0001568969

false

--12-31

Q2

0001568969

false

--12-31

Q2

0001568969

2023-01-01

2023-06-30

0001568969

2023-08-14

0001568969

2023-06-30

0001568969

2022-12-31

0001568969

2023-04-01

2023-06-30

0001568969

2022-04-01

2022-06-30

0001568969

2022-01-01

2022-06-30

0001568969

us-gaap:PreferredStockMember

2022-12-31

0001568969

us-gaap:CommonStockMember

2022-12-31

0001568969

APYP:StockPayablesMember

2022-12-31

0001568969

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001568969

us-gaap:RetainedEarningsMember

2022-12-31

0001568969

us-gaap:ParentMember

2022-12-31

0001568969

us-gaap:NoncontrollingInterestMember

2022-12-31

0001568969

us-gaap:PreferredStockMember

2023-01-01

2023-06-30

0001568969

us-gaap:CommonStockMember

2023-01-01

2023-06-30

0001568969

APYP:StockPayablesMember

2023-01-01

2023-06-30

0001568969

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-06-30

0001568969

us-gaap:RetainedEarningsMember

2023-01-01

2023-06-30

0001568969

us-gaap:ParentMember

2023-01-01

2023-06-30

0001568969

us-gaap:NoncontrollingInterestMember

2023-01-01

2023-06-30

0001568969

us-gaap:PreferredStockMember

2023-06-30

0001568969

us-gaap:CommonStockMember

2023-06-30

0001568969

APYP:StockPayablesMember

2023-06-30

0001568969

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001568969

us-gaap:RetainedEarningsMember

2023-06-30

0001568969

us-gaap:ParentMember

2023-06-30

0001568969

us-gaap:NoncontrollingInterestMember

2023-06-30

0001568969

us-gaap:PreferredStockMember

2021-12-31

0001568969

us-gaap:CommonStockMember

2021-12-31

0001568969

APYP:StockPayablesMember

2021-12-31

0001568969

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001568969

us-gaap:RetainedEarningsMember

2021-12-31

0001568969

us-gaap:ParentMember

2021-12-31

0001568969

us-gaap:NoncontrollingInterestMember

2021-12-31

0001568969

2021-12-31

0001568969

us-gaap:PreferredStockMember

2022-01-01

2022-06-30

0001568969

us-gaap:CommonStockMember

2022-01-01

2022-06-30

0001568969

APYP:StockPayablesMember

2022-01-01

2022-06-30

0001568969

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-06-30

0001568969

us-gaap:RetainedEarningsMember

2022-01-01

2022-06-30

0001568969

us-gaap:ParentMember

2022-01-01

2022-06-30

0001568969

us-gaap:NoncontrollingInterestMember

2022-01-01

2022-06-30

0001568969

us-gaap:PreferredStockMember

2022-06-30

0001568969

us-gaap:CommonStockMember

2022-06-30

0001568969

APYP:StockPayablesMember

2022-06-30

0001568969

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001568969

us-gaap:RetainedEarningsMember

2022-06-30

0001568969

us-gaap:ParentMember

2022-06-30

0001568969

us-gaap:NoncontrollingInterestMember

2022-06-30

0001568969

2022-06-30

0001568969

us-gaap:PreferredStockMember

2023-03-31

0001568969

us-gaap:CommonStockMember

2023-03-31

0001568969

APYP:StockPayablesMember

2023-03-31

0001568969

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001568969

us-gaap:RetainedEarningsMember

2023-03-31

0001568969

us-gaap:ParentMember

2023-03-31

0001568969

us-gaap:NoncontrollingInterestMember

2023-03-31

0001568969

2023-03-31

0001568969

us-gaap:PreferredStockMember

2023-04-01

2023-06-30

0001568969

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001568969

APYP:StockPayablesMember

2023-04-01

2023-06-30

0001568969

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0001568969

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0001568969

us-gaap:ParentMember

2023-04-01

2023-06-30

0001568969

us-gaap:NoncontrollingInterestMember

2023-04-01

2023-06-30

0001568969

us-gaap:PreferredStockMember

2022-03-31

0001568969

us-gaap:CommonStockMember

2022-03-31

0001568969

APYP:StockPayablesMember

2022-03-31

0001568969

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001568969

us-gaap:RetainedEarningsMember

2022-03-31

0001568969

us-gaap:ParentMember

2022-03-31

0001568969

us-gaap:NoncontrollingInterestMember

2022-03-31

0001568969

2022-03-31

0001568969

us-gaap:PreferredStockMember

2022-04-01

2022-06-30

0001568969

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0001568969

APYP:StockPayablesMember

2022-04-01

2022-06-30

0001568969

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2022-06-30

0001568969

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0001568969

us-gaap:ParentMember

2022-04-01

2022-06-30

0001568969

us-gaap:NoncontrollingInterestMember

2022-04-01

2022-06-30

0001568969

us-gaap:SeriesAPreferredStockMember

APYP:BorisMolchadskyMember

2021-07-02

2021-07-02

0001568969

APYP:StockExchangeAgreementMember

APYP:SleepXLtdMember

2021-08-02

0001568969

APYP:StockExchangeAgreementMember

APYP:SleepXLtdMember

2021-08-01

2021-08-02

0001568969

APYP:StockExchangeAgreementMember

APYP:SleepXLtdMember

2021-08-02

0001568969

APYP:BorisMolchadskyMember

APYP:SleepXLtdMember

2023-06-30

0001568969

APYP:SleepXLtdMember

2023-06-30

0001568969

APYP:BorisMolchadskyMember

2022-12-31

0001568969

APYP:BorisMolchadskyMember

2022-01-01

2022-12-31

0001568969

APYP:NexenseTechnologiesLTDMember

2021-12-31

0001568969

APYP:NexenseTechnologiesLTDMember

2022-01-01

2022-12-31

0001568969

APYP:TanoomaLtdMember

us-gaap:NoncontrollingInterestMember

2020-12-31

0001568969

APYP:TanoomaLtdMember

us-gaap:NoncontrollingInterestMember

2023-06-30

0001568969

APYP:EvergreenVentureCapitalLLCMember

2021-08-21

2021-08-22

0001568969

APYP:EvergreenVentureCapitalLLCMember

2021-08-22

0001568969

APYP:EvergreenVentureCapitalLLCMember

2022-06-30

0001568969

APYP:EvergreenVentureCapitalLLCMember

2023-06-30

0001568969

APYP:OldCLAMember

2023-01-01

2023-06-30

0001568969

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2022-12-31

0001568969

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2022-12-31

0001568969

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2022-12-31

0001568969

us-gaap:FairValueMeasurementsRecurringMember

2022-12-31

0001568969

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2023-06-30

0001568969

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2023-06-30

0001568969

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2023-06-30

0001568969

us-gaap:FairValueMeasurementsRecurringMember

2023-06-30

0001568969

2022-01-01

2022-12-31

0001568969

APYP:OldCLAMember

srt:MaximumMember

2023-01-01

2023-06-30

0001568969

APYP:OldCLAMember

srt:MinimumMember

2023-01-01

2023-06-30

0001568969

APYP:OldCLAMember

2022-01-01

2022-12-31

0001568969

APYP:OldCLAMember

2023-06-30

0001568969

APYP:OldCLAMember

2022-12-31

0001568969

srt:MinimumMember

2023-06-30

0001568969

srt:MaximumMember

2023-06-30

0001568969

srt:MinimumMember

2022-12-31

0001568969

srt:MaximumMember

2022-12-31

0001568969

us-gaap:MeasurementInputPriceVolatilityMember

srt:MinimumMember

2023-06-30

0001568969

us-gaap:MeasurementInputPriceVolatilityMember

srt:MaximumMember

2023-06-30

0001568969

