 | |

| Total liabilities | |

| 110,823,612 | | |

| 117,254,837 | |

| | |

| | | |

| | |

| STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Series 1 Convertible Preferred Stock, $0.001 par value - authorized 250,000 shares, issued and outstanding 170,332 shares at $5.00 stated value | |

| 851,660 | | |

| 851,660 | |

| Series 2 Convertible Preferred Stock, $0.001 par value - authorized 25,000 shares, issued and outstanding 21,952 shares at $1,000 stated value | |

| 21,952,000 | | |

| 21,952,000 | |

| Common stock, $0.0001 par value - authorized 40,000,000 shares, issued and outstanding 21,752,304 shares at June 30, 2023 and 21,750,804 shares at December 31, 2022 | |

| 2,176 | | |

| 2,176 | |

| Additional paid in capital | |

| 41,602,734 | | |

| 39,819,420 | |

| Accumulated deficit | |

| (37,118,453 | ) | |

| (31,590,583 | ) |

| Total stockholders’ equity | |

| 27,290,117 | | |

| 31,034,673 | |

| | |

$ | 138,113,729 | | |

$ | 148,289,510 | |

Non-GAAP Measures

We regularly review a number of metrics, including

the following key metrics, to evaluate our business, measure our performance, identify trends affecting our business, formulate financial

projections and make strategic decisions.

Adjusted EBITDA represents net income before interest,

stock-based compensation, taxes, depreciation (other than depreciation of leased merchandise), amortization, and one-time or non-recurring

items. We believe that Adjusted EBITDA provides us with an understanding of one aspect of earnings before the impact of investing and

financing charges and income taxes.

Key performance metrics for the three months ended

June 30, 2023 and 2022 are as follows:

| | |

Three months ended

June 30, | | |

| | |

| |

| | |

2023 | | |

2022 | | |

$ Change | | |

% Change | |

| Gross Profit: | |

| | |

| | |

| |

| Gross lease billings and fees | |

$ | 32,501,656 | | |

$ | 39,596,845 | | |

$ | (7,095,189 | ) | |

| (17.9 | ) |

| Provision for doubtful accounts | |

| (10,847,413 | ) | |

| (15,732,876 | ) | |

| 4,885,463 | | |

| (31.1 | ) |

| Gain on sale of lease receivables | |

| 1,252,600 | | |

| 6,604,507 | | |

| (5,351,907 | ) | |

| (81.0 | ) |

| Net lease billing and fees | |

$ | 22,906,843 | | |

$ | 30,468,476 | | |

$ | (7,561,633 | ) | |

| (24.8 | ) |

| Loan revenues and fees | |

| 3,446,893 | | |

| 3,098,400 | | |

| 348,493 | | |

| 11.2 | |

| Net changes in the fair value of loans receivable | |

| (1,821,700 | ) | |

| 2,981,275 | | |

| (4,802,975 | ) | |

| (161.1 | ) |

| Net loan revenues | |

$ | 1,625,193 | | |

$ | 6,079,675 | | |

$ | (4,454,482 | ) | |

| (73.3 | ) |

| Total revenues | |

$ | 24,532,036 | | |

$ | 36,548,151 | | |

$ | (12,016,115 | ) | |

| (32.9 | ) |

| Depreciation and impairment of lease merchandise | |

| (14,485,417 | ) | |

| (18,207,305 | ) | |

| 3,721,888 | | |

| (20.4 | ) |

| Loans origination costs and fees | |

| (1,655,424 | ) | |

| (804,228 | ) | |

| (851,196 | ) | |

| 105.8 | |

| Gross profit | |

$ | 8,391,195 | | |

$ | 17,536,618 | | |

$ | (9,145,423 | ) | |

| (52.2 | ) |

| Gross profit margin | |

| 34 | % | |

| 48 | % | |

| | | |

| | |

| | |

Three months ended

June 30, | | |

| | |

| |

| | |

2023 | | |

2022 | | |

$ Change | | |

% Change | |

| Adjusted EBITDA: | |

| | |

| | |

| | |

| |

| Net (loss)/ income | |

$ | (5,297,655 | ) | |

$ | 14,389,221 | | |

$ | (19,686,876 | ) | |

| (136.8 | ) |

| Income taxes | |

| (1,302,225 | ) | |

| (11,734,467 | ) | |

| 10,432,242 | | |

| (88.9 | ) |

| Amortization of debt issuance costs | |

| 111,807 | | |

| 56,283 | | |

| 55,524 | | |

| 98.7 | |

| Amortization of discount on the promissory note related to acquisition | |

| 59,238 | | |

| — | | |

| 59,238 | | |

| | |

| Other amortization and depreciation | |

| 1,884,544 | | |

| 1,122,263 | | |

| 762,281 | | |

| 67.9 | |

| Interest expense | |

| 4,397,513 | | |

| 2,291,555 | | |

| 2,105,958 | | |

| 91.9 | |

| Stock-based compensation | |

| 443,800 | | |

| 257,476 | | |

| 186,324 | | |

| 72.4 | |

| Adjusted EBITDA | |

$ | 297,022 | | |

$ | 6,382,331 | | |

$ | (6,085,309 | ) | |

| (95.3 | ) |

Key performance metrics for the six months ended

June 30, 2023 and 2022 are as follows:

| | |

Six months ended

June 30, | | |

| | |

| |

| | |

2023 | | |

2022 | | |

$ Change | | |

% Change | |

| Gross Profit: | |

| | |

| | |

| |

| Gross lease billings and fees | |

$ | 66,756,740 | | |

$ | 79,194,274 | | |

$ | (12,437,534 | ) | |

| (15.7 | ) |

| Provision for doubtful accounts | |

| (22,085,828 | ) | |

| (27,563,993 | ) | |

| 5,478,165 | | |

| (19.9 | ) |

| Gain on sale of lease receivables | |

| 2,950,089 | | |

| 6,604,507 | | |

| (3,654,418 | ) | |

| (55.3 | ) |

| Net lease billing and fees | |

$ | 47,621,001 | | |

$ | 58,234,788 | | |

$ | (10,613,787 | ) | |

| (18.2 | ) |

| Loan revenues and fees | |

| 8,533,858 | | |

| 4,810,748 | | |

| 3,723,110 | | |

| 77.4 | |

| Net changes in the fair value of loans receivable | |

| (837,048 | ) | |

| 2,457,851 | | |

| (3,294,899 | ) | |

| (134.1 | ) |

| Net loan revenues | |

$ | 7,696,810 | | |

$ | 7,268,599 | | |

$ | 428,211 | | |

| 5.9 | |

| Total revenues | |

$ | 55,317,811 | | |

$ | 65,503,387 | | |

$ | (10,185,576 | ) | |

| (15.5 | ) |

| Depreciation and impairment of lease merchandise | |

| (29,831,205 | ) | |

| (37,367,916 | ) | |

| 7,536,711 | | |

| (20.2 | ) |

| Loans origination costs and fees | |

| (3,489,051 | ) | |

| (1,229,741 | ) | |

| (2,259,310 | ) | |

| 183.7 | |

| Gross profit | |

$ | 21,997,555 | | |

$ | 26,905,730 | | |

$ | (4,908,175 | ) | |

| (18.2 | ) |

| Gross profit margin | |

| 40 | % | |

| 41 | % | |

| | | |

| | |

| | |

Six months ended

June 30, | | |

| | |

| |

| | |

2023 | | |

2022 | | |

$ Change | | |

% Change | |

| Adjusted EBITDA: | |

| | |

| | |

| | |

| |

| Net (loss)/ income | |

$ | (5,527,870 | ) | |

$ | 12,008,286 | | |

$ | (17,536,156 | ) | |

| (146.0 | ) |

| Income taxes | |

| (1,450,764 | ) | |

| (12,594,247 | ) | |

| 11,143,483 | | |

| (88.5 | ) |

| Amortization of debt issuance costs | |

| 182,174 | | |

| 106,886 | | |

| 75,288 | | |

| 70.4 | |

| Amortization of discount on the promissory note related to acquisition | |

| 118,476 | | |

| — | | |

| 118,174 | | |

| | |

| Other amortization and depreciation | |

| 3,710,703 | | |

| 2,059,323 | | |

| 1,651,380 | | |

| 80.2 | |

| Interest expense | |

| 8,799,234 | | |

| 4,199,020 | | |

| 4,600,214 | | |

| 109.6 | |

| Stock-based compensation | |

| 864,548 | | |

| 562,705 | | |

| 301,843 | | |

| 53.6 | |

| Adjusted EBITDA | |

$ | 6,696,501 | | |

$ | 6,341,973 | | |

$ | 354,226 | | |

| 5.6 | |

The Company refers to Adjusted EBITDA in the above

table as the Company uses this measure to evaluate operating performance and to make strategic decisions about the Company. Management

believes that Adjusted EBITDA provides relevant and useful information which is widely used by analysts, investors and competitors in

its industry in assessing performance.

About FlexShopper

FlexShopper, Inc. (FPAY) is a financial technology

company that provides electronics, home furnishings and other durable goods to underserved consumers on a lease-to-own (LTO) basis through

its patented e-commerce marketplace (www.FlexShopper.com). FlexShopper also provides LTO and loan technology platforms to a growing number

of retailers and e-retailers to facilitate transactions with consumers without access to traditional financing.

Forward-Looking Statements

All statements in this release that are not based

on historical fact are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934. Forward-looking statements, which are based on certain assumptions and describe our future

plans, strategies and expectations, can generally be identified by the use of forward-looking terms such as “believe,” “expect,”

“may,” “will,” “should,” “could,” “seek,” “intend,” “plan,”

“goal,” “estimate,” “anticipate,” or other comparable terms. Examples of forward-looking statements

include, among others, statements we make regarding expectations of lease originations, the expansion of our lease-to-own program; expectations

concerning our partnerships with retail partners; investments in, and the success of, our underwriting technology and risk analytics platform;

our ability to collect payments due from customers; expected future operating results and expectations concerning our business strategy.

Forward-looking statements involve inherent risks and uncertainties which could cause actual results to differ materially from those in

the forward-looking statements, as a result of various factors including, among others, the following: our ability to obtain adequate

financing to fund our business operations in the future; the failure to successfully manage and grow our FlexShopper.com e-commerce platform;

our ability to maintain compliance with financial covenants under our credit agreement; our dependence on the success of our third-party

retail partners and our continued relationships with them; our compliance with various federal, state and local laws and regulations,

including those related to consumer protection; the failure to protect the integrity and security of customer and employee information;

and the other risks and uncertainties described in the Risk Factors and in Management’s Discussion and Analysis of Financial Condition

and Results of Operations sections of our Annual Report on Form 10-K and subsequently filed Quarterly Reports on Form 10-Q. The forward-looking

statements made in this release speak only as of the date of this release, and FlexShopper assumes no obligation to update any such forward-looking

statements to reflect actual results or changes in expectations, except as otherwise required by law.

Contact:

FlexShopper, Inc.

Investor Relations

ir@flexshopper.com

FlexShopper, Inc.

7

v3.23.2

Cover

|

Aug. 14, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 14, 2023

|

| Entity File Number |

001-37945

|

| Entity Registrant Name |

FlexShopper, Inc.

|

| Entity Central Index Key |

0001397047

|

| Entity Tax Identification Number |

20-5456087

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

901 Yamato Road

|

| Entity Address, Address Line Two |

Suite 260

|

| Entity Address, City or Town |

Boca Raton

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33431

|

| City Area Code |

855

|

| Local Phone Number |

353-9289

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

FPAY

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

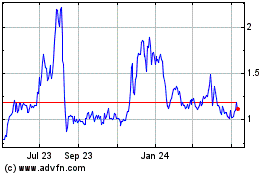

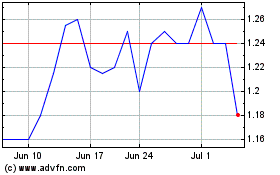

FlexShopper (NASDAQ:FPAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

FlexShopper (NASDAQ:FPAY)

Historical Stock Chart

From Apr 2023 to Apr 2024