us-gaap:MeasurementInputPriceVolatilityMember

2022-12-31

0001568969

us-gaap:MeasurementInputExpectedDividendRateMember

2023-06-30

0001568969

us-gaap:MeasurementInputExpectedDividendRateMember

2022-12-31

0001568969

srt:MinimumMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2023-06-30

0001568969

srt:MaximumMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2023-06-30

0001568969

srt:MinimumMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2022-12-31

0001568969

srt:MaximumMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2022-12-31

0001568969

APYP:MeasurementInputCommomMarketValueMember

2023-06-30

0001568969

APYP:MeasurementInputCommomMarketValueMember

2022-12-31

0001568969

APYP:WarrantOneMember

2022-12-31

0001568969

APYP:WarrantOneMember

srt:MinimumMember

2022-12-31

0001568969

APYP:WarrantTwoMember

2022-12-31

0001568969

APYP:WarrantTwoMember

srt:MaximumMember

2022-12-31

0001568969

APYP:WarrantThreeMember

2022-12-31

0001568969

APYP:WarrantThreeMember

srt:MinimumMember

2022-12-31

0001568969

APYP:WarrantFourMember

2022-12-31

0001568969

APYP:WarrantFourMember

srt:MaximumMember

2022-12-31

0001568969

APYP:WarrantOneMember

2023-06-30

0001568969

APYP:WarrantOneMember

srt:MinimumMember

2023-06-30

0001568969

APYP:WarrantTwoMember

2023-06-30

0001568969

APYP:WarrantTwoMember

srt:MaximumMember

2023-06-30

0001568969

APYP:WarrantThreeMember

2023-06-30

0001568969

APYP:WarrantThreeMember

srt:MinimumMember

2023-06-30

0001568969

APYP:WarrantFourMember

2023-06-30

0001568969

APYP:WarrantFourMember

srt:MaximumMember

2023-06-30

0001568969

APYP:WarrantFIveMember

2023-06-30

0001568969

APYP:WarrantFIveMember

srt:MaximumMember

2023-06-30

0001568969

2021-07-01

2021-07-01

0001568969

2022-01-01

2022-01-01

0001568969

srt:MinimumMember

2023-01-01

2023-06-30

0001568969

srt:MaximumMember

2023-01-01

2023-06-30

0001568969

2021-07-01

0001568969

srt:MinimumMember

2022-01-01

0001568969

srt:MaximumMember

2022-01-01

0001568969

APYP:ChiefFinancialOfficerAndAdvisorMember

2023-01-01

2023-06-30

0001568969

APYP:ChiefFinancialOfficerAndAdvisorMember

2022-01-01

2022-06-30

0001568969

APYP:RonMeklerMember

2023-01-01

2023-01-01

0001568969

APYP:RonMeklerMember

2023-01-01

0001568969

APYP:AdiShemerMember

2023-02-01

2023-02-01

0001568969

APYP:AdiShemerMember

2023-02-01

0001568969

APYP:InvestorTwoMember

2023-03-31

0001568969

APYP:InvestorTwoMember

2023-01-01

2023-01-31

0001568969

APYP:CRMCampaignsMember

2023-05-01

2023-05-01

0001568969

APYP:ConsultantMember

2023-06-01

2023-06-01

0001568969

2023-06-17

2023-06-18

0001568969

us-gaap:SubsequentEventMember

2023-07-01

2023-07-01

0001568969

us-gaap:SubsequentEventMember

2023-07-01

0001568969

APYP:MrPoratMember

us-gaap:SubsequentEventMember

2023-12-30

2023-12-31

0001568969

srt:ChiefExecutiveOfficerMember

us-gaap:SubsequentEventMember

2023-07-06

2023-07-07

0001568969

srt:ChiefExecutiveOfficerMember

us-gaap:SubsequentEventMember

2023-07-07

0001568969

srt:ChiefExecutiveOfficerMember

us-gaap:SubsequentEventMember

2023-07-05

2023-07-07

0001568969

us-gaap:InvestorMember

2023-06-01

2023-06-30

0001568969

us-gaap:InvestorMember

2023-06-30

0001568969

APYP:CommonStockPurchaseWarrantsMember

2023-06-30

0001568969

us-gaap:WarrantMember

2023-06-30

0001568969

2023-06-01

2023-06-30

0001568969

us-gaap:SubsequentEventMember

2023-07-30

2023-07-31

0001568969

us-gaap:SubsequentEventMember

2023-07-01

2023-09-30

0001568969

us-gaap:SeriesAPreferredStockMember

us-gaap:SubsequentEventMember

2023-07-25

2023-07-26

0001568969

us-gaap:SeriesAPreferredStockMember

us-gaap:SubsequentEventMember

2023-08-03

2023-08-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

APYP:Integer

iso4217:ILS

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-Q

MARK

ONE

☒

Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

for

the Quarterly Period ended June 30, 2023; or

☐

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

for

the transition period from ________ to ________

Commission

File Number: 000-55403

APPYEA,

Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

46-1496846 |

| (State

or other jurisdiction of |

|

(I.R.S.

Employer |

| incorporation

or organization) |

|

Identification

No.) |

| 16

Natan Alterman St, Gan Yavne, Israel |

|

|

| (Address

of principal executive offices) |

|

Zip

Code |

(800)

674-3561

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding

12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☐ |

Smaller

reporting company |

☒ |

| |

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As

of August 14, 2023, there were outstanding 240,321,157 shares of the registrant’s common stock, par value $0.0001 per share.

APPYEA,

INC.

Form

10-Q

June

30 June 30, 2023

APPYEA

INC.

CONDENSED

CONSOLIDATED BALANCE SHEETS

(U.S.

dollars in thousands)

| | |

June

30, | | |

December

31, | |

| | |

2023 | | |

2022 | |

| | |

Unaudited | | |

Audited | |

| ASSETS | |

| | | |

| | |

| Current

assets | |

| | | |

| | |

| Cash

and cash equivalents | |

| 47 | | |

| 60 | |

| Other

accounts receivables | |

| 43 | | |

| 19 | |

| | |

| | | |

| | |

| Total

current assets | |

| 90 | | |

| 79 | |

| | |

| | | |

| | |

| Non-current

assets | |

| | | |

| | |

| Property

and equipment, net | |

| 1 | | |

| 2 | |

| Intangible

assets, net | |

| 113 | | |

| 124 | |

| Total

non-current assets | |

| 114 | | |

| 126 | |

| | |

| | | |

| | |

| Total

assets | |

| 204 | | |

| 205 | |

| | |

| | | |

| | |

LIABILITIES

AND DEFICIENCY | |

| | | |

| | |

| Current

liabilities | |

| | | |

| | |

| Trade

payables | |

| 38 | | |

| 67 | |

| Other

accounts payable and related party payables | |

| 511 | | |

| 340 | |

| Short-term

loans from related party | |

| 79 | | |

| 80 | |

| Convertible

loans from related party | |

| 38 | | |

| 36 | |

| Convertible

Short-term loans at fair value | |

| 233 | | |

| 693 | |

| Convertible

loans at fair value | |

| 1,416 | | |

| 1,528 | |

| Warrants

liability | |

| 231 | | |

| 24 | |

| | |

| | | |

| | |

| Total

liabilities | |

| 2,546 | | |

| 2,768 | |

| | |

| | | |

| | |

| DEFICIENCY | |

| | | |

| | |

| AppYea

Inc. Stockholders’ Deficiency: | |

| | | |

| | |

| Convertible

preferred stock, $0.0001 par value | |

| - | | |

| - | |

| Common

stock, $0.0001 par value | |

| 22 | | |

| 21 | |

| Stock

Payables | |

| 74 | | |

| 27 | |

| Additional

Paid in Capital | |

| 2,716 | | |

| 1,912 | |

| Accumulated

deficit | |

| (5,140 | ) | |

| (4,509 | ) |

| Total

AppYea Inc. stockholders’ deficiency | |

| (2,328 | ) | |

| (2,549 | ) |

| Non-controlling

interests | |

| (14 | ) | |

| (14 | ) |

| | |

| | | |

| | |

| Total

Deficiency | |

| (2,342 | ) | |

| (2,563 | ) |

| | |

| | | |

| | |

| Total

liabilities and deficiency | |

| 204 | | |

| 205 | |

APPYEA

INC.

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(U.S.

dollars in thousands)

| | |

2023 | | |

2022 | | |

| | |

2022 | |

| | |

For

the period of three months ended June 30, | | |

For

the period of six months ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

Unaudited | | |

Unaudited | |

| | |

| | |

| | |

| | |

| |

| Research

and development expenses | |

| 7 | | |

| 17 | | |

| 16 | | |

| 42 | |

| Sales

and marketing | |

| 2 | | |

| 3 | | |

| 2 | | |

| 1

1 | |

| General

and administrative expenses | |

| 440 | | |

| 632 | | |

| 867 | | |

| 1,079 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating

loss | |

| (449 | ) | |

| (652 | ) | |

| (885 | ) | |

| (1,132 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Change

in fair value of convertible loans and warrant liability | |

| 95 | | |

| (125 | ) | |

| 261 | | |

| 1,123 | |

| Financial

income (expenses), net | |

| 12 | | |

| (30 | ) | |

| (7 | ) | |

| (46 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income

tax benefit | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Net

loss | |

| (342 | ) | |

| (807 | ) | |

| (631 | ) | |

| (55 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net

Loss attributable to AppYea Inc. | |

| (342 | ) | |

| (807 | ) | |

| (631 | ) | |

| (55 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss

per Common Share | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 0 | | |

| (0.003 | ) | |

| 0 | | |

| 0 | |

| Diluted | |

| 0 | | |

| (0.003 | ) | |

| 0 | | |

| 0 | |

| | |

| | | |

| | | |

| | | |

| | |

Weighted

Average number of Common Shares Outstanding basic and diluted

| |

| 234,943,286 | | |

| 219,074,483 | | |

| 230,272,456 | | |

| 218,660,405 | |

APPYEA

INC.

CONDENSED

CONSOLIDATED STATEMENTS OF CHANGES IN DEFICIENCY

(U.S.

dollars in thousands except share data)

| | |

Number | | |

Amount | | |

Number | | |

Amount | | |

Payables | | |

Capital | | |

Deficit | | |

Total | | |

interests | | |

Deficiency | |

| | |

Preferred

Stock | | |

Common

Stock | | |

Stock | | |

Additional

Paid in | | |

Accumulated | | |

| | |

Non-controlling | | |

Total | |

| | |

Number | | |

Amount | | |

Number | | |

Amount | | |

Payables | | |

Capital | | |

Deficit | | |

Total | | |

interests | | |

Deficiency | |

| | |

| | |

| | |

| | |

| | |

| | |

Unaudited | | |

| | |

| | |

| | |

| |

| Balance

as of January 1, 2023 | |

| 300,000 | | |

| - | | |

| 220,930,798 | | |

| 21 | | |

| 27 | | |

| 1,912 | | |

| (4,509 | ) | |

| (2,549 | ) | |

| (14 | ) | |

| (2,563 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share

issuance upon conversion of Convertible notes | |

| - | | |

| - | | |

| 19,390,359 | | |

| 1 | | |

| - | | |

| 242 | | |

| - | | |

| 243 | | |

| - | | |

| 243 | |

| Stock

payables | |

| - | | |

| - | | |

| - | | |

| - | | |

| 47 | | |

| - | | |

| - | | |

| 47 | | |

| - | | |

| 47 | |

| Share

based compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 562 | | |

| - | | |

| 562 | | |

| - | | |

| 562 | |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (631 | ) | |

| (631 | ) | |

| - | | |

| (631 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance

as of June 30, 2023 | |

| 300,000 | | |

| - | | |

| 240,321,157 | | |

| 22 | | |

| 74 | | |

| 2,716 | | |

| (5,140 | ) | |

| (2,328 | ) | |

| (14 | ) | |

| (2,342 | ) |

| | |

Preferred

Stock | | |

Common

Stock | | |

Stock | | |

Additional

Paid in | | |

Accumulated | | |

| | |

Non-controlling | | |

Total | |

| | |

Number | | |

Amount | | |

Number | | |

Amount | | |

Payables | | |

Capital | | |

Deficit | | |

Total | | |

interests | | |

Deficiency | |

| | |

| | |

| | |

| | |

| | |

| | |

Unaudited | | |

| | |

| | |

| | |

| |

| Balance

as of January 1, 2022 | |

| 300,000 | | |

| - | | |

| 218,246,326 | | |

| 21 | | |

| - | | |

| 768 | | |

| (3,205 | ) | |

| (2,416 | ) | |

| (14 | ) | |

| (2,430 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance

of shares to service providers | |

| - | | |

| - | | |

| 2,484,472 | | |

| - | | |

| - | | |

| 80 | | |

| - | | |

| 80 | | |

| - | | |

| 80 | |

| Stock

payables | |

| - | | |

| - | | |

| - | | |

| - | | |

| 28 | | |

| | | |

| - | | |

| 28 | | |

| - | | |

| 28 | |

| Share

based compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 508 | | |

| - | | |

| 508 | | |

| - | | |

| 508 | |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (55 | ) | |

| (55 | ) | |

| - | | |

| (55 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

|

| Balance

as of June 30, 2022 | |

| 300,000 | | |

| - | | |

| 220,730,798 | | |

| 21 | | |

| 28 | | |

| 1,356 | | |

| (3,260 | ) | |

| (1,855 | ) | |

| (14 | ) | |

| (1869 | ) |

APPYEA

INC.

CONDENSED

CONSOLIDATED STATEMENTS OF CHANGES IN DEFICIENCY

(U.S.

dollars in thousands except share data)

| | |

Preferred

Stock | | |

Common

Stock | | |

Stock | | |

Additional

Paid in | | |

Accumulated | | |

| | |

Non-controlling | | |

Total | |

| | |

Number | | |

Amount | | |

Number | | |

Amount | | |

Payables | | |

Capital | | |

Deficit | | |

Total | | |

interests | | |

Deficiency | |

| | |

| | |

| | |

| | |

| | |

| | |

Unaudited | | |

| | |

| | |

| | |

| |

| Balance

as of April 1, 2023 | |

| 300,000 | | |

| - | | |

| 229,565,414 | | |

| 22 | | |

| 28 | | |

| 2,351 | | |

| (4,798 | ) | |

| (2,397 | ) | |

| (14 | ) | |

| (2,411 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share

issuance upon conversion of Convertible notes | |

| - | | |

| - | | |

| 10,755,743 | | |

| - | | |

| - | | |

| 83 | | |

| - | | |

| 83 | | |

| - | | |

| 83 | |

| Stock

payables | |

| - | | |

| - | | |

| - | | |

| - | | |

| 46 | | |

| | | |

| - | | |

| 46 | | |

| - | | |

| 46 | |

| Share

based compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 282 | | |

| - | | |

| 282 | | |

| - | | |

| 282 | |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (342 | ) | |

| (342 | ) | |

| - | | |

| (342 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance

as of June 30, 2023 | |

| 300,000 | | |

| - | | |

| 240,321,157 | | |

| 22 | | |

| 74 | | |

| 2,716 | | |

| (5,140 | ) | |

| (2,328 | ) | |

| (14 | ) | |

| (2,342 | ) |

| | |

Preferred

Stock | | |

Common

Stock | | |

Stock | | |

Additional

Paid in | | |

Accumulated | | |

| | |

Non-controlling | | |

Total | |

| | |

Number | | |

Amount | | |

Number | | |

Amount | | |

Payables | | |

Capital | | |

Deficit | | |

Total | | |

interests | | |

Deficiency | |

| | |

| | |

| | |

| | |

| | |

| | |

Unaudited | | |

| | |

| | |

| | |

| |

| Balance

as of April 1, 2022 | |

| 300,000 | | |

| | | |

| 218,246,326 | | |

| 21 | | |

| - | | |

| 1,020 | | |

| (2,453 | ) | |

| (1,412 | ) | |

| (14 | ) | |

| (1,426 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Beginning

balance, value | |

| 300,000 | | |

| | | |

| 218,246,326 | | |

| 21 | | |

| - | | |

| 1,020 | | |

| (2,453 | ) | |

| (1,412 | ) | |

| (14 | ) | |

| (1,426 | ) |

| Issuance

of shares to service providers | |

| - | | |

| - | | |

| 2,484,472 | | |

| - | | |

| - | | |

| 80 | | |

| - | | |

| 80 | | |

| - | | |

| 80 | |

| Stock

payables | |

| - | | |

| - | | |

| - | | |

| - | | |

| 28 | | |

| | | |

| - | | |

| 28 | | |

| - | | |

| 28 | |

| Share

based compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 256 | | |

| - | | |

| 256 | | |

| - | | |

| 256 | |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (807 | ) | |

| (807 | ) | |

| - | | |

| (807 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance

as of June 30, 2022 | |

| 300,000 | | |

| - | | |

| 220,730,798 | | |

| 21 | | |

| 28 | | |

| 1,356 | | |

| (3,260 | ) | |

| (1,855 | ) | |

| (14 | ) | |

| (1869 | ) |

| Ending

balance, value | |

| 300,000 | | |

| - | | |

| 220,730,798 | | |

| 21 | | |

| 28 | | |

| 1,356 | | |

| (3,260 | ) | |

| (1,855 | ) | |

| (14 | ) | |

| (1869 | ) |

APPYEA

INC.

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(U.S.

dollars in thousands)

| | |

2023 | | |

2022 | |

| | |

For

The six Months Ended | |

| | |

June

30, | |

| | |

2023 | | |

2022 | |

| | |

Unaudited | |

| Cash

flows from operating activities: | |

| | | |

| | |

| Net

loss | |

| (631 | ) | |

| (55 | ) |

| Adjustments

to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation

and amortization | |

| 12 | | |

| 12 | |

| Share

based compensation | |

| 570 | | |

| 603 | |

| Change

in fair value of convertible loans and warrant liability and financial expenses | |

| (261 | ) | |

| (1,077 | ) |

| Changes

in operating assets and liabilities: | |

| | | |

| | |

| Other

current assets | |

| (24 | ) | |

| (9 | ) |

| Accounts

payable | |

| 76 | | |

| 124 | |

| Accounts

payables – related party | |

| 66 | | |

| - | |

| | |

| | | |

| | |

| Net

cash used in operating activities | |

| (192 | ) | |

| (402 | ) |

| | |

| | | |

| | |

| Cash

flows from financing activities: | |

| | | |

| | |

| Proceeds

on account of Stock Payables | |

| 40 | | |

| 13 | |

| Proceeds

from convertible Note received less issuance expenses | |

| 141 | | |

| 368 | |

| Issuance

of warrants measured at FV | |

| - | | |

| 9 | |

| | |

| | | |

| | |

| Net

cash provided by financing activities | |

| 181 | | |

| 390 | |

| | |

| | | |

| | |

| Effect

of foreign exchange on cash and cash equivalents | |

| 2 | | |

| (5 | ) |

| Change

in cash and cash equivalents | |

| (9 | ) | |

| (17 | ) |

| Cash

and cash equivalents at beginning of period | |

| 60 | | |

| 206 | |

| | |

| | | |

| | |

| Cash

and cash equivalents at end of period | |

| 51 | | |

| 189 | |

APPYEA

INC.

NOTES

TO THE FINANCIAL STATEMENTS

NOTE

1

- GENERAL

AppYea,

Inc. (“AppYea”, “the Company”, “we” or “us”) was incorporated in the State of South Dakota

on November 26, 2012 to engage in the acquisition, purchase, maintenance and creation of mobile software applications. The Company is

in the development stage with no significant revenues and no operating history. On November 1, 2021 the Company was redomiciled in the

State of Nevada.

The

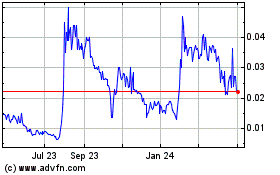

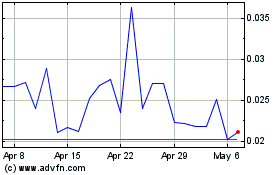

Company’s common stock is traded on the OTC Markets, pink tier, under the symbol “APYP”.

Reverse

merger

In

anticipation of the reverse merger described below, on July 2, 2021, Boris Molchadsky a majority shareholder of the Company, acquired

in a private transaction from the former majority shareholder two hundred and twenty-five thousand (225,000) Shares of Series A Preferred

Stock of the Company. The Series A Preferred Shares have the right to vote at 1,000 to 1 as shares of common stock and are convertible

at a rate of 1,500 to 1 as shares of common stock of the Company. The acquisition of the Preferred Shares provided Boris Molchadsky control

of a majority of the Company’s voting equity capital.

On

August 2, 2021, the Company entered into a stock exchange agreement with SleepX Ltd., a company formed under the laws of the State of

Israel (“SleepX”) and controlled by the majority shareholder of AppYea, Pursuant to the agreement, the outstanding equity

capital consisting of 1,724 common shares of SleepX was exchanged for 174,595,634 shares of common stock of the Company, based on the

agreement that determined that to SleepX shareholders will be issued common shares in the amount that will result in them holding 80%

of the common shares issued of AppYea. As a result, SleepX became a wholly owned subsidiary of the Company. On December 31, 2021, the

terms of the agreement were fulfilled; however, the issuance of the shares to SleepX shareholders, due to administrative matters, was

completed in March 2022 after the Company completed a reverse stock split. The shares that were issued are represented in the 2021 financial

statements.

As

of the result of the transactions mentioned above, Mr. Molchadsky controls approximately 71.4% of the total voting power of AppYea as

of June 30, 2023 .

SleepX

is an Israeli research and development company that has developed a unique product for monitoring and treating sleep apnea and snoring.

The technology is protected by several international patents and, subject to raising working capital, of which no assurance can be provided,

the Company plans to start serial production in Q4 2023. The Company will focus on further development and commercialization of the products.

Its strategy will include continued investment in research and development and new initiatives in sales and marketing.

SleepX

has incorporated, together with an unrelated third party, a privately held company under the laws of the State of Israel named Ta-nooma

Ltd. (“Ta-nooma”). Ta-nooma has developed sleeping monitoring technology for which patent applications were filed and has

no revenue from operation. Since its incorporation and as of the financial statements date, SleepX holds 66.7% of the voting interest

of Ta-nooma.

In

addition to SleepX, the Company has four wholly owned subsidiaries with no active operations.

APPYEA

INC.

NOTES

TO THE FINANCIAL STATEMENTS

NOTE

1 - GENERAL (cont.)

Financial

position

The

financial statements are presented on a going concern basis. The Company has not yet generated any material revenues, has suffered recurring

losses from operations and is dependent upon external sources for financing its operations. As of June 30, 2023, and December 31, 2022,

the Company has a stockholders’ deficiency of $2,328,000 and $2,549,000, respectively. These matters, among others, raise substantial

doubt about the Company’s ability to continue as a going concern. The Company intends to continue to finance its operating activities

by raising capital. There are no assurances that the Company will be successful in obtaining an adequate level of financing needed for

its long-term research and development activities on commercially reasonable terms or at all. If the Company will not have sufficient

liquidity resources, the Company may not be able to continue the development of its product candidates or may be required to implement

cost reduction measures and may be required to delay part of its development programs.

The

financial statements do not include any adjustments for the values of assets and liabilities and their classification may be necessary

in the event that the Company is no longer able to continue its operations as a “going concern”.

NOTE

2 - SIGNIFICANT ACCOUNTING POLICIES

The

interim financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America

(“U.S. GAAP”). The interim financial statements do not include a full disclosure as required in annual financial statements

and should be read with the annual financial statements of the Company as of December 31, 2022. The accounting policies implemented in

the interim financial statements is consistent with the accounting policies implemented in the annual financial statements as of December

31, 2022, except of the following accounting pronouncement adopted by the company.

Recently

Issued Accounting Pronouncements

In

August 2020, the FASB issued ASU 2020-06, “Debt – Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives

and Hedging – Contracts in Entity’s Own Equity (Subtopic 815-40)” (“ASU 2020-06”), which is intended to

address issues identified as a result of the complexity associated.

APPYEA

INC.

NOTES

TO THE FINANCIAL STATEMENTS

NOTE

2 - SIGNIFICANT ACCOUNTING POLICIES

(cont.)

with

applying GAAP for certain financial instruments with characteristics of liabilities and equity. For convertible instruments, ASU 2020-06

reduces the number of accounting models for convertible debt instruments and convertible preferred stocks, and enhances information transparency

by making targeted improvements to the disclosures for convertible instruments and earnings-per-share guidance on the basis of feedback

from financial statement users. ASU 2020-06 is effective for fiscal years, and interim periods in those fiscal years, beginning after

December 15, 2023 (effective January 1, 2024) for smaller reporting companies. The Company is determining the adoption

of this new accounting guidance and the effect on its consolidated financial statements throughout the period until implementation.

Use

of Estimates in Preparation of Financial Statements

The

preparation of consolidated financial statements in conformity with U.S. GAAP accounting principles requires management to make estimates

and assumptions. The Company’s management believes that the estimates, judgments, and assumptions used are reasonable based upon

information available at the time they are made. These estimates, judgments and assumptions can affect the reported amounts of assets

and liabilities and disclosure of contingent assets and liabilities at the dates of the financial statements, and the reported amounts

of expenses during the reporting period. Actual results could differ from those estimates.

NOTE

3 - RELATED PARTY BALANCES AND TRANSACTIONS

A.

Loan from related party

During

December 2022, Boris Molchadsky lent to the Company a total amount of NIS 80,000 ($22,734). The loan bears interest at an annual rate

of 5%. The loan was fully repaid during the first and second quarters, 2023.

B.

Short-term loans from related parties

During

2021, SleepX borrowed from Nexense an aggregate amount of $47,623. According to the agreement, the loan shall be repaid in the event

that the Company’s profits are sufficient to repay the aggregate loan amount and upon such terms and in such installments as shall

be determined by the Board. The loan shall bear interest at an annual rate equal to the minimum rate approved by applicable law in Israel

(2.9% in 2023).

During

2020, the minority shareholder of Ta-nooma loaned Ta-nooma NIS 115,725. The loan does not carry any interest expense and the repayment

terms have yet to be determined. As of June 30, 2023, the loan balance amounted to NIS 115,725 ($31,277).

C.

Convertible loans from related party

On

August 22, 2021 Evergreen Venture Partners LLC, owned by Douglas O. McKinnon, principle stockholder of the Company, agreed to advance

to the Company up to $265,000 in tranches under the terms of an 18 month unsecured promissory note. Under the terms of the note, which

bears interest at a rate of 8% per annum, the note holder can convert the note into shares of common stock at 35% discount to the highest

daily trading price over the 10 days’ preceding conversion but in any event not less than $0.10 per share. The note contains standard

events of default. As of June 30, 2022, the related party has advanced to the Company $25,000 funds under the Note and there are no assurances

if there will be additional loans. As of June 30, 2023, the principal plus interest is estimated by the company as $29,025 .

APPYEA

INC.

NOTES

TO THE FINANCIAL STATEMENTS

NOTE

3 - RELATED PARTY BALANCES AND TRANSACTIONS

(cont.)

D.

Balances with related parties

SCHEDULE

OF BALANCE WITH RELATED PARTIES

| | |

June

30,

2023 | | |

December

31, 2022 | |

| | |

In

U.S. dollars in thousands | |

| | |

| |

| Liabilities: | |

| | | |

| | |

| Employees

and payroll accruals | |

| 185 | | |

| 268 | |

| Related

party payables | |

| 206 | | |

| 140 | |

| Short

term loan | |

| 79 | | |

| 80 | |

Convertible

loan

| |

| 38 | | |

| 36 | |

E.

Transactions with related parties

SCHEDULE

OF TRANSACTION WITH RELATED PARTIES

| | |

2023 | | |

2022 | |

| | |

Six

months ended June

30, | |

| | |

2023 | | |

2022 | |

| | |

In

U.S. dollars in thousands | |

| | |

| |

| Expenses: | |

| | | |

| | |

| Management

fee to the Company’s CEO | |

| 90 | | |

| 35 | |

| Salaries

and related cost *) | |

| 614 | | |

| 593 | |

|

Salaries and related cost | |

| 614 | | |

| 593 | |

| *) | and $487,000,

respectively. |

APPYEA

INC.

NOTES

TO THE FINANCIAL STATEMENTS

NOTE

4 - CONVERTIBLE LOANS AND WARRANTS

The

following table summarizes fair value measurements by level as of June 30, 2023 and December 31, 2022 measured at fair value on a recurring

basis:

SCHEDULE OF FAIR VALUE RECURRING BASIS

| December

31, 2022 | |

Level

1 | | |

Level

2 | | |

Level

3 | | |

Total | |

| | |

In

U.S. dollars in thousands | |

| Assets | |

| | | |

| | | |

| | | |

| | |

| None | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Liabilities | |

| | | |

| | | |

| | | |

| | |

| Convertible

Loans | |

| - | | |

| - | | |

| 2,257 | | |

| 2,257 | |

| Warrants | |

| | | |

| - | | |

| 24 | | |

| 24 | |

| June

30, 2023 | |

Level

1 | | |

Level

2 | | |

Level

3 | | |

Total | |

| | |

In

U.S. dollars in thousands | |

| Assets | |

| | | |

| | | |

| | | |

| | |

| None | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Liabilities | |

| | | |

| | | |

| | | |

| | |

| Convertible

Loans | |

| - | | |

| - | | |

| 1,687 | | |

| 1,687 | |

| Warrants | |

| | | |

| - | | |

| 231 | | |

| 231 | |

The

Convertible Loans changes consist of the following as of June 30, 2023 and December 31, 2022:

SCHEDULE

OF CONVERTIBLE LOANS AT FAIR VALUE

| | |

June

30, 2023 | | |

December

31, 2022 | |

| | |

Convertible

Loans at Fair Value | |

| | |

June

30, 2023 | | |

December

31, 2022 | |

| | |

$000 | |

| Opening

Balance | |

| 2,257 | | |

| 2,492 | |

| Additional

convertible loans (a) | |

| 153 | | |

| 526 | |

| Repayment

of convertible loan (b) | |

| - | | |

| (18 | ) |

| Conversion

of convertible loan (c) | |

| (243 | ) | |

| - | |

| Change

in fair value of convertible loans liability | |

| (480 | ) | |

| (743 | ) |

| Closing

balance | |

| 1,687 | | |

| 2,257 | |

APPYEA

INC.

NOTES

TO THE FINANCIAL STATEMENTS

NOTE

4 - CONVERTIBLE LOANS AND WARRANTS (cont.)

The

estimated fair values of the Convertible loans were measured according to the Monte Carlo Model using the following assumptions:

SCHEDULE

OF FAIR VALUES OF WARRANTS AND CONVERTIBLE LOAN ASSUMPTION USED

| | |

As

of June 30, | | |

As

of December 31, | |

| | |

2023 | | |

2022 | |

| Expected

term (in years) | |

| 1-1.5 | | |

| 0.5 | |

| Expected

average (Monte Carlo) volatility | |

| 171 | % | |

| 169 | % |

| Expected

dividend yield | |

| - | | |

| - | |

| Risk-free

interest rate | |

| 5.2%-5.4 | % | |

| 4.8 | % |

| WACC | |

| 30 | % | |

| 30 | % |

The

following table summarizes information relating to outstanding and exercisable warrants as of December 31, 2022:

SUMMARIZES

RELATING TO OUTSTANDING AND EXERCISABLE WARRANTS

| Warrants

Outstanding and Exercisable | | |

| |

| Number

of | | |

Weighted

Average Remaining Contractual life | | |

Weighted

Average | | |

Valuation

as of | |

| Warrants | | |

(in

years) | | |

Exercise

Price | | |

December

31, 2022 | |

| | 300,000 | | |

| 2.9 | | |

| 0.043 | | |

$ | 11,351 | |

| | 300,000 | | |

| 3.35 | | |

| 0.043 | | |

$ | 11,679 | |

| | 8,334 | | |

| 2.9 | | |

| 0.6 | | |

$ | 230 | |

| | 32,500 | | |

| 3.35 | | |

| 0.6 | | |

$ | 992 | |

The

following table summarizes information relating to outstanding and exercisable warrants as of June 30, 2023:

| Warrants

Outstanding and Exercisable | | |

| |

| Number

of | | |

Weighted

Average Remaining Contractual life | | |

Weighted

Average | | |

Valuation

as of | |

| Warrants | | |

(in

years) | | |

Exercise

Price | | |

June

30, 2023 | |

| | 300,000 | | |

| 2.41 | | |

| 0.022 | | |

$ | 1,794 | |

| | 300,000 | | |

| 2.86 | | |

| 0.022 | | |

$ | 1,955 | |

| | 8,334 | | |

| 2.41 | | |

| 0.6 | | |

$ | 23 | |

| | 32,500 | | |

| 2.86 | | |

| 0.6 | | |

$ | 116 | |

| | 7,000,000 | * | |

| 1.00 | | |

| 0.04 | | |

$ | 227,014 | |

During

the quarter the company issued a new warrant to an Additional Third Party Note holder. See Note 6-H.

APPYEA

INC.

NOTES

TO THE FINANCIAL STATEMENTS

NOTE

4 - CONVERTIBLE LOANS AND WARRANTS (cont.)

The

estimated fair values of the Warrants were measured according to the data as follows:

SCHEDULE OF FAIR VALUES OF WARRANTS AND CONVERTIBLE LOAN ASSUMPTION USED

| | |

As

of June 30, | | |

As

of December 31, | |

| | |

2023 | | |

2022 | |

| Expected

term | |

| 2.41-2.86 | | |

| 2.9-3.35 | |

| Expected

average volatility | |

| 172.17%-174 | % | |

| 179 | % |

| Expected

dividend yield | |

| - | | |

| - | |

| Risk-free

interest rate | |

| 4.54%-4.74 | % | |

| 4.09%-4.15 | % |

| Common

Stock Market Value | |

$ | 0.009 | | |

$ | 0.043 | |

NOTE

5 - STOCK BASED COMPENSATION

| |

A. |

The

table below depicts the number of options granted to consultants and employees: |

SCHEDULE OF NUMBER OF OPTIONS GRANTED

| | |

| | | |

| | |

| | |

Six

months ended June 30, 2023 | |

| | |

Number

of

options | | |

Weighted

average exercise price in USD | |

| | |

| | |

| |

| Options

outstanding at January 1, 2023 | |

| 10,846,284 | | |

$ | 0.0001 | |

| Options

granted during the period | |

| 3,532,290 | | |

$ | 0.0001 | |

| Options

outstanding at the end of period | |

| 14,378,574 | | |

$ | 0.0001 | |

| Options

exercisable at the end of period | |

| 11,550,240 | | |

$ | 0.0001 | |

| B. | The

estimated fair values of the options granted to directors and employees were measured using

Black and Scholes Model based on the following assumptions: |

SCHEDULE OF FAIR VALUE OF OPTIONS

| Grant

date | |

July

1, 2021 | | |

January 2022 | | |

Q1-Q2’2023 | |

| Vesting

period | |

| 2

years | | |

| 2

years | | |

| 0.25-3

years | |

| Expected

average volatility | |

| 187.7 | % | |

| 187.7 | % | |

| 178%-187.7 | % |

| Expected

dividend yield | |

| - | | |

| - | | |

| - | |

| Common

Stock Value | |

$ | 0.76 | | |

$ | 0.01-$0.08 | | |

$ | 0.01-$0.02 | |

| Risk-free

interest rate | |

| 0.3 | % | |

| 1.81 | % | |

| 3.39%-3.98 | % |

For

the six months ended June 30, 2023 and 2022 the company recognized expenses, to such options, in the amount of $562,000 and $507,000,

respectively. The expense is non-cash stock-based compensation expense resulting from options awards to our Chief Financial Officer and

advisors. The expense represents the aggregate grant date fair value for the option awards granted and vested during the fiscal years

presented, determined in accordance with FASB ASC Topic 718.

APPYEA

INC.

NOTES

TO THE FINANCIAL STATEMENTS

NOTE

6 - SIGNIFICANT EVENTS DURING THE PERIOD

| A- | On

January 1, 2023, the company engaged Ron Mekler as a board member. For his services he was

granted stock option to purchase 500,000 of the Company’s common stock, valued at $21,498.

Upon grant, the Options vest as follows: (i) 50% following 12 months on the first anniversary

of the appointment and (ii) the balance of shares of Common Stock, in four (4) consecutive

fiscal quarters, beginning with the quarter ending March 31, 2024. The Option shall be exercisable

at a per share exercise price of $0.0001 and shall otherwise be subject to the other terms

and conditions specified in an Option Grant Agreement to be entered into between Mr. Mekler

and the Company. |

| B- | On

February 1, 2023, the company engaged with Adi Shemer as a board advisor. For his services

he was granted stock option to purchase 1,000,000 of the Company’s common stock, valued

at $20,498. Upon grant, the Options vest as follows: (i) 33% following 12 months on the first

anniversary of the appointment and (ii) the balance of shares of Common Stock, in eight (8)

consecutive fiscal quarters, beginning with the quarter ending April 31, 2024. The Option

shall be exercisable at a per share exercise price of $0.0001 and shall otherwise be subject

to the other terms and conditions specified in an Option Grant Agreement to be entered into

between Mr. Shemer and the Company. |

| C- | During

the first quarter, the company signed an amendment with a Principal $437,190 CLA lender the following

understandings: (i) the note shall be amended so that the Fixed Conversion Price is $0.022,

(ii) the Note shall be increased by $7,500, (iii) if any portion of the balance due under

the Note remains outstanding on April 30, 2023, an extension fee equal to 15% of such outstanding

balance shall be added to it. (iv) The Maturity Date with respect to all Tranches advanced

under the Note shall be amended to be July 31, 2023. (v) several sale limitations on trading

during the period beginning on the Effective Date and ending on the Amended Maturity Date.

The warrant exercise price was adjusted accordingly. Since this amendment was known already

in December 2022 its results were included in the fair value as of 31.12.2022. |

| D- | On

May 1, 2023, the company engaged a consultant for management of CRM system and marketing

campaigns. In consideration, the consultant was granted stock options to purchase 500,000

of the Company’s common stock, valued at $7,489. Upon grant, the Options vest as follows:

(i) 33% following 12 months anniversary of the appointment and (ii) the balance of shares

of Common Stock, in eight (8) consecutive quarters, beginning with the quarter ending April

30, 2024. The Option shall be exercisable, for a period of 2 years after reaching full vesting,

at a per share exercise price of $0.0001 and shall otherwise be subject to the other terms

and conditions specified in an Option Grant Agreement to be entered into between the consultant

and the Company. |

| E- | On

June 1, 2023, the company engaged a consultant for its digital marketing effort. For his

services the consultant was granted stock options to purchase 500,000 of the Company’s

common stock, valued at $5,414. Upon grant, the Options vest on a monthly basis over a period

of 3 months from grant. The Option shall be exercisable for a period of two years following

vesting, at a per share exercise price of $0.0001 and shall otherwise be subject to the other

terms and conditions specified in an Option Grant Agreement to be entered into between the

consultant and the Company. |

| F- | On

June 14, 2023, SleepX Ltd, the Company’s subsidiary, was granted a patent (US20150119741A1)

by the United States Patent and Trademark Office, titled: “Apparatus and Method for

Diagnosing Sleep Quality.” The patent extends through February 2036, and provides broad

coverage in the field of sleep monitoring. |

| G- | On

June 18 2023, the holders of the majority (the “Majority Holders”) of the Company

outstanding convertible Preferred Series A Shares par value $0.0001 per share (the “Preferred

Shares”) agreed to provide that each Preferred Share shall have voting rights equal

to 3,000 shares of the Company’s Common Stock which may be vote at any meeting or any

action of the Company shareholders at which the holders of the Common Stock are entitled

to participate. |

APPYEA

INC.

NOTES

TO THE FINANCIAL STATEMENTS

NOTE

6 - SIGNIFICANT EVENTS DURING THE PERIOD (Cont.)

| |

H- |

In connection with Note 7-C, the holder of the Additional Third

Party Note agreed to extend the maturity date of such note to June 30, 2024 and to not convert such note during such period. In consideration

thereof, the Company agreed with the holder that in the event that on June 30, 2024 the preceding 90 day VWAP is less than $0.04 (the

“90 day VWAP”), then the Company will issue to the holder additional shares of the Company’s common stock where the

number of shares is determined by quotient of (i) the spread below $0.04 times seven million shares divided by the 90 day VWAP. Solely

for the purposes of illustration, if the 90-day VWAP is $0.03 the holder of the Additional Third Party Note would be issued an additional

2,333,333 shares [$0.01 X 7,000,000 / $0.03]. |

NOTE

7 - SUBSEQUENT EVENTS

| A- | On

July 1, 2023, Asaf Porat, our CFO, was granted stock options to purchase

10,237,740 of the Company’s common stock, valued at $92,102. Upon grant, the Options

vest over a period of 24 months, on a monthly basis. The Option is exercisable at a

per share exercise price of $0.0001 and shall otherwise be subject to the other terms and

conditions specified in an Option Grant Agreement between Mr. Porat and the Company. In addition,

subject to the investment in the Company, Mr. Porat shall be entitled to an additional 14,500,000

common shares on December 31, 2023. |

| B- | On

July 7, 2023, the Board of Directors appointed

Adi Shemer as Chief Executive Officer (“CEO”) of the Company, effective immediately.

Mr. Shemer has been working with the Company since February 2023 as a consultant. In connection

with his appointment as CEO, Mr. Shemer and the Company’s subsidiary SleepX, Ltd. entered

into an Employment Agreement (the “Agreement”) setting forth the terms of his

employment and compensation. Under the Agreement, Mr. Shemer is entitled to monthly salary

of 40,000 NIS (equivalent to $10,810 as of the date of this report), of which the payment

of 20,000 NIS is deferred until such time as the Company raises at least $1 million in aggregate

proceeds from the private placement of its securities. Under the Agreement, Mr. Shemer is

also entitled to the following: (i) Manager’s Insurance under Israeli law to which

SleepX contributes amounts equal to (a) 8-1/3 percent for severance payments, and 6.5%, or

up to 7.5% (including disability insurance) designated for premium payment (and Mr. Shemer

contributes an additional 6%) of each monthly salary payment, and (b) 7.5% of his salary

(with Mr. Shemer contributing an additional 2.5%) to an education fund, a form of deferred

compensation program established under Israeli law. Either Mr. Shemer or SleepX is entitled

to terminate the employment at any time upon 30 days prior notice. |

| | | |

| | | Under

the Agreement, Mr. Shemer was awarded options under the Company’s employee stock option

plan for 11,500,000 shares of the Company’s common stock at a per share exercise price

of $0.0001, vesting over a period of 30 months, on a quarterly basis, beginning with the

quarter ending September 30, 2023, provided that Mr. Shemer continues in the employ of SleepX

and continues to provide CEO services to the Company. At the end of the 30-month period,

Mr. Shemer is entitled to options for an additional 11,500,000 shares at the same exercise

price provided he has been in the continuous employ of SleepX. The options are exercisable

through July 2033. In connection with the consulting services rendered prior to his appointment

as CEO, he was awarded options for 1,000,000 shares of the Company’s common stock,

exercisable through July 2033 at a per share exercise price of $0.0001 per share, all of

which have vested. |

| C- | In

June 2023, the Company entered into a Subscription Agreement (the “Subscription Agreement”)

with a qualified investor (the “Investor”), pursuant to which the Company agreed

to issue and sell (the “Offering”) an aggregate of 13,300,000 shares of the Company’s

common stock par value $0.0001 per share (the “Common Stock”) at a per share

purchase price of $0.01, and Common Stock purchase warrants, exercisable for a two year period

from the date of issuance, to purchase up to an additional 13,300,000 shares of Common Stock

at a per share exercise price of $0.04 (the “Warrants”). The subscription agreement

was closed on July 19, 2023. As of June 30, 2023, the Company received $40,000 out of aggregate

gross proceeds of $133,000 received by the end of July 2023. |

APPYEA

INC.

NOTES

TO THE FINANCIAL STATEMENTS

NOTE

7 - SUBSEQUENT EVENTS (Cont.)

| | | The

subscription proceeds are being used by the Company to complete the IOS design and development

of its biofeedback snoring treatment wristband (the “Snoring Treatment Device”)

as well as general corporate matters. While not legally obligated, the Investors informally

indicated that they would invest during the third quarter of 2023 an additional $266,000

by the purchase of additional shares of Common Stock and Warrants on the same terms as the

initial investment, to be utilized towards the completion of the design and development and

readying for commercialization of the Snoring Treatment Device. |

| | | Subject

to the satisfactory operation of the Snoring Treatment Device as determined by the Investor,

the Investor informally indicated that it would invest an additional $950,000 within a nine-month

period by the purchase of additional shares of Common Stock and Warrants on the same terms

as the initial investment. No assurance can be provided that the Investors will in fact provide

the additional investments as indicated. |

| | | |

| | | The

Investor and other unaffiliated entities (collectively, the “Purchasers’) purchased

from Leonite Fund LP and Diagonal Lending LLC outstanding convertible promissory notes issued

by the Company in the aggregate amount of $724,658. Following the purchase of these outstanding

notes, the Purchasers agreed to amend the terms of the notes to extend the maturity date

of each note to December 31, 2024 and to amend the conversion price thereof to $0.00561 (in

the case of note purchased from Leonite Funding LP) and $0.005 (in the case of the note purchased

from Diagonal Lending LLC). In addition, the Purchasers agreed to not convert the notes purchased

until the earlier of June 30, 2024 and such time as the Purchasers complete the purchase

of an additional outstanding promissory note issued by the Company to an unrelated third

party in the aggregate amount of $720,000 (the “Additional Third Party Note”). |

| | | |

| | | In

connection with the purchase from Leonite of the Note by the Purchasers, the 600,000 Warrants

previously issued to Leonite were cancelled. |

| | | |

| D- | On

July 25, 2023, SleepX Ltd, our subsidiary, was granted a patent (US 11672472

B2) by the United States Patent and Trademark Office, titled: “Methods and systems

for estimation of obstructive sleep apnea severity in wake subjects by multiple speech analyses.”

The patent extends through December 2038, and provides broad coverage in the field of sleep

monitoring. |

| | | |

| E- | On

July 26, 2023, Mr. Boris Molchadsky, our Chairman, sold 2,307 Series A convertible preferred stocks. |

| | | |

| F- | On

August 4, 2023, the aforementioned Purchasers completed the purchase of 66,868 Series A convertible

preferred stocks. |

| ITEM

2. |

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Forward-looking

Statements

This

Quarterly Report on Form 10-Q contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995 and other Federal securities laws, and is subject to the safe-harbor created by such Act and laws. In some cases, you can

identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,”

“intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,”

“potential” or “continue,” the negative of such terms, or other variations thereon or comparable terminology.

The statements herein and their implications are merely predictions and therefore inherently subject to known and unknown risks, uncertainties,

assumptions and other factors that may cause actual results, performance levels of activity, or our achievements, or industry results

to be materially different from those contemplated by the forward-looking statements. Except as required by law, we undertake no obligation

to release publicly the result of any revision to these forward-looking statements that may be made to reflect events or circumstances

after the date hereof or to reflect the occurrence of unanticipated events. Further information on potential factors that could affect

our business is described under the heading “Risk Factors” in our annual report on Form 10-K for the year ended December

31, 2022 as filed with the Securities and Exchange Commission, or the SEC, on June 30, 2023/ As used in this quarterly report, the terms

“we”, “us”, “our”, the “Company” and “AppYea” mean AppYea, Inc. and our wholly-owned

subsidiaries Sleepx LTD and Ta-Nooma LTD unless otherwise indicated or as otherwise required by the context.

Overview

AppYea,

Inc. is a digital health company, focused on the development of accurate wearable monitoring solutions to treat sleep apnea and snoring

and fundamentally improve quality of life.

Our

solutions are based on our proprietary intellectual property portfolio comprised of Artificial Intelligence (AI) and sensing technologies

for the tracking, analysis, and diagnosis of vital signs and other physical parameters during sleep time, offering extreme accuracy at

affordable cost.

AI

is a broad term generally used to describe conditions where a machine mimics “cognitive” functions associated with human

intelligence, such as “learning” and “problem solving. Basic AI includes machine learning, where a machine uses algorithms

to parse data, learn from it, and then make a determination or prediction about a given phenomenon. The machine is “trained”

using large amounts of data and algorithms that provide it with the ability to learn how to perform the task.

General

Background

Snoring

is a general disorder caused due to repetitive collapsing and narrowing of the upper airway. Individuals with snoring problems are at

increased risk of accidental injury, depression and anxiety, heart disease and stroke. Currently available treatments include surgical

and non-surgical devices.

According

to Fior Markets, a market intelligence company, the Global Anti-Snoring Treatment Market is expected to grow from USD 4.3 billion in

2020 to USD 8.6 billion by 2028, with a 9.07% CAGR between 2021 and 2028. While North America had the largest market share of 28.12%

in 2020, Asia-Pacific region is witnessing significant growth due to the increasing prevalence of obesity and sedentary lifestyles in

emerging economies.

Currently

available anti-snoring devices consist mainly of oral appliances that are recommended for use by patients suffering from snoring or obstructive

sleep apnea. These appliances are put before sleep and have a simple function of pushing either the lower jaw or the tongue forward.

This keeps the epiglottis parted from the uvula and prevents the snoring sound created by the vibration of soft tissues of palate.

Sleep

apnea is a severe sleep condition in which individuals frequently stop breathing in their sleeping, this leads to insufficient oxygen

supply to the brain and the rest of the body which, in turn may lead to critical problems. There are three main types of apnea: (i) Obstructive

Sleep Apnea (“OSA”), the most common form caused by the throat muscles relaxing during sleep; (ii) Central sleep apnea, which

occurs when the brain doesn’t send the proper signals to the muscles that control the breathing; and (iii) complex sleep apnea

syndrome, which occurs when an individual suffers from both OSA and central sleep apnea. While OSA is a common disorder in the elderly

population, affecting approximately 13 to 32% of people aged over 65, sleep apnea can occur at any age and affects approximately 25%

of men and nearly 10% of women.

In

2020, North America dominated the sleep apnea device market, as it accounted for 49% of the revenue, the global market size was valued

at USD 3.7 billion and is expected to expand by 6.2% CAGR, according to a report by Grand View Research Inc., reaching USD 6.1 billion

by 2028.

The

global sleep apnea and snoring market is driven in large part by solutions that can be applied in at home-settings or healthcare settings,

as these tools will drive decisions regarding specific treatments and the associated outlays. However, despite advances in medical imaging

and other diagnostic tools, misdiagnosis remains a common occurrence. We believe that improved diagnoses and outcomes are achievable

through the adoption of AI-based decision support tools.

Our

Products and Product Candidates

Our

initial focus is on the development of supporting solutions utilizing our proprietary platform. Our current business plan focuses on

two principal devices and an App currently in development:

DreamIT

– Biofeedback snoring treatment wristband, combined with the SleepX App.

This

wristband uses unique algorithms designed by SleepX combined with sensors to monitor physiological parameters during sleep. Based on

real time reactions, the wristband will vibrate, when necessary, in order to decrease the snoring and regulate breathing by gently bringing

the user to a lighter sleep and thus ceasing the snoring event.

The

DreamIT product is currently in testing and calibration stage in preparation for serial manufacturing.

DreamIT

PRO – is a wristband for the treatment of sleep apnea using biofeedback in combination with SleepX PRO app. The unique algorithms

of SleepX PRO, combined with the wristband sensors, monitor sleep apnea events and additional physiological parameters during sleep,

and when necessary, the wristband vibrates according to real time events, in order to decrease and cease sleep apnea events.

The

DreamIT PRO product is currently in advanced development stages, following which it would be ready to begin the testing stage in preparation

for filing for FDA approval.

SleepX

PRO – Is a medical application, available for downloading on a smartphone, and used to monitor breathing patterns in the sleep

and identify sleep apnea episodes without direct contact to the user.

The

SleepX PRO product is to begin final calibration, following which we will file for 510(k) FDA approval.

Recent

Corporate History

Reverse

Merger

On

August 2, 2021, AppYea entered into a stock exchange agreement with SleepX Ltd., a company formed under the laws of the State of Israel

(“SleepX”) and controlled by the majority shareholder of AppYea, our chairman Barry Molchadsky. Pursuant to the agreement,

the outstanding equity capital consisting of 1,724 common shares of SleepX was exchanged for 174,595,634 shares of common stock of the

Company, based on the agreement that determined that to SleepX shareholders will be issued common shares in the amount that will result

in them holding 80% of the common shares issued of AppYea. The agreement was subject to certain terms before the agreement could be closed.

On December 31, 2021, the agreement was consummated as the terms of the agreement were fulfilled; As a result, SleepX became a wholly

owned subsidiary of the Company. The issuance of the shares to SleepX shareholders, due to administrative matters was completed in March

2022 after the Company completed a reverse stock split.

In

anticipation of the reverse merger described below, on July 2, 2021, Boris Molchadsky a majority shareholder of the Company, acquired

in a private transaction from the former majority shareholder two hundred and twenty-five thousand (225,000) Shares of Series A Preferred

Stock of the Company. The Series A Preferred Shares have the right to vote 3,000 to 1 as shares of common stock and are convertible into

1,500 to 1 of the shares of common stock of the Company. The acquisition of the Preferred Shares provides Boris Molchadsky control of

a majority of the Company’s voting equity capital.

The

License Agreement

Our

business derives from a licensing agreement entered into as of March 15, 2020, as subsequently amended (the “License Agreement”),

by SleepX Ltd., our Israeli subsidiary, B.G. Negev Technologies and Applications Ltd., a company formed under the laws of the State of

Israel (“BGN”) and Mor Research Application Ltd. a company formed under the laws of Israel (“Mor”; together with

BGN, the Licensors”). BGN is a company wholly owned by Ben Gurion University of the Negev in Israel and Mor, is the technology

transfer arm of the Clalit Health Services, an Israeli non-profit healthcare insurance and service provider. Under the License Agreement,

our Israeli subsidiary was granted a worldwide royalty bearing and exclusive license exclusive worldwide license with the right to grant